SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrant x Filed by a party other than the registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy statement |

| x | Definitive proxy statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by 14a-6(e)(2)) |

| ¨ | Definitive additional materials |

| ¨ | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

CARDIOVASCULAR BIOTHERAPEUTICS, INC.

(Name of Registrant as Specified in Its Charter)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule or registration statement no.: |

CARDIOVASCULAR BIOTHERAPEUTICS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 21, 2007

9:00 A.M. PACIFIC TIME

TO THE STOCKHOLDERS OF CARDIOVASCULAR BIOTHERAPEUTICS, INC.:

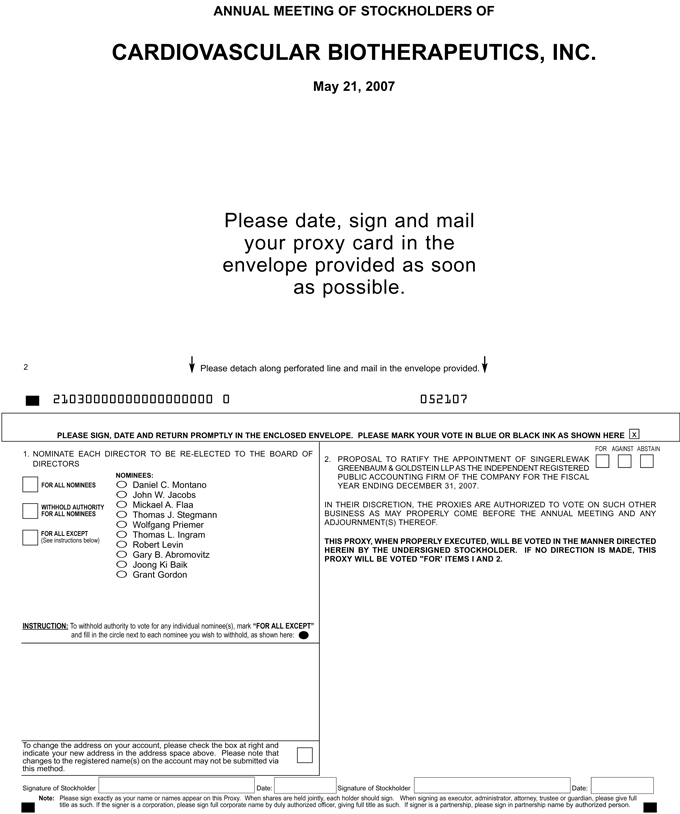

NOTICE IS HEREBY GIVEN that the 2007 Annual Meeting of Stockholders (the “Annual Meeting”) of CardioVascular BioTherapeutics, Inc., a Delaware corporation (the “Company”), will be held on May 21, 2007 at 9:00 a.m. Pacific Time, at JW Marriott Las Vegas Resort, Spa & Golf, 221 N. Rampart Blvd., Las Vegas, Nevada 89145 for the following purposes:

| | 1. | To elect directors to serve until the 2008 Annual Meeting of Stockholders; |

| | 2. | To ratify the appointment of Singer Lewak Greenbaum & Goldstein LLP as independent registered public accounting firm of the Company for the year ending December 31, 2007; and |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment(s) thereof. |

The foregoing business items are more fully described in the following pages that are made part of this Notice. Stockholders of record at the close of business on Friday, March 30, 2007, may attend and vote at the Annual Meeting. If you will not be attending the meeting, the Company requests that you vote your shares as promptly as possible. You may mark your votes, date, sign and return the Proxy or voting instruction form in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person, even if he, she or it has already returned a Proxy.

Daniel C. Montano

Chairman

Board of Directors

Las Vegas, Nevada

Date: April 16, 2007

IMPORTANT: Regardless of whether you plan to attend the Annual Meeting, you are requested to promptly complete, sign, date, and return the enclosed Proxy in the envelope provided.

CARDIOVASCULAR BIOTHERAPEUTICS, INC.

Corporate Headquarters

1635 Village Center Circle

Suite 250

Las Vegas, Nevada 89134

(702) 839-7200

PROXY STATEMENT FOR 2007 ANNUAL MEETING OF STOCKHOLDERS

The enclosed Proxy is solicited on behalf of the Company for use at the Annual Meeting to be held on Monday, May 21, 2007, at 9:00 a.m., Pacific Time, and at any adjournment(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the JW Marriott Las Vegas Resort, Spa & Golf, 221 N. Rampart Blvd., Las Vegas, Nevada 89145.

These proxy solicitation materials, which include the Proxy Statement, Proxy, and the Company’s Annual Report on Form 10-K for the year ended December 31, 2006, were first mailed on or about April 18, 2007, to all stockholders entitled to vote at the Annual Meeting.

Vote Required; Recommendation of Board of Directors

The nominee receiving the highest number of affirmative votes for each board seat shall be elected as a director. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum for the transaction of business but have no other legal effect under Delaware law. The Board of Directors has been advised by the Control Group described on page 6 hereof that it intends to vote FOR each of the Nominees in Proposal No. 1, thereby assuring that each of them will be elected.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEE SET FORTH ABOVE

INFORMATION CONCERNING SOLICITATION AND VOTING

Record Date

Stockholders of record at the close of business on March 30, 2007 (the “Record Date”) are entitled to notice of the Annual Meeting and to vote at the Annual Meeting. Presence in person or by Proxy of a majority of the shares of Common Stock outstanding on the Record Date is required for a quorum. As of the close of business on the Record Date, 129,457,198 shares of Common Stock, par value of $0.001 per share, were issued and outstanding and were the only class of voting securities outstanding.

Revocability of Proxies

Properly executed and unrevoked proxies received by the Company will be voted at the Annual Meeting in accordance with the instructions thereon. Where no instructions are specified, the proxies will be voted in favor of all proposals set forth in the Notice of Meeting.

Any person giving a proxy in response to this solicitation has the power to revoke it at any time before it is voted. Proxies may be revoked by any of the following actions:

| | • | | filing a written notice of revocation with the Company’s Secretary at its principal executive office at 1635 Village Center Circle, Suite 250, Las Vegas, Nevada, 89134. |

| | • | | filing a properly executed proxy showing a later date with the Company’s Secretary at its principal executive office at 1635 Village Center Circle, Suite 250, Las Vegas, Nevada, 89134; or |

| | • | | attending the Annual Meeting and voting in person by ballot. |

The Company’s Voting Recommendations

The Board of Directors recommends that you vote:

| | • | | “FOR” the Nominees to serve as directors until the 2008 Annual Meeting of Stockholders; |

| | • | | “FOR” the ratification of the appointment of Singer Lewak Greenbaum & Goldstein LLP as independent registered public accounting firm of the Company for the year ending December 31, 2007. |

Voting and Solicitation

Each share of Common Stock outstanding on the Record Date of March 30, 2007, will be entitled to one vote on all matters presented at the Annual Meeting. Stockholders do not have the right to cumulate their votes in the election of directors.

Shares of Common Stock represented by properly dated, executed, and returned Proxies will, unless such Proxies have been previously revoked, be voted in accordance with the instructions indicated thereon. In the absence of specific instructions to the contrary, properly executed Proxies will be voted: (i) FOR the election of each of the Company’s nominees for director; and (ii) FOR the ratification of the appointment of Singer Lewak Greenbaum & Goldstein LLP as independent registered public accounting firm of the Company for the year ending December 31, 2007. No business other than that set forth in the accompanying Notice of Annual Meeting of Stockholders is expected to come before the Annual Meeting. Should any other matter requiring a vote of stockholders properly arise, the persons named in the enclosed form of proxy will vote such proxy in accordance with the recommendation of the Board of Directors.

The Company will pay the costs of soliciting Proxies from stockholders, including the preparation, assembly, printing and mailing of proxy solicitation materials. The Company will provide copies of solicitation materials to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward these materials to the beneficial owners of Common Stock. The Company may reimburse brokerage firms and other such persons representing beneficial owners of Common Stock for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by certain of the directors, officers and employees of the Company, without additional compensation, personally or by telephone, telegram, letter, e-mail or facsimile.

Quorum; Abstentions; Broker Non-Votes

The required quorum for the transaction of business at the Annual Meeting is a majority of the votes eligible to be cast by holders of shares of Common Stock issued and outstanding on the Record Date. Shares that are voted “FOR” or “AGAINST” a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at the Annual Meeting (the “Votes Cast”) with respect to such matter.

Although there is no definitive statutory or case law authority in Delaware as to the proper treatment of abstentions, the Company believes that abstentions should be counted for purposes of determining both (i) the presence or absence of a quorum for the transaction of business and (ii) the total number of Votes Cast with respect to a proposal (other than the election of directors). In the absence of controlling precedent to the contrary, the Company intends to treat abstentions in this manner. Accordingly, abstentions will have the same effect as a vote AGAINST the proposal.

The Delaware Supreme Court has held that, while broker non-votes should be counted for the purpose of determining the presence or absence of a quorum for the transaction of business, broker non-votes should not be counted for purposes of determining the number of Votes Cast with respect to the particular proposal on which the broker has expressly not voted. Accordingly, the Company intends to treat broker non-votes in this manner. Thus, a broker non-vote will not affect the outcome of the voting on a proposal.

2

Deadline For Receipt Of Stockholder Proposals

Stockholders may submit proposals that they believe should be voted upon at an Annual Meeting or nominate persons for election to the Company’s Board of Directors. Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (“Rule 14a-8”), some stockholder proposals may be eligible for inclusion in the Company’s 2008 Proxy Statement. Any such stockholder proposals must be submitted in writing to the attention of the Company’s Secretary, CardioVascular BioTherapeutics, Inc., 1635 Village Center Circle, Suite 250, Las Vegas, Nevada 89134, no later than December 23, 2007. Stockholders interested in submitting such a proposal are advised to contact knowledgeable legal counsel with regard to the detailed requirements of applicable securities laws. The submission of a stockholder proposal does not guarantee that it will be included in the Company’s 2008 Proxy Statement. If a stockholder gives notice of a proposal after the deadline, the stockholder will not be permitted to present the proposal to the stockholders for a vote at the 2008 Annual Meeting.

Certain Financial Information and Certifications

Please take note that the Company’s financial statements and related information as well as the required certifications as promulgated by the Sarbanes-Oxley Act of 2002 (the “SOX Act”) are as set forth in its Annual Report on Form 10-K to be filed with the Securities and Exchange Commission (“SEC”) on or about April 16, 2007.

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees

The Company’s Board of Directors is currently composed of ten (10) members. The Company’s Bylaws provide for a minimum of four (4) and a maximum of eleven (11) members of the Board of Directors. The members of the Board of Directors are elected at each Annual Meeting of Stockholders to hold office until the next Annual Meeting of Stockholders. The term for all of the current directors will expire at the Annual Meeting and thus each are nominated for re-election (“Nominees”). There are no family relationships among any directors or executive officers, including the Nominees.

Unless otherwise instructed, the holders of Proxies solicited by this Proxy Statement will vote the Proxies received by them for the Nominees. Directors are elected by a plurality (excess of votes cast over opposing nominees) of the votes present in person or represented by proxy and entitled to vote at the meeting. Shares represented by signed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. In the event that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the Proxy holders will vote for a nominee designated by the present Board of Directors to fill the vacancy. The Company is not aware of any reason that any of the Nominees will be unable or will decline to serve as directors. The Board of Directors recommends a vote “FOR” the election of the Nominees.

The names of the members of the Company’s Board of Directors, their ages as of March 31, 2007 and certain information about them, are set forth below.

| | | | |

Name | | Age | | Position(s) |

Daniel C. Montano | | 58 | | Chairman of the Board of Directors, Co-President, Chief Executive Officer and Co-Founder |

| | |

Grant Gordon | | 45 | | Director, Vice Chairman of the Board of Directors and Co-Founder |

| | |

Thomas Stegmann, M.D. | | 59 | | Director, Co-Founder, Co-President and Chief Medical Officer |

| | |

Wolfgang Priemer, Ph.D. | | 67 | | Director and Co-Founder |

| | |

John (Jack) W. Jacobs, Ph.D. | | 57 | | Director, Vice President, Chief Operating Officer, and Chief Scientific Officer |

| | |

Mickael A. Flaa. | | 54 | | Director, Vice President, Treasurer and Chief Financial Officer |

| | |

Gary B. Abromovitz | | 63 | | Director |

| | |

Thomas L. Ingram | | 52 | | Director |

| | |

Robert Levin | | 75 | | Director |

| | |

Joong Ki Baik | | 52 | | Director |

Daniel C. Montano is a Co-Founder of the Company and has been Chairman of the Board, Co-President and Chief Executive Officer since 1998. Mr. Montano is also currently the Chairman of the Board, President and Chief Executive Officer of Phage Biotechnology Corporation (“Phage”), an affiliated biotechnology company that manufactures recombinant protein drugs and is the Company’s sole supplier of its drug candidates. Additionally, Mr. Montano has been a member of the Board of Directors for Cardio Phage International “CPI”) since 1998, an affiliated company with which the Company has a distribution agreement for future products.

4

From 1981 until 2004, he was also a member of the Board of Directors of Helen of Troy, Limited, a corporation whose shares are publicly traded. He received his MBA from the University of Southern California and his undergraduate degree from California State University, Los Angeles.

Grant Gordon is a Co-Founder of the Company and has been a member of its Board of Directors since February 2005, currently serving as Vice Chairman of the Company’s Board. Mr. Gordon is also President of CPI and Principal of GHL Financial Services Ltd., an international financial services group registered in the British Virgin Islands. GHL provided seed and capital for the company in the form of Common and Preferred Stock and the series one and two convertible notes.

Thomas Stegmann, M.D. is a Co-Founder, Co-President and Director of the Company, and has served as the Company’s Chief Medical Officer since 1998. From December 1984 through December 31, 2005, he held the position of Professor of Surgery and Director of the Department for Thoracic and Cardiovascular Surgery at the Fulda Medical Center in Germany. He is also a member of the faculty of Hannover Medical School in Germany. Dr. Stegmann is the cardiac surgeon who pioneered the procedure upon which the Company is founded. He received his medical degree from Heidelberg University, Heidelberg, Germany. Dr. Stegmann has published more than 200 scientific papers in international journals. He also is a member of international societies and associations in the cardiovascular area. Additionally, Dr. Stegmann has been awarded the “Rudolf-Nissen-Memorial-Prize” by the German Society for Thoracic and Cardiovascular Surgery (1982). He also has the privileged distinction to be an Honorary Member of the “Rideau Institute of Canada.” He authored the book:New Vessels for the Heart (2004).

Wolfgang Priemer Ph.D., is a Co-Founder and has been a member of the Board of Directors of the Company since incorporation. For the past eight years, he has been a private venture capitalist, specializing in life sciences, biotechnology, and advanced technology businesses. Prior to that, since 1969 he had been an executive officer of several companies in Europe. Dr. Priemer received his Masters Degree in Industrial Engineering and Business Administration from the University of Darmstadt and his Ph.D. in Marketing from the University of Fribourg/Switzerland.

John (Jack) W. Jacobs, Ph.D. has served as the Company’s Vice President, Chief Scientific Officer and Chief Operating Officer since April 2000, and has been a member of its Board of Directors since February 2005. He has been a member of the Board of Directors for CPI since 1998. He has held similar positions with Phage since April 2000. From September 1989 to April 2000, Dr. Jacobs was Director of Basic Research at the Hitachi Chemical Research Center in Irvine, California. At the same time, Dr. Jacobs was a Professor (adjunct) of Biological Chemistry at the University of California, Irvine’s College of Medicine. Prior to joining Hitachi, from December 1984 to September 1989, Dr. Jacobs worked for Merck & Co., Inc. as the head of its Department of Biological Chemistry at the Merck Sharp & Dohm Research Laboratories in West Point, Pennsylvania. From August 1981 to December 1984, he served as Assistant Professor of Medicine and Biochemistry at the University of Texas Health Center. Dr. Jacobs received his Ph.D. in molecular biology from the Washington University School of Medicine in 1978 in St. Louis, Missouri, and his undergraduate degree in Chemistry from Davidson College. He devotes a sufficient amount of his time to the Company’s business and the balance to Phage.

Mickael A. Flaa is a consultant who has served as the Company’s Treasurer, Vice President and Chief Financial Officer since June 2003, and has been a member of its Board of Directors since February 2005. He has held the position of Chief Financial Officer with Phage since June 2003. He has been a member of the Board of Directors for CPI since May 2005. He served as Interim Chief Financial Officer on a consulting basis for Breakaway Solutions, Inc., a public company, from February 2001 to 2002. From October 2000 to March 2002, Mr. Flaa served on the Board of Directors of UniCapital Corporation, a public company. From January 1999 to March 2000, he served as Chief Financial Officer and was a member of the Board of Directors for Sunbelt Integrated Trade Services, Inc. From May 1977 to January 1999, Mr. Flaa held various management positions with KPMG Peat Marwick LLP, and in 1990 was elected to partnership. He is a member of the Board of Directors of Gestalt, LLC. Mr. Flaa received his undergraduate degree from Central Washington University. Mr. Flaa serves in a similar capacity with Phage.

5

Gary B. Abromovitzhas been a member of the Company’s Board of Directors since February 2005. He serves as Lead Director, Chair of the Compensation, Audit, Corporate Governance, and Conflict Resolution Committees, and is a member of the European Compliance Committee. He also Chairs the Executive Session of Independent Directors. Mr. Abromovitz is Deputy Chairman of the Board and Lead Director of Helen of Troy Limited, a public company. He Chairs the Compensation Committee, the Nominating and Governance Committee of Helen of Troy, Limited. and is the former Chair of the Audit Committee of which he continues to be a member. He has been a Director of Helen of Troy, Limited. since 1990. He is an attorney and has acted as a consultant to several law firms in business related matters including trade secrets, unfair competition and commercial litigation. He has been active in various real estate development and acquisitions for over 30 years in Arizona and California, with experience in the areas of industrial buildings, medical offices, commercial, residential and historic properties.

Thomas L. Ingram has been a member of the Company’s Board of Directors since February 2005 and has been a private investor focusing on real estate, small business and certain securities transactions for more than ten years. From 1982 to 1997, he had various positions at Troster Singer (a securities broker-dealer), including Head Over-the-Counter Trader/Office Manager from 1984 to 1997. He holds a B.S. degree in Business and Finance from Pepperdine University.

Robert Levin has been a member of the Company’s Board of Directors since February 2005 and has been a retired businessman and investor since 1992. For the 30 years prior to that, he owned and operated a major recreational vehicle sales and service company in Southern California.

Joong Ki Baik has been a member of the Company’s Board of Directors since February 2005, and, since July 2000, has been Chief Executive Officer of Seoul Angels Group Inc., which raises venture capital funds for Korean companies. Since December 2000, he has also been Chief Executive Officer of Korea Bio-Development Corporation, which is involved in consulting and investing in Asian bio-ventures. From June 1997 to July 2000, he was the Executive Director of the Economic Research Department of the Korea Chamber of Commerce and Industry. From October 1978 to March 1998, he served as a researcher of economic and industrial trends for the Korea Chamber of Commerce and Industry. Prior to that, he worked at the Korea Exchange Bank. He has a Masters Degrees in Economics from Yonsei University in Korea and University of York in England.

Control Group

Daniel C. Montano, Thomas Stegmann, Grant Gordon, Wolfgang Priemer, and Joong-Ki Baik (the “Control Group”) hold, in the aggregate, a significant majority, approximately 64.19% as of March 30, 2007, of the Company’s voting power and they, as well as their designees, will continue to comprise a majority of the Company’s Board. They entered into a Controlling Stockholders Agreement on August 30, 2004, later amended on April 13, 2006, agreeing to vote their shares together. They have filed a Schedule 13D with the SEC to report their holding of the Company’s Common Stock as a group. As a result, the Company will not have a majority of independent directors on its Board and plans to continue with a majority of directors that include members of the Control Group or its designees. In addition, directors who are members or designees of the Control Group will continue to oversee the director nomination and executive compensation functions.

6

Board Meetings and Committees

The Board of Directors of the Company held a total of four (4) meetings during the fiscal year ended December 31, 2006. Each meeting was conducted in person. Each director is expected to attend each meeting of the Board of Directors and those Committees on which he serves. All incumbent directors attended all the meetings of the Board of Directors held during the fiscal year ending December 31, 2006. All incumbent directors are encouraged to attend the Annual Meeting of Stockholders. All incumbent directors attended the 2006 Annual Meeting of Stockholders. Certain matters were approved by the Board of Directors, or a Committee of the Board of Directors, by unanimous written consent. The Board of Directors has six standing committees, which include the Audit Committee, Compensation Committee, Corporate Governance Committee, Nominating Committee, Conflicts Resolution Committee, and European Compliance Committee. The members of the Company’s Committees and the number of meetings each Committee held during the fiscal year ended December 31, 2006 are as follows:

| | | | |

Name of Committee | | Members of the Committee | | Number of Meetings in 2006 |

AUDIT COMMITTEE | | Gary B. Abromovitz, Chair Thomas L. Ingram Robert Levin | | 5 |

| | |

COMPENSATION COMMITTEE | | Gary B. Abromovitz, Chair Thomas L. Ingram Robert Levin | | 2 |

| | |

CORPORATE GOVERNANCE COMMITTEE | | Gary B. Abromovitz, Chair Thomas L. Ingram Robert Levin | | 2 |

| | |

NOMINATING COMMITTEE | | Daniel C. Montano, Chair Thomas J. Stegmann, M.D. Wolfgang Priemer, Ph.D. | | 1 |

| | |

EUROPEAN COMPLIANCE COMMITTEE | | Wolfgang Priemer, Ph.D., Chair Gary B. Abromovitz | | 0* |

| | |

CONFLICT RESOLUTION COMMITTEE | | Gary B. Abromovitz, Chair Thomas L. Ingram Robert Levin Thomas J. Stegmann Wolfgang Priemer, Ph.D. Joong Ki Baik | | 2 |

| * | The Chair reports quarterly to the Board of Directors regarding status of European compliance. Formal European Compliance Committee meetings were not necessary in 2006. |

Audit Committee

Pursuant to its charter, the Audit Committee reviews the results and scope of the annual audit and other services provided by the Company’s independent accountants, reviews and evaluates the Company’s control functions and monitors transactions between the Company’s employees, officers and directors and the Company. The Audit Committee also oversees the Company’s Code of Business Conduct. The Company believes that the composition of the Company’s Audit Committee will meet the requirements for independence under the current requirements of the SOX Act and SEC rules and regulations. The Audit Committee met five (5) times in 2006; three (3) meetings were held in person and two (2) were held telephonically.

7

Compensation Committee

Pursuant to its charter, the Compensation Committee will provide assistance to the Board of Directors by designing, recommending to the Board of Directors for approval and evaluating the Company’s compensation plans, policies and programs, especially those regarding executive compensation. It also reviews and approves the compensation of the Company’s Chief Executive Officer and other officers and directors, administers any stock-based compensation plan, and assists the Board of Directors in producing an annual report on executive compensation for inclusion in the Company’s proxy materials in accordance with applicable rules and regulations. The Company believes that the composition of the Committee meets the requirements for independence under the SOX Act and SEC rules and regulations.

Nominating Committee

Pursuant to its charter, the Nominating Committee will nominate persons to serve on the board. None of the members of the Nominating Committee is independent. All are members of the Control Group. Control of the nominating process by the Control Group is an exception to independence requirements of certain principal U.S. stock exchanges, which do not apply to the U.S. The Control Group has no present intention to turn the nominating process over to independent board members.

Notwithstanding that the Control Group intends to control the nominating process for Board members, the Nominating Committee will consider properly submitted stockholder nominations for candidates for membership on the Board of Directors. In evaluating such nominations, the Nominating Committee will seek to achieve a balance of knowledge, experience and capability on the Board of Directors. In addition, the Nominating Committee expects that members of the Board of Directors should have the highest professional and personal ethics and values; broad experience at the policy-making level in business, government, education, technology or the public interest; be committed to enhancing stockholder value; and have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them to perform responsibly all director duties.

Any stockholder nominations proposed for the Nomination Committee to consider should include the nominee’s name and qualifications for Board membership, and the nominee’s consent to serve. It should be addressed to:

Corporate Secretary

CardioVascular BioTherapeutics, Inc.

1635 Village Center Circle, Suite 250

Las Vegas, Nevada 89134

The Nominating Committee will utilize a variety of methods for identifying and evaluating nominees for director. If vacancies on the Board of Directors are anticipated, or otherwise arise, the Nominating Committee will consider various potential candidates for director. Candidates may come to the attention of the Nominating Committee through current Board members, professional search firms, stockholders or other persons. Candidates will be evaluated at regular or special meetings of the Nominating Committee. As noted above, the Nominating Committee considers properly submitted stockholder nominations for candidates for the Board of Directors to be included in the Company’s proxy statement. Following verification of the stockholder status of people proposing candidates, recommendations will be considered together by the Nominating Committee at a meeting prior to the issuance of the Company’s proxy statement for the next annual meeting. If materials are provided by the stockholder in connection with the nomination of a director candidate, such materials will be reviewed by the Nominating Committee. As noted above, in evaluating all nominations, the Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board of Directors.

Corporate Governance Committee

Pursuant to its charter, the Corporate Governance Committee will review and recommend corporate governance principles applicable to the Company, and evaluate board performance.

8

European Compliance Committee

Pursuant to its charter, the European Compliance Committee monitors the Company’s activities in Europe from the legal, regulatory and tax compliance perspectives.

Conflicts Resolution Committee

Pursuant to its charter, the Conflicts Resolution Committee acts on behalf of the Company in discussions with parties for purposes of addressing existing or potential conflicts of interest with conflicted individuals or affiliated companies such as Phage and CPI. The committee is comprised of independent directors and directors having no affiliation with Phage or CPI. At any particular time, the needs of Phage, CPI or any other related party could cause one or more of the Company’s executive officers to devote such attention at the expense of devoting attention to the Company. In addition, matters may arise that place the fiduciary duties of these individuals in conflicting positions. Furthermore, in the event a member of the Conflicts Resolution Committee has an interest in a matter under review by the Conflicts Resolution Committee, that member shall recuse himself from the matter and be replaced by a non-conflicted Board member. Potential and actual conflicts are resolved by the Conflicts Resolution Committee. The Company’s Board of Directors vests the Conflicts Resolution Committee with the authority to make decisions for it with regard to transactions that pose conflicts of interest, which decision will be communicated to and transacted by the officers of the Company.

Availability of Committee Charters

The charters for the Company’s Audit, Compensation, Corporate Governance, and Nominating committees are available on the Company’s website, www.cvbt.com.

Stockholder Communication with the Board

Stockholders who wish to communicate with the board, non-management directors as a group, a committee of the board or a specific director may do so by letters addressed in care of the Company’s Corporate Secretary at the address noted above. Letters will be reviewed by the Corporate Secretary and relayed to the addressees as appropriate.

The Board of Directors has requested that certain items unrelated to the duties and responsibilities of the Board not be relayed on to Directors. These include unsolicited marketing materials or mass mailings; unsolicited publications; surveys and questionnaires; resumes and other forms of job inquiries; and requests for business contacts or referrals. In addition, the Corporate Secretary may handle in her discretion any director communication that is an ordinary business matter including routine questions, complaints and comments, and related communications that can appropriately be handled by management.

Director Compensation

The Company’s non-employee directors are reimbursed for their out-of-pocket expenses incurred in connection with attending board and committee meetings. Each Non-Employee Director is paid $5,000 per board meeting.

Each committee member, except for the lead independent director and committee chairs, is paid $1,000 for each committee meeting attended. There is no annual retainer paid to any director. The Chair of the Audit Committee is paid an annual fee of $40,000. The Lead Independent Director presides over Executive Sessions of the Independent Directors, chairs the Compensation and Governance committees and performs the duties required by those positions in addition to his duties as Lead Independent Director. The Lead Independent Director is paid an annual fee of $60,000, but is not paid any additional sum for his role as Chair of the Compensation and Corporate Governance Committees. The Chair of the Company’s European Compliance

9

Committee is paid an annual fee of $60,000. After the effective date of the initial public offering, and after compliance with all State and Federal securities regulations, each non-employee director received a fully vested option to purchase 50,000 shares of the Company’s Common Stock at the initial public offering price. Three directors, Gary Abromovitz, Robert Levin, and Thomas Ingram, cancelled their stock option shares due to the requirements for Independent Directors of the Alternative Investment Market of the London Stock Exchange (“AIM”). In exchange, the Company granted Gary Abromovitz 32,000 shares of the Company’s common stock and Robert Levin 16,000 shares of the Company’s common stock. Thomas Ingram chose not to receive any shares of the Company’s common stock.

The table below reflects the compensation paid to Non-Employee directors in 2006:

CVBT DIRECTOR COMPENSATION PAID IN 2006

| | | | | | | | | | | | | | |

Name (a) | | Fees Earned

or Paid in

Cash ($) (b) | | Stock

Awards

($) (c) | | Option

Awards

($) (d) | | Non-Equity

Incentive Plan

Compensation

($) (e) | | Change in

Pension Value and

Nonqualified

Deferred

Compensation

Earnings

($) (f) | | All Other

Compensation

($) (g) | | Total

($) (j) |

Gary B. Abromovitz | | 119,996 | | — | | — | | — | | — | | — | | 119,996 |

Thomas I. Ingram | | 28,500 | | — | | — | | — | | — | | — | | 28,500 |

Robert Levin | | 26,000 | | — | | — | | — | | — | | — | | 26,000 |

Dr. Wolfgang Priemer | | 80,000 | | — | | — | | — | | — | | — | | 80,000 |

*Alexander G. Montano | | 15,000 | | — | | — | | — | | — | | — | | 15,000 |

Joong-Ki Baik | | 20,000 | | — | | — | | — | | — | | — | | 20,000 |

Dr. Thomas J. Stegmann | | 20,000 | | — | | — | | — | | — | | — | | 20,000 |

Grant Gordon | | 40,000 | | — | | — | | — | | — | | — | | 40,000 |

Mickael A. Flaa | | 20,000 | | — | | — | | — | | — | | — | | 20,000 |

Jack Jacobs, Ph.D. | | — | | — | | — | | — | | — | | — | | — |

Daniel C. Montano | | — | | — | | — | | — | | — | | — | | — |

| (b) | Includes director, committee and chair fees paid to non-employee directors. Employees do not receive director fees. |

| * | On August 28, 2006, Mr. Alexander Montano resigned from the CVBT Board of Directors. |

Compensation Discussion & Analysis

Overview of Compensation Program

The Compensation Committee (for purposes of this analysis, the “Committee”) of the Board has responsibility for establishing, implementing and continually monitoring adherence with the Company’s compensation philosophy, as described below. The Committee ensures that the total compensation paid to the executive management is fair, reasonable and competitive. Generally, the types of compensation and benefits provided to members of the executive management, including the named executive officers (NEOs), are similar to those provided to other executive officers.

The Committee is empowered to review and approve, or in some cases recommend for the approval of the full Board of Directors, the annual compensation and compensation procedures for the NEOs of the Company: the Chief Executive Officer, the Co-Presidents, the Chief Operating Officer, and Chief Financial Officer. Throughout this proxy statement, the individuals who served as the Company’s Chief Executive Officer and Chief Financial Officer during fiscal 2006, as well as the other individuals included in the Summary Compensation Table on page 14, are referred to as the “named executive officers” or “NEOs.”

10

Philosophy (Objectives of Compensation Program)

The Committee evaluates both performance and compensation to ensure that the Company maintains its ability to attract and retain superior executive management in key positions and that compensation provided to executive management remains competitive relative to the compensation paid to similarly situated executives of the Company’s peer companies. To that end, the Committee believes executive compensation packages provided by the Company to its executives is an important element of compensation, thus, in the future, the Company may include both cash and stock-based compensation that reward performance as measured against established goals.

The Company’s compensation program is designed to attract and retain executive management, motivating them to achieve superior performance, with the ultimate goal of increasing stockholder value over the long term. Executive compensation impacts all employees by setting general levels of compensation and helping to create an environment of goals and expectations. Because the Company believes that the performance of every employee is important to the Company’s success, it is mindful of the effect of executive compensation and incentive programs on all of its employees.

The Company believes that the compensation of the NEOs should reflect their success as a management team, rather than as individuals, in attaining key operating objectives. Such objectives include the growth of sales as the Company moves toward becoming revenue producing, growth of operating earnings and earnings per share and growth or maintenance of market share and long-term competitive advantage, with the ultimate goal of increasing the Company’s stock price. The Company believes that the performance of the NEOs in managing the Company, considered in light of general economic and specific company, industry and competitive conditions, should be the basis for determining their overall compensation. The Company also believes that their compensation should not be based on the short-term performance of the Company’s stock, whether favorable or unfavorable, but rather that the price of the Company’s stock will, in the long-term, reflect its operating performance, and ultimately, the management of the Company by its executives.

What The Company’s Compensation Program is Designed to Reward

The Company’s compensation program is designed to reward contribution to the Company. Regarding most compensation matters, including executive and director compensation, the Company’s management provides recommendations to the Committee. The Committee, however, does not delegate any of its functions to others in setting compensation. The Company does not currently engage any consultant to advise it as to executive and/or director compensation matters.

Stock price performance has not been a factor in determining annual compensation because the price of the Company’s common stock is subject to a variety of factors outside the Company’s control. The Company does not have a formula for allocating between cash and non-cash compensation.

Elements of the Company’s Compensation Plan

For the fiscal year ended December 31, 2006, the principal components of compensation for NEOs were:

Compensation Process, Factors Considered, and Determination of Compensation Amounts

Base Salary

The process for determining compensation of NEOs consists of several informal telephonic conferences of the Committee and a minimum of two formal meetings with committee members in attendance. The first formal meeting takes place at the beginning of each year. The second formal meeting generally occurs prior to the end of

11

the second quarter. The Committee reviews the current BioWorld Executive Compensation Report during telephonic meetings and at the first formal meeting. The Chairman of the Committee then briefs senior management and discusses comparisons of the BioWorld data. The Chief Executive Officer may make compensation recommendations to the Committee with respect to the NEOs who report to him. Such executive officers are not present at the time of these deliberations. The Chairman of the Committee then makes compensation recommendations to the Committee with respect to the Chief Executive Officer, who is absent from that meeting. The Committee may accept or adjust such recommendations.

Base salaries are set for the Company’s NEOs at the second meeting of the Committee and presented to the entire Board of Directors at the next regularly scheduled meeting of the Board. Throughout the year, the Committee considers recommendations from management for stock awards to eligible employees.

It is the Committee’s intention to set total executive cash compensation at a level that will attract and retain a strong and motivated leadership team.

Factors considered by the Committee in setting base compensation include:

| | • | | difficulty of achieving desired results in the coming year; |

| | • | | value of the executives’ unique skills and capabilities to support long-term performance of the Company; |

| | • | | contribution as a member of the executive management team; |

| | • | | financial reserves of the Company; and |

| | • | | peer group compensation analysis of comparable companies. |

In setting base salaries for fiscal year 2006, the Committee reviewed the 2006 BioWorld Executive Compensation Report which examined the compensation of executives in 264 public biotech companies. In addition, the Committee considered each of the factors set forth above and the internal pay equity of its executive officers. Each NEO’s current and prior compensation is considered in setting future compensation. To some extent, the Company’s compensation plan is based on the market and the companies it competes against for executive management.

These elements fit into the Company’s overall compensation objectives by helping to secure the future potential of its operations, facilitating its entry into new markets, providing proper compliance and regulatory guidance, and helping to create a cohesive team. At such time that the Company becomes revenue producing, other compensation components such as long-term equity incentive compensation, retirement and other benefits may be considered.

2004 Stock Plan

The Company’s stock option program is the primary vehicle for offering long-term incentives and rewarding its NEOs and employees. The Company also regards its stock option program as a key retention tool. This is a very important factor in the Committee’s determination of the type of award to grant and the number of underlying shares that are granted in connection with that award. Because of the direct relationship between the value of an option and the market price of the Company’s common stock, it has always believed that granting stock awards is the best method of motivating the NEOs to manage the Company in a manner that is consistent with the interests of the Company and its stockholders. However, because of the evolution of regulatory, tax and accounting treatment of equity incentive programs and because it is important to the Company to retain its NEOs and employees, it is essential to utilize other forms of equity awards as and when the Company may deem necessary.

12

Bonuses

It is the Committee general philosophy that management is rewarded for its performance. The Committee believes that this is important to aligning its NEOs and promoting teamwork among them. However, since the Company did not generate revenue in 2006 and it believes that the total compensation awarded to the NEOs met its objectives, the Company did not provide performance-based bonuses to executive officers. The Committee reserves the opportunity to award bonuses, even in the formative years of the Company before revenue is generated, if it believes it to be in the best interests of its shareholders.

Perquisites

Company perquisites are limited and not available to all employees. Mr. Montano and Dr. Jacobs are provided health insurance for themselves and family members. Dr. Jacobs is provided with a minimal automobile allowance. Mr. Montano, Dr. Stegmann, Mr. Flaa and Dr. Jacobs are provided with a personal travel benefit for spouses if travel exceeds one week and they choose to bring their spouse on the trip.

Retirement and Other Benefits

The Company offers a 401k plan to its full-time employees. The Company is not obligated to make contributions to the 401k plan. In 2006, the Company did not make any contributions to the 401k plan, though several employees participated in the 401k plan with their own contributions. The Company does not provide pension plans, supplemental executive retirement plans (SERPS), deferred compensation plans, post-retirement health coverage, change in control provisions, golden parachute arrangements, gross-up provisions, termination pay, life insurance benefits, or similar benefits for NEOs or employees. The Committee may consider offering other forms of retirement plans, such as pensions, savings plans or other similar benefits in the future as the Company gets closer to becoming revenue producing.

13

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Summary Compensation Table

Out of the four NEOs, two presently serve under the Company’s employment contract. The following table sets forth summary information concerning compensation of the Company’s Chief Executive Officer and each of the other current executive officers during these fiscal years ended December 31, 2006, 2005 and 2004. The Company refers to these persons as its NEOs.

SUMMARY NAMED EXECUTIVE OFFICER COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position (a) | | Year

(b) | | Salary ($) (c) | | Bonus

($) (d) | | Stock

Awards ($) (e) | | Option

Awards

($) (f) | | | Non-Equity

Incentive Plan

Compensation

($) (g) | | Change in

Pension Value and

Nonqualified

Deferred

Compensation

Earnings ($) (h)1 | | All Other

Compensation

($) (i) | | | Total ($) (j) |

Daniel C. Montano(2) President and Chief Executive Officer | | 2006

2005

2004 | | 480,000

431,538

286,154 | | 0

0

0 | | 0

0

0 | | 0

0

0 |

| | 0

0

0 | | 0

0

0 | | 0

12,885

0 |

(2)

| | 480,000

458,760

299,039 |

Mickael A. Flaa(1) (2) Chief Financial Officer | | 2006

2005

2004 | | 240,000

260,000

118,000 | | 0

0

0 | | 0

0

0 | | 1,602,500

0

0 | (3)

| | 0

0

0 | | 0

0

0 | | 22,861

5,110

0 | (2)

(2)

| | 1,865,361

265,110

118,000 |

John W. Jacobs(2) (4) Vice President, Chief Operating Officer and Chief Scientific Officer | | 2006

2005

2004 | | 240,000

207,787

126,000 | | 0

0

0 | | 0

0

0 | | 0

0

0 |

| | 0

0

0 | | 0

0

0 | | 6,000

11,162

6,000 | (4)

(2)(4)

(2) | | 246,000

218,949

132,000 |

Thomas Stegmann(1) (3) (5) Chief Medical Officer | | 2006

2005

2004 | | 480,000

379,250

258,000 | | 0

0

0 | | 0

0

0 | | 0

0

0 |

| | 0

0

0 | | 0

0

0 | | 17,523

32,477

0 | (5)

(5)

| | 497,523

392,477

258,000 |

| | (1) | Mr. Flaa and Dr. Stegmann are not employees. Their compensation is paid in the form of consulting fees. |

| | (2) | Includes travel for spouse of executive directors. |

| | (3) | Warrant, a form of option grant, issued to Mr. Flaa, a non-employee in his capacity as an officer, to purchase 250,000 shares of Common Stock at $10.00 per share, the amount reflects compensation expense calculated using Black Scholes recorded for the warrant as of the date of grant. |

| | (4) | Includes for vehicle allowance |

| | (h)1 | The Company currently provides no Pension Plan Compensation. |

14

Warrant Grants in Last Fiscal Year

Pursuant to a compensation arrangement approved by the Board of Directors, warrants to purchase 250,000 shares of Common Stock were issued to the Company’s Chief Financial Officer, Mickael A. Flaa, in 2006 in his capacity as an officer. The following table sets forth information with respect to warrants to purchase Common Stock granted to the Company’s NEOs during the fiscal year ended December 31, 2006.

Warrant Grants in 2006

| | | | | | | | | | | | | | | | |

| | | Number of Securities Underlying

Warrant Granted | | Percent of Total Warrants Granted to

Officers/Employees(1) | | | Exercise

Price per

Share(2) | | Expiration

Date | | Potential Realizable Value

at Assumed Annual Rates

of Stock Price

Appreciation for Warrant Term |

| | | | | | | 5% | | 10% |

Mickael A. Flaa | | 250,000 | | 100 | % | | $ | 10.00 | | 4/3/2016 | | $ | 676,345 | | $ | 2,557,798 |

(1) | Based on a total of warrants granted to all officers and employees in the fiscal year ended December 31, 2006. |

(2) | The exercise price of the warrant is equal to the initial public offering price of $10 as determined by the Company’s Board of Directors and was above the quoted market price of the Company’s stock on the date of grant. |

The fair market value of the shares underlying the warrants granted to Michael A. Flaa on April 3, 2006 was $7.80, which was the closing price of March 31, 2006, the day before the date of grant.

EQUITY COMPENSATION PLAN TABLE

The following table sets forth additional information as of December 31, 2006, about our Common Shares that may be issued upon the exercise of options and other rights under our existing equity compensation plans and arrangements, divided between plans approved by our shareholders and plans or arrangements not submitted to our shareholders for approval. The information includes the number of shares covered by, and the weighted average exercise price of, outstanding options, warrants and other rights and the number of shares remaining available for future grants, excluding the shares to be issued upon exercise of outstanding options, warrants, and other rights.

| | | | | | | | |

Plan Category | | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights (a) | | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | Number of securities

remaining available

for issuance under equity compensation plans (excluding

securities reflected

in column (a))(c) |

Equity compensation plans approved by security holders(1) | | 403,550 | (2) | | $ | 10.00 | | 4,596,450 |

Equity compensation plans not approved by security holders | | N/A | | | | N/A | | N/A |

| | | | | | | | |

Total | | 403,550 | | | $ | 10.00 | | 4,596,450 |

| | | | | | | | |

(2) | As of the date of this table there are no warrants, Stock Appreciation Rights or restricted stock issued under the 2004 Stock Plan. |

15

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| | | | | | | | | | | | | | | | | | | | |

| | | Option awards | | Stock Awards |

(a) | | (b) | | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) | | (j) |

Name | | Number of

securities

underlying

unexercised

options (#)

exercisable | | | Number of

securities

underlying

unexercised

options (#)

unexercisable | | Equity

incentive

plan

awards:

Number of

securities

underlying

unexercised

unearned

options (#) | | Option

exercise

price ($) | | Option

expiration

date | | Number

of shares

or units

of stock

that

have not

vested (#) | | Market

value of

shares or

units of

stock

that have

not

vested ($) | | Equity

incentive

plan

awards:

Number of

unearned

shares,

units or

other

rights that

have not

vested (#) | | Equity

incentive

plan

awards:

Market or

payout

value of

unearned

shares,

units or

other

rights that

have not

vested ($) |

Daniel C. Montano | | — | | | — | | — | | $ | — | | — | | — | | — | | — | | — |

Thomas J. Stegmann | | 50,000 | (1) | | — | | — | | $ | 10.00 | | 2/8/2016 | | — | | — | | — | | — |

Mickael A. Flaa | | 50,000

200,000

250,000 | (2)

(3)

(3) | | —

—

— | | —

—

— | | $

$

$ | 10.00

2.00

10.00 | | 8/15/2015

6/23/2013

4/3/2016 | | —

—

— | | —

—

— | | —

—

— | | —

—

— |

John W. Jacobs | | 500,000 | (4) | | — | | — | | $ | 0.30 | | 1/12/2010 | | — | | — | | — | | — |

(1) | Option award to Dr. Stegmann from the 2004 Stock Plan in his capacity as a director. |

(2) | Option award to Mr. Flaa from the 2004 Stock Plan in his capacity as a director. |

(3) | Warrant issued to Mr. Flaa in his capacity as an officer. |

(4) | On January 1, 2000, John W. Jacobs was originally granted a stock option to purchase 1,000,000 shares of Common Stock of the Issuer. He transferred an option to purchase 500,000 shares of Common Stock of the Issuer to Ellen Simpson on 12.1.06 without consideration, pursuant to a separation of assets agreement. |

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to beneficial ownership of the Company’s Common Stock as of March 30, 2007 by: (i) each person known by the Company to be the beneficial owner of more than 5% of the Company’s Common Stock, (ii) by each director, (iii) by each of the Company’s NEOs and (iv) all directors and executive officers as a group. Except as otherwise indicated, the address for each person is 1635 Village Center Circle, Suite 250, Las Vegas, Nevada 89134. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Except as otherwise indicated in the footnotes to the table, and subject to community property laws, where applicable, the persons and entities identified in the table below have sole voting and investment power with respect to all shares beneficially owned. The number of shares of Common Stock outstanding used in calculating the percentage for each listed person includes shares of Common Stock underlying options or warrants held by such person that are exercisable within 60 calendar days of April 3, 2006, but excludes shares of Common Stock underlying options or warrants held by any other person. Percentage of beneficial ownership is based on 129,457,198 shares of Common Stock outstanding as of March 30, 2007.

| | | | | |

| | | Shares Beneficially Owned | |

Name of Beneficial Owner | | Number of Shares

of Common Stock | | % of

Outstanding

Common

Stock | |

Daniel C. Montano (1) (11) (12) | | 30,812,131 | | 23.80 | % |

Thomas Stegmann, M.D.(2) (11) (12) | | 30,107,130 | | 23.26 | % |

Wolfgang Priemer, Ph.D.(3) (11) (12) | | 15,050,001 | | 11.63 | % |

Grant Gordon(4) (11) | | 5,550,001 | | 4.29 | % |

Joong Ki Baik(5) (11) | | 1,581,783 | | 1.22 | % |

John (Jack) W. Jacobs, Ph.D.(6) | | 625,001 | | * | |

Thomas L. Ingram(7) | | 620,001 | | * | |

Mickael A. Flaa(8) | | 500,001 | | * | |

Robert Levin(9) | | 175,926 | | * | |

Gary B. Abromovitz(10) | | 34,001 | | * | |

All Directors and Named Executives | | 85,055,976 | | 65.70 | % |

Control Group(11) (12) | | 83,101,046 | | 64.19 | % |

(1) | Mr. Montano’s holdings include 630,000 shares held in the name of Qure Biopharmaceuticals, Inc. (“Qure”). Mr. Montano is a majority owner of Qure and has sole voting and investment control. His holdings also include 30,000,000 shares held in the name of Vizier Investment Capital. Mr. Montano owns 50% of Vizier Investment Capital and has sole voting and investment control over these shares. Mr. Montano owns 57,131 shares of Common Stock and possesses voting and investment control over these shares. Mr. Montano’s spouse indirectly holds 125,000 shares and has sole voting and investment control over these shares. Principal address for Qure Biopharmaceuticals, Inc. is 24975 Heartwood Circle, Lake Forest, CA 92630 and Vizier Investment Capital Ltd. is 2877 Paradise Road, Unit 901, Las Vegas, NV 89109. |

(2) | Dr. Thomas Stegmann owns 30,107,130 shares of Common Stock of the Company. He possesses voting and investment control over these shares. Includes 50,000 shares of Common Stock issuable pursuant to options exercisable within sixty days of the date of this proxy statement. |

(3) | Wolfgang Priemer, Ph.D. owns 15,000,000 shares of Common Stock of the Company and has voting and investment control over these shares held in the name of WOBEMA. Dr. Priemer owns one (1) share of Common Stock held in his name and has voting and investment control over these shares. Dr. Priemer also owns 50,000 shares of Common Stock issuable pursuant to options exercisable within sixty days of the date of this proxy statement. |

17

(4) | Mr. Gordon and his ex-wife have joint voting and investment control over 3,000,000 shares held in the name of GHL Financial Services, Ltd., Principal address for GHL Financial Services Ltd. is Unit 411, Chyland Pioneer, Mandaluyong, Manila Phillippines. Mr. Gordon owns 2,550,000 shares of Common Stock of the Company in his own name and has voting and investment control over these shares held in the name of GHL Financial Services, Ltd. Mr. Gordon also owns one (1) share of Common Stock held in his name and has voting and investment control over these shares. Includes 50,000 shares of Common Stock issuable pursuant to options exercisable within sixty days of the date of this proxy statement. |

(5) | Joong Ki Baik owns 1,581,783 shares of Common Stock of the Company in his own name and has voting and investment control over these shares. Mr. Baik and his wife jointly control Alhambra, Inc. which owns 1,431,782 shares. Mr. Baik and his wife have joint voting and investment control over the shares held in the name of Alhambra, Inc. Alhambra, Inc.’s Principal address is Unit 301 Gabriel 111 Condominium San Miguel Avenue, Ortigas Center, Pasig City, Phillippines. Includes 50,000 shares of Common Stock issuable pursuant to options exercisable within sixty days of the date of this proxy statement. |

(6) | Dr. Jacobs owns 625,001 shares of Common Stock in his own name and has voting and investment control over these shares. Includes 500,000 shares of Common Stock issuable pursuant to options exercisable within sixty days of the date of this proxy statement.He transferred an option to purchase 500,000 shares of Common Stock of the Company to Ellen Simpson on 12.1.06 without consideration, pursuant to a separation of assets agreement. |

(7) | As trustee of the Ingram Living Trust, Mr. Ingram has voting and investment control over 620,000 shares of Common Stock. He also owns one (1) share of Common Stock in his own name and has voting and investment control over this share. |

(8) | Mr. Flaa holds voting and investment control over an immediately exercisable warrant to purchase 200,000 shares of Common Stock at $2.00 per share. Mr. Flaa also holds voting and investment control over an immediately exercisable warrant to purchase 250,000 shares of Common Stock at $10.00 per share. Mr. Flaa also owns one (1) share of Common Stock held in his name. In addition, Mr. Flaa owns 50,000 shares of Common Stock issuable pursuant to options exercisable within sixty days of this proxy statement |

(9) | As trustee of the Robert Levin Trust, Mr. Levin has voting and investment control over 166,000 shares. He also owns one (1) share of Common Stock in his own name and has voting and investment control over this share. Mr. Levin’s spouse holds directly 9,925 shares of Common Stock in her own name and has voting and investment control over these shares. |

(10) | Mr. Abromovitz owns 32,001 shares and has voting control over 2,000 shares held in the name of Klanco, L.L.C., an Arizona limited liability company, located at 213 W. Montebello Ave., Phoenix, AZ 85013. Mr. Abromovitz and his wife have voting and investment control over these shares. |

(11) | The Control Group consists of Daniel C. Montano, Thomas Stegmann, M.D., Wolfgang Priemer, Ph.D., Joong Ki Baik and Grant Gordon. |

(12) | Daniel C. Montano’s address is 2877 Paradise Rd., Unit 901, Las Vegas, NV 89109. Dr. Thomas Stegmann’s address is Spiegel – Str. 10, 36100 Petersberg, Germany. Dr. Wolfgang Priemer’s address is 15 Gaus Street, Buende Germany D-32257. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors, executive officers, and persons who own more than ten percent (10%) of a registered class of the Company’s equity securities (“10% Stockholders”) to file with the SEC reports of ownership on Form 3 and reports of changes in ownership on Form 4 or Form 5. Such executive officers, directors, and 10% Stockholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) forms that they file. Based solely on its review of the copies of such forms received by the Company and written representations from certain reporting persons, except as set forth below, the Company believes that through the Record Date its executive officers, directors, and 10% Stockholders have complied with all applicable Section 16(a) filing requirements. One Form 4 was filed late for Robert Levin for the Robert Levin Trust reporting one transaction. One Form 4 was filed late for Mickael A. Flaa reporting one transaction.

18

Ethical Considerations

The Company has adopted a Code of Business Conduct and a Code of Ethics for Senior Financial Officers. Copies of each are available on written request to the Secretary of the Company. A copy of the Company’s Code of Business Conduct is also available on the Company’s website, www.cvbt.com.

19

THE COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Determination of the Mix of Compensation Components

The Committee considers the full range of pay components, including, but not limited to, structure of programs, desired mix of cash and equity awards, goals for distribution of awards throughout the Company, how executive pay relates to the pay of other employees, desirability of employment contracts, supplemental executive retirement plans (SERPS), deferred compensation arrangements, recent compensation history, and perks. The Company began trading on the OTC Bulletin Board on March 10, 2005, and is not expected to generate revenue until it obtains FDA approval of FGF-1141 which can take several years. Therefore, the Committee believes that many of the provisions commonly found in employment agreements for executives employed by companies generating income would not be appropriate to include at the present time. However, as the Company matures and/or products are developed and marketed, the Committee’s goal is to achieve a balanced pay-for-performance executive compensation package. The Committee has reviewed all components of the CEO’s and NEOs’ compensation as set forth in the Summary Compensation Table.

Deductibility of Compensation Under Internal Revenue Code Section 162 (m)

Section 162(m) of the Internal Revenue Code, adopted in 1993, imposes a $1 million cap, subject to certain exceptions, on the deductibility to a company of compensation paid to the NEOs in such company’s proxy statement. The compensation paid this fiscal year subject to the Section 162(m) cap is not expected to exceed $1 million for any NEO. Therefore, the Committee believes that the Company will not be subject to any Section 162(m) limitations on the deductibility of compensation paid to the Company’s NEOs for fiscal year 2006.

Compensation Comparison to Companies Reviewed in the 2006 BioWorld® Executive Compensation Report

CEO Compensation. The average total CEO compensation in 2006, defined as base pay plus bonus, published in the BioWorld® Executive Compensation Report for 2006, was $596,000. The salary of the Company’s CEO, Mr. Montano, for the full 2006 calendar year was $480,000. The Committee did not award any additional equity based compensation or bonus to Mr. Montano in 2006.

Chief Medical Officer and Co-President Compensation.The salary reflected in the Summary Compensation Table for Dr. Stegmann, the Company’s Chief Medical Officer, Co-Founder, and Co-President, is $480,000 plus a one-time perquisite of $50,000 in 2005 for tax planning in consideration of Dr. Stegmann’s agreement to devote his full time to the Company. Dr. Stegmann received $480,000 pursuant to his 2006 compensation plan. This position was not reported in the BioWorld Executive Compensation Report.

Research and Development Executive Compensation. The average 2006 total compensation reported by 146 companies with titles suggesting responsibilities for research and development activities was $276,000. Dr. Jacobs, the Company’s Chief Scientific Officer, received a fiscal year 2006 compensation of $212,160.

CFO Compensation. The average total CFO compensation in 2006 for 264 biotech companies surveyed was $251,000. Mr. Flaa’s salary for fiscal year 2006 was $240,000. He received a warrant, as reflected in the Summary Compensation Table. His average total compensation is within acceptable standards when compared with other executives engaged in duties of the CFO and Treasurer of public companies in the industry.

The Committee believes that the Company’s internal pay equity (the relative difference between the CEO’s compensation and the compensation of the company’s other executives) is consistent with the differences found in the biotechnology industry as disclosed in the BioWorld® Executive Compensation Report 2006.

The Committee, after discussion with management, concludes that although the CEO and each of the NEOs have other business interests outside the Company, either with related companies or personal investments, that each devotes such time, attention, skill and effort as is necessary to the faithful performance and discharge of his duties as required by his position as an executive of the Company.

20

Continuing Education Philosophy of Compensation Committee

Committee members are encouraged to avail themselves of the wealth of information regarding compensation issues provided by various organizations and made available to directors of public companies. The Committee Chair is a member of the National Association of Corporate Directors and has attended each of the Executive Compensation Conferences, co-sponsored by the NASPP since its inception either in person or via the internet broadcast. In 2006, Mr. Abromovitz, Committee Chair and Mr. Roth, General Counsel, both attended the Executive Compensation Conference in person. The Committee has been briefed on the SEC disclosure proposals for executive compensation and will continue to review sections of the SEC, NASDAQ, Sarbanes-Oxley rules, and ISS updates devoted to compensation matters, at each committee meeting of its members as part of its ongoing plan for director education.

Conclusion

The Committee has reviewed and discussed the Compensation Discussion and Analysis (the “CD&A”) for the year ended December 31, 2006 with management. In reliance on the reviews and discussions referred to above, the compensation committee recommended to the board, and the board has approved, that the CD&A be included in the proxy statement for the year ended December 31, 2006 for filing with the SEC.

Respectfully submitted,

Gary B. Abromovitz, Chair

Thomas L. Ingram

Robert Levin

21

RELATED PARTY TRANSACTIONS

The Company is a member of an affiliated group, through common management, which includes Phage Biotechnology Corporation (“Phage”), Cardio Phage International Inc. (“CPI”), Qure Biopharmaceuticals, Inc. (“Qure”), known collectively as the “affiliates.” Daniel C. Montano, John W. Jacobs and Mickael A. Flaa are, respectively, Chairman of the Board/Chief Executive Officer, Chief Operating Officer/Chief Scientific Officer, and Chief Financial Officer of both the Company and Phage. Mr. Flaa and Mr. Jacobs are on Phage’s board of directors. Daniel C. Montano is a principal stockholder in the Company, Phage, and Qure. The common management of Phage and the Company spend a sufficient amount of their business time to satisfy their duties with each company and the remaining balance to other interests.

The Company’s directors have determined that if any future conflicts of interest arise with affiliated companies such conflicts will be resolved by the Company’s Independent Directors and Directors having no affiliation with the affiliated company in question, through the Conflicts Resolution Committee which is constituted when necessary and is chaired by Gary B. Abromovitz.

The following are the business activities performed by each affiliate:

| | • | | Phage is a developer of recombinant protein pharmaceuticals; certain of the Company’s officers and directors as of March 31, 2007 control 27% of the outstanding common stock of Phage as of March 31, 2007. As of March 31, 2007, the Company owns 4.3% of the Common Stock of Phage; |

| | • | | CPI is a distributor for the future products for both Phage and the Company in locations throughout the world other than North America, Europe, Japan, and, with respect to the Company only, the Republic of Korea, China, and Taiwan. Cardio and Phage each own 43% of CPI and each is able to appoint 45% of CPI’s directors; and |

| | • | | Qure was developing commercial medical applications. |

During the period from 1999 through 2001, the Company entered into transactions with Qure pursuant to which they paid expenses on the Company’s behalf aggregating $187,600. Qure owns 630,000 shares of the Company’s Common Stock as of March 31, 2007.

Grant Gordon is Vice Chairman of the Board of Directors of the Company and is also a principal of GHL Financial Services Ltd. (“GHL”). GHL and Zimmerman Adams International (“ZAI”) have entered into a sub-placing agreement whereby GHL is to serve as a sub-placing agent to ZAI. Upon funds raised for the Placing from subscribers procured by GHL, in its capacity as sub-placing agent to ZAI, a commission of six percent (6%) of the aggregate value at the Placing Price of the Placing Shares subscribed by such investors pursuant to the Placing, will be payable to GHL.

Administrative Support

For the years December 31, 2004, 2005 and 2006 and the period from March 11, 1998 (inception) to December 31, 2006 Phage provided the Company with administrative support in Phage’s research facility and billed the Company for Phage’s actual costs incurred plus the Company’s pro-rata share (based on costs incurred for the Company as compared to total Phage overhead costs) of Phage’s overhead costs. Payments to Phage for such support for the years ended December 31, 2004, 2005 and 2006 and the period from March 11, 1998 (inception) to December 31, 2006 were $181,348, $263,922, $144,963, $1,160,421, respectively.

Joint Patent Agreement

Cardio has a Joint Patent Agreement with Phage. Under that agreement, Cardio and Phage, respectively, own an undivided one half interest in the U.S. and foreign patent rights, including rights to future patents and patent applications, necessary to develop and commercialize our drug candidates; and Phage agrees to provide

22

certain technical development services to Cardio and to manufacture our drug candidates for Cardio’s clinical trials at cost. The parties acknowledged that Cardio would have exclusive rights within a defined field, while Phage would have exclusive rights outside that field. Any product Phage manufactures for Cardio commercialization purposes is paid for on a percentage of sales basis as defined in the agreement. As a part of this agreement, (i) Cardio shall pay Phage a six percent (6%) royalty on the net sales price of finished product to end customer or distributor, in consideration for the grant of the exclusive right to patent rights in the defined field, and (ii) pay to Phage four percent (4%) of net sales for our drug candidates manufactured for Cardio by Phage. The agreement also provides for each party to have certain rights in the event of insolvency of the other party. This agreement expires on the last to expire of the patent rights covered, including extensions.

Currently it is the Company’s intention to contract with Phage for manufacturing of its drug candidates for the ongoing FDA trials and for further commercial production. However, the Company has the right to and may choose to use a third party for manufacturing. Phage is manufacturing the drug candidates for the Company in its clinical trials, and may manufacture them for subsequent commercial production.

Furthermore, the Company paid Phage for technical development services and for manufacture of its drug candidates for clinical trials, which Phage provided to the Company at cost. For the years December 31, 2004, 2005 and 2006 and the period from March 11, 1998 (inception) to December 31, 2006 payments to Phage relating to such services were $181,936, $578,052, $2,372,817, and $3,935,822, respectively.

Distribution Agreement

Phage and the Company have entered into a distribution agreement with CPI to handle future distribution of the Company’s drug candidates and any other products licensed to CPI when available for commercial distribution. CPI’s territory is limited to areas other than the United States, Canada, Europe (defined as the Ural Mountains west including Iceland, excluding Turkey and Cyprus), Japan and with respect to the Company only, the Republic of Korea, China and Taiwan. Phage and the Company each own approximately 43% of the CPI outstanding stock and the companies have the right to each appoint 45% of the CPI board. The Company has made no payments to CPI and does not anticipate making any payments in the near future.

As of December 31, 2004, the Company’s 43% interest in Cardio Phage International (CPI), was being accounted for under the equity method. As of December 31, 2006 the Company’s statement of operations includes a loss of $43,304,891, which represents the Company’s equity in loss on its investment in CPI. The loss reduced the Company’s investment in CPI to zero and, as a consequence, the Company’s future financial results will not be negatively affected by CPI’s ongoing operations. The Company has no obligation to fund future operating losses nor has any guarantees on any of CPI’s obligations. There is no material difference between the Company’s carrying value for CPI and underlying equity in CPI’s net assets. There is no quoted market price for CPI’s net assets. There is no quoted market price for CPI’s shares.

Royalty Agreement

The Company has entered into an agreement with Dr. Stegmann, one of its directors, Co-President and the Company’s Chief Medical Officer, whereby the Company will pay Dr. Stegmann a royalty of one percent (1%) of the Company’s net revenue (as defined) from commercial sales of all inventions relating to growth factors in exchange for rights granted to the Company to utilize the results of Dr. Stegmann’s German clinical trials. This agreement terminates on December 31, 2013. The Company has made no payments to Dr. Stegmann under this agreement.

23

Asia Exclusive Patent License and Distribution Agreement