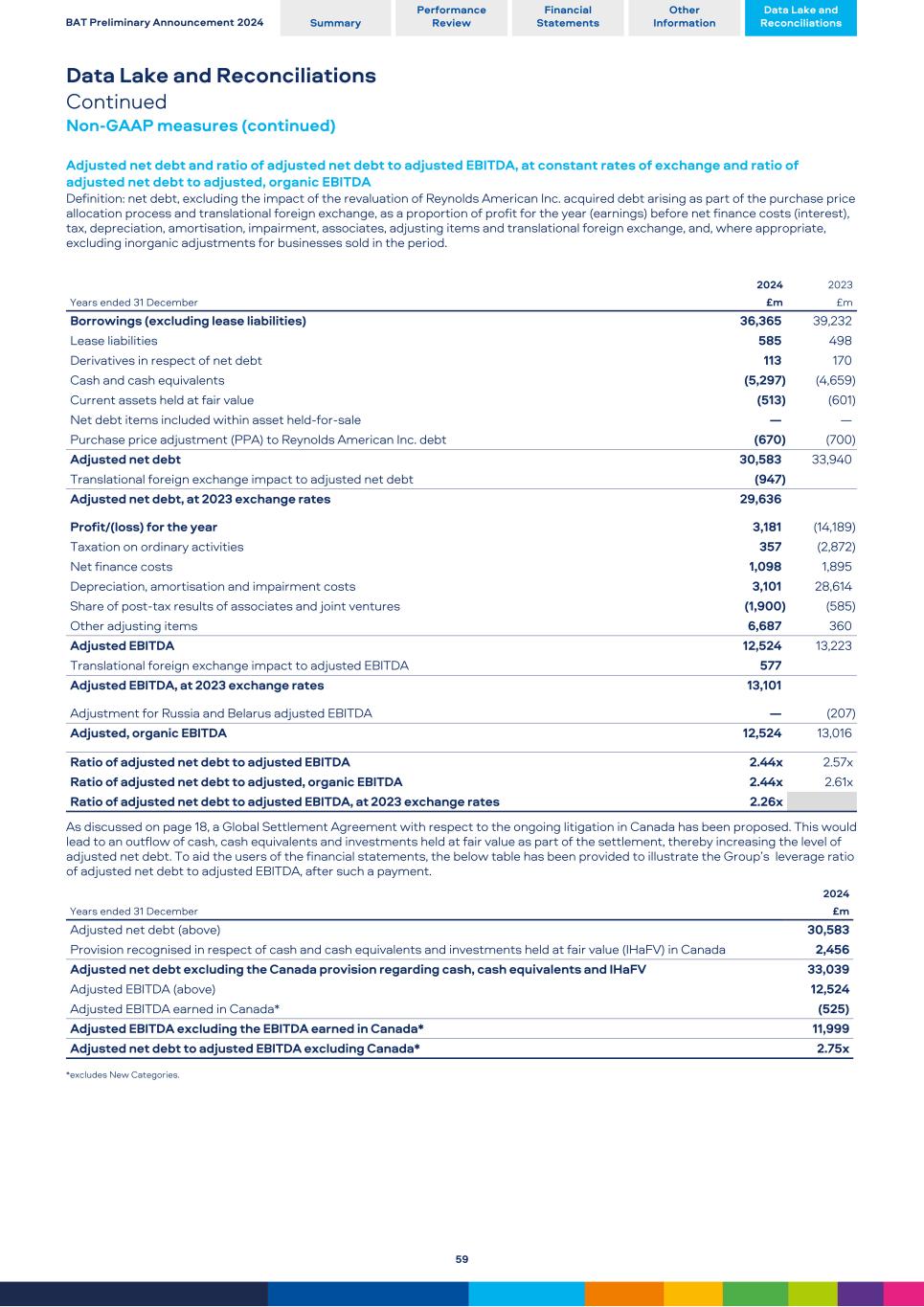

13 February 2025 – Press Release/Preliminary Results British American Tobacco p.l.c. Preliminary results for the year ended 31 December 2024 Building a Smokeless World Tadeu Marroco, Chief Executive “We are committed to Building a Smokeless World and becoming a predominantly Smokeless business by 2035. I am confident that we have the right strategy, science, innovation, breadth of capabilities and people to achieve this ambition and deliver long-term sustainable value for all our stakeholders. 2024 was an investment year with delivery in line with our guidance. We continued our transformation this year, adding 3.6 million adult consumers (to a total of 29.1 million) of our Smokeless products, which now account for 17.5% of Group revenue, an increase of 1.0 ppts vs FY23. Our performance has accelerated in the second half, driven by the phasing of New Categories innovation and the benefits of investment in U.S. commercial actions, together with the unwind of related wholesaler inventory movements. Our focus on Quality Growth delivered better returns on more targeted investments across all three New Categories, and our prioritisation and focus is already transforming our business performance in Europe. We made further progress on increasing profitability across New Categories, and I am particularly pleased with our performance in Modern Oral. In the U.S., our targeted investments have strengthened the business, despite a challenging macro-economic backdrop and a growing presence of illicit single-use vapour products. Through our commercial actions, we started to improve our performance with sharper execution and we are opening up untapped growth opportunities, particularly related to Modern Oral. We have achieved another strong performance in AME and APMEA, with their combined results delivering in line with our mid-term algorithm. We are making good progress and while there is still more to do, I am certain that the investment actions taken in 2024 are the right way forward for BAT. Our foundations are strong and we will continue to reward shareholders through our strong cash returns, including our progressive dividend and sustainable share buy-back. In 2025, while we expect significant regulatory and fiscal headwinds in Bangladesh and Australia to impact our combustibles performance, I am confident that we will progressively build on our delivery as we shift from investment to deployment and we remain committed to returning to our mid-term guidance of 3-5% revenue and 4-6% adjusted profit from operations* growth on a constant currency in 2026." Summary – Revenue down 5.2%, driven by the sale of our businesses in Russia and Belarus in September 2023 and translational FX headwinds – Organic revenue up 1.3% (at constant rates), driven by New Categories revenue up 8.9% – Total combustibles organic revenue increased 0.1% (at constant rates), as organic price/mix of +5.3% was offset by 5.2% lower volume – Reported profit from operations of £2,736m (2023: loss of £15,751m) with 2024 including a provision of £6.2 billion in respect of the proposed settlement in Canada, while 2023 was negatively impacted by one-off impairment charges largely in the U.S. – Adjusted organic profit from operations up 1.4% (at constant rates), driven by AME and APMEA – New Categories contribution increased by £251 million on an adjusted organic, constant FX basis, with category contribution margin now at 7.1%, an increase of 7.1 ppts on 2023 – Reported diluted EPS at 136.0p; adjusted organic diluted EPS up 3.6% (at constant rates) – Free cash flow of £7,901 million; adjusted net debt / adjusted EBITDA down 0.13x to 2.44x (down 0.3x at constant rates) – Dividend growth of 2.0% to 240.24p - with £900 million share buy-back planned in 2025 – Continued Sustainability progress - launched OmniTM, a major global initiative to help in making a Smokeless World a reality Performance highlights Reported Adjusted2 Adjusted2 Organic3 For year ended 31 December 2024 Current vs 2023 Current vs 2023 vs 2023 rates (current) rates (constant) (constant) Cigarette and HP volume share +10 bps Cigarette and HP value share -30 bps Consumers of Smokeless products1 29.1m +3.6m Revenue (£m) £25,867m -5.2% £25,867m -0.5 % +1.3 % Revenue from New Categories (£m) £3,432m +2.5% £3,432m +6.1 % +8.9 % Smokeless revenue as a % of total revenue (%) 17.5% +1.0 ppts Profit from operations (£m) £2,736m n/m £11,890m -0.2 % +1.4 % Adjusted gross profit growth (%) +0.5 % +2.2 % Category contribution - New Categories (£m) £249m n/m n/m Category contribution margin - New Categories (%)** 7.1% +6.6 ppts +7.1 ppts Operating margin (%) +10.6% 68.3 ppts +46.0% +10 bps flat Diluted earnings per share (pence) 136.0p n/m 362.5p +1.7 % +3.6 % Net cash generated from operating activities (£m) £10,125m -5.5% Free cash pre-dividend (£m) £7,901m -5.5 % Cash conversion (%) +370% +438 ppts +101% 30 bps Borrowings including lease liabilities (£m) £36,950m -7.0% Adjusted net debt to adjusted EBITDA ratio 2.44x -0.13x Dividend per share (pence) 240.24 +2.0% The use of non-GAAP measures, including adjusting items and constant currencies, are further discussed from page 49, with reconciliation from the most comparable IFRS measure provided. Notes: 1. Internal estimate, see page 43 for a discussion on the revision to prior estimates. 2. See page 29 for discussion on adjusting items. 3. Organic measures exclude the performance of businesses sold (including the Group's Russian and Belarusian businesses) or acquired, or that have an enduring structural change impacting performance that may significantly affect the users' understanding of the Group's performance in the current and comparator periods to ensure like-for-like assessment across all periods. * Due to the uncertainty around the timing of any settlement in Canada, the Group will present certain measures excluding the profit earned from ITCAN (except for New Categories) for 2025, with 2024 comparatives rebased accordingly. Please refer to page 18. ** measure presented at constant rates only. n/m refers to movements that are not meaningful as prior year was a loss. EXHIBIT 1 1

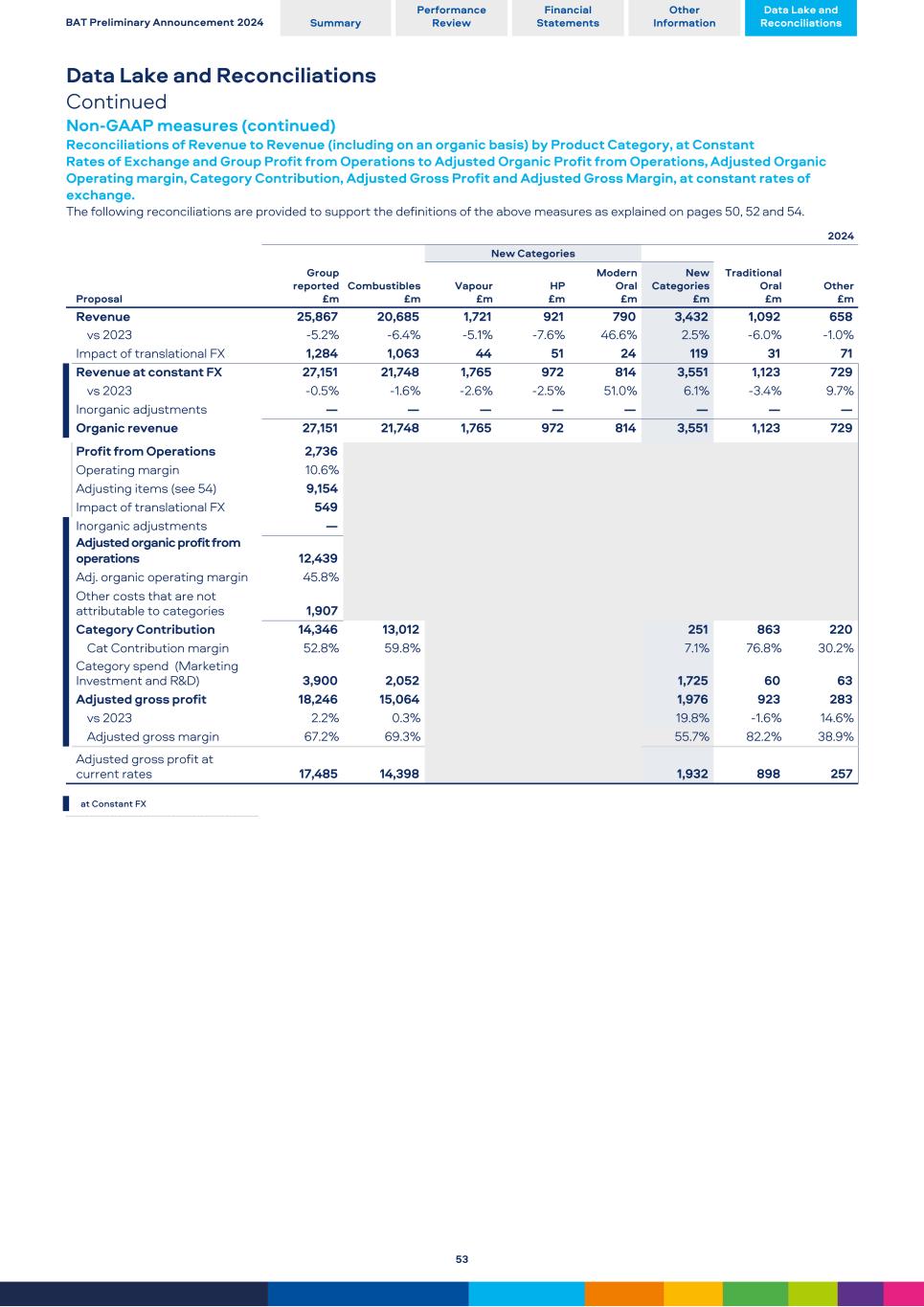

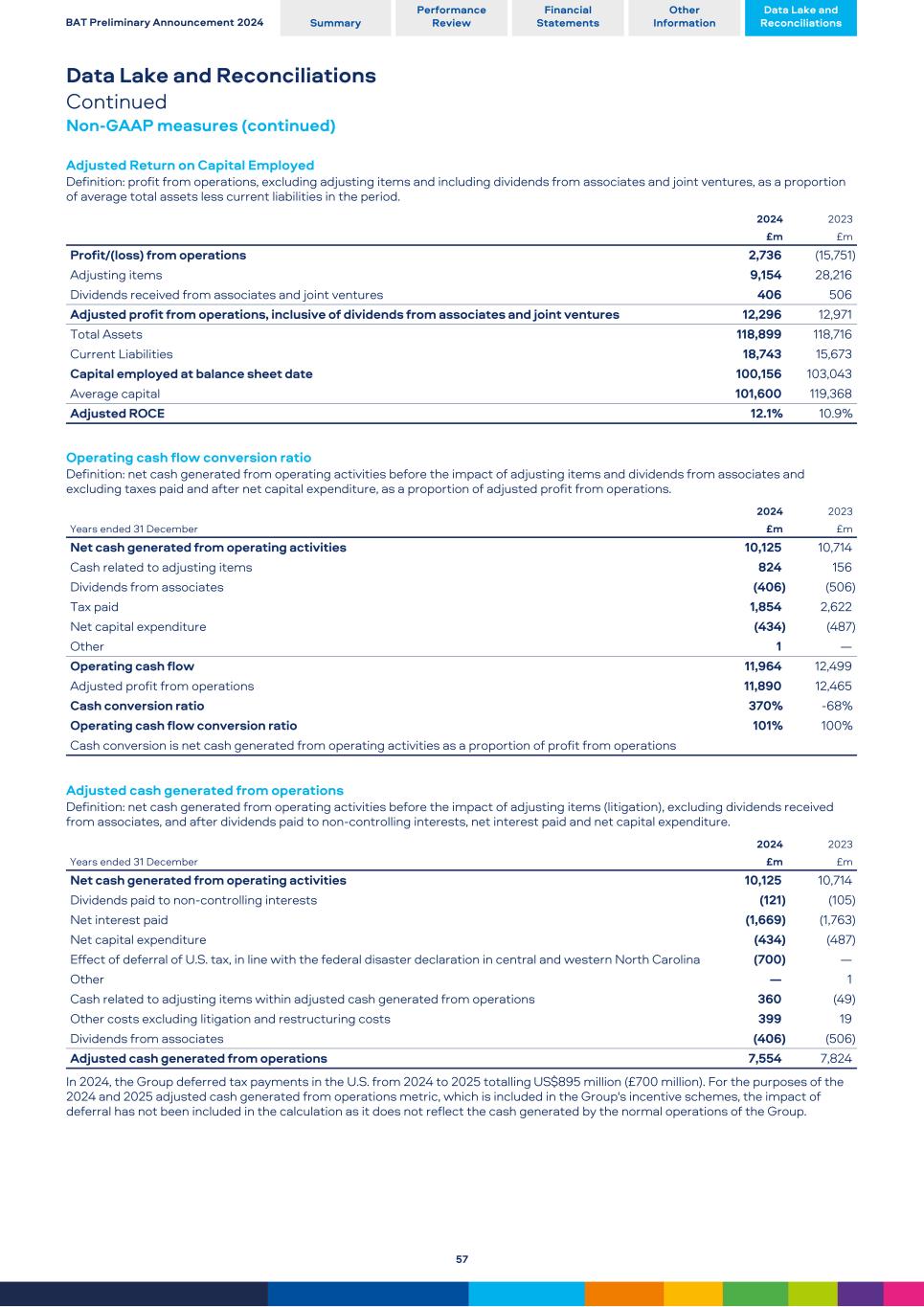

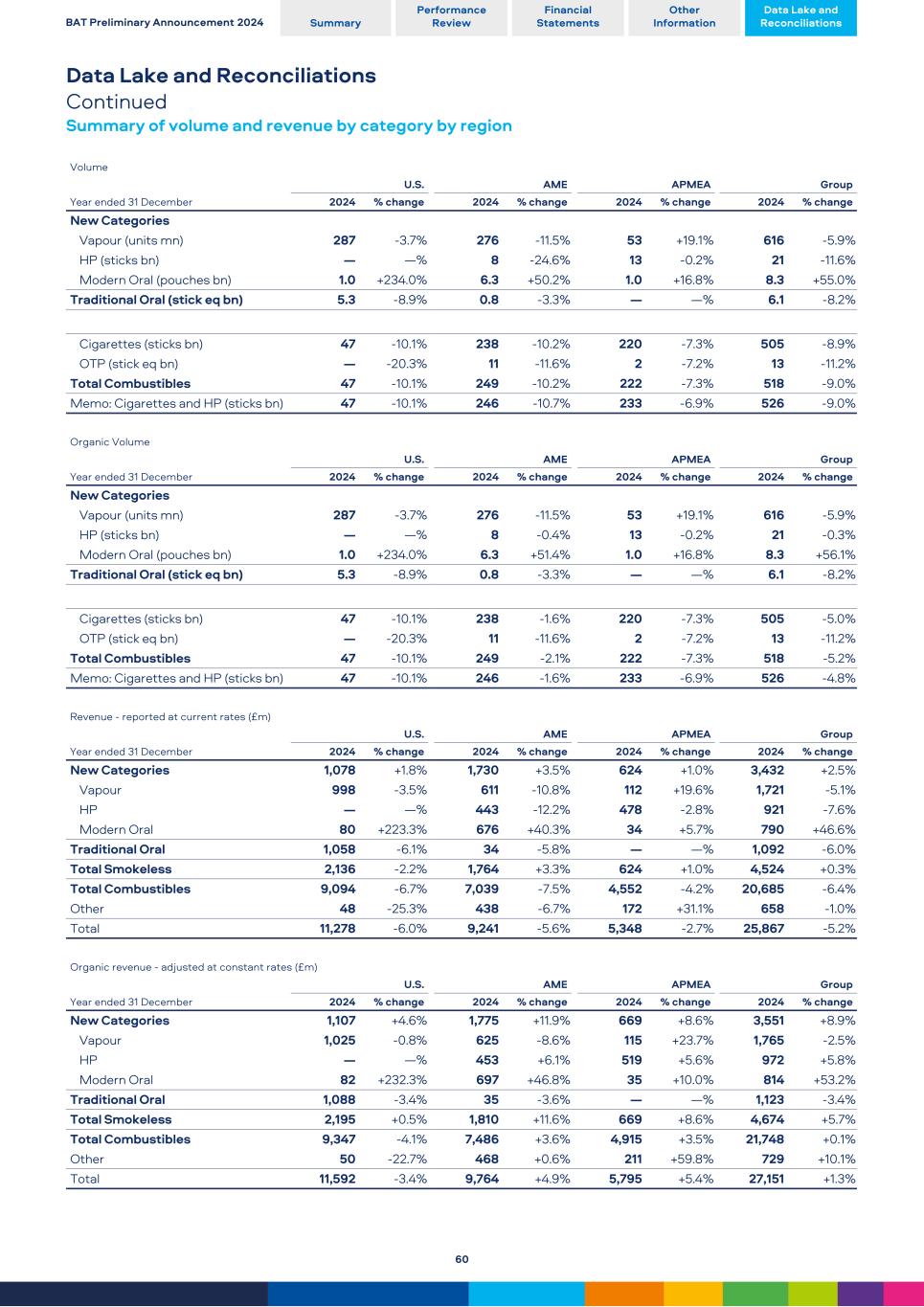

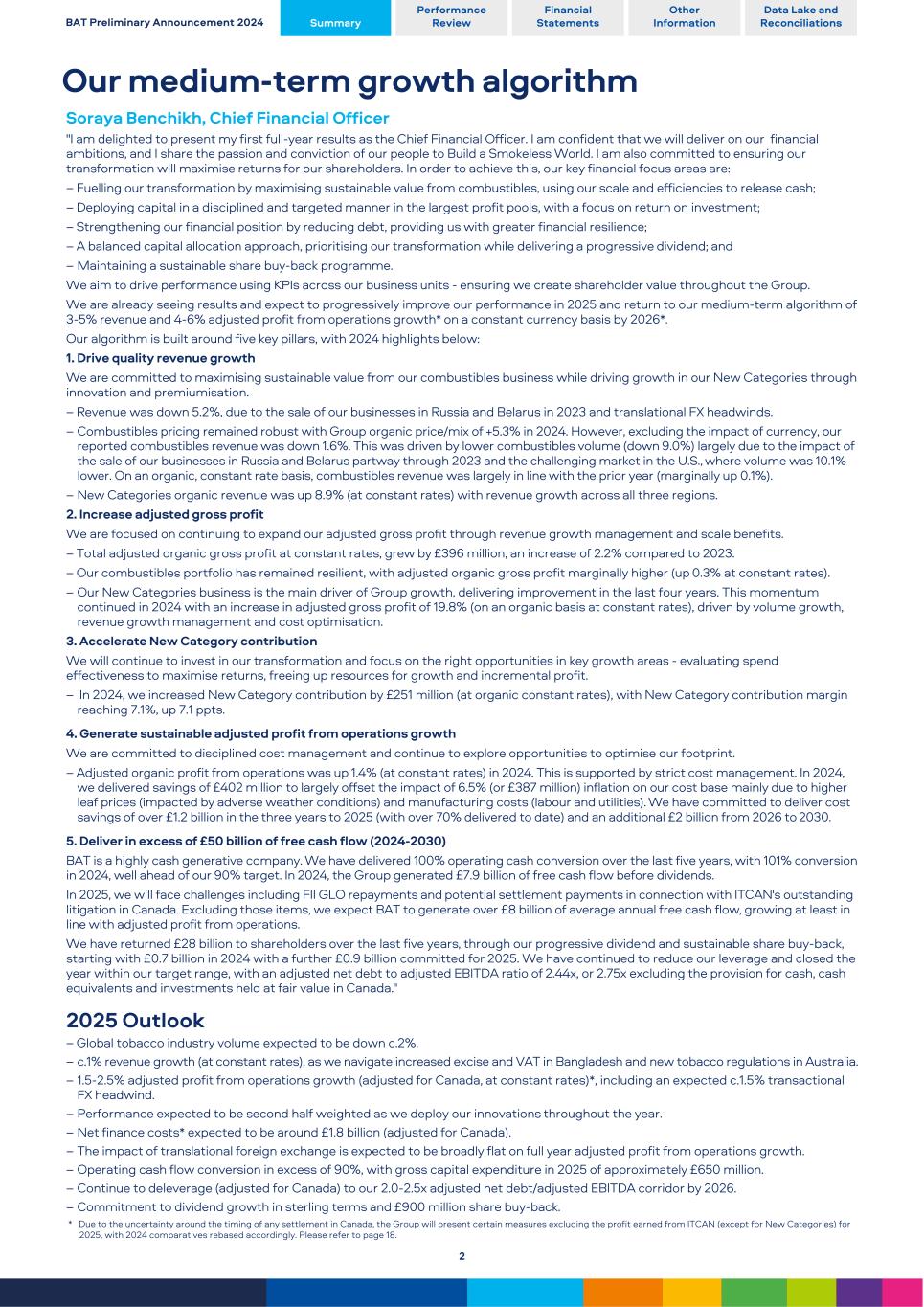

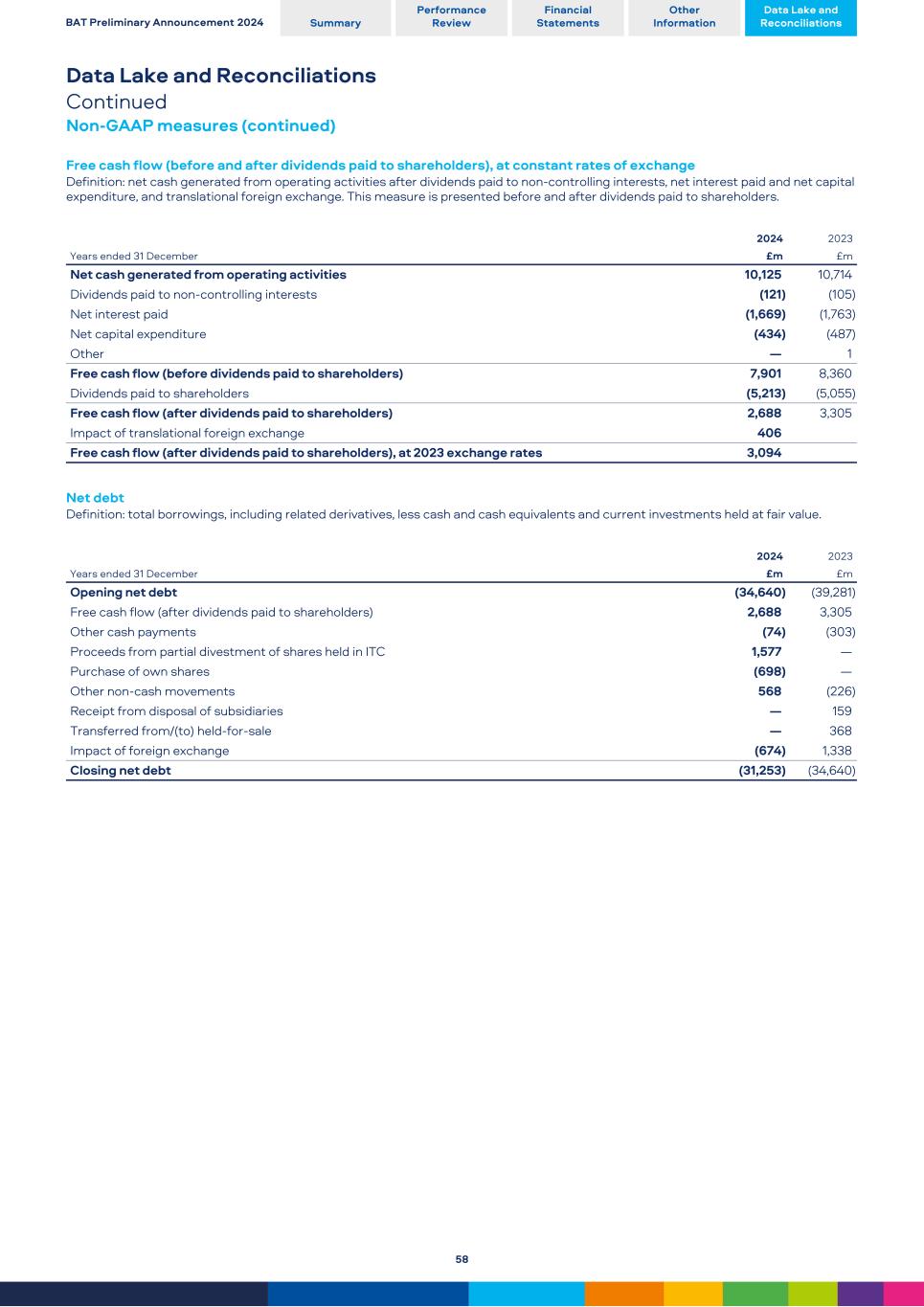

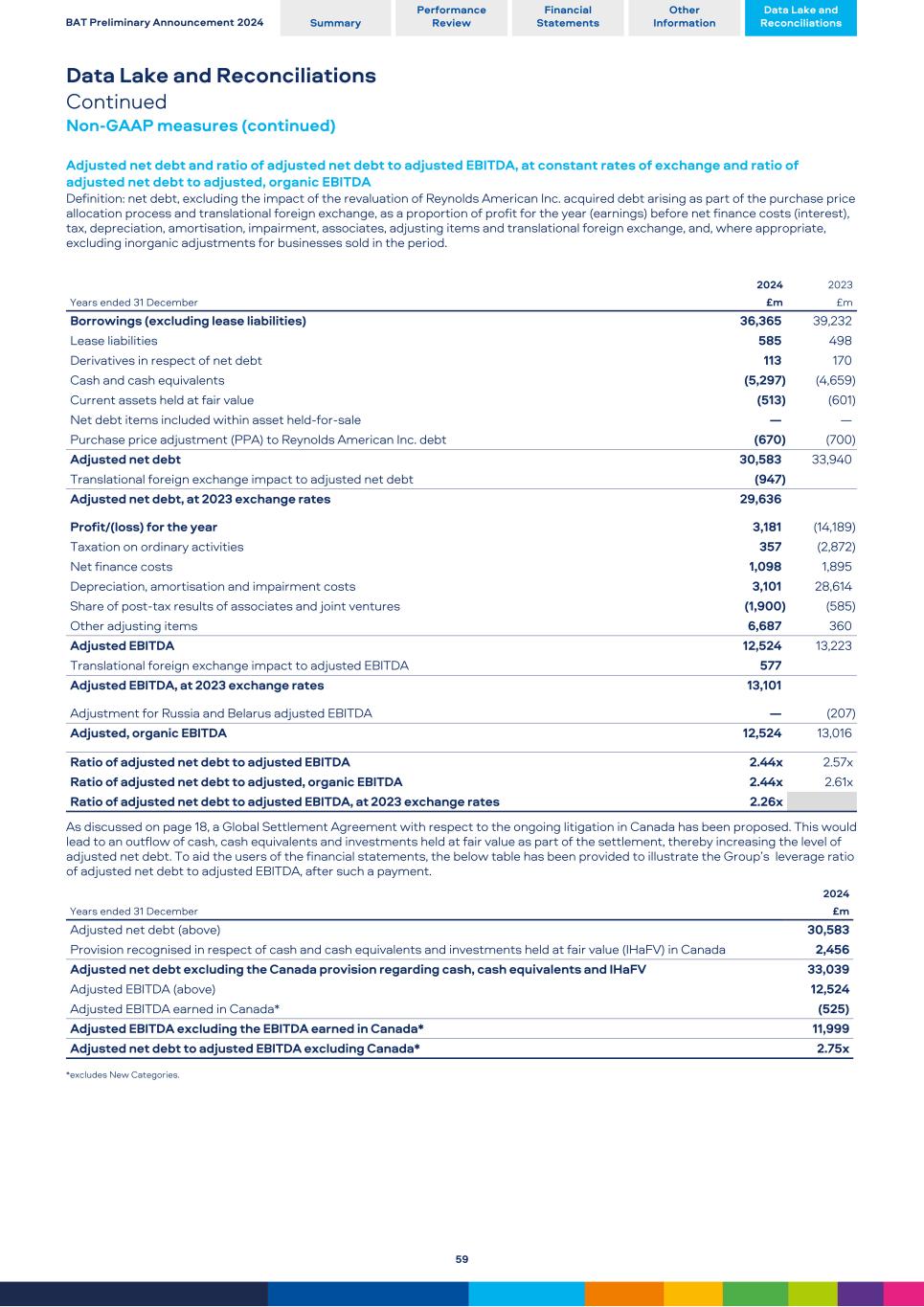

Our medium-term growth algorithm Soraya Benchikh, Chief Financial Officer "I am delighted to present my first full-year results as the Chief Financial Officer. I am confident that we will deliver on our financial ambitions, and I share the passion and conviction of our people to Build a Smokeless World. I am also committed to ensuring our transformation will maximise returns for our shareholders. In order to achieve this, our key financial focus areas are: – Fuelling our transformation by maximising sustainable value from combustibles, using our scale and efficiencies to release cash; – Deploying capital in a disciplined and targeted manner in the largest profit pools, with a focus on return on investment; – Strengthening our financial position by reducing debt, providing us with greater financial resilience; – A balanced capital allocation approach, prioritising our transformation while delivering a progressive dividend; and – Maintaining a sustainable share buy-back programme. We aim to drive performance using KPIs across our business units - ensuring we create shareholder value throughout the Group. We are already seeing results and expect to progressively improve our performance in 2025 and return to our medium-term algorithm of 3-5% revenue and 4-6% adjusted profit from operations growth* on a constant currency basis by 2026*. Our algorithm is built around five key pillars, with 2024 highlights below: 1. Drive quality revenue growth We are committed to maximising sustainable value from our combustibles business while driving growth in our New Categories through innovation and premiumisation. – Revenue was down 5.2%, due to the sale of our businesses in Russia and Belarus in 2023 and translational FX headwinds. – Combustibles pricing remained robust with Group organic price/mix of +5.3% in 2024. However, excluding the impact of currency, our reported combustibles revenue was down 1.6%. This was driven by lower combustibles volume (down 9.0%) largely due to the impact of the sale of our businesses in Russia and Belarus partway through 2023 and the challenging market in the U.S., where volume was 10.1% lower. On an organic, constant rate basis, combustibles revenue was largely in line with the prior year (marginally up 0.1%). – New Categories organic revenue was up 8.9% (at constant rates) with revenue growth across all three regions. 2. Increase adjusted gross profit We are focused on continuing to expand our adjusted gross profit through revenue growth management and scale benefits. – Total adjusted organic gross profit at constant rates, grew by £396 million, an increase of 2.2% compared to 2023. – Our combustibles portfolio has remained resilient, with adjusted organic gross profit marginally higher (up 0.3% at constant rates). – Our New Categories business is the main driver of Group growth, delivering improvement in the last four years. This momentum continued in 2024 with an increase in adjusted gross profit of 19.8% (on an organic basis at constant rates), driven by volume growth, revenue growth management and cost optimisation. 3. Accelerate New Category contribution We will continue to invest in our transformation and focus on the right opportunities in key growth areas - evaluating spend effectiveness to maximise returns, freeing up resources for growth and incremental profit. – In 2024, we increased New Category contribution by £251 million (at organic constant rates), with New Category contribution margin reaching 7.1%, up 7.1 ppts. 4. Generate sustainable adjusted profit from operations growth We are committed to disciplined cost management and continue to explore opportunities to optimise our footprint. – Adjusted organic profit from operations was up 1.4% (at constant rates) in 2024. This is supported by strict cost management. In 2024, we delivered savings of £402 million to largely offset the impact of 6.5% (or £387 million) inflation on our cost base mainly due to higher leaf prices (impacted by adverse weather conditions) and manufacturing costs (labour and utilities). We have committed to deliver cost savings of over £1.2 billion in the three years to 2025 (with over 70% delivered to date) and an additional £2 billion from 2026 to 2030. 5. Deliver in excess of £50 billion of free cash flow (2024-2030) BAT is a highly cash generative company. We have delivered 100% operating cash conversion over the last five years, with 101% conversion in 2024, well ahead of our 90% target. In 2024, the Group generated £7.9 billion of free cash flow before dividends. In 2025, we will face challenges including FII GLO repayments and potential settlement payments in connection with ITCAN's outstanding litigation in Canada. Excluding those items, we expect BAT to generate over £8 billion of average annual free cash flow, growing at least in line with adjusted profit from operations. We have returned £28 billion to shareholders over the last five years, through our progressive dividend and sustainable share buy-back, starting with £0.7 billion in 2024 with a further £0.9 billion committed for 2025. We have continued to reduce our leverage and closed the year within our target range, with an adjusted net debt to adjusted EBITDA ratio of 2.44x, or 2.75x excluding the provision for cash, cash equivalents and investments held at fair value in Canada." 2025 Outlook – Global tobacco industry volume expected to be down c.2%. – c.1% revenue growth (at constant rates), as we navigate increased excise and VAT in Bangladesh and new tobacco regulations in Australia. – 1.5-2.5% adjusted profit from operations growth (adjusted for Canada, at constant rates)*, including an expected c.1.5% transactional FX headwind. – Performance expected to be second half weighted as we deploy our innovations throughout the year. – Net finance costs* expected to be around £1.8 billion (adjusted for Canada). – The impact of translational foreign exchange is expected to be broadly flat on full year adjusted profit from operations growth. – Operating cash flow conversion in excess of 90%, with gross capital expenditure in 2025 of approximately £650 million. – Continue to deleverage (adjusted for Canada) to our 2.0-2.5x adjusted net debt/adjusted EBITDA corridor by 2026. – Commitment to dividend growth in sterling terms and £900 million share buy-back. * Due to the uncertainty around the timing of any settlement in Canada, the Group will present certain measures excluding the profit earned from ITCAN (except for New Categories) for 2025, with 2024 comparatives rebased accordingly. Please refer to page 18. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 2

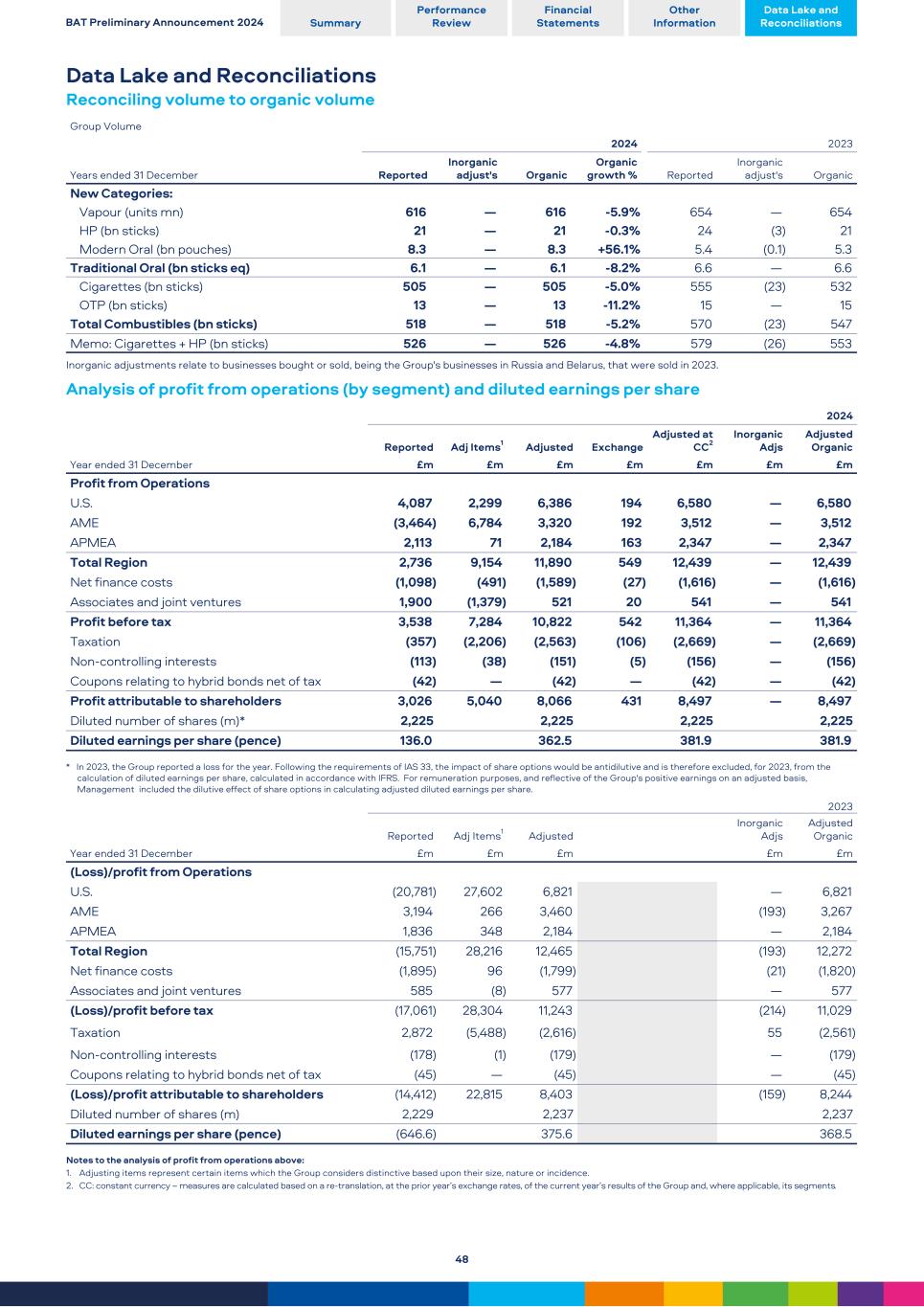

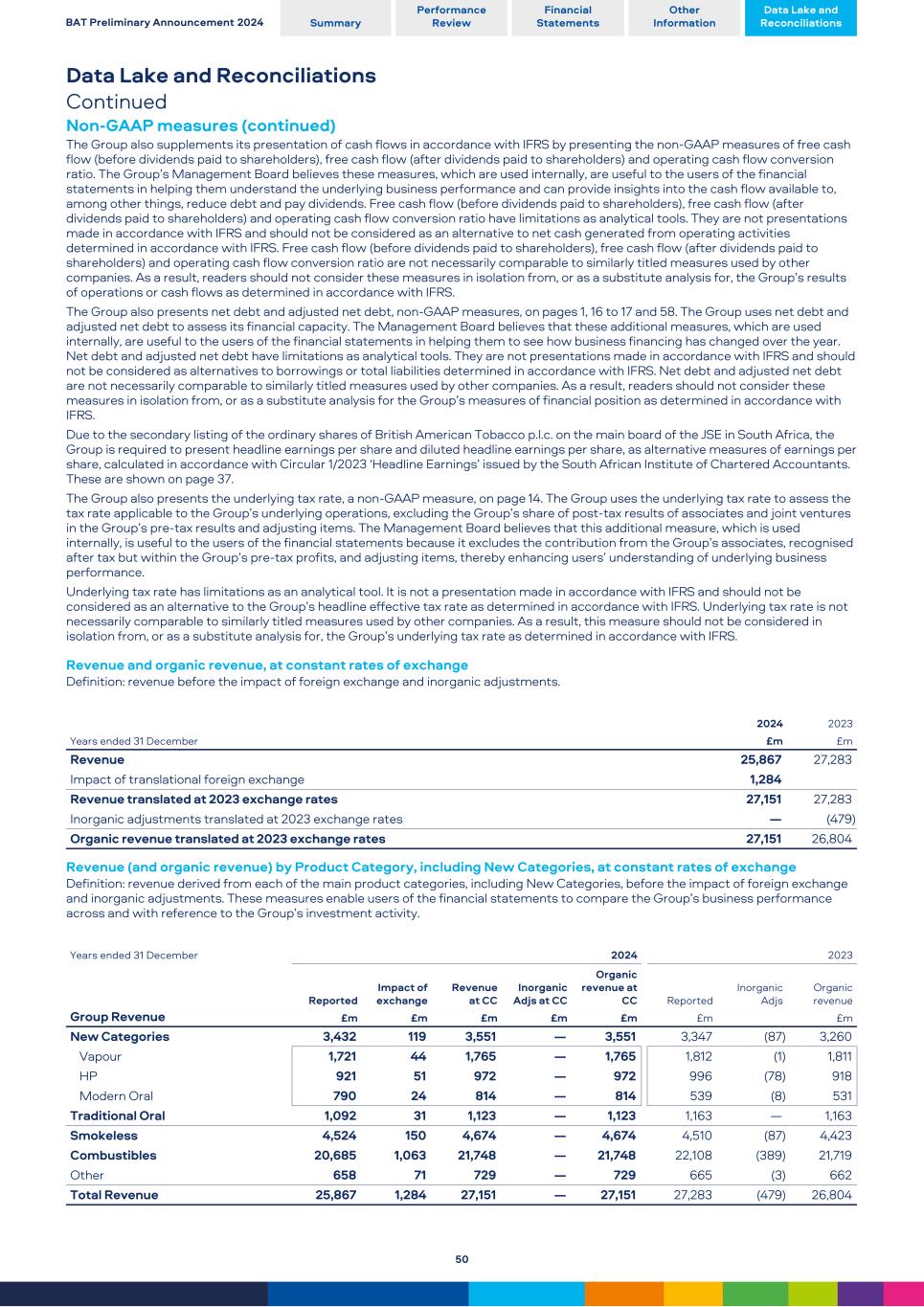

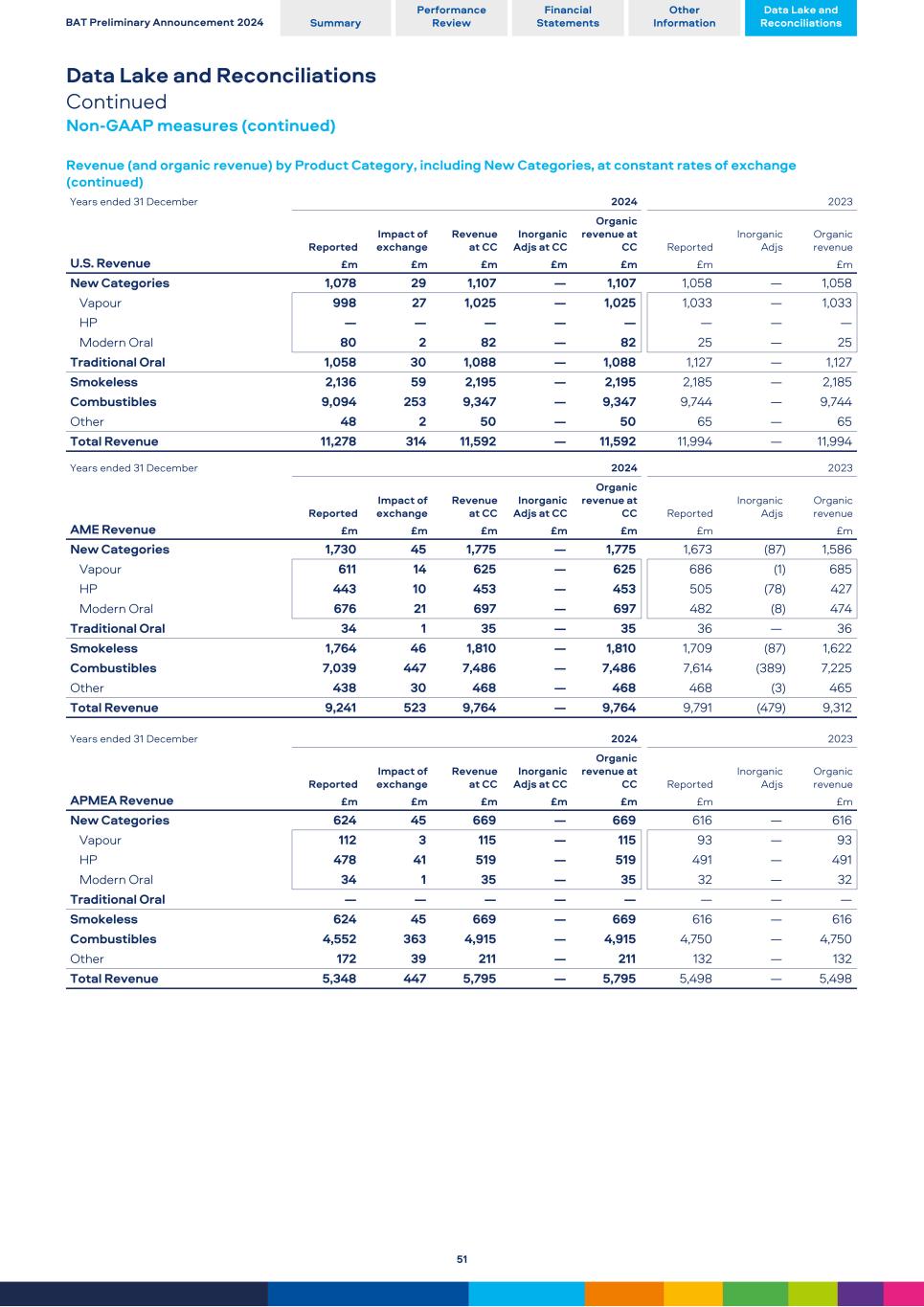

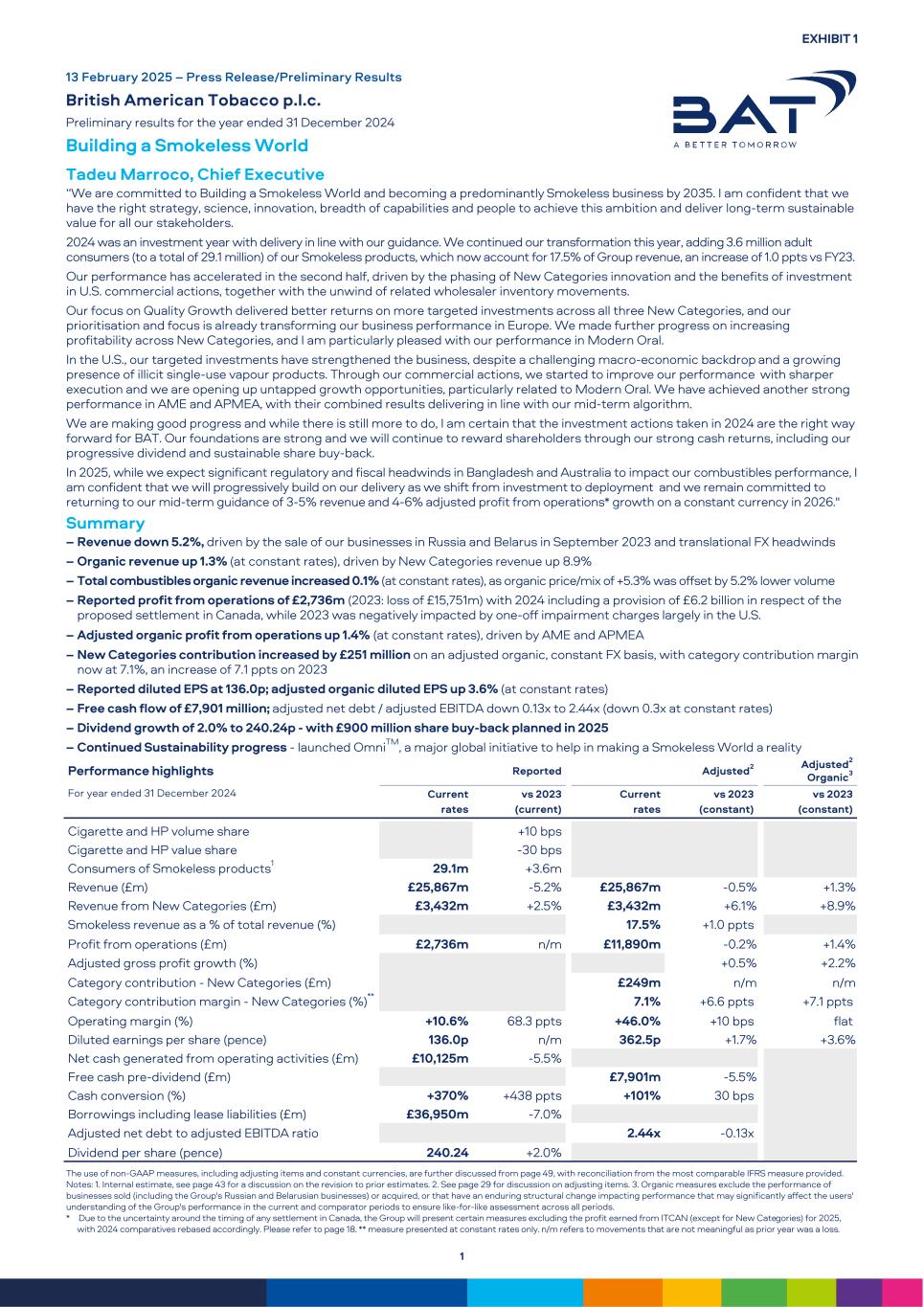

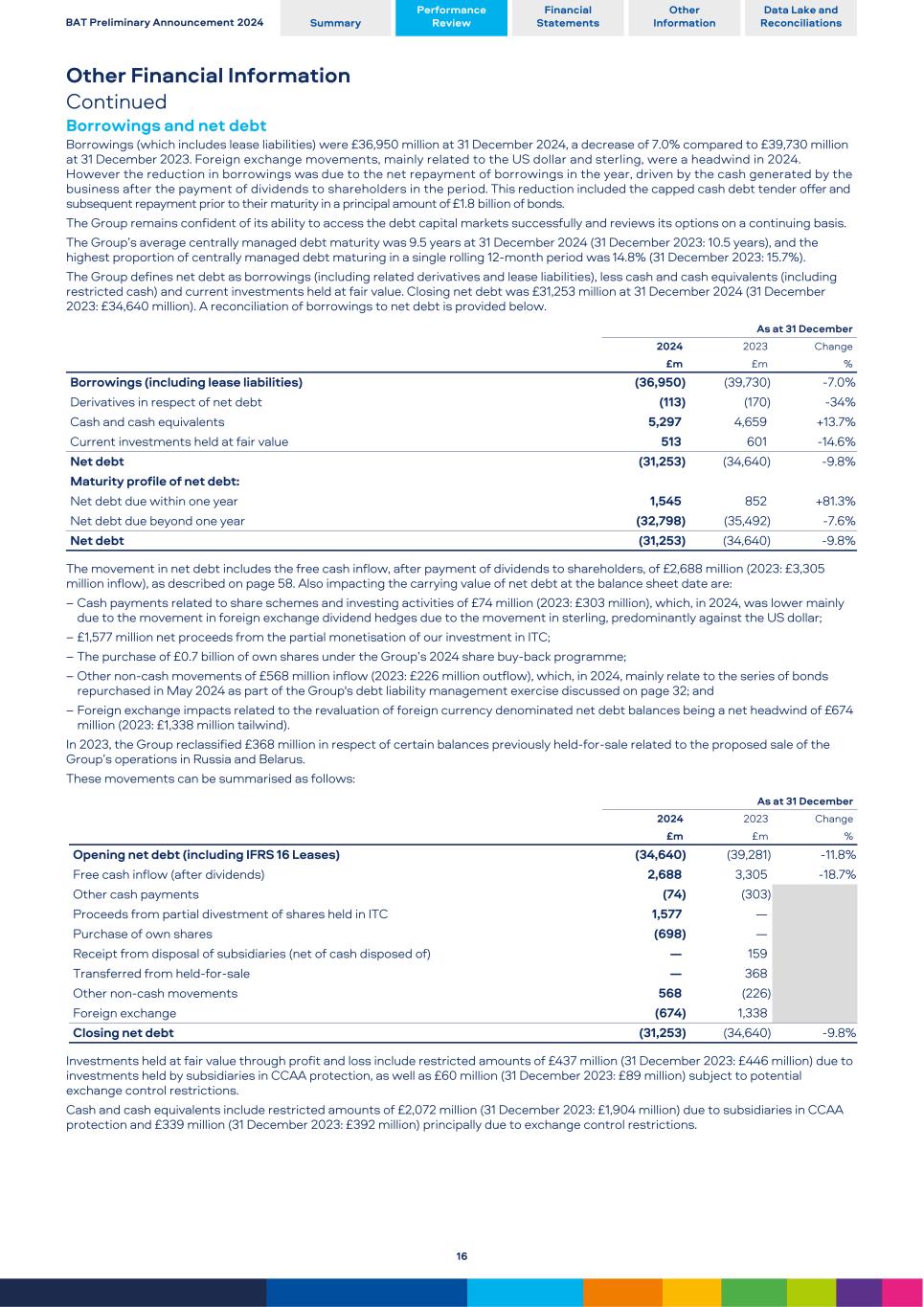

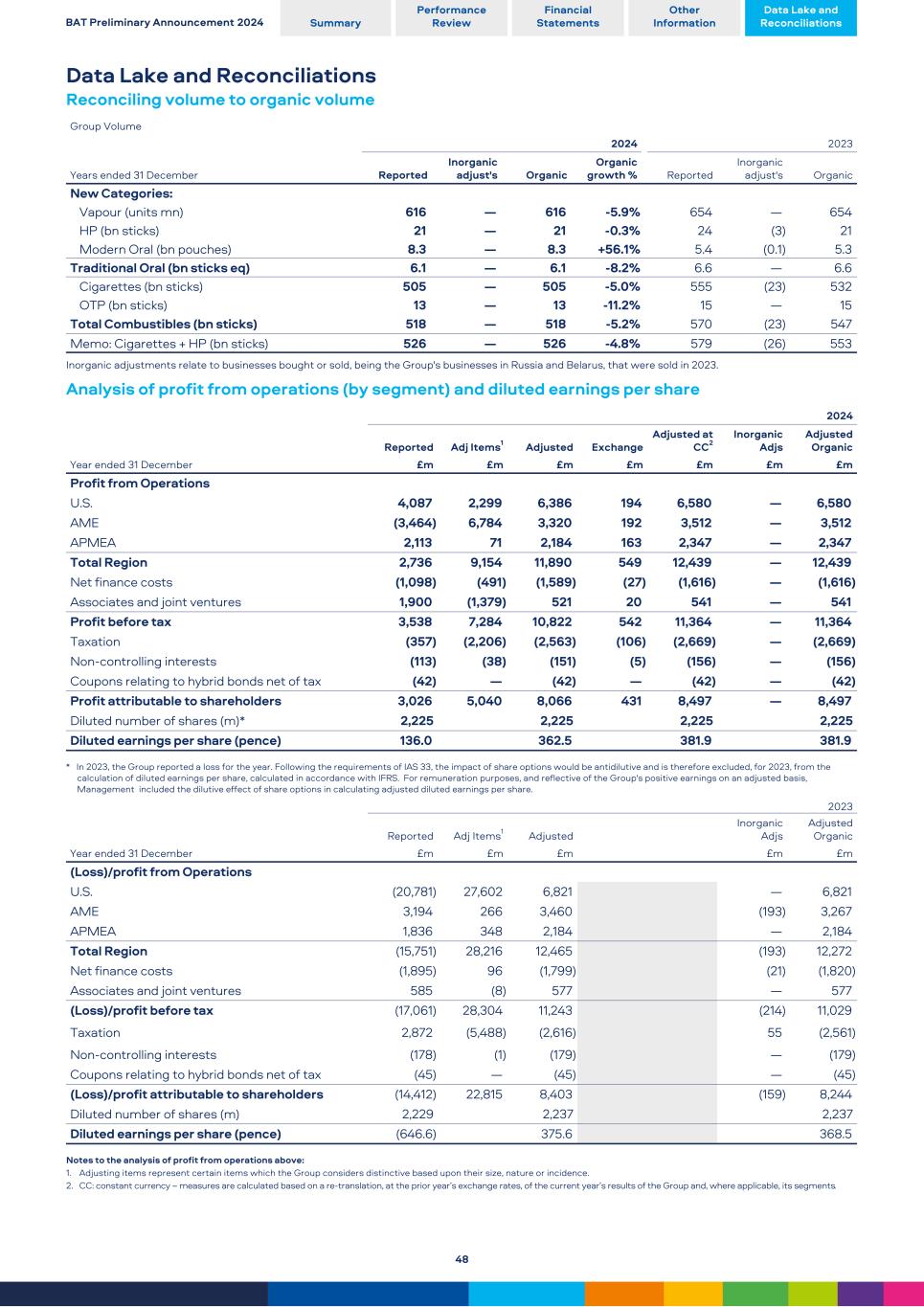

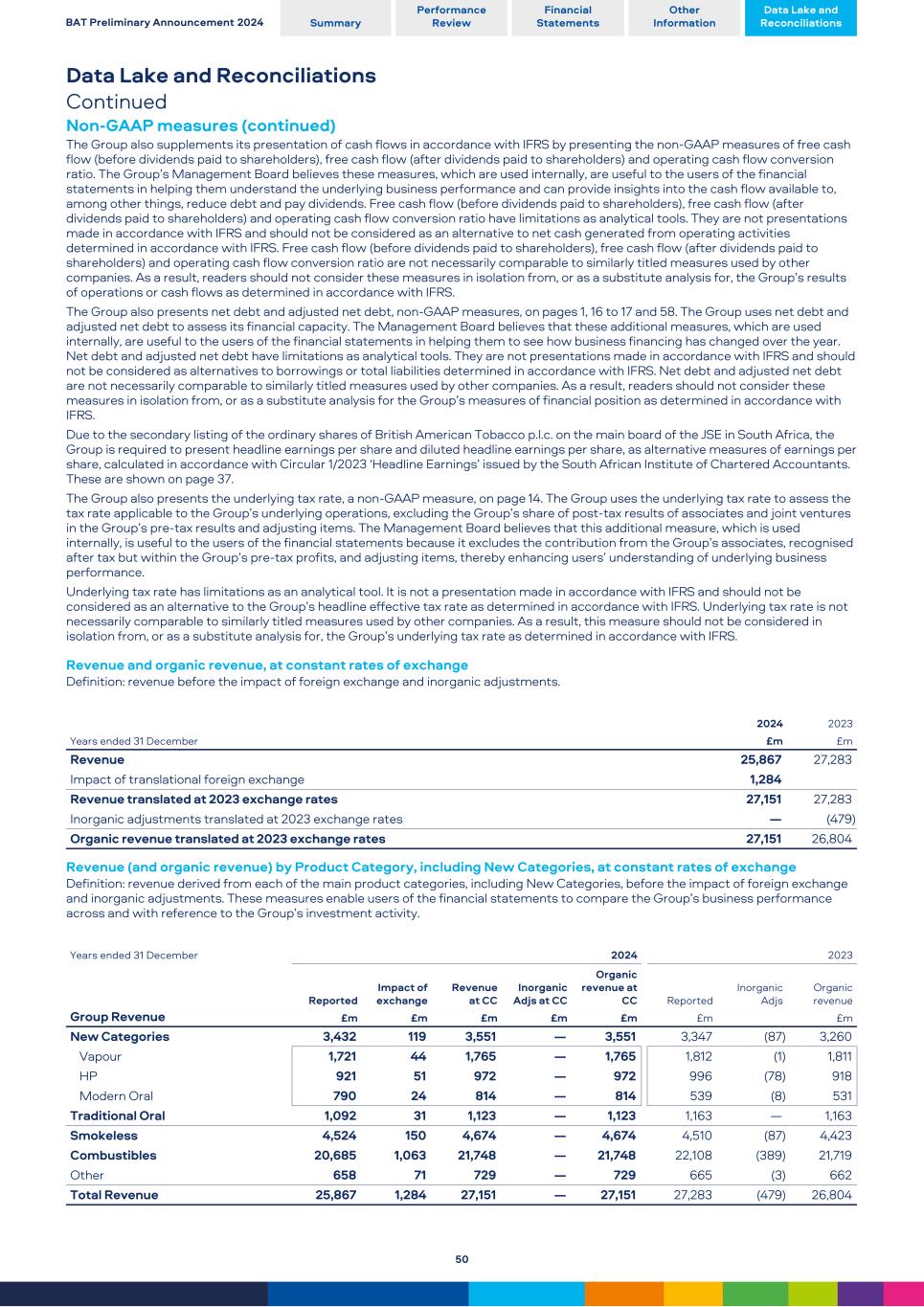

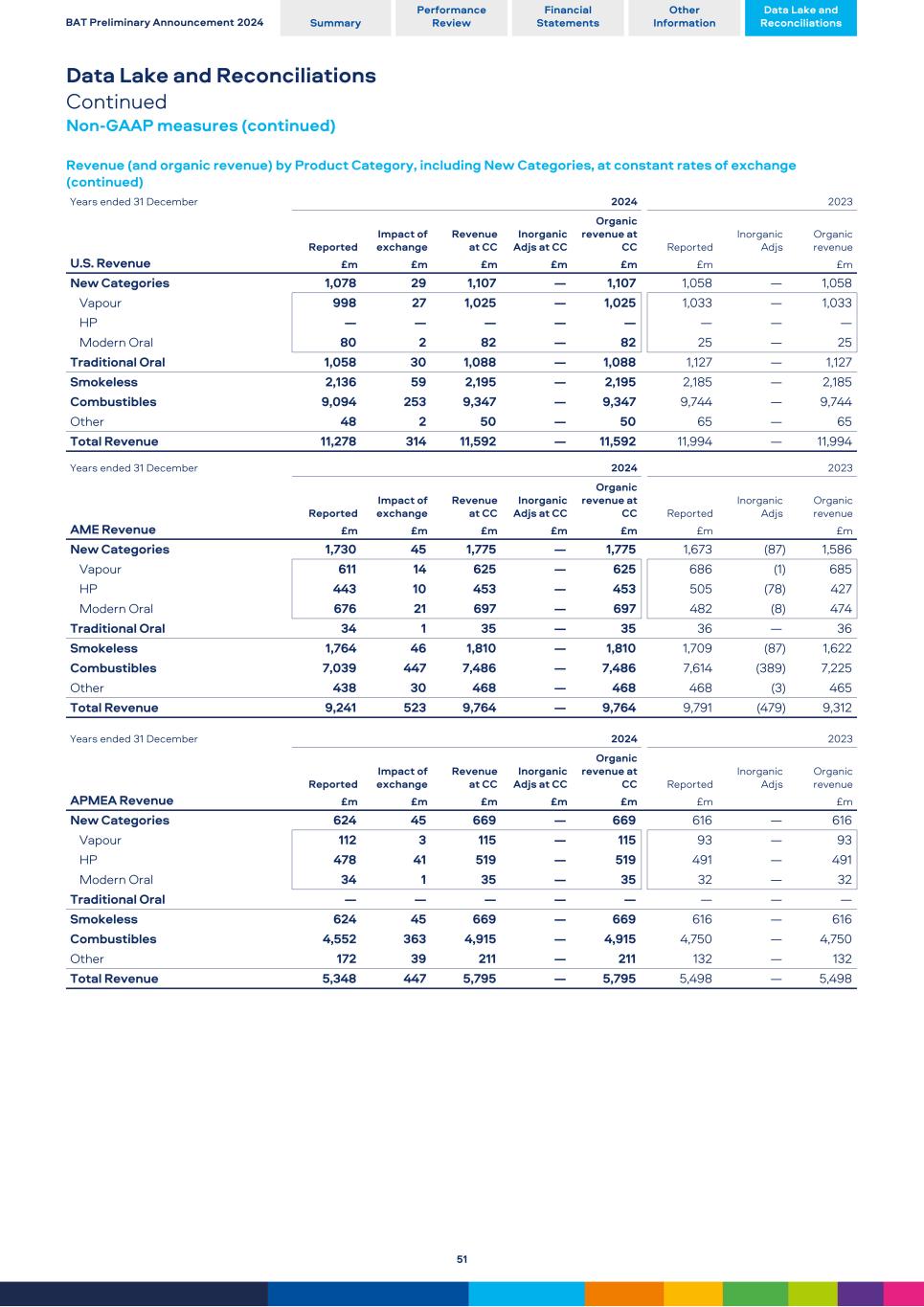

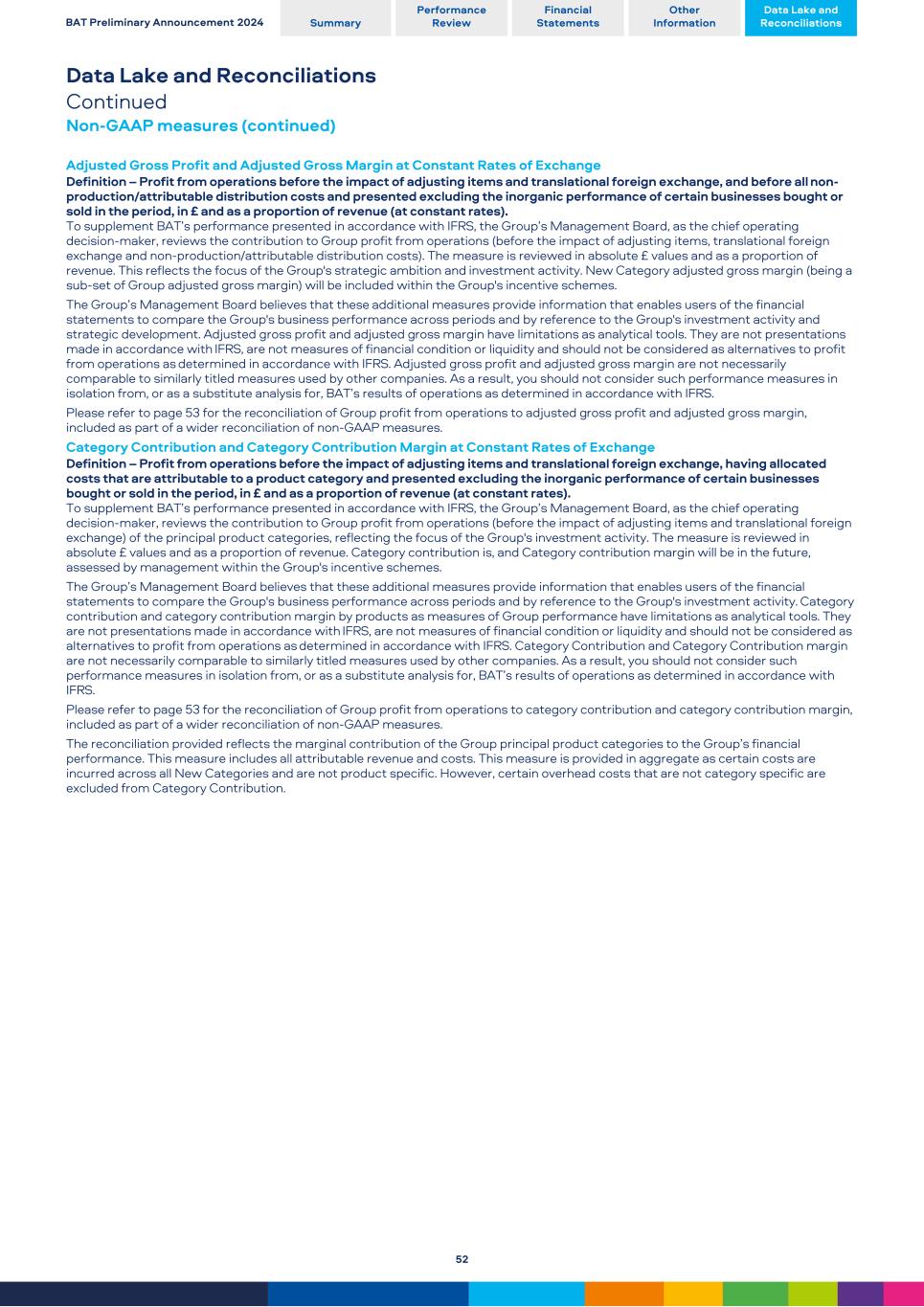

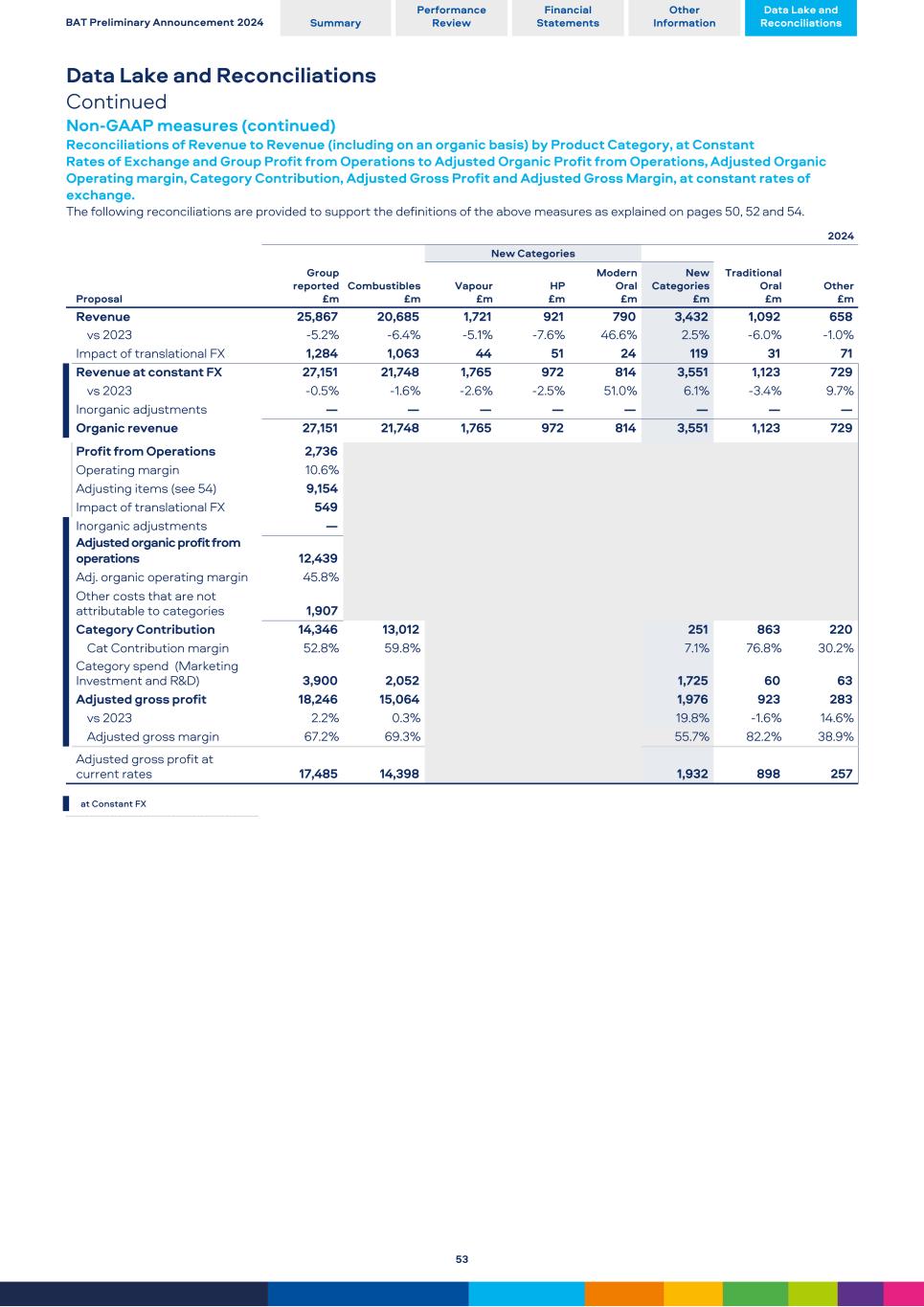

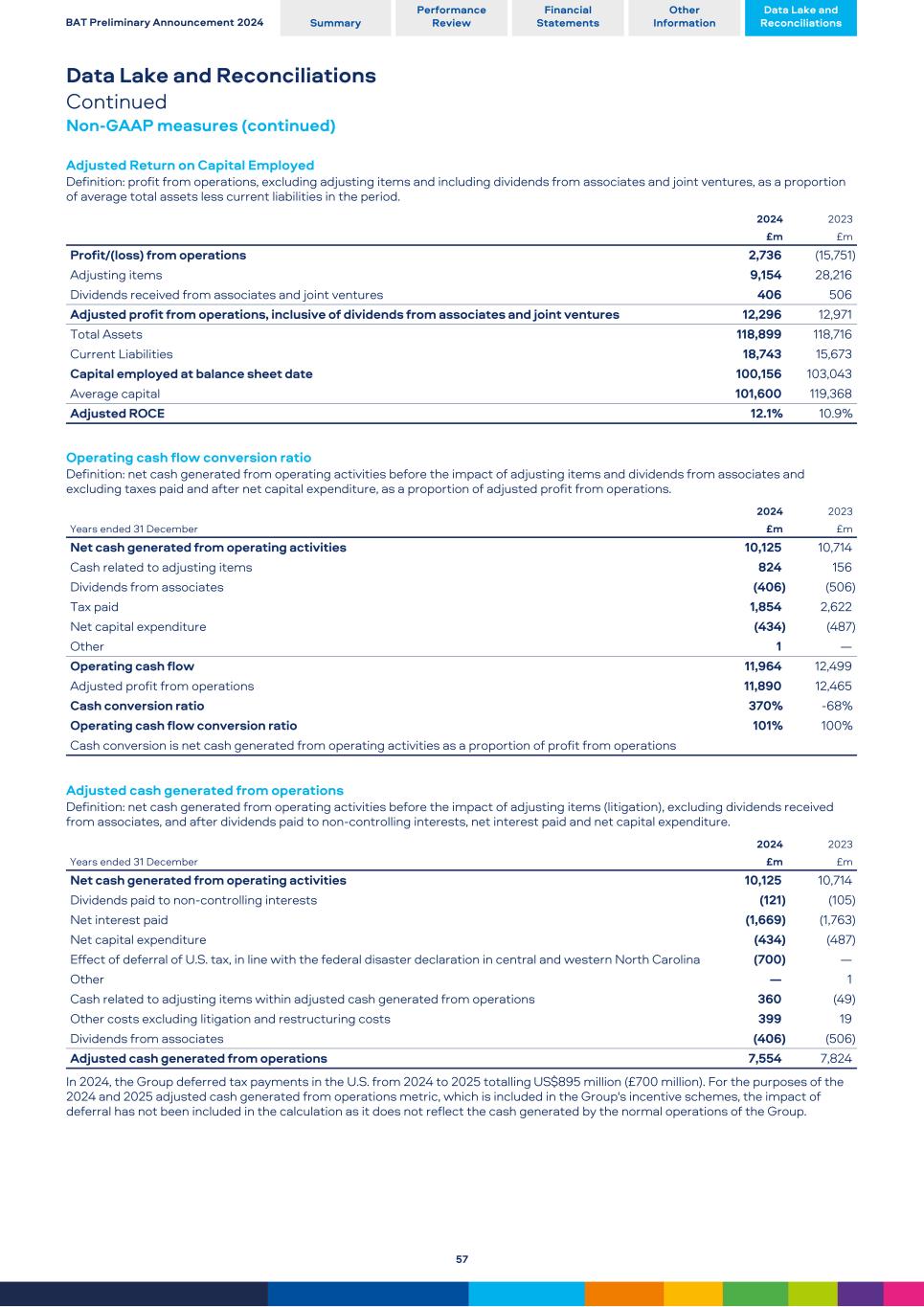

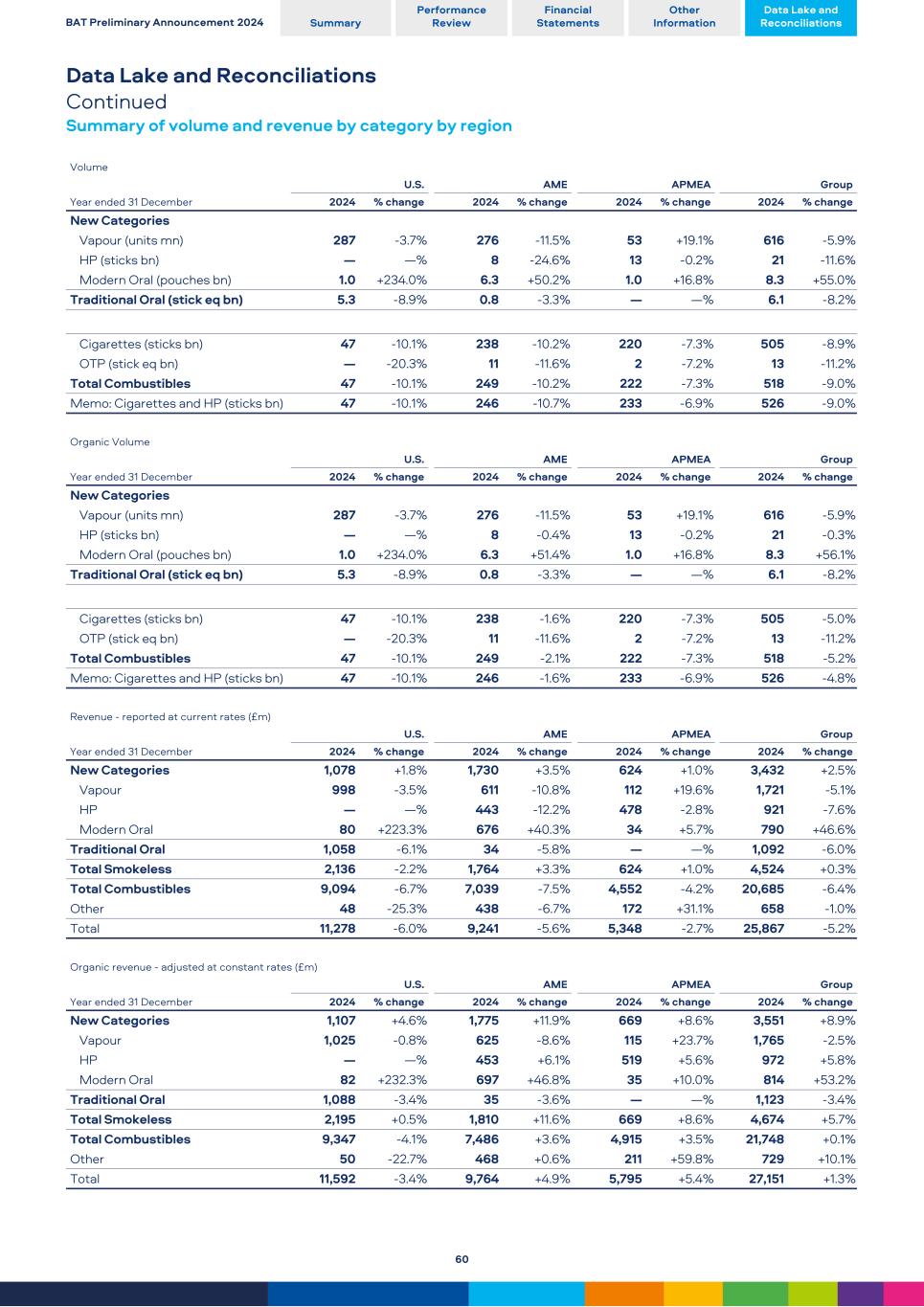

Group Operating Review Total Group volume and revenue Prior year data is provided in the tables on pages 48 and 50. For year ended 31 December 2024 Volume Revenue Reported Organic Reported Organic Current Exchange Constant Constant Unit vs 2023 vs 2023 £m vs 2023 £m £m vs 2023 £m vs 2023 New Categories 3,432 +2.5 % 119 3,551 +6.1 % 3,551 +8.9 % Vapour (units mn) 616 -5.9 % -5.9 % 1,721 -5.1 % 44 1,765 -2.6 % 1,765 -2.5 % Heated Products (sticks bn) 20.9 -11.6 % -0.3 % 921 -7.6 % 51 972 -2.5 % 972 +5.8 % Modern Oral (pouches bn) 8.3 +55.0 % +56.1 % 790 +46.6 % 24 814 +51.0 % 814 +53.2 % Traditional Oral (stick eq bn) 6.1 -8.2 % -8.2 % 1,092 -6.0 % 31 1,123 -3.4 % 1,123 -3.4 % Total Smokeless 4,524 +0.3 % 150 4,674 +3.6 % 4,674 +5.7 % Cigarettes (sticks bn) 505 -8.9 % -5.0 % OTP incl RYO/MYO (stick eq bn) 13 -11.2 % -11.2 % Total Combustibles 518 -9.0 % -5.2 % 20,685 -6.4 % 1,063 21,748 -1.6 % 21,748 +0.1 % Other 658 -1.0 % 71 729 +9.7 % 729 +10.1 % Total 25,867 -5.2 % 1,284 27,151 -0.5 % 27,151 +1.3 % Cigarettes and HP (sticks bn) 526 -9.0 % -4.8 % Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. Movement in Revenue The following chart is in £m -5.2% Reported at Current -0.5% at Constant FX headwind 4.7% +1.3% Organic at Constant 27,283 (479) 26,804 (1,121) 1,150 291 (40) 67 27,151 (1,284) 25,867 FY23 Reported Revenue Russia Belarus FY23 Organic Revenue Comb. Volume Comb. Price/Mix New Categories Traditional Oral Other FY24 Organic and Reported Revenue (constant) Translational FX FY24 Reported Revenue Reported revenue decreased by 5.2% to £25,867 million, largely due to: – The sale of the Group's businesses in Russia and Belarus partway through 2023, with £479 million revenue included in the prior year; and – A translational foreign exchange headwind of 4.7%. Excluding such items, on an organic, constant rates basis, revenue from our New Categories was up 8.9%, with combustibles marginally higher (up 0.1%) as price/mix of +5.3% was largely offset by a 5.2% decline in volume, which was impacted by the supply chain disruption in Sudan and market exits (in West Africa). Global duty paid industry cigarette volume was estimated to be down by c.2%. In our Top markets, Group cigarette volume share was up 20 bps, with value share 20 bps lower vs 2023. The following analysis is on an organic, constant currency basis, which we believe reflects the operational performance of the Group: – In the U.S., revenue was down 3.4% as cigarette pricing and New Categories growth of 4.6% were more than offset by 10.1% lower cigarette volume. The cigarette industry volume was 8.4% lower (on a sales to wholesaler basis) due to the continued macro-economic pressures on consumer spending, with a growth in the deep-discounted category (in which the Group is not present) and lack of enforcement against illicit single-use Vapour products. Our New Categories revenue in the U.S. was driven by: – Vapour, the Group maintained leadership in value share (of closed system consumables, including single-use Vapour products in tracked channels) despite a decline of 2.0 ppts to 50.2%. The growth of illicit single-use Vapour products continues to negatively impact the legal market with industry volumes in rechargeable closed systems down c. 9%. Consequently, our Vapour revenue was 0.8% lower than 2023 as price/mix (+2.9%) was more than offset by consumables volume which was down 3.7%; and – Modern Oral, as volume grew 234%, with volume share up 2.1 ppts to 6.6%, delivering higher revenue, which was up 232%, driven by the traction of our refreshed Velo brand expression and Grizzly Modern Oral roll-out; – In AME, revenue grew 4.9%, driven by combustibles (up 3.6%, underpinned by a robust price/mix of +5.7%) and New Categories which were up 11.9% (driven by Modern Oral despite a decline in Vapour revenue in Canada where a lack of enforcement of illegal single-use products following the flavour ban in the province of Québec has impacted volumes); and – In APMEA, revenue was up 5.4%, as growth in Saudi Arabia, Japan, Nigeria and Pakistan more than offset the impact of lower volume in Bangladesh, Australia and Sudan (with the latter driven by the supply chain disruption due to the ongoing conflict in that country). On an organic, constant rate basis, Group revenue was up 1.3% to £27,151 million (2023: £26,804 million). Please refer to pages 7 to 9 for a further discussion on the performance by category and pages 10 to 12 for discussion on regional performance. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 3

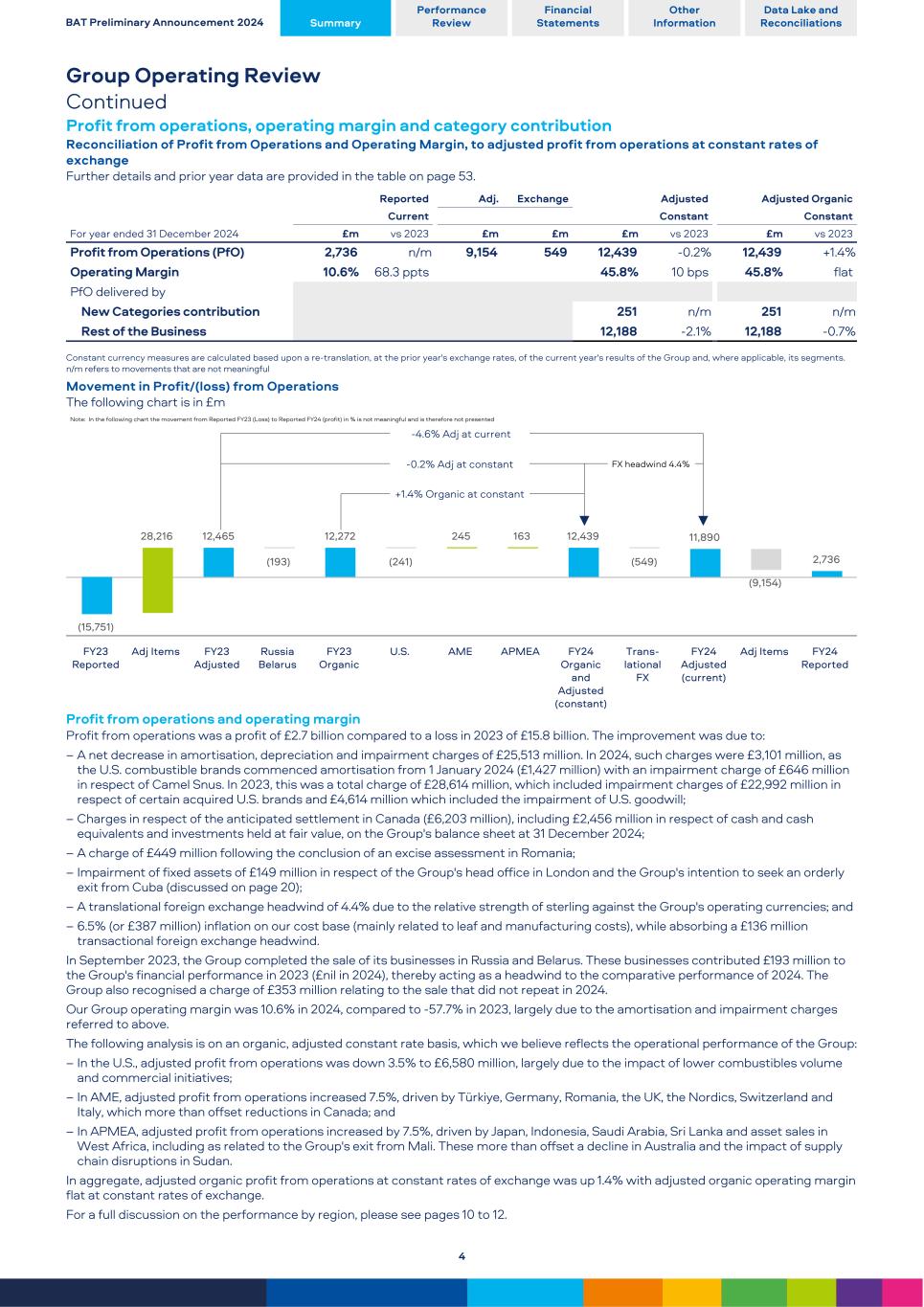

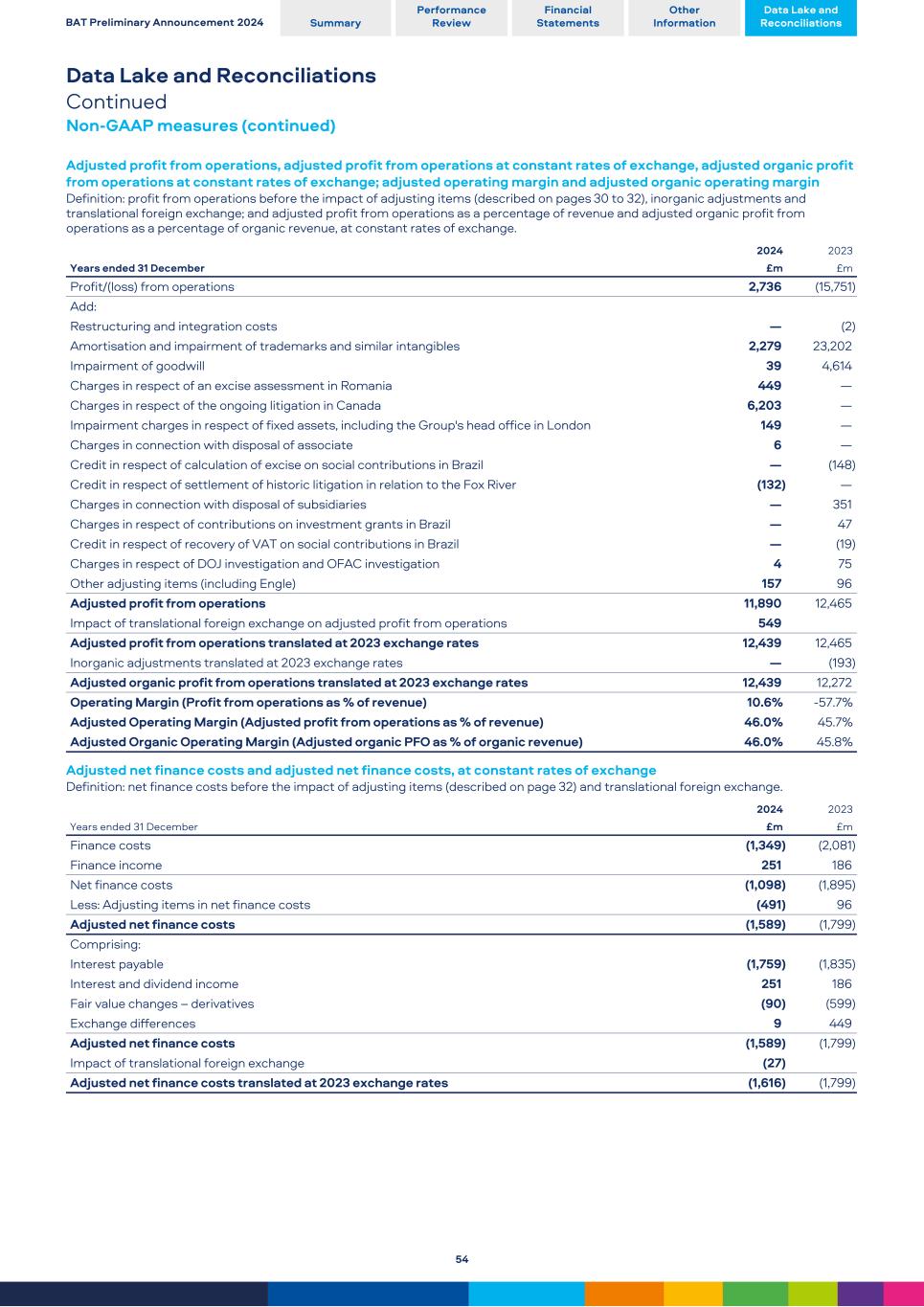

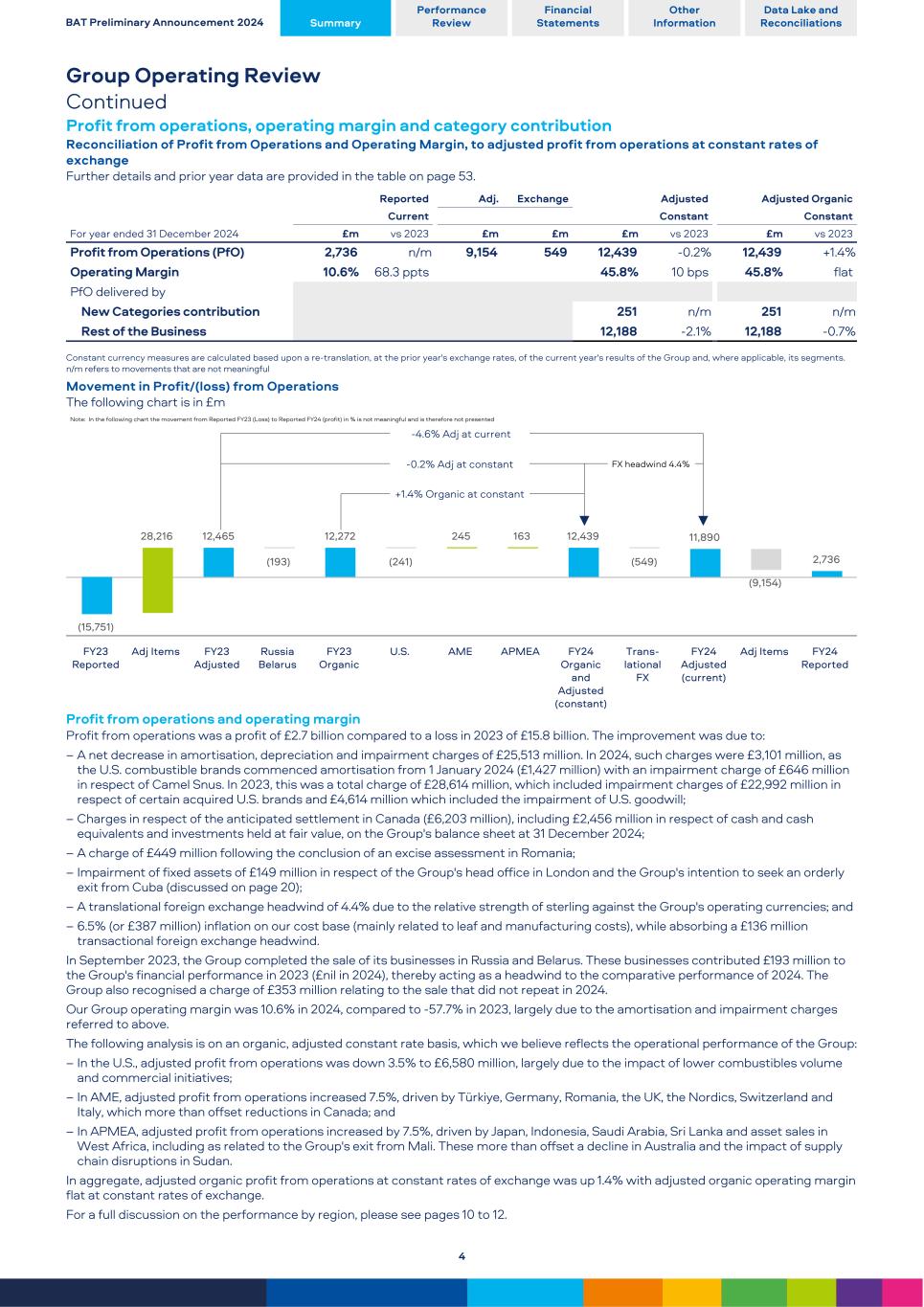

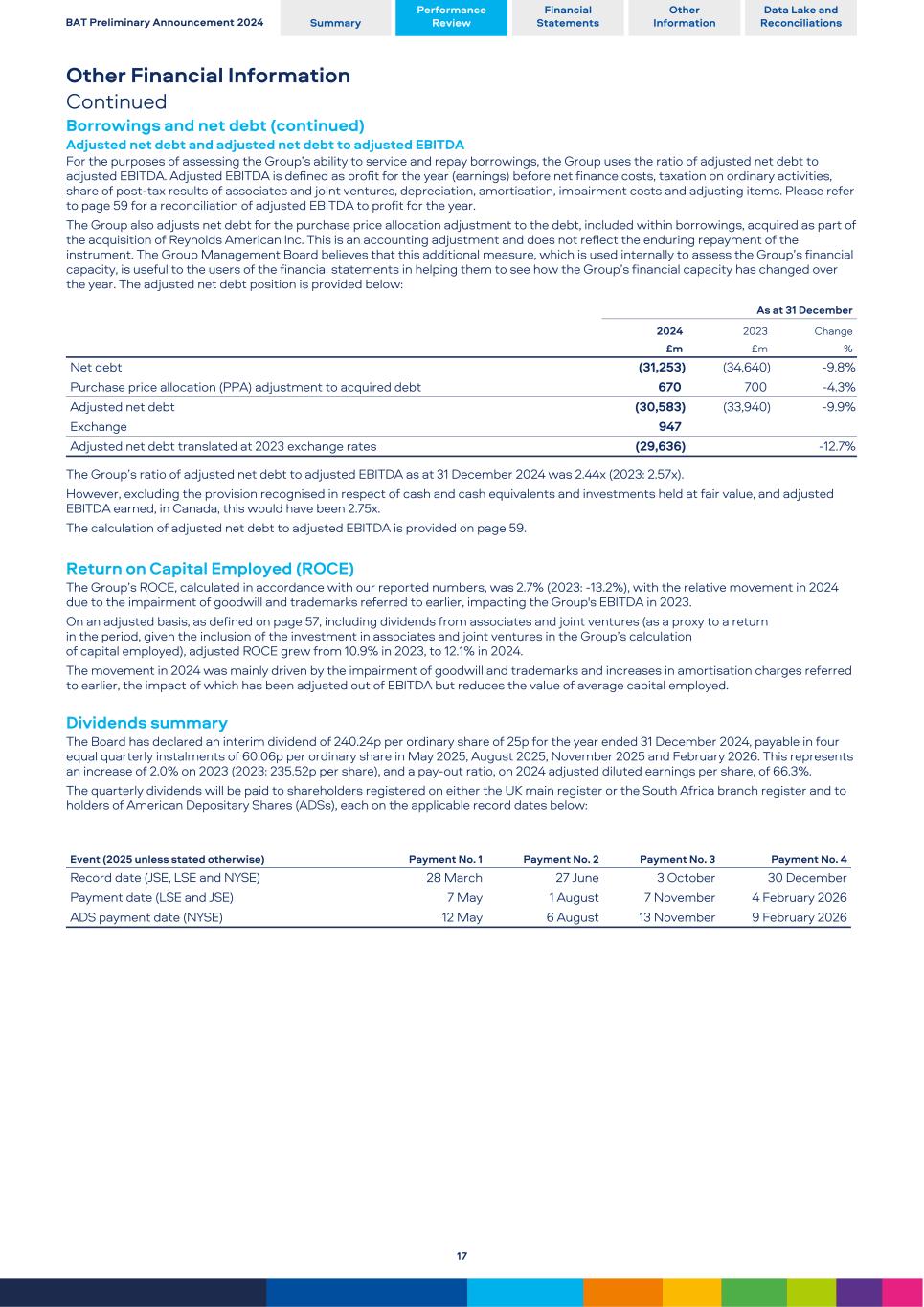

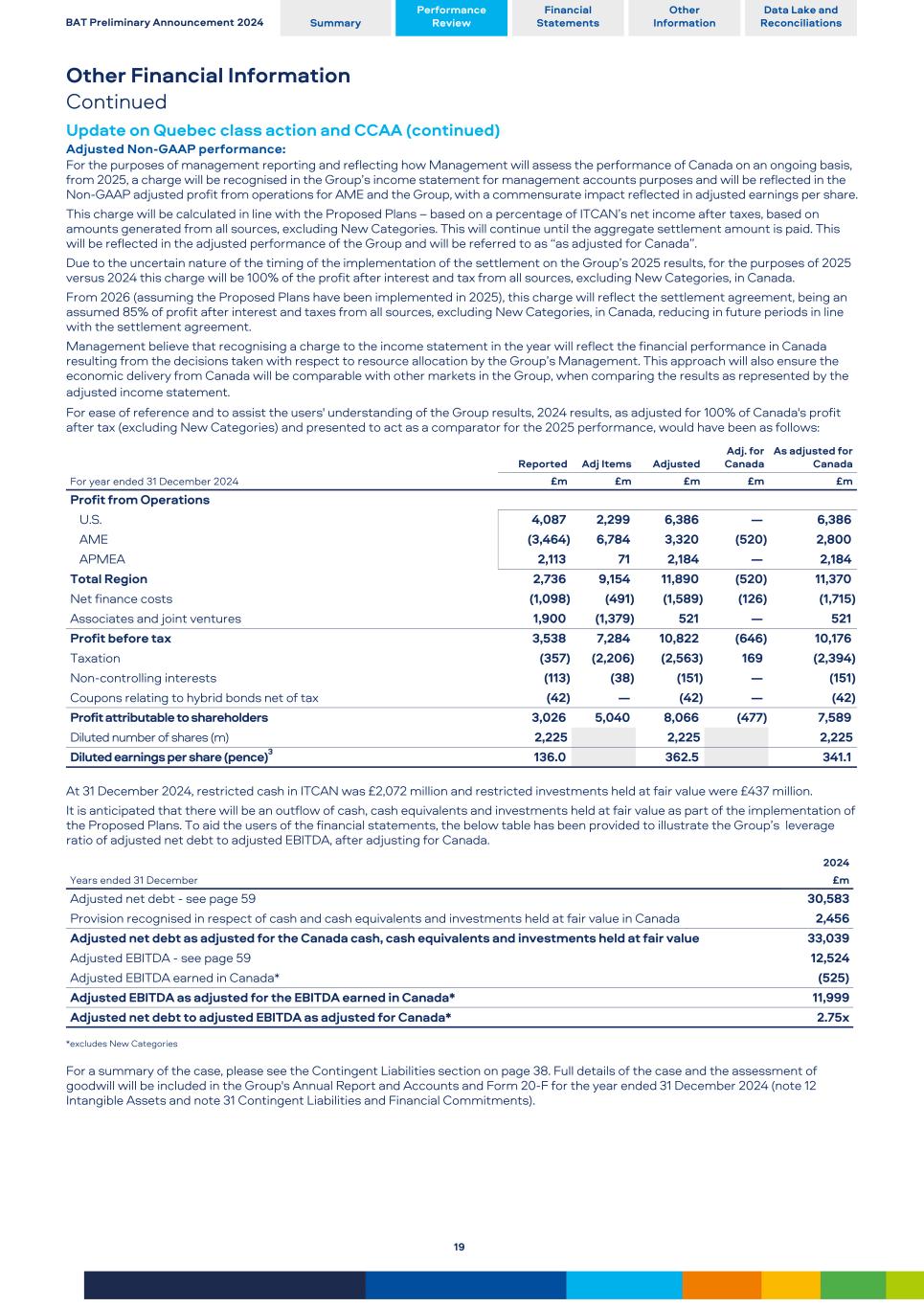

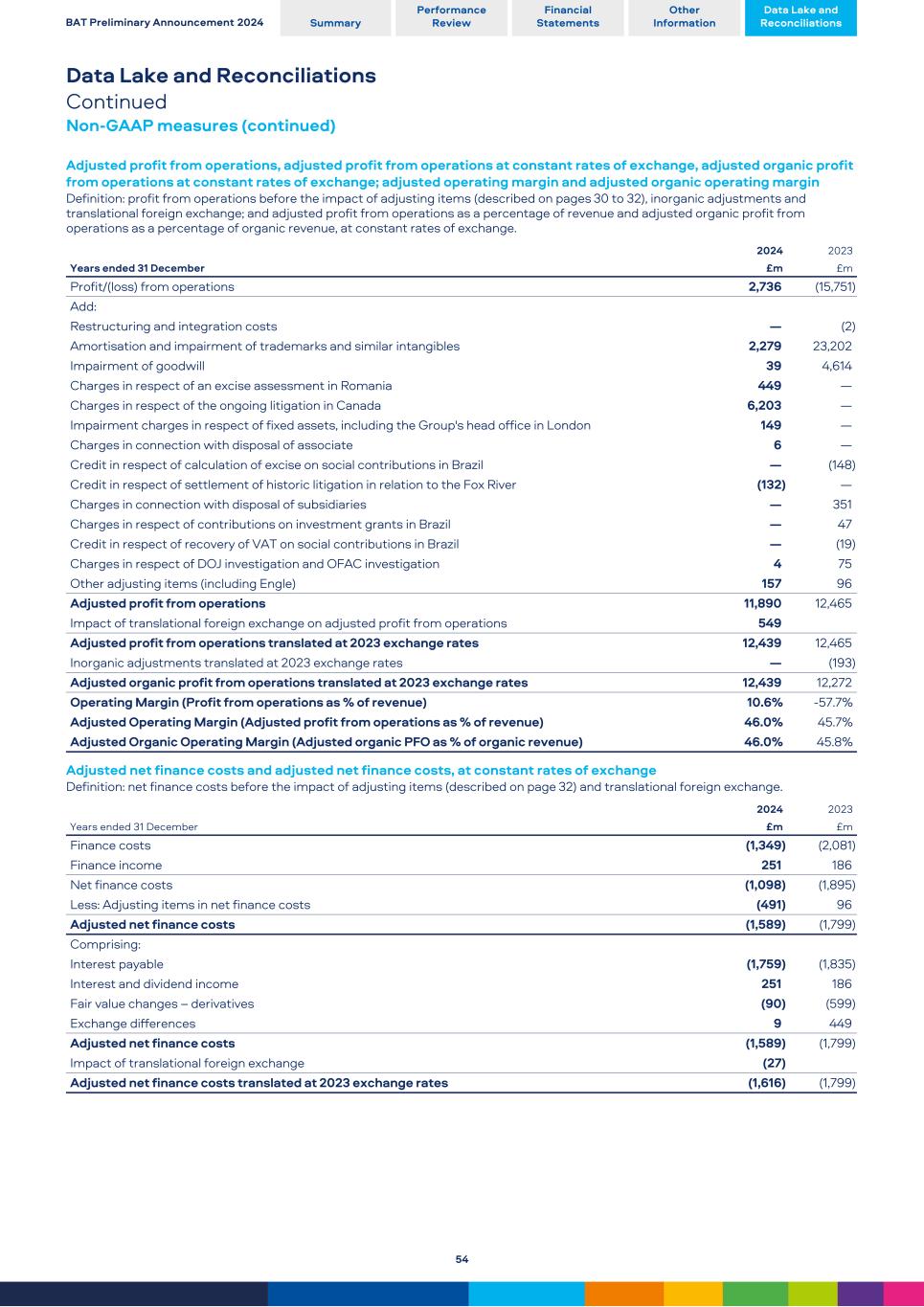

Group Operating Review Continued Profit from operations, operating margin and category contribution Reconciliation of Profit from Operations and Operating Margin, to adjusted profit from operations at constant rates of exchange Further details and prior year data are provided in the table on page 53. For year ended 31 December 2024 Reported Adj. Exchange Adjusted Adjusted Organic Current Constant Constant £m vs 2023 £m £m £m vs 2023 £m vs 2023 Profit from Operations (PfO) 2,736 n/m 9,154 549 12,439 -0.2 % 12,439 +1.4 % Operating Margin 10.6% 68.3 ppts 45.8% 10 bps 45.8% flat PfO delivered by New Categories contribution 251 n/m 251 n/m Rest of the Business 12,188 -2.1 % 12,188 -0.7 % Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. n/m refers to movements that are not meaningful Movement in Profit/(loss) from Operations The following chart is in £m Note: In the following chart the movement from Reported FY23 (Loss) to Reported FY24 (profit) in % is not meaningful and is therefore not presented -4.6% Adj at current -0.2% Adj at constant FX headwind 4.4% +1.4% Organic at constant (15,751) 28,216 12,465 (193) 12,272 (241) 245 163 12,439 (549) 11,890 (9,154) 2,736 FY23 Reported Adj Items FY23 Adjusted Russia Belarus FY23 Organic U.S. AME APMEA FY24 Organic and Adjusted (constant) Trans- lational FX FY24 Adjusted (current) Adj Items FY24 Reported Profit from operations and operating margin Profit from operations was a profit of £2.7 billion compared to a loss in 2023 of £15.8 billion. The improvement was due to: – A net decrease in amortisation, depreciation and impairment charges of £25,513 million. In 2024, such charges were £3,101 million, as the U.S. combustible brands commenced amortisation from 1 January 2024 (£1,427 million) with an impairment charge of £646 million in respect of Camel Snus. In 2023, this was a total charge of £28,614 million, which included impairment charges of £22,992 million in respect of certain acquired U.S. brands and £4,614 million which included the impairment of U.S. goodwill; – Charges in respect of the anticipated settlement in Canada (£6,203 million), including £2,456 million in respect of cash and cash equivalents and investments held at fair value, on the Group's balance sheet at 31 December 2024; – A charge of £449 million following the conclusion of an excise assessment in Romania; – Impairment of fixed assets of £149 million in respect of the Group's head office in London and the Group's intention to seek an orderly exit from Cuba (discussed on page 20); – A translational foreign exchange headwind of 4.4% due to the relative strength of sterling against the Group's operating currencies; and – 6.5% (or £387 million) inflation on our cost base (mainly related to leaf and manufacturing costs), while absorbing a £136 million transactional foreign exchange headwind. In September 2023, the Group completed the sale of its businesses in Russia and Belarus. These businesses contributed £193 million to the Group's financial performance in 2023 (£nil in 2024), thereby acting as a headwind to the comparative performance of 2024. The Group also recognised a charge of £353 million relating to the sale that did not repeat in 2024. Our Group operating margin was 10.6% in 2024, compared to -57.7% in 2023, largely due to the amortisation and impairment charges referred to above. The following analysis is on an organic, adjusted constant rate basis, which we believe reflects the operational performance of the Group: – In the U.S., adjusted profit from operations was down 3.5% to £6,580 million, largely due to the impact of lower combustibles volume and commercial initiatives; – In AME, adjusted profit from operations increased 7.5%, driven by Türkiye, Germany, Romania, the UK, the Nordics, Switzerland and Italy, which more than offset reductions in Canada; and – In APMEA, adjusted profit from operations increased by 7.5%, driven by Japan, Indonesia, Saudi Arabia, Sri Lanka and asset sales in West Africa, including as related to the Group's exit from Mali. These more than offset a decline in Australia and the impact of supply chain disruptions in Sudan. In aggregate, adjusted organic profit from operations at constant rates of exchange was up 1.4% with adjusted organic operating margin flat at constant rates of exchange. For a full discussion on the performance by region, please see pages 10 to 12. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 4

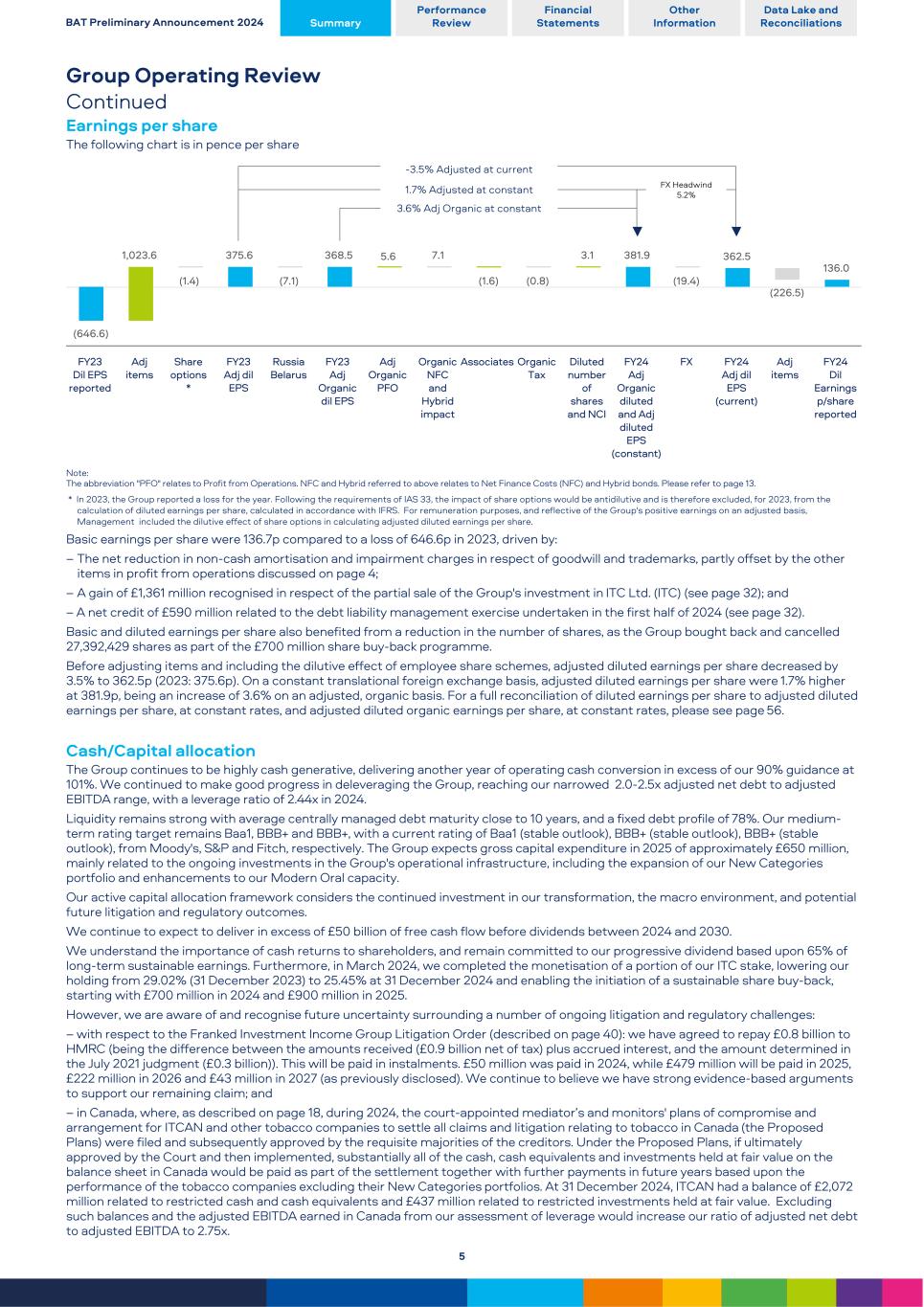

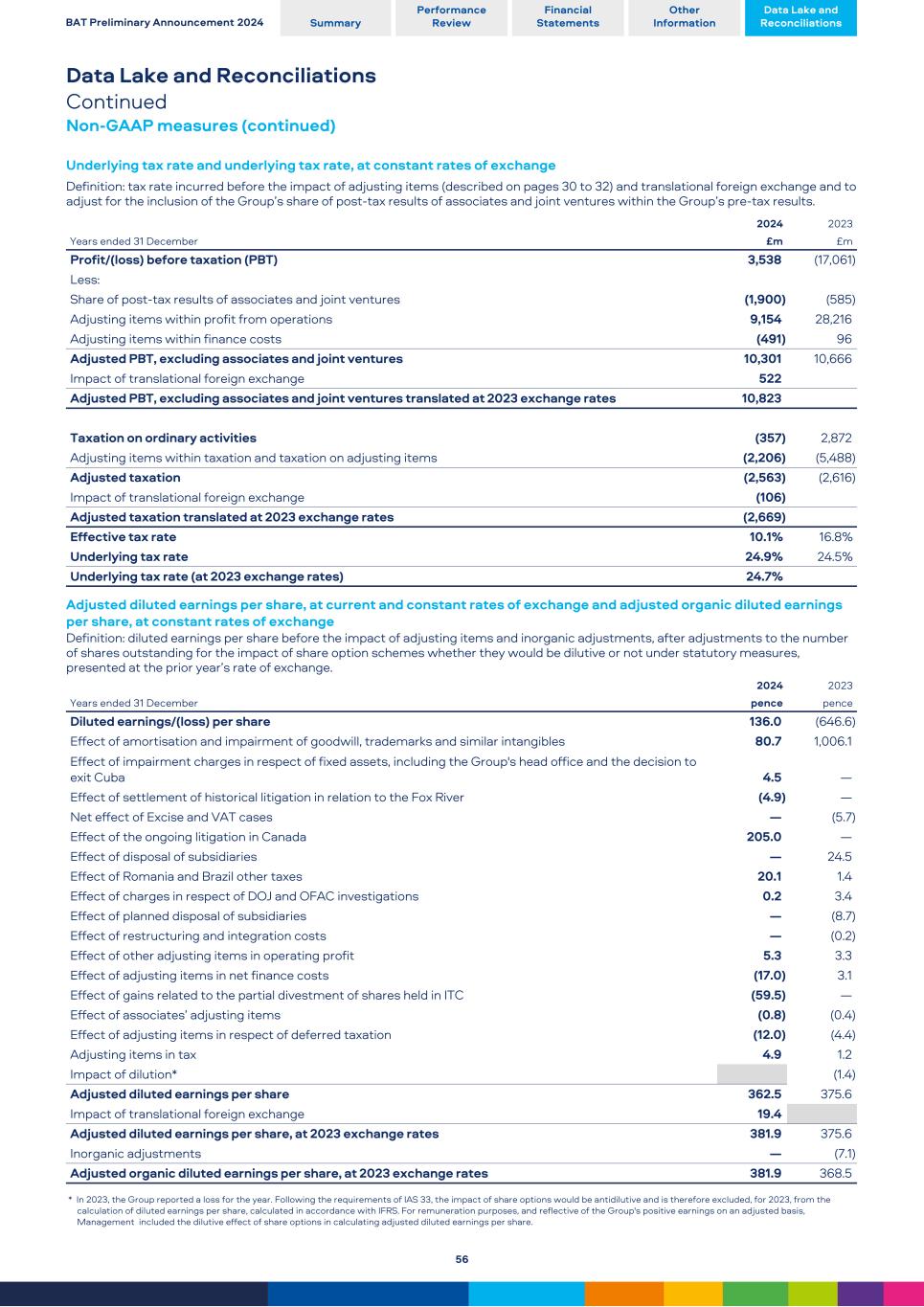

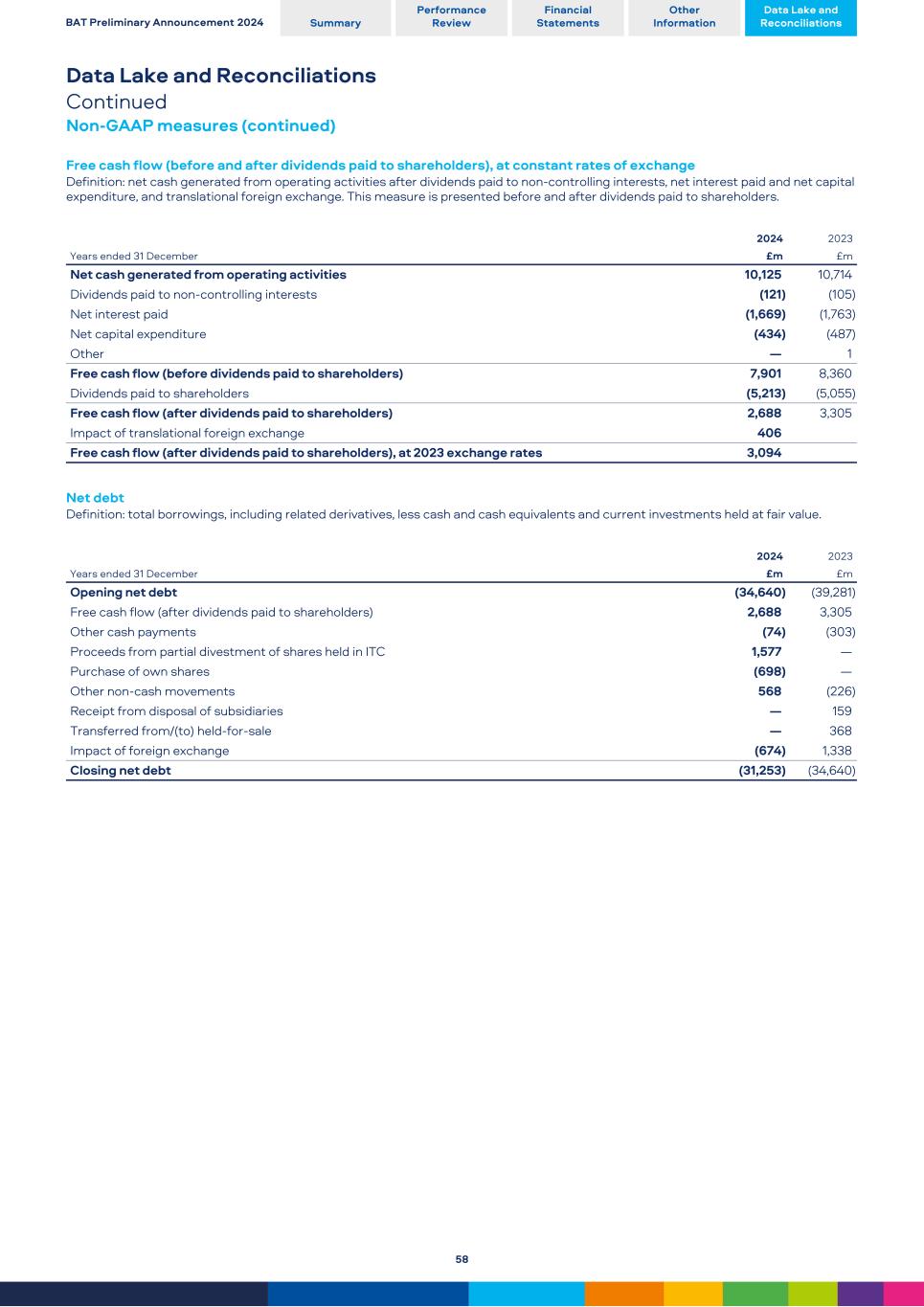

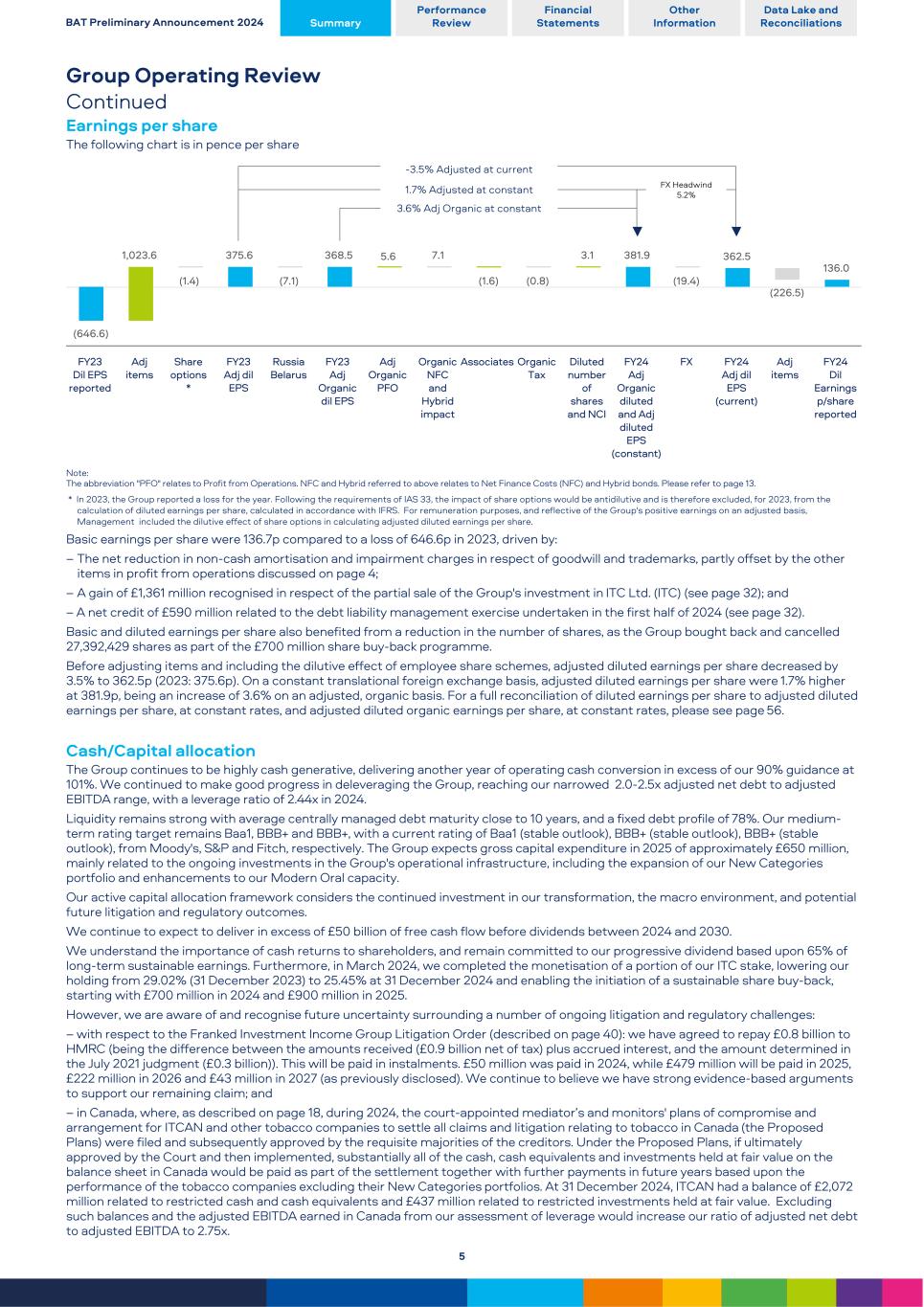

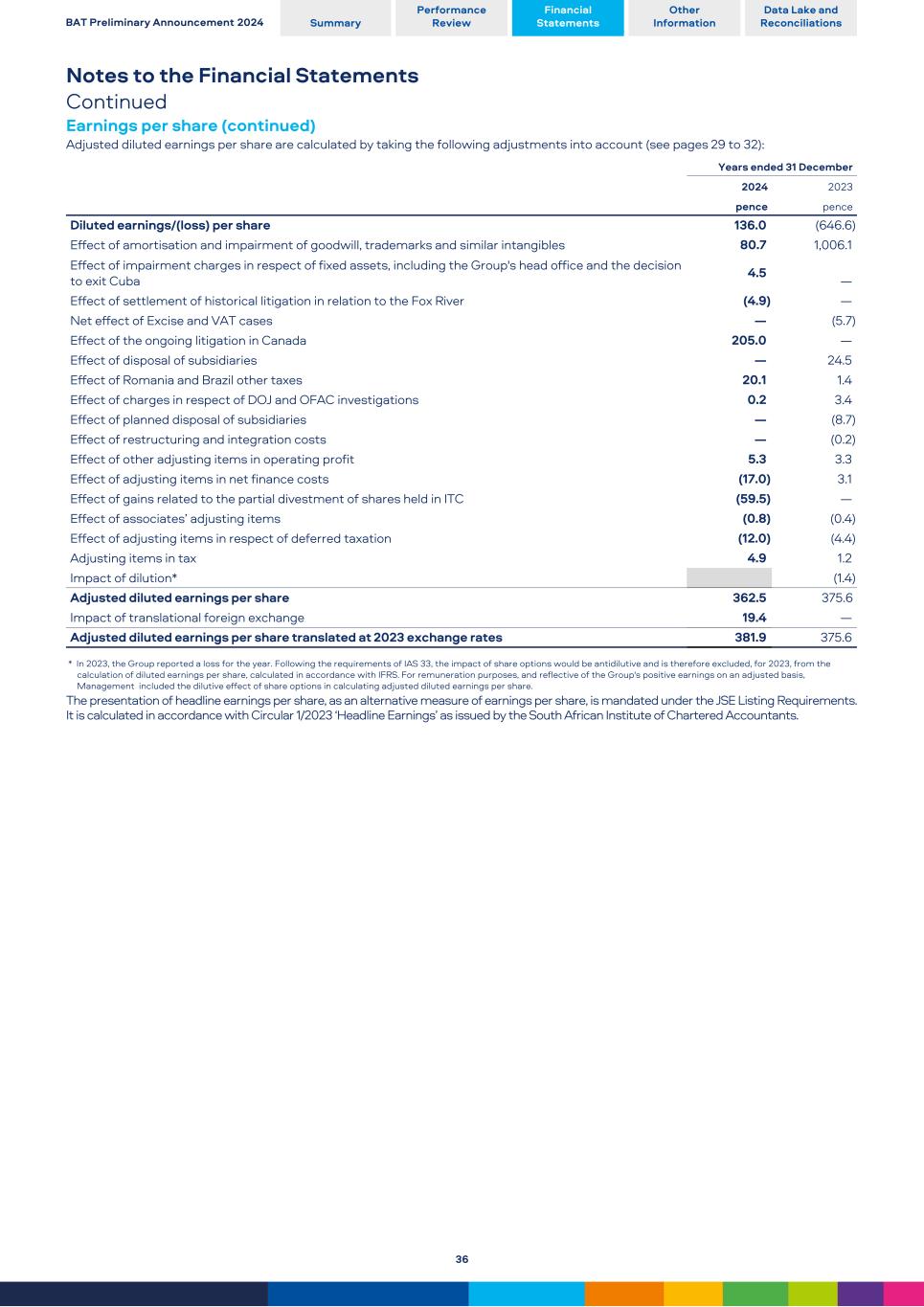

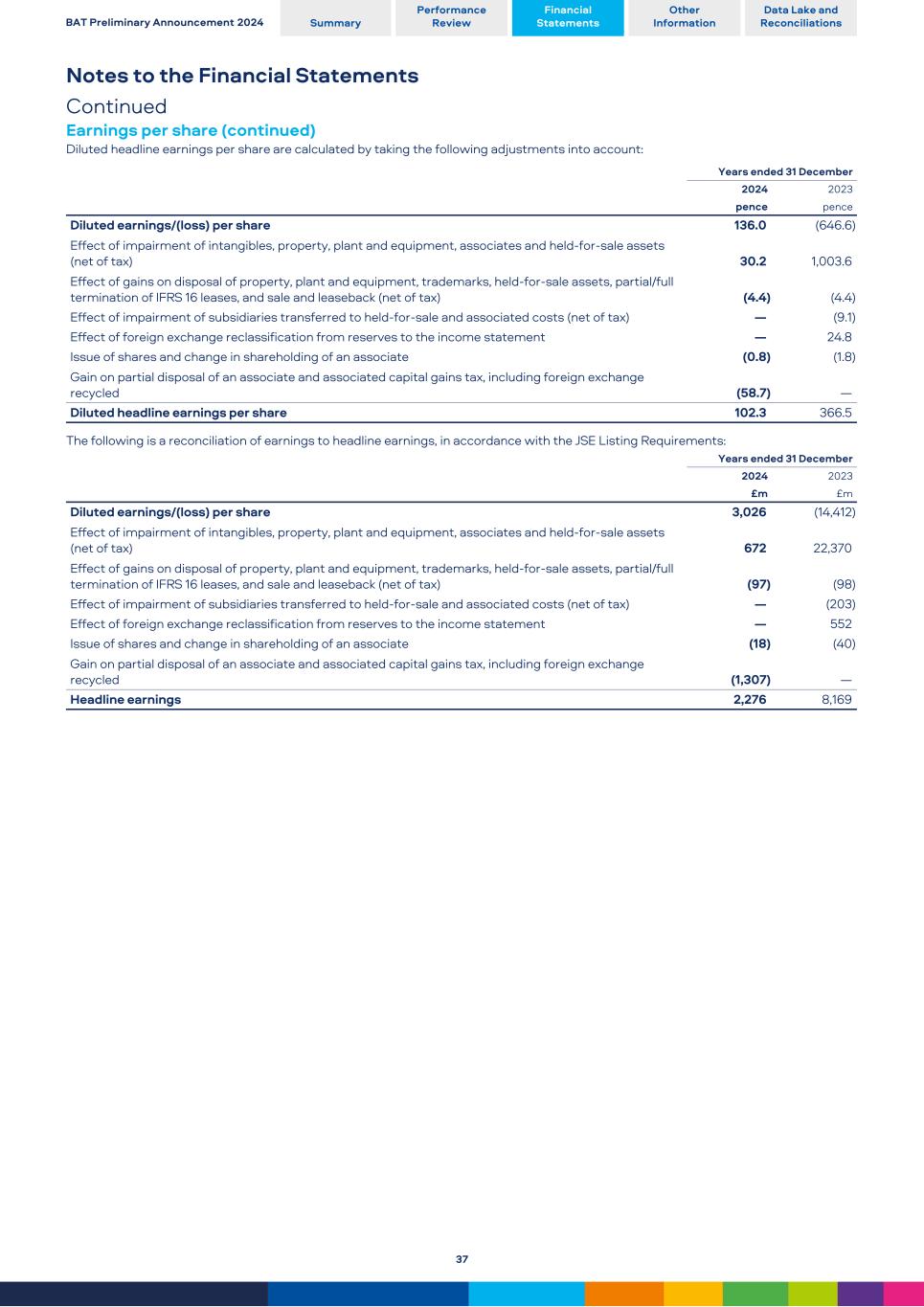

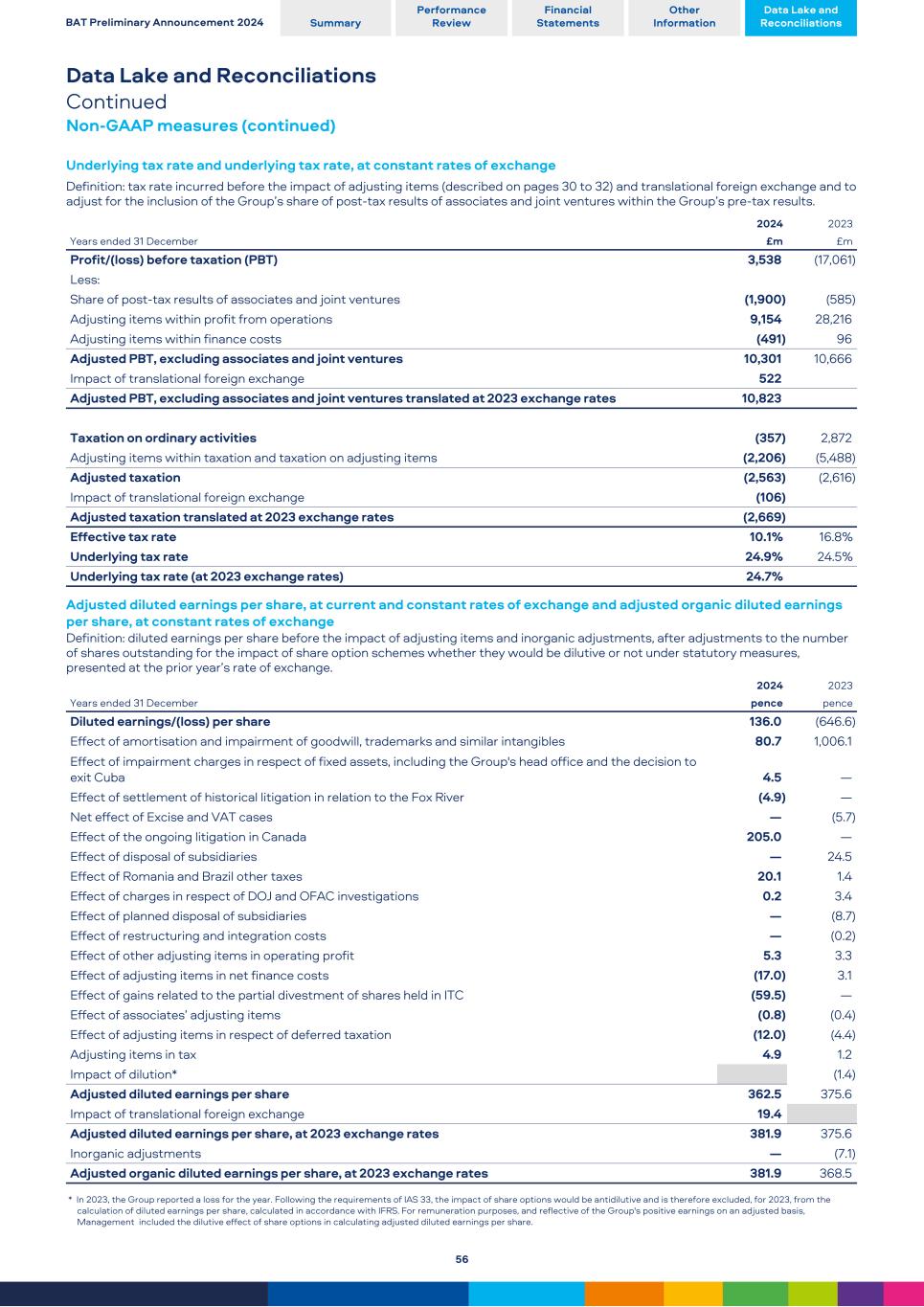

Group Operating Review Continued Earnings per share The following chart is in pence per share -3.5% Adjusted at current 1.7% Adjusted at constant FX Headwind 5.2% 3.6% Adj Organic at constant (646.6) 1,023.6 (1.4) 375.6 (7.1) 368.5 5.6 7.1 (1.6) (0.8) 3.1 381.9 (19.4) 362.5 (226.5) 136.0 FY23 Dil EPS reported Adj items Share options * FY23 Adj dil EPS Russia Belarus FY23 Adj Organic dil EPS Adj Organic PFO Organic NFC and Hybrid impact Associates Organic Tax Diluted number of shares and NCI FY24 Adj Organic diluted and Adj diluted EPS (constant) FX FY24 Adj dil EPS (current) Adj items FY24 Dil Earnings p/share reported Note: The abbreviation "PFO" relates to Profit from Operations. NFC and Hybrid referred to above relates to Net Finance Costs (NFC) and Hybrid bonds. Please refer to page 13. * In 2023, the Group reported a loss for the year. Following the requirements of IAS 33, the impact of share options would be antidilutive and is therefore excluded, for 2023, from the calculation of diluted earnings per share, calculated in accordance with IFRS. For remuneration purposes, and reflective of the Group's positive earnings on an adjusted basis, Management included the dilutive effect of share options in calculating adjusted diluted earnings per share. Basic earnings per share were 136.7p compared to a loss of 646.6p in 2023, driven by: – The net reduction in non-cash amortisation and impairment charges in respect of goodwill and trademarks, partly offset by the other items in profit from operations discussed on page 4; – A gain of £1,361 million recognised in respect of the partial sale of the Group's investment in ITC Ltd. (ITC) (see page 32); and – A net credit of £590 million related to the debt liability management exercise undertaken in the first half of 2024 (see page 32). Basic and diluted earnings per share also benefited from a reduction in the number of shares, as the Group bought back and cancelled 27,392,429 shares as part of the £700 million share buy-back programme. Before adjusting items and including the dilutive effect of employee share schemes, adjusted diluted earnings per share decreased by 3.5% to 362.5p (2023: 375.6p). On a constant translational foreign exchange basis, adjusted diluted earnings per share were 1.7% higher at 381.9p, being an increase of 3.6% on an adjusted, organic basis. For a full reconciliation of diluted earnings per share to adjusted diluted earnings per share, at constant rates, and adjusted diluted organic earnings per share, at constant rates, please see page 56. Cash/Capital allocation The Group continues to be highly cash generative, delivering another year of operating cash conversion in excess of our 90% guidance at 101%. We continued to make good progress in deleveraging the Group, reaching our narrowed 2.0-2.5x adjusted net debt to adjusted EBITDA range, with a leverage ratio of 2.44x in 2024. Liquidity remains strong with average centrally managed debt maturity close to 10 years, and a fixed debt profile of 78%. Our medium- term rating target remains Baa1, BBB+ and BBB+, with a current rating of Baa1 (stable outlook), BBB+ (stable outlook), BBB+ (stable outlook), from Moody's, S&P and Fitch, respectively. The Group expects gross capital expenditure in 2025 of approximately £650 million, mainly related to the ongoing investments in the Group's operational infrastructure, including the expansion of our New Categories portfolio and enhancements to our Modern Oral capacity. Our active capital allocation framework considers the continued investment in our transformation, the macro environment, and potential future litigation and regulatory outcomes. We continue to expect to deliver in excess of £50 billion of free cash flow before dividends between 2024 and 2030. We understand the importance of cash returns to shareholders, and remain committed to our progressive dividend based upon 65% of long-term sustainable earnings. Furthermore, in March 2024, we completed the monetisation of a portion of our ITC stake, lowering our holding from 29.02% (31 December 2023) to 25.45% at 31 December 2024 and enabling the initiation of a sustainable share buy-back, starting with £700 million in 2024 and £900 million in 2025. However, we are aware of and recognise future uncertainty surrounding a number of ongoing litigation and regulatory challenges: – with respect to the Franked Investment Income Group Litigation Order (described on page 40): we have agreed to repay £0.8 billion to HMRC (being the difference between the amounts received (£0.9 billion net of tax) plus accrued interest, and the amount determined in the July 2021 judgment (£0.3 billion)). This will be paid in instalments. £50 million was paid in 2024, while £479 million will be paid in 2025, £222 million in 2026 and £43 million in 2027 (as previously disclosed). We continue to believe we have strong evidence-based arguments to support our remaining claim; and – in Canada, where, as described on page 18, during 2024, the court-appointed mediator’s and monitors' plans of compromise and arrangement for ITCAN and other tobacco companies to settle all claims and litigation relating to tobacco in Canada (the Proposed Plans) were filed and subsequently approved by the requisite majorities of the creditors. Under the Proposed Plans, if ultimately approved by the Court and then implemented, substantially all of the cash, cash equivalents and investments held at fair value on the balance sheet in Canada would be paid as part of the settlement together with further payments in future years based upon the performance of the tobacco companies excluding their New Categories portfolios. At 31 December 2024, ITCAN had a balance of £2,072 million related to restricted cash and cash equivalents and £437 million related to restricted investments held at fair value. Excluding such balances and the adjusted EBITDA earned in Canada from our assessment of leverage would increase our ratio of adjusted net debt to adjusted EBITDA to 2.75x. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 5

Group Operating Review Continued Sustainability performance update We seek to take a leading role in tackling some of the biggest global challenges in sustainability. We aim to do so by responsibly Building a Smokeless World, reducing our use of natural resources, and delivering our climate goals as we transition to A Better Tomorrow™. We strive to create a meaningful impact in the communities where we operate and inspire all our employees to drive change. In 2024, we refined our Sustainability Strategy to better address our material topics and continue to deliver value to our stakeholders, focused on five strategic impact areas: Tobacco Harm Reduction, Climate, Nature, Circularity and Communities. We have received a Triple-A rating from CDP for our 2024 disclosures on Climate Change, Water Security and Forest, reflecting our commitment to environmental transparency and action. TOBACCO HARM REDUCTION (THR): To migrate adult smokers from cigarettes to smokeless products. We continue to transform our business and made significant progress on our goals. In 2024, we launched Omni™, our evidence-based manifesto for change, which captures our commitment and progress towards creating A Better Tomorrow™ by Building a Smokeless World. We also published our 'Commitment to Responsible Vaping Products' to tackle pressing societal concerns such as underage access, product safety and the enforcement of regulation1. CLIMATE: To transition towards a low-carbon economy. Our 2030 near-term Science-Based Targets (SBTs) are in line with a 1.5°C warming pathway and underpinned by commitments across energy, waste, water and nature. During 2024, in line with our climate transition efforts, we submitted Net Zero Greenhouse Gas (GHG) emissions targets for validation to the Science Based Targets initiative (SBTi). We continue to make progress towards our Scope 1 and 2 emission reduction targets. Energy reduction initiatives and increasing the use of renewable fuels resulted in a 42.6% reduction in these emissions vs our 2020 baseline. We are making progress against our Scope 3 emissions which reduced by 11% year-on-year. Our Supplier Enablement programme has proven instrumental, guiding our suppliers to decarbonise their own operations. By the end of 2024, 23.5% of our suppliers of purchased goods and services by spend had SBTs in place, and an additional 17.3% have committed to setting them. NATURE: To contribute to a Nature Positive2 Future. In line with the Science-Based Targets Network (AR3T framework), we have adopted a mitigation hierarchy for our nature commitments. Our Global Leaf Agronomy Development (GLAD) centre continues to promote the use of agricultural technologies and practices. In Brazil, we introduced a satellite monitoring system to detect potential deforestation or conversion cases by tracking forest cover changes over time. Our recently developed regenerative agriculture framework will be piloted in 2025. It includes a methodology for assessing and prioritising local risks and the monitoring of progress on the regeneration of the farmland ecosystem. We continue to prioritise water stewardship initiatives across our own operations. We met our 2025 target for reduction in water withdrawn two years early and continue to work on maintaining this target, achieving a 47.4% reduction in 2024 (vs our 2017 baseline). CIRCULARITY: To reduce the use of virgin raw materials. We continue to enhance our material science and design capabilities to improve the circularity of our products and packaging. In 2024, we introduced and began testing a set of ecodesign principles, which will provide insights to support the reduction of our environmental impacts across the product life cycle. In France, Ireland, Denmark, Sweden and the UK, we recently launched two variants of Velo cans that were certified by the International Sustainability and Carbon Certification for using bio-plastic or Post-Consumer Resin plastic through a mass balance approach3. Additionally in Nottinghamshire, UK, we have partnered with a waste management company to pilot a collection and recycling programme for used vapour products. COMMUNITIES: To support the livelihoods and the resilience of our communities. We continue to work with stakeholders in communities where we operate, implementing community-focused initiatives. In 2024, our ‘Living Income’ methodology was revised to better represent living costs in rural areas and are in the process of co-creating action plans with suppliers to target key income drivers for farmers. We continued to work with the Responsible Business Alliance (RBA) as a Supporter Member. This gives us access to the Responsible Mineral Initiative and RBA-approved auditors who conduct on-site labour audits of our suppliers. Across our own workforce, we maintained our year-on-year consistency in compensating men and women within 1% of each other, as well as Ethnically Diverse and Non-ethnically Diverse groups (as defined on page 43) within 1% of one another for performing the same work or work of equal value. 1. bat.com/commitment-to-responsible-vaping-products. 2. According to The Nature Positive Initiative, 'Nature Positive' is a goal which refers to measurable outcomes that contribute to halting and reversing nature loss with significant benefits to society (https://www.naturepositive.org/about/the-initiative) 3. 'Mass balance' is a principle that matches inputs (such as plastic waste) with outputs from a recycling or production process, to determine the recycled content (source: https://zerowasteeurope.eu/wp-content/uploads/2021/05/ rpa_2021_mass_balance_booklet-2.pdf). Enquiries For more information, please contact Investor Relations: Victoria Buxton +44 (0)20 7845 2012 Amy Chamberlain +44 (0)20 7845 1124 John Harney +44 (0)20 7845 1263 BAT IR Team IR_Team@bat.com Press Office: +44 (0)20 7845 2888 | @BATplc BAT Media team Webcast and Q&A session: BAT will hold a live webcast for investors and analysts at 9.30am (GMT) on 13 February 2025, hosted by Tadeu Marroco, Chief Executive, and Soraya Benchikh, Chief Financial Officer. The presentation will be followed by a Q&A session. The webcast and presentation slides will be available to view on our website at www.bat.com/latestresults. If you prefer to listen via conference call, please use the following dial-in details (participant passcode: BAT FY 24). Standard International: +44 (0) 33 0551 0200 SA (toll free): 0 800 980 512 UK (toll free): 0808 109 0701 U.S. (toll free): 866 571 0905 Video: Chief Executive and CFO's take on Full-Year 2024 Results: To watch highlights of this year's results, please visit: www.bat.com/highlights-video-fy24 BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 6

Category Performance Review Please see page 50 for a full reconciliation to constant currency and organic metrics, including prior year data. All references to volume share or value share movement in the following discussion are compared to 2023. See page 42 for a discussion on the use of these measures. Our products as sold in the U.S., including Vuse, Velo, Grizzly, Kodiak, and Camel Snus, are subject to FDA regulation and no reduced-risk claims will be made as to these products without agency clearance. For year ended 31 December 2024 Volume Revenue Reported Organic Reported Organic Current Exchange Constant Constant Unit vs 2023 vs 2023 £m vs 2023 £m £m vs 2023 £m vs 2023 New Categories 3,432 +2.5 % 119 3,551 +6.1 % 3,551 +8.9 % Vapour (units mn) 616 -5.9 % -5.9 % 1,721 -5.1 % 44 1,765 -2.6 % 1,765 -2.5 % HP (sticks bn) 20.9 -11.6 % -0.3 % 921 -7.6 % 51 972 -2.5 % 972 +5.8 % Modern Oral (pouches bn) 8.3 +55.0 % +56.1 % 790 +46.6 % 24 814 +51.0 % 814 +53.2 % New Categories contribution* 251 n/m 251 n/m Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. *New Categories contribution is presented above on adjusted and adjusted organic bases, in each case at constant rates of exchange. n/m refers to movements that are not meaningful Vapour – Maintained global value share* leadership, U.S. illicit Vapour headwinds persist – BAT maintained global leadership in tracked channels with value share of 40.0% in Top Vapour markets**, down 1.2 ppts vs 2023, with strong gains in Europe more than offset by the U.S. and Canada. – Vapour is the largest contributor to New Category usage, reaching 11.9 million adult consumers, adding 0.1 million in 2024. – Our new range of innovative products, which reached the market in Q4 2024, are performing well, driven by key consumer-focused features, including enhanced sensorials and a removable battery in many of our single-use products. – Four of the seven Top Vapour markets are profitable (on a category contribution basis), driven by increased scale and marketing spend effectiveness, as we continue to focus on delivering Quality Growth. Vapour volume declined 5.9% vs 2023, with revenue down 5.1% to £1,721 million, or down 2.5% on an organic constant currency basis, driven by lack of enforcement of illegal flavoured single-use Vapour products in the U.S. and the impact of the flavour ban and current lack of enforcement on illegally sold products in the province of Québec in Canada. In the U.S., the world's largest Vapour market, the Group maintained leadership in value share (of closed system consumables, including single-use Vapour products in tracked channels) despite a decline of 2.0 ppts to 50.2%. Revenue was down 0.8% on a constant currency basis, driven by continued lack of enforcement of illegal flavoured and single-use products. While we estimate illicit Vapour products to be almost 70% of the total U.S. Vapour market, we are encouraged by: – The Food and Drug Administration (FDA) increasing frequency of warning letters, seizures and penalties; – Implementation of Vapour directories in three states, with an additional 11 states having passed Vapour directory and enforcement legislation, with staggered implementation up to Q4 2025; and – Continued signs of illicit products volume decline in Louisiana, the first state to implement a Vapour directory and enforcement legislation in October 2023, with Vuse Alto capturing the majority of the volume outflow back into the legal segment. Much more effective enforcement is needed to drive a meaningful impact. This is why we have taken the proactive step of filing two complaints with the U.S. International Trade Commission. One of those complaints—based on patents—is ongoing and under investigation. The other complaint—based on unfair competition—was strategically withdrawn so we can re-file to introduce new evidence that would increase the likelihood of a favourable outcome. In AME, our Vapour volume declined by 11.5% and revenue was down 10.8%, (a decline of 8.6% on an organic constant currency basis) largely due to Canada where a lack of enforcement of illegal single-use products following the flavour ban in the province of Québec has impacted volumes. Vuse Go Reload, our new rechargeable closed system, with enhanced sensorials, longer lasting battery and device lock is performing well in Europe. The rechargeable closed system segment began to return to growth at industry level in Europe. We are well-positioned to capitalise on this momentum with global leadership in the rechargeable closed segment, with value share of 59.9%. Effective regulation and enforcement of Vapour products will remain a key focus to unlock the full potential of the category. In addition to the enforcement issues in the U.S. and in the province of Québec in Canada, we believe there is a lack of enforcement regarding the 2ml tank liquid capacity limit in the UK, both of which continue to negatively impact the legitimate market. Following the Mexican Government’s decision to ban the sale of Vapour products, Vuse will no longer be sold in Mexico. We believe this decision is counter to the goal of reducing smoking rates, a goal we share. Smokeless products, including Vapour products, are associated with an accelerated decline in smoking prevalence. In APMEA, total Vapour consumables volume grew strongly by 19.1%, with revenue up 19.6%, or 23.7% on organic constant currency basis, driven by South Korea and New Zealand. * Based on estimated value share in measured retail for Vapour (i.e., value share of rechargeable closed systems consumables and disposables sales in retail) in the Top Vapour markets. ** Top Vapour markets are defined as the Top markets by Vapour industry revenue and account for c.80% of global Vapour industry revenue in 2024. Top markets are the U.S., Canada, France, the UK, Spain, Poland and Germany. The Top markets were revised in 2024, with an increase in value share in respect of 2023 to 41.2%. Also in 2024, the Group changed from Marlin to Retail Scan Data for the U.S. Vapour market, with the Group's Vapour value share in 2023 rebased to 52.1%. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 7

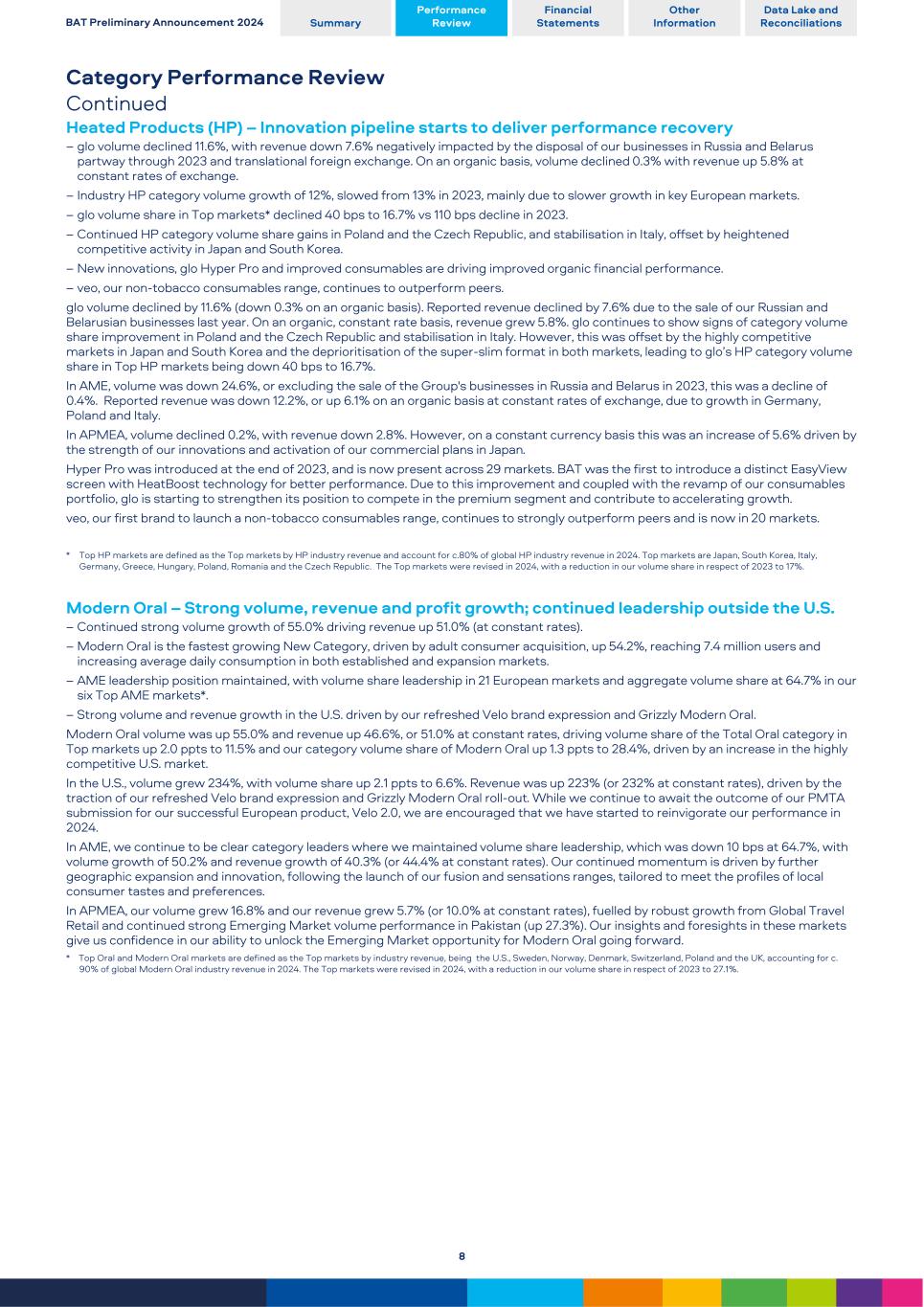

Category Performance Review Continued Heated Products (HP) – Innovation pipeline starts to deliver performance recovery – glo volume declined 11.6%, with revenue down 7.6% negatively impacted by the disposal of our businesses in Russia and Belarus partway through 2023 and translational foreign exchange. On an organic basis, volume declined 0.3% with revenue up 5.8% at constant rates of exchange. – Industry HP category volume growth of 12%, slowed from 13% in 2023, mainly due to slower growth in key European markets. – glo volume share in Top markets* declined 40 bps to 16.7% vs 110 bps decline in 2023. – Continued HP category volume share gains in Poland and the Czech Republic, and stabilisation in Italy, offset by heightened competitive activity in Japan and South Korea. – New innovations, glo Hyper Pro and improved consumables are driving improved organic financial performance. – veo, our non-tobacco consumables range, continues to outperform peers. glo volume declined by 11.6% (down 0.3% on an organic basis). Reported revenue declined by 7.6% due to the sale of our Russian and Belarusian businesses last year. On an organic, constant rate basis, revenue grew 5.8%. glo continues to show signs of category volume share improvement in Poland and the Czech Republic and stabilisation in Italy. However, this was offset by the highly competitive markets in Japan and South Korea and the deprioritisation of the super-slim format in both markets, leading to glo’s HP category volume share in Top HP markets being down 40 bps to 16.7%. In AME, volume was down 24.6%, or excluding the sale of the Group's businesses in Russia and Belarus in 2023, this was a decline of 0.4%. Reported revenue was down 12.2%, or up 6.1% on an organic basis at constant rates of exchange, due to growth in Germany, Poland and Italy. In APMEA, volume declined 0.2%, with revenue down 2.8%. However, on a constant currency basis this was an increase of 5.6% driven by the strength of our innovations and activation of our commercial plans in Japan. Hyper Pro was introduced at the end of 2023, and is now present across 29 markets. BAT was the first to introduce a distinct EasyView screen with HeatBoost technology for better performance. Due to this improvement and coupled with the revamp of our consumables portfolio, glo is starting to strengthen its position to compete in the premium segment and contribute to accelerating growth. veo, our first brand to launch a non-tobacco consumables range, continues to strongly outperform peers and is now in 20 markets. * Top HP markets are defined as the Top markets by HP industry revenue and account for c.80% of global HP industry revenue in 2024. Top markets are Japan, South Korea, Italy, Germany, Greece, Hungary, Poland, Romania and the Czech Republic. The Top markets were revised in 2024, with a reduction in our volume share in respect of 2023 to 17%. Modern Oral – Strong volume, revenue and profit growth; continued leadership outside the U.S. – Continued strong volume growth of 55.0% driving revenue up 51.0% (at constant rates). – Modern Oral is the fastest growing New Category, driven by adult consumer acquisition, up 54.2%, reaching 7.4 million users and increasing average daily consumption in both established and expansion markets. – AME leadership position maintained, with volume share leadership in 21 European markets and aggregate volume share at 64.7% in our six Top AME markets*. – Strong volume and revenue growth in the U.S. driven by our refreshed Velo brand expression and Grizzly Modern Oral. Modern Oral volume was up 55.0% and revenue up 46.6%, or 51.0% at constant rates, driving volume share of the Total Oral category in Top markets up 2.0 ppts to 11.5% and our category volume share of Modern Oral up 1.3 ppts to 28.4%, driven by an increase in the highly competitive U.S. market. In the U.S., volume grew 234%, with volume share up 2.1 ppts to 6.6%. Revenue was up 223% (or 232% at constant rates), driven by the traction of our refreshed Velo brand expression and Grizzly Modern Oral roll-out. While we continue to await the outcome of our PMTA submission for our successful European product, Velo 2.0, we are encouraged that we have started to reinvigorate our performance in 2024. In AME, we continue to be clear category leaders where we maintained volume share leadership, which was down 10 bps at 64.7%, with volume growth of 50.2% and revenue growth of 40.3% (or 44.4% at constant rates). Our continued momentum is driven by further geographic expansion and innovation, following the launch of our fusion and sensations ranges, tailored to meet the profiles of local consumer tastes and preferences. In APMEA, our volume grew 16.8% and our revenue grew 5.7% (or 10.0% at constant rates), fuelled by robust growth from Global Travel Retail and continued strong Emerging Market volume performance in Pakistan (up 27.3%). Our insights and foresights in these markets give us confidence in our ability to unlock the Emerging Market opportunity for Modern Oral going forward. * Top Oral and Modern Oral markets are defined as the Top markets by industry revenue, being the U.S., Sweden, Norway, Denmark, Switzerland, Poland and the UK, accounting for c. 90% of global Modern Oral industry revenue in 2024. The Top markets were revised in 2024, with a reduction in our volume share in respect of 2023 to 27.1%. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 8

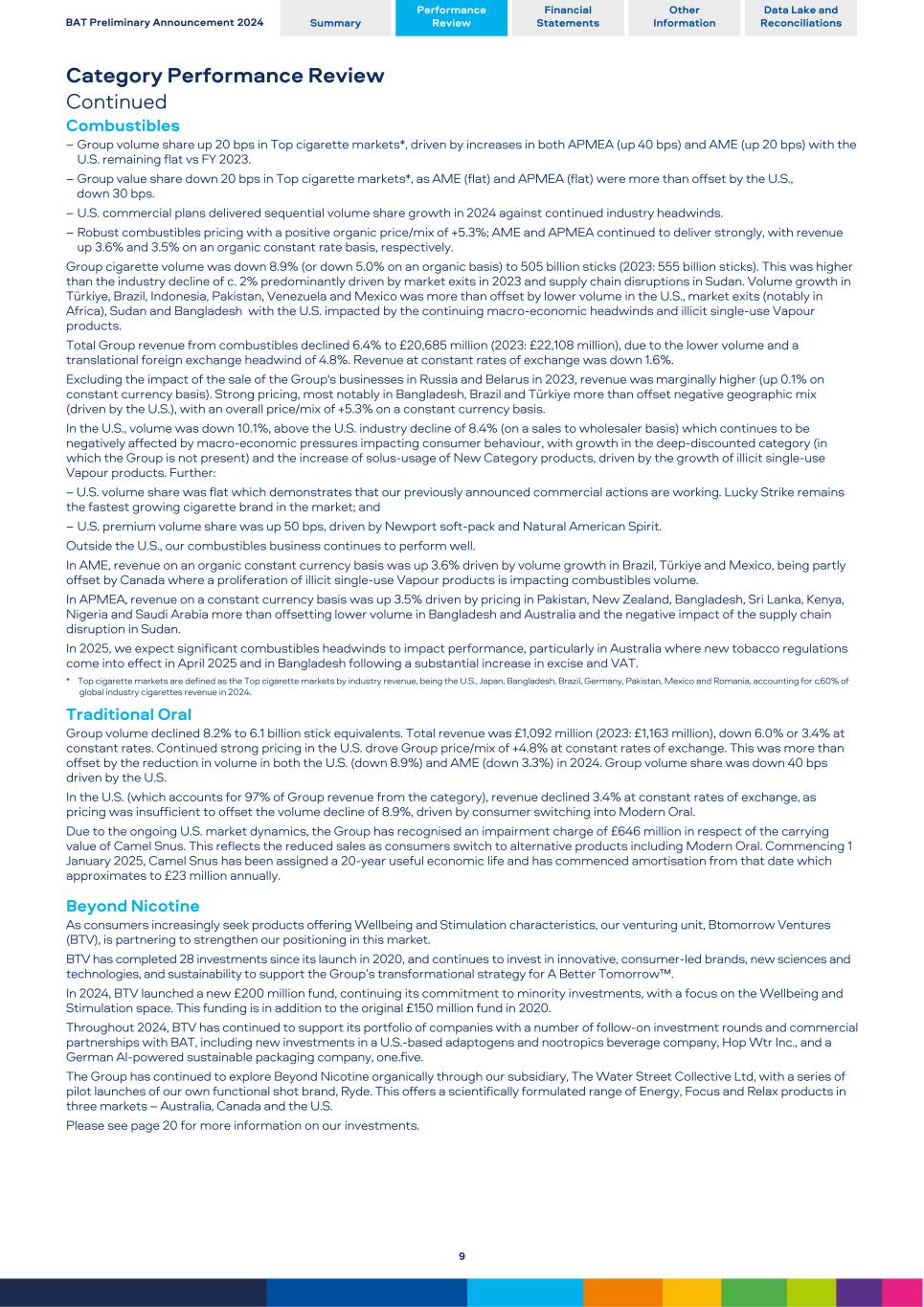

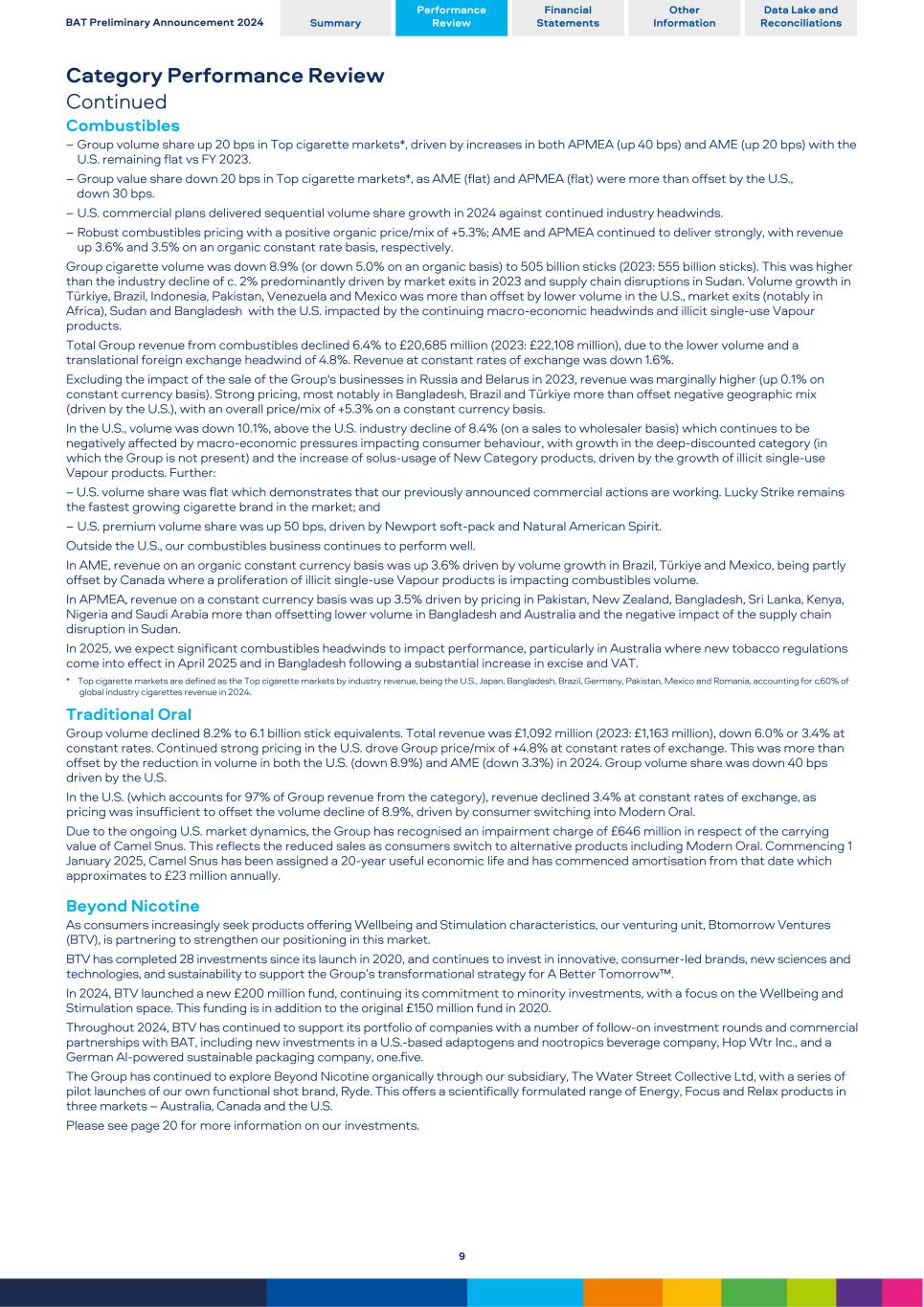

Category Performance Review Continued Combustibles – Group volume share up 20 bps in Top cigarette markets*, driven by increases in both APMEA (up 40 bps) and AME (up 20 bps) with the U.S. remaining flat vs FY 2023. – Group value share down 20 bps in Top cigarette markets*, as AME (flat) and APMEA (flat) were more than offset by the U.S., down 30 bps. – U.S. commercial plans delivered sequential volume share growth in 2024 against continued industry headwinds. – Robust combustibles pricing with a positive organic price/mix of +5.3%; AME and APMEA continued to deliver strongly, with revenue up 3.6% and 3.5% on an organic constant rate basis, respectively. Group cigarette volume was down 8.9% (or down 5.0% on an organic basis) to 505 billion sticks (2023: 555 billion sticks). This was higher than the industry decline of c. 2% predominantly driven by market exits in 2023 and supply chain disruptions in Sudan. Volume growth in Türkiye, Brazil, Indonesia, Pakistan, Venezuela and Mexico was more than offset by lower volume in the U.S., market exits (notably in Africa), Sudan and Bangladesh with the U.S. impacted by the continuing macro-economic headwinds and illicit single-use Vapour products. Total Group revenue from combustibles declined 6.4% to £20,685 million (2023: £22,108 million), due to the lower volume and a translational foreign exchange headwind of 4.8%. Revenue at constant rates of exchange was down 1.6%. Excluding the impact of the sale of the Group's businesses in Russia and Belarus in 2023, revenue was marginally higher (up 0.1% on constant currency basis). Strong pricing, most notably in Bangladesh, Brazil and Türkiye more than offset negative geographic mix (driven by the U.S.), with an overall price/mix of +5.3% on a constant currency basis. In the U.S., volume was down 10.1%, above the U.S. industry decline of 8.4% (on a sales to wholesaler basis) which continues to be negatively affected by macro-economic pressures impacting consumer behaviour, with growth in the deep-discounted category (in which the Group is not present) and the increase of solus-usage of New Category products, driven by the growth of illicit single-use Vapour products. Further: – U.S. volume share was flat which demonstrates that our previously announced commercial actions are working. Lucky Strike remains the fastest growing cigarette brand in the market; and – U.S. premium volume share was up 50 bps, driven by Newport soft-pack and Natural American Spirit. Outside the U.S., our combustibles business continues to perform well. In AME, revenue on an organic constant currency basis was up 3.6% driven by volume growth in Brazil, Türkiye and Mexico, being partly offset by Canada where a proliferation of illicit single-use Vapour products is impacting combustibles volume. In APMEA, revenue on a constant currency basis was up 3.5% driven by pricing in Pakistan, New Zealand, Bangladesh, Sri Lanka, Kenya, Nigeria and Saudi Arabia more than offsetting lower volume in Bangladesh and Australia and the negative impact of the supply chain disruption in Sudan. In 2025, we expect significant combustibles headwinds to impact performance, particularly in Australia where new tobacco regulations come into effect in April 2025 and in Bangladesh following a substantial increase in excise and VAT. * Top cigarette markets are defined as the Top cigarette markets by industry revenue, being the U.S., Japan, Bangladesh, Brazil, Germany, Pakistan, Mexico and Romania, accounting for c.60% of global industry cigarettes revenue in 2024. Traditional Oral Group volume declined 8.2% to 6.1 billion stick equivalents. Total revenue was £1,092 million (2023: £1,163 million), down 6.0% or 3.4% at constant rates. Continued strong pricing in the U.S. drove Group price/mix of +4.8% at constant rates of exchange. This was more than offset by the reduction in volume in both the U.S. (down 8.9%) and AME (down 3.3%) in 2024. Group volume share was down 40 bps driven by the U.S. In the U.S. (which accounts for 97% of Group revenue from the category), revenue declined 3.4% at constant rates of exchange, as pricing was insufficient to offset the volume decline of 8.9%, driven by consumer switching into Modern Oral. Due to the ongoing U.S. market dynamics, the Group has recognised an impairment charge of £646 million in respect of the carrying value of Camel Snus. This reflects the reduced sales as consumers switch to alternative products including Modern Oral. Commencing 1 January 2025, Camel Snus has been assigned a 20-year useful economic life and has commenced amortisation from that date which approximates to £23 million annually. Beyond Nicotine As consumers increasingly seek products offering Wellbeing and Stimulation characteristics, our venturing unit, Btomorrow Ventures (BTV), is partnering to strengthen our positioning in this market. BTV has completed 28 investments since its launch in 2020, and continues to invest in innovative, consumer-led brands, new sciences and technologies, and sustainability to support the Group’s transformational strategy for A Better Tomorrow™. In 2024, BTV launched a new £200 million fund, continuing its commitment to minority investments, with a focus on the Wellbeing and Stimulation space. This funding is in addition to the original £150 million fund in 2020. Throughout 2024, BTV has continued to support its portfolio of companies with a number of follow-on investment rounds and commercial partnerships with BAT, including new investments in a U.S.-based adaptogens and nootropics beverage company, Hop Wtr Inc., and a German AI-powered sustainable packaging company, one.five. The Group has continued to explore Beyond Nicotine organically through our subsidiary, The Water Street Collective Ltd, with a series of pilot launches of our own functional shot brand, Ryde. This offers a scientifically formulated range of Energy, Focus and Relax products in three markets – Australia, Canada and the U.S. Please see page 20 for more information on our investments. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 9

Regional Review The performances of the regions are discussed below. The following discussion is based upon the Group’s internal reporting structure. All references to volume share or value share movement in the following discussion are compared to FY 2023. See page 42 for a discussion on the use of this measure. Our products as sold in the US, including Vuse, Velo, Grizzly, Kodiak, and Camel Snus, are subject to FDA regulation and no reduced-risk claims will be made as to these products without agency clearance. United States (U.S.): – We maintained Vapour value share leadership in tracked channels at 50.2% (down 2.0 ppts vs 2023) - despite a decrease in revenue by 3.5%, or 0.8% at constant rates of exchange, driven by lower volume due to the continued impact of illicit single-use Vapour products. – Combustibles volume down 10.1%, driven by macro-economic pressures continuing to impact consumer affordability and the increase of solus-usage of New Category products, driven by the growth of illicit single-use Vapour products. – U.S. premium volume share up 50 bps, driven by performance of Newport soft-pack and Natural American Spirit. – Grizzly Modern Oral commenced national roll-out in 2024 - achieving c.1% volume share of Modern Oral by December 2024. Volume/Revenue Please see page 51 for a full reconciliation to constant currency and organic metrics, including prior year data. For year ended 31 December 2024 Volume Revenue Reported Organic Reported Organic Current Exchange Constant Constant Unit vs 2023 vs 2023 £m vs 2023 £m £m vs 2023 £m vs 2023 New Categories 1,078 +1.8 % 29 1,107 +4.6 % 1,107 +4.6 % Vapour (units mn) 287 -3.7 % -3.7 % 998 -3.5 % 27 1,025 -0.8 % 1,025 -0.8 % HP (sticks bn) — — % — % — — % — — — % — — % Modern Oral (pouches bn) 1.0 +234 % +234 % 80 +223 % 2 82 +232 % 82 +232 % Traditional Oral (stick eq bn) 5.3 -8.9 % -8.9 % 1,058 -6.1 % 30 1,088 -3.4 % 1,088 -3.4 % Total Smokeless 2,136 -2.2 % 59 2,195 +0.5 % 2,195 +0.5 % Total Combustibles 47 -10.1 % -10.1 % 9,094 -6.7 % 253 9,347 -4.1 % 9,347 -4.1 % Other 48 -25.3 % 2 50 -22.7 % 50 -22.7 % Total 11,278 -6.0 % 314 11,592 -3.4 % 11,592 -3.4 % Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. See page 47 for a discussion on the preparation of the U.S. financial information, initially based on U.S. GAAP as the primary financial record and converted to IFRS for the purpose of consolidation within the results of the Group Reported revenue decreased 6.0%, including a foreign exchange headwind of 2.6%. Smokeless now represents 18.9% of total revenue. On a constant currency basis (excluding translational foreign exchange), which we believe reflects the operational performance, revenue declined 3.4%. This was driven by: – Vapour, where the U.S. is the world's largest market, as the Group maintained leadership in value share (of closed system consumables, including single-use Vapour products in tracked channels) despite a decline of 2.0 ppts to 50.2%. Revenue was down 0.8% driven by continued lack of enforcement of illegal flavoured and single-use products. We estimate illicit Vapour products to be almost 70% of the total U.S. Vapour market. As explained on page 7, we are encouraged by the Food and Drug Administration (FDA) actions, the implementation of Vapour directories and continued signs of illicit products volume decline in Louisiana. However, we believe much more effective enforcement is needed to drive a meaningful impact; – Modern Oral, as volume grew 234%, with volume share up 2.1 ppts to 6.6%. Revenue was up 232%, driven by the traction of our refreshed Velo brand expression and Grizzly Modern Oral roll-out; – Traditional Oral revenue declined 3.4% as pricing was insufficient to offset the volume decline (down 8.9%), negatively impacted by accelerated cross-category switching, particularly to Modern Oral and reduced consumption. Value share in Traditional Oral decreased 40 bps, with volume share down 40 bps; and – Combustibles, as volume was down 10.1%, above the U.S. industry decline of 8.4% (on a sales to wholesaler basis) which continues to be negatively affected by macro-economic pressures impacting consumer behaviour, with growth in the deep-discounted category (in which the Group is not present) and the increase of solus-usage of New Category products, driven by the growth of illicit single-use Vapour products. Consequently, revenue was down 4.1% despite higher price/mix (+6.0%). Our premium volume share was up 50 bps, driven by Newport soft-pack and Natural American Spirit. Our total volume share was flat after a period of decline (which demonstrates that our previously announced commercial actions are working), with value share down 30 bps, having declined 60 bps in 2023. Profit from operations and operating margin Please see page 48 for a full reconciliation to constant currency and organic metrics, including prior year data. For year ended 31 December 2024 Reported Adj. Exchange Adjusted Adjusted Organic Current Constant Constant £m vs 2023 £m £m £m vs 2023 £m vs 2023 Profit from Operations 4,087 n/m 2,299 194 6,580 -3.5 % 6,580 -3.5 % Operating Margin 36.2 % 209.5 ppts 56.8 % -10 bps 56.8 % -10 bps Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. n/m refers to movements that are not meaningful. Reported profit from operations increased to £4,087 million from a loss of £20,781 million, due to the £4.3 billion impairment of goodwill and £23.0 billion impairment of the carrying value of some of the Group's U.S. acquired brands recognised in 2023. From 1 January 2024, the Group commenced amortising Newport, Camel, Natural American Spirit and Pall Mall over a period not exceeding 30 years. The non- cash charge was £1.4 billion per year and was treated as an adjusting item. In 2024, the Group has recognised a charge of £646 million in respect of Camel Snus, which will be designated as a definite-lived brand (with an assumed life of 20 years) from 1 January 2025. Translational foreign exchange was a headwind of 2.9%. Also in 2024, the Group recognised net income of £132 million in connection with the settlement of historical litigation in respect of the Fox River. On a constant currency basis, and excluding adjusting items (including amortisation and impairment charges in both periods), adjusted profit from operations was down 3.5% to £6,580 million largely due to the impact of lower combustibles volume and commercial initiatives. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 10

Regional Review Continued Americas and Europe (AME): – Resilient combustibles performance driven by pricing, with financial performance negatively impacted by the sale of the Russian and Belarusian businesses partway through 2023. – Multi-category region with Smokeless now representing 19.1% of revenue. – New Category revenue growth of 3.5%, or 6.1% at constant rates of exchange (or 11.9% on an organic constant rate basis). – Combustibles volume share up 20 bps and value share flat. Volume/Revenue Please see page 51 for a full reconciliation to constant currency and organic metrics, including prior year data. For year ended 31 December 2024 Volume Revenue Reported Organic Reported Organic Current Exchange Constant Constant Unit vs 2023 vs 2023 £m vs 2023 £m £m vs 2023 £m vs 2023 New Categories 1,730 +3.5 % 45 1,775 +6.1 % 1,775 +11.9 % Vapour (units mn) 276 -11.5 % -11.5 % 611 -10.8 % 14 625 -8.8 % 625 -8.6 % HP (sticks bn) 8 -24.6 % -0.4 % 443 -12.2 % 10 453 -10.4 % 453 +6.1 % Modern Oral (pouches bn) 6.3 +50.2 % +51.4 % 676 +40.3 % 21 697 +44.4 % 697 +46.8 % Traditional Oral (stick eq bn) 0.8 -3.3 % -3.3 % 34 -5.8 % 1 35 -3.6 % 35 -3.6 % Total Smokeless 1,764 +3.3 % 46 1,810 +5.9 % 1,810 +11.6 % Total Combustibles 249 -10.2 % -2.1 % 7,039 -7.5 % 447 7,486 -1.7 % 7,486 +3.6 % Other 438 -6.7 % 30 468 +0.2 % 468 +0.6 % Total 9,241 -5.6 % 523 9,764 -0.3 % 9,764 +4.9 % Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. Reported revenue was down 5.6% at current rates, negatively impacted by a £479 million drag on the regional performance due to the timing of the sale of the Group's businesses in Russia and Belarus partway through 2023 and a 5.3% translational foreign exchange headwind. Smokeless now represents 19.1% of total revenue. On a constant currency basis (excluding translational foreign exchange), which we believe reflects the operational performance, revenue was largely in line with prior year (down 0.3%) but up 4.9% on an organic basis. This organic performance was driven by: – Higher revenue from combustibles (up 3.6%), driven by volume growth in Brazil, Türkiye and Mexico, being partly offset by Canada where a proliferation of illicit single-use Vapour products is impacting combustibles volume; – Lower revenue in Vapour (down 8.6%), driven by Canada where a lack of enforcement of illegal single-use products following the flavour ban in the province of Québec has impacted volumes; – A good revenue performance in HP (up 6.1%) due to growth in Germany, Poland and Italy, with regional volume being relatively stable (down 0.4%); and – Modern Oral revenue growth of 46.8%, driven by Sweden, the UK, Norway, Austria and Finland, as we maintained volume share leadership in 21 markets, with total volume share at 64.7% (down 10 bps compared to 2023). Profit from operations and operating margin Please see page 48 for a full reconciliation to constant currency and organic metrics, including prior year data. For year ended 31 December 2024 Reported Adj. Exchange Adjusted Adjusted Organic Current Constant Constant £m vs 2023 £m £m £m vs 2023 £m vs 2023 (Loss)/Profit from Operations (3,464) -208 % 6,784 192 3,512 +1.5 % 3,512 +7.5 % Operating Margin -37.5 % -70.1 ppts 36.0 % 70 bps 36.0 % 90 bps Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. Reported profit from operations declined by 208.5%, including a translational foreign exchange headwind of 5.5%. 2024 was negatively impacted by the sale of our businesses in Russia and Belarus in September 2023. Further, both years were impacted by a number of charges affecting comparability of the regional result. In 2024, this included total charges of £6,203 million following the publication of a proposed settlement of litigation in Canada (please see page 38), a charge of £449 million in respect of an excise assessment in Romania and impairment of fixed assets of £149 million (including the Group's head office in London and recognising the Group's intention to seek an orderly exit from Cuba). This compares to charges of £353 million (in 2023) related to the sale of the Group's businesses in Russia and Belarus. 2023 was also affected by net credits of £120 million in Brazil, largely related to the conclusion of historical VAT and excise tax claims. Excluding the impact of foreign exchange, adjusting items and on an organic basis (which we believe reflects the operational performance), adjusted profit from operations was up 7.5% to £3,512 million, driven by an improved operational performance in: – Türkiye, where the combustibles portfolio performed well with higher volume and pricing; – Germany, driven by our HP portfolio; – Romania, following continued strong combustibles pricing and growth in New Categories; – the UK, driven by continued growth in our New Categories portfolio; and – the Nordics, Switzerland and Italy, which all improved their New Categories financial performance. These were partly offset by a decline in adjusted profit from operations from Canada, where adjusted profit from operations declined to £539 million due to lower combustibles volume and a lack of enforcement of illegal single-use Vapour products following the flavour ban in the province of Québec. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 11

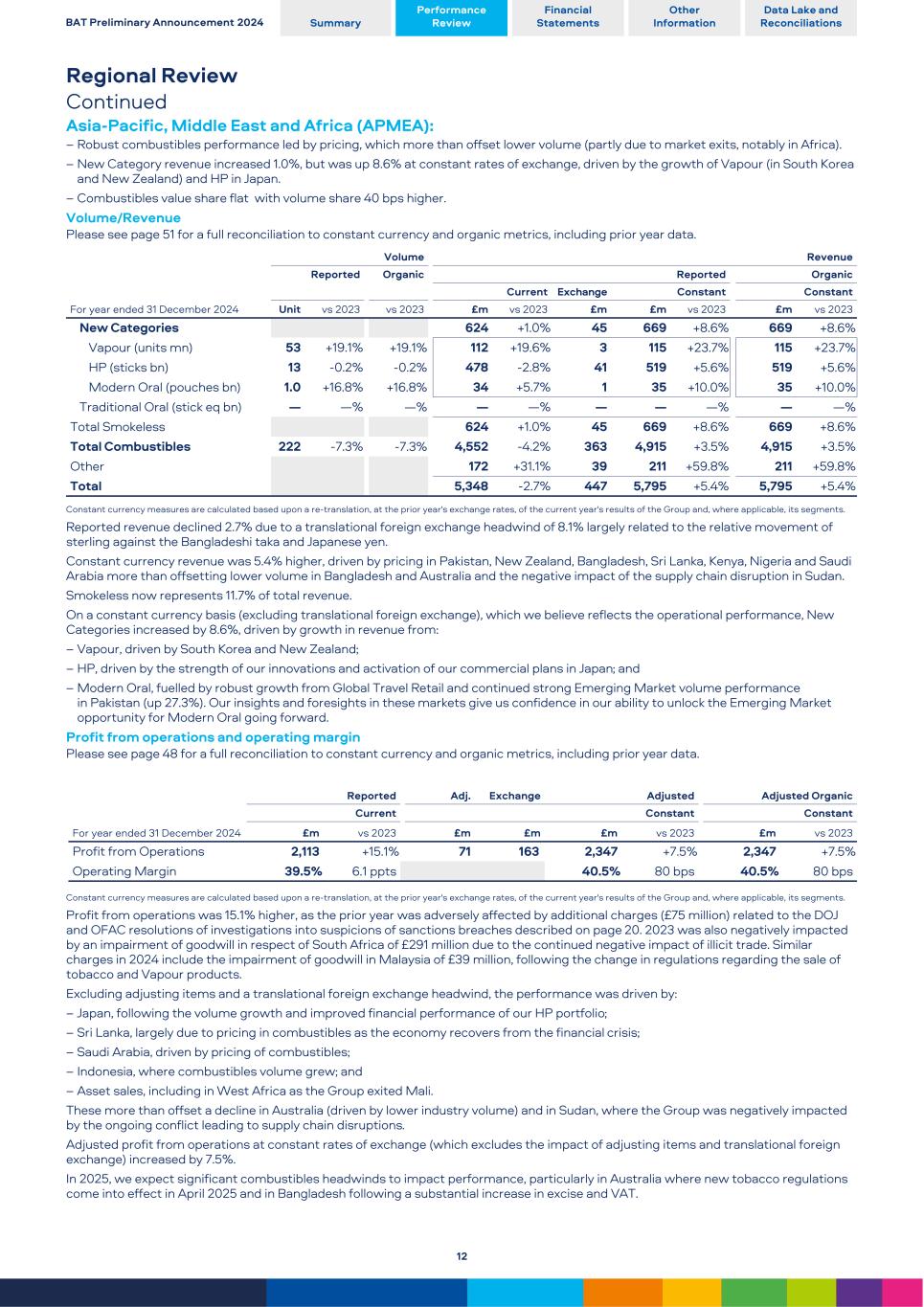

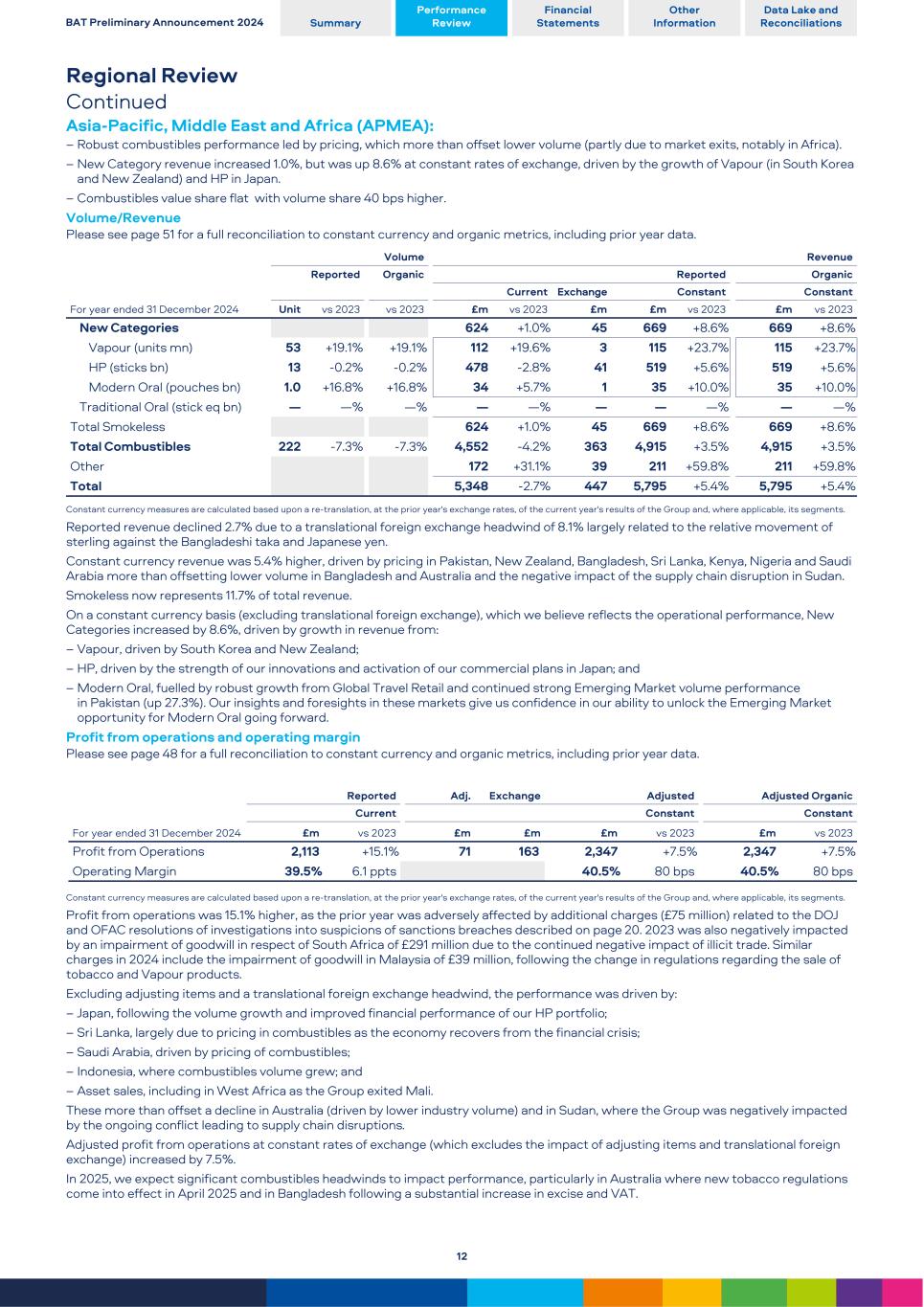

Regional Review Continued Asia-Pacific, Middle East and Africa (APMEA): – Robust combustibles performance led by pricing, which more than offset lower volume (partly due to market exits, notably in Africa). – New Category revenue increased 1.0%, but was up 8.6% at constant rates of exchange, driven by the growth of Vapour (in South Korea and New Zealand) and HP in Japan. – Combustibles value share flat with volume share 40 bps higher. Volume/Revenue Please see page 51 for a full reconciliation to constant currency and organic metrics, including prior year data. For year ended 31 December 2024 Volume Revenue Reported Organic Reported Organic Current Exchange Constant Constant Unit vs 2023 vs 2023 £m vs 2023 £m £m vs 2023 £m vs 2023 New Categories 624 +1.0 % 45 669 +8.6 % 669 +8.6 % Vapour (units mn) 53 +19.1 % +19.1 % 112 +19.6 % 3 115 +23.7 % 115 +23.7 % HP (sticks bn) 13 -0.2 % -0.2 % 478 -2.8 % 41 519 +5.6 % 519 +5.6 % Modern Oral (pouches bn) 1.0 +16.8 % +16.8 % 34 +5.7 % 1 35 +10.0 % 35 +10.0 % Traditional Oral (stick eq bn) — — % — % — — % — — — % — — % Total Smokeless 624 +1.0 % 45 669 +8.6 % 669 +8.6 % Total Combustibles 222 -7.3 % -7.3 % 4,552 -4.2 % 363 4,915 +3.5 % 4,915 +3.5 % Other 172 +31.1 % 39 211 +59.8 % 211 +59.8 % Total 5,348 -2.7 % 447 5,795 +5.4 % 5,795 +5.4 % Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. Reported revenue declined 2.7% due to a translational foreign exchange headwind of 8.1% largely related to the relative movement of sterling against the Bangladeshi taka and Japanese yen. Constant currency revenue was 5.4% higher, driven by pricing in Pakistan, New Zealand, Bangladesh, Sri Lanka, Kenya, Nigeria and Saudi Arabia more than offsetting lower volume in Bangladesh and Australia and the negative impact of the supply chain disruption in Sudan. Smokeless now represents 11.7% of total revenue. On a constant currency basis (excluding translational foreign exchange), which we believe reflects the operational performance, New Categories increased by 8.6%, driven by growth in revenue from: – Vapour, driven by South Korea and New Zealand; – HP, driven by the strength of our innovations and activation of our commercial plans in Japan; and – Modern Oral, fuelled by robust growth from Global Travel Retail and continued strong Emerging Market volume performance in Pakistan (up 27.3%). Our insights and foresights in these markets give us confidence in our ability to unlock the Emerging Market opportunity for Modern Oral going forward. Profit from operations and operating margin Please see page 48 for a full reconciliation to constant currency and organic metrics, including prior year data. For year ended 31 December 2024 Reported Adj. Exchange Adjusted Adjusted Organic Current Constant Constant £m vs 2023 £m £m £m vs 2023 £m vs 2023 Profit from Operations 2,113 +15.1 % 71 163 2,347 +7.5 % 2,347 +7.5 % Operating Margin 39.5 % 6.1 ppts 40.5 % 80 bps 40.5 % 80 bps Constant currency measures are calculated based upon a re-translation, at the prior year's exchange rates, of the current year's results of the Group and, where applicable, its segments. Profit from operations was 15.1% higher, as the prior year was adversely affected by additional charges (£75 million) related to the DOJ and OFAC resolutions of investigations into suspicions of sanctions breaches described on page 20. 2023 was also negatively impacted by an impairment of goodwill in respect of South Africa of £291 million due to the continued negative impact of illicit trade. Similar charges in 2024 include the impairment of goodwill in Malaysia of £39 million, following the change in regulations regarding the sale of tobacco and Vapour products. Excluding adjusting items and a translational foreign exchange headwind, the performance was driven by: – Japan, following the volume growth and improved financial performance of our HP portfolio; – Sri Lanka, largely due to pricing in combustibles as the economy recovers from the financial crisis; – Saudi Arabia, driven by pricing of combustibles; – Indonesia, where combustibles volume grew; and – Asset sales, including in West Africa as the Group exited Mali. These more than offset a decline in Australia (driven by lower industry volume) and in Sudan, where the Group was negatively impacted by the ongoing conflict leading to supply chain disruptions. Adjusted profit from operations at constant rates of exchange (which excludes the impact of adjusting items and translational foreign exchange) increased by 7.5%. In 2025, we expect significant combustibles headwinds to impact performance, particularly in Australia where new tobacco regulations come into effect in April 2025 and in Bangladesh following a substantial increase in excise and VAT. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 12

Other Financial Information Analysis of profit from operations (by segment) and diluted earnings per share Prior year data is provided in the table on page 48. For year ended 31 December 2024 Reported vs 2023 Adj Items1 Adjusted vs 2023 Exch. Adjusted at CC2 vs 2023 Adjusted Organic at CC2 vs 2023 £m % £m £m % £m £m % £m % Profit from Operations U.S. 4,087 n/m 2,299 6,386 -6.4 % 194 6,580 -3.5 % 6,580 -3.5 % AME (3,464) -208 % 6,784 3,320 -4.0 % 192 3,512 +1.5 % 3,512 +7.5 % APMEA 2,113 +15.1 % 71 2,184 0.0 % 163 2,347 +7.5 % 2,347 +7.5 % Total Region 2,736 n/m 9,154 11,890 -4.6 % 549 12,439 -0.2 % 12,439 +1.4 % Net finance costs (1,098) -42.1 % (491) (1,589) -11.7 % (27) (1,616) -10.2 % (1,616) -11.2 % Associates and joint ventures 1,900 +225 % (1,379) 521 -9.7 % 20 541 -6.2 % 541 -6.2 % Profit before tax 3,538 n/m 7,284 10,822 -3.7 % 542 11,364 +1.1 % 11,364 +3.0 % Taxation (357) -112 % (2,206) (2,563) -2.0 % (106) (2,669) +2.0 % (2,669) +4.2 % Non-controlling interests (113) -36.5 % (38) (151) -15.9 % (5) (156) -12.7 % (156) -12.7 % Coupons relating to hybrid bonds net of tax (42) -6.6 % — (42) -6.6 % — (42) -6.6 % (42) -6.6 % Profit attributable to shareholders 3,026 n/m 5,040 8,066 -4.0 % 431 8,497 +1.1 % 8,497 +3.1 % Diluted number of shares (m) 2,225 -0.2 % 2,225 -0.5 % 2,225 -0.5 % 2,225 -0.5 % Diluted earnings per share (pence)3 136.0 n/m 362.5 -3.5 % 381.9 +1.7 % 381.9 +3.6 % 1. Adjusting items represent certain items which the Group considers distinctive based upon their size, nature or incidence. 2. CC: constant currency – measures are calculated based on a re-translation, at the prior year’s exchange rates, of the current year’s results of the Group and, where applicable, its segments. 3. In 2023, the Group reported a loss for the year. Following the requirements of IAS 33, the impact of share options would be antidilutive and are therefore excluded, for 2023, from the calculation of diluted earnings per share, calculated in accordance with IFRS. Net finance costs Net finance costs were £1,098 million, compared to £1,895 million in 2023, a decrease of 42.1%. The performance in 2024 was driven by a net credit of £590 million related to the capped cash debt tender offers, which targeted a series of low-priced, long-dated GBP-, EUR- and USD-denominated bonds, under which the Group repurchased bonds prior to their maturity in a principal amount of £1.8 billion, including £15 million of accrued interest partly offset by a fair value loss of £9 million (2023: £151 million) on debt-related derivatives and, including other costs of £3 million, treated as an adjusting item. 2024 was impacted by a translational foreign exchange tailwind of 1.5% (2023: marginal headwind) due to the relative movement of sterling. Our performance was also impacted by a number of items that are not deemed to be in the normal course of the Group's ongoing operations and have been treated as adjusting items, including finance costs related to: – The Franked Investment Income Group Litigation Order (FII GLO) of £61 million (2023: £60 million); – A fair value loss of £19 million (2023: £nil ) on embedded derivatives related to associates; – A charge of £14 million in relation to a tax case in Brazil; – Interest charges of £8 million (2023: £16 million) in relation to a tax provision in the Netherlands; – Interest of £11 million on a tax provision in Indonesia; – A release of £25 million of interest on tax provision in Canada in relation to a settlement agreement with local authorities; and – A further £11 million interest charge recorded on government liability balances accumulated during CCAA protection. On an adjusted, constant currency basis, net finance costs were £1,616 million, a decrease of 10.2% (2023: £1,799 million). This was: – Largely due to higher interest income, driven by higher cash balances resulting from the sale of a part of the ordinary shares held in the Group's main associate ITC, higher interest rates on local deposits and an increase in interest income in Canada (up £20 million to £110 million) due to the cash build up in that market; and – Lower interest expense driven by a reduction in short term funding requirements in the year. The Group's average cost of debt declined to 4.9% (compared to 5.2% in 2023) with the prior year including a fair value loss of £151 million. Excluding this, the average cost of debt in 2024 was an increase of 0.1% compared to 4.8% in 2023. Also in 2024, in line with IAS 33 Earnings Per Share, £42 million (2023: £45 million) has been recognised as a deduction to EPS related to the perpetual hybrid bonds issued in 2021, as the coupons paid on such instruments are recognised in equity rather than as a charge to the income statement in net finance costs. For a full reconciliation of net finance costs to adjusted net finance costs at constant rates, see page 54. All of the adjustments noted above have been included in the adjusted earnings per share calculation on page 32. The Group has debt maturities of around £3.3 billion annually in the next two years. Due to higher interest rates, net finance costs are expected to increase as debts are refinanced. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 13

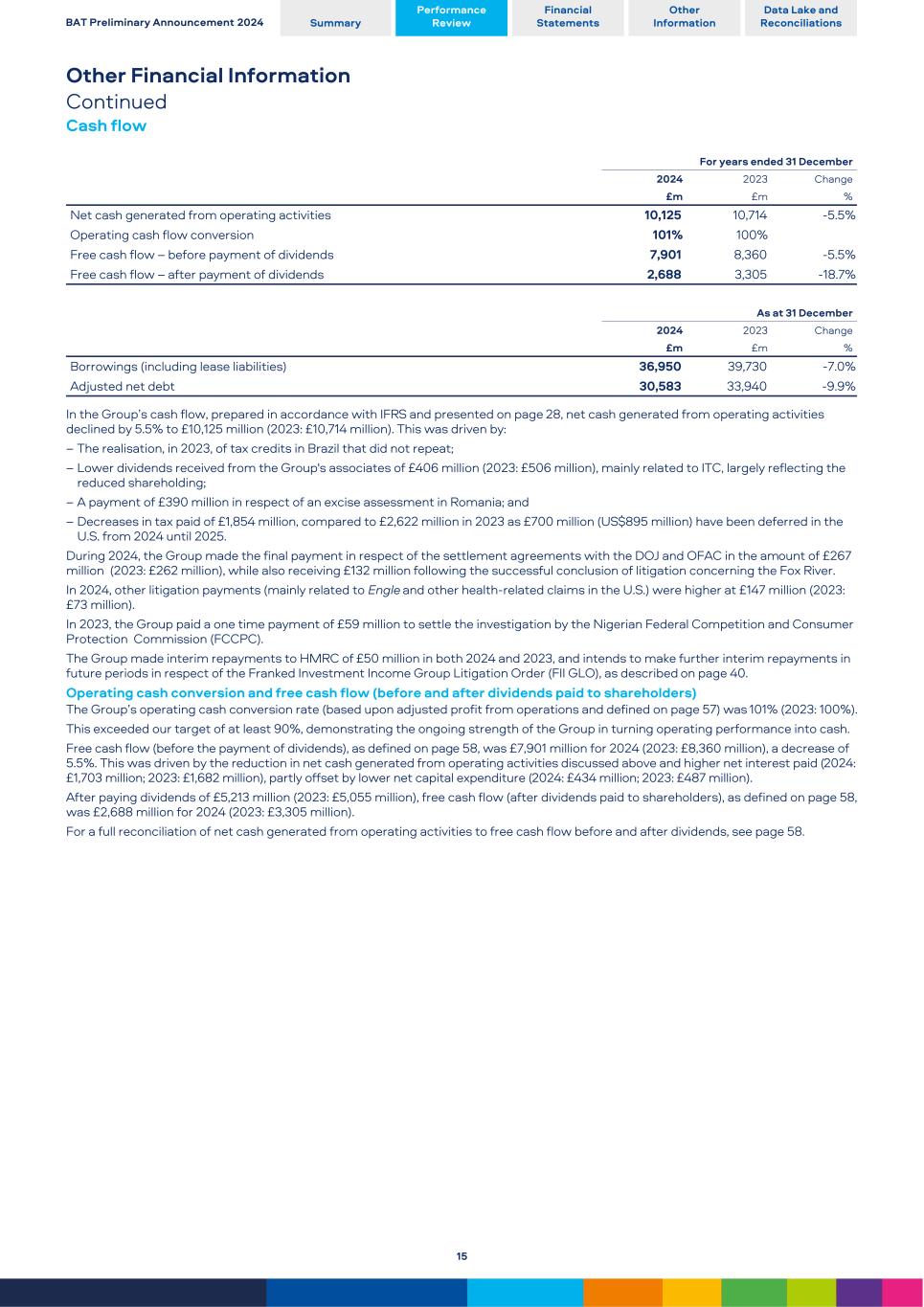

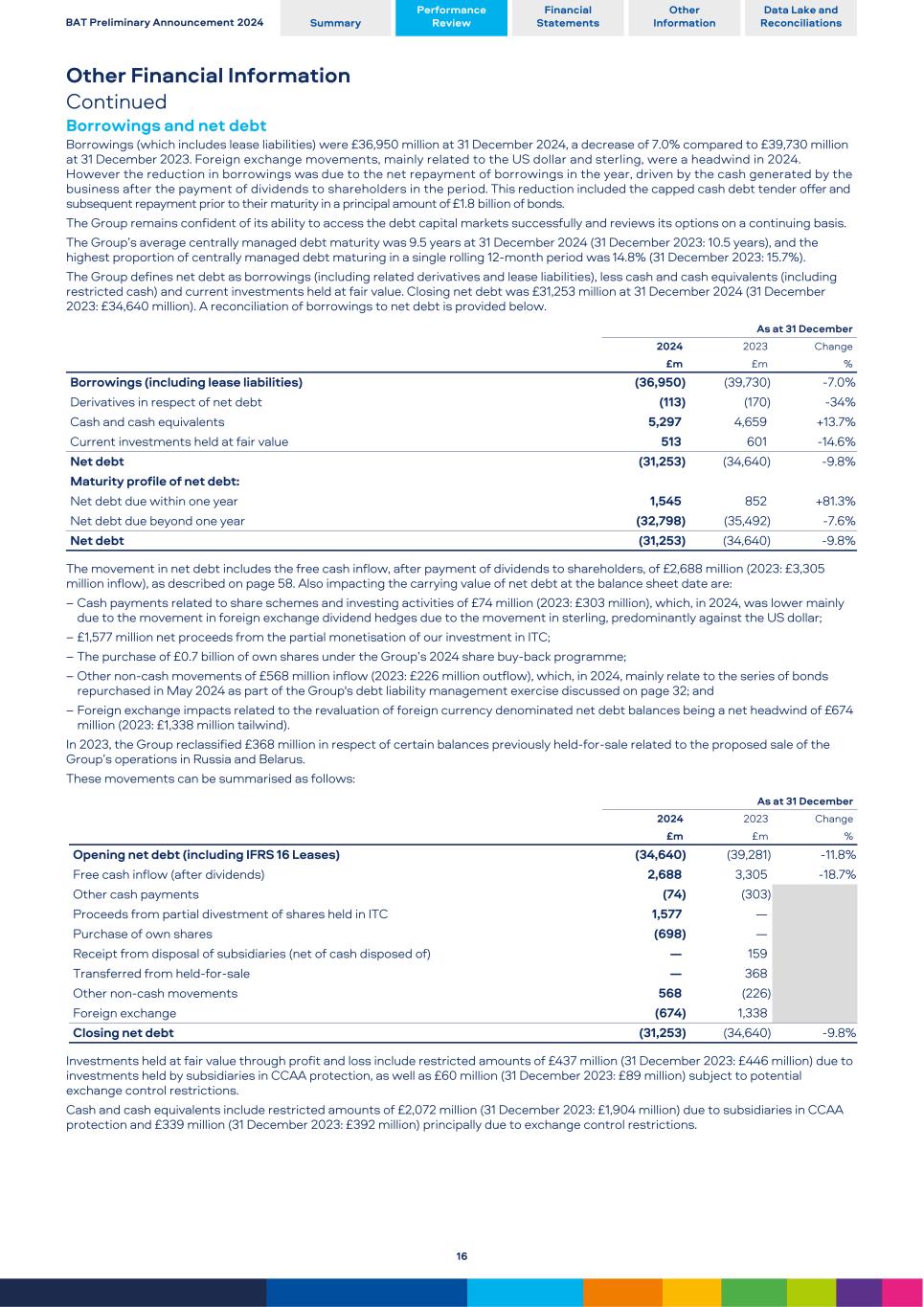

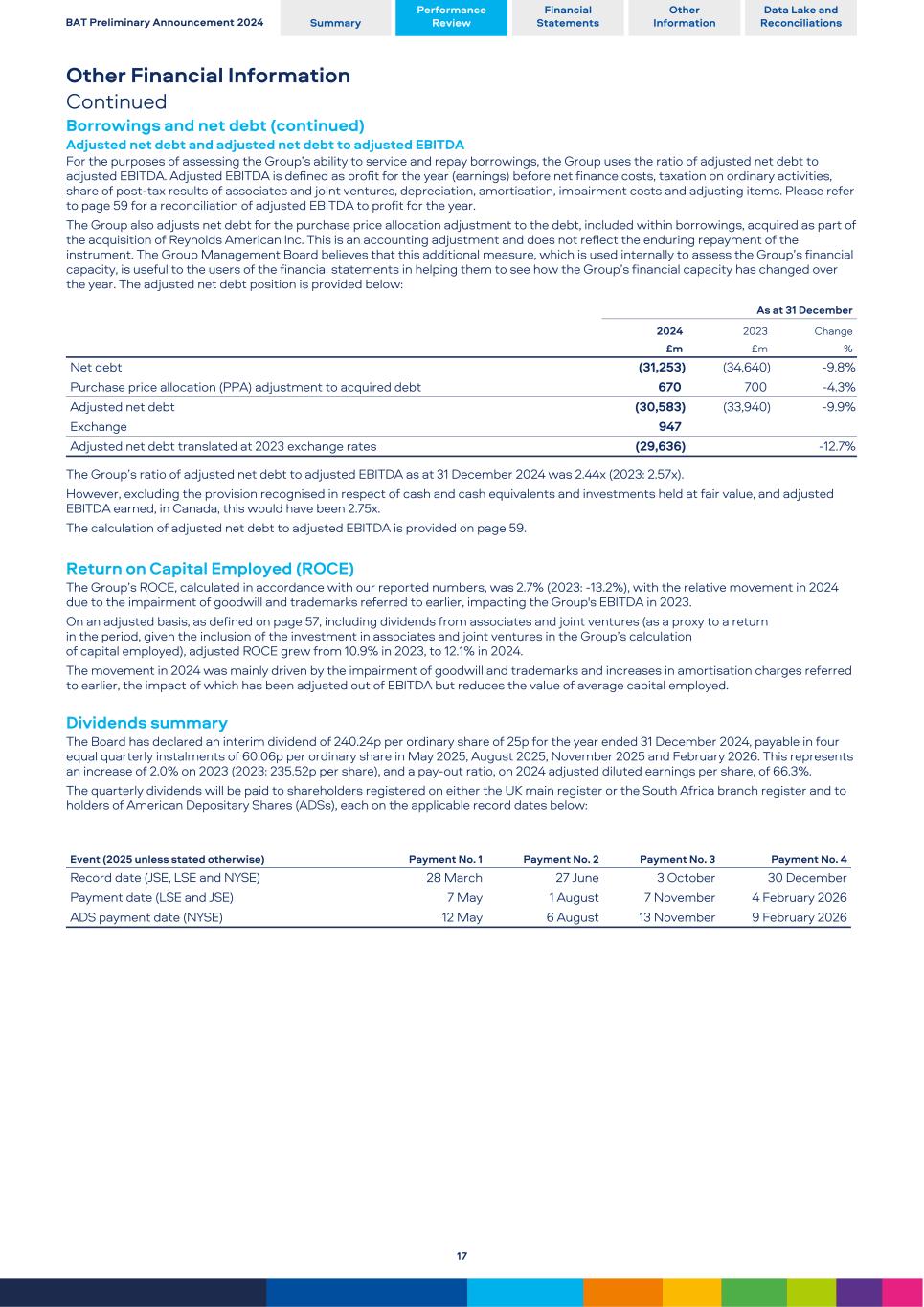

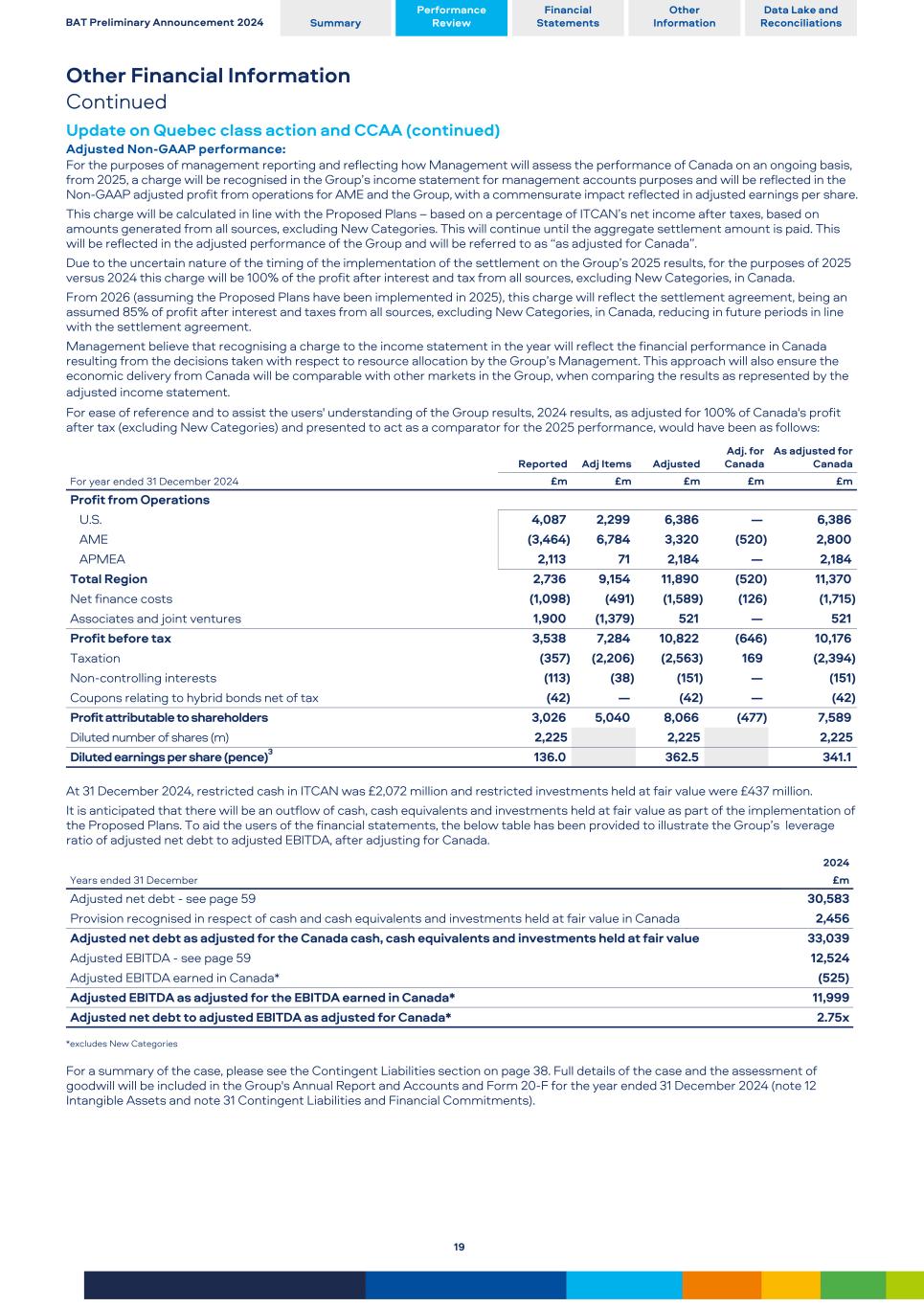

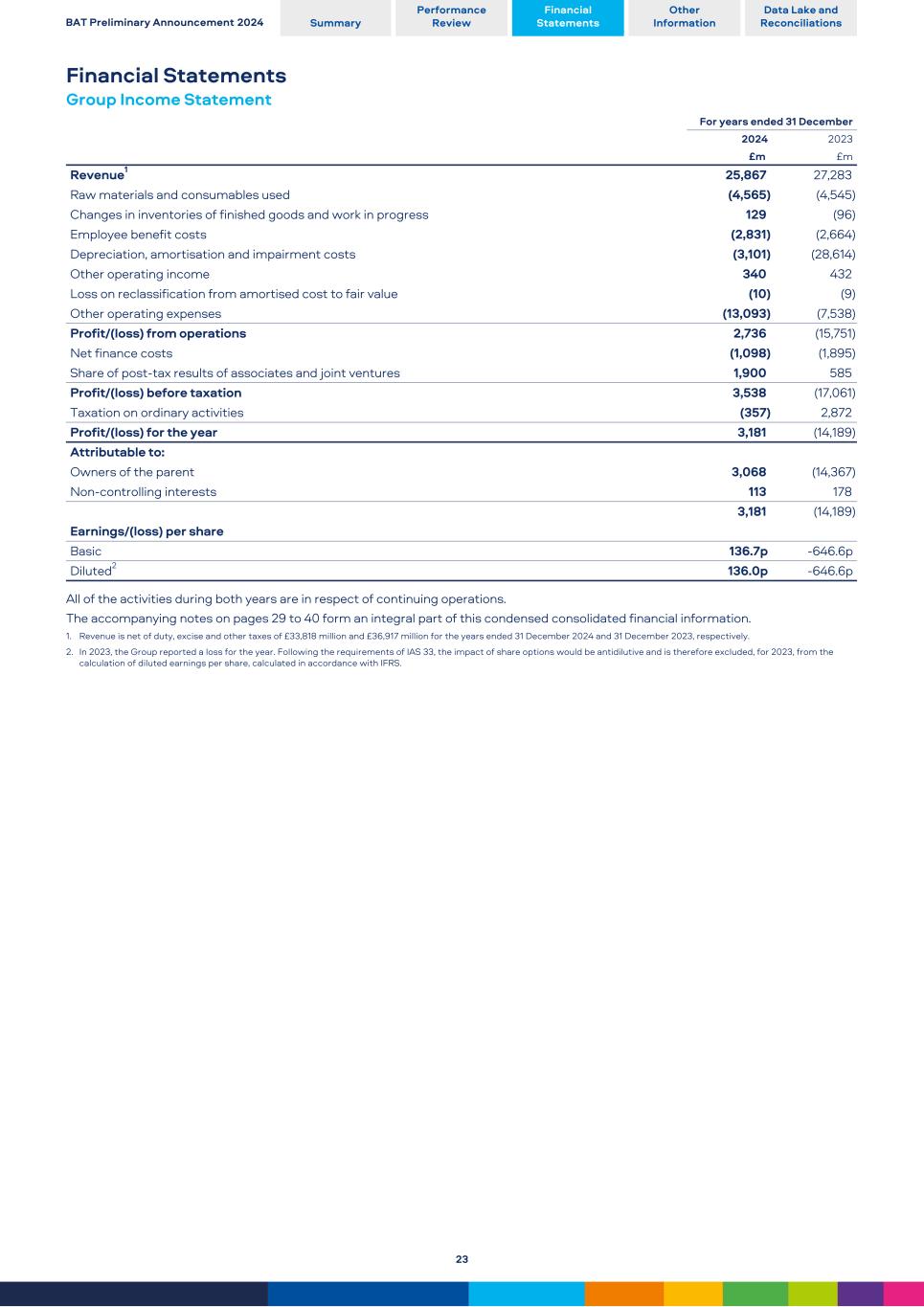

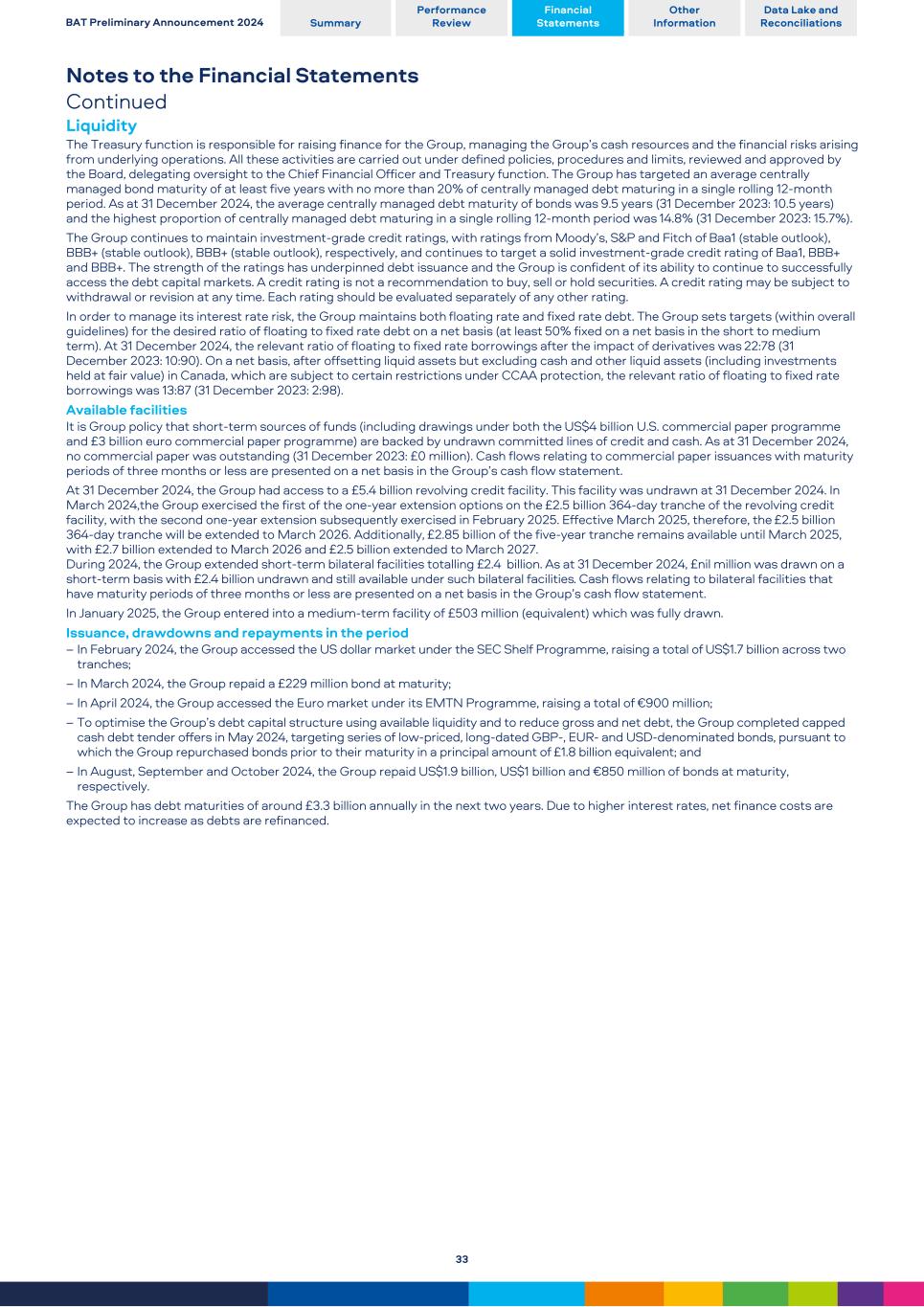

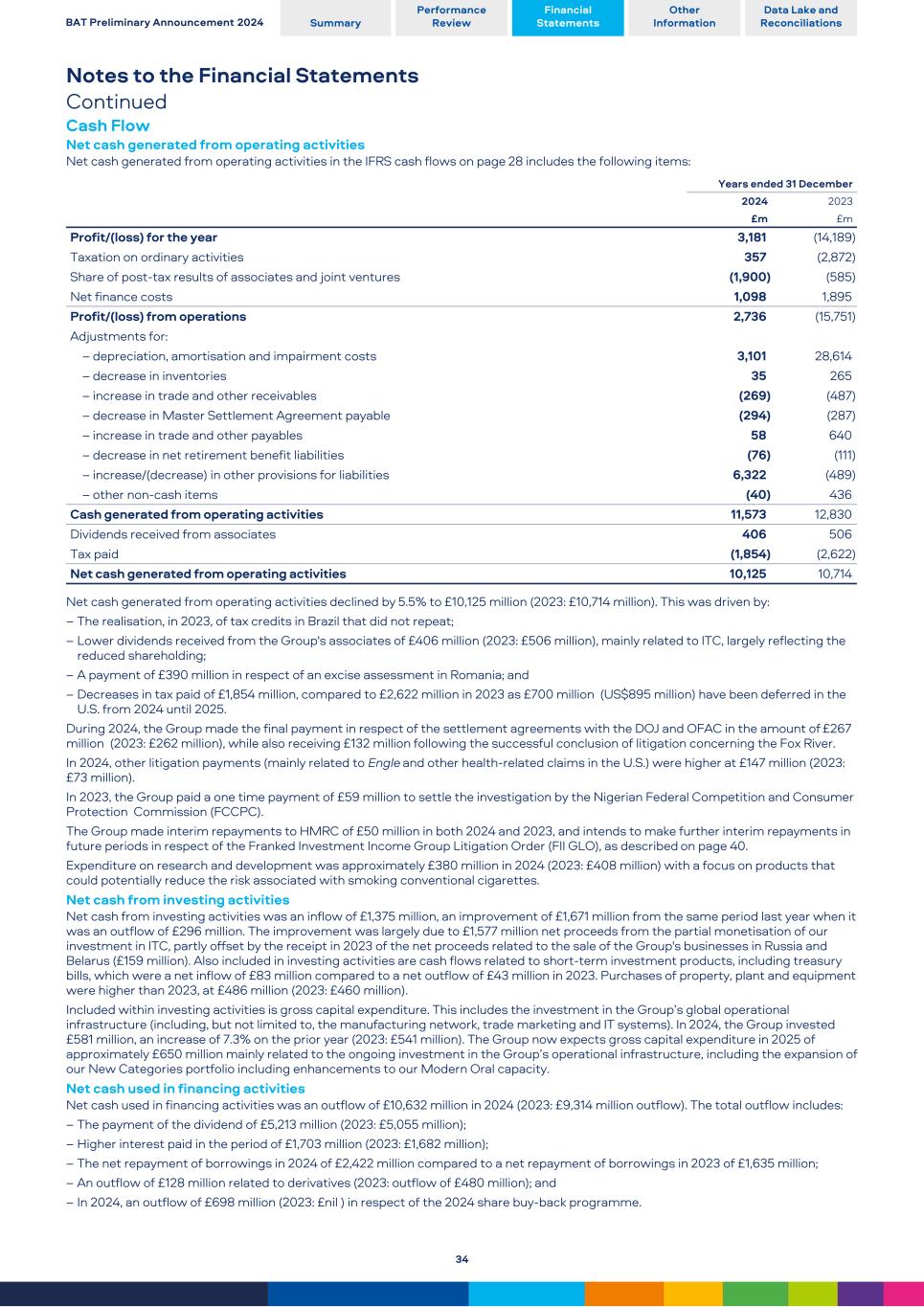

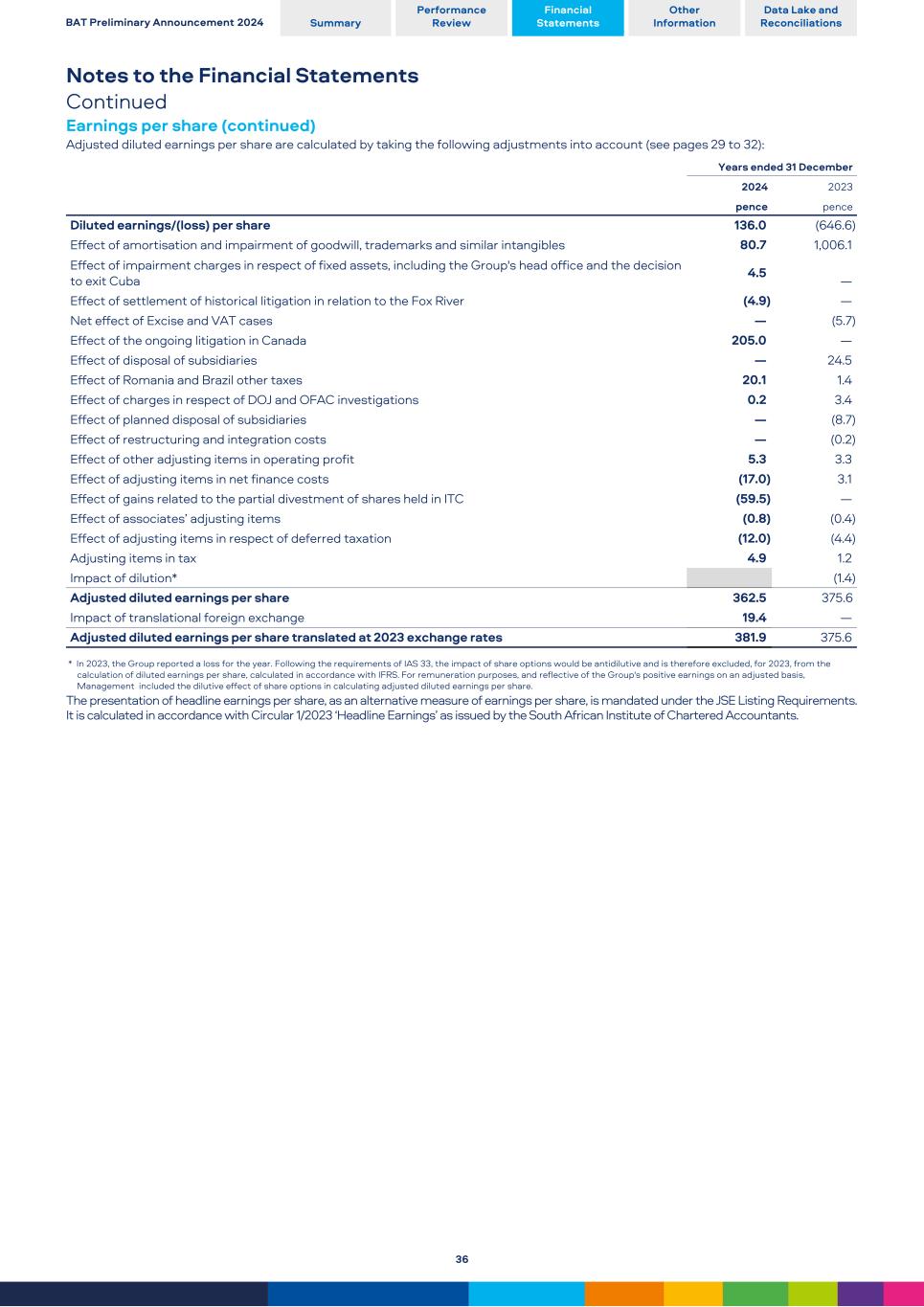

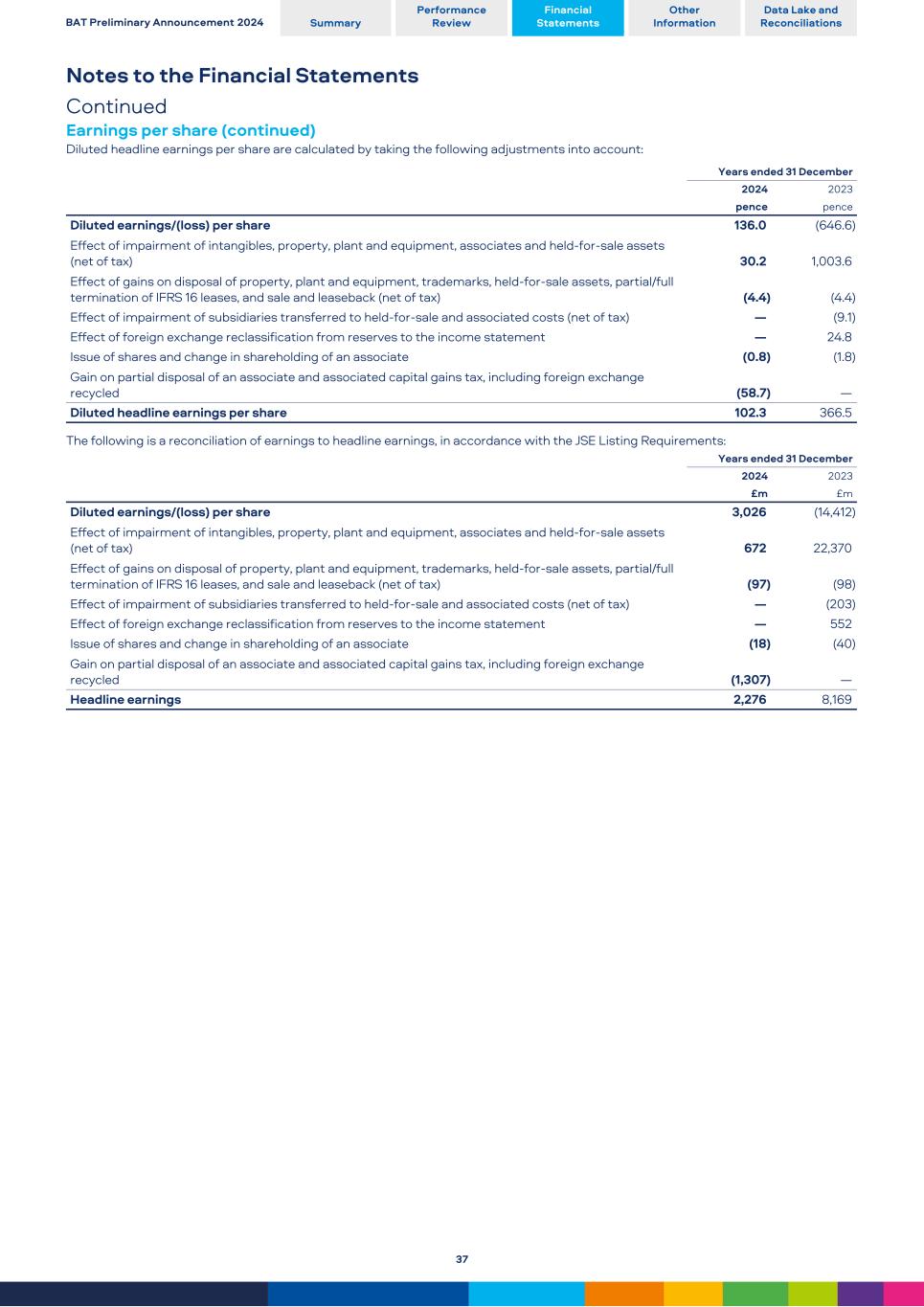

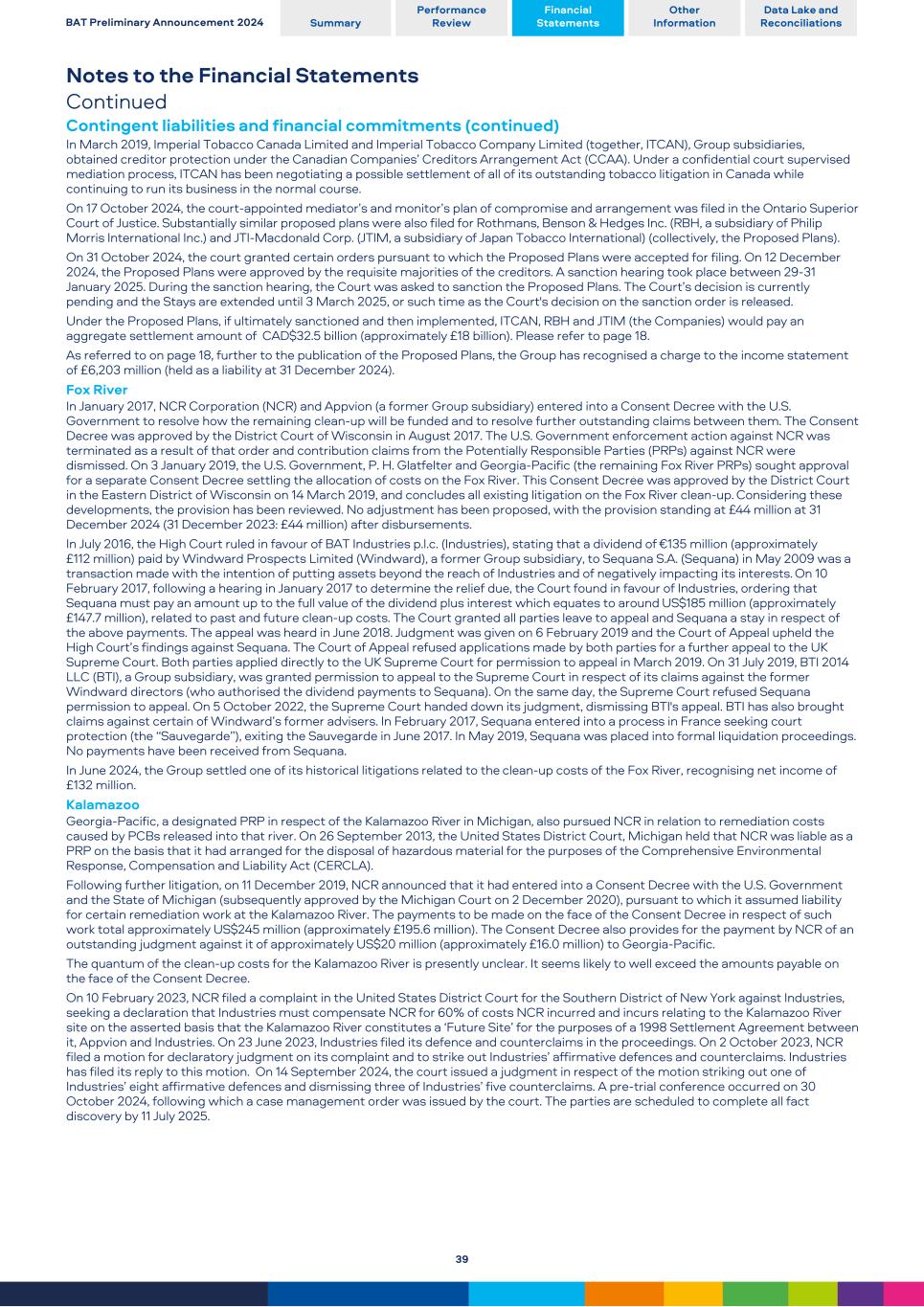

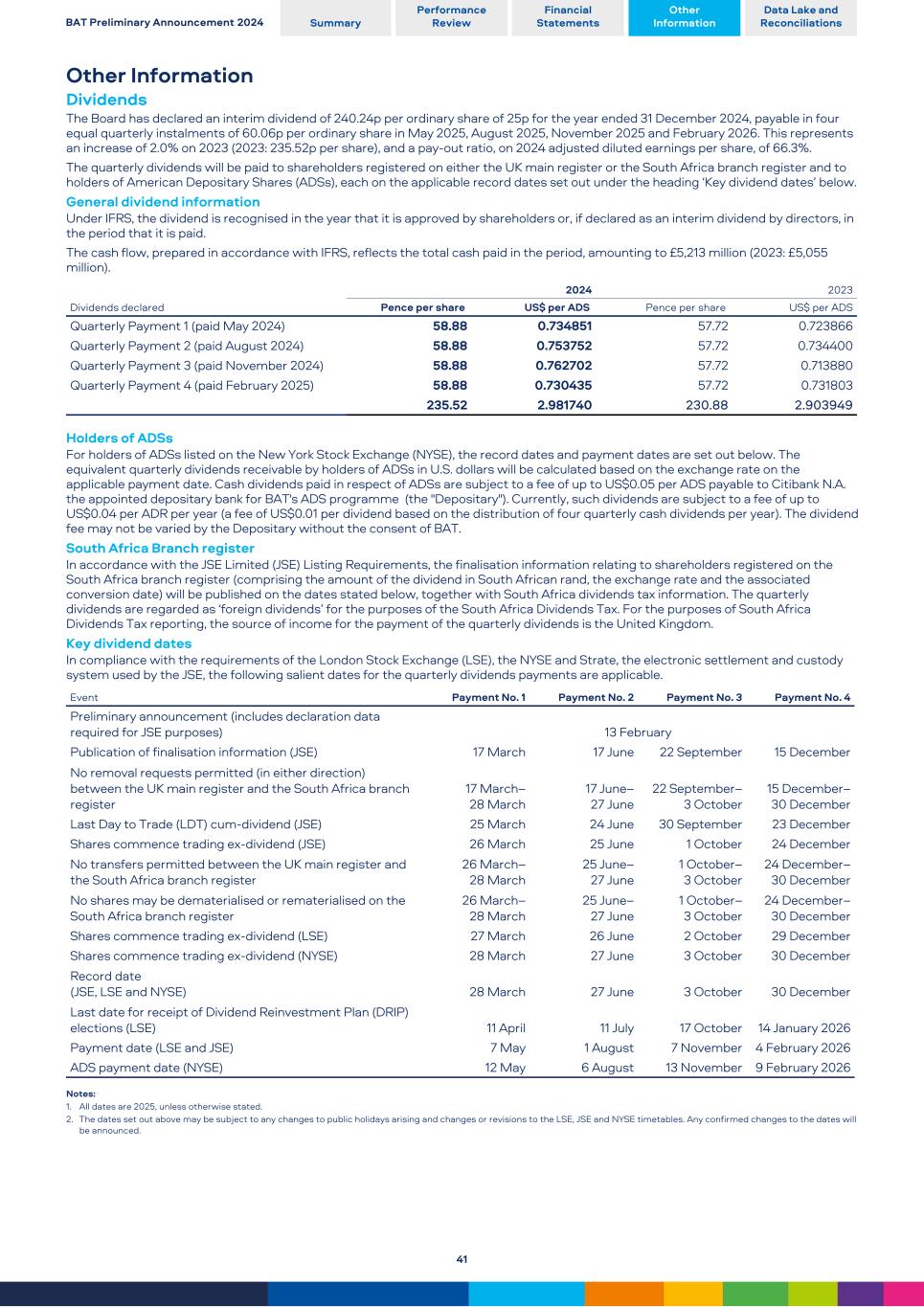

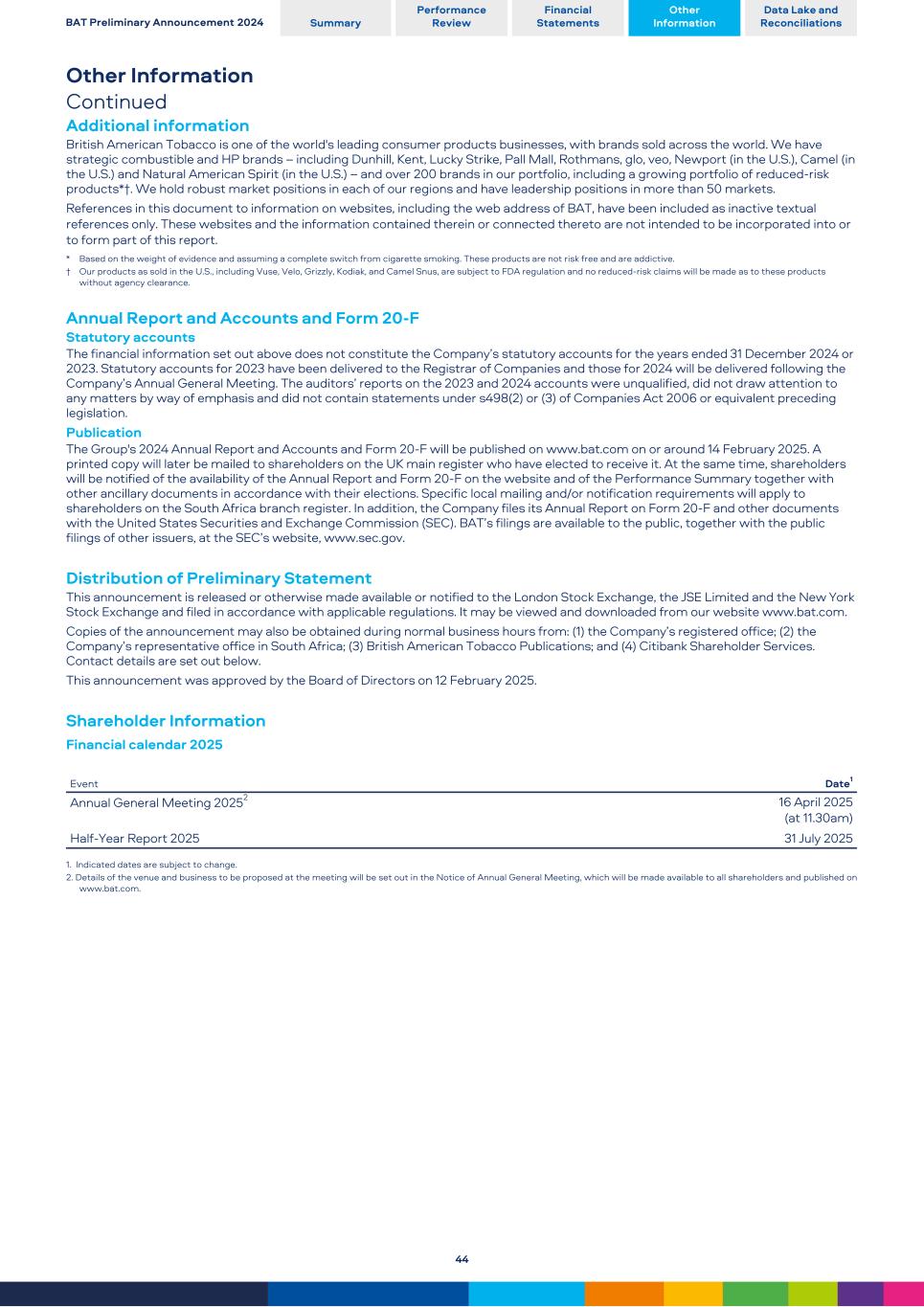

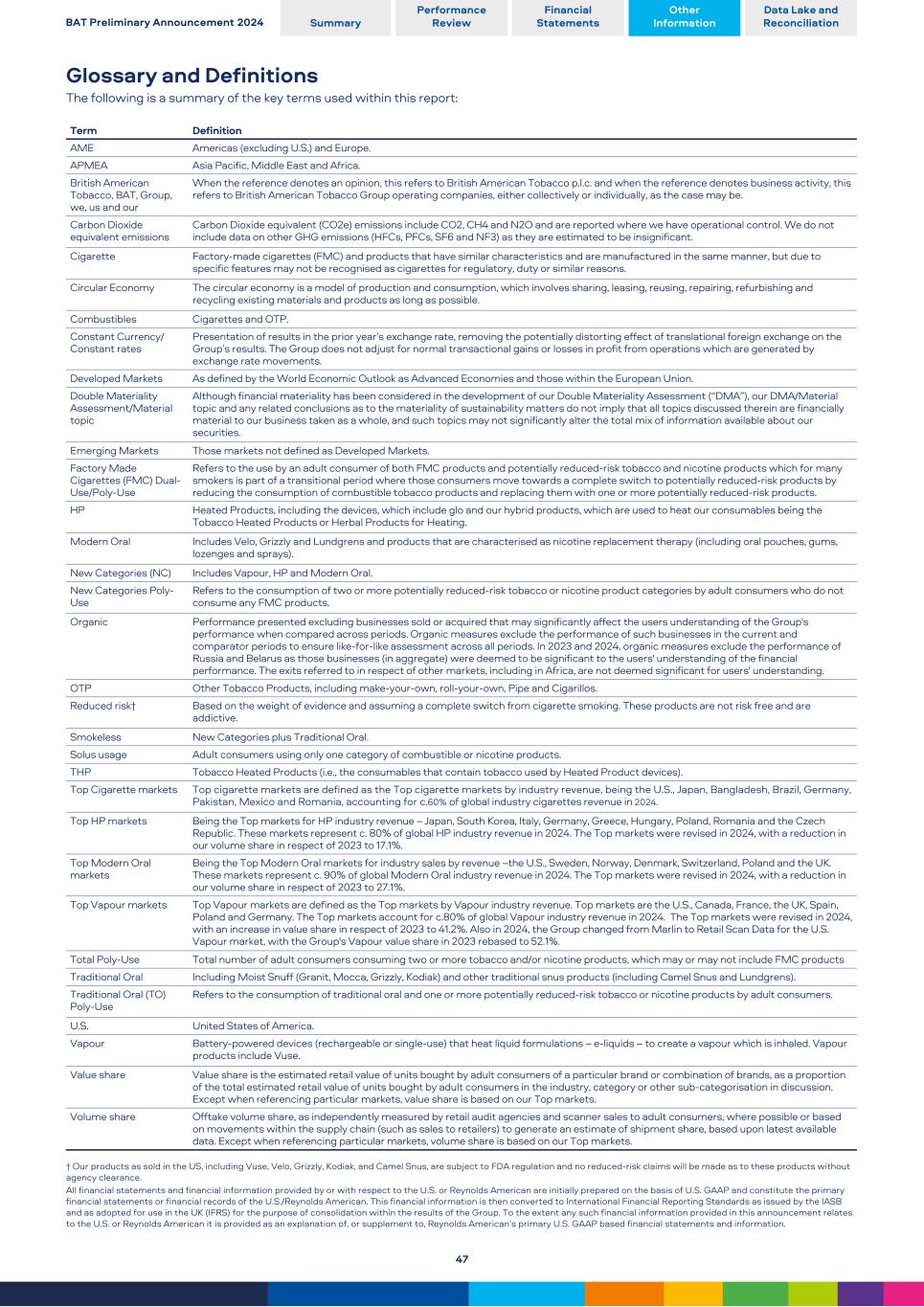

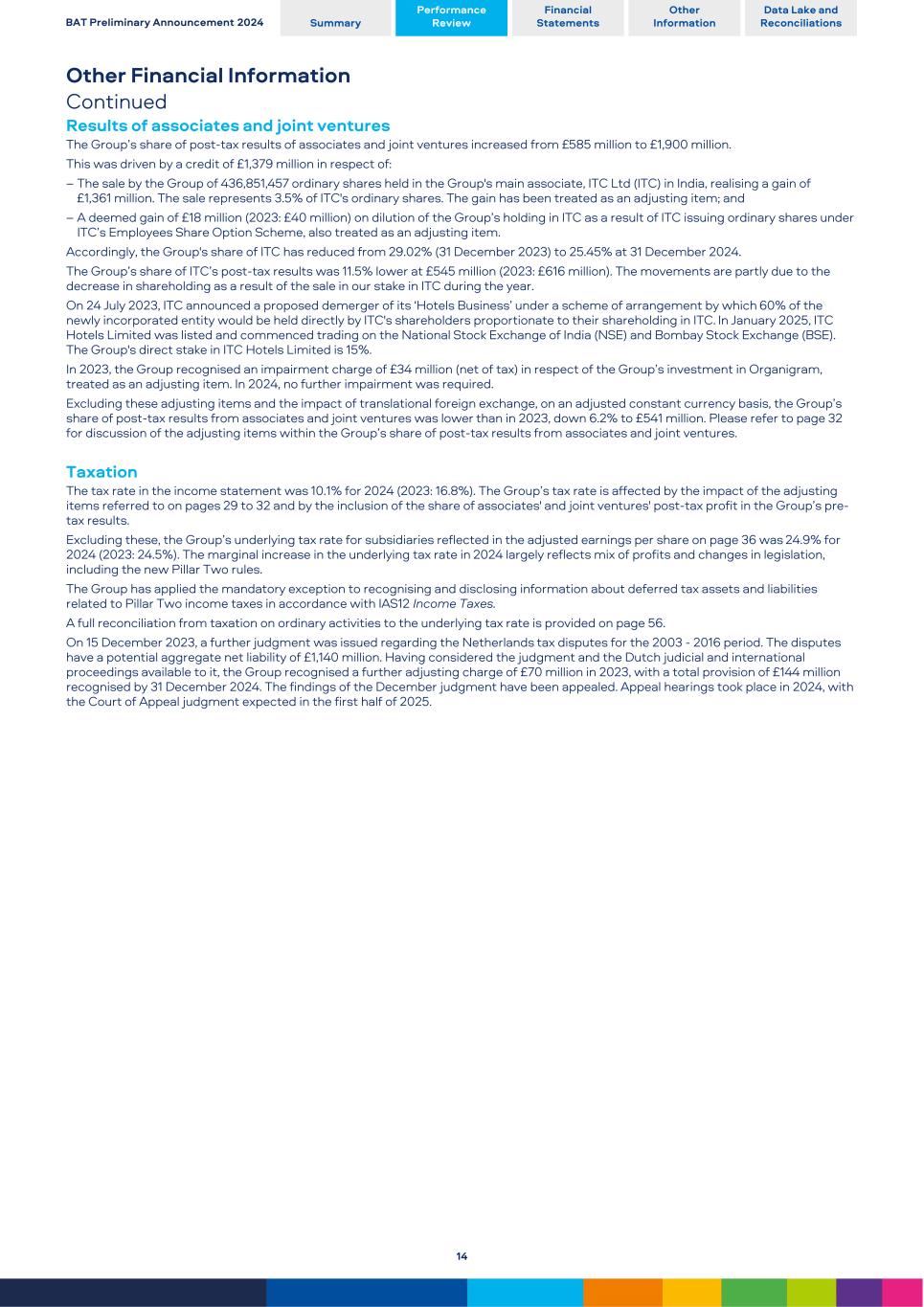

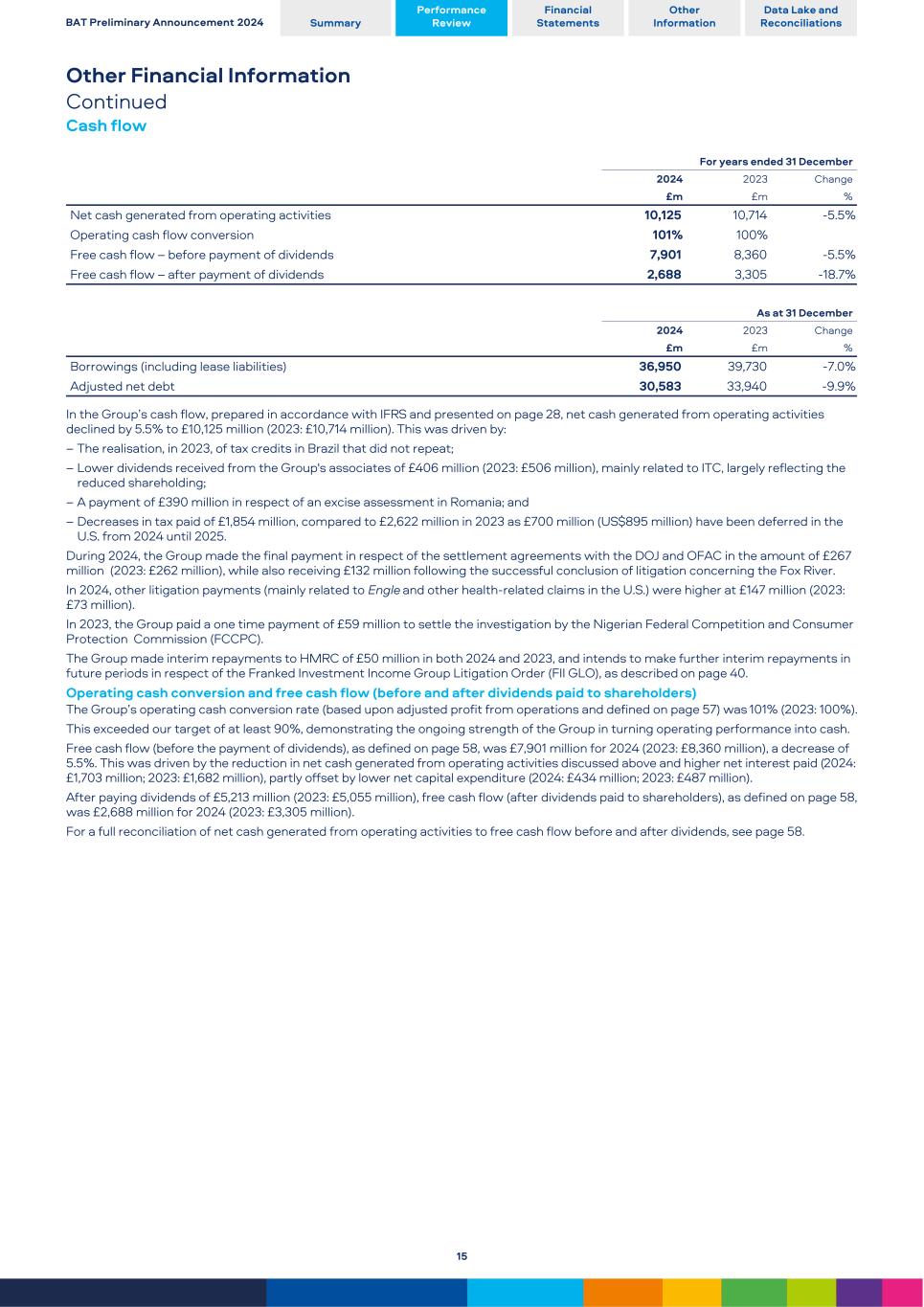

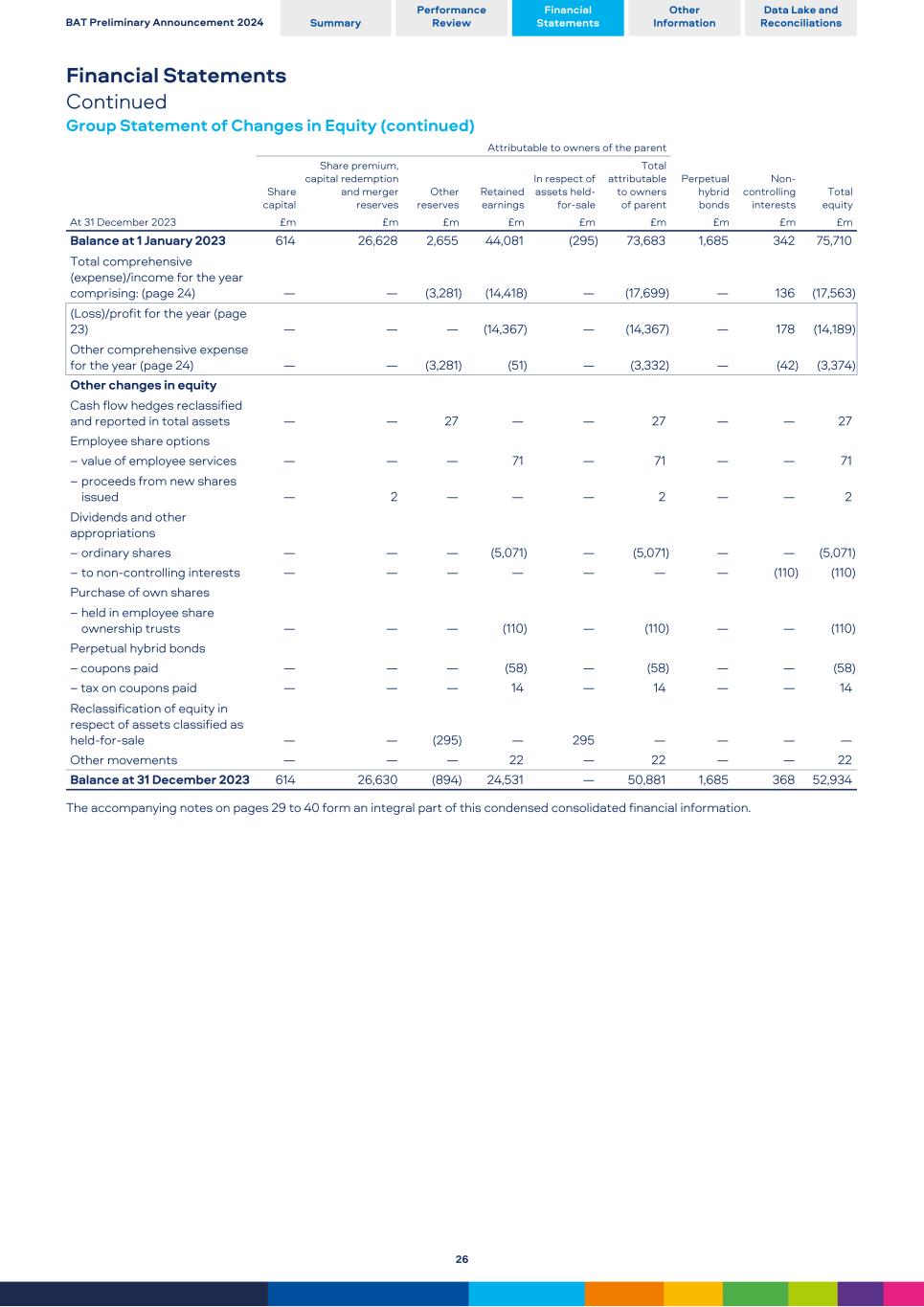

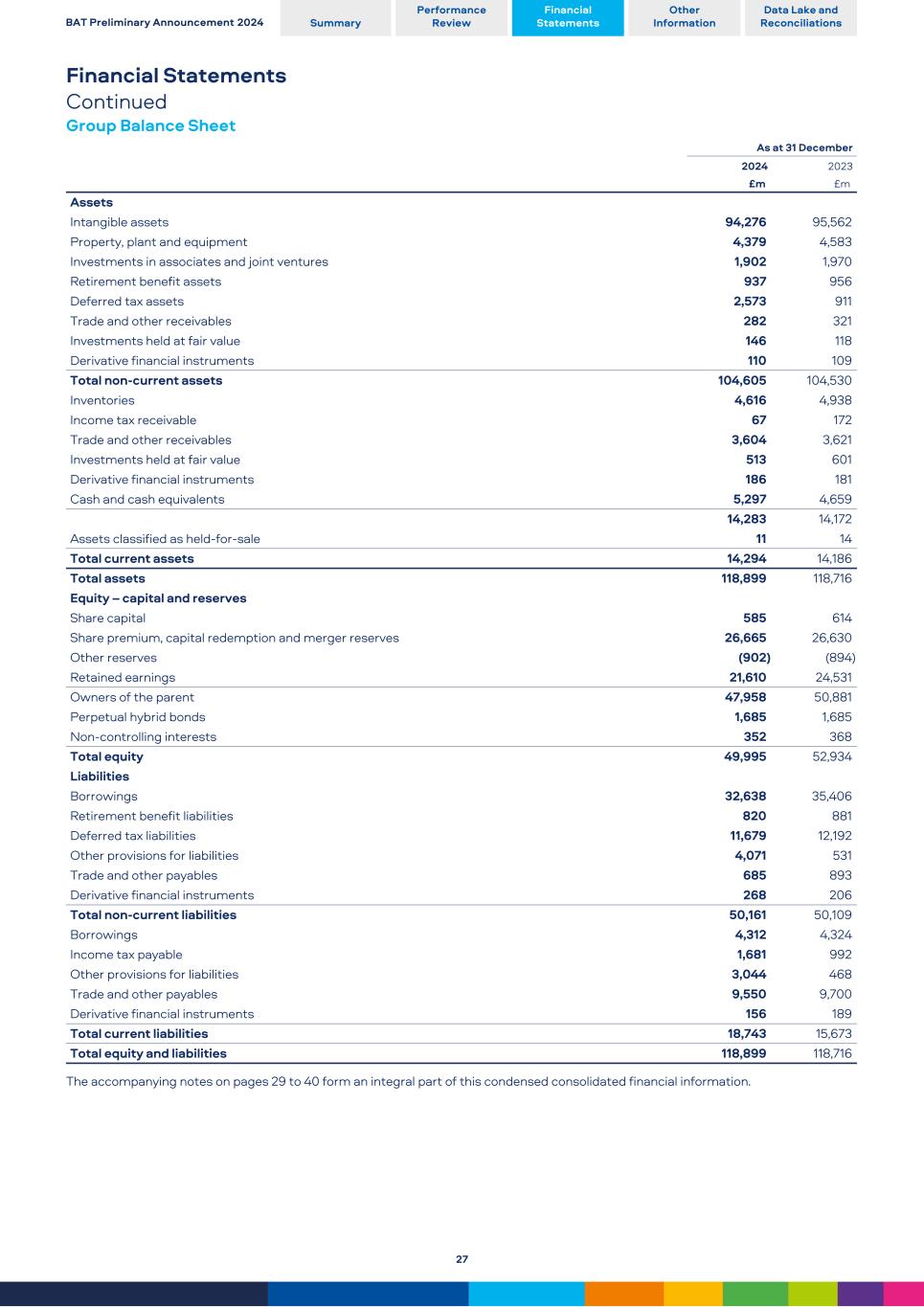

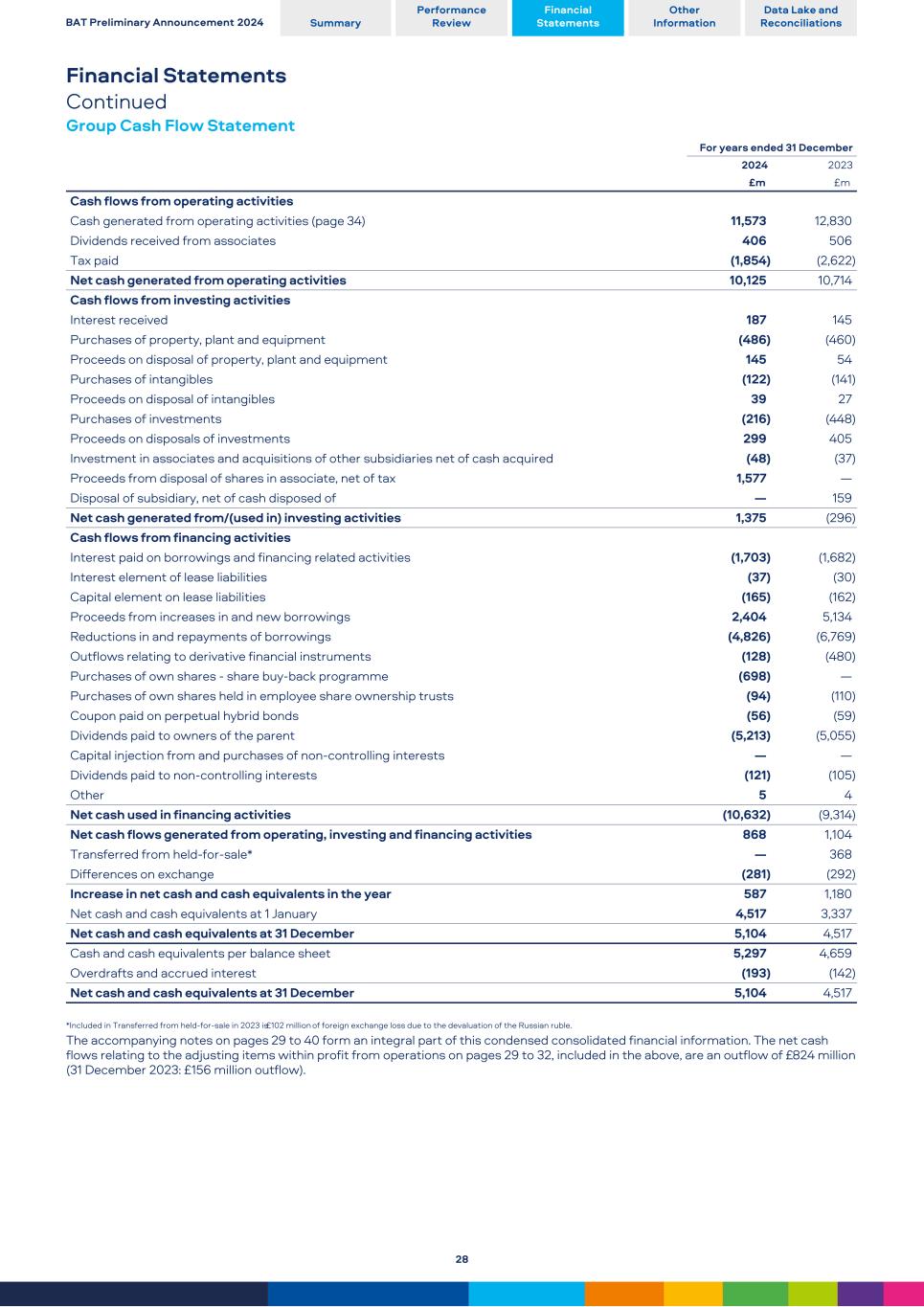

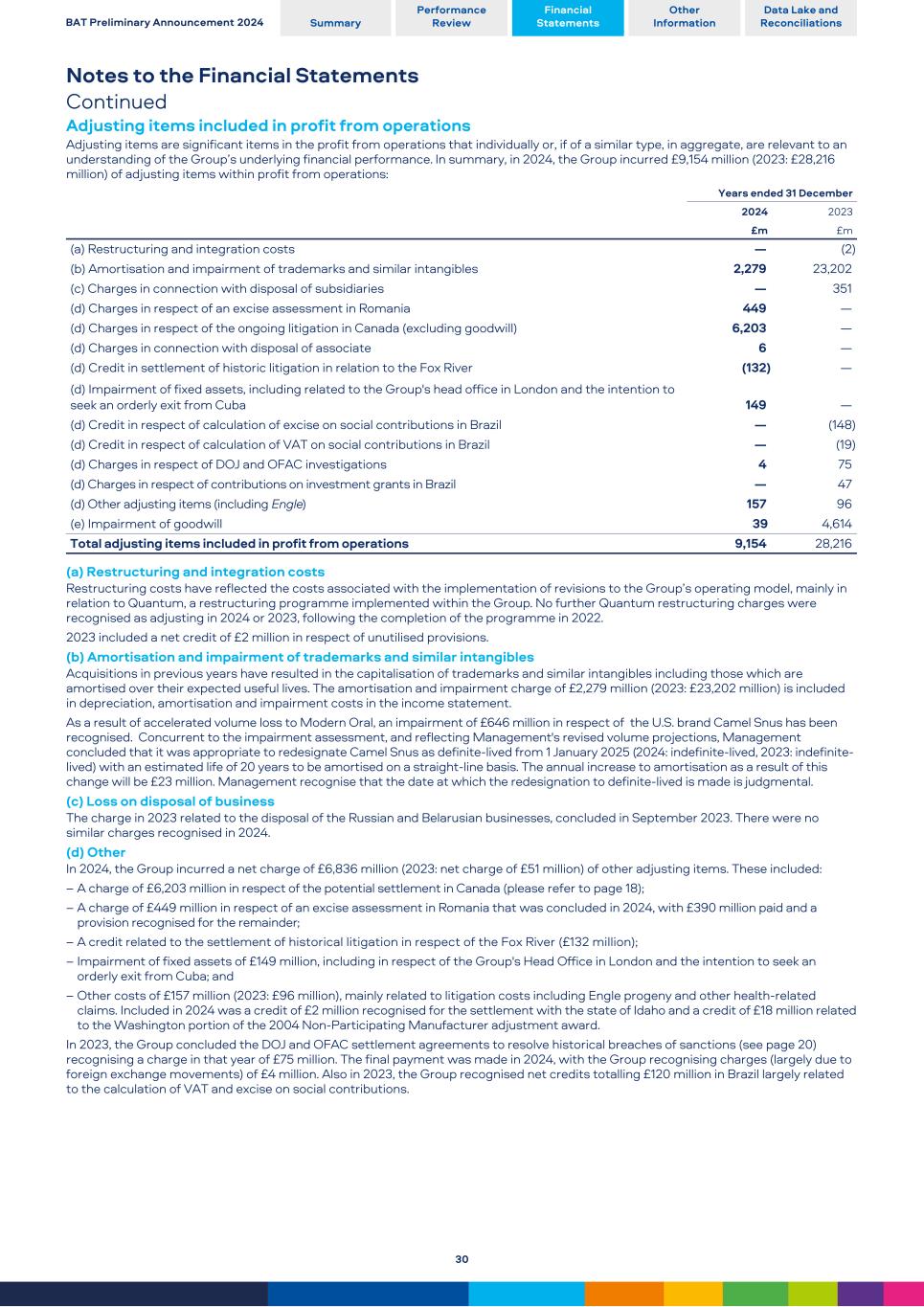

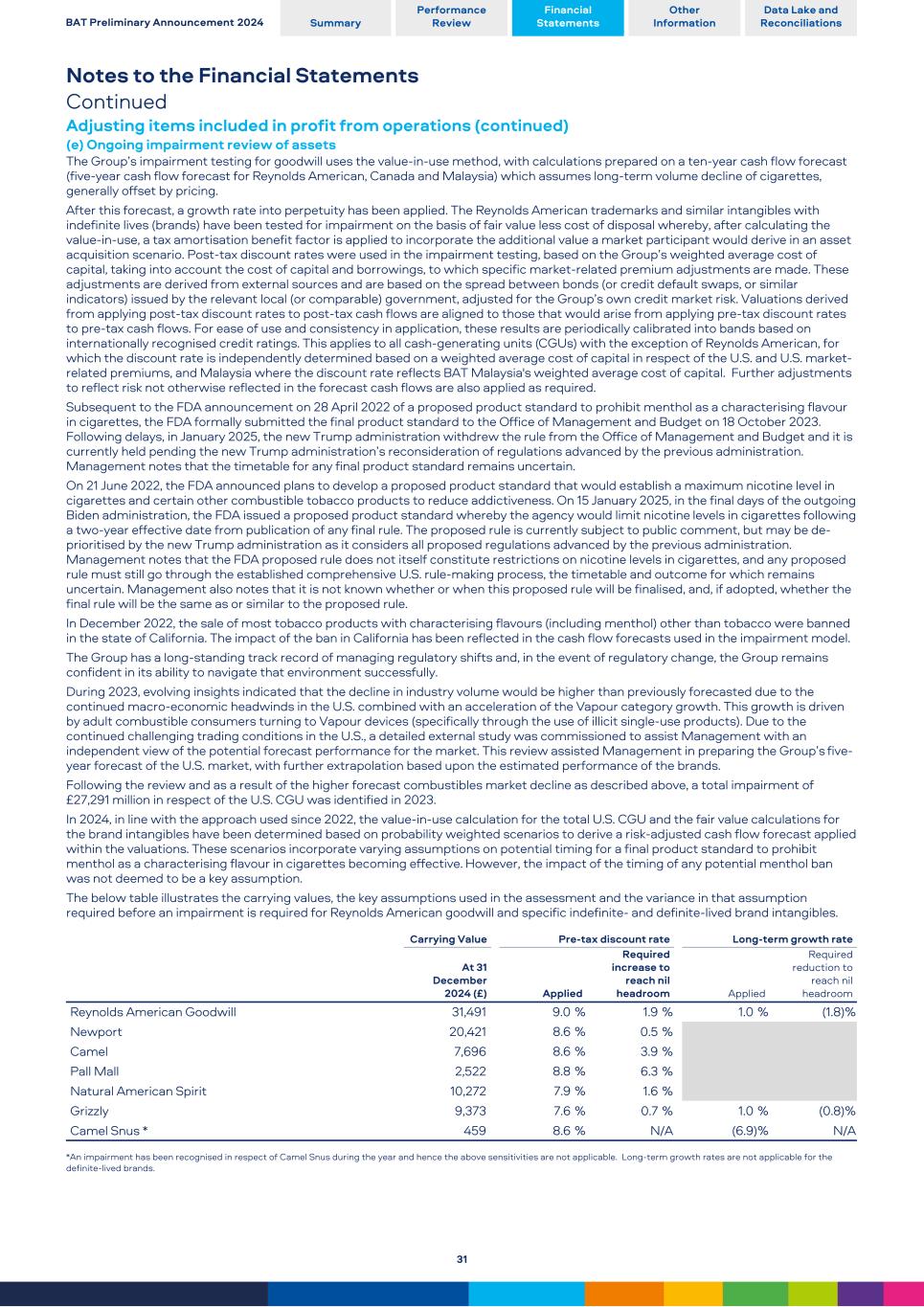

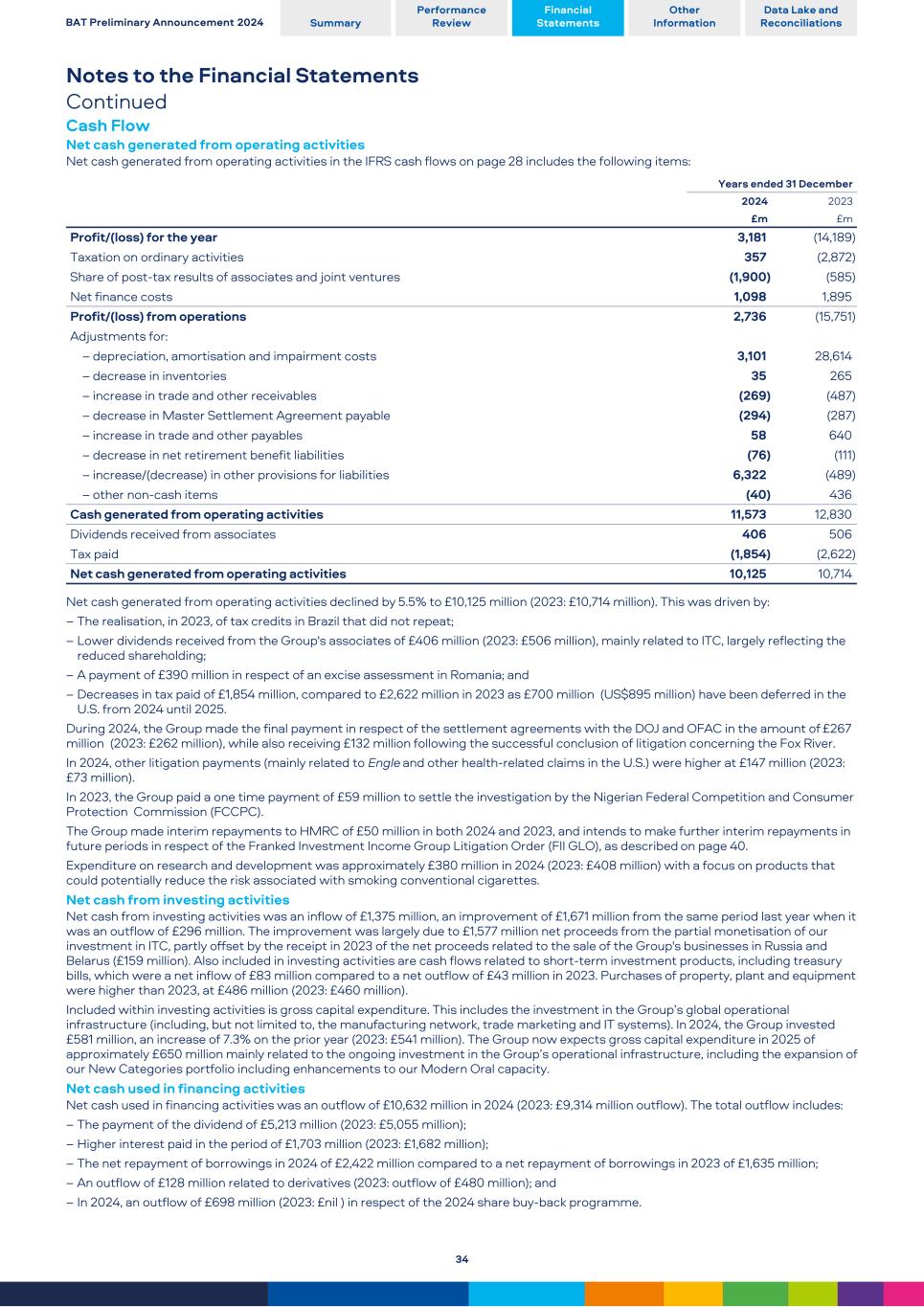

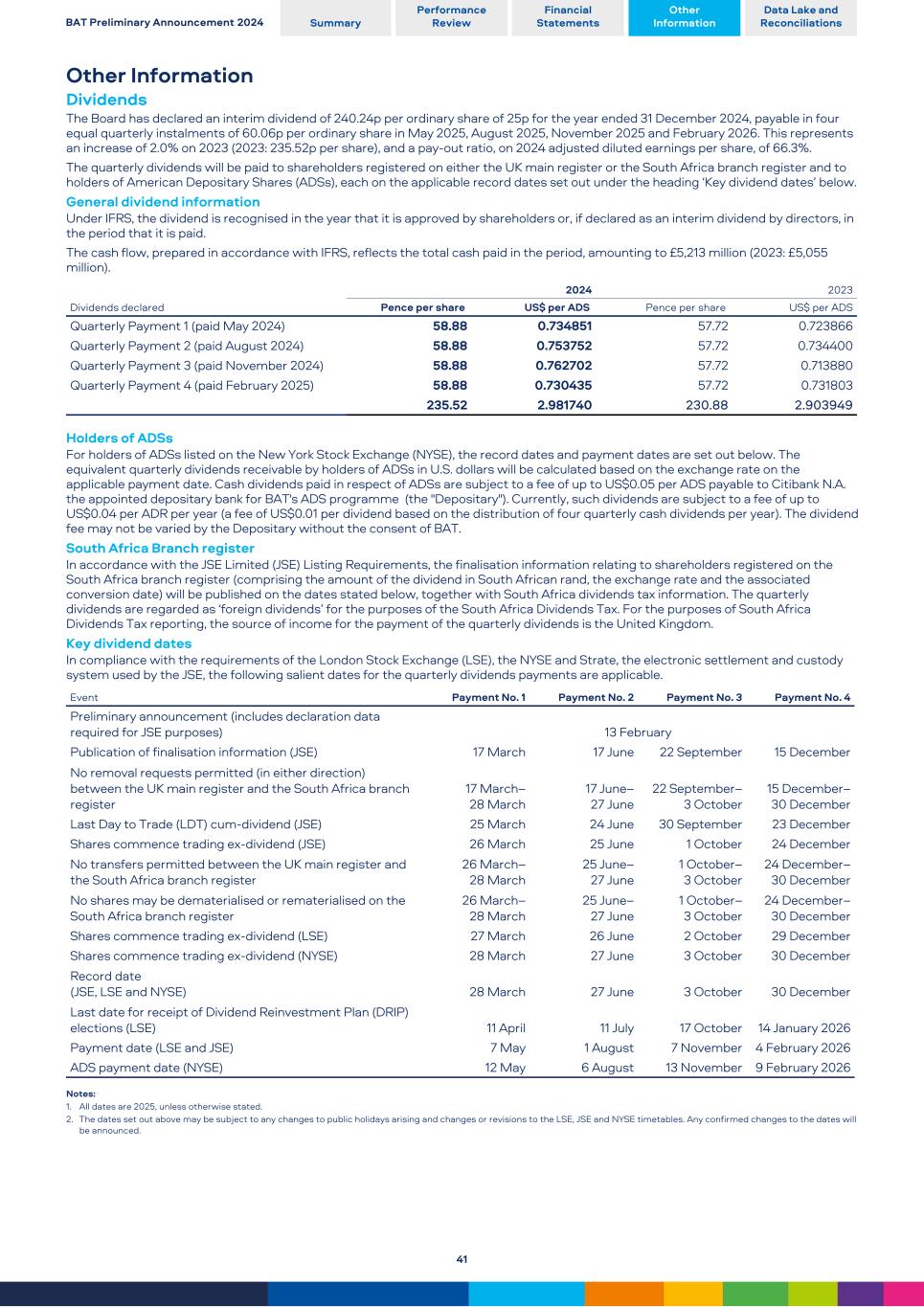

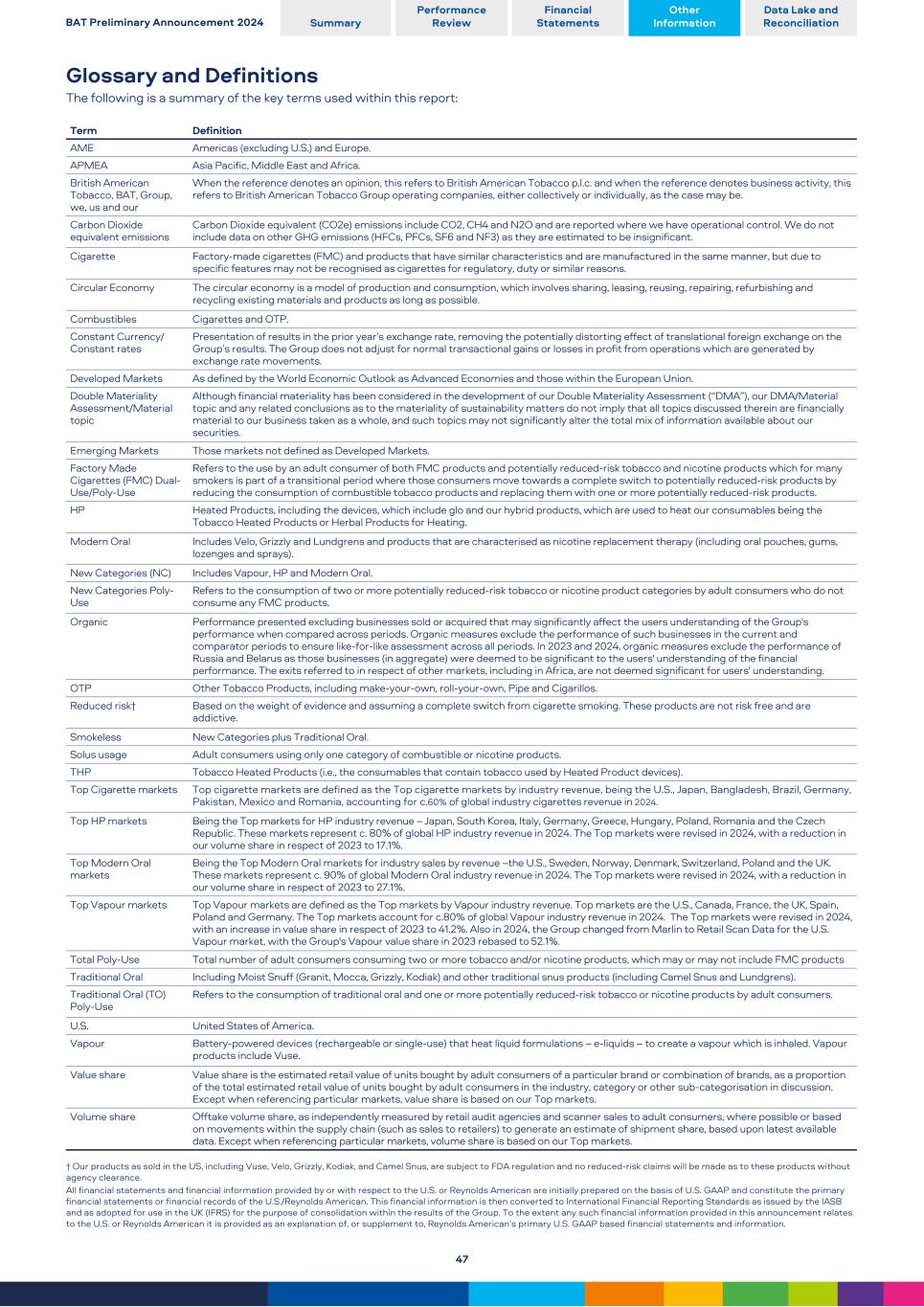

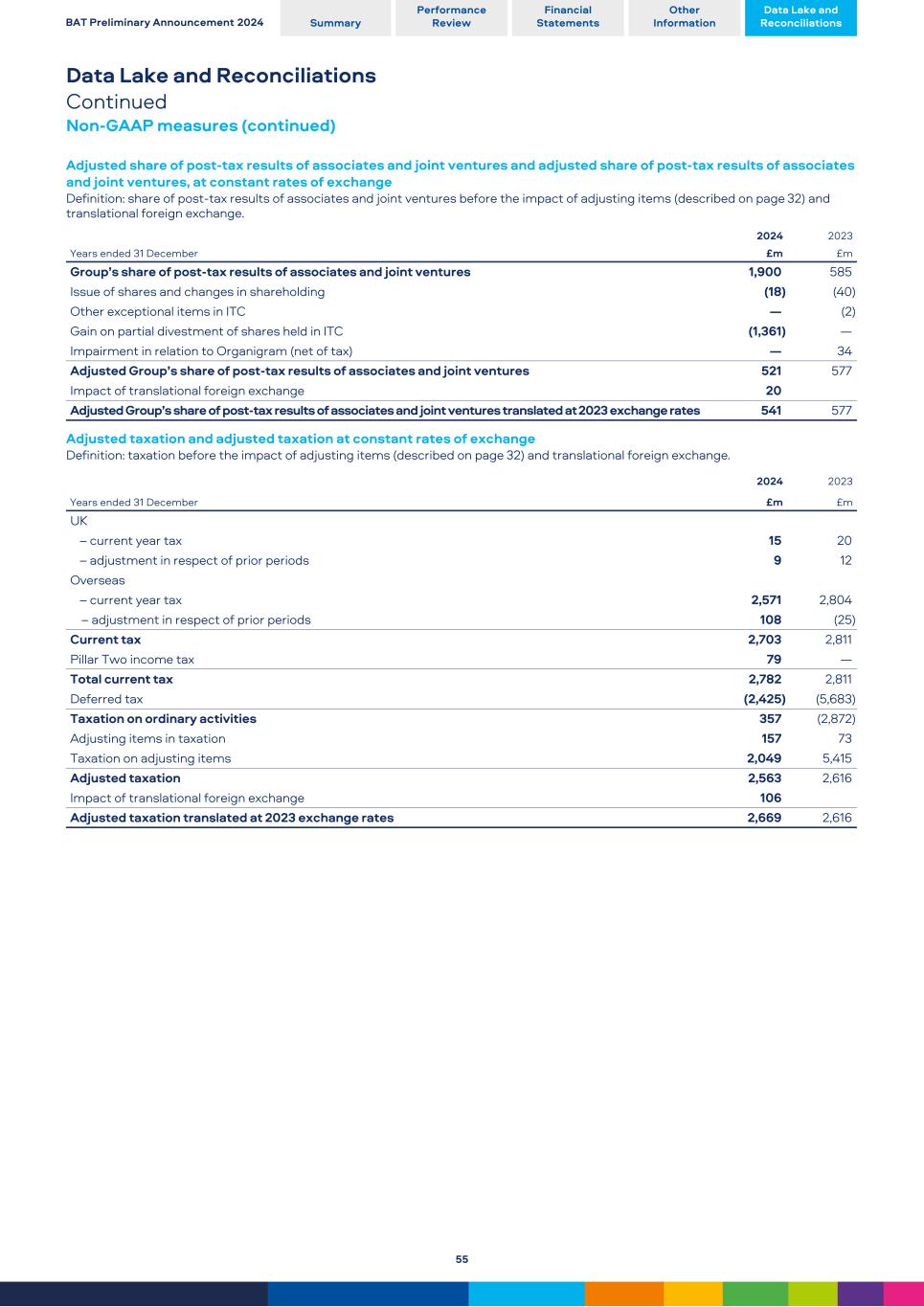

Other Financial Information Continued Results of associates and joint ventures The Group’s share of post-tax results of associates and joint ventures increased from £585 million to £1,900 million. This was driven by a credit of £1,379 million in respect of: – The sale by the Group of 436,851,457 ordinary shares held in the Group's main associate, ITC Ltd (ITC) in India, realising a gain of £1,361 million. The sale represents 3.5% of ITC's ordinary shares. The gain has been treated as an adjusting item; and – A deemed gain of £18 million (2023: £40 million) on dilution of the Group’s holding in ITC as a result of ITC issuing ordinary shares under ITC’s Employees Share Option Scheme, also treated as an adjusting item. Accordingly, the Group's share of ITC has reduced from 29.02% (31 December 2023) to 25.45% at 31 December 2024. The Group’s share of ITC’s post-tax results was 11.5% lower at £545 million (2023: £616 million). The movements are partly due to the decrease in shareholding as a result of the sale in our stake in ITC during the year. On 24 July 2023, ITC announced a proposed demerger of its ‘Hotels Business’ under a scheme of arrangement by which 60% of the newly incorporated entity would be held directly by ITC's shareholders proportionate to their shareholding in ITC. In January 2025, ITC Hotels Limited was listed and commenced trading on the National Stock Exchange of India (NSE) and Bombay Stock Exchange (BSE). The Group's direct stake in ITC Hotels Limited is 15%. In 2023, the Group recognised an impairment charge of £34 million (net of tax) in respect of the Group’s investment in Organigram, treated as an adjusting item. In 2024, no further impairment was required. Excluding these adjusting items and the impact of translational foreign exchange, on an adjusted constant currency basis, the Group’s share of post-tax results from associates and joint ventures was lower than in 2023, down 6.2% to £541 million. Please refer to page 32 for discussion of the adjusting items within the Group’s share of post-tax results from associates and joint ventures. Taxation The tax rate in the income statement was 10.1% for 2024 (2023: 16.8%). The Group’s tax rate is affected by the impact of the adjusting items referred to on pages 29 to 32 and by the inclusion of the share of associates' and joint ventures' post-tax profit in the Group’s pre- tax results. Excluding these, the Group’s underlying tax rate for subsidiaries reflected in the adjusted earnings per share on page 36 was 24.9% for 2024 (2023: 24.5%). The marginal increase in the underlying tax rate in 2024 largely reflects mix of profits and changes in legislation, including the new Pillar Two rules. The Group has applied the mandatory exception to recognising and disclosing information about deferred tax assets and liabilities related to Pillar Two income taxes in accordance with IAS12 Income Taxes. A full reconciliation from taxation on ordinary activities to the underlying tax rate is provided on page 56. On 15 December 2023, a further judgment was issued regarding the Netherlands tax disputes for the 2003 - 2016 period. The disputes have a potential aggregate net liability of £1,140 million. Having considered the judgment and the Dutch judicial and international proceedings available to it, the Group recognised a further adjusting charge of £70 million in 2023, with a total provision of £144 million recognised by 31 December 2024. The findings of the December judgment have been appealed. Appeal hearings took place in 2024, with the Court of Appeal judgment expected in the first half of 2025. BAT Preliminary Announcement 2024 Summary Performance Review Financial Statements Other Information Data Lake and Reconciliations 14