Avantair, Inc. (AAIR)

Investor Presentation

August 2008

SAFE HARBOR

This document contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements, other

than statements of historical fact, including, without limitation, statements

regarding Avantair’s financial position, business strategy, plans, and

Avantair’s management’s objectives and its future operations, and industry

conditions, are forward-looking statements. Although Avantair believes

that the expectations reflected in such forward-looking statements are

reasonable, Avantair can give no assurance that such expectations will

prove to be correct. Important factors that could cause actual results to

differ materially from Avantair’s expectations (“Cautionary Statements”)

include, without limitation, the effect of existing and future laws and

governmental regulations, the results of future financing efforts, and the

political and economic climate of the United States. All subsequent written

and oral forward-looking statements attributable to Avantair, or persons

acting on Avantair’s behalf, are expressly qualified in their entirety by the

Cautionary Statements.

2

INVESTMENT HIGHLIGHTS

Sole provider of the Piaggio Avanti P.180 - roomiest, quietest,

safest and most fuel efficient aircraft with the lowest operating cost

in the light jet category

Compelling drivers spurring demand for private aviation

Rapidly expanding fleet

Significant growth in recurring maintenance and management fees

Strong revenue growth provides clear path to profitability

3

OUR BUSINESS

“Time shares” in Avanti aircraft make private travel available to our

customers

Buy aircraft wholesale, break them into 16 shares (50 hours of

flying time), and sell the shares retail

Aircraft available when customers need to travel

Provide flight operations and fleet maintenance for our customers

Recurring monthly maintenance and management fees

associated with each share sold

5-year agreement with annual CPI increases

Operations include scheduling, pilots and pilot training,

maintenance, chartering, and repositioning

4

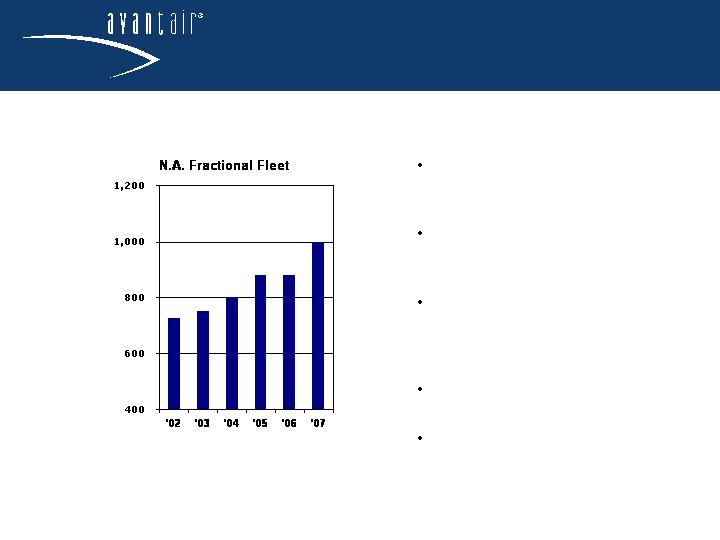

1 Source: Federal Reserve Board

( www.federalreserve.gov/pubs/oss/oss2/2004/scf2004home.html)

2 Source: AvData

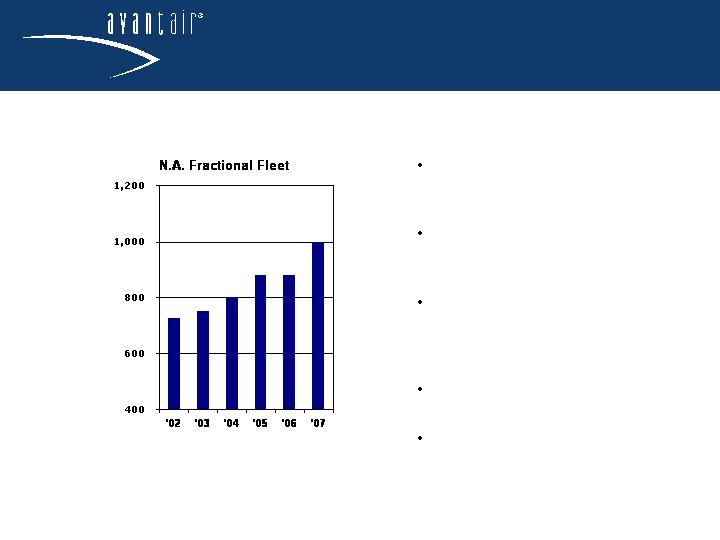

2 million households with

net worth between $5-$30

million1 and growing

Unfavorable conditions for

travelers in commercial

aviation market

Fractionally owned aircraft

fleet has grown from 8

aircraft in 1986 to 998 as of

May 31, 20072

3 fractional shareholders in

1986 to 59022 today

Card fractional programs

represent a new growth

vehicle for industry

Fractional Aircraft Ownership Growing in Popularity

LARGE ADDRESSABLE MARKET

5

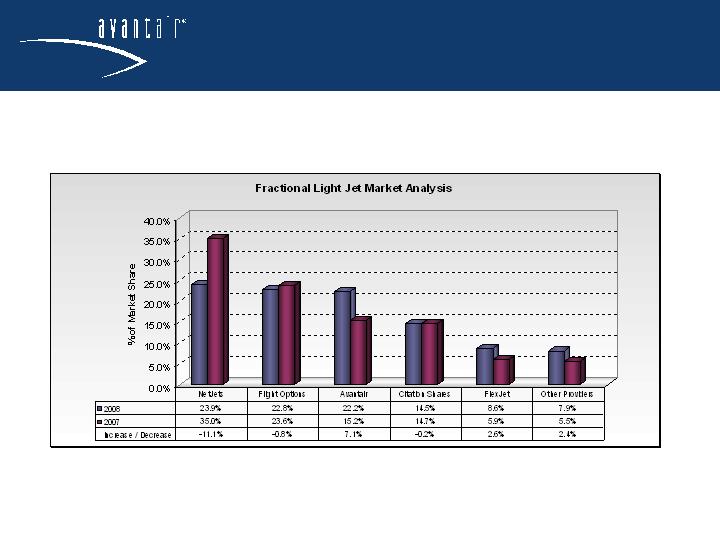

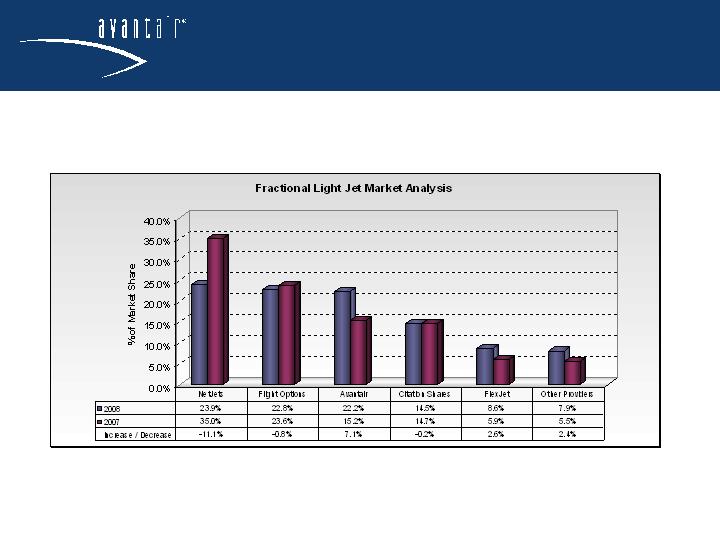

LIGHT JET MARKET GROWTH

With 7.1% year-over-year market share growth, Avantair is currently the fastest growing fractional in

the light jet market

Source: UBS Estimates, Amstat, Boston Aviation

TOTAL MARKET GROWTH

With 1.3% increase in market share from 2007 to 2008, Avantair has the highest percentage of

growth in the fractional industry

Source: UBS Estimates, Amstat, Boston Aviation

COMPETITIVE ADVANTAGES

Sole fleet operator of the

Piaggio Avanti P.180

Lowest fuel burn and fuel

surcharge

30%-50% more fuel

efficient than

comparable jets

Approximately 25%

more efficient than twin

turboprops*

Largest cabin in category

Short runway capability

Powerful leverage in business

model

Increase in fleet size

reduces operating costs

Opportunity for significant

margin growth

Single type aircraft fleet

Lower maintenance and

training costs

Fewer parts in inventory

Company-owned FBOs

* Source: Business and Commercial Aviation, ARG/US ( http://aviationresearch.com/Free/facprgms.asp) and company pricing sheets as of

September 2006

8

BUSINESS MODEL

Maintain aggressive delivery schedule with goal of approximately

one aircraft sold per month

49 aircraft in fleet currently

11 deliveries expected in FY 2009

Total of 60 additional Piaggio Avanti II aircraft on order through

2013

Economies of scale due to larger fleet size

Reduces non-revenue repositioning flights

Leverages existing infrastructure

Fixed Base Operators in two key hubs provide operating and

maintenance efficiencies and lower fuel costs

Drives maintenance and management fees

Disciplined focus on keeping costs down

9

AIRPLANES IN FLEET

*As of end of year

10

Base continues to grow

Up ~70% in FY 2007 to ~$39 million

Leverage opportunities

Fewer repositioning flights

Fewer charters

Leverage infrastructure and fixed costs of

flight operations

Fleet Expansion Drives Recurring Maintenance & Management Fees

FLEET EXPANSION

11

IMPROVING OPERATING EFFICIENCIES

Increase in fleet size lowers total operating costs

49% year-over-year increase in fleet size Q3 FY 2008

versus Q3 FY 2007

Consistent month-over-month decrease in operating loss

in Q3 FY 2008 (January, February, March): $2,123,252,

$1,887,238 and $1,149,553, respectively

57% decrease in year-over-year charter expenses Q3 FY

2008 versus Q3 FY 2007

12

PIAGGIO AVANTI

P.180 AIRCRAFT

THE PIAGGIO AVANTI P.180

As the best value in the fractional industry, the Avanti P.180 offers the

perfect combination of comfort, speed, performance and efficiency.

14

PIAGGIO AERO INDUSTRIES

World’s oldest aircraft company

Developed first amphibious aircraft

Built world’s first helicopter

Invented pressurization

A leading aircraft company today

Airplanes, engines, and

aerostructures

Civilian and military

Well-capitalized: owned by

Ferrari and diMase families (55%)

and Mubadala Development (35%)

Global customer base

Multinational partners

Rolls Royce

Honeywell

Pratt & Whitney

Lockheed Martin

Total order book of over $800 million

15

AVANTI P.180 FEATURES AND BENEFITS

16

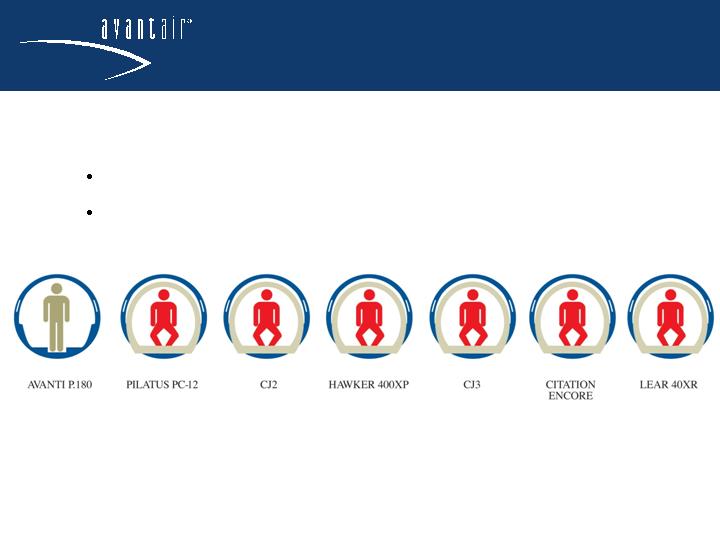

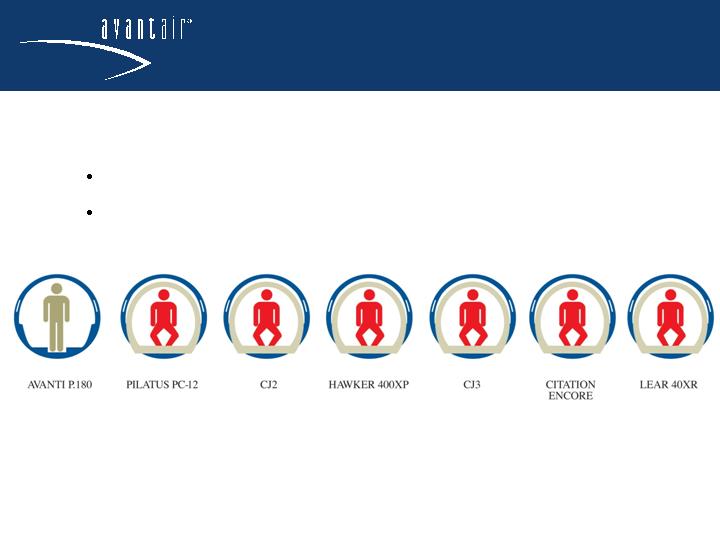

AVANTI P.180 CABIN COMPARISON

The Avanti P.180 has the most comfortable cabin in its class

Over a foot taller than other light jets

Over a foot wider than other light jets

17

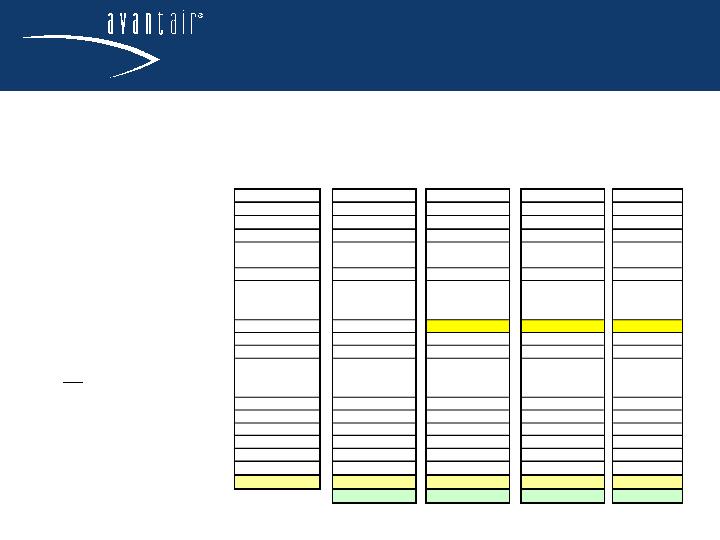

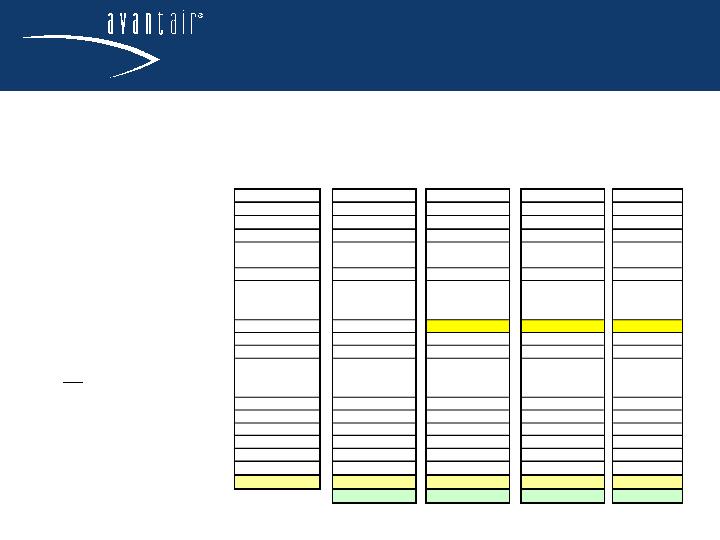

COMPETITIVE PRICING STRUCTURE

18

* Based on 1/16th share, or 50 hours per year. Source: July 2008 publicly available competitor data.

Avantair, Inc.

Year One Annual Operating Cost Comparison

July 2008

Aircraft Description:

Avantair

CitationShares

Flight Options

NetJets

Flexjet

Make

Piaggio

Cessna

Raytheon

Raytheon

Bombardier

Model

P180

CJ3

Hawker 400XP

Hawker 400XP

Lear40XR

Acquisition Cost

425,000

$

480,000

$

412,500

$

416,625

$

560,000

$

Share Size

1/16

1/16

1/16

1/16

1/16

Maximum Hours per Year

50

50

50

50

50

Unit Operating Costs:

Occupied Hourly Rate

$0

$5,152

$1,350

$1,786

$1,825

Fuel Surcharge/Hour

$444

$0

$1,896

$1,159

$1,532

FET on Occupied Rate

$297

7.5%

7.5%

7.5%

7.5%

Monthly Management Fee

$9,650

$7,644

$7,469

$7,295

Year

One

Annual Operating Costs:

Occupied Hourly Cost

-

$

257,584

$

67,500

$

89,300

$

91,250

$

Fuel Surcharge Cost

22,200

$

-

$

94,800

$

57,950

$

76,600

$

FET on Hourly Cost

3,563

$

19,319

$

12,173

$

11,044

$

12,589

$

Management Fee

115,800

$

-

$

91,728

$

89,628

$

87,540

$

Total Annual Operating Costs

141,563

$

276,903

$

266,201

$

247,922

$

267,979

$

Effective Hourly Rate of Operation

2,831

$

5,538

$

5,324

$

4,958

$

5,360

$

Yearly Cost Savings With Avantair

49%

47%

43%

47%

STRONG CONSUMER DEMAND AND LOYALTY

50% of sales from customer referrals

12% of owners purchase additional shares within one year of

ownership

Average purchase is approximately 1.2 shares, or 60 hours

Conducting a record number of demo flights

Historical demo-to-close ratio is approximately 80%

Charter card program develops strong sales leads

Approximately 20% of charter card holders convert to

shareowners

Increasing marketing and advertising to target new customers

19

EXPERIENCED MANAGEMENT TEAM

Steven F. Santo

Chief Executive Officer

Avantair Founder

Former Assistant District Attorney in NY

Former Managing Partner, Field, Silver & Santo

Former CEO of Skyline Aviation, aircraft leasing company

Pilot for 20 years

Over 1,000 flight hours in the Piaggio Avanti

Richard Pytak

Chief Financial Officer

Former Treasurer at Gibraltar Industries

Former Senior Manager at PricewaterhouseCoopers

Kevin Beitzel

Chief Operating Officer

Former Executive VP of Maintenance and Operations

20 years experience in aviation industry

16 years with US Airways

Kevin V. McKamey

Executive Vice President

Avantair charter employee

20 years experience in aviation industry specifically in operations,

maintenance and servicing

Former manager of flight operations and sales support for Piaggio

America

Over 3,000 flight hours in the Piaggio Avanti

20

FINANCIAL

SECTION

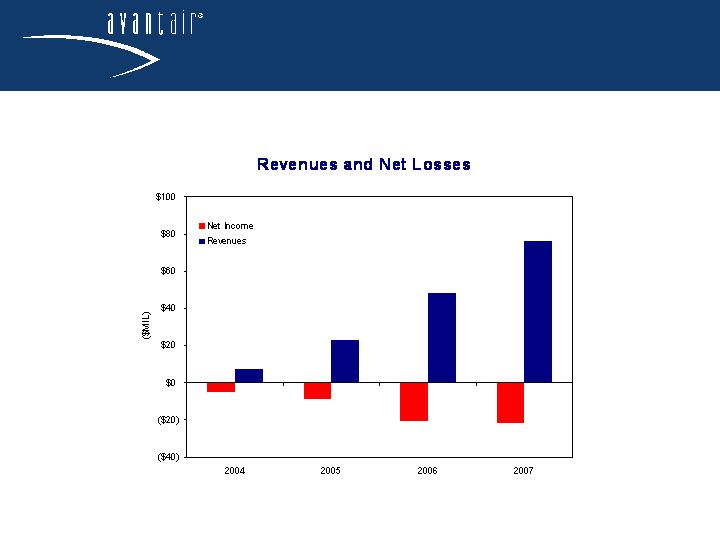

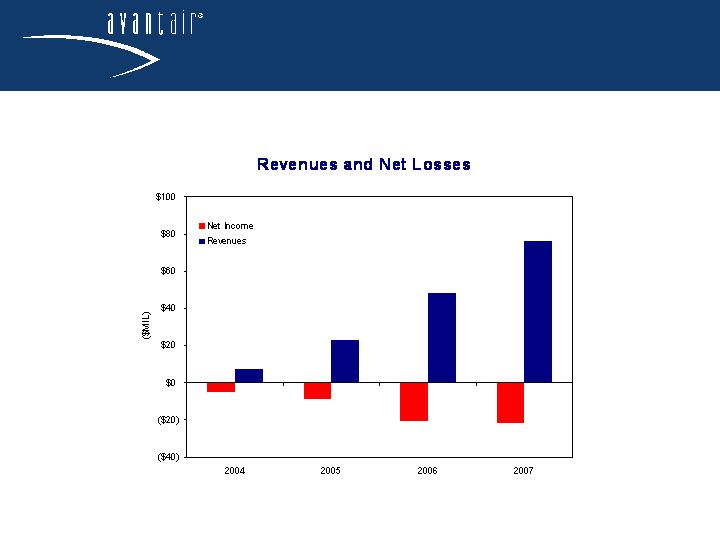

ANNUAL REVENUE AND OPERATING RESULTS

22

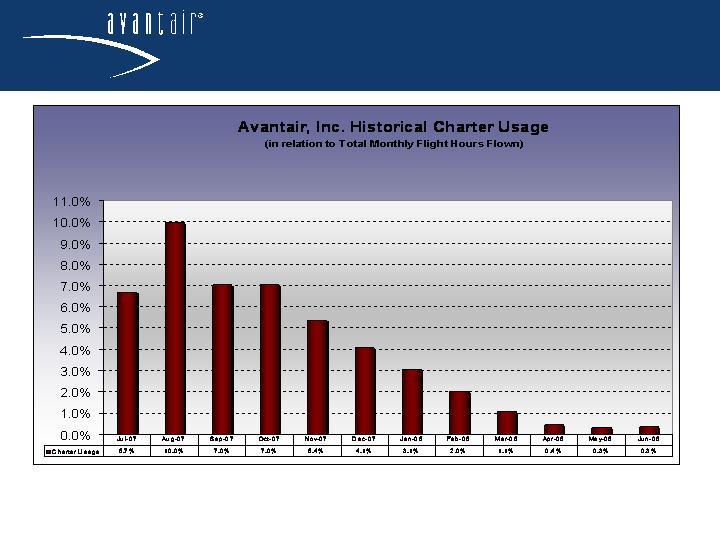

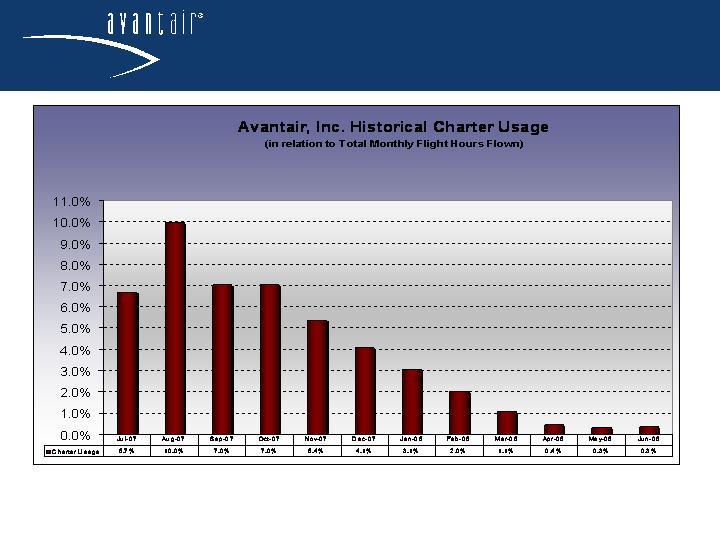

CHARTER USAGE

23

Note:

12 Month Avg. = 3.9% / 2006 Avg. = 6.1% / 2007 Avg. = 6.3% / 2008 YTD Avg. = 1.2%

INDUSTRY SALES 4th QUARTER FY 2008

Data Source: Boston Aviation

In Q4, Avantair was the only fractional provider with a positive net change – taking into

account shares sold and subtracting ‘buy back’ hours.

Aircraft Sold (New &

Pre-Owned)

Aircraft Bought

Back

Net Change

CitationShares

2,250

2,600

-350

Bravo

1,075

1,400

-325

CJ3

625

425

200

Excel / XLS

550

775

-225

Flexjet

925

950

-25

Lear 40 / 40XR

675

250

425

Lear 45 / 45XR

250

700

450

NetJets

7,725

8,000

-275

Ultra

450

1,700

-1,250

Hawker 400XP

550

650

-100

Encore / +

2,425

575

1,850

Excel / XLS

4,300

5,075

-775

Flight Options

3,000

4,700

-1,700

400A / 400XP

3,000

4,700

-1,700

Avantair

1,850

250

1,600

Piaggio Avanti

1,850

250

1,600

FINANCIAL MODEL

Fractional share sales are paid in cash up front with

revenue amortized over 60 months

Approximately $1 million gross profit per aircraft

Aircraft deliveries are lumpy

Maintenance and management fees provide recurring

monthly revenues

Growth in fractional shares add incremental monthly fees

on growing base

Expenses have seasonal component

25

FISCAL THIRD QUARTER 2008 RESULTS

Revenues up 51% year-over-year to $29.9 million

36% increase in shares sold to date – 624.5 at 3/31/08 vs.

458 at 3/31/07

Increases in both charter card and demonstration and other

revenues of 42% and 80%, respectively, over last year’s

levels

Net loss declined to $5.4 million from $7.4 million in the prior-

year period

Expect delivery of 11 aircraft in FY 2009

26

AVANTAIR KEY TAKEAWAYS

Large addressable market growing rapidly as the

popularity of fractional aircraft ownership expands

Key competitive advantage due to exclusivity and

competitive pricing for Avanti P.180

Continue with strategic delivery schedule for FY 2009,

with another 60 Piaggio Avanti II aircraft on order through

2013

Expansion of fleet and growth in revenues enhance

operating efficiencies and enable long term profitability

27

Avantair, Inc. (AAIR)

Headquartered in

Clearwater, FL

727.539.0071

avantair.com