Avantair, Inc. (AAIR)

21st Annual

Roth Capital Partners

OC Growth Stock Conference

February 17, 2009

SAFE HARBOR

This document contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements, other

than statements of historical fact, including, without limitation, statements

regarding Avantair’s financial position, business strategy, plans, and

Avantair’s management’s objectives and its future operations, and industry

conditions, are forward-looking statements. Although Avantair believes

that the expectations reflected in such forward-looking statements are

reasonable, Avantair can give no assurance that such expectations will

prove to be correct. Important factors that could cause actual results to

differ materially from Avantair’s expectations (“Cautionary Statements”)

include, without limitation, the effect of existing and future laws and

governmental regulations, the results of future financing efforts, and the

political and economic climate of the United States. All subsequent written

and oral forward-looking statements attributable to Avantair, or persons

acting on Avantair’s behalf, are expressly qualified in their entirety by the

Cautionary Statements.

2

INVESTMENT HIGHLIGHTS

Sole fractional provider of the Piaggio Avanti in North America -

the roomiest, quietest, safest and most fuel efficient aircraft with

the lowest operating cost in the light jet category

Compelling secular and economic drivers spurring demand for

lower-cost alternatives within the private aviation market

New innovative Axis program bridges the gap between the

financial commitment of a fractional share and charter cards

Business model offers clear path to sustainable profitability

3

EXPERIENCED MANAGEMENT TEAM

Steven F. Santo

Chief Executive Officer

Avantair Founder

Former Assistant District Attorney in NY

Former Managing Partner, Fields, Silver & Santo

Former CEO of Skyline Aviation, aircraft leasing company

Pilot for 20 years

Over 1,000 flight hours in the Piaggio Avanti

Richard Pytak

Chief Financial Officer

Former Treasurer at Gibraltar Industries

Former Senior Manager at PricewaterhouseCoopers

Kevin Beitzel

Chief Operating Officer

Former Executive VP of Maintenance and Operations

20 years experience in aviation industry

16 years with US Airways

Kevin V. McKamey

Executive Vice President

Avantair charter employee

20 years experience in aviation industry specifically in operations,

maintenance and servicing

Former manager of flight operations and sales support for Piaggio

America

Over 3,000 flight hours in the Piaggio Avanti

4

OUR BUSINESS

Fractional shares in Avanti aircraft offer an affordable private travel

option

Buy aircraft wholesale

Break them into 16 shares (50 hours of flying time)

Sell the shares retail

Aircraft available when customers need to travel

Provide flight operations and fleet maintenance for our customers

Generates recurring monthly maintenance and management fees with

each share sold

5-year agreement with annual CPI increases

Flight operations include scheduling, pilots and pilot training,

maintenance, flight tracking and repositioning

5

AVANTAIR PROGRAM SUMMARY

6

Avantair Fractional Ownership

Hourly Operating Cost:*

$2,633

(1/16th share)

Program Highlights:

One time acquisition cost; no

hourly cost

Customizable fractional share sizes

5 year term

No restricted travel days

Expanded Primary Service Area

42% lower operating cost per hour

than other fractional programs

AXIS Club Membership

By Avantair

Hourly Operating Cost:*

$3,725 - $4,440

Program Highlights:

One time membership fee

Tiered membership options to fit

customer travel needs

3 year term

No restricted travel days

Expanded Primary Service Area

Fractional conversion and

upgrade options available

Edge Time Card

Hourly Operating Cost:*

$4,945

(25 hour card)

Program Highlights:

All inclusive, one time cost

15 or 25 hour cards available

12 month term

Only 10 restricted travel days per

year

Expanded Primary Service Area

Conversion options available

* Includes FET and fuel

NEW AXIS CLUB MEMBERSHIP PROGRAM

7

Hybrid program, designed to bridge the gap between the financial commitment of a fractional share and charter cards

Offers access to blocks of flight hours at a locked-in rate, subject to annual CPI increase

One time membership fee starting as low as $75,000

3 year membership allows customers the opportunity to purchase blocks of 25 hours for $80,000 or less

Fractional conversion and upgrade options available

1 Source: Federal Reserve Board

(www.federalreserve.gov/pubs/oss/oss2/2004/scf2004home.html)

2 Source: Business Jet Monthly Report by UBS Investment

Research

3 Source: AMSTAT, Boston Aviation estimates 2/17/09

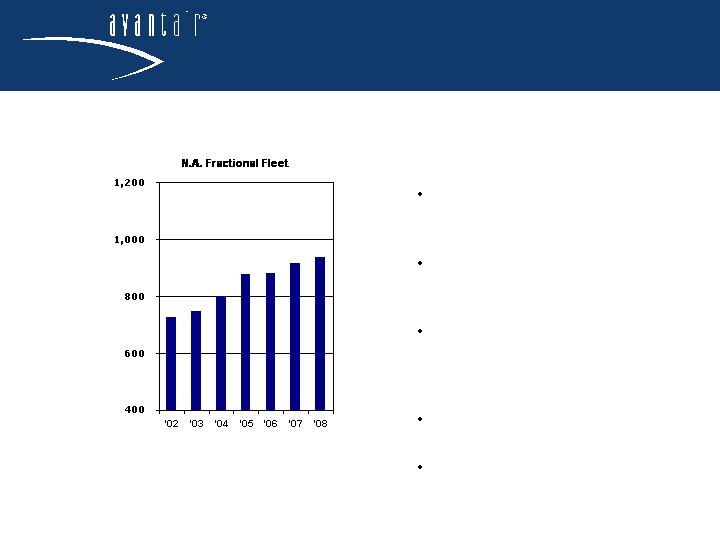

2 million households with

net worth between $5-$30

million1 and growing

Unfavorable conditions for

travelers in commercial

aviation market

Fractionally owned aircraft

fleet has grown from 8

aircraft in 1986 to 937 as of

June 18, 20082

3 fractional shareholders in

1986 to 6,5903 today

Card fractional programs

represent a new growth

segment for industry

Fractional Aircraft Ownership Growing in Popularity

LARGE ADDRESSABLE MARKET

8

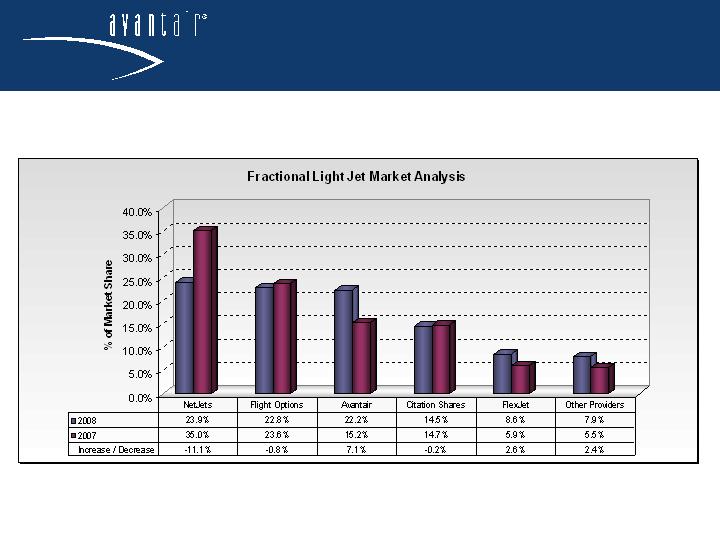

LIGHT JET MARKET GROWTH

With 7.1 basis point year-over-year market share growth, Avantair is the fastest growing fractional in

the light jet market

Source: UBS Estimates, Amstat, Boston Aviation

9

TOTAL MARKET GROWTH

With 1.3 basis point increase in market share from 2007 to 2008, Avantair has the highest

percentage of growth in the fractional industry

Source: UBS Estimates, Amstat, Boston Aviation

10

COMPETITIVE ADVANTAGES

Sole fractional fleet operator of

the Piaggio Avanti

Lowest fuel burn and fuel

surcharge

30%-50% more fuel

efficient than

comparable jets

Approximately 25%

more efficient than twin

turboprops*

Largest cabin in category

Short runway capability

Substantial leverage in business

model

Increase in fleet size

reduces operating costs

Opportunity for significant

margin growth

Single type aircraft fleet

Lower maintenance and

training costs

Fewer parts in inventory

Company-owned FBOs

* Source: Business and Commercial Aviation, ARG/US (http://aviationresearch.com/Free/facprgms.asp) and company pricing sheets as of September 2006

11

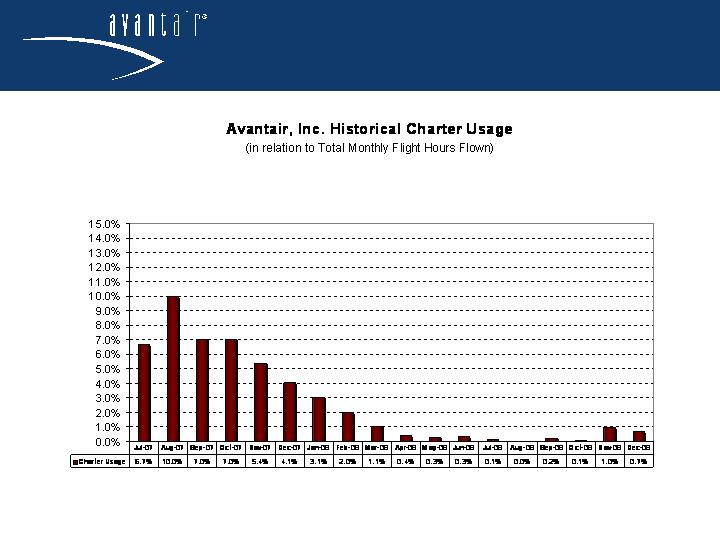

BUSINESS MODEL

Maintain aggressive delivery schedule

Goal of approximately 3/4 aircraft sold (12 Shares) per month

52 aircraft in fleet currently

9 deliveries expected in FY 2009

Total of 57 additional Piaggio Avanti aircraft on order through 2013

Realize economies of scale due to larger fleet size

Reduces non-revenue repositioning flights and charter costs

Leverages existing infrastructure

Fixed Base Operators in three key hubs provide operating and maintenance

efficiencies and lower fuel costs

Drives maintenance and management fees

Disciplined fiscal controls

13

THE PIAGGIO AVANTI

As the best value in the fractional industry, the Piaggio Avanti offers

the perfect combination of comfort, speed, performance and efficiency.

14

LEAD GENERATION + CUSTOMER LOYALTY = SALES

16

Substantial marketing leverage generated as growing customer base results in more customer referrals

70% of new leads are current owners in competing fractional programs

45% of leads are from advertising (direct mail, online and print)

70% of sales are from existing customer referrals

12% of owners purchase additional shares within one year of ownership

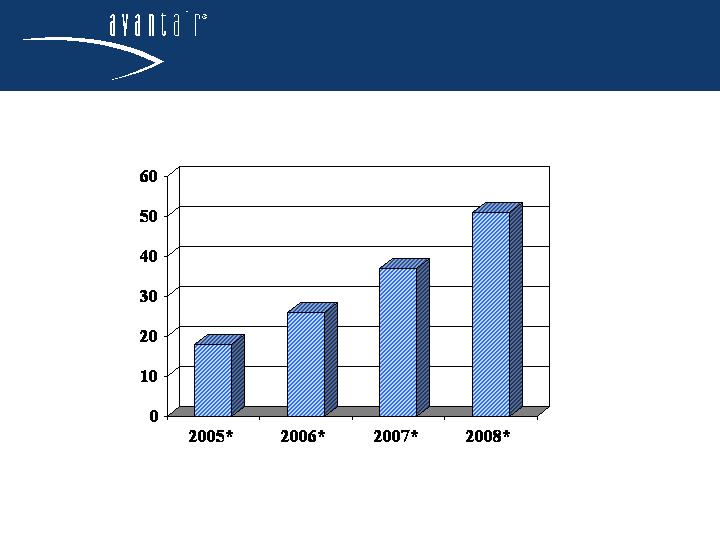

AIRPLANES IN FLEET

*As of end of calendar year

17

$17.7 million for fiscal second quarter, up 25.1% year-over-year

Monthly fee of $9,650 during the fiscal second quarter versus $9,400

in the prior year quarter

Leverage opportunities

Fewer repositioning flights

Fewer charters

Decrease in overall costs of flight operations

Fleet expansion drives recurring maintenance and management fees

REALIZING ECONOMIES OF SCALE

18

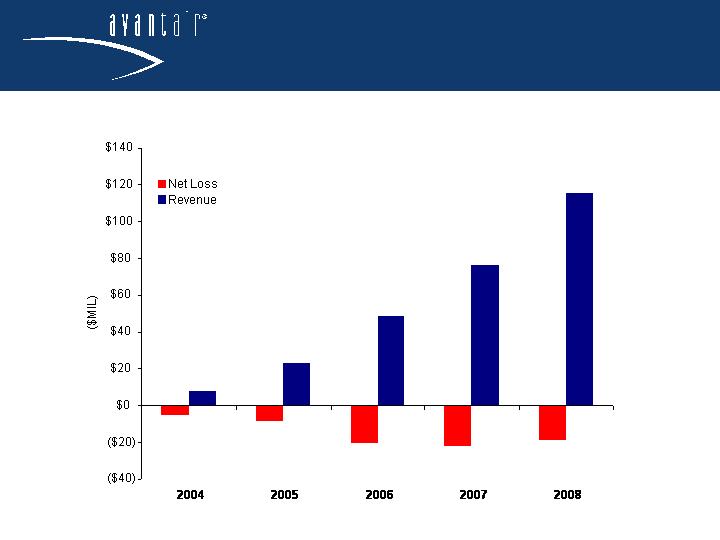

ANNUAL REVENUE AND OPERATING RESULTS

21

PROFITABILITY PROGRESS

22

Management currently estimates that income from operations before depreciation and

amortization sufficient to cover interest charges can be achieved on a sustainable basis

through either fully fractionalizing 48 aircraft, increasing the sale of charter cards to 150

on an annual basis (either individually or through the Company’s Axis Membership Program),

or a combination thereof.

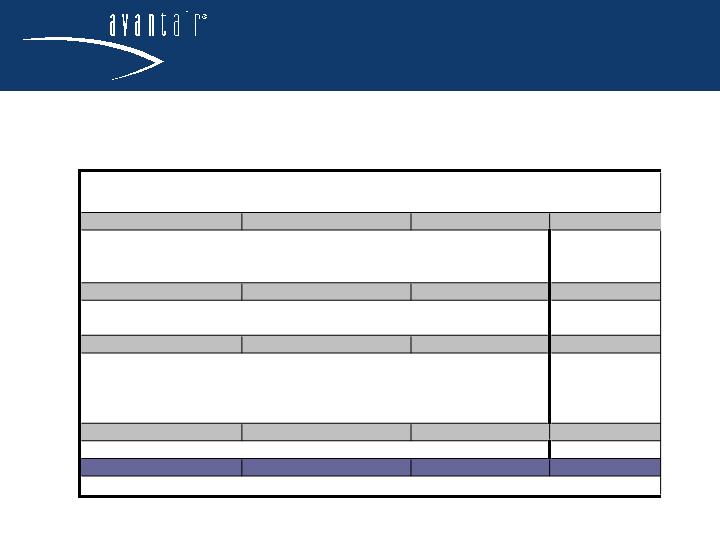

SECOND QUARTER and YTD FISCAL 2009

REVENUE AND OPERATING RESULTS

23

FISCAL SECOND QUARTER 2009 HIGHLIGHTS

Total record revenues of $35.4 million, up 23.7% year-over-year

Reported delivery of 50th Piaggio Avanti

Charter card sales up 96% quarter-over-quarter, to 53 from 27

Announced new hybrid flight program – ‘Axis Club’ – designed to bridge the gap

between the financial commitment of a fractional share and charter cards

EBITDA (profitable results from operations before depreciation and amortization) of

$690,360, up 118.1% year-over-year

Loss from operations of $0.6 million, down 86.9% year-over-year

24

INDUSTRY SALES

� 60; Data Source: Boston Aviation

25

As of September 30, 2008, Avantair was the only fractional provider in the light jet category that has

sustained a positive net change for three consecutive quarters – taking into account shares sold and

subtracting ‘buy back’ hours.

Aircraft Sold

(New & Pre-Owned)

Aircraft Bought

Back

Net Change

CitationShares

2,375

2,500

-125

Bravo

825

1,475

-650

CJ3

675

450

225

Excel / XLS

875

575

300

Flexjet

550

1,175

-625

Lear 40 / 40XR

300

150

150

Lear 45 / 45XR

250

1,025

-775

NetJets

6,275

6,700

-425

Ultra

150

2,425

-2,275

Hawker 400XP

150

400

-250

Encore / +

3,025

400

2,625

Excel / XLS

2,950

3,475

-525

Flight Options

3,500

5,151

-1,651

400A / 400XP

3,500

5,151

-1,651

Avantair

1,925

800

1,125

Piaggio Avanti

1,925

800

1,125

FINANCIAL MODEL

Fractional share sales are paid in cash up front with revenue

amortized over 60 months

Approximately $1 million gross profit per fractionalized aircraft

Maintenance and management fees provide recurring monthly

revenues

Growth in fractional shares add incremental monthly fees on

growing base

26

AVANTAIR KEY TAKEAWAYS

Superior growth rate relative to private aviation market;

Avantair continues to gain market share at competitors’

expense

Defensible competitive advantages - the Piaggio Avanti is

technologically superior to other light jets and is exclusive to

Avantair

Recurring revenue stream via fractional share sales

Substantial operating leverage inherent to business model,

leading to sustainable profitability

27

Avantair, Inc. (AAIR)

Headquartered in

Clearwater, FL

727.538.7910

www.avantair.com