ANNUAL INFORMATION FORM

of

Suite 1901 – 1177 West Hastings Street

Vancouver, British Columbia

V6E 2K3

January 25, 2006

TABLE OF CONTENTS

ITEM 1:

PRELIMINARY NOTES

Documents Incorporated by Reference

Date of Information

Currency and Exchange Rates

Metric Equivalents

Forward-Looking Statements

Caution Regarding Adjacent or Similar Mineral Properties

Caution Regarding Reference to Resources and Reserves

Glossary of Terms

ITEM 2:

CORPORATE STRUCTURE

Name, Address and Incorporation

Intercorporate Relationships

ITEM 3:

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

Significant Acquisitions

Significant Dispositions

ITEM 4:

NARRATIVE DESCRIPTION OF THE BUSINESS

General

Stage of Development

Specialized Skill and Knowledge

Competitive Conditions

Components

Business Cycles

Economic Dependence

Renegotiation or Termination of Contracts

Employees

Risk Factors

Mineral Projects

ITEM 5:

DIVIDENDS

ITEM 6:

DESCRIPTION OF CAPITAL STRUCTURE

General

ITEM 7:

MARKET FOR SECURITIES

Trading Price and Volume

ITEM 8:

ESCROWED SECURITIES

ITEM 9:

DIRECTORS AND OFFICERS

ITEM 10:

AUDIT COMMITTEE

ITEM 11:

PROMOTERS

ITEM 12:

LEGAL PROCEEDINGS

ITEM 13:

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

ITEM 14:

TRANSFER AGENT AND REGISTRAR

ITEM 15:

MATERIAL CONTRACTS

ITEM 16:

NAMES AND INTERESTS OF EXPERTS

ITEM 17:

ADDITIONAL INFORMATION

ITEM 1:

PRELIMINARY NOTES

Documents Incorporated by Reference

Incorporated by reference into this Annual Information Form (“AIF”) are the following documents:

·

Consolidated Financial Statements and Management Discussion and Analysis of the Company for the year ended October 31, 2005

·

Management Information Circular dated March 15, 2005 in respect of the 2005 Annual General Meeting (“Information Circular”)

·

Technical report dated January 22, 2006 entitled “Diamond Drill Report on the Baja California Norte IOCG Project (San Fernando, Picale and Amargosa Properties) – Baja California Norte, Mexico” prepared by Gary D. Belik, P.Geo.

·

Technical report dated August 6, 2005 entitled “Geological Valuation Report of the Pampa de Pongo Property, Arequipa Department, Caraveli Province, Peru” prepared by J.N. Helsen, Ph.D., P.Geo.

·

Technical report dated January 12, 2006 entitled “Technical Report on the Geology of the Huachi Porphyry Copper Prospect, San Juan Province, Argentina” prepared by S. Enns P.Geo. and A. Findlay P.Geo.

copies of which may be obtained online from SEDAR atwww.sedar.com.

All financial information in this AIF is prepared in accordance with generally accepted accounting principles in Canada.

Date of Information

All information in this AIF is as of October 31, 2005 unless otherwise indicated.

Currency and Exchange Rates

All dollar amounts in this AIF are expressed in Canadian dollars unless otherwise indicated. The Company’s accounts are maintained in Canadian dollars and the Company’s financial statements are prepared in accordance with generally accepted accounting principles in Canada. All references to “U.S. dollars”, “USD” or to “US$” are to U.S. dollars.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in United States dollars in effect at the end of the periods indicated, the average of exchange rates in effect on the last day of each month during such periods, and the high and low exchange rates during such periods based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into United States dollars.

Year Ended October 31 | |||

Canadian Dollars to U.S. Dollars | 2005 | 2004 | 2003 |

Rate at end of period | US$0.8474 | US$0.8210 | US$0.7584 |

Average rate for period | US$0.8209 | US$0.7584 | US$0.6939 |

High for period | US$0.8613 | US$0.8225 | US$0.7680 |

Low for period | US$0.7872 | US$0.7141 | US$0.6283 |

Metric Equivalents

For ease of reference, the following factors for converting Imperial measurements into metric equivalents are provided:

To convert from Imperial | To metric | Multiply by |

Acres | Hectares | 0.404686 |

Feet | Metres | 0.30480 |

Miles | Kilometres | 1.609344 |

Tons | Tonnes | 0.907185 |

Ounces (troy)/ton | Grams/Tonne | 34.2857 |

Terms used and not defined in this AIF that are defined in National Instrument 51-102 Continuous Disclosure Obligations shall bear that definition. Other definitions are set out in National Instrument 14-101 Definitions, as amended.

Forward-Looking Statements

Certain of the statements made and information contained or incorporated by reference in this AIF and in the documents incorporated by reference herein may contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, including statements concerning the Company’s plans at its Baja IOCG Project, Pampa de Pongo, Huachi and other mineral properties, which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, assume, intend, plan, project, estimate, postulate, strategy, goals, objective, potential, may, could, would, might, will and similar expressions, or which by their nature refer to future events. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including without limitation, risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of any mineral deposits that may be located, the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations, variations in mining dilution and metal recoveries, accidents, equipment breakdowns, title matters, labour disputes or other unanticipated difficulties with or interruptions in production, the potential for delays in exploration or deve lopment activities or the completion of a feasibility study, political risks involving operations in Mexico, Argentina and Peru and other countries and the policies of other nations towards companies doing business in these jurisdictions, the inherent uncertainty of exploration program, production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, failure to obtain required financing on a timely basis and other risks and uncertainties, including those described under Risk Factors in this AIF as well as in the Management’s Discussion and Analysis incorporated by reference into this AIF. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Forward-looking statements in this AIF include statements regarding the expectations and beliefs of management, the assumed long-term pri ce of gold, silver, copper and iron ore, the estimation of mineral reserves and resources, and the realization of mineral reserve estimates in future expected production, anticipated future capital and operating costs, and the potential of the Company’s properties and expectations of growth. The Company does not expect to update forward-looking statements continually as conditions change and you are referred to the full discussion of the Company’s business contained in the Company’s disclosure filed with the Canadian securities regulatory authorities. Readers are advised not to place undue reliance on forward-looking statements.

Caution Regarding Adjacent or Similar Mineral Properties

This AIF contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. The Company advises US investors that the mining guidelines of the US Securities and Exchange Commission (the “SEC”) strictly prohibit information of this type in documents filed with the SEC. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties are not indicative of mineral deposits on the Company’s properties.

Caution Regarding Reference to Resources and Reserves

National Instrument 43-101 Standards of Disclosure of Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all reserve and resource estimates contained in or incorporated by reference in this prospectus have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the “CIM Standards”) as they may be amended from time to time by the CIM. These definitions under NI 43-101 and the CIM Standards, including that for mineral “reserve&# 148;, differ from the definitions adopted by the SEC in Industry Guide 7 and may not be comparable to similar information disclosed by U.S. companies. In the United States, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made. This is different from the definition under NI 43-101, which is defined in the Glossary of Terms.

The term “mineral resource” used in the Company’s disclosure is a Canadian mining term as defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards and is not used by U.S. companies reporting in accordance with Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability. See “Glossary of Terms”.

Glossary of Terms

The following is a glossary of certain mining terms used in this Annual Information Form.

“adit” | A passage driven horizontally into a mountainside providing access to a mineral deposit from the surface of the working of a mine. | |

“Ag” | Silver | |

“alteration” | Changes in the chemical or mineralogical composition of a rock, generally produced by weathering or hydrothermal solutions | |

“anomalous” | Departing from the expected or normal | |

“anomaly” | A geological feature, especially in the subsurface, distinguished by geological, geophysical or geochemical means, which is different from the general surroundings and is often of potential economic value | |

“As” | Arsenic | |

“Au” | Gold | |

“bedding” | The arrangement of sedimentary rock in layers; stratification; also, the general character or pattern of the beds and their contacts within a rock mass | |

“breccia” | Angular broken rock fragments held together by a mineral cement or a fine-grained matrix | |

“Cardero Argentina” | Cardero Argentina, S.A., a wholly owned Argentinean subsidiary of the Company | |

“clastic” | Pertaining to a rock or sediment composed principally of fragments derived from pre-existing rocks or minerals and transported some distance from their places of origin; also said of the texture of such a rock | |

“cm” | Centimetres | |

“Co” | Cobalt | |

“Common Shares” | The common shares without par value in the capital stock of the Company as the same are constituted on the date hereof | |

“conglomerate” | A coarse grained clastic sedimentary rock, composed of rounded to sub-angular fragments larger than 2mm in diam set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica or hardened clay | |

“Cu” | Copper | |

“dacite” | Igneous rock which is fine grained or volcanic equivalent of granodiorite and quartz dirorite. | |

“deposit” | A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves or ore, unless final legal, technical and economic factors are resolved | |

“diamond drill” | A type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of the long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock which is recovered in long cylindrical sections, an inch or more in diameter. | |

“dike” | A tabular body of igneous rock that cuts across the structure of adjacent rocks or cuts massive rocks | |

“dip” | The angle that a stratum or any planar feature makes with the horizontal, measured perpendicular to the strike and in the vertical plane | |

“Director” | A member of the Board of Directors of the Company | |

“disseminated” | Fine particles of mineral dispersed throughout the enclosing rock | |

“distal” | Said of an ore deposit formed at a considerable distance (e.g. tens of kilometres) from the volcanic source from which its constituents have been derived | |

“drift” | A horizontal tunnel driven along or parallel to the strike of the orebody, for the extraction or exploration of minerals. | |

“epithermal” | Said of a hydrothermal mineral deposit formed within about 1 kilometre of the earth’s surface and in the temperature range of 50-200° C, occurring mainly as veins | |

“felsic” | An igneous rock having abundant light coloured minerals, also, applied to those minerals (quartz, feldspars, feldspathoids, muscovite) as a group | |

“g/t” | Grams per metric tonne | |

“gneiss” | A foliated rock formed by regional metamorphism, in which bands or lenticles of granular materials alternate with bands or lenticles of minerals with flaky or elongate prismatic habit | |

“grade” | To contain a particular quantity of ore or mineral, relative to other constituents, in a specified quantity of rock | |

“greywacke” | A dark grey firmly indurated coarse grained sandstone believed to have been deposited by submarine turbidity currents | |

“halo” | In geochemical prospecting, diffusion into surrounding ground or rocks of a sufficiently high concentration of the sought mineral to aid in its location. | |

“hydrothermal” | A term pertaining to hot acqueous solutions of magmatic origin which may transport metals and minerals in solution. | |

“ignimbrite” | The rock formed by widespread deposition and consolidation of ash flows and swift-flowing, turbulent gaseous clouds erupted from a volcano and containing ash and other pyroclastics | |

“intrusion” | The process of the emplacement of magma in pre-existing rock, magmatic activity. Also, the igneous rock mass so formed | |

“intrusive” | Of or pertaining to intrusion, both the process and the rock so formed | |

“IOCG” | iron oxide copper-gold | |

“km” | Kilometres | |

“m” | Metres | |

“mm” | Millimetres | |

“mafic” | Said of an igneous rock composed chiefly of dark, ferromagnesian minerals | |

“magnetite” | A black, isometric, strongly magnetic, opaque mineral of the spinel group which constitutes an important ore of iron and is a very common and widely distributed accessory mineral in rock of all kinds | |

“manto” | A flat-lying, bedded deposit; either a sedimentary bed or a replacement, strata-bound orebody | |

“martite” | Hermatite occurring in iron-black octahedral crystals pseudomorphous after magnetite | |

“mineral reserve” | The economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined and processed. | |

“mineral resource” | A concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. The term “mineral resource” covers mineralization and natural material of intrinsic economic interest which has been identified and estimated through exploration and sampling and within which mineral reserves may subsequently be defined by the consideration and application of technical, economic, legal, environmental, socio-economic and governmental factors. The phrase “reasonable prospects for economic extraction&# 148; implies a judgement by a qualified person (as that term is defined in NI 43-101) in respect of the technical and economic factors likely to influence the prospect of economic extraction. A mineral resource is an inventory of mineralization that, under realistically assumed and justifiable technical and economic conditions, might become economically extractable | |

“mineralization” | The concentration of metals and their chemical compounds within a body of rock | |

“MMC” | Minerales Y Metales California, S.A. de C.V., a wholly owned Mexican subsidiary of the Company | |

“National Instrument 43-101”/ “NI 43-101” | National Instrument 43-101 entitled “Standards of Disclosure for Mineral Projects” | |

“NSR” | Net smelter return | |

“Pb” | Lead | |

“porphyry” | An igneous rock of any composition that contains conspicuous phenocrysts (relatively large crystals) in a fine-grained groundmass | |

“PPB” or “ppb” | Parts per billion | |

“PPM or “ppm” | Parts per million | |

“pseudomorph” | A mineral whose outward crystal form is that of another mineral; it is described as being” after” the mineral whose outward form it has. Adj: pseudomorphous | |

“silicified” | Any rock to which silica has been added | |

“stockwork” | A mineral deposit consisting of a three-dimensional network of irregular veinlets closely enough spaced that the whole mass can be mined. | |

“strike” | The direction taken by a structural surface | |

“sulfide” | A mineral compound characterized by the linkage of sulphur with a metal, such as galena (PbS) or pyrite (FeS2) | |

“tailings” | The material that remains after all metals considered economic have been removed from ore during milling. | |

“TSXV” | TSX Venture Exchange | |

“tuff” | A general term for all pyroclastic rocks, may be consolidated or non-consolidated | |

“Zn” | Zinc | |

ITEM 2:

CORPORATE STRUCTURE

Name, Address and Incorporation

Cardero Resource Corp. (“Cardero”) was incorporated under theCompany Act (British Columbia) on December 31, 1985 under the name “Halley Resources Ltd.”. The name was subsequently changed to “Rugby Resources Limited” on September 6, 1991, to “Euro-Ad Systems Inc.” on April 30, 1993, to “Sun Devil Gold Corp.” on July 3, 1997, and to “Cardero Resource Corp.” on May 18, 1999. Cardero was transitioned under theBusiness Corporations Act (British Columbia) on January 13, 2005, and is now governed by that statute.

The office and principal business address of Cardero is located at Suite 1901 – 1177 West Hastings Street, Vancouver, British Columbia V6E 2K3, and its registered and records office is located at Suite 2300, Four Bentall Centre, 1055 Dunsmuir Street, P.O. Box 49122, Vancouver, B.C. V7X 1J1.

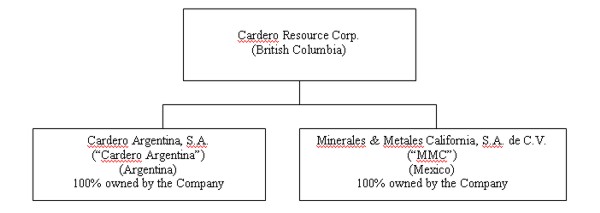

Intercorporate Relationships

The following corporate chart sets forth all of Cardero’s subsidiaries and their jurisdictions of incorporation. Each of these subsidiaries is wholly owned by Cardero:

Throughout this document references made to the “Company” refer to Cardero and its consolidated subsidiaries, Cardero Argentina and MMC.

ITEM 3:

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

The Company is a mineral exploration company engaged in the acquisition, exploration and development of mineral properties. The Company currently holds or has the right to acquire interests in a number of mineral properties in Argentina, Mexico, and Peru. The Company is in the exploration stage as its properties have not yet reached commercial production and none of its properties is beyond the preliminary exploration stage. All work presently planned by the Company is directed at defining mineralization and increasing understanding of the characteristics of, and economics of, that mineralization.Other than the Pampa de Pongo property, there are currently no identified mineral resources or mineral reserves on any of the Company’s other mineral properties.

Over the past three financial years, the Company has focussed primarily on the acquisition and exploration of mineral properties in Argentina, Mexico and, more recently, Peru. During the 2003, 2004 and 2005 financial years, the Company has entered into a number of option agreements to acquire properties in these countries that it believes have the potential to host large gold and/or silver deposits. Some of these, such as the Condor Yacu property in Argentina and the La Zorra property in Mexico, have since been returned to the respective vendors, and the associated costs written off in light of disappointing exploration results. Others, such as the Santa Josefina, La Encantada, El Coche, Santa Marta, Ursus, El Cirio 2, Ludivina, Ludivina 2 and Bonet concessions in Mexico and the Chingolo Property in Argentina, are currently being reviewed, and further work is not planned at this time. In addition, the Company has specialized in identifying and acquiring potential IOCG deposits (referred to as “Olympic Dam” type deposits) and entered into option agreements to acquire a number of properties in Mexico and Peru that it believes are prospective for IOCG deposits.

In pursuance of these objectives, during this period the Company has entered into a number of agreements to acquire an interest, or the right to acquire an interest, in a number of properties, as follows:

Mexico

·

Sirena Project, Baja California State, Mexico: Pursuant to an agreement dated December 12, 2001 between the Company and a private Mexican company, the Company acquired a 100% interest in 6 mineral concessions located in Baja California State, Mexico in consideration of the issuance of an aggregate of 400,000 common shares of the Company. The validity of this agreement is being challenged. See “Legal Proceedings”.

·

Coahuila Copper Data Acquisition, Coahuila de Zaragoza State, Mexico: Pursuant to an acquisition agreement dated August 22, 2003 between the Company and two individuals, the Company obtained copies of and non-exclusive rights to use and retain certain property data and other information pertaining to copper prospects in Coahuila de Zaragoza State, Mexico, in consideration of the issuance of an aggregate of 20,000 common shares (issued).

·

Crockite IOCG Data Acquisition, Baja California State, Mexico: Pursuant to an agreement dated October 27, 2003 between the Company, an individual and a private B.C. company, the Company acquired all right, title and interest to certain geological information, data and materials with respect to the potential for, and occurrences of, iron oxide type copper gold (“IOCG”) deposits in Baja California State, Mexico in consideration of the issuance of an aggregate of 200,000 common shares, as follows:

·

100,000 common shares on January 20, 2004 (issued);

·

100,000 common shares on or before the day that is ten (10) business days from the earliest of the following to occur:

·

Anglo American Mexico S.A. de C.V. (“Anglo”) having earned an interest in certain mineral concessions situated in Baja California State in accordance with and pursuant to the agreement between Anglo and the Company (the “Anglo Agreement” as described below;

·

The Company having been advised by Anglo that Anglo has incurred aggregate Exploration Expenditures (as defined in the Anglo Agreement) of not less than USD 2,000,000; and,

·

If the Anglo Agreement is terminated prior to Anglo having incurred USD 2,000,000 in Exploration Expenditures, then upon Anglo, the Company or any third party which subsequently enters into an agreement with the Company to earn an interest in the Company’s IOCG properties in Baja California State collectively having incurred Exploration Expenditures of not less than USD 2,000,000.

·

Baja IOCG Project, Baja California State, Mexico: Pursuant to an agreement December 1, 2002, the Company entered into a an agreement (as amended by an agreement dated November 26, 2003) (the “Anglo Agreement”) with Anglo American Mexico, S.A. de C.V. (“Anglo”) whereby Anglo has agreed to acquire mineral concessions on behalf of the joint venture within Baja California State, Mexico, and expend, prior to December 1, 2006, USD 3,700,000 on acquiring and exploring such mineral concessions, as consideration for a 70% interest in the acquired mineral concessions and all mining rights appertaining thereto, and the right to be issued 70% of the initial equity interest in a Mexican subsidiary to be incorporated by Anglo and the Issuer to hold the acquired mineral concessions. Upon Anglo incurring an aggregate USD 3,700,000 of exploration expenditures, a joint venture will be formed, with each party required to contribute its pro rata share of all future exploration expenditures. Certain concessions in which the Company holds an interest are also subject to the joint venture. To date, Anglo has applied for, on behalf of the joint venture, approximately 190,500 hectares of exploration concessions in two blocks (the Main Alisitos Property Block and the Pilitas property) and has entered into option agreements to acquire an additional approximately 4,750 hectares of concessions from third parties. Anglo is responsible for planning, funding and carrying out all work on the joint venture property until it has earned its interest.

Pursuant to an amending agreement dated June 30, 2005 between the Company and Anglo, the Company has assumed operatorship of the project. Under the terms of the amending agreement, the Company must incur exploration expenditures of not less than USD 500,000 within a 12 month period and, upon doing so, will have earned an additional 10% interest, thereby increasing its retained interest in the project to 40% upon the exercise by Anglo of its option. Upon having incurred the required USD 500,000 in exploration expenditures, the Company may either elect to terminate its expenditure period by delivering a resumption notice to Anglo, or may elect to remain as operator and continue to incur exploration expenditures. If the Company elects to continue incurring exploration expenditures following the USD 500,000 having been incurred, it will earn an additional one tenth of one percent (0.1%) interest for each additional USD10,000 of exploration expenditures incurred. If the Company elects to continue incurring exploration expenditures, at such time as it has incurred an aggregate of USD 1,400,000 (and has thereby increased its retained interest to 49% upon the exercise by Anglo of its option), it must deliver an election request notice to Anglo. Upon receipt by Anglo of a resumption notice or an election request notice, Anglo must (unless it otherwise so elects) immediately resume incurring aggregate Exploration Expenditures of USD 3,700,000 in order to earn its interest in the project (which will range from 60% to 51%, depending upon the amount of exploration expenditures incurred by the Company prior to the delivery of a resumption notice) with the original exploration expenditure dates extended to take into account the time the Company acted as operator. If the Company delivers a resumption notice, or if the Company delivers an election request notice and Anglo elects to continue incurring exploration expenditures, and thereafter Anglo fails to maintain its option in good standing, the Company may terminate the agreement. If the Company delivers an election request notice and Anglo does not elect to resume incurring exploration expenditures, the agreement is automatically terminated. In either case, in the event of termination, the Company will retain its 100% interest in the project, with Anglo having no residual interest therein. See “Narrative Description of the Business – Mineral Properties – Baja California Norte IOCG Project, Mexico” for more information.

·

Acquisition of MMC: Pursuant to an agreement dated September 9, 2002 between the Company and two Mexican individuals, the Company acquired a 100% interest in MMC, a private Mexican corporation that owns 8,055 hectares of mineral concessions situated in Baja California State, Mexico, in consideration of aggregate payments of USD 75,000 and the issuance of an aggregate of 225,000 common shares of the Company. In addition to the above concessions, pursuant to an agreement made November 3, 2003, between MMC and a Mexican individual, MMC acquired a 100% interest in three mineral concessions covering 30 hectares upon payment of USD 45,000.

·

Franco Project, San Luis Potosi State, Mexico: Pursuant to an agreement dated August 29, 2003 and accepted on September 3, 2003, as amended by an agreement dated October 1, 2004, and September 13, 2005, between the Company and a private Mexican company, the Company can acquire a 100% interest (subject to a 2% NSR retained by the vendor) in the Franco Project, San Luis Potosi State, Mexico, upon payment to the vendor of an aggregate of USD 1,145,000 and incurring exploration expenditures on the property aggregating USD 1,050,000. The obligation to incur not less than USD 250,000 in exploration expenditures is a firm commitment of the Company, and if the Company terminates the agreement before doing so, then the Company is required to pay to the vendor the difference between USD 250,000 and the amount of exploration expenditures ac tually incurred. The Company can buy one-half (being 1%) of the NSR retained by the vendor at any time for USD 2,000,000. On November 18, 2005, as a result of the inability of the Company to obtain safe and unrestricted access to the Franco property in order to carry out exploration work, the Company declared an event of force majeure, effective as and from September 19, 2005, thereby suspending all ongoing obligations to make payments to the vendor or to incur any exploration expenditures. The Company is attempting to resolve the issues giving rise to the force majeure but has, as of the date of these statements, been unable to do so.

Argentina

·

Chingolo Silver Project:Pursuant to an agreement dated May 22, 2002 between the Company and a private Argentinean company, the Company has the right to acquire a 100% interest in three mineral concessions in Jujuy Province, Argentina by making a payment of USD 10,000 on or before October 18, 2002 (paid) and issuing an aggregate of 250,000 common shares, as follows:

·

50,000 common shares on or before October 18, 2002 (issued);

·

100,000 common shares on or before October 18, 2003 (issued); and,

·

100,000 common shares on or before October 18, 2006.

Two of these concessions form part of other projects that were written down to a nominal value. The third concession forms part of the Chingolo Silver Project.

·

Cerro Atajo Project, Catamarca Province, Argentina:The Company has entered into two agreements involving Sociedad Minera Catamarquena de Economia Mixta (“Somicadem”), a governmental corporation owned as to 51% by the Province of Catamarca and 49% by two private Argentinean companies (the “Shareholders”) in order to acquire an interest in the Cerro Atajo project, consisting of 17 mineral concessions in Catamarca Province, Argentina. Somicadem is the holder of the Cerro Atajo property. The first of these agreements is with respect to the acquisition by the Company of the interest of the Shareholders in Somicadem and the second is with respect to the acquisition by the Company from Somicadem of the rights to explore and exploit the property itself. All parties are at arm’s length to the Company.

Pursuant to the first agreement, dated August 24, 2004 (as amended by an agreement dated December 10, 2004), among the Company and the Shareholders, the Company has the option to acquire the 49% of the issued share capital of Somicadem from the Shareholders, together with all of the interest of the Shareholders in their existing Exploration, Exploitation and Mining Lease Agreements dated September 10 and 13, 1991 (collectively, the “Existing Lease”) with Somicadem relating to the Cerro Atajo property. In order to exercise the option, the Company is required to pay the Shareholders an aggregate of USD 11,650,000, and issue 1,750,000 common shares to the Shareholders, as follows:

Payments

·

USD 300,000 upon the Company having completed its due diligence (as provided for below) following the Company having entered into a satisfactory amendment to the Existing Lease (which occurred, and the payment was made, on January 12, 2005);

·

USD 350,000 on or before January 12, 2006 (subsequently re-negotiated for 6 months to June 12, 2006);

·

USD 1,000,000 on or before January 12, 2007;

·

USD 2,000,000 on or before January 12, 2008;

·

USD 3,000,000 on or before January 12, 2009;

·

USD 5,000,000 on or before January 12, 2010;

Share Issuances

·

100,000 common shares on or before January 12, 2006 (subsequently re-negotiated for 6 months to June 12, 2006);

·

150,000 common shares on or before January 12, 2007;

·

500,000 common shares on or before January 12, 2008; and

·

1,000,000 common shares on or before January 12, 2009.

At the election of the Company, it can settle the obligation to issue some or all of the foregoing Common Shares by making payments to the Shareholders equal to USD 5.00 per share (up to USD 8,750,000 in total).

Pursuant to the second agreement, which is a modification agreement dated January 12, 2005 among the Shareholders, Somicadem and the Company to amend the Existing Lease, the Company has the right to carry out prospecting, exploration, development and exploitation activities at Cerro Atajo, and the option to enter into a 40-year mining lease. In order to maintain the exploration rights and option to enter into a mining lease in good standing, the Company is required to complete the following:

Payments to the Province of Catamarca aggregating USD 550,000, as follows:

·

USD 50,000 on execution of the modification agreement (paid);

·

USD 100,000 on or before January 12, 2007;

·

USD 100,000 on or before January 12, 2008;

·

USD 100,000 on or before January 12, 2009;

·

USD 100,000 on or before January 12, 2010; and

·

USD 100,000 on or before January 12, 2011;

Exploration expenditures of not less than USD 1,525,000 on or before January 12, 2011 (to be incurred in carrying out a prescribed program of work).

If the Company determines to proceed with the mining lease option (which must be exercised on or before March 12, 2011), then the Company will be required to make aggregate payments of USD27,000,000 to the Province of Catamarca, as follows:

·

USD 10,000,000 following a production decision and prior to the commencement of production; and

·

USD 17,000,000 during the first 2 years of production.

In addition, the Company will be required to pay to the Province of Catamarca a royalty consisting of 15% of the net profits realized by the Company from the exploitation of the property. The agreements with respect to the Cerro Atajo Project remain subject to acceptance for filing by the TSXV.

Detailed mapping, at 1:2500 scale, of prospective alteration and associated copper oxide mineralization was undertaken in the summer of 2005. The Company has also completed an Induced Polarization (“IP”) survey on the Cerro Atajo Project. Initial mapping by the Company defined a large hydrothermal system consistent with a porphyry setting. The most recent detailed mapping program further defined the alteration zones and outlined several geological targets for geophysical follow-up. Quantec GeoScience Argentina S.A. conducted a 14 line km pole:dipole survey; the results of which outlined a coherent NE trending charageability : resistivity anomaly (ranging between 20 – 40 milliseconds and 40 –70 ohms respectively) over approximately 1800 to 2100m strike and a minumum width of at least 350m. The anomaly, which sub-parallels the regional, syn-intrusive, Lavadero fault zone, occurs at depths from sub-crop to in excess of 30 – 350m and is associated with several potassically altered dacitic feldspar porphyry outcrops and coeval volcanoclatics which are cut by NW trending quartz – copper oxide – pyrite/chalcopyrite veins and veinlets. A 1500m diamond drill test commenced in the fall of 2005 with additional drilling contingent on favourable results.

The drill hole geochemical results are only weakly anomalous and do not warrant additional expenditures. Therefore it is concluded that further exploration for a concealed porphyry deposit is not justified in the absence of any encouragement for such a target at reasonable depth (at less than 500m or so below valley elevation).

The exploration potential remaining at Cerro Atajo is for bulk mineable epithermal high sulphidation mineralisation. A final interpretation of all sample data from the various earlier exploration programs is in progress to assess the potential for this style of mineralisation on the property.

·

Cerro Juncal Property, Salta Province, Argentina:Pursuant to an agreement dated November 12, 2004 between the Company and a private Argentinean company, the Company has the right to acquire a 100% interest, subject to a 0.5% NSR to the vendor, in the Cerro Juncal property, consisting of 2 mineral concessions (approximately 2600 hectares) in Salta Province, Argentina in consideration of payment to the vendor of the sum of USD 2,000,000 on or before the date that is 3 years after the Company commences exploration on the property. Prior to the exercise of the purchase option, the Company is required to pay the vendor an aggregate of USD 360,000 in order to keep the purchase option in good standing, as follows:

·

USD 25,000 on signing (paid);

·

USD 60,000 on or before November 12, 2005 (paid);

·

USD 50,000 on or before May 12, 2006;

·

USD 75,000 on or before November 12, 2006; and

·

USD 150,000 on or before May 12, 2007.

The Company has the option to purchase the 0.5% NSR at any time for the sum of USD 1,000,000. If the Company exercises the option to purchase the property prior to May 12, 2007, the requirement to make any remaining option payments outlined above ceases. Commencing with the 5th year after execution of the agreement if, in such year or any subsequent year prior to the exercise of the purchase option, the vendor has not received at least the sum of USD 100,000 pursuant to the NSR in such year, the Company is required to pay to the vendor the difference between USD 100,000 and the amount received by the vendor pursuant to the NSR.

·

Mina Angela Property, Chubut Province, Argentina:Pursuant to an agreement dated April 25, 2004 between the Company and a private Argentinean company, the Company can acquire a 100% interest in the Mina Angela property, consisting of 44 mineral concessions in Chubut Province, Argentina, subject to a 1% NSR to the vendor, in consideration of aggregate cash payments to the vendor of USD 400,000, as follows:

·

USD 50,000 on or before April 25, 2005 (paid);

·

USD 50,000 on or before April 25, 2006;

·

USD 150,000 on or before April 25, 2007; and

·

USD 150,000 on or before April 25, 2008.

The Company is required to carry out a program of work on the property as agreed between the vendor and the Company, but the extent and cost thereof have not yet been agreed. The Company has the option to purchase the 1% NSR royalty from the vendor for the sum of USD 500,000 at any time.

·

Huachi Property, Argentina: Pursuant to an option agreement dated June 13, 2005 between the Company and a private Argentinean company, the Company can acquire a 100% interest in 30 mining concessions referred to as the Huachi Property in the Province of San Juan, Argentina. See “General Development of the Business – Significant Acquisitions” below and “Narrative Description of the Business – Mineral Properties – Huachi Gold-Copper Property, San Juan Province, Argentina” for more information.

·

Organullo Property, Salta Province, Argentina:Pursuant to an agreement dated October 1, 2004 between the Company and an Argentinean individual, the Company purchased a 100% interest in the Organullo property, consisting of 8 mineral concessions in Salta Province, Argentina in consideration of the issuance of 70,000 Common Shares. These common shares were issued during the fiscal year ended October 31, 2005. The Company is in the process of reviewing the available data and formulating a proposed work program for this property.

Peru

·

Marcona Project, Lucanas, Nazca and Caraveli Provinces, Peru (Carbonera and Daniella Properties): Pursuant to option agreements dated October 1, 2003 and October 23, 2003 between the Company and a private Peruvian company, the Company acquired mineral concessions covering approximately 30,000 hectares in Lucanas, Nazca and Caraveli Provinces, Peru, referred to as the Carbonera and Daniella properties. Approximately 10,500 hectares of these concessions are subject to an underlying agreement with Rio Tinto Mining and Exploration Limited (“Rio Tinto”). The private company holds the exclusive right and option to acquire a 100% interest from Rio Tinto, subject to a 0.5% NSR to Rio Tinto, by incurring USD 450,000 in exploration expenditures over three years ending August 22, 2006 and by paying Rio Tinto USD 500,000 (of which USD 50,000 has been paid) on or before August 22, 2007. The Company can earn a 100% interest in all 30,000 hectares by assuming and performing all commitments to Rio Tinto pursuant to the underlying agreement, paying the vendor an aggregate of USD 120,000 (paid) and issuing an aggregate of 650,000 Common Shares to the vendor (issued).

·

Iron Sands Project, Marcona Region, Peru: Subsequent to the acquisition of the rights to acquire the Marcona Project properties referred to above, the Company began to investigate the possibility that the unconsolidated and semi-consolidated sand layer covering such properties may contain significant amounts of magnetite which could be mined to produce an iron concentrate. After initial investigations, the Company acquired, by staking, the rights to 39 mineral claims in the region which now, together with the Carbonera and Daniella properties referred to above, constitute its Peruvian Iron Sands Project (totalling approximately 32,000 acres of mineral sands potential).

·

Peregrine Option: As the Company’s main focus on the Peruvian Iron Sands Project is the magnetite potential of the sand layer, the Company has granted an option to another company to earn an interest in the bedrock portion of the Iron Sands Project. Pursuant to a property option agreement dated October 20, 2005 between the Company and a Peruvian subsidiary of Peregrine Diamonds Ltd., a public company of Vancouver, British Columbia (the “Optionee”), the Company has granted to the Optionee an option to acquire an undivided 70% interest in the hard rock potential of the mineral claims comprising the Iron Sands Project. The option on the Iron Sands Project does not include rights to the unconsolidated and semi consolidated sands, and all minerals therein, overlying the bedrock on the Iron Sands Project. In order to exercise the opti on, the Optionee must incur an aggregate of $3,000,000 in expenditures on the Iron Sands Project prior to October 20, 2009, as provided in the option agreement, and the Optionee must fully assume all liabilities and timely perform each and every obligation and duty of the Company under the underlying agreements referenced above in respect of the Carbonera and Daniella properties, including the underlying agreement with Rio Tinto. Upon the Optionee having fully exercised the option, the Optionee and the Company will form a joint venture corporation for the purpose of holding title to the Iron Sands Project and continuing the exploration, evaluation, development and, if warranted, mining of the Iron Sands Project.

·

Katanga Property, Chumbirilcas Province, Peru: Pursuant to an option agreement dated October 1, 2004 between the Company and a private Peruvian company, the Company can acquire a 100% interest in the Katanga property, consisting of approximately 9,560 hectares of mineral concessions in Chumbirilcas Province, Peru. The private Peruvian company holds the exclusive right and option to acquire a 100% interest in these concessions from a group of vendors comprised of 3 private Peruvian companies and two Peruvian individuals (“Underlying Vendors”). The private Peruvian company has the right to acquire a 100% interest in the subject concessions in consideration of aggregate payments of USD 1,900,000 over 5 years. The Company can acquire a 100% interest in the concessions by assuming the obligations of the private Peruvian com pany to the Underlying Vendors and making aggregate payments to the private Peruvian company of USD 501,000 as follows:

·

USD 261,000 on or before the execution of the agreement (paid); and

·

USD 240,000, as to USD 10,000 on or before November 1, 2004 and as to the balance on or before the first day of each succeeding month (paid).

Following additional field work, the “non-core” claims were returned to the vendor. Consequently a rapid, low cost, 14 - 18 line km walking magnetic survey was designed to screen the various outcropping magnetic bodies zones for undercover extensions. It is anticipated that 3D modelling of the resultant dataset will enable more accurate assessment of the depth potential of the systems pending further work.

·

Pampa de Pongo Property, Caraveli Province, Peru: Pursuant to an option agreement dated February 2, 2004 between the Company and a private Peruvian company, the Company can acquire a 100% interest in 8 mineral concessions covering approximately 8,000 hectares in Carvelli Province, Peru. The private Peruvian company holds the exclusive right and option to acquire a 100% interest in these concessions from Rio Tinto in consideration of the payment to Rio Tinto of aggregate payments of USD 500,000 over four years. The Company can earn a 100% interest in the property by assuming all of the obligations of the private company pursuant to the underlying agreement with Rio Tinto, paying USD 65,900.00 (for back taxes on the property) and USD 65,000.00 to the private company (all paid) and issuing 70,000 Common Shares (issued). All parties are at arm’s length to the Company. See “Narrative Description of the Business – Mineral Properties – Pampa de Pongo Property” for further information on the Pampa de Pongo property.

·

Corongo Project, Huanuco Province, Peru: Pursuant to an option agreement between the Company and a private Peruvian company made as of May 15, 2005, the Company has the option to acquire a 100% interest in 10 mineral claims located in the Department of Ancash, Peru covering approximately 6,400 hectares by making a payment of USD 40,000 upon signing (paid) and issuing an aggregate of 300,000 common shares, as follows:

·

100,000 shares on or before 10 days after the date of regulatory acceptance (not yet received);

·

100,000 shares on or before November 15, 2006; and

·

100,000 shares on or before May 15, 2008.

In addition to being prospective for copper-gold deposits, IOCG deposits have potential to host significant iron ore deposits and, given the current prices for iron ore, the Company intends to evaluate the iron ore potential of any IOCG deposits it should encounter. This is especially true of the IOCG prospects in the Marcona area of Peru, and, in particular, Pampa de Pongo. The Company is also focussing on the iron ore potential of the mineral sands on its Peruvian Iron Sands Project, as well as investigating similar properties in other jurisdictions.

The Company continues to actively seek out, identify and acquire additional mineral properties which it believes have the potential to host significant gold and/or silver deposits or which it believes are potential IOCG deposits (in respect of both the copper-gold and iron ore potential). While the Company intends to carry out much of the exploration work on its properties directly, the Company will also consider optioning or joint venturing its properties to other companies, and is negotiating a number of agreements in this regard.

Significant Acquisitions

Since November 1, 2004, being the commencement of the Company’s last completed fiscal year, the Company has entered into the following agreements with respect to significant acquisitions of mineral properties:

Huachi Gold-Copper Property, San Juan Province, Argentina

Pursuant to an option agreement dated June 13, 2005 between the Company and a private Argentinean company, the Company has an option to acquire a 100% interest in the Huachi copper-gold property in San Juan Province in northwestern Argentina. The Huachi copper-gold property is 432 hectares and consists of 72 pertenencias in 30 claim blocks, located in the Precordillera Range of Argentina over elevations varying from 2800 to 3250 metres. The terms of the agreement are as follows:

Payments:

On signing (paid)

US$70,000

10 months from signing

US$70,000

24 months from signing

US$200,000

36 months from signing

US$600,000

48 months from signing

US$1,000,000

60 months from signing

US$3,560,000

Total payments

US$5,500,000

In addition, the Company is required to incur minimum exploration expenditures of not less than US$750,000 within the first 30 months from signing, and not less than an additional US$1,250,000 within the period from 30 months to 60 months after signing of the agreement. The owners retain a 2% net smelter return royalty, which provides for minimum advance royalties (not deductible from actual production royalties).

The Company is carrying out an initial work program consisting of upgrading the access to the property, to be followed by topographic surveys, mapping and geochemical sampling.

Significant Dispositions

There have been no significant dispositions by the Company since November 1, 2004, being the commencement of the Company’s last completed financial year.

ITEM 4:

NARRATIVE DESCRIPTION OF THE BUSINESS

General

The Company currently holds, or has rights to acquire, a 100% interest in several mineral properties (subject, in certain cases, to net smelter return royalties payable to the original property vendors) in Argentina, Mexico and Peru. The Company considers that the properties forming part of the Baja California Norte IOCG Project joint venture with Anglo in Mexico, the Pampa de Pongo property (part of the Marcona IOCG Project) in Peru and the Huachi copper-gold property in Argentina are its material mineral properties at the present time.

Stage of Development

The Company is in the exploration stage and does not produce, develop or sell any products at this time, nor do any of its current properties have any known or identified mineral resources or mineral reserves. The progress on, and results of, work programs on the Company’s material mineral properties is set out in the Mineral Projects section of this AIF. The Company does not propose any method of production at this time.

Specialized Skill and Knowledge

All aspects of the Company’s business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, drilling, logistical planning and implementation of exploration programs and accounting. While recent increased activity in the resource mining industry has made it more difficult to locate competent employees and consultants in such fields, the Company has found that it can locate and retain such employees and consultants and believes it will continue to be able to do so.

Competitive Conditions

Competition in the mineral exploration industry is intense. The Company competes with other mining companies, many of which have greater financial resources and technical facilities for the acquisition and development of, and production from, mineral concessions, claims, leases and other interests, as well as for the recruitment and retention of qualified employees and consultants.

Components

All of the raw materials the Company requires to carry on its business are readily available through normal supply or business contracting channels in Canada, Argentina, Mexico and Peru. The Company has secured personnel to conduct its contemplated programs. Over the past 15 months the increased mineral exploration activity on a global scale has made some services difficult to procure, particularly skilled and experienced contract drilling personnel. It is possible that delays or increased costs may be experienced in order to proceed with drilling activities during the current period.

Business Cycles

The mining business is subject to mineral price cycles. The marketability of minerals and mineral concentrates is also affected by worldwide economic cycles.

Economic Dependence

The Company’s business is not substantially dependent on any contract such as a contract to sell the major part of its products or services or to purchase the major part of its requirements for goods, services or raw materials, or on any franchise or licence or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends.

Renegotiation or Termination of Contracts

It is not expected that the Company’s business will be affected in the current financial year by the renegotiation or termination of contracts or sub-contracts.

Employees

As of October 31, 2005, the Company had 5 full-time employees and no part-time employees. The Company primarily relies upon consultants to carry on many of its activities and, in particular, to supervise work programs on its mineral properties.

Risk Factors

In addition to those risk factors discussed elsewhere in this AIF, the Company is subject to the following risk factors:

Resource Exploration and Development is Generally a Speculative Business: Resource exploration and development is a speculative business and involves a high degree of risk, including, among other things, unprofitable efforts resulting both from the failure to discover mineral deposits and from finding mineral deposits which, though present, are insufficient in size and grade at the then prevailing market conditions to return a profit from production. The marketability of natural resources which may be acquired or discovered by the Company will be affected by numerous factors beyond the control of the Company. These factors include market fluctuations, the proximity and capacity of natural resource markets, government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protec tion. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital.

There is no known ore body on any of the Company’s properties. The majority of exploration projects do not result in the discovery of commercially mineable deposits of ore. Substantial expenditures are required to establish ore reserves through drilling and metallurgical and other testing techniques, determine metal content and metallurgical recovery processes to extract metal from the ore, and construct, renovate or expand mining and processing facilities. No assurance can be given that any level of recovery of ore reserves will be realized or that any identified mineral deposit will ever qualify as a commercial mineable ore body which can be legally and economically exploited.

Fluctuation of Metal Prices: Even if commercial quantities of mineral deposits are discovered by the Company, there is no guarantee that a profitable market will exist for the sale of the metals produced. The Company’s long-term viability and profitability depend, in large part, upon the market price of metals which have experienced significant movement over short periods of time, and are affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods. The supply of and demand for metals are affected by various factors, including political events, economic conditions and production costs in major producing regions. There can be no assurance that the price of any minerals produced from the Company’s properties will be such that any such deposits can be mined at a profit.

Permits and Licenses: The operations of the Company will require licenses and permits from various governmental authorities. There can be no assurance that the Company will be able to obtain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects, on reasonable terms or at all. Delays or a failure to obtain such licenses and permits or a failure to comply with the terms of any such licenses and permits that the Company does obtain, could have a material adverse effect on the Company.

Acquisition of Mineral Concessions under Agreements: The agreements pursuant to which the Company has the right to acquire a number of its properties provide that the Company must make a series of cash payments and/or share issuances over certain time periods, expend certain minimum amounts on the exploration of the properties or contribute its share of ongoing expenditures. The Company does not presently have the financial resources required to make all payments and complete all expenditure obligations under its various property acquisition agreements. Failure by the Company to make such payments, issue such shares or make such expenditures in a timely fashion may result in the Company losing its interest in such properties. There can be no assurance that the Company will have, or be able to obtain, the necessary financial resources to be able to main tain all of its property agreements in good standing, or to be able to comply with all of its obligations thereunder, with the result that the Company could forfeit its interest in one or more of its mineral properties.

Title and Access Matters: The acquisition of title to mineral concessions in Mexico, Peru and Argentina is a very detailed and time-consuming process. Title to, and the area of, mineral concessions may be disputed. While the Company has diligently investigated title to all mineral concessions in which it has an interest and, to the best of its knowledge, title to all such concessions is in good standing, this should not be construed as a guarantee of title. Title to the concessions may be affected by undetected defects such as aboriginal or indigenous peoples’ land claims, or unregistered agreements or transfers. The Company has not obtained title opinions for the majority of its mineral properties. Not all the mineral properties in which the Company has an interest have been surveyed, and their actual extent and location may be in dou bt. In many areas, the rights of surface access to the ground subject to mineral concessions, either for exploration or development, must be negotiated with various governmental authorities, surface owners, landholders, co-operative associations or aboriginal or indigenous peoples. There can be no guarantee that the Company will be successful in obtaining any required surface access, on acceptable terms or at all, and the inability to do so could result in the Company being unable to explore and/or develop a particular concession or property.

No Assurance of Profitability: The Company has no history of production or earnings and due to the nature of its business there can be no assurance that the Company will be profitable. The Company has not paid dividends on its shares since incorporation and does not anticipate doing so in the foreseeable future. All of the Company’s properties are in the exploration stage and the Company has not defined or delineated any proven or probable reserves on any of its properties. None of the Company’s properties are currently under development. Continued exploration of its existing properties and the future development of any properties found to be economically feasible, will require significant funds. The only present source of funds available to the Company is through the sale of its equity shares, short-term, high-cost borrowing or t he sale or optioning of a portion of its interest in its mineral properties. Even if the results of exploration are encouraging, the Company may not have sufficient funds to conduct the further exploration that may be necessary to determine whether or not a commercially mineable deposit exists. While the Company may generate additional working capital through further equity offerings, short-term borrowing or through the sale or possible syndication of its properties, there is no assurance that any such funds will be available on favourable terms, or at all. At present, it is impossible to determine what amounts of additional funds, if any, may be required. Failure to raise such additional capital could put the continued viability of the Company at risk.

Uninsured or Uninsurable Risks: Exploration, development and mining operations involve various hazards, including environmental hazards, industrial accidents, metallurgical and other processing problems, unusual or unexpected rock formations, structural cave-ins or slides, flooding, fires, metal losses and periodic interruptions due to inclement or hazardous weather conditions. These risks could result in damage to or destruction of mineral properties, facilities or other property, personal injury, environmental damage, delays in operations, increased cost of operations, monetary losses and possible legal liability. The Company may not be able to obtain insurance to cover these risks at economically feasible premiums or at all. The Company may elect not to insure where premium costs are disproportionate to the Company’s perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration and production activities.

Government Regulation: Any exploration, development or mining operations carried on by the Company will be subject to government legislation, policies and controls relating to prospecting, development, production, environmental protection, mining taxes and labour standards.

Insufficient Financial Resources: The Company does not presently have sufficient financial resources to undertake by itself the acquisition, exploration and development of all of its planned acquisition, exploration and development programs. Future property acquisitions and the development of the Company’s properties will therefore depend upon the Company’s ability to obtain financing through the joint venturing of projects, private placement financing, public financing, short or long term borrowings or other means. There is no assurance that the Company will be successful in obtaining the required financing. Failure to raise the required funds could result in the Company losing, or being required to dispose of, its interest in its properties.

Foreign Countries and Political Risk: The Company’s principal properties are located in Peru, Argentina and Mexico where mineral exploration and mining activities may be affected in varying degrees by political or economic instability, expropriation of property and changes in government regulations such as tax laws, business laws, environmental laws and mining laws. Any changes in regulations or shifts in political conditions are beyond the control of the Company and may materially adversely affect it business, or if significant enough, may make it impossible to continue to operate in certain countries. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, foreign exchange restrictions, export controls, income taxes, expropriation of property, environmental legislation and min e safety.

Dependence Upon Others and Key Personnel: The success of the Company’s operations will depend upon numerous factors, many of which are beyond the Company’s control, including (i) the ability of the Company to enter into strategic alliances through a combination of one or more joint ventures, mergers or acquisition transactions; and (ii) the ability to attract and retain additional key personnel in sales, marketing, technical support and finance. These and other factors will require the use of outside suppliers as well as the talents and efforts of the Company. There can be no assurance of success with any or all of these factors on which the Company’s operations will depend. The Company has relied and may continue to rely, upon consultants and others for operating expertise.

Currency Fluctuations: The Company maintains its accounts in Canadian and U.S. dollars and Argentinean and Mexican pesos, making it subject to foreign currency fluctuations. Such fluctuations may materially affect the Company’s financial position and results.

Share Price Volatility: In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly those considered exploration or development stage companies, have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. There can be no assurance that significant fluctuations in price will not occur.

Exploration and Mining Risks: Fires, power outages, labour disruptions, flooding, explosions, cave-ins, land slides and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in the operation of mines and the conduct of exploration programs. Substantial expenditures are required to establish reserves through drilling, to develop metallurgical processes, to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. The economics of developing mineral properties is affected by many factors in cluding the cost of operations, variations of the grade of ore mined, fluctuations in the price of gold or other minerals produced, costs of processing equipment and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. In addition, the grade of mineralization ultimately mined may differ from that indicated by drilling results and such differences could be material. Short term factors, such as the need for orderly development of ore bodies or the processing of new or different grades, may have an adverse effect on mining operations and on the results of operations. There can be no assurance that minerals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site conditions or in production scale operations. Material changes in geological resources, grades, stripping ratios or recovery rates may affect the economic viability of projects.

Financing Risks: The Company has limited financial resources, has no source of operating cash flow and has no assurance that additional funding will be available to it for further exploration and development of its projects or to fulfil its obligations under any applicable agreements. Although the Company has been successful in the past in obtaining financing through the sale of equity securities, there can be no assurance that it will be able to obtain adequate financing in the future or that the terms of such financing will be favourable. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and development of its projects with the possible loss of such properties.

Environmental Restrictions: The activities of the Company are subject to environmental regulations promulgated by government agencies in different countries from time to time. Environmental legislation generally provides for restrictions and prohibitions on spills, releases or emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility f or companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

Regulatory Requirements: The activities of the Company are subject to extensive regulations governing various matters, including environmental protection, management and use of toxic substances and explosives, management of natural resources, exploration, development of mines, production and post-closure reclamation, exports, price controls, taxation, regulations concerning business dealings with indigenous peoples, labour standards on occupational health and safety, including mine safety, and historic and cultural preservation.

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties, enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions, any of which could result in the Company incurring significant expenditures. The Company may also be required to compensate those suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspension of the Company’s operations and delays in the exploration and development of the Company’s properties.

Limited Experience with Development-Stage Mining Operations: The Company has limited experience in placing resource properties into production, and their ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that the Company will have available to it the necessary expertise when and if it places its resource properties into production.

Estimates of Mineral Reserves and Resources and Production Risks: The mineral reserve and resource estimates included in this Annual Information Form are estimates only and no assurance can be given that any particular level of recovery of minerals will in fact be realized or that an identified reserve or resource will ever qualify as a commercially mineable (or viable) deposit which can be legally and economically exploited. In addition, the grade of mineralization ultimately mined may differ from that indicated by drilling results and such differences could be material. Production can be affected by such factors as permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Short term factors, such as the need for orderly development of depos its or the processing of new or different grades, may have a material adverse effect on mining operations and on the results of operations. There can be no assurance that minerals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site conditions or in production scale operations. Material changes in reserves or resources, grades, stripping ratios or recovery rates may affect the economic viability of projects. The estimated reserves and resources described in this Annual Information Form should not be interpreted as assurances of mine life or of the profitability of future operations.

Enforcement of Civil Liabilities: As substantially all of the assets of the Company and its subsidiaries are located outside of Canada, and certain of the directors and officers of the Company are resident outside of Canada, it may be difficult or impossible to enforce judgements granted by a court in Canada against the assets of the Company and its subsidiaries or the directors and officers of the Company residing outside of Canada.

Mining Industry is Intensely Competitive: The Company’s business of the acquisition, exploration and development of mineral properties is intensely competitive. The Company may be at a competitive disadvantage in acquiring additional mining properties because it must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than the Company. The Company may also encounter increasing competition from other mining companies in efforts to hire experienced mining professionals. Competition for exploration resources at all levels is currently very intense, particularly affecting the availability of manpower, drill rigs and helicopters. Increased competition could adversely affect the Company’s ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

The Company may be a “passive foreign investment company” under the U.S. Internal Revenue Code, which may result in material adverse U.S. federal income tax consequences to investors in Common Shares that are U.S. taxpayers. Investors in Common Shares that are U.S. taxpayers should be aware that the Company may be a “passive foreign investment company” under Section 1297(a) of the U.S. Internal Revenue Code (a “PFIC”). If the Company is or becomes a PFIC, generally any gain recognized on the sale of the Common Shares and any “excess distributions” (as specifically defined) paid on the Common Shares must be ratably allocated to each day in a U.S. taxpayer’s holding period for the Common Shares. The amount of any such gain or excess distribution allocated to prior years of such U.S. taxpayer’s holding period for the Common Shares generally will be subject to U.S. federal income tax at the highest tax applicable to ordinary income in each such prior year, and the U.S. taxpayer will be required to pay interest on the resulting tax liability for each such prior year, calculated as if such tax liability had been due in each such prior year.

Alternatively, a U.S. taxpayer that makes a “qualified electing fund” (a “QEF”) election with respect to the Company generally will be subject to U.S. federal income tax on such U.S. taxpayer’s pro rata share of the Company’s “net capital gain” and “ordinary earnings” (as specifically defined and calculated under U.S. federal income tax rules), regardless of whether such amounts are actually distributed by the Company. U.S. taxpayers should be aware, however, that there can be no assurance that the Company will satisfy record keeping requirements under the QEF rules or that the Company will supply U.S. taxpayers with required information under the QEF rules, in event that the Company is a PFIC and a U.S. taxpayer wishes to make a QEF election. As a second alternative, a U.S. taxpayer may make a “mark-to-market election” if the Company is a PFIC and the Common Shares are “marketable stock” (as specifically defined). A U.S. taxpayer that makes a mark-to-market election generally will include in gross income, for each taxable year in which the Company is a PFIC, an amount equal to the excess, if any, of (a) the fair market value of the Common Shares as of the close of such taxable year over (b) such U.S. taxpayer’s adjusted tax basis in the Common Shares.

Mineral Projects

Baja California Norte IOCG Project, Mexico