| NR11-04 | January 31, 2011 |

CarderoReceives Final Results from

2010 Titac ResourceDefinition Drilling Program

Intersects Additional Massive

Iron - Titanium – Copper Mineralization

At Titac Project, Northern Minnesota, USA.

Hole-019: 462.1 metres grading 20.1%TiO2, 33.2% Fe2O3 and 0.4%Cu

Hole-029: 247.2 metres grading 17.5%TiO2, 33.6% Fe2O3 and 0.15% Cu

Provides Update on Organullo Drill Program, Northwest Argentina

Cardero Resource Corp.(“Cardero” or the “Company”) -- (TSX: CDU, NYSE-A: CDY, Frankfurt: CR5) announces positive final drill results from its 2010 drill program at the Titac Ferro-Titanium project in northern Minnesota, USA. Results confirm the presence of semi-massive to massive iron and titanium oxide and associated copper mineralization over exceptionally broad intervals. Cardero has been aggressively drilling and evaluating potential resources at Titac and Longnose - both projects previously having been subject to historical exploration with Longnose, according to BHP Minerals (now BHP Billiton) being“the largest known ilmenite (FeTiO3) resource in North America.”

The Company has completed a total of 36 diamond drill holes on the Minnesota projects for a total of 11,506 metres, with significant iron-titanium and copper mineralization being intersected in the majority of the holes at both projects.

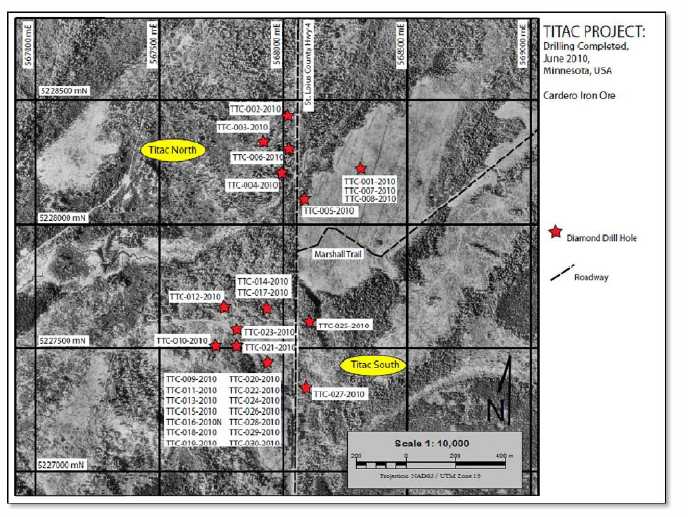

Final results are presented for Titac North and South (Figure 1, Table 1). Additional resource definition drilling at Titac South and Longnose will commence in early February and will be completed in the coming months. SRK Consulting of Vancouver, Canada has been retained to prepare an independent NI 43-101 resource estimate for Titac South and Longnose.

The Company also provides an update on exploration at the Organullo gold exploration project, northwest Argentina. A total of 8 diamond holes were drilled during the 2010 program for a total of 2,053 metres. Drilling was hampered by technical difficulties and poor ground conditions. As a result, none of the drillholes tested the geophysical targets at depth. The grades intersected are not considered to be significant but since the priority targets remain untested, the property does warrant additional exploration. The Company has signed a number of confidentiality agreements and hopes to secure an option/joint venture agreement during 2011, which would allow exploration to progress and allow Cardero to focus on core projects. At this time, no further work is planned by Cardero at Organullo.

| Cardero Resource Corp. | 2 | January 31, 2011 |

| NR11-04 – Continued |

Table 1: Drill results from Titac iron-titanium project in Minnesota

| TITAC SOUTH | From (m) | To (m) | Thickness (m) | Weighted Average (%) | |||

| Drillhole | TiO2% | Fe2O3% | Cu % | ||||

| TTC-015-2010 | 39.9 | 109.4 | 69.5 | 16.4 | 30.8 | 0.35 | |

| incl. | 39.9 | 56.4 | 16.5 | 25.6 | 41.2 | 0.48 | |

| incl. | 76.4 | 97.5 | 21.1 | 19.6 | 35.2 | 0.46 | |

| TTC-016-201020120102010N | 40.5 | 101.5 | 61.0 | 18.4 | 36.9 | 0.27 | |

| incl. | 40.5 | 69.2 | 28.7 | 22.6 | 40.7 | 0.36 | |

| TTC-017-2010 | 214.3 | 229.5 | 15.2 | 17.2 | 25.4 | 0.20 | |

| TTC-018-2010 | 38.4 | 84.7 | 46.3 | 18.1 | 34.1 | 0.30 | |

| TTC-019-2010 | 27.9 | 490.0 | 462.1 | 20.6 | 33.2 | 0.37 | |

| TTC-020-1020 | 38.9 | 185.0 | 146.1 | 17.2 | 33.6 | 0.29 | |

| incl. | 38.9 | 81.1 | 42.2 | 20.3 | 37.0 | 0.38 | |

| TTC-021-2010 | 30.8 | 374.0 | 343.2 | 17.6 | 30.6 | 0.21 | |

| incl. | 94.8 | 374.0 | 279.2 | 19.5 | 33.0 | 0.24 | |

| incl. | 187.8 | 217.8 | 30.0 | 28.7 | 45.5 | 0.20 | |

| incl. | 335.9 | 364.8 | 28.9 | 27.7 | 34.2 | 0.32 | |

| TTC-022-2010 | 29.9 | 92.4 | 62.5 | 16.6 | 33.1 | 0.25 | |

| TTC-023-2010 | 213.7 | 239.9 | 26.2 | 18.6 | 27.5 | 0.32 | |

| TTC-024-2010 | 146.0 | 213.8 | 67.8 | 16.4 | 32.6 | 0.18 | |

| 256.6 | 291.8 | 35.2 | 20.1 | 35.2 | 0.24 | ||

| 264.0 | 278.6 | 14.6 | 23.4 | 36.2 | 0.28 | ||

| TTC-025-2010 | 29.3 | 120.7 | 91.4 | 19.3 | 46.6 | 0.21 | |

| incl. | 29.3 | 42.1 | 12.8 | 29.1 | 50.5 | 0.19 | |

| incl. | 82.3 | 100.6 | 18.3 | 21.7 | 42.2 | 0.23 | |

| 138.1 | 282.9 | 144.8 | 17.9 | 30.5 | 0.21 | ||

| 349.9 | 369.4 | 19.5 | 22.2 | 38.5 | 0.25 | ||

| TTC-026-2010 | incl. | 168.2 | 328.6 | 160.4 | 19.3 | 33.6 | 0.27 |

| TTC-027-2010 | 152.7 | 383.4 | 230.7 | 17.5 | 31.7 | 0.28 | |

| incl. | 182.3 | 221.9 | 39.6 | 20.4 | 33.4 | 0.30 | |

| 293.2 | 323.1 | 29.9 | 20.7 | 35.1 | 0.33 | ||

| TTC-028-2010 | 29.4 | 134.7 | 105.3 | 20.2 | 34.9 | 0.28 | |

| incl. | 29.4 | 77.7 | 48.3 | 24.2 | 39.5 | 0.37 | |

| TTC-029-2010 | 29.3 | 276.5 | 247.2 | 17.5 | 33.6 | 0.15 | |

| incl. | 29.3 | 162.5 | 133.2 | 20.7 | 38.6 | 0.17 | |

| incl. | 29.3 | 88.4 | 59.1 | 24.2 | 44.4 | 0.13 | |

| TTC-030-2010 | 43.0 | 83.2 | 40.2 | 20.4 | 39.0 | 0.18 | |

| 145.4 | 177.1 | 31.7 | 17.8 | 29.2 | 0.22 | ||

| TITAC NORTH | From (m) | To (m) | Thickness (m) | Weighted Average (%) | |||

| Drillhole | TiO2 % | Fe2O3 % | Cu % | ||||

| TTC-006-2010 | 40.5 | 53.2 | 12.7 | 16.3 | 33.9 | 0.24 | |

| TTC-007-2010 | 292.5 | 360.9 | 68.4 | 15.3 | 36.5 | 0.28 | |

| Cardero Resource Corp. | 3 | January 31, 2011 |

| NR11-04 – Continued |

MINNESOTA FERRO-TITANIUM PROJECTS

Titac and Longnose Resource Drilling Program

The Company initiated exploration and resource drilling in mid-February 2010, aiming to complete an initial NI 43-101 compliant resource estimate on Titac South and Longnose. A total of 36 drillholes (including two abandoned) have been completed of which six provided an initial test of the Longnose project. The remaining 30 holes focused on the Titac project. Significant intersections for the Longnose property and the first 14 holes for the Titac property were disclosed in a previous news release (NR-10-2010).

Current Work

Work has been ongoing in preparation for the 2011 winter drilling program, scheduled to commence in mid-February 2011. The program will focus on completion of resource definition drilling at Titac South and Longnose and is expected to total 1,600 metres, in addition to the 11,506 metres already completed. SRK Consulting of Vancouver, Canada has been retained to prepare an independent NI 43-101 resource estimate for Titac South and Longnose.

Figure 1: Drilling completed on Titac project in 2010 –

Note that multiple holes were drilled from some platforms

| Cardero Resource Corp. | 4 | January 31, 2011 |

| NR11-04 – Continued |

ORGANULLO GOLD EXPLORATION PROJECT

The Organullo Project is located in the Salta Province of north-western Argentina in the central South American Andes mountain ranges approximately 18 kilometres by road south of San Antonio de Los Cobres. The Company holds a 100% interest in the property, which covers approximately 6,100 hectares.

The positive results from surface exploration, conducted during 2009 and early 2010, indicated potential for a large, bulk-tonnage gold system. In mid-2010, the Company commenced a 2,000 metre, 5-hole diamond drill program. The drilling was designed to test an approximately 2.1 -kilometre long by 800-metre wide north-south trending structural zone defined by the coincidence of significant historical drill intercepts, gold-in-rock surface geochemistry, and variably developed advanced argillic (alunite+/-dickite+/-pyrophyllite) and silica alteration in the vicinity of the former Julio Verne mine.

A total of 8 diamond drillholes were drilled during the program for a total of 2,053 metres, but drilling was hampered by technical difficulties and poor ground conditions. As a result, none of the drillholes tested the geophysical targets at depth. The best intersections from the drilling completed are outlined in Table 2.

Table 2: Organullo 2010 Highlights

| HOLE NO. | DEPTH (from) metres | Depth (to) metres | Interval (metres) | Gold (ppm) |

| ORG10-02 | 3.80 | 37.20 | 33.40 | 0.165 |

| ORG10-03 | 6.10 | 12.80 | 6.70 | 0.211 |

| ORG10-04 | 7.80 | 91.30 | 82.50 | 0.109 |

| ORG10-05 | 16.40 | 139.20 | 122.80 | 0.221 |

| Includes | 52.60 | 68.60 | 16.00 | 0.957 |

| ORG10-05 | 190.90 | 256.00 | 65.10 | 0.429 |

| Includes | 208.75 | 226.10 | 17.35 | 0.834 |

| ORG10-06 | 47.50 | 63.30 | 15.80 | 0.258 |

| 78.30 | 193.90 | 115.60 | 0.200 | |

| Includes | 78.30 | 101.90 | 23.60 | 0.585 |

| ORG10-07 | 4.50 | 71.50 | 67.00 | 0.302 |

| Includes | 5.90 | 54.80 | 48.90 | 0.345 |

| ORG10-08 | 0.0 | 445.0 | 445.0 | 0.142 |

| Includes | 47.10 | 353.60 | 306.50 | 0.168 |

| 116.40 | 175.20 | 58.80 | 0.294 |

The grades intersected are not considered to be significant but since the priority targets remain untested, the property does warrant additional exploration. The Company has signed a number of confidentiality agreements and hopes to secure an option/joint venture agreement during 2011, which would allow exploration to progress and allow Cardero to focus on core projects. No further work is planned by Cardero at Organullo.

Minnesota Ferro-Titanium Project Background

Cardero has acquired interests in and is exploring two iron-titanium projects on the edge of the Duluth Complex in north-eastern Minnesota.

| Cardero Resource Corp. | 5 | January 31, 2011 |

| NR11-04 – Continued |

TheLongnose Projectwas first discovered in the 1950's through aeromagnetic and gravity geophysical surveys, and was first drilled by Bear Creek Mining Company in 1958. The Partridge River Intrusion (PRI) hosts the Longnose body, which dominantly consists of oxide-bearing peridotite, pyroxenite, and semi-massive and massive iron and titanium oxide. BHP Minerals previously produced a historic (pre-NI 43-101 standards),"probable reserve" at Longnose, estimating 27.57 million tonnes at 21.3% TiO2, stating at the time that Longnose is "... the largest known ilmenite resource in North America."However, the Company cautions that both the BHP report and the included resource estimate were prepared before the introduction of NI 43-101, and are therefore historical in nature and the Company is not treating such resources as a current resource under NI 43-101. Investors are further cautioned that a qualified person has not yet completed sufficient work to be able to verify the historical resources, and therefore they should not be relied upon.

TheTitac Projectwas first drilled by U.S. Steel Corporation after it discovered several magnetic highs in the area. The Titac body is hosted by anorthositic and troctolitic rocks of the Anorthositic Series, the Boulder Lake intrusion, and the Western Margin intrusion. The Titac body dominantly consists of oxide-bearing pyroxenite and peridotite, and massive and semi-massive iron and titanium oxide.

Titanium dioxide (TiO2) is primarily used as a white powder pigment due to its brightness and very high refractive index. It provides excellent opacity to products such as paints, coatings, plastics, paper, inks, fibres, food and cosmetics. Titanium metal is also used as a light, high-strength and corrosion-resistant material in the fabrication of specialized components in the aeronautical and aerospace industries, and in high-end sporting goods and medical components.

Recent North America contract prices for titanium dioxide have been in the range of US$1.17 -1.34/lb.

Organullo Project Background

The Organullo property is situated in the Province of Salta, northwest Argentina, in the central South American Andes mountain ranges. The property is located approximately 18 kilometres by road south of San Antonio de Los Cobres, the capital city of the Los Andes department, which has both power and rail infrastructure. Cardero holds a 100% interest in the property, which covers approximately 6,100 hectares. Elevations range from 3,990 to 4,580 metres above sea level in this arid region of the altiplano known in Argentina as the Puna.

Gold mineralization on the Organullo property is hosted in Tertiary age dacite to andesite pyroclastic rocks and underlying Paleozoic age Puncoviscana metasedimentary rocks in a tectonically fertile part of the Argentinean Puna. Textures, geochemistry, host rocks and alteration assemblages are consistent with both low- and high-sulphidation styles of epithermal mineralization that host prolific gold mineralization elsewhere in the central Andes, such as in the Pascua - El Indio belt, and do not preclude the potential for a large Bajo de la Alumbrera or El Salvador style porphyry deposit at depth.

The earliest recorded work in the area of the Organullo property comes from reports of small-scale production from the Julio Verne mine during the 1930’s. Mining activity centered on 2 high-grade sub-parallel veins with concentrates reported to average 12.5% bismuth and 8.2% copper with gold ranging between 10-20 g/t. Early regional work was undertaken in the area by Fabricaciones Militares in 1962-72 in partnership with the United Nations, followed up by an IP survey and drilling by Cities Service Corporation. In 1994-1995 Triton Mining Corp. and Northern Orion Explorations, Ltd. jointly conducted a detailed surface sampling, mapping and prospecting campaign and completed a 17-hole, 3,295-metre RC drill program. This was followed with a 6 hole diamond drill program in 1997 and an additional 12-hole RC drill program in 1999 by Northern Orion. Cardero purchased the project in 2004.

| Cardero Resource Corp. | 6 | January 31, 2011 |

| NR11-04 – Continued |

2011 Annual Report Filed

On January 31 2011, Cardero filed its Annual Information Form for the year ended October 31, 2010 with certain securities commissions in Canada and its Form 40F for the year ended October 31, 2010 with the US Securities and Exchange Commission. Shareholders can obtain copies of these documents, as well as the Company’s audited financials for the year ended October 31, 2010 and related management discussion and analysis, on Cardero’s website atwww.cardero.com. Cardero will also provide hard copies of these documents, free of charge, to shareholders who request a copy directly from the Company.

Qualified Person

EurGeol Keith J. Henderson, P.Geo., Cardero’s Vice-President Exploration and a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information that forms the basis for this news release (other than historical data) and has approved the disclosure herein. Mr. Henderson is not independent of the Company as he is a senior officer and employee and holds incentive stock options.

The analytical results were reviewed by Tansy O'Connor-Parsons, Cardero’s Senior Geochemist. Cardero’s on-site personnel at the projects rigorously collect and track samples which are then security sealed and shipped to ALS Laboratory Group. ALS Laboratory Group's quality system complies with the requirements for the international standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Quality control is further assured by the use of international and in-house standards. Certified reference material, blank material, and quarter-core duplicates are inserted at regular intervals into the sample sequence by field personnel prior to shipping in order to independently assess analytical accuracy and precision. In addition, representative blind duplicate samples are routinely forwarded an ISO-compliant third party laboratory for additional quality control.

About Cardero Resource Corp.

Through 2011 Cardero will continue its migration from high-risk, early-stage grassroots exploration projects and will continue to add value through identification and acquisition of advanced projects.

In recent years, Cardero’s focus has increasingly been on iron ore and iron-making technologies. The sale of Cardero’s wholly-owned Pampa de Pongo iron deposit in late 2009 for US$100 million cash represented an early success in the iron market. Cardero continues to hold significant iron ore resources at the Iron Sands Project in Peru and iron-titanium interests in Minnesota, USA. More recently, in keeping with bulk-commodity focus, Cardero acquired a 45% interest in Coalhunter Mining Corp., with a right to increase its interest to 51% in certain circumstances. Coalhunter holds a 75% interest in the Carbon Creek Metallurgical Coal deposit in north-eastern British Columbia.

The common shares of the Company are currently listed on the Toronto Stock Exchange (symbol CDU), the NYSE-Amex (symbol CDY) and the Frankfurt Stock Exchange (symbol CR5). For further details on the Company readers are referred to the Company’s web site (www.cardero.com), Canadian regulatory filings on SEDAR atwww.sedar.comand United States regulatory filings on EDGAR atwww.sec.gov.

| Cardero Resource Corp. | 7 | January 31, 2011 |

| NR11-04 – Continued |

On Behalf of the Board of Directors of

CARDERO RESOURCE CORP.

“Hendrik van Alphen” (signed)

Hendrik van Alphen, President

| Contact Information: | Nancy Curry Manager – Corporate Communications & Investor Relations |

| Email:info@cardero.com | |

| Phone: 1-888-770-7488 (604) 408-7488 / Fax: (604) 408-7499 |

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the discovery and delineation of mineral deposits/resources/reserves, the possibility of the option/sale/ joint venture by the Company of any of its projects (including Organullo), the ability of the Company to identify and acquire advanced stage projects, and financing plans and business trends, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company’s 2011 Annual Information Form filed with certain securities commissions in Canada and the Company’s 2011 Annual Report on Form 40-F filed with the United States Securities and Exchange Commission (the “SEC”), and other information released by the Company and filed with the appropriate regulatory agencies. All of the Company's Canadian public disclosure filings may be accessed viawww.sedar.comand its United States public disclosure filings may be accessed viawww.sec.gov,and readers are urged to review these materials, including the latest technical reports filed with respect to the Company’s mineral properties.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

-30-