Exhibit 99.1

INVESTOR PRESENTATION

Forward Looking Information

Certain statements contained in this presentation, including, without limitation, statements containing the words “believes”, “anticipates”, “intends”, and “expects”, and words of similar import, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following: general economic and business conditions in those areas in which the Company operates, demographic changes, competition, fluctuations in interest rates, changes in business strategy or development plans, changes in governmental regulation, credit quality, the availability of capital to fund the expansion of the Company’s business, and other factors referenced in this presentation. The Company disclaims any obligation to update any such factors or to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

2

Securities Law Matters

This presentation may be deemed to be solicitation material in respect to the proposed transaction between Community Bancorp and Bank of Commerce pursuant to an Agreement to Merge and Plan of Reorganization, dated as of May 19, 2005 by and among Community Bancorp, Community Bank of Nevada and Bank of Commerce (the “Agreement”). Filing of this presentation is being made in connection with Rules 165 and 425 promulgated by the Securities and Exchange Commission (“SEC”).

In connection with the proposed transaction, Community Bancorp has filed with the SEC a registration statement on SEC Form S-4. The registration statement contains a proxy statement/prospectus which describes the proposed transaction and its proposed terms and conditions. Shareholders of Bank of Commerce are encouraged to read the registration material and proxy statement/prospectus because these documents contain important information about the transaction. A copy of the Agreement has been filed with the SEC as an exhibit to Community Bancorp’s 8-K, a separate filing from the Form S-4. The registration statement, the Form 8-K and all other documents filed with the SEC in connection with the transaction are available for free when filed, both on SEC’s web-site (www.sec.gov) or by contacting Cathy Robinson, Executive Vice President and Chief Financial Officer, Community Bancorp, 400 South 4th Street, Las Vegas, Nevada 89101. Additionally, all forms filed with the SEC and additional shareholder information is available free of charge on Community’s web-site: www.communitybanknv.com. Community posts these reports to its web-site as soon as reasonably practicable after filing them with the SEC. None of the information on or hyper-linked from Community’s web-site is incorporated into this presentation.

3

Key Investment Considerations

One of the largest community banks headquartered in the high growth market of Las Vegas

Consistent, high performing institution

Five year CAGR of assets and net income of 26% and 15% respectively

Five year average ROE and ROA of 17.3% and 1.23% respectively

Second quarter 2005 ROE and ROA of 10% and 1.32% respectively

Focus on business lending and relationship banking

Experienced management team with extensive Las Vegas experience

Successful initial public offering in December 2004 – priced above initial filing range and was over 10x oversubscribed

Bellagio

4

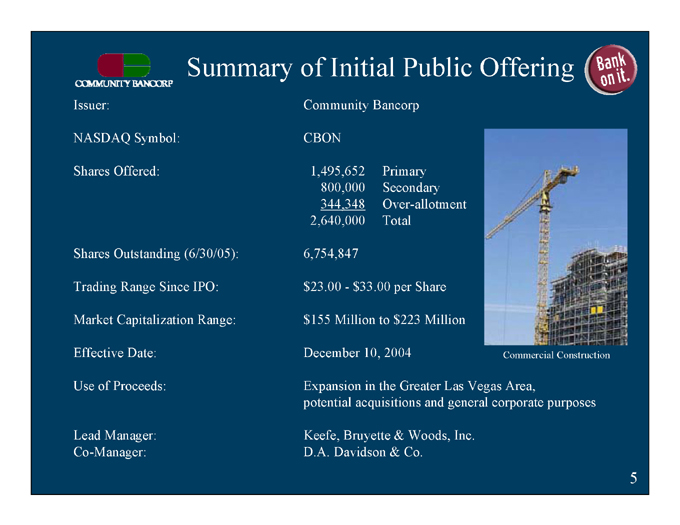

Summary of Initial Public Offering

Issuer:

Community Bancorp

NASDAQ Symbol:

CBON

Shares Offered:

1,495,652 Primary

800,000 Secondary

344,348 Over-allotment

2,640,000 Total

Shares Outstanding (6/30/05): 6,754,847

Trading Range Since IPO: $23.00 - $33.00 per Share

Market Capitalization Range: $155 Million to $223 Million

Effective Date: December 10, 2004

Use of Proceeds: Expansion in the Greater Las Vegas Area, potential acquisitions and general corporate purposes

Lead Manager: Keefe, Bruyette & Woods, Inc.

Co-Manager: D.A. Davidson & Co.

Commercial Construction

5

Company Overview

Community Bancorp is the bank holding company for Community Bank of Nevada serving the Greater Las Vegas market with six branches

Community Bank of Nevada, founded in 1995, is one of the largest community banks headquartered in the greater Las Vegas area

Profitable every year since 1995

Provides a complete array of commercial banking products and services to small-to-medium sized businesses

Emphasis on relationship banking and personalized service

Trends in growth and profitability have continued in the first half of 2005 with growth in assets of 13.5%, growth in deposits of 5.8%, ROE of 11.0% and ROA of 1.44%

Corporate Headquarters

6

Community Bancorp/Bank of Commerce

On May 19, 2005 Community Bancorp announced the signing of a definitive agreement to acquire all of the common stock and equivalents of Henderson, NV based Bank of Commerce for approximately $40.0 million in cash and stock. On July 15, 2005 the Federal Reserve Bank of San Francisco approved the acquisition.

Shareholders of Bank of Commerce will have the option to receive cash, shares of Community Bancorp common stock, or a combination subject to an aggregate consideration limit of 50% stock and 50% cash.

The acquisition has been approved by the Board of Directors of each company and is expected to be accretive to Community Bancorp’s earnings per share in 2005 and 2006.

Under the consummation of the transaction, Bank of Commerce will be merged into Community Bank of Nevada under the holding company, Community Bancorp.

7

Community Bancorp/Bank of Commerce

Bank of Commerce, founded in 1997, is a commercial bank with assets of $153 million* as of June 30, 2005

Bank of Commerce is locally owned and operated

They have three branches serving the communities of Las Vegas and Henderson, Nevada

Their focus is handling the banking needs of small to mid-size businesses

Vegas Vic

*Unaudited, based on internal financial statements

8

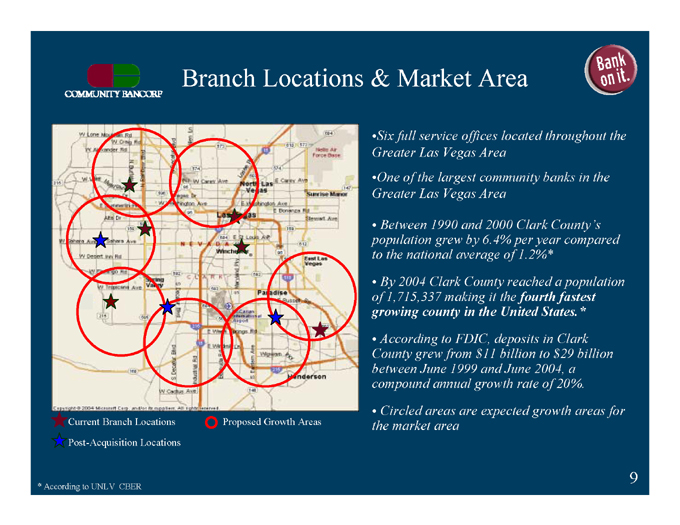

Branch Locations & Market Area

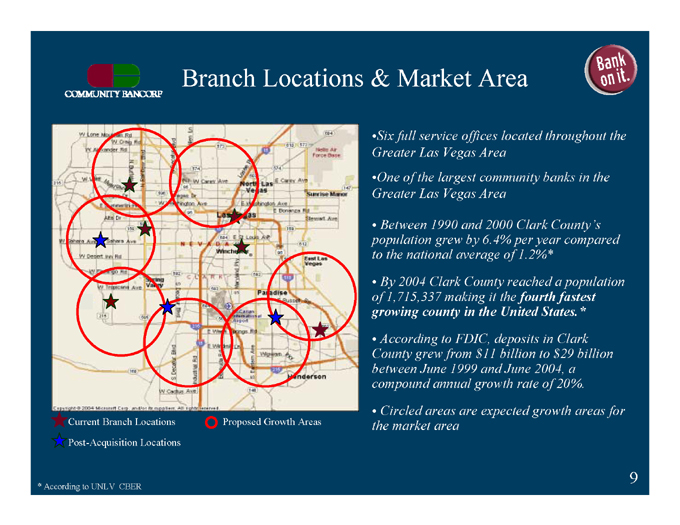

Six full service offices located throughout the Greater Las Vegas Area

One of the largest community banks in the Greater Las Vegas Area

Between 1990 and 2000 Clark County’s population grew by 6.4% per year compared to the national average of 1.2%*

By 2004 Clark County reached a population of 1,715,337 making it the fourth fastest growing county in the United States.*

According to FDIC, deposits in Clark County grew from $11 billion to $29 billion between June 1999 and June 2004, a compound annual growth rate of 20%.

Circled areas are expected growth areas for the market area

Current Branch Locations Proposed Growth Areas

Post-Acquisition Locations

* According to UNLV CBER

W Lone Mountain Rd W Craig Rd W Alexander Rd N Buffalo W Lake Meed Blvd Vegas Dr E Summerlin Pky Alta Dr W Sahara Ave W Sahara Ave W Desert Inn Rd W Flamingo Rd W Tropicana Ave N Rainbow Blvd N Decatur Blvd Allen Ln Losee Rd W Carey Ave Vegas Dr W Washington Ave Spring Valley S Decatur Blvd S Decatur Blvd Industrial Rd W Cactus Ave Nellis Air Force Base E Carey Ave North Las Vegas Sunrise Manor E Washington Ave E Bonanza Rd Las vegas Stewart Ave E St Louis Ave NEVADA Winchester CLARK clark East Las Vegas S Maryland Pky Paradise E Russell Rd Mc Carran International Airport E Warm Springs Rd E Windmill Ln Wigwam Pky Bermuda Rd S Eastern Ave Henderson Copyright ©2004 Microsoft Corp. and/or its suppliers. All rights reserved.

9

Deposit Market Share

COUNTY: Clark, Nevada

Rank Institution Type Branch Count Total Deposits in Market ($000) Total Market Share (%)

1 Citigroup Inc. (NY) Bank 13 6,663,054 23.36

2 Bank of America Corp. (NC) Bank 48 5,986,101 20.98

3 Wells Fargo & Co. (CA) Bank 67 4,797,414 16.82

4 Zions Bancorp (UT) Bank 48 1,926,091 6.75

5 Western Alliance Bancorp (NV) Bank 5 1,251,452 4.39

6 U.S. Bancorp (MN) Bank 33 1,240,783 4.35

7 Washington Mutual Inc. (WA) Thrift 28 950,744 3.33

8 Marshall & Ilsley Corp. (WI) Bank 1 941,842 2.95

9 Community Bancorp (NV) Bank 6 530,258 1.86

10 First NB Holding Company (AZ) Bank 5 518,029 1.82

11 Silver State Bancorp (NV) Bank 9 493,839 1.73

12 Golden West Financial (CA) Thrift 2 429,565 1.51

13 Capitol Bancorp Ltd. (MI) Bank 4 286,358 1.00

14 Intermountain First Bancorp (NV) Bank 1 285,288 1.00

15 Irwin Financial Corp. (IN) Bank 0 254,828 0.89

16 Colonial BancGroup Inc. (AL) Bank 7 208,915 0.73

17 Sun West Capital Corp. (NV) Bank 3 202,303 0.71

18 Central Financial Corp. (KS) Bank 3 187,123 0.66

19 Business Bank Corporation (NV) Bank 3 185,572 0.65

20 BNP Paribas Group Bank 7 184,996 0.65

21 Valley Bancorp (NV) Bank 2 160,950 0.56

22 United Svcs Automobile Assn. (TX Thrift 1 159,908 0.56

23 Marin National Bancorp (NV) Bank 1 128,864 0.45

24 Bank of Commerce (NV) Bank 3 121,438 0.43

25 West Point Bancorp Inc. (NE) Bank 1 106,429 0.37

All other Institutions 12 423,564 2

Total 313 28,625,708 100

One of the largest community banks based in Las Vegas

Bank of Commerce

Source: SNL Securities at 6/30/04

10

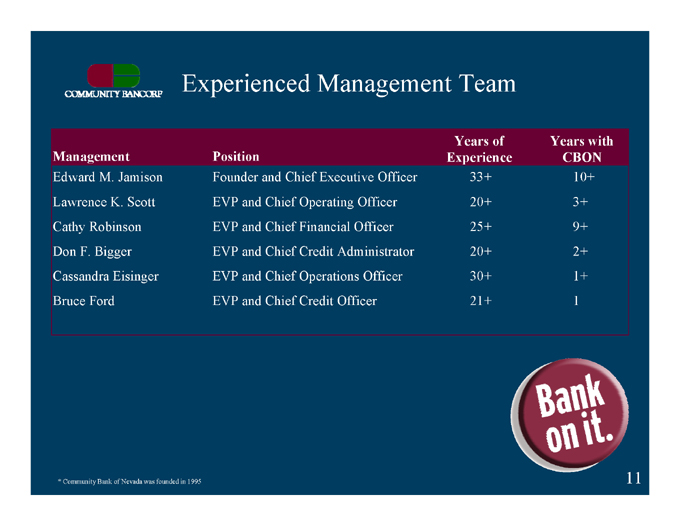

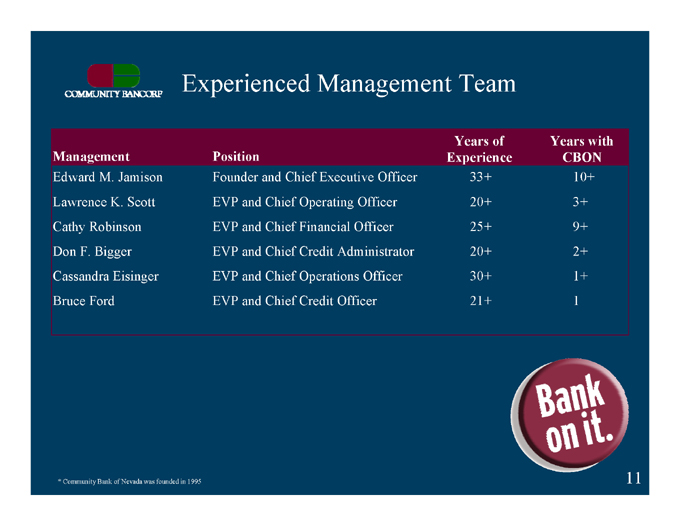

Experienced Management Team

Years of Experience

Years with CBON

Management

Position

33+

20+

25+

20+

30+

21+

Founder and Chief Executive Officer

EVP and Chief Operating Officer

EVP and Chief Financial Officer

EVP and Chief Credit Administrator

EVP and Chief Operations Officer

EVP and Chief Credit Officer

Edward M. Jamison

Lawrence K. Scott

Cathy Robinson

Don F. Bigger

Cassandra Eisinger

Bruce Ford

10+

3+

9+

2+

1+

1

* Community Bank of Nevada was founded in 1995

11

Growth Strategies

To continue strong, focused organic growth in assets, loans and deposits

To capitalize on growth opportunities in Las Vegas and other rapidly expanding markets

Acquire other community banks in strategic or contiguous markets

Planning the 10th branch (post-acquisition) for the spring of 2006 and plans to open one additional branch per year through 2009

Compete the acquisition of Bank of Commerce in late third quarter or early fourth quarter 2005

World Market Center

12

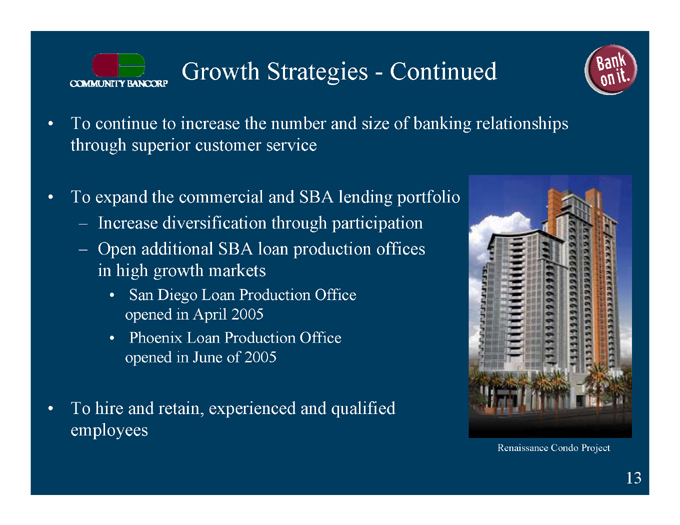

Growth Strategies - Continued

To continue to increase the number and size of banking relationships through superior customer service

To expand the commercial and SBA lending portfolio

Increase diversification through participation

Open additional SBA loan production offices in high growth markets

San Diego Loan Production Office opened in April 2005

Phoenix Loan Production Office opened in June of 2005

To hire and retain, experienced and qualified employees

Renaissance Condo Project

13

Operating Strategies

Enhance risk management functions

Proactively manage sound procedures

Commit experienced human resources to this effort

Maintain high asset quality by continuing to utilize rigorous loan underwriting standards and credit risk management practices

Continue to actively manage interest rate and market risks

Closely monitor volume and maturity of our rate sensitive assets to our interest sensitive liabilities

The Curve Condo Project

14

FINANCIAL PERFORMANCE

15

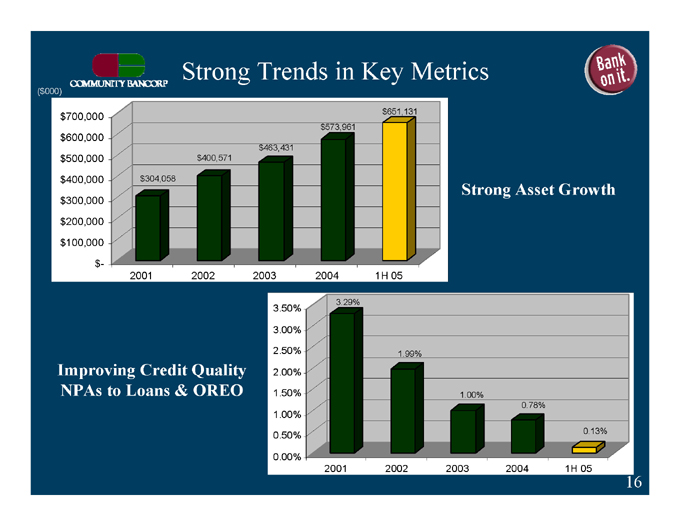

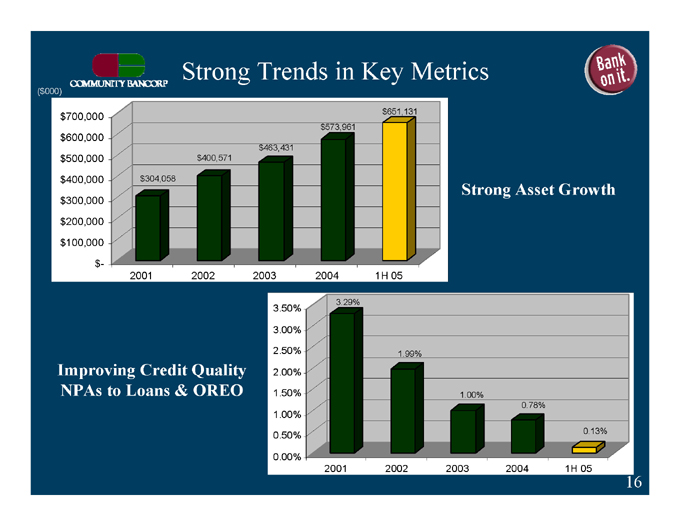

Strong Trends in Key Metrics

($000)

$651,131

$700,000

$573,961

$600,000

$463,431

$500,000

$400,571

$304,058

Strong Asset Growth

$400,000

$300,000

$200,000

$100,000

$-

1H 05

2004

2003

2002

2001

3.29%

3.50%

3.00%

1.99%

2.50%

Improving Credit Quality NPAs to Loans & OREO

2.00%

1.50%

1.00%

0.78%

1.00%

0.13%

0.50%

0.00%

2004

2003

2002

2001

1H 05

16

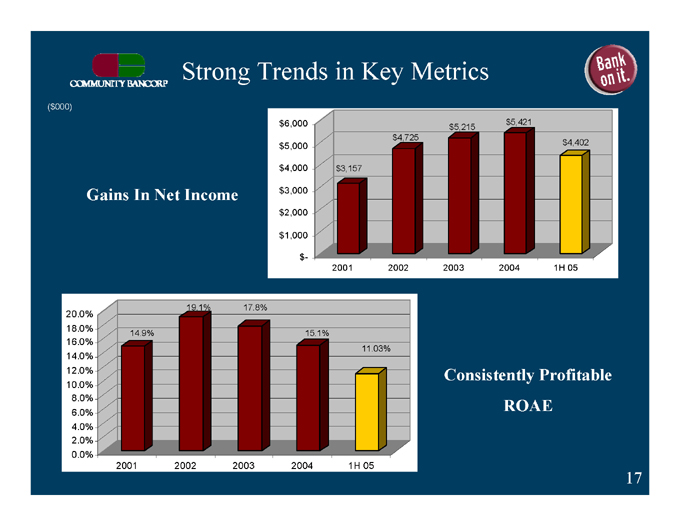

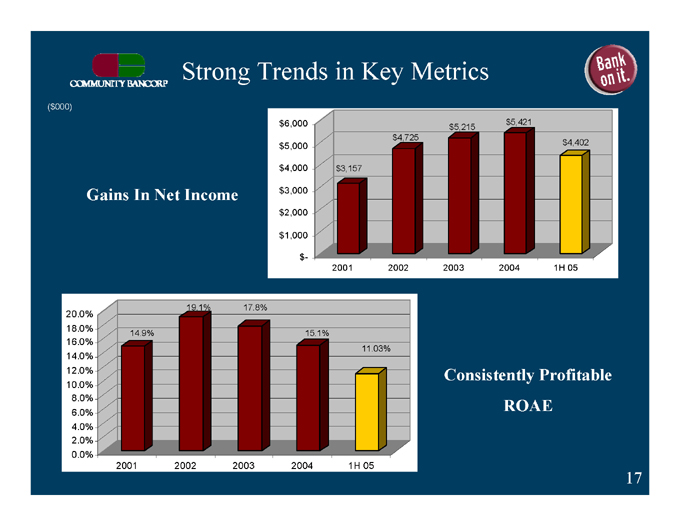

Strong Trends in Key Metrics

($000)

Gains In Net Income

$5,421

$5,215

$6,000

$4,725

$4,402

$5,000

$3,157

$4,000

$3,000

$2,000

$1,000

$-

2004

2003

2002

2001

1H 05

19.1%

17.8%

20.0%

18.0%

14.9%

15.1%

11.03%

16.0%

14.0%

Consistently Profitable

ROAE

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

2004

2003

2002

2001

1H 05

17

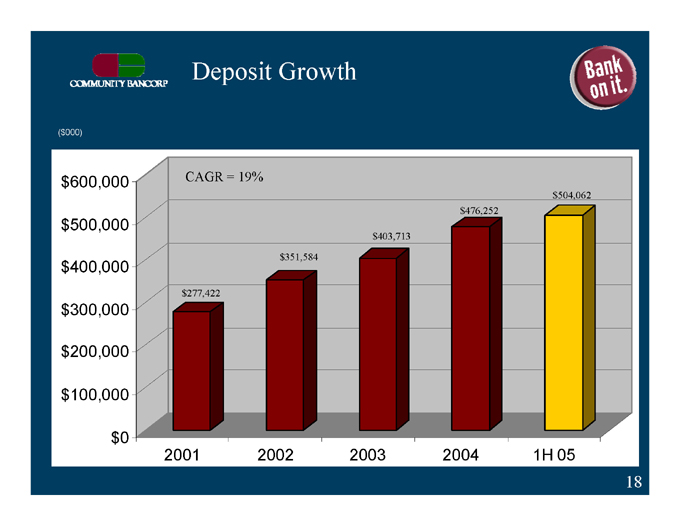

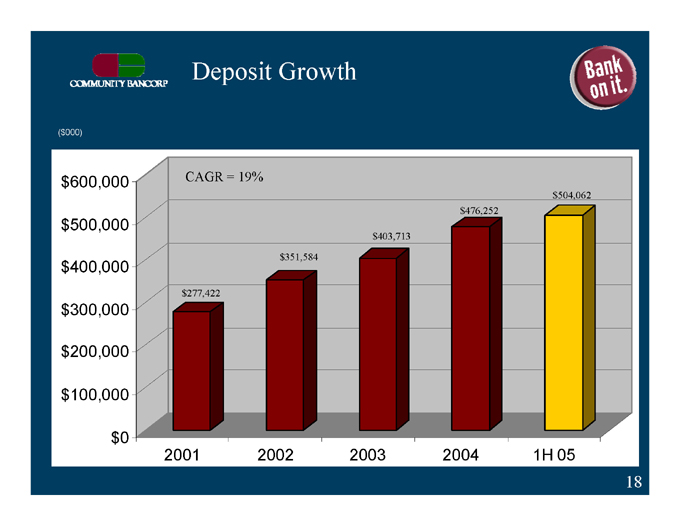

Deposit Growth

($000)

CAGR = 19%

$600,000

$504,062

$476,252

$500,000

$403,713

$351,584

$400,000

$277,422

$300,000

$200,000

$100,000

$0

2004

2003

2002

2001

1H 05

18

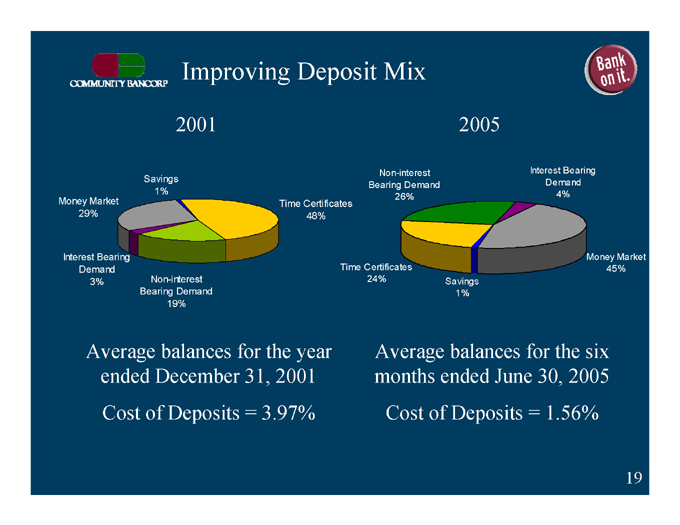

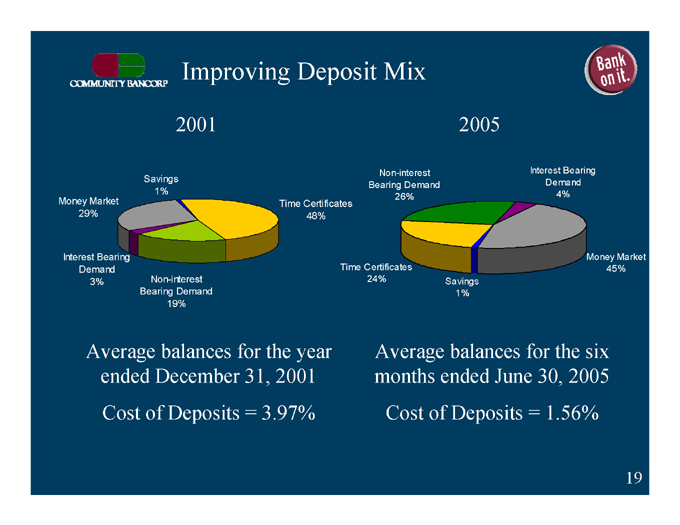

Improving Deposit Mix

2001

2005

Interest Bearing

Savings

Non-interest

Bearing Demand

Demand

4%

26%

1%

Time Certificates

Money Market

29%

48%

Money Market

Interest Bearing

45%

Demand

Time Certificates

Non-interest

Savings

3%

24%

1%

Bearing Demand

19%

Average balances for the year ended December 31, 2001

Cost of Deposits = 3.97%

Average balances for the six months ended June 30, 2005

Cost of Deposits = 1.56%

19

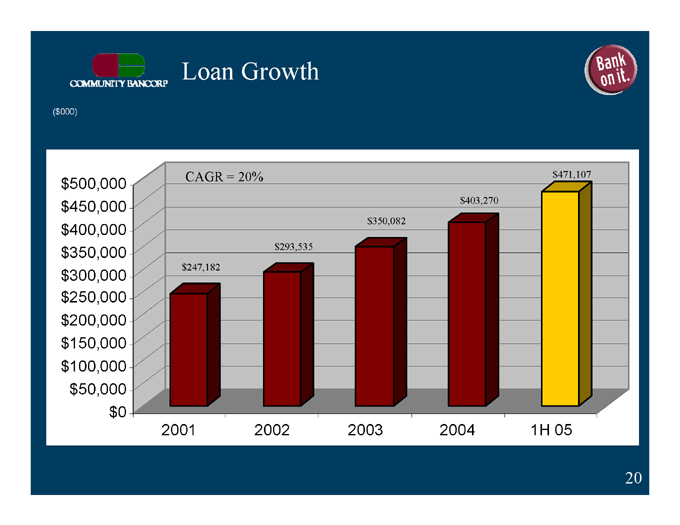

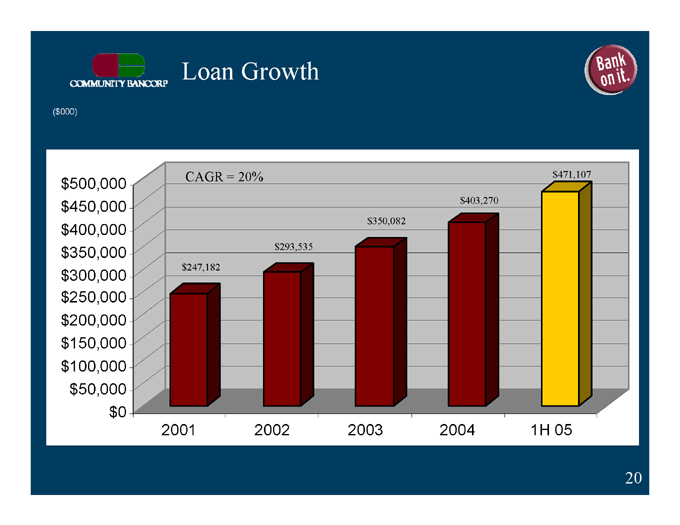

Loan Growth

($000)

$471,107

CAGR = 20%

$500,000

$403,270

$450,000

$350,082

$400,000

$293,535

$350,000

$247,182

$300,000

$250,000

$200,000

$150,000

$100,000

$50,000

$0

2004

2003

2002

2001

1H 05

20

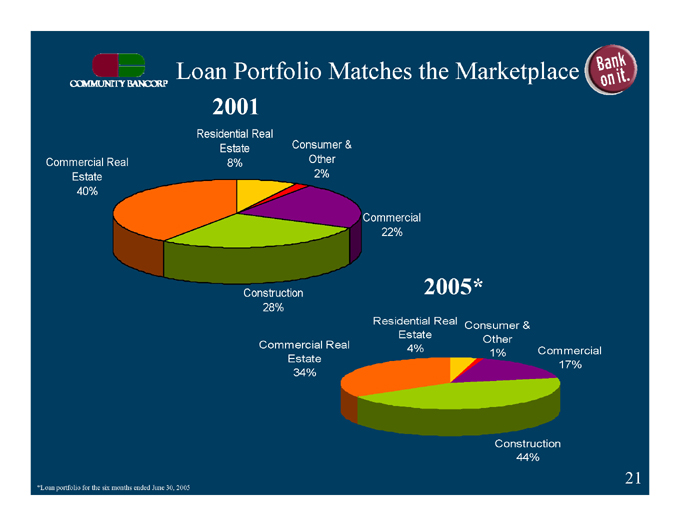

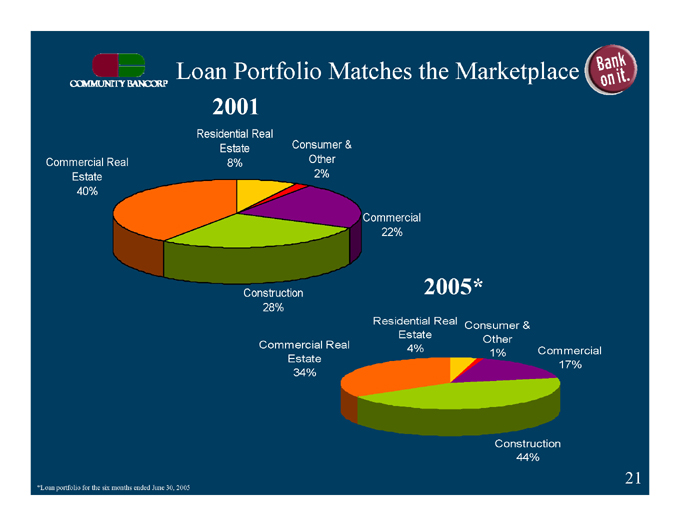

Loan Portfolio Matches the Marketplace

2001

Residential Real

Estate

Consumer &

Commercial Real

8%

Other

Estate

2%

40%

Commercial

22%

2005*

Construction

28%

Consumer &

Residential Real

Other

Estate

4%

Commercial

Commercial Real

Estate

1%

17%

34%

Construction

44%

*Loan portfolio for the six months ended June 30, 2005

21

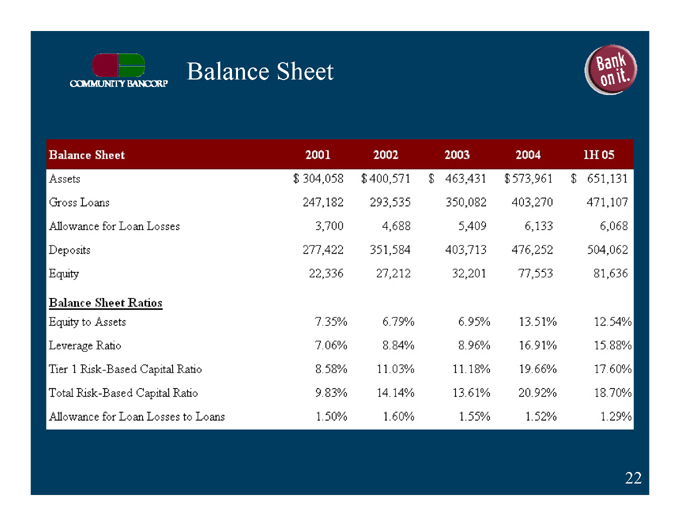

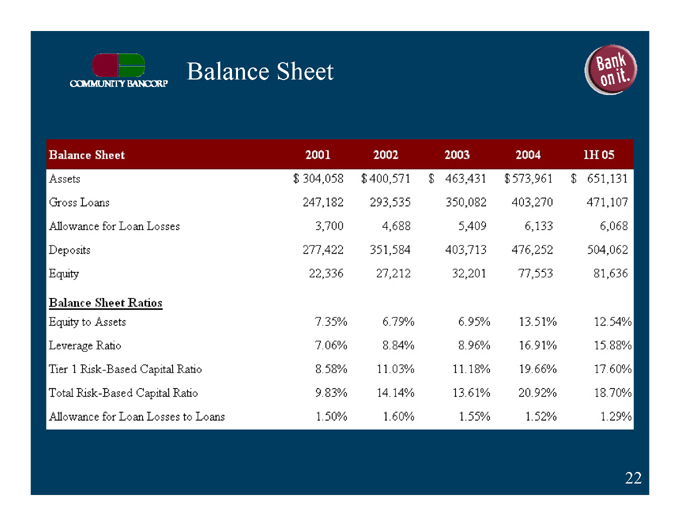

Balance Sheet

Balance Sheet 2001 2002 2003 2004 1H05

Assets $ 304,058 $400,571 $463,431 $573,961 $651,131

Gross Loans 247,182 293,535 350,082 403,270 471,107

Allowance for Loan Losses 3,700 4,688 5,409 6,133 6,068

Deposits 277,422 351,584 403,713 476,252 504,062

Equity 22,336 27,212 32,201 77,553 81,636

Balance Sheet Ratios

Equity to Assets 7.35% 6.79% 6.95% 13.51% 12.54%

Leverage Ratio 7.06% 8.84% 8.96% 16.91% 15.88%

Tier 1 Risk-Based Capital Ratio 8.58% 11.03% 11.18% 19.66% 17.60%

Total Risk-Based Capital Ratio 9.83% 14.14% 13.61% 20.92% 18.70%

Allowance for Loan Losses to Loans 1.50% 1.60% 1.55% 1.52% 1.29%

22

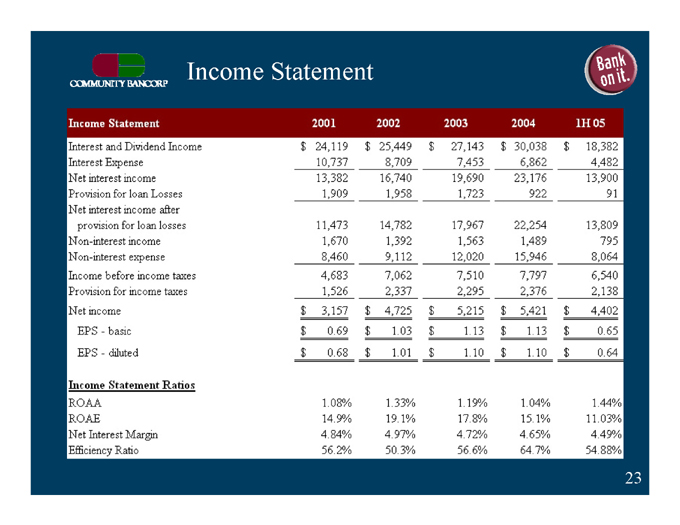

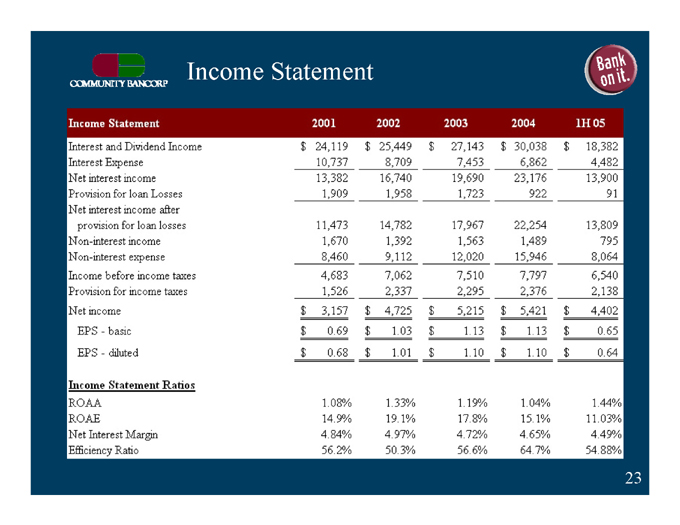

Income Statement

Income Statement 2001 2002 2003 2004 1H05

Interest and Dividend Income $24,119 $25,449 $27,143 $30,038 $18,382

Interest Expense 10,737 8,709 7,453 6,862 4,482

Net interest income 13,382 16,740 19,690 23,176 13,900

Provision for loan Losses 1,909 1,958 1,723 922 91

Net interest income after provision for loan losses 11,473 14,782 17,967 22,254 13,809

Non-interest income 1,670 1,392 1,563 1,489 795

Non-interest expense 8,460 9,112 12,020 15,946 8,064

Income before income taxes 4,683 7,062 7,510 7,797 6,540

Provision for income taxes 1,526 2,337 2,295 2,376 2,138

Net income $3,157 $4,725 $5,215 $5,421 $4,402

EPS - basic $0.69 $1.03 $1.13 $1.13 $0.65

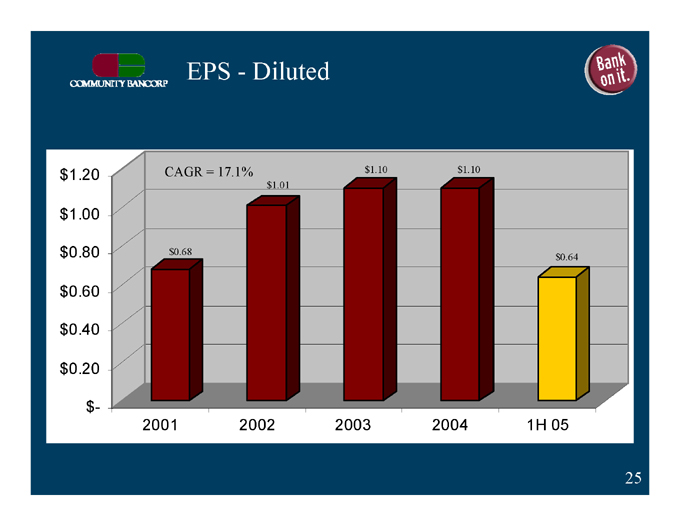

EPS - diluted $0.68 $1.01 $1.10 $1.10 $0.64

Income Statement Ratios

ROAA 1.08% 1.33% 1.19% 1.04% 1.44%

ROAE 14.9% 19.1% 17.8% 15.1% 11.03%

Net Interest Margin 4.84% 4.97% 4.72% 4.65% 4.49%

Efficiency Ratio 56.2% 50.3% 56.6% 64.7% 54.88%

23

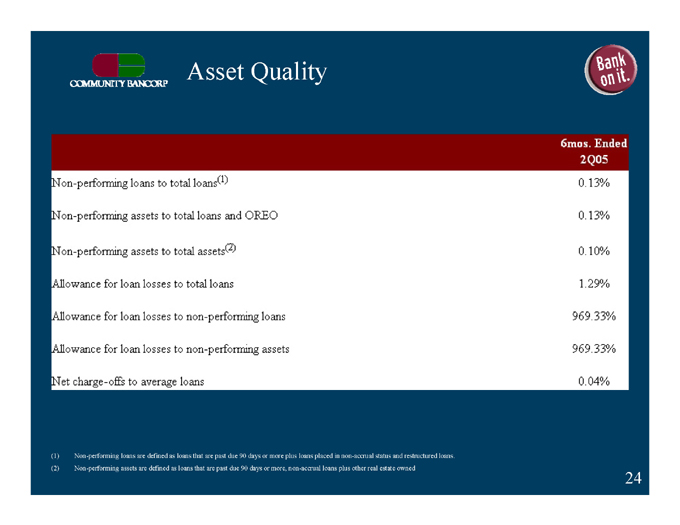

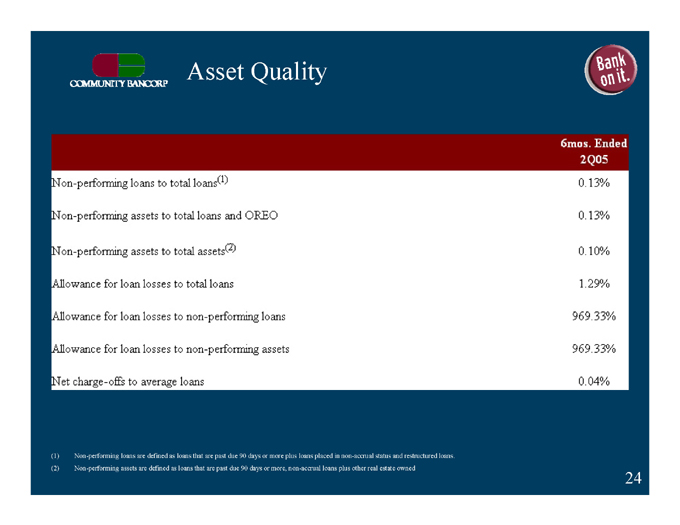

Asset Quality

6mos. Ended 2Q05

Non-performing loans to total loans(1)

Non-performing assets to total loans and OREO

Non-performing assets to total assets(2)

Allowance for loan losses to total loans

Allowance for loan losses to non-performing loans

Allowance for loan losses to non-performing assets

Net charge-offs to average loans

0.13%

0.13%

0.10%

1.29%

969.33%

969.33%

0.04%

(1) Non-performing loans are defined as loans that are past due 90 days or more plus loans placed in non-accrual status and restructured loans.

(2) Non-performing assets are defined as loans that are past due 90 days or more, non-accrual loans plus other real estate owned.

24

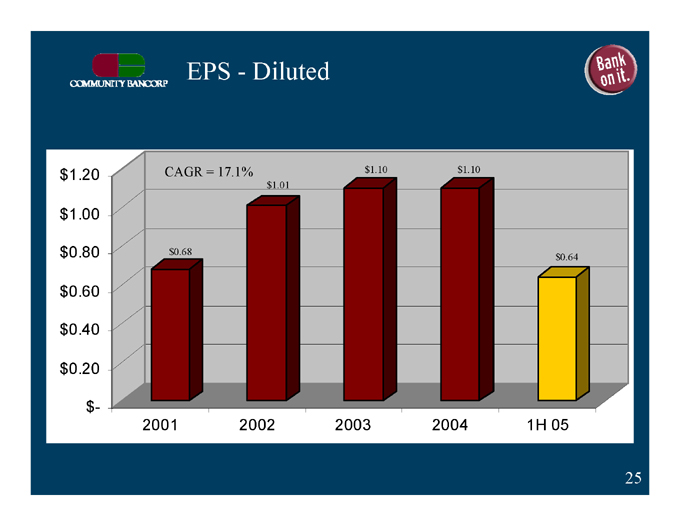

EPS - Diluted

$1.10

CAGR = 17.1%

$1.10

$1.01

$0.64

$0.68

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$-

2004

2003

2002

2001

1H 05

25

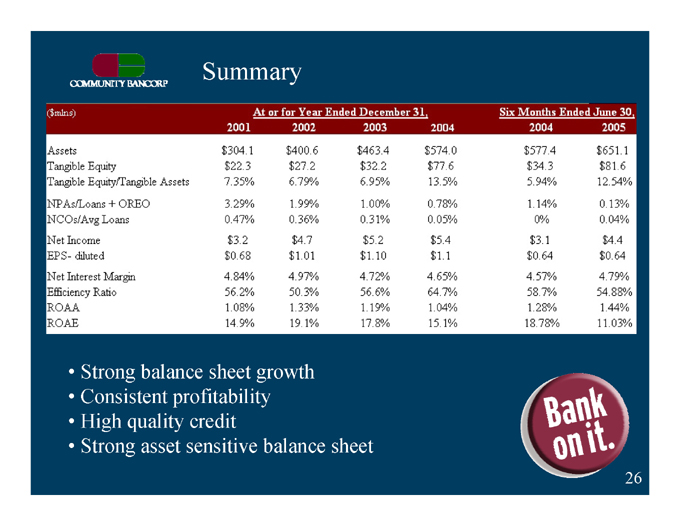

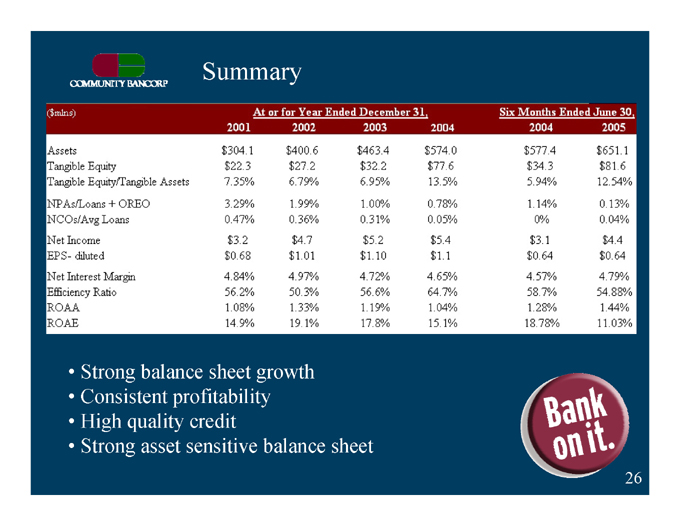

Summary

($mlns) At or for Year Ended December 31, Six Months Ended June 30,

2001 2002 2003 2004 2004 2005

Assets $304.1 $400.6 $463.4 $574.0 $577.4 $651.1

Tangible Equity $22.3 $27.2 $32.2 $77.6 $34.3 $81.6

Tangible Equity/Tangible Assets 7.35% 6.79% 6.95% 13.5% 5.94% 12.54%

NPAs/Loans + OREO 3.29% 1.99% 1.00% 0.78% 1.14% 0.13%

NCOs/Avg Loans 0.47% 0.36% 0.31% 0.05% 0% 0.04%

Net Income $3.2 $4.7 $5.2 $5.4 $3.1 $4.4

EPS - diluted $0.68 $1.01 $1.10 $1.1 $0.64 $0.64

Net Interest Margin 4.84% 4.97% 4.72% 4.65% 4.57% 4.79%

Efficiency Ratio 56.2% 50.3% 56.6% 64.7% 58.7% 54.88%

ROAA 1.08% 1.33% 1.19% 1.04% 1.28% 1.44%

ROAE 14.9% 19.1% 17.8% 15.1% 18.78% 11.03%

Strong balance sheet growth

Consistent profitability

High quality credit

Strong asset sensitive balance sheet

26

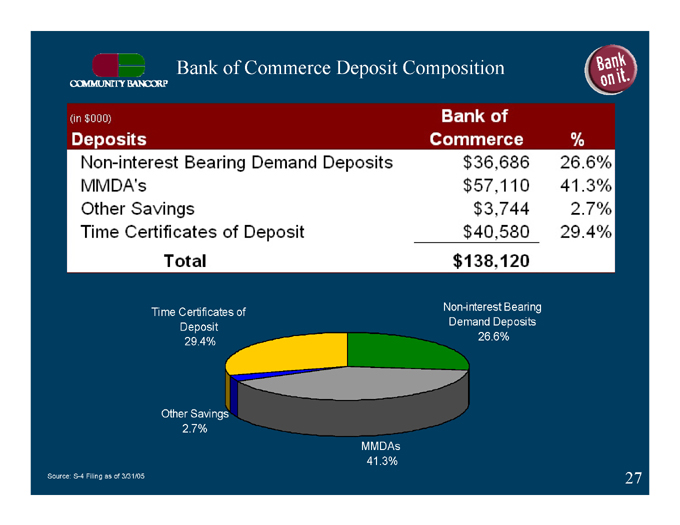

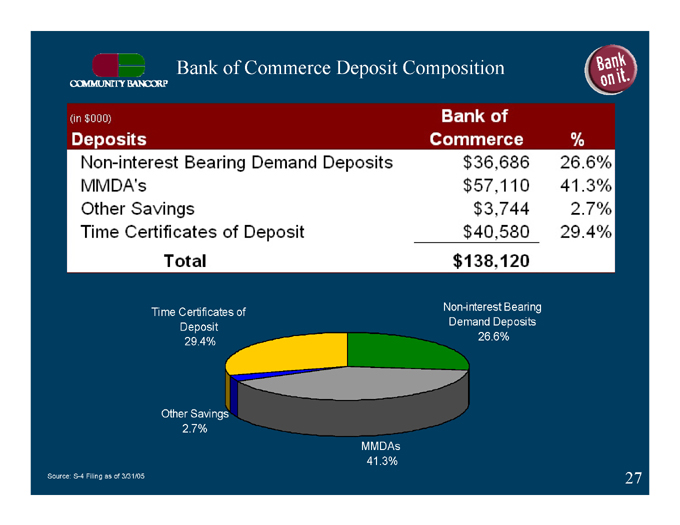

Bank of Commerce Deposit Composition

(in $000)

Deposits Bank of Commerce %

Non-interest Bearing Demand Deposits $36,686 26.6%

MMDA’s $57,110 41.3%

Other Savings $3,744 2.7%

Time Certificates of Deposit $40,580 29.4%

Total $138,120

Time Certificates of

Non-interest Bearing

Deposit

Demand Deposits

29.4%

26.6%

Other Savings

2.7%

MMDAs

41.3%

Source: S-4 Filing as of 3/31/05

27

Bank of Commerce Loan Composition

(in $000) Loans

Construction

Commercial

Real Estate- Commercial

Real Estate- Residential

Consumer & Other

Total

Bank of Commerce

$19,284

$37,847

$54,045

$9,758

$702

$121,636

%

15.9%

31.1%

44.4%

8.0%

0.6%

Consumer & Other

Real Estate- Residential

Construction

8%

16%

1%

Real Estate- Commercial

31%

Commercial

44%

Source: S-4 Filing as of 3/31/05

28

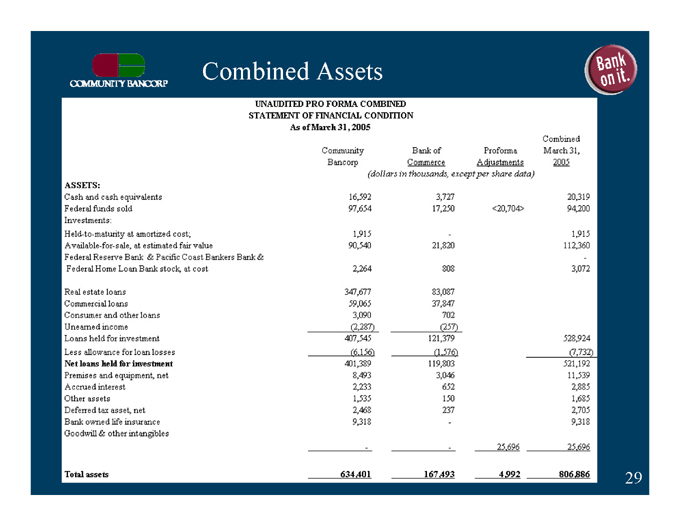

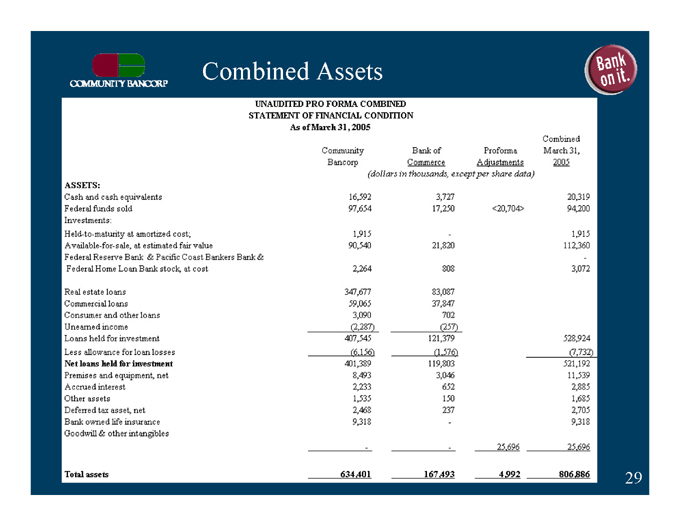

Combined Assets

UNAUDITED PRO FORMA COMBINED

STATEMENT OF FINANCIAL CONDITION

As of March 31, 2005

ASSETS:

Cash and cash equivalents

Federal funds sold

Investments:

Held-to-maturity at amortized cost;

Available-for-sale, at estimated fair value

Federal Reserve Bank & Pacific Coast Bankers Bank & Federal Home Loan Bank stock, at cost

Real estate loans

Commercial loans

Consumer and other loans

Unearned income

Loans held for investment

Less allowance for loan losses

Net loans held for investment

Premises and equipment, net

Accrued interest

Other assets

Deferred tax asset, net

Bank owned life insurance

Goodwill & other intangibles

Total assets

(dollars in thousands, except per share data)

Community Bancorp

16,592

97,654

1,915

90,540

2,264

347,677

59,065

3,090

(2,287)

407,545

(6,156)

401,389

8,493

2,233

1,535

2,468

9,318

-

634,401

Bank of Commerce

3,727

17,250

-

21,820

808

83,087

37,847

702

(257)

121,379

(1,576)

119,803

3,046

652

150

237

-

-

167,493

Proforma Adjustments

<20,704>

25,696

4,992

Combined March 31, 2005

20,319

94,200

1,915

112,360

-

3,072

528,924

(7,732)

521,192

11,539

2,885

1,685

2,705

9,318

25,696

806,886

29

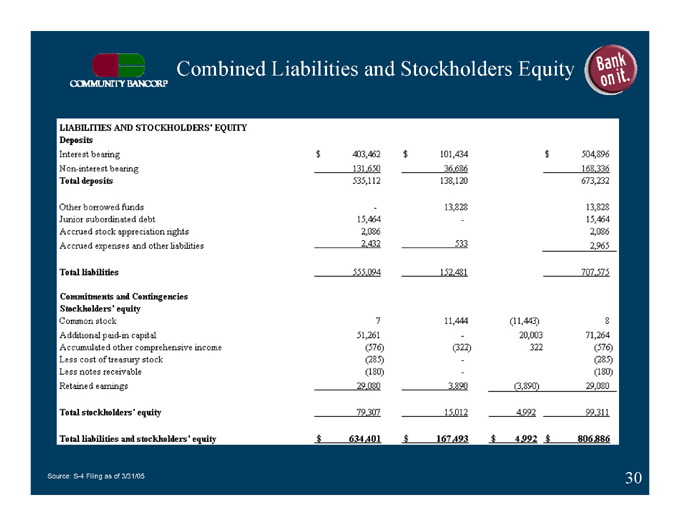

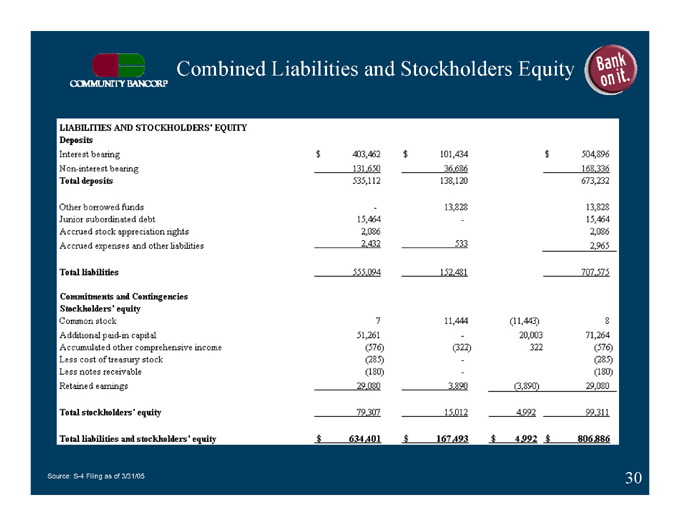

Combined Liabilities and Stockholders Equity

LIABILITIES AND STOCKHOLDERS’ EQUITY

Deposits

Interest bearing $403,462 $101,434 $504,896

Non-interest bearing 131,650 36,686 168,336

Total deposits 535,112 138,120 673,232

Other borrowed funds - 13,828 13,828

Junior subordinated debt 15,464 - 15,464

Accrued stock appreciation rights 2,086 2,086

Accrued expenses and other liabilities 2,432 533 2,965

Total liabilities 555,094 152,481 707,575

Commitments and Contingencies Stockholders’ equity

Common stock 7 11,444 (11,443) 8

Additional paid-in capital 51,261 - 20,003 71,264

Accumulated other comprehensive income (576) (322) 322 (576)

Less cost of treasury stock (285) - (285)

Less notes receivable (180) - (180)

Retained earnings 29,080 3,890 (3,890) 29,080

Total stockholders’ equity 79,307 15,012 4,992 99,311

Total liabilities and stockholders’ equity $634,401 $167,493 $4,992 $806,886

Source: S-4 Filing as of 3/31/05

30

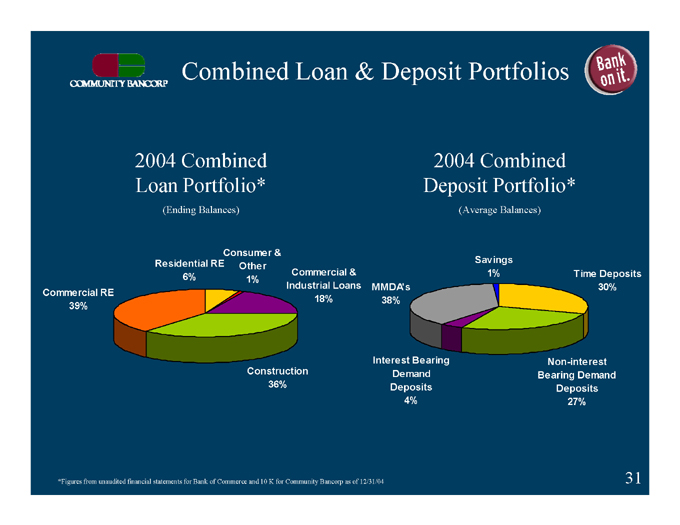

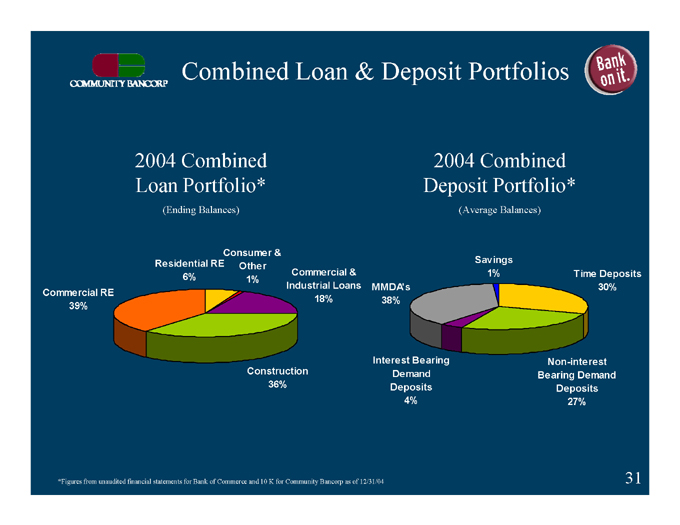

Combined Loan & Deposit Portfolios

2004 Combined Loan Portfolio*

(Ending Balances)

2004 Combined Deposit Portfolio*

(Average Balances)

Consumer &

Residential RE

Other

Savings

1%

Time Deposits

6%

Commercial &

Industrial Loans

1%

30%

Commercial RE

MMDA’s

18%

38%

39%

Non-interest

Interest Bearing

Demand

Bearing Demand

Construction

Deposits

Deposits

36%

27%

4%

*Figures from unaudited financial statements for Bank of Commerce and 10 K for Community Bancorp as of 12/31/04

31

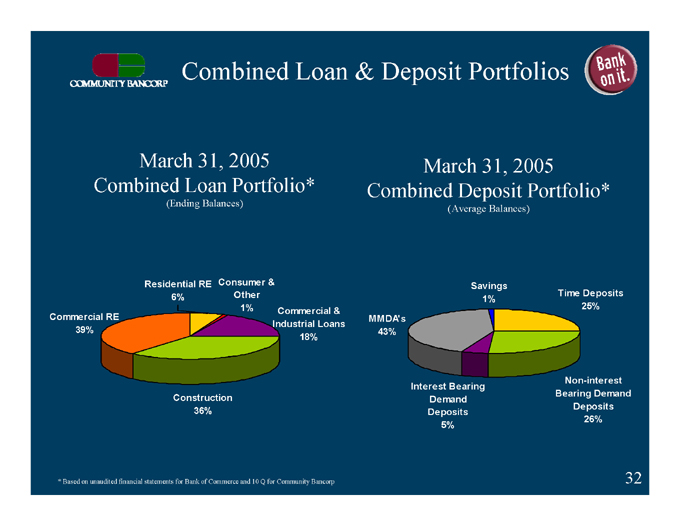

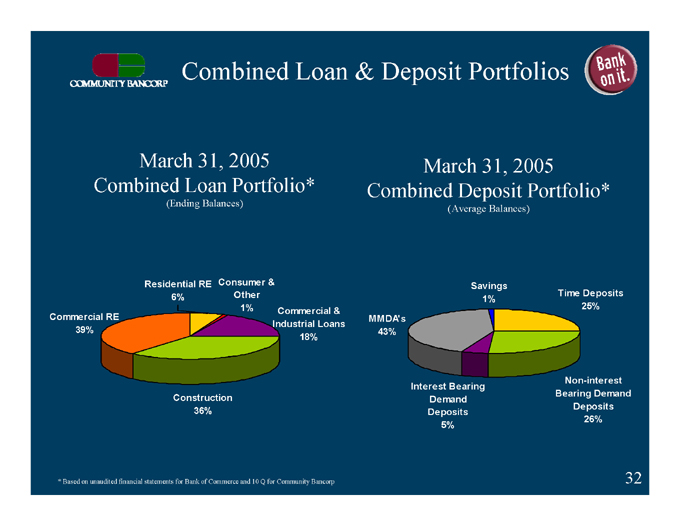

Combined Loan & Deposit Portfolios

March 31, 2005

Combined Deposit Portfolio*

(Average Balances)

March 31, 2005

Combined Loan Portfolio*

(Ending Balances)

Consumer &

Residential RE

Savings

Other

6%

1%

Time Deposits

1%

Commercial &

25%

Commercial RE

MMDA’s

39%

Industrial Loans

18%

43%

Interest Bearing

Non-interest

Construction

Demand

Bearing Demand

36%

Deposits

Deposits

5%

26%

* Based on unaudited financial statements for Bank of Commerce and 10 Q for Community Bancorp

32

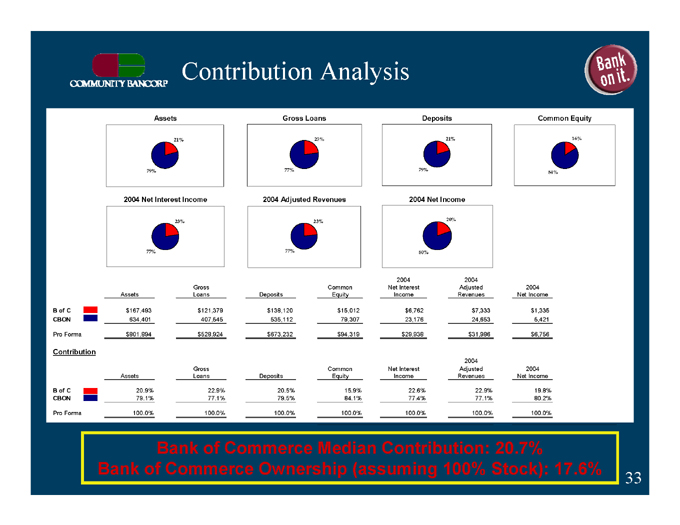

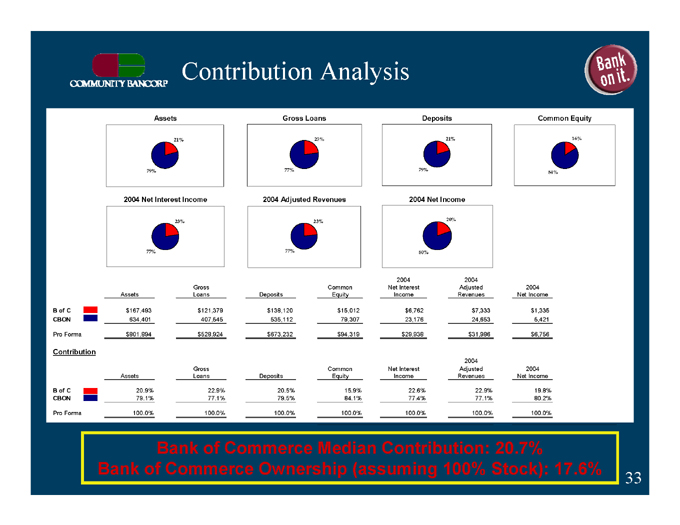

Contribution Analysis

Common Equity

Deposits

Gross Loans

Assets

21%

23%

21%

16%

77%

79%

84%

79%

2004 Net Income

2004 Adjusted Revenues

2004 Net Interest Income

23%

23%

20%

77%

80%

77%

Assets

Gross Loans

Deposits

Common Equity

2004 Net Interest Income

2004 Adjusted Revenues

2004 Net Income

B of C

$1,335

$7,333

$6,762

$15,012

$138,120

$121,379

$167,493

CBON

5,421

24,653

23,176

79,307

535,112

407,545

634,401

Pro Forma

$6,756

$31,986

$29,938

$94,319

$673,232

$528,924

$801,894

Contribution

Assets

Gross Loans

Deposits

Common Equity

2004 Net Interest Income

2004 Adjusted Revenues

2004 Net Income

19.8%

22.9%

22.6%

15.9%

20.5%

22.9%

20.9%

B of C

80.2%

77.1%

77.4%

84.1%

79.5%

77.1%

79.1%

CBON

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

Pro Forma

Bank of Commerce Median Contribution: 20.7%

Bank of Commerce Ownership (assuming 100% Stock): 17.6%

33

Investment Thesis

One of the largest community banks headquartered in the high growth market of Las Vegas

Excellent expansion opportunities in both Las Vegas and other high growth markets

Consistent, high performance institution

Five year CAGR of assets and net income of 26% and 15% respectively

Five year average ROE and ROA of 17.3% and 1.23% respectively

Focus on commercial banking and total client relationships

Experienced management team with over 145 years banking experience in the Greater Las Vegas area

34

INVESTOR PRESENTATION