Exhibit 99.1

INVESTOR PRESENTATION

Forward Looking Information

Certain statements contained in this presentation, including, without limitation, statements containing the words “believes”, “anticipates”, “intends”, and “expects”, and words of similar import, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following: general economic and business conditions in those areas in which the Company operates, demographic changes, competition, fluctuations in interest rates, changes in business strategy or development plans, changes in governmental regulation, credit quality, the availability of capital to fund the expansion of the Company’s business, and other factors referenced in this presentation. The Company disclaims any obligation to update any such factors or to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

Key Investment Considerations

One of the largest community banks headquartered in the high growth market of Las Vegas

Consistent, high performing institution

Five year CAGR of assets and net income of 26% and 15% respectively

Five year average ROE and ROA of 17.3%

and 1.23% respectively

Second quarter 2005 ROE and ROA of 10%

and 1.32% respectively

Focus on business lending and relationship

banking

Experienced management team with extensive

Las Vegas experience

Successful initial public offering in December 2004 – priced above initial filing range and was over 10x oversubscribed

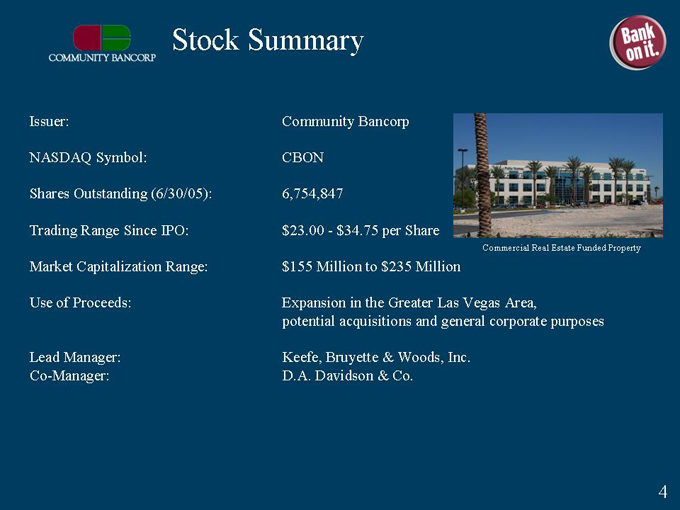

Stock Summary

Issuer: Community Bancorp

NASDAQ Symbol: CBON

Shares Outstanding (6/30/05): 6,754,847

Trading Range Since IPO: $23.00—$34.75 per Share

Market Capitalization Range: $155 Million to $235 Million

Use of Proceeds: Expansion in the Greater Las Vegas Area, potential acquisitions and general corporate purposes

Lead Manager: Keefe, Bruyette & Woods, Inc.

Co-Manager: D.A. Davidson & Co.

Company Overview

Community Bancorp is the bank holding company for Community Bank of Nevada serving the Greater Las Vegas market with nine branches

Community Bank of Nevada, founded in 1995, is one of the largest community banks headquartered in the greater Las Vegas area

Profitable every year since 1995

Provides a complete array of commercial banking products and services to small-to-medium sized businesses

Emphasis on relationship banking and personalized service

Trends in growth and profitability have continued in the first half of 2005 with growth in assets of 13.5%, growth in deposits of 5.8%, ROE of 11.0% and ROA of 1.44%

On August 26, 2005 closed the acquisition of Bank of Commerce for approximately $40.0 million in 50 % cash and 50% stock. Acquisition closed 99 days after the signing of definitive agreement.

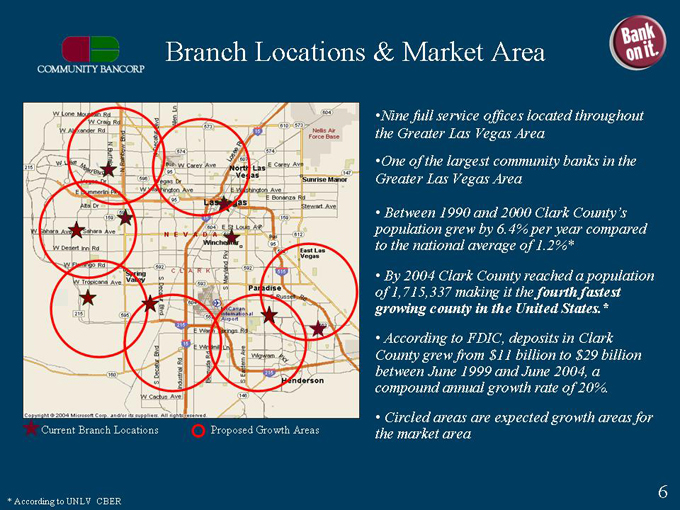

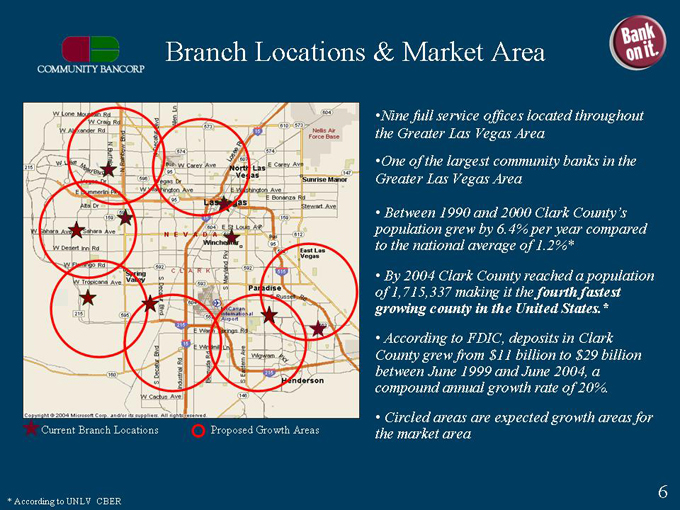

Branch Locations & Market Area

Nine full service offices located throughout the Greater Las Vegas Area

One of the largest community banks in the Greater Las Vegas Area

Between 1990 and 2000 Clark County’s population grew by 6.4% per year compared to the national average of 1.2%*

By 2004 Clark County reached a population of 1,715,337 making it the fourth fastest growing county in the United States.*

According to FDIC, deposits in Clark County grew from $11 billion to $29 billion between June 1999 and June 2004, a compound annual growth rate of 20%.

Circled areas are expected growth areas for the market area

Current Branch Locations

Proposed Growth Areas

Deposit Market Share

One of the largest community banks based in Las Vegas

Source: SNL Securities at 6/30/04 (includes Bank of Commerce deposits)

Growth Strategies

To continue strong, focused organic growth in assets, loans and deposits

To capitalize on growth opportunities in Las Vegas and other rapidly expanding markets

Acquire other community banks in strategic or contiguous markets

Planning the 10th branch for the spring of 2006 and plans to open one additional branch per year through 2009

Continue to hire seasoned, well networked banking professionals to leverage relationships and expand market share in a dynamic burgeoning economy.

World Market Center

Growth Strategies – Continued

To continue to increase the number and size of banking relationships through superior cross-selling techniques. And expand on the vast number of relationships that our bankers have developed from many years in the market.

To expand the commercial and SBA lending portfolio

Increase diversification through participation

Open additional loan production offices in high growth markets

San Diego Loan Production Office opened in April 2005

Phoenix Loan Production Office opened in June of 2005

9

Operating Strategies

Be an industry leader of internal controls and risk management

Proactively manage sound procedures

Commit experienced human resources to this effort. In Q305 an experienced former bank regulator joined the management team to oversee this commitment to internal controls.

Maintain high asset quality by continuing to utilize rigorous loan underwriting standards and credit risk management practices

Continue to actively manage interest rate and market risks

Closely monitor volume and maturity of our rate sensitive assets to our interest sensitive liabilities

Commercial Real Estate Funded Property

10

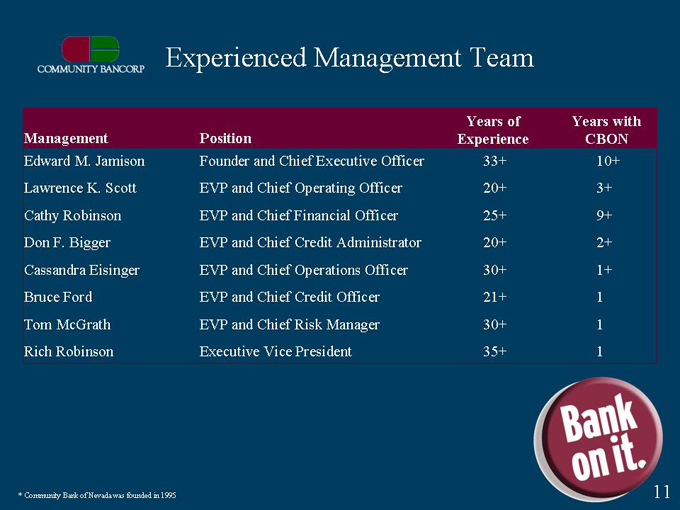

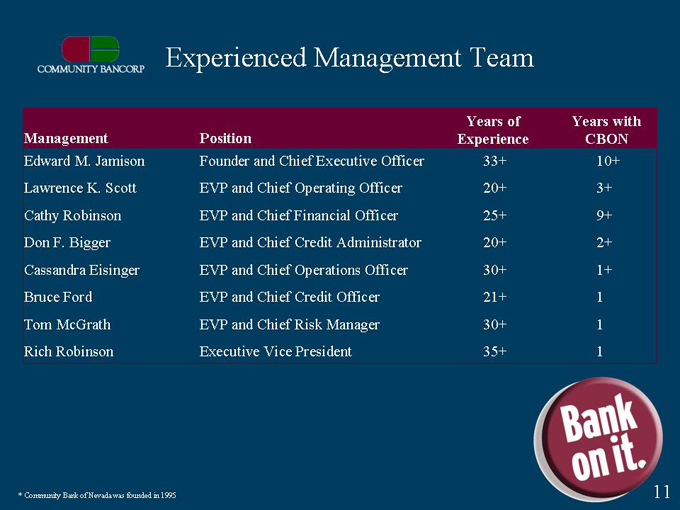

Experienced Management Team

Management

Edward M. Jamison

Lawrence K. Scott

Cathy Robinson

Don F. Bigger

Cassandra Eisinger

Bruce Ford

Tom McGrath

Rich Robinson

Position

Founder and Chief Executive Officer

EVP and Chief Operating Officer

EVP and Chief Financial Officer

EVP and Chief Credit Administrator

EVP and Chief Operations Officer

EVP and Chief Credit Officer

EVP and Chief Risk Manager

Executive Vice President

Years of Experience

33+

20+

25+

20+

30+

21+

30+

35+

Years with CBON

10+

3+

9+

2+

1+

* Community Bank of Nevada was founded in 1995

11

COMMUNITY BANCORP

FINANCIAL PERFORMANCE

12

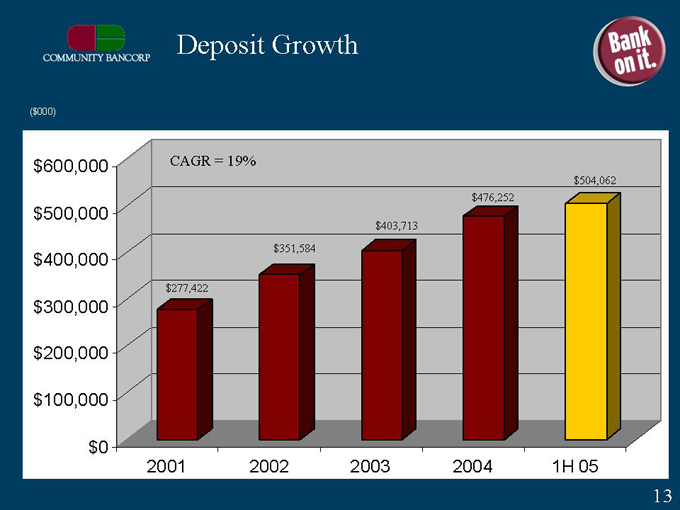

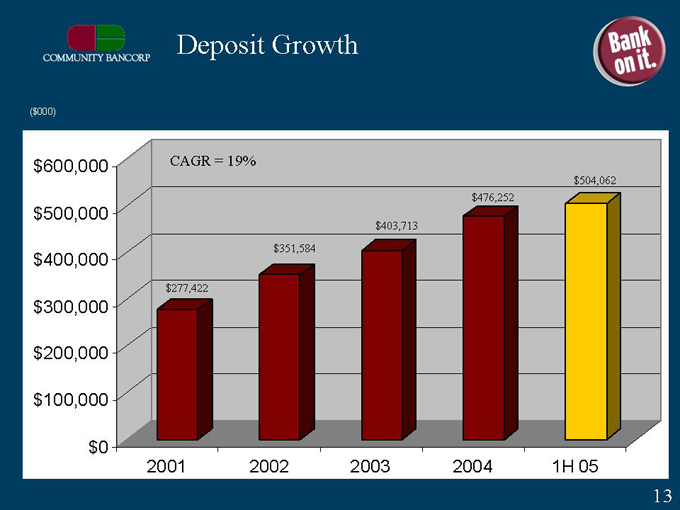

Deposit Growth

($000)

CAGR = 19%

$600,000

$500,000

$400,000

$300,000

$200,000

$100,000

$0

$277,422

$351,584

$403,713

$476,252

$504,062

2001 2002 2003 2004 1H 5

13

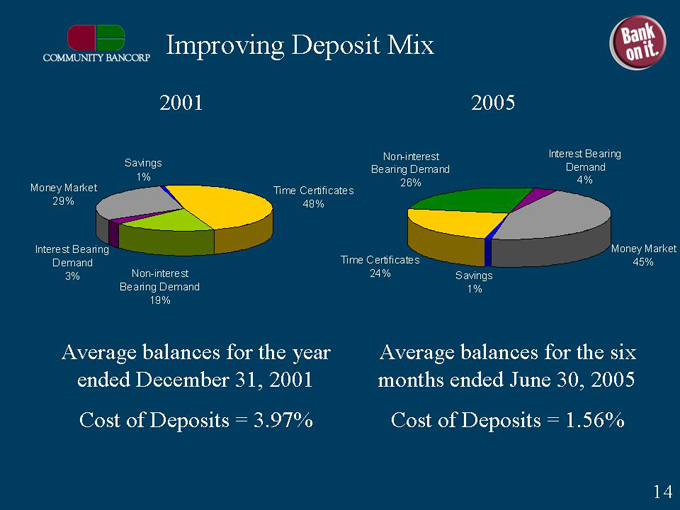

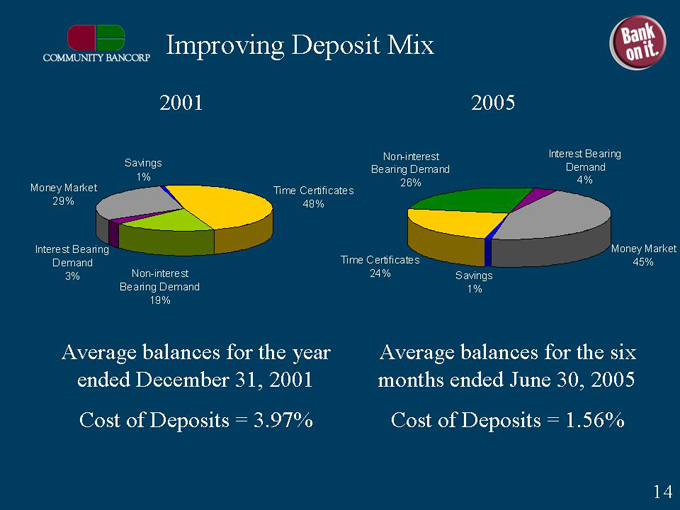

Improving Deposit Mix

2001 2005

Saving 1%

Money Market 29%

Interest Bearing Demand 3%

Non-interest Bearing Demand 19%

Time Certificates 48%

Saving 1%

Money Market 45%

Interest Bearing Demand 4%

Non-interest Bearing Demand 26%

Time Certificates 24%

Average balances for the year ended December 31, 2001

Cost of Deposits = 3.97%

Average balances for the six months ended June 30, 2005

Cost of Deposits = 1.56%

14

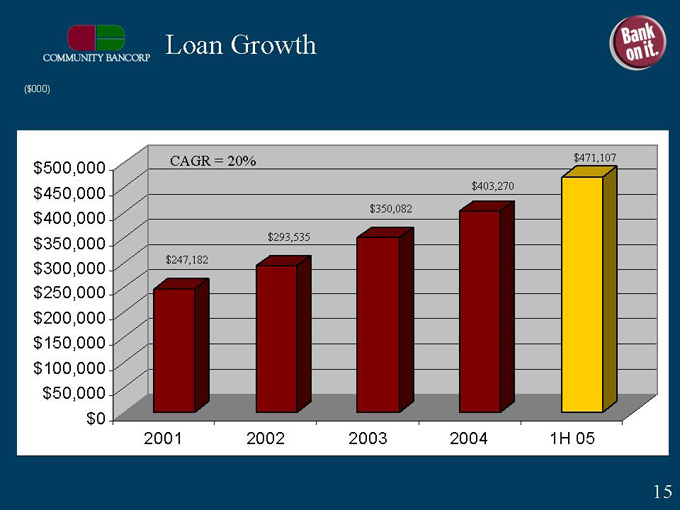

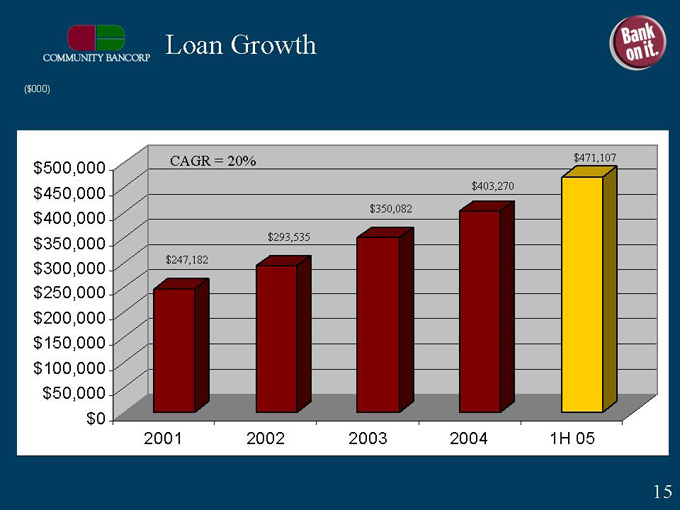

Loan Growth

($000)

CAGR = 20%

$247,182

$293,535

$350,082

$403,270

$471,107

$500,000

$450,000

$400,000

$350,000

$300,000

$250,000

$150,000

$100,000

$50,000

$0

2001 2002 2003 2004 1H 05

15

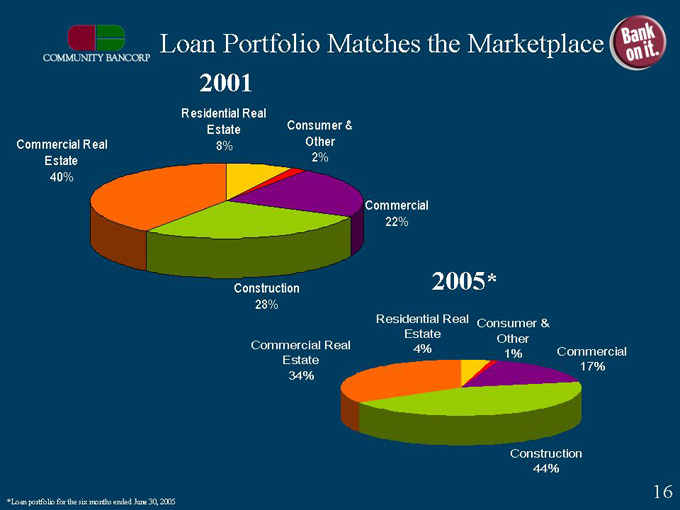

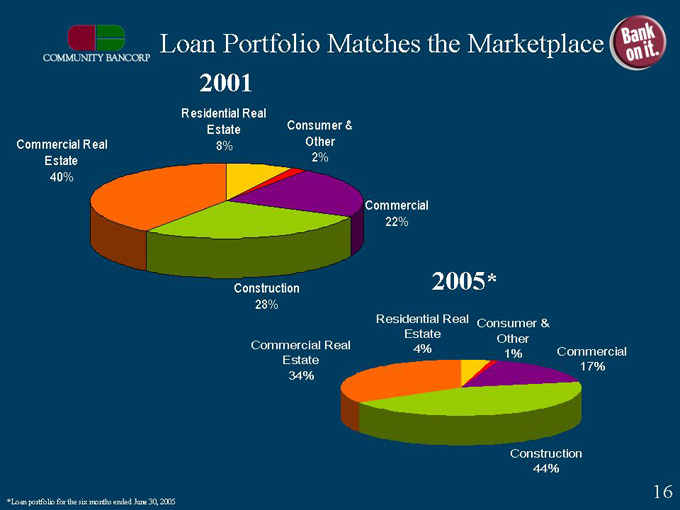

Loan Portfolio Matches the Marketplace

2001

Commercial Real Estate 40%

Residential Real Estate 8%

Consumer & Other 2%

Commercial 22%

Construction 28%

2005*

Commercial Real Estate 34%

Residential Real Estate 4%

Consumer & Other 1%

Commercial 17%

Construction 44%

*Loan portfolio for the six months ended June 30, 2005

16

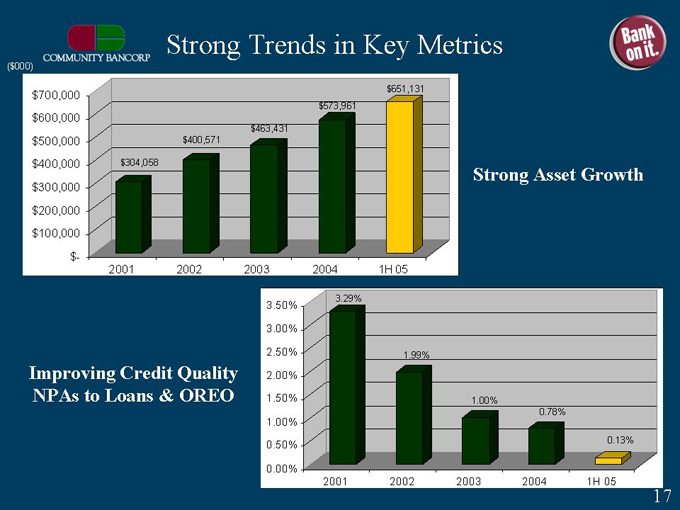

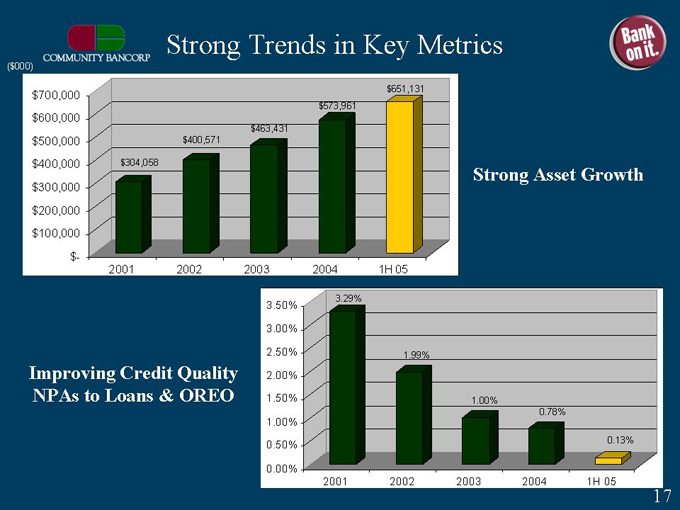

Strong Trends in Key Metrics

($000)

$304,058

$400,571

$463,431

$573,961

$651,131

$700,000

$600,000

$500,000

$400,000

$300,000

$200,000

$100,000

$-

2001 2002 2003 2004 1H 05

Improving Credit Quality NPAs to Loans & OREO

3.29%

1.99%

1.00%

0.78%

0.13%

3.50%

3.00%

2.50%

2.00%

2.00%

1.50%

1.00%

0.50%

0.00%

2001 2002 2003 2004 IH 05

17

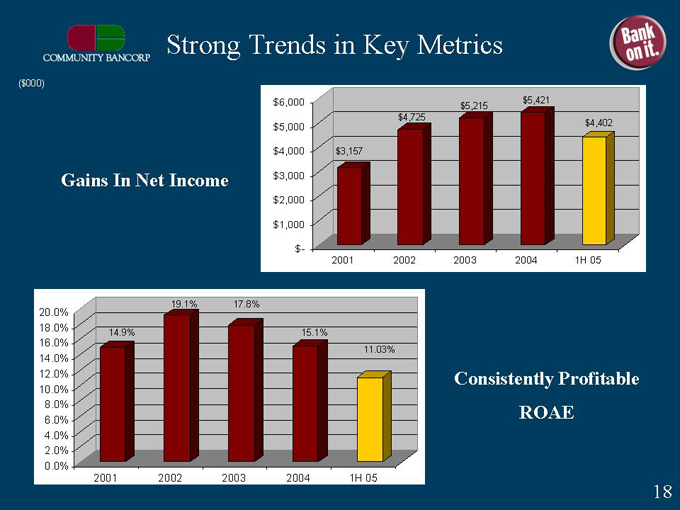

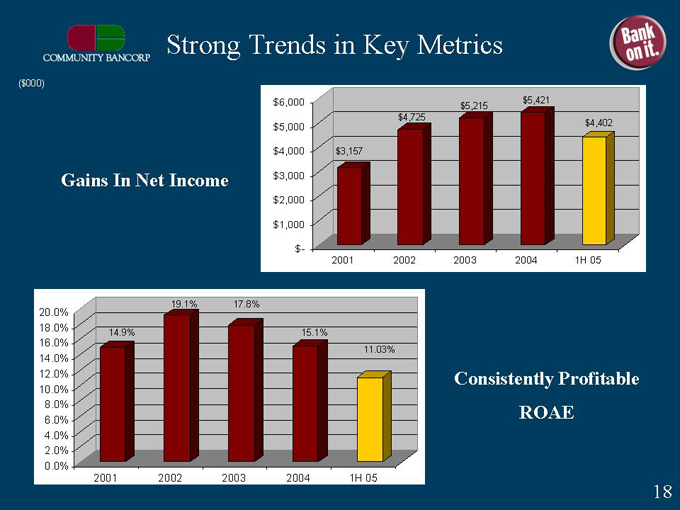

Strong Trends in Key Metrics

($000)

Gains In Net Income

$3,157

$4,725

$5,215

$5,421

$4,402

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$-

2001 2002 2003 2004 IH 05

Consistently Profitable ROAE

14.9%

19.1%

17.8%

15.1%

11.03%

20.0%

18.0%

16.0%

14.0%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

2001 2002 2003 2003 2004 IH 05

18

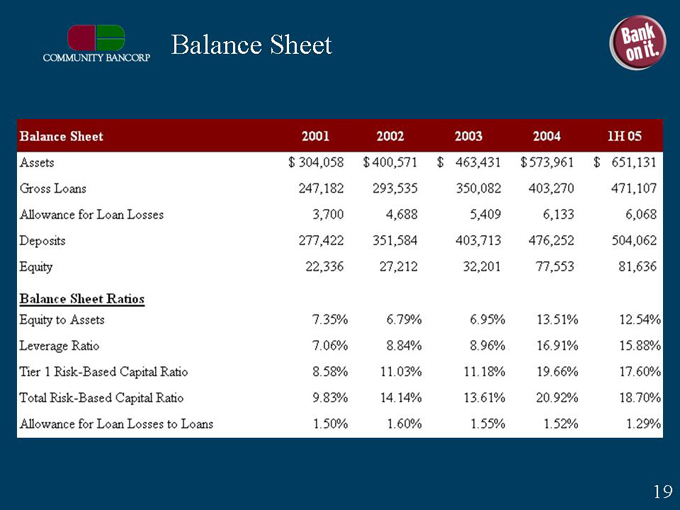

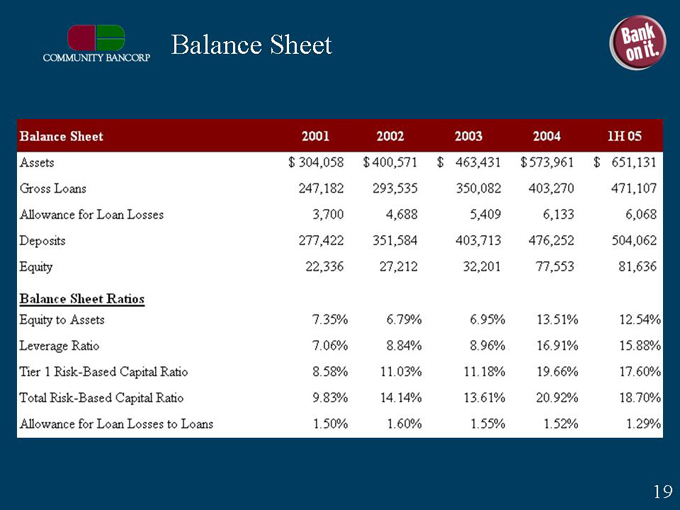

Balance Sheet

19

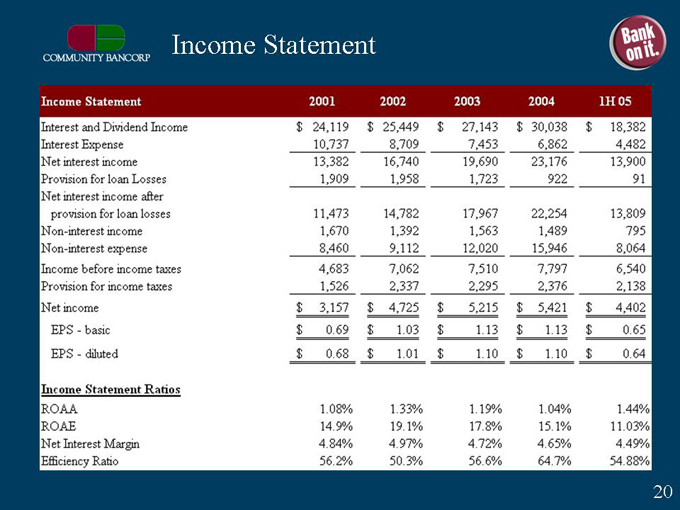

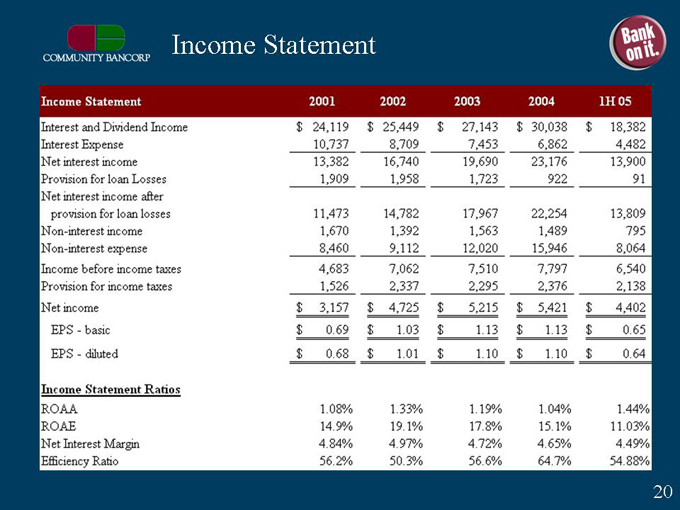

Income Statement

20

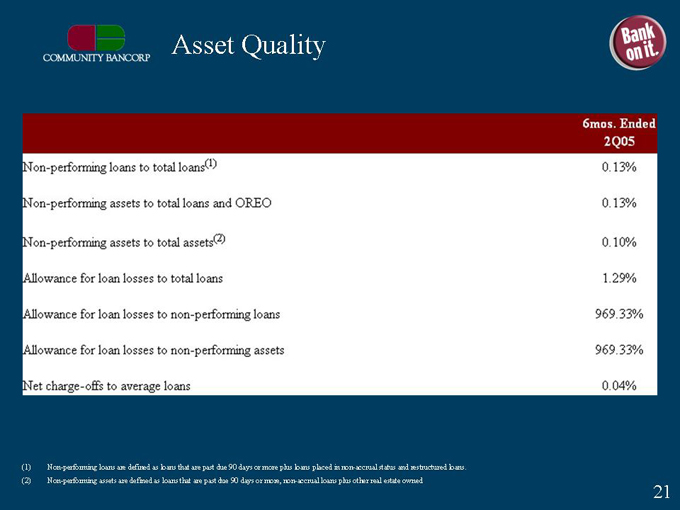

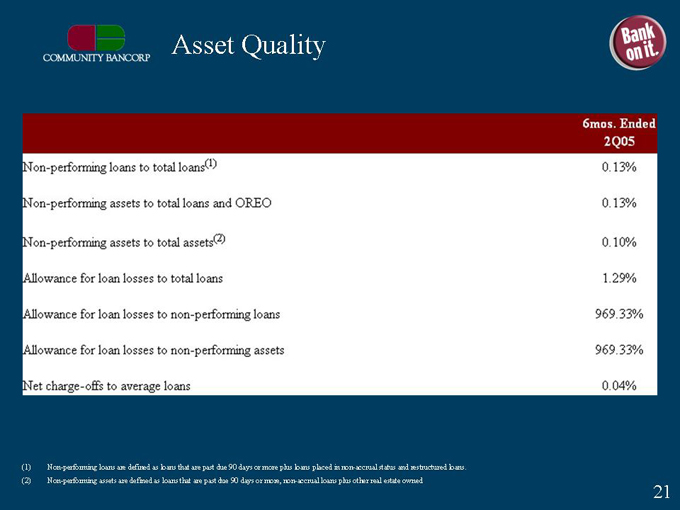

Asset Quality

Non-performing loans are defined as loans that are past due 90 days or more plus loans placed in non-accrual status and restructured loans.

Non-performing assets are defined as loans that are past due 90 days or more, non-accrual loans plus other real estate owned.

21

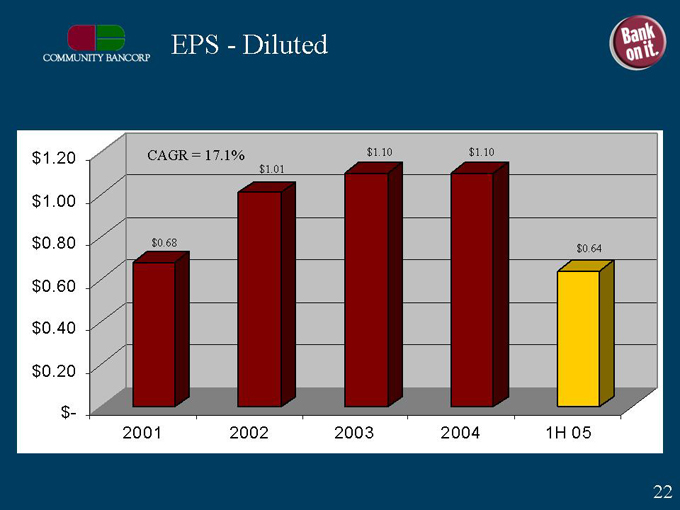

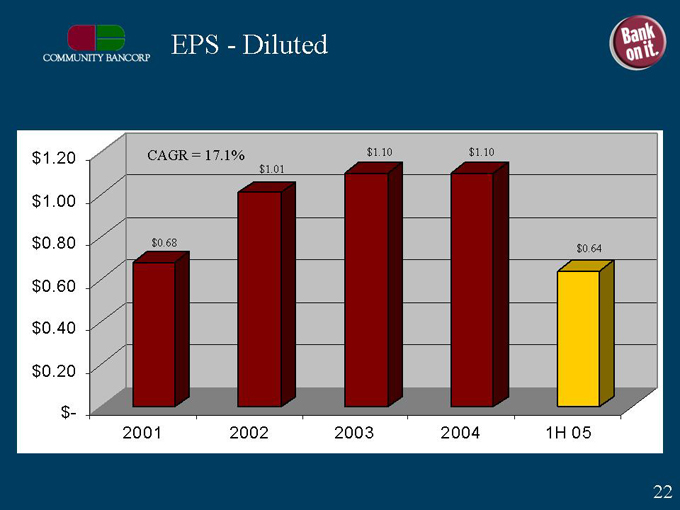

EPS—Diluted

CAGR = 17.1%

$0.68

$1.01

$1.10

$1.10

$0.64

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$-

2001 2002 2003 2004 IH 05

22

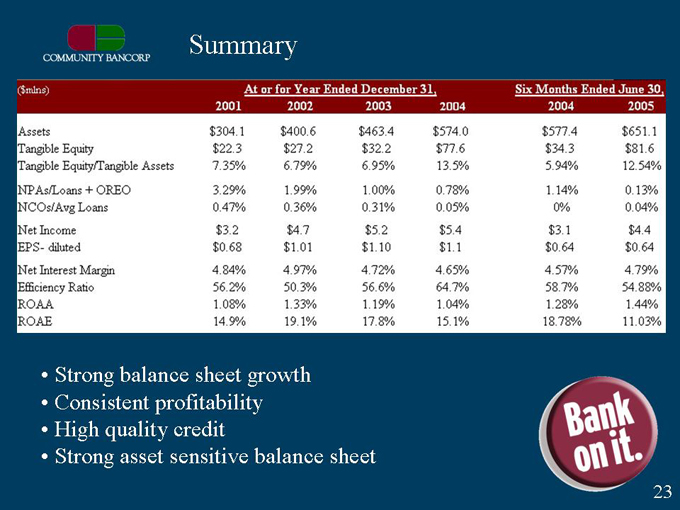

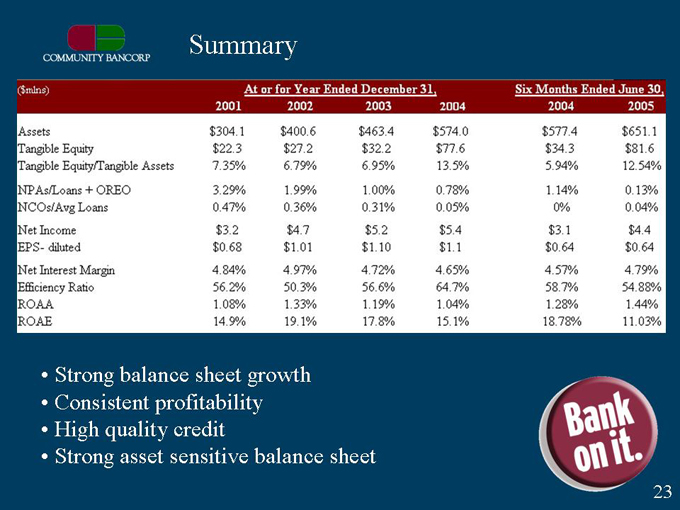

Summary

Strong balance sheet growth

Consistent profitability

High quality credit

Strong asset sensitive balance sheet

23

Investment Thesis

One of the largest community banks headquartered in the high growth market of Las Vegas

Excellent expansion opportunities in both Las Vegas and other high growth markets

Consistent, high performance institution

Five year CAGR of assets and net income of 26% and 15% respectively

Five year average ROE and ROA of 17.3% and 1.23% respectively

Focus on commercial banking and total client relationships

Experienced management team with over 210 years banking experience in the Greater Las Vegas area

24

INVESTOR PRESENTATION