Bob Currey – Chief Executive Officer

Steve Childers – Chief Financial Officer

May 2009

1

Safe Harbor

2

Company Overview

12th largest Independent Local Exchange Carrier in the U.S., with

operations in Illinois, Texas and Pennsylvania

Approximately 259,787 ILEC access lines, 73,737 CLEC access line equivalents,

94,554 DSL subscribers, 18,207 IPTV subscribers, and 7,141 VOIP subscribers

representing 453,426 total connections

Providing voice, video and data services

Triple play offerings in all markets

Full Year 2008 CNSL financial overview:

Revenues of $418.4 million

Adjusted EBITDA of $191.3 million, excluding Hurricane Ike recovery exp.

$92.4 million in cash from operations

Dividend payout ratio of 71.6%

First Quarter 2009 CNSL financial overview:

Revenues of $101.7 million

Adjusted EBITDA of $45.3

Dividend payout ratio of 64.3%

3

Well-Established Operating History

1894

1984

2005

1997

2002

2004

CCI was formed and

non-regulated

businesses incorporated

from 1984-1989

CCI acquired

by McLeodUSA

Lumpkin,

Providence and

Spectrum

acquire CCI

Mattoon

Telephone Co.

founded by Dr.

I.A. Lumpkin

CCI acquires

TXUCV and

VOIP deployed in

TX

Consolidated

completes IPO; IPTV

Launch in Illinois

CNSL

acquires

NPSI

2006

IPTV Launch

in TX

2007

2008

IPTV launch

in PA

VOIP

deployed in IL

4

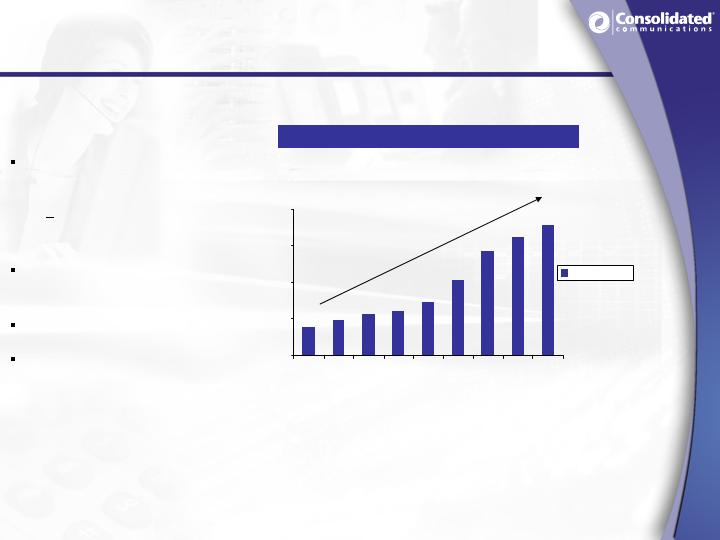

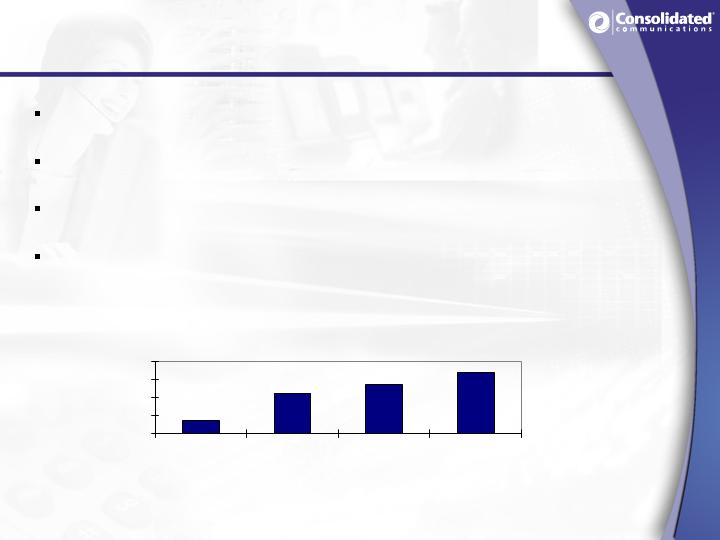

Consistent Organic and Acquisition Growth

2002 – New Consolidated created after acquisition from McLeod.

2004 – Tripled the size of the company with TXU acquisition.

2005 – Initial Public Offering.

2007 – Completed acquisition of North Pittsburgh Systems, Inc.

$191.3M

$418.4M

2008

$45.3M

$101.7M

Q1 2009

$143.8M

$329.2M

2007

$139.8M

$136.8M

$123.3M

$45.7M

Adj.

EBITDA

$320.8M

$321.4M

$269.6M

$132.3M

Revenue

2006

2005

2004

2003

CNSL

5

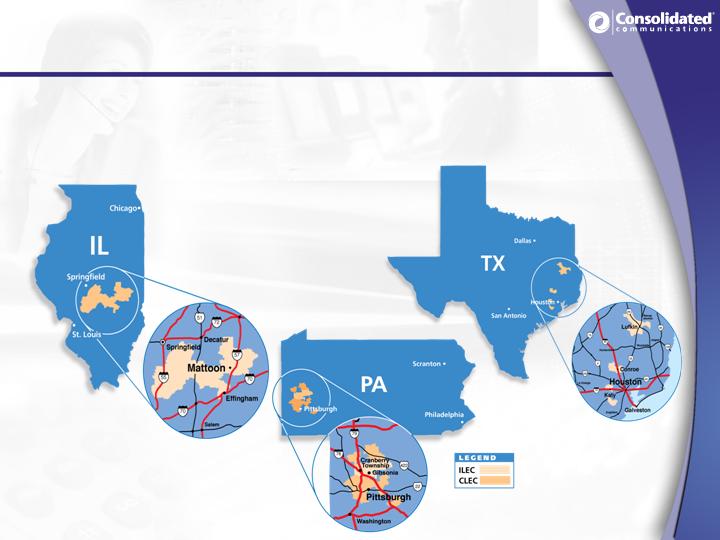

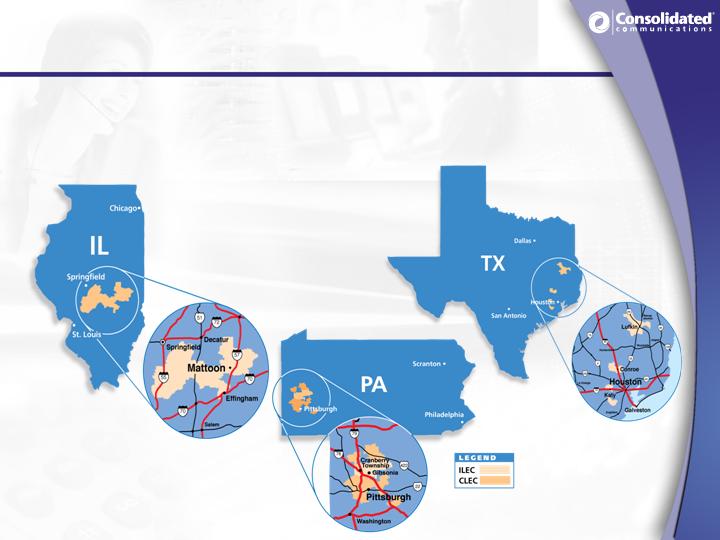

Operations in Illinois, Texas and

Pennsylvania

ILEC markets are a balance of both rural and

suburban markets

6

Texas – A large engineering construction company, KBR, has reported

it will be building a 900,000 square foot facility in our Katy market

centralizing approximately 4,500 employees

Pennsylvania – Westinghouse is consolidating its nuclear division in

Cranberry Woods, which is reported to bring as many as 3,000

employees to our service area

Construction is underway and we are providing services today.

Illinois – Futuregen is near-zero emission coal fired power plant that

has selected Mattoon, IL as site and would produce about 3,000

temporary construction jobs and about 200 full-time positions.

Future depends on Department of Energy’s support of project.

Attractive Markets

Suburban markets continue to expand:

7

Westinghouse – Cranberry, PA

8

Regulatory Landscape

The regulatory environment is stable.

We have very good relations with the FCC and the state Public Utility

Commissions.

We support appropriate intercarrier compensation reform

Have been and continue to be actively involved in broad reform

that will support ongoing investment in rural America

The rules and applications for the Broadband Stimulus are still in

development.

We are actively involved and plan to pursue any opportunity that

helps support expansion and increased speeds.

Regulatory Environment

9

Experienced & Operations-Focused

Management Team

Executive

Title

Telecom

Experience

Bob Currey

President & CEO

39 Years

Steve Childers

Senior Vice President &

Chief Financial Officer

23 Years

Joe Dively

Senior Vice President

23 Years

Steve Shirar

Senior Vice President

27 Years

Bob Udell

Senior Vice President

21 Years

Chris Young

Chief Information Officer

22 Years

Richard Lumpkin

Chairman

48 Years

CCI Date of

Initial Hire

1990

1986

1991

1996

1993

1985

1963

10

Executing on our Strategy

Sustain

and grow

cash flow

Increase

revenue

per customer

Improve

operating

efficiency

Pursue selective

acquisitions

Maintain

effective capital

deployment

11

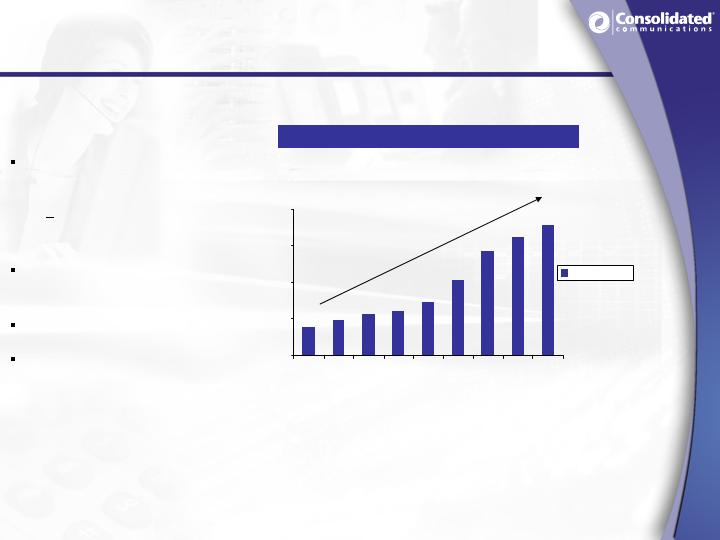

Increase Revenue per Customer

DSL Subscriber Growth

Q1'09

Q4'08

Q2'08

Q4'07

Q2'07

Q4'06

Q2'06

Q4'05

100,000

85,000

70,000

55,000

40,000

IPTV Subscriber Growth

Attractive, feature rich

broadband offerings

Multiple DSL speeds

and price points

Higher margin products

IPTV enables the Triple

Play offering

Enhances the value of

the bundle and

deepens customer

relationships

0

3,000

6,000

9,000

12,000

15,000

18,000

Q4'05

Q2'06

Q4'06

Q2'07

Q4'07

Q2'08

Q4'08

Q1'09

Pro-Forma IL, TX & PA

Pro-Forma IL, TX & PA

12

Broadband Penetration

* Data based on company reports and Wall Street Research

Q109 DSL Penetration

% of ILEC Access Lines

36%

34%

34%

33%

27%

26%

18%

0%

5%

10%

15%

20%

25%

30%

35%

40%

CNSL

WIN

CTL

IWA

FTR

EQ

FRP

13

IPTV Service in all markets

A robust offering with over 200 all-digital channels,

premium movie packages and over a 1000 hours of

movies on demand

14

Video Drives Incremental Revenue Per Customer

IPTV enables the Triple Play offering

Incremental Product Rollout

Leverages existing resources and IP Backbone/ADSL 2+

Future CapEx is success based

Enhances the value of the bundle and deepens customer

relationships

Service available in all markets

18,207 total video subscribers

Approx. 148,000 homes passed

Doubled HD channels in 2008 – will do the same in 2009

Q2 2008, rolled out IPTV service in PA and DVR in all states

15

ILEC VOIP

ILEC VOIP Subscriber Growth

Maintains customer

relationship

Save opportunity for

line disconnection

Provides new customer

opportunities

Triple play bundle.

Competes head-to-head

with cable provider.

0

2,000

4,000

6,000

8,000

Q1'07

Q2'07

Q3'07

Q4'07

Q1'08

Q2'08

Q3'08

Q4'08

Q1'09

IL, TX & PA

16

PA ILEC Access Line Trends

-2.6%

-3.8%

-4.8%

-5.1%

-9.1%

-10.0%

-10.0%

-9.5%

-8.0%

-6.8%

-6.5%

-5.4%

-5.7%

-12.0%

-10.0%

-8.0%

-6.0%

-4.0%

-2.0%

0.0%

Q405

Q106

Q206

Q306

Q406

Q107

Q207

Q307

Q407

Q108

Q208

Q308

Q408

Competition launches

VOIP

CNSL announces

NPSI acquisition

CNSL closes

NPSI acquisition

CNSL launches

IPTV

17

CLEC Overview

True “edge-out” strategy, which leverages ILEC network, human capital skills

and reputation in the surrounding markets

Cash flow positive due to focus on success-based capital expenditures

Focus on small to mid-sized business customers (5 to 500 lines), educational

institutions and healthcare facilities

Operates an extensive SONET optical network with over 300 route miles of fiber

optic facilities in the Pittsburgh metropolitan market

Focus is on migrating to an on-net, ethernet and VoIP delivery system

18

Disciplined Capital Deployment

IP platform supports triple play, increased data speeds and new

products

Delivering an all digital video signal over existing fiber/copper network

96% of total access lines are DSL-capable in Illinois and Texas, 100%

in Pennsylvania

Technology investments, which enable operating expense reductions

Historically capital spending has run 10% -12% of revenue

2009 Cap ex Guidance is $42 million to $43 million

Cap ex focused on enhancing revenue, service quality and

efficiency gains

19

CNSL Acquisition Criteria

Attractiveness of the markets

North Pittsburgh:

High growth, affluent markets

Edge-out CLEC provides synergy with ILEC

Wireless partnerships overlap with ILEC and CLEC markets

Quality of the network

North Pittsburgh:

Well maintained plant

Short loops enable higher broadband speeds and efficient video overlay

Ability to integrate efficiently

North Pittsburgh:

Leverage existing, proven systems and processes

Potential for operating synergies

North Pittsburgh:

$7-$11 million annually in estimated Op Ex savings

$3-$6 million annually in estimated Cap Ex savings

Cash flow accretive

North Pittsburgh:

Improves dividend payout ratio

20

PA Integration Update

Integration efforts ahead of schedule and synergies.

Exceeded 2008 synergies Opex synergies by 10%.

Ahead of plan for 2009 synergies.

Substantial savings realized from multiple system integrations.

IPTV launched within four months of close.

Last system migration will complete in June.

21

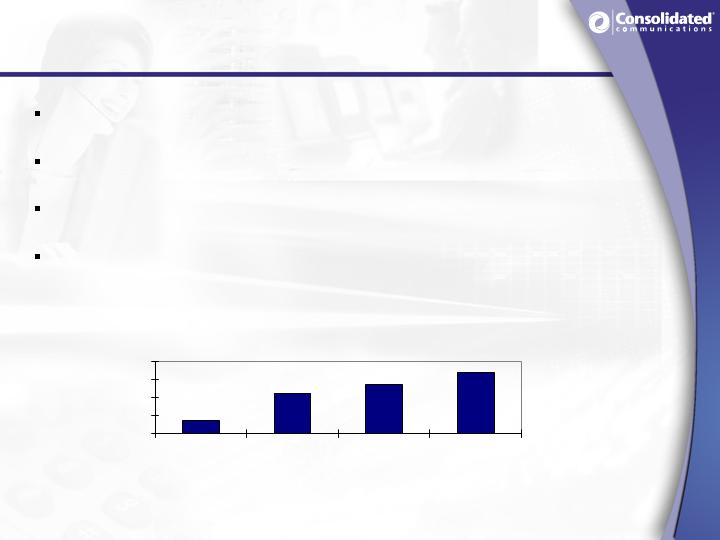

Wireless Partnerships

In addition to its core business, CNSL derives a portion of its cash

flow from five wireless partnerships.

All are managed by Verizon Wireless and overlap with our ILEC and

CLEC markets.

All have experienced solid revenue, operating income, cash

distribution and subscriber growth over the past few years.

Contribution for the first quarter of 2009 was $5.1 million.

Cash Distributions from Wireless Partnerships

$ in millions

$4.0

$8.0

$12.0

$16.0

$20.0

2005

2006

2007

2008

22

Cash Available for Dividends vs. Access Lines

Stable CAPD despite Access Line loss.

Q307 excludes $2.1M subsidy true up

Cash Available for Dividends

$000's

0

50,000

100,000

150,000

200,000

250,000

Q1 '07

Q2 '07

Q3 '07

Q4 '07

Q1 '08

Q2 '08

Q3 '08

Q4 '08

Q1 '09

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

Res Lines

Bus Lines

CAPD

23

CNSL Delivering Strong Financial Results…

($ in millions)

2005

2006

2007

(1)

2008

Q109

CNSL

Revenue

321.4

$

320.8

$

329.2

$

418.4

$

101.7

$

Adjusted EBITDA

136.8

$

139.8

$

143.8

$

189.8

$

45.3

$

Cash Provided by Operating Activities

72.5

$

84.6

$

82.1

$

92.4

$

19.4

$

CapEx

31.1

$

33.4

$

33.5

$

48.0

$

10.2

$

Payout Ratio

(1)

68.9%

76.6%

75.9%

71.6%

64.3%

CNSL Balance Sheet

Total Cash and Marketable Securities

31.4

$

26.7

$

34.3

$

15.5

$

13.3

$

Total Debt

555.0

$

594.0

$

893.0

$

881.0

$

881.0

$

Net Leverage

3.8x

4.1x

4.6x

4.6x

4.7x

(1) Balance Sheet data includes impact of the North Pittsburgh acquisition closed and funded on Dec. 31, 2007.

24

Advanced IP Network

Leading Operating

Metrics

Investment Highlights

Growing Free Cash

Flow

Attractive and

Stable Markets

Sustainable and

Attractive Dividend

Yield

Experienced

Management Team

25

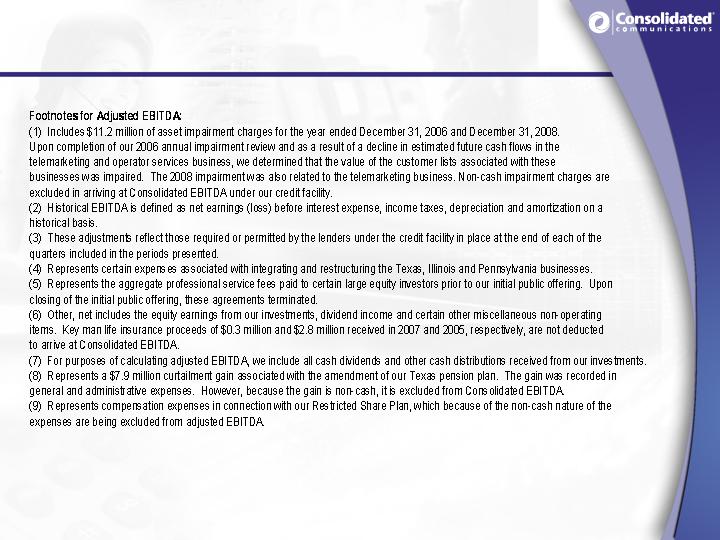

Regulation G Disclaimer

This presentation includes certain non-GAAP financial measures. Each of our earnings releases providing

quarterly results has been posted to the investor relations section of our website at www.consolidated.com.

Each release provides an explanation of the use of non-GAAP financial measures and contains

reconciliations of these measures to their nearest GAAP equivalent.

26

GAAP Reconciliation

This presentation, includes disclosures regarding “EBITDA”, “Adjusted EBITDA”, “cash available to pay

dividends”, “total net debt to last twelve month Adjusted EBITDA coverage ratio”, “adjusted diluted net income,”

and “adjusted net income per share”, all of which are non-GAAP financial measures. Accordingly, they should

not be construed as alternatives to net cash from operating or investing activities, cash and cash equivalents,

cash flows from operations, net income (loss) or net income (loss) per share as defined by GAAP and are not,

on their own, necessarily indicative of cash available to fund cash needs as determined in accordance with

GAAP. In addition, not all companies use identical calculations, and the non-GAAP financial measures may not

be comparable to other similarly titled measures of other companies. A reconciliation of the differences between

these non-GAAP financial measures and the most directly comparable financial measures presented in

accordance with GAAP is included in the tables that follow.

Adjusted EBITDA is comprised of EBITDA, adjusted for certain items as permitted or required by the lenders

under the credit facility in place at the end of each quarter in the periods presented. The tables that follow

include an explanation of how Adjusted EBITDA is calculated for each of the periods presented.

EBITDA is defined as net earnings (loss) before interest expense, income taxes, depreciation and amortization

on an historical basis. We believe net cash provided by operating activities is the most directly comparable

financial measure to EBITDA under GAAP. EBITDA is a non-GAAP financial measure.

Cash available to pay dividends represents Adjusted EBITDA plus cash interest income less (1) cash interest

expense, (2) capital expenditures, and (3) cash taxes.

We present Adjusted EBITDA and cash available to pay dividends for several reasons. Management believes

Adjusted EBITDA and cash available to pay dividends are useful as a means to evaluate our ability to fund our

estimated uses of cash (including interest on our debt) and pay dividends. In addition, we have presented

Adjusted EBITDA and cash available to pay dividends to investors in the past because they are frequently used

by investors, securities analysts and other interested parties in the evaluation of companies in our industry, and

management believes presenting them here provides a measure of consistency in our financial reporting.

Adjusted EBITDA and cash available to pay dividends, referred to as Available Cash in our credit agreement,

are also components of the restrictive covenants and financial ratios contained in the agreements governing our

debt that require us to maintain compliance with these covenants and limit certain activities, such as our ability to

incur debt and to pay dividends.

27

GAAP Reconciliation cont…

The definitions in these covenants and ratios are based on Adjusted EBITDA and cash available to pay

dividends after giving effect to specified charges. We present other information related to the non-GAAP

financial measures, specifically “total net debt to last twelve month Adjusted EBITDA coverage ratio,”

principally to put these other measures in context and facilitate comparisons by investors, security analysts

and others; this ratio differs in certain respects from the similar ratio used in our credit agreement. As a

result, management believes the presentation of Adjusted EBITDA and cash available to pay dividends, as

supplemented by “total net debt to last twelve months Adjusted EBITDA coverage ratio,” provides

important additional information to investors. In addition, Adjusted EBITDA and cash available to pay

dividends provide our board of directors with meaningful information to determine, with other data,

assumptions and considerations, our dividend policy and our ability to pay dividends under the restrictive

covenants in the agreements governing our debt and to measure our ability to service and repay debt.

These non-GAAP financial measures have certain shortcomings. In particular, Adjusted EBITDA does not

represent the residual cash flows available for discretionary expenditures, since items such as debt

repayment and interest payments are not deducted from such measure. Similarly, while we may generate

cash available to pay dividends, we are not required to use any such cash to pay dividends, and the

payment of any dividends is subject to declaration by our board of directors, compliance with applicable

law and the terms of our credit agreement.

Because Adjusted EBITDA is a component of the Dividend Payout Ratio and the ratio of total net debt to

last twelve month Adjusted EBITDA, these measures are also subject to the material limitations discussed

above. In addition, the ratio of total net debt to last twelve month Adjusted EBITDA is subject to the risk

that we may not be able to use the cash on the balance sheet to reduce our debt on a dollar-for-dollar

basis. Management believes these ratios are useful as a means to evaluate our ability to incur additional

indebtedness in the future and, together with adjusted net income and adjusted diluted net income per

share, assist investors, securities analysts and other interested parties in evaluating both our company

over time and the relative performance of the companies in our industry.

28

Adjusted EBITDA Reconciliation

($ in thousands)

IL& TX

2005

IL& TX

2006

IL& TX

2007

IL, TX & PA

2008

IL, TX & PA

Q1 2009

Historical EBITDA:

Net cash provided by operating activities

72,475

$

84,593

$

82,069

$

92,411

$

19,354

$

Adjustments:

Pension curtailment gain

7,880

-

-

-

-

Compensation from restricted share plan

(8,590)

(2,482)

(4,034)

(1,901)

(433)

Loss on extinguishment of debt

-

-

(10,323)

(9,224)

-

Intangible asset impairment (1)

-

(11,240)

-

(6,050)

-

Extraordinary gain, net of tax

-

-

-

7,240

-

Other adjustments, net

(19,068)

3,157

(3,781)

46,053

1,443

Changes in operating assets and liabilities

10,220

6,669

2,828

(24,347)

5,010

Interest expense, net

53,443

42,899

56,780

66,292

14,470

Income taxes

10,935

405

4,674

6,639

2,386

Historical EBITDA (2)

127,295

124,001

128,213

177,113

42,230

Adjustments to EBITDA (3)

Integration and restructuring (4)

7,400

3,684

1,187

4,847

2,380

Professional service fees (5)

2,867

-

-

-

-

Other, net (6)

(3,036)

(7,143)

(6,567)

(19,918)

(4,904)

Investment distributions (7)

1,590

5,516

6,586

17,778

5,159

Pension curtailment gain (8)

(7,880)

-

-

-

-

Loss on extinguishment of debt

-

-

10,323

9,224

-

Intangible assets impairment (1)

-

11,240

-

6,050

-

Extraordinary gain, net of tax

-

-

-

(7,240)

-

Non-cash compensation (9)

8,590

2,482

4,034

1,901

433

Adjusted EBITDA

136,826

$

139,780

$

143,776

$

189,755

$

45,298

$

29

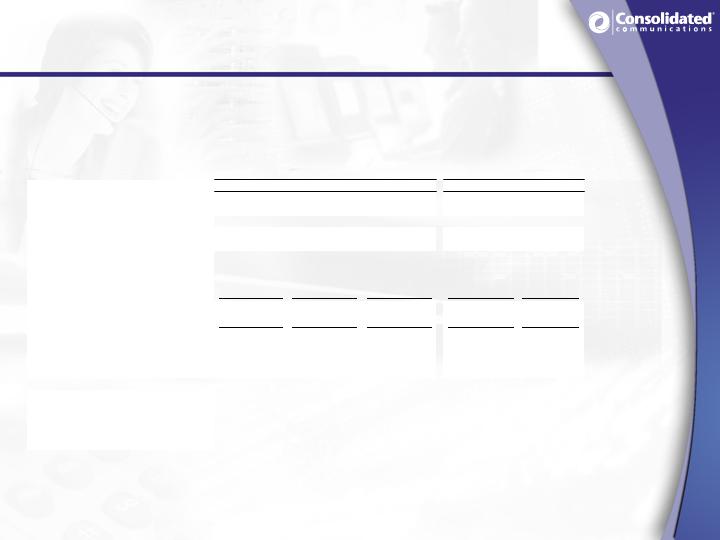

Adjusted EBITDA Reconciliation

30

Cash Available to Pay Dividends

($ in thousands)

IL, TX & PA

IL, TX & PA

2005

2006

2007

YE 2008

Q1 - 2009

Adjusted EBITDA

35,626

$

139,780

$

143,776

$

189,755

$

45,298

$

- Cash interest expense

(9,384)

(40,613)

(44,222)

(65,061)

(14,085)

- Capital Expenditures

(9,498)

(33,388)

(33,495)

(48,027)

(10,157)

+ Proceeds from asset sales

(1)

-

6,594

-

-

-

- Cash income taxes

(172)

(8,237)

(13,976)

(13,540)

(3,153)

+ Cash interest income

174

745

893

367

21

- Principal payments on debt

-

-

-

-

(224)

- Repurchases of stock

-

(87)

-

-

-

Cash available to pay dividends

16,746

$

64,794

$

52,976

$

63,494

$

17,700

$

Quarterly Dividend

11,537

$

44,593

$

40,195

$

45,449

$

11,388

$

Payout Ratio

68.9%

68.8%

75.9%

71.6%

64.3%

(1) Represents $673 of proceeds from the sale of idle property and $5,921 of proceeds from the redemption of class C

shares of RTB stock.

IL and TX Year Ended December 31,

31

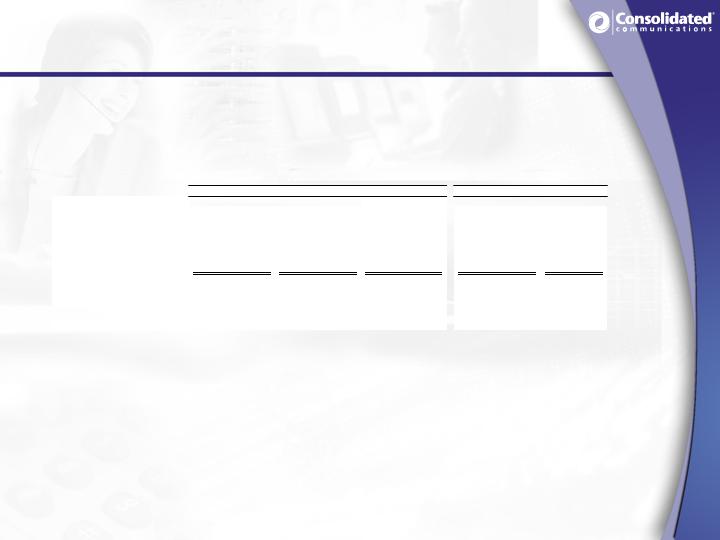

Total Net Debt to Adjusted EBITDA Ratio

($ in thousands)

IL, TX & PA

IL, TX & PA

2005

2006

2007

YE 2008

Q1 - 2009

Summary of Outstanding Debt

Senior Notes

130,000

$

130,000

$

130,000

$

-

$

-

$

Term loan

425,000

464,000

760,000

880,000

880,000

Capital Leases

-

-

2,646

1,266

1,042

Total debt as of December 31, 2007

555,000

$

594,000

$

892,646

$

881,266

$

881,042

$

Less cash on hand

(31,409)

(26,672)

(37,297)

(15,471)

(13,347)

Total net debt

523,591

$

567,328

$

855,349

$

865,795

$

867,695

$

Adjusted EBITDA for the trailing

twelve months.

136,826

$

139,780

$

187,000

$

189,755

$

185,862

$

Total Net Debt to Adjusted EBITDA

3.8

4.1

4.6

4.6

4.7

IL and TX Year Ended December 31,

32