UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended September 30, 2012 |

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to . |

Commission file number: 001-35377

INERGY MIDSTREAM, L.P.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 20-1647837 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Two Brush Creek Boulevard, Suite 200, Kansas City, Missouri 64112

(Address of principal executive offices) (Zip Code)

(816) 842-8181

(Registrant’s telephone number including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Units representing limited partnership interests | | The New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer ¨ | | | | Accelerated filer ¨ |

Non-accelerated filer x | | (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of March 30, 2012, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's common units held by non-affiliates of the registrant was $382.1 million based on a closing price of $20.91 per common unit as reported on the New York Stock Exchange on such date.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated by reference into the indicated parts of this report: None.

INERGY MIDSTREAM, L.P.

INDEX TO ANNUAL REPORT ON FORM 10-K

|

| | |

| | | Page |

| | | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| Mine Safety Disclosures | |

| | | |

| | | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | | |

| | | |

| | |

GLOSSARY

The terms below are common to our industry and used throughout this report.

|

| |

| /d | per day |

| Balancing services | Services pursuant to which natural gas storage customers pay fees to help balance and true up their deliveries to, or takeaways of natural gas from, storage facilities. |

| Barrel (bbl) | One barrel of petroleum products equal to 42 U.S. gallons. |

| Base gas | A quantity of natural gas held within the confines of the natural gas storage facility and used for pressure support and to maintain a minimum facility pressure. May consist of injected base gas or native base gas. Also known as cushion gas. |

| Bcf | One billion cubic feet of natural gas. A standard volume measure of natural gas products. |

| Cycle | A complete withdrawal and injection of working gas. |

| Dth | One dekatherm of natural gas. |

| FERC | Federal Energy Regulatory Commission. |

| Firm service | Services pursuant to which customers receive an assured, or “firm”, right to (i) in the context of storage service, store product in the storage facility or (ii) in the context of transportation service, transport product through a pipeline, over a defined period of time. |

| GAAP | Generally Accepted Accounting Principles. |

| Gas storage capacity | The maximum volume of natural gas that can be cost-effectively injected into a storage facility and extracted during the normal operation of the storage facility. Gas storage capacity excludes base gas. |

| Hub | Geographic location of a natural gas storage facility and multiple pipeline interconnections. |

| Hub services | With respect to our natural gas operations, the following services: (i) interruptible storage services, (ii) firm and interruptible park and loan services, (iii) interruptible wheeling services, and (iv) balancing services. |

| Injection rate | The rate at which a customer is permitted to inject natural gas into a natural gas storage facility. |

| Interruptible service | Services pursuant to which customers receive only limited assurances regarding the availability of (i) with respect to natural gas storage services, capacity and deliverability in storage facilities or (ii) with respect to natural gas transportation services, capacity and deliverability from receipt points to delivery points. Customers pay fees for interruptible services based on their actual utilization of the storage or transportation assets. |

| Local distribution companies (LDCs) | The local gas utility companies that transport natural gas from interstate and intrastate pipelines to retail and industrial customers through small-diameter distribution pipelines. |

| Liquefied natural gas (LNG) | Natural gas that has been cooled to minus 161 degrees Celsius for transportation, typically by ship. The cooling process reduces the volume of natural gas by 600 times. |

| Mcf | One thousand cubic feet of natural gas. We have converted throughput numbers from a heating value number to a volumetric number based upon a conversion factor of 1 MMbtu equals 1 Mcf. |

| MMbtu | One million British thermal units, which is approximately equal to one Mcf. One British thermal unit is equivalent to an amount of heat required to raise the temperature of one pound of water by one degree. |

| MMcf | One million cubic feet of natural gas. |

| Natural gas | A gaseous mixture of hydrocarbon compounds, the primary one being methane, but other components include ethane, propane and butane. |

| Natural Gas Act | Federal law enacted in 1938 that established the FERC's authority to regulate interstate pipelines. |

| Natural gas liquids (NGLs) | Those hydrocarbons in natural gas that are separated from the natural gas as liquids through the process of absorption, condensation, adsorption or other methods in natural gas processing or cycling plants. Natural gas liquids include natural gas plant liquids (primarily ethane, propane, butane and isobutane) and lease condensate (primarily pentanes produced from natural gas at lease separators and field facilities). |

| Park and loan services | Services pursuant to which natural gas storage customers receive the right to store natural gas in (park), or borrow natural gas from (loan), storage facilities on a seasonal basis. |

| Reservoir | An underground formation that originally contained crude oil or natural gas, or both. |

|

| |

| Salt cavern | A man-made cavern developed in a salt dome or salt beds by leaching or mining of the salt. |

| Wheeling | The transportation of natural gas from one pipeline to another pipeline through the pipeline facilities of a natural gas storage facility. The gas does not flow into or out of actual storage, but merely uses the surface facilities of the storage operation. |

| Wheeling services | Services pursuant to which natural gas customers pay fees for the limited right to move a volume of natural gas from one interconnection point through storage and redelivering the natural gas to another interconnection point. |

| Withdrawal rate | The rate at which a customer is permitted to withdraw gas from a natural gas storage facility. |

| Working gas | Natural gas in a storage facility in excess of base gas. Working gas may or may not be completely withdrawn during any particular withdrawal season. |

| Working gas storage capacity | See gas storage capacity (above). |

PART I

Item 1. Business.

Unless the context requires otherwise, references to “we,” “us,” “our,” “our company,” “Inergy Midstream” and like terms refer to Inergy Midstream, L.P. and its consolidated subsidiaries. Unless otherwise indicated, information contained herein is reported as of September 30, 2012.

Introduction

Inergy Midstream, L.P. is a publicly-traded Delaware limited partnership formed in November 2011. We are a predominantly fee-based, growth-oriented partnership that develops, acquires, owns and operates midstream energy assets. We are headquartered in Kansas City, Missouri, and our common units representing limited partner interests are listed on the New York Stock Exchange under the symbol “NRGM”.

We conduct business through our subsidiaries, which own and operate natural gas and NGL storage and transportation facilities and a salt production business located in the Northeast region of the United States. We have two reporting segments: (i) storage and transportation and (ii) salt. Our storage and transportation reporting segment includes four natural gas storage facilities with an aggregate working gas storage capacity of approximately 41.0 Bcf; natural gas pipeline facilities with 905 MMcf/d of transportation capacity; and a 1.5 million barrel NGL storage facility. Our salt reporting segment includes the assets and operations of our wholly-owned subsidiary, US Salt, LLC ("US Salt"), a leading solution mining and salt production company.

Our primary business objective is to increase the cash distributions that we pay to our unitholders by growing our business through the development, acquisition and operation of additional midstream assets situated near major shale production and end user demand centers. An integral part of our growth strategy entails the continued development of our platform of interconnected natural gas assets in the Northeast that can be operated as an integrated storage and transportation hub. We expect our growth strategy to reflect our desire to diversify our operations, in terms of both our geographic footprint and the type of midstream services we provide to customers.

Consistent with our growth and diversification goals, on November 3, 2012, we entered into an agreement to acquire Rangeland Energy, LLC (“Rangeland Energy”) for $425 million, subject to certain performance goals and working capital adjustments. Rangeland Energy owns and operates an integrated crude oil rail and truck terminal, storage and pipeline facilities (the “COLT Hub”) located in Williams County, North Dakota in the heart of the Bakken and Three Forks shale oil-producing region. The Colt Hub primarily consists of 720,000 barrels of crude oil storage, two 8,700-foot rail loops, an eight-bay truck unloading rack, and 21-mile bidirectional crude oil pipeline that connects the terminal to crude oil gathering systems and crude oil interstate pipelines. We expect to complete the Rangeland Energy acquisition in calendar 2012. See “Recent Developments” for additional information.

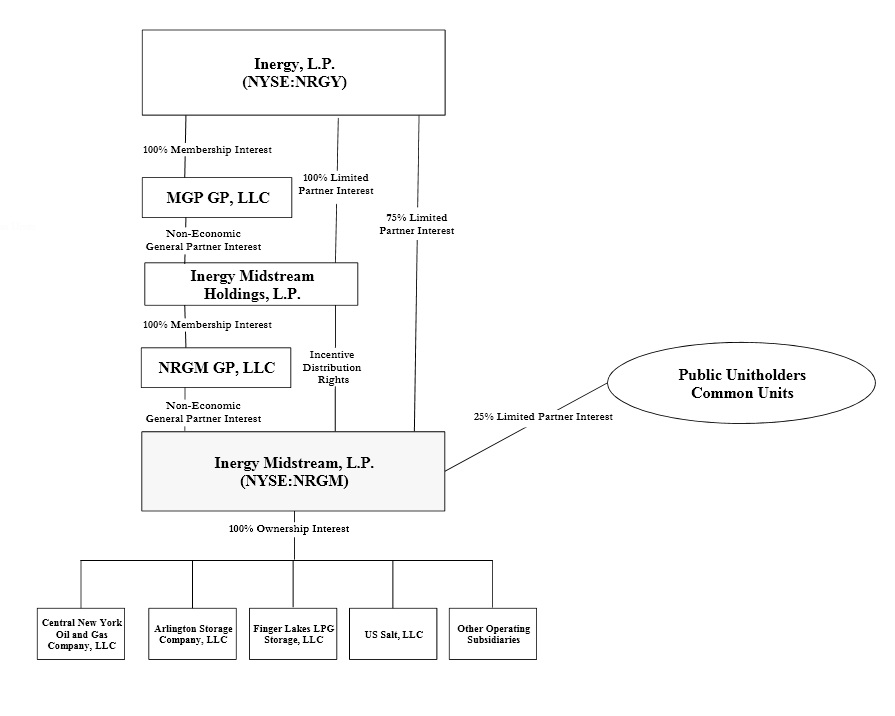

Ownership Structure

The diagram below reflects a simplified version of our ownership structure:

We were formed by Inergy, L.P. ("Inergy") on November 14, 2011. We were formed by converting Inergy Midstream, LLC from a Delaware limited liability company into a Delaware limited partnership named Inergy Midstream, L.P. This conversion occurred as part of our initial public offering, which closed December 21, 2011. Our non-economic general partner interest is held by NRGM GP, LLC, which we refer to as our "general partner" and which is indirectly owned by Inergy. Inergy also indirectly owns all of our incentive distribution rights ("IDRs") and directly owns approximately 75% of our common units representing limited partnership interests as of September 30, 2012.

Our Assets

Storage and Transportation

We own and operate four high-performance natural gas storage facilities located in New York and Pennsylvania that have an aggregate working gas storage capacity of approximately 41.0 Bcf, which we believe makes us the largest independent natural gas storage provider in the Northeast. Our storage facilities have low maintenance costs, long useful lives and comparatively high cycling capabilities. The interconnectivity of our storage facilities with interstate pipelines offers flexibility to shippers in the Northeast, and our facilities are located in close proximity to the Northeast demand market and a prolific supply source, the Marcellus shale. Our natural gas storage facilities, all of which generate fee-based revenues, include:

| |

| • | Stagecoach, a multi-cycle, depleted reservoir storage facility located approximately 150 miles northwest of New York City in Tioga County, New York and Bradford County, Pennsylvania. Stagecoach, which is owned and operated by our subsidiary, Central New York Oil And Gas Company, L.L.C. ("CNYOG"), has 26.25 Bcf of certificated working gas capacity. Its 24-mile, 30-inch diameter south pipeline lateral connects the storage facility to Tennessee Gas Pipeline's ("TGP") 300 Line, and its 10-mile, 20-inch diameter north pipeline lateral connects to the Millennium Pipeline ("Millennium"). As of September 30, 2012, 100% of Stagecoach's available storage capacity is contracted; |

| |

| • | Thomas Corners, a multi-cycle, depleted reservoir storage facility in Steuben County, New York. Thomas Corners, which is owned and operated our subsidiary, by Arlington Storage Company, LLC ("ASC"), has 7.0 Bcf of certificated working gas capacity. Its 8-mile, 12-inch diameter pipeline lateral connects the storage facility to TGP's 400 Line, and its 7.5-mile, 8-inch diameter pipeline lateral connects to Millennium. As of September 30, 2012, 100% of Thomas Corners' available storage capacity is contracted; |

| |

| • | Steuben, a single-turn, depleted reservoir storage facility in Schuyler County, New York. Steuben, which is owned and operated by our subsidiary, Steuben Gas Storage Company ("Steuben Gas Storage"), has 6.2 Bcf of certificated working gas capacity. Its 12.5-mile, 12-inch diameter pipeline lateral connects the storage facility to the Dominion Transmission Inc. ("Dominion") system, and a 6-inch diameter pipeline measuring less than one mile connects our Steuben and Thomas Corners storage facilities. As of September 30, 2012, 100% of Steuben's available storage capacity is contracted; and |

| |

| • | Seneca Lake, a multi-cycle, bedded salt storage facility in Schuyler County, New York. Seneca Lake, which is owned and operated by ASC, has 1.45 Bcf of certificated working gas capacity. Its 19-mile, 16-inch diameter pipeline lateral connects the storage facility to Millennium and Dominion's system. We acquired the Seneca Lake facility from New York State Electric & Gas Corporation ("NYSEG") on July 13, 2011. As of September 30, 2012, 100% of Seneca Lake's available storage capacity is contracted. |

The following provides additional information about our natural gas storage facilities:

|

| | | | | | | | | | | | | | | | |

| Facility Name/ Location | | Cycling Capability (Number of Cycles per Year) | | Certificated Working Gas Storage Capacity (Bcf) | | Maximum Injection Rate (MMcf/d) | | Maximum Withdrawal Rate (MMcf/d) | | Pipeline Connections |

Stagecoach Tioga County, NY; Bradford County, PA | | 2x | | 26.25 |

| | | 250 |

| | | 500 |

| | | TGP's 300 Line; Millennium; Transco's Leidy Line(1) |

Thomas Corners Steuben County, NY | | 2x | | 7.0 |

| | | 70 |

| | | 140 |

| | | TGP's 400 Line; Millennium; Dominion(2) |

Seneca Lake Schuyler County, NY | | 12x(3) | | 1.45 |

| | | 72.5 |

| | | 145 |

| | | Dominion; Millennium |

Steuben Steuben County, NY | | 1x | | 6.3 |

| | | 30 |

| | | 60 |

| | | TGP's 400 Line; Millennium; Dominion(4) |

| Total | | | | 41.0 |

| | | 422.5 |

| | | 845 |

| | | |

| |

| (1) | Stagecoach's south lateral will be connected to Transco's Leidy Line as a result of our MARC I Pipeline. |

| |

| (2) | Thomas Corners is connected to Dominion indirectly through our Steuben facility. |

| |

| (3) | Seneca Lake was designed for 12-turn service, but we operate it as a nine-turn high-deliverability storage facility. |

| |

| (4) | Steuben is connected to TGP and Millennium indirectly through our Thomas Corners facility. |

Our NGL storage assets include the Bath storage facility, a 1.5 million barrel NGL storage facility located near Bath, New York. The facility is located approximately 210 miles northwest of New York City. It is supported by both rail and truck terminal facilities capable of loading and unloading 23 railcars per day and approximately 70 truck transports per day. Our Bath storage facility generates fee-based revenues, and as of September 30, 2012, 100% of its available storage capacity is sold to an affiliate, Inergy Services, LLC ("Inergy Services").

We own natural gas transportation facilities located in New York and Pennsylvania. These facilities have low maintenance costs and long useful lives, and they are located in or near the Marcellus shale. Throughput on our transportation assets can also be expanded at relatively low capital costs. Our natural gas transportation facilities include:

| |

| • | North-South Facilities, which include compression and appurtenant facilities installed to expand transportation capacity on the Stagecoach north and south pipeline laterals. The bi-directional facilities, which are owned and operated by CNYOG, provide 325 MMcf/d of firm interstate transportation service to shippers. The North-South Facilities, which were placed into service on December 1, 2011, generate fee-based revenues under a negotiated rate structure authorized by the FERC; |

| |

| • | MARC I Pipeline, a 39-mile, 30-inch diameter interstate natural gas pipeline that connects the Stagecoach south lateral and TGP's 300 Line in Bradford County, Pennsylvania, with Transcontinental Gas Pipe Line Company, LLC's ("Transco") Leidy Line in Lycoming County, Pennsylvania. The bi-directional pipeline, which is owned and operated by CNYOG, will provide 550 MMcf/d of interstate transportation capacity. It includes a 16,360 horsepower gas-fired compressor station in the vicinity of the Transco interconnection, and a 15,000 horsepower electric-powered compressor station at the proposed interconnection between the Stagecoach south lateral and TGP's 300 Line. We expect to place the MARC I Pipeline into service on December 1, 2012, and it will generate fee-based revenues under a negotiated rate structure authorized by the FERC; and |

| |

| • | East Pipeline, a 37.5 mile, 12-inch diameter natural gas intrastate pipeline located in New York, which transports 30 MMcf/d of natural gas from Dominion to the Binghamton, New York city gate. The pipeline, which is owned and operated by Inergy Pipeline East, LLC ("IPE"), runs within three miles of our Stagecoach north lateral's point of interconnection with Millennium. The East Pipeline generates fee-based revenues under a negotiated rate structure authorized by the New York State Public Service Commission ("NYPSC"). We acquired the East Pipeline (formerly known as the Seneca Lake east pipeline) from NYSEG on July 13, 2011 as part of our acquisition of the Seneca Lake natural gas storage facility. |

The following provides additional information about our natural gas transportation facilities:

|

| | | | | | |

| Facility Name | | Pipeline Diameter (Inches) | | Design Capacity (MMcf/d) | | Pipeline Connections |

| North-South Facilities | | 20 (North lateral); 30 (South lateral) | | 560 (North lateral); 728 (South lateral) | | Millennium (North lateral); TGP's 300 Line (South lateral) |

MARC I Pipeline (1) | | 30 | | 550 | | Stagecoach South Lateral; TGP's 300 Line; Transco's Leidy Line |

| East Pipeline | | 12 | | 30 | | Dominion |

| |

| (1) | The MARC I Pipeline is expected to be placed into commercial service December 1, 2012. |

Salt

We own US Salt, an industry-leading solution mining and salt production company located on the shores of Seneca Lake near Watkins Glen in Schuyler County, New York. US Salt is located in close proximity to our Seneca Lake natural gas storage facility and our Watkins Glen NGL storage development project. It is one of five major solution mined salt manufacturers in the United States, producing evaporated salt products for food, industrial, pharmaceutical and water conditioning uses. US Salt produces and sells more than 300,000 tons of evaporated salt each year, and the solution mining process used by US Salt creates salt caverns that can be converted into natural gas and NGL storage capacity.

We transferred US Salt to Inergy on November 25, 2011 in connection with our initial public offering. On May 14, 2012, we re-acquired US Salt from Inergy for a total purchase price of $192.5 million, including $182.5 million in cash and 473,707 common units.

Growth Projects

MARC I Pipeline

In August 2010, we requested FERC authorization to construct, own and operate the MARC I Pipeline, a 39-mile bi-directional interstate natural gas pipeline that runs through Bradford, Sullivan and Lycoming Counties, Pennsylvania. Before doing so, we entered into binding precedent agreements with four shippers under which they agreed to subscribe for 550 MMcf/d of firm transportation service on the MARC I Pipeline for a period of 10 years. At that time, we expected to receive a FERC certificate order authorizing our pipeline by mid-summer 2011 and to place the pipeline into service by July 2012. Our development plans have taken longer than anticipated due to regulatory delays and legal challenges, however, and the MARC I Pipeline is scheduled to be placed into service on December 1, 2012. As of September 30, 2012, we have incurred aggregate capital costs of approximately $213.5 million for development and construction of the MARC I Pipeline.

In October 2012, the MARC I shippers requested that their volumetric commitments be reduced from 550 MMcf/d to 450 MMcf/d. Under our precedent agreements, the shippers could terminate their contractual obligations if the pipeline was not placed into service on or before October 1, 2012. In response to the request, we agreed to reduce the shippers' volumetric requirements from 550 MMcf/d to 450 MMcf/d and the shippers agreed not to terminate their contracts if the MARC I Pipeline is placed into service on or before January 1, 2013. We have received FERC authorization to place the pipeline into interim service and we are working to complete the final commissioning activity before requesting FERC authorization to place the pipeline into full commercial service on December 1, 2012. We expect to sell all or substantially all of the 100 MMcf/d of turned-back capacity at or near rates payable by the releasing MARC I shippers. If we are unable to sell any such capacity on a firm basis under long-term contracts, then we expect to sell the capacity on an interruptible basis until market conditions support the execution of long-term contracts at acceptable rates.

Watkins Glen NGL Storage Development Project

We are developing a 2.1 million barrel NGL storage facility near Watkins Glen, New York, using existing cavern capacity created by US Salt's solution-mining process. Propane and butane are expected to be stored in these caverns seasonally. The facility will be supported by rail and truck terminal facilities capable of loading and unloading 32 railcars per day and 45 truck transports per day, and will connect with TEPPCO's NGL interstate pipeline. We have entered into a five-year contract with an affiliate, Inergy Services, under which Inergy Services will effectively market the facility's storage capacity for our economic benefit under a pass-through revenue arrangement.

We filed an application with the New York State Department of Environmental Conservation ("NYSDEC") for an underground storage permit in October 2009, and we have encountered delays in the permitting process. We believe we have provided all of the information the NYSDEC requires to issue the requested permit, and we expect to receive the requested permit early next year. Subject to receiving the requested permit and barring any other unexpected delays, we expect to construct and place into service the NGL storage facility within 120 days after receiving the underground storage permit. As of September 30, 2012, we have incurred approximately $44.9 million of aggregate capital costs for the Watkins Glen NGL storage development project.

Truck Rack Expansion and Upgrade

In November 2012, we completed construction of a new truck loading and unloading facilities at our Bath NGL storage facility. The new truck rack has two bays and arms capable of loading and unloading 70 trucks per day. We are also upgrading the existing truck rack to increase the rack's loading and unloading capabilities from 17 trucks to 30 trucks per day, which we expect to complete in December 2012. Upon completion of the upgrade, our truck racks at the Bath facility are expected to be able to load and unload up to 100 trucks per day. As of September 30, 2012, we have incurred approximately $0.9 million of total capital costs for this project. Our affiliate that utilizes and markets all of the Bath storage capacity, Inergy Services, will pay higher annual reservation fees as a result of the new truck rack.

Commonwealth Pipeline Project

In February 2012, we announced plans to jointly market and develop a new interstate natural gas pipeline project with affiliates of UGI Corporation and WGL Holdings, Inc. The Commonwealth Pipeline project is designed to provide a direct, cost-effective basis for moving Marcellus shale gas to growing natural gas demand markets in southeastern Pennsylvania and the Mid-Atlantic markets. The project sponsors held a non-binding open season for capacity on the Commonwealth Pipeline late in the second quarter of calendar 2012. Based on the results of the open season and subsequent discussions with potential shippers, the project sponsors on September 20, 2012 announced that, among other things, (i) the pipeline is expected to run approximately 120 miles to the southern terminus of our MARC I Pipeline to a point of interconnection with several interstate

pipelines in Chester County, Pennsylvania; (ii) the 30-inch diameter pipeline will have an initial capacity of 800 MMcf/d of natural gas; (iii) affiliates of UGI Corporation and WGL Holdings have entered into binding precedent agreements to subscribe for firm transportation service on the Commonwealth Pipeline at negotiated rates under 10-year contracts; and (iv) the sponsors expect to place the pipeline into service in 2015.

The project sponsors are continuing to refine costs, route options and other information required to complete a feasibility study, and assess market demand for the proposed transportation capacity. We remain optimistic that the market will support this low-cost transportation option for providing a direct path for moving local Marcellus shale gas to local demand centers, although we can provide no assurance that the project will be placed into service.

Seneca Lake Expansion (Gallery 2)

In fiscal 2012, we performed pre-construction activity and pursued the regulatory approvals required to expand the working gas capacity of our Seneca Lake natural gas storage facility by approximately 0.5 Bcf. We estimate the total capital cost of this expansion to be approximately $3.0 million. We have filed an application with the NYSDEC for the underground storage permit required to debrine and inject natural gas into the cavern. Upon receipt of the underground storage permit, we will request FERC authorization to place the expansion capacity into natural gas storage service. We expect to place this expansion capacity into service in the second half of calendar 2013.

North-South II Expansion and Extension

In September 2011, we held a non-binding open season to gauge shipper interest in our North-South II expansion project, which involved the installation of pipeline, compression and other facilities to enable shippers to move higher volumes of natural gas on a firm basis through our Stagecoach laterals from TGP's 300 Line to Millennium, and all points in between. As part of this project, we would (i) extend our Stagecoach north lateral approximately three miles to interconnect with the East Pipeline, which would enable shippers to transport volumes from TGP's 300 Line (as well as intermediate points, including Millennium) to the point of interconnection between the East Pipeline and Dominion's system in Tompkins County, New York, and (ii) expand the capacity of the Stagecoach laterals, by installing additional compression or looping, to enable shippers to move higher volumes over the existing pipeline route of the North-South Facilities. We believe the market will desire the additional transportation flexibility provided by this project and are continuing both our commercial discussions with potential shippers and our efforts to acquire the land rights necessary to complete the three-mile extension of the Stagecoach north lateral, although we can provide no assurance that the project will be placed into service.

Other Growth Projects

In May 2012, we connected our Seneca Lake natural gas storage facility to Millennium. We installed this interconnection at a total capital cost of approximately $7.4 million. This interconnection provides our storage customers with greater takeaway and delivery options, which we believe will translate into greater revenues from higher storage rates and increased wheeling services.

We have identified existing salt caverns on US Salt's property that we believe can be converted into natural gas and NGL storage capacity. This storage capacity is in addition to the caverns designated for NGL storage by the Watkins Glen NGL storage development project and the expansion of our Seneca Lake natural gas storage facility by approximately 0.5 Bcf. In the normal course of our business, we periodically review cavern information to assess whether caverns are potential candidates for natural gas or NGL storage conversion, evaluate whether market demand would support developing incremental storage services, and discuss storage opportunities with potential customers. We continue to believe the market will require additional natural gas and NGL storage capacity in the Northeast to help satisfy growing demand, and we believe our solution-mined caverns will be able to provide cost-effective solutions.

Our Services

Storage and Transportation

We contract with customers to provide storage and transportation services on a firm (natural gas and NGL) and interruptible (natural gas only) basis. We seek to maximize the portion of physical capacity sold in our storage facilities and on our pipelines under firm contracts. To the extent the physical capacity that is contracted for firm service is not being fully utilized, we attempt to sell the available capacity on an interruptible basis.

The terms and conditions of the agreements under which we provide interstate storage and transportation services to customers are governed by our FERC tariffs. The general terms and conditions of our tariffs address customary matters such as creditworthiness, extension and termination rights, force majeure, fuel reimbursement and capacity releases. Non-conforming service agreements must be submitted to the FERC for approval.

Firm Storage Services. Firm storage services include storage services pursuant to which customers receive an assured, or “firm,” right to store the commodity in our facilities over a defined period, typically three to five years with respect to our natural gas firm storage contracts. Under our firm storage contracts, we receive fixed monthly capacity reservation fees regardless of whether or not the storage capacity is used. The amount of the monthly reservation fees is typically determined by the number of cycles a customer can fill and empty its contracted storage capacity. Under our firm storage contracts for natural gas storage, we also typically collect a cycling fee based on the volume of natural gas nominated for injection and/or withdrawal and retain a small portion of the gas nominated for injection as compensation for our fuel use. No-notice service, which is commonly referred to as load-following service, is a premium type of firm storage service that entitles natural gas shippers to priority service and provides additional nominating and balancing flexibility.

Transportation Services. We provide interstate and intrastate transportation services. Our customers choose, based upon their particular needs, the applicable mix of services depending upon availability of pipeline capacity, the price of services and the volume and timing of the customer's requirements. Firm transportation customers reserve a specific amount of pipeline capacity at specified receipt and delivery points on our system. Firm customers generally pay fees based on the quantity of capacity reserved regardless of use, plus a commodity and a fuel charge paid on the volume of gas actually transported. Capacity reservation revenues derived from a firm service contract are generally consistent during the contract term. Our firm transportation contracts generally range in term from five to ten years, although we may enter into shorter or longer term contracts. In providing interruptible transportation service, we agree to transport gas for a customer when capacity is available. Interruptible transportation service customers pay a commodity charge only for the volume of gas actually transported, plus a fuel charge. Interruptible transportation agreements have terms ranging from day-to-day to multiple years, with rates that change on a daily, monthly or seasonal basis.

Our interstate transportation services include firm wheeling services and firm and interruptible transportation services provided under our FERC tariffs. We have entered into firm wheeling agreements with five shippers under which we are providing 325 MMcf/d of firm wheeling service to the North-South Facilities shippers at negotiated rates for an initial five-year period. We have entered into firm transportation agreements with four shippers under which we will, upon placement of the MARC I Pipeline into service, provide 450 MMcf/d of firm transportation service to the MARC I shippers at negotiated rates for an initial 10-year period. Our East Pipeline provides intrastate transportation services to NYSEG under a firm transportation service agreement approved by the NYPSC. Under this 10-year contract agreement, we make 30 MMcf/d of transportation capacity available to NYSEG on our East Pipeline for transporting natural gas from Dominion's system to NYSEG's city gates.

Hub Services. With respect to our natural gas storage and transportation operations, hub services include: (i) interruptible storage services, under which customers receive only limited assurances regarding the availability of capacity and deliverability in our storage facilities and pay fees based on their actual utilization of our assets; (ii) firm and interruptible park and loan services, under which customers receive the right to store gas in (park), or borrow gas from (loan), our facilities on a short-term or seasonal basis; (iii) interruptible wheeling services, under which customers pay fees for the limited right to move a volume of natural gas from one interconnection point through storage and redelivering the natural gas to another interconnection point; and (iv) balancing services, under which customers pay us fees to help balance and true up their deliveries of natural gas to, or takeaways of natural gas from, our facilities.

The table below indicates the types of storage and transportation services that we offer to natural gas customers under our FERC tariffs, as of September 30, 2012:

|

| | | | | | | | | | |

| | | | | Facility (FERC-Certificated Operator) |

| Type of Service | | Category of Service(1) | | Stagecoach (CNYOG) | | Thomas Corners (ASC) | | Seneca Lake (ASC) | | Steuben (Steuben Gas)(2) |

| Firm Storage Service | | Firm S/S | | Ÿ | | Ÿ | | Ÿ | | Ÿ |

| Interruptible Storage Service | | Hub | | Ÿ | | Ÿ | | Ÿ | | Ÿ |

| No-Notice Storage Service | | Firm S/S | | | | Ÿ | | Ÿ | | Ÿ |

| Firm Parking Service | | Hub | | | | Ÿ | | Ÿ | | Ÿ |

| Interruptible Parking Service | | Hub | | | | Ÿ | | Ÿ | | Ÿ |

| Firm Loan Service | | Hub | | | | Ÿ | | Ÿ | | Ÿ |

| Interruptible Loan Service | | Hub | | | | Ÿ | | Ÿ | | Ÿ |

| Firm Wheeling Service | | Transport | | Ÿ | | | | | | |

| Interruptible Wheeling Service | | Hub | | Ÿ | | Ÿ | | Ÿ | | Ÿ |

| Enhanced Interruptible Wheeling Service | | Hub | | | | Ÿ | | Ÿ | | Ÿ |

Firm Transportation Service(3) | | Transport | | Ÿ | | | | | | |

| Interruptible Transportation Service | | Transport | | Ÿ | | | | | | |

| Interruptible Hourly Balancing Service | | Hub | | | | Ÿ | | Ÿ | | Ÿ |

(1) "Firm S/S" refers to firm storage services, "Hub" refers to hub services and "Transport" refers to transportation services

(2) Pro forma for pending merger of Steuben Gas Storage with and into ASC.

(3) Assumes the MARC I Pipeline is placed into service.

Salt

Our salt products are manufactured for food, industrial, pharmaceutical and water conditioning applications. We produce evaporated salt products for customers according to customized specifications, and our product line includes food-grade salt, pharmaceutical-grade salt, bulk salt for chemical feedstock, water softening pellets, pool salt and salt blocks. US Salt does not market and distribute products under its own brand.

When we enter into long-term contracts, we attempt to secure minimum volumetric purchase requirements and other appropriate contractual protections. We have entered into a limited number of long-term contracts under which we agreed to provide a fixed volume of product to the customer at certain times over the life of the contract, subject to standard contractual protections like force majeure rights.

Our Customers

Our natural gas storage and transportation customers consist primarily of natural gas LDCs, electric generation companies, natural gas producers, other natural gas pipelines, and natural gas marketing companies. We provide storage and transportation services in both natural gas supply and demand markets.

Our natural gas customers are largely investment-grade customers. For the fiscal year ended September 30, 2012, Consolidated Edison Inc. ("ConEd") accounted for approximately 14% of our total revenue. With respect to our natural gas customers that are either unrated or non-investment grade, we are authorized by our FERC tariffs and policies to request credit support to secure a portion of our customers' obligations.

Our salt customers are largely creditworthy industrial companies, pharmaceutical companies, food manufacturing companies, and distribution companies, including retail companies such as national grocer chains.

Industry Background

Storage and Transportation

The midstream sector of the natural gas industry provides the link between exploration and production and the delivery of natural gas and its components to end-use markets. The midstream sector consists generally of gathering and processing, transportation and storage activities. Our midstream operations focus on storage and transportation activities for natural gas and NGLs.

The fundamentals of the natural gas market create a basic demand for storage. Natural gas is produced at a relatively steady rate throughout the year so natural gas supply is relatively constant. However, natural gas consumption is highly seasonal because the market consumes more natural gas in the winter than can be produced. In contrast, more natural gas is produced in the summer than is consumed, which creates this fundamental need for storage. Natural gas storage acts as the balancing mechanism between supply and demand.

Natural gas storage plays a vital role in maintaining the reliability of natural gas supplies needed to meet consumer demands. Storage facilities are used by pipelines to balance operations, by end users (such as power generation companies and local gas distribution companies) to manage volatility and secure natural gas supplies, and by independent natural gas marketing and trading companies in connection with the execution of their trading strategies. Storage allows for the warehousing of natural gas and is used to inject excess production during periods of low demand (typically, warmer summer months) and to withdraw natural gas during periods of high demand (typically, colder winter months).

As is the case with natural gas storage, natural gas transportation pipelines play a vital role in ensuring gas supplies find a market (i.e., moving supply to demand). Transportation pipelines receive natural gas from other mainline transportation pipelines and gathering systems and deliver the natural gas to industrial end-users, utilities and other pipelines.

A recent shift in supply sources, from conventional to unconventional, has affected the supply patterns, the flows and the rates that can be charged on pipeline systems. The impacts will vary among pipelines according to the location and the number of competitors attached to these new supply sources. These changing market dynamics are prompting midstream companies to evaluate the construction of short-haul pipelines as a means of providing demand markets with cost-effective access to newly-developed production regions, as compared to relying on higher-cost, long-haul pipelines that were originally designed to transport natural gas greater distances across the country.

Demand for natural gas storage can be negatively impacted during periods in which there is a narrow seasonal spread between current and future natural gas prices. The natural gas industry is currently experiencing a significant shift in the sources of supply with prolific new shale plays primarily, and this dramatic change could affect our operations.

Natural gas produced at the wellhead normally contains NGLs. Unprocessed natural gas containing NGLs is generally not acceptable for transportation in the U.S. interstate pipeline system or for commercial use. Processing plants extract the NGLs, leaving residual dry gas that meets interstate pipeline and commercial quality specifications. NGL storage facilities are used for the storage of mixed NGLs and NGL products owned by third-parties in storage tanks and underground wells, which allow for the injection and withdrawal of such products at various times of the year to meet demand cycles.

Salt Production

According to the Salt Institute, a North American based non-profit salt industry trade association, more than 290 million metric tons of salt were produced in the world in calendar 2011. Salt is generally categorized into four types based upon the method of production: evaporated salt, solar salt, rock salt and salt in brine. Dry salt is produced through the following methods: solution mining and mechanical evaporation, solar evaporation or deep-shaft mining. US Salt produces salt using solution mining and mechanical evaporation. In solution mining, wells are drilled into salt beds or domes and then water is injected into the formation and circulated to dissolve the salt. After salt is removed from a solution-mined salt deposit, the empty cavern can be used to store other substances, such as natural gas, NGLs or compressed air.

The salt solution, or brine, is next pumped out of the cavern and taken to a processing plant for evaporation. The brine may be treated to remove minerals and then pumped into vacuum pans in which the brine is boiled, and evaporated until a salt slurry is created. The slurry is then dried and separated. Depending on the type of salt product to be produced, iodine and an anti-caking agent may be added to the salt. Most food grade table salt is produced in this manner.

Regulation

Our operations are subject to extensive regulation by federal, state and local authorities. The regulatory burden on our operations increases our cost of doing business and, in turn, affects our profitability. We have experienced increased and more burdensome regulatory oversight over the past few years and, based on our expectation that this trend will continue for the foreseeable future, we anticipate that greater time and resources will be required to obtain the approvals necessary to acquire, develop, and construct midstream infrastructure. We believe the regulatory environment for projects located in the Northeast is particularly challenging, as public opposition to upstream oil and gas activities has increasingly influenced regulatory processes.

We believe that our operations are in substantial compliance with existing federal, state, and local laws and regulations (including the laws and regulations described below), and that our on-going compliance with applicable law will not have a material adverse effect on our business or results of operations. However, we can provide no assurance that the adoption of new laws and regulations will not add significant costs that could have a material adverse effect on our operations and financial results, or that our results from operations will not be materially and adversely impacted if regulations become more stringent in general. Our inability to obtain or maintain any material permit required to operate or expand our projects could have an adverse impact on our revenues.

Natural Gas Storage and Transportation

Our natural gas storage and transportation operations are subject to extensive federal and state regulation. In particular, our natural gas storage and transportation facilities are subject to regulation by the FERC, and our natural gas pipelines (including storage lateral pipelines) are subject to regulation by the Department of Transportation's ("DOT") Pipeline and Hazardous Materials Safety Administration ("PHMSA").

Under the Natural Gas Act, the FERC has authority to regulate gas transportation services in interstate commerce, which includes natural gas storage services. The FERC exercises jurisdiction over rates charged for services and the terms and conditions of service; the certification and construction of new facilities; the extension or abandonment of services and facilities; the maintenance of accounts and records; the acquisition and disposition of facilities; standards of conduct between affiliated entities; and various other matters. Regulated natural gas companies are prohibited from charging rates determined by the FERC to be unjust, unreasonable, or unduly discriminatory, and both the existing tariff rates and the proposed rates of regulated natural gas companies are subject to challenge.

The rates and terms and conditions of our natural gas storage and transportation services are found in the FERC-approved tariffs of CNYOG, the owner of the Stagecoach facility and laterals, the North-South Facilities and the MARC I Pipeline; Steuben Gas Storage, the owner of the Steuben facility; and ASC, the owner of the Thomas Corners and Seneca Lake facilities. CNYOG and ASC are authorized to charge and collect market-based rates for storage services provided at the Stagecoach, Thomas Corners and Seneca Lake natural gas storage facilities, and CNYOG is authorized to charge and collect negotiated rates for transportation services provided by the North-South Facilities and MARC I Pipeline. Steuben Gas Storage is authorized to charge and collect cost-of-service rates at the Steuben facility. Market-based and negotiated rate authority allows us to negotiate rates with individual customers based on market demand, which we then make public. A loss of market-based or negotiated rate authority or any successful complaint or protest against the rates charged or provided by CNYOG or ASC could have an adverse impact on our revenues.

On August 6, 2010, CNYOG filed an application with the FERC (Docket No. CP10-480) requesting authority to construct, operate and own the MARC I Pipeline. On November 14, 2011, the FERC issued a certificate order granting the requested authorization. On February 13, 2012, the FERC issued an order denying or dismissing all requests for rehearing of the certificate order and a request for stay of that order.

On February 14, 2012, certain of the parties seeking rehearing of the MARC I certificate order filed with the Second Circuit Court of Appeals an appeal and emergency motion for stay of the MARC I certificate. A temporary stay was granted on February 17, 2012, which halted all construction-related activity on the Pipeline until a three-judge panel vacated the temporary stay on February 28, 2012. In March, the Second Circuit granted the request for an expedited hearing briefing schedule for the MARC I certificate appeal. On June 12, 2012, the appellate court held that the FERC properly discharged its responsibilities and summarily dismissed with prejudice petition challenging the MARC I certificate and rehearing orders.

On May 21, 2012, we filed applications with the FERC (Docket Nos. CP12-465 and CP12-466) requesting authority (i) to abandon the FERC tariff held by Steuben Gas Storage and (ii) for ASC to acquire the Steuben facility, via the merger of Steuben Gas Storage into ASC, and to charge marketed-based rates under ASC's tariff for services at the Steuben facility. On October 11, 2012, the FERC issued an order granting the requested authorizations. Effective April 1, 2013, we will have the ability to charge market-based rates for storage service provided by our Thomas Corners, Seneca Lake and Steuben facilities and to provide wheeling services under one tariff (ASC's tariff). Thomas Corners will also effectively be connected to Dominion, and Steuben will effectively be connected to TGP and Millennium, with respect to services offered under ASC's tariff. These actions move us closer toward our goal of developing and operating a fully-integrated natural gas storage and transportation hub in the Northeast.

Our pipelines used to store and transport natural gas are subject to regulation by PHMSA under the Natural Gas Pipeline Safety Act of 1968 ("NGPSA"). The NGPSA regulates safety requirements in the design, installation, testing, construction, operation

and maintenance of natural gas pipeline facilities. The NGPSA has since been amended by the Pipeline Safety Act of 1992, the Pipeline Safety Improvement Act of 2002, and the Pipeline Inspection, Protection, Enforcement, and Safety Act of 2006. These amendments, along with implementing regulations more recently adopted by PHMSA, have imposed additional safety requirements on pipeline operators such as the development of a written qualification program for individuals performing covered tasks on pipeline facilities and the implementation of pipeline integrity management programs. These integrity management plans require more frequent inspections and other preventative measures to ensure pipeline safety in “high consequence areas,” such as high population areas, areas unusually sensitive to environmental damage, and commercially navigable waterways.

Notwithstanding the investigatory and preventative maintenance costs incurred performing routine pipeline management activities, we may incur significant expenses if anomalous pipeline conditions are discovered or due to the implementation of more stringent pipeline safety standards as a result of new or amended legislation. For example, in January 2012, President Obama signed the Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011 (“Pipeline Safety Act”), which requires increased safety measures for gas and hazardous liquids transportation pipelines. Among other things, the Pipeline Safety Act directs the Secretary of Transportation to promulgate rules or standards relating to expanded integrity management requirements, automatic or remote-controlled valve use, excess flow valve use, and leak detection system installation. The Pipeline Safety Act also directs owners and operators of interstate and intrastate gas transmission pipelines to verify their records confirming the maximum allowable pressure of pipelines in certain class locations and high consequence areas, requires promulgation of regulations for conducting tests to confirm the material strength of pipe operating above 30% of specified minimum yield strength in high consequence areas, and increases the maximum penalty for violation of pipeline safety regulations from $1 million to $2 million. PHMSA is also considering changes to its natural gas transmission pipeline regulations to, among other things, expand the scope of "high consequence areas", strengthen integrity management requirements applicable to existing operators; strengthen or expand non-integrity pipeline management standards relating to such matters as valve spacing, automatic or remotely-controlled valves, corrosion protection, and gathering lines; and add new regulations to govern the safety of underground natural gas storage facilities including underground storage caverns and injection or withdrawal well piping that are not regulated today. We cannot predict the final outcome of these legislative or regulatory efforts or the precise impact that compliance with any resulting new requirements may have on our business.

Our natural gas storage operations are also subject to non-rate regulation by various state agencies. For example, the NYSDEC has jurisdiction over the underground storage of natural gas and well drilling, conversion and plugging in New York. The NYSDEC therefore regulates aspects of our Stagecoach, Thomas Corners, Seneca Lake and Steuben natural gas storage facilities.

IPE, as the owner and operator of our East Pipeline, is subject to lightened regulation under NYPSC regulations and policies. Lightened regulation generally exempts IPE from NYPSC regulation applicable to the provision of retail service. IPE remains subject to limited corporate (e.g., obtaining approval prior to any transfer of its ownership interests or the issuance of debt securities) and operational and safety (e.g., filing of vegetation management plan and annual reports detailing the gas volumes transported over the pipeline) regulation established and maintained by the NYPSC.

On September 15, 2011, we filed an application with the NYPSC (Docket No. 11-G-0510) requesting authority to pledge the equity interests of IPE in collateral support of, and to guarantee, up to $3 billion of Inergy's long-term indebtedness. The application described that, upon completion of our initial public offering, the scope of the requested authorization would be limited to pledges and guarantees supporting up to $1.5 billion of long-term indebtedness of Inergy Midstream and its wholly-owned subsidiaries. On December 15, 2011, the NYPSC issued an order granting the requested authorization.

NGL Storage

Our NGL storage operations are also subject to federal, state and local regulatory oversight. For example, our NGL storage operations are subject to non-rate regulation by state agencies. The NYSDEC has jurisdiction over the underground storage of NGLs and well drilling, conversion and plugging in New York. Thus, the NYSDEC regulates aspects of our Bath facility and our proposed Watkins Glen facility.

In October 2009, we filed an application with the NYSDEC for an underground storage permit for our Watkins Glen NGL storage facility. In November 2010, the NYSDEC issued a Positive Declaration for the project. In August 2011, the NYSDEC determined that the Draft Supplemental Environmental Impact Statement we submitted for the project was complete. A public hearing on the project was held in September 2011, and a second public hearing was held in November 2011. In early 2012, based on concerns expressed by interested stakeholders and conversations with NYSDEC Staff, we informed the NYSDEC that we would reduce our environmental footprint and modified our brine pond design. In September 2012, we submitted to the

NYSDEC all final drawings and plans for our revised project design. We expect the NYSDEC to issue an underground storage permit to us early next year.

Salt Production

Our salt production and manufacturing business is highly regulated. Under the Food, Drug and Cosmetic Act, the United States Food and Drug Administration regulates food and pharmaceutical standards applicable to salt products for human consumption and drug products. The United States Environmental Protection Agency ("EPA") administers regulations for emissions control under a Title V air permit, operation and control of solution mining operations, and stormwater pollution prevention for petroleum products. The NYSDEC regulates the drilling and plugging of brine production wells, cooling/process water intake, and wastewater and stormwater discharges. The NYSDEC also administers regulations for bulk petroleum and chemical storage.

Environmental, Health and Safety

In addition, our operations are subject to stringent federal, regional, state and local laws and regulations governing the discharge and emission of pollutants into the environment, environmental protection, or occupational health and safety. These laws and regulations may impose significant obligations on our operations, including the need to obtain permits to conduct regulated activities; restrict the types, quantities and concentration of materials that can be released into the environment; apply workplace health and safety standards for the benefit of employees; require remedial activities or corrective actions to mitigate pollution from former or current operations; and impose substantial liabilities on us for pollution resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of sanctions, including administrative, civil and criminal penalties; the imposition of investigatory, remedial and corrective action obligations or the incurrence of capital expenditures; the occurrence of delays in the development of projects; and the issuance of injunctions restricting or prohibiting some or all of the activities in a particular area.

The following is a summary of the more significant existing environmental laws and regulations, each as amended from time to time, to which our business operations are subject:

| |

| • | The federal Comprehensive Environmental Response, Compensation and Liability Act of 1980, a remedial statute that imposes strict liability on generators, transporters and arrangers of hazardous substances at sites where hazardous substance releases have occurred or are threatening to occur; |

| |

| • | The federal Resource Conservation and Recovery Act, which governs the treatment, storage and disposal of solid wastes, including hazardous wastes; |

| |

| • | The federal Clean Air Act, which restricts the emission of air pollutants from many sources and imposes various pre-construction, monitoring and reporting requirements; |

| |

| • | The federal Water Pollution Control Act, also known as the federal Clean Water Act, which regulates discharges of pollutants from facilities to state and federal waters; |

| |

| • | The federal Safe Drinking Water Act, which ensures the quality of the nation's public drinking water through adoption of drinking water standards and controlling the injection of substances into below-ground formations that may adversely affect drinking water sources; |

| |

| • | The National Environmental Policy Act, which requires federal agencies to evaluate major agency actions having the potential to significantly impact the environment and which may require the preparation of Environmental Assessments and more detailed Environmental Impact Statements that may be made available for public review and comment; |

| |

| • | The federal Endangered Species Act, which restricts activities that may affect federally identified endangered and threatened species or their habitats through the implementation of operating restrictions or a temporary, seasonal, or permanent ban in affected areas; and |

| |

| • | The federal Occupational Safety and Health Act, which establishes workplace standards for the protection of the health and safety of employees, including the implementation of hazard communications programs designed to inform employees about hazardous substances in the workplace, potential harmful effects of these substances, and appropriate control measures. |

Certain of these environmental laws impose strict, joint and several liability for costs required to clean up and restore properties where pollutants have been released regardless of whom may have caused the harm or whether the activity was performed in compliance with all applicable laws. In the course of our operations, generated materials or wastes may have been spilled or released from properties owned or leased by us or on or under other locations where these materials or wastes have been taken for recycling or disposal. In addition, many of the properties owned or leased by us were previously operated by third parties whose management, disposal or release of materials and wastes was not under our control. Accordingly, we may be liable for the costs of cleaning up or remediating contamination arising out of our operations or as a result of activities by others who previously occupied or operated on properties now owned or leased by us. Private parties, including the owners of properties that we lease and facilities where our materials or wastes are taken for recycling or disposal, may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property or natural resource damages. We may not be able to recover some or any of these additional costs from insurance.

We have not received any notices that we have violated these environmental laws and regulations in any material respect and we have not otherwise incurred any material liability or capital expenditures thereunder. Future developments, such as stricter environmental laws or regulations, or more stringent enforcement of existing requirements could affect our operations. For instance, the EPA and other federal and state agencies are considering or have already commenced the study of potential adverse impacts that certain drilling methods (including hydraulic fracturing) may have on water quality and public health, with the U.S. Department of Energy having released a report recommending the implementation of a variety of measures to reduce the environmental impacts from shale-gas production. Similarly, Congress and several states, including New York and Pennsylvania, have proposed or enacted legislation or regulations that are expected to make it more difficult or costly for exploration and production companies to produce natural gas and NGLs. These initiatives, enactments and regulations could have an indirect adverse impact on us by decreasing demand for the storage and transportation services that we offer.

In addition, federal and state occupational safety and health laws require us to organize information about materials, some of which may be hazardous or toxic, that are used, released, or produced in the course of our operations. Certain portions of this information must be provided to employees, state and local governmental authorities and responders, and local citizens in accordance with applicable federal and state Emergency Planning and Community Right-to-Know Act requirements. Our operations are also subject to the safety hazard communication requirements and reporting obligations set forth in federal workplace standards.

Competition

Natural gas storage operators compete for customers based on geographical location, which determines connectivity to pipelines and proximity to supply sources and end-users, as well as operating reliability and flexibility, price, available capacity and service offerings. From an operator's perspective, having a diverse customer group that requires a variety of storage services is important to maximizing asset utilization and capturing incremental revenue opportunities while minimizing costs. An increase in competition in our markets could arise from new ventures or expanded operations from existing competitors.

Our principal competitors in our natural gas storage market include other independent storage providers and major natural gas pipelines. These major pipeline natural gas transmission companies have existing storage facilities connected to their systems that compete with certain of our facilities. The FERC has adopted a policy that favors authorization of new storage projects, and there are numerous natural gas storage options in the New York/Pennsylvania geographic market. Pending and future construction projects, if and when brought on line, may also compete with our natural gas storage operations. These projects may include FERC-certificated storage expansions and greenfield construction projects. We also compete with the numerous alternatives to storage available to customers, including pipeline balancing/no-notice services, seasonal/swing services provided by pipelines and marketers and on-system LNG facilities.

Our primary competitors in the NGL storage business include integrated major oil companies, refiners and processors, and other pipeline and storage companies.

Our salt operations compete for customers primarily based on price and service. Because transportation costs are a material component of the costs our customers pay, most of our customers are geographically located east of the Mississippi River.

Employees

Our subsidiary, US Salt, has 140 employees, 105 of which are members of the United Steel Workers union. We do not otherwise have employees, and we rely on Inergy under our Omnibus Agreement to provide us the corporate and other employees needed to carry out our operations. We believe that our relationship with our employees (including union labor) is satisfactory.

Available Information

Our website is located at www.inergylp.com. We make available, free of charge, on or through our website our annual reports on Form 10-K, which include our audited financial statements, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as we electronically file such material with the Securities and Exchange Commission ("SEC"). These documents are also available, free of charge, at the SEC's website at www.sec.gov. In addition, copies of these documents, excluding exhibits, may be requested at no cost by contacting Investor Relations, Inergy Midstream, L.P., Two Brush Creek Boulevard, Suite 200, Kansas City, Missouri, 64112, and our corporate telephone number is (816) 842-8181.

We also make available within the “Corporate Governance” section of our website our corporate governance guidelines, the charter of our Audit Committee and our Code of Business Conduct and Ethics. Requests for copies may be directed in writing to: Inergy Midstream, L.P., Two Brush Creek Boulevard, Suite 200, Kansas City, Missouri, 64112, Attention: General Counsel. Interested parties may contact the chairperson of any of our Board committees, our Board's independent directors as a group or our full Board in writing by mail to Inergy Midstream, L.P., Two Brush Creek Boulevard, Suite 200, Kansas City, Missouri, 64112, Attention: General Counsel. All such communications will be delivered to the director or directors to whom they are addressed.

Item 1A. Risk Factors

Risks Inherent in Our Business

The supply and demand for natural gas could be adversely affected by many factors outside of our control which could negatively affect us.

Our success depends on the supply and demand for natural gas. The degree to which our business is impacted by changes in supply or demand varies. Our business can be negatively impacted by sustained downturns in supply and demand for natural gas, including reductions in our ability to renew contracts on favorable terms and to construct new infrastructure. One of the major factors that will impact natural gas demand will be the potential growth of the demand for natural gas in the power generation market, particularly driven by the speed and level of existing coal-fired power generation that is replaced with natural gas-fired power generation. One of the major factors impacting natural gas supplies has been the significant growth in unconventional sources such as shale plays. In addition, the supply and demand for natural gas for our business will depend on many other factors outside of our control, which include, among others:

| |

| • | adverse changes in general global economic conditions. The level and speed of the recovery from the recent recession remains uncertain and could impact the supply and demand for natural gas and our future rate of growth in our business; |

| |

| • | adverse changes in domestic regulations that could impact the supply or demand for natural gas; |

| |

| • | technological advancements that may drive further increases in production and reduction in costs of developing natural gas shales; |

| |

| • | competition from imported LNG and Canadian supplies and alternate fuels; |

| |

| • | increased prices of natural gas or NGLs that could negatively impact demand for these products; |

| |

| • | increased costs to explore for, develop, produce, gather, process and transport natural gas or NGLs; |

| |

| • | adoption of various energy efficiency and conservation measures; and |

| |

| • | perceptions of customers on the availability and price volatility of our services, particularly customers' perceptions on the volatility of natural gas prices over the longer-term. |

If volatility and seasonality in the natural gas industry decrease, because of increased production capacity or otherwise, the demand for our services and the prices that we will be able to charge for those services may decline. In addition to volatility and seasonality, an extended period of high natural gas prices would increase the cost of acquiring base gas and likely place upward pressure on the costs of associated expansion activities. An extended period of low natural gas prices could adversely impact storage values for some period of time until market conditions adjust. These commodity price impacts could have a negative impact on our business, financial condition, and results of operations.

If we do not complete growth projects or make acquisitions, our future growth may be limited.

Our business strategy depends on our ability to complete growth projects and make acquisitions from Inergy and third parties that result in an increase in cash generated from operations on a per unit basis (i.e., complete accretive transactions). However, Inergy (i) is entitled under the omnibus agreement to review, and has the first option on, any third-party acquisition opportunities presented to us or to Inergy, (ii) is not obligated to make acquisition opportunities available to us, (iii) is not restricted from competing with us, and (iv) may acquire, construct or dispose of natural gas or NGL facilities or other midstream assets in the future without any obligation to offer us the opportunity to purchase or construct those assets. Moreover, we may be unable to complete successful, accretive growth projects or acquisitions for any of the following reasons:

| |

| • | we fail to identify attractive expansion or development projects or acquisition candidates that satisfy our economic and other criteria, or we are outbid for such opportunities by our competitors; |

| |

| • | we cannot raise financing for such projects or acquisitions on economically acceptable terms; |

| |

| • | we fail to secure adequate customer commitments to use the facilities to be developed, expanded or acquired; or |

| |

| • | we cannot obtain governmental approvals or other rights, licenses or consents needed to complete such projects or acquisitions. |

Our operations are subject to extensive regulation, and regulatory measures adopted by regulatory authorities could have a material adverse effect on our business, financial condition and results of operations.

Our operations are subject to extensive regulation by federal, state and local regulatory authorities. For example, because we transport natural gas in interstate commerce and we store natural gas that is transported in interstate commerce, our natural gas storage and transportation facilities are subject to comprehensive regulation by the FERC under the Natural Gas Act. Federal regulation under the Natural Gas Act extends to such matters as:

| |

| • | rates, operating terms and conditions of service; |

| |

| • | the form of tariffs governing service; |

| |

| • | the types of services we may offer to our customers; |

| |

| • | the certification and construction of new, or the expansion of existing, facilities; |

| |

| • | the acquisition, extension, disposition or abandonment of facilities; |

| |

| • | contracts for service between storage and transportation providers and their customers; |

| |

| • | creditworthiness and credit support requirements; |

| |

| • | the maintenance of accounts and records; |

| |

| • | relationships among affiliated companies involved in certain aspects of the natural gas business; |

| |

| • | the initiation and discontinuation of services; and |

Natural gas companies may not charge rates that, upon review by FERC, are found to be unjust and unreasonable or unduly discriminatory. Existing interstate transportation and storage rates may be challenged by complaint and are subject to prospective change by FERC. Additionally, rate increases proposed by a regulated pipeline or storage provider may be challenged and such increases may ultimately be rejected by FERC. We currently hold authority from FERC to charge and collect (i) market-based rates for interstate storage services provided at the Stagecoach, Thomas Corners and Seneca Lake facilities and (ii) negotiated rates for interstate transportation services provided by our North-South Facilities and our MARC I Pipeline. FERC's “market-based rate” policy allows regulated entities to charge rates different from, and in some cases, less than, those which would be permitted under traditional cost-of-service regulation. Among the sorts of changes in circumstances that could raise market power concerns would be an expansion of capacity, acquisitions or other changes in market dynamics. There can be no guarantee that we will be allowed to continue to operate under such rate structures for the remainder of those assets' operating lives. Any successful challenge against rates charged for our storage and transportation services, or our loss of market-based rate authority or negotiated rate authority, could have a material adverse effect on our business, financial condition, results of operations and ability to make distributions. Our market-based rate authority for our natural gas storage facilities may be subject to review and possible revocation if FERC determines that we have the ability to exercise market power in our market area. If we were to lose our ability to charge market-based rates, we would be required to file rates based on our cost of providing service, including a reasonable rate of return. Cost-of-service rates may be lower than our current market-based rates.

There can be no assurance that FERC will continue to pursue its approach of pro-competitive policies as it considers matters such as pipeline rates and rules and policies that may affect rights of access to natural gas transportation capacity and transportation and storage facilities. Failure to comply with applicable regulations under the Natural Gas Act, the Natural Gas Policy Act of 1978, the Pipeline Safety Act of 1968 and certain other laws, and with implementing regulations associated with these laws, could result in the imposition of administrative and criminal remedies and civil penalties of up to $1,000,000 per day, per violation.

We may not be able to renew or replace expiring contracts.