QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on October 27, 2006

Registration No. 333-133949

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

AMENDMENT No. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACA Capital Holdings, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | 6351

(Primary Standard Industrial

Classification Code Number) | 75-3170112

(I.R.S. Employer

Identification Number) |

140 Broadway

New York, New York 10005

(212) 375-2000

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Nora J. Dahlman, Esq.

Managing Director, General Counsel

ACA Capital Holdings, Inc.

140 Broadway

New York, New York 10005

(212) 375-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: |

Valerie Ford Jacob, Esq.

Stuart H. Gelfond, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York 10004

(212) 859-8000 | | Ethan T. James, Esq.

Davis Polk & Wardwell

450 Lexington Avenue

New York, New York 10017

(212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the registration statement for the same offering. o .

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities

to be Registered

| | Proposed Maximum Aggregate

Offering Price(1)(2)

| | Amount of

Registration Fee

|

|---|

|

| Common Stock, $0.10 par value per share | | $238,591,991 | | $25,529.35(3) |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933.

- (2)

- Including shares of common stock which may be purchased by the underwriters to cover over-allotments, if any, and proceeds from the sale of shares of common stock by the selling stockholders.

- (3)

- $10,700 of which has been previously paid.

The registrant hereby amends the Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated October 27, 2006

12,204,323 Shares

ACA Capital Holdings, Inc.

Common Stock

We are selling 6,875,000 shares of our common stock and the selling stockholders named in this prospectus are selling 5,329,323 shares. We will not receive any proceeds from the sale of shares by the selling stockholders. Prior to this offering, there has been no public market for our common stock. The initial public offering price is expected to be between $15 and $17 per share. Our common stock has been approved for listing on the New York Stock Exchange under the symbol "ACA" subject to official notice of issuance.

The underwriters have an option to purchase a maximum of 1,830,500 additional shares of our common stock to cover over-allotments of shares.

Investing in our common stock involves risks. See "Risk Factors" starting on page 10.

| | Price to

Public

| | Underwriting

Discounts and

Commissions

| | Proceeds to

ACA Capital

| | Proceeds to

the Selling

Stockholders

|

|---|

Per Share |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Total | | $ | | | $ | | | $ | | | $ | |

Delivery of the shares of common stock will be made on or about , 2006.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Credit Suisse |

|

JPMorgan |

|

Bear, Stearns & Co. Inc. |

| Stephens Inc. | | Keefe, Bruyette & Woods |

The date of this prospectus is , 2006.

TABLE OF CONTENTS

| | Page

|

|---|

| PROSPECTUS SUMMARY | | 1 |

| RISK FACTORS | | 10 |

| FORWARD-LOOKING STATEMENTS | | 28 |

| USE OF PROCEEDS | | 30 |

| DIVIDEND POLICY | | 31 |

| CAPITALIZATION | | 32 |

| DILUTION | | 33 |

| SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA | | 35 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 37 |

| INDUSTRY OVERVIEW | | 103 |

| BUSINESS | | 112 |

| MANAGEMENT | | 142 |

| COMMITTEES OF THE BOARD OF DIRECTORS | | 145 |

| EXECUTIVE COMPENSATION | | 148 |

| PRINCIPAL AND SELLING STOCKHOLDERS | | 154 |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 158 |

| DESCRIPTION OF CAPITAL STOCK | | 160 |

| SHARES ELIGIBLE FOR FUTURE SALE | | 164 |

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS | | 166 |

| UNDERWRITING | | 170 |

| LEGAL MATTERS | | 176 |

| EXPERTS | | 176 |

| CHANGE IN INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 176 |

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | | 176 |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | F-1 |

In this prospectus, "we," "us" and "our" refer to ACA Capital Holdings, Inc., or ACA Capital, and its subsidiaries and not to the underwriters.

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate as of the date specified herein or on the date of this document.

The data included in this prospectus regarding markets and product categories, including, but not limited to, the size of certain markets and product categories, are based on our estimates and definitions, which have been derived from third party sources and management's knowledge and experience in the areas in which the relevant businesses operate. We have given market data for which the most recent information is available, which may be a different time period for different markets. We believe that these sources, in each case, provide reasonable estimates. However, market data is subject to change and cannot be verified with certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. In addition, we may define our markets in a way that may be different from how third parties, including our competitors, define various markets in which we participate.

Until , 2006, all dealers that buy, sell or trade in shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus and may not contain all of the information that may be important to you. You should read all of the information in this prospectus, including the consolidated financial statements and related notes, and the risks of investing in our common stock discussed under "Risk Factors," before making an investment decision.

OUR BUSINESS

ACA Capital is a holding company engaged in the business of providing financial guaranty insurance products to participants in the global credit derivatives markets, structured finance capital markets and municipal finance capital markets. We also provide asset management services to specific segments of the structured finance capital markets. We participate in our target markets both as a provider of credit protection through the sale of financial guaranty insurance products, for risk-based revenues, and as an asset manager, for fee-based revenues. We conduct our financial guaranty insurance businesses through ACA Financial Guaranty Corporation, our "A" rated, regulated insurance subsidiary. We conduct our asset management business through ACA Management, L.L.C., a subsidiary of ACA Financial Guaranty. As of June 30, 2006, we had insured credit exposure of $31.4 billion and our assets under management for third parties were $12.1 billion. For the six months ended June 30, 2006, we had total revenues of $215.3 million and net income of $26.2 million. As of June 30, 2006, our stockholders' equity was $412.7 million.

We operate through three strategic business units: our two insurance lines of business, Structured Credit and Municipal Finance, and our CDO Asset Management business. Each of these businesses relies on our core competencies of credit analysis, transaction structuring, risk management and surveillance. Applying these competencies across our platform allows us to create efficiencies in our operations and to deliver a wide range of services and products to our institutional customers.

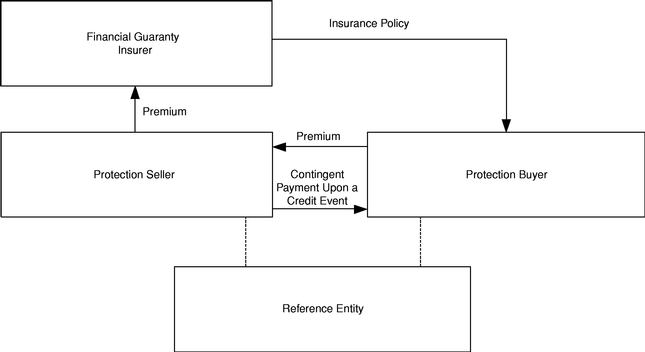

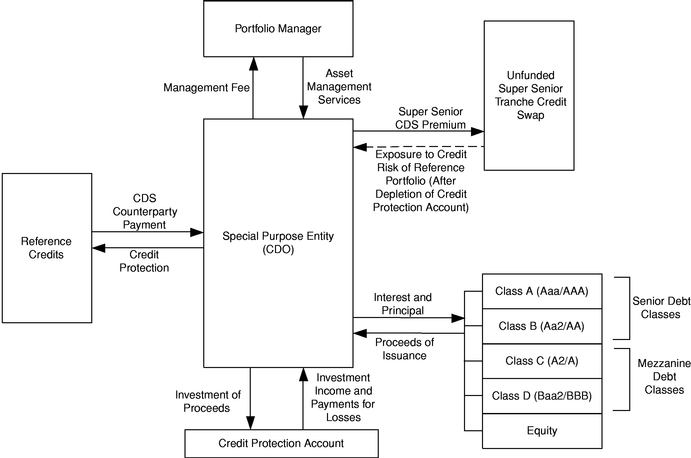

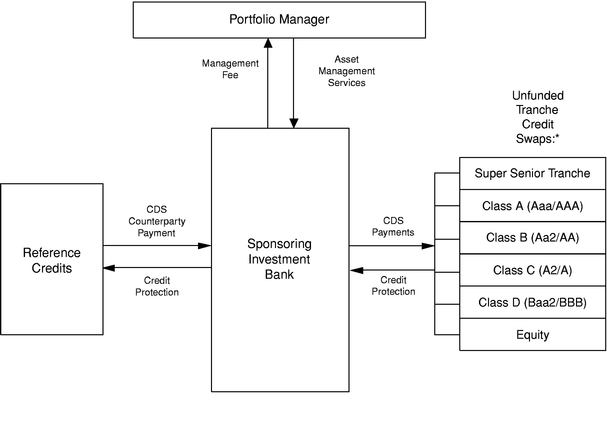

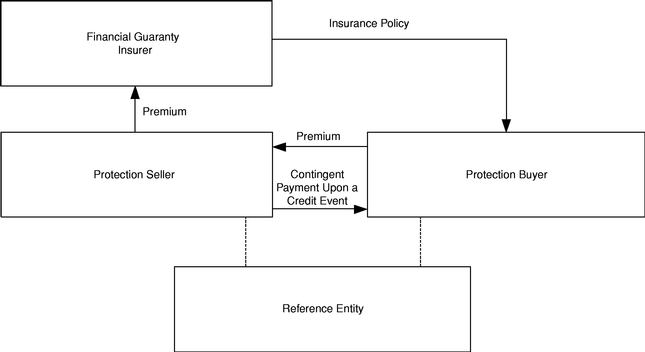

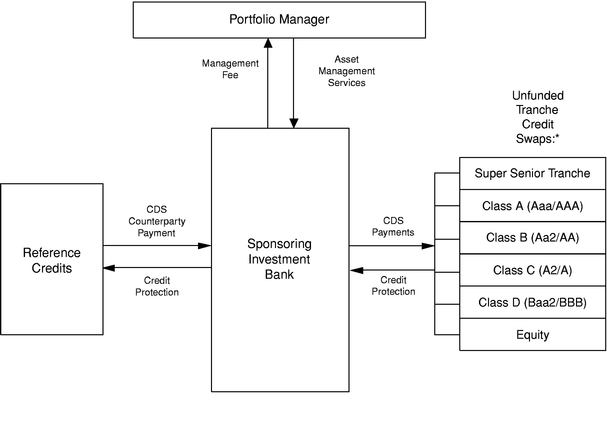

Financial Guaranty Insurance Lines of Business

Structured Credit: As part of our financial guaranty insurance business, we select, structure and sell credit protection through insured credit swaps in the institutional fixed income markets. A credit swap is a derivative instrument, the performance of which is directly related to the performance of an underlying financial obligation, or reference obligation, such as a bond or a loan, issued by a third party, or reference entity. Credit swaps are capital markets products used to manage or transfer credit risk and are freely tradable separately from the obligations of the underlying reference entity. We execute our credit swaps through special purpose vehicles whose obligations under these swaps are insured by ACA Financial Guaranty. Historically, we have generally sold credit protection through insured credit swaps on highly rated layers of risk associated with pools of assets that were either selected by us or held within CDOs of financial assets managed by third parties. The financial assets underlying our insured credit swaps principally include corporate credits, ABS and mortgaged backed securities, or MBS.

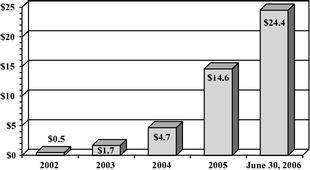

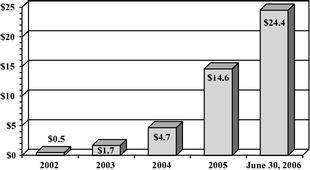

We generate revenues in our Structured Credit business through the premiums paid to ACA Financial Guaranty to insure against the risk of default on the assets underlying our credit swaps. Currently our insured credit swap portfolio is constructed primarily of exposures with credit profiles equivalent to "AAA" rated exposures. We executed our first Structured Credit transaction in July 2002 and, as of June 30, 2006, we had completed 121 Structured Credit transactions with 22 different counterparties; 108 of these transactions are currently outstanding, representing $24.4 billion in total outstanding insured credit swaps. As of June 30, 2006 the weighted average premium in our then current insured Structured Credit portfolio was 0.19% per annum.

Municipal Finance: Since 1997, we have provided financial guaranty insurance on municipal and other public finance bonds that guarantee to the investor the timely payment of interest and the ultimate payment of principal on such obligations. Through our "A" ("strong," the sixth highest of 21 rating levels) rated financial guaranty insurance subsidiary by Standard & Poor's Rating Services, or S&P, we target low investment grade, non-investment grade and unrated sectors of the

1

market. Our market segment is underserved by higher rated financial guarantors due to rating agency limitations and company specific risk policy constraints. We also target markets that are underserved by reason of industry sector, credit characteristics or transaction size. We are licensed to provide financial guaranty insurance in all 50 states, the District of Columbia, Guam, Puerto Rico and the U.S. Virgin Islands. The maintenance of our financial guaranty insurance subsidiary also provides us with significant execution flexibility that we utilize across our other business lines.

We generate revenue in our Municipal Finance business through the receipt of premiums for the insurance we provide. As of June 30, 2006 we had $6.3 billion of net par insured in our municipal finance portfolio. As of June 30, 2006 our weighted average premium as a percentage of total debt service on our insured Municipal Finance portfolio was 2.49%.

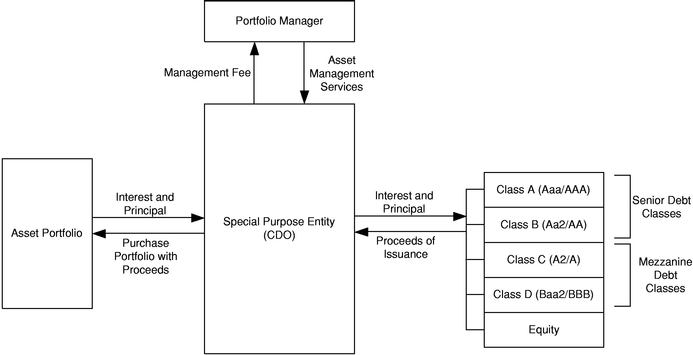

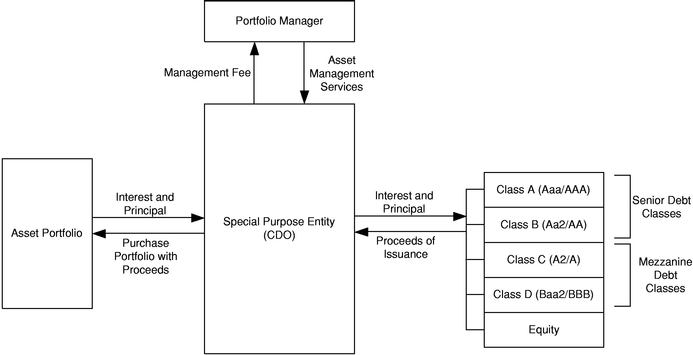

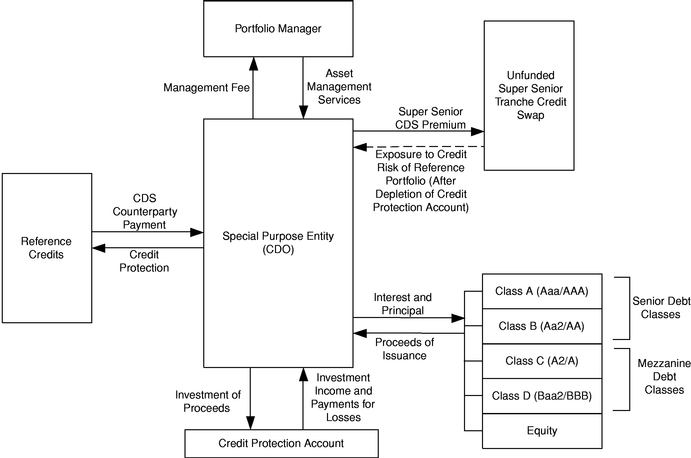

Other Financial Services

CDO Asset Management: We serve as an asset manager of collateralized debt obligations, or CDOs. A CDO is a securitization of fixed income assets such as bonds, loans, asset backed securities, or ABS, and credit default swaps, or credit swaps. To grow our assets under management, we sponsor CDOs that acquire pools of fixed-income assets that we select and manage. CDO assets are funded by the issuance of various liabilities with credit profiles ranging from "AAA" rated debt to non-rated equity. Our CDOs have a diverse worldwide institutional investor base that includes banks, money managers, non-bank financial institutions, hedge funds, pension funds and insurance companies.

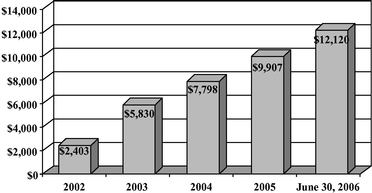

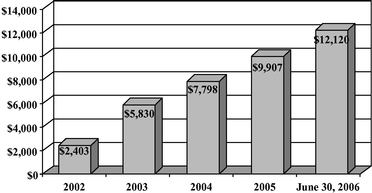

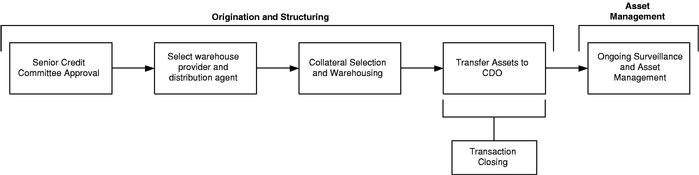

Our CDO Asset Management revenues consist of asset management fees and risk-based revenue in the form of return on our equity investments in our CDOs. Typically, we invest in some portion of the equity of our managed CDOs, currently between 5% to 25% of the total equity offered. These investments increase the marketability of our CDOs by aligning our interests as asset manager with those of our CDO investors and thereby maximizing our CDO assets under management. In 2005 and the first six months of 2006, we invested a total of $16.0 million and $2.9 million, respectively, in the equity of our CDOs while increasing our assets under management by $2.1 billion and $2.2 billion, respectively. We completed our first CDO in January 2002 and, as of June 30, 2006, we had closed 17 CDO transactions and have grown our CDO assets under management from $2.4 billion as of year-end 2002 to $12.1 billion as of June 30, 2006. At June 30, 2006, our weighted average asset management fee was 0.21% per annum on CDO assets under our management. Based on our knowledge of the market, we believe we are one of the largest global CDO managers as ranked by assets under management.

Growth in Our Markets

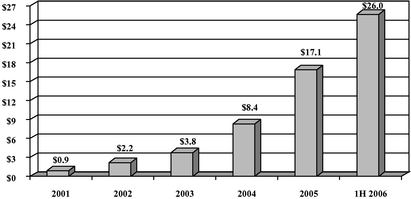

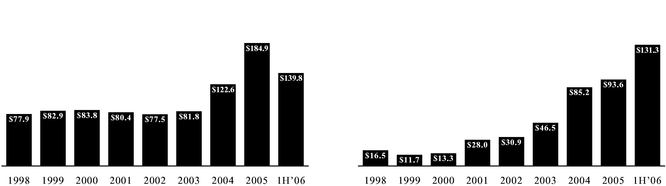

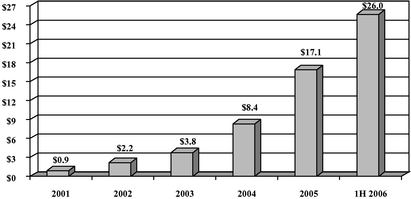

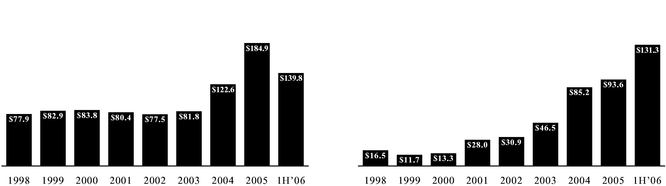

Our three business lines focus on segments of the credit markets that have experienced rapid growth and/or represent large markets which remain underserved by traditional providers of credit protection products. Our Structured Credit business has benefited from the high rate of growth in the number of transactions and market participants, including banks, broker/dealers, hedge funds and other institutional investors, in the global credit derivatives markets. The total notional outstanding of the credit swaps market has grown from approximately $918.9 billion in 2001 to approximately $26.0 trillion through the first half of 2006, representing a compound annual growth rate of 110.2% during this period. Within our Municipal Finance business we benefit from being the only "A" rated financial guarantor focused on markets that are large and underserved. The total amount of new low investment grade, non-investment grade and non-rated municipal issues in 2005 was $62.4 billion. Excluding the sectors of the municipal finance market in which we currently do not participate based on our underwriting criteria, total new issuance in 2005 was $29.4 billion, of which we had a 1.7% overall market penetration. Our CDO Asset Management products are designed to serve investors' growing demand for structured products. New issue funded CDO volume in the U.S. and European markets increased from $94.4 billion at December 31, 1998 to $271.1 billion at June 30, 2006, representing a compound annual growth rate of 15.1% during this period.

2

Competitive Strengths

We believe that the following competitive strengths enable us to capitalize on opportunities to assume credit exposures through our "A" rated insurance company on select opportunities that meet our risk-adjusted return objectives and to grow our assets under management.

Extensive credit and risk management expertise. We have a proven track record in each of our principal business lines of strong and successful credit analysis and risk management as evidenced by our low loss experience. We apply a rigorous underwriting and credit process to analyze each transaction and its incremental effect on our existing risk portfolio and also employ sophisticated qualitative and quantitative institutional risk management systems to monitor and manage our exposure across our business lines and in our investment portfolio.

- •

- In our Structured Credit business we use proprietary quantitative models to analyze and optimize risk positions in terms of capital usage and risk-adjusted returns. We have significant competence in understanding and assessing relative values between transactional opportunities. Since the establishment of this business line in July 2002, we have made no payments in respect of defaults under our insured credit swaps.

- •

- In our Municipal Finance business we have a seasoned underwriting team with substantial experience in our target markets. Since our inception in September 1997, we have paid $4.9 million of net losses and loss adjustment expenses on our total Municipal Finance portfolio, which represents less than 2% of premiums written.

- •

- In our CDO Asset Management business our strength lies in our asset selection expertise and ongoing management of individual credits included in our CDOs. Since the completion of our first CDO in January 2002, we have not experienced any adverse rating actions or downgrades on any of the debt securities issued by our CDOs.

Our credit assessment, underwriting and monitoring processes are designed to limit loss frequency and severity, however, we anticipate both cyclical and idiosyncratic loss activity across our portfolio of credit exposures. Consequently, we place significant emphasis on managing loss severity should losses occur. We have adopted a formalized underwriting and risk management approach which is designed to ensure that the risk profile of a given credit or transaction meets our credit, profitability and loss tolerance standards, as well as to monitor and limit our exposure across all of our business lines and our own investment portfolio.

Operating flexibility and counterparty security from our insurance subsidiary's "A" financial strength rating. Our insurance subsidiary's "A" financial strength rating enables us to achieve an optimal balance between providing broad operating flexibility for us and providing security for our counterparties and investors in our Structured Credit and Municipal Finance businesses.

- •

- Structured Credit. Our "A" rating affords our Structured Credit business significant flexibility to offer credit protection through our financial guaranty insurance products on any portion of a given capital structure, from "AAA" equivalent exposures through equity, and on a diverse mix of asset classes, as compared to other market participants with higher credit ratings or more limited operating platforms. Though our "A" rating generally eliminates the need to post security on performing transactions, we have the flexibility, unlike other higher rated entities, to post collateral to secure our transactions in the event the transaction performance severely deteriorates or we experience a corporate credit event. Our willingness to provide such security, combined with our "A" rated platform, enhances counterparties' willingness to transact with us.

- •

- Municipal Finance. As the only "A" rated financial guarantor in the municipal finance business, our insurance subsidiary is not only able to guarantee the obligations of lower investment grade issuers, but is the only financial guaranty insurer able to offer significant capacity to non-investment grade and unrated municipal credits. In the municipal finance market, our financial guaranty insurance platform allows us to issue policies for the life of the insured exposure, a significant advantage versus bank letter of credit competition in that market.

3

Diverse revenue sources. Our three business lines provide diverse revenue sources, both risk- and fee-based, from three distinct segments of the credit markets. The Structured Credit business provides risk-based revenue and attractive risk-adjusted returns on capital. The Municipal Finance business generally receives premiums up-front which provide current year cash flow and a predictable stream of longer term revenues as the unearned premiums are recognized as income over the typically 30-year life of the guaranteed bond. We also earn interest income on the investment portfolio of our insurance subsidiary which had invested assets of $536.7 million as of June 30, 2006. The CDO Asset Management business provides a stable and growing source of fee income based on assets under management. We also receive fees related to the origination of CDOs and a return on our equity investments in our CDOs. A significant portion of such revenues is included as investment income in our financial statements since some of our earlier CDOs are consolidated under accounting principles generally accepted in the United States of America, or U.S. GAAP.

Efficient and scalable operations. Our credit analysis, transaction structuring and risk management expertise, together with our quantitative analytical capability and infrastructure of information technology, accounting, legal and other professionals with significant experience in our businesses, allows us to easily and quickly grow our assets under management and expand into new credit-based product lines without incurring significant additional costs.

Management team with significant industry and operating experience. Our senior executive management team has an average of over 22 years of industry experience in fixed income analysis, finance, investment banking, and financial guaranty insurance and reinsurance. Additionally, our Board of Directors consists of members with substantial experience in the financial services industry.

Business Strategy

Our business strategy is to continue to leverage our credit management expertise to generate attractive risk-adjusted returns on our capital in our financial guaranty insurance lines of business through the insurance of targeted credit exposure and to grow our assets under management. We plan to achieve these objectives through the following strategies:

Grow our insured credit exposure and assets under management. We have significantly increased our insured credit exposure and assets under management, and intend to continue to grow our financial guaranty insurance Structured Credit and Municipal Finance businesses and CDO Asset Management business, in terms of number of transactions, size of transactions, as well as the types of asset classes that we insure and manage. For example, in 2005 we insured additional credit exposure in our Structured Credit portfolio of $10.0 billion and added leveraged loan CDOs, or CLOs, and synthetic ABS CDO products. We are also in the process of expanding our Structured Credit and CDO Asset Management businesses internationally.

Target the most attractive risk-adjusted returns in the credit markets. In our financial guaranty insurance business lines, we target those segments of the markets that we believe offer enhanced economic returns. In our Structured Credit business, we currently focus on selling credit protection through our insurance products on layers of exposure with credit profiles equivalent to "AAA" rated exposures, which we believe currently offers the most favorable risk-adjusted returns. However, we have the operating flexibility to assume credit exposures throughout the entire capital structure based on our relative value view of risk and return under changing market conditions. In our Municipal Finance business we will continue to increase penetration in our target markets which we believe offer attractive risk-adjusted returns.

Expand our existing product lines and develop new credit product areas. Our ability to expand existing products into broader geographic areas, asset classes and credit profiles is a function of the flexibility of our execution alternatives and "A" rating of our insurance subsidiary, ACA Financial Guaranty. By using our execution alternatives (insurance policies, insured credit swaps and cash), alone or in combination, we can assume credit exposure in various markets and access opportunities when

4

they emerge. In our Structured Credit business we will continue developing our credit expertise into the evolving ABS, leveraged loan, project finance and MBS credit swap markets. In our Municipal Finance business we plan to utilize our expertise in financing municipal health care, transportation, student housing, and similar revenue-based projects to expand our business into broader financing opportunities for enterprises, tax-exempt or otherwise.

Expand counterparty and other key relationships for our insurance lines of business. Our Structured Credit business is dependent upon our developing and maintaining strong business relationships with other financial institutions that act as counterparties in insured credit swap transactions. We have substantially increased our relationships in recent years, increasing our Structured Credit counterparties to 22 at June 30, 2006, and will continue to focus on building new counterparty relationships. In our Municipal Finance business we intend to strengthen our marketing efforts and expand our relationships with the investment banks and financial advisors most responsible for producing transactions in our target markets.

Sustain the operating flexibility of an "A" financial strength rating for our financial guaranty insurance subsidiary. We believe an "A" rating for our insurance subsidiary is optimal for maximizing our strategic business opportunities. Our objective is to maintain capital adequacy in excess of S&P's requirements for "A" rated insurers so that we have excess rating agency capital to absorb unforeseen losses but to otherwise operate in a manner consistent with the greater operating flexibility afforded to us due to our "A" rating by S&P, which is not afforded to higher rated insurers.

Risks Relating to Our Business and this Offering

We face certain risk factors that could materially affect our business, results of operations or financial condition, which include:

Failure to effectively analyze credit and other risks. Our ability to analyze and manage credit risk is at the core of each of our business lines. All of our business lines will be materially impacted if we fail to do this effectively.

General economic and capital markets factors. Our business is impacted by general economic conditions and capital markets activities that affect demand for our products, including the potential negative impact of recessions and business failures as well as any tightening of credit spreads.

Concentration of liabilities and investments. While we seek diversification across our businesses, in each of our business lines and in our investment portfolio, we face risks to the extent that our aggregate exposure to losses is concentrated geographically, by industry, sector, obligor or type of credit or investment. In the event that a particular industry or region experiences an economic downturn or natural disaster, or we are over-exposed to a business that experiences a credit event, our performance may be materially negatively impacted.

Possibility of negative ratings action. If S&P places us on CreditWatch or downgrades our insurance subsidiary's financial strength rating, it could have a material adverse effect on our ability to compete and on our results of operations.

Adequacy of loss reserves. We establish estimated liabilities, or loss reserves, to reflect the estimated cost of claims incurred that we will ultimately be required to pay in respect of the financial guaranty insurance we have written. If our loss reserves at any time are determined to be inadequate, we would be required to increase loss reserves at the time of such determination. This could cause a material increase in our liabilities and a reduction in our profitability, or possibly an operating loss and reduction of capital.

For more information about these and other risks relating to our Company, see "Risk Factors" beginning on page 10. You should carefully consider these risk factors together with all the other information included in this prospectus.

5

THE OFFERING

| Common stock offered by ACA Capital | | 6,875,000 shares |

| Common stock offered by selling stockholders | | 5,329,323 shares |

| Common stock to be outstanding after this shares offering(1) | | 36,762,281 shares |

| Use of proceeds | | We estimate that our net proceeds from the initial public offering of our common stock, after deducting the underwriting discounts and commissions and our estimated offering expenses, will be approximately $98,300,000 (based on the midpoint of the price range on the cover of this prospectus). We estimate that our net proceeds will be approximately $125,537,840 if the underwriters exercise their over-allotment option in full (based on the midpoint of the price range on the cover of this prospectus). We intend to use the net proceeds of this offering for general corporate purposes. See "Use of Proceeds." We will not receive any of the proceeds from the sale of shares by the selling stockholders. |

| NYSE symbol | | "ACA" |

| Dividend policy | | We do not anticipate paying dividends on our common stock in the foreseeable future. We plan to retain earnings for use in the operation of our business and to fund future growth. |

- (1)

- The number of shares of common stock to be outstanding after this offering reflects a dividend to effect a 6-for-1 split of our outstanding common stock which was effective August 23, 2006 and the conversion of our preferred shares into common stock, in the case of our convertible preferred stock and senior convertible preferred stock, at a conversion rate of 6,000 shares of common stock for each such share of preferred stock and, in the case of series B senior convertible preferred stock, at a conversion rate of six shares of common stock for each such share or preferred stock, all of which will occur concurrently with the closing of this offering. The number of shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of October 3, 2006, the number of shares included in this offering and 239,000 shares of restricted stock that we have granted contingent upon the completion of this offering to certain independent directors and employees at the effective time of this offering and excludes:

- •

- 1,830,500 shares of common stock issuable upon the exercise of the underwriters' over-allotment option;

- •

- 2,973,918 shares of common stock reserved under our Amended and Restated 2006 Stock Incentive Plan but not yet issued as of October 3, 2006 (543,000 shares of which are reserved for issuance pursuant to the exercise of certain options granted contingent upon the completion of this offering); and

- •

- 3,354,054 shares of common stock that may be issued pursuant to options outstanding as of October 3, 2006 at a weighted average exercise price of $11.28 per share.

ADDITIONAL INFORMATION

ACA Capital is a Delaware corporation. Our principal subsidiary through which we currently operate our business is ACA Financial Guaranty Corporation, our "A" rated insurance subsidiary that is organized in the State of Maryland. ACA Service, L.L.C., a wholly-owned indirect subsidiary of ACA Financial Guaranty, is a Delaware limited liability company that owns the majority of the special purpose entities through which we execute our insured credit swaps. ACA Financial Guaranty insures the obligations of the special purpose vehicles in our Structured Credit line of business. Our CDO Asset Management services are conducted through ACA Management, L.L.C., also a wholly-owned indirect subsidiary of ACA Financial Guaranty. ACA Management, L.L.C. is a Delaware limited liability company. ACA Management, L.L.C. is registered with the Securities and Exchange Commission as an investment adviser. In addition to our three operating businesses, we have a fourth line of business that includes insurance products in which we no longer write new business. Our principal executive office is located at 140 Broadway, New York, New York 10005 and our telephone number is (212) 375-2000. We maintain a website at www.aca.com. Information on our website is not a part of this prospectus.

ACA Capital was formed in 1997 and our largest stockholders include Bear Stearns Merchant Banking, SF Holding Corp. (f/k/a Stephens Group, Inc.), the Third Avenue Value Trust, GCC Investments, LLC and AEGON USA Inc.

6

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

The following table sets forth our selected consolidated financial data for the periods presented. The consolidated statements of operations for the years ended December 31, 2003, 2004 and 2005 and the consolidated balance sheet data as of December 31, 2004 and 2005 are derived from our audited consolidated financial statements and related notes included elsewhere in this prospectus. The consolidated statements of operations for the years ended December 31, 2001 and 2002 and the consolidated balance sheet data as of December 31, 2001, 2002 and 2003 are derived from our historical consolidated financial statements not included in this prospectus. The selected historical financial data as of and for the six months ended June 30, 2005 and 2006 is derived from our unaudited interim financial statements and includes, in the opinion of management, all adjustments, consisting only of normal recurring adjustments, that we consider necessary for the fair presentation of our financial position and results of operations for these periods. The results of operations for prior accounting periods are not necessarily indicative of the results to be expected for any future accounting periods. You should read this information together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| | Year Ended December 31,

| | Six Months

Ended June 30,

| |

|---|

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

| | 2005

| | 2006

| |

|---|

| | (in thousands, except per share amounts)

| |

|---|

| Statement of Operations Data(a): | | | | | | | | | | | | | | | | | | | | | | |

| Gross premiums written | | $ | 23,021 | | $ | 53,350 | | $ | 60,981 | | $ | 44,570 | | $ | 41,280 | | $ | 17,805 | | $ | 20,515 | |

| Net premiums written | | $ | 5,459 | | $ | 45,520 | | $ | 57,516 | | $ | 45,481 | | $ | 41,918 | | $ | 18,571 | | $ | 20,329 | |

| Premiums earned | | $ | 6,672 | | $ | 12,062 | | $ | 18,796 | | $ | 29,833 | | $ | 33,343 | | $ | 16,221 | | $ | 13,357 | |

| Net insured credit swap revenue | | | — | | | 1,557 | | | 6,841 | | | 16,018 | | | 21,571 | | | 4,543 | | | 22,111 | |

| Net investment income | | | 11,567 | | | 20,269 | | | 52,868 | | | 126,170 | | | 254,591 | | | 114,474 | | | 160,164 | |

| Net realized gains (losses) on investments | | | 6,511 | | | 4,138 | | | 3,188 | | | (6,547 | ) | | (2,777 | ) | | (1,223 | ) | | (3,223 | ) |

| Net realized and unrealized gains (losses) on derivative instruments | | | — | | | (25,092 | ) | | 9,124 | | | 6,520 | | | 8,410 | | | 4,040 | | | 6,139 | |

| Other net credit swap revenue | | | — | | | 4,975 | | | 12,121 | | | 10,990 | | | 4,157 | | | 2,524 | | | 5,544 | |

| Fee income | | | 194 | | | 4,236 | | | 8,898 | | | 6,091 | | | 11,110 | | | 4,366 | | | 11,073 | |

| Other income | | | — | | | 676 | | | 423 | | | 3,937 | | | 189 | | | 295 | | | 104 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | Total revenues | | | 24,944 | | | 22,821 | | | 112,259 | | | 193,012 | | | 330,594 | | | 145,240 | | | 215,269 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Loss and loss adjustment expenses | | | 1,636 | | | 1,801 | | | 3,168 | | | 46,590 | | | 14,038 | | | 4,139 | | | 3,682 | |

| Policy acquisition costs | | | 3,680 | | | 4,046 | | | 4,077 | | | 3,835 | | | 8,652 | | | 3,984 | | | 4,160 | |

| Other operating expenses | | | 16,053 | | | 18,683 | | | 29,466 | | | 38,645 | | | 37,443 | | | 14,669 | | | 23,294 | |

| Interest expense | | | 126 | | | 9,869 | | | 39,260 | | | 101,137 | | | 214,313 | | | 95,504 | | | 137,383 | |

| Depreciation and amortization | | | 730 | | | 1,081 | | | 4,115 | | | 6,935 | | | 8,583 | | | 4,064 | | | 4,717 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | Total expenses | | | 22,225 | | | 35,480 | | | 80,086 | | | 197,142 | | | 283,029 | | | 122,360 | | | 173,236 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| (Income) loss of minority interest | | | — | | | — | | | — | | | 476 | | | (3,708 | ) | | (1,685 | ) | | (2,229 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) before provision (benefit) for income taxes | | | 2,719 | | | (12,659 | ) | | 32,173 | | | (3,654 | ) | | 43,857 | | | 21,195 | | | 39,804 | |

| Provision (benefit) for income taxes | | | 110 | | | (6,318 | ) | | 12,206 | | | 135 | | | 15,097 | | | 8,078 | | | 13,615 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss) | | $ | 2,609 | | $ | (6,341 | ) | $ | 19,967 | | $ | (3,789 | ) | $ | 28,760 | | $ | 13,117 | | $ | 26,189 | |

| | |

| |

| |

| |

| |

| |

| |

| |

Share and Per Share Data(b): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share | | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | $ | 0.42 | | $ | (1.01 | ) | $ | 3.18 | | $ | (0.61 | ) | $ | 1.26 | | $ | 0.58 | | $ | 1.15 | |

| | Diluted | | $ | 0.22 | | $ | (1.01 | ) | $ | 1.51 | | $ | (0.61 | ) | $ | 0.96 | | $ | 0.44 | | $ | 0.87 | |

| Weighted average number of shares of common stock outstanding | | | | | | | | | | | | | | | | | | | | | | |

| | Basic | | | 6,168 | | | 6,282 | | | 6,270 | | | 6,168 | | | 22,794 | | | 22,698 | | | 22,830 | |

| | Diluted | | | 11,868 | | | 6,282 | | | 13,260 | | | 6,168 | | | 29,886 | | | 29,682 | | | 29,846 | |

| Book value per share(c) | | $ | 13.49 | | $ | 12.42 | | $ | 15.04 | | $ | 12.38 | | $ | 13.04 | | $ | 12.89 | | $ | 13.89 | |

7

| | As of December 31,

| | As of June 30,

|

|---|

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

| | 2005

| | 2006

|

|---|

| | (in thousands, except per share amounts and

where otherwise noted)

|

|---|

| Summary Balance Sheet Data(a): | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents(d) | | $ | 32,355 | | $ | 82,361 | | $ | 212,511 | | $ | 259,000 | | $ | 224,605 | | $ | 249,345 | | $ | 276,771 |

| Total investments(e) | | | 199,317 | | | 726,184 | | | 3,109,179 | | | 5,275,699 | | | 5,418,079 | | | 5,416,782 | | | 5,312,037 |

| Derivative assets | | | 0 | | | 6,752 | | | 19,343 | | | 28,460 | | | 15,250 | | | 20,108 | | | 16,868 |

| Total assets(d)(e) | | | 299,062 | | | 916,966 | | | 3,463,863 | | | 5,691,961 | | | 5,792,200 | | | 5,808,066 | | | 5,745,503 |

| Unearned premiums | | | 101,208 | | | 136,222 | | | 172,278 | | | 180,140 | | | 187,739 | | | 181,602 | | | 194,486 |

| Reserve for losses and loss adjustment expenses | | | 3,405 | | | 6,555 | | | 4,984 | | | 36,006 | | | 34,306 | | | 27,122 | | | 37,244 |

| Total debt(e) | | | 825 | | | 541,470 | | | 2,964,332 | | | 4,903,047 | | | 5,029,348 | | | 5,077,464 | | | 4,956,448 |

| Derivative liabilities | | | 0 | | | 40,010 | | | 64,045 | | | 58,755 | | | 46,538 | | | 63,618 | | | 31,628 |

| Total liabilities | | | 128,144 | | | 757,106 | | | 3,269,557 | | | 5,306,424 | | | 5,385,646 | | | 5,406,543 | | | 5,299,658 |

| Minority interest | | | — | | | — | | | — | | | 20,923 | | | 22,241 | | | 22,935 | | | 33,129 |

| Accumulated other comprehensive income | | | 919 | | | (5,583 | ) | | 8,896 | | | 21,952 | | | 11,132 | | | 24,309 | | | 12,680 |

| Total stockholders' equity | | | 170,918 | | | 159,860 | | | 194,306 | | | 364,614 | | | 384,313 | | | 378,588 | | | 412,716 |

| Other Data(g): | | | | | | | | | | | | | | | | | | | | | |

| Credit exposure(f) (in millions) | | $ | 5,563 | | $ | 6,378 | | $ | 8,563 | | $ | 11,296 | | $ | 21,467 | | $ | 14,017 | | $ | 31,406 |

| CDO assets under management (in millions) | | | N/A | | $ | 2,403 | | $ | 5,830 | | $ | 7,798 | | $ | 9,907 | | $ | 8,440 | | $ | 12,120 |

| Statutory Financial Data (ACA Financial Guaranty)(g): | | | | | | | | | | | | | | | | | | | | | |

| Contingency reserve(h) | | $ | 13,959 | | $ | 21,162 | | $ | 31,520 | | $ | 46,129 | | $ | 74,377 | | $ | 61,921 | | $ | 90,893 |

| Policyholders' surplus | | | 106,802 | | | 123,635 | | | 134,565 | | | 279,985 | | | 266,108 | | | 270,485 | | | 263,444 |

| | |

| |

| |

| |

| |

| |

| |

|

| Qualified statutory capital(i) | | $ | 120,761 | | $ | 144,797 | | $ | 166,085 | | $ | 326,114 | | $ | 340,485 | | $ | 332,406 | | $ | 354,337 |

| | |

| |

| |

| |

| |

| |

| |

|

- (a)

- Under U.S. GAAP, we are required to consolidate into our financial statements the income, expense, assets and liabilities related to certain of our CDOs when we are deemed to be the primary beneficiary of the CDO vehicle. Although these CDOs are consolidated, we do not have the right to use the assets of the CDOs for general operations or in satisfaction of our corporate debt obligations. Our investment exposure to our CDOs is therefore limited to the equity we retain, which is the first loss position of the CDO. For a description of the impact of consolidation on our financial statements, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—Consolidation of Variable Interest Entities (VIEs) and Other Restricted Investments" and "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results by Business Line—CDO Asset Management—Consolidation of VIEs."

- (b)

- Earnings per share and weighted average number of shares of common stock outstanding were restated to reflect the 6-for-1 stock split that was completed on August 23, 2006.

- (c)

- Book value per share is based on total stockholders' equity divided by basic common stock outstanding after giving effect to the August 23, 2006 stock split and gives effect to the conversion of our convertible preferred stock, senior convertible preferred stock and series B senior convertible preferred stock on a post-conversion basis.

- (d)

- Includes cash and cash equivalents related to our consolidated CDOs of $0, $6.1 million, $109.6 million, $141.3 million, $125.2 million, $147.6 million and $187.7 million as of December 31, 2001, 2002, 2003, 2004 and 2005 and June 30, 2005, and 2006 respectively. Also includes restricted cash balances of $0, $22.0 million, $30.9 million, $30.1 million, $50.2 million, $40.3 million and $54.1 million as of December 31, 2001, 2002, 2003, 2004 and 2005 and June 30, 2005 and 2006, respectively. Restricted cash balances relate to cash on deposit for the benefit of various counterparties in our CDO Asset Management and Structured Credit businesses.

- (e)

- Includes investments related to our consolidated CDOs of $0, $382.7 million, $2,711.4 million, $4,732.2 million, $4,810.9 million, $4,818.4 million and $4,709.9 million and a guaranteed investment contract related to our consolidated CDOs of $0, $122.5 million, $122.5 million, $122.6 million, $119.3 million, $122.6 million and $119.3 million both as of December 31, 2001, 2002, 2003, 2004 and 2005, and June 30, 2005 and 2006, respectively. Includes non-recourse debt related to our consolidated CDOs of $0, $494.5 million, $2,804.8 million, $4,728.6 million, $4,833.2 million, $4,882.1 million and $4,762.6 million as of December 31, 2001, 2002, 2003, 2004 and 2005, and June 30, 2005 and 2006, respectively.

8

- (f)

- Equal to the amount of notional and net par outstanding guaranteed by ACA Financial Guaranty.

- (g)

- This information is not derived from our audited consolidated financial statements or unaudited interim consolidated financial statements.

- (h)

- Under statutory accounting practices, or SAP, prescribed or permitted by the Maryland Insurance Administration, we are required to establish contingency reserves based on a specified percentage of either written premiums or insured exposure by bond type. A contingency reserve is an additional liability reserve established to protect the policyholder against the effects of adverse economic developments or cycles or other unforeseen circumstances.

- (i)

- Qualified statutory capital, comprised of the sum of policyholders' surplus and contingency reserve, is a commonly used measure of statutory based equity in the financial guaranty industry.

9

RISK FACTORS

An investment in our common stock involves a number of risks. You should carefully consider the following information about these risks, together with all of the other information in this prospectus, before deciding to invest in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks that we currently don't know about or deem to be immaterial may also impair our business or results of operations. Any of the risks described below could result in a significant or material adverse effect on our results of operations or financial condition, and a corresponding decline in the market price of our common stock. You could lose part or all of your investment.

Risks Related to Our Business

Our failure to effectively analyze and monitor credit and other risks could have a material adverse effect on our financial condition, results of operations and capital adequacy.

Our ability to analyze, monitor and manage credit risk is at the core of each of our business lines. All of our business lines will be materially impacted if we fail to do this effectively.

In our Structured Credit business, if we fail to accurately analyze the credit and other risks associated with selling credit protection through our financial guaranty insurance products in our Structured Credit line of business, we may suffer unexpected losses, which could materially and adversely affect our results of operations and financial condition.

Our Municipal Finance operations also depend significantly on our ability to effectively analyze and monitor credit risks. We guarantee obligations over an extended period of time, typically up to 30 years, and in riskier credit rating categories and sectors than the other financial guaranty insurance companies. As of June 30, 2006, based on our risk management internal rating systems, 34.9% of our Municipal Finance par exposure was rated non-investment grade. We have also targeted certain industry sectors, such as healthcare and long-term care, which are higher risk credits than those exposures typically taken by other financial guaranty insurers. We have in the past, and expect in the future to, incur losses in our Municipal Finance portfolio. If we do not accurately assess the credit risk and the related security and structural protections in these transactions and effectively monitor and manage these risks on an ongoing basis, we may incur significant losses in excess of our expectations.

Our future success in structuring and managing CDOs will depend on our ability to accurately analyze the financial assets that comprise the CDOs. We attempt to manage our CDO portfolio by selling deteriorating credits in a timely manner in order to mitigate losses as they develop; however, we may not be able to do so. If we do not effectively manage our CDOs, our reputation as a CDO asset manager could be negatively affected, which could materially and adversely affect our ability to originate future CDOs. In some cases, we also bear a portion of the risk associated with credit losses if there are defaults or assets otherwise become ineligible for inclusion in a CDO during the warehousing phase. See "Business—CDO Asset Management—Origination and Structuring of CDOs." Furthermore, since we also own at least some portion, or in our earlier CDOs, all or most, of the first loss or equity tranche in our CDOs, if we experience losses in excess of our modeled expectations we could experience returns below our expectations or lose a portion or all of our equity interests in those CDOs. Our aggregate first loss, or equity, position in our CDOs was $203.4 million as of June 30, 2006.

If S&P lowers the financial strength rating that it has assigned to ACA Financial Guaranty, our ability to generate new business in our Structured Credit and Municipal Finance business lines, as well as our results of operations and liquidity would be materially adversely affected.

ACA Financial Guaranty, our insurance subsidiary, has an "A" financial strength rating from S&P with a "stable" outlook. This rating is crucial to our Structured Credit and Municipal Finance businesses as well as our ongoing business strategy. This rating is subject to periodic review by S&P, and S&P may revise or withdraw its rating at any time at its sole discretion. Such an action may be based on factors which are entirely outside of our control, such as changes in the views or the policies

10

of the rating agencies in relation to the financial guaranty industry, changes to the risk profile of ACA Financial Guaranty's insurance portfolio or to other factors considered by S&P in providing such rating, or adverse developments in the financial condition or results of operations of ACA Financial Guaranty.

In addition, S&P may change its standards for maintaining an "A" rating, including, for instance, by increasing capital requirements. The financial strength rating of financial guaranty companies is based in part on the maintenance of specified amounts of resources available to pay claims. As our business grows, we may need additional capital and we may not be able to raise such capital. We could also face ratings actions by S&P. S&P's stable ratings outlook on ACA Financial Guaranty assumes that our insurance subsidiaries will satisfy S&P's current minimum capital requirement of $300 million. As of June 30, 2006, ACA Financial Guaranty met this capital requirement with paid-in capital and retained earnings of $354.3 million. S&P may revise its capital requirements at any time, and losses in excess of our expectations could diminish our capital below required rating agency levels. For example, we had to raise additional capital in response to an increase in capital requirements by S&P in 2004. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Overview—Additional Information—2004 Recapitalization." Although we currently intend to operate our business in a manner that maintains our "A" rating, we are under no obligation to do so and we may not be able to do so.

If S&P were to downgrade our financial strength rating, put us on its CreditWatch negative list or change its outlook for us to negative, our reputation in the municipal finance industry would be materially adversely affected, which in turn could materially adversely impact our financial performance. CreditWatch highlights the potential direction of a rating, focusing on identifiable events and short-term trends that cause ratings to be placed under special surveillance by S&P. Ratings appear on CreditWatch negative when such an event or a deviation from an expected trend occurs and S&P needs additional information to evaluate the rating. Even though a listing on CreditWatch negative does not mean a rating change is inevitable, being placed on CreditWatch negative would have a material impact on our reputation and financial performance.

Our Structured Credit business would also be negatively affected by a downgrade of ACA Financial Guaranty's financial strength rating to below "A" or a withdrawal of our rating. Because ACA Financial Guaranty insures our credit swaps and our counterparties rely on ACA Financial Guaranty's financial strength rating, we might be unable to enter into any new credit swap transactions and we could be required to provide collateral in the form of cash or securities securing our obligations under any new credit swaps that we may enter. In addition, under the terms of our credit agreement, to the extent we had outstanding borrowings under this facility, these borrowings would become due immediately, and we would be unable to make future borrowings, if our financial strength rating falls below "A-." Such collateral posting requirements and acceleration of our existing line of credit could severely disrupt our business and materially negatively impact our liquidity and reputation. It could also severely strain our capital resources thereby putting us at a competitive disadvantage.

In our Structured Credit business we have contingent collateral posting requirements that in adverse circumstances may severely strain our liquidity and capital resources.

If ACA Financial Guaranty's financial strength rating is downgraded below "A-," we are required to post collateral with respect to most of our existing credit swaps in the amount of any negative mark to market fair value of the credit swap. Additionally, should credit events or, in some circumstances, credit migration occur with respect to the reference entities included in our various Structured Credit transaction portfolios resulting in losses above pre-agreed-upon levels or, in some circumstances, a downgrade of the "AAA" rated liabilities in the structure, we are generally required to post collateral in an amount that is the lesser of the amount by which actual losses exceed this pre-agreed point and the amount of any negative mark to market value of the credit swap. Posting collateral could materially and adversely impact our liquidity, the adequacy of our capital and our ability to enter into future credit swaps. We may not have sufficient liquidity to meet any posting requirements depending on the size of

11

the negative mark at the time we are required to post collateral. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources."

General economic and market factors may materially adversely affect our loss experience, the demand for our products and our financial results.

Our business is impacted by general economic and market conditions. We could experience decreased demand for our products or incur losses due to extended economic recessions, business failures, interest rate changes or volatility, credit spread volatility, capital markets volatility, or changes in investor perceptions about the value of financial guaranty insurance, or combinations of such factors. Additionally, terrorist attacks of significant scale could cause volatility in the financial markets, particularly in the credit markets, and uncertainty in the economies of the areas in which they occur and in the global economy.

The market for the sale of credit protection under credit swaps and, consequently, related premiums are affected by a number of economic and market factors not within our control. The occurrence of credit events with respect to reference entities, for instance, such as bankruptcy or the failure to pay indebtedness, may be caused by cyclicality of the economy in general, industry cyclicality or credit events within the industry and capital market volatility generally, which may impact the supply and demand conditions in the credit swap market. Our financial results depend to a significant degree upon the premiums that we receive for the sale of our insurance products through our credit swaps. These premiums are established at origination of the transaction and are generally a function of both absolute credit spreads and the level of correlation among credit portfolios and the movement of related spreads, each of which change over time as a result of changes in the overall economy, supply and demand conditions in the credit swap market and other factors affecting the corporate credit market in general. If a low credit swap premiums environment persists, we may not be able to achieve profitable growth, which may have a material adverse effect on our financial condition and our results of operations. We can give no assurance that the credit swap market will continue to grow as it has in recent periods or at all or that it will not decline. Any such decline could have a material adverse effect on our financial condition.

Prevailing interest rates affect demand for financial guaranty insurance in the municipal finance market. Higher interest rates may result in declines in new bond issuances and refunding volumes which may reduce demand for our financial guaranty products. Lower interest rates generally are accompanied by narrower interest rate spreads between insured and uninsured obligations resulting in lower cost savings to issuers from the use of financial guaranty insurance than is the case during periods of higher interest rates. These lower cost savings could be accompanied by a corresponding decrease in demand for financial guaranty insurance.

Specifically, the performance of our CDOs and our ability to originate future CDOs may be materially adversely affected by any of these factors or by a combination of these factors. Changes in the level of credit spreads (i.e., the difference in interest rates between risky securities and risk remote securities, such as U.S. Treasury securities) can affect our ability to acquire financial assets for our CDOs that create sufficient spread in the transaction to pay the CDO liabilities and the fees and expenses of the CDO, including our asset management fees. If we are unable to acquire assets with sufficient spread, we may not be paid all or any portion of our asset management fees and the CDOs may pay returns below our expectations or not pay returns at all on our investment in the equity tranche. Further, we may not be able to continue to originate additional CDOs of the size of our current CDOs or at all. Increasing default rates may also negatively impact our equity returns and the overall performance of our CDOs. Poor performance in our CDOs could also hurt our reputation as an asset manager.

12

We face risks from the concentration of our liabilities and investments.

We face concentration risks in all of our businesses. While we seek diversification across our businesses, in each of our business lines and in our investment portfolio, we face risks to the extent that our aggregate exposure to losses is concentrated geographically, by industry, sector, obligor or type of credit or investment.

Our corporate synthetic CDOs, CLOs and Structured Credit transactions may include concentrations in particular industries or in geographical regions or in highly correlated industries and geographical regions. In the event that a particular industry or region experiences an economic downturn or natural disaster, the performance of our synthetic CDOs or CLOs may be materially negatively impacted. We may also experience significant numbers of credit events in relation to the reference entities included in the portfolios against which we sell protection in our Structured Credit transactions. Should such events occur, we could experience returns below our expectations on, or lose a portion or all of our equity investments in, our CDOs. Such an occurrence could harm our ability to continue to originate CDOs. Each of these events could materially and adversely impact our liquidity position as well as the adequacy of our capital.

In our Municipal Finance business we face default risk from the concentration of our exposure in certain states and in certain industries. As of June 30, 2006, $1,133.4 million, or 18.1%, of our outstanding financial guaranty exposure was concentrated in California-located issuers, and $2,689.7 million, or 42.9%, of our financial guaranty exposure was concentrated in nine additional states. This concentration increases our vulnerability to economic downturns, natural disasters, or terrorist attacks in those states. In addition, as of June 30, 2006, $1,459.1 million, or 23.3% of our financial guaranty exposure, was related to higher education and $1,636.3 million, or 26.1%, of our financial guaranty exposure was in the healthcare and long-term care facilities sector. Both the healthcare and long-term care sectors are facing rising costs and revenue constraints. As a result, healthcare and long-term care are perceived to be higher risks than other segments of the municipal finance market. These factors could undermine the assumptions we made in our credit analysis of the issuers in those sectors and cause actual losses to exceed estimated losses.

A large portion of the financial assets included in our CDOs are residential MBS, or RMBS, which present concentration risk to the national housing market. As of June 30, 2006, there was $7.4 billion of RMBS in our CDO assets under management. Should the country experience an economic decline, mortgage borrowers comprising the security underlying such RMBS may default on their loans which may in turn result in a default on the RMBS and losses to any of our CDOs which purchased such RMBS exposure. Also, some of the mortgages underlying our CDO exposures include interest only payments which are due to reset in the coming years. The reset of these mortgages to include interest plus principal payments may also cause an increase in obligor defaults of these mortgages. In addition, a significant portion of the assets securing the RMBS that we buy are secured by mortgages on properties in California and to a lesser extent in New York and Florida. Should one of those states specifically experience an economic downturn or natural disaster resulting in significant defaults on mortgages issued in that state, certain RMBS purchased into our CDOs may also experience defaults or lower market values. The occurrence of defaults in RMBS, could materially negatively impact the performance of our CDOs generally, making it difficult for us to continue to sponsor CDOs, and cause us to experience returns below our expectations on, or lose a portion or all of, our equity investment in our CDOs. The flattening in appreciation of home values, or depreciation of home prices, either nationally or regionally, particularly in areas where we have concentrated exposure, may increase the severity of the economic impact of this risk. Though to a lesser degree, we also have some exposure to RMBS underlying our credit swaps in our Structured Credit line of business. Should the country experience significant defaults on mortgages, we could also experience an increased number of credit events in our synthetic ABS structured credit transactions.

13

We may need to refinance our existing debt and otherwise require additional capital in the future, which may not be available or may only be available on unfavorable terms.

To the extent that our existing capital or the funds generated from this offering and our operations are insufficient to meet our future requirements, we may need to raise additional funds through financings. If additional funds are unavailable, we may need to curtail our growth, change our business strategy or sell assets. In addition, we will have to refinance our medium term note program, which matures in 2010 and which date is in advance of the maturity date of many of the assets acquired with the proceeds of such issuance. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Indebtedness." Any equity or debt financing, if available at all, may be on terms that are not favorable to us. Equity or debt we may issue in the future may have rights, preferences and privileges that are senior to those of the current common stock. In the case of equity financings, our stockholders could experience material dilution.

We may also need to obtain reinsurance in order to comply with state insurance regulatory and rating agency capital requirements and single risk limits as our business grows. Reinsurance allows us to grow our business by reducing our exposure to risks we have reinsured. As of October 3, 2006, we had purchased an aggregate of $42.3 million of facultative reinsurance in respect of 28 of our municipal bond insurance policies in order to reduce our single risk exposure to those credits, and $50 million of catastrophic coverage through an excess of loss reinsurance policy. If we need to seek additional reinsurance, reinsurance may not be available at acceptable terms or at all. This could have an adverse impact on our ability to grow our insurance business and could adversely affect our "A" rating and future results of operations.

We assume construction and completion risk in our Municipal Finance transactions.

In underwriting Municipal Finance transactions, we are willing to assume exposure to the credit during construction or otherwise prior to completion of the related project. While we have strict underwriting standards in assuming this risk and structure and seek to monitor these transactions with the view towards minimizing our potential exposure, the risk of loss on a Municipal Finance transaction is typically most significant during the construction and completion phases. Construction costs may exceed expectations and available funding, and timing delays, which may be caused by construction delays, natural disasters or economic downturn that diminish demand for a project, will delay the production of revenue necessary to pay debt service on the insured bonds. Delays in revenue production may also be caused post construction by delays in the commencement of operations. These delays can be caused by a variety of factors including industry-specific concerns such as obtaining all required regulatory approvals and such delays in the production of revenue may result in our payment of claims until the project may be completed and revenue generated. In the event a project is not completed, a default of the guaranteed bonds may occur resulting in the payment of claims by us. Depending on the status of the construction, our recoveries may be materially less than our claims paid as we rely on our security interest in the land and project itself for recoveries. Such an occurrence could negatively impact our results of operations. Also, should we experience a high level of defaults on these credits, the losses incurred could materially adversely impact our capital adequacy as well as our financial strength rating.

Our failure to accurately set our loss reserves may result in having to increase our loss reserves or make payments in excess of our loss reserves, which could materially and adversely impact our financial condition.

We establish loss reserves on our non-derivative financial guaranty insurance exposures. Setting our loss reserves involves significant reliance upon estimates with regard to the probability, magnitude and timing of losses. Our reserves may prove to be inaccurate, especially during an extended economic downturn. As of June 30, 2006, we have non-specific loss reserves of $19.0 million established in connection with our Municipal Finance line of business and case specific loss reserves of $18.2 million net of anticipated salvage of $7.2 million. If our loss reserves are determined to be inadequate, we will

14

be required to increase our loss reserves which would result in a corresponding reduction in our net income and stockholders' equity in the period in which the deficiency is recognized. Sizable losses could have a material impact on our capital adequacy and, ultimately, S&P financial strength rating. In addition, the Financial Accounting Standards Board, or FASB, is considering whether additional accounting guidance is necessary regarding methods of determining non-specific reserves. We may be required to increase our loss reserves or restate our current reserve allocations as a result of FASB's review. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates." As insured credit swaps constitute derivative instruments and are marked to market in accordance with Financial Accounting Standard ("FAS") No. 133, no loss reserves are recorded in connection with these transactions.

Changes in accounting rules relating to the financial guaranty industry could have a material adverse effect on us and our industry.

In June 2005, the Securities and Exchange Commission, or the SEC, asked the FASB to consider the accounting by financial guaranty insurers for claims liability recognition, premium recognition and deferred policy acquisition costs in addition to a then existing request to review loss reserving accounting policies for the financial guaranty industry. The proposed guidance from this review is expected to be issued later in 2006 and the final guidance is expected to be issued in 2007. When the FASB reaches a conclusion, it is possible that we and the financial guaranty insurance industry may be required to change some aspects of our and the industry's relevant accounting policies. Changes in our accounting policies relating to the timing of premium and expense recognition could have a material effect on us and on our industry. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates—FASB Financial Guaranty Insurance Review."

Certain of our CDOs must be consolidated in accordance with applicable accounting rules which introduces volatility into our balance sheet and statement of operations and may make it difficult to communicate economic trends and factors underlying our business and which may result in negative investor perception of us.

Pursuant to FASB Interpretation No. 46(R), we are required to consolidate into our balance sheet, assets and liabilities related to certain of our CDOs when we are deemed to be the primary beneficiary of the CDO vehicle. In general, this occurs when we own more than 35% of the equity of the vehicle. CDO assets are reflected on our balance sheet as fixed-maturity securities available for sale, at fair value. Although these CDOs are consolidated, we do not have the right to use the assets of the CDOs for general operations or in satisfaction of our corporate debt obligations. Similarly, the liabilities issued by the CDO are reflected on our balance sheet as debt. The consolidation of seven of our CDOs makes it more difficult for us to communicate economic trends and factors underlying our business. Additionally, losses in the asset portfolios that are consolidated could exceed our true economic risk. Our true economic risk is the amount of our equity investment. Losses could occur in connection with defaults in the underlying assets in response to a variety of economic pressures on the underlying obligor or structure. To the extent losses in the CDO asset portfolios exceed our associated equity investment, the financial statement impact is offset at CDO maturity, when the associated liabilities are written off; however, the potential mismatch could cause negative investor perception of us and negatively impact our stock price. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates."

15

Our net income may be volatile because a portion of the credit risk we assume is in the form of credit swaps and a number of our consolidated CDOs utilize interest rate swaps, both of which are derivatives and are accounted for under FAS 133/149, requiring that these instruments be marked to market.

As credit spreads increase or decrease, the spreads on the underlying assets included in our portfolios referenced by our insured credit swaps in our Structured Credit and synthetic CDO transactions will also increase or decrease, which will result in changes to the fair value of the credit swaps. Furthermore, changes in demand for such products, changes in the applicable legal and regulatory environments and over-all growth in this sector can also affect the fair value of our credit swaps. Our insured credit swaps meet the definition of derivatives under Statement of Financial Accounting Standards Nos. 133/149. Derivatives must be accounted for either as assets or liabilities on the balance sheet and measured at fair mark to market value. Although there is no cash flow effect from this "marking to market" as we enter into these insured credit swaps with an intent that they remain outstanding to maturity, changes in the fair value of the derivative are reported in our consolidated statement of operations, together with the fixed premiums payable to us under the contract, in net insured credit swap revenue and other net credit swap revenue and therefore will affect our reported earnings. We use various systems, models and stress test scenarios to monitor and manage market risk. These models include estimates made by management that use current and historic market information. The valuation results from these models could differ materially from amounts that actually are realized in the market. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures about Market Risk." Volatility in our reported earnings, even if there is no ultimate cash impact, can materially negatively impact our stock price, our ability to secure future financings and our reputation, which is critical to obtaining new business.

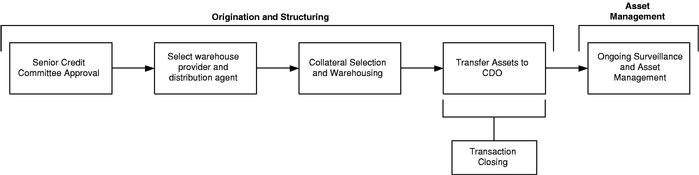

Common events that may cause credit spreads to fluctuate on the underlying assets included in the portfolios referenced by our credit swaps include changes in the state of national or regional economic conditions, industry cyclicality, changes in the business or financial assets of a specific issuer of the underlying assets included in a referenced portfolio, such as the issuer's competitive position within an industry, management changes, changes in the ratings of the underlying security, movements in interest rates, default or failure to pay interest, or any other factor leading investors to revise expectations about such issuer's ability to pay principal and interest on its debt obligations. These events are outside of our control. Similarly, common events that may cause credit spreads on an underlying structured security referenced in a credit swap to fluctuate may include the occurrence and severity of collateral defaults, changes in demographic trends impact on the levels of credit enhancement, rating changes, changes in interest rates or prepayment speeds, or any other factor leading investors to revise expectations about the risk of the collateral or the ability of the servicer to collect payments on the underlying assets sufficient to pay principal and interest. For a discussion of the historical fluctuations on the changes in fair value of our insured credit swaps, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations."