Table of Contents

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(E)(2)) | |||

| x | Definitive Proxy Statement | |||||

| ¨ | Definitive Additional Materials | |||||

| ¨ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 | |||||

ASHLAND INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: N/A |

| (2) | Aggregate number of securities to which transaction applies: N/A |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| (4) | Proposed maximum aggregate value of transaction: N/A |

| (5) | Total fee paid: N/A |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: N/A |

| (2) | Form, Schedule or Registration Statement No.: N/A |

| (3) | Filing Party: N/A |

| (4) | Date Filed: N/A |

Notes:

Table of Contents

James J. O’Brien Chairman and Chief Executive Officer | Ashland Inc. 50 E. RiverCenter Blvd., P.O. Box 391 Covington, KY 41012-0391 | |

| December 4, 2009 | ||

Dear Ashland Inc. Shareholder:

On behalf of your Board of Directors and management, I am pleased to invite you to attend the 2010 Annual Meeting of Shareholders of Ashland Inc. The meeting will be held on Thursday, January 28, 2010, at 10:30 a.m. (EST), at the Metropolitan Club, 50 E. RiverCenter Boulevard, Covington, Kentucky.

You may have noticed changes in the way we are providing proxy materials to our shareholders in connection with our 2010 Annual Meeting. Where possible, we have elected to provide access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules. We believe that providing our proxy materials over the Internet reduces the environmental impact of our Annual Meeting without limiting our shareholders’ access to important information about Ashland.

Whether or not you plan to attend the meeting, we encourage you to vote promptly.

We appreciate your continued confidence in Ashland, and we look forward to seeing you at the meeting.

Sincerely,

James J. O’Brien

Table of Contents

Ashland Inc.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held January 28, 2010

To our Shareholders:

Ashland Inc. will hold its Annual Meeting of Shareholders on Thursday, January 28, 2010, at 10:30 a.m. (EST) at the Metropolitan Club, 50 E. RiverCenter Boulevard, Covington, Kentucky. Ashland’s shareholders will act on the following matters at the Annual Meeting or any adjournment of that meeting:

| (1) | To elect three directors to Class III: Mark C. Rohr, Theodore M. Solso and Michael J. Ward; |

| (2) | To ratify the appointment of PricewaterhouseCoopers LLP as independent registered public accountants for fiscal 2010; and |

| (3) | To consider any other business properly brought before the Annual Meeting. |

In order that your Ashland Common Stock may be represented at the Annual Meeting, please vote your shares by proxy using one of the following methods: (a) vote by telephone or via the Internet using the instructions on your Notice or proxy card or (b) if you received printed proxy materials, you may complete, sign, date and return your proxy card in the postage-paid envelope provided.

By Order of the Board of Directors,

LINDA L. FOSS

Assistant General Counsel

and Corporate Secretary

Covington, Kentucky

December 4, 2009

Table of Contents

| Page | ||

| 1 | ||

| 4 | ||

Ashland Common Stock Ownership of Directors and Executive Officers of Ashland | 5 | |

| 7 | ||

| 7 | ||

| 8 | ||

Continuing Directors Not Up for Election at the 2010 Annual Meeting | 9 | |

| 12 | ||

| 12 | ||

| 13 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| 16 | ||

| 17 | ||

| 17 | ||

| 17 | ||

| 18 | ||

| 18 | ||

| 19 | ||

Personnel and Compensation Committee Interlocks and Insider Participation | 21 | |

| 22 | ||

| 22 | ||

Principles and Objectives of Ashland’s Executive Compensation Program | 22 | |

| 23 | ||

| 25 | ||

| 27 | ||

| 29 | ||

| 36 | ||

| 37 | ||

| 37 | ||

| 38 | ||

| 38 | ||

| 38 | ||

| 39 | ||

| 39 | ||

Personnel and Compensation Committee Report on Executive Compensation | 40 | |

| 41 | ||

| 43 | ||

| 45 | ||

| 47 | ||

| 49 | ||

| 54 | ||

| 55 | ||

Table of Contents

| Page | ||

| 63 | ||

Ratification of Independent Registered Public Accountants—Item 2 | 65 | |

| 66 | ||

| 66 | ||

| 66 | ||

| 66 | ||

| 67 | ||

Table of Contents

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE MEETING

| Q: | What am I voting on? |

| A: | (1) | Election of three directors to Class III: Mark C. Rohr, Theodore M. Solso, and Michael J. Ward; and | ||

| (2) | Ratification of PricewaterhouseCoopers LLP (“PwC”) as Ashland’s independent registered public accountants for fiscal 2010. | |||

| Q: | Who may vote at the Annual Meeting? |

| A: | Shareholders of Ashland Inc. (“Ashland” or the “Company”) at the close of business on December 1, 2009 (the “Record Date”), are entitled to vote at the Annual Meeting. As of the Record Date, there were 77,973,061 shares of Ashland Common Stock outstanding. Each share of Ashland Common Stock is entitled to one vote. |

| Q: | Who can attend the Annual Meeting? |

| A: | All Ashland shareholders on the Record Date are invited to attend the Annual Meeting, although seating is limited. If your shares are held in the name of a nominee (e.g., through a bank or broker), you will need to bring a proxy or letter from that nominee that confirms you are the beneficial owner of those shares. |

| Q: | Why did I receive the Notice of Internet Availability of Proxy Materials (“Notice”) in the mail instead of a full set of proxy materials? |

| A: | In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we may furnish proxy materials, including this proxy statement and our 2009 Annual Report, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials, unless they have specifically requested them. Instead, a Notice will be mailed to shareholders starting on or around December 10, 2009. The Notice will instruct you how you may access and review all of the proxy materials on the Internet. The Notice also instructs you how you may submit your vote on the Internet or by phone. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice. |

| Q: | How do I get electronic access to the proxy materials? |

| A: | The Notice will provide you with instructions regarding how to view Ashland’s proxy materials for the Annual Meeting and 2009 Annual Report on the Internet. |

| Q: | How do I vote? |

| A: | If you are a shareholder as of the Record Date, you can vote (i) by attending the Annual Meeting, (ii) by following the instructions on your Notice for voting by telephone or on the Internet, or (iii) by signing, dating and mailing in a proxy card. If you hold shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the meeting, you must first obtain a proxy issued in your name from the institution that holds your shares. |

All shares represented by validly executed proxies will be voted at the Annual Meeting, and such shares will be voted in accordance with the instructions provided. If no voting specification is made on your signed and returned proxy card, James J. O’Brien or Linda L. Foss, as individuals named on the proxy card, will vote FOR the election of the three director nominees and FOR the ratification of PwC.

1

Table of Contents

| Q: | Can I change my vote after I have voted? |

| A: | Yes. You have the right to change or revoke your proxy (1) at any time before the Annual Meeting by (a) notifying Ashland’s Corporate Secretary in writing, (b) returning a later-dated proxy card, or (c) entering a later-dated telephone or Internet vote; or (2) voting in person at the Annual Meeting. However, any changes or revocations of voting instructions to the Trustee of the Leveraged Employee Stock Ownership Plan (the “LESOP”), Ashland’s Employee Savings Plan (the “Employee Savings Plan”) and the Hercules Incorporated Savings and Investment Plan (the “SIP”) must be received by our proxy tabulator, Corporate Election Services (“CES”), before 6:00 a.m. (EST) on Tuesday, January 26, 2010. |

| Q: | Who will count the vote? |

| A: | Representatives of CES will tabulate the votes and will act as the inspector of election. |

| Q: | Is my vote confidential? |

| A: | Yes. Your vote is confidential. |

| Q: | What shares are included in the Notice or proxy card? |

| A: | Your Notice or proxy card represents all shares of Ashland Common Stock that are registered in your name and any shares you hold in Ashland’s Open Enrollment Dividend Reinvestment and Stock Purchase Plan (the “DRP”), the LESOP, the Employee Savings Plan, or the SIP. If your shares are held through a nominee, you will receive either a Notice, a voting instruction form or a proxy card from the nominee to vote your shares. |

| Q: | How do I vote my shares in the DRP? |

| A: | Shares of Ashland Common Stock credited to your account in the DRP will be voted by Computershare Trust Company, N.A. (“Computershare”), the plan administrator, in accordance with your voting instructions. |

| Q: | How will the Trustees of the Employee Savings Plan, the LESOP and the SIP vote? |

| A: | Each participant in the Employee Savings Plan, the LESOP or the SIP will instruct the applicable Trustee how to vote the shares of Ashland Common Stock credited to the participant’s account in each plan. This instruction also applies to a proportionate number of those shares of Ashland Common Stock allocated to participants’ accounts but for which voting instructions are not timely received by the Trustee and, in the case of the SIP, this instruction also applies to a proportionate number of those shares of Ashland Common Stock that are not allocated to participant accounts. These shares are collectively referred to as Non-Directed shares. Each participant who gives the Trustee such an instruction acts as a named fiduciary for the plans under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). Your vote must be received by our proxy tabulator before 6:00 a.m. (EST) on Tuesday, January 26, 2010. |

| Q: | Can a plan participant vote the Non-Directed shares differently from shares credited to his or her account? |

| A: | Yes, provided that you are a participant in the Employee Savings Plan or the LESOP. Any participant in the Employee Savings Plan or the LESOP who wishes to vote the Non-Directed shares differently from the shares credited to his or her account or who wishes not to vote the Non-Directed shares at all may do so by requesting a separate voting instruction card from Corporate Election Services, P.O. Box 535600, Pittsburgh, PA 15253. Participants in the SIP, however, cannot direct that the Non-Directed shares be voted differently from the shares in their accounts. |

2

Table of Contents

| Q: | What constitutes a quorum? |

| A: | As of the Record Date, 77,973,061 shares of Ashland Common Stock were outstanding. A majority of the outstanding shares present in person or by proxy is required to constitute a quorum to transact business at the Annual Meeting. If you vote in person, by telephone, over the Internet or by returning a properly executed proxy card, you will be considered a part of that quorum. |

Abstentions and broker non-votes (i.e., when a broker does not have authority to vote on a specific issue) will be treated as present for the purpose of determining a quorum but as unvoted shares for the purpose of determining the approval of any matter submitted to the shareholders for a vote.

| Q: | What vote is required for approval of each matter to be considered at the Annual Meeting? |

| A: (1) | Election of directors—Under Article XII of Ashland’s Articles of Incorporation, as amended, the affirmative vote of a majority of votes cast with respect to each director nominee is required for the nominee to be elected. A majority of votes cast means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that director nominee. |

| (2) | Ratification of independent registered public accountants—The appointment of PwC will be deemed ratified if votes cast in its favor exceed votes cast against it. |

| Q: | How will broker non-votes be treated? |

| A: | Ashland will treat broker non-votes as present to determine whether or not there is a quorum at the Annual Meeting, but they will not be treated as entitled to vote on the matters, if any, for which the broker indicates it does not have discretionary authority. This means that broker non-votes will not have any effect on whether a matter being considered passes. |

| Q: | What happens if other matters come up during the meeting? |

| A: | If matters other than those referred to in the Notice properly come before the meeting, the individuals named on the proxy card will vote the proxies held by them in accordance with their best judgment. Ashland is not aware of any other business other than the items referred to in the Notice that may be considered at the Meeting. |

| Q: | Where can I find the voting results of the meeting? |

| A: | We intend to announce preliminary voting results at the meeting. We will publish the final results in a press release or in our Quarterly Report on Form 10-Q for the first quarter of fiscal 2010. You can obtain a copy of the Form 10-Q by logging on to our website at http://investor.ashland.com, by calling the SEC at 1-800-SEC-0330 for the location of the nearest public reference room, or through the EDGAR system athttp://www.sec.gov. |

| Q: | How can I find Ashland’s proxy materials and annual report on the Internet? |

| A: | Important Notice regarding the availability of Proxy Materials for the Annual Meeting to be held on January 28, 2010. This proxy statement and Ashland’s 2009 Annual Report to Shareholders are available at www.ashland.com/proxy. |

3

Table of Contents

ASHLAND COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth information with respect to each person known to Ashland to beneficially own more than 5% of the outstanding shares of Ashland Common Stock as of September 30, 2009.

Name and Address of Beneficial Owner | Amount and Nature of Common Stock Beneficial Ownership | Percent of Class of Common Stock* | ||||

FMR LLC | 8,773,055 | (1) | 11.71 | % | ||

82 Devonshire Street | ||||||

Boston, Massachusetts 012109 | ||||||

Barclays Global Investors UK Holdings Ltd. | 6,180,259 | (2) | 8.26 | % | ||

1 Churchill Place | ||||||

Canary Wharf | ||||||

London, England E14 5HP | ||||||

Fidelity Management Trust Company | 5,979,488 | (3) | 7.99 | % | ||

82 Devonshire Street | ||||||

Boston, Massachusetts 02109 | ||||||

| * | Based on 74,861,436 shares of Ashland Common Stock outstanding as of September 30, 2009. |

| (1) | Based upon information contained in the Form 13G filed by FMR LLC (“FMR”) with the SEC on July 10, 2009, FMR is a parent holding company which beneficially owns 8,773,055 shares of Ashland Common Stock, with sole voting power over 907,394 shares, shared voting power over no shares and sole dispositive power over all of the 8,773,055 shares. Of the 8,773,055 shares, Fidelity Management & Research Company (“Fidelity”), an investment adviser and a wholly-owned subsidiary of FMR, is the beneficial owner of 7,841,161 shares. Edward C. Johnson 3d, Chairman of FMR, and FMR, through its control of Fidelity, each have sole dispositive power over these shares. The remaining 931,894 shares are held by various entities affiliated with FMR. |

| (2) | Based upon a Form 13F filed with the SEC for the quarter ended September 30, 2009 by Barclays Global Investors UK Holdings Limited, an indirect subsidiary of Barclays PLC and a direct wholly-owned subsidiary of Barclays Bank PLC (collectively, “Barclays”), Barclays and affiliated entities were the beneficial owners of 6,180,259 shares of Ashland Common Stock on that date. Barclays has sole voting power for 5,392,151 of these shares and no voting power for 788,108 of these shares. Barclays has sole dispositive power for each of these shares. |

| (3) | As of September 30, 2009, Fidelity Management Trust Company (“FMT”) was the record owner of 5,979,488 shares of Ashland Common Stock. These shares include 2,923,979 shares held by it as Trustee of the LESOP and 3,055,509 shares held by it as Trustee of the Employee Savings Plan. FMT will vote shares allocated to a participant’s LESOP and Employee Savings Plan account as instructed by the participant. This instruction also applies to a proportionate number of those shares of Ashland Common Stock allocated to participants’ accounts but for which voting instructions are not timely received by the Trustee. FMT disclaims beneficial ownership of these shares. |

4

Table of Contents

ASHLAND COMMON STOCK OWNERSHIP OF DIRECTORS

AND EXECUTIVE OFFICERS OF ASHLAND

The following table shows as of October 30, 2009, the common stock ownership of all directors and executive officers of Ashland named in the Summary Compensation Table onpage 41 of this proxy statement and common stock ownership of the directors and executive officers of Ashland as a group.

Common Stock Ownership

Name of Beneficial Owner | Aggregate Number of Shares of Common Stock Beneficially Owned | |||

James J. O’Brien | 330,337 | (1)(2)(3) | ||

Lamar M. Chambers | 102,169 | (1)(2)(3)(4) | ||

David L. Hausrath | 57,595 | (1)(2)(3) | ||

Theodore L. Harris | 53,247 | (1)(2)(3)(4) | ||

Samuel J. Mitchell | 64,588 | (1)(2)(3) | ||

Roger W. Hale | 32,045 | (2)(3)(5)(6) | ||

Bernadine P. Healy | 38,886 | (2)(3)(5) | ||

Kathleen Ligocki | 48,725 | (2)(3)(5) | ||

Vada O. Manager | 3,299 | (2)(5) | ||

Barry W. Perry | 4,855 | (2)(5) | ||

Mark C. Rohr | 7,849 | (2)(5) | ||

George A. Schaefer, Jr. | 24,065 | (2)(3)(5) | ||

Theodore M. Solso | 49,964 | (2)(3)(5) | ||

John F. Turner | 4,855 | (2)(5) | ||

Michael J. Ward | 43,891 | (2)(3)(5) | ||

All directors and executive officers as a group (22 people) | 1,111,917 | (1)(2)(3)(4)(5)(6) | ||

None of the listed individuals owned more than 1% of Ashland’s Common Stock outstanding as of the Record Date. All directors and executive officers as a group owned 1,111,917 shares of Ashland Common Stock, which equaled 1.4% of the Ashland Common Stock outstanding on the Record Date. Shares of Ashland Common Stock outstanding on the Record Date include shares deemed to be outstanding for computing the percentage ownership of the applicable person, but are not deemed to be outstanding for computing the percentage ownership of any other person.

| (1) | Includes shares of Ashland Common Stock held under the Employee Savings Plan, the SIP and the LESOP by executive officers. Participants can vote the Employee Savings Plan, the SIP and the LESOP shares, and can invest in numerous investment options available under the Employee Savings Plan and SIP. |

| (2) | Includes stock and/or restricted stock units (share equivalents) held by executive officers in the Ashland Common Stock Fund under Ashland’s nonqualified deferred compensation plans for employees (the “Employees’ Deferral Plan”) or by directors under the nonqualified deferred compensation plans for non-employee directors (the “Directors’ Deferral Plan”): as to Mr. O’Brien, 133,366 units; as to Mr. Chambers, 24,938 units; as to Mr. Hausrath, 21,961 units; as to Mr. Harris, 2,120 units; as to Mr. Mitchell, 31,892 units; as to Mr. Hale, 13,521 units; as to Dr. Healy, 13,328 units; as to Ms. Ligocki, 13,273 units; as to Mr. Manager, 1,849 units; as to Mr. Perry, 3,855 units; as to Mr. Rohr, 1,849 units; as to Mr. Schaefer, 3,855 units; as to Mr. Solso, 35,052 units; as to Mr. Turner, 3,855 units; as to Mr. Ward, 29,979 units; and as to all directors and executive officers as a group, 352,982 units. |

| (3) | Includes shares of Ashland Common Stock with respect to which the directors and executive officers have the right to acquire beneficial ownership within 60 calendar days after October 30, 2009, through the exercise of stock options or stock appreciation rights (“SARs”): as to Mr. O’Brien, 86,204 shares |

5

Table of Contents

through SARs; as to Mr. Chambers, 21,373 shares through options and 21,102 shares through SARs; as to Mr. Hausrath, 21,102 shares through SARs; as to Mr. Harris, 17,240 shares through SARs; as to Mr. Mitchell, 19,375 shares through options and 10,344 shares through SARs; as to Dr. Healy, 20,036 shares through options; as to Messrs. Hale and Schaefer, 16,474 shares through options; as to Messrs. Solso, Ward, and Ms. Ligocki, 12,912 shares through options; and as to all directors and executive officers as a group, 135,140 shares through options and 210,159 shares through SARs. All unexercised options on this table are reported as gross shares. All SARs included in this table are reported on a net basis based on the closing price for Ashland Common Stock as reported on the New York Stock Exchange Composite Tape (“NYSE”) on October 30, 2009. All SARs are stock settled and not issued in tandem with an option. |

| (4) | Includes restricted shares of Ashland Common Stock: as to Mr. Chambers, 14,000 shares; as to Mr. Harris, 30,000 shares; and as to all executive officers as a group, 186,500 shares. |

| (5) | Includes 1,000 restricted shares of Ashland Common Stock for each of the non-employee directors. |

| (6) | Includes shares of Ashland Common Stock held under the DRP, which provides participants with voting power with respect to such shares. |

6

Table of Contents

ITEMS TO BE VOTED ON BY SHAREHOLDERS

ELECTION OF DIRECTORS

Item 1

The Board of Directors is currently made up of eleven directors, divided into three classes. The three individuals nominated for election as Class III directors at the 2010 Annual Meeting are Mark C. Rohr, Theodore M. Solso and Michael J. Ward. The nominees to Class III will be elected to serve a three-year term until the 2013 Annual Meeting. The Governance and Nominating Committee (“G&N Committee”) has confirmed that all three nominees will be available to serve as directors upon election and recommends that shareholders vote for them at the Annual Meeting.

Under Article XII of Ashland’s Articles of Incorporation, as amended, in an uncontested election the affirmative vote of a majority of votes cast with respect to a director nominee is required for the nominee to be elected. Therefore, the number of votes cast “for” a nominee must exceed those cast “against” a nominee for the nominee to be elected to the Board of Directors.

Pursuant to the Board of Directors’ resignation policy in Ashland’s Corporate Governance Guidelines (published on Ashland’s website (http://www.investor.ashland.com)), any nominee who is serving as a director at the time of an uncontested election who fails to receive a greater number of votes “for” his or her election than votes “against” his or her election will tender his or her resignation within ten days following the certification of the shareholder vote for consideration by the Board of Directors. The Board will decide, through a process managed by the G&N Committee, whether to accept the resignation within 90 days following the date of the shareholder meeting. The Company will then promptly disclose the Board’s decision and reasons therefore. As a condition to his or her nomination, each person nominated by the G&N Committee must agree in advance to abide by the policy. Mark C. Rohr, Theodore M. Solso and Michael J. Ward, the three nominees to Class III, have each agreed to abide by the policy.

If no voting specification is made on a properly returned or voted proxy card, James J. O’Brien or Linda L. Foss (proxies named on the proxy card) will vote FOR the three nominees named in this proxy statement. If any of the nominees should be unable or unwilling to stand for election at the time of the Annual Meeting, the proxies may vote for a replacement nominee recommended by the Board of Directors, or the Board may reduce the number of directors to be elected at the Annual Meeting. At this time, the Board knows of no reason why any of the nominees may not be able to serve as a director if elected.

The Board of Directors recommends a vote FOR Mark C. Rohr, Theodore M. Solso and Michael J. Ward for election as Class III directors at the 2010 Annual Meeting.

7

Table of Contents

Nominees for Election at the 2010 Annual Meeting

Class III Directors

(Term expiring in 2013)

| Mark C. Rohr | Director since 2008 | ||

| Mr. Rohr, 58, is Chairman of the Board, Chief Executive Officer and President of Albemarle Corporation. Prior to this position, he held several executive positions with Albemarle, including Chief Operating Officer and Executive Vice President—Operations. Before joining Albemarle, he served with Occidental Chemical Corp. as Senior Vice President—Specialty Chemicals. Mr. Rohr holds Bachelor of Science degrees in chemistry and chemical engineering from Mississippi State University. He is also Lead Director of Celanese Corp. where he is a member of the Compensation and Nominating and Corporate Governance Committees. He also serves on the Executive Committee of the American Chemistry Council and the Board of Directors of the Wildlife Habitat Council. Mr. Rohr is a member of Ashland’s Audit and Environmental, Health and Safety Committees. | ||||

| Theodore M. Solso | Director since 1999 | ||

| Mr. Solso, 62, is Chairman of the Board and Chief Executive Officer of Cummins Inc. Prior to this position, he held several executive positions with Cummins, including President and Chief Operating Officer. Mr. Solso holds a Bachelor of Arts degree in psychology from DePauw University and a Masters in Business Administration from the Harvard Business School. He is also a Director of Ball Corporation where he is a member of the Audit and Human Resources Committees. Mr. Solso also serves as Chairman of the Cummins Foundation and Director of the Indiana Economic Development Corp. He also serves as an Advisory Trustee of DePauw University. Mr. Solso is Co-Chair of the U.S.-Brazil CEO Forum and a member of the Earth University Foundation Board. Mr. Solso is Chairman of Ashland’s Personnel and Compensation Committee and a member of the Finance and Governance and Nominating Committees. | ||||

| Michael J. Ward | Director since 2001 | ||

| Mr. Ward, 59, is Chairman of the Board and Chief Executive Officer of CSX Corporation. Prior to this position, he was President of CSX Transportation, the corporation’s rail unit. Mr. Ward holds a Bachelor of Arts degree from the University of Maryland and a Masters in Business Administration from the Harvard Business School. In 2005, Mr. Ward served as Chairman of the Association of American Railroads’ Board of Directors. He is also a Director of American Coalition for Clean Coal Electricity, City Year, and Take Stock in Children. His other business affiliations include The Florida Council of 100, The Business Roundtable, and the HSC Foundation. Mr. Ward is Chairman of Ashland’s Finance Committee and a member of the Personnel and Compensation Committee. | ||||

8

Table of Contents

Continuing Directors Not Up for Election at the 2010 Annual Meeting

Class I Directors

(Term expiring in 2011)

| Bernadine P. Healy, M.D. | Director since 1998 | ||

| Dr. Healy, 65, is a columnist and health editor for U.S. News and World Report. Prior to this position, she served as President and Chief Executive Officer of the American Red Cross, and Dean, College of Medicine and Public Health, and Professor of Medicine, The Ohio State University. Dr. Healy holds a Bachelor of Arts degree from Vassar College and a Doctor of Medicine from Harvard University. Dr. Healy is also a director of The Progressive Corporation, where she serves on the Audit Committee; and Invacare, Inc. where she serves as Chairman of the Investment Committee and a member of the Compensation, Management Development and Corporate Governance Committees. She is also a Trustee of Battelle Memorial Institute where she serves on the Science and Technology Committee. Dr. Healy is a member of Ashland’s Audit, Environmental, Health and Safety and Governance and Nominating Committees. | ||||

| Kathleen Ligocki | Director since 2004 | ||

| Ms. Ligocki, 53, is the Chief Executive Officer of GS Motors, a subsidiary of a large conglomerate based in Mexico City. She is also a principal in Pine Lake Partners, Inc., a consulting firm focused on turnarounds and startup companies. Prior to these positions, she served as President and Chief Executive Officer of Tower Automotive, Inc. from August 2003 to August 2007. Tower Automotive filed to reorganize under Chapter 11 of the U.S. Bankruptcy Codes in February 2005, and on July 31, 2007 emerged from Chapter 11 when substantially all of its assets were purchased by an affiliate of Cerberus Capital Management, L.P. Prior to joining Tower Automotive, Ms. Ligocki worked at the Ford Motor Company, United Technologies and General Motors Corporation. Ms. Ligocki holds a Bachelor of Arts degree in liberal studies from Indiana University, a Masters in Business Administration from The Wharton School at the University of Pennsylvania and honorary doctorates from Indiana University and Central Michigan University. She serves on a variety of non-profit and academic boards focused on women, families and life-long education. Ms. Ligocki is Chairman of Ashland’s Environmental, Health and Safety Committee and a member of the Audit and Personnel and Compensation Committees. | ||||

| James J. O’Brien | Director since 2002 | ||

| Mr. O’Brien, 55, is Ashland’s Chairman of the Board and Chief Executive Officer. Prior to this position, Mr. O’Brien was President and Chief Operating Officer of Ashland and Senior Vice President and Group Operating Officer of Ashland. He also served as the President of Valvoline from 1995 to 2001. Mr. O’Brien holds a Bachelor of Science degree in accounting and finance and a Masters in Business Administration from The Ohio State University. Mr. O’Brien is a Director of Humana Inc., where he serves on the Investment and Audit Committees. He serves as a member of the Dean’s Advisory Council for the Fisher Graduate College of Business at The Ohio State University. A past volunteer “big brother” with Big Brothers/Big Sisters of the Bluegrass, Mr. O’Brien also serves on the organization’s national Board of Directors. He is Chairman of the Board of Trustees for Midway College in Kentucky. | ||||

9

Table of Contents

Continuing Directors Not Up for Election at the 2010 Annual Meeting (continued)

| Barry W. Perry | Director since 2007 | ||

| Mr. Perry, 63, served as Chairman and Chief Executive Officer of Englehard Corporation from January 2001 to June 2006. Prior to this position, he held various management positions with Englehard Corporation beginning in 1993. From 1991 to 1993, Mr. Perry was a Group Vice President of Rhone-Poulene. Prior to joining Rhone-Poulene, he held a number of executive positions with General Electric Company. Mr. Perry holds a Bachelor of Science degree in plastics engineering from the University of Massachusetts. Mr. Perry is also a director of Arrow Electronics, Inc., where he serves on the Compensation and Audit Committees; Cookson Group PLC, where he serves on the Audit and Compensation Committees; and Albemarle Corporation. Mr. Perry is a member of Ashland’s Environmental, Health and Safety, Governance and Nominating and Personnel and Compensation Committees. | ||||

Class II Directors

(Term expiring in 2012)

| Roger W. Hale | Director since 2001 | ||

| Mr. Hale, 66, is currently acting as an independent consultant. He served as Chairman of the Board and Chief Executive Officer of LG&E Energy Corporation, a diversified energy services company headquartered in Louisville, Kentucky, from August 1990 until retiring in April 2001. Prior to joining LG&E Energy, he was Executive Vice President of BellSouth Corporation, a communications services company in Atlanta, Georgia. From 1966 to 1986, Mr. Hale held several executive positions with AT&T Co., a communications services company, including Vice President, Southern Region from 1983 to 1986. Mr. Hale holds a Bachelor of Arts degree from the University of Maryland and a Masters of Science in Management from the Massachusetts Institute of Technology, Sloan School of Management. Mr. Hale serves as a Director of Hospira, Inc., where he is a member of the Compensation and Governance and Public Policy Committees. Mr. Hale is Chairman of Ashland’s Audit Committee and a member of the Finance Committee. | ||||

| Vada O. Manager | Director since 2008 | ||

| Mr. Manager, 48, is currently an independent global consultant. He served as the Senior Director of Global Issues Management for Nike, Inc., from 2006 until March 2009, and held various management positions at Nike, beginning in 1997. Before joining Nike, he performed a similar role for Levi Strauss & Co. and was also a Vice President of the Washington, D.C.-based public affairs firm, Powell Tate, a part of Weber Shandwick. Mr. Manager holds a Bachelor of Arts degree in political science from Arizona State University and performed graduate work at the London School of Economics. Mr. Manager is as a member of Ashland’s Finance and Personnel and Compensation Committees. | ||||

10

Table of Contents

Continuing Directors Not Up for Election at the 2010 Annual Meeting (continued)

| George A. Schaefer, Jr. | Director since 2003 | ||

| Mr. Schaefer, 64, served as Chairman of the Board of Directors of Fifth Third Bancorp headquartered in Cincinnati, Ohio until June, 2008. Prior to this position, he held several executive positions with Fifth Third, including Chief Executive Officer, President and Chief Operating Officer. Mr. Schaefer holds a Bachelor of Science degree from the U.S. Military Academy at West Point and a Masters in Business Administration from Xavier University. He is also a Director of Wellpoint Inc., where he serves as Chairman of the Audit Committee. He is also a member of the Board of Trustees of the University of Cincinnati Foundation, a Trustee for the University of Cincinnati Medical School Advisory Board, and director of U.C. Physicians. Mr. Schaefer is Chairman of Ashland’s Governance and Nominating Committee and a member of the Audit and Finance Committees. | ||||

| John F. Turner | Director since 2006 | ||

| Mr. Turner, 67, served as Assistant Secretary of State for the U.S. Department of State’s Bureau of Oceans and International and Scientific Affairs in Washington, D.C., from November 2001 until July 2005. Prior to serving at the Department of State, he was President and Chief Executive Officer of The Conservation Fund, a non-profit organization dedicated to conserving America’s natural and historic heritage. Between 1989 and 1993, Mr. Turner was Director of the U.S. Fish and Wildlife Service. Mr. Turner also served in the Wyoming state legislature for 19 years and is a past president of the Wyoming State Senate. Mr. Turner holds a Bachelor of Arts degree in biology from the University of Notre Dame and a Master of Science degree in wildlife ecology from the University of Michigan. Mr. Turner is also a Director of Peabody Energy Company where he serves on the Compensation and Nominating and Corporate Governance Committees; International Paper Company where he chairs the Governance and Public Policy and Environment Committees; and, American Electric Power Company, Inc. where he is a member of the Audit, Corporate Governance and Environmental Health and Safety Committees. He is also a managing partner in The Triangle X Ranch in Wyoming. Mr. Turner is Chairman of the Ruckelshaus Institute of Environmental Natural Resources at the University of Wyoming and Senior Associate of The Conservation Fund. Mr. Turner is a member of Ashland’s Environmental, Health and Safety and Governance and Nominating Committees. | ||||

11

Table of Contents

The following table is a summary of compensation information for the fiscal year ended September 30, 2009, for Ashland’s non-employee directors as of September 30, 2009. Compensation paid to Mr. O’Brien, Chairman of the Board and Chief Executive Officer, is disclosed in theSummary Compensation Table to this proxy statement and is not included in this table.

Name | Fees Earned or Paid in Cash (1) ($) | Stock Awards (2) ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||

Roger W. Hale | 105,000 | 408,383 | 0 | 0 | 0 | 0 | 513,383 | |||||||

Dr. Bernadine P. Healy | 97,500 | 408,383 | 0 | 0 | 0 | 0 | 505,883 | |||||||

Kathleen Ligocki | 105,000 | 417,174 | 0 | 0 | 0 | 0 | 522,174 | |||||||

Vada O. Manager | 90,000 | 410,887 | 0 | 0 | 0 | 0 | 500,887 | |||||||

Barry W. Perry | 90,000 | 421,836 | 0 | 0 | 0 | 0 | 511,836 | |||||||

Mark C. Rohr | 97,500 | 410,887 | 0 | 0 | 0 | 0 | 508,387 | |||||||

George A. Schaefer, Jr. | 105,000 | 408,384 | 0 | 0 | 0 | 0 | 513,384 | |||||||

Theodore M. Solso | 117,500 | 408,384 | 0 | 0 | 0 | 0 | 525,884 | |||||||

John F. Turner | 90,000 | 421,440 | 0 | 0 | 0 | 0 | 511,440 | |||||||

Michael J. Ward | 97,500 | 408,384 | 0 | 0 | 0 | 0 | 505,884 | |||||||

| (1) | For fiscal 2009 Ms. Ligocki and Messrs. Perry, Solso and Ward deferred their fees into the Directors’ Deferral Plan. |

| (2) | The dollar amount for each non-employee director shown in this column (c) represents the amount recognized in fiscal year 2009 for financial accounting purposes pursuant to the Financial Accounting Standards Board’s Statement of Financial Accounting Standards 123 (revised) (“FAS 123R”) for (i) unvested restricted stock units, and (ii) 1,000 shares of restricted Ashland Common Stock granted to Ms. Ligocki, and Messrs. Manager, Perry, Rohr and Turner upon their election as directors. |

Each non-employee director received a grant of 12,121 restricted stock units of Ashland Common Stock in the Directors’ Deferral Plan on January 29, 2009, with a grant date market value of $100,000. Each restricted stock unit is equivalent to a share of Ashland Common Stock. The restricted stock units vest as described inthe Restricted Shares/Units section of this proxy statement. The amounts in column (c) represent $408,383 for each director recognized as an expense in fiscal 2009 for financial accounting purposes under FAS 123R.

Each non-employee director is granted 1,000 shares of restricted Ashland Common Stock upon becoming a director. This grant vests as described inthe Restricted Shares/Units section of this proxy statement. The

12

Table of Contents

amounts in this column (c) also include the amount recognized as an expense in fiscal 2009 for financial accounting purposes under FAS 123R as follows: as to Ms. Ligocki, $8,790; Mr. Manager, $9,352; Mr. Perry, $13,452; Mr. Rohr, $9,352; and Mr. Turner, $13,056. For restricted stock, the grant date fair value is calculated using the closing price of Ashland Common Stock as reported on the NYSE on the date of grant.

As of September 30, 2009, the following table identifies the aggregate amount of outstanding stock and option awards granted to each current non-employee director.

Name | Shares of Restricted Ashland Common Stock (#) | Restricted Stock Units of Ashland Common Stock (a) (#) | Outstanding Ashland Stock Options (b) (#) | |||

Roger W. Hale | 1,000 | 16,159 | 16,474 | |||

Dr. Bernadine P. Healy | 1,000 | 16,159 | 20,036 | |||

Kathleen Ligocki | 1,000 | 16,159 | 12,912 | |||

Vada O. Manager | 1,000 | 14,153 | 0 | |||

Barry W. Perry | 1,000 | 16,159 | 0 | |||

Mark C. Rohr | 1,000 | 14,153 | 0 | |||

George A. Schaefer, Jr. | 1,000 | 16,159 | 16,474 | |||

Theodore M. Solso | 1,000 | 16,159 | 12,912 | |||

John F. Turner | 1,000 | 16,159 | 0 | |||

Michael J. Ward | 1,000 | 16,159 | 12,912 | |||

| (a) | Includes credit for reinvested dividends allocated since the grant date. |

| (b) | No stock options have been granted to non-employee directors since January 26, 2006. |

Ashland’s non-employee director compensation program provides: (a) an annual retainer of $90,000 for each director; (b) an additional annual retainer of $20,000 for the Lead Independent Director; (c) an additional annual retainer of $15,000 for the Chair of the Audit Committee and $7,500 for Audit Committee members; and (d) an additional annual retainer of $7,500 for other Committee Chairs.

Non-employee directors may elect to receive all retainers in cash or as shares of Ashland Common Stock. They may also elect to have a portion or all retainers deferred and paid through the Directors’ Deferral Plan. The directors who make an election to defer retainers may have the deferred amounts held as stock units (share equivalents) in the hypothetical Ashland Common Stock Fund or invested under the other available hypothetical investment options under the plan. The payout of the deferred annual retainer occurs upon termination of service by a director. Directors may elect to have the payout in a single lump sum or in installments, not to exceed 15 years. For deferrals before January 1, 2005, upon a “change in control” of Ashland (as defined in the Directors’ Deferral Plan), amounts in the directors’ deferral accounts will be automatically distributed as a lump sum in cash to the director. For deferrals on and after January 1, 2005, distributions for such deferrals will be made pursuant to each director’s election and valued at the time of the distribution.

13

Table of Contents

Pursuant to Ashland’s incentive plans, upon election to the Board of Directors, a new director receives 1,000 restricted shares of Ashland Common Stock. The restricted shares may not be sold, assigned, transferred or otherwise encumbered until the earliest to occur of: (i) retirement from the Board of Directors; (ii) death or disability of the director; (iii) a 50% change in the beneficial ownership of Ashland; or (iv) voluntary early retirement to enter governmental service. The G&N Committee has discretion to limit a director’s forfeiture of these shares if he or she leaves the Board of Directors for reasons other than those listed above.

Each non-employee director also receives an annual award of deferred restricted stock units in the Directors’ Deferral Plan with a grant date value of $100,000. The restricted stock units will vest one year after date of grant or upon the date of the next annual shareholder meeting, if earlier. Dividends on restricted stock units are reinvested in additional restricted stock units. Upon a change in control, the restricted stock units immediately vest. A director may elect before the restricted stock units vest to have his or her vested units paid in shares of Ashland Common Stock or in cash after the director terminates from service.

Stock Ownership Guidelines for Directors

The Board of Directors considers Ashland Common Stock ownership by directors to be of utmost importance. The Board believes that such ownership enhances the commitment of directors to Ashland’s future and aligns their interests with those of Ashland’s other shareholders. The Board has therefore established minimum stock ownership guidelines for non-employee directors which require each director to own the lesser of (i) 12,500 shares or units of Ashland Common Stock, or (ii) Ashland Common Stock having a value of at least five times their base annual retainer of $90,000. In addition, any director who acquires Ashland shares via option exercise for options granted after February 2005 must retain 50% of the net shares acquired for at least 12 months or such earlier time as the individual ceases to be a director of Ashland. Each newly elected director has five years from the year elected to reach this ownership level. All of Ashland’s current directors have attained the minimum stock ownership levels based on holdings as of October 31, 2009.

14

Table of Contents

Ashland is committed to adhering to sound corporate governance practices. The information described below is published on Ashland’s website (http://investor.ashland.com). These documents are also available for free in print to any shareholder who requests them. Among the corporate governance practices followed by Ashland are the following:

| • | Ashland has adopted Corporate Governance Guidelines. These guidelines provide the framework for the Board of Directors’ governance of Ashland and include a general description of the Board’s purpose, director qualification standards, retirement and resignation policies and other responsibilities. The Corporate Governance Guidelines require that two-thirds of Ashland’s directors be independent, as defined by Ashland’s Director Independence Standards (the “Standards”). |

| • | Ashland also requires compliance with its code of business conduct which applies to all of Ashland’s directors and employees, including the principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. Ashland intends to post any amendments or waivers of the code (to the extent applicable to Ashland’s directors and executive officers) on Ashland’s website or in a current report on Form 8-K. |

| • | Each of Ashland’s Board Committees, including the Audit Committee, G&N Committee, and Personnel and Compensation Committee (“P&C Committee”), has adopted charters defining their respective purposes and responsibilities. |

| • | Only independent directors, as defined in the Standards, may serve on the Audit Committee, G&N Committee, and P&C Committee of the Board. |

| • | Ashland has designated a Lead Independent Director to coordinate the activities of the independent directors. The Lead Independent Director must be an independent director and is appointed by the Board. In addition to the duties of all Board members, the Lead Independent Director advises the Chairman of the Board. The Lead Independent Director also coordinates with the Chairman of the Board to determine the appropriate schedule of meetings; places any item he or she determines is appropriate on the Board’s agenda; directs that specific materials be included in Board mailings and works with the G&N Committee to assess the quality, quantity and timeliness of the flow of information from management to the Board; directs the retention of consultants and advisors to report directly to the Board; coordinates with the G&N Committee to oversee compliance with Ashland’s Corporate Governance Guidelines and to recommend appropriate revisions thereto; and develops the agenda for and coordinates executive sessions of the Board’s independent directors; and acts as principal liaison with the independent directors and the Chairman of the Board and Chief Executive Officer on sensitive matters. Mr. Solso is currently the Lead Independent Director. In November 2009, the non-management directors of the Board designated Mr. Perry to serve in this capacity beginning after Ashland’s 2010 Annual Meeting through the 2011 Annual Meeting. |

| • | The Board, and each Committee of the Board, has the authority to engage independent consultants and advisors. |

Director Independence and Certain Relationships

The Board of Directors has adopted the Standards to assist in its determination of director independence. To qualify as independent under these Standards, the Board must affirmatively determine that a director has no material relationship with Ashland, other than as a director.

Pursuant to the Standards, the Board of Directors undertook a review of director independence in November 2009. During this review, the Board considered relationships and transactions between each director, any member of his or her immediate family, and his or her affiliates, and Ashland and its subsidiaries and affiliates.

15

Table of Contents

As provided for in the Standards, the purpose of the review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As a result of the review, the Board of Directors affirmatively determined that Messrs. Hale, Manager, Perry, Rohr, Schaefer, Solso, Turner and Ward and Dr. Healy and Ms. Ligocki are each independent of Ashland and its affiliates. Mr. O’Brien, Ashland’s Chief Executive Officer, is the only director determined not to be independent of Ashland.

In the normal course of business, Ashland had transactions with other corporations where certain directors are executive officers. None of the transactions were material in amount as to Ashland and none were reportable under the federal securities laws. Ashland’s Board of Directors has concluded that the following relationships between Ashland and the director-affiliated entities are immaterial pursuant to the Standards and the G&N Committee has determined that the transactions are not “Related Person Transactions,” as defined in the Related Person Transaction Policy.

Mark C. Rohr, a director of Ashland, is Chairman of the Board and Chief Executive Officer of Albemarle Corporation (“Albemarle”). During fiscal 2009, Ashland paid Albemarle approximately $5.5 million and Albemarle paid Ashland approximately $5.9 million for certain products and/or services.

Theodore M. Solso, a director of Ashland, is Chairman of the Board and Chief Executive Officer of Cummins Inc. (“Cummins”). During fiscal 2009, Ashland paid Cummins approximately $109,000 for certain products and services, and Cummins paid Ashland approximately $30.0 million for goods and services. The monies paid to Ashland by Cummins were primarily paid for the initial fill of engines with oil and lubricants, as well as for lubricants supplied to Cummins and its distributors. Additionally, Valvoline, a division of Ashland, and Cummins are partners in joint ventures in Argentina, Brazil, China and India. The joint ventures market lubricants for servicing heavy duty engines and equipment.

Michael J. Ward, a director of Ashland, is Chairman of the Board and Chief Executive Officer of CSX Corporation (“CSX”). During fiscal 2009, Ashland paid CSX and its subsidiaries approximately $6.4 million for transportation services, and CSX paid Ashland approximately $250,000 for certain products and/or services.

Related Person Transaction Policy

Federal securities laws require Ashland to describe any transaction, since the beginning of the last fiscal year, or any currently proposed transaction, in which Ashland was or is to be a participant and the amount involved exceeds $120,000, and in which any related person had or will have a direct or indirect material interest. Related persons are directors and executive officers, nominees for director and any immediate family members of directors, executive officers or nominees for director. Ashland is also required to describe its policies and procedures for the review, approval or ratification of any related person transaction.

Pursuant to the Related Person Transactions Policy (the “Policy”), the G&N Committee is responsible for reviewing the material facts of all transactions that could potentially be “transactions with related persons.” The Policy covers any transaction, arrangement or relationship or series of similar transactions, arrangements or relationships (including any indebtedness or guarantee of indebtedness) in which (1) the aggregate amount involved will or may be expected to exceed $120,000 in any fiscal year, (2) Ashland is a participant, and (3) any related person has or will have a direct or indirect interest (other than solely as a result of being a director or a less than 10% beneficial owner of another entity). Transactions between Ashland and any firm, corporation or entity in which a related person is an executive officer or general partner, or in which any related persons collectively hold more than 10% of the ownership interest, are also subject to review under the Policy.

Under the Policy, Ashland’s directors and executive officers are required to annually identify potential transactions with related persons or their firms that meet the criteria set forth in the Policy, and management is

16

Table of Contents

required to forward all such disclosures to the G&N Committee. The G&N Committee reviews each disclosed transaction to determine if it is a transaction with a related person. The G&N Committee has discretion to approve, disapprove or otherwise act if a transaction is deemed to be a related person transaction. Only disinterested members of the G&N Committee may participate in the determinations made with regard to a particular transaction. If it is impractical to convene a meeting of the G&N Committee, the Chairman of the G&N Committee is authorized to make a determination and promptly report such in writing to the other G&N Committee members. All determinations made under the Policy are required to be reported to the full Board of Directors.

Certain transactions have been determined by the Board of Directors to NOT be related person transactions, and therefore fall outside the scope of the Policy, even if such transactions exceed $120,000 in a fiscal year. Those exceptions are:

| a. | compensation to a director or executive officer which is or/will be disclosed in Ashland’s proxy statement; |

| b. | compensation to an executive officer which is approved by the P&C Committee and would have been disclosed in Ashland’s proxy statement if the executive officer was a “named executive officer;” |

| c. | a transaction in which the rates or charges involved are determined by competitive bids, or which involves common, contract carrier or public utility services at rates or charges fixed in conformity with law or governmental authority; |

| d. | a transaction that involves services as a bank depository of funds, transfer agent, registrar, indenture trustee, or similar services; and |

| e. | a transaction in which the related person’s interest arises solely from the ownership of Ashland stock and all shareholders receive the same benefit on a pro rata basis. |

The Board of Directors has established a process by which shareholders and other interested parties may communicate with the Board. Persons interested in communicating with the Board, or with a specific member or Committee of the Board, may do so by writing to the Lead Independent Director in care of the General Counsel of Ashland, 50 E. RiverCenter Boulevard, P.O. Box 391, Covington, Kentucky 41012-0391. Communications directed to the Lead Independent Director will be reviewed by the General Counsel and distributed to the Lead Independent Director as well as to other individual directors, as appropriate, depending on the subject matter and facts and circumstances outlined in the correspondence. Communications that are not related to the duties and responsibilities of the Board, or are otherwise inappropriate, will not be forwarded to the Lead Independent Director, although all communications directed to the Board will be available to any director upon request.

Ashland has a policy and practice of strongly encouraging all directors to attend the Annual Meeting. Each of Ashland’s then current directors were present at the Annual Meeting held on January 29, 2009.

Executive Sessions of Directors

The non-employee directors meet in executive session at each regularly scheduled meeting of the Board, and at other times as they may determine appropriate. The Audit and P&C Committees of the Board meet in executive session during every Committee meeting. Other Board Committees meet in executive session at the discretion of the Committee members.

17

Table of Contents

Shareholder Recommendations for Directors

The G&N Committee considers director candidates recommended by other directors, employees and shareholders, and is authorized, at its discretion, to engage a professional search firm to identify and suggest director candidates. Written suggestions for director candidates should be sent via registered, certified, or express mail to the Corporate Secretary of Ashland at 50 E. RiverCenter Boulevard, P.O. Box 391, Covington, Kentucky 41012-0391. Such suggestions must be received no later than September 1, 2010, to be considered by the G&N Committee for inclusion as a director nominee for the 2011 Annual Meeting. Suggestions for director candidates should include all information required by Ashland’s By-laws, and any other relevant information, as to the proposed candidate. The G&N Committee selects each director nominee based on the nominee’s skills, achievements and experience. The G&N Committee will review all director candidates in accordance with its charter and Ashland’s Corporate Governance Guidelines, and it will identify qualified individuals consistent with criteria approved by the Board of Directors. The G&N Committee shall select individuals as director nominees who exhibit the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who shall be most effective in serving the interests of Ashland’s shareholders. Additionally, the G&N Committee shall seek director candidates who exhibit the following personal and professional qualifications: (1) significant experience in either the chemical or consumer marketing industries; (2) product or process innovation experience; (3) international business expertise; (4) diverse experience in policy-making in business, government, education and/or technology, or in areas that are relevant to Ashland’s global business and strategy; (5) an inquisitive and objective nature, practical wisdom and mature judgment; and (6) the ability to work with Ashland’s existing directors and management. Individuals recommended by shareholders in accordance with these procedures will be evaluated by the G&N Committee in the same manner as individuals who are recommended through other means.

Shareholder Nominations of Directors

In order for a shareholder to nominate a director at an Annual Meeting who is not otherwise nominated by the G&N Committee, Ashland’s By-laws require that a shareholder provide written notice of intent to nominate a director not later than 90 days prior to the Annual Meeting (if the Annual Meeting is held on the last Thursday in January). For an Annual Meeting held earlier than the last Thursday in January, notice must be given within 10 days of the first public disclosure of the date of the Annual Meeting. Public disclosure may include a public filing with the SEC.

The notice must contain the following information:

| • | The name and address of the shareholder who intends to make the nomination and the name and address of the person(s) to be nominated; |

| • | A representation that the shareholder is a shareholder of record of Ashland Common Stock entitled to vote at such meeting and that the shareholder intends to appear in person or by proxy to make the nomination(s) specified in the notice; |

| • | A description of all arrangements or understandings between the shareholder and each nominee and any other person(s) pursuant to which the nomination(s) are to be made by the shareholder. The other person(s) must be named in the notice; |

| • | Information about each nominee that would be required in a proxy statement, according to the rules of the SEC, had the nominee been proposed by the Board of Directors; |

| • | The consent of each nominee to serve as a director if so elected; and |

| • | A representation as to whether or not the shareholder will solicit proxies in support of his or her nominee(s). |

The chairman of any meeting of shareholders to elect directors and the Board of Directors may refuse to acknowledge any nomination that is not made in compliance with the procedure described above or if the shareholder fails to comply with the representations set forth in the notice.

18

Table of Contents

COMMITTEES AND MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors has five committees: Audit Committee; Environmental, Health and Safety Committee; Finance Committee; G&N Committee; and P&C Committee. All Committees are composed entirely of independent directors. During fiscal 2009, nine meetings of the Board were held. Each current director attended at least 75% of the total meetings of the Board and the Committees on which he or she served. Overall attendance at Board and Committee meetings was 91%. The following table describes the members of each of the Committees, its primary responsibilities and the number of meetings held during fiscal 2009.

| Meetings and Current Members | Summary of Responsibilities | |

AUDIT COMMITTEE

Meetings in fiscal 2009: 8

The Committee also met 4 times to discuss and review Ashland’s earnings and to approve Ashland’s earnings press releases.

Members:

Roger W. Hale (Chairman) Bernadine P. Healy Kathleen Ligocki Mark C. Rohr George A. Schaefer, Jr. | • Oversees Ashland’s financial reporting process, including earnings releases and the filing of financial reports • Reviews management’s implementation and maintenance of adequate systems of internal accounting and financial controls (including internal control over financial reporting) • Oversees performance of Ashland’s internal audit function and independent auditors, who report directly to this Committee • Evaluates the independence and performance of the independent auditors • Selects independent auditors based on qualification and independence and approves audit fees and services performed by independent auditors • Reviews the effectiveness of Ashland’s legal and regulatory compliance programs • Discusses the overall scope and plans for audits with both internal and independent auditors • Reviews and investigates any matters pertaining to the integrity of management • Establishes and maintains procedures for handling complaints regarding accounting and auditing matters • Reviews Ashland’s risk management policies and assessment processes | |

ENVIRONMENTAL, HEALTH AND SAFETY COMMITTEE

Meetings in fiscal 2009: 4

Members:

Kathleen Ligocki (Chairman) Bernadine P. Healy Barry W. Perry Mark C. Rohr John F. Turner | • Oversees and reviews Ashland’s environmental, health and safety policies, programs, practices, risks, competitors’ activities and industry best practices • Oversees and reviews environmental, health and safety regulatory trends, including Ashland’s overall compliance, remediation and sustainability efforts • Reports to the Board concerning implementation of environmental health and safety policies and assists the Board in assuring Ashland’s compliance with policies |

19

Table of Contents

| Meetings and Current Members | Summary of Responsibilities | |

FINANCE COMMITTEE

Meetings in fiscal 2009: 9

Members:

Michael J. Ward (Chairman) Roger W. Hale Vada O. Manager George A. Schaefer, Jr. Theodore M. Solso | • Reviews Ashland’s current and contemplated funding requirements • Oversees significant financial issues such as capital structure, dividend action, offerings of debt or equity securities and major borrowings • Reviews financial post-audits of major investments • Oversees funding and investment policy related to employee benefit plans • Monitors and reviews Ashland’s use of derivatives | |

GOVERNANCE AND NOMINATING COMMITTEE

Meetings in fiscal 2009: 4

Members:

George A. Schaefer, Jr. (Chairman) Bernadine P. Healy Barry W. Perry Theodore M. Solso John F. Turner | • Recommends nominees for the Board of Directors and its Committees • Reviews suggested potential candidates for the Board • Recommends desirable size and composition of the Board and its Committees • Recommends to the Board programs and procedures relating to director compensation, evaluation, retention and resignation • Reviews corporate governance guidelines, corporate charters and proposed amendments to the articles and by-laws of Ashland • Reviews transactions pursuant to the Related Person Transaction Policy • Assists the Board in ensuring the Board’s independence as it exercises its corporate governance and oversight roles • Oversees the evaluation of the Board • Reviews the process for succession planning for the executive management of Ashland • Reviews all Committee charters • Reviews and makes recommendations to address shareholder proposals |

20

Table of Contents

| Meetings and Current Members | Summary of Responsibilities | |

PERSONNEL AND COMPENSATION COMMITTEE

Meetings in fiscal 2009: 7

Members:

Theodore M. Solso (Chairman) Kathleen Ligocki Vada O. Manager Barry W. Perry Michael J. Ward | • Ensures Ashland’s executive compensation programs are appropriately competitive, support organizational objectives and shareholder interests, and emphasize pay for performance linkage • Evaluates and approves compensation and sets performance criteria for compensation programs with respect to Ashland’s Chief Executive Officer • �� Evaluates and approves compensation and sets performance criteria for compensation programs for all key senior executives and elected officers • Oversees the execution of senior management succession plans • Approves any employment agreements, consulting arrangements, severance or retirement arrangements, change-in-control agreements, and/or any other special or supplemental benefits covering any current or former executive officer • Adopts, amends, terminates and performs other settlor functions for Ashland’s benefit plans • Oversees the implementation and administration of Ashland’s compensation plans, including the funding of the plans • Monitors and evaluates Ashland’s compensation and benefits structure, providing guidance on philosophy, policy matters and excessive risk taking • Oversees regulatory compliance on compensation matters, including Ashland’s policies on structuring compliance programs to preserve tax liability • Oversees the preparation of the annual report on executive compensation |

Personnel and Compensation Committee Interlocks and Insider Participation

The members of the P&C Committee for fiscal 2009 were Theodore M. Solso (Chairman), Kathleen Ligocki, Vada O. Manager, Barry W. Perry and Michael J. Ward. There were no impermissible interlocks or inside directors on the P&C Committee.

21

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Principles and Objectives of Ashland’s Executive Compensation Program

Ashland’s executive compensation program is designed to attract, motivate and retain individuals with the skills required to formulate and drive our strategic direction and achieve annual and long-term performance goals necessary to create shareholder value. The program is designed to reflect the individual executive’s contribution and the performance of Ashland. The core principles of Ashland’s approach to executive compensation design and evaluation are as follows:

| • | Programs should create alignment between the interests of the executives and the shareholders by ensuring that compensation opportunity for executives is linked to building long-term shareholder value through the achievement of the financial and strategic objectives of Ashland. |

| • | Programs should provide competitive, market-driven compensation to attract and retain executive talent for the long-term. |

| • | Compensation should generally be targeted between the median and 75th percentile of the market when compared to the compensation of individuals in similar-sized organizations in the chemical industry as well as general industry. |

| • | The concept of opportunity is important. We believe individuals should have the opportunity to do well when Ashland does well, and that total compensation should vary in relation to our performance. |

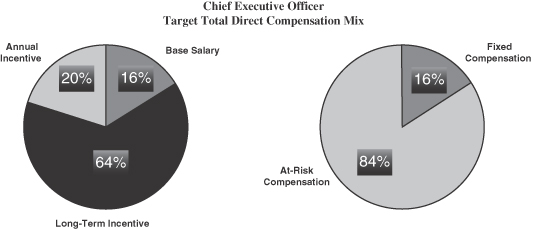

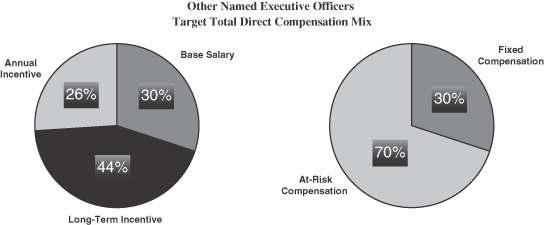

| • | There should be a balance between fixed and variable compensation, with variable compensation constituting a larger portion of an executive’s total compensation the more senior the executive. The targeted pay mix for an executive should also be aligned with market competitive practices. |

| • | Programs should promote ownership of Ashland stock to align the interests of management and shareholders. |

| • | Incentive compensation should not promote excessively risky behavior that could threaten the long-term value of Ashland. |

The 2009 global economic recession affected existing programs and created the need to take additional actions. Below is a listing of the key actions taken in fiscal 2009:

| • | Salary Reduction/Furlough Program—All members of Ashland’s Operating Committee took a temporary pay reduction. The temporary pay reduction was equivalent to three weeks of pay or 5.7% of annual base salary. For most other employees in the United States and Canada, a two week furlough program was implemented. Outside of the United States and Canada, a voluntary furlough program was offered and had significant participation. |

| • | Salary Freeze—A global salary freeze was implemented for fiscal 2009. |

| • | Incentive Compensation Plan Design—To insure that no payout under the Incentive Compensation program would occur unless Ashland met its financial debt covenants, for fiscal 2009 two minimum performance thresholds for EBITDA and Working Capital Efficiency were established. Achievement of these minimum performance thresholds was required in order for the plan to be funded. These performance thresholds are discussedon page 31. |

| • | Long Term Incentive Plan (LTIP) Payment Declined—The Chief Executive Officer, Chief Financial Officer and General Counsel all declined receipt of their LTIP award payments otherwise paid to participants in Ashland Common Stock. |

| • | Perquisites—Several changes to perquisites occurred: |

| ¡ | Personal Use of Aircraft Eliminated—Ashland’s Aviation department was closed in January 2009. |

| ¡ | Financial Planning Reduced—The amount executives may be reimbursed for financial and tax planning was reduced. |

22

Table of Contents

Other actions taken in 2009, which are described further in this Compensation Discussion and Analysis include:

| • | An assessment of risk related to Incentive Plans |

| • | Implementation of a “clawback” policy that is effective with incentive plan years beginning October 1, 2009 |

| • | Modifications of change in control agreements to eliminate the excise tax gross up for agreements entered into after July 2009 |

This Compensation Discussion and Analysis describes the overall executive compensation policies and practices at Ashland and specifically analyzes the total compensation for the following named executive officers:

| • | James J. O’Brien, Chairman and Chief Executive Officer |

| • | Lamar M. Chambers, Senior Vice President and Chief Financial Officer |

| • | David L. Hausrath, Senior Vice President and General Counsel |

| • | Theodore L. Harris, Vice President and President, Ashland Performance Materials, Global Supply Chain and Environmental, Health and Safety; and |

| • | Samuel J. Mitchell, Vice President and President, Ashland Consumer Markets |

Oversight of Ashland’s Executive Compensation Program

The Personnel & Compensation (“P&C”) Committee’s Role

The P&C Committee is composed of independent directors and is responsible for the approval and administration of compensation programs for executive officers and certain other employees of Ashland. The P&C Committee regularly reviews Ashland’s compensation practices, and when making decisions considers:

| • | Ashland’s compensation philosophy; |

| • | Ashland’s financial and operating performance; |

| • | Individual performance of executives; |

| • | Compensation policies and practices for Ashland employees generally; and |

| • | Practices and executive compensation levels within peer and similarly-sized general industry companies. |

The P&C Committee’s primary responsibilities are to:

| • | Ensure that the Company’s executive compensation programs are appropriately competitive, support organizational objectives and shareholder interests, and emphasize the pay for performance linkage; |

| • | Review, evaluate and approve on an annual basis, the goals and objectives of the Chief Executive Officer. The P&C Committee annually evaluates the Chief Executive Officer’s performance in light of these established goals and objectives and, based on these evaluations after an executive session of the P&C Committee, sets the Chief Executive Officer’s annual compensation, including base salary, annual incentives and equity compensation; |

| • | Review and approve compensation of all key senior executives and elected corporate officers; |

| • | Approve any employment agreements, consulting arrangements, severance or retirement arrangements, change in control agreements, and/or any special or supplemental benefits or provisions covering any current or former executive officer of Ashland; |

| • | Adopt, amend, terminate the benefit plans of the Company, and perform any other design functions in connection with the Company’s employee benefit plans; |

23

Table of Contents

| • | Oversee the implementation and administration of the compensation plans of the Company, including pension, welfare, incentive and equity-based plans, and ensure that these plans are consistent with the Company’s general compensation policies; |

| • | Monitor and evaluate the compensation and benefits structure of the Company, including providing guidance on philosophy and policy matters and excessive risk-taking; |

| • | Oversee regulatory compliance with respect to compensation matters, including overseeing the Company’s policies on structuring compensation programs to preserve tax deductibility; and |

| • | Oversee the development and execution of Chief Executive Officer and senior management development and succession plans and report to the Board periodically on such plans. |

The P&C Committee may form and delegate authority to subcommittees with regard to any of the above responsibilities.

In determining and administering the executive compensation programs the P&C Committee takes into consideration:

| • | Recommendations of the Chief Executive Officer and the Vice President, Human Resources and Communications regarding potential changes to named executive officer compensation based on performance, competitiveness, personnel and organizational changes, regulatory issues, strategic initiatives and other matters; |

| • | Information provided by the Human Resources-Global Total Rewards function at Ashland and its compensation consultant; and |

| • | Advice of an outside, independent, executive compensation consultant on all aspects of executive compensation, including comparison to the practices and executive compensation levels within peer and non-peer companies. |

The P&C Committee meets in executive session for a portion of each meeting.

Management’s Role

Management plays an important role in the process of setting compensation for executives, other than the Chief Executive Officer. The Chief Executive Officer (and the other members of the Executive Committee in certain instances), in consultation with the P&C Committee’s independent executive compensation consultant and the Vice President, Human Resources and Communications, develops compensation recommendations for the Committee’s consideration including:

| • | business performance targets and objectives that are tied to Ashland’s annual and long-term incentive plans; |

| • | plan design changes based on competitive analysis of executive pay practices; |

| • | individual performance evaluations; |

| • | recommendation of base salary and target bonus opportunities; |

| • | the mix of restricted stock, stock appreciation rights and performance unit grants; |

| • | recommendation of adjustments to the reported financial results for purposes of determining annual incentive payments; and |

| • | recommendation of adjustments to the award. |

24

Table of Contents