1

Filed by Ashland Inc.

Pursuant to Rule 425

Under the Securities Act of 1933

Subject Company

Hercules Incorporated

Commission File Number 1-00496

Hercules Inc. Acquisition

Conference Call

July 11, 2008

Conference Call

July 11, 2008

Ashland Inc. Participants

James J. O'Brien, Chairman and Chief Executive Officer

Lamar M. Chambers, Sr. Vice President and Chief Financial Officer

Eric N. Boni, Director, Investor Relations

Hercules Inc. Participants

Craig A. Rogerson, President and Chief Executive Officer

2

Forward-Looking Statements

Forward-Looking Statements

This document contains forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. These statements include those that refer to Ashland’s and Hercules’ current expectations about the acquisition

of Hercules. Although Ashland and Hercules believe their expectations are based on what management believes to be reasonable assumptions,

they cannot assure the expectations reflected in this document will be achieved as they are subject to risks and uncertainties that are difficult to

predict and may be outside of Ashland’s and Hercules’ control. These risks and uncertainties may cause actual results to differ materially from

those stated, projected or implied. Such risks and uncertainties include the possibility that the benefits anticipated from the Hercules transaction

will not be fully realized; the possibility the transaction may not close, including as a result of failure to obtain the approval of Hercules

stockholders; the possibility that financing may not be available on the terms committed; and other risks that are described in filings made by

Ashland and Hercules with the Securities and Exchange Commission (SEC) in connection with the proposed transaction. Other factors,

uncertainties and risks affecting Ashland and Hercules are contained in each company’s periodic filings made with the Securities and Exchange

Commission, including Ashland’s Form 10-K for the fiscal year ended Sept. 30, 2007, Ashland’s Form 10-Q for the quarter ended March 31, 2008,

Hercules’ Form 10-K for the fiscal year ended Dec. 31, 2007, and Hercules’ Form 10-Q for the quarter ended March 31, 2008 filed with the SEC

and available on Ashland’s Investor Relations website at www.ashland.com/investors or Hercules’ website at www.herc.com or the SEC’s website

at www.sec.gov. Ashland and Hercules undertake no obligation to subsequently update or revise the forward-looking statements made in this

document to reflect events or circumstances after the date of this document.

Securities Exchange Act of 1934. These statements include those that refer to Ashland’s and Hercules’ current expectations about the acquisition

of Hercules. Although Ashland and Hercules believe their expectations are based on what management believes to be reasonable assumptions,

they cannot assure the expectations reflected in this document will be achieved as they are subject to risks and uncertainties that are difficult to

predict and may be outside of Ashland’s and Hercules’ control. These risks and uncertainties may cause actual results to differ materially from

those stated, projected or implied. Such risks and uncertainties include the possibility that the benefits anticipated from the Hercules transaction

will not be fully realized; the possibility the transaction may not close, including as a result of failure to obtain the approval of Hercules

stockholders; the possibility that financing may not be available on the terms committed; and other risks that are described in filings made by

Ashland and Hercules with the Securities and Exchange Commission (SEC) in connection with the proposed transaction. Other factors,

uncertainties and risks affecting Ashland and Hercules are contained in each company’s periodic filings made with the Securities and Exchange

Commission, including Ashland’s Form 10-K for the fiscal year ended Sept. 30, 2007, Ashland’s Form 10-Q for the quarter ended March 31, 2008,

Hercules’ Form 10-K for the fiscal year ended Dec. 31, 2007, and Hercules’ Form 10-Q for the quarter ended March 31, 2008 filed with the SEC

and available on Ashland’s Investor Relations website at www.ashland.com/investors or Hercules’ website at www.herc.com or the SEC’s website

at www.sec.gov. Ashland and Hercules undertake no obligation to subsequently update or revise the forward-looking statements made in this

document to reflect events or circumstances after the date of this document.

ADDITIONAL INFORMATION

In connection with the proposed transaction, Ashland will file a registration statement on Form S-4, which will include a preliminary

proxy statement/prospectus, with the SEC. Ashland and Hercules intend to mail a definitive proxy statement/prospectus to Hercules’

stockholders containing information regarding the proposed transaction. Investors and security holders are urged to read the

registration statement on Form S-4 and the related preliminary and definitive proxy/prospectus when they become available because

they will contain important information about the proposed transaction. Investors and security holders may obtain free copies of

these documents (when they are available) and other documents filed with the SEC at the SEC’s web site at www.sec.gov and by

contacting Ashland Investor Relations at (859) 815-4454 or Hercules Investor Relations at (302) 594-7151. Investors and security

holders may obtain free copies of the documents filed with the SEC on Ashland’s Investor Relations website at

www.ashland.com/investors or Hercules’ website at www.herc.com or the SEC’s website at www.sec.gov.

proxy statement/prospectus, with the SEC. Ashland and Hercules intend to mail a definitive proxy statement/prospectus to Hercules’

stockholders containing information regarding the proposed transaction. Investors and security holders are urged to read the

registration statement on Form S-4 and the related preliminary and definitive proxy/prospectus when they become available because

they will contain important information about the proposed transaction. Investors and security holders may obtain free copies of

these documents (when they are available) and other documents filed with the SEC at the SEC’s web site at www.sec.gov and by

contacting Ashland Investor Relations at (859) 815-4454 or Hercules Investor Relations at (302) 594-7151. Investors and security

holders may obtain free copies of the documents filed with the SEC on Ashland’s Investor Relations website at

www.ashland.com/investors or Hercules’ website at www.herc.com or the SEC’s website at www.sec.gov.

Hercules and its directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of

Hercules in connection with the proposed transaction. Information regarding the special interests of these directors and executive

officers in the proposed transaction will be included in the proxy statement/prospectus described above. Additional information

regarding the directors and executive officers of Hercules is also included in Hercules’ proxy statement for its 2008 Annual Meeting

of Stockholders, which was filed with the SEC on March 19, 2008. These documents are available free of charge at the SEC’s web

site at www.sec.gov and from Investor Relations at Ashland and Hercules as described above.

Hercules in connection with the proposed transaction. Information regarding the special interests of these directors and executive

officers in the proposed transaction will be included in the proxy statement/prospectus described above. Additional information

regarding the directors and executive officers of Hercules is also included in Hercules’ proxy statement for its 2008 Annual Meeting

of Stockholders, which was filed with the SEC on March 19, 2008. These documents are available free of charge at the SEC’s web

site at www.sec.gov and from Investor Relations at Ashland and Hercules as described above.

3

Agenda

• Transaction Overview

– Terms

– Strategic Benefits

• Business Descriptions

– Ashland

– Hercules

• Financing

• Synergies

• Integration Plan

• Next Steps

4

Key Terms

• Hercules shareholders to receive consideration of:

– $18.60 per Hercules share in cash

– 0.093 of a share of Ashland stock

• Value of $23.01 per share, based upon Ashland closing

price on July 10

price on July 10

– 38-percent premium to Hercules' closing stock price on July 10

– 26-percent premium to Hercules' 30-day average stock price

• Total transaction value of $3.3 billion

– Includes $2.6 billion equity value, plus net assumed debt

of $0.7 billion

of $0.7 billion

• Expected to close by end of calendar 2008

5

• Creates a major, global specialty chemicals company

– ~75 percent of estimated pro forma* EBITDA derived from specialty chemicals

– More than $10 billion in pro forma revenue

– Boosts pro forma revenue from outside North America to approximately

$3.5 billion

$3.5 billion

• Significantly enhances focus and expands scale

in three specialty chemical businesses

in three specialty chemical businesses

– Specialty additives and ingredients, paper and water technologies,

and specialty resins

and specialty resins

• Creates leadership position in attractive and growing

renewable/sustainable chemistries

renewable/sustainable chemistries

– Derives approximately one-third of estimated pro forma EBITDA

from bio-based chemistries

from bio-based chemistries

* For the 12 months ended March 31, 2008. Sales & Operating Revenue includes intersegment sales.

EBITDA excludes Unallocated and Other.

EBITDA excludes Unallocated and Other.

Drives stronger, more profitable

and less cyclical earnings

and less cyclical earnings

Strategic Benefits

6

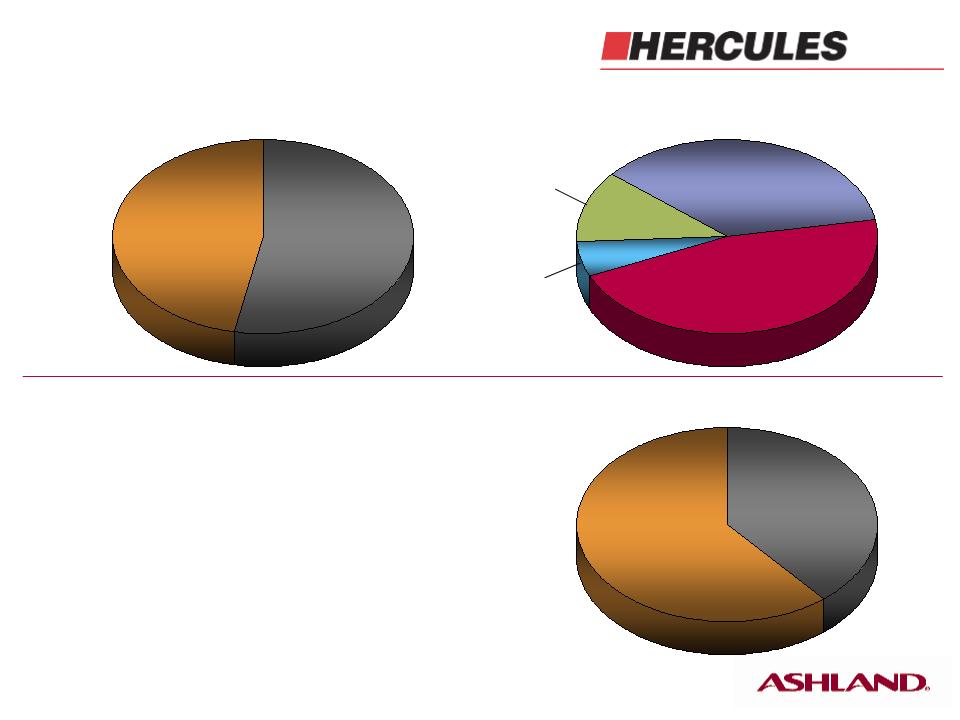

• Founded in 1924; sales in 100 countries

• Number of employees: ~11,700

• A leading manufacturer of composite

polymers, adhesives, metal casting

consumables, and process and utility water

treatments

polymers, adhesives, metal casting

consumables, and process and utility water

treatments

• A leading North American distributor of

chemicals, plastics and composite materials

chemicals, plastics and composite materials

• Marketer of premium-branded lubricants,

automotive chemicals and quick-lube services

automotive chemicals and quick-lube services

Business Description

Ashland

Distribution

51%

Distribution

51%

Ashland

Distribution

51%

Distribution

51%

Performance

Materials

19%

Materials

19%

Performance

Materials

19%

Materials

19%

Valvoline

20%

20%

Sales & Operating Revenue*: $7.9 billion

Water Technologies

Water Technologies

EBITDA*: $365 million

Ashland

Distribution

16%

Distribution

16%

Ashland

Distribution

16%

Distribution

16%

Performance

Materials

34%

Materials

34%

Performance

Materials

34%

Materials

34%

Valvoline

39%

39%

Water Technologies

Water Technologies

10%

10%

11%

11%

* For the 12 months ended March 31, 2008. Sales & Operating Revenue includes intersegment sales.

EBITDA in the pie chart graph excludes Unallocated and Other.

EBITDA in the pie chart graph excludes Unallocated and Other.

Latin

America/

Other

America/

Other

Latin

America/

Other

America/

Other

3%

3%

Asia/Pacific

Asia/Pacific

North

America

71%

America

71%

North

America

71%

America

71%

Europe

21%

21%

Europe

21%

21%

5%

5%

Ashland Overview

7

• Founded in 1912 as a spinoff from DuPont

• Number of employees: ~4,700

• Leading supplier of functional, process

and water treatment chemical programs

for the pulp and paper industry

and water treatment chemical programs

for the pulp and paper industry

• World leader in products that manage

the flow characteristics of water-based

products

the flow characteristics of water-based

products

Business Description

Paper

Technologies

& Ventures

53%

Technologies

& Ventures

53%

Paper

Technologies

& Ventures

53%

Technologies

& Ventures

53%

Aqualon47%

Aqualon47%

Sales & Operating Revenue*: $2.2 billion

EBITDA*: $392 million

Aqualon

61%

61%

Aqualon

61%

61%

EBITDA Margin

24%

24%

EBITDA Margin

24%

24%

Paper

Technologies

& Ventures

39%

Technologies

& Ventures

39%

* For the 12 months ended March 31, 2008, as previously reported by Hercules Inc.

EBITDA in the pie chart graph excludes Corporate Items.

EBITDA in the pie chart graph excludes Corporate Items.

Latin

America/

Other

America/

Other

Latin

America/

Other

America/

Other

6%

6%

Asia/Pacific

Asia/Pacific

North

America

46%

America

46%

North

America

46%

America

46%

Europe

36%

36%

Europe

36%

36%

12%

12%

EBITDA

Margin

13%

Margin

13%

Hercules Overview

8

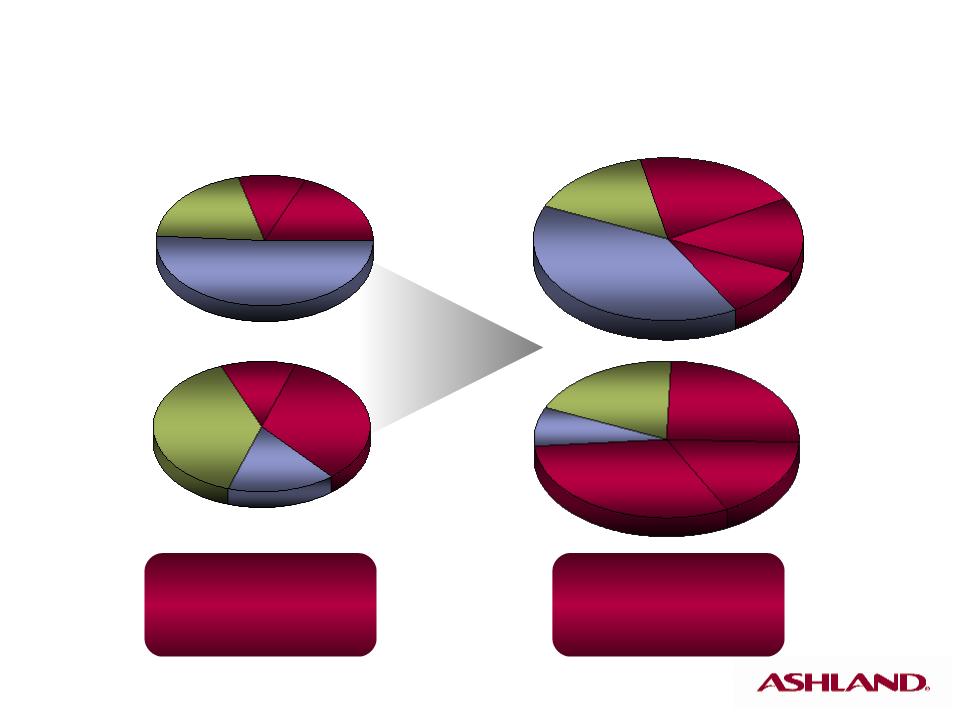

Water

10%

Performance

Materials

Materials

19%

Distribution

Distribution

51%

51%

Valvoline

20%

EBITDA

Performance

Materials

Materials

34%

Distribution

Distribution

16%

16%

Water

11%

Valvoline

39%

Specialty Chemicals

29% of Ashland revenue

45% of Ashland EBITDA

Current Ashland

Specialty Chemicals

45% of Ashland revenue

72% of Ashland EBITDA

EBITDA

Distribution

Distribution

40%

40%

Water &

Hercules Paper

20%

Aqualon - - 10%

Valvoline

15%

Performance

Materials

Materials

17%

Distribution - - 8%

Distribution - - 8%

Valvoline

20%

Performance

Materials - - 15%

Materials - - 15%

Water &

Hercules Paper

25%

Aqualon

30%

Estimated Pro Forma

Sales &

Operating

Revenue

Operating

Revenue

Sales &

Operating

Revenue

Operating

Revenue

* For the 12 months ended March 31, 2008. Sales & Operating Revenue includes intersegment sales.

Revenue and Profit Profile*

9

~75 percent

of global EBITDA

derived from

specialty chemicals

Chemistries

Water Treatment

Markets

Markets

Water Treatment

Markets

Markets

Transportation

Markets

Markets

Transportation

Markets

Markets

Building &

Construction

Markets

Construction

Markets

Building &

Construction

Markets

Construction

Markets

Regulated Markets

Regulated Markets

Light

Vehicle

Vehicle

Recreational

Marine

Marine

Pulp &

Paper

Paper

Industrial

Municipal

Marine

Paint &

Coatings

Coatings

Resid. /

Comm.

Bldgs.

Comm.

Bldgs.

Wind

Energy

Food

Pharma-

ceuticals

ceuticals

Personal

Care

Care

Extraction

Specialty Chemicals Core

10

Hercules

Ashland

· Broad product offering

encompassing the entire

paper-making process

encompassing the entire

paper-making process

· Support by the largest

technical sales force

in the industry

technical sales force

in the industry

· Satisfies customers’

preference toward fewer

suppliers and suppliers

with a productivity

orientation

preference toward fewer

suppliers and suppliers

with a productivity

orientation

· Broad process and

functional capabilities

to address critical

customer needs

functional capabilities

to address critical

customer needs

· Backward integrated on

key functional additives

key functional additives

· Specialized sales

channel

channel

· Expertise in process

and utility water

treatment

and utility water

treatment

· Backward integrated on

key process chemicals

key process chemicals

· Key product formulation

and application

capabilities

and application

capabilities

This acquisition creates a differentiated offering

within the paper vertical.

within the paper vertical.

11

Financing

• $2.7 billion new financing

– Commitments from Bank of America and Scotia Capital

– $2.2 billion expected to be drawn at closing

• 10.5 million new common shares issued at closing

• Estimated Debt/EBITDA ratio at close: 3.2x to 3.3x

– Target: 1.5x to 2.0x

• Goal of attaining investment-grade credit rating

in two to four years

in two to four years

12

Financial Benefits

• At least $50 million annual run-rate cost savings

by Year 3

by Year 3

– Overhead redundancies (selling and administrative)

– Integrated technology platform

– Raw material procurement

– Freight and logistics

• Modestly dilutive to reported EPS in Year 1

• Significantly accretive to EPS in Year 1

excluding merger costs and noncash depreciation

and amortization charges related to the transaction

excluding merger costs and noncash depreciation

and amortization charges related to the transaction

13

Timeline and Next Steps

• Hercules shareholder approval

• Receipt of regulatory approvals

• Other customary closing conditions

• Anticipated close by end of calendar 2008

14

Questions?

15

Appendix

Ashland Performance Materials: A global leader in specialty chemicals Revenue*: $1.6 billion Business Overview Customers Auto manufacturers, foundries, pipe and tank fabricators, boat builders, wide and narrow web printers Products/ Services Composite Polymers Unsaturated polyester resins Vinyl ester resins Gelcoats Casting Solutions Foundry binder resins aids Chemicals Sleeves and filters Design services Specialty Polymers & Adhesives Pressure-sensitive adhesives Structural adhesives Specialty resins Markets Transportation, construction, marine, packaging and converting Revenue*: $1.6 billion By Market Trans-portation 25% Transportation 25% Ind. Constr. 25% Res. Constr. 15% Infra- structure 16% Pkg. & Converting - - 9% Marine - 10% By Geography Latin America/ Other - 7% Asia/ Pacific - 8% Europe 33% North America 52%

Ashland Distribution: A leading North American chemical and plastics distributor Business Overview Customers Diversified customer base Products/ Services More than 7,000 packaged and bulk chemicals, solvents, plastics and additives Comprehensive, hazardous and nonhazardous waste-management solutions in North America Markets Construction Transportation Paint and coatings Chemical manufacturing Retail consumer Medical Personal care Marine Revenue*: $4.1 billion By Market Marine - 4% Personal Care - 6% Medical - 6% Construction 25% Other 15% Trans- portation 15% Paint & Coatings - 11% By Product Line Chemicals 44% Plastics 42% Composites

12% Environmen-tal Services/ Other - 2% * For the 12 months ended March 31, 2008.

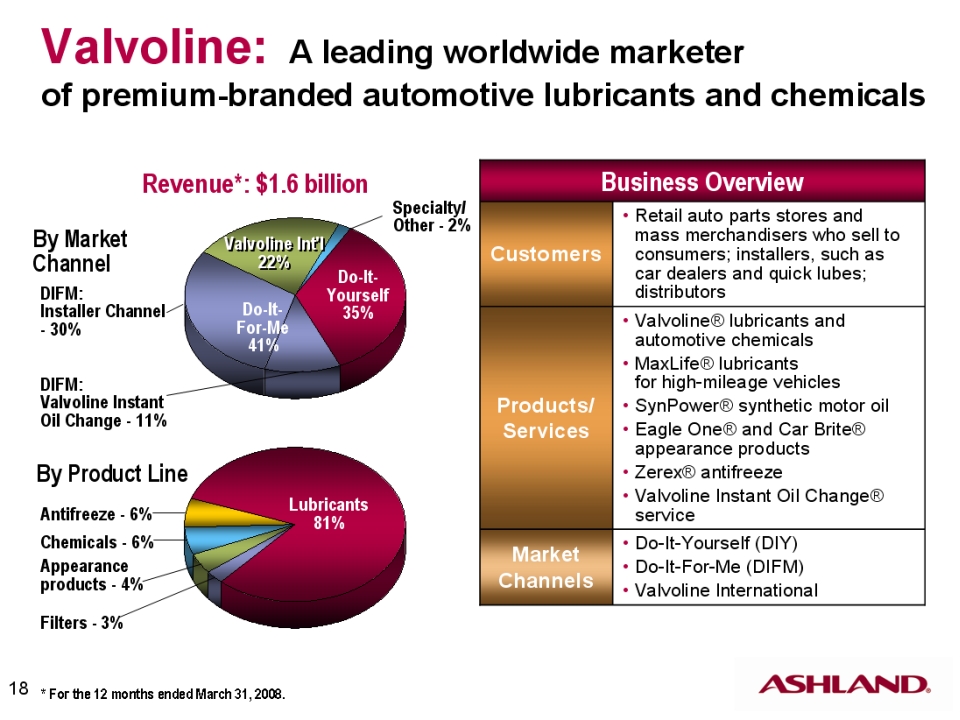

Valvoline: A leading worldwide marketer of premium-branded automotive lubricants and chemicals Revenue*: $1.6 billion By Market Channel DIFM: Installer Channel - 30% Specialty/ Other - 2% Valvoline Int'l 22% Do-It-Yourself 35% Do-It-For-Me 41% DIFM: Valvoline Instant Oil Change - 1% By Product Line Antifreeze - 6% Chemicals - 6% Appearance products - 4% Filters - 3% * For the 12 months ended March 31, 2008. Lubricants 81% Business Overview Customers Retail auto parts stores and mass merchandisers who sell to consumers; installers, such as car dealers and quick lubes; distributors Products/ Services Valvoline® lubricants and automotive chemicals MaxLife® lubricants for high-mileage vehicles SynPower® synthetic motor oil Eagle One® and Car Brite® appearance products Zerex® antifreeze Valvoline Instant Oil Change® service Market Channels Do-It-Yourself (DIY) Do-It-For-Me (DIFM) Valvoline International

Ashland Water Technologies: A major global supplier to the water treatment industry Revenue*: $0.8 billion By Segment Marine 16% Industrial 41% E&PS 43% Europe 47% North America 32% Asia/ Pacific 16% Latin America/Other - 5% By Region * For the 12 months ended March 31, 2008. Business Overview Customers/Markets Automotive Municipal waste water treatment Pulp and paper processing Paint and coatings Adhesives Printing inks Commercial and institutional building management Merchant marine Products/Services Chemicals and consulting services for utility water treatment Process water treatments Technical products and shipboard services for the merchant marine and cruise ship industry

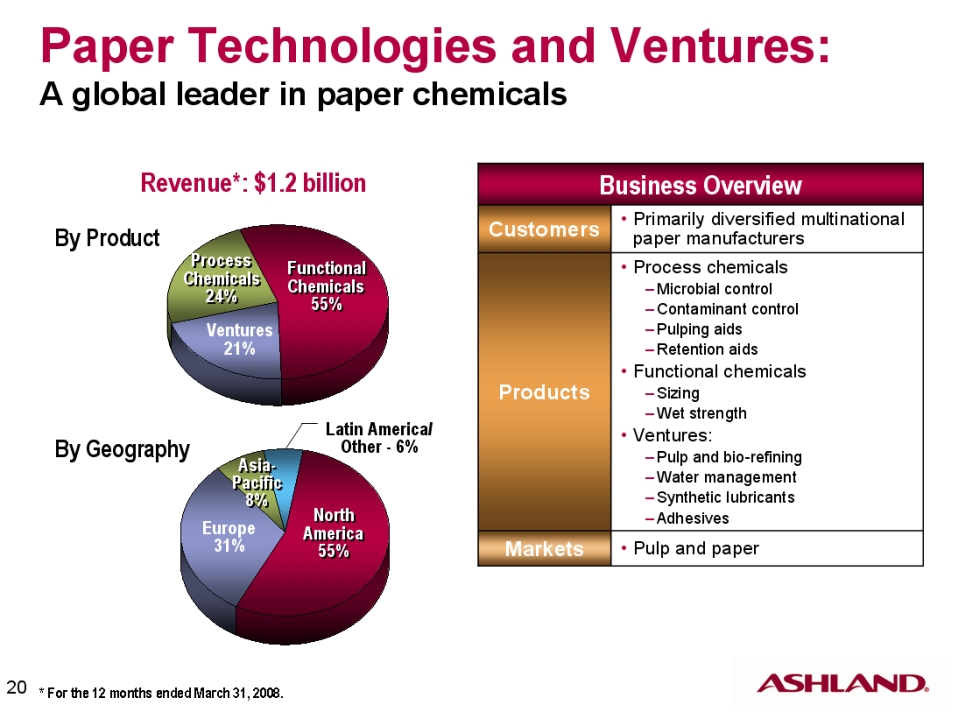

Business Overview Customers Primarily diversified multinational paper manufacturers Products Process chemicals Microbial control Contaminant control Pulping aids Retention aids Functional chemicals Sizing Wet strength Ventures: Pulp and bio-refining Water management Synthetic lubricants Adhesives Markets Pulp and paper Paper Technologies and Ventures: A global leader in paper chemicals Revenue*: $1.2 billion By Product Process Chemicals 24% Functional Chemicals 55% Ventures 21% Asia-Pacific 8% Latin America/ Other - 6% North America 55% Europe 31% By Geography * For the 12 months ended March 31, 2008.

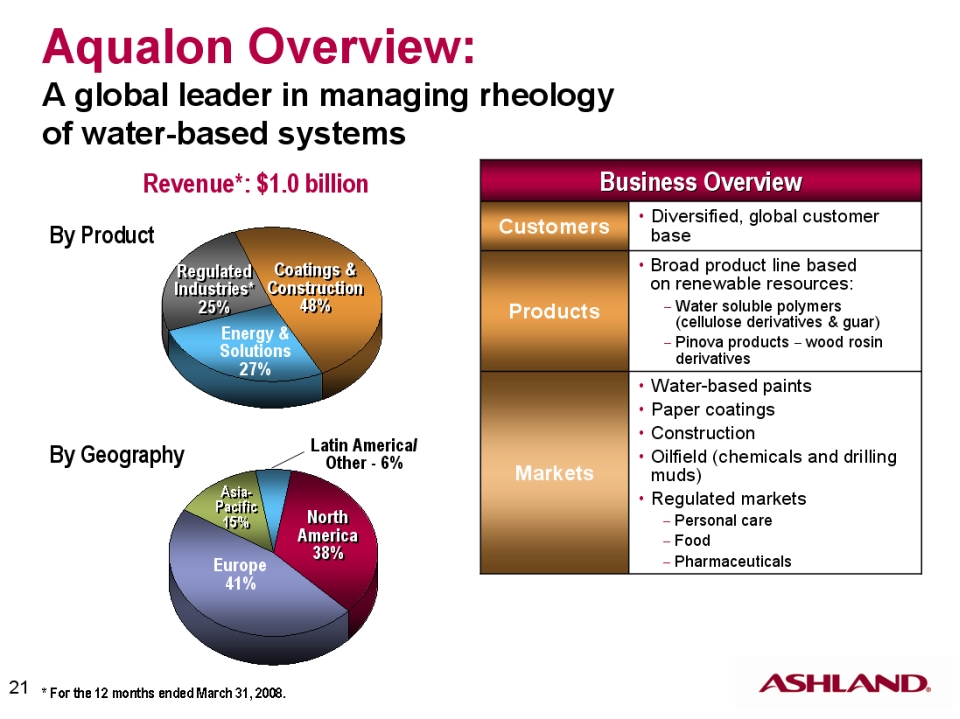

Aqualon Overview: A global leader in managing rheology of water-based systems Business Overview Customers Diversified, global customer base Products Broad product line based on renewable resources: Water soluble polymers (cellulose derivatives & guar) Pinova products – wood rosin derivatives Markets Water-based paints Paper coatings Construction Oilfield (chemicals and drilling muds) Regulated markets Personal care Food Pharmaceuticals Revenue*: $1.0 billion By Product Regulated Industries* 25% Coatings & Construction 48% Energy & Solutions 27% By Geography Latin America/Other - 6% Asia-Pacific 15% North America 38% Europe 41% * For the 12 months ended March 31, 2008.

22

(in millions)

Ashland Inc. | Trailing 12 Months Ended March 31, 2008 | ||

Operating income | $ | 215) | |

Non-North American entities reporting lag | (5) | ||

Due diligence related to potential growth opportunities | 8) | ||

Depreciation and amortization | 147) | ||

EBITDA | $ | 365) | |

Regulation G:

Reconciliation of Operating Income to EBITDA

Reconciliation of Operating Income to EBITDA

23

(in millions)

* Effective Jan. 1, 2008, Hercules elected to change its method of accounting for its qualified defined-benefit pension

plans in the United States and United Kingdom. This change in accounting method increased income in this caption

by $42 million during this 12-month period.

plans in the United States and United Kingdom. This change in accounting method increased income in this caption

by $42 million during this 12-month period.

Regulation G: Reconciliation of Income Before Income

Taxes, Minority Interest and Equity (Loss) Income to EBITDA

Taxes, Minority Interest and Equity (Loss) Income to EBITDA