EXHIBIT 99.1

® Registered trademark, Ashland or its subsidiaries, registered in various countries

* Registered trademark owned by a third party.

*

*

Lender Presentation

$750 million Revolving Credit Facility

$1,200 million Term Loan A

$1,700 million Term Loan B

June 16, 2011

$750 million Revolving Credit Facility

$1,200 million Term Loan A

$1,700 million Term Loan B

June 16, 2011

2

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements

include those that refer to Ashland’s current expectations about the acquisition of International Specialty

Products Inc. (ISP). Although Ashland believes its expectations are based on what management

believes to be reasonable assumptions, Ashland cannot assure that the expectations reflected in this

presentation or in any oral statements related to the acquisition of ISP will be achieved, as they are

subject to risks and uncertainties that are difficult to predict and may be outside of Ashland’s control.

These risks and uncertainties may cause actual results to differ materially from those stated, projected

or implied. Such risks and uncertainties include, among other things, the possibility that the benefits

anticipated from the acquisition of ISP will not be fully realized, the possibility that the transaction may

not close, and the possibility that financing may not be available on the terms committed. Other factors,

uncertainties and risks affecting Ashland are contained in its periodic filings made with the Securities

and Exchange Commission (SEC), including Ashland’s Form 10-K for the fiscal year ended Sept. 30,

2010, and Ashland’s quarterly Form 10-Q filings, which are available on Ashland’s Investor Relations

website at http://investor.ashland.com or the SEC’s website at www.sec.gov. Ashland undertakes no

obligation to subsequently update or revise the forward-looking statements made in this presentation to

reflect events or circumstances after the date of this presentation.

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements

include those that refer to Ashland’s current expectations about the acquisition of International Specialty

Products Inc. (ISP). Although Ashland believes its expectations are based on what management

believes to be reasonable assumptions, Ashland cannot assure that the expectations reflected in this

presentation or in any oral statements related to the acquisition of ISP will be achieved, as they are

subject to risks and uncertainties that are difficult to predict and may be outside of Ashland’s control.

These risks and uncertainties may cause actual results to differ materially from those stated, projected

or implied. Such risks and uncertainties include, among other things, the possibility that the benefits

anticipated from the acquisition of ISP will not be fully realized, the possibility that the transaction may

not close, and the possibility that financing may not be available on the terms committed. Other factors,

uncertainties and risks affecting Ashland are contained in its periodic filings made with the Securities

and Exchange Commission (SEC), including Ashland’s Form 10-K for the fiscal year ended Sept. 30,

2010, and Ashland’s quarterly Form 10-Q filings, which are available on Ashland’s Investor Relations

website at http://investor.ashland.com or the SEC’s website at www.sec.gov. Ashland undertakes no

obligation to subsequently update or revise the forward-looking statements made in this presentation to

reflect events or circumstances after the date of this presentation.

Regulation G: Adjusted and Pro Forma Results

The information presented herein regarding certain unaudited adjusted and pro forma results does not

conform to generally accepted accounting principles (GAAP) and should not be construed as an

alternative to the reported results determined in accordance with GAAP. Management has included this

non-GAAP and pro forma information to assist in understanding the operating performance of the

company and its reporting segments. The non-GAAP and pro forma information provided may not be

consistent with the methodologies used by other companies. All non-GAAP information related to

previous Ashland filings with the SEC has been reconciled with reported GAAP results.

conform to generally accepted accounting principles (GAAP) and should not be construed as an

alternative to the reported results determined in accordance with GAAP. Management has included this

non-GAAP and pro forma information to assist in understanding the operating performance of the

company and its reporting segments. The non-GAAP and pro forma information provided may not be

consistent with the methodologies used by other companies. All non-GAAP information related to

previous Ashland filings with the SEC has been reconciled with reported GAAP results.

3

Introduction

David Jaffe

Managing Director, Citi

4

1 $1,199 million of ISP total debt and $244 million of ISP cash as of 3/31/2011.

2 Includes financing fees, transaction expenses, interest-rate-swap termination cost, and change-of-control payments.

Transaction Structure

4 On May 31, 2011, Ashland announced the all-cash acquisition of International Specialty

Products (“ISP”)

Products (“ISP”)

- Specialty chemical manufacturer of innovative functional ingredients

- Solutions provider to key growth markets such as personal care and pharmaceutical

4 Combined pro forma trailing 12-month financials for the period ended March 31, 2011

- Sales: $7.6 billion

- Adjusted EBITDA: $1.1 billion

4 $3.2 billion purchase price

- $1.2 billion to pay off ISP debt ($1.0 billion net of cash)(1)

- $2.2 billion to purchase ISP equity

- 8.9x TTM 3/31/2011 Adjusted EBITDA

4 Sources of funds

- $2.9 billion of funded credit facilities

- $300 million Ashland cash for purchase price

- ~$200 million Ashland cash for transaction costs and other upfront expenses(2)

4 Expected closing prior to end of September quarter

- Subject to regulatory approval and other customary closing conditions

5

(1)

Sources and Uses

6

(3)

(2)

Pro Forma Capitalization

7

Transaction Overview

Jim O'Brien

Chairman and CEO

8

Introductions

4 Jim O'Brien, Chairman and CEO

4 Lamar Chambers, Senior Vice President and CFO

4 John Panichella, Senior Vice President, Ashland, and President,

Ashland Aqualon Functional Ingredients

Ashland Aqualon Functional Ingredients

4 Jack Joy, Vice President, Corporate Development

4 Kevin Willis, Vice President and Treasurer

4 Stan Turner, Director, Enterprise Strategy

4 Lynn Freeman, Assistant Treasurer

4 Shea Blackburn, Manager, Debt

9

Ashland’s Strategy

Furthering our long-term strategic goals

Furthering our long-term strategic goals

4Global #1 or strong #2 market position

4Broad global footprint

4Robust cash-generating businesses

4Leverage competitive strengths

4Preferably water-based or sustainable

chemistries

chemistries

ISP

ü

ü

ü

ü

ü

10

Transaction Rationale

4 Strengthens positions in a number of important high-growth,

high-margin end markets

high-margin end markets

- Pharmaceutical: Excipients

- Personal Care: Hair Care, Skin Care, Oral Care

4 Broadens our intellectual property portfolio of water-soluble polymers

and global R&D and applications capability

- Strong pipeline of new products to drive growth of the combined

business

business

- New product development opportunities by leveraging new chemistries

4 Deepens relationships with existing customers and enhances

penetration of existing markets

penetration of existing markets

- Complementary product offerings in a number of areas

4 Generates more consistent, predictable earnings and cash-flow

generation

generation

- Stable, less-cyclical end markets

11

4 Diversified business portfolio serving a wide range of end markets

4 Strengthens Functional Ingredients business and R&D efforts

4 Leading market positions in all markets served

4 Broad geographical diversity

- ISP has ~60% of revenues outside North America

- Pro forma company will generate approximately $3.5 billion in

revenues outside North America

revenues outside North America

4 Achievable synergies

- Expected annualized run-rate synergies of at least $50 million by

year 2

year 2

- We will pursue disciplined, bottom-up approach similar to that used

for Hercules

for Hercules

4 Commitment to deleveraging

- Proven track record in Hercules transaction

- Target leverage of 2.0x

4 Experienced management team

Investment Highlights

12

Ashland Overview

Jim O'Brien

Chairman and CEO

13

Ashland Overview

Ashland

Performance Materials

23%

Performance Materials

23%

Ashland

Performance Materials

23%

Performance Materials

23%

Ashland

Consumer Markets

31%

Consumer Markets

31%

By commercial unit

Ashland Hercules

Water Technologies

Water Technologies

Ashland Hercules

Water Technologies

Water Technologies

30%

30%

Ashland

Aqualon

Functional

Ingredients

Aqualon

Functional

Ingredients

Ashland

Aqualon

Functional

Ingredients

Aqualon

Functional

Ingredients

16%

16%

1 For trailing 12 months ended March 31, 2011.

North America

58%

58%

North America

58%

58%

Asia Pacific

13%

13%

Asia Pacific

13%

13%

Latin America/

Other - 5%

Other - 5%

Europe

Europe

24%

24%

Sales1: $6.0 billion

Adjusted EBITDA1: $735 million

Ashland

Performance

Materials - 13%

Performance

Materials - 13%

Ashland

Performance

Materials - 13%

Performance

Materials - 13%

Ashland Consumer

Markets

37%

Markets

37%

Ashland Hercules

Water Technologies

Water Technologies

Ashland Hercules

Water Technologies

Water Technologies

23%

23%

Ashland Aqualon Functional

Ashland Aqualon Functional

Ingredients

Ingredients

27%

27%

NYSE Ticker Symbol: | ASH |

Total Employees: | ~12,500 |

Outside North America | ~40% |

Number of Countries in Which Ashland Has Sales: | More than 100 |

14

Klucel™

6%

Latin America/

Other - 8%

North

America

America

North

America

America

35%

35%

Asia

Pacific

Pacific

Asia

Pacific

Pacific

20%

20%

Europe

37%

Coatings

Additives

33%

Additives

33%

Coatings

Additives

33%

Additives

33%

Energy &

Specialties

Solutions

19%

Specialties

Solutions

19%

Regulated

Industries

30%

Industries

30%

Regulated

Industries

30%

Industries

30%

Sales

by Geography

by Geography

Sales

by Market

by Market

Trailing 12 Months Ended March 31, 2011

Sales: $1.0 billion

Adjusted EBITDA: $208 million

Adjusted EBITDA Margin: 21.8%

· Diversified, global customer base

Customers

· Regulated markets

- Personal care

- Pharmaceutical

- Food

· Water-based paints

· Oilfield (chemicals and drilling muds)

· Construction

Markets

· Broad product line based

on renewable resources

on renewable resources

- Water-soluble polymers

(cellulose ethers and guar derivatives)

(cellulose ethers and guar derivatives)

Products

Business Overview

Sales

by Product

by Product

CMC

20%

20%

CMC

20%

20%

HEC

32%

32%

HEC

32%

32%

MC

18%

18%

MC

18%

18%

Other

16%

16%

Other

16%

16%

™ Trademark, Ashland or its subsidiaries, registered in various countries

15

Trailing 12 Months Ended March 31, 2011

Sales: $1.8 billion

Adjusted EBITDA: $180 million

Adjusted EBITDA Margin: 9.9%

Process

25%

25%

Process

25%

25%

Utility

34%

34%

Utility

34%

34%

Functional

41%

41%

Functional

41%

41%

Growth

51%

51%

Growth

51%

51%

Base

31%

31%

· Growth

- Commercial and - Packaging

institutional - Tissue and towel

- Food and beverage - Pulp

- Mining

· Base

- Printing and writing

- Specialty chemicals

- General manufacturing

· Opportunistic

- Lubricants - Basic chemicals/

- Municipal other

Customers/

Markets

Markets

· Process chemicals: microbial and

contaminant control, pulping aids,

retention aids and defoamers

contaminant control, pulping aids,

retention aids and defoamers

· Utility water treatments

· Functional chemicals: sizing/strength

Products/

Services

Services

Business Overview

North

America

America

North

America

America

49%

49%

Europe

33%

Latin

America/

America/

Other - 7%

16

Pkg. &

Converting

23%

23%

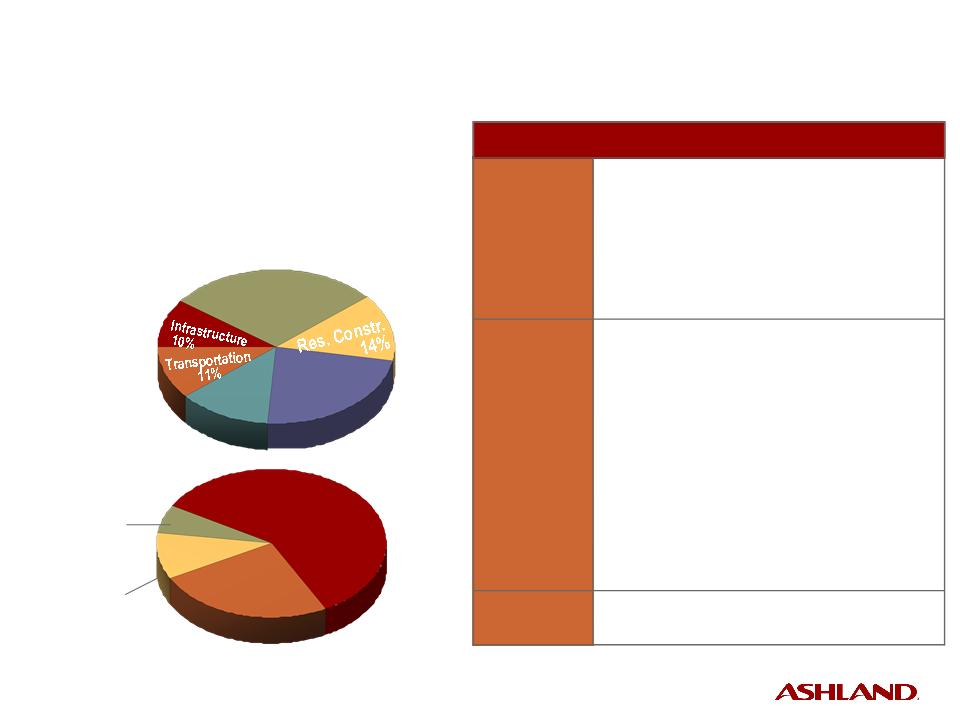

Ashland Performance Materials

A global leader in specialty chemicals

A global leader in specialty chemicals

North

America

America

North

America

America

59%

59%

Europe

25%

Latin

America/

Other -

6%

America/

Other -

6%

Industrial

Construction

29%

Construction

29%

· Auto manufacturers; foundries; pipe

and tank fabricators; packaging and

converting; bathware, countertop and

window lineal manufacturers; pipe

relining contractors; boat builders;

wide and narrow web printers

and tank fabricators; packaging and

converting; bathware, countertop and

window lineal manufacturers; pipe

relining contractors; boat builders;

wide and narrow web printers

Customers

· Construction, packaging and con-

verting, marine and transportation

verting, marine and transportation

Markets

· Composites and Adhesives

- Unsaturated polyester resins

- Vinyl ester resins

- Gelcoats

- Pressure-sensitive adhesives

- Structural adhesives

- Specialty resins

· Casting Solutions/ASK Chemicals2

- Foundry binder resins

- Chemicals

- Sleeves and filters

- Design services

Products/

Services

Services

Business Overview

Sales

by Geography1

by Geography1

Sales

by Market1

by Market1

Trailing 12 Months Ended March 31, 2011

Sales: $1.4 billion

Adjusted EBITDA: $96 million

Adjusted EBITDA Margin: 7.1%

Marine

13%

13%

Asia Pacific

10%

10%

1 Excludes sales from Casting Solutions.

2 Joint venture launched in December 2010. Ashland retains 50% interest.

17

Ashland Consumer Markets: A leading worldwide

marketer of premium-branded automotive lubricants and chemicals

marketer of premium-branded automotive lubricants and chemicals

Lubricants

86%

Filters - 2%

Valvoline

Int'l

23%

Int'l

23%

Valvoline

Int'l

23%

Int'l

23%

Do-It-

Yourself

Yourself

36%

· Retail auto parts stores and mass

merchandisers who sell to consumers

merchandisers who sell to consumers

· Installers, such as car dealers and

quick lubes; distributors

quick lubes; distributors

· Fleet owners; manufacturers and users

of industrial and power generation

equipment

of industrial and power generation

equipment

Customers

· Do-It-Yourself (DIY)

· Do-It-For-Me (DIFM)

· Valvoline International

Market

Channels

Channels

· Valvoline™ lubricants and automotive

chemicals

chemicals

· MaxLife™ lubricants

for high-mileage vehicles

for high-mileage vehicles

· SynPower™ synthetic motor oil

· Eagle One™ and Car Brite™

appearance products

appearance products

· Zerex™ antifreeze

· Valvoline Instant Oil Change™ service

· NextGenTM recycled motor oils

Products/

Services

Services

Business Overview

Sales

by Product Line

by Product Line

Sales

by Market Channel

by Market Channel

Do-It-

For-Me

38%

For-Me

38%

DIFM:

Installer channel

27%

Installer channel

27%

Specialty/

Other - 3%

Other - 3%

DIFM:

Valvoline Instant Oil

Change - 11%

Valvoline Instant Oil

Change - 11%

Antifreeze - 5%

Appearance

products - 2%

products - 2%

Chemicals - 5%

Trailing 12 Months Ended March 31, 2011

Sales: $1.9 billion

Adjusted EBITDA: $288 million

Adjusted EBITDA Margin: 15.5%

™ Trademark, Ashland or its subsidiaries, registered in various countries

18

ISP Overview

John Panichella

Senior Vice President, Ashland, and

President, Ashland Aqualon Functional Ingredients

19

ISP Overview

High-margin, global business

High-margin, global business

4Leading manufacturer of functional ingredients

to personal care and pharmaceutical markets

to personal care and pharmaceutical markets

- EBITDA margins ~ 21% - 22%

- Robust top-line growth

4Unique technology portfolio that meets a variety

of demanding customer applications

of demanding customer applications

- More than 400 active patents

- Approximately 275 scientists, positioned globally

4Strong global presence

- Nearly 60% of sales from outside North America

4Extensive relationships with leading consumer

brand and pharmaceutical providers

brand and pharmaceutical providers

4Approximately 2,700 employees

20

Personal Care | Pharma & Nutrition | Performance | Intermediates | Elastomers | |

Financial & Operating Information | |||||

2010 EBIT ($mm) | $124 | $76 | $35 | $29 | |

Key End Markets | Skin Care 4Skin lotions and anti- aging products 4Body washes 4Suncare products 4Body washes Hair Care 4Shampoo / Conditioner 4Mousses / Gels 4Hairsprays 4Body washes Oral Care 4Toothpastes 4Mouthwashes 4Denture adhesives | Pharmaceutical 4Tablets 4Dialysis membranes 4Wound care 4Capsules 4Body washes Other 4Food 4Beverages 4Fine chemicals | 4Oilfield 4Detergents and household cleaners 4Inkjet paper coatings 4Adhesives 4Agriculture 4Paints 4Chemical processing 4Electronics | 4Polyesters 4Urethanes 4Polybutylene terephthalate (PBT) plastics 4Value-added chemical products | 4Tires 4Hoses 4Belting |

Key Products | 4Biofunctional ingredients 4UV absorbers 4Bioadhesives 4Polymers 4Emulsifiers / emollients | 4Excipients 4Reaction solvents 4Bioavailability enhancers 4Clarification polymers 4Radiation-sensitive films | 4Polymers 4Monomers 4Solvents 4Biocides | 4Butanediol (BDO) | 4Emulsion SBR (ESBR) |

Key Customers | 4Alberto Culver 4Avon 4Colgate 4L’Oreal 4Playtex 4P&G 4Unilever | 4Fresenius 4GSK 4Merck 4Novartis 4Pfizer | 4Bayer 4Dow 4Halliburton 4HP 4Reckitt Benckiser | 4Bayer 4DSM 4DuPont 4Novamont | 4 Bridgestone/ Firestone 4 Cooper Tires 4 Michelin 4 Toyo Tires |

Specialty Chemicals

Industrial Chemicals

ISP Portfolio Overview

Broad Portfolio in Stable Markets

Broad Portfolio in Stable Markets

21

Global/Regional HQ

Technical Center

Manufacturing

Cologne, Germany

Memmingen, Germany

Bradford, UK

Paris, France

Sophia Antipolis, France

Hyderabad, India

Shanghai, China

Singapore

Texas City, TX

Mexico City, Mexico

Sao Paulo, Brazil

Wayne, NJ

N.A. Manufacturing

• Calvert City, KY

• Chatham, NJ

• Columbia, MD

• Columbus, OH

• Freetown, MA

• Huntsville, AL

• Leaside, Canada

• Lima, OH

• Port Neches, TX

• Texas City, TX

L.A. Manufacturing

• Cabreuva, Brazil

European. Manufacturing

• Horhausen, Germany

• Marl, Germany

• Memmingen, Germany

• Newton Aycliffe, UK

• Poole, UK

• Sophia Antipolis, France

ISP Locations

Strong global positions

Strong global positions

2010 Sales | |

North America | 41% |

Europe | 35% |

Asia Pacific | 14% |

Latin America | 10% |

~60% of sales

outside of North

America

outside of North

America

22

Personal

Care

47%

Care

47%

Personal

Care

47%

Care

47%

Pharma &

Nutrition

29%

Nutrition

29%

Pharma &

Nutrition

29%

Nutrition

29%

Performance

13%

13%

Performance

13%

13%

EBIT: $264 million

ISP 2010 EBIT by Segment

Greater than 75% of earnings from personal care & pharmaceutical

Greater than 75% of earnings from personal care & pharmaceutical

23

ISP Historical Performance1

Fast-growing, high-margin segments

Fast-growing, high-margin segments

Historical Growth

5-yr sales CAGR

5-yr sales CAGR

Operating

Margin

Margin

Pharma & Nutrition

Personal

Care

Care

Elastomers

Performance

Intermediates

Size of bubble denotes

relative 2010 Operating

Income

relative 2010 Operating

Income

1 Based on calendar-year 2010 ISP financials and historical data provided by ISP management.

24

Business Overview

2010 Sales by Product

Key Customers

Skin Care

42%

42%

Skin Care

42%

42%

Hair Care

32%

32%

Hair Care

32%

32%

Oral Care

26%

26%

Oral Care

26%

26%

Solid Reputation For Quality

4 Alberto Culver

4 Avon

4 Colgate

4 L’Oreal

4 Playtex

4 P&G

4 Unilever

Personal Care - Overview

4 Manufactures critical ingredients in well-known

cosmetic and skin-, hair- and oral-care products

cosmetic and skin-, hair- and oral-care products

4 Market is relatively noncyclical, with sustainable

growth and exceptional margins

growth and exceptional margins

4 Leading position as a strategic supplier by 8

of the top 10 global beauty care companies

of the top 10 global beauty care companies

4 Strong programs in upstream research (new

molecules), materials science, formulation

science, hair and skin biology and regional

technical support

molecules), materials science, formulation

science, hair and skin biology and regional

technical support

25

Business Overview

Pharma

59%

59%

Pharma

59%

59%

Pharma

Solvents

14%

Solvents

14%

Pharma

Solvents

14%

Solvents

14%

Beverage

14%

14%

Beverage

14%

14%

Key Customers

2010 Sales by Product

4 Fresenius

4 GSK

4 Merck

4 Novartis

4 Pfizer

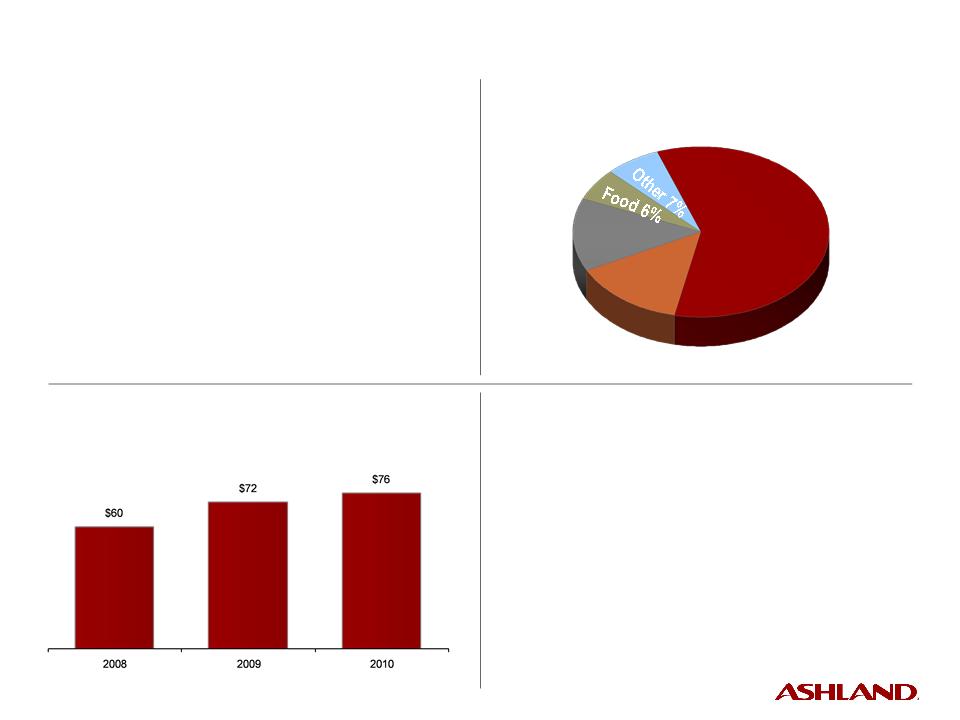

Operating Income

($ in millions)

($ in millions)

Pharma and Nutrition - Overview

4 Products are key ingredients for prescription and

over-the-counter tablets, injectable prescription

drugs, antiseptics and dialysis membranes

over-the-counter tablets, injectable prescription

drugs, antiseptics and dialysis membranes

4 Strong specialty-excipients business and global

network of tablet formulation laboratories

network of tablet formulation laboratories

4 Manufactures specialty solvents for pharma API

manufacture; radiation-sensitive films for medical

imaging; clarification and stabilization aids for beer

and wine; and fine chemicals and food ingredients

manufacture; radiation-sensitive films for medical

imaging; clarification and stabilization aids for beer

and wine; and fine chemicals and food ingredients

26

Business Overview

Specialty

Solvents

45%

Solvents

45%

Specialty

Solvents

45%

Solvents

45%

Performance

33%

33%

Performance

33%

33%

Biocides

14%

14%

Biocides

14%

14%

Key Customers

2010 Sales by Product

4 Bayer

4 Dow

4 Halliburton

4 HP

4 Reckitt Benckiser

Operating Income

($ in millions)

($ in millions)

Performance Chemicals - Overview

4 ISP segment with the broadest product portfolio

and range of applications

and range of applications

4 Manufactures vinyl pyrrolidone, vinyl caprolactam

and acrylate polymers, solvents and

alkylpyrrolidones, vinyl monomers and ethers,

specialty styrene-butadiene rubber, and industrial

biocides

and acrylate polymers, solvents and

alkylpyrrolidones, vinyl monomers and ethers,

specialty styrene-butadiene rubber, and industrial

biocides

4 End markets include adhesives and sealants,

agrochemicals, coatings and inks, electronics,

HI&I cleaning, mining and mineral slurries, oilfield,

membranes, plastics, pulp and paper, and water

conditioning

agrochemicals, coatings and inks, electronics,

HI&I cleaning, mining and mineral slurries, oilfield,

membranes, plastics, pulp and paper, and water

conditioning

27

Business Overview

Elastomers

68%

68%

Elastomers

68%

68%

Intermediates

32%

32%

Intermediates

32%

32%

Key Customers

2010 Sales by Product

Intermediates:

4 Bayer

4 DSM

4 DuPont

4 Novamont

Elastomers:

4 Bridgestone /

Firestone

Firestone

4 Cooper Tires

4 Michelin

4 Toyo Tires

Operating Income

($ in millions)

($ in millions)

Industrial Chemicals - Overview

4 Engaged in the manufacture and sale of:

- Intermediates, principally butanediol, sold in the

merchant market for use in performance plastics

and synthetic fibers

merchant market for use in performance plastics

and synthetic fibers

- Elastomers, principally cold emulsion styrene-

butadiene rubber, which is used in tires and

industrial rubber products

butadiene rubber, which is used in tires and

industrial rubber products

4 Competes as a low-cost manufacturer

with its extensive manufacturing experience

and field sales organization

with its extensive manufacturing experience

and field sales organization

28

Strategic Fit with Ashland

Stan Turner

Director, Enterprise Strategy

29

Ashland EBITDA Transformation

ISP continues to build world-class specialty chemical company

ISP continues to build world-class specialty chemical company

Pre-Transformation:

2004

Pro Forma1

Divested

Segments

69%

Segments

69%

Divested

Segments

69%

Segments

69%

Ashland

Specialty

Chemicals

15%

Specialty

Chemicals

15%

Ashland

Specialty

Chemicals

15%

Specialty

Chemicals

15%

Ashland

Consumer

Markets

16%

Consumer

Markets

16%

Ashland

Consumer

Markets

16%

Consumer

Markets

16%

Specialty Chemical

Commercial Units

74%

Commercial Units

74%

Specialty Chemical

Commercial Units

74%

Commercial Units

74%

1 Pro forma Adjusted EBITDA for trailing 12 months ended March 31, 2011.

Ashland

Consumer

Markets

26%

Consumer

Markets

26%

Ashland

Consumer

Markets

26%

Consumer

Markets

26%

30

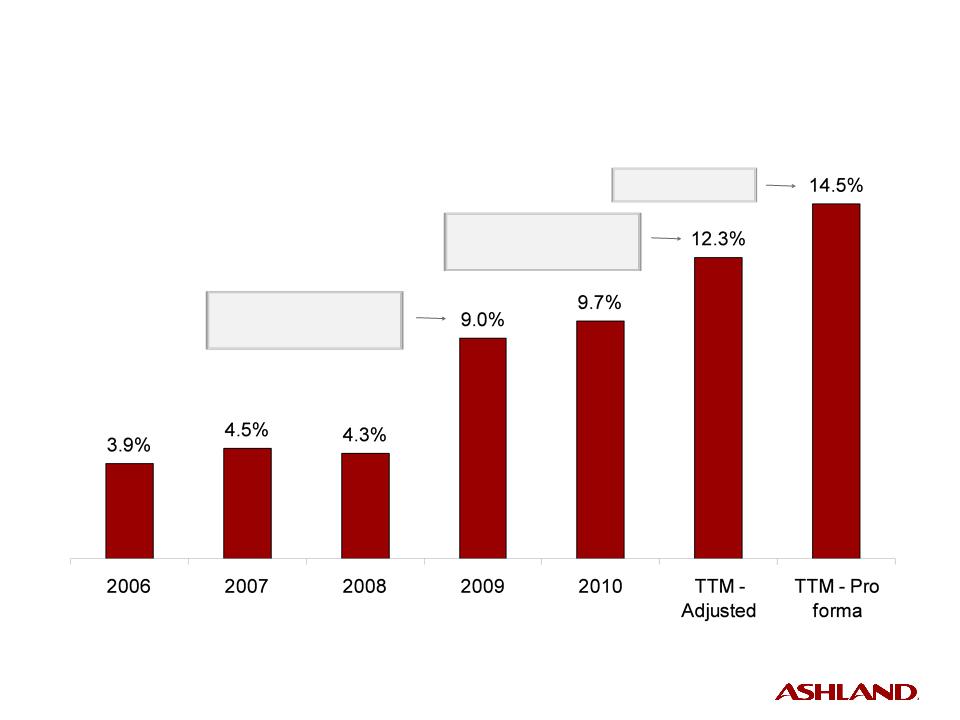

EBITDA Margin Expansion1

Strategic decisions have dramatically expanded margins over time

Strategic decisions have dramatically expanded margins over time

1 2006 through 2010 EBITDA margin as reported in the fiscal year noted and not adjusted for future transactions.

TTM - Adjusted represents adjusted results for the trailing 12 months ended March 31, 2011.

TTM - Adjusted represents adjusted results for the trailing 12 months ended March 31, 2011.

Acquired Hercules

November 2008

November 2008

Divested Distribution

March 2011

March 2011

ISP Acquisition

31

Ashland EBITDA Transformation

Enhanced margin performance

Enhanced margin performance

1 For trailing 12 months ended March 31, 2011.

Ashland

Performance

Materials

13%

Performance

Materials

13%

Ashland

Performance

Materials

13%

Performance

Materials

13%

Ashland

Consumer

Markets

37%

Consumer

Markets

37%

Ashland

Hercules Water

Technologies

Hercules Water

Technologies

Ashland

Hercules Water

Technologies

Hercules Water

Technologies

23%

23%

Ashland Aqualon

Functional

Functional

Ashland Aqualon

Functional

Functional

Ingredients

Ingredients

27%

27%

Ashland

Performance

Materials - 8%

Performance

Materials - 8%

Ashland

Performance

Materials - 8%

Performance

Materials - 8%

Ashland

Consumer

Markets

26%

Consumer

Markets

26%

Ashland

Hercules Water

Technologies

Hercules Water

Technologies

Ashland

Hercules Water

Technologies

Hercules Water

Technologies

16%

16%

Ashland Aqualon

Functional

Functional

Ashland Aqualon

Functional

Functional

Ingredients

Ingredients

18%

18%

Pro Forma1

Today1

ISP

ISP

32%

32%

32

Functional Ingredients Strategy

ISP aligns with our previously stated core and adjacency goals

ISP aligns with our previously stated core and adjacency goals

· ISP strengthens our position in 5 of our 8 targeted, adjacent markets

- Surfactants, Tablet Coatings, Controlled Release, Hair Care and Skin Care

Slide extracted from

June 2010 Ashland

Analyst Day

June 2010 Ashland

Analyst Day

33

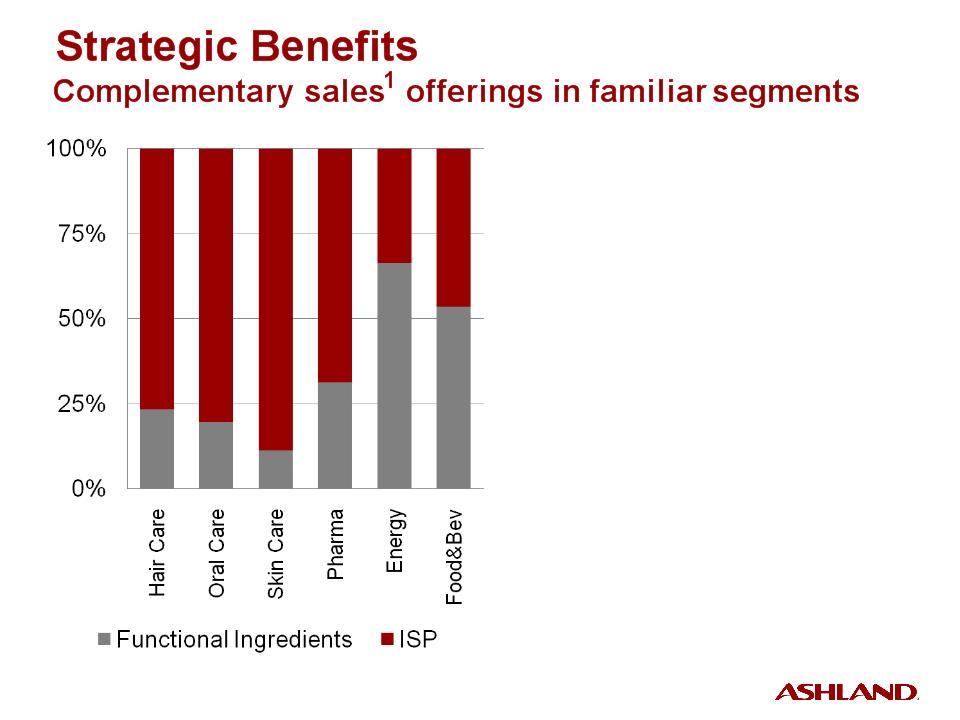

1 Approximated from management estimates, 2010 ISP sales data, and Ashland’s sales data.

· Hair Care

- Fixatives for hair gels and hairsprays

- Shampoo thickeners and conditioners

· Oral Care

- Tartar and gingivitis control

- Toothpaste thickeners, stabilizers

· Skin Care

- Actives: UV, anti-wrinkle, etc.

- Rheology modifiers

· Pharmaceutical

- Immediate release disintegrants

- Controlled release

· Energy

- Fluid loss additives, hydrate inhibitors

- Drilling aids, cement additives

· Food & Beverage

- Beverage clarifiers

- Texture modifiers and thickeners

34

Significant Synergy Opportunity

4 Approximately $50 million annual synergies

- Phased in over two years

4 Main areas of synergy savings

- Back office & administrative

- Commercial & technical

- Other G&A

4 Implementation costs are approximately 1.0x to 1.5x annual

synergy savings

synergy savings

4 Disciplined, bottom-up approach similar to that used for the

Hercules acquisition

Hercules acquisition

35

Clear, Focused Integration Plan

4 We will retain key managers to ensure ongoing success

4 Ashland has a proven track record in successfully

integrating acquisitions

integrating acquisitions

4 ISP will be integrated with the Ashland Aqualon

Functional Ingredients segment

Functional Ingredients segment

- John Panichella, president of Ashland Aqualon Functional

Ingredients, will lead the integration

Ingredients, will lead the integration

4 Create best practices

36

Financial Overview

Lamar Chambers

Senior Vice President and CFO

37

1 Board authorization remains in place and shares may still be repurchased over time.

2 Approximately $90 million of letters of credit outstanding at close.

Financial Policy

4 Use majority of available global cash to repay debt

- We have terminated our automatic 10b5-1 stock repurchase plan1

4 Continue to target leverage of 2.0x, achieving this target

through discretionary debt paydown from free cash flow

through discretionary debt paydown from free cash flow

4 Maintain adequate liquidity ($750 million undrawn revolver2 in place

at closing and $300 million to $400 million of cash)

at closing and $300 million to $400 million of cash)

4 Expect to execute swaps to effectively fix 70% - 80% of total

outstanding debt

outstanding debt

38

Note: Net Debt and Net Debt / EBITDA are as defined in Ashland’s current credit agreement.

Proven Ability to Delever Quickly

39

(3)

Strong Pro Forma Financials

40

Functional Ingredients

Water Technologies

($ in millions)

Note: Functional Ingredients and Water Technologies include 2008 data as reported by Hercules.

Ashland Historical Financial Summary

41

Sales

($ in millions)

ISP Historical Financial Summary

42

Appendix

43

Note: TTM 3/31/2011 financials are unaudited.

ISP Summary Financials

44

™ Trademark, Ashland or its subsidiaries, registered in various countries