UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21652

Fiduciary/Claymore MLP Opportunity Fund

(Exact name of registrant as specified in charter)

| | |

| 2455 Corporate West Drive, Lisle, IL | | 60532 |

| (Address of principal executive offices) | | (Zip code) |

Nicholas Dalmaso, Chief Legal and Executive Officer

Fiduciary/Claymore MLP Opportunity Fund

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 505-3700

Date of fiscal year end: November 30

Date of reporting period: May 31, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

www.fiduciaryclaymore.com

| | | | |

| | | ...your pipeline to the LATEST, most up-to-date INFORMATION about the Fiduciary/Claymore MLP Opportunity Fund | | |

The shareholder report you are reading right now is just the beginning of the story. Online at fiduciaryclaymore.com, you will find:

| | • | | Daily, weekly and monthly data on share prices, distributions, dividends and more |

| | • | | Monthly portfolio overviews and performance analyses |

| | • | | Announcements, press releases and special notices |

| | • | | Fund and adviser contact information |

Fiduciary Asset Management and Claymore are constantly updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

| | |

2 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Dear Shareholder |

We are pleased to submit the first semiannual shareholder report for Fiduciary/Claymore MLP Opportunity Fund from the Fund’s commencement of operations on December 28, 2004 through May 31, 2005. As you may know, the Fund’s investment objective is to provide a high level of after-tax total return with an emphasis on current distributions paid to shareholders. To seek to achieve that objective, the Fund primarily invests in master limited partnerships (MLPs), which can provide shareholders with attractive tax deferral benefits.

Fiduciary Asset Management, LLC is the Fund’s sub-adviser and manages a wide range of institutional products and was a pioneer in the management of MLP assets. Fiduciary currently has approximately $16 billion in client assets under management.

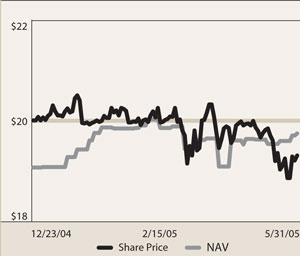

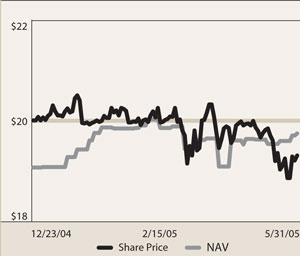

In this abbreviated period, the Fund generated a total return of 5% at net asset value (NAV). On a market value basis, the Fund declined 1.96%. This represents a change in NAV to $19.74 on May 31, 2005 from $19.10 on December 28, 2004. The Fund’s market price was $19.30 on May 31 down from $20.00 at inception. This discount from NAV highlights the fact that many closed-end funds have fallen out of favor with investors recently. However, we believe that this discount represents an opportunity as common shares of the Fund are now available in the market at prices below the value of the securities in the underlying portfolio. Shareholders have the opportunity to reinvest their dividends from the Fund through the Dividend Reinvestment Plan (DRIP) that is described in detail on page 21 of this report.

When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the quarterly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an IRS limitation that the purchase price can not be more than 5% below the market price per share. The DRIP provides a low-cost means to accumulate additional shares and enjoy the benefits of compounding returns over time.

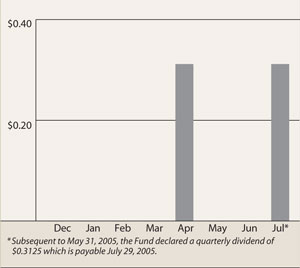

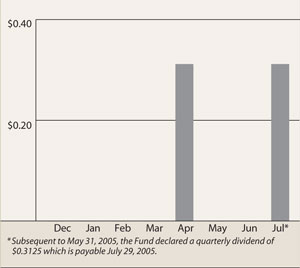

On April 30, 2005, the Fund paid its initial quarterly dividend of $0.3125 per share, which represented a distribution yield of 6.25% based on the Fund’s initial offering price of $20.00. On July 29, 2005 — after the close of this reporting period — the Fund is scheduled to pay its second quarterly dividend of $0.3125 per share, representing a distribution yield of 6.32% based on the closing market price of $19.77 per share on June 30, 2005.

| | |

| | | SemiAnnual Report | May 31, 2005 | 3 |

FMO | Fiduciary/Claymore MLP Opportunity Fund | Dear Shareholder continued

To learn more about the Fund’s performance over this fiscal period, we encourage you to read the Questions & Answers section of the report on page 5. In it, you’ll find information on Fiduciary Asset Management’s investment philosophy and discipline and detailed information on the structure of the portfolio and its performance during the fiscal period ended May 31.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at www.fiduciaryclaymore.com.

|

Sincerely, |

|

|

Nicholas Dalmaso |

| Chief Executive Officer, Fiduciary/Claymore MLP Opportunity Fund |

July 14, 2005

| | |

4 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Questions & Answers

Fiduciary/Claymore MLP Opportunity Fund (FMO) is managed by Fiduciary Asset Management, LLC. In the following interview, Portfolio Manager James Cunnane, Jr., CFA discusses the Fund’s performance since its commencement of operations on December 28, 2004 through May 31, 2005.

Will you provide your thoughts on the master limited partnership (“MLP”) market over the course of this period?

The MLP marketplace has performed quite well in the period and this has, of course, supported the Fund’s performance. There have been two primary drivers of this strong performance.

One is increased investor awareness. Until recently, investing in MLPs was complicated and cumbersome for retail investors. With MLPs offered in a closed-end fund product, the demand for this asset class has increased dramatically. In 2004, the first MLP closed-end funds began operations. Through their structure as regular corporations (C-corporations) they enabled shareholders to invest in a basket of MLPs with a single 1099-DIV tax form to file each year. This is in sharp contrast to a direct investment in an MLP, which generates an individual Form K-1 tax statement that can report a variety of income and expense items. For investors looking to diversify their exposure in the MLP market, this meant a cumbersome series of tax forms/filings each calendar year. Due to taxation issues, direct MLP investments also did not make sense for investors looking to invest tax-deferred or tax-exempt assets such as IRA assets. At this point, there is a small, but growing, group of closed-end funds, such as the Fiduciary/Claymore MLP Opportunity Fund that invest in MLPs. The ease of this investment, compared with direct individual investment, resonated with investors.

The second driver of strong performance is higher than expected distributions. Year to date in 2005, MLPs increased their distributions at a much higher rate than we had forecasted. Strong merger and acquisition activity among many MLPs drove these increases. Through acquisition, the distributable cash flows of MLPs increased, as have distributions to investors such as the Fund.

How did the Fund perform during the period?

In this abbreviated period, the Fund gained 5.00% in net asset value (“NAV”). This represents an increase in NAV to $19.74 ( as of May 31, 2005) from $19.10 (as of December 28, 2004). On a market value basis, the Fund declined 1. 96%. The Fund’s market value was $19.30 on May 31, down from $20.00 at inception.

When considering NAV performance, it is important to consider the special tax structure of the Fund. While the Fund gained ground on an NAV basis, the unrealized appreciation of the Fund was much higher. For every dollar earned by the Fund, the NAV tends to rise by a smaller percentage. That is because the Fund is a taxable entity, meaning that there is a contingent deferred tax liability that builds up in the portfolio and in the NAV. This structure provides a mechanism to keep the shares reflecting the true after-tax value of the portfolio. With that said, we still have those additional assets to manage until we pay the taxes, which could be years down the road.

Did the Fund meet its distribution objective?

Yes, the Fund made two distribution payments since its inception. On April 30, 2005, the Fund paid its initial quarterly dividend of $0.3125 per share, which represented a distribution yield of 6.25% based on the Fund’s initial offering price of $20. On July 29, 2005 – after the close of this reporting period – the Fund is scheduled to pay its second quarterly dividend of $0.3125 per share, representing a distribution yield of 6.32% based on the closing market price of $19.77 per share on June 30, 2005.

Will you tell us about how you select securities for the Fund?

We believe that our initial invest-up of this Fund was unique relative to our peers. We used a very aggressive invest-up process and fully invested the initial Fund principal by January 26, 2005 – approximately one month after the Fund’s shares began trading. Our goal was to take advantage of the attractive valuations that existed in the MLP sector. Considering that multiple new closed-end MLP funds launched at approximately

| | |

| | | SemiAnnual Report | May 31, 2005 | 5 |

FMO | Fiduciary/Claymore MLP Opportunity Fund | Questions & Answers continued

the same time, we expected that MLP valuations would rise as the other managers invested their assets, and we were correct.

While not all of the securities that we purchased initially will be long-term holdings for the Fund, they provided attractive yields and more total return than we could have received with a portion of the Fund’s assets in cash equivalents. At this time, we are in the process of narrowing down the current portfolio to our focus list of securities. Our focus list is built on basic fundamental factors – those partnerships that we believe offer the best combination of growth, yield and risk. As of May 31, there were 33 MLP holdings in the Fund.

Will you discuss how you structured the Fund’s portfolio?

In general, the Fund’s strategy is to hold a portfolio of MLP securities. While we are currently making changes to the specific partnerships held by the Fund, we anticipate keeping its asset allocation similar to where it was at the end of the fiscal period. As of May 31, 2005, midstream energy infrastructure MLPs represented 80.1%, coal MLPs represented 11.1%, propane MLPs represented 7.0% and shipping MLPs represented 1.8% of long-term investments.

A majority of the Fund’s total MLP assets were held in common units, while the remaining balance was held in restricted shares of MLPs that we received in private or direct placements. For a closed-end fund, access to private or direct placements can be advantageous. MLPs use private placements of restricted units to raise capital to fund acquisitions or other growth initiatives. Unregistered shares, or restricted units, typically convert to common units and become fully-tradable. The Fund may benefit if it purchases the units at a discount to the price of the MLP’s common units. One of the primary risks of owning unregistered shares is that they are restricted from trading for a period of time. For a closed-end fund such as this, that risk is acceptable, as there is generally no need to trade the units to fund redemptions as might be the case in an open-end mutual fund. There is also the risk that restricted units will lose value relative to their purchase price when converted into common units, but that is a risk common to most investments.

What is a master limited partnership?

Master Limited Partnerships (MLPs) are publicly-traded partnerships whose interests (limited partnership units) are traded on securities exchanges like shares of corporate stock. An MLP consists of general partner and limited partners. The general partner manages the partnership, has an ownership stake in the partnership and is eligible to receive an incentive distribution. To qualify as an MLP, a partnership must receive at least 90% of its income from qualifying sources such as energy and natural resources activities, interest, and dividends, among other specified sources. Currently, most MLPs operate in the energy, natural resources or real estate sectors. Due to their partnership structure, MLPs generally do not pay income taxes. Thus, unlike investors in corporate securities, direct MLP investors are generally not subject to double taxation (i.e. corporate level tax and tax on corporate dividends).

Why are MLPs attractive investments?

In our opinion, MLPs offer the best combination of current income and growth available in the market-place. We believe their current yields, combined with their long-term growth potential, outshines other types of growth and income investments such as fixed income, utilities and real estate investment trusts.

Also we believe the partnership structure of these MLPs is attractive. Much of their current income is tax deferred until the asset is sold. That may allow the Fund to pass through an almost entirely tax-deferred dividend yield for the first couple of years of operations.

Finally, we believe that the diversification benefits are extraordinary. MLPs have a historically low correlation to other types of investments.

Energy stocks had a very strong run over the past few years. Might your exposure to energy MLPs be at risk if oil and natural gas prices decline?

With oil and gas prices at record highs, there is much debate about whether energy securities can maintain

| | |

6 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund | Question & Answers continued

their upward momentum. The unique and important difference between many midstream energy infrastructure MLPs vs. and energy securities is that a majority of the energy infrastructure MLP profits are volume driven, not price driven. Also, the movement of commodity prices does not significantly impact the performance of many of these partnerships because many of them are pipeline operators. They get paid to move energy product from point A to point B. In most cases, they do not actually own economic interests in the assets that they are transporting.

Energy infrastructure MLPs are, however, impacted by changes in commodity supply and demand, which has historically been much more stable than commodity prices. While prices can fluctuate significantly day by day, supply and demand of energy product changes more gradually. Additionally, we focus our investments in assets that access growing or stable supplies of energy and that deliver to stable or growing geographic areas.

Please tell us about the Fund’s holdings in coal and propane partnerships.

As mentioned previously the Fund’s position in coal MLPs represents about 11.1% of long-term investments, while propane MLPs represent about 7.0% of long-term investments.

The Fund’s coal MLPs are focused on coal operations or in partnerships that receive royalties from coal operations. Coal is a very abundant resource in the U.S. With oil and natural gas prices near historic highs, coal is becoming an alternative fuel source. Electrical plants, in particular, are turning to coal to support their electric generation needs. Today’s coal producers are also making strides in improving clean coal technology, which we believe will support further use of this commodity. Unlike the midstream energy infrastructure MLP investments, partnerships invested in coal are subject to a good deal of price risk. Should prices of oil and natural gas decline substantially, coal prices will most likely decrease. At this point, however, we are optimistic about the prospects of a growing market for coal-generated energy.

We are less enthusiastic about our position in propane MLPs. While they may offer attractive current yields, propane is a much lower growth business than both coal and midstream energy infrastructure assets.

Will you please tell us about the Fund’s potential use of an options overlay?

The Fund has engaged in no derivatives transaction to this point. In the future, however, defensive options strategies, such as covered call writing, may be utilized as an effective source of income generation or capital protection.

How does the Fund use leverage?

FMO, like many closed-end funds, utilizes leverage as part of its investment strategy. The purpose of leverage is to fund the purchase of additional securities that provide increased income and potentially greater appreciation potential to shareholders than could be achieved from an unleveraged portfolio. The Fund is targeting the ongoing use of leverage at about 30% (as a percent of total assets). We began employing leverage soon after our original principal was fully invested. Of course, leverage results in greater NAV volatility and entails more downside risk than an unleveraged portfolio. The use of leverage also makes the Fund more vulnerable to rising interest rates. During the period, rising short-term interest rates increased the Fund’s cost of leverage. While our cost of leverage increased, it still added overall value. We will continue to employ a leveraged strategy as long as we believe that it benefits shareholders.

FMO Risks and Other Considerations

There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

There are certain tax risks associated with an investment in MLP units. Much of the benefit the Fund derives from its investment in equity securities of MLPs is a result of MLPs generally being treated as partnerships for U.S. federal income tax purposes. A change in current tax law, or a change in the business of a given MLP, could result in an MLP being treated as a corporation for U.S. federal income tax purposes, which would result in such MLP being required to pay U.S. federal income tax on its taxable income.

The classification of an MLP as a corporation for U.S. federal income taxation purposes would have the effect of reducing the amount of cash available for distribution by the MLP and causing any such distributions received by the Fund to be taxed as dividend income. Thus, if any of the MLPs owned by the Fund were treated as corporations for U.S. federal income tax purposes, the after-tax return to

| | |

| | | SemiAnnual Report | May 31, 2005 | 7 |

FMO | Fiduciary/Claymore MLP Opportunity Fund | Question & Answers continued

the Fund with respect to its investment in such MLPs would be materially reduced, which could cause a substantial decline in the value of the common shares.

The Fund expects that a substantial portion of the cash flow it receives will be derived from its investments in equity securities of MLP entities. The amount and tax characterization of cash available for distribution by an MLP entity depends upon the amount of cash generated by such entity’s operations. Cash available for distribution by MLP entities will vary widely from quarter to quarter and is affected by various factors affecting the entity’s operations. In addition to the risks described herein, operating costs, capital expenditures, acquisition costs, construction costs, exploration costs and borrowing costs may reduce the amount of cash that an MLP entity has available for distribution in a given period.

Historically, MLPs have been able to offset a significant portion of their income with tax deductions. The portion, if any, of a distribution received by the Fund from an MLP that is offset by the MLP’s tax deductions is essentially treated as tax-deferred return of capital. However, any such deferred tax will be reflected in the Fund’s adjusted basis in the equity securities of the MLP, which will result in an increase in the amount of gain (or decrease in the amount of loss) that will be recognized by the Fund on the sale of any such equity securities. In addition, the Fund will incur a current income tax liability on the portion of a distribution from the MLP that is not offset by the MLP’s tax deductions. The percentage of an MLP’s distributions that is offset by the MLP’s tax deductions will fluctuate over time.

The Fund intends to pay substantially all of its net investment income to Common Shareholders through quarterly distributions. Net investment income of the Fund will consist of cash and paid-in-kind distributions from MLP entities, dividends from common stocks, interest from debt securities, gains from option writing and income from other investments of the Fund; less operating expenses, taxes on the Fund’s taxable income and realized gains and the costs of any Financial Leverage utilized by the Fund. The Fund anticipates that, due to the tax characterization of cash distributions made by MLPs, a significant portion of the Fund’s distributions to Common Shareholders will consist of tax-deferred return of capital.

As a result of the length of time the Adviser and Sub-Adviser believe it will take to fully invest the proceeds of the offering, the Fund expects that in its first year of operations, the return and yield on the common shares may be lower than when the Fund is fully invested in accordance with its investment objective and policies. The Fund anticipates that a significant portion of its first distribution to holders of common shares will be made from sources other than cash distributions from MLP entities and may consist of return of capital.

The Fund’s potential issuance of preferred shares and use of other forms of leverage creates special risks that may adversely affect the return for the holders of common shares, including: greater volatility of the net asset value and market price of the Fund’s common shares; fluctuations in the dividend rates on any preferred shares or interest rates on other forms of leverage; and the possibility that the increased costs associated with leverage, which would be borne entirely by holders of the Fund’s common shares, may reduce the Fund’s total return. Leverage is a speculative investment technique, and there can be no assurance that the Fund’s potential leverage strategy will be successful. Because the fees received by Claymore Advisors, LLC (the “Investment Adviser”) and Fiduciary Asset Management, LLC (the “Sub-Adviser”) are based on the managed assets of the Fund (including the proceeds of any leverage), the aforementioned firms have a financial incentive for the Fund to utilize leverage, which may create a conflict of interest between them and the common shareholders.

Investors should consider the investment objectives and policies, risk considerations, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information relevant to an investment in the Fund. Please read the prospectus carefully before you invest or send money. For a free prospectus, or to learn more about investment solutions offered by Claymore, please access the link on the literature section of this sight, or contact your securities representative or Claymore Securities, Inc., 2455 Corporate West Drive, Lisle, IL 60532, 800-345-7999.

The Fund’s prospectus offers a more thorough discussion of the risks and considerations associated with an investment in the Fund. Such risks and considerations include, but are not limited to: No Operating History; Not a Complete Investment Program; Market Discount Risk; Equity Risk; Income Risk; Interest Rate Risk; Foreign Securities; Non-diversified Status; Royalty Trusts; Affiliated Party Risk; Small-Cap Risk; Valuation Risk; Turnover Risk; Concentration Risk; Lower-Rated Securities; Financial Leverage; Management Risk; Anti-Takeover Provisions; Illiquid Securities; Derivative Risks and Geopolitical Risks. There can be no assurance that a percentage of dividends paid on common shares, if any, will consist of qualifying dividend income. Please read the prospectus carefully before you invest or send money.

NOT FDIC-INSURED • NOT BANK-GUARANTEED • MAY LOSE VALUE

| | |

8 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Fund Summary | As of May 31, 2005 (unaudited)

| | | | |

Fund Statistics

| | | |

Share Price | | $ | 19.30 | |

Common Share Net Asset Value | | $ | 19.74 | |

Premium/Discount to NAV | | | -2.23 | % |

Net Assets ($000) | | $ | 356,653 | |

| | | | | | |

Total Returns

| | | | | | |

(Inception 12/22/04)

| | Market

| | | NAV

| |

Since Inception (non-annualized) | | -1.96 | % | | 5.00 | % |

| | | |

Top Sectors

| | % of Long-Term

Investments

| |

Midstream Energy Infrastructure | | 80.1 | % |

Coal | | 11.1 | % |

Propane | | 7.0 | % |

Shipping | | 1.8 | % |

| | | |

Top Ten Issuers

| | % of Long-Term

Investments

| |

Magellan Midstream Partners, L.P. | | 13.2 | % |

Energy Transfer Partners, L.P. | | 11.2 | % |

Kinder Morgan Energy Partners, L.P. | | 10.9 | % |

Enbridge Energy Partners, L.P. | | 9.2 | % |

Enterprise Products Partners, L.P. | | 7.3 | % |

Alliance Resource Partners, L.P. | | 5.6 | % |

Plains All American Pipeline, L.P. | | 4.1 | % |

Inergy, L.P. | | 3.8 | % |

TEPPCO Partners, L.P. | | 3.5 | % |

Northern Border Partners, L.P. | | 3.2 | % |

Share Price & NAV Performance

Distributions to Shareholders

| | |

| | | SemiAnnual Report | May 31, 2005 | 9 |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Portfolio of Investments | May 31, 2005 (unaudited)

| | | | | | |

Number of

Shares

| | | | Value

| |

| | | Master Limited Partnerships – 128.6% | | | | |

| | | Coal – 14.2% | | | | |

| 357,800 | | Alliance Resource Partners, L.P. | | $ | 25,478,938 | |

| 214,700 | | Natural Resource Partners, L.P. | | | 12,489,099 | |

| 274,000 | | Penn Virginia Resource Partners, L.P. | | | 12,809,500 | |

| | | | |

|

|

|

| | | | | | 50,777,537 | |

| | | | |

|

|

|

| | | Midstream Energy Infrastructure – 103.0% | | | | |

| 129,300 | | Atlas Pipeline Partners, L.P. | | | 5,390,517 | |

| 292,400 | | Buckeye Partners, L.P. | | | 13,011,800 | |

| 213,400 | | Copano Energy, L.L.C. | | | 6,369,990 | |

| 256,100 | | Crosstex Energy, L.P. | | | 9,398,870 | |

| 816,300 | | Enbridge Energy Partners, L.P. | | | 42,112,917 | |

| 1,620,580 | | Energy Transfer Partners, L.P. | | | 51,194,122 | |

| 1,299,600 | | Enterprise Products Partners, L.P. | | | 33,399,720 | |

| 139,100 | | Hiland Partners, L.P. | | | 4,868,500 | |

| 104,450 | | Holly Energy Partners, L.P. | | | 4,251,115 | |

| 194,600 | | Kaneb Pipe Line Partners, L.P. | | | 11,934,818 | |

| 665,900 | | Kinder Morgan Energy Partners, L.P. | | | 31,803,384 | |

| 409,027 | | Kinder Morgan Management, L.L.C. (a) | | | 18,230,334 | |

| 1,604,260 | | Magellan Midstream Partners, L.P. | | | 50,405,849 | |

| 347,826 | | Magellan Midstream Partners, L.P. (b)(c) | | | 10,292,171 | |

| 146,550 | | Markwest Energy Partners, L.P. | | | 7,063,710 | |

| 312,800 | | Northern Border Partners, L.P. | | | 14,889,280 | |

| 145,900 | | Pacific Energy Partners, L.P. | | | 4,537,490 | |

| 441,200 | | Plains All American Pipeline, L.P. | | | 18,631,876 | |

| 133,100 | | Sunoco Logistics Partners, L.P. | | | 4,944,665 | |

| 385,000 | | TEPPCO Partners, L.P. | | | 15,919,750 | |

| 77,025 | | TransMontaigne Partners, L.P. (a) | | | 1,890,964 | |

| 114,000 | | Valero, L.P. | | | 6,892,440 | |

| | | | |

|

|

|

| | | | | | 367,434,282 | |

| | | | |

|

|

|

| | | Propane – 9.0% | | | | |

| 158,200 | | AmeriGas Partners, L.P. | | $ | 4,978,554 | |

| 190,900 | | Ferrellgas Partners, L.P. | | | 4,201,709 | |

| 551,300 | | Inergy, L.P. | | | 17,266,716 | |

| 166,500 | | Suburban Propane Partners, L.P. | | | 5,609,385 | |

| | | | |

|

|

|

| | | | | | 32,056,364 | |

| | | | |

|

|

|

| | | Shipping – 2.4% | | | | |

| 62,000 | | K-Sea Transportation Partners, L.P. | | | 2,064,600 | |

| 38,800 | | Martin Midstream Partners, L.P. | | | 1,218,320 | |

| 36,000 | | Teekay LNG Partners, L.P. (Marshall Islands) (a) | | | 949,320 | |

| 165,700 | | U.S. Shipping Partners, L.P. | | | 4,241,920 | |

| | | | |

|

|

|

| | | | | | 8,474,160 | |

| | | | |

|

|

|

| | | Total Investments – 128.6% | | | | |

| | | (Cost $427,829,934) | | | 458,742,343 | |

| | | Borrowings Outstanding (24.6%) | | | (87,675,000 | ) |

| | | Liabilities in Excess of Other Assets – (4.0%) | | | (14,414,155 | ) |

| | | | |

|

|

|

| | | Net Assets – 100.0% | | $ | 356,653,188 | |

| | | | |

|

|

|

| (a) | Non-income producing security. |

| (b) | Security is restricted and may be resold only in transactions exempt from registration, normally to qualified institutional buyers. At May 31, 2005, this security’s market value amounted to $10,292,171 or 2.9% of net assets with a cost of $9,999,998 and acquisition date of 4/13/05. |

| (c) | Security is valued in accordance with the Fair Valuation procedures established in good faith by the Board of Trustees. The total market value of such security is $10,292,171 which represents 2.9% of net assets. |

See notes to financial statements.

| | |

10 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Statement of Assets and Liabilities | May 31, 2005 (unaudited)

| | | | |

Assets | | | | |

Investments, at value (cost $427,829,934) | | $ | 458,742,343 | |

Cash | | | 1,914,833 | |

Other assets | | | 36,246 | |

| | |

|

|

|

Total assets | | | 460,693,422 | |

| | |

|

|

|

Liabilities | | | | |

Borrowings | | | 87,675,000 | |

Contingent deferred tax liability | | | 12,141,452 | |

Payable for investments purchased | | | 3,017,845 | |

Interest due on borrowings | | | 382,414 | |

Offering costs payable | | | 377,653 | |

Advisory fee payable | | | 375,339 | |

Accrued expenses and other liabilities | | | 70,531 | |

| | |

|

|

|

Total liabilities | | | 104,040,234 | |

| | |

|

|

|

Net Assets | | $ | 356,653,188 | |

| | |

|

|

|

Composition of Net Assets | | | | |

Common stock, $.01 par value per share; unlimited number of shares authorized, 18,067,021 shares issued and outstanding | | $ | 180,670 | |

Additional paid-in capital | | | 338,576,698 | |

Net unrealized appreciation on investments, net of deferred tax liability | | | 18,770,957 | |

Net realized loss on investments | | | (428,277 | ) |

Accumulated net investment loss | | | (446,860 | ) |

| | |

|

|

|

Net Assets | | $ | 356,653,188 | |

| | |

|

|

|

Net Asset Value (based on 18,067,021 common shares outstanding) | | $ | 19.74 | |

| | |

|

|

|

See notes to financial statements.

| | |

| | | SemiAnnual Report | May 31, 2005 | 11 |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Statement of Operations | For the Period December 28, 2004* through May 31, 2005 (unaudited)

| | | | | | | |

Investment Income | | | | | | | |

Dividends, net of return of capital distributions received of $9,211,348 | | $ | 1,717,796 | | | | |

Interest | | | 260,139 | | | | |

| | | | | |

|

|

|

Total income | | | | | $ | 1,977,935 | |

| | | | | |

|

|

|

Expenses | | | | | | | |

Advisory fee | | | 1,599,771 | | | | |

Professional fees | | | 53,965 | | | | |

Trustees’ fees and expenses | | | 52,154 | | | | |

Administration fee | | | 44,735 | | | | |

Fund accounting | | | 37,306 | | | | |

Custodian fee | | | 24,071 | | | | |

Transfer agent fee | | | 22,121 | | | | |

Printing expense | | | 20,683 | | | | |

Insurance | | | 16,313 | | | | |

NYSE listing fee | | | 11,104 | | | | |

Miscellaneous | | | 5,575 | | | | |

Interest expense on borrowings | | | 536,997 | | | | |

| | | | | |

|

|

|

Total expenses | | | | | | 2,424,795 | |

| | | | | |

|

|

|

Net investment loss before taxes | | | | | | (446,860 | ) |

| | | | | |

|

|

|

Realized and Unrealized Gain (Loss) on Investments | | | | | | | |

Net realized loss on investments | | | | | | (428,277 | ) |

Net unrealized appreciation on investments | | | | | | 30,912,409 | |

| | | | | |

|

|

|

Net realized and unrealized gain on investments | | | | | | 30,484,132 | |

| | | | | |

|

|

|

Net Increase in Net Assets Resulting from Operations Before Taxes | | | | | | 30,037,272 | |

Contingent deferred tax expense | | | | | | 12,141,452 | |

| | | | | |

|

|

|

Net Increase in Net Assets Resulting from Operations | | | | | $ | 17,895,820 | |

| | | | | |

|

|

|

| * | Commencement of investment operations. |

See notes to financial statements.

| | |

12 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Statement of Changes in Net Assets |

| | | | |

| | | For the Period

December 28, 2004*

through May 31, 2005

(unaudited)

| |

Increase in Net Assets from Operations | | | | |

Net investment loss | | $ | (446,860 | ) |

Net realized loss on investments | | | (428,277 | ) |

Net unrealized appreciation on investments | | | 30,912,409 | |

Contingent deferred tax expense | | | (12,141,452 | ) |

| | |

|

|

|

Net increase in net assets resulting from operations | | | 17,895,820 | |

| | |

|

|

|

| |

Distributions to Common Shareholders from | | | | |

Return of capital | | | (5,629,763 | ) |

| | |

|

|

|

| |

Capital Share Transactions | | | | |

Net proceeds from the issuance of Common Shares | | | 343,991,000 | |

Reinvestment of dividends | | | 1,016,447 | |

Common share offering costs charged to paid-in capital | | | (720,400 | ) |

| | |

|

|

|

Net increase from capital share transactions | | | 344,287,047 | |

| | |

|

|

|

Total increase in net assets | | | 356,553,104 | |

| |

Net Assets | | | | |

Beginning of period | | | 100,084 | |

| | |

|

|

|

End of period (including accumulated net investment loss of $ 446,860) | | $ | 356,653,188 | |

| | |

|

|

|

| * | Commencement of investment operations. |

See notes to financial statements.

| | |

| | | SemiAnnual Report | May 31, 2005 | 13 |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Statement of Cash Flows |

For the Period December 28, 2004* through May 31, 2005 (unaudited)

| | | | |

Cash Flows from Operating Activities: | | | | |

Net increase in net assets resulting from operations | | $ | 17,895,820 | |

| | |

|

|

|

Adjustments to Reconcile Net Increase in Net Assets | | | | |

Resulting from Operations to Net Cash Used in Operating and Investing Activities: | | | | |

Net unrealized appreciation on investments | | | (30,912,409 | ) |

Net accretion of bond discount and amortization of bond premium | | | (247,778 | ) |

Net realized loss on investments | | | 428,277 | |

Purchases of long-term investments | | | (481,700,109 | ) |

Return of capital distributions received | | | 9,211,348 | |

Proceeds from sale of long-term investments | | | 44,230,550 | |

Net sale of short-term investments | | | 247,778 | |

Increase in other assets | | | (36,246 | ) |

Increase in contingent deferred tax expense | | | 12,141,452 | |

Increase in payable for investments purchased | | | 3,017,845 | |

Increase in interest due on borrowings | | | 382,414 | |

Increase in offering costs payable | | | 377,653 | |

Increase in advisory fee payable | | | 375,339 | |

Increase in accrued expenses and other liabilities | | | 70,531 | |

| | |

|

|

|

Net Cash Used in Operating and Investing Activities | | | (424,517,535 | ) |

| | |

|

|

|

Cash Flows From Financing Activities: | | | | |

Net proceeds from the issuance of Common Shares | | | 343,991,000 | |

Reinvestment of dividends | | | 1,016,447 | |

Return of capital distributions | | | (5,629,763 | ) |

Increase in borrowings | | | 87,675,000 | |

Offering expenses in connection with the issuance of Common Shares | | | (720,400 | ) |

| | |

|

|

|

Net Cash Provided by Financing Activities | | | 426,332,284 | |

| | |

|

|

|

Net increase in cash | | | 1,814,749 | |

Cash at Beginning of Period | | | 100,084 | |

| | |

|

|

|

Cash at End of Period | | $ | 1,914,833 | |

| | |

|

|

|

Supplemental Disclosure of Cash Flow Information: Cash paid during the period for interest | | $ | 154,583 | |

| | |

|

|

|

Non-Cash Financing Activities: Reinvestment of distributions to shareholders | | $ | 1,016,447 | |

| | |

|

|

|

| * | Commencement of investment operations. |

See notes to financial statements.

| | |

14 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Financial Highlights |

| | | | |

Per share operating performance for a share outstanding throughout the period

| | For the Period

December 28, 2004*

through May 31, 2005 (unaudited)

| |

Net asset value, beginning of period | | $ | 19.10 | (b) |

| | |

|

|

|

Income from investment operations | | | | |

Net investment loss (a) | | | (0.03 | ) |

Net realized and unrealized gain on investments | | | 1.02 | |

| | |

|

|

|

Total from investment operations | | | 0.99 | |

| | |

|

|

|

Common shares’ offering expenses charged to paid-in capital | | | (0.04 | ) |

| | |

|

|

|

Distributions to Common Shareholders | | | | |

Return of capital | | | (0.31 | ) |

| | |

|

|

|

Net asset value, end of period | | $ | 19.74 | |

| | |

|

|

|

Market value, end of period | | $ | 19.30 | |

| | |

|

|

|

Total investment return (c) | | | | |

Net asset value | | | 5.00 | % |

Market value | | | -1.96 | % |

Ratios and supplemental data | | | | |

Net assets, end of period (thousands) | | $ | 356,653 | |

Ratios to Average Net Assets applicable to Common Shares: (d) | | | | |

Total expenses, excluding interest expense and contingent deferred tax expense | | | 1.28 | % |

Total expenses, including interest expense and contingent deferred tax expense | | | 9.89 | % |

Interest expense | | | 0.36 | % |

Contingent deferred tax expense | | | 8.25 | % |

Net investment income/(loss), including interest expense and contingent deferred tax expense | | | (8.55 | )% |

Net investment income, excluding interest expense and contingent deferred tax expense | | | 0.06 | % |

Ratios to Average Managed Assets: (d)(e) | | | | |

Total expenses, excluding interest expense and contingent deferred tax expense | | | 1.18 | % |

Total expenses, including interest expense and contingent deferred tax expense | | | 9.11 | % |

Interest expense | | | 0.34 | % |

Contingent deferred tax expense | | | 7.59 | % |

Net investment income/(loss), including interest expense and contingent deferred tax expense | | | (7.87 | )% |

Net investment income, excluding interest expense and contingent deferred tax expense | | | 0.06 | % |

Portfolio Turnover Rate | | | 11 | % |

Senior Indebtedness | | | | |

Total borrowings outstanding (in thousands) | | $ | 87,675 | |

Asset coverage per $1,000 of indebtedness (f) | | $ | 5,068 | |

| * | Commencement of investment operations. |

| (a) | Based on average shares outstanding during the period. |

| (b) | Before deduction of offering expenses charged to capital. |

| (c) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (e) | Managed assets is equal to net assets plus outstanding leverage. |

| (f) | Calculated by subtracting the Fund’s total liabilities (not including the borrowings) from the Fund’s total assets and dividing by the total borrowings. |

See notes to financial statements.

| | |

| | | SemiAnnual Report | May 31, 2005 | 15 |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Notes to Financial Statements | May 31, 2005 (unaudited)

Note 1 – Organization:

Fiduciary/Claymore MLP Opportunity Fund (the “Fund”) was organized as a Delaware statutory trust on October 4, 2004. The Fund is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended.

The Fund’s investment objective is to provide a high level of after-tax total return with an emphasis on current distributions paid to shareholders. The Fund has been structured to seek to provide an efficient vehicle through which its shareholders may invest in a portfolio of publicly traded securities of master limited partnerships (“MLPs”). MLPs combine the tax benefits of limited partnerships with the liquidity of publicly traded securities. The Fund believes that as a result of the tax characterization of cash distributions made by MLPs to their investors (such as the Fund) a significant portion of the Fund’s income will be tax-deferred returns of capital, which will allow distributions by the Fund to its shareholders to include high levels of tax-deferred income. There can be no assurance that the Fund will achieve its investment objective.

Note 2 – Accounting Policies:

The preparation of the financial statements in accordance with U.S. generally accepted accounting principals requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

The following is a summary of significant accounting policies followed by the Fund.

(a) Valuation of Investments

Readily marketable securities listed on an exchange are valued at the last reported sale price on the primary exchange or in the principal over the counter (“OTC”) market on which they are traded. Readily marketable securities traded on an exchange or OTC for which there are no transactions on a given day are valued at the mean of the closing bid and asked prices. Securities traded on NASDAQ are valued at the NASDAQ Official Closing Price. Debt securities are valued by independent pricing services or dealers using the last available bid price for such securities or, if such prices are not available, at prices for securities of comparable maturity, quality and type. For those securities where quotations or prices are not available, valuations are determined in accordance with procedures established in good faith by the Board of Trustees. Short-term securities having a remaining maturity of sixty days or less are valued at amortized cost, which approximates market value.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts or premiums on debt securities purchased are accreted or amortized to interest income over the lives of the respective securities using the effective interest method.

The Fund records dividend income and return of capital based on estimates made at the time such distributions are received. These estimates are based upon a historical review of information available from each MLP and other industry sources. The Fund’s characterization of the estimates may subsequently be revised based on information received from MLPs after their tax reporting periods conclude.

(c) Distributions to Shareholders

The Fund intends to make quarterly distributions to shareholders. Distributions to shareholders are recorded on the ex-dividend date. The character of distributions to shareholders made during the year may differ from their ultimate characterization for federal income tax purposes. The Fund anticipates that a significant portion of its distributions will be comprised of return of capital as a result of the tax character of cash distributions made by MLPs. For tax purposes the Fund estimates the current distribution to shareholders is comprised of 100% return of capital for the current fiscal year. The Fund is unable to make final determinations as to the tax character of the distributions to shareholders until after the end of the calendar year. The Fund will inform shareholders of the final tax character of the distributions following the end of the calendar year.

Note 3 – Investment Advisory Agreement, Sub-Advisory Agreement and Other Agreements:

Pursuant to an Investment Advisory Agreement (the “Advisory Agreement”) between the Fund and Claymore Advisors, LLC (the “Adviser”), the Adviser will furnish offices, necessary facilities and equipment, provide administrative services, oversee the activities of Fiduciary Asset Management, LLC (the “Sub-Adviser”), provide personnel including certain officers required for its administrative management and pay the compensation of all officers and Trustees of the Fund who are its affiliates. As compensation for these services, the Fund will pay the Adviser an annual fee, payable monthly in an amount equal to 1.00% of the Fund’s average daily Managed Assets.

Pursuant to a Sub-Advisory Agreement (the “Sub-Advisory Agreement”) between the Fund, the Adviser and the Sub-Adviser, the Sub-Adviser under the supervision of the Fund’s Board of Trustees and the Adviser, provides a continuous investment program for the Fund’s portfolio; provides investment research and makes and executes recommendations for the purchase and sale of securities; and provides certain facilities and personnel, including certain officers required for its administrative management and pays the compensation of all officers and Trustees of the Fund who are its affiliates. As compensation for its services, the Adviser, out of its own resources, pays the Sub-Adviser a fee, payable monthly, in an annual amount equal to 0.50% of the Fund’s average daily Managed Assets.

The Bank of New York (“BNY”) acts as the Fund’s custodian, accounting agent, administrator and transfer agent. As custodian, BNY is responsible for the custody of the Fund’s assets. As accounting agent and administrator, BNY is responsible for maintaining the books and records of the Fund’s securities and cash. As transfer agent, BNY is responsible for performing transfer agency services for the Fund.

Note 4 – Federal Income Taxes:

The Fund will be treated as a regular corporation, or “C” corporation, for U.S. federal income tax purposes. Accordingly, the Fund generally will be subject to U.S. federal income tax on its taxable income at the graduated rates applicable to corporations (currently at a maximum rate of 35%). In addition, as a regular corporation, the Fund will be subject to state income tax by reason of its investments in MLPs. The Fund may be subject to a 20% alternative minimum tax on its alternative minimum taxable income to the extent that the alternative minimum tax exceeds the Fund’s regular income tax liability. The extent to which the Fund is required to pay U.S. corporate income tax or alternative minimum tax could materially reduce the Fund’s cash available to make distributions on the Common Shares.

| | |

16 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund | Notes to Financial Statements (unaudited) continued

Information on the components of investments as of May 31, 2005 is as follows:

| | | | | | | | | | | |

Cost of

investments

| | Gross

unrealized

appreciation

| | Gross

unrealized

depreciation

| | | Net unrealized

appreciation

on investments

|

| $ | 427,829,934 | | $ | 32,553,964 | | $ | (1,641,555 | ) | | $ | 30,912,409 |

Contingent deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting purposes and the amounts used for tax purposes. The Fund will accrue contingent deferred income taxes for its future tax liability associated with that portion of MLP distributions considered to be a tax-deferred return of capital as well as capital appreciation of its investments. For purposes of estimating contingent deferred tax liability for financial statement reporting and determining its net asset value, the Fund will be required to rely, to some extent, on information provided by the MLPs in which it invests. Such information may not be received in a timely manner. Accordingly, the Fund will, from time to time, modify its estimates or assumptions regarding its contingent deferred tax liability as new information becomes available. Upon the sale of an equity security in an MLP, the Fund generally will be liable for any previously contingent deferred taxes. The Fund’s income tax provision consists of the following:

| | | |

Current federal and state income taxes | | $ | 0 |

Contingent deferred federal income taxes | | | 11,511,620 |

Contingent deferred state income taxes | | | 629,832 |

| | |

|

|

Total contingent deferred tax expense | | $ | 12,141,452 |

| | |

|

|

Components of the Fund’s contingent deferred tax liability as of May 31, 2005 are as follows:

| | | |

Unrealized gain on investments | | $ | 8,630,086 |

Return of capital distributions received from investments | | | 3,511,366 |

| | |

|

|

Total contingent deferred tax liability | | $ | 12,141,452 |

| | |

|

|

Note 5 – Investments in Securities:

For the period ended May 31, 2005, purchases and sales of investments, excluding short-term securities, were $481,700,109 and $44,230,550, respectively.

Note 6 – Borrowings:

The Fund entered into an agreement with BNY to provide a line of credit to the Fund. Interest on the amount borrowed is based on the Federal Funds Rate plus a spread. At May 31, 2005, there was an outstanding borrowing of $87,675,000 in connection with the Trust’s line of credit. The average daily amount of borrowings during the period ended May 31, 2005 was $29,957,306 with a related weighted average interest rate of 4.15%. The maximum amount outstanding during the period ended May 31, 2005, was $91,260,000.

Note 7 – Capital:

Common Shares

In connection with its organization process, the Fund sold 5,240 shares of beneficial interest to Claymore Securities, Inc., an affiliate of the Adviser, for consideration of $100,084, at a price of $19.10 per share. The Fund has an unlimited amount of common shares, $0.01 par value, authorized and 18,067,021 issued and outstanding. Of this amount, the Fund issued 16,500,000 shares of common stock in its initial public offering and issued, pursuant to an over allotment option to the underwriters, an additional 1,000,000 shares on January 21, 2005 and 510,000 shares on February 7, 2005. All of these shares were issued at $19.10 per share after deducting the sales load.

In connection with the Fund’s dividend reinvestment plan, the Fund issued 51,781 shares during the period.

Offering costs, estimated at $720,400 or $0.04 per share, in connection with the issuance of common shares have been borne by the Fund and were charged to paid-in capital. The Adviser has agreed to pay offering expenses (other than sales load, but including reimbursement of expenses to the underwriters) in excess of $0.04 per common share. In addition, the Fund’s Adviser has agreed to pay all of the Fund’s organizational costs.

Note 8 – Concentration Risk:

Because the Fund is focused in MLP entities in the energy, natural resources and real estate sectors of the economy, such concentration may present more risks than if the Fund were broadly diversified over numerous industries and sectors of the economy. A downturn in the energy, natural resources or real estate sectors of the economy could have a larger impact on the Fund than on an investment company that does not concentrate in such sectors. At times, the performance of securities of companies in the energy, natural resources and real estate sectors of the economy may lag the performance of other sectors or the broader market as a whole.

An investment in MLP units involves risks that differ from a similar investment in equity securities, such as common stock, of a corporation. Holders of MLP units have the rights typically afforded to limited partners in a limited partnership. As compared to common shareholders of a corporation, holders of MLP units have more limited control and limited rights to vote on matters affecting the partnership. There are certain tax risks associated with an investment in MLP units. Additionally, conflicts of interest may exist between common unit holders, subordinated unit holders and the general partner of an MLP; for example a conflict may arise as a result of incentive distribution payments.

Note 9 – Restricted Securities:

The Fund may invest up to 40% of its Managed Assets (net assets plus any assets attributable to financial leverage) in unregistered or otherwise restricted securities. Restricted securities are securities that are unregistered, held by control persons of the issuer or are subject to contractual restrictions on resale. The Fund will typically acquire restricted securities in directly negotiated transactions. Restricted securities are fair valued in accordance with procedures established by the Fund’s Board of Trustees. As of May 31, 2005, the Fund held the following restricted security:

| | | | | | | | | | | | | |

Security

| | Date of

Acquisition

| | Shares

| | Cost

| | Current Value

| | Fair Value

Price

|

Magellan Midstream Partners L.P. | | 4/13/05 | | 347,826 | | $ | 9,999,998 | | $ | 10,292,171 | | $ | 29.59 |

Note 10 – Indemnifications:

In the normal course of business, the Fund enters into contracts that contain a variety of representations, which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

Note 11 – Subsequent Event:

On July 1, 2005, the Board of Trustees declared a quarterly dividend of $0.3125 per common share. This dividend will be payable July 29, 2005 to shareholders of record on July 15, 2005.

Effective July 15, 2005, the Fund entered into a commercial paper conduit funding agreement with a line of credit of $150,000,000. The proceeds from this program will be used to completely repay the outstanding bank borrowings.

| | |

| | | SemiAnnual Report | May 31, 2005 | 17 |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Supplemental Information | (unaudited)

Trustees

The Trustees of the Fiduciary/Claymore MLP Opportunity Fund and their principal occupations during the past five years:

| | | | | | | | |

Name, Address*, Age and

Position(s) held

with Registrant

| | Term of Office**

and Length of

Time Served

| | Principal Occupation During the Past Five Years and Other Affiliations

| | Number of

Portfolios In The

Fund Complex***

Overseen by Trustee

| | Other Directorships

Held by Trustee

|

Independent Trustees: | | | | | | |

| | | | |

Randall C. Barnes Age: 53 Trustee | | Since 2004 | | Formerly, Senior Vice President Treasurer (1993-1997), President, Pizza Hut International (1991-1993) and Senior Vice President, Strategic Planning and New Business Development (1987-1990) of PepsiCo, Inc. (1987-1997). | | 3 | | None. |

| | | | |

Howard H. Kaplan Age: 35 Trustee | | Since 2004 | | Principal of Blumenfeld, Kaplan & Sandweiss P.C., a law firm providing legal advice in business law and litigation. | | 2 | | None. |

| | | | |

Robert B. Karn III Age: 63 Trustee | | Since 2004 | | Consultant (1998-present). Previously, Managing Partner, Financial and Economic Consulting, St. Louis Office of Arthur Andersen, LLP. | | 2 | | Director of Peabody Energy Company, GP, Natural Resource Partners LLC and Kennedy Capital Management, Inc. |

| | | | |

Ronald A. Nyberg Age: 51 Trustee | | Since 2004 | | Principal of Ronald A. Nyberg, Ltd., a law firm specializing in corporate law, estate planning and business transactions (2000-present). Formerly, Executive Vice President, General Counsel and Corporate Secretary of Van Kampen Investments (1982-1999). | | 10 | | None. |

| | | | |

John M. Roeder Age: 62 Trustee | | Since 2005 | | Financial consultant (1999-present). Director in Residence at The Institute for Excellence in Corporate Governance of the University of Texas at Dallas School of Management. Formerly, Office Managing Partner, Arthur Andersen, LLP. | | 2 | | Director, LMI Aerospace. |

| | | | |

Ronald E. Toupin, Jr. Age: 46 Trustee | | Since 2004 | | Formerly, Vice President, Manager and Portfolio Manager of Nuveen Asset Management (1998-1999), Vice President of Nuveen Investment Advisory Corporation (1992-1999), Vice President and Manager of Nuveen Unit Investment Trusts (1991-1999), and Assistant Vice President and Portfolio Manager of Nuveen Unit Investment Trusts (1988-1999), each of John Nuveen & Company, Inc. (1982-1999). | | 9 | | None. |

| | | |

Interested Trustees: | | | | | | |

| | | | |

Nicholas Dalmaso† Age: 40 Trustee; Chief Legal and Executive Officer; Chief Compliance Officer | | Since 2004 | | Senior Managing Director and General Counsel of Claymore Advisors, LLC and Claymore Securities, Inc. (2001-present). Formerly, Assistant General Counsel, John Nuveen and Company, Inc. (1999-2000). Former Vice President and Associate General Counsel of Van Kampen Investments, Inc. (1992-1999). | | 10 | | None. |

| | | | |

Joseph E. Gallagher, Jr.†† 8112 Maryland Avenue Suite 400 St. Louis, MO 63105 Age: 48 Trustee | | Since 2004 | | Executive Managing Director and Chief Operating Officer of Fiduciary Asset Management, LLC (1994-present). Member of the St. Louis Chapter of the National Association for Business Economics. | | 2 | | Member of the Board of Directors for the Delta Gamma Center for Children with Visual Impairments and for the Rossman School. |

| * | Address for all Trustees unless otherwise noted: 2455 Corporate West Drive, Lisle, IL 60532 |

| ** | After a Trustee’s initial term, each Trustee is expected to serve a three-year term concurrent with the class of Trustees for which he serves: |

| | – | Messrs. Barnes and Dalmaso, as Class I trustees, are expected to stand for re-election at the Fund’s annual meeting of shareholders for the 2005 fiscal period. |

| | – | Messrs. Gallagher, Kaplan and Nyberg, as Class II trustees, are expected to stand for re-election at the Fund’s annual meeting of shareholders for the 2006 fiscal year. |

| | – | Messrs. Roeder, Toupin and Karn, as Class III trustees, are expected to stand for re-election at the Fund’s annual meeting of shareholders for the 2007 fiscal year. |

| *** | The Claymore Fund Complex consists of U.S. registered investment companies advised or serviced by Claymore Advisors, LLC or Claymore Securities, Inc. |

| † | Mr. Dalmaso is an “interested person” (as defined in section 2(a)(19) of the 1940 Act) of the Fund because of his position as an officer of Claymore Advisors, LLC, the Fund’s Investment Adviser. |

| †† | Mr. Gallagher is an “interested person” (as defined in section 2(a)(19) of the 1940 Act) of the Fund because of his position as an officer of Fiduciary Asset Management, LLC, the Fund’s Sub-Adviser. |

| | |

18 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund | Supplemental Information (unaudited) continued

Officers

The officers of the Fiduciary/Claymore MLP Opportunity Fund and their principal occupations during the past five years:

| | | | |

Name, Address*, Age and Position(s) held with Registrant

| | Term of Office**

and Length of

Time Served

| | Principal Occupation During the Past Five Years and Other Affiliations

|

| Officers | | | | |

| | |

Steven M. Hill Age: 40 Chief Accounting Officer, Chief Financial Officer and Treasurer | | Since 2004 | | Managing Director of Claymore Advisors, LLC and Claymore Securities, Inc. Previously, Treasurer of Henderson Global Funds and Operations Manager for Henderson Global Investors (North America) Inc., from 2002-2003; Managing Director, FrontPoint Partners LLC (2001-2002); Vice President, Nuveen Investments (1999-2001); Chief Financial Officer, Skyline Asset Management LP, (1999); Vice President, Van Kampen Investments and Assistant Treasurer, Van Kampen mutual funds (1989-1999). |

| | |

Heidemarie Gregoriev Age: 34 Secretary | | Since 2004 | | Vice President and Assistant General Counsel, Claymore Advisors, LLC and Claymore Securities, Inc. since 2004; Legal Counsel, Henderson Global Investors (North America) Inc. and Assistant Secretary (2001-2004) and Chief Legal Officer (2003-2004) of Henderson Global Funds; Attorney, Gardner, Carton & Douglas LLP, (1997-2001). |

| | |

Jim Howley Age: 33 Assistant Treasurer | | Since 2004 | | Vice President, Fund Administration of Claymore Securities, Inc. (2004-present). Previously, Manager, Mutual Fund Administration of Van Kampen Investments, Inc. |

| | |

Richard Sarhaddi Age: 32 Assistant Secretary | | Since 2004 | | Assistant Vice President of Claymore Advisors, LLC and Claymore Securities, Inc. Previously, Editor, CCH Incorporated. |

| * | Address for all Officers: 2455 Corporate West Drive, Lisle, IL 60532 |

| ** | Officers serve at the pleasure of the Board of Trustees and until his or her successor is appointed and qualified or until his or her earlier resignation or removal. |

| | |

| | | SemiAnnual Report | May 31, 2005 | 19 |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Investment Advisory and Sub-Advisory Agreement Contracts | (unaudited)

Section 15(c) of the Investment Company Act of 1940, as amended (the “1940 Act”) contemplates that the Board of Trustees (the “Board”) of the Fund, including a majority of the Trustees who have no direct or indirect interest in the investment advisory or investment sub-advisory agreements and are not “interested persons” of the Fund, as defined in the 1940 Act (the “Independent Trustees”), are required to approve the terms of the Fund’s investment advisory and sub-advisory agreements prior to the commencement of Fund operations. In this regard, the Board reviewed and approved the Advisory Agreement and the Sub-Advisory Agreement with the Adviser and the Sub-Adviser for the Fund.

At a meeting held on November 12, 2004, the Board, including the Independent Trustees advised by their independent legal counsel, considered the factors and reached the conclusions described below relating to the selection of the Adviser and the Sub-Adviser and approval of the Advisory Agreement and of the Sub-Advisory Agreement. Going forward, the Board will review the Advisory Agreement and the Sub-Advisory Agreement on an annual basis (after the initial two year term) and approval from the Board will be required for the agreements to remain in effect.

Approval of the Advisory Agreement

In approving the Advisory Agreement, the Fund’s Board of Trustees, including the Independent Trustees, considered in general the nature, quality and scope of services to be provided by the Adviser. The Board of Trustees, including the Independent Trustees, met with representatives of the Adviser and the Sub-Adviser, who described the Fund’s investment objective and policies and discussed the Fund’s target portfolio, as described in the Prospectus.

The Board of Trustees discussed with representatives of the Adviser the history and current operations of the Adviser, the background, experience and expertise of various key personnel of the Adviser, the responsibilities of the Adviser, including investment advisory oversight, compliance and filings and dividend management, and the experience and abilities of the Adviser with regard to each of its responsibilities.

The Board of Trustees reviewed the experience of the Adviser as investment adviser to other closed-end investment companies and its affiliated entity’s experience as a shareholder servicing agent to various closed-end investment companies. As part of its analysis of the Adviser, the Board of Trustees also considered the personnel of the Adviser who would be responsible for compliance, investment advisory oversight and the performance monitoring of the portfolio management team of the Sub-Adviser. Particularly in light of the services to be provided and the previous experience of these personnel in performing similar tasks, the Board of Trustees concluded that the Adviser’s personnel were qualified to serve the Fund in the functions proposed.

Prior to approving the proposed investment advisory fee, the Board of Trustees reviewed and discussed with the Adviser materials prepared and distributed in advance by the Adviser regarding the comparability of the proposed investment advisory fee with the fees of other closed-end investment companies with strategies similar to the Fund’s. In addition, the Board of Trustees received information regarding the other expenses, total expense ratios and inception dates for comparable funds. The Board of Trustees also considered the details of and possible rationales for the fee waivers in place for those comparable funds that are currently waiving a portion of their advisory fees. The Board of Trustees, after reviewing the totality of the information presented, including the services to be provided, the investment advisory oversight role of the Adviser, its compliance oversight and monitoring of the Fund’s portfolio, support of the Adviser’s parent entity, comparable fees and total expense ratios, concluded that the services to be provided and the proposed total investment advisory fee of 1.00% (of which 0.50% will be paid to the Sub-Adviser by the Adviser pursuant to the Sub-Advisory Agreement) is fair and reasonable for the Fund and that the Advisory Agreement is in the best interests of the Fund and its shareholders.

Approval of the Sub-Advisory Agreement

In approving the Sub-Advisory Agreement, the Fund’s Board of Trustees, including the Independent Trustees, considered in general the nature, quality and scope of services to be provided by the Sub-Adviser. James J. Cunnane, Jr., the Fund’s portfolio manager, discussed with the Board of Trustees his background and experience and the background and experience of the Sub-Adviser generally, focusing on both general investment experience and experience with the specific investment strategies to be utilized by the Fund. Mr. Cunnane also discussed the history and current operations of the Sub-Adviser. The Board considered the history and current operations of the Sub-Adviser and the fact that the Sub-Adviser advises two other closed-end funds, including one fund with investment objectives and policies similar to those of the Fund. Particularly in light of the services to be provided and previous experience of these personnel in performing similar tasks, the Board of Trustees concluded that the Sub-Adviser’s personnel and portfolio management team were qualified to serve the Fund in the proposed function.

In evaluating the fees to be paid by the Fund to the Sub-Adviser, the Board of Trustees received the Form ADV of the Sub-Adviser. The Board of Trustees also considered information regarding investment advisory fees paid by and total expense ratios of other closed-end investment companies with strategies similar to those of the Fund, as discussed above. The Board of Trustees, after reviewing the totality of the information presented including the services to be provided, comparable fees and total expense ratios, concluded that the services to be provided and the proposed sub-advisory fee of 0.50% to be paid to the Sub-Adviser by the Adviser pursuant to the Sub-Advisory Agreement is fair and reasonable for the Fund and that the Sub-Advisory Agreement is in the best interests of the Fund and its shareholders.

Considerations and Conclusions of the Independent Trustees

The Independent Trustees met separately with their independent counsel to discuss their fiduciary responsibilities in general and also with respect to the approval of investment advisory agreements. In their discussion and review of the Advisory and Sub-Advisory Agreements, the Independent Trustees discussed the proposed total investment advisory fee, the allocation of that fee between the Adviser and the Sub-Adviser, the services to be provided by the Adviser and the Sub-Adviser and the personnel and experience of the Adviser and the Sub-Adviser. The Board of Trustees, including the Independent Trustees, after reviewing the totality of the information presented, including the nature, quality and extent of services to be provided, the management fees and total expense ratios compared to other investment companies with similar investment strategies, economies of scale, the investment performance of the Sub-Adviser in managing MLPs, the reasonableness of the advisory and sub-advisory fee, that the Adviser is responsible for supervising the Sub-Adviser and Claymore’s expected efforts on behalf of the Fund and concluded that the services to be provided and the fees to be paid were fair and reasonable.

| | |

20 | SemiAnnual Report | May 31, 2005 | | |

FMO | Fiduciary/Claymore MLP Opportunity Fund

Dividend Reinvestment Plan | (unaudited)

Unless the registered owner of common shares elects to receive cash by contacting the Plan Administrator, all dividends declared on common shares of the Fund will be automatically reinvested by the Bank of New York (the “Plan Administrator”), Administrator for shareholders in the Fund’s Dividend Reinvestment Plan (the “Plan”), in additional common shares of the Fund. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notice if received and processed by the Plan Administrator prior to the dividend record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. Some brokers may automatically elect to receive cash on your behalf and may re-invest that cash in additional common shares of the Fund for you. If you wish for all dividends declared on your common shares of the Fund to be automatically reinvested pursuant to the Plan, please contact your broker.

The Plan Administrator will open an account for each common shareholder under the Plan in the same name in which such common shareholder’s common shares are registered. Whenever the Fund declares a dividend or other distribution (together, a “Dividend”) payable in cash, non-participants in the Plan will receive cash and participants in the Plan will receive the equivalent in common shares. The common shares will be acquired by the Plan Administrator for the participants’ accounts, depending upon the circumstances described below, either (i) through receipt of additional unissued but authorized common shares from the Fund (“Newly Issued Common Shares”) or (ii) by purchase of outstanding common shares on the open market (“Open-Market Purchases”) on the New York Stock Exchange or elsewhere. If, on the payment date for any Dividend, the closing market price plus estimated brokerage commission per common share is equal to or greater than the net asset value per common share, the Plan Administrator will invest the Dividend amount in Newly Issued Common Shares on behalf of the participants. The number of Newly Issued Common Shares to be credited to each participant’s account will be determined by dividing the dollar amount of the Dividend by the net asset value per common share on the payment date; provided that, if the net asset value is less than or equal to 95% of the closing market value on the payment date, the dollar amount of the Dividend will be divided by 95% of the closing market price per common share on the payment date. If, on the payment date for any Dividend, the net asset value per common share is greater than the closing market value plus estimated brokerage commission, the Plan Administrator will invest the Dividend amount in common shares acquired on behalf of the participants in Open-Market Purchases.

If, before the Plan Administrator has completed its Open-Market Purchases, the market price per common share exceeds the net asset value per common share, the average per common share purchase price paid by the Plan Administrator may exceed the net asset value of the common shares, resulting in the acquisition of fewer common shares than if the Dividend had been paid in Newly Issued Common Shares on the Dividend payment date. Because of the foregoing difficulty with respect to Open-Market Purchases, the Plan provides that if the Plan Administrator is unable to invest the full Dividend amount in Open-Market Purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the Plan Administrator may cease making Open-Market Purchases and may invest the uninvested portion of the Dividend amount in Newly Issued Common Shares at net asset value per common share at the close of business on the Last Purchase Date provided that, if the net asset value is less than or equal to 95% of the then current market price per common share; the dollar amount of the Dividend will be divided by 95% of the market price on the payment date.

The Plan Administrator maintains all shareholders’ accounts in the Plan and furnishes written confirmation of all transactions in the accounts, including information needed by shareholders for tax records. Common shares in the account of each Plan participant will be held by the Plan Administrator on behalf of the Plan participant, and each shareholder proxy will include those shares purchased or received pursuant to the Plan. The Plan Administrator will forward all proxy solicitation materials to participants and vote proxies for shares held under the Plan in accordance with the instruction of the participants.

There will be no brokerage charges with respect to common shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commission incurred in connection with Open-Market Purchases. The automatic reinvestment of Dividends will not relieve participants of any Federal, state or local income tax that may be payable (or required to be withheld) on such Dividends.