QuickLinks -- Click here to rapidly navigate through this documentAs filed Pursuant to Rule 424(b)(4)

Registration No. 333-113873

US $1,000,000,000

Kingfisher Trust 2004-1G

Mortgage Backed Floating Rate Notes, Class A

Australia and New Zealand

Banking Group Limited (ABN 11 005 357 522)

Seller and Servicer

Perpetual Trustee Company Limited (ABN 42 000 001 007)

in its capacity as trustee of Kingfisher Trust 2004-1G

Issuer Trustee

ANZ Capel Court Limited (ABN 30 004 768 807)

Trust Manager

Neither the Class A notes nor the underlying mortgage loans are insured or guaranteed by any governmental agency or instrumentality. The Class A notes are not deposits or other liabilities of the Australia and New Zealand Banking Group Limited or any of its affiliates for any purpose, including the Banking Act of 1959 in Australia.

Investing in the Class A notes involves risks. See "Risk Factors" beginning on page A-20.

The Class A notes represent obligations of the issuer trustee in its capacity as trustee of the Kingfisher Trust 2004-1G only, and are not guaranteed by Perpetual Trustee Company Limited or any other entity. |

|

The Class A Notes

The Class A notes will be issued by the issuer trustee in its capacity as trustee of the Kingfisher Trust 2004-1G.

The Trust

Kingfisher Trust 2004-1G has been established by the trust manager, ANZ Capel Court Limited. The trust has been formed under, and is governed by, the laws of New South Wales.

The Mortgage Loans

The Class A notes will be secured by a pool of first ranking mortgage loans originated by Australia and New Zealand Banking Group Limited which are, in turn, secured by residential properties located in Australia. The mortgage loans will be serviced by Australia and New Zealand Banking Group Limited in the manner described in this prospectus.

Listing

Application has been made to the United Kingdom Financial Services Authority in its capacity as competent authority under the Financial Services and Markets Act 2000 of the United Kingdom (the "UK Listing Authority") for the US$1,000,000,000 Class A notes due September, 2035 of Kingfisher Trust 2004-1G to be admitted to the official list maintained by the UK Listing Authority ("Official List") and the London Stock Exchange plc for such Class A notes to be admitted to trading on the London Stock Exchange. This prospectus (including part A, part B and all annexed financial information and reports including Appendices A-I and A-II) comprises listing particulars approved by the UK Listing Authority issued in compliance with the listing rules made under Section 74 of the Financial Services and Markets Act 2000 of the United Kingdom (the "FSMA") for the purposes of giving information with regard to the issue of Class A notes. A copy of this prospectus has been delivered to the Registrar of Companies in England and Wales as required by section 83 of the FSMA. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Class A notes or determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

|

| | Initial Principal

Balance

| | Initial Interest Rate

| | Price to Public

| | Underwriting

Discounts

| | Proceeds to

Issuer Trustee

|

|---|

|

| Class A Notes | | $1,000,000,000 | | LIBOR + 0.13% | | 100% | | 0.14% | | $998,600,000 |

|

Delivery of the Class A notes in book-entry form through the Depository Trust Company, Clearstream, Luxembourg and the Euroclear System will be made on or about July 7, 2004. You should refer to "Plan of Distribution" for additional information on the offering of the Class A notes.

Deutsche Bank Securities

ANZ Securities

Citigroup

JP Morgan

The date of this prospectus is June 29, 2004

Important Notice About Information Presented in this Prospectus

This prospectus consists of two parts: (1) part A, which describes the specific terms of the Kingfisher Trust 2004-1G and the related offering of Class A notes and (2) part B, which provides general information about the Kingfisher Securitization Program.

Neither part A nor part B contains all of the information included in the registration statement filed with the Securities and Exchange Commission. The registration statement also includes copies of the various contracts and documents referred to in this prospectus. You may obtain copies of these documents for review. See "Where You Can Find More Information" in part B of this prospectus.

Terms used in this prospectus are defined in the glossary at page B-64 of this prospectus.

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act 1933. Specifically, forward-looking statements, together with related qualifying language and assumptions, are found in the materials, including tables, under the headings "Risk Factors" and "Prepayment and Yield Considerations". Forward-looking statements are also found in other places throughout this prospectus, and may be identified by accompanying language, including "expects", "intends", "anticipates", "estimates" or analogous expressions, or by qualifying language or assumptions. These statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results or performance to differ materially from the forward-looking statements. These risks, uncertainties and other factors include, among others, general economic and business conditions (particularly in Australia), competition, changes in political, social and economic conditions, regulatory initiatives and compliance with governmental regulations, customer preference and various other matters, many of which are beyond the issuer trustee's control. These forward-looking statements speak only as of the date of this prospectus. The issuer trustee expressly disclaims any obligation or undertaking to distribute any updates or revisions to any forward-looking statements to reflect changes in the issuer trustee's expectations with regard to those statements or any change in events, conditions or circumstances on which any forward-looking statement is based except as required by law, or unless required to do so by the Listing Rules of the UK Listing Authority.

iii

TABLE OF CONTENTS

For Part A

| U.S./AUSTRALIAN DOLLAR PRESENTATION | | vi |

| AUSTRALIAN DISCLAIMERS | | vi |

| DISCLAIMERS WITH RESPECT TO SALES TO NON-U.S. INVESTORS | | vi |

| STRUCTURAL DIAGRAM | | x |

| SUMMARY | | A-1 |

| RISK FACTORS | | A-20 |

| THE TRUST | | A-38 |

| | General | | A-38 |

| | The Master Trust Deed | | A-38 |

| | The Supplemental Deed | | A-38 |

| ASSETS OF THE TRUST | | A-39 |

| | The Mortgage Loans | | A-39 |

| | Transfer and Assignment of the Mortgage Loans | | A-39 |

| | Representations, Warranties and Eligibility Criteria | | A-40 |

| DESCRIPTION OF THE POOL OF MORTGAGE LOANS | | A-40 |

| | General | | A-40 |

| | Details of the Pool of Mortgage Loans | | A-41 |

| DESCRIPTION OF THE CLASS A NOTES | | A-41 |

| | General | | A-41 |

| | Governing Law | | A-42 |

| | Form of Class A Notes | | A-42 |

| | Collections; Distributions on the Class A Notes | | A-43 |

| | Key Dates and Periods | | A-44 |

| | Determination of Total Available Income | | A-45 |

| | Principal Draw | | A-47 |

| | Liquidity Draw | | A-47 |

| | Distribution of Total Available Income | | A-47 |

| | Distribution of Excess Available Income | | A-48 |

| | Interest on the Notes | | A-49 |

| | Determination of Principal Collections | | A-50 |

| | Distribution of Principal Collections | | A-50 |

| | Redraws | | A-51 |

| | Principal Charge-offs | | A-51 |

| | The Interest Rate Swaps | | A-52 |

| | The Currency Swap | | A-56 |

| | Withholding or Tax Deductions | | A-61 |

| | Redemption of the Notes for Taxation or Other Reasons | | A-61 |

| | Redemption of the Notes upon an Event of Default | | A-62 |

| | Optional Redemption of the Notes | | A-63 |

| | Final Maturity Date | | A-64 |

| | Redemption upon Final Payment | | A-64 |

| | | |

iv

| | No Payments of Principal in Excess of Stated Amount | | A-64 |

| | The Liquidity Facility | | A-65 |

| | The Redraw Facility | | A-67 |

| | Seller Deposit | | A-70 |

| | Further Advances | | A-70 |

| THE MORTGAGE INSURANCE POLICIES | | A-71 |

| | General | | A-71 |

| | Primary Mortgage Insurance | | A-71 |

| | The Lender's Mortgage Pool Insurance Policy | | A-74 |

| | Description of the Insurer | | A-77 |

| DESCRIPTION OF THE TRUSTEES | | A-78 |

| | The Issuer Trustee | | A-78 |

| | The Security Trustee | | A-78 |

| | The Note Trustee | | A-79 |

| SERVICING | | A-79 |

| | The Servicer | | A-79 |

| | Delegation by the Servicer | | A-79 |

| | Servicing of Mortgage Loans | | A-79 |

| | Collection and Enforcement Procedures | | A-80 |

| | Delinquency, Foreclosure and Loss Statistics | | A-82 |

| | Portfolio Delinquency and Foreclosure Experience | | A-82 |

| ONE-TO-FOUR-FAMILY RESIDENTIAL LOANS | | A-82 |

| PREPAYMENT AND YIELD CONSIDERATIONS | | A-83 |

| | General | | A-83 |

| | Prepayments | | A-83 |

| | Rate of Payments | | A-84 |

| | Prepayment Rate Model and Modeling Assumptions | | A-84 |

| USE OF PROCEEDS | | A-88 |

| ADDITIONAL INFORMATION | | A-88 |

| LEGAL INVESTMENT CONSIDERATIONS | | A-88 |

| ERISA CONSIDERATIONS | | A-88 |

| PLAN OF DISTRIBUTION | | A-88 |

| | Underwriting | | A-88 |

| | Offering Restrictions | | A-89 |

| | Exchange Controls and Limitations | | A-91 |

| ANNOUNCEMENT | | A-91 |

| RATINGS OF THE CLASS A NOTES | | A-92 |

| LEGAL MATTERS | | A-92 |

| LISTING AND GENERAL INFORMATION | | A-92 |

| | Listing | | A-92 |

| | Authorization | | A-93 |

| | Litigation | | A-93 |

| | Transaction Documents Available for Inspection | | A-93 |

| APPENDIX A-I MORTGAGE LOAN POOL CHARACTERISTICS | | A-96 |

| APPENDIX A-II TERMS AND CONDITIONS OF THE CLASS A NOTES | | A-102 |

v

U.S./AUSTRALIAN DOLLAR PRESENTATION

In this prospectus, references to "U.S. dollars" and "US$" are references to U.S. currency and references to "Australian dollars" and "A$" are references to Australian currency. Unless otherwise stated in this prospectus, any translations of Australian dollars into U.S. dollars have been made at a rate of US$0.7067 = A$1.00, the noon buying rate in New York City for cable transfers in Australian dollars as certified for customs purposes by the Federal Reserve Bank of New York on June 1, 2004. Use of such rate is not a representation that Australian dollar amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at that rate.

AUSTRALIAN DISCLAIMERS

- •

- The Class A notes do not represent deposits or other liabilities of Australia and New Zealand Banking Group Limited, ANZ Capel Court Limited, the trust manager or any affiliates of Australia and New Zealand Banking Group Limited.

- •

- The holding of the Class A notes is subject to investment risk, including possible delays in repayment and loss of income and principal invested.

- •

- None of Australia and New Zealand Banking Group Limited (in its individual capacity or as originator, seller, servicer, custodian, basis swap provider, fixed rate swap provider, liquidity facility provider or redraw facility provider), ANZ Capel Court Limited, or any affiliate of the foregoing entities, the issuer trustee, the currency swap provider, the security trustee, the note trustee, the note registrar, any paying agent, the calculation agent nor any underwriter in any way stands behind the value and/or performance of the Class A notes or the assets of the trust, or guarantees the payment of interest or the repayment of principal due on the Class A notes, except to the limited extent provided in the transaction documents for the trust.

- •

- None of the obligations of Perpetual Trustee Company Limited, in its capacity as issuer trustee of the trust, or ANZ Capel Court Limited, as trust manager in respect of the Class A notes, are guaranteed in any way by Australia and New Zealand Banking Group Limited or any affiliate of Australia and New Zealand Banking Group Limited or by Perpetual Trustee Company Limited (in its individual capacity) or any affiliate of Perpetual Trustee Company Limited. The issuer trustee and the security trustee do not guarantee the success or performance of the trust nor the repayment of capital or any particular rate of capital or income return.

DISCLAIMERS WITH RESPECT TO SALES TO NON-U.S. INVESTORS

This section applies only to the offering of the Class A notes in countries other than the United States of America. References to Perpetual Trustee Company Limited in this section are to that company in its capacity as issuer trustee of the Kingfisher Trust 2004-1G, and not its individual capacity. ANZ Capel Court Limited, the trust manager, is responsible and liable for this prospectus in the United States of America.

The underwriters are offering the Class A notes globally for sale in those jurisdictions in the United States, Europe, Asia and elsewhere where it is lawful to make such offers. The distribution of this prospectus and the offering and sale of the Class A notes in certain foreign jurisdictions may be restricted by law. This prospectus does not constitute, and may not be used in connection with, an offer by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation. Each underwriter has agreed to comply with all applicable securities laws and regulations in each jurisdiction in which it purchases, offers, sells or delivers Class A notes or possesses or distributes this prospectus or any other offering material. See "Plan of Distribution" in part A of this prospectus. You should also inform yourself about and observe any of these restrictions. In

vi

addition, Perpetual Trustee Company Limited has not authorised any offer of the Class A Notes to the public in the United Kingdom within the meaning of the FSMA or the Public Offers of Securities Regulations 1995, as amended.

This prospectus does not and is not intended to constitute an offer to sell or a solicitation of any offer to buy any of the Class A notes by or on behalf of Perpetual Trustee Company Limited or ANZ Capel Court Limited in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make an offer or solicitation in such jurisdiction.

Perpetual Trustee Company Limited accepts responsibility for the information contained in this prospectus. To the best knowledge and belief of Perpetual Trustee Company Limited, which has taken reasonable care to ensure that such is the case, the information contained in this prospectus is in accordance with the facts and does not omit anything likely to affect the import of that information.

Any reference in this prospectus to listing particulars means this prospectus excluding all information incorporated by reference. The issuer trustee has confirmed that any information incorporated by reference, including any such information to which readers of this prospectus are expressly referred, has not been and does not need to be included in the listing particulars to satisfy the requirements of the FSMA or the Listing Rules of the UK Listing Authority. The issuer trustee believes that none of the information incorporated therein by reference conflicts in any material respect with the information included in the listing particulars.

Australia and New Zealand Banking Group Limited, as originator, seller, servicer, custodian, fixed rate swap provider, basis swap provider, liquidity facility provider and redraw facility provider, accepts responsibility for the information contained in "Summary—The Mortgage loans," "Description of the Pool of Mortgage Loans," "Servicing" and Appendix A-I (Mortgage Loan Pool Characteristics) in part A of this prospectus and "Securitization Program," "Australia and New Zealand Banking Group Limited," "The Servicer," "The Seller," "The Seller's Residential Loan Program" and "The Seller's Product Types" in part B of this prospectus. To the best of the knowledge and belief of Australia and New Zealand Banking Group Limited, which has taken all reasonable care to ensure that such is the case, the information contained in those sections is in accordance with the facts and does not omit anything likely to affect the import of that information.

The Bank of New York accepts responsibility for the information contained in "Description of the Trustees—The Note Trustee" in part A of this prospectus. To the best of the knowledge and belief of The Bank of New York, which has taken all reasonable care to ensure that such is the case, the information contained in that section is in accordance with the facts and does not omit anything likely to affect the import of that information.

The Royal Bank of Scotland plc accepts responsibility for the information contained in "Currency Swap Provider—The Royal Bank of Scotland plc". To the best of the knowledge and belief of The Royal Bank of Scotland plc , which has taken all reasonable care to ensure that such is the case, the information contained in that section is in accordance with the facts and does not omit anything likely to affect the import of that information.

Except with respect to the information for which it accepts responsibility in the preceding three paragraphs, none of Australia and New Zealand Banking Group Limited, in its individual capacity and as originator, seller, servicer, custodian, fixed rate swap provider, basis swap provider, liquidity facility provider and redraw facility provider, ANZ Capel Court Limited, as trust manager, P.T. Limited, as security trustee, The Bank of New York, as note trustee, note registrar, principal paying agent, calculation agent and paying agent or The Royal Bank of Scotland plc, as the currency swap provider, accepts any responsibility for any information contained in this prospectus and has not separately verified the information contained in this prospectus and makes no representation, warranty or

vii

undertaking, express or implied, as to the accuracy or completeness of any information contained in this prospectus or any other information supplied in connection with the Class A notes.

Australia and New Zealand Banking Group Limited, in its individual capacity and as originator, seller, servicer, custodian, fixed rate swap provider, basis swap provider, liquidity facility provider and redraw facility provider, Perpetual Trustee Company Limited, in its individual capacity and as issuer trustee, ANZ Capel Court Limited, as trust manager, P.T. Limited, in its individual capacity and as security trustee, The Bank of New York, as note trustee, note registrar, principal paying agent, calculation agent and paying agent, The Royal Bank of Scotland plc, as the currency swap provider, and the underwriters do not recommend that any person should purchase any of the Class A notes and do not accept any responsibility or make any representation as to the tax consequences of investing in the Class A notes.

Each person receiving this prospectus:

- •

- acknowledges that he or she has not relied on discussions or correspondence with the entities listed in the preceding paragraph nor on any person affiliated with any of them in connection with his or her investigation of the accuracy of the information in this prospectus or his or her investment decisions;

- •

- acknowledges that this prospectus and any other information supplied in connection with the Class A notes is not intended to provide the basis of any credit or other evaluation;

- •

- acknowledges that the underwriters have expressly not undertaken to review the financial condition or affairs of the trust or any party named in the prospectus during the life of the Class A notes;

- •

- should make their own independent investigation of the trust and the Class A notes; and

- •

- should seek their own tax, accounting and legal advice as to the consequences of investing in any of the Class A notes.

No person has been authorized to give any information or to make any representations other than those contained in this prospectus in connection with the issue or sale of the Class A notes. If such information or representation is given or received, it must not be relied upon as having been authorized by Australia and New Zealand Banking Group Limited, Perpetual Trustee Company Limited, P.T. Limited, ANZ Capel Court Limited, The Bank of New York, The Royal Bank of Scotland plc or any of the underwriters.

Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that:

- •

- there has been no material change in the affairs of the trust or any party named in this prospectus since the date of this prospectus or the date upon which this prospectus has been most recently amended or supplemented; or

- •

- any other information supplied in connection with the Class A notes is correct as of any time subsequent to the date on which it is supplied or, if different, the date indicated in the document containing the same.

Perpetual Trustee Company Limited's liability to make payments of interest and principal on the Class A notes is limited to the assets of the trust available to be applied towards those payments in accordance with the transaction documents. All claims against Perpetual Trustee Company Limited in relation to the Class A notes may only be satisfied out of the assets of the trust and are limited in recourse to the assets of the trust.

viii

(This page has been left blank intentionally.)

ix

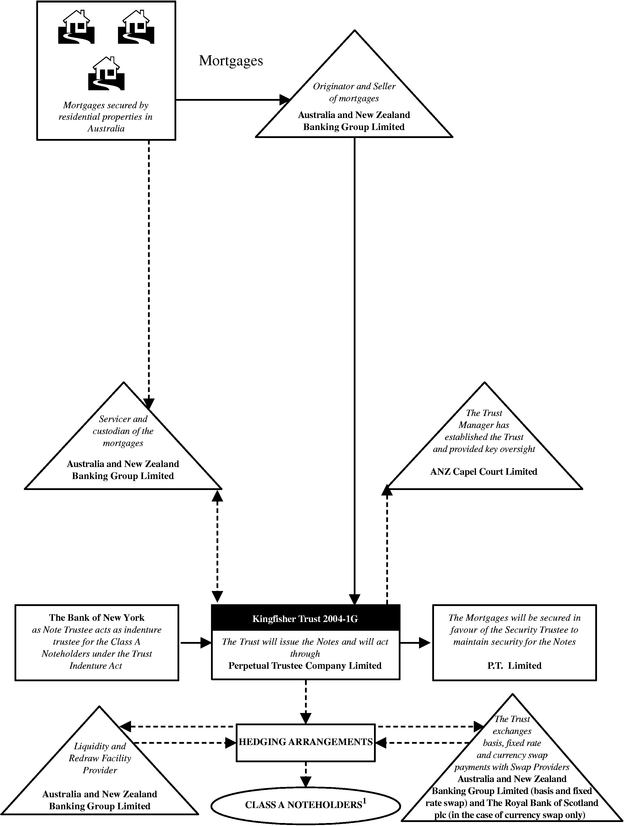

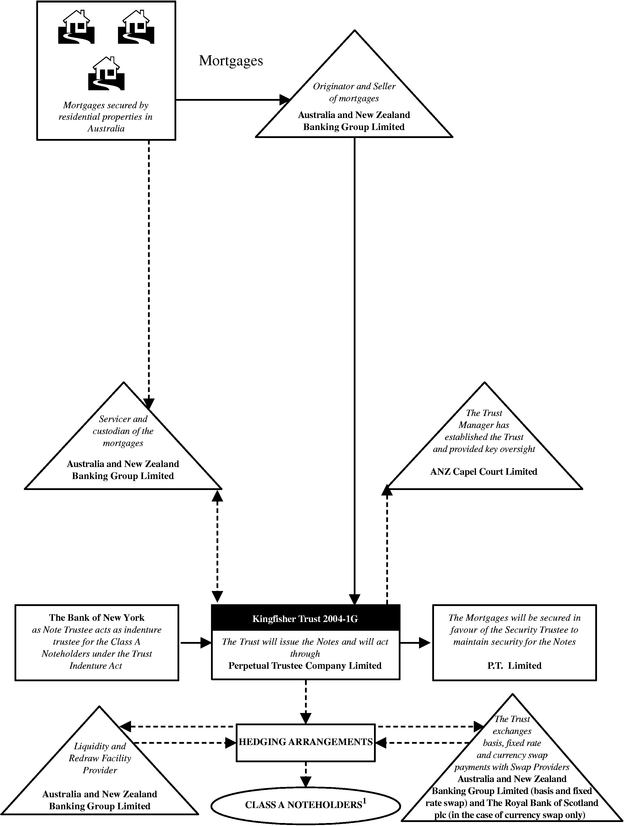

STRUCTURAL DIAGRAM

The Structural Diagram below identifies the principal parties to the transaction and summarizes key aspects of the transaction.*

- 1

- The Class B Notes will be issued in Australian dollars and are not subject to any currency swap. The currency swap is only applicable for the Class A Notes.

- *

- Broken lines indicate cashflow; solid lines indicate origination of, conveyance of or security over mortgage loans. See "Structural Overview" on the following page for a summary description of the issuance of the notes.

x

SUMMARY

This summary highlights selected information from this document and does not contain all of the information that you need to consider in making your investment decision. This summary contains an overview of some of the concepts and other information to aid your understanding. All of the information contained in this summary is qualified by the more detailed explanations in other parts of this prospectus, including the "Terms and Conditions of the Class A Notes" at Appendix A-II to part A of this prospectus.

Structural Overview

This prospectus describes the terms and offering of the Mortgage Backed Floating Rate Notes, Class A, the senior class of mortgage backed floating rate notes secured by mortgages on one-to-four-family residential properties located in Australia. The principal parties involved in the issuance and ongoing administration of the Class A notes are diagrammed on the previous page. See "Structural Diagram". Their duties and responsibilities differ in certain respects from those of their counterparts in U.S. mortgage securitizations and are summarized below.

All the mortgage loans underlying the notes were originated by Australia and New Zealand Banking Group Limited (identified in its capacity as the seller at the top of the preceding diagram).

Prior to issuance of the notes, the mortgage loans will be conveyed to Kingfisher Trust 2004-1G, an Australian trust. The trust will issue the notes and otherwise act through Perpetual Trustee Company Limited, as issuer trustee, an arrangement similar in many respects to the appointment of an owner trustee in U.S. domestic owner trust securitizations. The Bank of New York will serve as note trustee and will perform duties largely comparable to those of an indenture trustee in U.S. debt offerings (i.e., note issuance, administration and representation of the noteholders in enforcement and judiciary proceedings relating to the note trust deed and the Class A note terms and conditions as described herein).

To secure payments of the Class A notes, the mortgage loans and other related collateral will be secured in favor of P.T. Limited, a separate trustee (identified as the security trustee on the right side of the diagram) located in Australia. The security trustee's role in the transaction will be to maintain the security in the mortgage loans and other related collateral and to take steps to enforce the security over the assets of Kingfisher Trust 2004-1G upon the failure to timely pay noteholders or the occurrence of certain other events described in "Master Security Trust Deed—Events of Default".

Australia and New Zealand Banking Group Limited, as servicer of the mortgage loans, will be responsible for the day-to-day administration (i.e. making collections, sending notices) of the mortgage loans. Australia and New Zealand Banking Group Limited is permitted to delegate all or any part of its functions as servicer to other parties provided that Australia and New Zealand Banking Group Limited remains liable for the servicing of the mortgage loans and that it appoints any such delegate with due care. It is intended that certain functions of the Servicer will be delegated to such third parties with respect to the Kingfisher Trust 2004-1G, as described in "Servicing—Servicing of Mortgage Loans" in part A of this prospectus and "Description of Transaction Documents—The Master Servicer Deed" in part B of this prospectus. Any reference to the "servicer" in this prospectus will include a reference to Australia and New Zealand Banking Group Limited and, where the context requires, any such delegate of Australia and New Zealand Banking Group Limited.

Oversight and management of the trust will be maintained by ANZ Capel Court Limited, an Australian company and wholly-owned subsidiary of Australia and New Zealand Banking Group Limited, as the trust manager. The duties of the trust manager include preparation of investor reports, calculation (and auditing) of certain amounts, maintenance of accounts, delivery of notices, and other matters.

A-1

In addition to originating and selling mortgage loans to the trust, Australia and New Zealand Banking Group Limited will act as:

- •

- Liquidity Facility Provider. To avoid interruptions in the timely payment on the notes, the liquidity facility provider will "advance" amounts from time to time for payment on the Class A notes. Such amounts will be reimbursable to the liquidity facility provider from future trust cash flows.

- •

- Redraw Facility Provider. Certain of the mortgage loans permit the borrowers, subject to certain conditions, to re-borrow previously prepaid principal. The redraw facility provider has been retained to reimburse the seller for such amounts to the extent trust cash flow is insufficient to make such redraws. Amounts extended under the redraw facility will be repaid from future trust cash flows.

- •

- Fixed Rate and Basis Swap Providers. To manage its interest rate exposure, the issuer trustee will enter into a basis swap and a fixed rate swap. The purpose of the basis swap is to manage the basis risk between the interest on those mortgage loans which accrue interest at a discretionary variable rate of interest and the floating rate obligations of the trust, including the issuer trustee's obligations under the currency swaps. The purpose of the fixed rate swap is to manage the interest rate risk between the interest rate on those mortgage loans which accrue interest at a fixed rate of interest and the floating rate obligations of the trust, including the issuer trustee's payment obligations under the currency swaps.

There are significant risks associated with investment in the Class A notes, including the general structural risks associated with a mortgage-backed securitization, including the financial strength of support facility providers, special risks associated with an investment in Australian mortgage loans and special risks associated with certain features of the seller's mortgage loans to be assigned to the trust. See "Risk Factors" in part A of this prospectus.

All of the transaction documents will be governed by the laws of New South Wales, with the exception of the underwriting documents, which will be governed by New York law and any credit support annex which is entered into under the currency swap which would be governed by English law.

A-2

Parties to the Transaction:

| Trust | | KINGFISHER TRUST 2004-1G. The trust was created by the trust manager pursuant to the master trust deed, notice of creation of trust and the supplemental deed. |

Seller |

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED (ABN 11 005 357 522). |

Issuer Trustee |

|

PERPETUAL TRUSTEE COMPANY LIMITED (ABN 42 000 001 007). The trustee of the trust and the issuer of the notes pursuant to the master trust deed and the supplemental deed. |

Trust Manager |

|

ANZ CAPEL COURT LIMITED (ABN 30 004 768 807). The manager of the trust appointed pursuant to the master trust deed and the supplemental deed, and responsible for management of the assets and liabilities of the trust. ANZ Capel Court Limited is an Australian subsidiary of Australia and New Zealand Banking Group Limited. |

Note Trustee |

|

THE BANK OF NEW YORK. The note trustee appointed pursuant to the note trust deed (i.e., the indenture) to act for and exercise certain rights of the Class A noteholders with respect to the Class A notes. |

Security Trustee |

|

P.T. LIMITED (ABN 67 004 454 666). The security trustee for the notes and other secured obligations of the trust holding the benefit of the security over the assets of the trust pursuant to the master security trust deed and the deed of charge. |

Servicer |

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED. The servicer will act as servicer on behalf of the issuer trustee pursuant to the master servicer deed. |

|

|

As described above, certain servicing functions will be delegated by AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED to third parties, although in these cases, AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED will continue to be responsible for servicing the mortgage loans. |

Custodian |

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED. The custodian will act as custodian of the mortgage title documents on behalf of the issuer trustee pursuant to the supplemental deed. |

Principal Paying Agent and Class A Note Registrar |

|

THE BANK OF NEW YORK. |

Paying Agent |

|

THE BANK OF NEW YORK (LONDON BRANCH). |

Calculation Agent |

|

THE BANK OF NEW YORK. |

Authorised Adviser |

|

DEUTSCHE BANK AG, LONDON. |

Fixed Rate Swap Provider |

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED. |

| | | | | |

A-3

Basis Swap Provider |

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED. |

Currency Swap Provider |

|

THE ROYAL BANK OF SCOTLAND PLC. |

Liquidity Facility Provider |

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED. |

Redraw Facility Provider |

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED. |

Mortgage Insurer |

|

PMI MORTGAGE INSURANCE LTD (ABN 70 000 511 071) as primary mortgage insurer, premium policy insurer and pool insurer. |

Residual Capital Unitholder |

|

KINGFISHER SECURITISATION PTY LTD (ABN 89 093 469 375). |

Residual Income Unitholder |

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED. |

Underwriters |

|

DEUTSCHE BANK SECURITIES INC., ANZ SECURITIES INC., CITIGROUP GLOBAL MARKETS INC. and J.P. MORGAN SECURITIES INC. |

Rating Agencies |

|

MOODY'S INVESTORS SERVICE, INC., STANDARD & POOR'S RATINGS GROUP and FITCH RATINGS. |

A-4

The Mortgage Backed Floating Rate Notes

In addition to the Class A notes, the issuer trustee will also issue Class B notes secured by the same pool of mortgage loans but subordinated in right of payment to the Class A notes as described below. The Class B notes have not been, and will not be, registered in the United States or listed on the Official List of the UK Listing Authority or with any other authority or stock exchange and are not being offered by this prospectus. The following chart summarizes the principal terms of the note issuance:

| | Class A

| | Class B

|

|---|

Initial Principal Balance: |

|

US$1,000,000,000 |

|

A$23,500,000 |

Percentage of total Initial Principal Balance: |

|

98.41% |

|

1.59% |

Anticipated Ratings: |

|

|

|

|

Moody's Investors Service, Inc. |

|

Aaa |

|

Aa2 |

Standard & Poor's Ratings Group |

|

AAA |

|

AA |

Fitch Ratings |

|

AAA |

|

AA |

Interest rate up to but excluding the payment date falling on the Call Option Date |

|

three-month LIBOR plus 0.13% |

|

three-month Australian Bank Bill Rate plus 0.53% |

Interest rate after and including the Call Option Date unless on or after that payment date the issuer trustee proposes to redeem the notes and is unable to do so as described in part A of this prospectus, in which case the interest rate from and including that given payment date will be the rate specified in the line above |

|

three-month LIBOR + 0.26% |

|

three-month Australian Bank Bill Rate plus 0.53% |

Interest Accrual Method: |

|

Actual/360 |

|

Actual/365 |

Clearance/Settlement: |

|

DTC/Euroclear/Clearstream, Luxembourg |

|

To be cleared in Australia only |

Call Option Date |

|

The payment date on which the total principal outstanding on the pool of mortgage loans is less than 10% of the total principal outstanding on the pool of mortgage loans as of the Cut-off Date. |

Payment Dates: |

|

The 18th day or if the 18th day is not a Business Day, then the next Business Day, of each September, December, March and June beginning in September 2004. |

Cut-off Date: |

|

Close of business, June 22, 2004. |

Closing Date: |

|

On or about July 7, 2004. |

Final Maturity Date: |

|

The payment date occurring in September 2035. |

A-5

The mortgage loans

The pool of mortgage loans will be secured by registered, first ranking mortgages on one-to-four-family owner occupied and non-owner occupied residential properties. The mortgage loans will have original terms to stated maturity of no more than 30 years. The pool of mortgage loans has the summary characteristics described below determined as of the close of business on June 22, 2004 (the "Cut-off Date").

| Number of Mortgage loans | | | 12,345 |

| Aggregate Mortgage Loan Pool Balance | | A$ | 1,481,226,046.66 |

| Average Mortgage Loan Balance | | A$ | 119,985.91 |

| Maximum Mortgage Loan Balance | | A$ | 731,208.69 |

| Minimum Mortgage Loan Balance | | A$ | 20,004.67 |

| Total Valuation of the Properties | | A$ | 3,067,184,907.00 |

| Maximum Remaining Term to Maturity (in months) | | | 352.67 |

| Weighted Average Remaining Term to Maturity (in months) | | | 299.60 |

| Weighted Average Number of Months since Origination | | | 23.77 |

| Weighted Average Original Loan-to-Value Ratio | | | 67.80% |

| Weighted Average Current Loan-to-Value Ratio | | | 62.59% |

| Weighted Average Mortgage Rate for Mortgage loans | | | 6.64% |

| Maximum Current Loan-to-Value Ratio | | | 93.84% |

All mortgage loans in the pool as of the Cut-off Date are variable rate mortgage loans. However, the terms of the mortgage loans permit the borrower, subject to certain conditions, to convert the interest rate from a variable rate to a fixed rate. The term "fixed rate" mortgage loans as used in this prospectus does not have the same meaning as in U.S. mortgage securitizations, i.e., loans with a fixed rate for the life of the mortgage loan. Rather, the fixed rate mortgage loans in the seller's portfolio have a fixed rate that is set for a time period (generally not more than 10 years) shorter than the life of the loan (generally 25 or 30 years, although the term may be shorter) which then reverts to the standard variable rate applicable at the end of the fixed rate term unless the borrower elects an alternative product type.

Before the issuance of the Class A notes on the closing date, mortgage loans may be added to or removed from the mortgage loan pool. Additionally, new mortgage loans may be substituted for mortgage loans that are removed from the mortgage loan pool. This addition, removal or substitution of mortgage loans may result in changes in the mortgage loan pool characteristics shown in the preceding table and could affect the weighted average lives and yields of the Class A notes. The seller will not add, remove or substitute any mortgage loans prior to the closing date if this would result in a change of more than 5% in any of the characteristics of the pool of mortgage loans described above. Moreover, additions or removals of mortgage loans in the mortgage loan pool will not occur after the closing date, other than through removals as a result of the extinguishment of the issuer trustee's title in mortgage loans in favour of, or the repurchase by, the seller of mortgage loans affected by a breach of the seller's representations or warranties described under "The Seller—Breach of Representations and Warranties" in part B of this prospectus or in certain other limited circumstances referred to in this prospectus. "Extinguishment" of the issuer trustee's title means, where the issuer trustee has equitable title in any mortgage loans, that the issuer trustee extinguishes or surrenders its title in such mortgage loans in favour of the seller. The practical effect of extinguishment is equivalent to repurchase by the seller of the relevant mortgage loans and for the purposes of this prospectus the term "repurchase" or "resell" when used with respect to mortgage loans includes any such extinguishment. See Appendix A-I to part A of this prospectus for additional statistical information regarding the mortgage loan pool determined as of the Cut-off Date.

A-6

Sources and Applications of Cash Flow

Collections

The issuer trustee will receive for each collection period amounts, which are known as collections, which include:

- •

- payments of interest, principal and other amounts under the mortgage loans;

- •

- proceeds from the enforcement of the mortgage loans and mortgages and other securities relating to those mortgage loans;

- •

- amounts received under lender's mortgage insurance policies; and

- •

- amounts received from the seller for breaches of representations, warranties or undertakings in connection with the mortgage loans.

Collections will be allocated between income and principal.

Collections attributable to interest plus certain other amounts in the nature of income will be used (among other things) to pay certain fees and expenses of the trust, to repay any liquidity draw and to pay interest on the notes. If there is an excess of such collections after payment of such fees, expenses and interest on the notes, such excess will first be used to reimburse any losses previously allocated against the principal balance of the notes and the redraw facility, then to reimburse any principal draws and to make certain termination payments under the swap agreements. Any remaining excess will be distributed to the residual income unitholder.

Collections on the mortgage loans attributable to principal and certain other amounts in the nature of principal will be applied, among other things:

- •

- to repay the seller for advancing redraws under the mortgage loans;

- •

- to repay the redraw facility provider any principal outstanding under the redraw facility;

- •

- as income to cover a payment shortfall resulting from a deficiency in available interest and income collections; and

- •

- to pay principal on the notes.

Any remaining excess of principal collections will be distributed to the residual capital unitholder.

See "Description of the Class A Notes—Collections"; "—Distributions on the Class A Notes"; "—Determination of Total Available Income"; "—Distribution of Total Available Income"; "—Determination of Principal Collections"; and "—Distribution of Principal Collections" in part A of this prospectus.

Interest on the Notes

Interest on the notes is payable quarterly in arrears on each payment date. Interest will be paid on the Class B notes only after the payments of interest on the Class A notes are made. Interest on each note is calculated for each interest period as follows:

- •

- at the note interest rate;

- •

- on the outstanding principal balance of that note at the beginning of that interest period; and

- •

- on the basis of the actual number of days in that interest period and a year of 360 days for the Class A notes or a year of 365 days for the Class B notes.

See "Description of the Class A Notes—Interest on the Notes" in part A of this prospectus.

A-7

Principal on the Notes

Principal on the notes will be payable on each payment date. Principal collections on the mortgage loans available to pay principal on the notes will first be applied to pay the following items in the following order of priority:

- •

- to repay to the seller any redraws under the mortgage loans made by the seller during or prior to the preceding collection period;

- •

- to repay the redraw facility provider any principal outstanding under the redraw facility; and

- •

- to be applied as income to cover a payment shortfall resulting from a deficiency in available interest and other income collections.

After the application of principal collections on the mortgage loans in respect of the priorities listed above, any remaining principal collections will be first allocated to pay principal on the Class A notes until the outstanding principal balance of such class as reduced by losses allocated against such class, is reduced to zero. The balance of available principal collections on the mortgage loans remaining after the outstanding principal balance of the Class A notes has been reduced to zero will be paid to the Class B noteholders in respect of principal on the Class B notes until the outstanding principal balance of the Class B notes is reduced to zero.

If the security created by the master security trust deed and the deed of charge is enforced after an event of default, the proceeds from the enforcement, after payment of any amounts owing to the various trustees, any appointed receiver and any cash collateral held on behalf of a support facility provider and any other prior ranking obligations, will be distributed ratably among the Class A notes prior to any distributions to the Class B notes. See "Description of the Class A Notes—Distribution of Principal Collections" and "—Redemption of the Notes Upon an Event of Default."

Allocation of Cash Flows

On each payment date, the issuer trustee will pay interest and principal to each noteholder to the extent of available interest and income collections and available principal collections on the mortgage loans in accordance with the priority of payments. The charts on the next four pages summarize the flow and priority of payments:

A-8

| | | Determination of Total Available Income for Distribution on a Payment Date | | |

|

|

|

|

|

|

| | | Finance Charge Collections | | |

|

|

Amounts of interest or income received by the issuer trustee during the preceding collection period in respect of the mortgage loans or any similar amounts deemed by the servicer to be in the nature of income or interest, including amounts received from borrowers, or from enforcement of the mortgage loans or repurchases of the mortgage loans. |

|

|

|

| | | + | | |

|

| | | Mortgage Insurance Interest Proceeds | | |

|

|

Amounts received by the issuer trustee under a lender's mortgage insurance policy other than that which the Trust Manager determines should be accounted for as being in the nature of principal. |

|

|

|

| | | + | | |

|

| | | Other Income | | |

|

|

Interest received on authorized investments or other amounts in the collections account and any other miscellaneous income received by the issuer trustee and

excluding any interest on any collateral accounts under a support facility. |

|

|

|

| | | + | | |

|

|

|

Principal Draw |

|

|

|

|

Principal collections on the mortgage loans applied as income to cover a payment shortfall resulting from a deficiency in available interest and income collections in the related collection period. |

|

|

|

| | | + | | |

|

| | | Other Amounts under Support Facilities | | |

|

|

Other amounts received by the issuer trustee under the basis swap and the fixed rate swap and any other amount which the issuer trustee receives in respect of the assets of the trust in the nature of income in the related collection period excluding any break costs received under such facilities calculated with reference to the

prepayment of any fixed rate mortgage loan. |

|

|

|

| | | + | | |

|

| | | Liquidity Draw | | |

|

|

Any advance to be made under the liquidity facility on the payment date. |

|

|

|

| | | = | | |

|

| | | Total Available Income for Distribution | | |

|

A-9

| | | Priority of Distribution of Total Available Income on a Payment Date | | |

|

|

|

|

|

|

|

|

| | | First, solely with respect to the first payment date, to the seller an amount equal to the interest accrued and unpaid on all mortgage loans assigned to the issuer trustee, as at the close of business on the day immediately prior to the cut-off date. | | |

|

| | | / | | |

|

| | | Second, pay pari passu and ratably: | | |

| | | (i) | | any taxes relating to the trust; | | |

| | | (ii) | | the issuer trustee's quarterly fee; | | |

| | | (iii) | | the servicer's quarterly servicing fee; | | |

| | | (iv) | | the trust manager's quarterly management fee; | | |

| | | (v) | | the custodian's quarterly fees; | | |

| | | (vi) | | the note trustee's quarterly fee; | | |

| | | (vii) | | any expenses of enforcement of, or in relation to, the mortgage loans; and | | |

| | | (viii) | | all other expenses of the trust except for those described above or below. | | |

|

| | | / | | |

|

| | | Third, pay pari passu and ratably: | | |

| | | (i) | | the quarterly commitment fees in connection with the redraw facility and the liquidity facility; | | |

| | | (ii) | | any interest payable to the liquidity facility provider under the liquidity facility; and | | |

| | | (iii) | | any net amount payable to the basis swap provider under the basis swap and to the fixed rate swap provider under the fixed rate swap. | | |

|

| | | / | | |

|

| | | Fourth, repay to the liquidity facility provider outstanding draws under the liquidity facility made on prior payment dates. | | |

|

| | | / | | |

|

| | | Fifth, pay pari passu and ratably to: | | |

| | | (i) | | the currency swap provider payments under the currency swaps relating to interest due on the Class A notes; and | | |

| | | (ii) | | the redraw facility provider interest due on the redraw facility. | | |

|

| | | / | | |

|

| | | Sixth, pay to Class B noteholders interest due on the Class B notes. | | |

|

| | | / | | |

|

| | | Seventh, allocate the remaining interest/income collections to principal collections for distribution with respect to the amount of any unreimbursed losses charged against the notesfirst, to the Class A notes and the redraw facility, pro rata, andsecond, to the Class B notes. | | |

|

| | | / | | |

|

| | | Eighth, allocate to principal collections an amount equal to any unreimbursed principal draws as at that payment date. | | |

|

| | | / | | |

|

| | | Ninth,first to pay certain termination payments to the applicable swap provider under the basis swap and fixed rate swap andsecond to pay certain termination payments to the currency swap provider under the currency swap. | | |

|

| | | / | | |

|

| | | Tenth, distribute any remaining interest/income collections to the residual income unitholder. | | |

|

A-10

| | | Determination of Principal Collections Available for Distribution on a Payment Date | | |

|

|

|

|

|

|

| | | Collections | | |

|

|

The aggregate of collections received by the issuer trustee during the preceding collection period with respect to the mortgage loans as described at "—Sources and Applications of Cash Flow—Collections" above. |

|

|

|

|

|

|

|

|

| | | + | | |

|

|

|

|

|

|

| | | Principal Draws | | |

|

|

The amount of any previous principal draws to be repaid on the payment date. |

|

|

|

|

|

|

|

|

| | | + | | |

|

|

|

|

|

|

| | | Excess Note Issue | | |

|

|

In the case of the first payment date only, any amount received by the issuer trustee upon the initial issue of notes in excess of the purchase price of the mortgage loans. |

|

|

|

|

|

|

|

|

| | | + | | |

|

|

|

|

|

|

| | | Redraw Facility Advance | | |

|

|

Any advance to be made under the redraw facility on the payment date. |

|

|

|

|

|

|

|

|

| | | Minus | | |

|

|

|

|

|

|

| | | Finance Charge Collections for the preceding collection period | | |

|

|

|

|

|

|

| | | Minus | | |

|

|

|

|

|

|

| | | Mortgage Insurance Interest Proceeds

| | |

|

|

|

|

|

|

| | | = | | |

|

|

|

|

|

|

| | | Principal Collections. | | |

|

A-11

| | | Priority of Distribution of Principal Collections on a Payment Date | | |

|

|

|

|

|

|

| | | Redraws | | |

|

|

Repay to the seller any redraws under the mortgage loans provided by the seller up to and including the last day of the immediately preceding collection period and that have not previously been repaid. |

|

|

|

| | | / | | |

|

| | | Redraw Principal Outstanding | | |

|

|

Pay to the Redraw Facility Provider the principal outstanding (as reduced by any allocated losses) under the redraw facility agreement. |

|

|

|

| | | / | | |

|

| | | Principal Draw | | |

|

|

Apply as income to cover a payment shortfall, if any, resulting from a deficiency in available interest and income collections in the related collection period. |

|

|

|

| | | / | | |

|

| | | Class A Noteholders | | |

|

|

Pay to the currency swap provider in respect of a repayment to the Class A noteholders of the Australian dollar equivalent of outstanding principal balance (as reduced by any allocated losses) of the Class A notes. |

|

|

|

| | | / | | |

|

| | | Class B Noteholders | | |

|

|

Pay to the Class B noteholders the outstanding principal balance (as reduced by any allocated losses) of the Class B notes. |

|

|

|

| | | / | | |

|

| | | Residual Capital Unitholder | | |

|

|

Distribute any remaining amounts to the residual capital unitholder. |

|

|

|

A-12

Transaction Fees

The principal parties involved in the issuance and administration of the notes will be entitled to certain fees for the performance of their duties. The following table shows each party's fee rate or other basis of calculation of their fee compensation:

Party

| | Annual Fee

Rate

| | Explanation

|

|---|

| Issuer Trustee, Security Trustee and Note Trustee | | * | | The trust will pay a single quarterly fee to the issuer trustee in respect of these duties to be allocated among these three trustees. |

Trust Manager |

|

0.0225% |

|

The trust manager's fee is calculated by multiplying the annual fee rate by the outstanding principal balance of the mortgage loans as of the beginning of each quarter and multiplying such product by the number of days in the interest period divided by 365. |

Liquidity Facility Provider |

|

0.15% |

|

The liquidity facility provider's fee is a quarterly commitment fee based on the product of the undrawn portion of the liquidity facility limit and the annual fee rate (and multiplying such product by the number of days in the interest period divided by 365). In addition, draws under the liquidity facility must be repaid by the trust with interest at the Australian bank bill rate plus a specified margin. |

Redraw Facility Provider |

|

0.15% |

|

The redraw facility provider's fee is a quarterly commitment fee based on the product of the undrawn portion of redraw facility limit, and the annual fee rate (and multiplying such product by the number of days in the interest period divided by 365). In addition, draws under the redraw facility must be repaid by the trust with interest at the Australian bank bill rate plus a specified margin. |

Servicer |

|

0.35% |

|

The servicer's fee is calculated by multiplying the annual fee rate by the outstanding principal balance of the mortgage loans as of the beginning of each quarter and multiplying such product by the number of days in the interest period divided by 365. |

| | | | | |

A-13

Custodian |

|

0.015% |

|

The custodian's fee is calculated by multiplying the annual fee rate by the outstanding principal balance of the mortgage loans as of the beginning of each quarter and multiplying such product by the number of days in the interest period divided by 365. |

Mortgage Insurer |

|

None |

|

The up front premium to the mortgage insurance provider will be paid within 5 business days of the issue date of the notes; no fees will be paid by the Trust. |

- *

- The fees payable to the issuer trustee, the note trustee and the security trustee have been intentionally omitted. The aggregate transaction fees described above (including those payable to the issuer trustee and the security trustee) expressed as an annual percentage of the balance of the mortgage loans is not expected to exceed 0.6%. Except as described above, fees are payable quarterly from trust income prior to payment of noteholders.

Credit Enhancements

Payments of interest and principal on the Class A notes will be supported by the following forms of credit enhancement:

Subordination and Allocation of Losses

The Class B notes will always be subordinate to the Class A notes in their right to receive interest and principal payments.

The Class B notes will bear all losses on the mortgage loans before the Class A notes. The support provided by the Class B notes is intended to enhance the likelihood that the Class A notes will receive expected quarterly payments of interest and principal.

The "initial support percentage" to be provided by the Class B notes is calculated as the outstanding principal balance of the Class B notes on the closing date as a percentage of the aggregate outstanding principal balance of all notes to be issued on the closing date and will be no less than 1.5%.

Mortgage Insurance Policies

Each mortgage loan is insured individually under a lender's mortgage insurance policy issued by PMI Mortgage Insurance Ltd or under a mortgage pool insurance policy issued by PMI Mortgage Insurance Ltd. Either the seller will equitably assign its interest in each lender's mortgage insurance policy to the issuer trustee or the issuer trustee will be named as a party to each pool insurance policy (or both). Generally, each lender's mortgage insurance policy covers any loss realized upon enforcement of the related mortgaged property. The amount covered by each lender's mortgage insurance policy will, in general, equal the excess of the unpaid principal balance of the mortgage loans plus unpaid accrued interest and the expenses of enforcement of such mortgage loan over the proceeds realized upon enforcement of the mortgage loan. See "The Mortgage Insurance Policies" in part A of this prospectus.

A-14

Seller Deposit

If Australia and New Zealand Banking Group Limited is assigned a short-term deposit credit rating by Moody's Investors Service, Inc. of less than P-1, a short-term deposit credit rating by Standard & Poor's Ratings Group of less than A-1 or a short term rating of less than FI by Fitch Ratings or, in each case, a lesser rating as agreed between the trust manager, the issuer trustee, the seller and the relevant rating agency, it must deposit an amount in an account with respect to the set-off risk determined with reference to, and which may be less than, the balances of certain deposit accounts held by borrowers with Australia and New Zealand Banking Group Limited where the borrower mortgage loans do not have a waiver of set-off. The amount of the seller deposit may be adjusted on each payment date and will be reduced to zero if the seller regains the required credit ratings. The issuer trustee may use the seller deposit to meet liabilities of the seller in relation to amounts set-off against the amount due on a mortgage loan which have not been met within 20 Business Days of notice from the issuer trustee or the trust manager.

As an alternative to making the seller deposit, Australia and New Zealand Banking Group Limited may implement other arrangements agreed with the rating agencies so that ratings of the notes by those rating agencies will not be adversely affected. See "Description of the Class A Notes—Seller Deposit" in part A of this prospectus.

Excess Available Income

Any interest and income collections remaining after payments of interest on the notes and the trust's expenses on any payment date will be available to cover previously unreimbursed losses on the mortgage loans. See "Description of the Class A Notes—Distribution of Total Available Income" and "—Principal Charge-offs" in part A of this prospectus.

Liquidity Enhancement

To cover possible liquidity shortfalls in the payments of interest on the Class A notes, the issuer trustee will, in certain circumstances, be able to borrow funds under a liquidity facility to be provided by Australia and New Zealand Banking Group Limited. See "Description of the Class A Notes—The Liquidity Facility" in part A of this prospectus.

Redraws: Redraw Facility

Unlike U.S. mortgages (but common among Australian mortgage loans), certain mortgage loans included in the pool permit the borrowers, from time to time, subject to certain conditions, to draw down (i.e., reborrow) certain amounts previously prepaid as principal under their mortgage loans. The maximum amount permitted to be drawn down by a borrower is determined with reference to a principal balance schedule (simply, the amortization schedule for the loan calculated on the basis of the then current interest rate) and the actual amount outstanding. At any time, a borrower may "redraw" the amount by which the scheduled balance at the time of the proposed redraw exceeds the actual outstanding loan balance. As such, the amount available to be redrawn is largely a function of the amount of principal previously prepaid by the borrower. Generally, the greater the amount of prior prepayments, the larger the permitted redraw.

The seller may also agree to make further advances to a borrower in excess of the scheduled principal balance of his or her loan.

Although redraws and further advances will be disbursed directly by the seller to the borrowers, they will constitute assets of the trust except in circumstances where the provision of a further advance results in the creation of a new account (in which case such new account will not form part of the assets of the trust) or causes the scheduled principal balance of the mortgage loan to be exceeded by

A-15

more than one scheduled monthly installment, in which case the mortgage loan will be removed from the assets of the trust in exchange for payment of the then outstanding principal balance of the mortgage loan.

Following disbursement, the trust will be required to reimburse the seller for any redraws as follows:

First, to the extent of availability, from principal collections on hand; and

Second, to the extent principal collections are insufficient, by drawing on the redraw facility (which the trust will be required to repay to the redraw facility provider from future principal collections).

Prior to the occurrence of an event of default, reimbursements of redraws to the seller (or the redraw facility provider) will be required to be paid from trust cashflowbefore amounts are paid on the Class A notes. After the occurrence of an event of default, reimbursements of redraws to the seller rank equally with amounts payable on the Class A notes. As a result, the trust will have less funds available to pay principal on the notes on a current basis, but will have a corresponding greater amount of assets with which to make future payments. Although the seller is not able to predict the level of redraws in the future, the weighted average life of the Class A notes could be extended to the extent redraws are experienced on the mortgage loans. See "The Seller's Residential Loan Program" and "The Seller's Product Types" in part B of this prospectus and "Description of the Class A Notes—Redraws" and "—The Redraw Facility" in part A of this prospectus.

Hedging Arrangements

To hedge its interest rate and currency exposures, the issuer trustee will enter into the following hedging arrangements:

- •

- a basis swap with the basis swap provider to manage the basis risk between the interest on those mortgage loans which accrue interest at a discretionary variable rate of interest and the floating rate obligations of the trust, including the issuer trustee's payment obligations under the currency swaps;

- •

- a fixed rate swap with the fixed rate swap provider to manage the interest rate risk between the interest rate on those mortgage loans which accrue interest at a fixed rate of interest and the floating rate obligations of the trust, including the issuer trustee's payment obligations under the currency swaps; and

- •

- a currency swap with the currency swap provider to manage the currency risk on the collections on the mortgage loans and the basis risk on the amounts received by the issuer trustee under the basis swap and the fixed rate swap, which are denominated in Australian dollars and, in the case of the basis swap and fixed rate swap, calculated by reference to the Australian bank bill rate, against the obligation of the trust to pay interest and principal on the Class A notes, which are denominated in U.S. dollars and, in the case of interest, calculated by reference to LIBOR.

See "Description of the Class A Notes—The Interest Rate Swaps" and "—The Currency Swap" in part A of this prospectus.

Optional Redemption

Call Option. The issuer trustee will, if the trust manager directs it to do so, redeem all of the notes on any payment date falling on or after the payment date on which the current total outstanding principal balance of the mortgage loans on any payment date (calculated as at the end of the

A-16

immediately preceding collection period) is less than 10% of the total outstanding principal balance of the mortgage loans on the cut-off date. The issuer trustee's offer to redeem the notes may be either at:

- •

- the aggregate outstanding principal balance of the notes, plus accrued interest thereon (in which case exercise of the redemption will be mandatory and not require any consent of the noteholders); or

- •

- the aggregate outstanding principal balance of the notes, plus accrued interest thereon, as reduced by losses allocated against the notes (in which case exercise of the redemption will require approval of 75% of the aggregate of the Class A noteholders and Class B noteholders).

If the issuer trustee fails to exercise its option to redeem the notes on the payment date referred to above, then the percentage spread over LIBOR to be applied in determining the interest rate on the Class A notes on each payment date thereafter will increase to 0.26%. However, if the issuer trustee, at the direction of the trust manager, proposes to exercise its option to redeem the notes on a payment date occurring on or after the payment date referred to above at the lesser amount described above but is unable to do so because it cannot obtain the required consent of 75% of the aggregate of the Class A noteholders and Class B noteholders, then the percentage spread over LIBOR to be applied in determining the interest rate on the Class A notes as from that payment date will remain at, or revert to, the spread as at the closing date. See "Description of the Class A Notes—Optional Redemption of the Notes" in part A of this prospectus.

Material Australian Tax Consequences

In the opinion of Mallesons Stephen Jaques, Australian tax counsel for the trust manager, under present law, the Class A notes will not be subject to Australian interest withholding tax if they are issued in accordance with certain factual conditions and they are not held by certain Offshore Associates of the issuer trustee (in its capacity as trustee of the trust). The issuer trustee will seek to issue the Class A notes in a manner which will satisfy the conditions for an exemption from Australian interest withholding tax. One of these conditions is that the issuer trustee must, at the time of issue, not know or have reasonable grounds to suspect that a Class A note, or an interest in a Class A note, was being, or would later be, acquired directly or indirectly by an Offshore Associate of the issuer trustee other than in the capacity of a dealer, manager or underwriter in relation to the placement of the Class A notes, or a clearing house, custodian, funds manager or responsible entity of a registered managed investment scheme. Offshore Associate is defined in Part B of this prospectus. An Offshore Associate of the issuer trustee (in its capacity as trustee of the trust) would generally be any associate of Australia and New Zealand Banking Group that acquires the Class A notes offshore. Accordingly, such persons may not acquire the Class A notes (other than in the capacity noted above). See "Material Australian Tax Consequences" in part B of this prospectus.

If by virtue of a change in law:

- •

- the issuer trustee or the currency swap provider (as applicable) will be required to withhold or deduct amounts from payment of principal or interest to any class of noteholders or from any corresponding payment under the currency swap (as the case may be) due to taxes, duties, assessments or governmental charges; or

- •

- if the issuer trustee ceases to receive the total amount of interest payable by borrowers on the mortgage loans due to taxes, duties, assessments or other governmental charges,

then, the trust manager may, at its sole discretion, but subject to certain conditions, direct the issuer trustee to redeem all of the notes.

A-17

If the issuer trustee redeems the Class A notes, the Class A noteholders will receive a payment equal to either:

- •

- the aggregate outstanding principal balance of the notes, plus accrued interest thereon (in which case exercise of the redemption will be mandatory and not require any consent of the Class A noteholders); or

- •

- the aggregate outstanding principal balance of the notes, plus accrued interest thereon, as reduced by losses allocated against the notes (in which case exercise of the redemption will require approval of 75% of the Class A noteholders).

However, if the withholding or deduction relates only to Class A notes, Class A noteholders owning 75% of the voting rights represented thereby may direct the issuer trustee not to redeem the notes. See "Definitive Notes—Redemption of the Notes for Taxation or other Reasons" in part B of this prospectus.

Material United States Federal Income Tax Consequences

In the opinion of McKee Nelson LLP, special United States federal income tax counsel for the trust manager, although there is no authority directly on point, the Class A notes will be characterized as debt for United States federal income tax purposes, subject to the qualifications set forth in "Material United States Federal Income Tax Consequences" in part B of this prospectus. Each beneficial owner of a Class A note, by acceptance of a Class A note, agrees to treat the Class A notes as indebtedness. In addition, in the opinion of McKee Nelson LLP, the trust will not be subject to any entity level tax under the United States federal income tax laws and the issuer trustee will not be treated as engaged in the conduct of a United States trade or business (and, accordingly, not subject to United States federal income tax) solely as a result of any activities that it conducts in its capacity as issuer trustee of the trust. See "Material United States Federal Income Tax Consequences" in part B of this prospectus.

Legal Investment

The Class A notes willnot constitute "mortgage related securities" for the purposes of the U.S. Secondary Mortgage Market Enhancement Act of 1984. No representation is made as to whether the Class A notes constitute legal investments under any applicable statute, law, rule, regulation or order for any entity whose investment activities are subject to investment laws and regulations or to review by regulatory authorities. You are urged to consult with your own legal advisors as to whether the Class A notes constitute legal investments for you. See "Legal Investment Considerations" in parts A and B of this prospectus.

ERISA Considerations

In general, subject to the restrictions described in "ERISA Considerations" in parts A and B of this prospectus, the Class A notes will be eligible for purchase by retirement plans or other arrangements subject to the U.S. Employee Retirement Income Security Act of 1974 or Section 4975 of the Internal Revenue Code of 1986. See "ERISA Considerations" in part B of this prospectus.

Book-Entry Registration

The Class A notes will be initially issued in book-entry form only. Persons acquiring beneficial ownership of interests in the Class A notes will hold their interests through the Depository Trust Company in the United States or Clearstream, Luxembourg or Euroclear outside of the United States. Transfers within the Depository Trust Company, Clearstream, Luxembourg or Euroclear will be in accordance with the usual rules and operating procedures of the relevant system. Crossmarket transfers

A-18

between persons holding directly or indirectly through the Depository Trust Company, on the one hand, and persons holding directly or indirectly through Clearstream, Luxembourg or Euroclear, on the other hand, will take place in the Depository Trust Company through the relevant depositories of Clearstream, Luxembourg or Euroclear. See "Description of the Class A Notes—Form of the Class A Notes—Book Entry Registration" in part A of this prospectus and "Global Clearance and Settlement Procedures" in Appendix B to part B of this prospectus.

Ratings of the Class A Notes

It is a condition to the issuance of the Class A notes that they be rated "AAA" by Standard & Poor's Ratings Group, a division of the McGraw-Hill Companies Inc., "Aaa" by Moody's Investors Service, Inc. and "AAA" by Fitch Ratings. The security ratings of the Class A notes should be evaluated independently from similar ratings on other types of securities. A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the rating agencies. See "Ratings of the Class A Notes" in part A of this prospectus.

A-19

RISK FACTORS

The Class A notes are complex securities issued by a foreign entity and secured by mortgage loans on property located in a foreign jurisdiction. You should consider the following information which describes the principal risk factors of an investment in the Class A notes described in this prospectus. You should also read the detailed information set forth elsewhere in this prospectus.

General Structural Risks:

The Class A notes will be paid only from the assets of the trust and you may experience a loss if the assets of the trust are insufficient to repay the Class A notes. |

|

The Class A notes are debt obligations of the issuer trustee only in its capacity as trustee of the trust and do not represent an interest in or obligation of the issuer trustee in its individual capacity or of any other entity or party to this transaction. |

|

|

The assets of the trust will be the sole source of payments on the Class A notes. Therefore, if collections on the mortgage loans, amounts available under the support facilities and the other assets of the trust are insufficient to pay the interest and principal on your Class A notes when due, there will be no other source from which to receive these payments and you may not recover your entire investment or obtain the yield on your investment you expected to. |

|

|

If the interest and income collections during a collection period are insufficient to cover fees and expenses of the trust and the interest payments due on the Class A notes on the next payment date, the issuer trustee will make a principal draw. If the amounts available under principal draws are insufficient for this purpose, the issuer trustee may request an advance under the liquidity facility towards meeting such fees, expenses and interest. In the event that there is not enough money available by principal draws or under the liquidity facility, you may not receive a full payment of interest on that payment date, which will reduce the yield on your Class A notes. |

| | | | | |

A-20

The servicer may commingle collections on the mortgage loans with its assets which may lead to losses on your Class A notes. |

|

Before the servicer remits collections to the collections account, the collections may be commingled with the assets of the servicer. With some exceptions, the servicer may remit collections to the collections account on a quarterly basis. See "Description of the Class A Notes—Collections; Distributions on the Class A Notes" in part A of this prospectus. If the servicer becomes insolvent, the issuer trustee may only be able to claim those collections as an unsecured creditor of the insolvent company. This could lead to a failure to receive the collections on the mortgage loans, delays in receiving the collections, or losses to you. |

Losses and delinquent payments on the mortgage loans may affect the return on your Class A notes. |

|

Unlike the case in most securitizations of U.S. mortgage loans, if borrowers fail to make payments of interest and principal under the mortgage loans when due, the servicer has no obligation to make advances to cover the delinquent payment. However, under the liquidity facility provided in this transaction, the liquidity facility provider does cover shortfalls in interest and income collections on the mortgage loans available to pay interest on the Class A notes up to a specified limit. Accordingly, if the liquidity enhancement described in this prospectus is insufficient to protect your Class A notes from the borrowers' failure to pay, then the issuer trustee may not have enough funds to make full payments of interest due on your Class A notes. Consequently, the yield on your Class A notes could be lower than you expect and you could suffer losses. |

|

|