UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21656

Name of Fund: BlackRock Energy and Resources Trust (BGR)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Energy and Resources Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 10/31/2013

Date of reporting period: 10/31/2013

Item 1 – Report to Stockholders

OCTOBER 31, 2013

„ BlackRock Dividend Income Trust (BQY)

„ BlackRock EcoSolutions Investment Trust (BQR)

„ BlackRock Energy and Resources Trust (BGR)

„ BlackRock Enhanced Capital and Income Fund, Inc. (CII)

„ BlackRock Enhanced Equity Dividend Trust (BDJ)

„ BlackRock Global Opportunities Equity Trust (BOE)

„ BlackRock Health Sciences Trust (BME)

„ BlackRock International Growth and Income Trust (BGY)

„ BlackRock Real Asset Equity Trust (BCF)

„ BlackRock Resources & Commodities Strategy Trust (BCX)

„ BlackRock Utility and Infrastructure Trust (BUI)

| | |

| Not FDIC Insured ¡ May Lose Value ¡ No Bank Guarantee | | |

BlackRock Dividend Income Trust’s (BQY), BlackRock EcoSolutions Investment Trust’s (BQR), BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Global Opportunities Equity Trust’s (BOE), BlackRock Health Sciences Trust’s (BME), BlackRock International Growth and Income Trust’s (BGY), BlackRock Real Asset Equity Trust’s (BCF), BlackRock Resources & Commodities Strategy Trust’s (BCX) and BlackRock Utility and Infrastructure Trust’s (BUI) (each, a “Trust” and collectively, the “Trusts”), reported amounts and sources of distributions are estimates and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during the year and may be subject to changes based on the tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will explain the character of these dividends and distributions for federal income tax purposes.

October 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Cumulative Distributions

for the Fiscal Year | | % Breakdown of the Total Cumulative

Distributions for the Fiscal Year |

| | | Net

Investment

Income | | | Net Realized

Capital Gains

Short-Term | | | Net Realized

Capital Gains

Long-Term | | | Return of Capital | | | Total Per

Common Share | | Net

Investment

Income | | Net Realized

Capital Gains

Short-Term | | Net Realized

Capital Gains

Long-Term | | Return

of

Capital | | Total Per

Common Share |

BQY | | $ | 0.258759 | | | $ | 0.169464 | | | $ | 0.511777 | | | | — | | | $0.940000 | | 28% | | 18% | | 54% | | 0% | | 100% |

BQR* | | $ | 0.092232 | | | | — | | | | — | | | $ | 0.624768 | | | $0.717000 | | 13% | | 0% | | 0% | | 87% | | 100% |

BGR | | $ | 0.138553 | | | $ | 1.077085 | | | $ | 0.404362 | | | | — | | | $1.620000 | | 9% | | 66% | | 25% | | 0% | | 100% |

CII* | | $ | 0.303164 | | | | — | | | | — | | | $ | 0.896836 | | | $1.200000 | | 25% | | 0% | | 0% | | 75% | | 100% |

BDJ* | | $ | 0.169986 | | | | — | | | | — | | | $ | 0.390014 | | | $0.560000 | | 30% | | 0% | | 0% | | 70% | | 100% |

BOE* | | $ | 0.114145 | | | | — | | | | — | | | $ | 1.132455 | | | $1.246600 | | 9% | | 0% | | 0% | | 91% | | 100% |

BME | | $ | 0.135759 | | | $ | 1.693346 | | | $ | 0.558395 | | | | — | | | $2.387500 | | 6% | | 71% | | 23% | | 0% | | 100% |

BGY* | | $ | 0.123834 | | | | — | | | | — | | | $ | 0.547566 | | | $0.671400 | | 18% | | 0% | | 0% | | 82% | | 100% |

BCF* | | $ | 0.103393 | | | | — | | | | — | | | $ | 0.782607 | | | $0.886000 | | 12% | | 0% | | 0% | | 88% | | 100% |

BCX* | | $ | 0.226657 | | | | — | | | | — | | | $ | 0.933343 | | | $1.160000 | | 20% | | 0% | | 0% | | 80% | | 100% |

BUI* | | $ | 0.495558 | | | $ | 0.007714 | | | $ | 0.346901 | | | $ | 0.599827 | | | $1.450000 | | 34% | | 1% | | 24% | | 41% | | 100% |

| | * | Certain Trusts estimate they have distributed more than the amount of earned income and net realized gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with ‘yield’ or ‘income.’ |

Section 19(a) notices for each Trust, as applicable, are available on the BlackRock website http://www.blackrock.com.

The Trusts, acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees/Directors (the “Board”), each have adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a quarterly basis:

| | | | | | | | | | |

| | | Exchange Symbol | | | | | Amount Per Common Share | | | |

| | BQY | | | | | $0.230000 | | | |

| | BQR | | | | | $0.179250 | | | |

| | BGR | | | | | $0.405000 | | | |

| | CII | | | | | $0.300000 | | | |

| | BDJ | | | | | $0.140000 | | | |

| | BOE | | | | | $0.311650 | | | |

| | BME | | | | | $0.384375 | | | |

| | BGY | | | | | $0.167850 | | | |

| | BCF | | | | | $0.221500 | | | |

| | BCX | | | | | $0.290000 | | | |

| | | BUI | | | | | $0.362500 | | | |

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a quarterly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each quarterly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Trusts to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate a Trust’s Plan without prior notice if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to each Trust’s prospectus for a more complete description of its risks.

| | | | | | |

| 2 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 3 |

Dear Shareholder

Financial markets were volatile as 2012 drew to a close, with investors growing increasingly concerned over the possible implementation of pre-mandated tax increases and spending cuts known as the “fiscal cliff.” However, a last-minute tax deal averted the potential crisis and allowed markets to get off to a strong start in 2013. Money that had been pulled to the sidelines amid year-end tax-rate uncertainty poured back into the markets in January. Key indicators signaling modest but broad-based improvements in the world’s major economies, coupled with the absence of negative headlines from Europe, fostered an aura of comfort for investors. Global equities surged, while rising US Treasury yields pressured high quality fixed income assets. (Bond prices fall when yields rise.)

Global economic momentum slowed in February, however, and the pace of the rally moderated. In the months that followed, US stocks outperformed international stocks, as America showed greater stability compared to most other regions. Slow, but positive, growth was sufficient to support corporate earnings, while uncomfortably high unemployment reinforced expectations that the Federal Reserve would keep its asset purchase program intact and interest rates low. International markets experienced higher levels of volatility given a resurgence of political instability in Italy, a severe banking crisis in Cyprus and a generally poor outlook for European economies, many of which were mired in recession. Emerging markets significantly lagged the rest of the world as growth in these economies, particularly in China and Brazil, fell short of expectations.

In May, the Fed Chairman commented on the possibility of beginning to gradually reduce – or “taper” — the central bank’s asset purchase program before the end of 2013. Investors around the world retreated from higher risk assets in response. Markets rebounded in late June when the tone of the US central bank turned more dovish, and improving economic indicators and better corporate earnings helped extend gains through July.

Markets slumped again in August as investors became wary of looming macro risks. Mixed economic data stirred worries about global growth and uncertainty about when and how much the Fed would scale back on stimulus. Also weighing on investors’ minds was the escalation of the revolution in Egypt and the civil war in Syria, both of which fueled higher oil prices, an additional headwind for global economic growth.

September was surprisingly positive for investors, thanks to the easing of several key risks. Most important, the Fed defied market expectations with its decision to delay tapering. Additionally, the more hawkish candidate to become the next Fed Chairman, Larry Summers, withdrew from the race. On the geopolitical front, turmoil in Egypt and Syria subsided. In Europe, the re-election of Angela Merkel as Chancellor of Germany was welcomed as a continuation of the status quo. High levels of volatility returned in late September when the Treasury Department warned that the US national debt would breach its statutory maximum soon after Oct. 17. Political brinksmanship led to a partial government shutdown, roiling global financial markets through the first half of October, but the rally quickly resumed with a last-minute compromise to reopen the government and extend the debt ceiling until early 2014.

Though periods of heightened uncertainty drove high levels of market volatility over the past year, riskier asset classes generally outperformed lower-risk investments. Developed market equities generated the highest returns for the 6-and 12-month periods ended Oct. 31, with particular strength coming from US small-cap stocks. Emerging markets posted smaller, albeit positive returns after struggling with slowing growth and weakening currencies in the first half of 2013. Rising interest rates resulted in poor performance for US Treasury bonds and other higher-quality sectors such as tax-exempt municipals and investment grade corporate bonds. High yield bonds, on the other hand, moved higher as income-oriented investors sought meaningful returns in the low-rate environment. Short-term interest rates remained near zero, keeping yields on money market securities near historical lows.

At BlackRock, we believe investors need to think globally and extend their scope across a broader array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit www.blackrock.com for further insight about investing in today’s world.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“Though periods of heightened uncertainty drove high levels of market volatility over the past year, riskier asset classes generally outperformed lower-risk investments.”

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of October 31, 2013 | |

| | | 6-month | | | 12-month | |

US large cap equities

(S&P 500® Index) | | | 11.14 | % | | | 27.18 | % |

US small cap equities

(Russell 2000® Index) | | | 16.90 | | | | 36.28 | |

International equities

(MSCI Europe, Australasia, Far East Index) | | | 8.53 | | | | 26.88 | |

Emerging market equities

(MSCI Emerging Markets Index) | | | 1.18 | | | | 6.53 | |

3-month Treasury bill

(BofA Merrill Lynch

3-Month Treasury

Bill Index) | | | 0.03 | | | | 0.09 | |

US Treasury securities

(BofA Merrill Lynch

10- Year US Treasury

Index) | | | (6.07 | ) | | | (4.64 | ) |

US investment grade

bonds (Barclays US

Aggregate Bond Index) | | | (1.97 | ) | | | (1.08 | ) |

Tax-exempt municipal

bonds (S&P Municipal Bond Index) | | | (3.63 | ) | | | (1.69 | ) |

US high yield bonds

(Barclays US Corporate

High Yield 2% Issuer

Capped Index) | | | 1.50 | | | | 8.86 | |

|

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | | | | | |

| 4 | | THIS PAGE NOT PART OF YOUR TRUST REPORT | | | | |

| | |

| The Benefits and Risks of Option Over-Writing | | |

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue this goal primarily by investing in a portfolio of equity securities and utilizing an option over-writing strategy in an effort to enhance distribution yield and total return performance. However, these objectives cannot be achieved in all market conditions.

The Trusts primarily write single stock covered call options, and may also from time to time write single stock put options. When writing (selling) a covered call option, the Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trusts receive cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trusts. During the option term, the counterparty will elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust will be obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received will increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trusts will realize gains equal to the premiums received.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by the Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty will result in a sale below the current market value and will result in a gain or loss being realized by the Trust; and writing covered call options limits the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Each Trust employs a plan to support a level distribution of income, capital gains and/or return of capital. The goal of the plan is to provide shareholders with consistent and predictable cash flows by setting distribution rates based on expected long-term returns of the Trusts. Such distributions, under certain circumstances, may exceed a Trust’s total return performance. When total distributions exceed total return performance for the period, the difference will reduce the Trust’s total assets and net asset value per share (“NAV”) and, therefore, could have the effect of increasing the Trust’s expense ratio and reducing the amount of assets the Trust has available for long term investment. In order to make these distributions, a Trust may have to sell portfolio securities at less than opportune times.

The final tax characterization of distributions is determined after the fiscal year and is reported in the Trust’s annual report to shareholders. Distributions will be characterized as ordinary income, capital gains and/or return of capital. The Trust’s taxable net investment income or net realized capital gains (“taxable income”) may not be sufficient to support the level of distributions paid. To the extent that distributions exceed the Trust’s current and accumulated earnings and profits, the excess may be treated as a non-taxable return of capital. Distributions that exceed a Trust’s taxable income but do not exceed the Trust’s current and accumulated earnings and profits, may be classified as ordinary income which are taxable to shareholders.

A return of capital distribution does not necessarily reflect a Trust’s investment performance and should not be confused with ‘yield’ or ‘income.’ A return of capital is a return of a portion of an investor’s original investment. A return of capital is not taxable, but it reduces a shareholder’s tax basis in his or her shares, thus reducing any loss or increasing any gain on a subsequent disposition by the shareholder of his or her shares. It is possible that a substantial portion of the distributions paid during a calendar year may ultimately be classified as return of capital for income tax purposes when the final determination of the source and character of the distributions is made.

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option will expire and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 5 |

| | | | |

| Trust Summary as of October 31, 2013 | | | BlackRock Dividend Income Trust | |

BlackRock Dividend Income Trust’s (BQY) (the “Trust”) investment objective is to provide total return through a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing primarily in equity securities of issuers that pay above-average dividends and have the potential for capital appreciation. The Trust invests, under normal market conditions, at least 80% of its assets in equity securities that pay dividends. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust utilizes an option writing (selling) strategy to enhance dividend yield.

The Board approved a change to the Trust’s non-fundamental investment policies on June 4, 2013. Please refer to page 150 in the Additional Information section. In addition, on July 30, 2013, the Board approved a change to the Trust’s name from “BlackRock S&P Quality Rankings Global Equity Managed Trust” to “BlackRock Dividend Income Trust.” The name change became effective on August 13, 2013.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2013, the Trust returned 12.18% based on market price and 15.50% based on NAV. For the same period, the MSCI World Value Index returned 27.26%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust underperformed the benchmark index due to its option overwrite strategy, which is utilized to generate income. During the period, the option overwrite limited the Trust’s ability to capture price appreciation on its underlying portfolio holdings in the strong equity market while the benchmark index has no option component. Also detracting from the Trust’s performance was a combination of stock selection and a substantial underweight in the financials sector. Security selection within consumer staples, information technology (“IT”) and consumer discretionary hurt returns as the Trust held a bias toward higher-quality stocks, which did not perform as well as the broader equity market. Security selection within industrials and health care detracted from performance as well. At a broad level, while the Trust’s sector allocations contributed positively to results for the period, security selection hurt relative performance due to owning higher-capitalized, stronger companies which tended to lag their lower-quality counterparts during the period. |

| Ÿ | | Contributing positively to relative performance was the Trust’s underweight position in the energy sector and a combination of an underweight and strong stock selection in the materials sector. Overweight allocations to IT, consumer discretionary and industrials also had a positive impact on returns for the period. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, portfolio turnover ultimately remained very low. However, the Trust removed some of its Canadian bank holdings and reduced some of its materials and industrials positions given the prospect of slowing growth in emerging markets, where many of these companies have higher degrees of exposure. The Trust added to other, more attractively valued companies within the consumer discretionary, consumer staples, utilities and health care sectors given a more positive outlook for these stocks in the global economic environment. |

Describe Trust positioning at period end.

| Ÿ | | The investment advisor continues to maintain the view that dividend income is essential for total return, and that the prospect for dividend growth among U.S. multinational companies presents a unique investment opportunity in today’s marketplace. |

| Ÿ | | As of period end, the Trust was positioned to perform well in a wide range of economic scenarios. The Trust’s holdings emphasized companies that carry a diverse group of assets, have extensive customer bases among both retail and institutional clients, and lower sensitivity to broad changes in macroeconomic variables. By taking less factor-specific risk, the Trust typically maintains a lower volatility than the market, but remains able to capture upside as equity markets and the broader economy gain momentum. Owning companies that can participate in all parts of the economic cycle helps prepare the Trust for less certain times. The Trust continued to search for brand leadership and industry dominance in its investments with a preference for companies with the number one or number two products on the shelf in terms of market share. The Trust was also positioned to benefit from a shift in market leadership from lower-capitalized stocks to larger-capitalized stocks, while continuing to emphasize growth of income, relative protection and long-term total return as the core of its investment process. Overall, the Trust remained well-insulated, but poised to participate should markets continue to experience gains. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 6 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |

| | | | |

| | | | BlackRock Dividend Income Trust | |

| | |

Symbol on New York Stock Exchange (“NYSE”) MKT | | BQY |

Initial Offering Date | | May 28, 2004 |

Current Distribution Rate on Closing Market Price as of October 31, 2013 ($12.84)1 | | 7.17% |

Current Quarterly Distribution per Common Share2 | | $0.23 |

Current Annualized Distribution per Common Share2 | | $0.92 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a tax return of capital. See the financial highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain. |

|

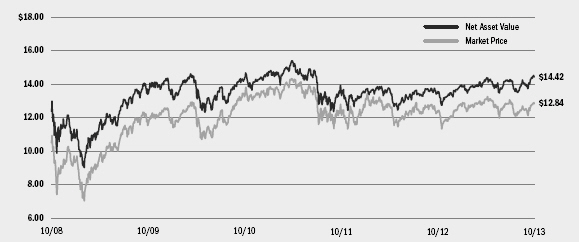

| Market Price and Net Asset Value Per Share Summary |

| | | | | | | | | | | | | | | | | | | | |

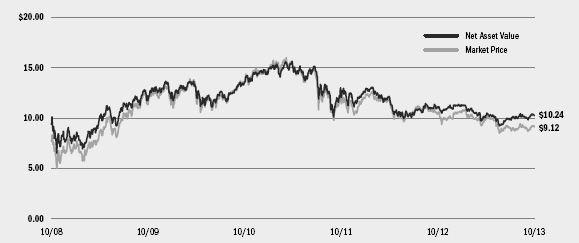

| | | 10/31/13 | | | 10/31/12 | | | Change | | | High | | | Low | |

Market Price | | $ | 12.84 | | | $ | 12.34 | | | | 4.05 | % | | $ | 13.27 | | | $ | 11.04 | |

Net Asset Value | | $ | 14.42 | | | $ | 13.46 | | | | 7.13 | % | | $ | 14.51 | | | $ | 12.73 | |

|

| Market Price and Net Asset Value History For the Past Five Years |

| | |

| Overview of the Trust’s Long-Term Investments |

| | | | | |

| Ten Largest Holdings | | 10/31/13 |

Exxon Mobil Corp. | | | | 3 | % |

AT&T Inc. | | | | 3 | |

Chevron Corp. | | | | 2 | |

Bristol-Myers Squibb Co. | | | | 2 | |

The Walt Disney Co. | | | | 2 | |

Emerson Electric Co. | | | | 2 | |

General Mills, Inc. | | | | 2 | |

Total SA - ADR | | | | 2 | |

Pfizer, Inc. | | | | 2 | |

Altria Group, Inc. | | | | 2 | |

| | | | | | | | | | |

| Sector Allocation | | 10/31/13 | | 10/31/12 |

Financials | | | | 20 | % | | | | 20 | % |

Consumer Staples | | | | 14 | | | | | 11 | |

Industrials | | | | 12 | | | | | 11 | |

Health Care | | | | 11 | | | | | 10 | |

Energy | | | | 11 | | | | | 12 | |

Consumer Discretionary | | | | 8 | | | | | 7 | |

Utilities | | | | 7 | | | | | 9 | |

Information Technology | | | | 7 | | | | | 8 | |

Telecommunication Services | | | | 6 | | | | | 8 | |

Materials | | | | 4 | | | | | 4 | |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 7 |

| | | | |

| Trust Summary as of October 31, 2013 | | | BlackRock EcoSolutions Investment Trust | |

BlackRock EcoSolutions Investment Trust’s (BQR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in equity securities issued by companies that are engaged in one or more of New Energy (e.g., products, technologies and services connected to the efficient use of energy or the provision or manufacture of alternative forms of energy), Water Resources and Agriculture business segments. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust utilizes an option writing (selling) strategy to enhance dividend yield.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2013, the Trust returned (0.34)% based on market price and 9.08% based on NAV. For the same period, the closed-end Lipper Utility Funds category posted an average return of 10.94% based on market price and 16.90% based on NAV. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust’s exposure to certain water utilities drove positive returns for the period, with strong performance from Aqua America, Inc., American States Water Co. and Severn Trent Plc. Exposure to industrial machinery stocks also had a positive impact on results as the Trust’s positions in Pentair Ltd. and Xylem, Inc. performed particularly well. The Trust benefited from holding companies with exposure to alternative fuels such as Archer-Daniels Midland Co. and Novozymes A/S as these stocks added significantly to returns for the period. Gains from the Trust’s option writing strategy had a positive impact on performance for the period. |

| Ÿ | | Detracting from performance were the Trust’s holdings of fertilizer and diversified chemicals names including Potash Corp. of Saskatchewan, Inc., Agrium, Inc. and K+S AG. The stocks declined on the back of weakness in the potash industry (a fertilizer product) partly driven by the news that the major Russian potash producer Uralkali plans to exit the Belorussian Potash Co. (i.e., the “BPC,” one of the key marketing groups for the commodity), which may potentially result in increased competition and |

| | | have an impact on potash prices. Certain water utility positions detracted from performance including Manila Water Co., Inc., Sabesp and Cia de Saneamento de Minas Gerais — COPASA. Sabesp and Cia de Saneamento de Minas Gerais — COPASA, both Brazilian water utilities, have underperformed given the potential negative impact that recent political issues in Brazil may have on near-term earnings growth and cash flow. In addition, the Trust held an elevated cash balance as a means of defensive positioning given near-term uncertainty about the market outlook. The Trust’s cash position had a modestly negative impact on performance as equities generally advanced. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Trust added a position in Tyson Foods, Inc. and exited a position in CNH Global NV within agriculture. In new energy, the Trust initiated positions in TransCanada Corp. and Chicago Bridge & Iron Co. NV and sold American Superconductor Corp. There were no significant positioning changes in the water space given the long-term nature of the investment advisor’s outlook for this segment. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Trust continued to hold large allocations to both the water and agriculture segments and less emphasis on new energy, which is reflective of the relative outlooks and valuations for each of these segments. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 8 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |

| | |

| | | BlackRock EcoSolutions Investment Trust |

| | |

| Trust Information | | |

Symbol on NYSE | | BQR |

Initial Offering Date | | September 28, 2007 |

Current Distribution Rate on Closing Market Price as of October 31, 2013 ($7.93)1 | | 9.04% |

Current Quarterly Distribution per Common Share2 | | $0.17925 |

Current Annualized Distribution per Common Share2 | | $0.71700 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a tax return of capital. See the financial highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain. |

| | | | | | | | | | | | | | | | | | | | |

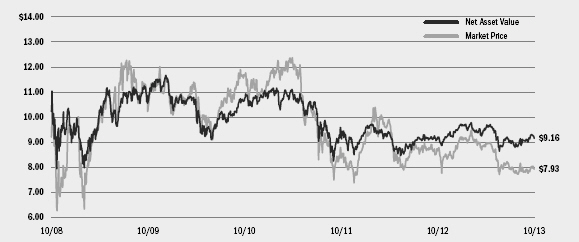

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | | | | | | | | | | | |

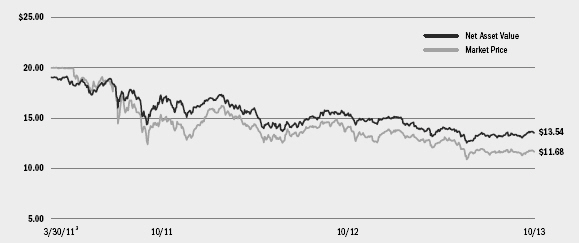

| | | 10/31/13 | | | 10/31/12 | | | Change | | | High | | | Low | |

Market Price | | $ | 7.93 | | | $ | 8.66 | | | | (8.43 | )% | | $ | 9.48 | | | $ | 7.59 | |

Net Asset Value | | $ | 9.16 | | | $ | 9.14 | | | | 0.22 | % | | $ | 9.78 | | | $ | 8.65 | |

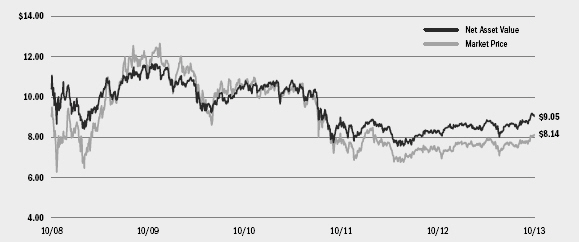

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | | | | |

| Ten Largest Holdings | | 10/31/13 |

Monsanto Co. | | | | 4 | % |

Severn Trent PLC | | | | 3 | |

Manila Water Co., Inc. | | | | 3 | |

Syngenta AG | | | | 3 | |

Aqua America, Inc. | | | | 3 | |

Sao Martinho SA | | | | 3 | |

Bunge Ltd. | | | | 3 | |

Inversiones Aguas Metropolitanas SA | | | | 3 | |

Agrium, Inc. | | | | 2 | |

BrasilAgro - Co. Brasileira de Propriedades Agricolas | | | | 2 | |

| | | | | | | | | | |

| Industry Allocation | | 10/31/13 | | 10/31/12 |

Water Utilities | | | | 26 | % | | | | 25 | % |

Chemicals | | | | 20 | | | | | 22 | |

Food Products | | | | 13 | | | | | 14 | |

Machinery | | | | 12 | | | | | 12 | |

Electric Utilities | | | | 4 | | | | | 4 | |

Electrical Equipment | | | | 4 | | | | | 3 | |

Other3 | | | | 21 | | | | | 20 | |

| 3 | Other includes a 3% holding or less in each of the following industries; Oil, Gas & Consumable Fuels, Real Estate Investment Trusts (REITs), Multi-Utilities, Commercial Services & Supplies, Construction & Engineering, Electronic Equipment, Instruments & Components, Biotechnology, Auto Components, Independent Power Producers & Energy Traders, Semiconductors & Semiconductor Equipment, Road & Rail, Real Estate Management & Development, Building Products, Paper & Forest Products and Metals & Mining. |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 9 |

| | | | |

| Trust Summary as of October 31, 2013 | | | BlackRock Energy and Resources Trust | |

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust utilizes an option writing (selling) strategy to enhance dividend yield.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2013, the Trust returned 17.70% based on market price and 23.68% based on NAV. For the same period, the closed-end Lipper Natural Resources Funds category posted an average return of 9.25% based on market price and 14.45% based on NAV. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | Exposure to oil & gas exploration & production companies, the Trust’s largest industry allocation, was the primary driver of positive returns for the period. The strong performance of this industry was supported by a series of promising results from drilling in the Utica and Marcellus shale regions as well as the Permian basin. Holdings in U.S.-based companies Gulfport Energy Corp., Pioneer Natural Resources Co. and EQT Corp. were among the Trust’s strongest individual performers. Gains from the Trust’s option writing strategy had a positive impact on performance for the period. |

| Ÿ | | Detracting from performance was the Trust’s exposure to precious metal equities. Gold and silver were subjected to heavy selling pressure in |

| | | 2013 as market participants anticipated a reduction in monetary stimulus from the Federal Reserve. Particularly poor performers amid falling metal prices were the Trust’s positions in Silver Wheaton Corp., a silver streaming company, and Goldcorp, Inc., a major gold producer. Also detracting from results was the Trust’s holding in exploration & production company Energy XXI (Bermuda) Ltd., which encountered operational challenges relating to its deep-water activity in the Gulf of Mexico. The Trust sold this position during the period. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Trust reduced exposure to companies involved in the production of non-energy related products, most notably metal and mining shares, in order to maintain a focus on traditional energy companies. The overall number of holdings in the Trust decreased during the period, resulting in fewer, higher-conviction positions. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Trust’s positioning reflected a preference for energy exploration and production companies and integrated oil & gas names, with smaller exposure to oil services. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 10 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |

| | |

| | | BlackRock Energy and Resources Trust |

| | |

| Trust Information | | |

Symbol on NYSE | | BGR |

Initial Offering Date | | December 29, 2004 |

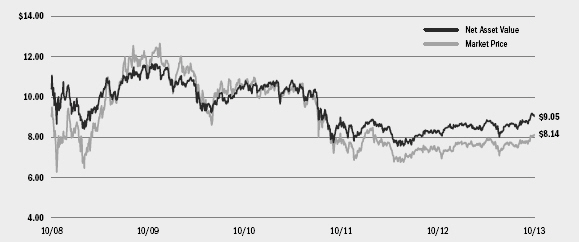

Current Distribution Rate on Closing Market Price as of October 31, 2013 ($26.82)1 | | 6.04% |

Current Quarterly Distribution per Common Share2 | | $0.405 |

Current Annualized Distribution per Common Share2 | | $1.620 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a tax return of capital. See financial highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain. |

| | | | | | | | | | | | | | | | | | | | |

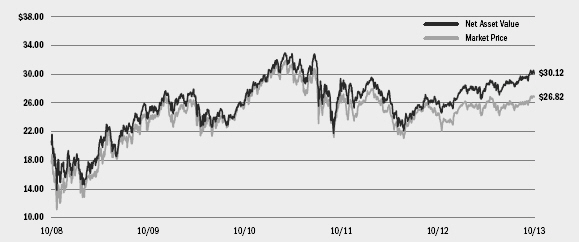

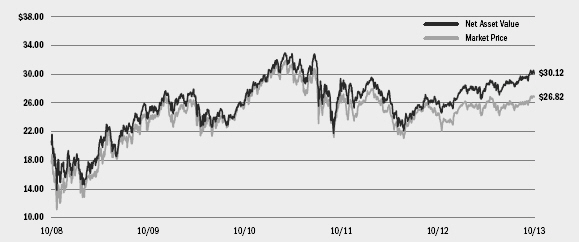

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | | | | | | | | | | | |

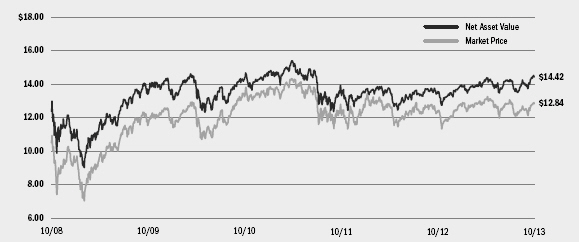

| | | 10/31/13 | | | 10/31/12 | | | Change | | | High | | | Low | |

Market Price | | $ | 26.82 | | | $ | 24.28 | | | | 10.46 | % | | $ | 27.07 | | | $ | 21.78 | |

Net Asset Value | | $ | 30.12 | | | $ | 25.95 | | | | 16.07 | % | | $ | 30.58 | | | $ | 24.64 | |

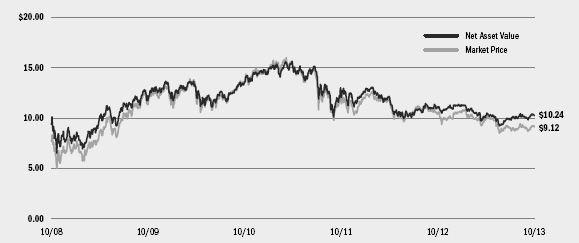

|

| Market Price and Net Asset Value History For the Past Five Years |

|

| Overview of the Trust’s Long-Term Investments |

| | | | | |

| Ten Largest Holdings | | 10/31/13 |

Chevron Corp. | | | | 9 | % |

Exxon Mobil Corp. | | | | 8 | |

Noble Energy, Inc. | | | | 6 | |

Schlumberger Ltd. | | | | 6 | |

ConocoPhillips | | | | 5 | |

Anadarko Petroleum Corp. | | | | 5 | |

Hess Corp. | | | | 5 | |

Halliburton Co. | | | | 4 | |

Whiting Petroleum Corp. | | | | 4 | |

EOG Resources, Inc. | | | | 4 | |

| | | | | | | | | | |

| Industry Allocation | | 10/31/13 | | 10/31/12 |

Oil, Gas & Consumable Fuels | | | | 83 | % | | | | 78 | % |

Energy Equipment & Services | | | | 17 | | | | | 16 | |

Metals & Mining | | | | — | | | | | 6 | |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 11 |

| | | | |

| Trust Summary as of October 31, 2013 | | | BlackRock Enhanced Capital and Income Fund, Inc. | |

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide investors with a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity and debt securities of US and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust utilizes an option writing (selling) strategy to enhance dividend yield.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2013, the Trust returned 14.11% based on market price and 18.97% based on NAV. For the same period, the benchmark S&P 500® Value Index returned 28.36%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust underperformed the benchmark index due to its option overwrite strategy, which is utilized to generate income. During the period, the option overwrite limited the Trust’s ability to capture price appreciation on its underlying portfolio holdings in the strong equity market while the benchmark index has no option component. Additionally, stock selection hurt results in several sectors including financials, energy and health care. Specifically, within financials, an underweight to money center banks proved costly as this segment continued to recover. Also having a negative impact was exposure to real estate investment trust Annaly Capital Management, Inc., which came under pressure as rising interest rates pressured the book value of the company’s underlying holdings. |

| Ÿ | | Conversely, favorable sector positioning aided relative returns. Relative to the S&P 500® Value Index, the Trust’s underweight in utilities proved beneficial as the sector lagged the broader equity rally during the period. |

| | Overweight allocations to information technology (“IT”) and health care, leading sectors in the market rally, also had a positive impact on performance. Additionally, several of the Trust’s high-conviction holdings drove positive results, including Google, Inc., which continued to deliver strong growth with no signs of slowing down, as well as Sciences Applications International Corp. and American International Group, Inc., each of which moved higher on investors’ reactions to their shareholder-friendly business restructuring. |

Describe recent portfolio activity.

| Ÿ | | Sector weightings in the Trust are generally a result of individual stock selection. Within that context, the Trust nearly doubled its weighting in IT while nearly eliminating exposure to utilities during the 12-month period. While other sector weightings were relatively unchanged, a number of the stocks held in the Trust were sold and replaced with new positions. Overall, the number of securities held by the Trust decreased, resulting in greater weightings of the Trust’s high-conviction positions. |

Describe portfolio positioning at period end.

| Ÿ | | Relative to the S&P 500® Value Index, the Trust ended the period overweight within IT, along with modest overweights in consumer discretionary, health care, materials and telecommunication services. In contrast, the Trust was dramatically underweight in utilities, industrials and financials. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 12 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |

| | |

| | | BlackRock Enhanced Capital and Income Fund, Inc. |

| | |

| Trust Information | | |

Symbol on NYSE | | CII |

Initial Offering Date | | April 30, 2004 |

Current Distribution Rate on Closing Market Price as of October 31, 2013 ($13.52)1 | | 8.88% |

Current Quarterly Distribution per Common Share2 | | $0.30 |

Current Annualized Distribution per Common Share2 | | $1.20 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a tax return of capital. See financial highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain. |

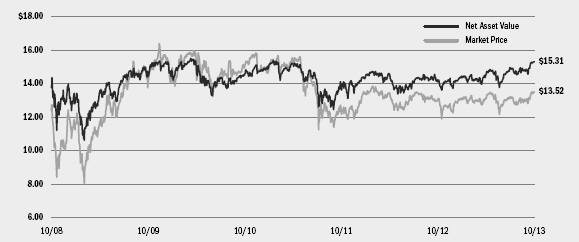

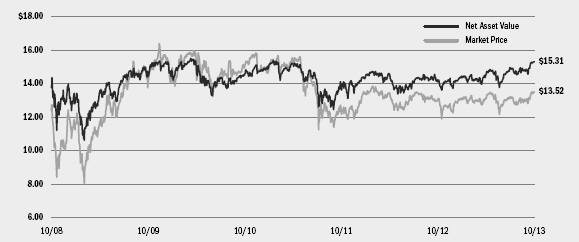

| | | | | | | | | | | | | | | | | | | | |

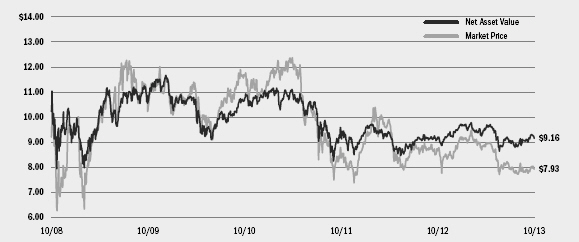

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | | | | | | | | | | | |

| | | 10/31/13 | | | 10/31/12 | | | Change | | | High | | | Low | |

Market Price | | $ | 13.52 | | | $ | 12.99 | | | | 4.08 | % | | $ | 13.57 | | | $ | 11.80 | |

Net Asset Value | | $ | 15.31 | | | $ | 14.11 | | | | 8.50 | % | | $ | 15.31 | | | $ | 13.62 | |

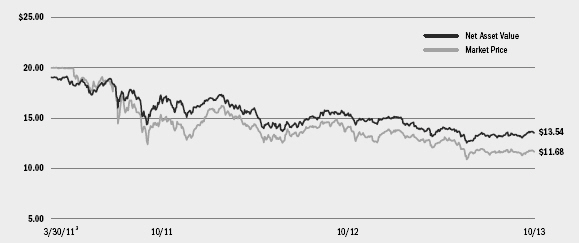

| | | | | | | | | | |

| Market Price and Net Asset Value History For the Past Five Years | | | | | | | | | | |

|

| Overview of the Trust’s Long-Term Investments |

| | | | | |

| Ten Largest Holdings | | 10/31/13 |

Google, Inc., Class A | | | | 6 | % |

American International Group, Inc. | | | | 6 | |

Japan Airlines Co. Ltd. | | | | 5 | |

Vodafone Group PLC - ADR | | | | 5 | |

CF Industries Holdings, Inc. | | | | 4 | |

Suncor Energy, Inc. | | | | 4 | |

Pfizer, Inc. | | | | 4 | |

UnitedHealth Group, Inc. | | | | 3 | |

Apple, Inc. | | | | 3 | |

JPMorgan Chase & Co. | | | | 3 | |

| | | | | | | | | | |

| Sector Allocation | | 10/31/13 | | 10/31/12 |

Information Technology | | | | 20 | % | | | | 12 | % |

Financials | | | | 18 | | | | | 22 | |

Health Care | | | | 14 | | | | | 12 | |

Energy | | | | 13 | | | | | 11 | |

Consumer Discretionary | | | | 11 | | | | | 8 | |

Industrials | | | | 7 | | | | | 10 | |

Consumer Staples | | | | 6 | | | | | 8 | |

Telecommunication Services | | | | 6 | | | | | 8 | |

Materials | | | | 5 | | | | | 4 | |

Utilities | | | | — | | | | | 5 | |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 13 |

| | |

| Trust Summary as of October 31, 2013 | | BlackRock Enhanced Equity Dividend Trust |

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by utilizing an option writing (selling) strategy to enhance distributions paid to the Trust’s shareholders. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2013, the Trust returned 12.09% based on market price and 15.11% based on NAV. For the same period, the Russell 1000® Value Index returned 28.29%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust underperformed the benchmark index due to its option overwrite strategy, which is utilized to generate income. During the period, the option overwrite limited the Trust’s ability to capture price appreciation on its underlying portfolio holdings in the strong equity market while the benchmark index has no option component. Also detracting from the Trust’s performance was a combination of an underweight position and stock selection within the financials sector. Stock selection within industrials and consumer discretionary had a negative impact on results as well. An underweight and stock selection in information technology (“IT”) hindered returns, as did an overweight and selection in consumer staples. Thematically, underweight positions at the individual stock level accounted for the majority of relative underperformance during the period. In many cases, the Trust was hurt by not owning lower-capitalized, lower-quality stocks represented in the benchmark index. |

| Ÿ | | Contributing positively to relative performance was the Trust’s underweight to the energy sector, specifically with respect to the oil, gas & consumable fuels industry. An overweight in the consumer discretionary sector, which was a strong performer during the period, also had a positive impact on results. An overweight position in industrials, particularly within the aerospace & defense industry, added substantially to relative returns during the period. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, portfolio turnover ultimately remained very low. However, some changes were made in financials, where the Trust |

| | | removed some of its Canadian bank holdings and added to other, more attractive industries within the sector, including regional banks and insurance companies. These changes resulted in an increased weighting in financials. Also during the period, the Trust exited some of its positions within materials and industrials given the prospect of slowing growth in emerging markets, where many of these companies have exposure. Lastly, the Trust exited positions in various utilities holdings during the period due to higher than normal valuations and uncertainty around future plans for some of the companies. |

Describe portfolio positioning at period end.

| Ÿ | | The investment advisor continues to maintain the view that dividend income is essential for total return, and that the prospect for dividend growth among U.S. multinational companies presents a unique investment opportunity in today’s marketplace. |

| Ÿ | | As of period end, the Trust was positioned to perform well in a wide range of economic scenarios. The Trust’s holdings emphasized companies that carry a diverse group of assets, have extensive customer bases among both retail and institutional clients, and lower sensitivity to broad changes in macroeconomic variables. By taking less factor-specific risk, the Trust typically maintains a lower volatility than the market, but remains able to capture upside as equity markets and the broader economy gain momentum. Owning companies that can participate in all parts of the economic cycle helps prepare the Trust for less certain times. The Trust continued to search for brand leadership and industry dominance in its investments with a preference for companies with the number one or number two products on the shelf in terms of market share. The Trust was also positioned to benefit from a shift in market leadership from lower-capitalized stocks to larger-capitalized stocks, while continuing to emphasize growth of income, relative protection and long-term total return as the core of its investment process. Overall, the Trust remained well-insulated, but poised to participate should markets continue to experience gains. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 14 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |

| | | | |

| | | | BlackRock Enhanced Equity Dividend Trust | |

| | |

| Trust Information | | |

Symbol on NYSE | | BDJ |

Initial Offering Date | | August 31, 2005 |

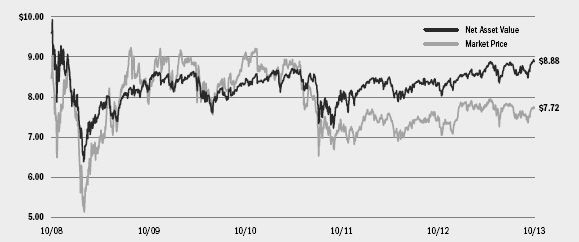

Current Distribution Rate on Closing Market Price as of October 31, 2013 ($7.72)1 | | 7.25% |

Current Quarterly Distribution per Common Share2 | | $0.14 |

Current Annualized Distribution per Common Share2 | | $0.56 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a tax return of capital. See financial highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain. |

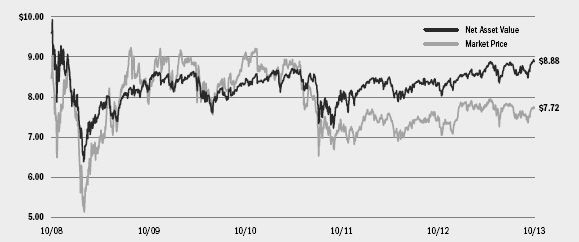

| | | | | | | | | | | | | | | | | | | | |

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | | | | | | | | | | | |

| | | 10/31/13 | | | 10/31/12 | | | Change | | | High | | | Low | |

Market Price | | $ | 7.72 | | | $ | 7.41 | | | | 4.18 | % | | $ | 8.02 | | | $ | 6.87 | |

Net Asset Value | | $ | 8.88 | | | $ | 8.30 | | | | 6.99 | % | | $ | 8.93 | | | $ | 8.03 | |

| | | | | | | | | | |

| Market Price and Net Asset Value History For the Past Five Years | | | | | | | | | | |

|

| Overview of the Trust’s Long-Term Investments |

| | | | | |

| Ten Largest Holdings | | 10/31/13 |

Chevron Corp. | | | | 3 | % |

Wells Fargo & Co. | | | | 3 | |

JPMorgan Chase & Co. | | | | 3 | |

General Electric Co. | | | | 3 | |

Comcast Corp., Special Class A | | | | 3 | |

Pfizer, Inc. | | | | 3 | |

The Home Depot, Inc. | | | | 2 | |

Exxon Mobil Corp. | | | | 2 | |

Verizon Communications, Inc. | | | | 2 | |

Merck & Co., Inc. | | | | 2 | |

| | | | | | | | | | |

| Sector Allocation | | 10/31/13 | | 10/31/12 |

Financials | | | | 21 | % | | | | 18 | % |

Energy | | | | 14 | | | | | 12 | |

Industrials | | | | 13 | | | | | 15 | |

Consumer Staples | | | | 12 | | | | | 13 | |

Consumer Discretionary | | | | 9 | | | | | 11 | |

Health Care | | | | 9 | | | | | 7 | |

Materials | | | | 7 | | | | | 5 | |

Utilities | | | | 6 | | | | | 10 | |

Information Technology | | | | 5 | | | | | 3 | |

Telecommunication Services | | | | 4 | | | | | 6 | |

For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 15 |

| | | | |

| Trust Summary as of October 31, 2013 | | | BlackRock Global Opportunities Equity Trust | |

BlackRock Global Opportunities Equity Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and utilizing an option writing (selling) strategy to enhance current gains. The Trust invests, under normal market conditions, at least 80% of its assets in equity securities or options on equity securities or indices or sectors of equity securities. Under normal circumstances, the Trust invests a substantial amount of its total assets in foreign issuers, issuers that primarily trade in a market located outside the United States or issuers that do a substantial amount of business outside the United States. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2013, the Trust returned 21.99% based on market price and 21.93% based on NAV. For the same period, the MSCI All Country World Index posted a return of 23.29%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust’s allocation to cash during a period of strong, rising equity markets was the largest detractor from performance relative to the benchmark index, which has no cash component. From a sector perspective, positioning within consumer discretionary hindered results as weaker-than-expected store traffic and an increasingly competitive promotional environment impacted some of the Trust’s holdings in apparel retail. |

| Ÿ | | Contributing positively to the Trust’s performance was favorable stock selection across nine of the ten sectors in the benchmark index, most notably within information technology (“IT”), industrials and consumer staples. In IT, a position in Facebook, Inc. drove positive results as the stock moved higher due to increased monetization of its mobile platform. Within industrials, positioning in companies such as Hino Motors benefited from Japan’s aggressive reflationary policies. Notable contributors in consumer staples included The Hain Celestial Group, Inc., |

| | | which benefited from increased demand for organic and natural food products, and Smithfield Foods, as the company was acquired for a premium by Shuagnhui International Holdings (which is not owned by the Trust). Gains from the Trust’s option writing strategy had a positive impact on performance for the period. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Trust reduced exposure to defensive-oriented areas such as utilities and consumer staples due to concerns about the potential negative impact of rising interest rates on these sectors. These reductions funded increased allocations to the industrials and consumer discretionary sectors, adding particularly to holdings deemed likely to benefit from a recovery in European economic growth. On a regional basis, the Trust reduced exposure to emerging markets and added to developed Europe. |

Describe portfolio positioning at period end.

| Ÿ | | At period end, the Trust’s positioning reflected a positive outlook for the world economy. The Trust’s regional positioning was consistent with the view that Europe and Japan look the most attractive given their improving growth dynamics in addition to the recent outperformance of developed versus emerging markets. However, the Trust continued to explore and identify emerging market opportunities, albeit on tactical basis given the ongoing structural challenges faced by many of these countries. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 16 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |

| | | | |

| | | | BlackRock Global Opportunities Equity Trust | |

| | |

| Trust Information | | |

Symbol on NYSE | | BOE |

Initial Offering Date | | May 31, 2005 |

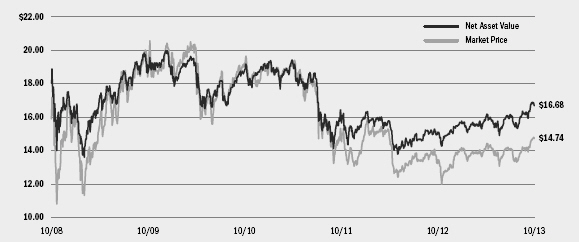

Current Distribution Rate on Closing Market Price as of October 31, 2013 ($14.74)1 | | 8.46% |

Current Quarterly Distribution per Common Share2 | | $0.31165 |

Current Annualized Distribution per Common Share2 | | $1.24660 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a tax return of capital. See financial highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain. |

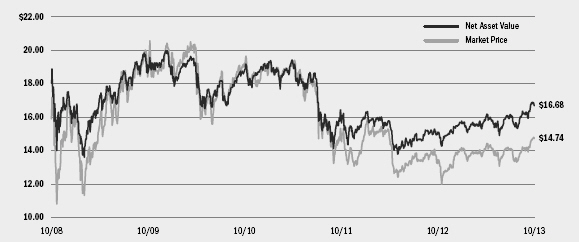

| | | | | | | | | | | | | | | | | | | | |

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | | | | | | | | | | | |

| | | 10/31/13 | | | 10/31/12 | | | Change | | | High | | | Low | |

Market Price | | $ | 14.74 | | | $ | 13.24 | | | | 11.33 | % | | $ | 14.83 | | | $ | 11.92 | |

Net Asset Value | | $ | 16.68 | | | $ | 14.99 | | | | 11.27 | % | | $ | 16.89 | | | $ | 14.27 | |

| | | | | | | | | | |

| Market Price and Net Asset Value History For the Past Five Years | | | | | | | | | | |

|

| Overview of the Trust’s Long-Term Investments |

| | | | | |

| Ten Largest Holdings | | 10/31/13 |

Google, Inc., Class A | | | | 3 | % |

Apple, Inc. | | | | 2 | |

Roche Holding AG | | | | 2 | |

Anheuser-Busch InBev NV | | | | 2 | |

Novartis AG | | | | 1 | |

Roper Industries, Inc. | | | | 1 | |

Facebook, Inc., Class A | | | | 1 | |

NH Hoteles SA | | | | 1 | |

Svenska Cellulosa AB, B Shares | | | | 1 | |

Daimler AG | | | | 1 | |

| | | | | | | | | | |

| Geographic Allocation | | 10/31/13 | | 10/31/12 |

United States | | | | 44 | % | | | | 47 | % |

United Kingdom | | | | 10 | | | | | 12 | |

France | | | | 8 | | | | | 4 | |

Japan | | | | 8 | | | | | 3 | |

Switzerland | | | | 5 | | | | | 2 | |

Other3 | | | | 25 | | | | | 32 | |

| 3 | Other includes a 5% holding or less in each of the following countries; Spain, Sweden, Hong Kong, Germany, Belgium, Russia, Italy, China, Ireland, Indonesia, Mexico, Australia, Norway, Netherlands, Brazil, Thailand, New Zealand, South Korea, Taiwan, Singapore, India, Cayman Islands, Bermuda, Canada and Argentina. |

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 17 |

| | | | |

| Trust Summary as of October 31, 2013 | | | BlackRock Health Sciences Trust | |

BlackRock Health Sciences Trust’s (BME) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust utilizes an option writing (selling) strategy to enhance dividend yield.

No assurance can be given that the Trust’s investment objective will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2013, the Trust returned 30.38% based on market price and 33.37% based on NAV. For the same period, the Russell 3000® Healthcare Index returned 36.06%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | As the Trust and the benchmark index generated strong positive returns for the period, there were few detractors from relative performance. The Trust’s positioning with the health care providers & services industry hindered results due to an underweight allocation to managed health care companies and stock selection within health care services. The Trust’s option writing strategy had a negative impact on performance for the period. |

| Ÿ | | The key contributor to the Trust’s positive relative performance was an overweight allocation and strong stock selection in the biotechnology industry. Several biotechnology holdings generated particularly strong returns driven primarily by clinical developments such as favorable drug trial results, regulatory approvals and the swift adoption of new products in the market place. The Trust also benefited from stock selection within pharmaceuticals, where an underweight to poor-performing |

| | | Merck & Co, Inc. aided results, as did overweight positions in strong performers including Roche Holding AG, Valeant Pharmaceuticals International, Inc. and Shire PLC. Stock selection within the health care equipment & supplies industry contributed positively as well. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Trust increased its overweight to biotechnology, while reducing its overweight to the health care providers & services industry with a focus on minimizing holdings with greater exposure to potential policy developments such as federal government budget reductions and subsequent health care reimbursement cuts. The Trust’s exposures to the pharmaceuticals and health care equipment & supplies industries remained generally unchanged over the period. |

Describe portfolio positioning at period end.

| Ÿ | | As of period end, the Trust continued to maintain a focus on innovative companies that seek to satisfy an unmet health care need or enhance current products or services. As a result, the Trust’s largest industry allocations continued to be pharmaceuticals and biotechnology. While policy uncertainty has diminished with the expected implementation of Health Care Reform, changes are still taking place due to austerity measures unfolding globally. As such, the Trust remained underweight in companies that would be at risk if government reimbursements were reduced. However, the new legislation is expected to benefit health care companies generally by creating increased consumer demand. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 18 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |

| | | | |

| | | | BlackRock Health Sciences Trust | |

| | |

| Trust Information | | |

Symbol on NYSE | | BME |

Initial Offering Date | | March 31, 2005 |

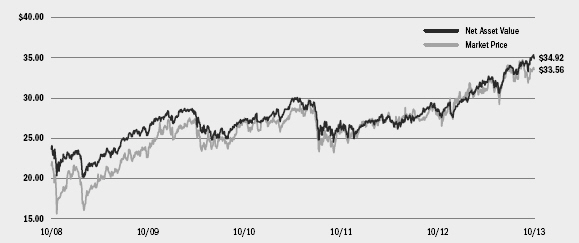

Current Distribution Rate on Closing Market Price as of October 31, 2013 ($33.56)1 | | 4.58% |

Current Quarterly Distribution per Common Share2 | | $0.384375 |

Current Annualized Distribution per Common Share2 | | $1.537500 |

| 1 | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a tax return of capital. See financial highlights for the actual sources and character of distributions. Past performance does not guarantee future results. |

| 2 | The quarterly distribution per common share, declared on December 9, 2013, was increased to $0.429975 per share. The current distribution rate on closing market price, current quarterly distribution per common share and current annualized distribution per common share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. A portion of the distribution may be deemed a tax return of capital or net realized gain. |

| | | | | | | | | | | | | | | | | | | | |

| Market Price and Net Asset Value Per Share Summary | | | | | | | | | | | | | | | | | | | | |

| | | 10/31/13 | | | 10/31/12 | | | Change | | | High | | | Low | |

Market Price | | $ | 33.56 | | | $ | 27.86 | | | | 20.46 | % | | $ | 34.97 | | | $ | 26.41 | |

Net Asset Value | | $ | 34.92 | | | $ | 28.34 | | | | 23.22 | % | | $ | 35.43 | | | $ | 27.59 | |

| | | | | | | | | | |

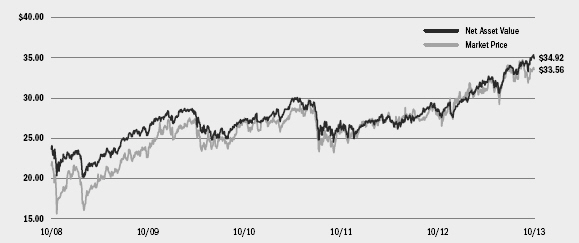

| Market Price and Net Asset Value History For the Past Five Years | | | | | | | | | | |

|

| Overview of the Trust’s Long-Term Investments |

| | | | | |

| Ten Largest Holdings | | 10/31/13 |

Johnson & Johnson | | | | 5 | % |

Celgene Corp. | | | | 5 | |

Amgen, Inc. | | | | 4 | |

Gilead Sciences, Inc. | | | | 4 | |

Bristol-Myers Squibb Co. | | | | 4 | |

Pfizer, Inc. | | | | 4 | |

AbbVie, Inc. | | | | 3 | |

Roche Holding AG | | | | 3 | |

Stryker Corp. | | | | 3 | |

Medtronic, Inc. | | | | 3 | |

| | | | | | | | | | |

| Industry Allocation | | 10/31/13 | | 10/31/12 |

Pharmaceuticals | | | | 35 | % | | | | 36 | % |

Biotechnology | | | | 32 | | | | | 22 | |

Health Care Equipment & Supplies | | | | 16 | | | | | 13 | |

Health Care Providers & Services | | | | 11 | | | | | 20 | |

Life Sciences Tools & Services | | | | 4 | | | | | 6 | |

Other3 | | | | 2 | | | | | 3 | |

| 3 | Other includes a 1% holding or less in each of the following industries; for 10/31/13, Diversified Consumer Services and Health Care Technology, and for 10/31/12, Food & Staples Retailing, Industrial Conglomerates, Diversified Consumer Services, Health Care Technology and Chemicals. |

For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

| | | | | | |

| | | ANNUAL REPORT | | OCTOBER 31, 2013 | | 19 |

| | | | |

| Trust Summary as of October 31, 2013 | | | BlackRock International Growth and Income Trust | |

BlackRock International Growth and Income Trust’s (BGY) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies of any market capitalization located in countries throughout the world and utilizing an option writing (selling) strategy to enhance current gains. The Trust invests, under normal market conditions, at least 80% of its assets in equity securities issued by non-U.S. companies of any market capitalization located in countries throughout the world. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

|

| Portfolio Management Commentary |

How did the Trust perform?

| Ÿ | | For the 12-month period ended October 31, 2013, the Trust returned 19.86% based on market price and 19.25% based on NAV. For the same period, the MSCI All Country World Index ex-US returned 20.29%. All returns reflect reinvestment of dividends. The Trust’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

What factors influenced performance?

| Ÿ | | The Trust’s allocation to cash during a period of strong, rising equity markets was the largest detractor from performance relative to the benchmark index, which has no cash component. From a sector perspective, positioning within materials hindered results due to the Trust’s exposures to gold miners and industrial-related metals as these companies suffered the impact of falling commodities prices during the period. |

| Ÿ | | Contributing positively to the Trust’s performance was favorable stock selection across nine of the ten sectors in the benchmark index, most notably within financials, industrials and health care. In financials, the Trust’s holdings in European asset managers benefited from net new investor inflows and the recent positive performance of financial markets. Within industrials, positioning in companies such as Kubota and |

| | | Hino Motors benefited from Japan’s aggressive reflationary policies. In health care, notable performance came from Roche Holding AG driven by its robust oncology pipeline. Gains from the Trust’s option writing strategy had a positive impact on performance for the period. |

Describe recent portfolio activity.

| Ÿ | | During the 12-month period, the Trust reduced exposure to defensive-oriented areas such as utilities and consumer staples due to concerns about the potential negative impact of rising interest rates on these sectors. These reductions funded increased allocations to the industrials and consumer discretionary sectors, adding particularly to holdings deemed likely to benefit from a recovery in European economic growth. On a regional basis, the Trust reduced exposure to emerging markets and added to developed Europe. |

Describe portfolio positioning at period end.

| Ÿ | | At period end, the Trust’s positioning reflected a positive outlook for the world economy. The Trust’s regional positioning was consistent with the view that Europe and Japan look the most attractive given their improving growth dynamics in addition to the recent outperformance of developed versus emerging markets. However, the Trust continued to explore and identify emerging market opportunities, albeit on tactical basis given the ongoing structural challenges faced by many of these countries. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | | | | | |

| 20 | | ANNUAL REPORT | | OCTOBER 31, 2013 | | |