UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:811-21656

Name of Fund: BlackRock Energy and Resources Trust (BGR)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Energy

and Resources Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800)882-0052, Option 4

Date of fiscal year end: 12/31/2019

Date of reporting period: 12/31/2019

Item 1 – Report to Stockholders

| | |

| | DECEMBER 31, 2019 |

BlackRock Energy and Resources Trust (BGR)

BlackRock Enhanced Capital and Income Fund, Inc. (CII)

BlackRock Enhanced Equity Dividend Trust (BDJ)

BlackRock Enhanced Global Dividend Trust (BOE)

BlackRock Enhanced International Dividend Trust (BGY)

BlackRock Health Sciences Trust (BME)

BlackRock Resources & Commodities Strategy Trust (BCX)

BlackRock Science and Technology Trust (BST)

BlackRock Science and Technology Trust II (BSTZ)

BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI)

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Trust’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call Computershare at (800)699-1236 to request that you continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC or its affiliates, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Supplemental Information (unaudited)

Section 19(a) Notices

BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Enhanced Global Dividend Trust’s (BOE), BlackRock Enhanced International Dividend Trust’s (BGY), BlackRock Health Sciences Trust’s (BME), BlackRock Resources & Commodities Strategy Trust’s (BCX), BlackRock Science and Technology Trust’s (BST), BlackRock Science and Technology Trust II (BSTZ) and BlackRock Utilities, Infrastructure & Power Opportunities Trust’s (BUI) (each, a “Trust” and collectively, the “Trusts”), amounts and sources of distributions reported are estimates and are being provided to you pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during its fiscal year and may be subject to changes based on tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for U.S. federal income tax purposes.

December 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Total Fiscal Year to Date

Cumulative Distributions by Character | | | Percentage of Fiscal Year to Date

Cumulative Distributions by Character | |

| Fund | | Ticker | | Net Investment Income | | | Net Realized Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of

Capital* | | | Total Per Common

Share | | | Net Investment Income | | | Net Realized

Capital Gains Short-Term | | | Net Realized Capital Gains Long-Term | | | Return of

Capital | | | Total Per

Common

Share | |

BlackRock Energy and Resources Trust | | BGR | | $ | 0.393543 | | | $ | — | | | $ | — | | | $ | 0.537657 | | | $ | 0.931200 | | | | 42 | % | | | 0 | % | | | 0 | % | | | 58 | % | | | 100 | % |

BlackRock Enhanced Capital and Income Fund, Inc. | | CII | | | 0.200165 | | | | — | | | | 0.504097 | | | | 0.294038 | | | | 0.998300 | | | | 20 | | | | 0 | | | | 50 | | | | 30 | | | | 100 | |

BlackRock Enhanced Equity Dividend Trust | | BDJ | | | 0.205304 | | | | — | | | | 0.545882 | | | | — | | | | 0.751186 | | | | 27 | | | | 0 | | | | 73 | | | | 0 | | | | 100 | |

BlackRock Global Opportunities Equity Trust | | BOE | | | 0.341056 | | | | — | | | | — | | | | 0.414944 | | | | 0.756000 | | | | 45 | | | | 0 | | | | 0 | | | | 55 | | | | 100 | |

BlackRock International Growth & Income Trust | | BGY | | | 0.173185 | | | | — | | | | — | | | | 0.232415 | | | | 0.405600 | | | | 43 | | | | 0 | | | | 0 | | | | 57 | | | | 100 | |

BlackRock Health Sciences Trust | | BME | | | 0.074037 | | | | — | | | | 2.325963 | | | | — | | | | 2.400000 | | | | 3 | | | | 0 | | | | 97 | | | | 0 | | | | 100 | |

BlackRock Resources and Commodities Strategy Trust | | BCX | | | 0.250327 | | | | — | | | | — | | | | 0.368873 | | | | 0.619200 | | | | 40 | | | | 0 | | | | 0 | | | | 60 | | | | 100 | |

BlackRock Science and Technology Trust | | BST | | | — | | | | — | | | | 3.500699 | | | | — | | | | 3.500699 | | | | 0 | | | | 0 | | | | 100 | | | | 0 | | | | 100 | |

BlackRock Science and Technology Trust II | | BSTZ | | | — | | | | — | | | | — | | | | 0.500000 | | | | 0.500000 | | | | 0 | | | | 0 | | | | 0 | | | | 100 | | | | 100 | |

BlackRock Utilities, Infrastructure and Power Opportunities Trust | | BUI | | | 0.439154 | | | | — | | | | 1.012846 | | | | — | | | | 1.452000 | | | | 30 | | | | 0 | | | | 70 | | | | 0 | | | | 100 | |

| | * | Certain Trusts estimate that they have distributed more than its net investment income and net realized capital gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce the Trust’s net asset value per share. | |

Section 19(a) notices for the Trusts, as applicable, are available on the BlackRock website atblackrock.com.

Section 19(b) Disclosure

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees/Directors (the “Board”), each have adopted a managed distribution plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a monthly basis as of December 31, 2019:

| | | | |

| Exchange Symbol | | Amount Per

Common Share | |

BGR | | $ | 0.0776 | |

CII | | | 0.0875 | |

BDJ | | | 0.0500 | |

BOE | | | 0.0630 | |

BGY | | | 0.0338 | |

BME | | | 0.2000 | |

BCX | | | 0.0516 | |

BST | | | 0.1655 | |

BSTZ | | | 0.1000 | |

BUI | | | 0.1210 | |

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available investment income to its shareholders required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient income (inclusive of net investment income and short-term capital gains) is not earned on a monthly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board; however, each Trust may make additional distributions from time to time, including additional capital gain distributions at the end of the taxable year, if required to meet requirements imposed by the Code and/or the Investment Company Act of 1940, as amended (the “1940 Act”).

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance is presented in its financial highlights table.

The Board may amend, suspend or terminate a Trust’s Plan at any time without prior notice to the Trust’s shareholders if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, changes in interest rates, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to BME, BST and BUI’s prospectuses for a more complete description of each Trust’s risks.

| | |

| 2 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

The Markets in Review

Dear Shareholder,

U.S. equities and bonds finished the last year of the decade with impressive returns, putting an exclamation point on a decade of strong performance despite the fears and doubts about the economy that were ultimately laid to rest with unprecedented monetary stimulus and a sluggish yet resolute performance from the U.S. economy. In many ways, it was fitting that the themes of 2019 — geopolitical uncertainty, fears of recession, and decisive monetary stimulus — put the capstone on a decade that was defined by grappling with these competing forces.

Equity and bond markets posted solid returns, particularly in the second half of the year, as investors began to realize that the U.S. economy was maintaining the modest yet steady growth that has characterized this economic cycle. U.S. large cap equities advanced the most, while equities at the high end of the risk spectrum — emerging markets and U.S. small cap — lagged while still posting solid returns.

Fixed-income securities played an important role in diversified portfolios by delivering strong returns amid economic uncertainty, as interest rates declined (and bond prices rose). Long-term bonds, particularly long-term Treasuries, generally posted the strongest returns, as inflation remained low. Investment-grade and high-yield corporate bonds also posted solid returns, as the credit fundamentals in corporate markets remained relatively solid.

As equity performance faltered in late 2018 and global economic growth slowed, the U.S. Federal Reserve (the “Fed”) shifted away from policies designed to decrease inflation in favor of renewed efforts to stimulate economic activity. The Fed left interest rates unchanged in January 2019, then reduced interest rates three times thereafter, starting in July 2019. Similarly, the Fed took measures to support liquidity in short-term lending markets. Following in the Fed’s footsteps, the European Central Bank announced aggressive economic stimulus measures, including lower interest rates and the return of its bond purchasing program. The Bank of Japan signaled a continuation of accommodative monetary policy, while China committed to looser credit conditions and an increase in fiscal spending.

The outpouring of global economic stimulus led to a sharp rally in risk assets throughout the world despite the headwind of rising geopolitical and trade tensions. Hopes continued to remain high as the current economic expansion became the longest in U.S. history.

Looking ahead, we believe U.S. economic growth will stabilize and gradually improve in 2020. The primary drivers of recent market performance — trade and monetary policies — could take a back seat to a nascent expansion in manufacturing and a recent uptick in global growth. The headwinds of policy uncertainty in 2019 could become tailwinds in 2020 due topro-cyclical policy shifts.

Overall, we favor increasing investment risk to benefit from the brighter outlook. In addition to having a positive view for equities overall, we favor emerging market equities over developed market equities. Increasing cyclical exposure through value-style investing and maintaining a meaningful emphasis on high-quality companies through quality factors also makes sense for diversified investors. In fixed income, government bonds continue to be important portfolio stabilizers, while emerging market bonds, particularly local currency bonds, offer relatively attractive income opportunities.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visitblackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of December 31, 2019 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 10.92% | | 31.49% |

U.S. small cap equities

(Russell 2000® Index) | | 7.30 | | 25.52 |

International equities

(MSCI Europe, Australasia, Far East Index) | | 7.01 | | 22.01 |

Emerging market equities

(MSCI Emerging Markets Index) | | 7.09 | | 18.42 |

3-month Treasury bills

(ICE BofAML3-Month U.S. Treasury Bill Index) | | 1.03 | | 2.28 |

U.S. Treasury securities

(ICE BofAML10-Year U.S. Treasury Index) | | 1.36 | | 8.91 |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | 2.45 | | 8.72 |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 2.21 | | 7.26 |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 3.98 | | 14.32 |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | | | |

| THIS PAGEISNOT PARTOF YOUR FUND REPORT | | | 3 | |

Table of Contents

Option Over-Writing Strategy

Overview

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue these goals primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options in an effort to generate current gains from option premiums and to enhance each Trust’s risk-adjusted return. Each Trust’s objectives cannot be achieved in all market conditions.

Each Trust primarily writes single stock covered call options, and may also from time to time write single stock put options. When writing (selling) a covered call option, a Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trust receives cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trust. During the option term, the counterparty may elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust is obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trust realizes gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by a Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty may result in a sale below the current market value and a gain or loss being realized by the Trust; and limiting the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. The premium that a Trust receives from writing a covered call option may not be sufficient to offset the potential appreciation on the underlying equity security above the strike price of the option that could have otherwise been realized by the Trust. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Option Over-Writing Strategy Illustration

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option expires and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call and other options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

| | | | |

| THE BENEFITSAND RISKSOF OPTION OVER-WRITING | | | 5 | |

| | |

| Trust Information as of December 31, 2019 | | BlackRock Energy and Resources Trust |

Investment Objective

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange (“NYSE”) | | BGR |

Initial Offering Date | | December 29, 2004 |

Current Distribution Rate on Closing Market Price as of December 31, 2019 ($11.88)(a) | | 7.84% |

Current Monthly Distribution per Common Share(b) | | $0.0776 |

Current Annualized Distribution per Common Share(b) | | $0.9312 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12-month period ended December 31, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BGR(a)(b) | | | 23.23 | % | | | 13.74 | % |

MSCI World Energy Call Overwrite Index(c) | | | N/A | | | | 10.47 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI World Energy Call Overwrite Index incorporates an option overlay component on the MSCI World Energy Index with a 33% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Crude oil prices experienced considerable gains in 2019, reflecting the backdrop of steady global growth, production discipline by the Organization of Petroleum Exporting Countries plus Russia, and declining shale production in the United States. Energy stocks also delivered a positive total return, as global equities were boosted by the favorable economic outlook and the accommodative policies of the world’s central banks. However, the sector lagged the broader equity market due to lower capital spending by large, integrated producers, as well as concerns U.S. production may have peaked.

The Trust’s overweight position in the exploration & production (“E&P”) subsector contributed to relative performance. An out-of-benchmark position in Kosmos Energy Ltd. was the leading contributor at the individual stock level. The company reported better-than-expected results and announced its intent to sell part of its stake in its assets off the coast of Mauritania and Senegal. An overweight position in Anadarko Petroleum Corp. — which was taken over by Occidental Petroleum Corp. — was also a top contributor.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance for the 12-month period.

U.S. natural gas prices declined in 2019, reflecting strong supply growth, adverse weather conditions and weakness in the European gas market. In this environment, the Trust’s out-of-benchmark position in the natural gas producer EQT Corp. was among the largest detractors from relative performance.

An underweight in midstream energy companies, including Enbridge, Inc. and Kinder Morgan, Inc. also detracted. Interest rate-sensitive stocks were boosted by the three rate cuts by the Fed and the corresponding downturn in bond yields.

Describe recent portfolio activity.

Among other shifts, the investment adviser increased the Trust’s weighting in the integrated energy subsector by increasing its weighting in TOTAL SA and initiating a position in Eni SpA. This move was funded by decreasing the portfolio’s allocation to E&P stocks, including the sale of Devon Energy Corp.

| | |

| 6 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2019 (continued) | | BlackRock Energy and Resources Trust |

Describe portfolio positioning at period end.

The investment adviser continued to focus on companies that are displaying signs of capital discipline and steady growth, as well as those that stand to benefit from growth in the emerging liquified natural gas industry.

The integrated energy subsector represented the Trust’s largest allocation, followed by the E&P, distribution, refining & marketing, and oil services industries, respectively.

As of December 31, 2019, the Trust had an options overwriting program in place whereby 32% of the underlying equities were overwritten with call options. These options were typically written at levels above prevailing market prices (estimated to be 2.7% out of the money) with an average time until expiration of 54 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

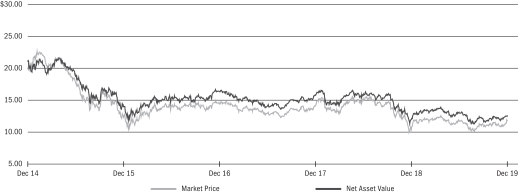

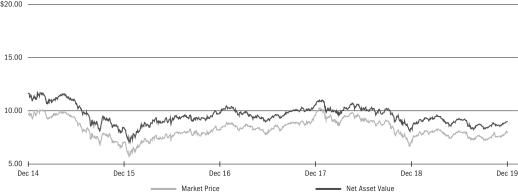

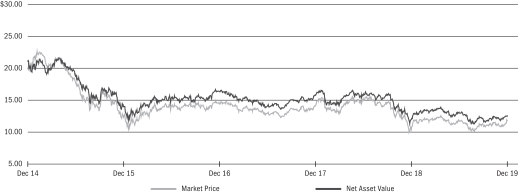

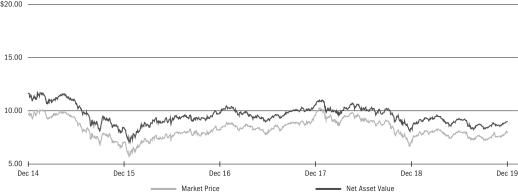

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 11.88 | | | $ | 10.45 | | | | 13.68 | % | | $ | 12.61 | | | $ | 10.16 | |

Net Asset Value | | | 12.57 | | | | 11.98 | | | | 4.92 | | | | 13.92 | | | | 11.34 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/19 | |

Royal Dutch Shell PLC — ADR | | | 12 | % |

TOTAL SA | | | 8 | |

Exxon Mobil Corp. | | | 8 | |

BP PLC | | | 8 | |

ConocoPhillips | | | 6 | |

EOG Resources, Inc. | | | 4 | |

TC Energy Corp | | | 4 | |

Williams Cos., Inc. | | | 4 | |

Suncor Energy, Inc. | | | 4 | |

Chevron Corp. | | | 4 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 12/31/19 | | | 12/31/18 | |

Oil, Gas & Consumable Fuels | | | 97 | % | | | 94 | % |

Energy Equipment & Services | | | 3 | | | | 6 | |

| | For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| | |

| Trust Information as of December 31, 2019 | | BlackRock Enhanced Capital and Income Fund, Inc. |

Investment Objective

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide investors with a combination of current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment objective by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | CII |

Initial Offering Date | | April 30, 2004 |

Current Distribution Rate on Closing Market Price as of December 31, 2019 ($17.25)(a) | | 6.09% |

Current Monthly Distribution per Common Share(b) | | $0.0875 |

Current Annualized Distribution per Common Share(b) | | $1.0500 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12-month period ended December 31, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

CII(a)(b) | | | 30.38 | % | | | 25.08 | % |

MSCI USA Call Overwrite Index(c) | | | N/A | | | | 25.70 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI USA Call Overwrite Index incorporates an option overlay component on the MSCI USA Index with a 55% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

In the equity allocation of the Trust, the largest detractor from relative performance for the 12-month period was stock selection within the consumer staples sector. In particular, overweight positions in beer-maker Molson Coors Beverage Co. and tobacco company Altria Group, Inc. weighed on relative performance. Stock selection in health care also detracted, with overweight positions in pharmaceutical company Pfizer, Inc. and biotech Biogen, Inc. produced weakness. Finally, security selection within the industrials sector further weighed on relative returns.

The largest equity allocation contributors to performance for the 12-month period was stock selection within the consumer discretionary sector. Most notably, overweight positions in homebuilder D.R. Horton, Inc. and discount retailer Dollar General Corp. provided strong relative returns. Among financials, the Trust’s lack of a position in insurance giant Berkshire Hathaway, Inc. and its overweight position in Bank of America Corp. enhanced performance. Stock selection within utilities, particularly with the Trust’s overweight position in Virginia-based AES Corp., further contributed to relative performance.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance for the 12-month period.

Describe recent portfolio activity.

During the 12-month period, the Trust significantly increased its exposure to the communication services sector. Holdings within consumer discretionary and industrials were also increased. Conversely, the Trust significantly reduced exposure to the health care sector. The Trust also lowered its allocation to materials and utilities.

Describe portfolio positioning at period end.

Relative to the benchmark, the Trust’s largest overweight positions were in the communication services, consumer discretionary and energy sectors. Conversely, the Trust’s largest relative underweights were in the real estate, information technology and utilities sectors.

As of December 31, 2019, the Trust had in place an option overwriting program whereby 48% of the underlying equities were overwritten with call options. These call options were typically written at prices above the prevailing market prices (estimated to be 2.1% out of the money) with an average time until expiration of 51 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 8 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2019 (continued) | | BlackRock Enhanced Capital and Income Fund, Inc. |

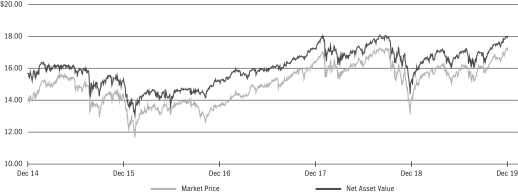

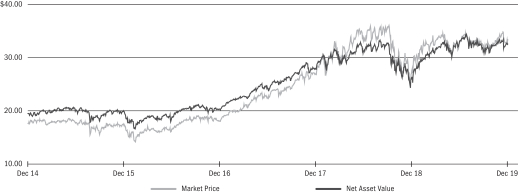

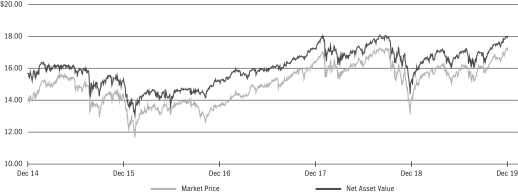

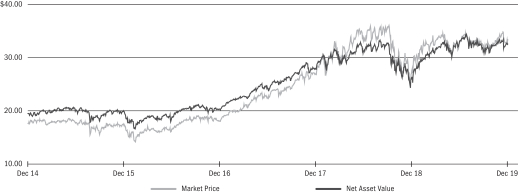

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 17.25 | | | $ | 14.08 | | | | 22.51 | % | | $ | 17.33 | | | $ | 13.92 | |

Net Asset Value | | | 17.96 | | | | 15.28 | | | | 17.54 | | | | 17.99 | | | | 14.97 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/19 | |

Microsoft Corp. | | | 6 | % |

Apple, Inc. | | | 6 | |

Alphabet, Inc. | | | 5 | |

JPMorgan Chase & Co. | | | 4 | |

UnitedHealth Group, Inc. | | | 3 | |

Bank of America Corp. | | | 3 | |

Verizon Communications, Inc. | | | 3 | |

Comcast Corp. | | | 3 | |

Walmart, Inc. | | | 3 | |

Cisco Systems, Inc. | | | 3 | |

| | * | Excludes option positions and money market funds. | |

SECTOR ALLOCATION

| | | | | | | | |

| Sector | | 12/31/19 | | | 12/31/18 | |

Information Technology | | | 21 | % | | | 20 | % |

Health Care | | | 14 | | | | 18 | |

Financials | | | 13 | | | | 15 | |

Communication Services | | | 13 | | | | 9 | |

Consumer Discretionary | | | 12 | | | | 10 | |

Industrials | | | 9 | | | | 7 | |

Consumer Staples | | | 7 | | | | 7 | |

Energy | | | 6 | | | | 6 | |

Materials | | | 3 | | | | 5 | |

Utilities | | | 2 | | | | 3 | |

| | For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. | |

| | |

| Trust Information as of December 31, 2019 | | BlackRock Enhanced Equity Dividend Trust |

Investment Objective

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by employing a strategy of writing (selling) call and put options. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BDJ |

Initial Offering Date | | August 31, 2005 |

Current Distribution Rate on Closing Market Price as of December 31, 2019 ($9.92)(a) | | 6.05% |

Current Monthly Distribution per Common Share(b) | | $0.0500 |

Current Annualized Distribution per Common Share(b) | | $0.6000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12-month period ended December 31, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BDJ(a)(b) | | | 38.53 | % | | | 24.52 | % |

MSCI USA Value Call Overwrite Index(c) | | | N/A | | | | 19.58 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI USA Value Call Overwrite Index incorporates an option overlay component on the MSCI USA Value Index with a 55% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

The most significant contributors to relative performance during the 12-month period were stock selection and allocation decisions within the financials sector. Specifically, selection within and an overweight to the banks, insurance and capital markets industries proved beneficial. In health care, stock selection in the health care providers & services industry boosted relative return, as did stock selection and an overweight to the health care equipment & supplies industry. Other notable contributors included stock selection in the energy and information technology (“IT”) sectors.

The largest detractor from relative performance came from stock selection and an underweight to the utilities sector. Notably, selection decisions and an underweight to the electric utilities industry weighed on relative return, as did an underweight to multi-utilities. Within communication services, stock selection in diversified telecommunication services also weighed on relative performance. Other modest detractors during the period included underweight allocations to the real estate and consumer sectors.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance for the 12-month period.

Describe recent portfolio activity.

During the period, a combination of portfolio trading activity and market price changes resulted in increased exposure to the financials, consumer discretionary and industrials sectors. Conversely, the Trust’s exposures to IT, health care and utilities were reduced.

Describe portfolio positioning at period end.

The Trust’s largest allocations were in the financials, health care and energy sectors. Relative to the benchmark, the Trust’s largest overweight positions were in the financials, health care and energy sectors. The Trust’s largest relative underweights were in the real estate, consumer staples and utilities sectors.

As of December 31, 2019, the Trust had in place an option overwriting program whereby 51% of the underlying equities were overwritten with call options. These call options were typically written at prices above the prevailing market prices (estimated to be 2.1% out of the money) with an average time until expiration of 53 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 10 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2019 (continued) | | BlackRock Enhanced Equity Dividend Trust |

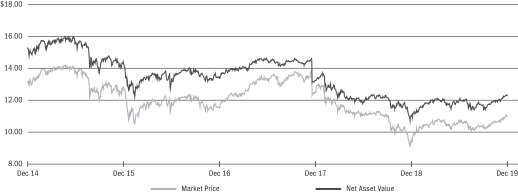

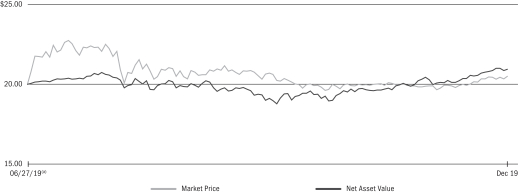

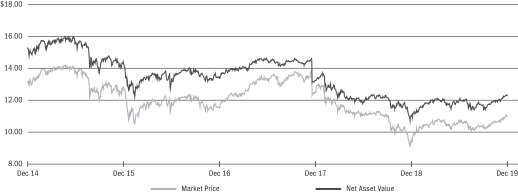

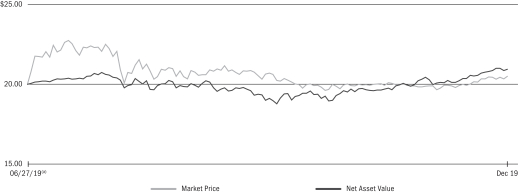

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 9.92 | | | $ | 7.77 | | | | 27.67 | % | | $ | 9.92 | | | $ | 7.72 | |

Net Asset Value | | | 10.03 | | | | 8.74 | | | | 14.76 | | | | 10.11 | | | | 8.64 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/19 | |

Verizon Communications, Inc. | | | 5 | % |

JPMorgan Chase & Co. | | | 4 | |

Citigroup, Inc. | | | 4 | |

Wells Fargo & Co. | | | 4 | |

Bank of America Corp. | | | 3 | |

Medtronic PLC | | | 3 | |

Anthem, Inc. | | | 3 | |

Koninklijke Philips NV | | | 2 | |

Comcast Corp. | | | 2 | |

American International Group, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

SECTOR ALLOCATION

| | | | | | | | |

| Sector | | 12/31/19 | | | 12/31/18 | |

Financials | | | 29 | % | | | 25 | % |

Health Care | | | 19 | | | | 23 | |

Energy | | | 10 | | | | 11 | |

Information Technology | | | 9 | | | | 12 | |

Industrials | | | 8 | | | | 6 | |

Communication Services | | | 8 | | | | 7 | |

Consumer Staples | | | 7 | | | | 7 | |

Consumer Discretionary | | | 6 | | | | 3 | |

Utilities | | | 3 | | | | 4 | |

Materials | | | 1 | | | | 2 | |

| | For Trust compliance purposes, the Trust’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. | |

| | |

| Trust Information as of December 31, 2019 | | BlackRock Enhanced Global Dividend Trust |

Investment Objective

BlackRock Enhanced Global Dividend Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and by employing a strategy of writing (selling) call and put options. Under normal circumstances, the Trust invests at least 80% of its net assets in dividend-paying equity securities and at least 40% of its assets outside of the U.S. (unless market conditions are not deemed favorable by Trust management, in which case the Trust would invest at least 30% of its assets outside of the U.S.). The Trust may invest in securities of companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BOE |

Initial Offering Date | | May 31, 2005 |

Current Distribution Rate on Closing Market Price as of December 31, 2019 ($10.99)(a) | | 6.88% |

Current Monthly Distribution per Common Share(b) | | $0.0630 |

Current Annualized Distribution per Common Share(b) | | $0.7560 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12-month period ended December 31, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BOE(a)(b) | | | 25.98 | % | | | 19.54 | % |

MSCI ACWI Call Overwrite Index(c) | | | N/A | | | | 23.66 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI ACWI Call Overwrite Index incorporates an option overlay component on the MSCI ACWI Index with a 45% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Stock selection in the industrials sector, particularly within air freight & logistics, contributed to returns during the 12-month period. Stock selection in the health care sector also contributed, largely due to an overweight position in pharmaceuticals. Additionally, the Trust’s lack of exposure to energy stocks added value. At the individual security level, British American Tobacco PLC was the top contributor to returns. The company’s shares rose following a favorable earnings forecast. Certain tobacco stocks were also boosted by press reports suggesting that all e-cigarette flavors other than menthol or tobacco would be banned, and after the Food and Drug Administration removed proposed rules regarding nicotine reduction from its web site, signaling that the momentum behind increased tobacco product regulation in the United States had waned. Holdings in the German courier company Deutsche Post AG also contributed, as the company reported solid financial results.

Stock selection within and an underweight to information technology (“IT”), particularly a lack of holdings within technology hardware, represented the largest detractor from performance. Stock selection within the financials and consumer discretionary sectors also weighed on the Trust’s return. At the security level, British tobacco company Imperial Brands PLC represented the largest detractor. The company issued a profit warning as sales of Imperial’s “Next Generation” smoking product disappointed, and the Trust exited the position. A lack of holdings in Apple Inc. also detracted from relative returns.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy detracted from relative performance for the 12-month period.

Describe recent portfolio activity.

The most significant change to the portfolio during the 12-month period was a material reduction within consumer staples, mostly attributable to sales of tobacco stocks. The Trust reinvested the proceeds among high quality, dividend-paying names where the investment adviser has high conviction, including health care and consumer discretionary stocks.

| | |

| 12 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2019 (continued) | | BlackRock Enhanced Global Dividend Trust |

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector exposures were in health care and consumer staples, with an emphasis on the pharmaceuticals and tobacco industries, respectively. The largest underweights were to IT and energy. The Trust had no exposure to utilities, real estate or energy at the end of the period. From a regional perspective, a majority of portfolio assets was invested either within the United States or Europe, with significant exposure in the United Kingdom and Switzerland.

As of December 31, 2019, the Trust had in place an option overwriting program whereby 43% of the underlying equities were overwritten with call options. These call options were typically written at prices above the prevailing market prices (estimated to be 2.0% out of the money) with an average time until expiration of 53 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

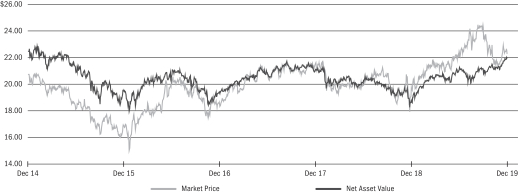

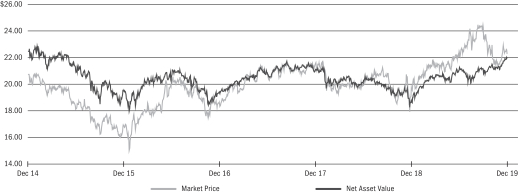

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 10.99 | | | $ | 9.37 | | | | 17.29 | % | | $ | 11.09 | | | $ | 9.30 | |

Net Asset Value | | | 12.32 | | | | 11.07 | | | | 11.29 | | | | 12.33 | | | | 10.91 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/19 | |

TELUS Corp. | | | 4 | % |

Johnson & Johnson | | | 3 | |

Novartis AG, Registered Shares | | | 3 | |

Genuine Parts Co. | | | 3 | |

GlaxoSmithKline PLC | | | 3 | |

Cisco Systems, Inc. | | | 3 | |

Rogers Communications, Inc. | | | 3 | |

Amcor PLC | | | 3 | |

Nestle SA, Registered Shares | | | 3 | |

British American Tobacco PLC | | | 3 | |

| | * | Excludes option positions and money market funds. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | |

| Country | | 12/31/19 | | | 12/31/18 | |

United States | | | 53 | % | | | 43 | % |

United Kingdom | | | 13 | | | | 16 | |

Switzerland | | | 7 | | | | 6 | |

Canada | | | 7 | | | | 7 | |

France | | | 4 | | | | 4 | |

Netherlands | | | 3 | | | | 2 | |

Singapore | | | 3 | | | | 3 | |

Australia | | | 3 | | | | 6 | |

Germany | | | 2 | | | | 2 | |

Denmark | | | 2 | | | | 1 | |

Finland | | | 1 | | | | 3 | |

Taiwan | | | 1 | | | | 2 | |

Sweden | | | 1 | | | | 1 | |

India | | | — | | | | 1 | |

Ireland | | | — | | | | 1 | |

China | | | — | | | | 1 | |

Other(a) | | | — | | | | 1 | |

| | (a) | Other includes a 1% holding or less in Japan. | |

| | |

| Trust Information as of December 31, 2019 | | BlackRock Enhanced International Dividend Trust |

Investment Objective

BlackRock Enhanced International Dividend Trust’s (BGY) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies of any market capitalization located in countries throughout the world and by employing a strategy of writing (selling) call and put options. The Trust invests, under normal circumstances, at least 80% of its net assets in dividend-paying equity securities issued by non-U.S. companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BGY |

Initial Offering Date | | May 30, 2007 |

Current Distribution Rate on Closing Market Price as of as of December 31, 2019 ($5.89)(a) | | 6.89% |

Current Monthly Distribution per Common Share(b) | | $0.0338 |

Current Annualized Distribution per Common Share(b) | | $0.4056 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12-month period ended December 31, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BGY(a)(b) | | | 27.22 | % | | | 20.20 | % |

MSCI ACWI ex USA Call Overwrite Index(c) | | | N/A | | | | 19.75 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI ACWI ex USA Overwrite Index incorporates an option overlay component on the MSCI ACWI ex USA Index with a 45% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

During the 12-month period, stock selection in the health care sector contributed to performance, largely due to an overweight position in pharmaceuticals. Security selection within the industrials sector also added to returns. Additionally, the Trust’s lack of exposure to energy stocks added value. At the individual security level, British American Tobacco PLC was the top contributor to returns. The company’s shares rose following a favorable earnings forecast. Certain tobacco stocks were also boosted by press reports suggesting that all e-cigarette flavors other than menthol or tobacco would be banned, and after the Food and Drug Administration removed proposed rules regarding nicotine reduction from its web site, signaling that the momentum behind increased tobacco product regulation in the United States had waned. Holdings in the German courier company Deutsche Post AG also contributed, as the company reported solid financial results.

Stock selection within the financials sector detracted from performance. The Trust’s underweight to information technology (“IT”) also subtracted from returns. In addition, stock selection within the consumer discretionary sector weighed on the Trust’s return. At the security level, British tobacco company Imperial Brands PLC represented the largest detractor. The company issued a profit warning as sales of Imperial’s “Next Generation” smoking product disappointed, and the Trust exited the position. The Trust’s holdings in the Canadian media company Rogers Communications, Inc. also detracted from relative return.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy detracted from relative performance for the 12-month period.

Describe recent portfolio activity.

The most significant change to the portfolio during the 12-month period was a material reduction within consumer staples, mostly attributable to sales of tobacco stocks. The Trust reinvested the proceeds among high quality, dividend-paying names where the investment adviser has high conviction, including health care and communication services stocks.

| | |

| 14 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2019 (continued) | | BlackRock Enhanced International Dividend Trust |

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector exposures were in health care and consumer staples, with an emphasis on the pharmaceuticals and tobacco industries, respectively. The largest underweights were to consumer discretionary and IT. The Trust had no exposure to utilities, real estate or energy at the end of the period. From a regional perspective, a majority of portfolio assets was invested in Europe, with significant exposure to Switzerland and the United Kingdom.

As of December 31, 2019, the Trust had in place an option overwriting program whereby 43% of the underlying equities were overwritten with call options. These call options were typically written at prices above the prevailing market prices (estimated to be 2.0% out of the money) with an average time until expiration of 54 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 5.89 | | | $ | 4.98 | | | | 18.27 | % | | $ | 5.89 | | | $ | 4.94 | |

Net Asset Value | | | 6.47 | | | | 5.79 | | | | 11.74 | | | | 6.48 | | | | 5.73 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/19 | |

TELUS Corp. | | | 7 | % |

British American Tobacco PLC | | | 6 | |

Amcor PLC | | | 6 | |

Rogers Communications, Inc. | | | 5 | |

GlaxoSmithKline PLC | | | 5 | |

Novartis AG, Registered Shares | | | 5 | |

Unilever PLC | | | 5 | |

Nestle SA, Registered Shares | | | 5 | |

Deutsche Post AG, Registered Shares | | | 5 | |

Koninklijke Philips NV | | | 4 | |

| | * | Excludes option positions and money market funds. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | |

| Country | | 12/31/19 | | | 12/31/18 | |

United Kingdom | | | 26 | % | | | 28 | % |

Switzerland | | | 13 | | | | 10 | |

Canada | | | 13 | | | | 11 | |

United States | | | 9 | | | | 5 | |

France | | | 7 | | | | 6 | |

Netherlands | | | 7 | | | | 4 | |

Australia | | | 5 | | | | 9 | |

Germany | | | 5 | | | | 4 | |

Singapore | | | 5 | | | | 3 | |

Denmark | | | 3 | | | | 2 | |

Finland | | | 2 | | | | 5 | |

Taiwan | | | 2 | | | | 3 | |

Sweden | | | 2 | | | | 3 | |

China | | | 1 | | | | 3 | |

India | | | — | (a) | | | 2 | |

Japan | | | — | | | | 2 | |

| | (a) | Represents less than 1% of the Trust’s total investments. | |

| | |

| Trust Information as of December 31, 2019 | | BlackRock Health Sciences Trust |

Investment Objective

BlackRock Health Sciences Trust’s (BME) (the “Trust”) investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on NYSE | | BME |

Initial Offering Date | | March 31, 2005 |

Current Distribution Rate on Closing Market Price as of December 31, 2019 ($42.50)(a) | | 5.65% |

Current Monthly Distribution per Common Share(b) | | $0.2000 |

Current Annualized Distribution per Common Share(b) | | $2.4000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12-month period ended December 31, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BME(a)(b) | | | 24.15 | % | | | 22.26 | % |

MSCI USA IMI Health Care Call Overwrite Index(c) | | | N/A | | | | 19.02 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s premium to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI USA IMI Health Care Call Overwrite Index incorporates an option overlay component on the MSCI IMI Health Care Index with a 33% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Health care stocks generated a robust gain in 2019, as equities in general were boosted by optimism surrounding the economic outlook and global central bank policy. However, the sector lagged the broader market due largely to its underperformance in the first half of the year.

Strong stock selection, primarily in the biotechnology and pharmaceutical subsectors, was the primary reason for the Trust’s positive relative performance.

A zero weighting in the biotechnology firm AbbVie, Inc. was the leading contributor to performance, as the stock declined after announcing its acquisition of the pharmaceutical firm Allergan PLC. In addition, AbbVie missed earnings expectations and lowered its guidance for 2019. An underweight position in the pharmaceutical giant Pfizer contributed to results, as well. The stock declined in August after the company announced that it was spinning off its off-patent and generic drug division and merging it with Mylan NV. While the spin-off sought to shift the company’s efforts into higher-margin areas of health care, the financially dilutive impact of the deal was viewed negatively by the market. Holdings in AstraZeneca PLC, Seattle Genetics, Inc. and RA Pharmaceuticals, Inc. also benefited performance.

Stock selection in the medical devices & supplies and health care providers & services sub-sectors detracted from relative performance.

A zero weighting in Celgene Corp., which was taken over at a substantial premium by Bristol-Myers Squibb Co., was the largest individual detractor. Not holding the medical devices & supplies firm Danaher Corp. also detracted, as investors reacted favorably to its acquisition of General Electric’s biopharmaceutical business. Holdings in Eli Lilly & Co., Zimmer Biomet Holdings, Inc., and Alcon, Inc. further detracted from performance.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance for the 12-month period.

Describe recent portfolio activity.

The Trust increased its allocation to the medical devices & supplies subsector, while its weightings in the pharmaceuticals, biotechnology, and health care providers & services subsectors remained largely the same.

| | |

| 16 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2019 (continued) | | BlackRock Health Sciences Trust |

Describe portfolio positioning at period end.

The investment adviser continued to look for opportunities stemming from key trends in the health care sector, such as the aging global population and the rising demand for more extensive medical care from the growing middle class in the emerging markets. Accordingly, the Trust was positioned with an overweight in the medical devices & supplies sub-sector. The investment adviser identified a number of companies in this area with strong fundamentals and increased penetration in the emerging markets.

Global demographic changes, particularly increased longevity, have led to growing demand in the health sciences industry. This trend has been further supported by innovation across multiple areas in health care. In drug development, for example, biotechnology and pharmaceutical companies’ use of genomic research has allowed for earlier diagnosis of disease and has facilitated a shift towards preventative care. In addition, there has been significant innovation in areas such as medical equipment, diagnostic services and biosensors.

At the close of the period, the Trust was overweight in the medical devices & supplies and health care providers & services sub-sectors, and it was underweight in pharmaceuticals and biotechnology.

As of December 31, 2019, the Trust had an options overwriting program in place whereby 36% of the underlying equities were overwritten with call options. These options were typically written at levels above prevailing market prices (estimated to be 3% out of the money) with an average time until expiration of 52 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 42.50 | | | $ | 36.45 | | | | 16.60 | % | | $ | 42.50 | | | $ | 35.75 | |

Net Asset Value | | | 41.19 | | | | 35.87 | | | | 14.83 | | | | 41.33 | | | | 34.65 | |

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/19 | |

UnitedHealth Group, Inc. | | | 9 | % |

Abbott Laboratories | | | 5 | |

Merck & Co., Inc. | | | 4 | |

Thermo Fisher Scientific, Inc. | | | 4 | |

Medtronic PLC | | | 3 | |

Amgen, Inc. | | | 3 | |

Johnson & Johnson | | | 3 | |

Stryker Corp. | | | 3 | |

Edwards Lifesciences Corp. | | | 3 | |

Zoetis, Inc. | | | 2 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 12/31/19 | | | 12/31/18 | |

Health Care Equipment & Supplies | | | 30 | % | | | 27 | % |

Pharmaceuticals | | | 23 | | | | 25 | |

Health Care Providers & Services | | | 21 | | | | 23 | |

Biotechnology | | | 17 | | | | 18 | |

Life Sciences Tools & Services | | | 8 | | | | 5 | |

Health Care Technology | | | 1 | | | | 1 | |

Diversified Consumer Services | | | — | | | | 1 | |

| | For Trust compliance purposes, the Trust’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. | |

| | |

| Trust Information as of December 31, 2019 | | BlackRock Resources & Commodities Strategy Trust |

Investment Objective

BlackRock Resources & Commodities Strategy Trust’s (BCX) (the “Trust”) primary investment objective is to seek high current income and current gains, with a secondary objective of capital appreciation. The Trust will seek to achieve its investment objectives, under normal market conditions, by investing at least 80% of its total assets in equity securities issued by commodity or natural resources companies, derivatives with exposure to commodity or natural resources companies or investments in securities and derivatives linked to the underlying price movement of commodities or natural resources. While permitted, the Trust does not currently expect to invest in securities and derivatives linked to the underlying price movement of commodities or natural resources. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on NYSE | | BCX |

Initial Offering Date | | March 30, 2011 |

Current Distribution Rate on Closing Market Price as of December 31, 2019 ($8.07)(a) | | 7.67% |

Current Monthly Distribution per Common Share(b) | | $0.0516 |

Current Annualized Distribution per Common Share(b) | | $0.6192 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate consists of income, net realized gains and/or a return of capital. See the Financial Highlights for the actual sources and character of distributions. Past performance does not guarantee future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Performance and Portfolio Management Commentary

Returns for the 12-month period ended December 31, 2019 were as follows:

| | | | | | | | |

| | | Returns Based On | |

| | | Market Price | | | Net Asset Value | |

BCX(a)(b) | | | 23.67 | % | | | 15.88 | % |

MSCI ACWI Select Liquidity Natural Resources Call Overwrite Index(c) | | | N/A | | | | 9.13 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | MSCI ACWI Select Liquidity Natural Resources Call Overwrite Index incorporates an option overlay component on the MSCI ACWI Select Liquidity Natural Resources Index with a 33% overwrite level. | |

N/A — Not applicable as the index does not have a market price.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Past performance is not indicative of future results.

The following discussion relates to the Trust’s relative performance based on the index cited above:

What factors influenced performance?

Natural resources stocks, while posting a gain in 2019, lagged the strong return of the broader world equity market. The shortfall was due, in part, to concerns about slowing economic growth in China and persistent uncertainty surrounding the U.S.-China trade dispute. Since China is the world’s leading consumer of commodities, both of these factors had an outsized impact on the resources sector compared to other areas of the market.

In the physical commodity space, prices of bulk commodities and precious metals rose while most base metals came under pressure. Crude oil prices rallied, due in part to the favorable backdrop of steady global growth, production discipline by the Organization of Petroleum Exporting Countries plus Russia, and declining shale production in the United States. In the agriculture sector, the most noteworthy event was the sharp decline in China’s pork supply brought about by African Swine Fever. The severity of the crisis caused global pork prices to rise exponentially, with U.S. pork sales to China doubling and European pork prices reaching a six-year high.

The Trust’s overweight positions in the mining and energy sectors contributed to relative performance. An out-of-benchmark holding in JBS SA was the largest contributor at the individual stock level. The company was viewed as a beneficiary of rising prices for pork, beef and chicken in the wake of the African Swine Fever crisis.

An out-of-benchmark position in Glanbia PLC, a global leader in sports nutrition, was a key detractor from relative performance. The stock plunged to its lowest level in five years after weaker international sales caused the company to issue a profit warning. The lack of a position in Fortescue Metals Group Ltd., which benefited from its high sensitivity to iron ore prices, also detracted from results.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s option overlay strategy contributed positively to relative performance for the 12-month period.

Describe recent portfolio activity.

Among other decisions, the investment adviser shifted the Trust’s holdings in the diversified mining sector. The Trust’s position in Glencore PLC was sold on the belief that the company had an unfavorable commodity mix and rising environmental, social and governance risks, and the proceeds were rotated into Anglo American PLC. The investment adviser also sold Nestle SA in order to fund opportunities within the protein space; for example, increasing the Fund’s position in Tyson Foods, Inc.

| | |

| 18 | | 2019 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Trust Information as of December 31, 2019 (continued) | | BlackRock Resources & Commodities Strategy Trust |

Describe portfolio positioning at period end.

The mining industry represented the Trust’s largest allocation, followed by energy and agriculture, respectively.

As of December 31, 2019, the Trust had an options overwriting program in place whereby 35% of the underlying equities were overwritten with call options. These options were typically written at levels above prevailing market prices (estimated to be 3.1% out of the money) with an average time until expiration of 52 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

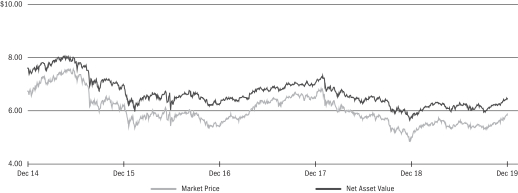

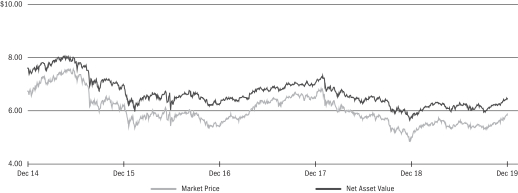

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/19 | | | 12/31/18 | | | Change | | | High | | | Low | |

Market Price | | $ | 8.07 | | | $ | 7.06 | | | | 14.31 | % | | $ | 8.38 | | | $ | 6.98 | |

Net Asset Value | | | 9.04 | | | | 8.44 | | | | 7.11 | | | | 9.64 | | | | 8.30 | |

Market Price and Net Asset Value History For Past Five Years

Overview of the Trust’s Total Investments *

TEN LARGEST HOLDINGS

| | | | |

| Security | | 12/31/19 | |

TOTAL SA | | | 6 | % |

BP PLC — ADR | | | 5 | |

Royal Dutch Shell PLC — ADR | | | 5 | |

BHP Group PLC | | | 5 | |

Anglo American PLC | | | 4 | |

Vale SA — ADR | | | 3 | |

FMC Corp. | | | 3 | |

Exxon Mobil Corp. | | | 3 | |

Barrick Gold Corp. | | | 3 | |

Packaging Corp. of America | | | 3 | |

| | * | Excludes option positions and money market funds. | |

INDUSTRY ALLOCATION

| | | | | | | | |

| Industry | | 12/31/19 | | | 12/31/18 | |

Oil, Gas & Consumable Fuels | | | 35 | % | | | 33 | % |

Metals & Mining | | | 35 | | | | 38 | |

Chemicals | | | 11 | | | | 14 | |

Containers & Packaging | | | 9 | | | | 3 | |

Food Products | | | 7 | | | | 7 | |

Specialty Retail | | | 1 | | | | — | |

Machinery | | | 1 | | | | 1 | |

Electronic Equipment, Instruments & Components | | | 1 | | | | 1 | |

Paper & Forest Products | | | — | | | | 1 | |