1 Dave Weidman, Chairman and Chief Executive Officer Steven Sterin, Senior Vice President and Chief Financial Officer Celanese Q4 2011 Earnings Conference Call / Webcast Tuesday, January 31st, 2012 10:00 a.m. ET Exhibit 99.2

2 Forward looking statements Reconciliation and use of non-GAAP measures to U.S. GAAP This presentation may contain “forward-looking statements,” which include information concerning the company's plans, objectives, goals, strategies, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. When used in this presentation, the words “outlook,” “forecast,” “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “may,” “can,” “could,” “might,” “will” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in this presentation. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of business cycles, particularly in the automotive, electrical, electronics and construction industries; changes in the price and availability of raw materials; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned capacity additions and expansions; the ability to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; market acceptance of our technology; the ability to obtain governmental approvals and to construct facilities on terms and schedule acceptable to the company; changes in the degree of intellectual property and other legal protection afforded to our products; compliance and other costs and potential disruption or interruption of production or operation due to accidents, cyber security incidents, terrorism or political unrest or other unforeseen events or delays in construction or operation of facilities; potential liability for remedial actions and increased costs under existing or future environmental regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; and various other factors discussed from time to time in the company's filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and the company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Reconciliation of Non-U.S. GAAP Measures to U.S. GAAP This presentation reflects the following performance measures: operating EBITDA, business operating EBITDA, affiliate EBITDA and proportional affiliate EBITDA, adjusted earnings per share, net debt and adjusted free cash flow as non-U.S. GAAP measures. These measurements are not recognized in accordance with U.S. GAAP and should not be viewed as an alternative to U.S. GAAP measures of performance. The most directly comparable financial measure presented in accordance with U.S. GAAP in our consolidated financial statements for operating EBITDA and business operating EBITDA is net income; for proportional affiliate EBITDA is equity in net earnings of affiliates; for affiliate EBITDA is operating profit; for adjusted earnings per share is earnings per common share-diluted; for net debt is total debt; and for adjusted free cash flow is cash flow from operating activities. Use of Non-U.S. GAAP Financial Information ► Operating EBITDA is defined by the company as net earnings less interest income plus loss (earnings) from discontinued operations, interest expense, taxes, and depreciation and amortization, and further adjusted for Other Charges and Adjustments as described in Table 7. We present operating EBITDA because we consider it an important supplemental measure of our operations and financial performance. We believe that operating EBITDA is more reflective of our operations as it provides transparency to investors and enhances period-to-period comparability of our operations and financial performance. Operating EBITDA is one of the measures management uses for its planning and budgeting process to monitor and evaluate financial and operating results and for the company's incentive compensation plan. Operating EBITDA should not be considered as an alternative to net income determined in accordance with U.S. GAAP. We may provide guidance on operating EBITDA and are unable to reconcile forecasted operating EBITDA to a U.S. GAAP financial measure because a forecast of Other Charges and Adjustments is not practical. ► Business operating EBITDA is defined by the company as net earnings less interest income plus loss (earnings) from discontinued operations, interest expense, taxes and depreciation and amortization, and further adjusted for Other Charges and Adjustments as described in Table 7, less equity in net earnings of affiliates, dividend income from cost investments and other (income) expense. This supplemental performance measure reflects the operating results of the company's operations without regard to the financial impact of its equity and cost investments. ► Affiliate EBITDA is defined by the company as operating profit plus the depreciation and amortization of its equity affiliates. Proportional affiliate EBITDA is defined by the company as the proportional operating profit plus the proportional depreciation and amortization of its equity investments. The company has determined that it does not have sufficient ownership for operating control of these investments to consider their results on a consolidated basis. The company believes that investors should consider proportional affiliate EBITDA as an additional measure of operating results. ► Adjusted earnings per share is a measure used by management to measure performance. It is defined by the company as net earnings (loss) available to common shareholders plus preferred dividends, adjusted for other charges and adjustments, and divided by the number of basic common shares, diluted preferred shares, and options valued using the treasury method. We may provide guidance on an adjusted earnings per share basis and are unable to reconcile forecasted adjusted earnings per share to a U.S. GAAP financial measure without unreasonable effort because a forecast of Other Items is not practical. We believe that the presentation of this non-U.S. GAAP measure provides useful information to management and investors regarding various financial and business trends relating to our financial condition and results of operations, and that when U.S. GAAP information is viewed in conjunction with non-U.S. GAAP information, investors are provided with a more meaningful understanding of our ongoing operating performance. Note: The income tax rate used for adjusted earnings per share approximates the midpoint in a range of forecasted tax rates for the year. This range may include certain partial or full-year forecasted tax opportunities, where applicable, and specifically excludes changes in uncertain tax positions, discrete items and other material items adjusted out of our U.S. GAAP earnings for adjusted earnings per share purposes, and changes in management's assessments regarding the ability to realize deferred tax assets. We analyze this rate quarterly and adjust if there is a material change in the range of forecasted tax rates; an updated forecast would not necessarily result in a change to our tax rate used for adjusted earnings per share. The adjusted tax rate is an estimate and may differ from the tax rate used for U.S.GAAP reporting in any given reporting period. It is not practical to reconcile our prospective adjusted tax rate to the actual U.S. GAAP tax rate in any given future period. ► Net debt is defined by the company as total debt less cash and cash equivalents. We believe that the presentation of this non-U.S. GAAP measure provides useful information to management and investors regarding changes to the company's capital structure. Our management and credit analysts use net debt to evaluate the company's capital structure and assess credit quality. Proportional net debt is defined as our proportionate share of our affiliates' net debt. ► Adjusted free cash flow is defined by the company as cash flow from operations less capital expenditures, other productive asset purchases, operating cash from discontinued operations and certain other charges and adjustments. We believe that the presentation of this non-U.S. GAAP measure provides useful information to management and investors regarding changes to the company’s cash flow. Our management and credit analysts use adjusted free cash flow to evaluate the company’s liquidity and assess credit quality. Results Unaudited The results presented in this presentation, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

3 Dave Weidman Chairman and Chief Executive Officer

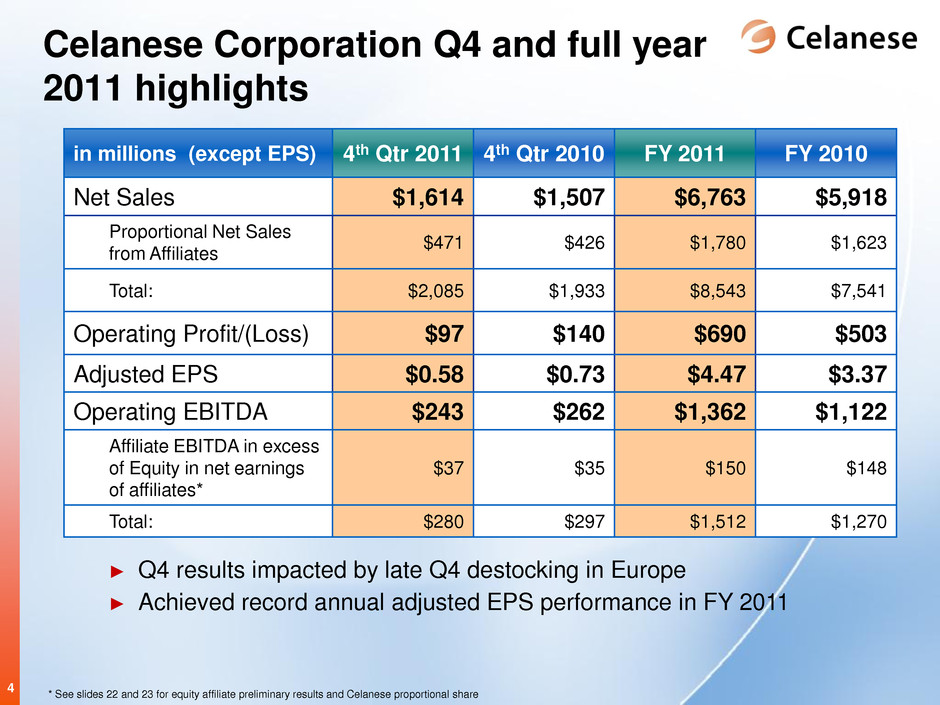

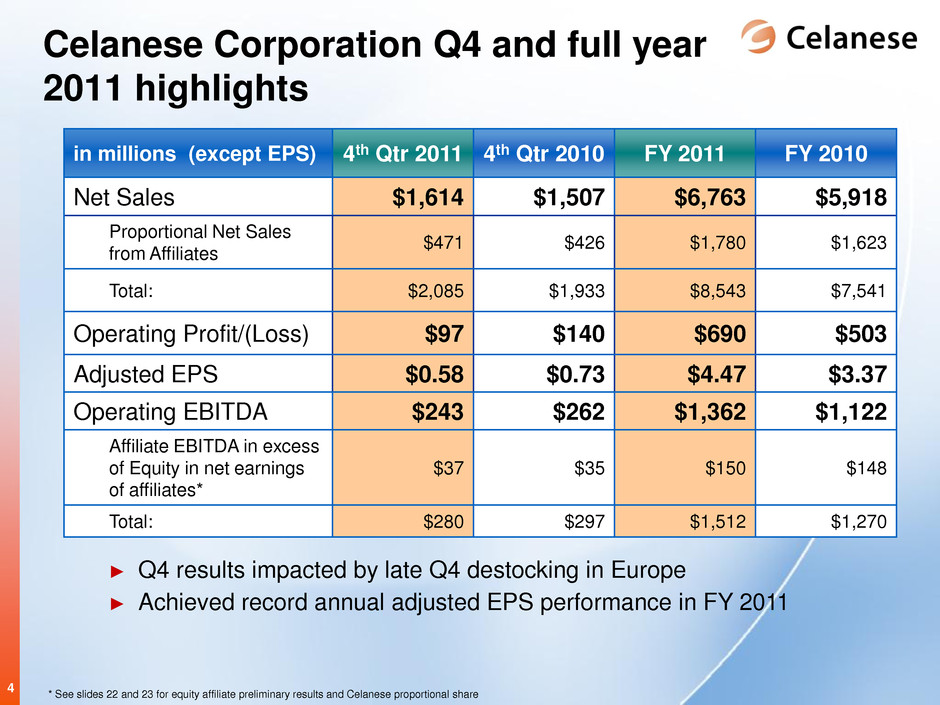

4 Celanese Corporation Q4 and full year 2011 highlights in millions (except EPS) 4th Qtr 2011 4th Qtr 2010 FY 2011 FY 2010 Net Sales $1,614 $1,507 $6,763 $5,918 Proportional Net Sales from Affiliates $471 $426 $1,780 $1,623 Total: $2,085 $1,933 $8,543 $7,541 Operating Profit/(Loss) $97 $140 $690 $503 Adjusted EPS $0.58 $0.73 $4.47 $3.37 Operating EBITDA $243 $262 $1,362 $1,122 Affiliate EBITDA in excess of Equity in net earnings of affiliates* $37 $35 $150 $148 Total: $280 $297 $1,512 $1,270 ► Q4 results impacted by late Q4 destocking in Europe ► Achieved record annual adjusted EPS performance in FY 2011 * See slides 22 and 23 for equity affiliate preliminary results and Celanese proportional share

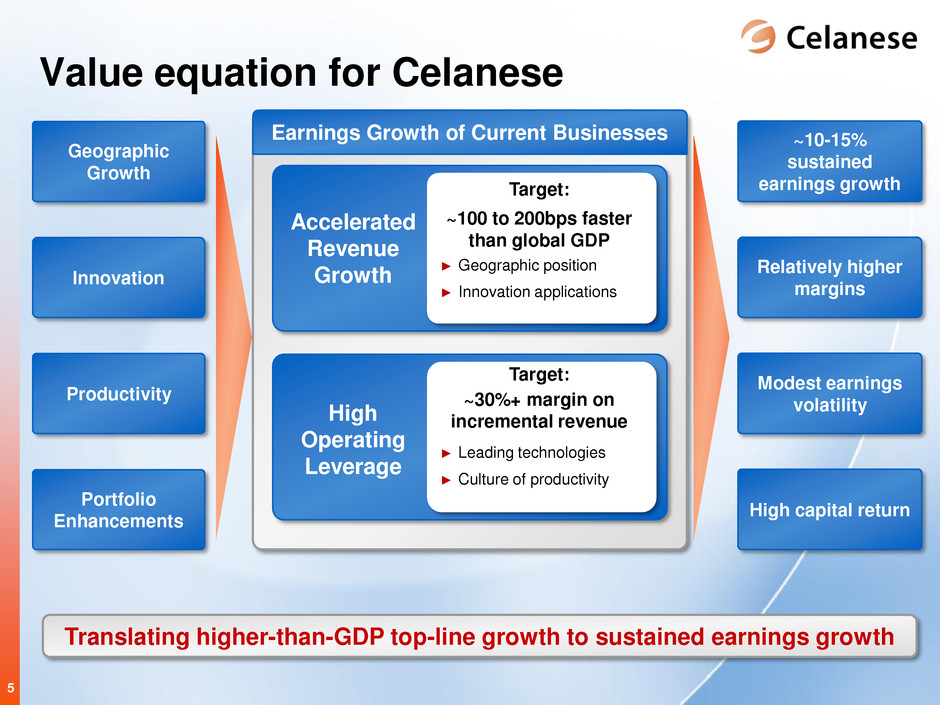

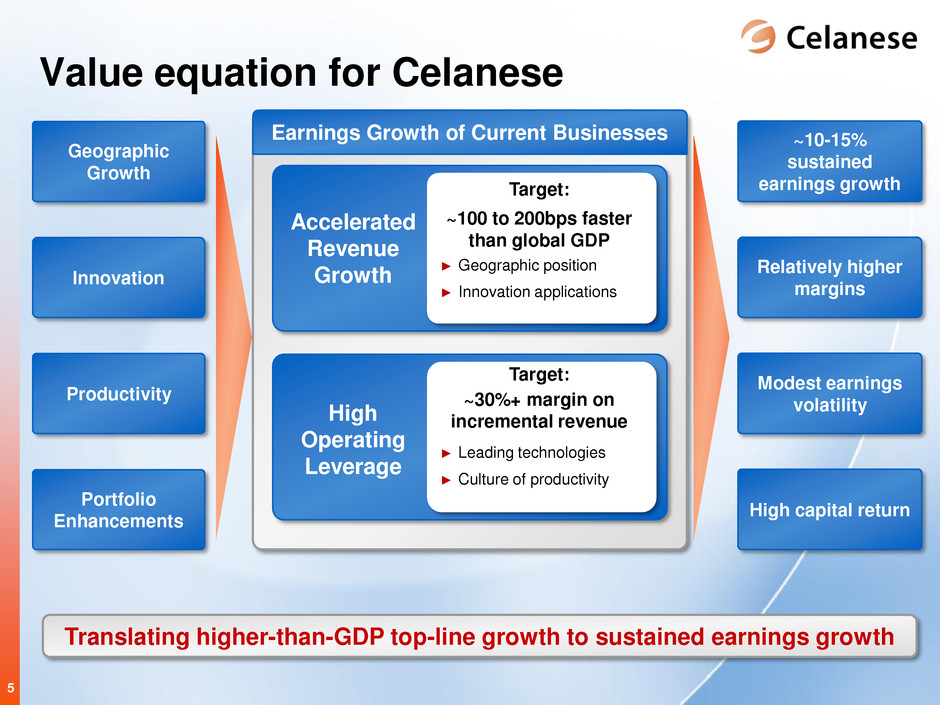

5 Value equation for Celanese Modest earnings volatility Relatively higher margins ~10-15% sustained earnings growth High capital return Translating higher-than-GDP top-line growth to sustained earnings growth Productivity Innovation Geographic Growth Portfolio Enhancements Earnings Growth of Current Businesses Accelerated Revenue Growth ~100 to 200bps faster than global GDP High Operating Leverage ► Leading technologies ► Culture of productivity Target: Target: ~30%+ margin on incremental revenue ► Geographic position ► Innovation applications

6 Steven Sterin Senior Vice President and Chief Financial Officer

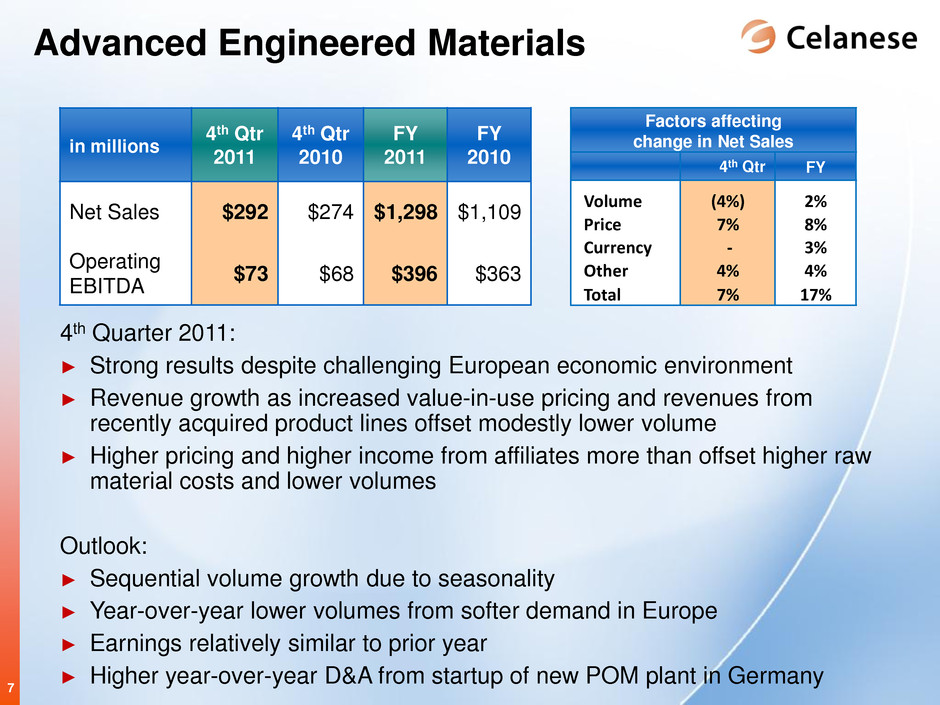

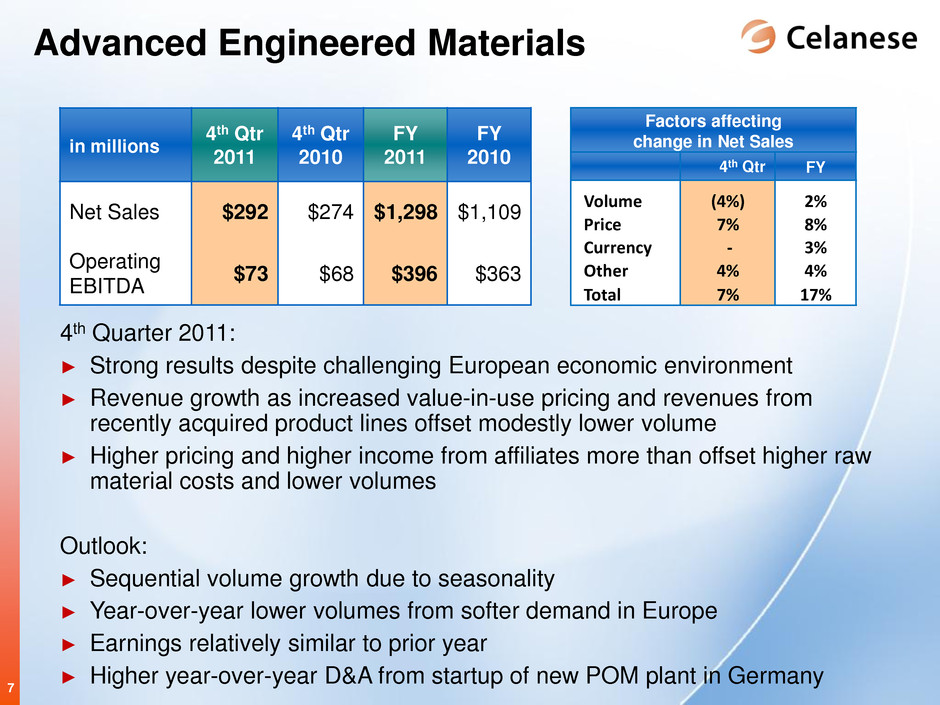

7 4th Quarter 2011: ► Strong results despite challenging European economic environment ► Revenue growth as increased value-in-use pricing and revenues from recently acquired product lines offset modestly lower volume ► Higher pricing and higher income from affiliates more than offset higher raw material costs and lower volumes Outlook: ► Sequential volume growth due to seasonality ► Year-over-year lower volumes from softer demand in Europe ► Earnings relatively similar to prior year ► Higher year-over-year D&A from startup of new POM plant in Germany Advanced Engineered Materials in millions 4th Qtr 2011 4th Qtr 2010 FY 2011 FY 2010 Net Sales $292 $274 $1,298 $1,109 Operating EBITDA $73 $68 $396 $363 Factors affecting change in Net Sales 4th Qtr FY Volume (4%) 2% Price 7% 8% Currency - 3% Other 4% 4% Total 7% 17%

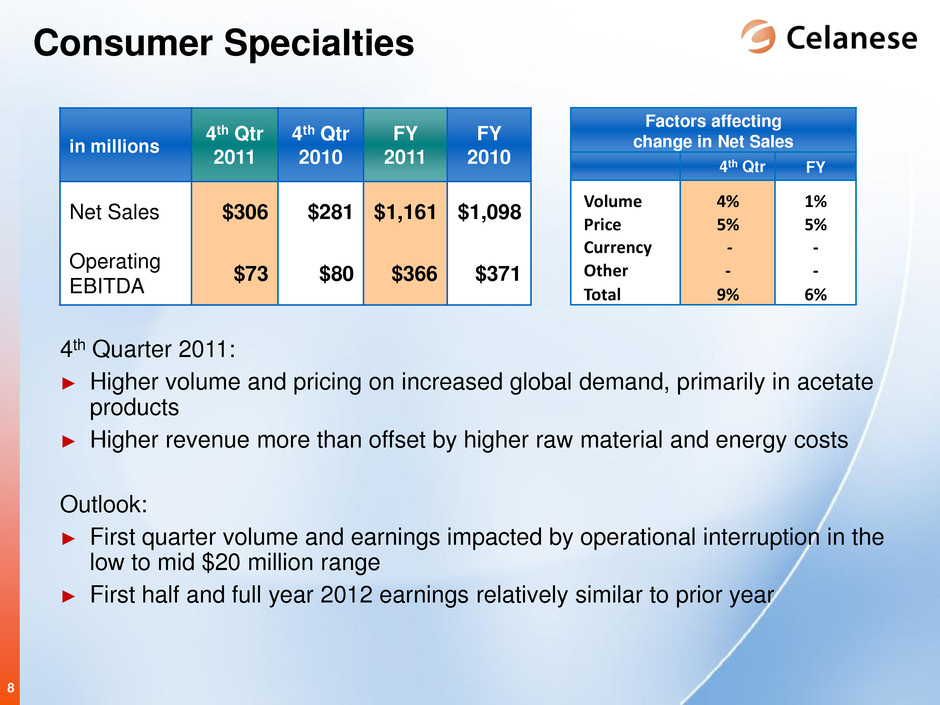

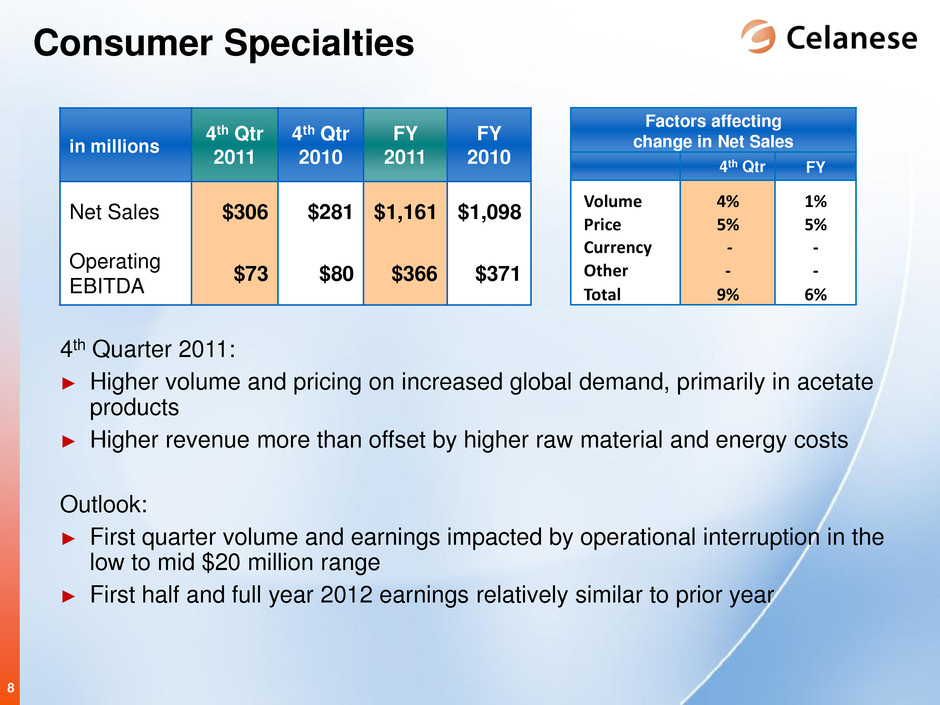

8 4th Quarter 2011: ► Higher volume and pricing on increased global demand, primarily in acetate products ► Higher revenue more than offset by higher raw material and energy costs Outlook: ► First quarter volume and earnings impacted by operational interruption in the low to mid $20 million range ► First half and full year 2012 earnings relatively similar to prior year Consumer Specialties in millions 4th Qtr 2011 4th Qtr 2010 FY 2011 FY 2010 Net Sales $306 $281 $1,161 $1,098 Operating EBITDA $73 $80 $366 $371 Factors affecting change in Net Sales 4th Qtr FY Volume 4% 1% Price 5% 5% Currency - - Other - - Total 9% 6%

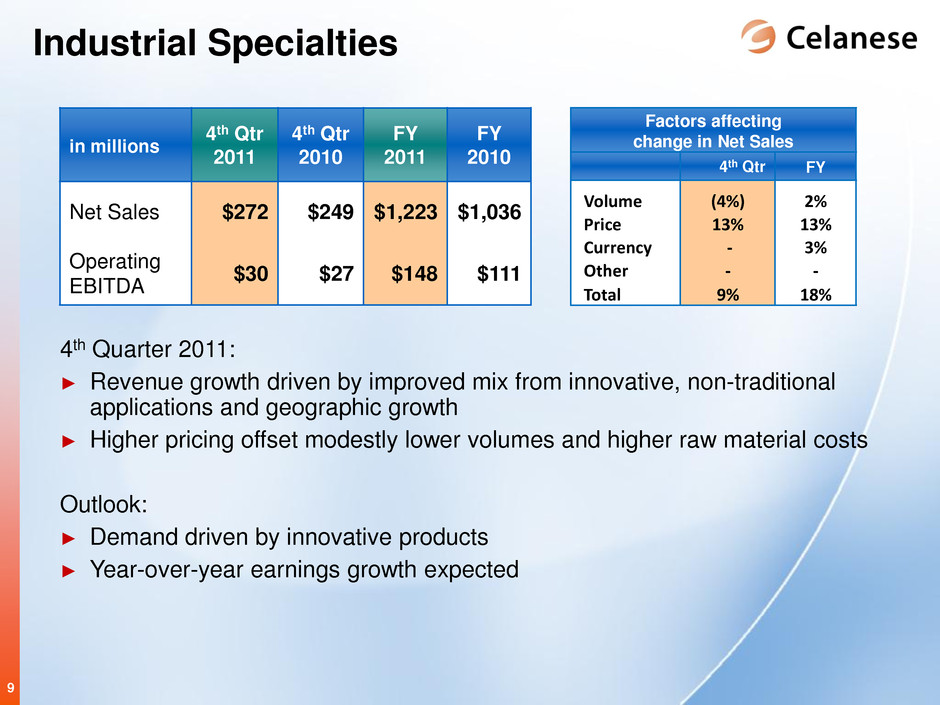

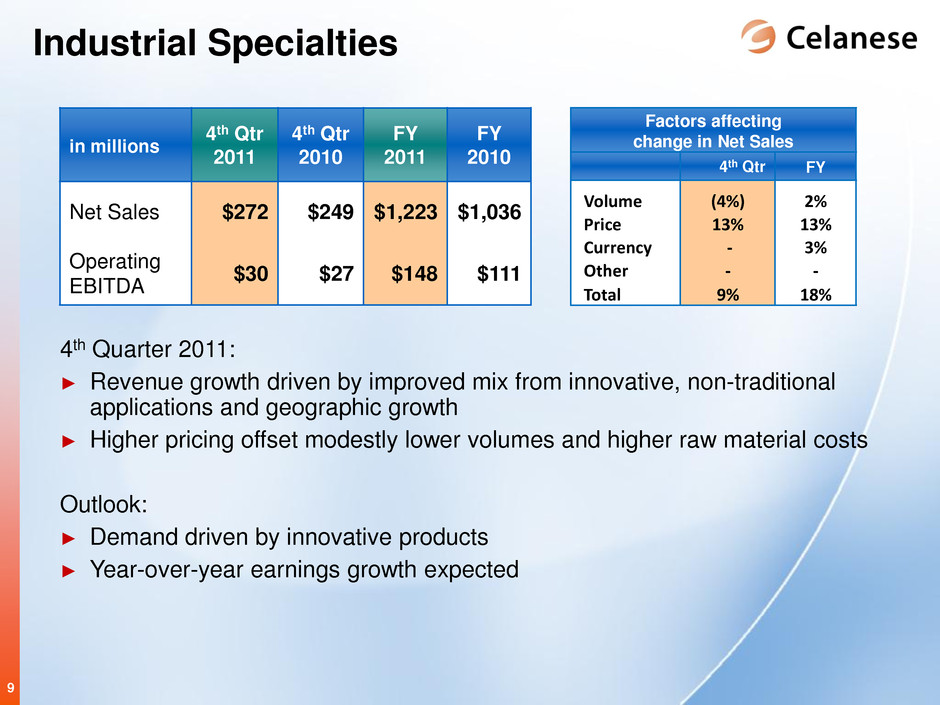

9 4th Quarter 2011: ► Revenue growth driven by improved mix from innovative, non-traditional applications and geographic growth ► Higher pricing offset modestly lower volumes and higher raw material costs Outlook: ► Demand driven by innovative products ► Year-over-year earnings growth expected Industrial Specialties in millions 4th Qtr 2011 4th Qtr 2010 FY 2011 FY 2010 Net Sales $272 $249 $1,223 $1,036 Operating EBITDA $30 $27 $148 $111 Factors affecting change in Net Sales 4th Qtr FY Volume (4%) 2% Price 13% 13% Currency - 3% Other - - Total 9% 18%

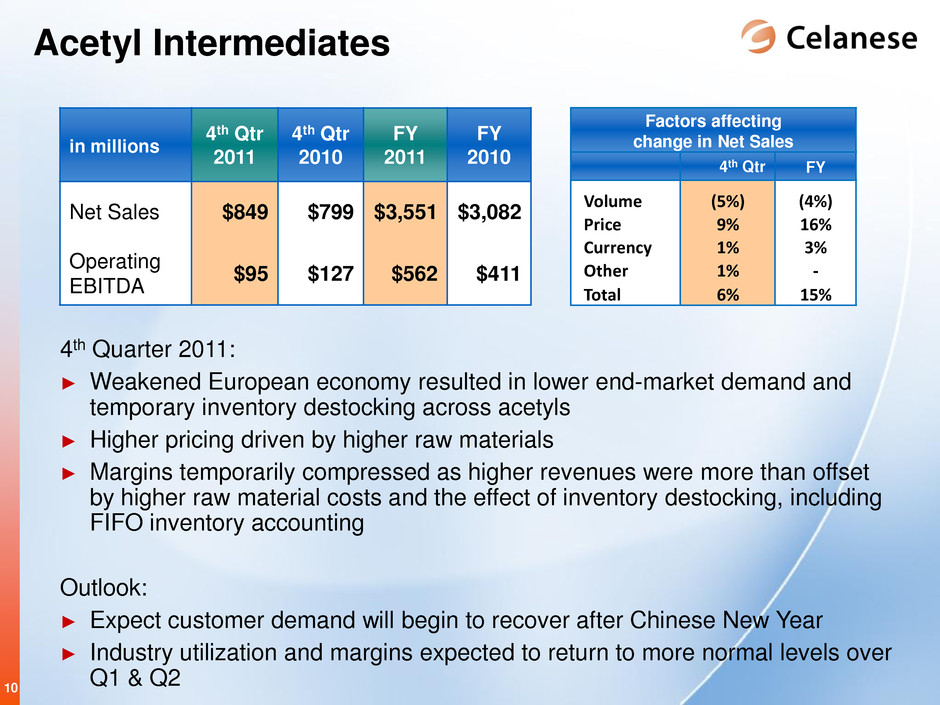

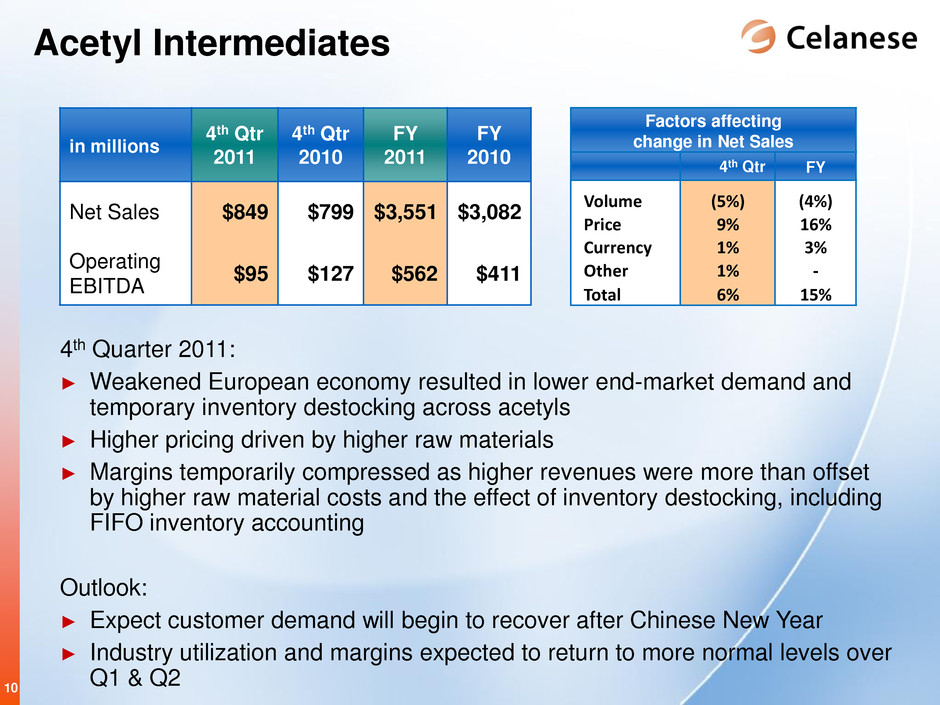

10 4th Quarter 2011: ► Weakened European economy resulted in lower end-market demand and temporary inventory destocking across acetyls ► Higher pricing driven by higher raw materials ► Margins temporarily compressed as higher revenues were more than offset by higher raw material costs and the effect of inventory destocking, including FIFO inventory accounting Outlook: ► Expect customer demand will begin to recover after Chinese New Year ► Industry utilization and margins expected to return to more normal levels over Q1 & Q2 Acetyl Intermediates in millions 4th Qtr 2011 4th Qtr 2010 FY 2011 FY 2010 Net Sales $849 $799 $3,551 $3,082 Operating EBITDA $95 $127 $562 $411 Factors affecting change in Net Sales 4th Qtr FY Volume (5%) (4%) Price 9% 16% Currency 1% 3% Other 1% - Total 6% 15%

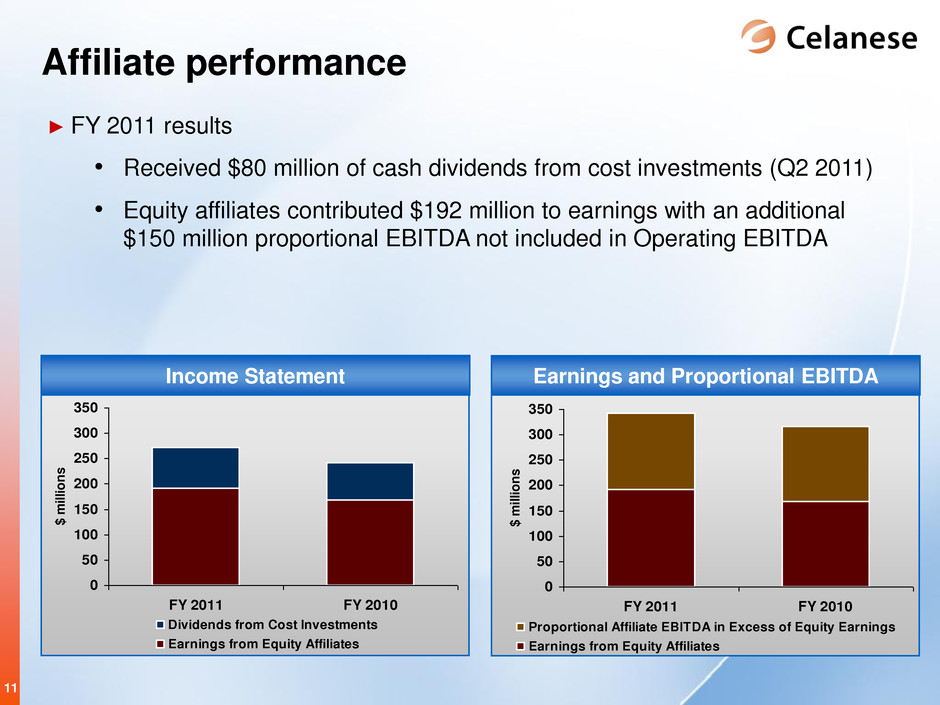

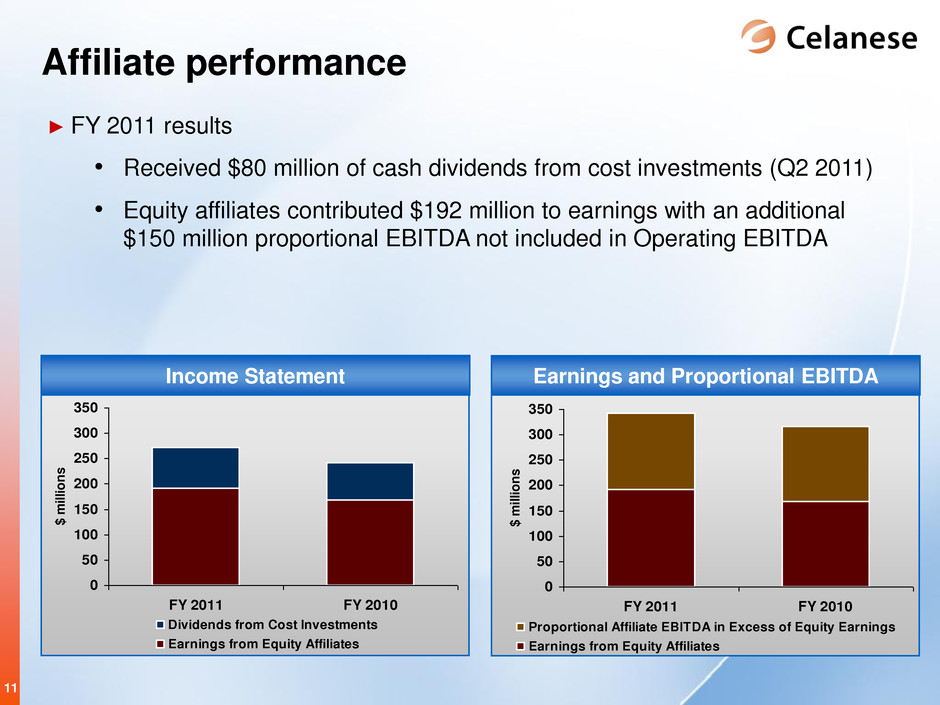

11 ► FY 2011 results • Received $80 million of cash dividends from cost investments (Q2 2011) • Equity affiliates contributed $192 million to earnings with an additional $150 million proportional EBITDA not included in Operating EBITDA Affiliate performance 0 50 100 150 200 250 300 350 FY 2011 FY 2010 $ m ill io ns Dividends from Cost Investments Earnings from Equity Affiliates Income Statement 0 50 100 150 200 250 300 350 FY 2011 FY 2010 $ m ill io ns Proport onal Affiliate EBITDA in Excess of Equity Earnings Earnings from Equity Affiliates Earnings and Proportional EBITDA

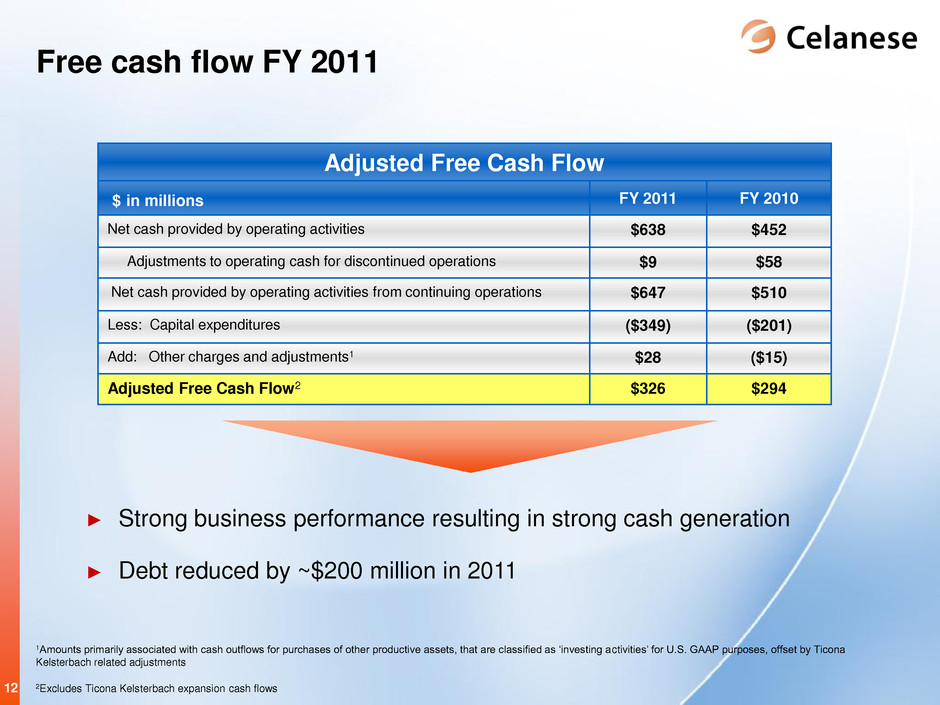

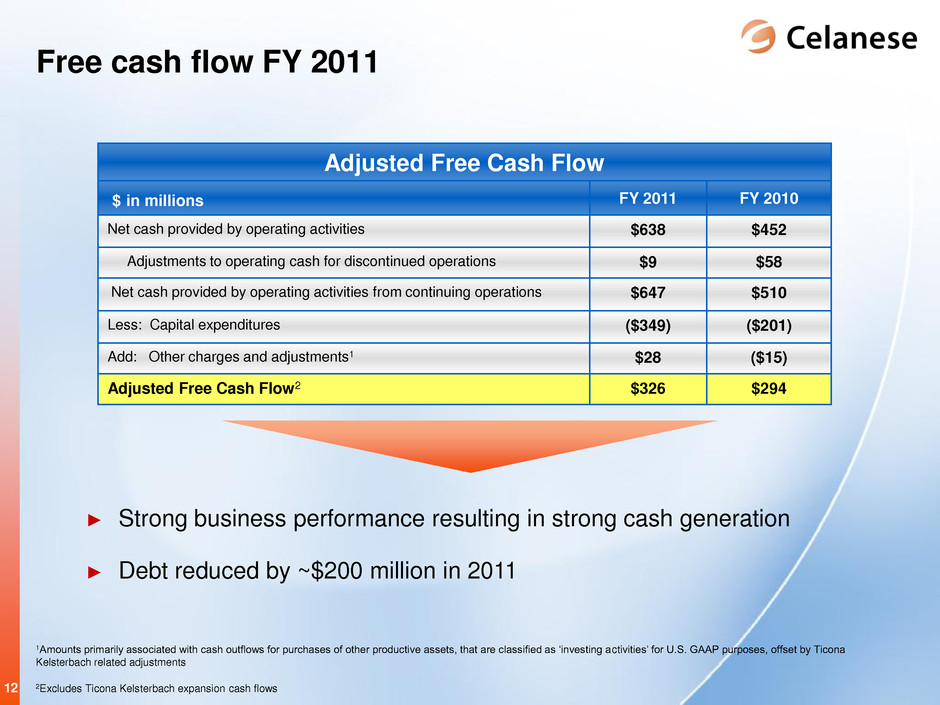

12 Free cash flow FY 2011 Adjusted Free Cash Flow $ in millions FY 2011 FY 2010 Net cash provided by operating activities $638 $452 Adjustments to operating cash for discontinued operations $9 $58 Net cash provided by operating activities from continuing operations $647 $510 Less: Capital expenditures ($349) ($201) Add: Other charges and adjustments1 $28 ($15) Adjusted Free Cash Flow2 $326 $294 1Amounts primarily associated with cash outflows for purchases of other productive assets, that are classified as ‘investing activities’ for U.S. GAAP purposes, offset by Ticona Kelsterbach related adjustments 2Excludes Ticona Kelsterbach expansion cash flows ► Strong business performance resulting in strong cash generation ► Debt reduced by ~$200 million in 2011

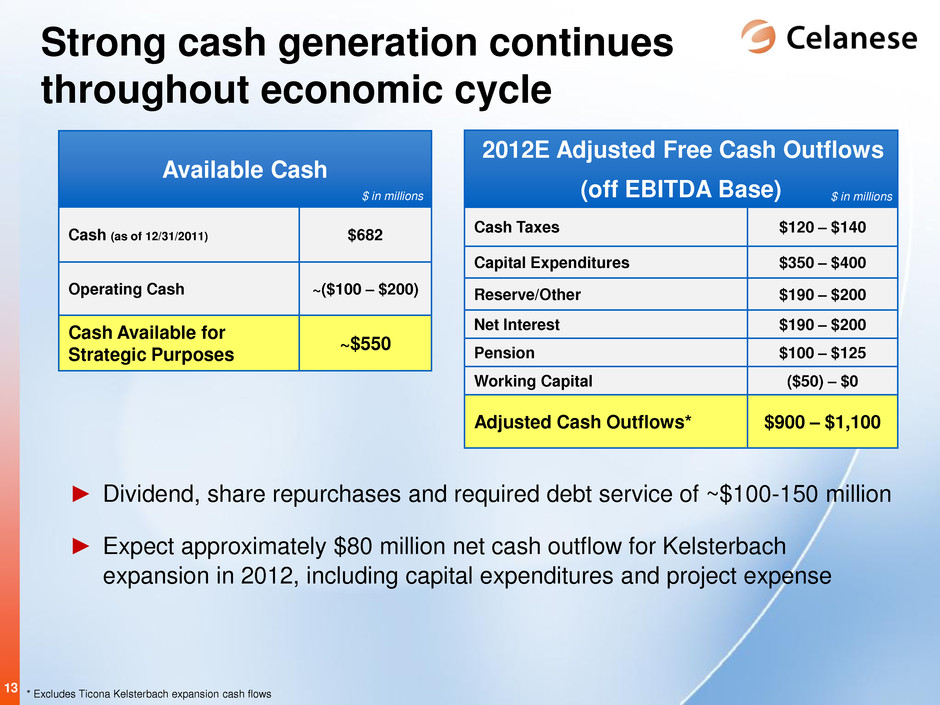

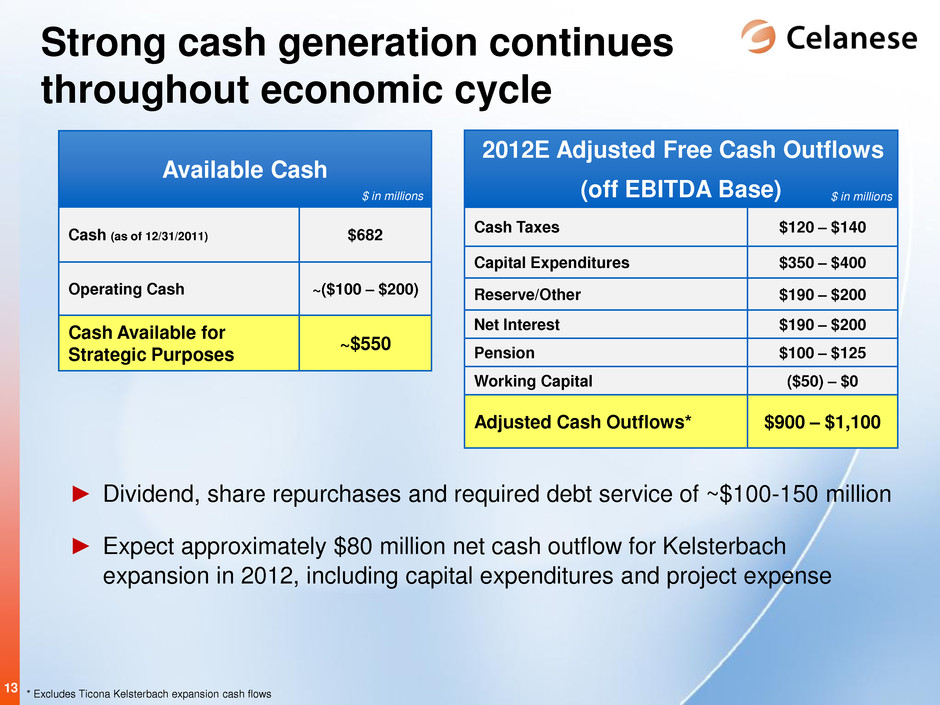

13 2012E Adjusted Free Cash Outflows (off EBITDA Base) Cash Taxes $120 – $140 Capital Expenditures $350 – $400 Reserve/Other $190 – $200 Net Interest $190 – $200 Pension $100 – $125 Working Capital ($50) – $0 Adjusted Cash Outflows* $900 – $1,100 ► Dividend, share repurchases and required debt service of ~$100-150 million ► Expect approximately $80 million net cash outflow for Kelsterbach expansion in 2012, including capital expenditures and project expense Strong cash generation continues throughout economic cycle Available Cash Cash (as of 12/31/2011) $682 Operating Cash ~($100 – $200) Cash Available for Strategic Purposes ~$550 $ in millions $ in millions * Excludes Ticona Kelsterbach expansion cash flows

14 Appendix Notes: References on the following slides to tables correspond to the tables included with Celanese press release dated January 31, 2012

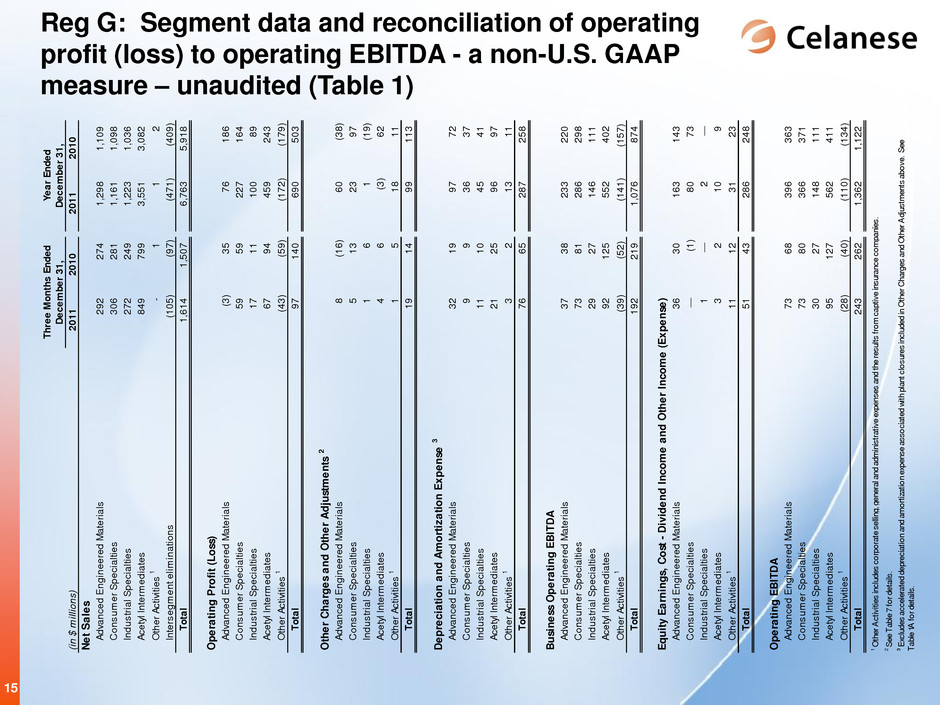

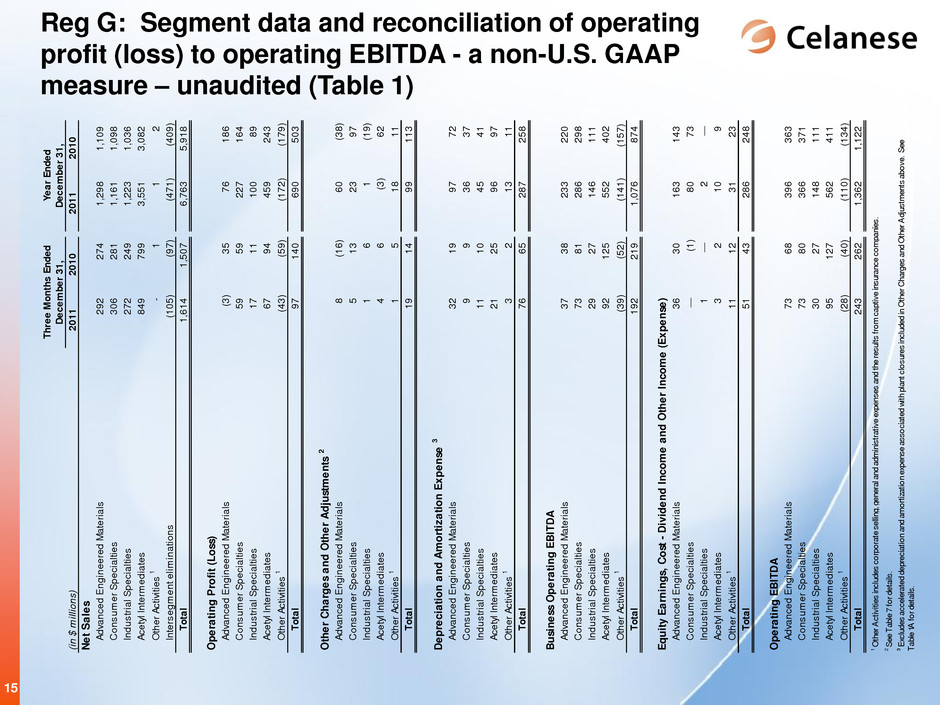

15 Reg G: Segment data and reconciliation of operating profit (loss) to operating EBITDA - a non-U.S. GAAP measure – unaudited (Table 1) (in $ m illi on s) 20 11 20 10 20 11 20 10 Ne t S al es Ad va nc ed E ng in ee re d Ma te ria ls 29 2 27 4 1, 29 8 1, 10 9 Co ns um er S pe cia ltie s 30 6 28 1 1, 16 1 1, 09 8 In du st ria l S pe cia ltie s 27 2 24 9 1, 22 3 1, 03 6 Ac et yl In te rm ed ia te s 84 9 79 9 3, 55 1 3, 08 2 Ot he r A cti vit ie s 1 - 1 1 2 In te rs eg m en t e lim in at io ns (1 05 ) (9 7) (4 71 ) (4 09 ) To ta l 1, 61 4 1, 50 7 6, 76 3 5, 91 8 Op er at in g Pr of it (L os s) Ad va nc ed E ng in ee re d Ma te ria ls (3 ) 35 76 18 6 Co ns um er S pe cia ltie s 59 59 22 7 16 4 In du st ria l S pe cia ltie s 17 11 10 0 89 Ac et yl In te rm ed ia te s 67 94 45 9 24 3 Ot he r A cti vit ie s 1 (4 3) (5 9) (1 72 ) (1 79 ) To ta l 97 14 0 69 0 50 3 Ot he r C ha rg es a nd O th er A dj us tm en ts 2 Ad va nc ed E ng in ee re d Ma te ria ls 8 (1 6) 60 (3 8) Co ns um er S pe cia ltie s 5 13 23 97 In du st ria l S pe cia ltie s 1 6 1 (1 9) Ac et yl In te rm ed ia te s 4 6 (3 ) 62 Ot he r A cti vit ie s 1 1 5 18 11 To ta l 19 14 99 11 3 De pr ec ia tio n an d Am or tiz at io n Ex pe ns e 3 Ad va nc ed E ng in ee re d Ma te ria ls 32 19 97 72 Co ns um er S pe cia ltie s 9 9 36 37 In du st ria l S pe cia ltie s 11 10 45 41 Ac et yl In te rm ed ia te s 21 25 96 97 Ot he r A cti vit ie s 1 3 2 13 11 To ta l 76 65 28 7 25 8 Bu sin es s O pe ra tin g EB IT DA Ad va nc ed E ng in ee re d Ma te ria ls 37 38 23 3 22 0 Co ns um er S pe cia ltie s 73 81 28 6 29 8 In du st ria l S pe cia ltie s 29 27 14 6 11 1 Ac et yl In te rm ed ia te s 92 12 5 55 2 40 2 Ot he r A cti vit ie s 1 (3 9) (5 2) (1 41 ) ( 15 7) To ta l 19 2 21 9 1, 07 6 87 4 Eq ui ty E ar ni ng s, Co st - D iv id en d In co m e an d Ot he r I nc om e (E xp en se ) Ad va nc ed E ng in ee re d Ma te ria ls 36 30 16 3 14 3 Co ns um er S pe cia ltie s — (1 ) 80 73 In du st ria l S pe cia ltie s 1 — 2 — Ac et yl In te rm ed ia te s 3 2 10 9 Ot he r A cti vit ie s 1 11 12 31 23 To ta l 51 43 28 6 24 8 Op er at in g EB IT DA Ad va nc ed E ng in ee re d Ma te ria ls 73 68 39 6 36 3 Co ns um er S pe cia ltie s 73 80 36 6 37 1 In du st ria l S pe cia ltie s 30 27 14 8 11 1 Ac et yl In te rm ed ia te s 95 12 7 56 2 41 1 Ot he r A cti vit ie s 1 (2 8) (4 0) (1 10 ) (1 34 ) To ta l 24 3 26 2 1, 36 2 1, 12 2 Th re e M on th s En de d Ye ar E nd ed De ce m be r 3 1, De ce m be r 3 1, 2 S ee Ta ble 7 fo r d eta ils . 3 E xc lud es acc ele rat ed de pre cia tio n a nd am or tiz ati on ex pe ns e a ss oc iat ed wi th pla nt clo su res in clu de d i n O the r C ha rge s a nd O the r A dju stm en ts ab ov e. Se e Ta ble 1A fo r d eta ils . 1 O the r A cti vit ies in clu de s c or po rat e s ell ing , g en era l a nd ad mi nis tra tiv e e xp en se s a nd th e r es ult s f ro m ca pti ve in su ran ce co mp an ies .

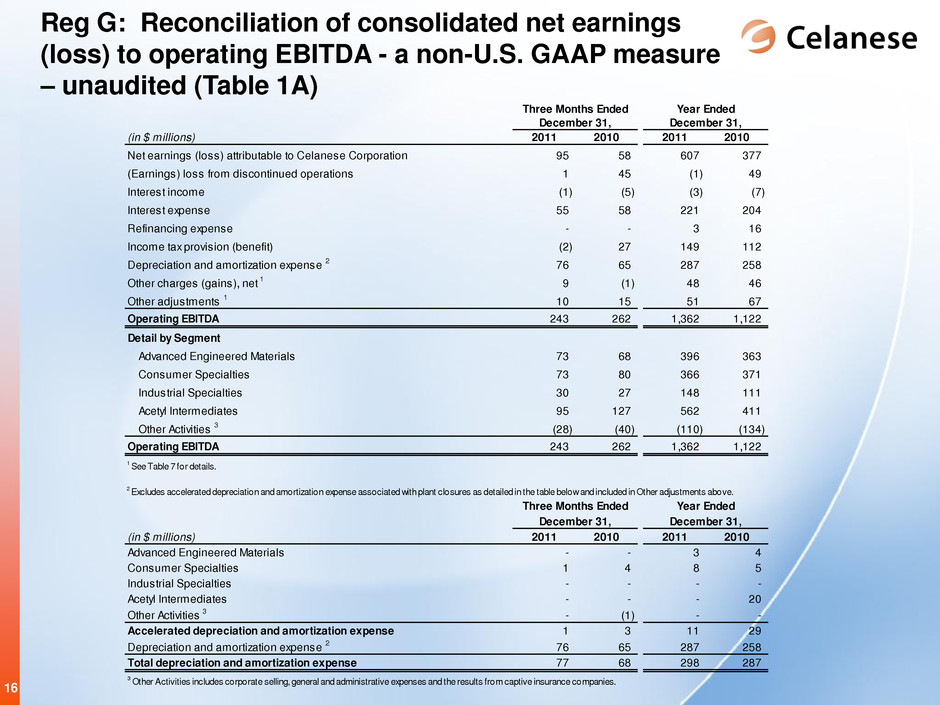

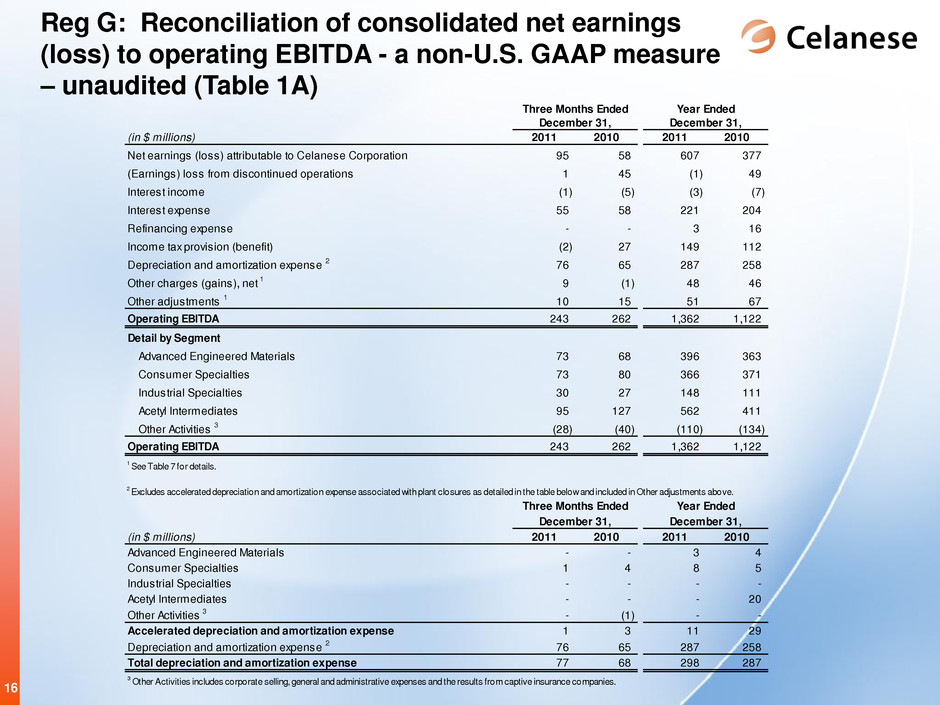

16 Reg G: Reconciliation of consolidated net earnings (loss) to operating EBITDA - a non-U.S. GAAP measure – unaudited (Table 1A) (in $ millions) 2011 2010 2011 2010 Net earnings (loss) attributable to Celanese Corporation 95 58 607 377 (Earnings) loss from discontinued operations 1 45 (1) 49 Interest income (1) (5) (3) (7) Interest expense 55 58 221 204 Refinancing expense - - 3 16 Income tax provision (benefit) (2) 27 149 112 Depreciation and amortization expense 2 76 65 287 258 Other charges (gains), net 1 9 (1) 48 46 Other adjustments 1 10 15 51 67 Operating EBITDA 243 262 1,362 1,122 Detail by Segment Advanced Engineered Materials 73 68 396 363 Consumer Specialties 73 80 366 371 Industrial Specialties 30 27 148 111 Acetyl Intermediates 95 127 562 411 Other Activities 3 (28) (40) (110) (134) Operating EBITDA 243 262 1,362 1,122 (in $ millions) 2011 2010 2011 2010 Advanced Engineered Materials - - 3 4 Consumer Specialties 1 4 8 5 Industrial Specialties - - - - Acetyl Intermediates - - - 20 Other Activities 3 - (1) - - Accelerated depreciation and amortization expense 1 3 11 29 Depreciation and amortization expense 2 76 65 287 258 Total depreciation and amortization expense 77 68 298 287 3 Other Activities includes corporate selling, general and administrative expenses and the results from captive insurance companies. Three Months Ended Year Ended December 31, December 31, Three Months Ended Year Ended December 31, December 31, 2 Excludes accelerated depreciation and amortization expense associated with plant closures as detailed in the table below and included in Other adjustments above. 1 See Table 7 for details.

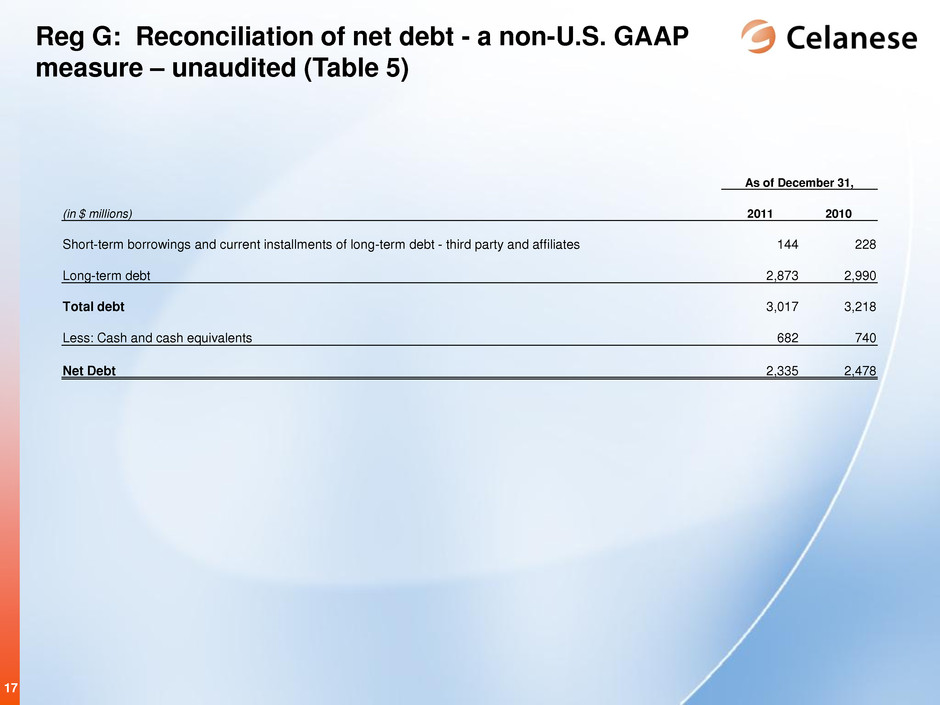

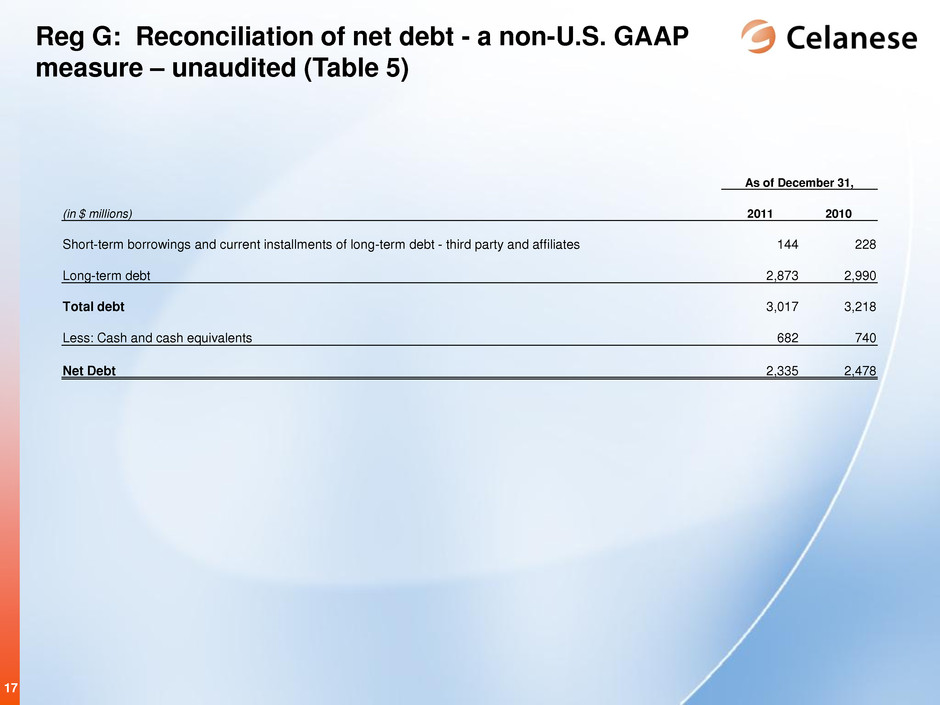

17 Reg G: Reconciliation of net debt - a non-U.S. GAAP measure – unaudited (Table 5) As of December 31, (in $ millions) 2011 2010 Short-term borrowings and current installments of long-term debt - third party and affiliates 144 228 Long-term debt 2,873 2,990 Total debt 3,017 3,218 Less: Cash and cash equivalents 682 740 Net Debt 2,335 2,478

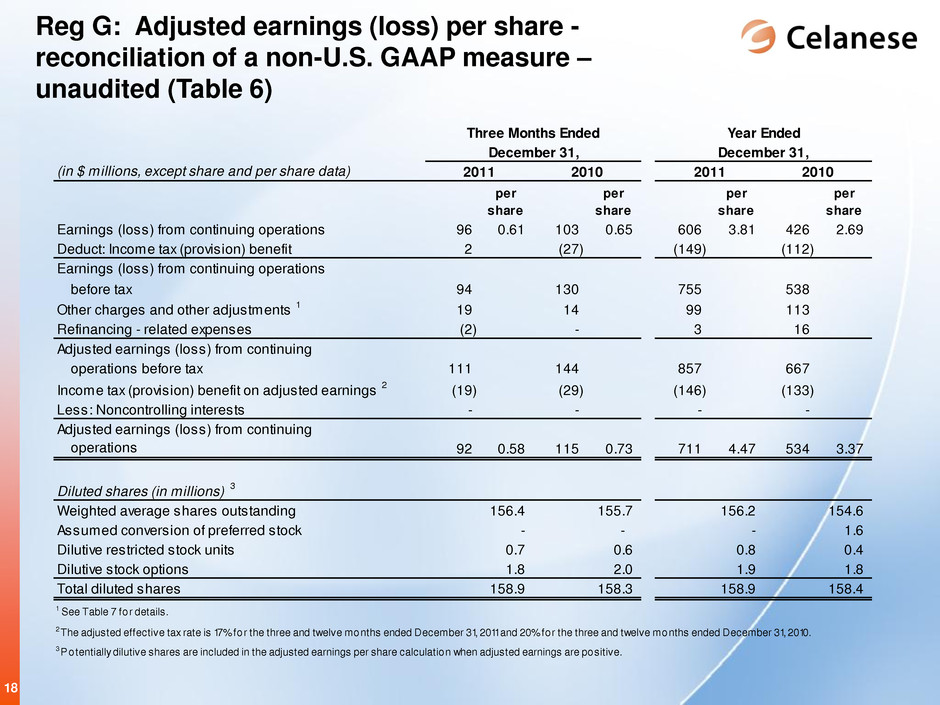

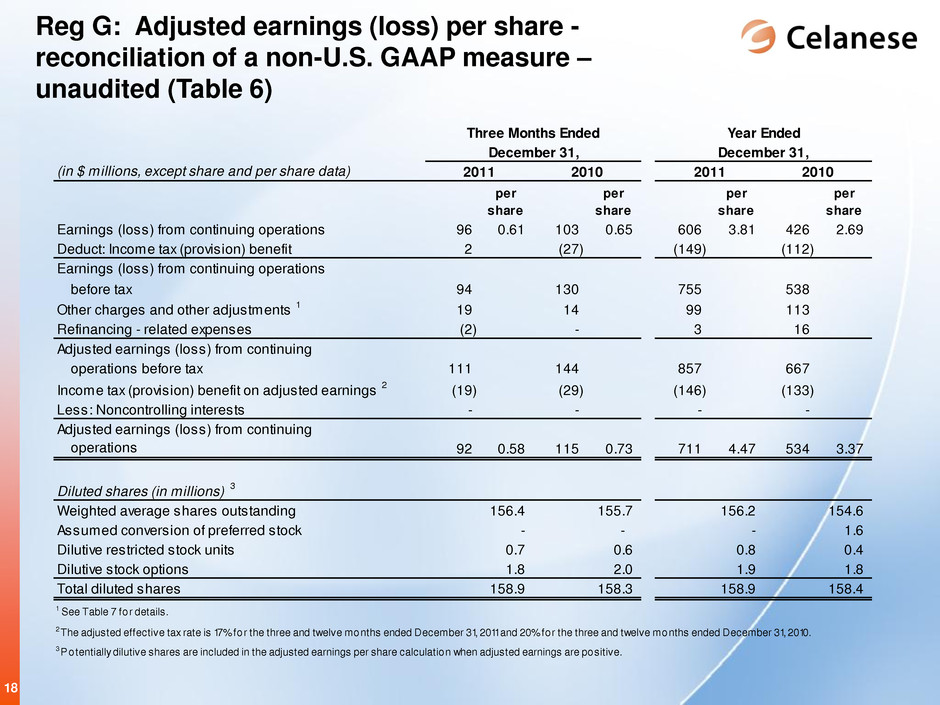

18 Reg G: Adjusted earnings (loss) per share - reconciliation of a non-U.S. GAAP measure – unaudited (Table 6) (in $ millions, except share and per share data) per share per share per share per share Earnings (loss) from continuing operations 96 0.61 103 0.65 606 3.81 426 2.69 Deduct: Income tax (provision) benefit 2 (27) (149) (112) Earnings (loss) from continuing operations before tax 94 130 755 538 Other charges and other adjustments 1 19 14 99 113 Refinancing - related expenses (2) - 3 16 Adjusted earnings (loss) from continuing operations before tax 111 144 857 667 Income tax (provision) benefit on adjusted earnings 2 (19) (29) (146) (133) Less: Noncontrolling interests - - - - Adjusted earnings (loss) from continuing operations 92 0.58 115 0.73 711 4.47 534 3.37 Diluted shares (in millions) 3 Weighted average shares outstanding 156.4 155.7 156.2 154.6 Assumed conversion of preferred stock - - - 1.6 Dilutive restricted stock units 0.7 0.6 0.8 0.4 Dilutive stock options 1.8 2.0 1.9 1.8 Total diluted shares 158.9 158.3 158.9 158.4 1 See Table 7 for details. 2 The adjusted effective tax rate is 17% for the three and twelve months ended December 31, 2011 and 20% for the three and twelve months ended December 31, 2010. 3 Potentially dilutive shares are included in the adjusted earnings per share calculation when adjusted earnings are positive. Three Months Ended Year Ended December 31, December 31, 2011 2010 2011 2010

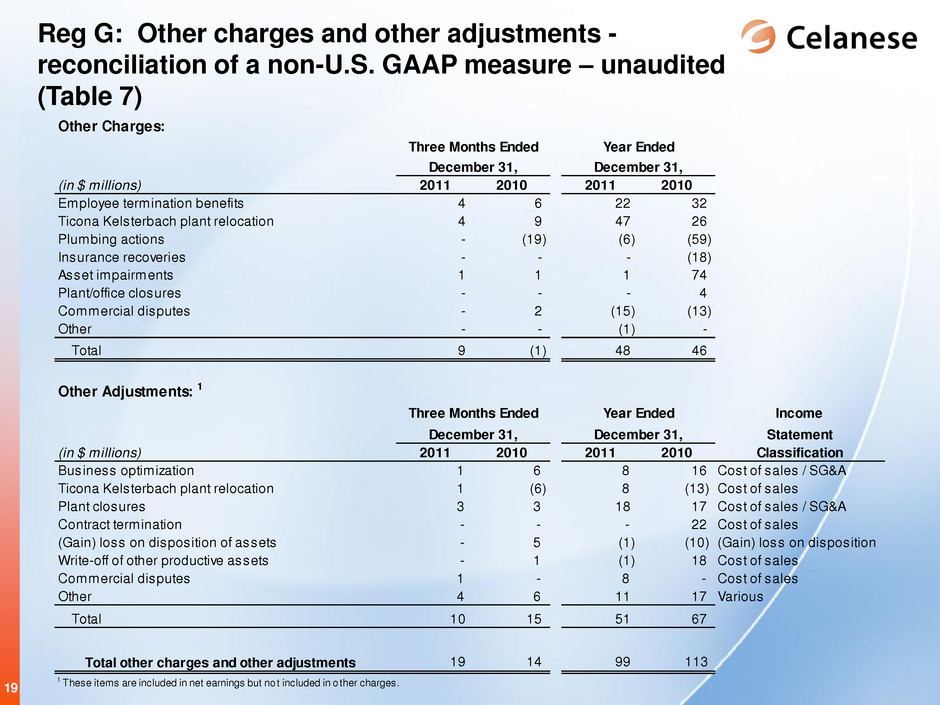

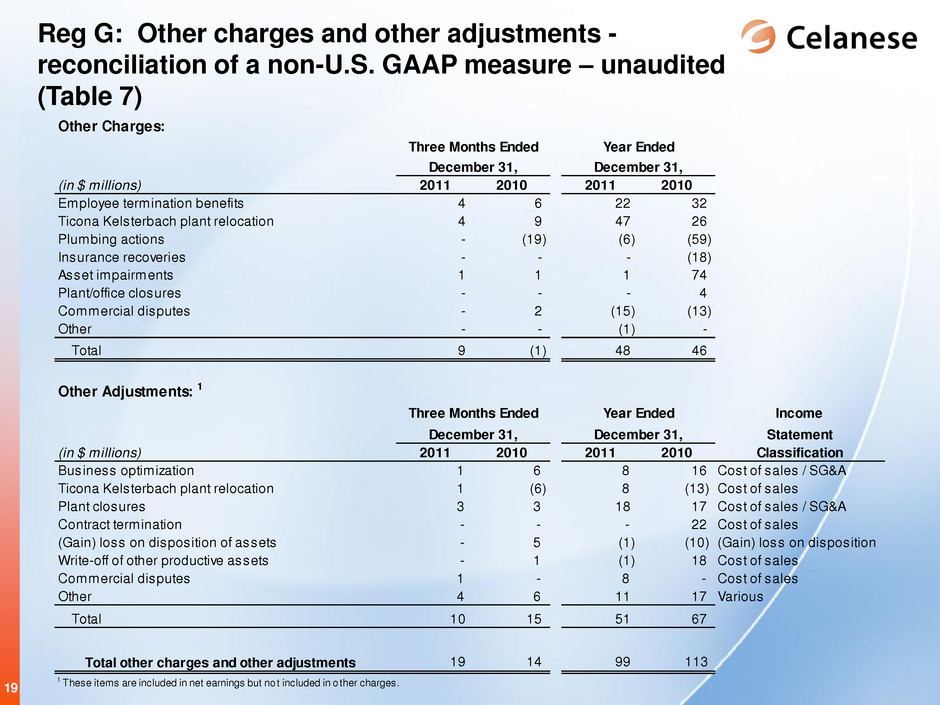

19 Reg G: Other charges and other adjustments - reconciliation of a non-U.S. GAAP measure – unaudited (Table 7) Other Charges: (in $ millions) 2011 2010 2011 2010 Employee termination benefits 4 6 22 32 Ticona Kelsterbach plant relocation 4 9 47 26 Plumbing actions - (19) (6) (59) Insurance recoveries - - - (18) Asset impairments 1 1 1 74 Plant/office closures - - - 4 Commercial disputes - 2 (15) (13) Other - - (1) - Total 9 (1) 48 46 Other Adjustments: 1 Income Statement (in $ millions) 2011 2010 2011 2010 Classification Business optimization 1 6 8 16 Cost of sales / SG&A Ticona Kelsterbach plant relocation 1 (6) 8 (13) Cost of sales Plant closures 3 3 18 17 Cost of sales / SG&A Contract termination - - - 22 Cost of sales (Gain) loss on disposition of assets - 5 (1) (10) (Gain) loss on disposition Write-off of other productive assets - 1 (1) 18 Cost of sales Commercial disputes 1 - 8 - Cost of sales Other 4 6 11 17 Various Total 10 15 51 67 Total other charges and other adjustments 19 14 99 113 1 These items are included in net earnings but not included in other charges. Three Months Ended Year Ended December 31, December 31, Three Months Ended Year Ended December 31, December 31,

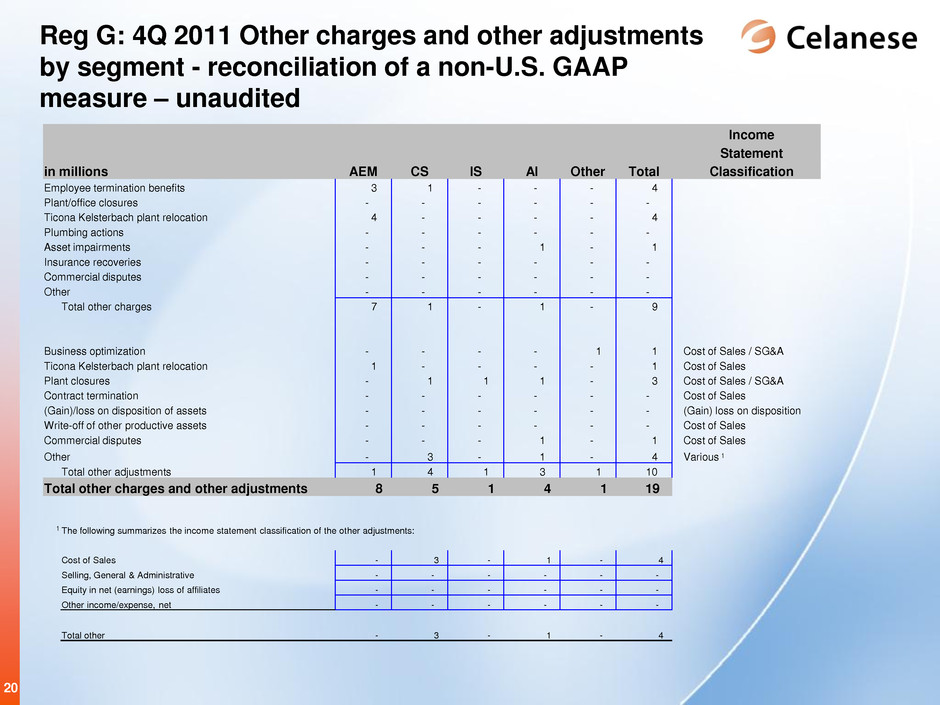

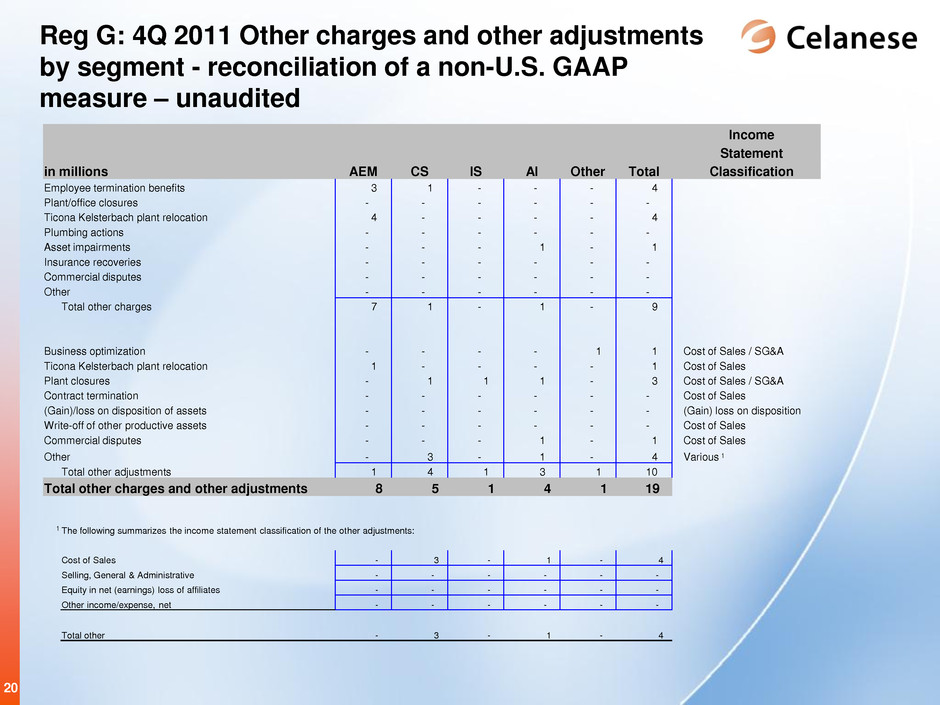

20 Reg G: 4Q 2011 Other charges and other adjustments by segment - reconciliation of a non-U.S. GAAP measure – unaudited Income Statement in millions AEM CS IS AI Other Total Classification Employee termination benefits 3 1 - - - 4 Plant/office closures - - - - - - Ticona Kelsterbach plant relocation 4 - - - - 4 Plumbing actions - - - - - - Asset impairments - - - 1 - 1 Insurance recoveries - - - - - - Commercial disputes - - - - - - Other - - - - - - Total other charges 7 1 - 1 - 9 Business optimization - - - - 1 1 Cost of Sales / SG&A Ticona Kelsterbach plant relocation 1 - - - - 1 Cost of Sales Plant closures - 1 1 1 - 3 Cost of Sales / SG&A Contract termination - - - - - - Cost of Sales (Gain)/loss on disposition of assets - - - - - - (Gain) loss on disposition Write-off of other productive assets - - - - - - Cost of Sales Commercial disputes - - - 1 - 1 Cost of Sales Other - 3 - 1 - 4 Various 1 Total other adjustments 1 4 1 3 1 10 Total other charges and other adjustments 8 5 1 4 1 19 1 The following summarizes the income statement classification of the other adjustments: Cost of Sales - 3 - 1 - 4 Selling, General & Administrative - - - - - - Equity in net (earnings) loss of affiliates - - - - - - Other income/expense, net - - - - - - Total other - 3 - 1 - 4

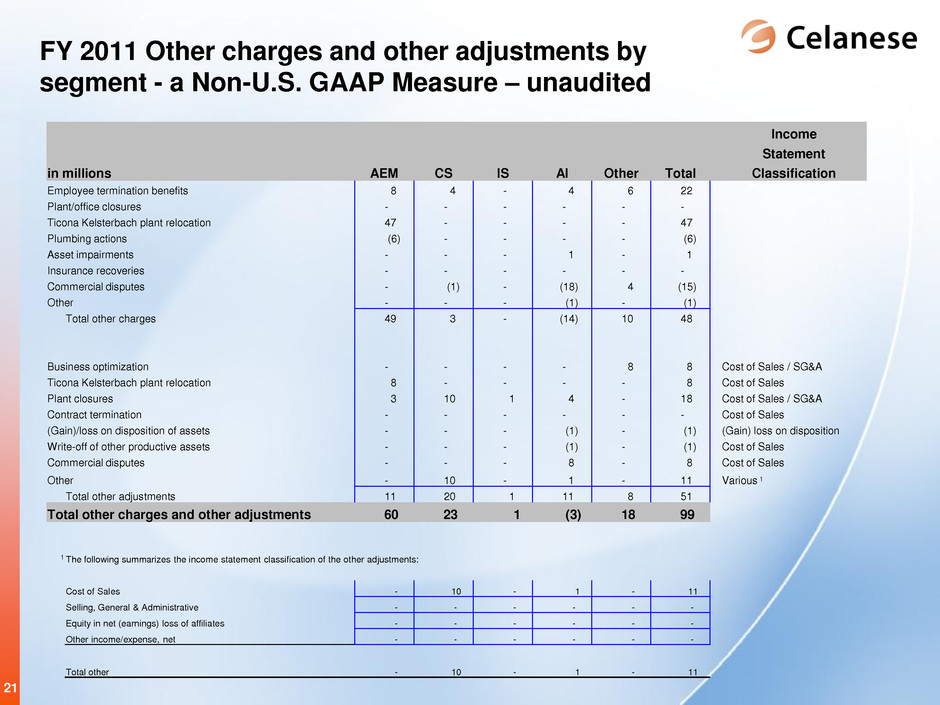

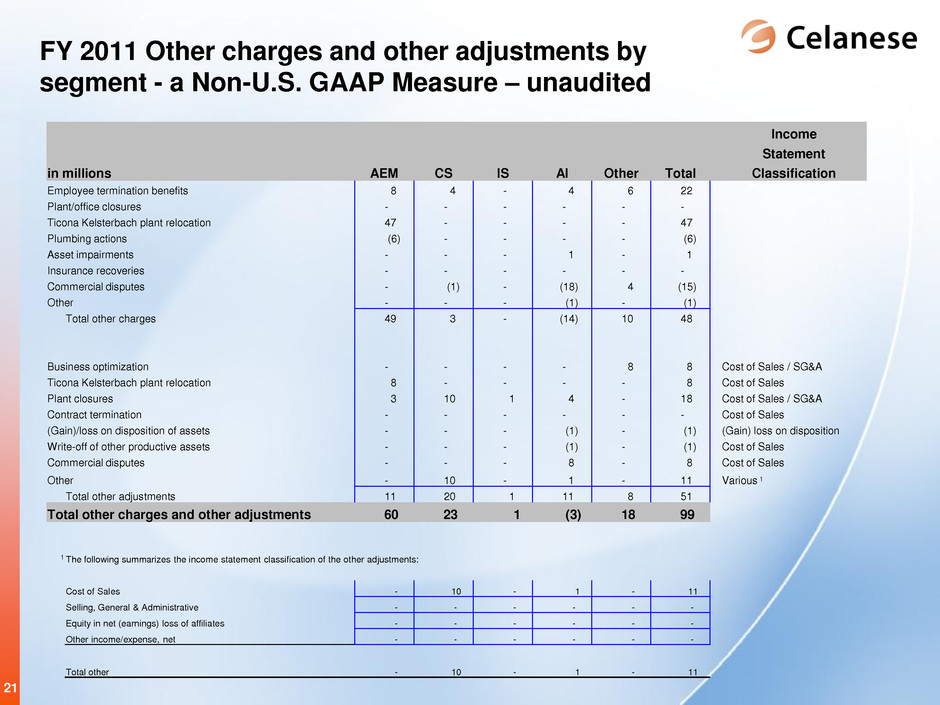

21 FY 2011 Other charges and other adjustments by segment - a Non-U.S. GAAP Measure – unaudited Income Statement in millions AEM CS IS AI Other Total Classification Employee termination benefits 8 4 - 4 6 22 Plant/office closures - - - - - - Ticona Kelsterbach plant relocation 47 - - - - 47 Plumbing actions (6) - - - - (6) Asset impairments - - - 1 - 1 Insurance recoveries - - - - - - Commercial disputes - (1) - (18) 4 (15) Other - - - (1) - (1) Total other charges 49 3 - (14) 10 48 Business optimization - - - - 8 8 Cost of Sales / SG&A Ticona Kelsterbach plant relocation 8 - - - - 8 Cost of Sales Plant closures 3 10 1 4 - 18 Cost of Sales / SG&A Contract termination - - - - - - Cost of Sales (Gain)/loss on disposition of assets - - - (1) - (1) (Gain) loss on disposition Write-off of other productive assets - - - (1) - (1) Cost of Sales Commercial disputes - - - 8 - 8 Cost of Sales Other - 10 - 1 - 11 Various 1 Total other adjustments 11 20 1 11 8 51 Total other charges and other adjustments 60 23 1 (3) 18 99 1 The following summarizes the income statement classification of the other adjustments: Cost of Sales - 10 - 1 - 11 Selling, General & Administrative - - - - - - Equity in net (earnings) loss of affiliates - - - - - - Other income/expense, net - - - - - - Total other - 10 - 1 - 11

22 Reg G: Equity affiliate results and reconciliation of operating profit to affiliate EBITDA - a non-U.S. GAAP measure - total - unaudited (Table 8) (in $ millions) 2011 2010 2011 2010 Net Sales Ticona Affiliates - Asia 1 405 400 1,637 1,543 Ticona Affiliates - Middle East 2 353 205 1,204 923 Infraserv Affiliates 3 595 579 2,192 2,070 Total 1,353 1,184 5,033 4,536 Operating Profit Ticona Affiliates - Asia 1 9 43 160 222 Ticona Affiliates - Middle East 2 172 84 541 400 Infraserv Affiliates 3 38 31 138 101 Total 219 158 839 723 Depreciation and Amortization Ticona Affiliates - Asia 1 19 22 76 85 Ticona Affiliates - Middle East 2 10 8 48 33 Infraserv Affiliates 3 36 26 120 101 Total 65 56 244 219 Affiliate EBITDA Ticona Affiliates - Asia 1 28 65 236 307 Ticona Affiliates - Middle East 2 182 92 589 433 Infraserv Affiliates 3 74 57 258 202 Total 284 214 1,083 942 Net Income Ticona Affiliates - Asia 1 1 27 104 134 Ticona Affiliates - Middle East 2 153 74 481 357 Infraserv Affiliates 3 29 20 95 75 Total 183 121 680 566 Net Debt Ticona Affiliates - Asia 1 172 53 172 53 Ticona Affiliates - Middle East 2 (110) (64) (110) (64) Infraserv Affiliates 3 236 277 236 277 Total 298 266 298 266 Three Months Ended Year Ended December 31, December 31, 1 Ticona Affiliates - Asia accounted for using the equity method includes Polyplastics (45%), Korean Engineering Plastics (50%), Fortron Industries (50%), Una SA (50%). Una SA was divested during the three months ended M arch 31, 2011. 2 Ticona Affiliates - M iddle East accounted for using the equity method includes National M ethanol Company (Ibn Sina) (25%). 3 Infraserv Affiliates accounted for using the equity method includes Infraserv Hoechst (32%), Infraserv Gendorf (39%) and Infraserv Knapsack (27%).

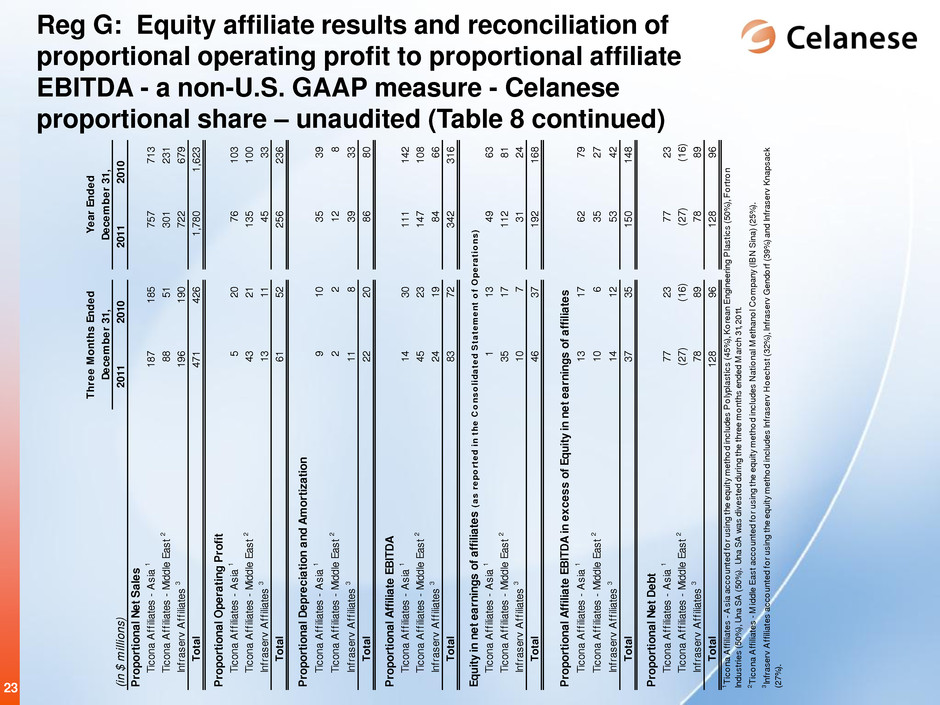

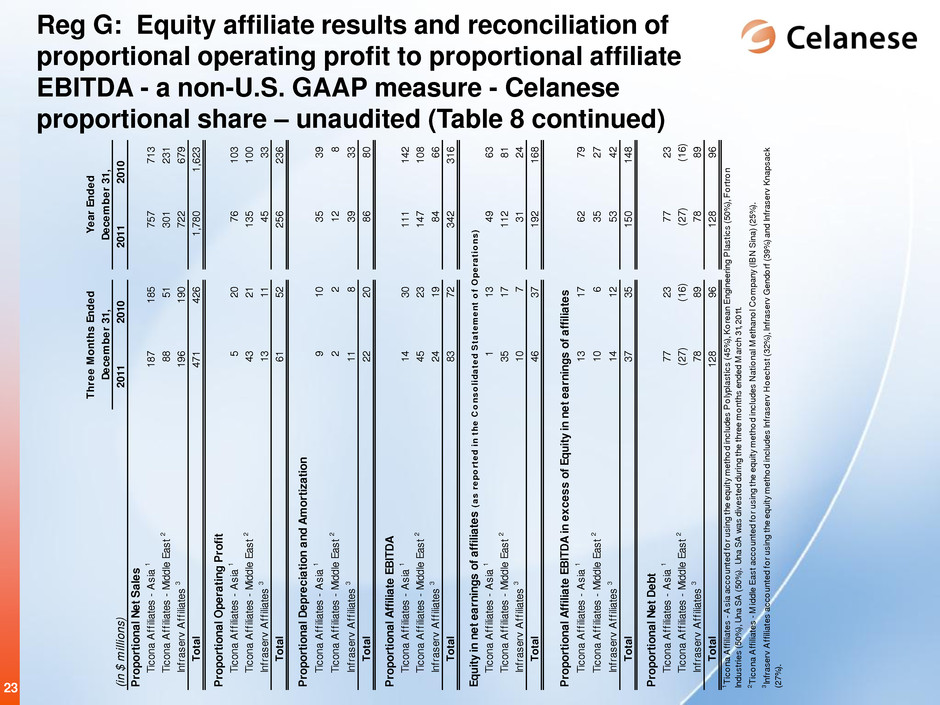

23 Reg G: Equity affiliate results and reconciliation of proportional operating profit to proportional affiliate EBITDA - a non-U.S. GAAP measure - Celanese proportional share – unaudited (Table 8 continued) (in $ m ill io ns ) 20 11 20 10 20 11 20 10 P ro po rt io na l N et S al es Ti co na A ff ilia te s - A si a 1 18 7 18 5 75 7 71 3 Ti co na A ff ilia te s - M id dl e Ea st 2 88 51 30 1 23 1 In fr as er v A ff ilia te s 3 19 6 19 0 72 2 67 9 T o ta l 47 1 42 6 1, 78 0 1, 62 3 P ro po rt io na l O pe ra tin g P ro fit Ti co na A ff ilia te s - A si a 1 5 20 76 10 3 Ti co na A ff ilia te s - M id dl e Ea st 2 43 21 13 5 10 0 In fr as er v A ff ilia te s 3 13 11 45 33 T o ta l 61 52 25 6 23 6 P ro po rt io na l D ep re ci at io n an d A m or tiz at io n Ti co na A ff ilia te s - A si a 1 9 10 35 39 Ti co na A ff ilia te s - M id dl e Ea st 2 2 2 12 8 In fr as er v A ff ilia te s 3 11 8 39 33 T o ta l 22 20 86 80 P ro po rt io na l A ff ili at e EB IT D A Ti co na A ff ilia te s - A si a 1 14 30 11 1 14 2 Ti co na A ff ilia te s - M id dl e Ea st 2 45 23 14 7 10 8 In fr as er v A ff ilia te s 3 24 19 84 66 T o ta l 83 72 34 2 31 6 Eq ui ty in n et e ar ni ng s of a ff ili at es (a s r e p o rt e d i n t h e C o n s o li d a te d S ta te m e n t o f O p e ra ti o n s ) Ti co na A ff ilia te s - A si a 1 1 13 49 63 Ti co na A ff ilia te s - M id dl e Ea st 2 35 17 11 2 81 In fr as er v A ff ilia te s 3 10 7 31 24 T o ta l 46 37 19 2 16 8 P ro po rt io na l A ff ili at e EB IT D A in e xc es s of E qu ity in n et e ar ni ng s of a ff ili at es Ti co na A ff ilia te s - A si a 1 13 17 62 79 Ti co na A ff ilia te s - M id dl e Ea st 2 10 6 35 27 In fr as er v A ff ilia te s 3 14 12 53 42 T o ta l 37 35 15 0 14 8 P ro po rt io na l N et D eb t Ti co na A ff ilia te s - A si a 1 77 23 77 23 Ti co na A ff ilia te s - M id dl e Ea st 2 (2 7) (1 6) (2 7) (1 6) In fr as er v A ff ilia te s 3 78 89 78 89 T o ta l 12 8 96 12 8 96 3 In fra ser v A ff ilia te s ac co un ted fo r u sing the equi ty m et ho d in clude s In fra ser v H o ec hs t (32 % ), In fra ser v Gend o rf (39 % ) and In fra ser v Knap sa ck (27 % ). Y e ar E n d e d T h re e M o n th s E n d e d D e ce m b e r 31 , D e ce m b e r 31 , 1 T ic o na A ff ilia te s - A sia a cc o un ted fo r u sing the equi ty m et ho d in clude s P o ly pla st ic s (45 % ), K o rean Engineering P la st ic s (50 % ), F o rt ro n Indu st rie s (50 % ), U na S A (50 % ). U na S A w as di ve st ed during the three m o nt hs ended M ar ch 3 1, 20 11 . 2 T ic o na A ff ilia te s - M iddle Ea st a cc o un ted fo r u sing the equi ty m et ho d in clude s N at io nal M et han o l C o m pan y (IB N Sina) (25 % ).