1 Mark Rohr, Chairman and Chief Executive Officer Steven Sterin, Senior Vice President and Chief Financial Officer Celanese Q2 2013 Earnings Thursday, July 18, 2013 Conference Call / Webcast Friday, July 19, 2013 10:00 a.m. EDT Exhibit 99.2

2 Forward-Looking Statements This presentation, and public statements made in connection with this presentation, may contain “forward-looking statements,” which include information concerning the company's plans, objectives, goals, strategies, future net sales or performance, capital expenditures, financing needs and other information that are not historical facts. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in such forward- looking statements. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, electronics and construction industries; changes in the price and availability of raw materials, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned capacity additions and expansions; the ability to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; market acceptance of our technology; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the company; changes in the degree of intellectual property and other legal protection afforded to our products or technology, or the theft of such intellectual property; compliance and other costs and potential disruption or interruption of production or operations due to accidents, cyber security incidents, terrorism or political unrest or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, including the occurrence of acts of war or terrorist incidents or as a result of weather or natural disasters; potential liability for remedial actions and increased costs under existing or future environmental regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; and various other factors discussed from time to time in the company's periodic reports with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and the company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Results Unaudited The results in this presentation, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year. Non-GAAP Financial Measures and Change in Accounting Policy This presentation, and statements made in connection with this presentation, contain references to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the company and referenced in this presentation, including definitions and reconciliations with comparable GAAP financial measures, as well as prior period information, please refer to Investor Relations/Financial Information/Non-GAAP Financial Measures on our website, www.celanese.com. The website materials also describe a change in accounting policy regarding pension and other postretirement benefits effective January 1, 2013.

3 Mark Rohr Chairman and Chief Executive Officer

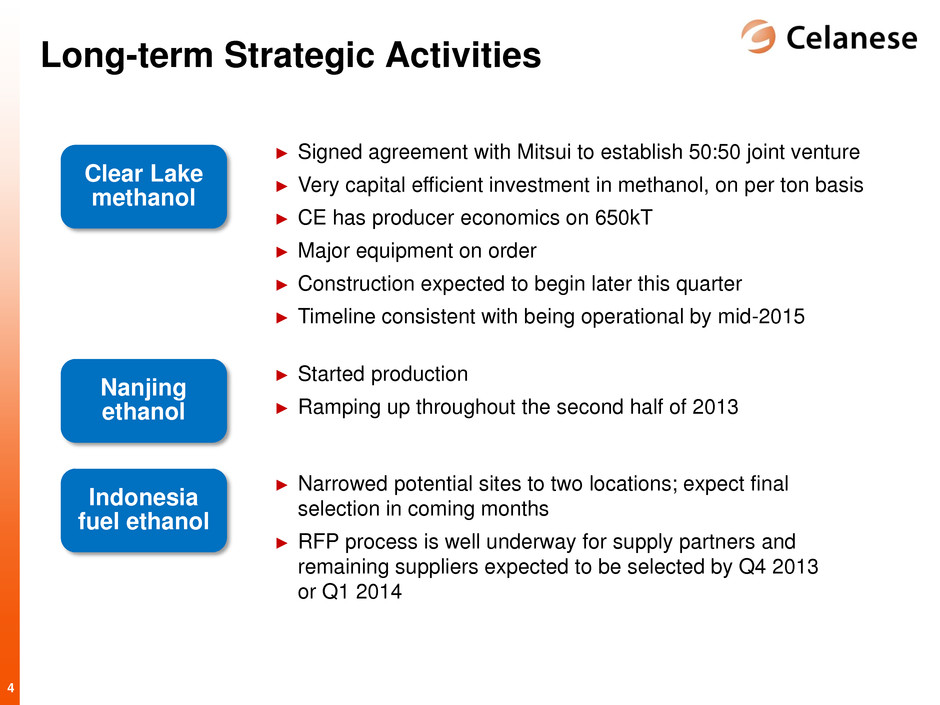

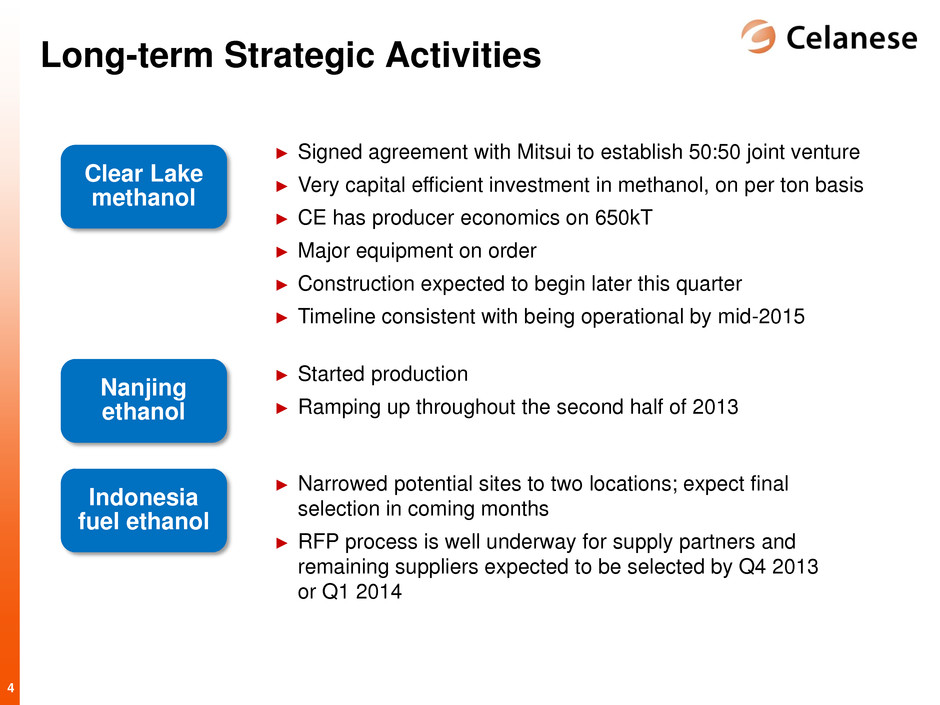

4 Long-term Strategic Activities ► Narrowed potential sites to two locations; expect final selection in coming months ► RFP process is well underway for supply partners and remaining suppliers expected to be selected by Q4 2013 or Q1 2014 Indonesia fuel ethanol ► Signed agreement with Mitsui to establish 50:50 joint venture ► Very capital efficient investment in methanol, on per ton basis ► CE has producer economics on 650kT ► Major equipment on order ► Construction expected to begin later this quarter ► Timeline consistent with being operational by mid-2015 Clear Lake methanol ► Started production ► Ramping up throughout the second half of 2013 Nanjing ethanol

5 Innovation Success QorusTM Sweetener Systems Electronic ► Allow customers to deliver authentic taste while reducing calories ► Currently in trials with several potential customers globally ► Sinalco will be using QorusTM in its Sinetta fruit beverages ► Enabled innovative organic LED light element that won an industry award ► Lighting solution replaces metal with a polymer application ► Provides opportunity for creative thin lighting designs Innovation success allows CE to continue to deliver growth

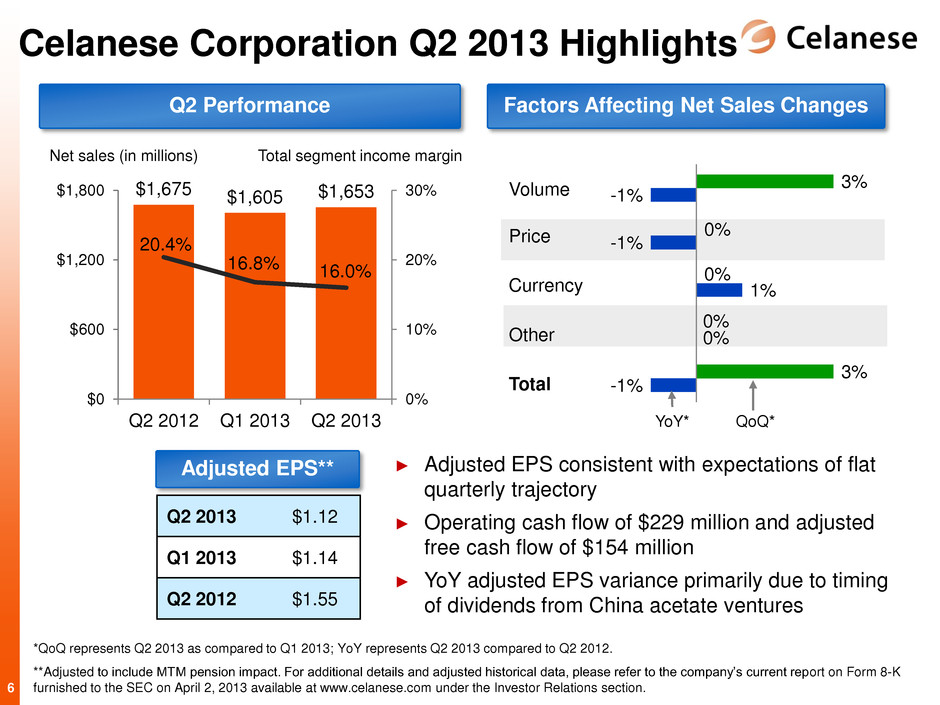

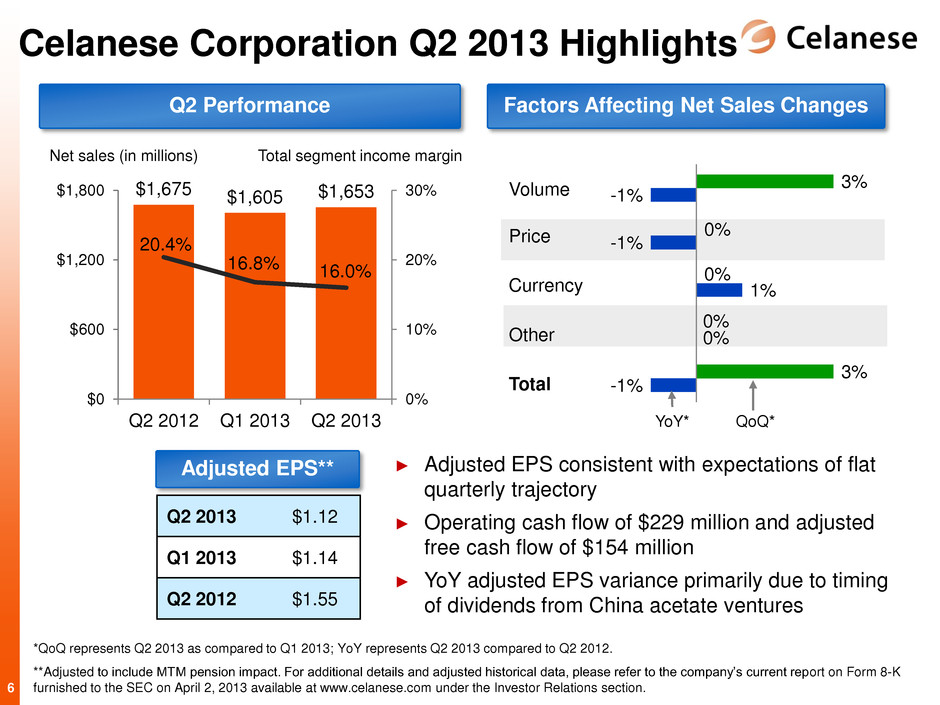

6 ► Adjusted EPS consistent with expectations of flat quarterly trajectory ► Operating cash flow of $229 million and adjusted free cash flow of $154 million ► YoY adjusted EPS variance primarily due to timing of dividends from China acetate ventures Celanese Corporation Q2 2013 Highlights Q2 2013 $1.12 Q1 2013 $1.14 Q2 2012 $1.55 Adjusted EPS** $1,675 $1,605 $1,653 20.4% 16.8% 16.0% 0% 10% 20% 30% $0 $600 $1,200 $1,800 Q2 2012 Q1 2013 Q2 2013 Q2 Performance Net sales (in millions) Total segment income margin Factors Affecting Net Sales Changes -1% 0% 1% -1% -1% 3% 0% 0% 0% 3% Volume Price Currency Other Total *QoQ represents Q2 2013 as compared to Q1 2013; YoY represents Q2 2013 compared to Q2 2012. **Adjusted to include MTM pension impact. For additional details and adjusted historical data, please refer to the company’s current report on Form 8-K furnished to the SEC on April 2, 2013 available at www.celanese.com under the Investor Relations section. QoQ* YoY*

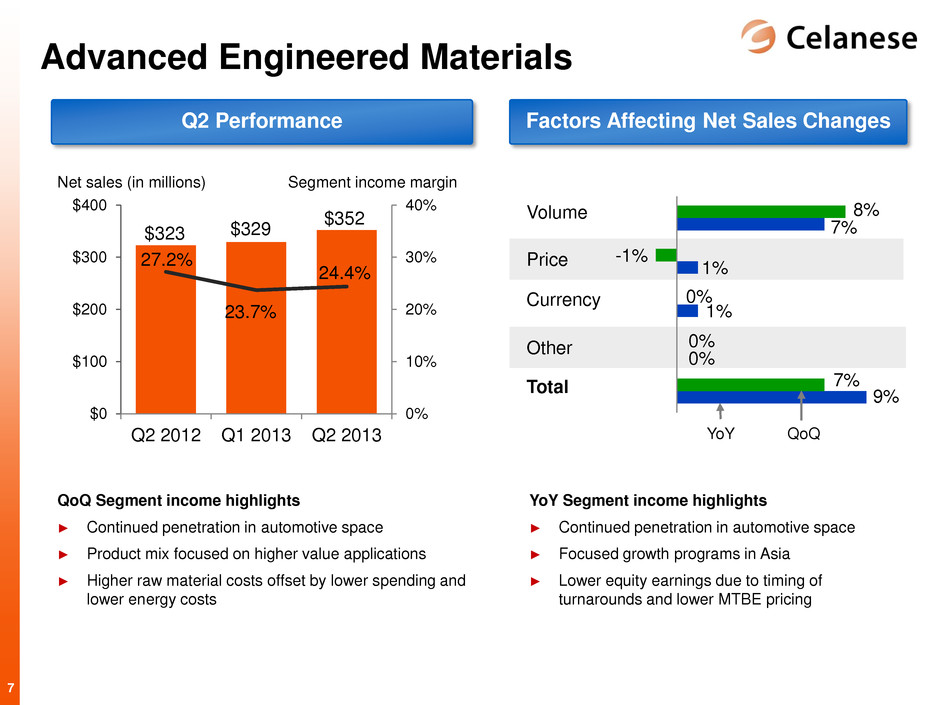

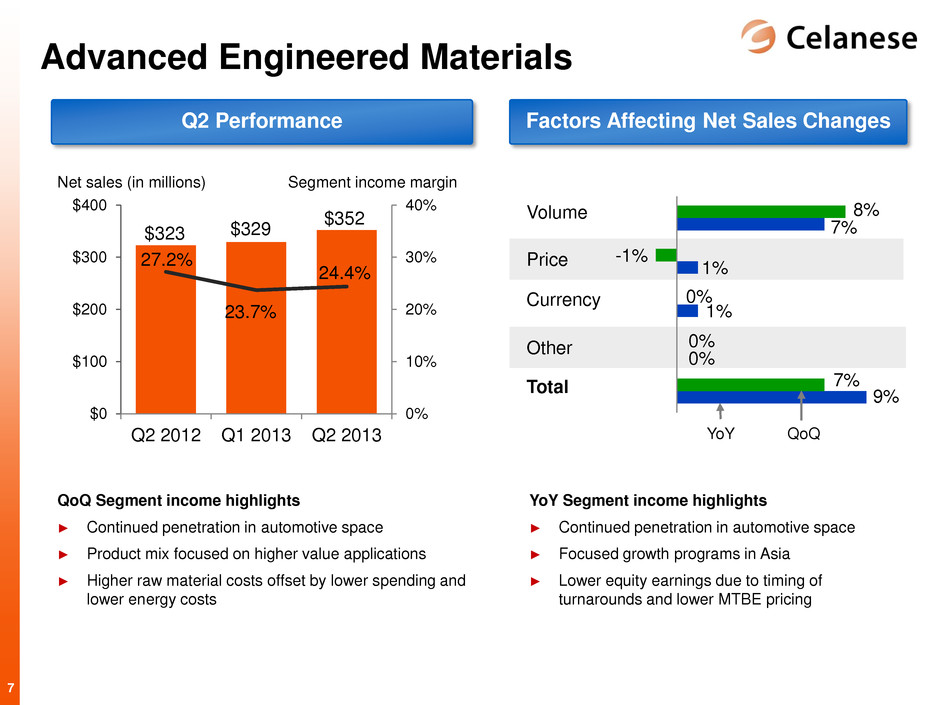

7 QoQ Segment income highlights ► Continued penetration in automotive space ► Product mix focused on higher value applications ► Higher raw material costs offset by lower spending and lower energy costs Advanced Engineered Materials 9% 0% 1% 1% 7% 7% 0% 0% -1% 8% Volume Price Currency Other Total $323 $329 $352 27.2% 23.7% 24.4% 0% 10% 20% 30% 40% $0 $100 $200 $300 $400 Q2 2012 Q1 2013 Q2 2013 Net sales (in millions) Segment income margin Q2 Performance Factors Affecting Net Sales Changes YoY Segment income highlights ► Continued penetration in automotive space ► Focused growth programs in Asia ► Lower equity earnings due to timing of turnarounds and lower MTBE pricing QoQ YoY

8 QoQ Segment income highlights ► Global demand remained strong ► Announced price increases in Acetate were implemented across customer base ► Higher raw material costs as higher annual wood pulp contract pricing fully realized ► Continued investment in operational reliability Consumer Specialties -4% 0% 0% 6% -10% 7% 0% 0% 1% 6% Volume Price Currency Other Total $327 $295 $314 48.9% 36.6% 34.7% 0% 20% 40% 60% 80% $0 $100 $200 $300 $400 Q2 2012 Q1 2013 Q2 2013 Net sales (in millions) Segment income margin Q2 Performance Factors Affecting Net Sales Changes YoY Segment income highlights ► Timing of dividends from China acetate ventures changed from annual to quarterly ► Ceased production at Spondon lowering energy and operating costs ► Acetate production interruption in Q1 2012 shifted volumes to Q2 2012, did not occur in 2013 QoQ YoY

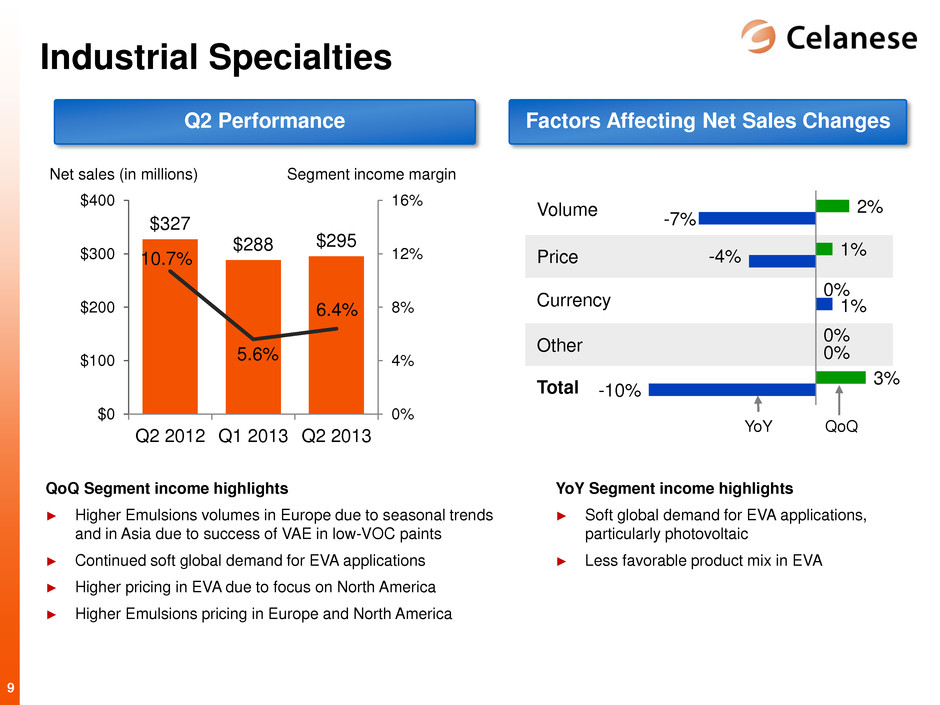

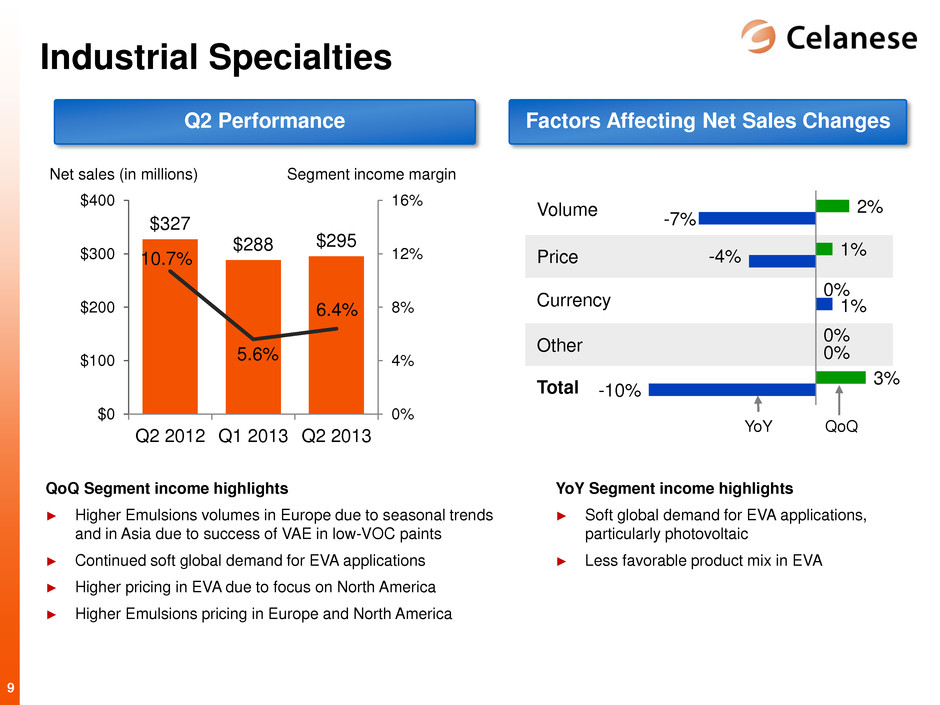

9 QoQ Segment income highlights ► Higher Emulsions volumes in Europe due to seasonal trends and in Asia due to success of VAE in low-VOC paints ► Continued soft global demand for EVA applications ► Higher pricing in EVA due to focus on North America ► Higher Emulsions pricing in Europe and North America Industrial Specialties -10% 0% 1% -4% -7% 3% 0% 0% 1% 2% Volume Price Currency Other Total $327 $288 $295 10.7% 5.6% 6.4% 0% 4% 8% 12% 16% $0 $100 $200 $300 $400 Q2 2012 Q1 2013 Q2 2013 Net sales (in millions) Segment income margin Q2 Performance Factors Affecting Net Sales Changes YoY Segment income highlights ► Soft global demand for EVA applications, particularly photovoltaic ► Less favorable product mix in EVA QoQ YoY

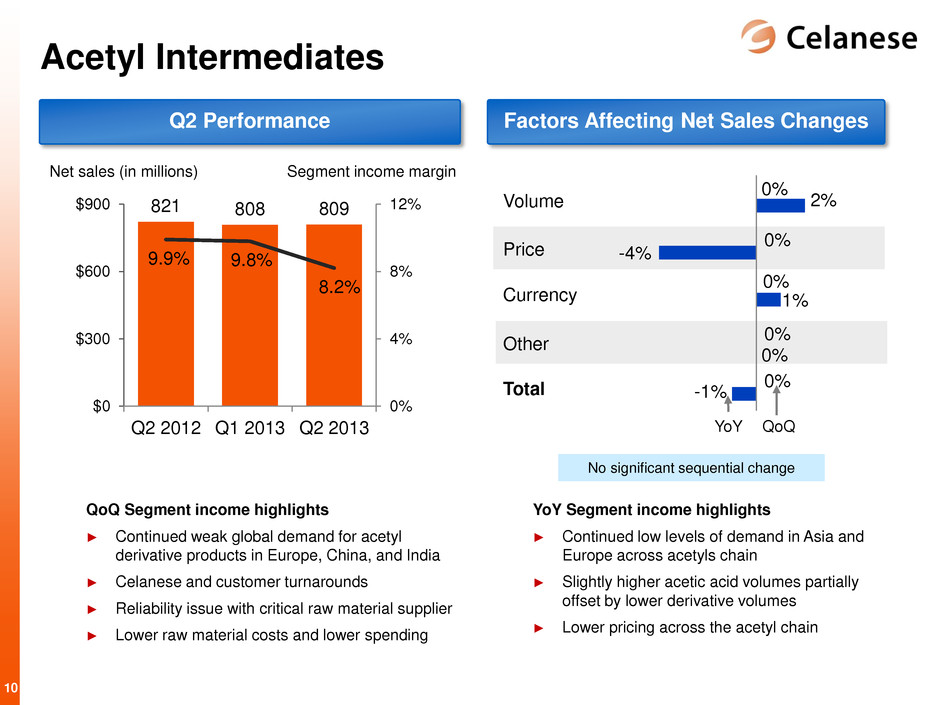

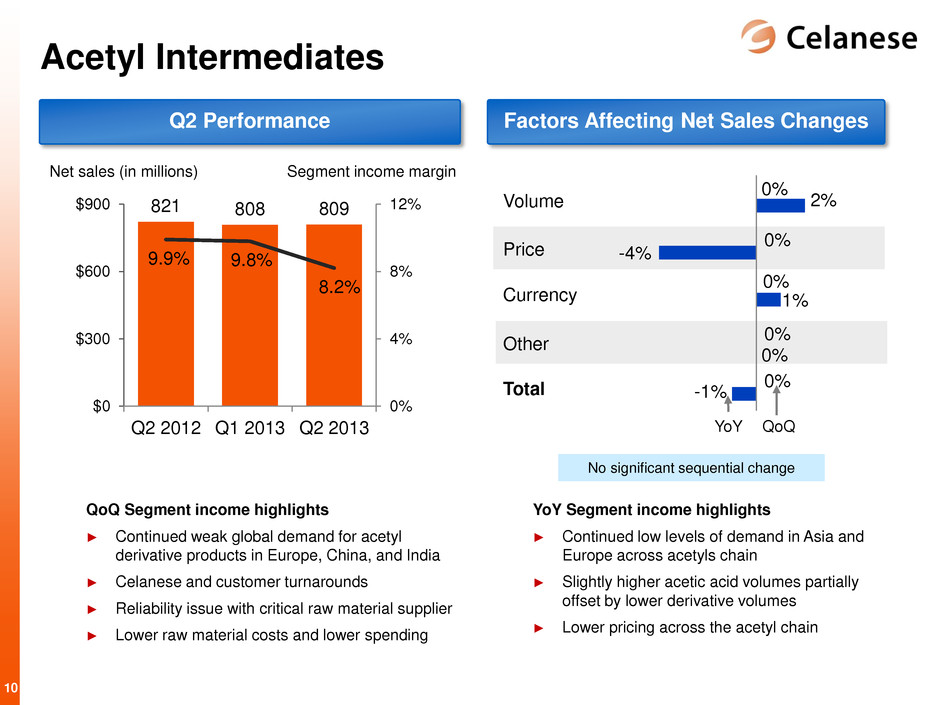

10 QoQ Segment income highlights ► Continued weak global demand for acetyl derivative products in Europe, China, and India ► Celanese and customer turnarounds ► Reliability issue with critical raw material supplier ► Lower raw material costs and lower spending Acetyl Intermediates -1% 0% 1% -4% 2% 0% 0% 0% 0% 0% Volume Price Currency Other Total 821 808 809 9.9% 9.8% 8.2% 0% 4% 8% 12% $0 $300 $600 $900 Q2 2012 Q1 2013 Q2 2013 Net sales (in millions) Segment income margin Q2 Performance Factors Affecting Net Sales Changes YoY Segment income highlights ► Continued low levels of demand in Asia and Europe across acetyls chain ► Slightly higher acetic acid volumes partially offset by lower derivative volumes ► Lower pricing across the acetyl chain YoY No significant sequential change QoQ

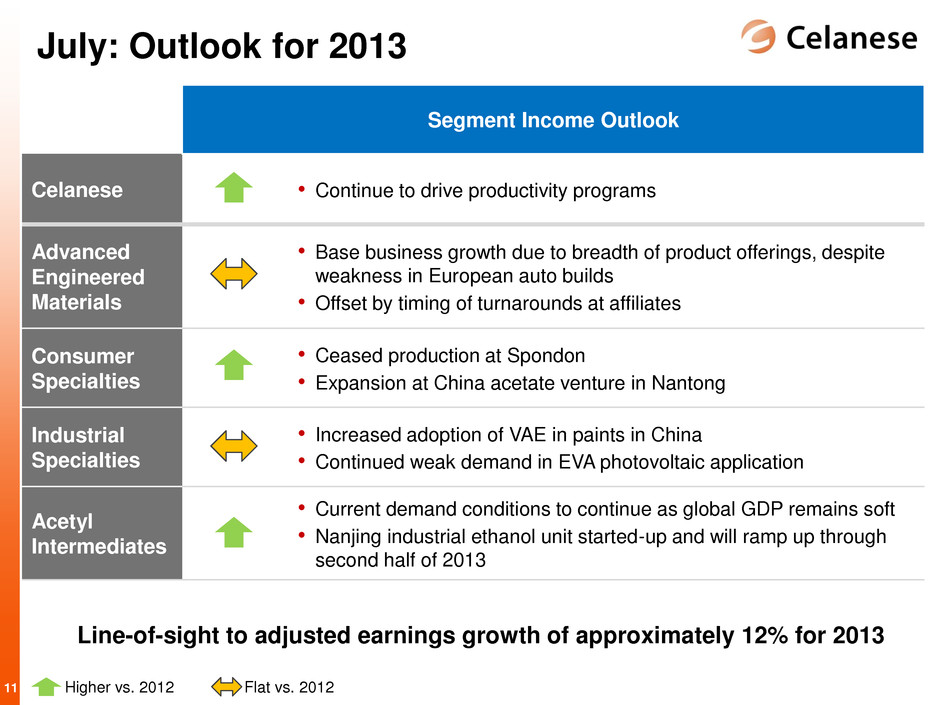

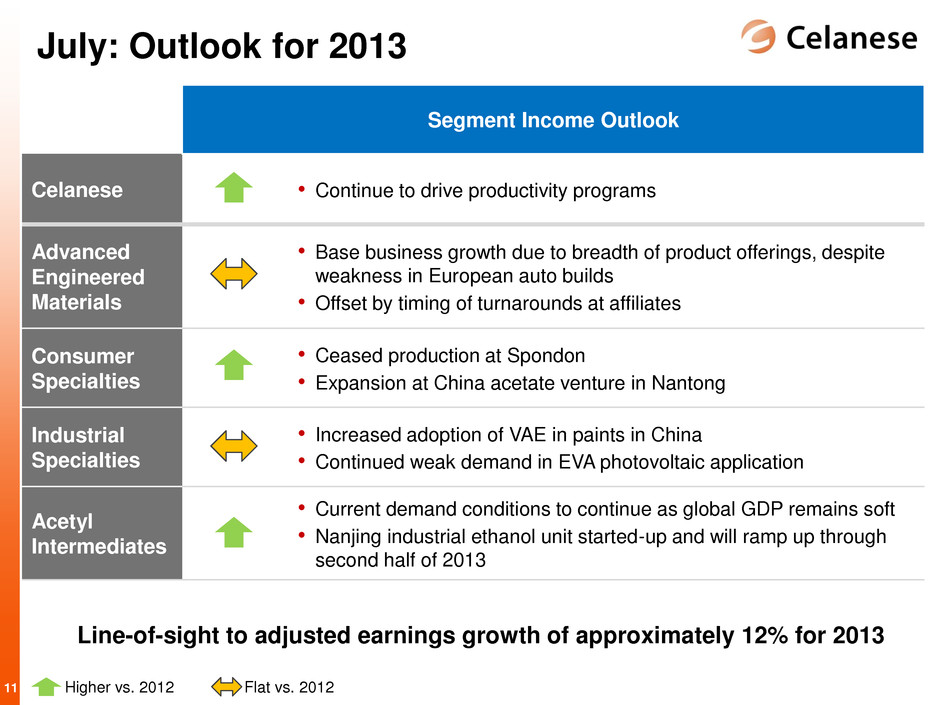

11 July: Outlook for 2013 Segment Income Outlook Celanese • Continue to drive productivity programs Advanced Engineered Materials • Base business growth due to breadth of product offerings, despite weakness in European auto builds • Offset by timing of turnarounds at affiliates Consumer Specialties • Ceased production at Spondon • Expansion at China acetate venture in Nantong Industrial Specialties • Increased adoption of VAE in paints in China • Continued weak demand in EVA photovoltaic application Acetyl Intermediates • Current demand conditions to continue as global GDP remains soft • Nanjing industrial ethanol unit started-up and will ramp up through second half of 2013 Higher vs. 2012 Flat vs. 2012 Line-of-sight to adjusted earnings growth of approximately 12% for 2013

12 Steven Sterin Senior Vice President and Chief Financial Officer

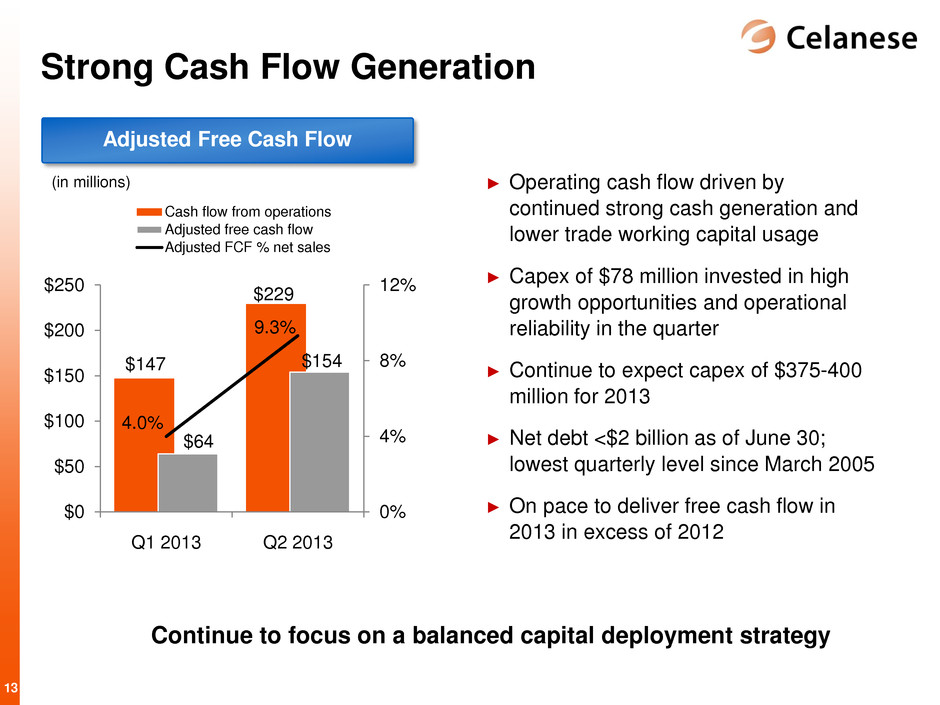

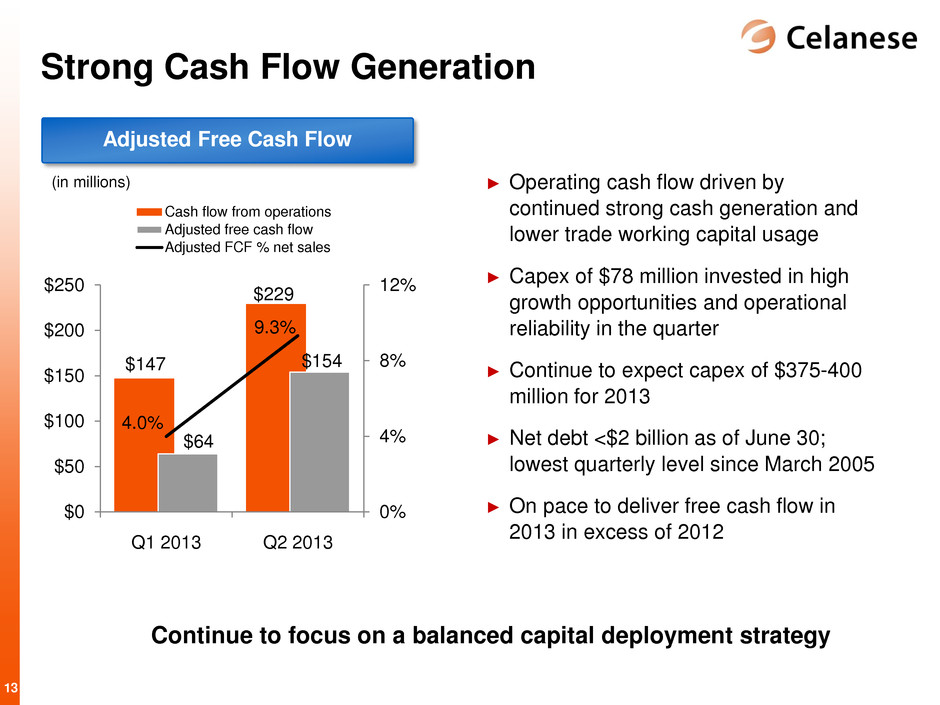

13 Strong Cash Flow Generation $147 $229 $64 $154 4.0% 9.3% 0% 4% 8% 12% $0 $50 $100 $150 $200 $250 Q1 2013 Q2 2013 Cash flow from operations Adjusted free cash flow Adjusted FCF % net sales Adjusted Free Cash Flow (in millions) ► Operating cash flow driven by continued strong cash generation and lower trade working capital usage ► Capex of $78 million invested in high growth opportunities and operational reliability in the quarter ► Continue to expect capex of $375-400 million for 2013 ► Net debt <$2 billion as of June 30; lowest quarterly level since March 2005 ► On pace to deliver free cash flow in 2013 in excess of 2012 Continue to focus on a balanced capital deployment strategy