Celanese Q1 2015 Earnings Thursday, April 16, 2015 Conference Call / Webcast Friday, April 17, 2015 10:00 a.m. Eastern Time © Celanese Mark Rohr, Chairman and Chief Executive Officer Chris Jensen, Senior Vice President, Finance Exhibit 99.3

© Celanese Celanese Corporation 2 This presentation may contain "forward-looking statements," which include information concerning the company's plans, objectives, goals, strategies, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in this release. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, textiles, electronics and construction industries; changes in the price and availability of raw materials, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned capacity additions and expansions; the ability to reduce or maintain their current levels of production costs and to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; market acceptance of our technology; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the company; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, cyber security incidents, terrorism or political unrest or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the occurrence of acts of war or terrorist incidents or as a result of weather or natural disasters; potential liability for remedial actions and increased costs under existing or future environmental regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; and various other factors discussed from time to time in the company's filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and the company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Results Unaudited The results in this presentation, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year. Presentation This presentation presents the Company’s business segments in two subtotals, Acetyl Chain and Materials Solutions, based on similarities among customers, business models and technical processes. The Acetyl Chain includes the Company’s Acetyl Intermediates segment and the Industrial Specialties segment. Materials Solutions includes the Company’s Advanced Engineered Materials segment and the Consumer Specialties segment. For comparative purposes, the historical financial information included herein has been presented to reflect the Acetyl Chain and Materials Solutions subtotals. There has been no change to the composition of the Company’s business segments. Non-GAAP Financial Measures This presentation, and statements made in connection with this presentation, contain references to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the company and referenced in this presentation, including definitions and reconciliations with comparable GAAP financial measures, as well as prior period information, please refer to the Non-US GAAP Financial Measures and Supplemental Information document available under Investor Relations/Financial Information/Non-GAAP Financial Measures on our website, www.celanese.com. Forward-Looking Statements

© Celanese Celanese Corporation 3 Mark Rohr Chairman and Chief Executive Officer

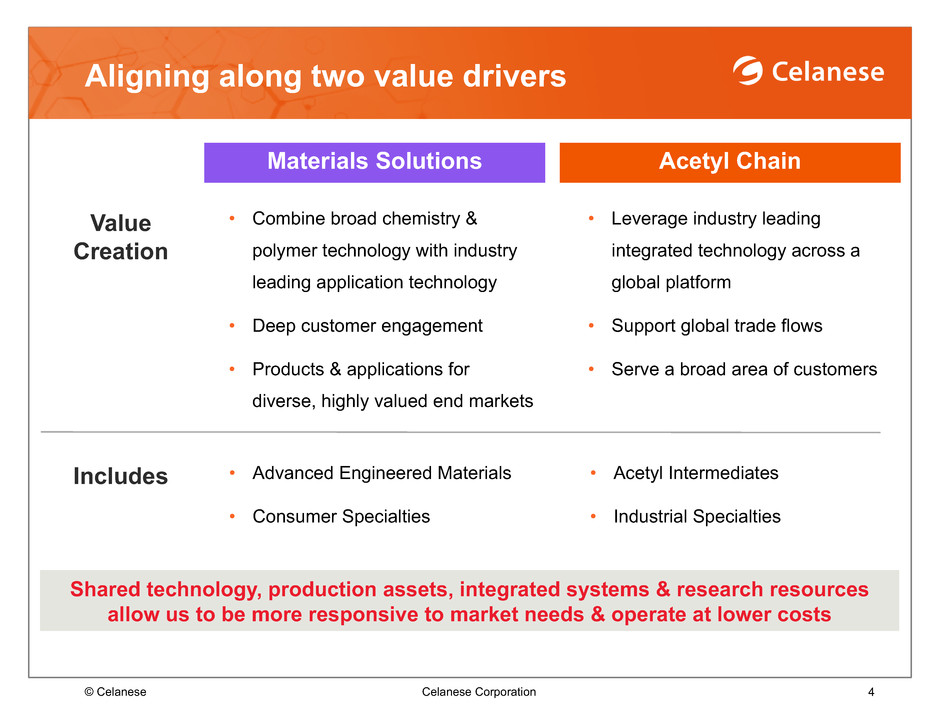

© Celanese Celanese Corporation 4 Aligning along two value drivers Acetyl ChainMaterials Solutions Value Creation • Leverage industry leading integrated technology across a global platform • Support global trade flows • Serve a broad area of customers • Combine broad chemistry & polymer technology with industry leading application technology • Deep customer engagement • Products & applications for diverse, highly valued end markets Shared technology, production assets, integrated systems & research resources allow us to be more responsive to market needs & operate at lower costs Includes • Advanced Engineered Materials • Consumer Specialties • Acetyl Intermediates • Industrial Specialties

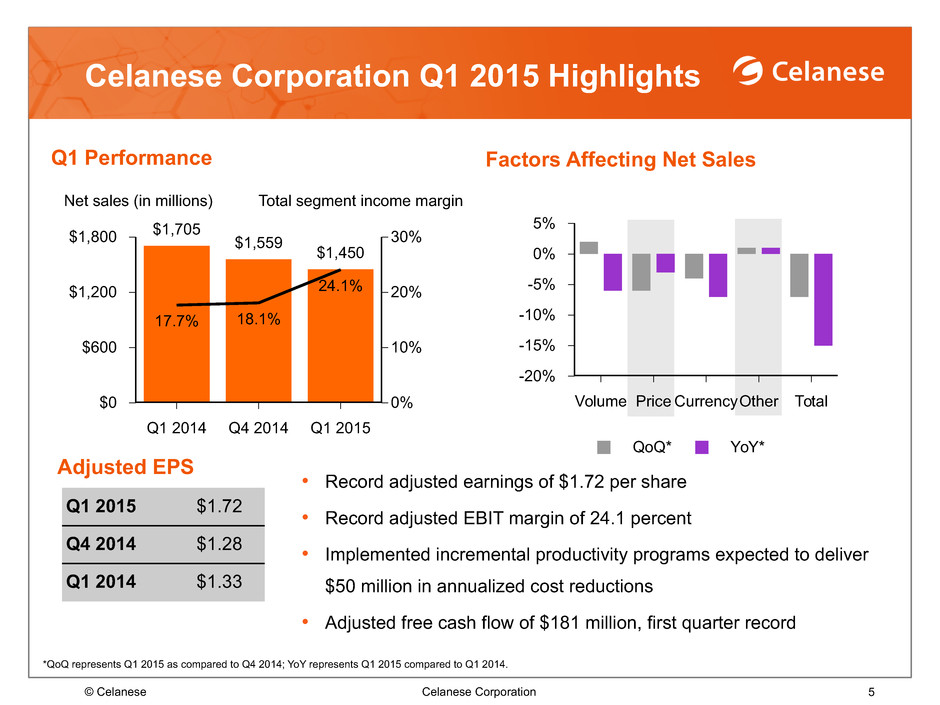

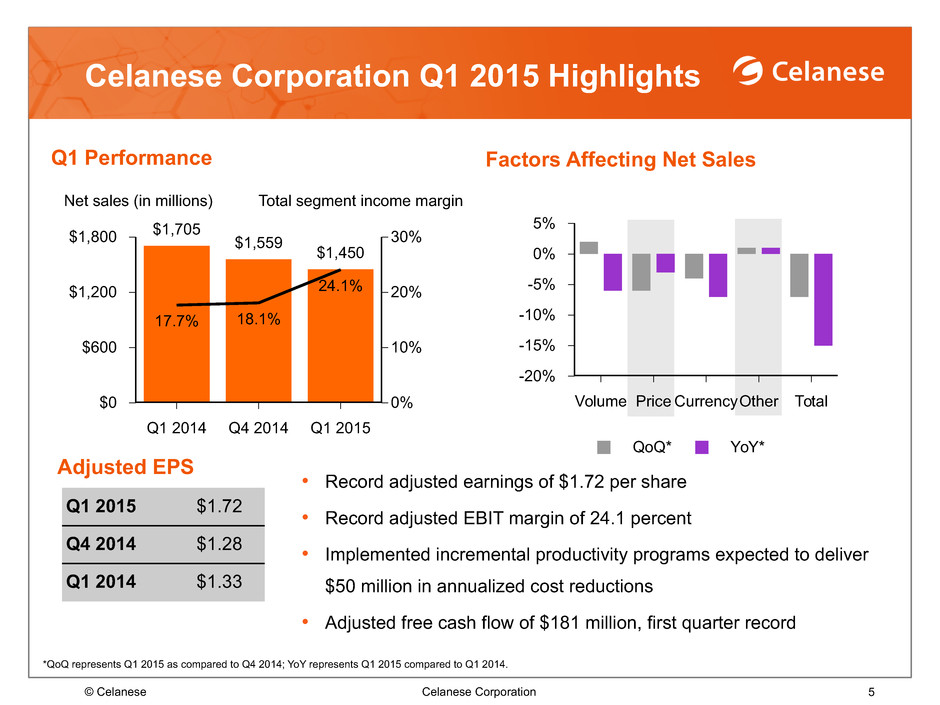

© Celanese Celanese Corporation 5 Factors Affecting Net Sales QoQ* YoY* 5% 0% -5% -10% -15% -20% Volume Price CurrencyOther Total $1,800 $1,200 $600 $0 30% 20% 10% 0% Q1 2014 Q4 2014 Q1 2015 17.7% 18.1% 24.1% $1,705 $1,559 $1,450 Q1 Performance Celanese Corporation Q1 2015 Highlights Net sales (in millions) • Record adjusted earnings of $1.72 per share • Record adjusted EBIT margin of 24.1 percent • Implemented incremental productivity programs expected to deliver $50 million in annualized cost reductions • Adjusted free cash flow of $181 million, first quarter record *QoQ represents Q1 2015 as compared to Q4 2014; YoY represents Q1 2015 compared to Q1 2014. Adjusted EPS Q1 2015 $1.72 Q4 2014 $1.28 Q1 2014 $1.33 Total segment income margin

© Celanese Celanese Corporation 6 Net sales (in millions) Materials Solutions Q1 Performance Factors Affecting Net Sales $800 $600 $400 $200 $0 60% 40% 20% 0% Q1 2014 Q4 2014 Q1 2015 31.3% 28.6% 34.4% $675 $609 $570 Total core income margin QoQ YoY 5% 0% -5% -10% -15% -20% Volume Price Currency Other Total YoY Core income highlights • Lower volume due to anticipated customer de- stocking in acetate tow • Price remained high enough to expand margin as raw material costs declined QoQ Core income highlights • Volume increase in Advanced Engineered Materials more than offset by anticipated customer de-stocking in acetate tow • Higher price in Advanced Engineered Materials across several regions & end uses more than offset price decline in tow & flake in Consumer Specialties & lower raw material costs

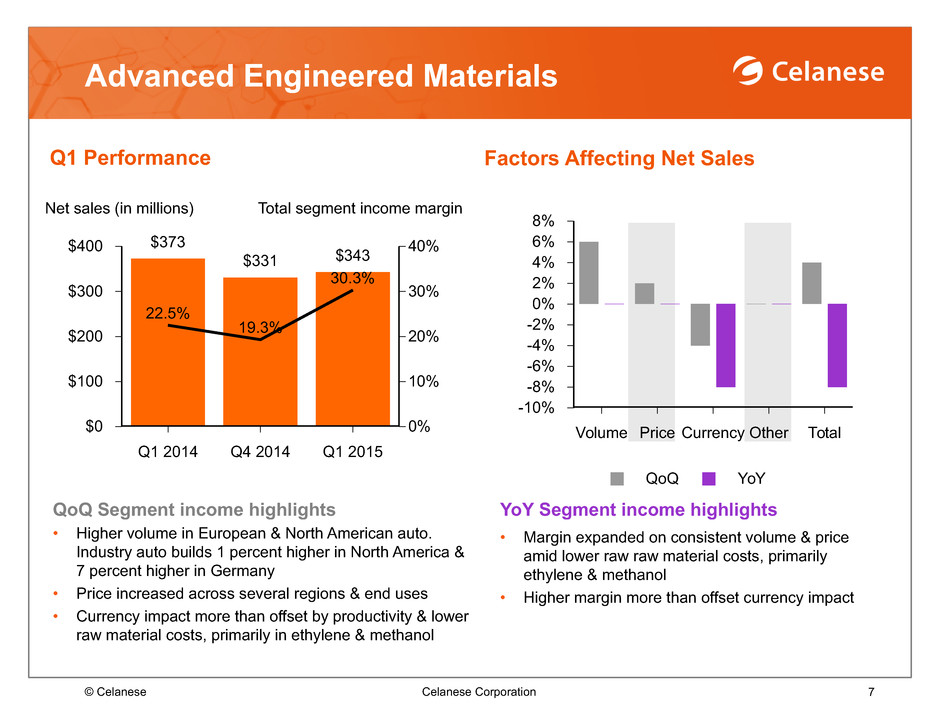

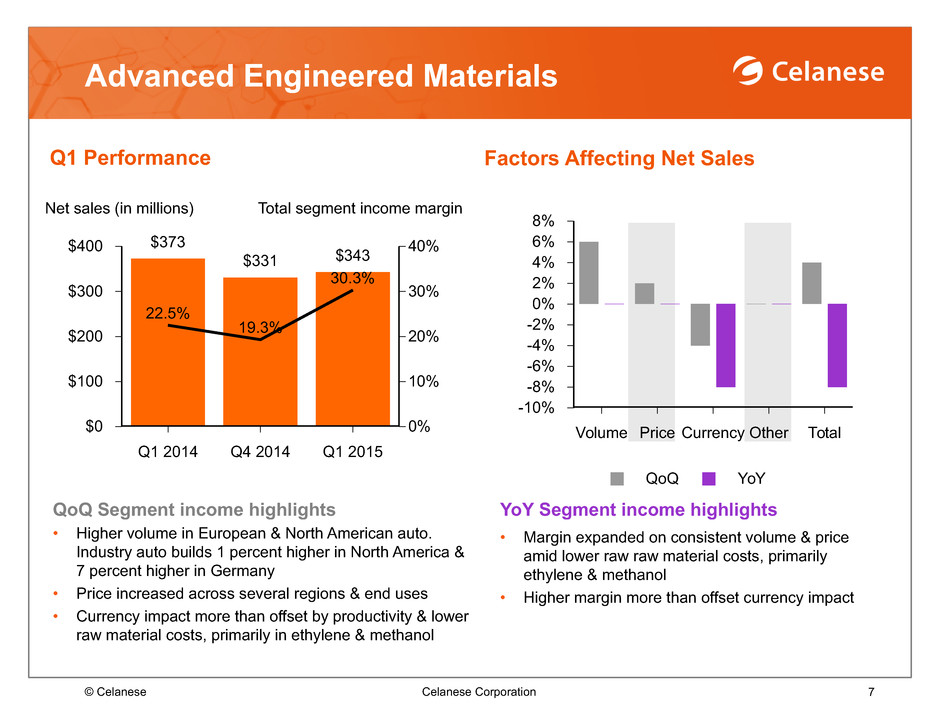

© Celanese Celanese Corporation 7 YoY Segment income highlights • Margin expanded on consistent volume & price amid lower raw raw material costs, primarily ethylene & methanol • Higher margin more than offset currency impact QoQ Segment income highlights • Higher volume in European & North American auto. Industry auto builds 1 percent higher in North America & 7 percent higher in Germany • Price increased across several regions & end uses • Currency impact more than offset by productivity & lower raw material costs, primarily in ethylene & methanol Net sales (in millions) Advanced Engineered Materials Q1 Performance Factors Affecting Net Sales $400 $300 $200 $100 $0 40% 30% 20% 10% 0% Q1 2014 Q4 2014 Q1 2015 22.5% 19.3% 30.3% $373 $331 $343 Total segment income margin QoQ YoY 8% 6% 4% 2% 0% -2% -4% -6% -8% -10% Volume Price Currency Other Total

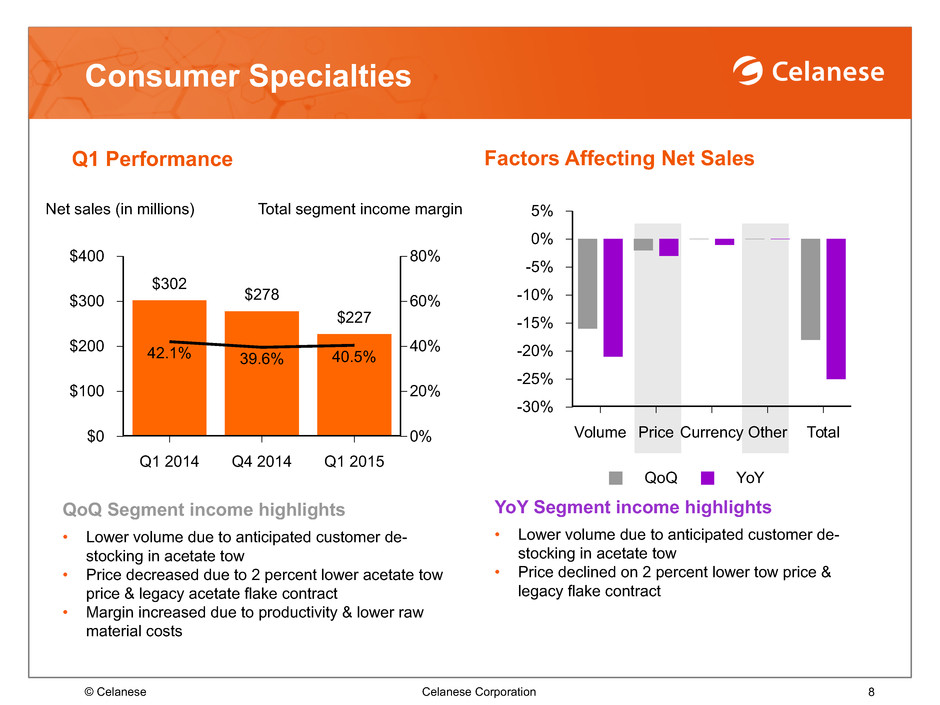

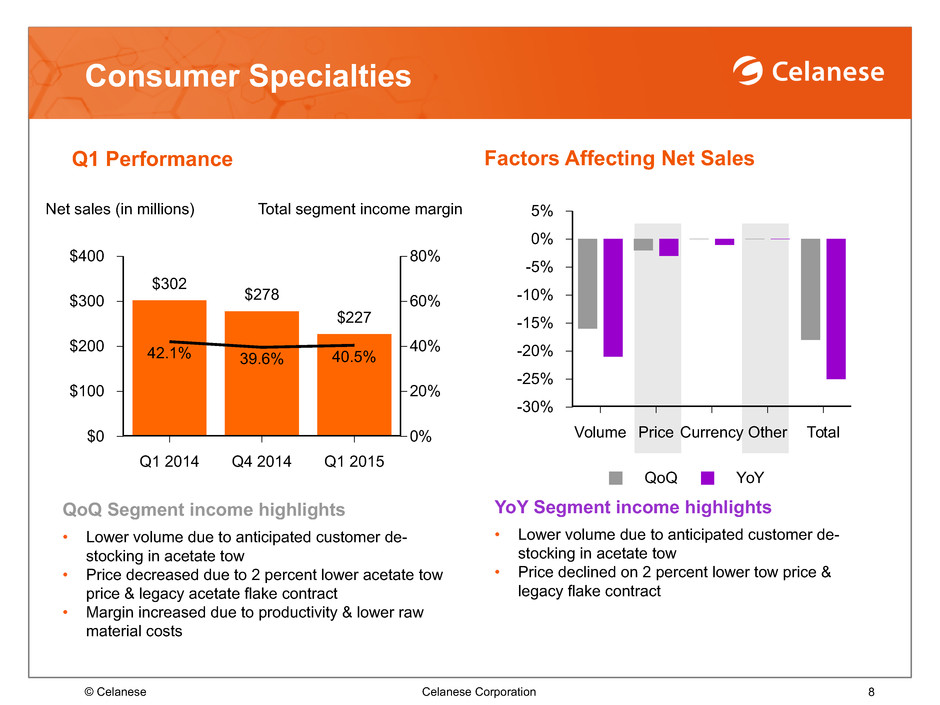

© Celanese Celanese Corporation 8 Consumer Specialties Q1 Performance Factors Affecting Net Sales YoY Segment income highlights • Lower volume due to anticipated customer de- stocking in acetate tow • Price declined on 2 percent lower tow price & legacy flake contract QoQ Segment income highlights • Lower volume due to anticipated customer de- stocking in acetate tow • Price decreased due to 2 percent lower acetate tow price & legacy acetate flake contract • Margin increased due to productivity & lower raw material costs Net sales (in millions) Total segment income margin QoQ YoY 5% 0% -5% -10% -15% -20% -25% -30% Volume Price Currency Other Total $400 $300 $200 $100 $0 80% 60% 40% 20% 0% Q1 2014 Q4 2014 Q1 2015 42.1% 39.6% 40.5% $302 $278 $227

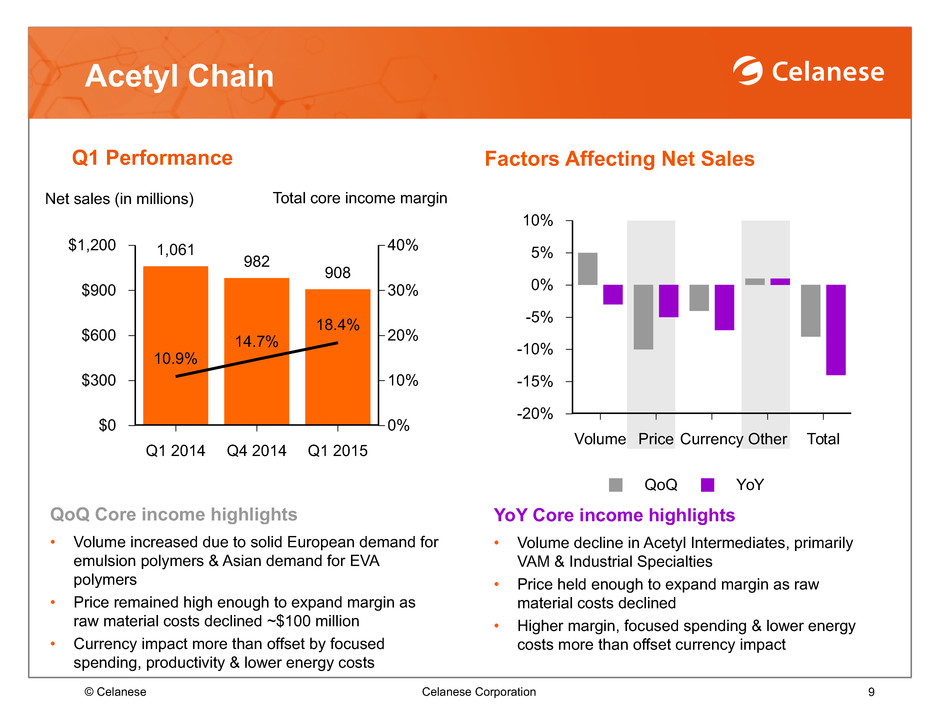

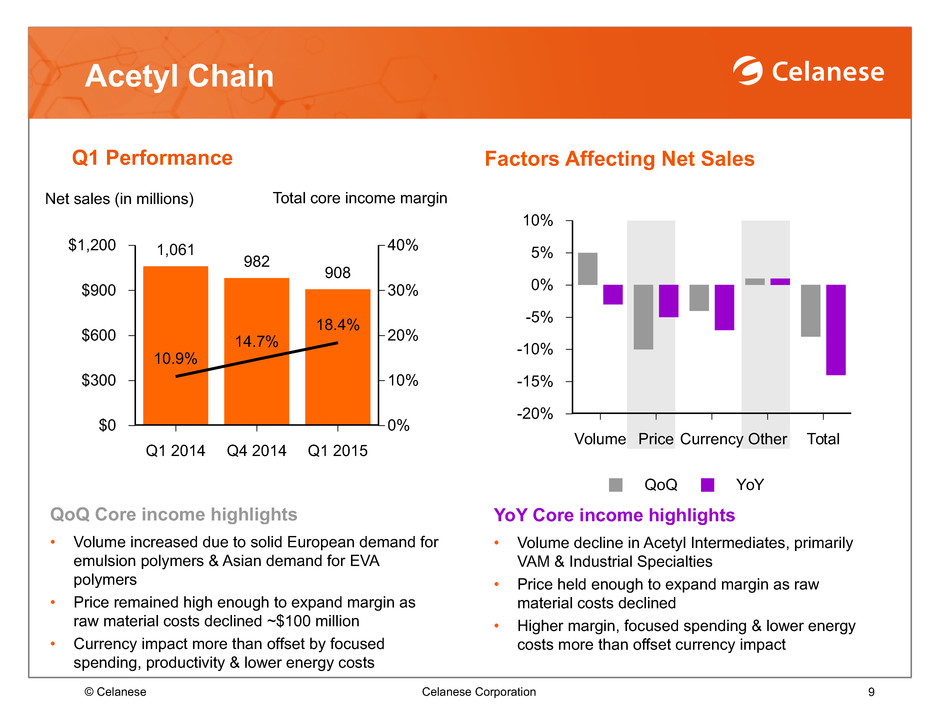

© Celanese Celanese Corporation 9 Acetyl Chain Q1 Performance Factors Affecting Net Sales YoY Core income highlights • Volume decline in Acetyl Intermediates, primarily VAM & Industrial Specialties • Price held enough to expand margin as raw material costs declined • Higher margin, focused spending & lower energy costs more than offset currency impact QoQ Core income highlights • Volume increased due to solid European demand for emulsion polymers & Asian demand for EVA polymers • Price remained high enough to expand margin as raw material costs declined ~$100 million • Currency impact more than offset by focused spending, productivity & lower energy costs Net sales (in millions) Total core income margin $1,200 $900 $600 $300 $0 40% 30% 20% 10% 0% Q1 2014 Q4 2014 Q1 2015 10.9% 14.7% 18.4% 1,061 982 908 QoQ YoY 10% 5% 0% -5% -10% -15% -20% Volume Price Currency Other Total

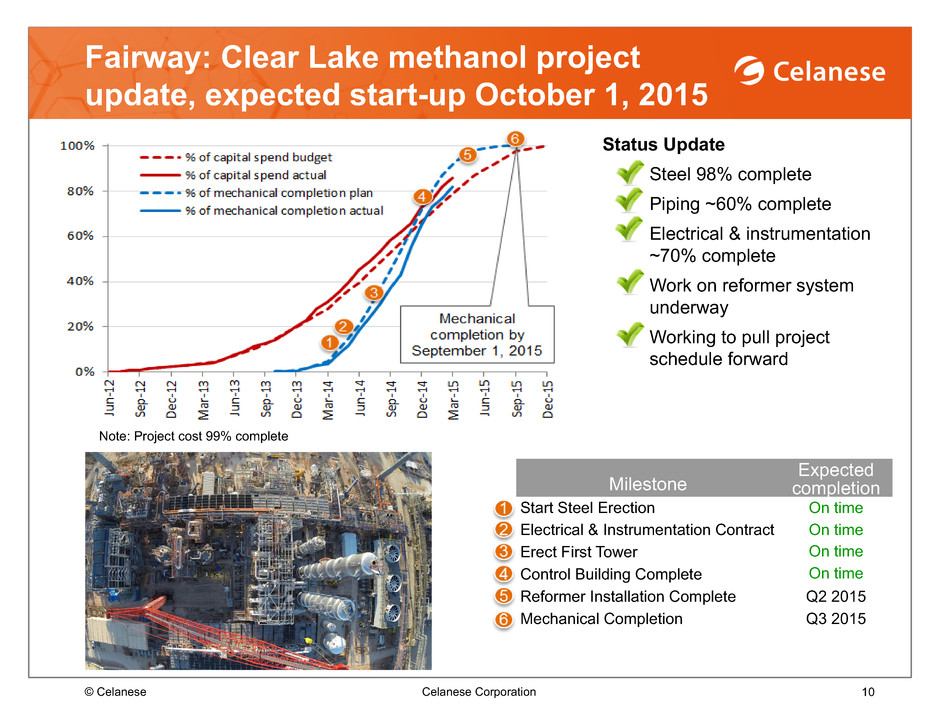

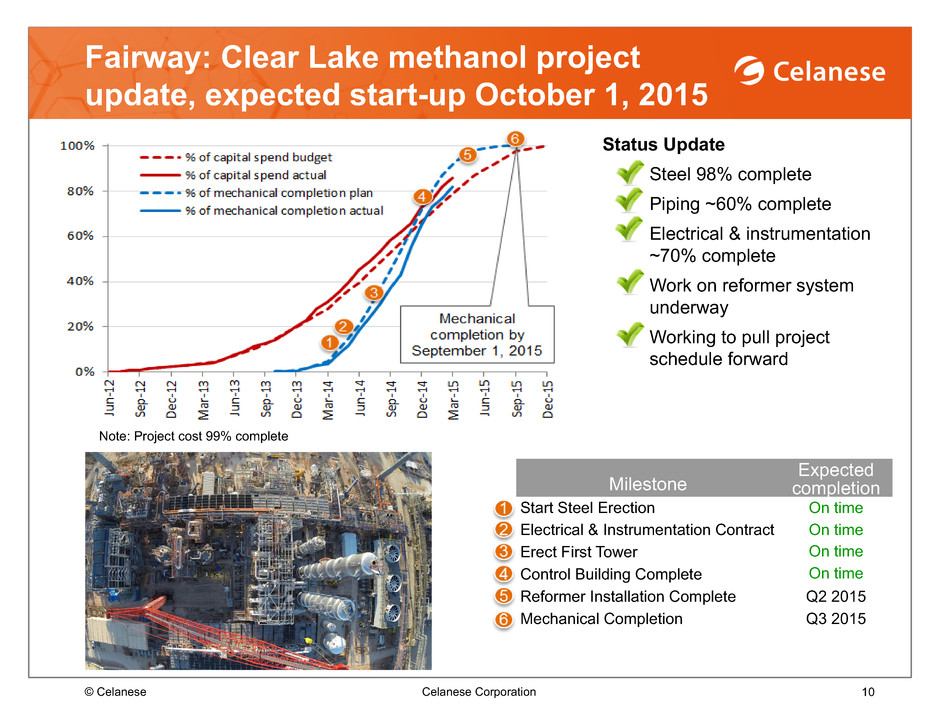

© Celanese Celanese Corporation 10 Fairway: Clear Lake methanol project update, expected start-up October 1, 2015 Status Update Steel 98% complete • Piping ~60% complete • Electrical & instrumentation ~70% complete • Work on reformer system underway • Working to pull project schedule forward Milestone Expected completion Start Steel Erection On time Electrical & Instrumentation Contract On time Erect First Tower On time Control Building Complete On time Reformer Installation Complete Q2 2015 Mechanical Completion Q3 2015 Note: Project cost 99% complete

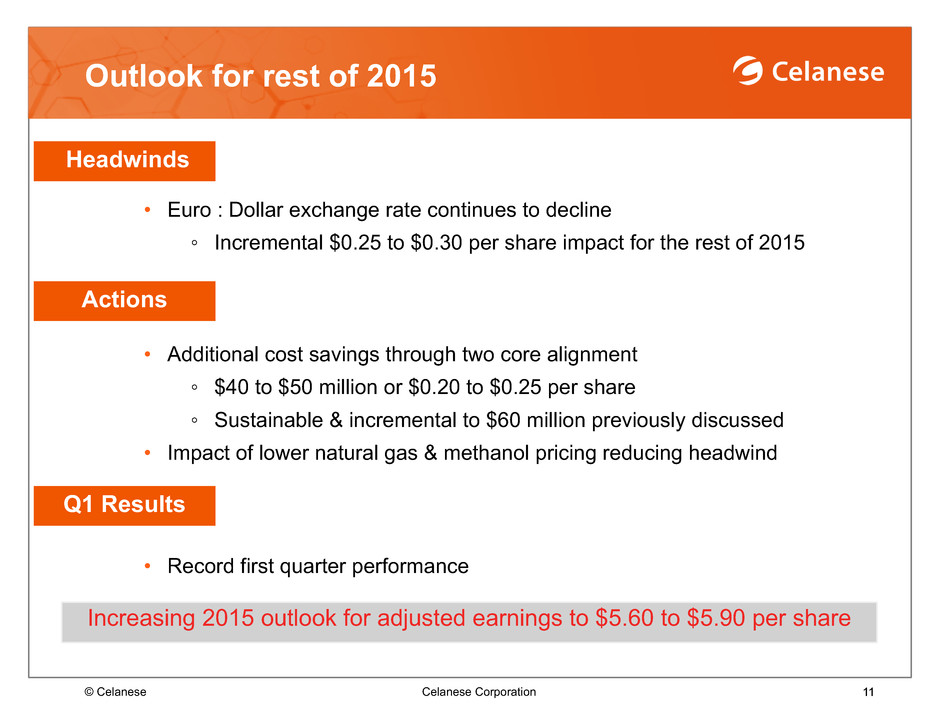

© Celanese Celanese Corporation 11 Outlook for rest of 2015 Headwinds • Euro : Dollar exchange rate continues to decline ◦ Incremental $0.25 to $0.30 per share impact for the rest of 2015 Increasing 2015 outlook for adjusted earnings to $5.60 to $5.90 per share Actions • Additional cost savings through two core alignment ◦ $40 to $50 million or $0.20 to $0.25 per share ◦ Sustainable & incremental to $60 million previously discussed • Impact of lower natural gas & methanol pricing reducing headwind Q1 Results • Record first quarter performance

© Celanese Celanese Corporation 12 Chris Jensen Senior Vice President, Finance

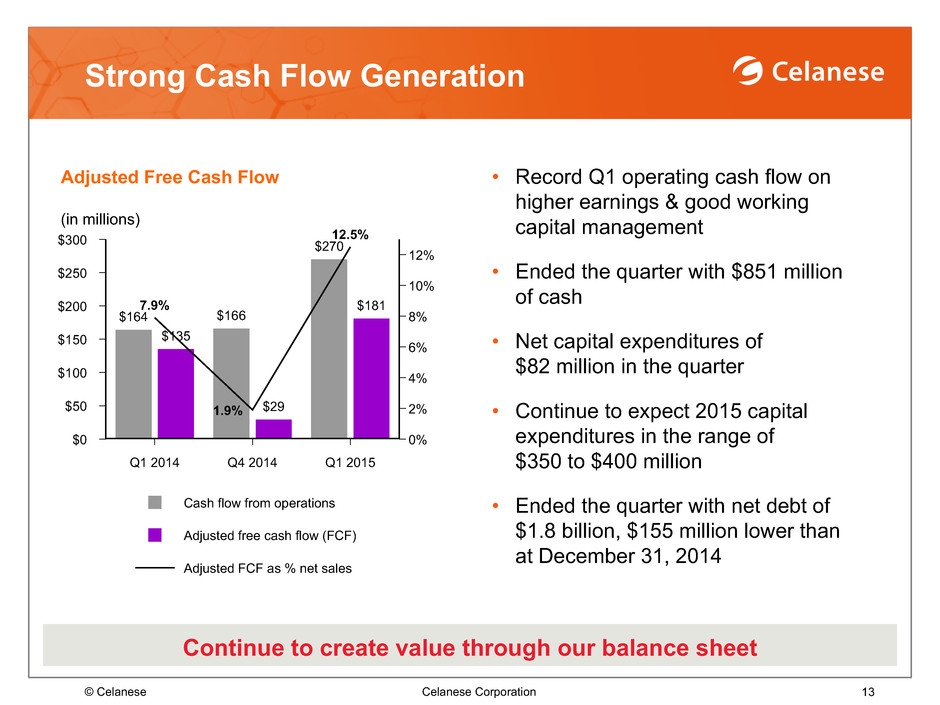

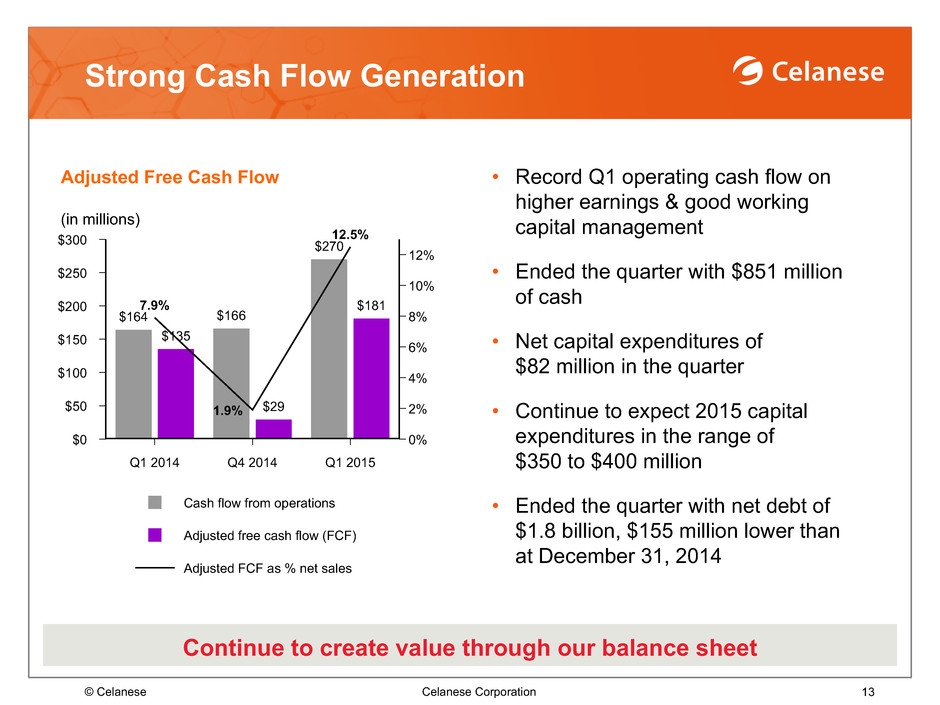

© Celanese Celanese Corporation 13 Strong Cash Flow Generation • Record Q1 operating cash flow on higher earnings & good working capital management • Ended the quarter with $851 million of cash • Net capital expenditures of $82 million in the quarter • Continue to expect 2015 capital expenditures in the range of $350 to $400 million • Ended the quarter with net debt of $1.8 billion, $155 million lower than at December 31, 2014 Continue to create value through our balance sheet Adjusted Free Cash Flow (in millions) Cash flow from operations Adjusted free cash flow (FCF) Adjusted FCF as % net sales $300 $250 $200 $150 $100 $50 $0 12% 10% 8% 6% 4% 2% 0% Q1 2014 Q4 2014 Q1 2015 $164 $166 $270 $135 $29 $1817.9% 1.9% 12.5%