EXHIBIT 99.1

| |

EXETER RESOURCE CORPORATION |

AMENDED NI 43-101 TECHNICAL REPORT ON THE CASPICHE PROJECT ATACAMA REGION, CHILE |

Effective Date: April 30, 2014 Amendment and Restated Date – 19 December 2014 |

Prepared By: Alquimia Conceptos S.A NCL Ingeniería y Construcción Spa (NCL) Carlos Guzmán, Mining Eng., FAusIMM. Leticia Conca, Mining Eng., SMEMember of Chilean Mining Commission Rick Adams, BSc, MAIG. | Prepared For: Exeter Resource Corporation. |

CERTIFICATE OF QUALIFIED PERSON

Carlos Guzmán

General del Canto 235

Providencia, Santiago, Chile

Telephone: (56 2) 2651-0800

Fax: (56 2) 2651-0890

cguzman@ncl.cl

I, Carlos Guzmán do hereby certify that:

| 1. | I am Principal and Project Director with the firm NCL Ingeniería y Construcción SpA., Santiago, Chile. My address is General del Canto 235, Providencia, Santiago Chile. |

| 2. | This certificate applies to the Technical Report titled "Amended NI 43-101 Technical Report on the Caspiche Project, Atacama Region, Chile", Date effective April 30, 2014, prepared for Exeter Resource Corporation. (the "Technical Report"). |

| 3. | I am a Graduate of the Universidad de Chile and hold a Mining Engineer title (1995). |

| 4. | I am a practicing Mining Engineer and a Fellow Member of the Australasian Institute of Mining and Metallurgy (FAusIMM, N° 229036); and a Registered Member of the Chilean Mining Commission (0119). |

| 5. | I have worked as a mining engineer for a total of 19 years. My relevant experience for the purpose of the Technical Report is: |

| | · | Review and report as a consultant on numerous exploration, mining operation and projects around the world for due diligence and regulatory requirements. |

| | · | I have extensive experience in mining engineering. I have worked on mining engineering assignments. |

| 6. | I have read the definition of “qualified person” set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and confirm that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 7. | I am responsible for the preparation of Items 15 and 16 and portions of items 1, 21, 22, 24, 25 and 26 that are directly relevant to those items of the “Amended NI 43-101 Technical Report on the Caspiche Project, Atacama Region, Chile", Date effective April 30, 2014. |

| 8. | I am independent of Exeter Resource Corporation. |

| 9. | I have had prior involvement with the Caspiche Project. I have been fully responsible for the Technical Report (NI 43-101) of the Prefeasibility Study for the Caspiche Project, Region III, Chile, for Exeter Resource Corporation, effective January 16th, 2012. |

| 10. | On April 12th, 2011, I completed a personal inspection of the Caspiche Project. |

| 11. | I have read NI 43-101 and the Technical Report has been prepared in compliance with NI 43-101. |

| 12. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the Technical Report contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this December 19, 2014.

Carlos Guzmán

_____________________________________

Carlos Guzmán

Mining Engineer, FAusIMM (229036)

Registered Member of the Chilean Mining Commission (0119)

CERTIFICATE OF QUALIFIED PERSON

Alonso de Córdova 5710, Office 404, Las Condes,

Santiago, Chile

Telephone: +56 (2) 2351 7700

Fax: +56 (2) 2351 7702

lconca@alquim.cl

I, Leticia Conca do hereby certify that:

| 1. | I am General Manager of Alquimia Conceptos S.A., a minerals processing consultant and engineering company, of Santiago, Chile. My address is Alonso de Córdova 5710, Office 404, Las Condes, Santiago, Chile. |

| 2. | This certificate applies to the Technical Report titled "Amended NI 43-101 Technical Report on the Caspiche Project, Atacama Region, Chile", Date effective April 30, 2014", prepared for Exeter Resource Corporation. (the "Technical Report"). |

| 3. | I graduated with a Bachelor of Science degree in Civil Mining Engineering from the Universidad de Chile, Santiago, Chile, in 1976 and a Civil Mining Engineer degree in 1993. |

| 4. | I am a practicing Mining Engineer and a Registered Member of the Chilean Mining Commission. |

| 5. | I have worked as a mining engineer for a total of 38 years. My relevant experience for the purposes of the Technical Report is: |

| | · | Review and report as a consultant on numerous mining operation and projects around the world for due diligence and regulatory requirements. |

| | · | Pre-feasibility and Feasibility Study work on several copper porphyry projects. |

| 6. | I have read the definition of “qualified person” set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and confirm that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 7. | I am responsible for the preparation of Items 2, 3, 13, 17, 18, 19, 20, 22 and 27, and portions of Items 1, 21, 24, 25 and 26 of the “Amended NI 43-101 Technical Report on the Caspiche Project, Atacama Region, Chile", Date effective April 30, 2014. I am responsible for the compilation of information and preparation of the overall Report. Significant contributions were also received from Cube and NCL. |

| 8. | I am independent of Exeter Resource Corporation. |

| 9. | I have had no prior involvement with the Caspiche Project. |

| 10. | On October 23rd, 2013, I completed a personal inspection of the Caspiche Project. |

| 11. | I have read NI 43-101 and the Technical Report has been prepared in compliance with NI 43-101. |

| 12. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the Technical Report contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this December 19, 2014.

Leticia Conca

_____________________________________

Leticia Conca

Civil Mining Engineer

Chilean Mining Commission.

CERTIFICATE OF QUALIFIED PERSON

Level 4, 1111 Hay Street. West Perth, Western Australia 6005

PO BOX 877. West Perth, Western Australia 6872

Phone: +61 (0) 8 9442 2111

Fax: +61 (0) 8 9442 2110

ricka@cubeconsulting.com

I, Patrick Adams do hereby certify that:

| 1. | I am Director and Consultant Geologist at Cube Consulting Pty Ltd., a mining consulting and IT consulting services and systems provider to the resource sector. My address is Level 4, 1111 Hay Street, West Perth, Western Australia 6005. |

| 2. | This certificate applies to the Technical Report titled "Amended NI 43-101 Technical Report on the Caspiche Project, Atacama Region, Chile", Date effective April 30, 2014", prepared for Exeter Resource Corporation. (the "Technical Report"). |

| 3. | I graduated with a Bachelor of Science degree in Computer Science/Geology degree from the University of New South Wales, Sydney, Australia, in 1982 and a Graduate Certificate Geostatistics from the Edith Cowan University, in 2011. |

| 4. | I am a member of the Australian Institute of Geoscientists (MAIG 765) and a member of the AusIMM (112739) with Chartered Professional (Geology) accreditation. |

| 5. | I have worked as a Geologist for a total 27 years. My relevant experience for the purposes of the Technical Report is: |

| | · | Geological modelling and resource estimation of base and precious metal deposits located in Australia, Asia, Africa, Europe and South America. |

| | · | Review and report as a consultant on numerous mining operation and projects around the world for due diligence and regulatory requirements. |

| | · | I have been involved in 3D modelling of geology and mineralisation using traditional and advanced geostatistical methods with a particular interest in resource risk analysis. I have designed Mine grade control and undertaken reconciliation optimisation and MRE review and audit studies for a wide variety of styles of deposits, including copper and gold. |

| 6. | I have read the definition of “qualified person” set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and confirm that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| 7. | I am responsible for the preparation of Items 4 to 12, 14, 23 and 24, and portions of Items 1, 24, 25 and 26 of the “Amended NI 43-101 Technical Report on the Caspiche Project, Atacama Region, Chile", Date effective April 30, 2014. |

| 8. | I am independent of Exeter Resource Corporation. |

| 9. | I have had no prior involvement with the Caspiche Project. |

| 10. | From the 22nd to 24th October 2013, I completed a personal inspection of the Caspiche Project. |

| 11. | I have read NI 43-101 and the Technical Report has been prepared in compliance with NI 43-101. |

| 12. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the Technical Report contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this December 19, 2014.

Patrick John Adams

_____________________________________

Patrick John Adams

Geologist

Member of the Australian Institute of Geoscientists.

Member of AusIMM (CP Geo).

Table of Contents

| 1. | SUMMARY | 1 |

| | | |

| 1.1 | Introduction | 1 |

| 1.2 | Caution Regarding Forward-Looking Information | 2 |

| 1.3 | Project Location | 3 |

| 1.4 | Property Ownership | 4 |

| 1.5 | Property Description | 12 |

| 1.6 | Geology and Mineralization | 14 |

| 1.7 | Drilling | 17 |

| 1.8 | Mineral Processing and Metallurgical Testing | 18 |

| 1.8.1 | Oxide Mineralization | 18 |

| 1.8.2 | Sulphide Mineralization | 18 |

| 1.9 | Mineral Resource Estimate | 19 |

| 1.10 | Mineral Reserves Estimate | 21 |

| 1.11 | Mining Methods | 21 |

| 112 | Process Design and Recovery | 23 |

| 1.12.1 | Process Plant Description | 24 |

| 1.13 | Project Infrastructure | 24 |

| 1.13.1 | Power Supply | 25 |

| 1.13.2 | Tailings Handling | 25 |

| 1.14 | Marketing Studies | 26 |

| 1.14.1 | Refined Copper Market Review | 26 |

| 1.14.2 | Outlook for the Copper Price | 26 |

| 1.14.3 | Copper Concentrates 10 – 15 year Outlook | 27 |

| 1.14.4 | Treatment and Refining Charges and other Commercial Terms | 27 |

| 1.14.5 | Caspiche Concentrates Marketability | 29 |

| 1.14.6 | Doré Metal Market | 29 |

| 1.15 | Capital Cost Estimate | 30 |

| 1.16 | Operating Costs Estimate | 31 |

| 1.17 | Economic Analysis | 32 |

| 1.17.1 | Production and Revenue | 33 |

| 1.17.2 | Economic Evaluation Results | 34 |

| 1.18 | Conclusions and Recommendations | 34 |

| | | |

| 2. | INTRODUCTION | 37 |

| | | |

| 2.1 | Purpose of the Technical Report | 37 |

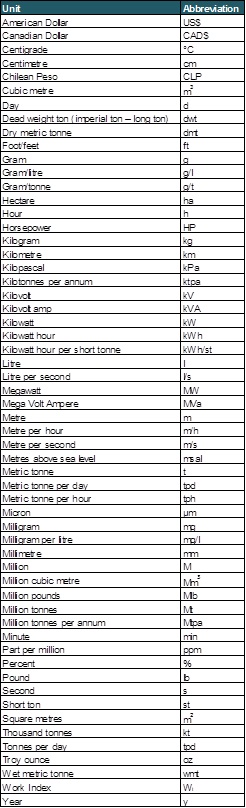

| 2.2 | Frequently Used Acronyms, Abbreviations, Definitions, and Units of Measurement | 38 |

| 2.3 | PEA Effective Dates | 44 |

| | | |

| 3. | RELIANCE ON OTHER EXPERTS | 45 |

| | | |

| 3.1 | Other Independent Expert Persons | 45 |

| | | |

| 4. | PROPERTY DESCRIPTION AND LOCATION | 46 |

| | | |

| 4.1 | Location | 46 |

| 4.2 | Mineral Tenure and Agreements | 47 |

| 4.2.1 | Mineral Rights | 48 |

| 4.2.2 | Agreements and Royalties | 58 |

| 4.3 | Operational Permits and Jurisdictions | 59 |

| 4.3.1 | Environmental Permits | 59 |

| 4.3.2 | Surface and Land Rights | 59 |

| 4.3.3. | Water Use Rights | 61 |

| | | |

| 5. | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 63 |

| | | |

| 5.1 | Accessibility | 63 |

| 5.2 | Climate | 63 |

| 5.3 | Local Resources | 63 |

| 5.4 | Current Infrastructure | 66 |

| 5.4.1 | Physiography | 66 |

| | | |

| 6. | HISTORY | 68 |

| | | |

| 7. | GEOLOGICAL SETTING AND MINERALIZATION | 70 |

| | | |

| 7.1 | Regional Geology | 70 |

| 7.2 | Local & Property Geology | 73 |

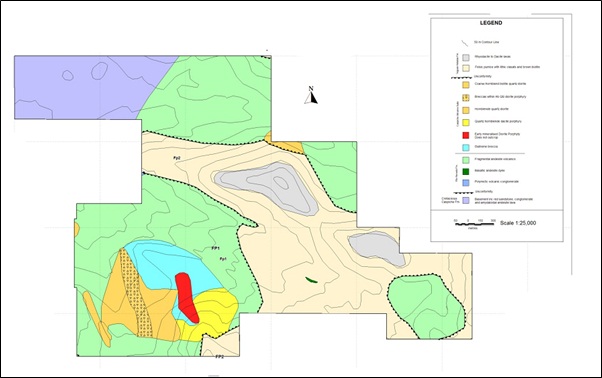

| 7.2.1 | Volcano-sedimentary Units | 76 |

| 7.2.2 | Intrusive Rocks | 77 |

| 7.2.3 | Structure | 78 |

| 7.2.4 | Alteration | 79 |

| 7.2.5 | Mineralization | 81 |

| | | |

| 8. | DEPOSIT TYPES | 83 |

| | | |

| 9. | EXPLORATION | 85 |

| | | |

| 9.1 | Exeter (2005 – 2013) | 85 |

| 9.2 | Newcrest (1996 – 1998) | 90 |

| 9.3 | Anglo (1986 – 1990) | 91 |

| | | |

| 10. | DRILLING | 92 |

| | | |

| 10.1 | Caspiche Porphyry | 93 |

| 10.2 | Caspiche Epithermals | 96 |

| 10.3 | Exploration Drilling | 96 |

| 10.4 | Drilling Procedures and Conditions | 99 |

| 10.4.1 | Exeter | 99 |

| 10.4.2 | Newcrest | 99 |

| 10.5 | Logging | 99 |

| 10.6 | Surveys | 100 |

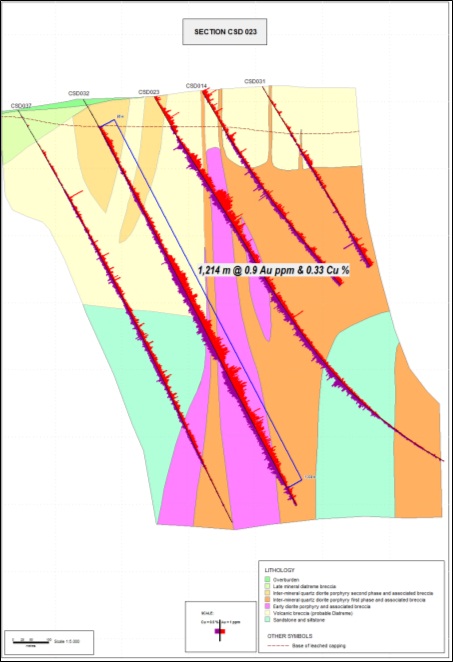

| 10.7 | Drilling Results | 100 |

| 10.8 | True Thickness of Mineralization | 105 |

| 10.9 | Orientation of Mineralization | 105 |

| | | |

| 11. | SAMPLE PREPARATION, ANALYSIS AND SECURITY | 106 |

| | | |

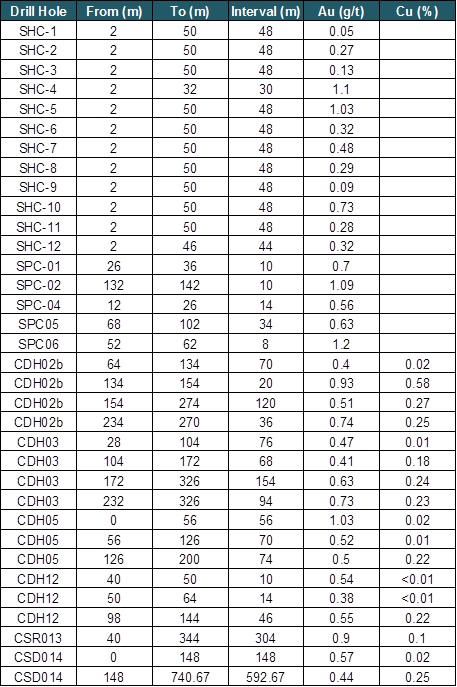

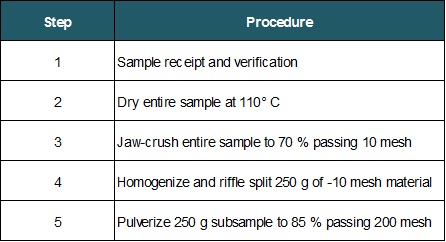

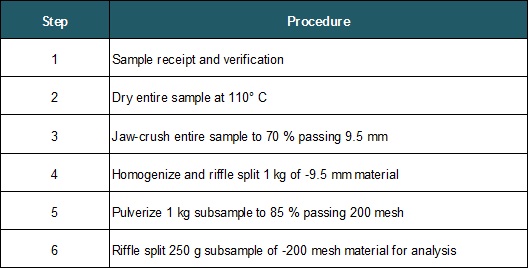

| 11.1 | Sample Procedures and Protocols | 106 |

| 11.1.1 | Surface Sampling | 106 |

| 11.1.2 | Drill Sampling | 106 |

| 11.2 | Sample Preparation and Analysis | 108 |

| 11.2.1 | Surface Samples | 108 |

| 11.2.2 | Drill Samples | 108 |

| 12. | DATA VERIFICATION | 127 |

| | | |

| 12.1 | Mineral Resource Database Audits | 127 |

| 12.1.1 | AMEC | 127 |

| 12.1.2 | Cube Consulting | 128 |

| 12.2 | Drill Hole Locations | 128 |

| 12.3 | Independent Sampling | 129 |

| 12.3.1 | AMEC Core Sampling | 129 |

| 12.3.2 | Cube Core Sampling | 130 |

| 12.3.3 | Rio Tinto Metallurgical Sampling | 131 |

| 12.4 | Exeter QA/QC | 132 |

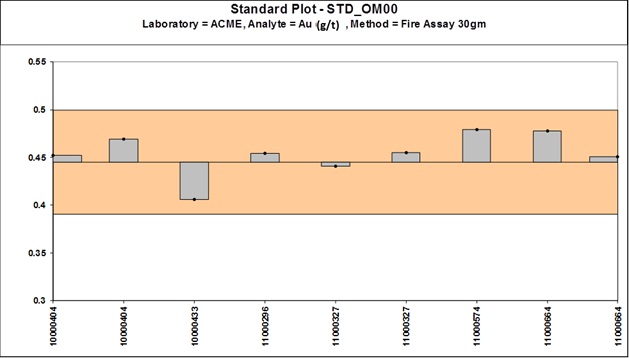

| 12.4.1 | Geochemical Standards | 132 |

| 12.5 | Twinned Holes | 132 |

| 12.6 | Check Assaying of Samples Greater Than 1 Au ppm | 133 |

| 12.7 | Cube Consulting Statement | 134 |

| | | |

| 13. | MINERAL PROCESSING AND METALLURGICAL RECOVERY | 135 |

| | | |

| 13.1 | Oxide Mineralization | 135 |

| 13.1.1 | Historical Testing | 135 |

| 13.1.2 | Leach Cycle Definition | 140 |

| 13.2 | Sulphide Mineralization | 141 |

| 13.2.1 | Historical Testing | 141 |

| 13.2.2 | Exeter 2008-2010 Metallurgical Testing | 142 |

| 13.2.3 | Exeter 2010-2011 Metallurgical Testing | 143 |

| 13.2.4 | Exeter 2012-2013 Metallurgical Testing | 145 |

| 13.2.5 | Metallurgical results and discussion | 148 |

| | | |

| 14. | MINERAL RESOURCE ESTIMATION | 159 |

| | | |

| 14.1 | Drilling database | 159 |

| 14.2 | Topography | 161 |

| 14.3 | Lithological model and definition of domains | 161 |

| 14.4 | Composites | 167 |

| 14.5 | Exploratory data analysis | 168 |

| 14.5.1 | Domain boundary analysis | 168 |

| 14.5.2 | Summary Statistics and Assay Capping | 172 |

| 14.6 | Variography | 182 |

| 14.7 | Block Model Definition | 186 |

| 14.7.1 | Estimation Plan | 187 |

| 14.8 | Model Bulk Density | 190 |

| 14.9 | Block Model Validation | 191 |

| 14.9.1 | Statistical Comparison | 191 |

| 14.9.2 | Swath Plots | 191 |

| 14.9.3 | Visual Validation | 193 |

| 14.9.4 | Theoretical Grade-Tonnage Curve Comparisons | 196 |

| 14.10 | Resource Classification and Tabulation | 197 |

| 14.10.1 | Gold Equivalent (AuEq) | 201 |

| 14.10.2 | Mineral Resource Statement | 202 |

| 14.10.3 | Qualified Persons Statement | 204 |

| 14.10.4 | Sensitivity Grade Tonnage Graphs and Tabulation | 205 |

| | | |

| 15. | MINERAL RESERVES ESTIMATES | 209 |

| | | |

| 16. | MINING METHODS | 210 |

| 16.2 | Conceptual Open Pit Design | 211 |

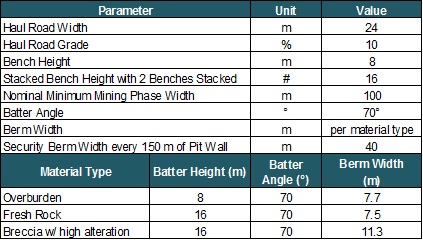

| 16.2.1 | Parameters for Mine Design | 212 |

| 16.2.2 | Pit Optimization Results | 214 |

| 16.2.3 | Option 1: Pit and Preliminary Mining Phases Design | 219 |

| 16.2.4 | Options 2&3: Pit and Preliminary Mining Phases Design | 224 |

| 16.2.5 | Waste and Stockpile Storage Areas | 230 |

| 16.3 | Conceptual Underground Design | 232 |

| 16.3.1 | General | 232 |

| 16.3.2 | Mining Methods | 233 |

| 16.3.3 | Preliminary Design Criteria | 237 |

| 16.3.4 | Cut-off Grade Estimate | 239 |

| 16.3.5 | Dilution | 240 |

| 16.3.6 | Underground Mining Inventory | 240 |

| 16.3.7 | Conceptual Underground Mine Design | 241 |

| 16.4 | Mine Production Schedules | 244 |

| 16.4.1 | Option 1 | 245 |

| 16.4.2 | Option 2 | 247 |

| 16.4.3 | Option 3 | 252 |

| 16.5 | Alternative Options | 257 |

| 16.5.1 | Option 4 | 258 |

| 16.5.2 | Option 5 | 258 |

| 16.6 | Hauling Distances | 261 |

| 16.7 | Equipment Requirement | 263 |

| 16.8 | Estimated Labor Requirement | 265 |

| 16.9 | Geotechnical Studies | 267 |

| 16.9.1 | General | 267 |

| 16.9.2 | Preliminary Pit Geotechnical Analysis | 269 |

| 16.9.3 | Underground Geotechnical Analysis | 269 |

| | | |

| 17. | RECOVERY METHODS | 270 |

| | | |

| 17.1 | Oxide Plant | 270 |

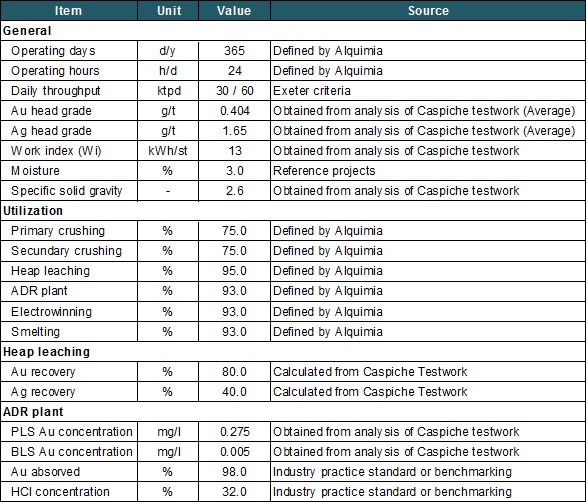

| 17.1.1 | Process Design Basis and Design Criteria Summary | 272 |

| 17.1.2 | Crushing | 272 |

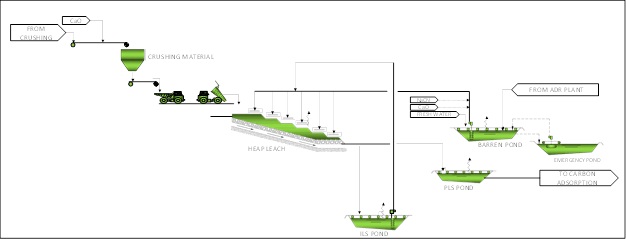

| 17.1.3 | Heap Leaching | 273 |

| 17.1.4 | ADR, EW and Smelting | 282 |

| 17.2 | Sulphide Plant | 286 |

| 17.2.1 | Process Design Basis and Design Criteria Summary | 290 |

| | | |

| 18. | PROJECT INFRASTRUCTURE | 304 |

| | | |

| 18.1 | Power Supply | 309 |

| 18.1.1 | Site Generation | 309 |

| 18.1.2 | Power Line from Cardones Substation | 309 |

| 18.1.3 | Power Line from Maricunga Substation | 310 |

| 18.1.4 | Power Supply by Option | 310 |

| 18.2 | Tailings Handling | 311 |

| 18.2.1 | Filtered Tailings | 311 |

| 18.2.2 | Thickened Tailings | 312 |

| 18.2.3 | Tailings Handling by Option | 312 |

| 18.3 | Roads | 313 |

| 18.3.1 | Access Road | 313 |

| 18.3.2 | On-site Roads | 314 |

| 18.4 | Fresh Water Supply | 315 |

| 18.5 | Port Facilities | |

| 18.6 | Operations Camp | 315 |

| 1.8.7 | Ancillary Site Buildings and Facilities | 316 |

| | | |

| 19. | MARKET STUDIES AND CONTRACTS | 317 |

| | | |

| 19.1 | Introduction and Scope | 317 |

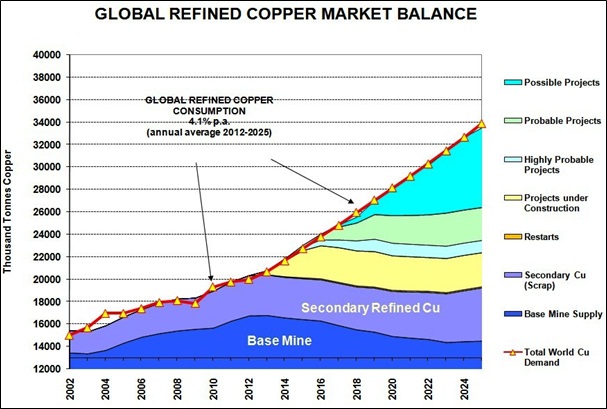

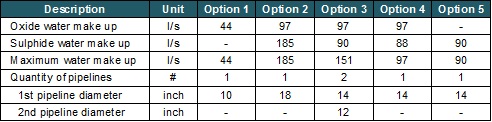

| 19.2 | Refined Copper Market Review | 318 |

| 19.3 | Outlook for the Copper Price | 320 |

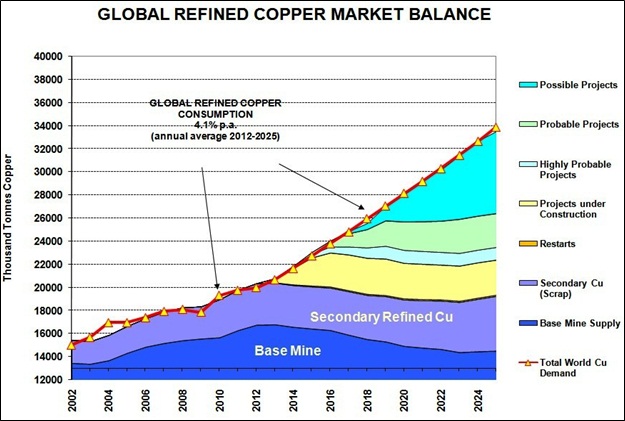

| 19.4 | Copper Concentrates 10 – 15 year Outlook | 321 |

| 19.5 | Concentrate Production Outpaces Smelter Capacity Growth | 322 |

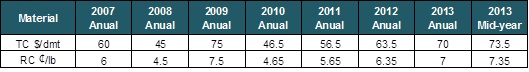

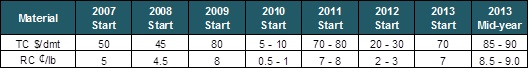

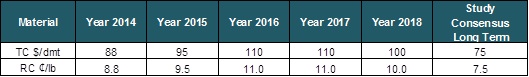

| 19.6 | Treatment and Refining Charges and other Commercial Terms | 323 |

| 19.7 | Caspiche Concentrates Marketability | 326 |

| 19.8 | Logistics Load Port Options | 330 |

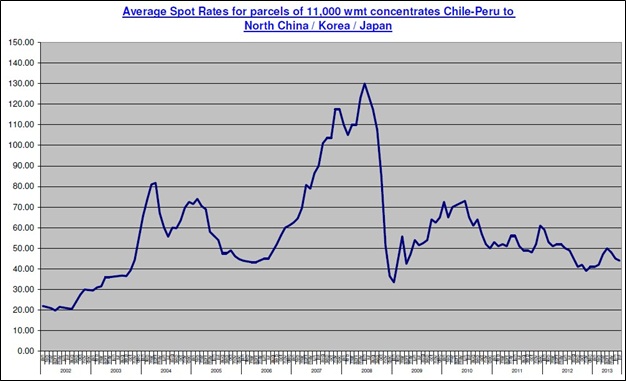

| 19.9 | Ocean Freight | 332 |

| 19.10 | Doré Metal Market | 335 |

| | | |

| 20. | ENVIRONMENTAL STUDIES, PERMITTING SOCIAL OR COMMUNITY IMPACT | 337 |

| | | |

| 20.1 | Principal Environmental Baseline Findings | 339 |

| 20.1.1 | Physical Environment: Climatic Characterization | 339 |

| 20.1.2 | Physical Environment: Main Geomorphological Units | 339 |

| 20.1.3 | Physical Environment Soil, characterizations and applications | 339 |

| 20.1.4 | Physical Environment: Hydrology | 340 |

| 20.1.5 | Biotic Environment: Flora and Vegetation | 340 |

| 20.1.6 | Biotic Environment: Fauna | 340 |

| 20.1.7 | Description of Socioeconomics-Cultural Environment: Demography | 341 |

| 20.1.8 | Historical and Archaeological Heritage | 342 |

| 20.1.9 | Anthropology | 342 |

| 20.2 | Summary of Main Environmental and Social Issues for the Project | 343 |

| 20.3 | Socio-economic Potential Impacts | 344 |

| 20.4 | Closure and Abandonment Stage | 345 |

| 20.4.1 | Closure Plan | 345 |

| 20.4.2 | Post-closing Stage or Abandonment | 348 |

| | | |

| 21. | CAPITAL AND OPERATING COSTS | 349 |

| | | |

| 21.1 | Introduction | 349 |

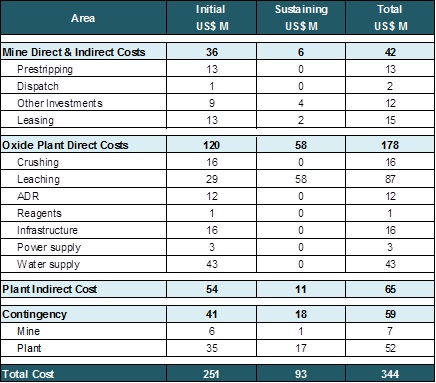

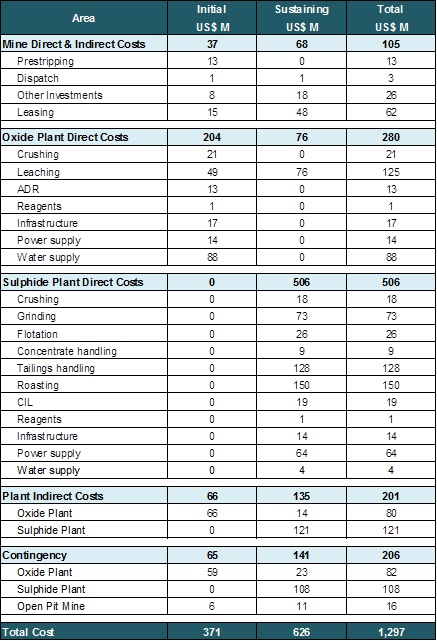

| 21.2 | Capital Cost Estimate | 349 |

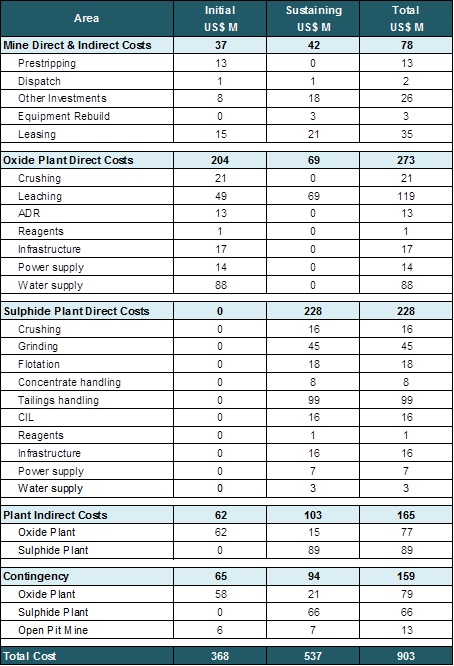

| 21.2.1 | Mine Capital Costs | 357 |

| 21.2.2 | Indirect Costs | 361 |

| 21.2.3 | Owners Cost | 362 |

| 21.2.4 | Contingency | 362 |

| 21.2.5 | Accuracy | 362 |

| 21.2.6 | Estimate Exclusions | 363 |

| 21.2.7 | Deferred and Sustainable Capital Cost | 363 |

| 2 1.3 | Operating Cost Estimates | 363 |

| 21.3.1 | Mining Operating Cost | 364 |

| 21.3.2 | Process Plant Operating Cost | 366 |

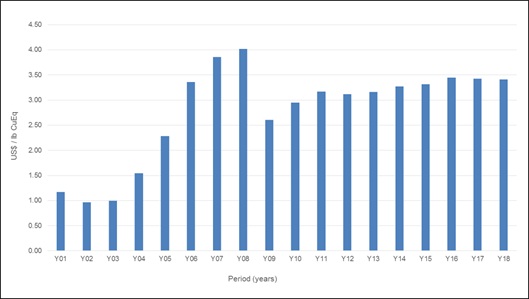

| 21.4 | Cash Cost Indicators | 369 |

| 21.4.1 | All-In Sustaining Cost (AISC) per Ounce of Gold Equivalent | 372 |

| 21.4.2 | C1 Cash Cost per Pound of Copper Equivalent | |

| | | 374 |

| 22. | ECONOMIC ANALYSIS | |

| | | 374 |

| 22.1 | Caution Regarding Forward-Looking Information | |

| 22.2 | Introduction | 374 |

| 22.3 | Methodology Used | 375 |

| 22.4 | Financial Model Parameters | 375 |

| 22.5 | Taxes and Royalties | 377 |

| 22.5.1 | Income Tax | 377 |

| 22.5.2 | Mining Royalty Tax | 379 |

| 22.5.3 | Production and Revenue | 380 |

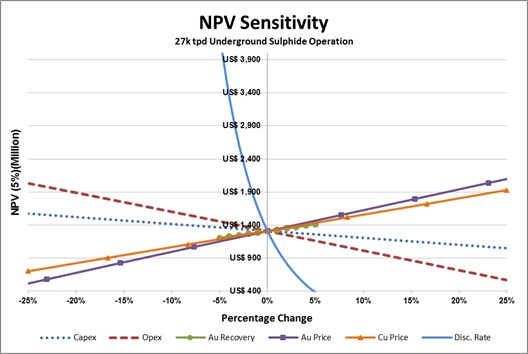

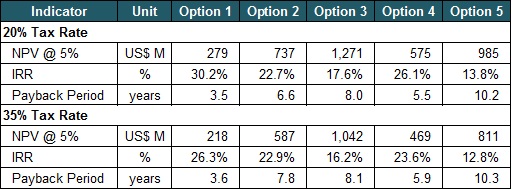

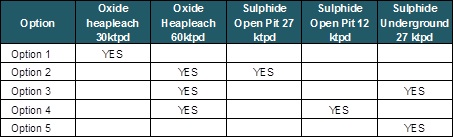

| 22.5.4 | PEA Economic Evaluation Results | 386 |

| 22.5.5 | Sensitivity Analysis | 392 |

| 22.6 | After Income Tax Analysis | 402 |

| 22.7 | Conclusion from the Preliminary Economic Analysis | 403 |

| | | |

| 23. | ADJACENT PROPERTIES | 405 |

| | | |

| 24. | OTHER RELEVANT INFORMATION | 406 |

| | | |

| 24.1 | Drilling Data | 406 |

| | | |

| 25. | INTERPRETATIONS AND CONCLUSIONS | 407 |

| | | |

| 25.1 | Strengths, Weaknesses, Opportunities and Threats | 407 |

| 25.1.1 | General | 408 |

| 25.1.2 | Geology | 408 |

| 25.1.3 | Mine | 409 |

| 25.1.4 | Recovery | 410 |

| 25.1.5 | Infrastructure | 411 |

| 25.1.6 | Marketing | 412 |

| 25.1.7 | Environmental | 412 |

| 25.2 | Conclusions | 413 |

| | | |

| 26. | RECOMMENDATIONS | 418 |

| | | |

| 26.1 | General Project Recommendations | 418 |

| 26.2 | Mining Recommendations | 418 |

| 26.3 | Process Recommendations | 419 |

| 26.4 | Estimated Budget to next phase | 419 |

| | | |

| 27. | REFERENCES | 420 |

| Figure 1-1: Caspiche Location Map (Source: Exeter, 2013) | 4 |

| | |

| Figure 1-2: Property Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2014) | 6 |

| | |

| Figure 1-3: “Caspiche” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 7 |

| | |

| Figure 1-4: “Reineta” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 8 |

| | |

| Figure 1-5: “Gloria” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 9 |

| | |

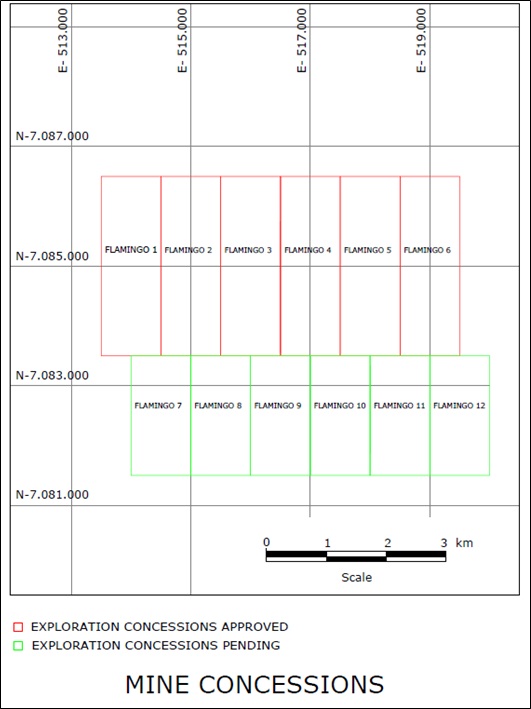

| Figure 1-6: “Flamingo” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 10 |

| | |

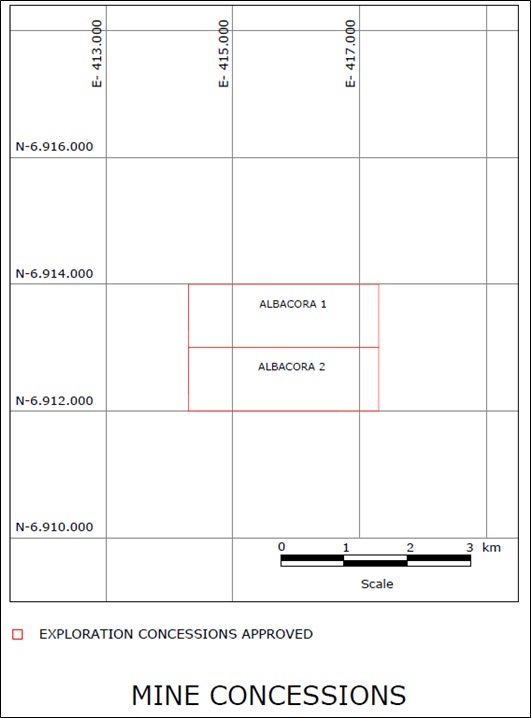

| Figure 1-7: “Albacora” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 11 |

| | |

| Figure 1-8: Caspiche Location Map (Source: Exeter, 2013) | 13 |

| | |

| Figure 1-9: Metallogenic Belts of Northern Chile and Argentina (Source: Vila and Sillitoe, 1991) | 15 |

| | |

| Figure 1-10: Regional Geology of the Maricunga Metallogenic Belt (Source: Vila and Sillitoe, 1991) | 16 |

| | |

| Figure 1-11: Global Refined Copper Market Balance (Source: Alfonso Gonzalez 2013 ©) | 27 |

| | |

| Figure 4-1: Caspiche Location Map (Source: Exeter, 2013) | 46 |

| | |

| Figure 4-2: Property Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2014) | 49 |

| | |

| Figure 4-3: “Caspiche” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 50 |

| | |

| Figure 4-4: “Reineta” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 51 |

| | |

| Figure 4-5: “Gloria” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 52 |

| | |

| Figure 4-6: “Flamingo” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 53 |

| | |

| Figure 4-7: “Albacora” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013) | 54 |

| | |

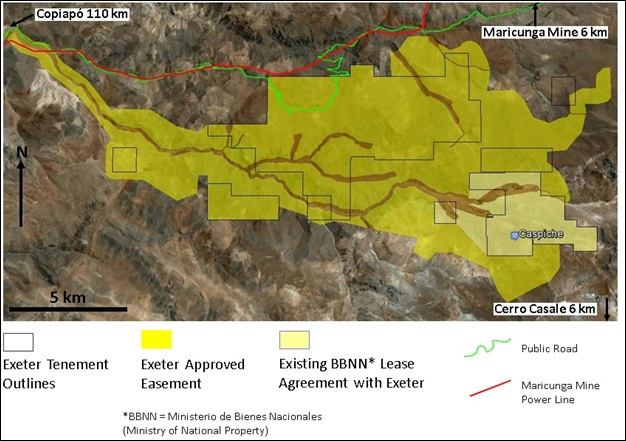

| Figure 4-8: Extended Surface Rights Caspiche Project (Exeter 2013) | 61 |

| | |

| Figure 5-1: Caspiche Location Map (Source: Exeter, 2013) | 65 |

| | |

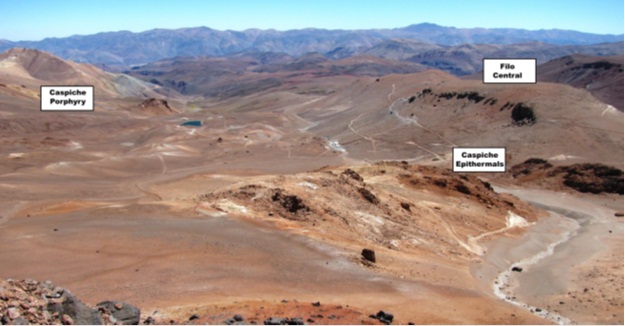

| Figure 5-2: Photograph of Caspiche Property Looking West (Source: Exeter, 2013) | 67 |

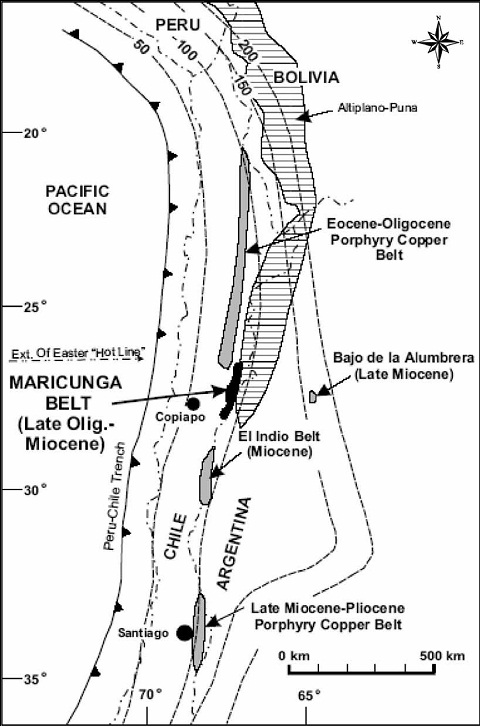

| Figure 7-1: Metallogenic Belts of Northern Chile and Argentina (Source: Vila and Sillitoe, 1991) | 71 |

| | |

| Figure 7-2: Regional Geology of the Maricunga Metallogenic Belt (Source: Vila and Sillitoe, 1991) | 72 |

| | |

| Figure 7-3: Bedrock Geology of the Caspiche Property (Source: Exeter, 2013) | 73 |

| | |

| Figure 7-4: Gold Grade Histogram in Red, Copper Grade Histogram in Purple (Source: Exeter, 2013) | 74 |

| | |

| Figure 8-1: Generalized Porphyry Model (Source: Vila and Sillitoe, 1991) | 84 |

| | |

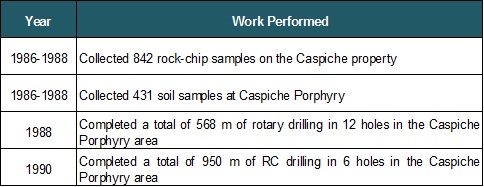

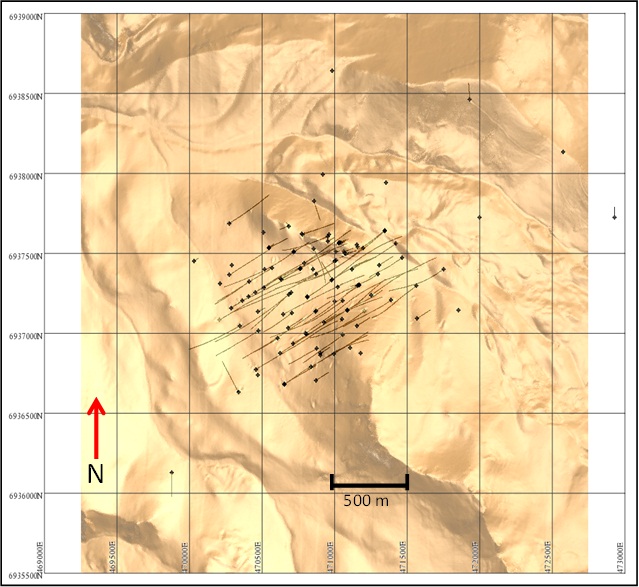

| Figure 10-1: Drill Hole Location Map for the Caspiche Porphyry Prospect Area (Source: Exeter, 2013) | 96 |

| | |

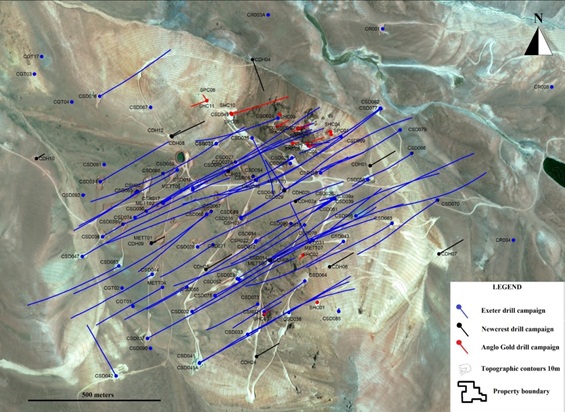

| Figure 10-2: Regional Drill Hole Location Map Showing Location of Exploration Drill Holes (2009-2011) (Source: Exeter, 2013) | 98 |

| | |

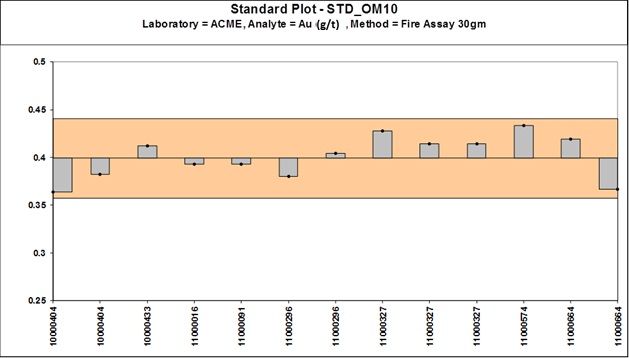

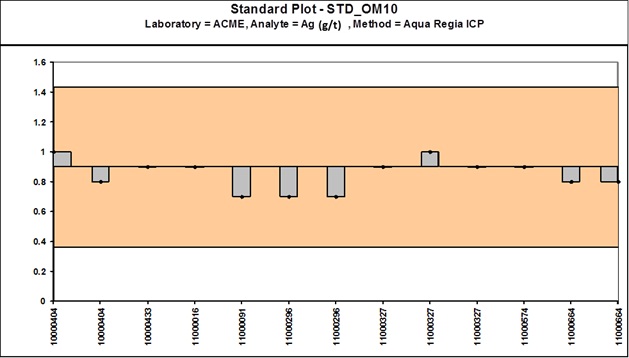

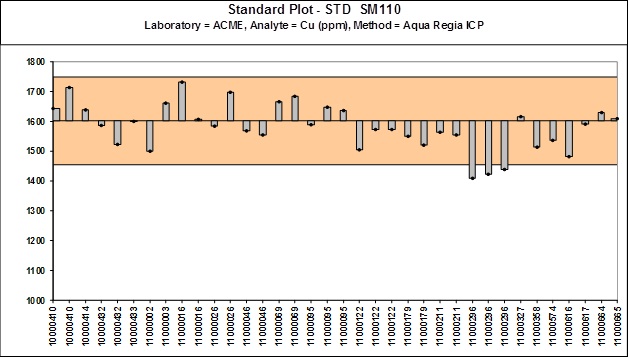

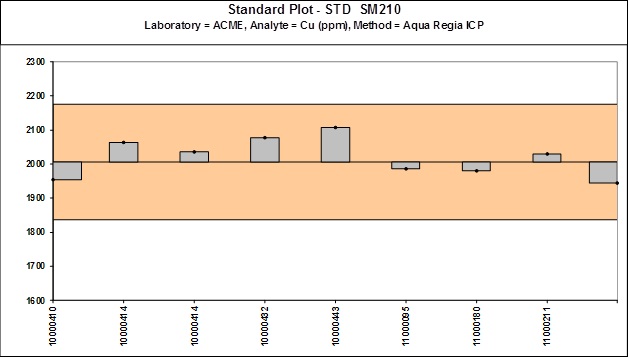

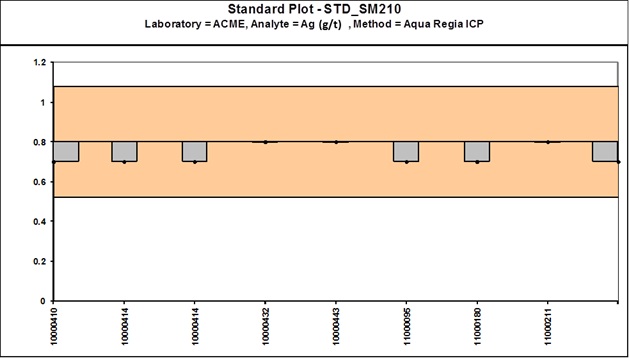

| Figure 11-1: SRM Control Chart OM00 (2010-2011) - Gold (Source: Cube Consulting, 2013) | 116 |

| | |

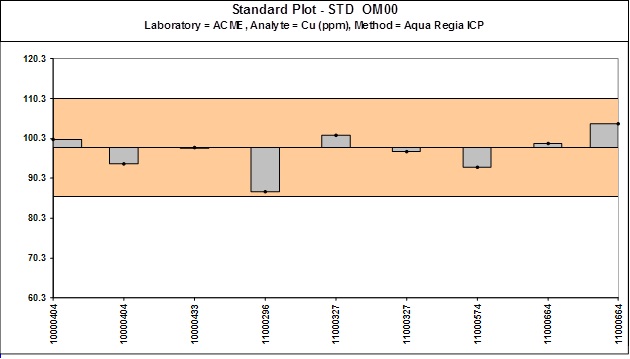

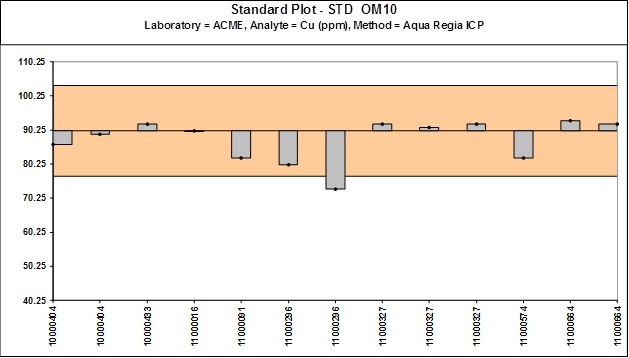

| Figure 11-2: SRM Control Chart OM00 (2010-2011) - Copper (Source: Cube Consulting, 2013) | 116 |

| | |

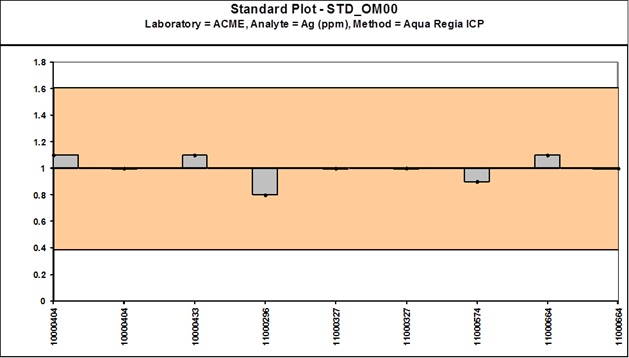

| Figure 11-3: SRM Control Chart OM00 (2010-2011) - Silver (Source: Cube Consulting, 2013) | 117 |

| | |

| Figure 11-4: SRM Control Chart OM10 (2010-2011) - Gold (Source: Cube Consulting, 2013) | 117 |

| | |

| Figure 11-5: SRM Control Chart OM10 (2010-2011) - Copper (Source: Cube Consulting, 2013) | 118 |

| | |

| Figure 11-6: SRM Control Chart OM10 (2010-2011) - Silver (Source: Cube Consulting, 2013) | 118 |

| | |

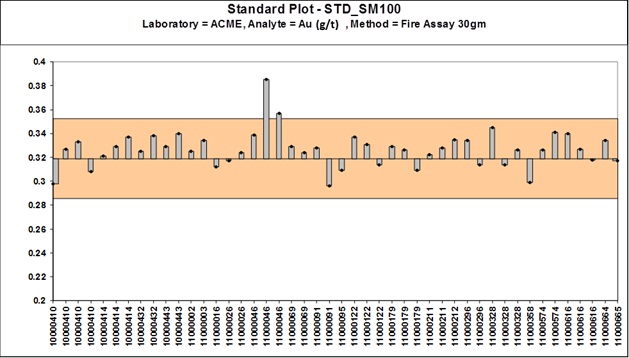

| Figure 11-7: SRM Control Chart OM100 (2010-2011) - Gold (Source: Cube Consulting, 2013) | 119 |

| | |

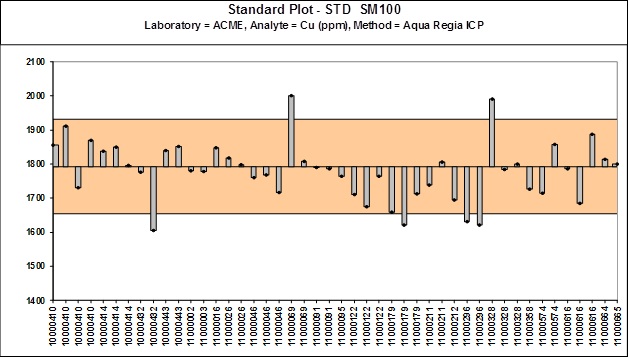

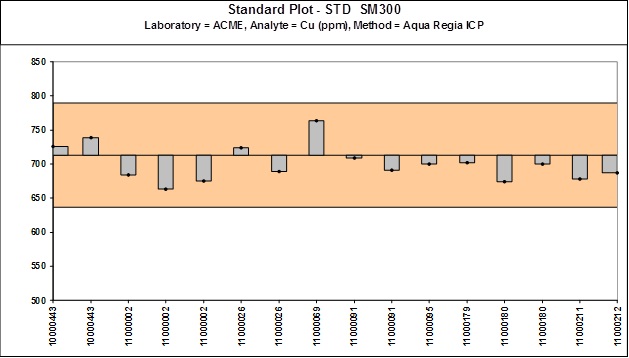

| Figure 11-8: SRM Control Chart OM100 (2010-2011) - Copper (Source: Cube Consulting, 2013) | 119 |

| | |

| Figure 11-9: SRM Control Chart OM100 (2010-2011) - Silver (Source: Cube Consulting, 2013) | 120 |

| | |

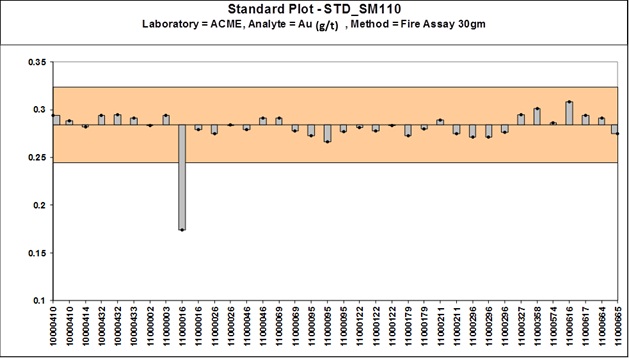

| Figure 11-10: SRM Control Chart OM110 (2010-2011) - Gold (Source: Cube Consulting, 2013) | 120 |

| | |

| Figure 11-11: SRM Control Chart OM110 (2010-2011) -Copper (Source: Cube Consulting, 2013) | 121 |

| | |

| Figure 11-12: SRM Control Chart OM110 (2010-2011) - Silver (Source: Cube Consulting, 2013) | 121 |

| | |

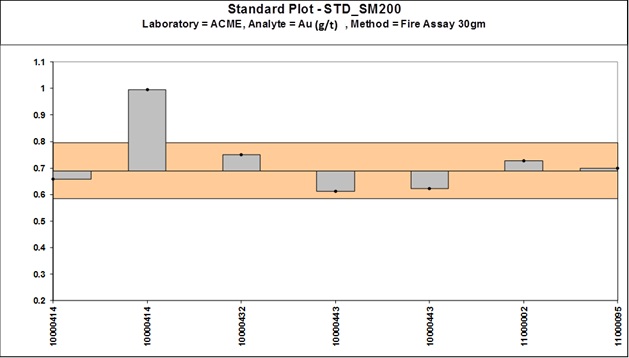

| Figure 11-13: SRM Control Chart OM200 (2010-2011) - Gold (Source: Cube Consulting, 2013) | 122 |

| | |

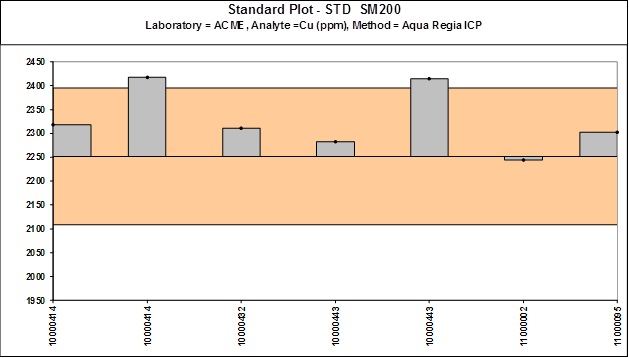

| Figure 11-14: SRM Control Chart OM200 (2010-2011) -Copper (Source: Cube Consulting, 2013) | 122 |

| | |

| Figure 11-15: SRM Control Chart OM200 (2010-2011) - Silver (Source: Cube Consulting, 2013) | 123 |

| | |

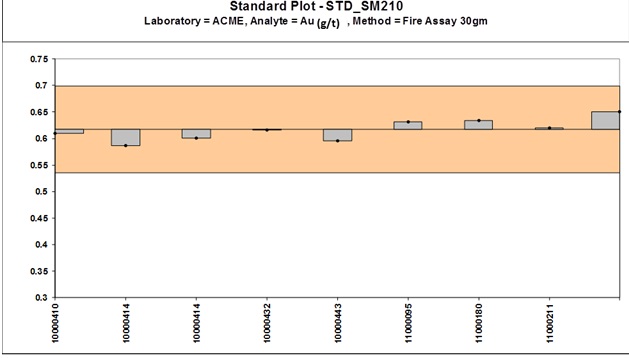

| Figure 11-16: SRM Control Chart OM210 (2010-2011) - Gold (Source: Cube Consulting, 2013) | 123 |

| | |

| Figure 11-17: SRM Control Chart OM210 (2010-2011) -Copper (Source: Cube Consulting, 2013) | 124 |

| | |

| Figure 11-18: SRM Control Chart OM210 (2010-2011) - Silver (Source: Cube Consulting, 2013) | 124 |

| | |

| Figure 11-19: SRM Control Chart OM300 (2010-2011) - Gold (Source: Cube Consulting, 2013) | 125 |

| | |

| Figure 11-20: SRM Control Chart OM300 (2010-2011) -Copper (Source: Cube Consulting, 2013) | 125 |

| Figure 11-21: SRM Control Chart OM300 (2010-2011) - Silver (Source: Cube Consulting, 2013) | 126 |

| | |

| Figure 12-1: Re-Assays of Samples >1 Au ppm | 134 |

| | |

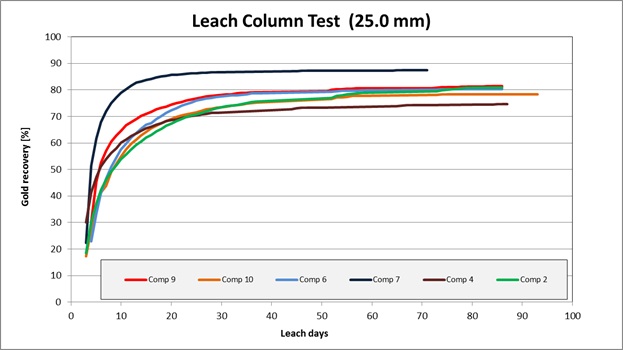

| Figure 13-1: Gold Leach Rate Profile – 25 mm | 139 |

| | |

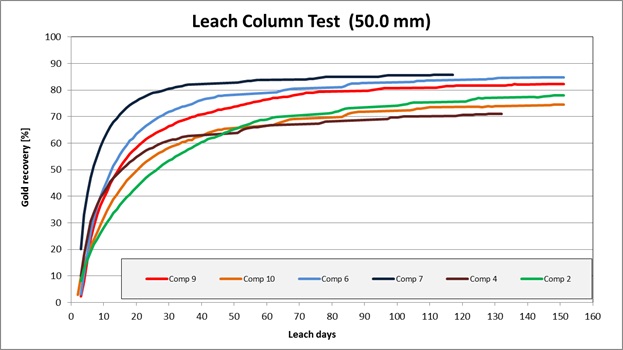

| Figure 13-2: Gold Leach Rate Profile – 50 mm | 140 |

| | |

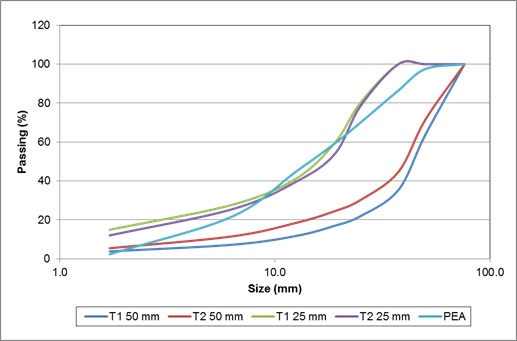

| Figure 13-3: Granulometric Curve for Heap Leach Feed | 141 |

| | |

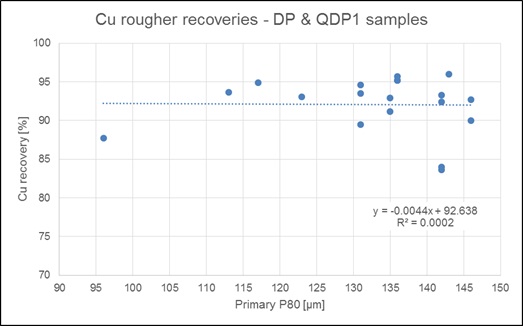

| Figure 13-4: Cu recovery in rougher flotation vs. primary P80 – DP and QDP1 samples | 150 |

| | |

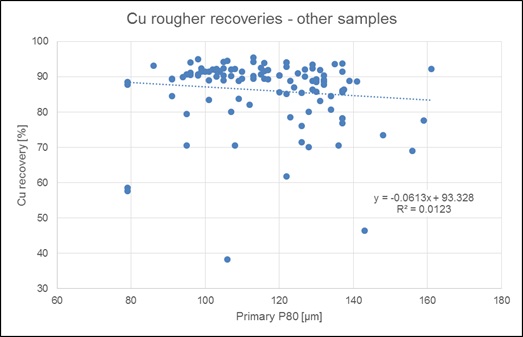

| Figure 13-5: Cu recovery in rougher flotation vs. primary P80 – Other samples | 150 |

| | |

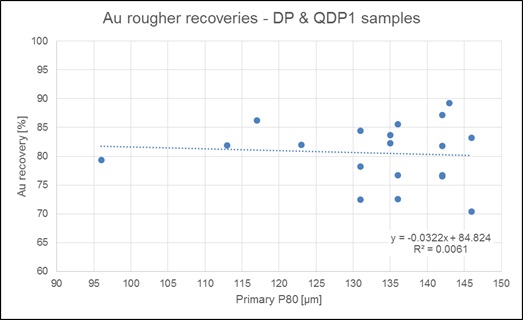

| Figure 13-6: Au recovery in rougher flotation vs. primary P80 – DP and QDP1 samples | 151 |

| | |

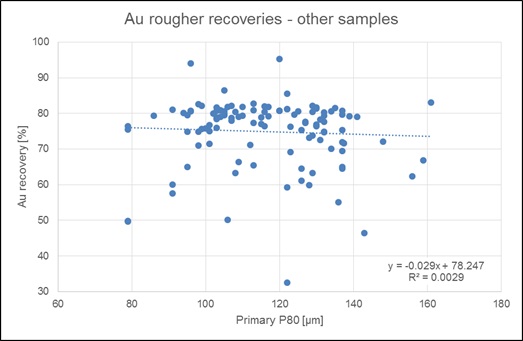

| Figure 13-7: Au recovery in rougher flotation vs. primary P80 – Other samples | 151 |

| | |

| Figure 13-8: Batch rougher flotation results at coarse grind | 152 |

| | |

| Figure 14-1: Caspiche topography and drill hole locations – Caspiche Porphyry Project (Source: Cube Consulting, April 11 2012) | 161 |

| | |

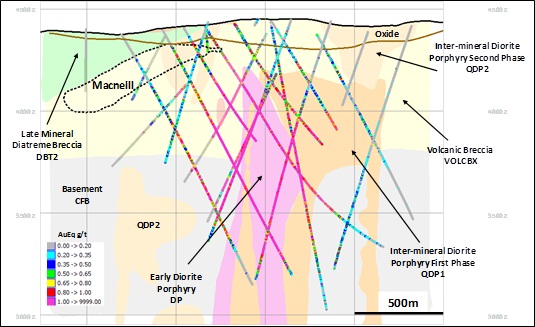

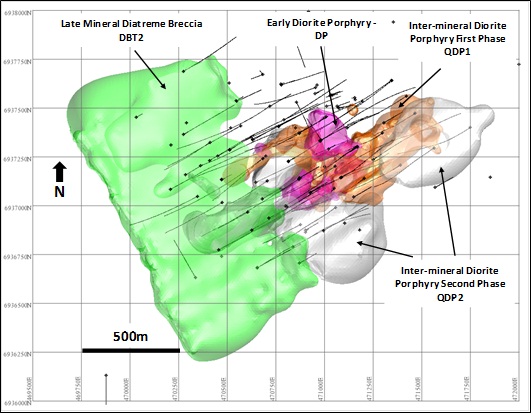

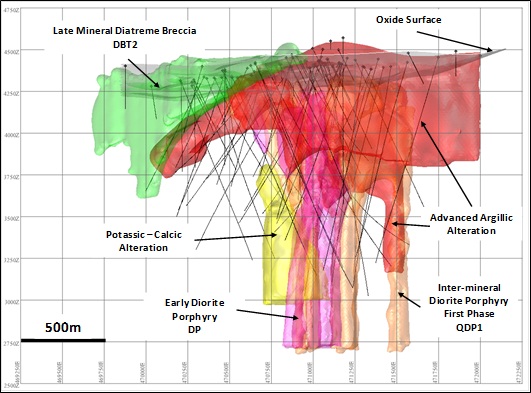

| Figure 14-2: Caspiche Stratigraphic Model Section - Looking Northwest (Source: Cube Consulting, 2012) | 163 |

| | |

| Figure 14-3: Caspiche Stratigraphic Model - Plan (Source: Cube Consulting, 2012) | 164 |

| | |

| Figure 14-4: Caspiche Stratigraphic Model – Looking North (Source: Cube Consulting, 2012) | 165 |

| | |

| Figure 14-5: Caspiche Stratigraphic and Alteration Model – Looking North (Source: Cube Consulting, 2012) | 166 |

| | |

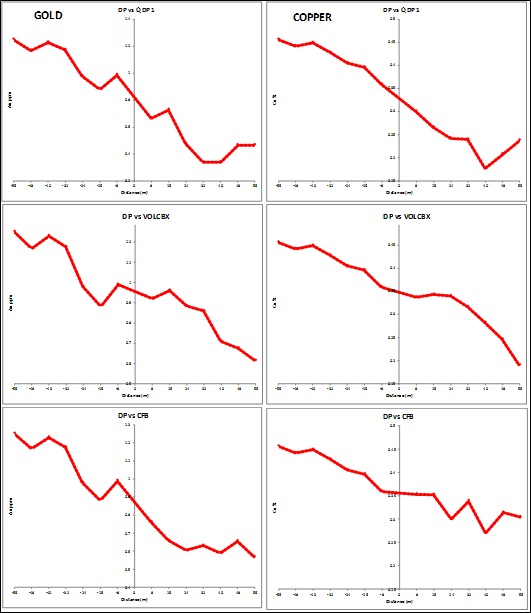

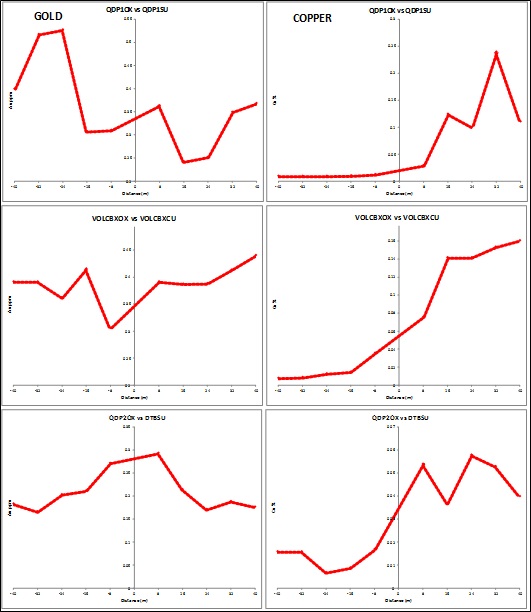

| Figure 14-6: Boundary Contact Analysis – DP v QDP1, VOLCBX and CFB | 170 |

| | |

| Figure 14-7: Boundary Contact Analysis – OXIDE v SULPHIDE | 171 |

| | |

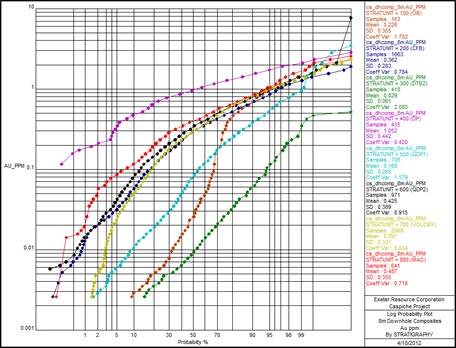

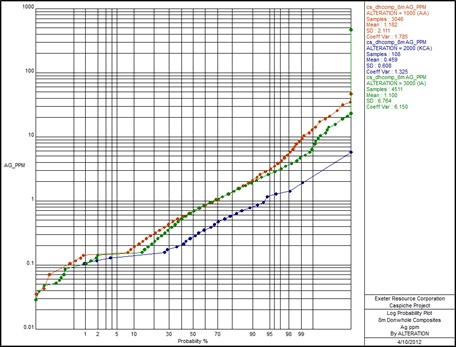

| Figure 14-8: Caspiche 8 m Composites by Stratigraphy – Log-Prob Plot - Au ppm | 174 |

| | |

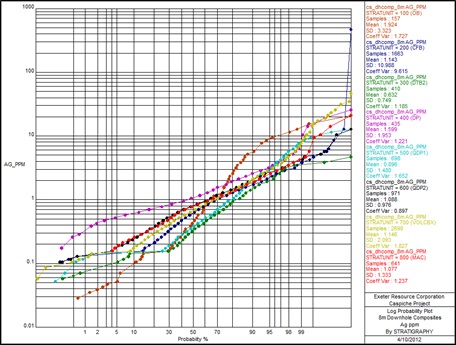

| Figure 14-9: Caspiche 8 m Composites by Stratigraphy – Log-Prob Plot - Ag ppm | 175 |

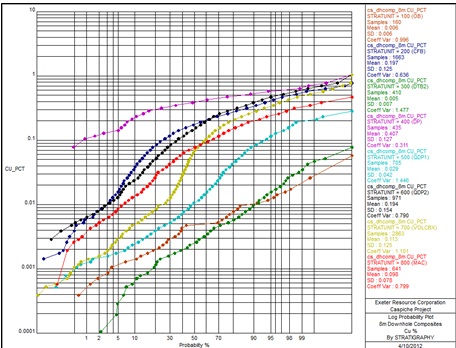

| | |

| Figure 14-10: Caspiche 8 m Composites by Stratigraphy – Log-Prob Plot - Cu % | 175 |

| | |

| Figure 14-11: Caspiche 8 m Composites by Alteration – Log-Prob Plot - Au ppm | 176 |

| | |

| Figure 14-12: Caspiche 8 m Composites by Alteration – Log-Prob Plot - Ag ppm | 176 |

| | |

| Figure 14-13: Caspiche 8 m Composites by Alteration – Log-Prob Plot - Cu % | 177 |

| | |

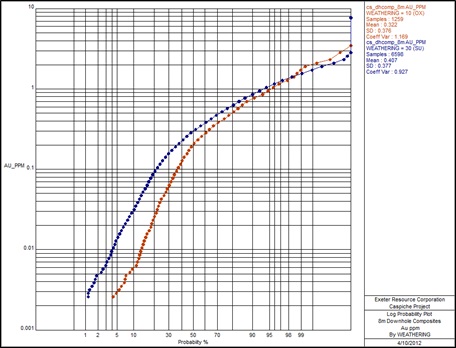

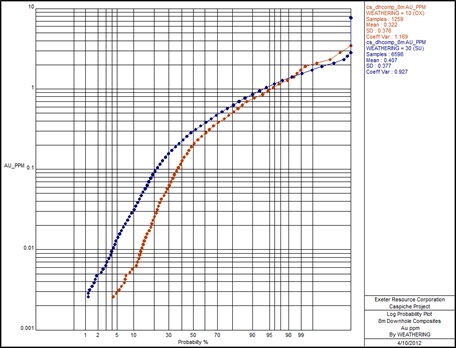

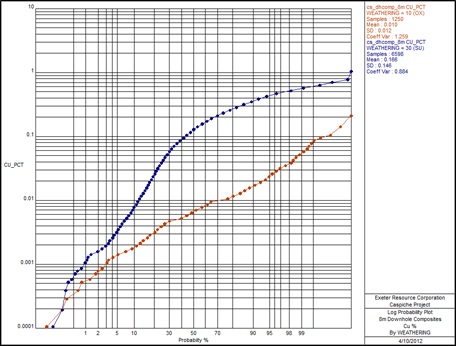

| Figure 14-14: Caspiche 8 m Composites by Weathering – Log-Prob Plot - Au ppm | 177 |

| | |

| Figure 14-15: Caspiche 8 m Composites by Weathering – Log-Prob Plot - Ag ppm | 178 |

| | |

| Figure 14-16: Caspiche 8 m Composites by Weathering – Log-Prob Plot - Cu % | 178 |

| | |

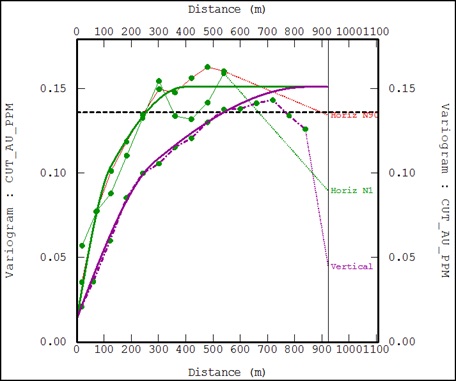

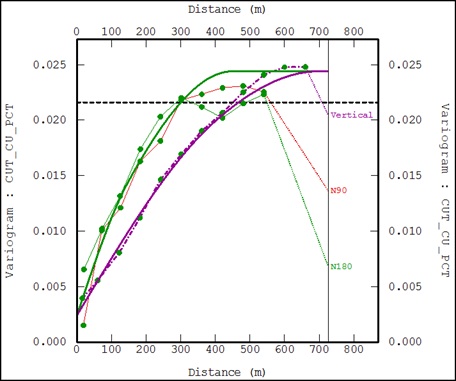

| Figure 14-17: Caspiche Variogram Model – DP+QDP1+VOLCBX+CFB - Gold | 183 |

| Figure 14-18: Caspiche Variogram Model – DP+QDP1+VOLCBX+CFB – Copper | 184 |

| | |

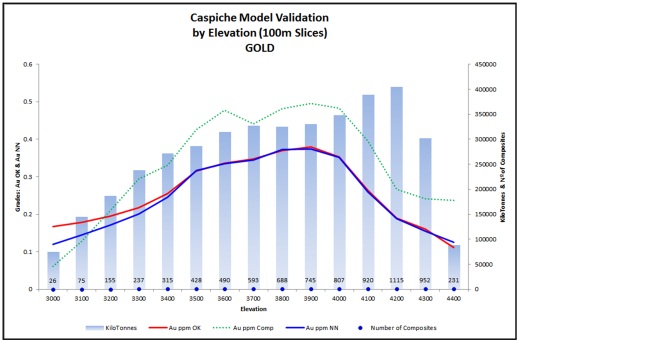

| Figure 14-19: Caspiche Swath Plots by 100 m Elevation - Gold | 192 |

| | |

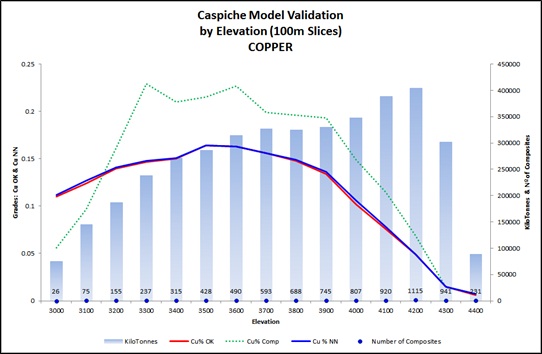

| Figure 14-20: Caspiche Swath Plots by 100 m Elevation – Copper | 193 |

| | |

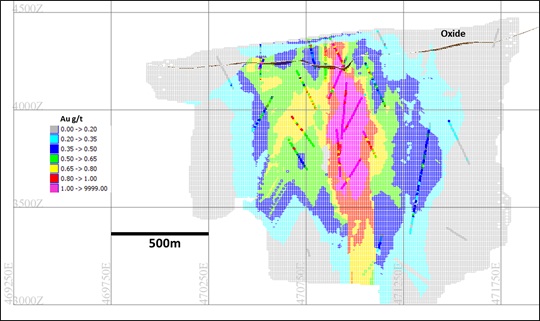

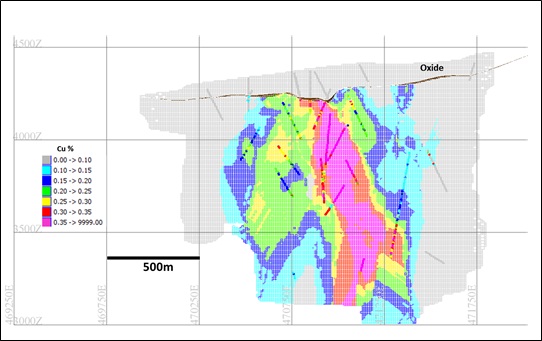

| Figure 14-21: Vertical Section 6937400mN (looking north) - Composite and Model Grades - Au ppm (Source: Cube Consulting, 2012) | 194 |

| | |

| Figure 14-22: Plan Section 4000mRL - Composite and Model Grades - Au ppm (Source: Cube Consulting, 2012) | 194 |

| | |

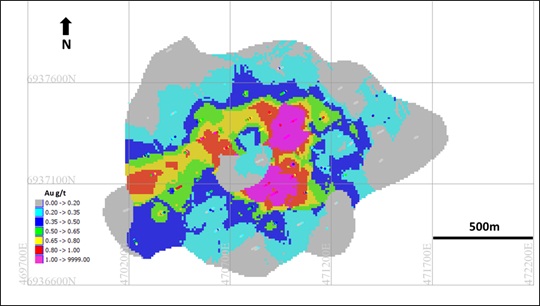

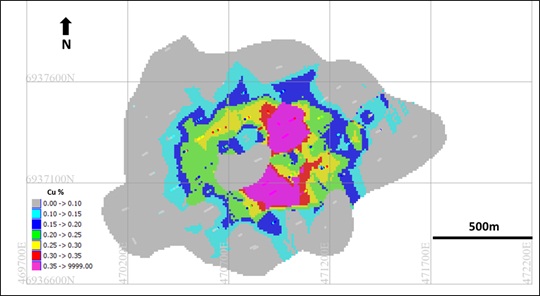

| Figure 14-23: Vertical Section 6937400mN (looking north) - Composite and Model Grades - Cu % (Source: Cube Consulting, 2012) | 195 |

| | |

| Figure 14-24: Plan Section 4000mRL - Composite and Model Grades - Cu % (Source: Cube Consulting, 2012) | 195 |

| | |

| Figure 14-25: Caspiche Global Grade-Tonnage Curve – OK vs DGM – Gold | 197 |

| | |

| Figure 14-26: Caspiche Global Grade-Tonnage Curve – OK vs DGM – Copper | 197 |

| | |

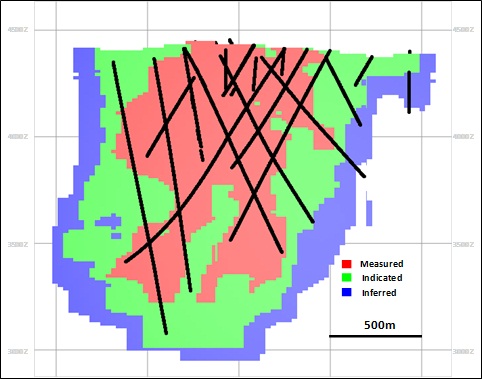

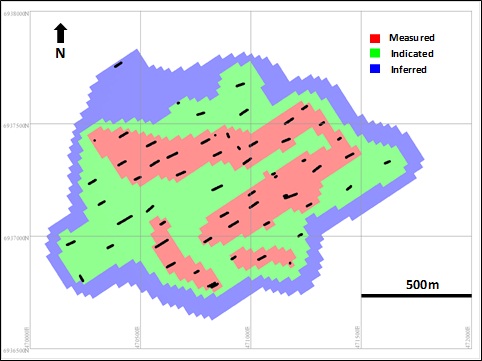

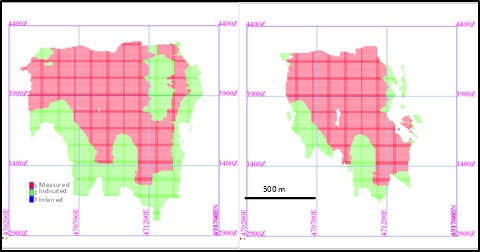

| Figure 14-27: Vertical Section (looking northwest) - Resource Classification (Source: Cube Consulting, 2012) | 200 |

| | |

| Figure 14-28: Plan Section 4000mRL - Resource Classification (Source: Cube Consulting, 2012) | 200 |

| | |

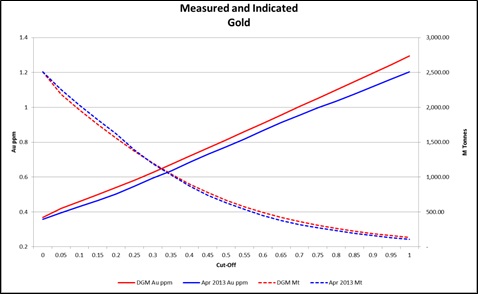

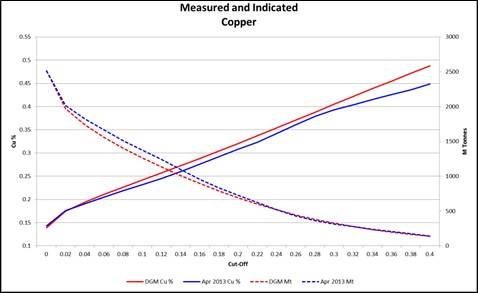

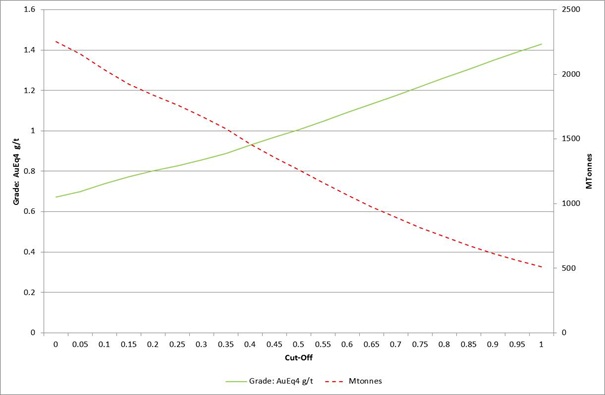

| Figure 14-29: Grade Tonnage Curve Estimated Blocks of oxide Material (Measured and Indicated) | 206 |

| | |

| Figure 14-30: Grade Tonnage Curve Estimated Blocks of non-oxidized (including Transitional) Material (Measured and Indicated) | 207 |

| | |

| Figure 14-31: Vertical Section at 6937000mN (looking north) – non-oxidized M+I (Source: Cube Consulting, 2012) | 208 |

| | |

| Figure 14-32: Vertical Section at 6937400mN (looking north) – non-oxidized M+I (Source: Cube Consulting, 2012) | 208 |

| | |

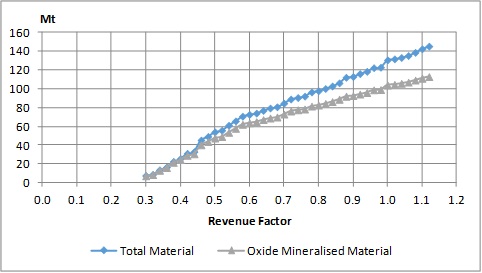

| Figure 16-1: Pit Optimization Results – Option 1 | 216 |

| | |

| Figure 16-2: Pit Optimization Results – Options 2&3 | 218 |

| | |

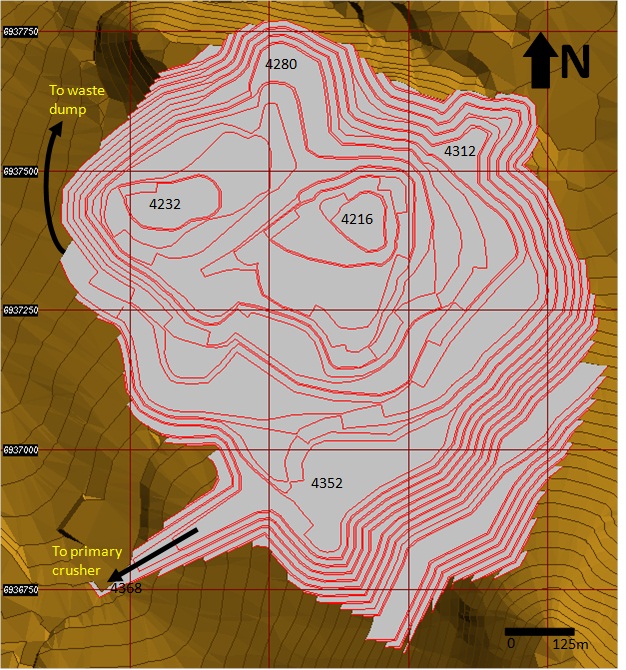

| Figure 16-3: Final Pit – Option 1 | 221 |

| | |

| Figure 16-4: Mining Phases – Option 1 | 223 |

| | |

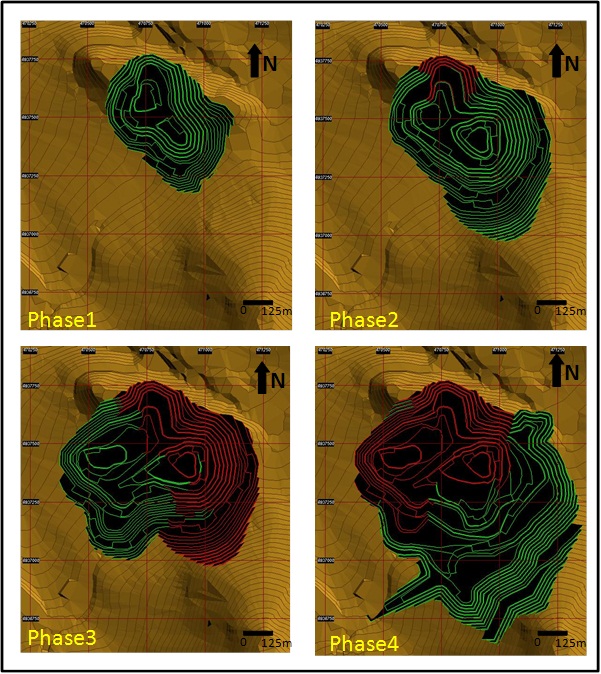

| Figure 16-5: Final Pit – Options 2&3 | 225 |

| | |

| Figure 16-6: Mining Phases – Options 2&3 | 226 |

| | |

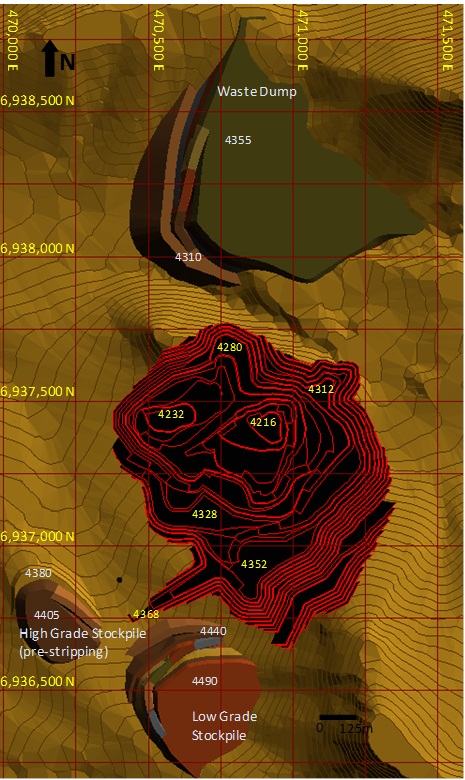

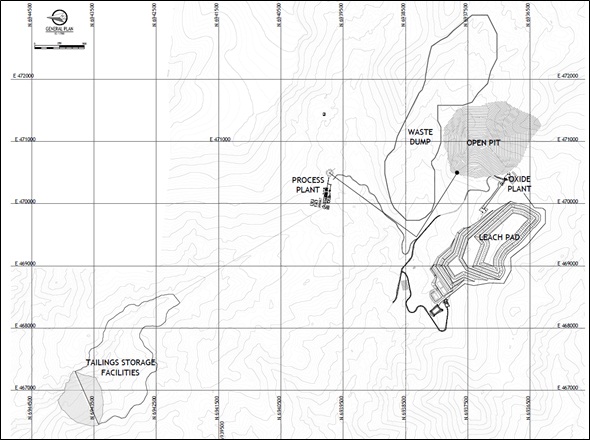

| Figure 16-7: General Layout – Option 1 | 231 |

| | |

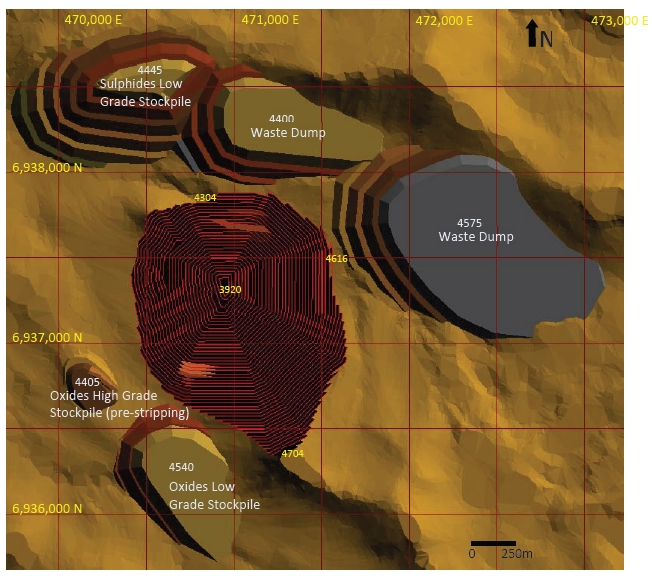

| Figure 16-8: General Layout – Options 2 | 232 |

| | |

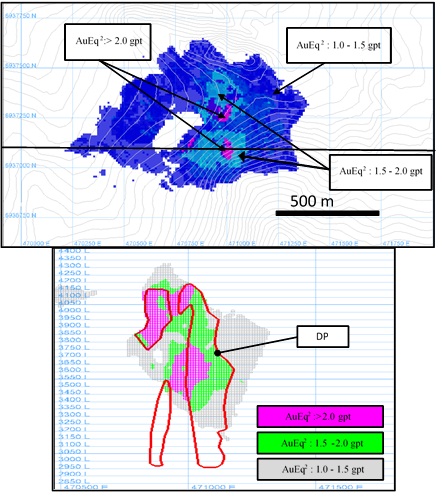

| Figure 16-9: Sulphide Resources Grades Distribution | 234 |

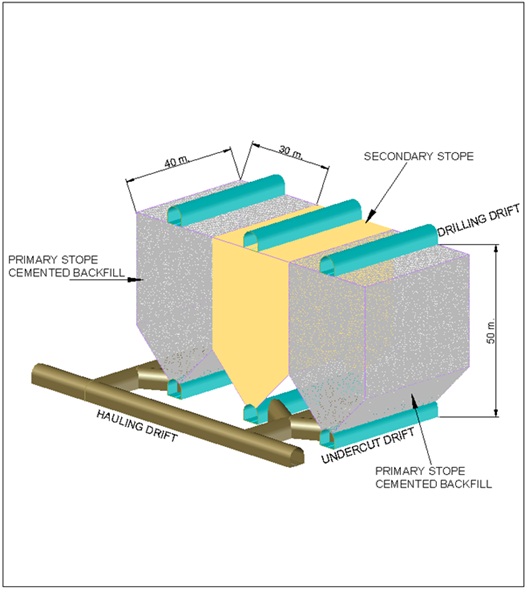

| Figure 16-10: Basic Blast hole Stoping Method | 235 |

| | |

| Figure 16-11: Mining Horizons | 238 |

| | |

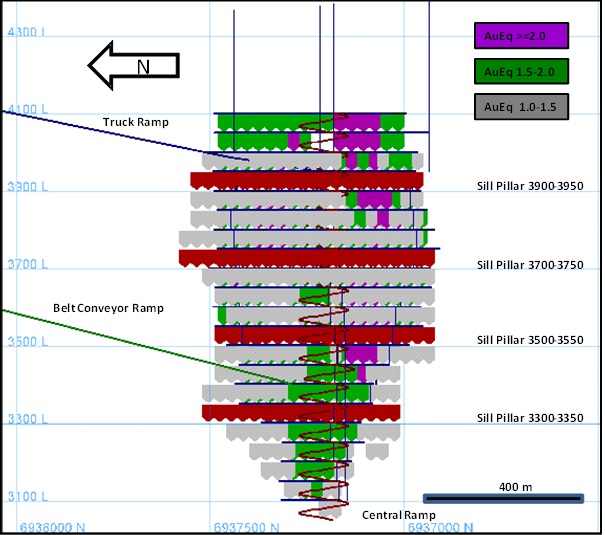

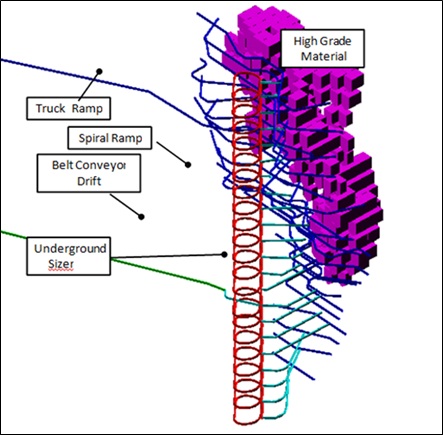

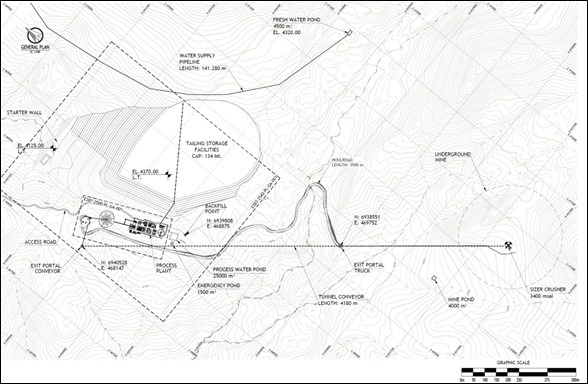

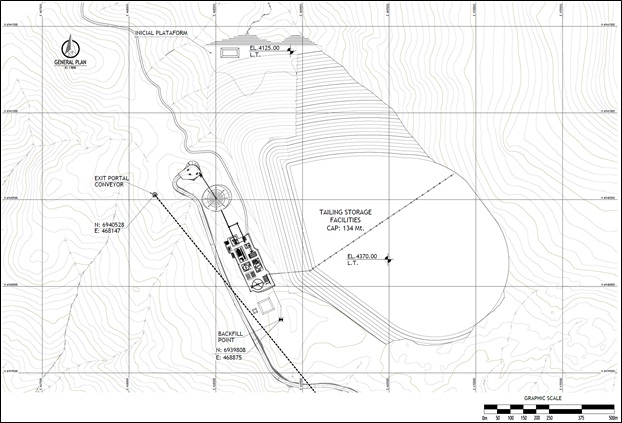

| Figure 16-12: Main Infrastructure | 241 |

| | |

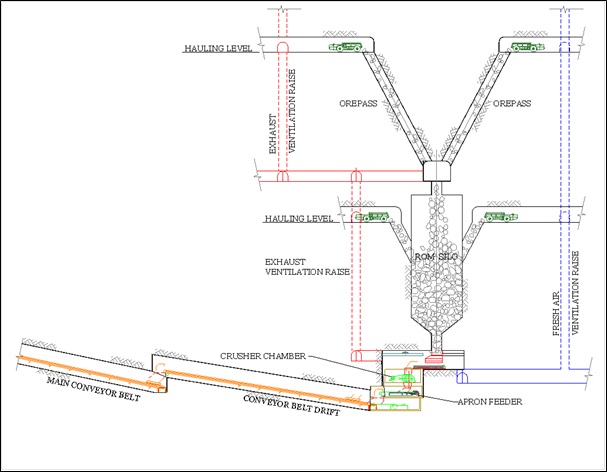

| Figure 16-13: Plant Feed Handling | 242 |

| | |

| Figure 16-14: Schematic of Paste Fill Distribution | 243 |

| | |

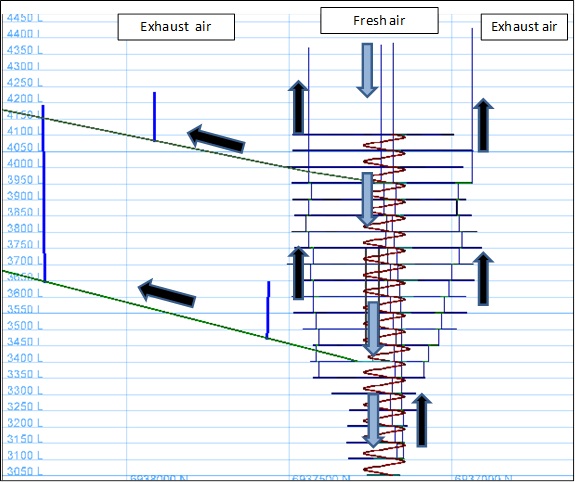

| Figure 16-15: Schematic of the Ventilation System | 244 |

| | |

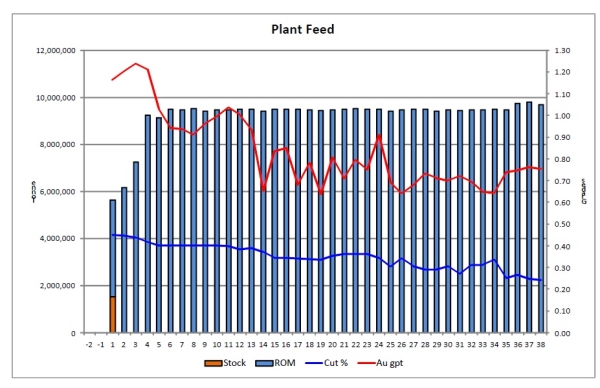

| Figure 16-16: Sulphide Plant Feed Schedule | 256 |

| | |

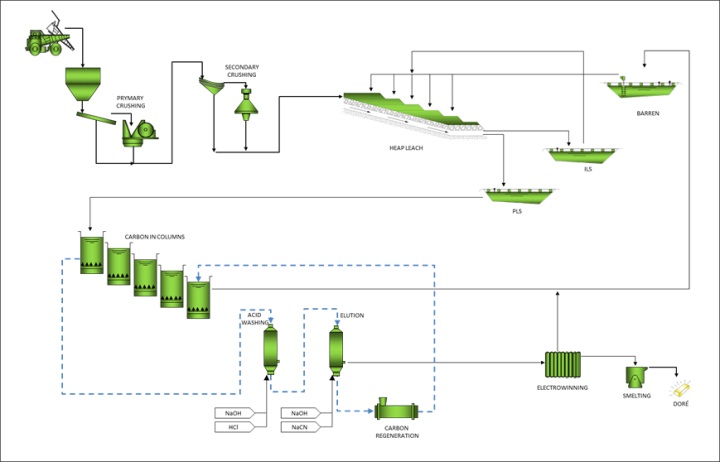

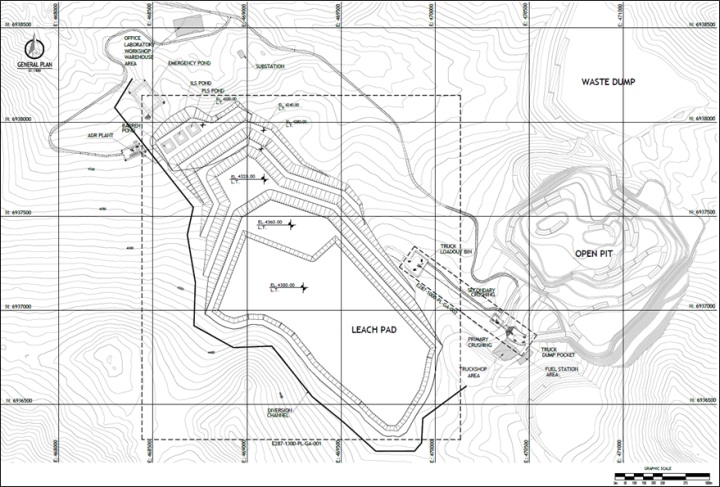

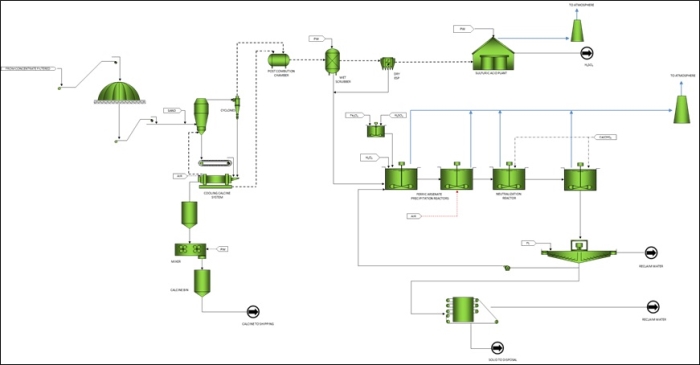

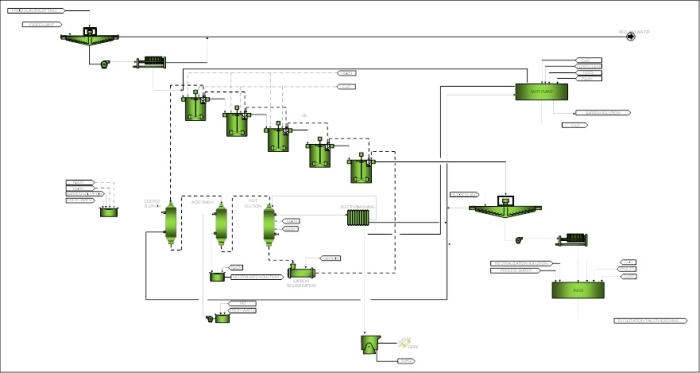

| Figure 17-1: Conceptual Process Plant Flowsheet | 271 |

| | |

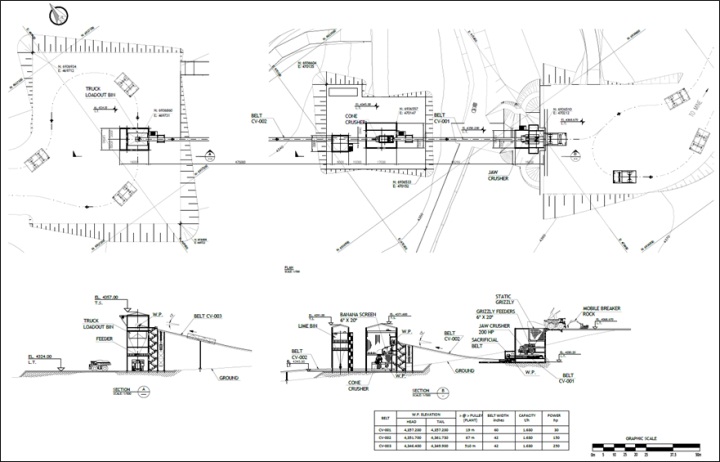

| Figure 17-2: Crushing Flow Diagram | 273 |

| | |

| Figure 17-3: Leaching Flow Diagram | 274 |

| | |

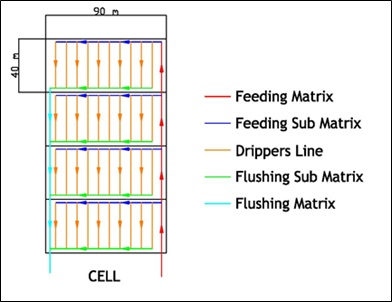

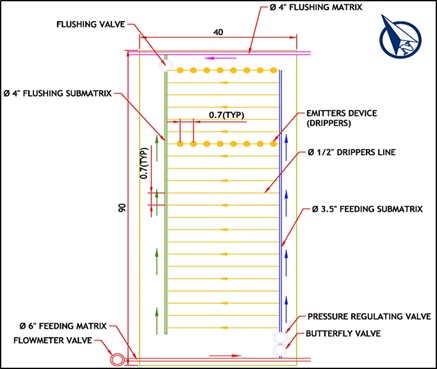

| Figure 17-4: Cell Configuration | 275 |

| | |

| Figure 17-5: Module Configuration | 276 |

| | |

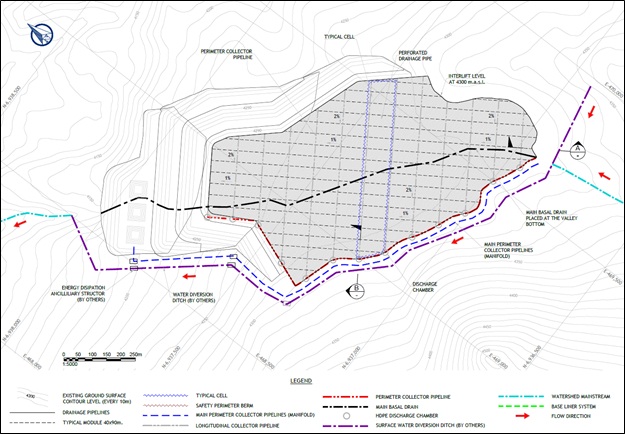

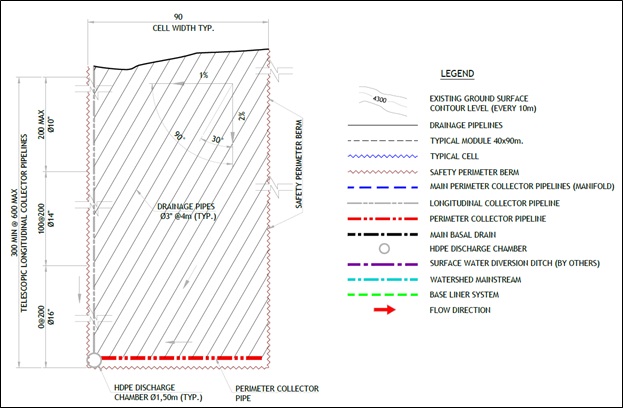

| Figure 17-6: Drainage and Collection System (Plan view) | 277 |

| | |

| Figure 17-7: Design Summary Sketch (Typical Cell – General Plant) | 278 |

| | |

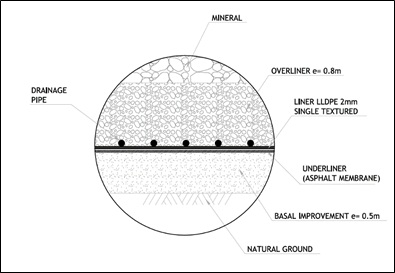

| Figure 17-8: Base Liner System | 280 |

| | |

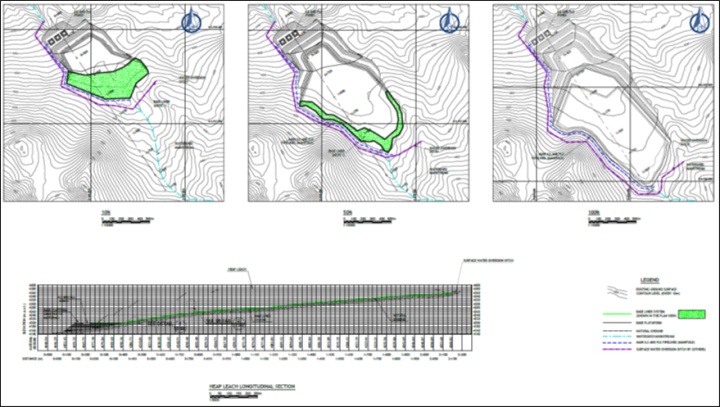

| Figure 17-9: Leach Pad Construction – 10%, 50% and 100% | 281 |

| | |

| Figure 17-10: ADR Plant Flow Diagram | 283 |

| | |

| Figure 17-11: Conceptual General Arrangement | 284 |

| | |

| Figure 17-12: Conceptual General Arrangement – Process Plant | 285 |

| | |

| Figure 17-13: Conceptual Process Plant Simplified Sketch | 289 |

| | |

| Figure 17-14: Primary Crushing Flow Diagram | 291 |

| | |

| Figure 17-15: Conceptual Grinding Flow Diagram | 292 |

| | |

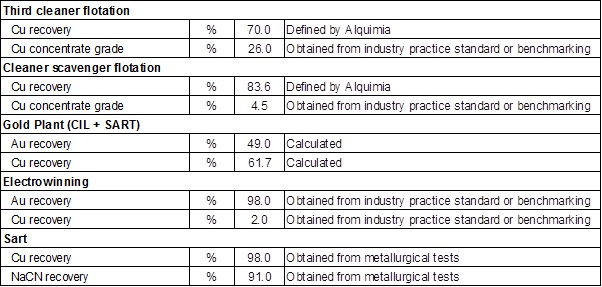

| Figure 17-16: Conceptual Flotation Flow Diagram | 293 |

| | |

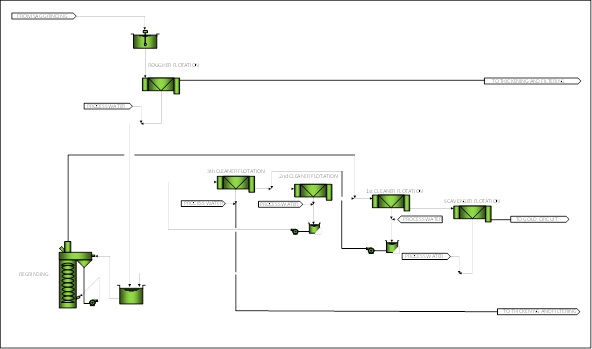

| Figure 17-17: Conceptual Concentrate Handling Flow Diagram | 295 |

| | |

| Figure 17-18: Conceptual final Cu-Au Concentrate Treatment Flow Diagram | 297 |

| | |

| Figure 17-19: Conceptual filtered Tailings Handling Flow Diagram | 299 |

| | |

| Figure 17-20: Thickened Handling Flow Diagram | 299 |

| Figure 17-21: Conceptual Gold Recovery Plant Flow Diagram | 301 |

| | |

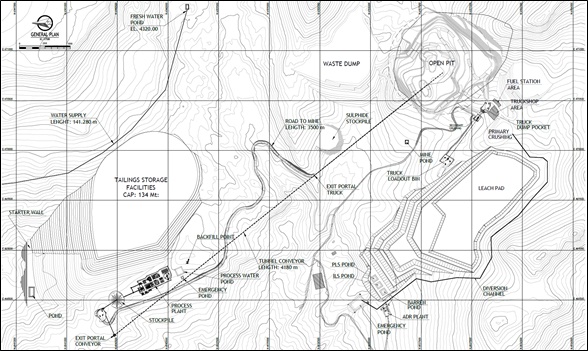

| Figure 18-1: Map Plant Area | 305 |

| | |

| Figure 18-2: Project Plot Plan – Option 1 | 306 |

| | |

| Figure 18-3: Project Plot Plan – Option 2 | 307 |

| | |

| Figure 18-4: Project Plot Plan – Option 3 | 308 |

| | |

| Figure 18-5: Project Plot Plan – Option 4 | 308 |

| | |

| Figure 18-6: Project Plot Plan – Option 5 | 309 |

| | |

| Figure 18-7: Cardones Power Line | 310 |

| | |

| Figure 18-8: Filtered Tailings Handling Facilities | 312 |

| | |

| Figure 18-9: Access Road | 313 |

| | |

| Figure 18-10: Fresh Water Pipeline | 315 |

| | |

| Figure 19-1: Global Refined Copper Market Balance (Source: Alfonso Gonzalez ©, 2013) | 318 |

| | |

| Figure 19-2: Increase in Mine Copper Production at World level (Source: Alfonso Gonzalez ©) | 322 |

| | |

| Figure 19-3: Copper Concentrates Top Importers (Source: Alfonso Gonzalez ©) | 325 |

| | |

| Figure 19-4: Port Options | 331 |

| | |

| Figure 19-5: Average Spot Ocean freight rates for concentrates (2002 -2013) | 332 |

| | |

| Figure 19-6: Baltic Dry Index (2009 -2014) | 334 |

| | |

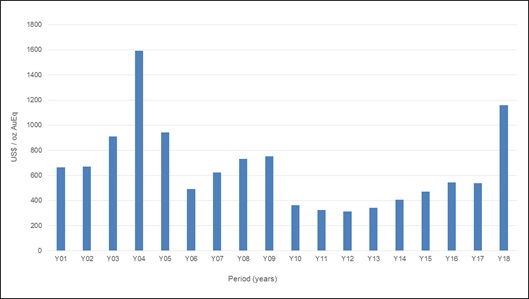

| Figure 21-1: Option 1: AISC per Ounce of Gold Equivalent | 369 |

| Figure 21-2: Option 2: AISC per Ounce of Gold Equivalent373 | 370 |

| | |

| Figure 21-3: Option 3: AISC per Ounce of Gold Equivalent373 | 370 |

| | |

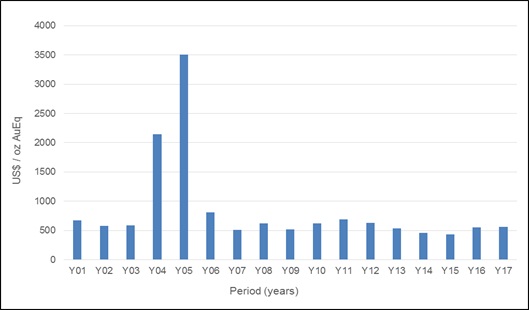

| Figure 21-4: Option 4: AISC per Ounce of Gold Equivalent387 | 371 |

| | |

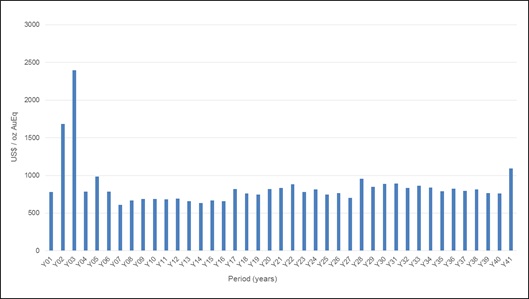

| Figure 21-5: Option 5: AISC per Ounce of Gold Equivalent | 371 |

| | |

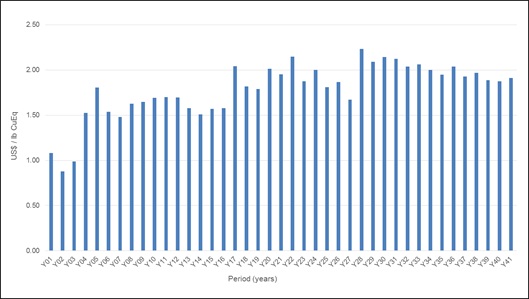

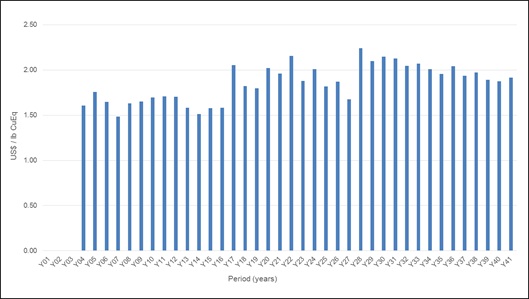

| Figure 21-6: Option 2: C1 Cash Cost per Pound of Copper Equivalent | 372 |

| | |

| Figure 21-7: Option 3: C1 Cash Cost per Pound of Copper Equivalent | 372 |

| | |

| Figure 21-8: Option 3: C1 Cash Cost per Pound of Copper Equivalent | 373 |

| | |

| Figure 21-9: Option 3: C1 Cash Cost per Pound of Copper Equivalent | 373 |

| | |

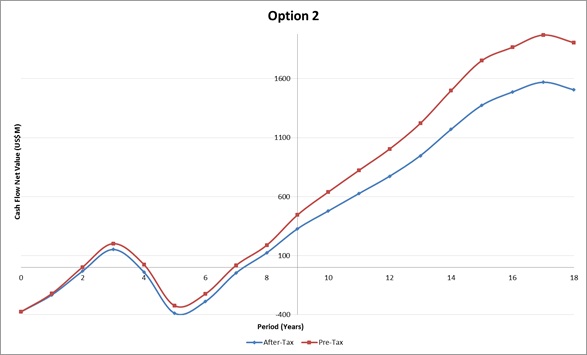

| Figure 22-2: Cash Flow – Option 2 | 387 |

| | |

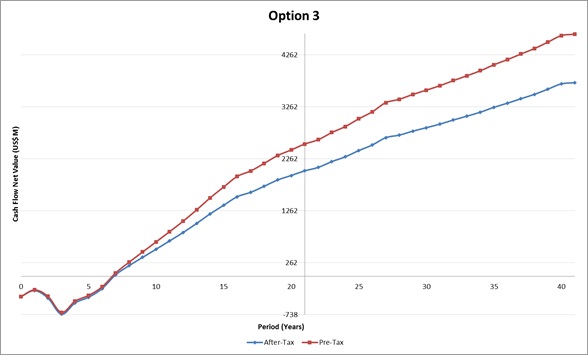

| Figure 22-3: Cash Flow – Option 3 | 388 |

| | |

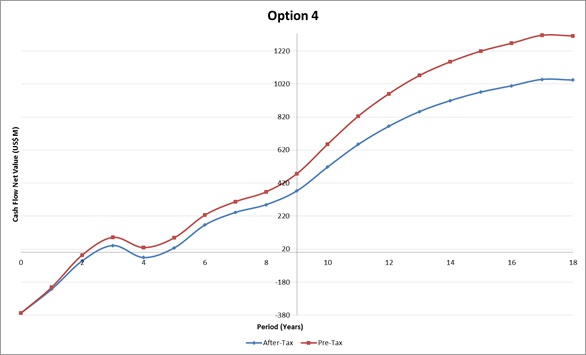

| Figure 22-4: Cash Flow – Option 4 | 388 |

| | |

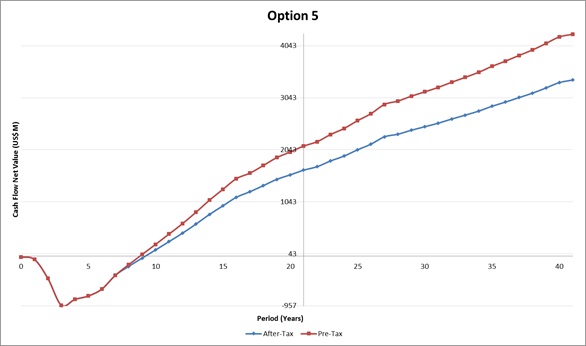

| Figure 22-5: Cash Flow – Option 5 | 389 |

| | |

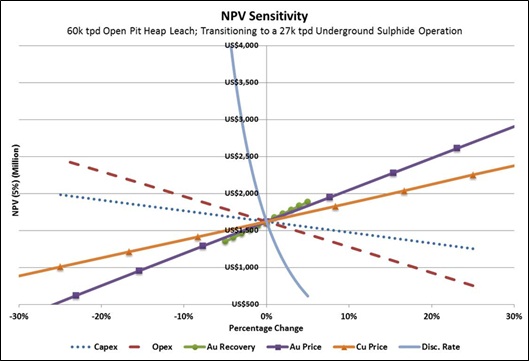

| Figure 22-6: NPV Sensitivity – Option 1 | 394 |

| | |

| Figure 22-7: NPV Sensitivity – Option 2 | 396 |

| | |

| Figure 22-8: NPV Sensitivity – Option 3 | 398 |

| | |

| Figure 22-9: NPV Sensitivity – Option 4 | 400 |

| | |

| Figure 22-10: NPV Sensitivity – Option 5 | 402 |

| |

List of Tables

| Table 1-1: Options Summary | 2 |

| | |

| Table 1-2: Exeter Exploration Concessions - Granted | 12 |

| | |

| Table 1-3: Summary of Drilling on the Caspiche and Adjacent Properties | 17 |

| | |

| Table 1-4: Recoveries for the production plan | 18 |

| | |

| Table 1-5: Caspiche Mineral Resource Statement April 2012 | 19 |

| | |

| Table 1-6: Caspiche – Transitional Measured and Indicated Mineral Resources - April 2013 above 0.75 g/t AuEq cut off | 20 |

| | |

| Table 1-7: Caspiche – Sulphide Project Measured and Indicated Mineral Resources - April 2013 above 0.75 g/t AuEq6 cut off | 21 |

| | |

| Table 1-8: Mining Schedule and Mine Life by Option (source: NCL, May, 2014) | 23 |

| | |

| Table 1-9: Metal Production | 23 |

| | |

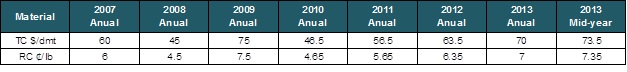

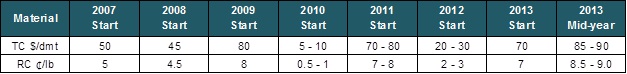

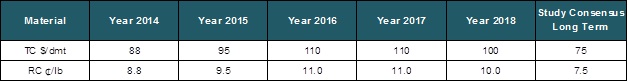

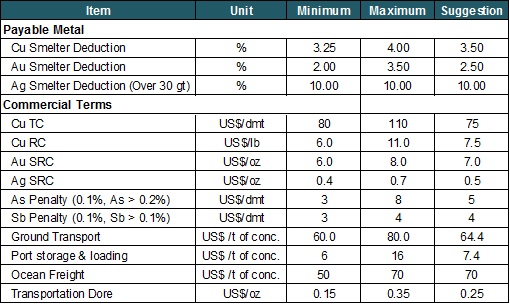

| Table 1-10: TC/RC’s Benchmark Terms | 28 |

| | |

| Table 1-11: TC/RC’s Spot Terms | 28 |

| | |

| Table 1-12: Outlook for Annual Contract Concentrates TC/RC’s | 28 |

| | |

| Table 1-13: Concentrates – Commercial Terms Assumptions | 28 |

| | |

| Table 1-14: Caspiche Concentrates Expected Annual Production | 29 |

| | |

| Table 1-15: Analysts’ Consensus for Gold Price 2013 – 2017 and Long Term (Source: Scotiabank) | 30 |

| | |

| Table 1-16: Capital Costs Summary | 31 |

| | |

| Table 1-17: Summary of Operating Costs | 32 |

| | |

| Table 1-18: Main Economic Parameters | 33 |

| | |

| Table 1-19: Production and Revenues Summary | 33 |

| | |

| Table 1-20: Summary of Pre-Tax Economic Evaluation Results | 34 |

| | |

| Table 1-21: Summary of Post-Tax Economic Evaluation Results (20% income tax rate) | 34 |

| | |

| Table 2-1: Options Summary | 38 |

| | |

| Table 2-2: Technical Terms and Abbreviations | 39 |

| | |

| Table 2-3: Units of Measurement | 43 |

| | |

| Table 4-1: Exeter Caspiche Mining Exploitation Concessions - Granted | 55 |

| Table 4-2: Exeter Caspiche Exploitation Concessions - In Application | 56 |

| | |

| Table 4-3: Exeter Exploration Concessions - Granted | 57 |

| | |

| Table 4-4: Summary of Ground Covered by Exeter Mineral Properties and Details of Exeter Concessions which Overlap Caspiche and Third Party Concessions | 58 |

| | |

| Table 4-5: Minimum Expenditures and Drilling Requirements under Exeter’s ORA with Anglo | 59 |

| | |

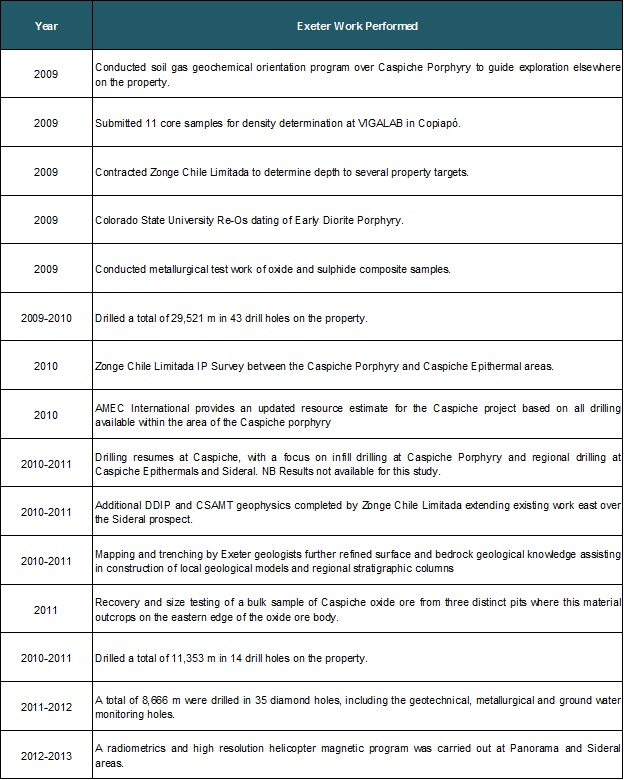

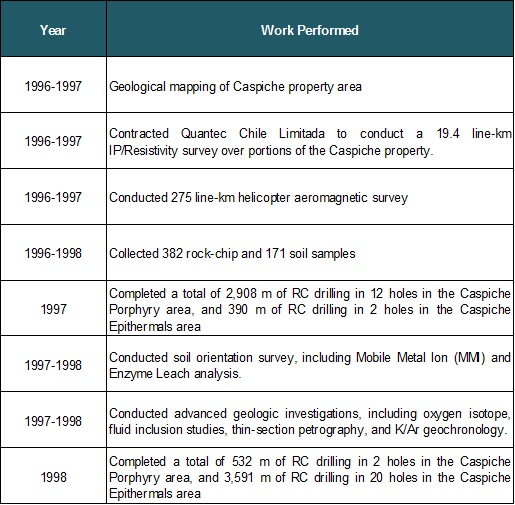

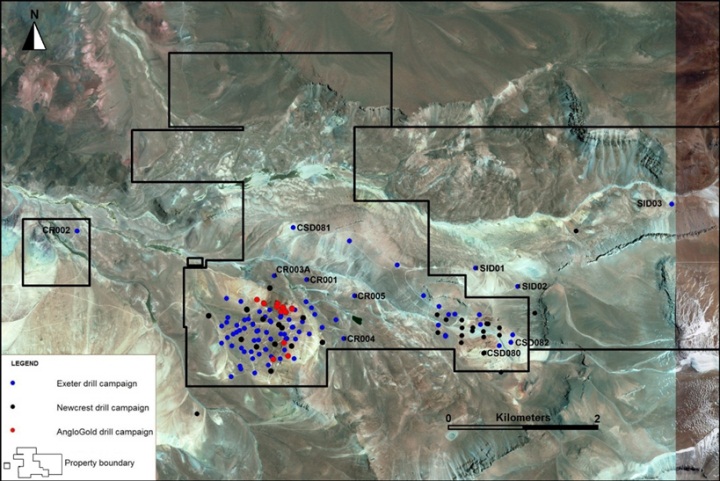

| Table 9-1: Summary of Exeter Exploration Programs on the Caspiche Property | 88 |

| | |

| Table 9-2: Summary of Exeter Exploration Programs on the Caspiche Property (continuation) | 89 |

| | |

| Table 9-3: Summary of Newcrest Exploration Programs on the Caspiche Property | 90 |

| | |

| Table 9-4: Summary of Anglo Exploration Programs on the Caspiche Property | 91 |

| | |

| Table 10-1: Summary of Drilling on the Caspiche and Adjacent Properties | 92 |

| | |

| Table 10-2: Summary of Drilling Campaigns at Caspiche Porphyry | 93 |

| | |

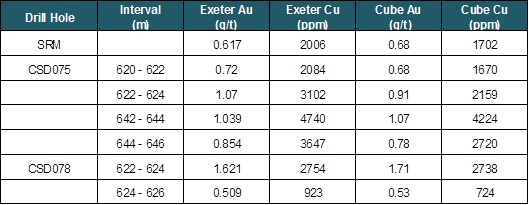

| Table 10-3: Significant Intercepts for the Caspiche Porphyry Prospect Area | 101 |

| | |

| Table 11-1: RC Sample Preparation Procedure for 2007-2008 Exeter Drill Samples | 110 |

| | |

| Table 11-2: Refined DD Sample Preparation Procedure for Exeter Drill Samples | 110 |

| | |

| Table 11-3: Further Refined DD Sample Preparation Procedure for Exeter Drill Samples | 111 |

| | |

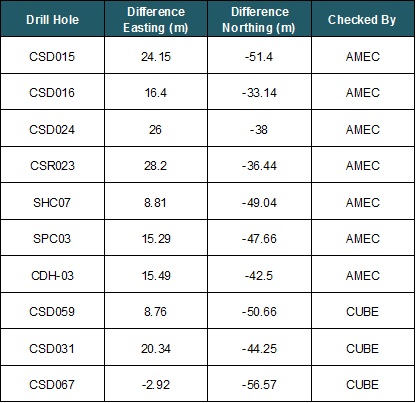

| Table 12-1: Caspiche Drill Hole Collar Checks | 129 |

| | |

| Table 12-2: Summary of AMEC Check Sampling of Caspiche Core | 130 |

| | |

| Table 12-3: Summary of Cube Check Sampling of Caspiche Core | 131 |

| | |

| Table 12-4: Summary of Rio Tinto Metallurgical Sampling of Caspiche Core | 131 |

| | |

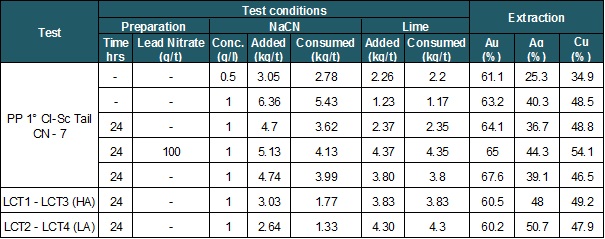

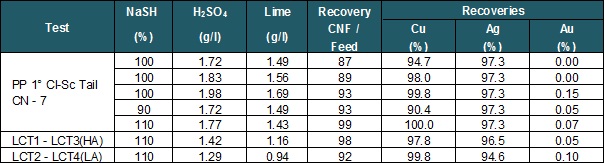

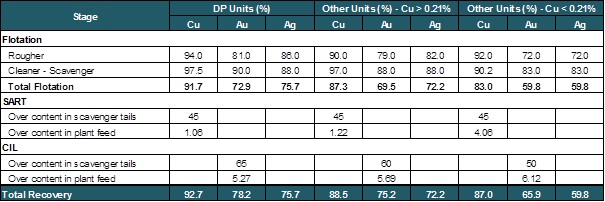

| Table 13-1: MLI Leach Program Main Results | 137 |

| | |

| Table 13-2: Results of Optimization Program | 138 |

| | |

| Table 13-3: Summary of MLI Program Results | 139 |

| | |

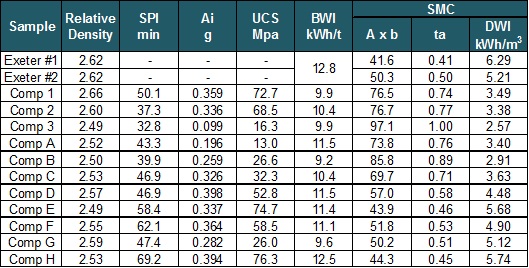

| Table 13-4: Grindability tests results | 149 |

| | |

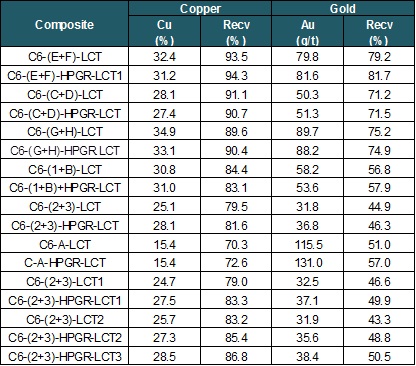

| Table 13-5: LCT results for cone crusher prepared samples | 153 |

| | |

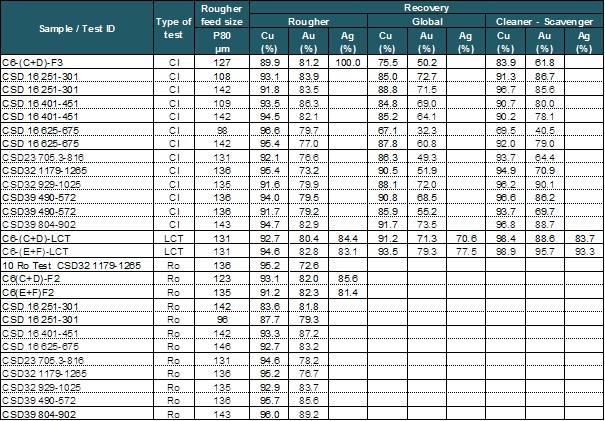

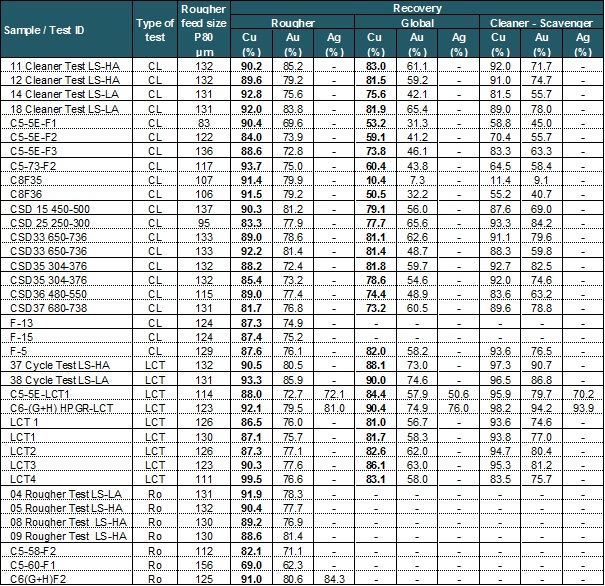

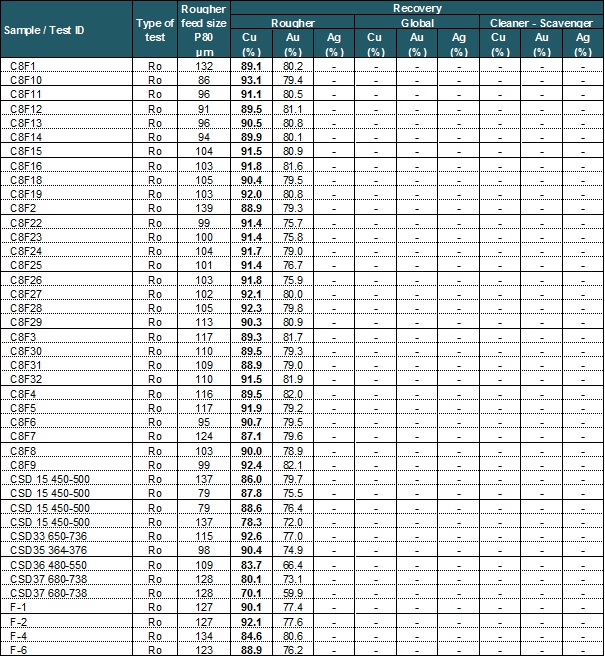

| Table 13-6: Flotation test results for DP and QDP1 samples | 154 |

| | |

| Table 13-7: Flotation test results other (Non DP) samples | 155 |

| | |

| Table 13-8: Flotation test results other (Non DP) samples | 156 |

| | |

| Table 13-9: CIL test results | 157 |

| Table 13-10: SART tests results | 157 |

| | |

| Table 13-11: Recoveries for the production plan | 158 |

| | |

| Table 14-1: Summary of Drill Data on the Caspiche and Adjacent Properties as at April 11, 2013. | 160 |

| | |

| Table 14-2: Stratigraphy Description | 162 |

| | |

| Table 14-3: Alteration Description | 162 |

| | |

| Table 14-4: Oxidation Description | 163 |

| | |

| Table 14-5: Estimation Domains and Data Combinations – Gold, Silver and Arsenic | 172 |

| | |

| Table 14-6: Estimation Domains and Data Combinations – Copper, Sulphur and Molybdenum | 172 |

| | |

| Table 14-7: Estimation Domains and Data Combinations – Iron | 172 |

| | |

| Table 14-8: Caspiche Assay Capping – 8 m Composites | 174 |

| | |

| Table 14-9: Caspiche 8 m Composites by Stratigraphy – Summary Statistics | 179 |

| | |

| Table 14-10: Caspiche 8 m Composites by Alteration – Summary Statistics | 180 |

| | |

| Table 14-11: Caspiche 8 m Composites by Alteration – Summary Statistics | 181 |

| | |

| Table 14-12: Caspiche 8 m Composites by Weathering – Summary Statistics | 182 |

| | |

| Table 14-13: Caspiche – Variogram Parameters – Overburden | 184 |

| | |

| Table 14-14: Caspiche – Variogram Parameters – DP, QDP1, VOLCBX and CFB | 185 |

| | |

| Table 14-15: Caspiche – Variogram Parameters – QDP2 | 185 |

| | |

| Table 14-16: Caspiche – Variogram Parameters – MacNeill | 185 |

| | |

| Table 14-17: Caspiche – Variogram Parameters – DTB2 | 186 |

| | |

| Table 14-18: Caspiche – Variogram Parameters – Iron | 186 |

| | |

| Table 14-19: Caspiche 3D Block Model Definition | 186 |

| | |

| Table 14-20: Caspiche Block Model Attribute Names | 187 |

| | |

| Table 14-21: Caspiche – Estimation Parameters – Overburden (Cu, S, Mo and Fe OX) | 188 |

| | |

| Table 14-22: Caspiche – Estimation Parameters – DP, QDP1, QDP2, VOLCBX, CFB and K-Ca Alt | 188 |

| | |

| Table 14-23: Caspiche – Estimation Parameters – DTB2 Alt | 189 |

| | |

| Table 14-24: Caspiche – Estimation Parameters – MacNeill | 189 |

| | |

| Table 14-25: Caspiche – Estimation Parameters – Iron (SU) | 189 |

| Table 14-26: Bulk Density – Sulphide | 190 |

| | |

| Table 14-27: Bulk Density - Oxide | 190 |

| | |

| Table 14-28: Comparison between Composite, OK and NN – Gold & Copper | 191 |

| | |

| Table 14-29: Caspiche Confidence Intervals – Gold | 199 |

| | |

| Table 14-30: Caspiche Confidence Intervals – Copper | 199 |

| | |

| Table 14-31: Marginal Cut-off Calculation Parameters and Results (Jan 2012 PFS) | 201 |

| | |

| Table 14-32: Caspiche Recovery Factors (NCL Nov 2013) | 202 |

| | |

| Table 14-33: Marginal Cut-off Calculation Parameters and Results Oxide and Non-oxide (Exeter Jan 16 2012) | 202 |

| | |

| Table 14-34: Caspiche Mineral Resource Statement April 2012* | 203 |

| | |

| Table 14-35: Caspiche – PEA Measured and Indicated Mineral Resources oxide portion - April 2013 above 0.18 g/t AuEq6 cut off* | 204 |

| | |

| Table 14-36: Caspiche – PEA Measured and Indicated Mineral Resources mixed oxide portion - April 2013 above 0.75 g/t AuEq6 cut off* | 204 |

| | |

| Table 14-37: Caspiche – PEA Measured and Indicated Mineral Resources non-oxide (sulphide) portion- April 2013 above 0.75 g/t AuEq6 cut off* | 204 |

| | |

| Table 14-38: Sensitivity – Oxide Material (Measured + Indicated) - April 2013 by AuEq6 cut off | 205 |

| | |

| Table 14-39: Sensitivity – Transitional and Sulphide Material (Measured + Indicated) April 2013 by AuEq6 cut off | 207 |

| | |

| Table 16-1: Options Summary | 211 |

| | |

| Table 16-2: Lerch-Grossman Optimization Parameters | 213 |

| | |

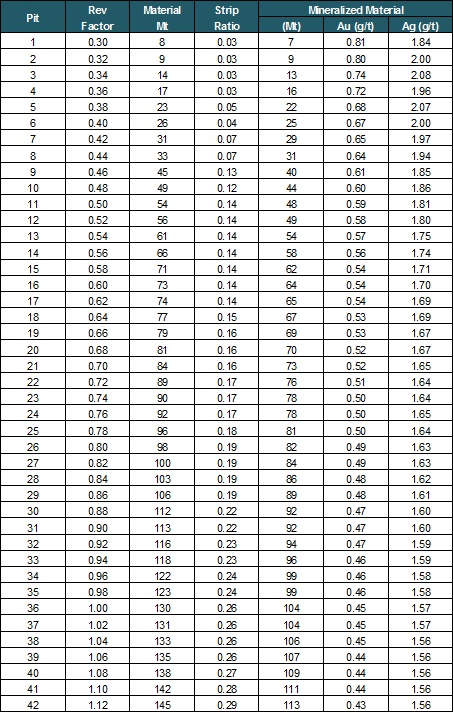

| Table 16-3: Pit Optimization Results – Option 1 | 215 |

| | |

| Table 16-4: Option 1 – Pit Shell 36 by Resource Category | 216 |

| | |

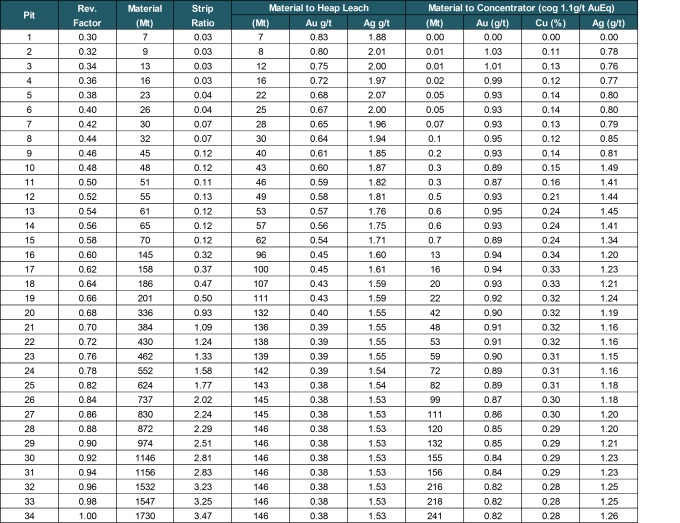

| Table 16-5: Pit Optimization Results – Options 2&3 | 217 |

| | |

| Table 16-6: Options 2&3 – Pit Shell 25 by Resource Category | 218 |

| | |

| Table 16-7: Selected Pit Shell Details – Options 2&3 | 219 |

| | |

| Table 16-8: Pit Design Parameters | 220 |

| | |

| Table 16-9: Mineral Resources Contained in Final Pit at Various Cut-Off Grades – Option 1 | 224 |

| | |

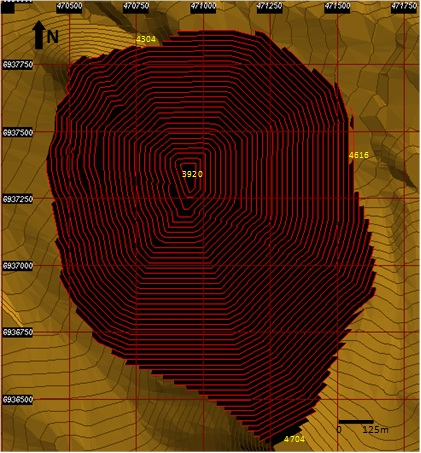

| Table 16-10: Resources Contained in Final (Oxide Push-Backs) – Options 2&3 | 228 |

| | |

| Table 16-11: Resources Contained in Final (Sulphide Push-Backs) – Options 2 | 229 |

| Table 16-12: Technical and Economic Parameters used for COG Estimate | 239 |

| | |

| Table 16-13: Sulphide Mining Inventory | 240 |

| | |

| Table 16-14: Sulphide Mining Inventory by Category | 241 |

| | |

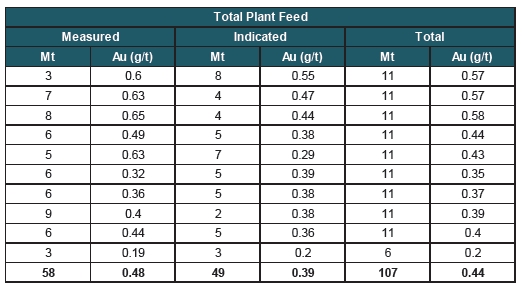

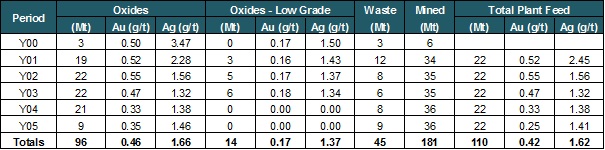

| Table 16-15: Mine Schedule and Plant Feed – Option 1 | 246 |

| | |

| Table 16-16: Option 1 – Plant Feed by Resource Category | 248 |

| | |

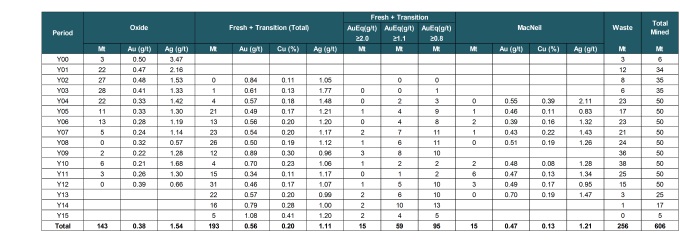

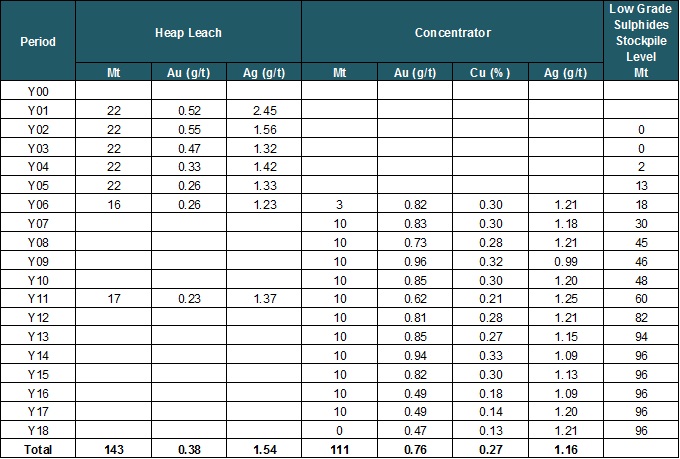

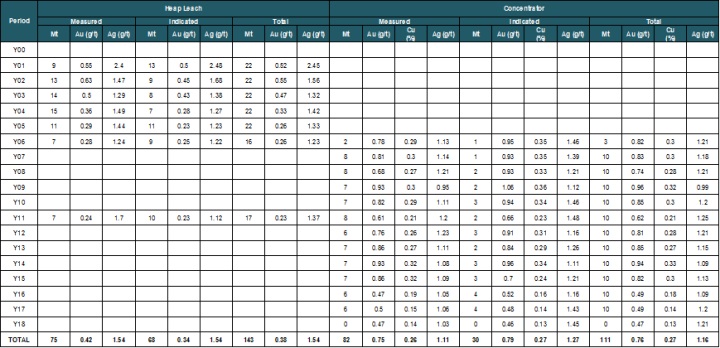

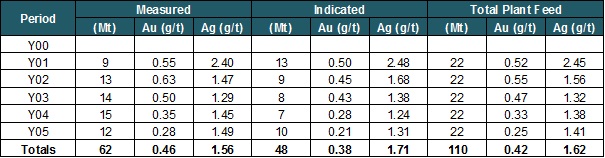

| Table 16-17: Mine Schedule – Option 2 | 249 |

| | |

| Table 16-18: Plant Feed – Option 2 | 250 |

| | |

| Table 16-19: Option 2 - Plant Feed by Resource Category | 251 |

| | |

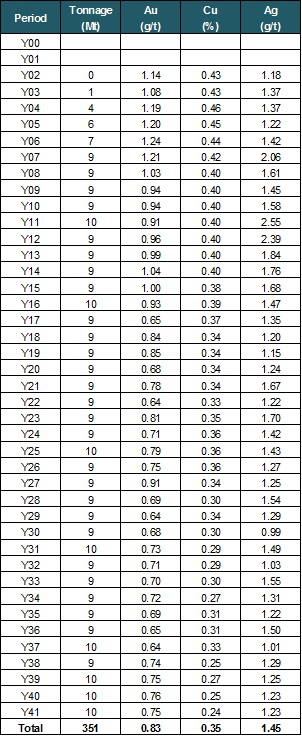

| Table 16-20: Mine Schedule and Plant Feed – Option 3 | 252 |

| | |

| Table 16-21: Option 3 – Oxides Plant Feed by Resource Category | 252 |

| | |

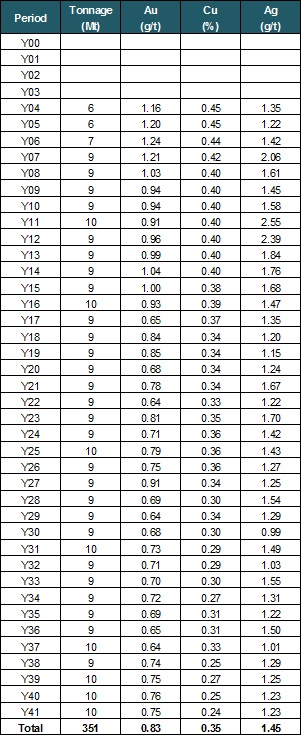

| Table 16-22: Mine Production Schedule – Option 3 | 254 |

| | |

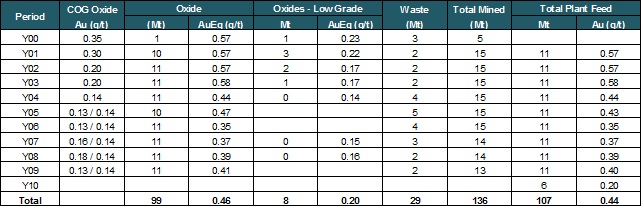

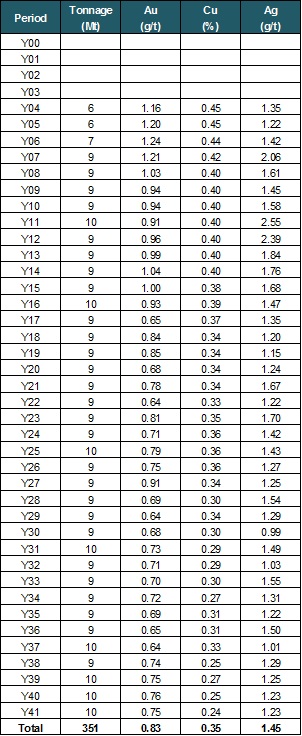

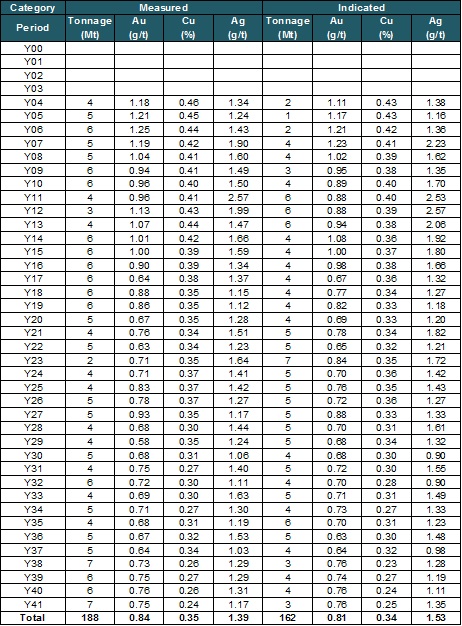

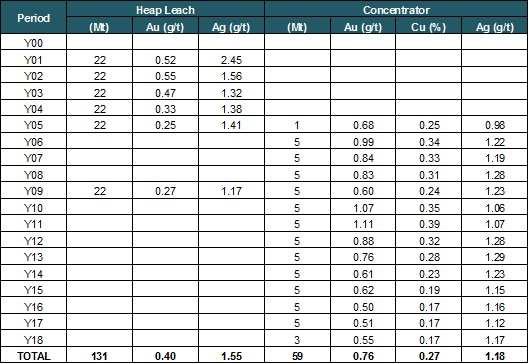

| Table 16-23: Underground Sulphides Plant Feed Schedule – Option 3 | 255 |

| | |

| Table 16-24: Underground Sulphides Plant Feed Schedule by Category – Option 3 | 257 |

| | |

| Table 16-25: Plant Feed – Option 4 | 258 |

| | |

| Table 16-26: Sulphides Plant Feed Schedule – Option 5 | 259 |

| | |

| Table 16-27: Underground Sulphides Plant Feed Schedule by Category – Option 5 | 260 |

| | |

| Table 16-28: Hauling Distances – Option1 | 262 |

| | |

| Table 16-29: Hauling Distances – Option 2 | 262 |

| | |

| Table 16-30: Hauling Distances – Option 3 | 262 |

| | |

| Table 16-31: Hauling Distances – Option 4 | 262 |

| | |

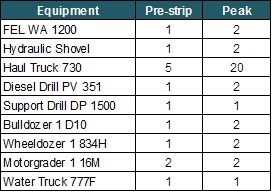

| Table 16-32: Equipment Selection – Option 1 | 263 |

| | |

| Table 16-33: Main Equipment Requirement – Option 1 | 264 |

| | |

| Table 16-34: Equipment Selection – Option 2&3 | 264 |

| | |

| Table 16-35: Main Equipment Requirement – Option 2&3 | 264 |

| | |

| Table 16-36: Main Equipment Requirement – Option 4 | 265 |

| | |

| Table 16-37: Underground Main Equipment Requirement – Options 3&5 | 265 |

| | |

| Table 16-38: Labor Requirement | 266 |

| Table 16-39: Geomechanical Properties (Source: AKL, December, 2013) | 268 |

| | |

| Table 17-1: Summary of Key Process Design Criteria | 272 |

| | |

| Table 17-2: Oxide Process Plant Main Equipment | 286 |

| | |

| Table 17-3: Summary of Key Process Design Criteria | 290 |

| | |

| Table 17-4: Sulphide Process Plant Main Equipment | 303 |

| | |

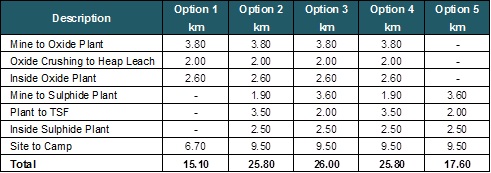

| Table 18-1: Options Summary | 304 |

| | |

| Table 18-2: On-Site Roads | 314 |

| | |

| Table 18-3: Fresh Water Requirements | 315 |

| | |

| Table 19-1: Analysts’ Consensus for Copper Price 2012 – 2017 and Long Term (Source: Scotiabank) | 320 |

| | |

| Table 19-2: TC/RC’s Benchmark Terms | 324 |

| | |

| Table 19-3: TC/RC’s Spot Terms | 324 |

| | |

| Table 19-4: Outlook for Annual Contract Concentrates TC/RC’s | 325 |

| | |

| Table 19-5: Concentrates – Commercial Terms Assumptions | 326 |

| | |

| Table 19-6: Caspiche Concentrates Expected Annual Production | 327 |

| | |

| Table 19-7: Analysts’ Consensus for Gold Price 2013 – 2017 and Long Term (Source: Scotiabank) | 336 |

| | |

| Table 20-1: Required Environmental Studies | 338 |

| | |

| Table 21-1: Options Summary | 350 |

| | |

| Table 21-2: Capital Costs Summary– Option 1 | 351 |

| | |

| Table 21-3: Capital Costs Summary – Option 2 | 352 |

| | |

| Table 21-4: Capital Costs Summary – Option 3 | 353 |

| | |

| Table 21-5: Capital Costs Summary – Option 4 | 354 |

| | |

| Table 21-6: Capital Costs Summary – Option 5 | 355 |

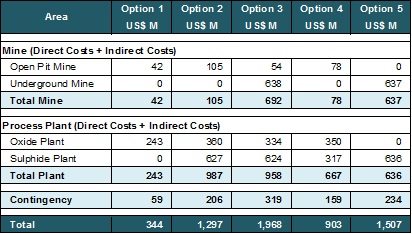

| | |

| Table 21-7: Main Unitary Construction Costs | 356 |

| | |

| Table 21-8: Chilean High Altitude Pay Scale | 356 |

| | |

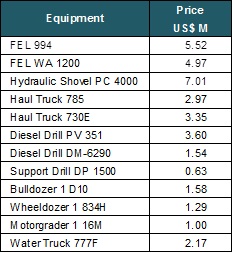

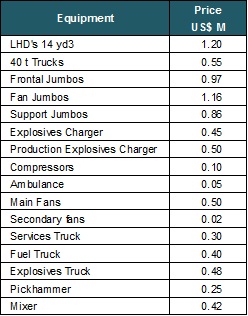

| Table 21-9: Equipment Prices (USD) | 358 |

| | |

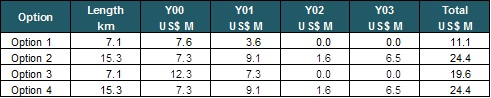

| Table 21-10: Road Construction by Option | 359 |

| | |

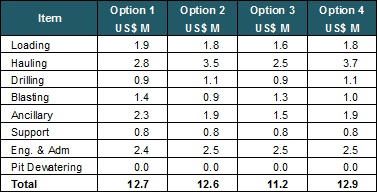

| Table 21-11: Open Pit Pre-Production Operation Expenses by Option | 359 |

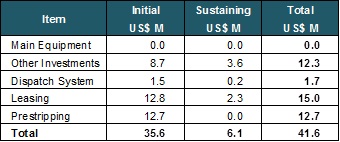

| Table 21-12: Open Pit Initial and Sustaining Capital Cost – Option 1 | 359 |

| | |

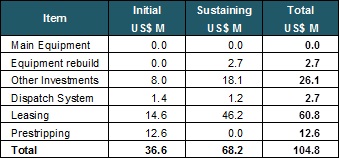

| Table 21-13: Open Pit Initial and Sustaining Capital Cost – Option 2 | 360 |

| | |

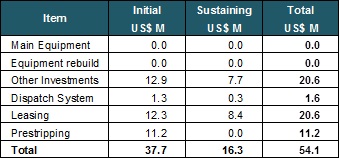

| Table 21-14: Open Pit Initial and Sustaining Capital Cost – Option 3 | 360 |

| | |

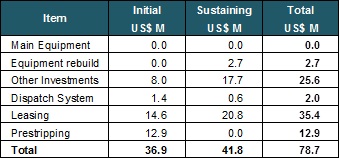

| Table 21-15: Open Pit Initial and Sustaining Capital Cost – Option 4 | 360 |

| | |

| Table 21-16: Underground Equipment Prices | 361 |

| | |

| Table 21-17: Underground Mine Initial and Sustaining Capital Costs | 361 |

| | |

| Table 21-18: Owners Costs | 362 |

| | |

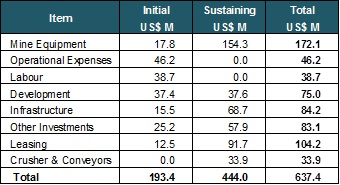

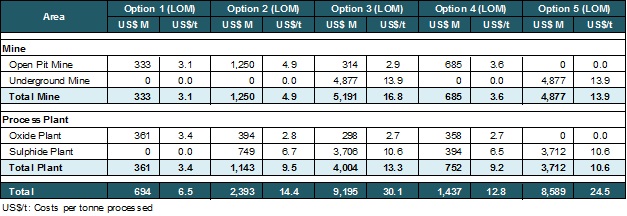

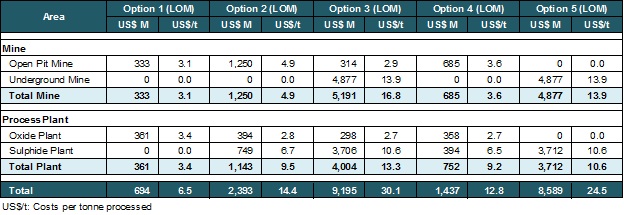

| Table 21-19: Summary of Operating Costs | 36 |

| | |

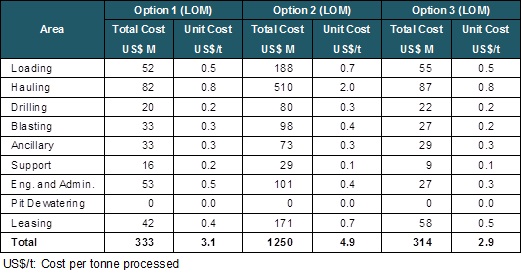

| Table 21-20: Open Pit Mine Costs | 364 |

| | |

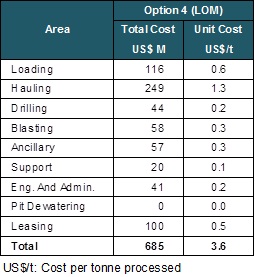

| Table 21-21: Open Pit Mine Costs - Option 4 | 365 |

| | |

| Table 21-22: Underground Mine Unit Costs - Options 3 and 5 | 366 |

| | |

| Table 21-23: Main Reagents and Consumables Unit Prices | 367 |

| | |

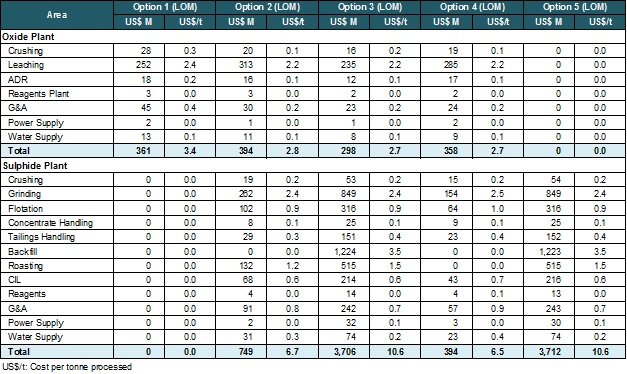

| Table 21-24: Summary of Process Plant Operating Cost | 368 |

| | |

| Table 21-25: Cash Cost Indicators | 369 |

| | |

| Table 22-1: Main Economic Parameters | 376 |

| | |

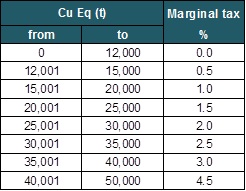

| Table 22-2: Mining Royalty Tax Scale for Mining Exploitation under 50,000 t of Equivalent Copper | 380 |

| | |

| Table 22-3: Mining Royalty Tax Scale for Mining Exploitation over 50,000 t of Equivalent Copper | 380 |

| | |

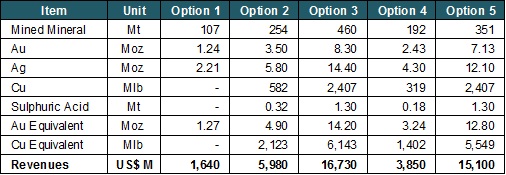

| Table 22-4: Options Summary | 381 |

| | |

| Table 22-5: Production Summary | 381 |

| | |

| Table 22-6: Annual Production – Option 1 | 382 |

| | |

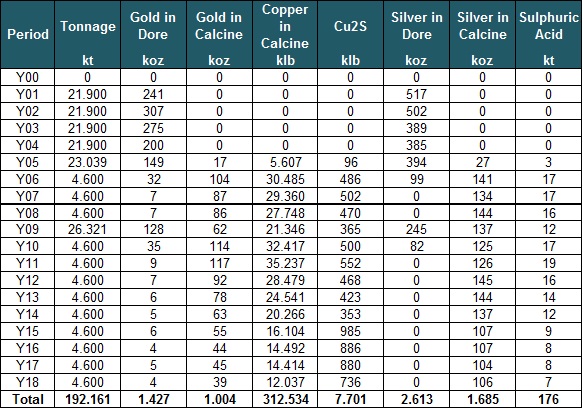

| Table 22-7: Annual Production – Option 2 | 382 |

| | |

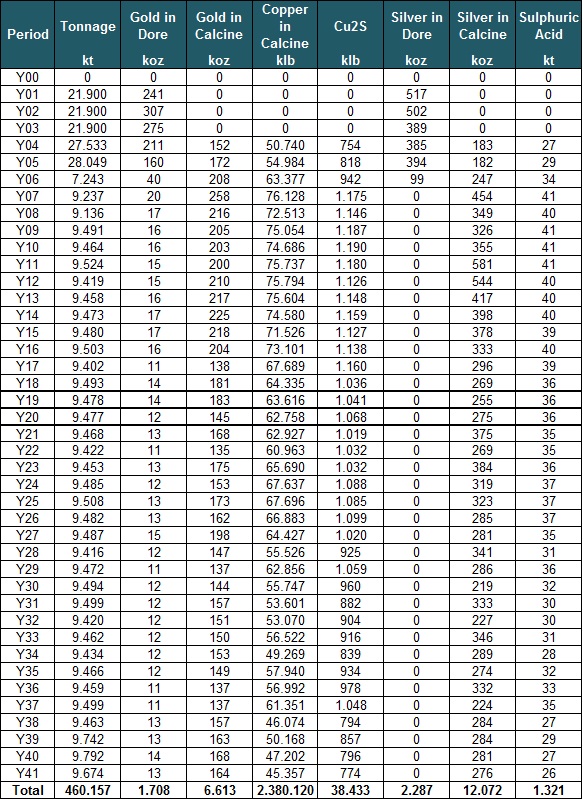

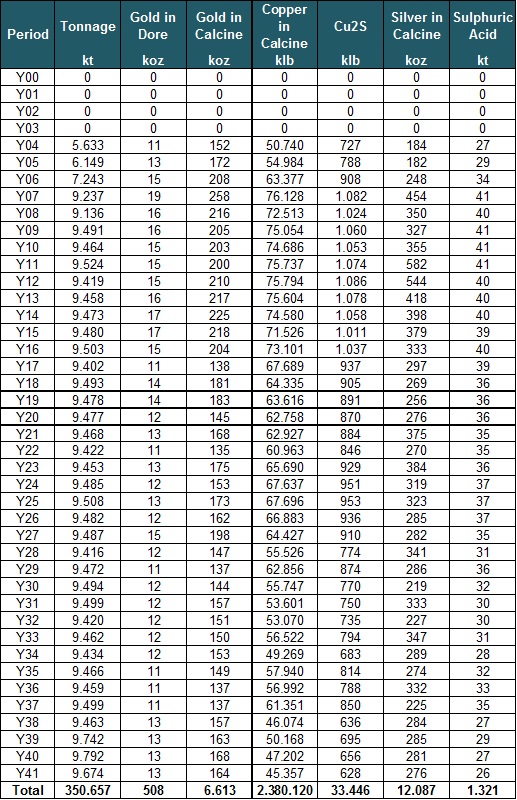

| Table 22-8: Annual Production – Option 3 | 383 |

| | |

| Table 22-9: Annual Production – Option 4 | 384 |

| | |

| Table 22-10: Annual Production – Option 5 | 385 |

| | |

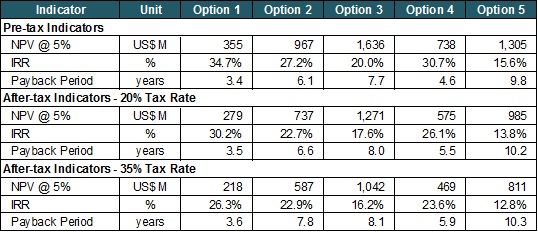

| Table 22-11: Summary of Pre-Tax Preliminary Economic Evaluation Results | 386 |

| | |

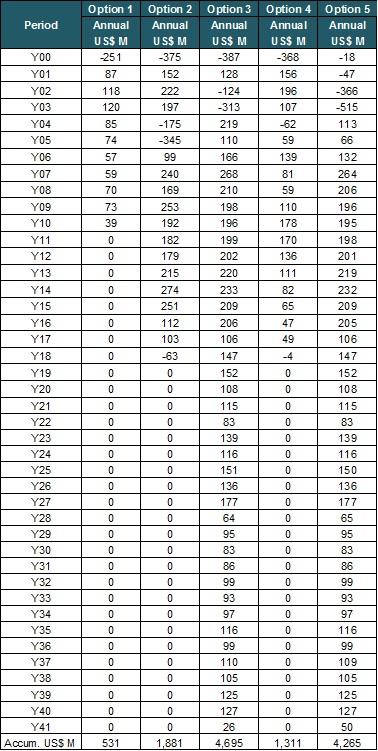

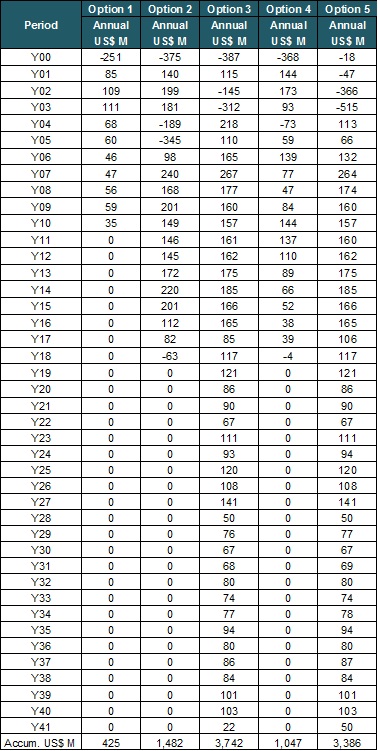

| Table 22-12: Annual and Accumulated Cash Flow Pre-tax | 390 |

| | |

| Table 22-13: Annual and Accumulated Cash Flow After-tax | 391 |

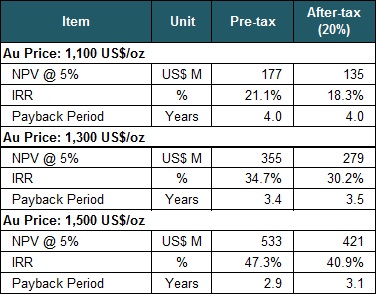

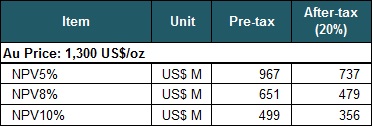

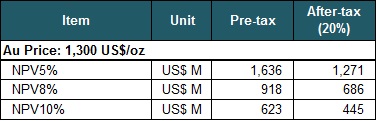

| Table 22-14: Gold Price Sensitivity – Option 1 | 393 |

| | |

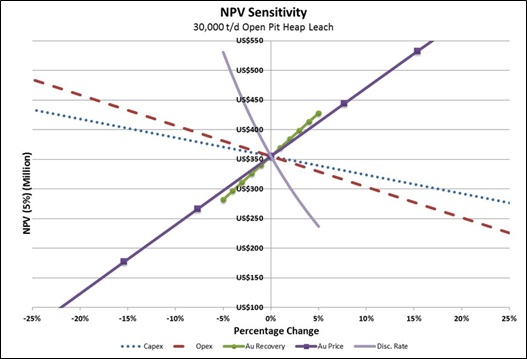

| Table 22-15: Discount Rate Sensitivity – Option 1 | 394 |

| | |

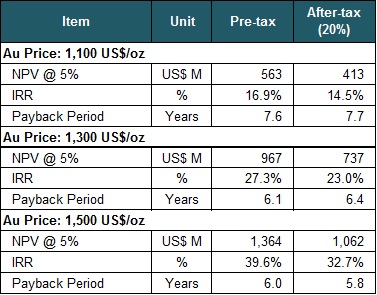

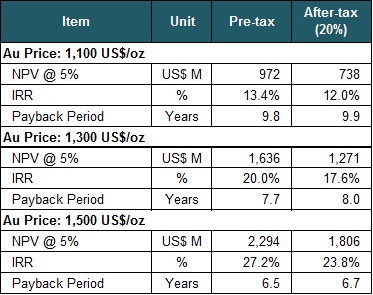

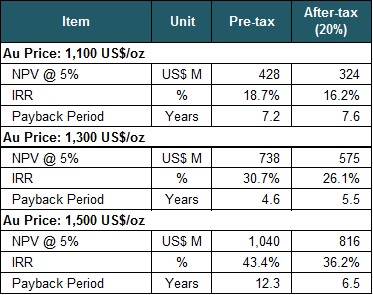

| Table 22-16: Gold Price Sensitivity – Option 2 | 395 |

| | |

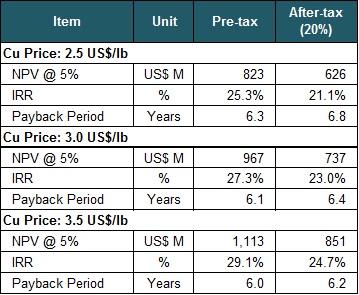

| Table 22-17: Copper Price Sensitivity – Option 2 | 395 |

| | |

| Table 22-18: Discount Rate Sensitivity – Option 2 | 396 |

| | |

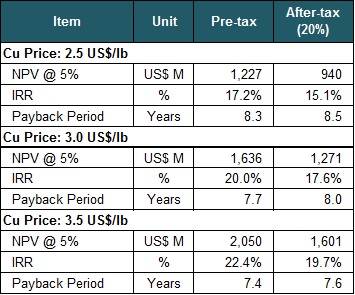

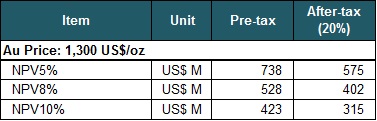

| Table 22-19: Gold Price Sensitivity – Option 3 | 397 |

| | |

| Table 22-20: Copper Price Sensitivity – Option 3 | 397 |

| | |

| Table 22-21: Discount Rate Sensitivity – Option 3 | 398 |

| | |

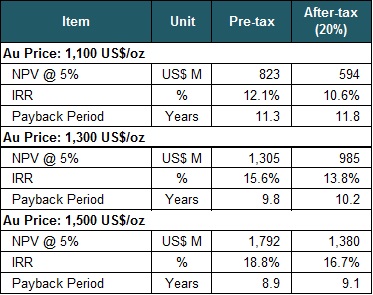

| Table 22-22: Gold Price Sensitivity – Option 4 | 399 |

| | |

| Table 22-23: Copper Price Sensitivity – Option 4 | 399 |

| | |

| Table 22-24: Discount Rate Sensitivity – Option 4 | 400 |

| | |

| Table 22-25: Gold Price Sensitivity – Option 5 | 401 |

| | |

| Table 22-26: Copper Price Sensitivity – Option 5 | 401 |

| | |

| Table 22-27: Discount Rate Sensitivity – Option 5 | 402 |

| | |

| Table 22-28: Summary of Post-Tax Economic Evaluation Results | 403 |

| | |

| Table 25-1: Options Summary | 414 |

| | |

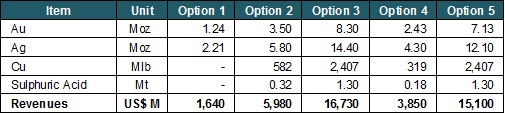

| Table 25-2: Metal Production | 415 |

| | |

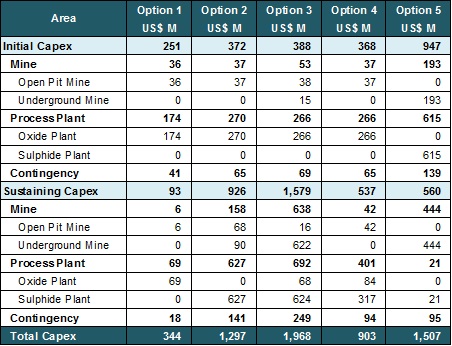

| Table 25-3: Capital Costs Estimate | 416 |

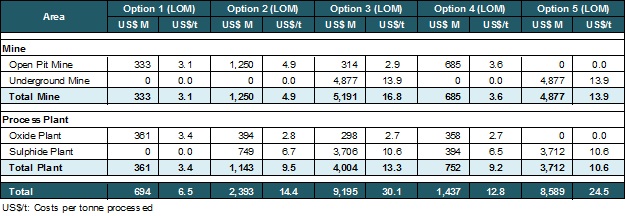

| | |

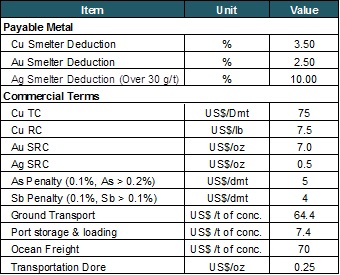

| Table 25-4: Operating Costs Estimate | 416 |

| | |

| Table 25-5: Economic Evaluation Summary | 417 |

| | |

| Table 26-1: Estimated Budget | 419 |

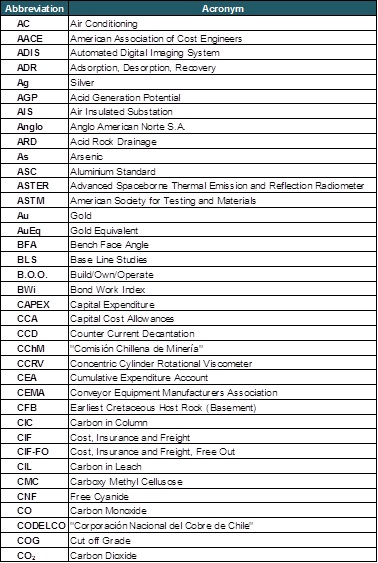

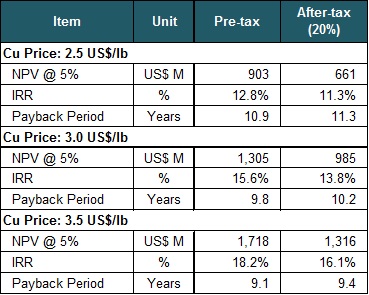

Exeter Resource Corporation (Exeter) commissioned Alquimia to prepare a Technical Report for the Caspiche Project to the standards required by National Instrument 43-101 for Preliminary Economic Assessment (PEA).

Introductory Cautionary Statement

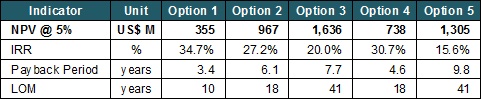

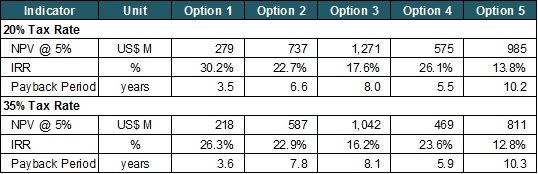

This Technical Report analyses the new options as detailed below, to a PEA level as alternatives to the Super Pit Option that had been analysed to a Pre-feasibility level in the 2012 Pre-feasibility Study (PFS). The Super Pit mine development plan in the PFS is no longer considered by Exeter to be the preferred option for developing the Caspiche project. This PEA reviews alternative, lower capital, staged development options for Caspiche. Exeter considers the PFS and mineral reserves resulting from the PFS no longer to be current.

The options considered in this PEA have been developed to AACE International recommendations for a class 5 study. The PEA operating and capital costs were developed to an accuracy of ± 35%.

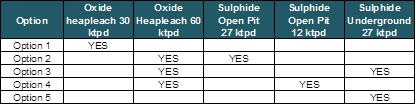

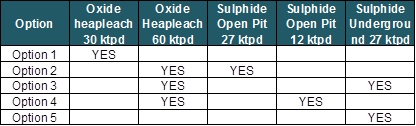

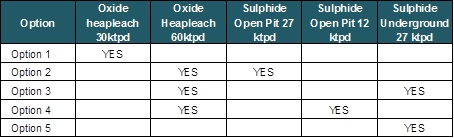

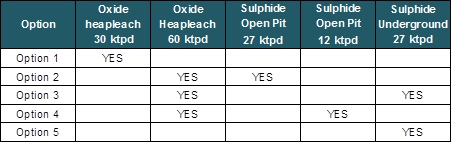

The scope of the work defined was to evaluate the economic potential of developing three projects, as follows:

| | ● | Option 1: 30 ktpd open pit mine for gold and silver oxide mineralization treated by heap leaching |

| | | |

| | ● | Option 2: 60 ktpd open pit mine for gold and silver oxide mineralization treated by heap leaching and a 27 ktpd open pit mine for gold and copper sulphide mineralization treated in a conventional concentrator plant |

| | | |

| | ● | Option 3: 60 ktpd open pit mine for gold and silver oxide mineralization treated by heap leaching and a 27 ktpd underground mine for gold and copper sulphide mineralization treated in a conventional concentrator plant. |

In addition, 2 further secondary options were also considered; these being

| | ● | Option 4: 60 ktpd open pit mine for gold and silver oxide mineralization treated by heap leaching and 12 ktpd open pit mine for gold and copper sulphide mineralization treated in a conventional concentrator plant |

| | | |

| | ● | Option 5: 27 ktpd underground mine for gold and copper sulphide mineralization treated in a conventional concentrator plant. |

In tabular format, this is illustrated as follows:

Table 1-1: Options Summary

The inclusion of these options into the study shows that there is further optionality in the Caspiche deposit which can be considered.

The economic analysis contained in the PEA is considered preliminary in nature. No inferred mineral resources form part of the PEA studies and no mineral reserves for the PEA have been established. Mineral resources are not mineral reserves and have no demonstrated economic viability. There is no certainty that economic forecasts outlined in the PEA will be realized. The PEA and the Cube 2012 Mineral Resource (as defined herein) may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors.

| 1.2 | Caution Regarding Forward-Looking Information |

Certain information and statements contained in this report are “forward-looking” in nature. Forward-looking statements include, but are not limited to, statements with respect to the economic and feasibility parameters of the Caspiche Project; the cost and timing of the development of the project; the proposed mine plan and mining method, stripping ratio, processing method and rates and production rates; grades; projected metallurgical recovery rates; infrastructure, capital, operating and sustaining costs; the projected life of mine and other expected attributes of the Caspiche Project; the net present value (NPV) and internal rate of return (IRR) and payback period of capital; cash costs and all-in sustaining costs; the success and continuation of exploration activities; estimates of mineral Resources; the future price of copper, gold and silver; the timing of environmental assessment process; government regulations and permitting timelines; estimates of reclamation obligations that may be assumed; requirements for additional capital; environmental risks; and general business and economic conditions.

Forward-looking information statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any of the future results, performance or achievements expressed or implied by forward-looking statements.

These risks, uncertainties and other factors include, but are not limited to, the assumptions underlying the Preliminary Economic Assessment and economic parameters discussed herein not being realized; decrease in future gold and copper prices; cost of labour, supplies, fuel and equipment rising; actual results of current exploration; adverse changes in project parameters; discrepancies between actual and estimated production, Mineral Resources and recoveries; exchange rate fluctuations; delays in costs inherent in consulting and accommodating rights of indigenous groups; title risks; regulatory risks and political or economic developments in Chile; changes to tax rates; risks and uncertainties with respect to obtaining necessary surface rights and permits or delays in obtaining same, risks associated with maintaining and renewing permits and complying with permitting requirements; and other risks involved in the exploration and development industry; as well as those risk factors discussed elsewhere in this report.

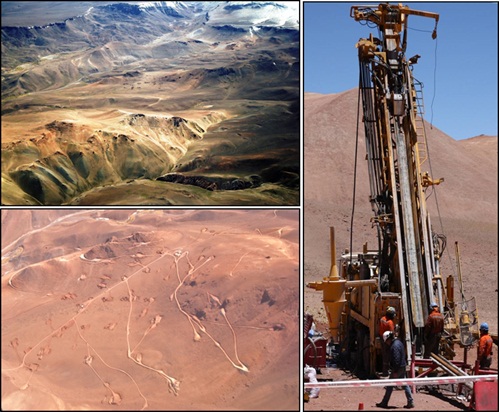

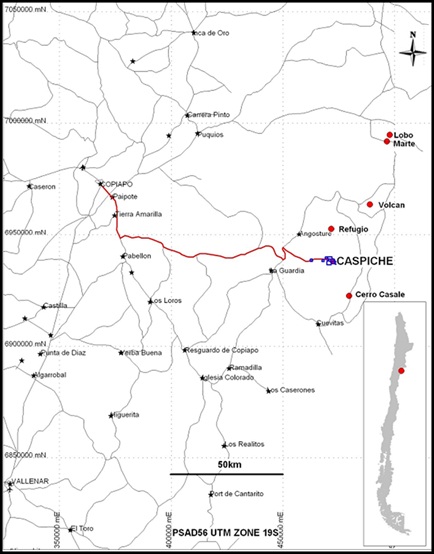

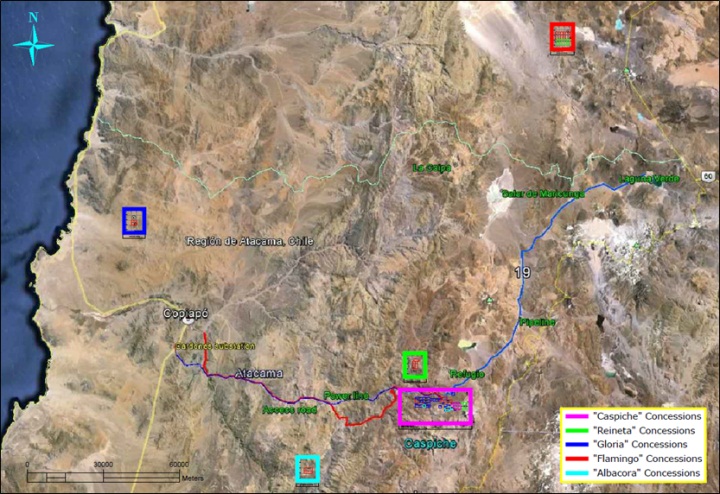

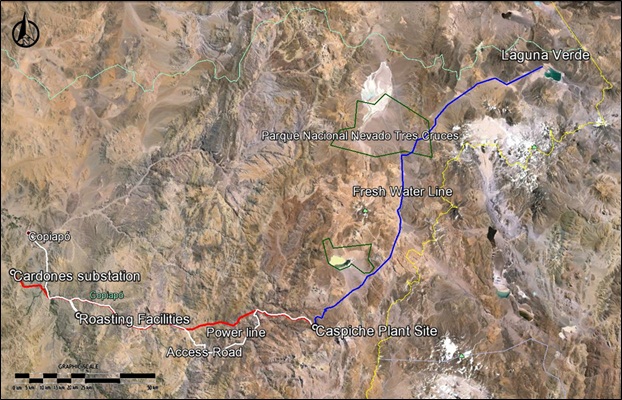

The Caspiche property is located 120 km ESE of Copiapó in the Atacama region of Chile (See Figure 1-1). The property is situated at the southern end of the Maricunga metallogenic belt, between the undeveloped Cerro Casale gold-copper project 12 km to the south, and the operating Maricunga Gold Mine, 15 km to the north.

Figure 1-1: Caspiche Location Map (Source: Exeter, 2013)

The geographic centre of the property is located at approximately 27° 41’ south latitude and 69° 18’ west longitude (UTM Zone 19J, Geodesic system). Coordinates using datum PSAD56 are 471,000 m east and 6,937,000 m north (UTM Zone 19S, Cartesian system). Known mineralization on the Caspiche property is located in two areas: Caspiche Porphyry and Caspiche Epithermals. Caspiche Porphyry has been referred to as Caspiche Central in previous Technical Reports. The Caspiche Epithermals has been referred to as Caspiche III in previous Technical Reports.

The Caspiche property is 100% owned by Exeter Resource Corporation. Anglo American Norte S.A. (Anglo), formerly Minera Anglo American Chile Limitada and its affiliate Empresa Minera Mantos Blancos S.A. (EMABLOS) retains a 3% Net Smelter Royalty (NSR) on production from

the project under the terms of the Purchase and Sale of Mining Claims agreement executed upon the exercise of an option to acquire the properties from Anglo. Anglo retains the right to repurchase the mineral properties for the agreed expenditures that Exeter has incurred on the property in the event that commercial production has not commenced by March 31, 2026. In addition to the EMABLOS NSR, a private Chilean company holds a 0.08% NSR on the property.

The Caspiche exploitation concessions do not have expiration dates, and are in good standing as of the effective date of this report. Exeter paid the annual license fee for the Caspiche concessions for the period 2013 to 2014 and expects to make all payments required to maintain the properties in good standing in the future.

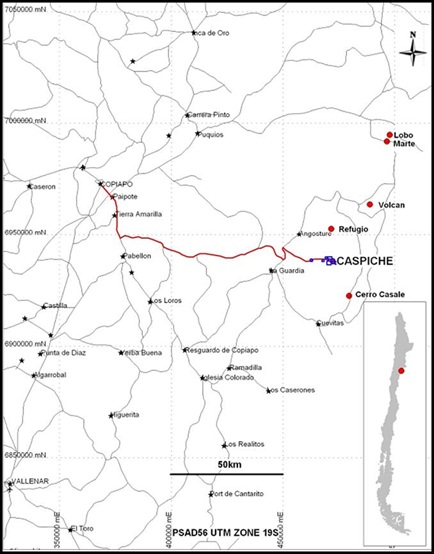

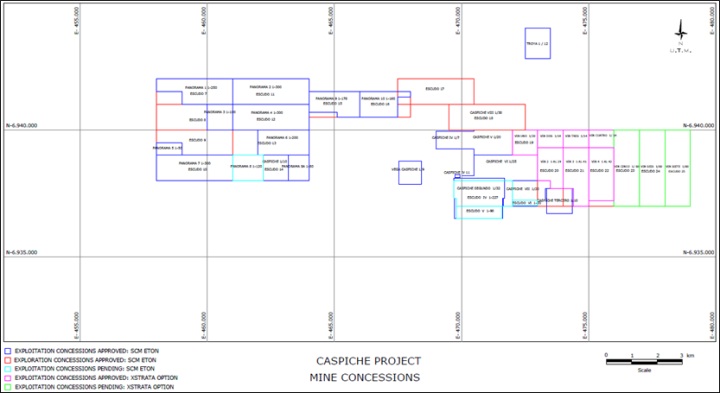

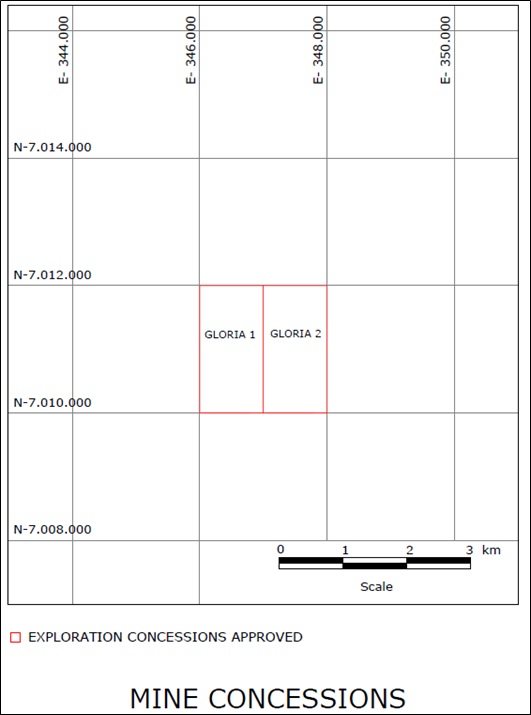

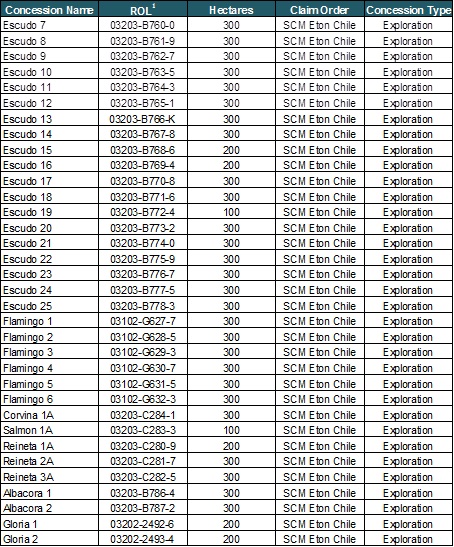

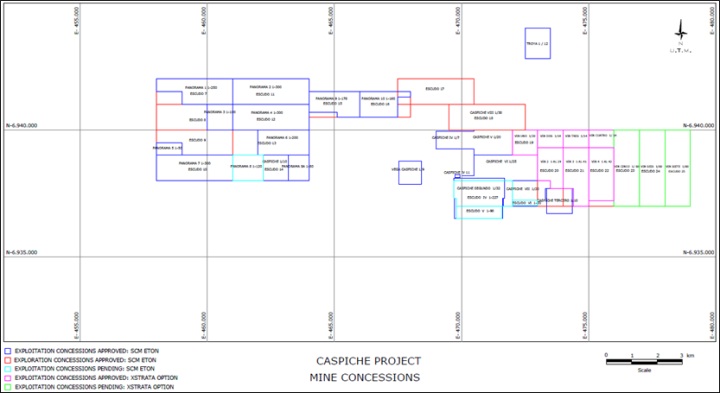

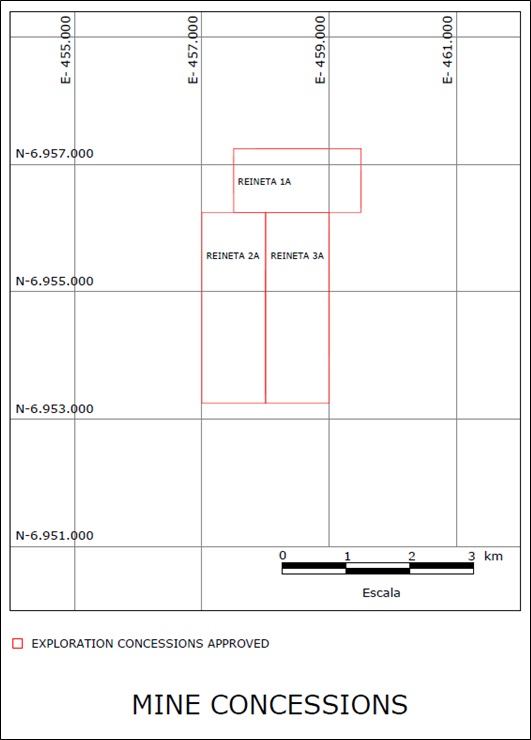

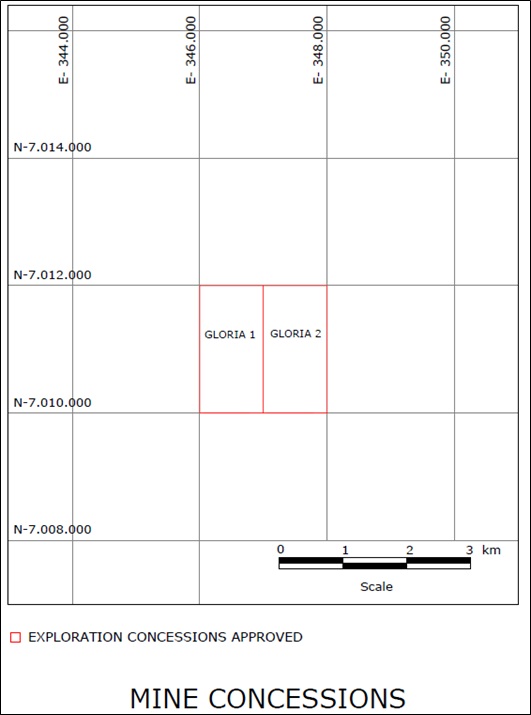

At the effective date of this report, the Caspiche property consists of twenty eight mining exploitation concessions totalling 4,467 ha and 34 mining exploration concessions over the original concessions, vacant ground and those of third parties, totalling 9,300 ha. In addition there are further seven Mining Exploitation Concessions in the process of being granted, totalling 1,357 ha. The Mining Exploration Concessions are valid under Chilean law, but are considered junior to the Caspiche and third party concessions where they overlap. The concessions that overlap the Caspiche concessions were established by Exeter as a safeguard only. The Panorama and Bonanza series of concessions were established to allow for various infrastructure location scenarios. All granted mining exploration concessions are free of encumbrances and they are not affected by the payment of royalties or other obligations in favour of third parties. The total granted Exeter mining exploration concessions are shown in Figure 1-2 and in detail in Figures 1-3 to 1-7.

Figure 1-2: Property Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2014)

Figure 1-3: “Caspiche” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013)

Figure 1-4: “Reineta” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013)

Figure 1-5: “Gloria” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013)

Figure 1-6: “Flamingo” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013)

Figure 1-7: “Albacora” Concessions Map Showing All Exploration and Exploitation Concessions Controlled by Exeter (Source: Exeter, 2013)

Table 1-2: Exeter Exploration Concessions - Granted

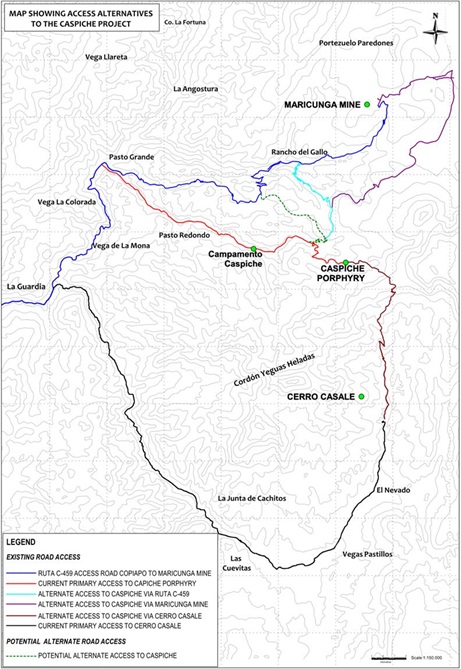

Access to the project is by 183 km of paved and gravel road from Copiapó. The initial 22 km running south from Copiapó through the town of Tierra Amarilla is paved highway which connects to a 161 km treated gravel road that runs east-southeast to the project site (Ruta C-459). The main gravel road serves as a regional transportation route to Argentina and is gradually being upgraded. From this road, which is the main access to Kinross Gold’s Maricunga Mine, several access alternatives exist to the project and other additional access options have been identified if required and are illustrated in Figure 1-8.

Figure 1-8: Caspiche Location Map (Source: Exeter, 2013)

The climate at Caspiche is typical for the central Andean Cordillera: windy, cold at night with limited precipitation, usually in the form of snow. Day-time temperatures in summer months approach 23 °C, with night-time lows of 5 °C. Day-time temperatures in winter are around freezing, with night-time temperatures dropping to -15 °C. Exploration field seasons generally run from late October through mid-May. Operating mines in the area, such as the nearby

Maricunga Gold Mine, are operated year-round at elevations similar to Caspiche at 4,200 to 4,500 m.a.s.l. Upon development, it is expected that the mine would be operated year-round.

The Caspiche property is located high in the central Chilean Andes within the region commonly described as the Atacama Desert. The topography within the property is almost entirely volcanic in nature and consists of broad open areas of moderate relief and prominent ridges with limited cliff zones of exposed bedrock.

Elevation within the property ranges from 4,200 to 4,700 m.a.s.l. Vegetation is limited to grasses and small thorny bushes and small marsh areas at the junction of creeks. Wildlife includes guanaco, vicuña, foxes, rabbits, ground squirrels, hawks, condors and small reptiles.

There are no significant population centres in the immediate vicinity of the Caspiche project. There are a number of local communities who raise crops and livestock in areas of the vegas that drain the region.

The Copiapó River and its tributaries are the main source of drinking and industrial/agricultural water for the Region and its resources are currently fully exploited. New and developing mining projects are either planning to exploit high altitude Andean endorheic basins with no hydraulic connection to the Copiapó River, or raw or desalinated seawater.

| 1.6 | Geology and Mineralization |

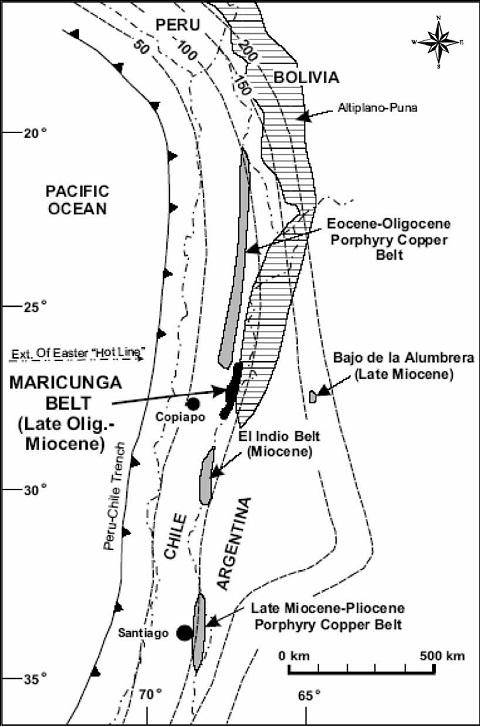

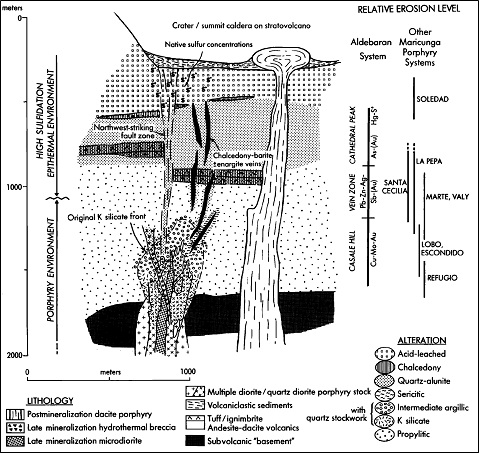

The Caspiche property is located in the Maricunga metallogenic belt, a north-northeast trending, linear zone containing at least 14 occurrences of gold and/or silver mineralization between latitudes 26° and 28° S in the Andean Cordillera of northern Chile1.

The Maricunga belt is composed of a series of volcanoes of andesitic to dacitic composition; this is presented in Figure 1-9. Two main structural trends are important in the Maricunga belt. North-south to north-northeast trending high-angle reverse faults form a series of horsts and graben blocks, and it is these graben structures that host significant mineralization. West-northwest to north-northwest trending structures occur as normal trans-tensional faults, dykes, veins and linear alteration zones, and are associated with alteration and mineralization in late Oligocene to early Miocene age volcanic centres. Figure 1-9 illustrates this phenomenon.

1 Vila and Sillitoe, 1991; Figure 7-1: Metallogenic Belts of Northern Chile and Argentina (Source: Vila and Sillitoe, 1991)

Figure 1-9: Metallogenic Belts of Northern Chile and Argentina (Source: Vila and Sillitoe, 1991)

The Maricunga belt hosts numerous significant mines and advanced projects. The deposits are typically of the porphyry gold-copper style or high sulphidation epithermal gold-silver. Examples of porphyry deposits in the Maricunga belt are the Maricunga mine, Cerro Casale, and Lobo Marte. High sulphidation examples include La Coipa and La Pepa and are illustrated in Figure

1-10. A strong northwest-southeast structural control to the mineralization is typical of many of the deposits. Some Maricunga deposits have epithermal alteration textures superimposed or telescoped onto porphyry alteration textures.

Figure 1-10: Regional Geology of the Maricunga Metallogenic Belt (Source: Vila and Sillitoe, 1991)

Stockwork-hosted, gold-copper porphyry, high-sulphidation epithermal gold mineralization and intermediate-sulphidation gold mineralization styles have been recognized on the Caspiche property. Mineralization at Caspiche Porphyry is interpreted to be a high-sulphidation epithermal gold deposit above a gold-rich, gold-copper porphyry deposit. The MacNeill zone, confined beneath the underside of the eastward-flared, late-mineral diatreme contact, is assigned an intermediate-sulphidation epithermal origin. It appears to be the product of the final mineralizing event in the Caspiche system, post-dating all alteration and partially overlapping Caspiche mineralization.

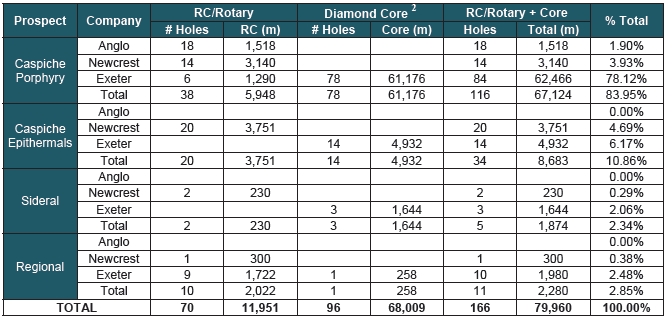

A total of 79,960 m of drilling in 166 drill holes have been completed on the Caspiche property and adjacent areas by Exeter, Newcrest, and Anglo from 1988 to April, 2012. Drilling is concentrated in two main areas of the Caspiche property: Caspiche Porphyry and Caspiche Epithermals.

Of the drill total, 116 holes totalling 67,124 m have been drilled at the Caspiche Porphyry prospect and 34 holes totalling 8,683 m have been drilled at the Caspiche Epithermals prospect.

Table 1-3: Summary of Drilling on the Caspiche and Adjacent Properties

2 RC pre-collar drill lengths are included in the core drilling totals. Drill totals for Exeter campaigns are current as of the effective date of the Resource Estimate. | 1.8 | Mineral Processing and Metallurgical Testing |

The Caspiche project oxide and sulphide mineralization has been subject to several physical characterization and metallurgical test programs to determine possible process routes and expected recoveries.

| 1.8.1 | Oxide Mineralization |

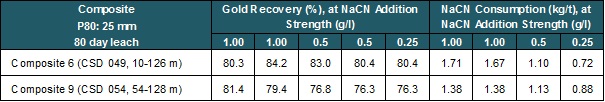

Alquimia carried out an extensive analysis of all column tests, in order to define the expected recoveries and leach irrigating cycle. Based on the information presented the recoveries to be used in this PEA are 80% for gold and 40% for silver.

The total irrigation cycle time, to obtain these recoveries, is estimated at 130 days for an irrigation rate of 10 l/m2/h, a lift height of 10 m and a bulk density for the mineral placed on the pad of 1.6 m3/t.

To accomplish this leach cycle time without generating excess solution or gold grade dilution, an intermediate leach solution (ILS) cycle and pond are considered, thus the irrigation cycle of 130 days is divided in 65 using ILS and 65 days using barren solution.

| 1.8.2 | Sulphide Mineralization |

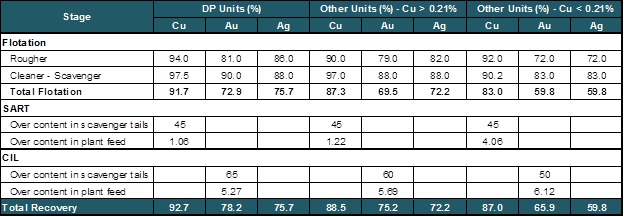

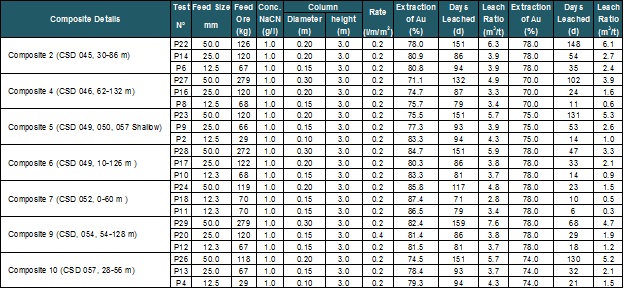

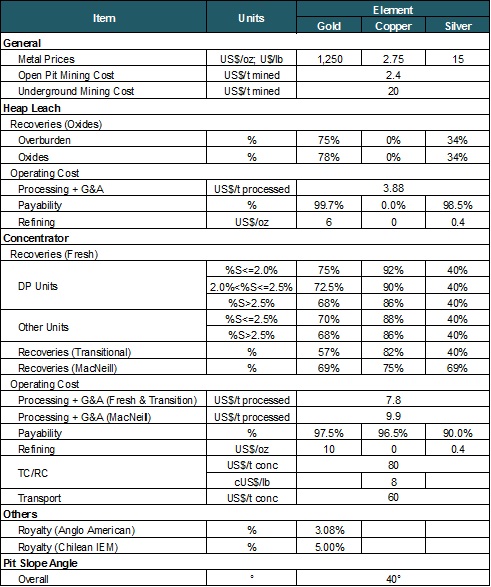

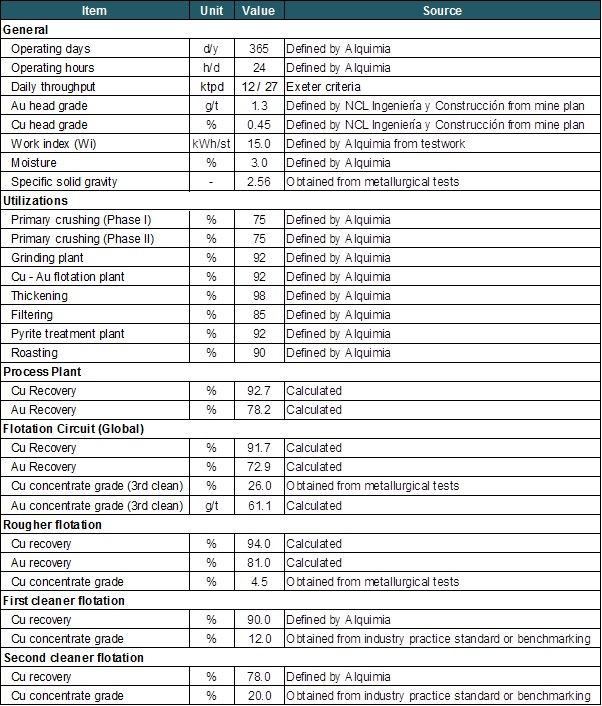

Alquimia conducted an extensive analysis of all test programs carried out for the sulphide mineralization, in order to define expected recoveries and predict metallurgical behavior. Table 1-4 summarizes the main recoveries used in this PEA.

Table 1-4: Recoveries for the production plan

| 1.9 | Mineral Resource Estimate |

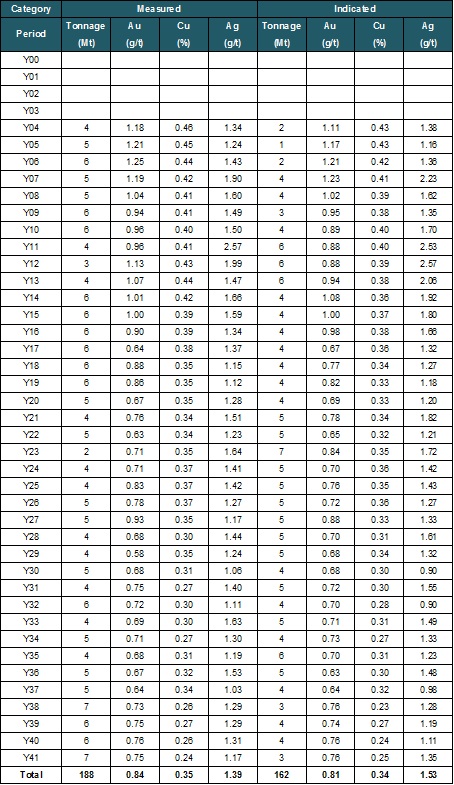

The Mineral Resource Estimate (MRE) reported below for the Caspiche Project with an effective date of April 11, 2012 (the “Cube 2012 Mineral Resource”) was prepared by Mr. Ted Coupland, MAusIMM(CP), at the time, Director and Principal Geostatistician of Cube Consulting Pty Ltd (“Cube”). The Cube 2012 Mineral Resource, was classified in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (Nov 2010). Mr. Patrick Adams MAusIMM(CP), Director and Principal Geologist of Cube has reviewed and validated the Cube 2012 Mineral Resource.

The Cube 2012 Mineral Resource reported from within the 'reasonable prospects' resource shell is summarized in Table 1-5 below. The Cube 2012 Mineral Resource may be affected by further infill and exploration drilling that may result in increases or decreases in subsequent resource estimates. The MRE may also be affected by subsequent assessments of mining, environmental, processing, permitting, taxation, socio-economic, and other as yet identified factors. The Cube 2012 Mineral Resource is reported above a gold equivalent (AuEq) cut-off. Oxide material was reported above 0.18 g/t AuEq cut-off and sulphide material was reported above 0.30 g/t AuEq4 cut-off. Note that the PEA does not include or use the inferred mineral resources.

Table 1-5: Caspiche Mineral Resource Statement April 20123

| Material | Class | Tonnes | Au (g/t) | Cu (%) | Ag (g/t) | (g/t) | |

| (Mt) | (Moz) |

| Oxide | Measured | 66 | 0.46 | | 1.55 | 0.46 | 1.0 |

| Oxide | Indicated | 56 | 0.39 | | 1.63 | 0.40 | 0.7 |

| Total Oxide | Meas + Ind | 122 | 0.43 | | 1.58 | 0.43 | 1.7 |

| Sulphide | Measured | 554 | 0.58 | 0.23 | 1.16 | 1.02 | 18.3 |

| Sulphide | Indicated | 727.9 | 0.48 | 0.18 | 1.17 | 0.84 | 19.6 |

| Total Sulphide | Meas + Ind | 1,282.1 | 0.52 | 0.20 | 1.17 | 0.92 | 37.9 |

| Total Meas+Ind | | 1,403.6 | 0.51 | 0.19 | 1.2 | 0.88 | 39.6 |

| | | | | | | | |

| Material | Class | Tonnes | Au (g/t) | Cu (%) | Ag (g/t) | AuEq4 (g/t) | Au Eq5 |

| (Mt) | (Moz) |

| Oxide | Inferred | 2.5 | 0.23 | 0 | 1.18 | 0.23 | 0 |

| Sulphide | Inferred | 195.6 | 0.29 | 0.12 | 0.91 | 0.52 | 3.3 |

| Total | Inferred | 198.1 | 0.29 | 0.12 | 0.91 | 0.52 | 3.3 |

3 Cautionary Note: Mineral resources that are not mineral reserves do not have demonstrated economic viability

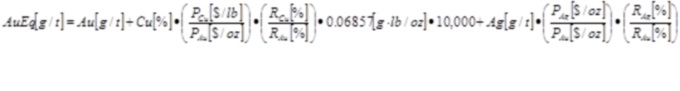

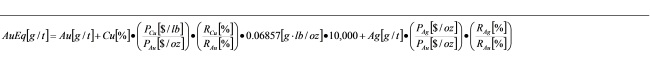

4 The following formula was used in calculating AuEq values in each block of the model:

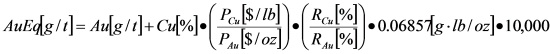

where Au and Cu are the block kriged Au and Cu grades, PAu and PCu are the Au and Cu prices (US$1,150/oz and US$2.50/lb, respectively), and RAu and RCu are the Au and Cu projected metallurgical recoveries, 65% and 85%, respectively for sulphide material and 78% for Au and 11% for Cu in the oxide zone.

Au Eq (Moz) = resource tonnes * AuEq4

Both the oxide and sulphide AuEq cut-off grades were selected as appropriate for the reporting of resources intended for open pit exploitation. Cu% grades shown in the oxide portions of the Cube 2012 Mineral Resource are provided for information only. Copper is not considered an economically viable product in the oxide portions of the Cube 2012 Mineral Resource.

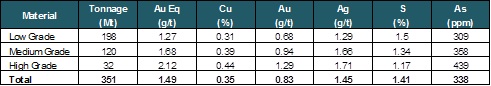

For the purposes of the PEA a sub set of the Cube 2012 Mineral Resource including only the sulphide portion of the Cube 2012 Mineral Resource are reported using an updated AuEq formula. The sulphide portions of the Cube 2012 Mineral Resource are reported in Table 1-6 and Table 1-7 above a cut off of 0.75 g/t AuEq6. This higher cut off was selected as appropriate for the reporting of mineral resources intended for underground exploitation based on preliminary economic cut off studies commissioned by Exeter during October 2013 (NCL 29/10/2013).

Table 1-6: Caspiche – Transitional Measured and Indicated Mineral Resources3 - April 2013 above 0.75 g/t AuEq6 cut off

| Material | Class | Tonnes (Mt) | Au (g/t) | Cu (%) | Ag (g/t) | AuEq6 (g/t) |

| Transitional | Measurd | 2.8 | 0.93 | 019 | 0.97 | 0.93 |

| Transitional | Indicated | 0.7 | 1.04 | 0.30 | 1.26 | 1.05 |

| Total Transitional | Meas + Ind | 3.5 | 0.95 | 0.21 | 1.02 | 0.95 |

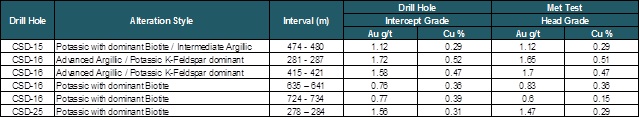

Table 1-7 details the recovery factors for gold, silver and copper within the oxidized, and sulphide domains and the DP and Non-DP stratigraphic units using a sulphur threshold determined by and provided by Exeter.

6 The following formula was used in calculating AuEq values in each block of the model:

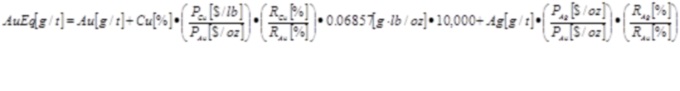

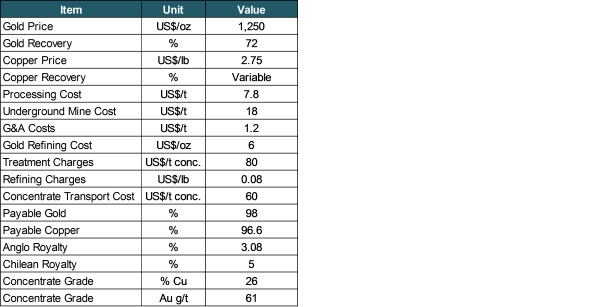

Where Au, Ag and Cu are the block kriged gold, silver and copper grades, PAu, PAg and PCu are the gold, silver and copper prices (1,250 US$/oz., 15US$/oz. and 2.75 US$/lb, respectively). RAu and RCu are the Au and Cu projected metallurgical recoveries based on a number of S % thresholds.

Table 1-7: Caspiche – Sulphide Project Measured and Indicated Mineral Resources3 - April 2013 above 0.75 g/t AuEq6 cut off

| Material | Clss | Tonnes (Mt) | Au (g/t) | Cu (%) | Ag (g/t) | AuEq6 (g/t) |

| Sulphide | Measured | 378.6 | 0.71 | 0.30 | 1.30 | 1.28 |

| Sulphide | Indicated | 431.6 | 0.64 | 0.27 | 1.40 | 1.16 |

| Total Sulphide | Meas + Ind | 810.2 | 0.67 | 0.29 | 1.35 | 1.22 |

| 1.10 | Mineral Reserves Estimate |

The economic analysis contained in the PEA is considered preliminary in nature. No inferred mineral resources form part of the PEA studies and no mineral reserves for the PEA have been established. There is no certainty that economic forecasts outlined in the PEA will be realized. The PEA and the Cube 2012 Mineral Resource (as defined herein) may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors.

NCL Ingeniería y Construcción SpA (NCL) was commissioned by Exeter Resource Corporation (Exeter) to provide mine planning services for the Caspiche Project.

NCL’s Scope of Work is summarized as follows:

| | ● | Develop conceptual mine plans and mine production schedules for the potential life of mine (LOM), for five defined options: |

| | | |

| | | º | Option 1: 30 ktpd open pit mine for gold and silver oxide mineralization treated by heap leaching |

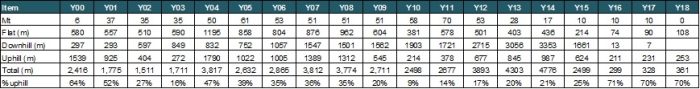

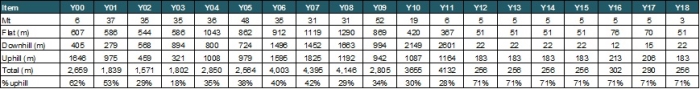

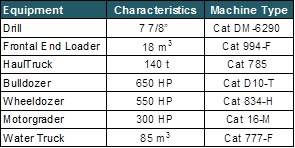

| | | | |