ANNUAL INFORMATION FORM

For the year ended December 31, 2012

Dated as of April 1, 2013

P.O. Box 41, Axa Place

Suite 1660, 999 West Hastings Street

Vancouver, B. C. V6C 2W2 Canada

Phone: (604) 688-9592

Fax: (604) 688-9532

TABLE OF CONTENTS

| | Page |

| | |

| PRELIMINARY NOTES | 1 |

| Date of Information | 1 |

| Currency | 1 |

| Conversion Table | 1 |

| Cautionary Statements Regarding Forward Looking Statements | 1 |

| Cautionary Note to United States Investors Regarding Resource Estimates | 3 |

| Glossary of Terms | 4 |

| Mineral Application Process in Chile | 7 |

| CORPORATE STRUCTURE | 8 |

| Name and Incorporation | 8 |

| Intercorporate Relationships | 8 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 8 |

| Three Year History | 8 |

| DESCRIPTION OF THE BUSINESS | 12 |

| General | 12 |

| PRINCIPAL PROJECT | 22 |

| CASPICHE | 22 |

| Location | 22 |

| Physiography | 22 |

| Accessibility | 23 |

| Climate | 23 |

| Current infrastructure | 23 |

| History | 24 |

| DIVIDENDS | 29 |

| DESCRIPTION OF CAPITAL STRUCTURE | 29 |

| MARKET FOR SECURITIES | 30 |

| DIRECTORS AND EXECUTIVE OFFICERS | 31 |

| Name, Address and Occupation | 31 |

| LEGAL PROCEEDINGS | 33 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 33 |

| TRANSFER AGENT | 33 |

| MATERIAL CONTRACTS | 33 |

| NAME AND INTEREST OF EXPERTS | 33 |

| AUDIT COMMITTEE | 34 |

| ADDITIONAL INFORMATION | 35 |

EXETER RESOURCE CORPORATION

PRELIMINARY NOTES

Date of Information

In this Annual Information Form (the “AIF”), unless the content otherwise requires, references to “our”, “us”, “it”, “its”, “the Company” or “Exeter” mean Exeter Resource Corporation and its subsidiaries. All the information contained in this AIF is as at December 31, 2012, the last day of the Company’s most recently completed financial year, unless otherwise indicated.

Currency

All dollar amounts referenced in this AIF are expressed in Canadian dollars, unless otherwise indicated.

Conversion Table

For ease of reference in this AIF, the following conversion factors from metric measurements into imperial equivalents are provided:

| To Convert from Metric | To Imperial | Multiply by |

| | | |

| Hectares (ha) | Acres | 2.471 |

| Metres (m) | Feet (ft) | 3.281 |

| Kilometres (km) | Miles | 0.621 |

| Tonnes | Tons (2000 pounds) | 1.102 |

| Grams/tonne (g/t) | Ounces/ton (troy/ton) | 0.029 |

Cautionary Statements Regarding Forward Looking Statements

This AIF contains “forward looking information” and “forward-looking statements” (together, “forward-looking statements”) within the meaning of securities legislation in Canada and the United States Private Securities Litigation Reform Act of 1995, as amended.Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Statements concerning mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed, and such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. While the Company has based these forward-looking statements on its expectations about future events as at the date that such statements were prepared, the statements are not a guarantee of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors and assumptions include, amongst others, the effects of general economic conditions, changing foreign exchange rates and actions by government authorities, uncertainties associated with negotiations and misjudgements in the course of preparing forward-looking statements. In addition, there are also known and unknown risk factors which may cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| · | risks related to the Company operating in the resource industry, which is highly speculative, and has certain inherent exploration risks which could have a negative effect on the Company’s operations; |

| · | risks related to the Company’s limited mineral reserves; |

| · | risks related to the Company’s requirement to make advance royalty payments and perform certain other obligations to maintain its interest in Caspiche; |

| · | risks related to the Company’s operations containing significant uninsured risks which could negatively impact future profitability as the Company maintains no insurance against its operations; |

| · | risks related to the Company not having surveyed any of its properties, including risks related to the lack of guarantee on clear title to mineral properties and the uncertainty that the Company could lose title and ownership of its properties which would have a negative effect on the Company’s operations and valuation; |

| · | risks related to changes in the market price of gold, copper, silver, and other minerals which in the past has fluctuated widely and which could affect the profitability of possible future operations and financial condition; |

| · | risks related to land reclamation requirements which may be burdensome; |

| · | risks related to regulations governing issues involving climate change, which could have a material adverse effect on the Company’s business; |

| · | risks related to the natural resource industry being highly competitive, which could restrict the Company’s growth; |

| · | risks related to market forces outside the Company’s control that could negatively impact the Company’s operations; |

| · | risks related to the Company being subject to environmental laws and regulations which may increase the costs of doing business and/or restrict operations; |

| · | risks related to the Company's property interests being in foreign countries which are subject to risks from political and economic instability in those countries; |

| · | risks related to the Company having a history of losses and expecting losses to continue for the foreseeable future and will require additional equity financings, which will cause dilution to existing shareholders; |

| · | risks related to the global economy; |

| · | risks related to the Company’s lack of cash flow sufficient to sustain operations and its expectation that it will not receive operating revenue in the foreseeable future; |

| · | risks related to foreign currency fluctuations; |

| · | risks related to the market for the Company’s common shares being subject to volume and price volatility which could negatively effect a shareholder’s ability to buy or sell the Company’s common shares; |

| · | risks related to officers and directors becoming associated with other natural resource companies which may give rise to conflicts of interests; |

| · | risks that the Company could be deemed a passive foreign investment company (“PFIC”), which could have negative consequences for U.S. investors; |

| · | risks related to the Company’s intent to not pay dividends; |

| · | risks related to increased costs and compliance risks as a result of being a public company; |

| · | risks related to differences in United States and Canadian reporting of reserves and resources; |

| · | risks related to the potential inability of U.S. investor’s to enforce civil liabilities against the Company or its directors, controlling persons and officers; and |

| · | risks related to the Company being a foreign private issuer under U.S securities laws. |

The above list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further in this AIF. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made, and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

Cautionary Note to United States Investors Regarding Mineral Reserve and Resource Estimates

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) -CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission’s (the “SEC”) Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and governmental authorizations must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this AIF and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Glossary of Terms

Ag -symbol used for silver in the periodic table of elements.

Alteration -any change in the mineral composition of a rock brought about by physical or chemical means.

Andesite - a dark-colored, fine-grained extrusive rock that, when porphyritic, contains phenocrysts composed primarily of zoned sodic plagioclase and one or more of the mafic minerals.

As - symbol used for arsenic in the periodic table of elements.

Assaying- laboratory examination that determines the content or proportion of a specific metal (e.g. silver) contained within a sample. Technique usually involves firing/smelting.

Au- symbol used for gold in the periodic table of elements.

Breccia - a rock in which angular fragments are surrounded by a mass of fine-grained minerals.

Bulk Sample - a collection of representative mineralized material whose location, geologic character and metal assay content can be determined, and then used for metallurgical or geotechnical testing purposes.

Carbon In Leach -a recovery processin which a slurry of gold ore, carbon granules and cyanide are mixed together. The cyanide dissolves the gold content and the gold is absorbed in the carbon. The carbon is subsequently separated from the slurry for further gold removal.

Channel Sampling -cutting a groove in a rock face or outcrop to obtain material for sampling.

Chip Sampling - taking of small pieces of rock with a pick along a line, or at random, from the width or face of an exposure or outcrop for exploration sampling.

Clastic - fragments of minerals and rocks that have been moved individually from their places of origin.

Cu - symbol used for copper in the periodic table of elements.

Cut-off grade - the lowest grade of mineralized material that qualifies as resource in a deposit. (i.e. contributing material of the lowest assay that is included in a resource estimate.)

Diorite - an intrusive igneous rock.

Diamond Drilling - a type of rotary drilling in which diamond bits are used as the rock-cutting tool to produce a recoverable drill core sample of rock for observation and analysis.

Dip - the angle that a structural surface, a bedding or fault plan, makes with the horizontal, measured perpendicular to the strike of the structure.

Disseminated- where minerals occur as scattered particles in the rock.

Epithermal- low temperature hydrothermal process or product.

Exploration- work involved in searching for ore, usually by drilling or driving a drift.

Fault- a fracture or break in rock along which there has been movement.

FeasibilityStudy- means a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production.

Felsic -an adjective describing an igneous rock having mostly light colored minerals and rich in silica, potassium and sodium.

Grade - the metal content of rock with precious metals, grade can be expressed as troy ounces or grams per tonne of rock.

Hg-symbol used for mercury in the periodic table of elements.

Hydrothermal- the products or the actions of heated waters in a rock mass such as a mineral deposit precipitating from a hot solution.

Ignimbrite-a felsic volcanic tuff in which the fragments were welded together as the tuff cooled.

Intrusion/ Intrusive- molten rock that is intruded (injected) into spaces that are created by a combination of melting and displacement.

Magnetometer - an instrument for detecting and measuring changes in the earth's magnetic field, including those in different rock formations which may indicate the presence of specific minerals.

Metallurgy- the study of the extractive processes which produce minerals from their host rocks.

Metallurgical Tests- are scientific examinations of rock/material to determine the optimum extraction of metal contained. Core samples from diamond drill holes are used as representative samples of the mineralization for this test work.

Mineral- a naturally formed chemical element or compound having a definitive chemical composition and usually a characteristic crystal form.

Mineralization- a natural concentration in rocks or soil of one or more metalliferous minerals.

Mineral Resource- is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

Net Smelter Return Royalty / NSR Royalty-a phrase used to describe a royalty payment made by a producer of metals based on gross metal production from the property, less deduction of certain limited costs including smelting, refining, transportation and insurance costs.

Open Pit - a mining method whereby the mineral reserves are accessed from surface by the successive removal of layers of material usually creating a large pit at the surface of the earth.

Outcrop- the part of a rock formation that appears at the surface of the ground.

Oxide- a compound of oxygen with another element.

Phyllic Alteration-a hydrothermal alteration common in porphyry base-metal systems.

Porphyry - any igneous rock in which relatively large crystals are set in a fine-grained matrix of rock.

Pre-feasibility Study -a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors.

Pyroclastic - produced by explosive or aerial ejection of ash, fragments, and glassy material from a volcanic vent; applied to the rocks and rock layers as well as to the textures so formed.

Quartz- crystalline silica; often forming veins in fractures and faults within older rocks.

Reverse Circulation (RC) Drilling - a type of percussion drilling where hammer force is transmitted down a length of steel drill rods to a rotating bit that breaks the rock into chips. The rock chips are forced to the surface using air or water forced down the outer chamber of a twin-walled drill rod and driven back to the surface through the inner chamber. The rock chips are then collected for analysis.

Rhyolite - a group of extrusive igneous rocks, typically porphyritic and commonly exhibiting flow texture, with phenocrysts of quartz and alkali feldspar in a glassy to cryptocrystalline groundmass; also, any rock in that group; the extrusive equivalent of granite.

Sampling- taking a sample of rock or material in order to test and assay its mineral composition.

Sediments/Sedimentary - rocks formed by the deposition of sediment or pertaining to the process of sedimentation.

Shear Zone - a zone in which shearing has occurred on a large scale so that the rock is crushed and brecciated.

Silification - the in situ alteration of a rock, which involves an increase in the proportion of silica minerals.

Tuff -a general term for all consolidated pyroclastic rocks.

Stockwork - a mineral deposit consisting of a three-dimensional network of planar to irregular veinlets closely enough spaced that the whole mass can potentially be mined.

Vein - a thin, sheet-like, crosscutting body of hydrothermal mineralization, principally quartz.

Volcanics -those originally molten rocks, generally fine grained, that have reached or nearly reached the Earth’s surface before solidifying.

Mineral Application Process in Chile

There are two types of mining concessions in Chile: exploration concessions and exploitation concessions. The principal characteristics of each are the following:

Exploration Concessions

The titleholder of an exploration concession has the right to carry out all types of mineral exploration activities within the area of the concession. Exploration concessions can overlap or be granted over the same area of land; however, the rights granted by an exploration concession can only be exercised by the titleholder with the earliest dated exploration concession over a particular area.

For each exploration concession the titleholder must pay an annual fee per ha to the Chilean Treasury and exploration concessions have a duration of two years. At the end of this period, they may (i) be renewed as an exploration concession for two further years in which case at least 50% of the surface area must be renounced, or (ii) be converted, totally or partially, into exploitation concessions.

A titleholder with the earliest dated exploration concession has a preferential right to an exploitation concession in the area covered by the exploration concession, over any third parties with a later dated exploration or exploitation concession request. The titleholder must oppose any applications made by third parties for exploitation concessions within the area for the exploration concession to remain valid.

Exploitation Concessions

The titleholder of an exploitation concession is granted the right to explore and exploit the minerals located within the area of the concession and to take ownership of the minerals that are extracted. Exploitation concessions can overlap or be granted over the same area of land; however, the rights granted by an exploitation concession can only be exercised by the titleholder with the earliest dated exploitation concession over a particular area.

Exploitation concessions are of indefinite duration and an annual fee is payable to the Chilean Treasury in relation to the number of ha.

Where a titleholder of an exploration concession has applied to convert the exploration concession into an exploitation concession, the application for the exploitation concession and the exploitation concession itself is back dated to the date of the request of the exploration concession. A titleholder to an exploitation concession must apply to annul or cancel any exploitation concessions which overlap with the area covered by its exploitation concession within a certain time period in order for the exploitation concession to remain valid.

In accordance with Chilean law, from the date that an application for an exploitation concession is made to the court, the applicant has the right to transfer or grant an option to purchase the exploitation concession in the process of being constituted and the court has no discretion to refuse the final grant of the concession.

CORPORATE STRUCTURE

Name and Incorporation

The Company was incorporated under the name of Square Gold Explorations Inc. on February 10, 1984 under theCompany Act of the Province of British Columbia (subsequently replaced by the Business Corporations Act (British Columbia)) with an authorized capital of 20,000,000 common shares without par value. On July 13, 1987, the Company changed its name to Glacier Resources Inc. and on August 19, 1988 changed its name to Golden Glacier Resources Inc.

On June 10, 2002 shareholders approved (i) a share consolidation on the basis of ten (10) old shares for one (1) new share (the "Consolidation"), (ii) an increase in the authorized share capital post-consolidation from 2,000,000 to 100,000,000 common shares, and (iii) a name change to Exeter Resource Corporation. The Consolidation and name change were made effective October 11, 2002.

On March 11, 2010, shareholders of the Company approved a plan of arrangement to create two independent companies independently focussed on mineral exploration and development in Argentina and Chile, respectively (the “Plan of Arrangement”) , and (ii) a change in the authorized share capital from 100,000,000 to an unlimited number of common shares. Under the Plan of Arrangement, which was approved by a final order of the British Columbia Supreme Court on March 12, 2010, Exeter retained all assets relating to the Caspiche gold-copper discovery, together with approximately $45.0 million in working capital, and focussed on the advancement of Caspiche. On March 22, 2010 Exeter transferred to Extorre Gold Mines Limited (“Extorre”), its Cerro Moro and other exploration properties in Argentina and approximately $25.0 million in working capital.

The head office of the Company is located at Suite 1660, 999 West Hastings Street, Vancouver, British Columbia, V6C 2W2. The address for service and the registered and records office of the Company is located at Suite 2900, 550 Burrard Street, Vancouver, British Columbia V6C 0A3.

Intercorporate Relationships

As of the effective date of this report, the Company has three wholly-owned subsidiaries: Sociedad Contractual Minera Eton Chile (“Eton Chile”), Sociedad Contractual Minera Retexe Chile (“Retexe Chile”), and Eton Mining Corp. (“Eton”). Eton Chile and Retexe Chile are Chilean corporations, registered to conduct the Company’s business in Chile. Eton is a British Columbia corporation, and is not currently active.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

The Company is engaged in the business of acquisition, exploration and development of mineral properties located in the Maricunga Region, Chile and subsequent to December 31, 2012 also is engaged in acquisition and exploration of mineral properties in Mexico; its business development over the last three years is described in the following paragraphs. Unless otherwise noted, Jerry Perkins, Vice President Development and Operations of the Company, a qualified person (“QP”) under NI 43-101, is responsible for the preparation of scientific or technical information in this AIF.

2010

In March 2010, the Company transferred all of its interest in the Cerro Moro project and the balance of its Argentine properties to Extorre, together with approximately $25.0 million in working capital pursuant to the Plan of Arrangement. The Company’s activities were exclusively devoted to the further exploration and development of its Caspiche project located in the Maricunga region of Chile.

Key exploration milestones during 2010 included an interim resource update at Caspiche announced in April 2010 and a further resource update in September 2010 based on all available drill data including almost 30 km of new drilling completed during the 2009/2010 program.

The September 2010 resource update reported that 80% of the total Caspiche mineral resource fell within the Measured and Indicated (M&I) resource categories. Specifically, the update reported M&I resources of 21.3 M (million) ounces of gold, 48.4 M ounces of silver and 5.3 B (billion) pounds of copper. This resource was based on 1,316 Mt (million metric tons) at a grade of 0.50 g/t gold (grams per metric ton) and 1.14 g/t silver, including 1,217 Mt at a grade of 0.20% copper from the sulphide zone. In addition to the M&I mineral resources, the Company reported an Inferred Mineral Resource of 5.1 M ounces of gold, 14.5 M ounces of silver and 1.4 B pounds of copper, based on 458 Mt at a grade of 0.35 g/t gold and 0.98 g/t silver, including 449 Mt at a grade of 0.15% copper. These tons and grades are based on marginal cutoffs of 0.2 g/t gold for the oxide zone and 0.3 g/t gold equivalent1 for the sulphide zone.

The Company continued an extensive program of long lead time metallurgical testing including column leaching tests on the oxide and locked cycle and pilot plant flotation programs on the sulphide portions of the deposit over the course of the year.

In October 2010, the Company resumed drilling at Caspiche with a multi rig program designed to run through to 2011 and complete additional infill drilling. The Company also completed an equity financing and issued 8,065,000 common shares at a price of $6.20 per share for gross proceeds of $50.0 million.

In November, the syndicate of underwriters exercised the 15% over-allotment option related to the financing completed in October and the Company issued 1,209,750 common shares at a price of $6.20 per share for gross proceeds of $7.5 million.

The Company also announced it had commissioned and engaged Aker Solutions (now Jacobs Engineering) of Santiago, Chile, an internationally recognized engineering group, to carry out two pre-feasibility studies for its Caspiche gold-copper project. The first study considered a stand-alone “oxide gold” project to mine the upper part of the deposit. The second study, which ran concurrently with the oxide study, considered mining both the oxide and sulphide deposits.

1

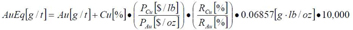

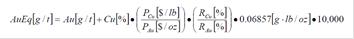

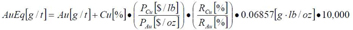

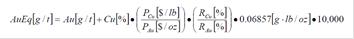

The following formula was used on calculating AuEq values in each block of the model: where Au and Cu were the block kriged gold and copper grades, PAu and PCu were the gold and copper prices ($950/oz and $2.30/lb, respectively), and RAu and RCu are the gold and copper projected metallurgical recoveries, 75% and 85%, respectively for sulphide material and 50% for gold in the oxide zone.

2011

During 2011 the Company continued work on the pre-feasibility studies referred to above.

In February, the Company announced that it had exercised the option to acquire 100% of the Caspiche properties from Anglo American. The Company also acquired an exclusive 2.5 year option (which was subsequently extended for a further 2 years) over 300 litres per second (“l/s”) of water within the northern Maricunga basin and worked during the year with specialised consultants to establish a water balance over the granted water rights.

In June, results from the study on the stand alone “oxide gold” project were released. The pre-feasibility study (“PFS”) for the potential mining of this outcropping +100 metre thick oxide “blanket” provided encouraging first pass economics.

The second pre-feasibility study, which considered both the oxide and sulphide portions of the deposit was extended through to January 2012 to allow for incorporation of an updated resource estimate and to incorporate additional engineering, completed to a pre-feasibility level, of an in pit crushing and conveying (IPCC) system within the proposed mine plan to assist with waste material movement.

To support the calculations of an updated resource estimate on the Caspiche porphyry, drilling from the 2010/2011 drill season was incorporated with the existing information and models and a mineral resource update was completed by AMEC International in August 2011 and validated by Cube Consulting Pty Ltd. (“Cube”) in November 2011. The inclusion of IPCC within the PFS was considered important as it had the potential to reduce waste haulage and mine operating costs.

The new mineral resource contained 1,360 M tonnes in the M&I Resource categories containing 22 M ounces of gold, 6.1 B pounds of copper and 49 M ounces of silver. A further 286 M tonnes was in the Inferred category containing 2.85 M ounces of gold, 1.3 B pounds of copper and 8.18 M ounces of silver. The mineral resource is inclusive of the project’s subsequently defined mineral reserves. This updated resource provided the basis, along with appropriate modifying factors, for the classification of Mineral Reserves by the engineers during the pre-feasibility study.

Additional drilling was also undertaken in 2011 to test regional exploration targets and to provide material for ongoing metallurgical testwork, process and flowsheet design and optimisation at Caspiche.

2012

In January 2012, the Company announced results of the second PFS which studied the potential for continued development of the oxide and sulphide portions of the Caspiche deposit following 14 months of detailed metallurgy, engineering and infrastructure studies.

The key highlights of this study were a pre-tax NPV(5), calculated from the time of potential commencement of the project, of US$2.8 billion and average operating costs of US$606 per ounce gold equivalent2. The gold production cost dropped to US$18 per ounce when copper and silver by-product credits were considered. The project considered a 19 year mine life and average annual production of 696,000 ounces of gold and 244 M pounds of copper per year.

2 Gold Equivalent was calculated by simple mathematical proportion. Gold, silver and copper revenues were calculated using estimated production multiplied by relevant metal price used in the study, these values were totalled and the total revenue was divided by the gold price used in the study. This was repeated for each year of operation and then averaged over the life of project.

The new PFS used Proven and Probable ore reserves in the development of the mine plan and financial evaluation (based on M&I resources). Total Proven and Probable ore reserves, generated from an updated resource estimate for the Super Pit are 1,091 M tonnes containing 19.3 M ounces of gold, 4.62 B pounds of copper, and 41.5 M ounces of silver.

The PFS considers a conventional concentrator process route for the sulphide ore and included a roaster to reduce arsenic levels in the final copper concentrate to commercially acceptable levels and a flotation by-product leach process to maximise gold recovery from the sulphide ore. In parallel with the concentrator, a valley fill heapleach would be operated to recover gold from oxidized near surface heap leachable material which would be extracted as part of the overall mine development and operation.

Work to advance the Caspiche project during 2012 included the following:

| · | Ongoing metallurgical programs designed to improve metal recoveries |

| · | Geotechnical studies to support the infrastructure placement |

| · | Hydrology and hydrogeological studies both at Caspiche and other locations with potential to act as viable water sources for the operations |

| · | Environmental base line programs to support an eventual Environmental Impact Assessment |

| · | Evaluation of alternative early power supply by an agreement to branch off the line which feeds the current Maricunga mine |

| · | Drilling operations at an area denominated Cuenca 1, one of the Company’s water exploration concession areas to determine the availability of water |

| · | Development of detailed topography to 0.5 m contours for the immediate project area and infrastructure required by the project |

| · | Application for an easement over the surface area that could potentially be affected by the development of the Caspiche project |

These programs are designed to allow development of a comprehensive feasibility study for the oxide stand alone portion of the project and an updated PFS on the larger Caspiche project should the Company determine to proceed to feasibility or updated PFS studies.

2013

The Company announced the continuation of water drilling exploration in January 2013, at Cuenca 1, one of the two water exploration concessions granted to the Company.

In February, the Company announced certain management changes, including the appointment of Wendell Zerb as President & CEO, the transition to Co-Chairman by Bryce Roxburgh, and the retirement of Douglas Scheving from the Board of Directors.

The Company entered into new Option and Joint Venture Agreements with San Marco Resources Inc. (“San Marco”), on two properties in Mexico: the Angeles and the La Buena properties.

The Company has the option to earn up to 70% of the Angeles property by incurring expenditures of $10M over 4 years to earn 51%, and the additional 19% by spending an additional $10M over the following 3 years. Exeter will also make cash payments of $950,000 staged over 7 years by way of placements in San Marco at a 25% premium to San Marco’s 20 day volume weighted average share price (“VWAP”). Exeter is committed to a first year expenditure of $1.0M.

The Company has the option to earn 60% of the La Buena property by spending $15M in expenditures and by making cash payments of $650,000 staged over 5 years. The cash payments will be by placements in San Marco at a 25% premium to its 20 day VWAP. The Company has committed to first year expenditures of $1.4M.

DESCRIPTION OF THE BUSINESS

General

The Company is a mineral resource exploration and development company. The Company’s principal property is the Caspiche property in northern Chile.

The Company is in the exploration and development stage of its corporate development; it owns no producing properties and, consequently has no current operating income or cash flow from the properties it holds, nor has it had any income from operations in the past three financial years. As a consequence, operations of the Company are primarily funded by equity subscriptions.

The progress on and results of work programs on the Company’s principal property is set out in the Principal Project section of this AIF. At this time, based on the exploration results to-date, the Company cannot project significant mineral production from any of its existing properties.

Specialized Skills

The Company’s business requires specialized skills and knowledge in the areas of geology, drilling, planning, implementation of exploration programs, and compliance. To date, the Company has been able to locate and retain such professionals in Canada and Chile, and believes it will be able to continue to do so.

Competitive Conditions

The Company operates in a very competitive industry, and competes with other companies, many of which have greater technical and financial facilities for the acquisition and development of mineral properties, as well as for the recruitment and retention of qualified employees and consultants.

Business Cycles

Late in 2008 the credit crisis in the United States sent many economies, including the Canadian economy, into a recession. Since then, some of the markets have recovered, however the economies of certain States within the European Economic Union have declined and the commodity market has remained volatile. The gold market, late in 2010, made significant gains in terms of US Dollars but remained volatile throughout 2011 and suffered declines through the latter part of the year. In addition to commodity price cycles and recessionary periods, exploration activity may also be affected by seasonal and irregular weather conditions in Chile. In particular, exploration on the Company’s Caspiche property at higher altitude is challenging and potentially not possible in winter.

Environmental Protection Requirements

The Company’s operations are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, and the use of cyanide which could result in environmental pollution. A breach of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards and enforcement with fines and penalties for non-compliance more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies including its directors, officers and employees. The cost of compliance with changes in governmental regulations has the potential to negatively affect future operations.

Employees

As of December 31, 2012, the Company had 6 employees in Canada (7 as of the date hereof), and approximately 18 employees in Chile (21 as of the date hereof). The Company relies on and engages consultants on a contract basis to provide services, management and personnel who assist the Company, to carry on its administrative or exploration activities either in Canada or Chile.

Foreign Operations

Mineral exploration and mining activities in Chile and Mexico may be affected in varying degrees by political instability and government regulations relating to the mining industry. Any changes in regulations or shifts in political conditions may adversely affect the Company’s business. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, environmental legislation and mine safety.

Social or Environmental Policies

In March 2008, the Company adopted its “Environment and Corporate Social Responsibility Principles and Policies”. The Company’s “Environment and Corporate Social Responsibility Principles and Policies” sets out the principles that all directors, management and employees are required to adhere to while conducting Company business. The principles are (i) environmental stewardship, which sets the objective of minimizing negative impacts on the environment; (ii) the commitment to conduct due diligence before undertaking material activities on the ground to ensure proper management of issues surrounding these activities; (iii) a commitment to engage host communities and other affected and interested parties by including all parties and providing clear and accurate information; (iv) contribute to community development; (v) upholding Human Rights; (vi) safeguarding the health and safety of workers and local populations by implementing sound health and safety policies; (vii) a commitment to accurate and transparent reporting; and (viii) the commitment to ethical business practices.

Risk Factors

Properties in which the Company has or is acquiring an interest in, are all currently at the exploration or development stage. The activities of the Company are speculative due to the high risk nature of its business which is the acquisition, financing, exploration and development of mining properties. The following risk factors, which are not exhaustive, could materially affect the Company’s business, financial condition or results of operations and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. These risks include but are not limited to the following:

Operations and Mineral Exploration Risks

The Company operates in the resource industry, which is highly speculative, and has certain inherent exploration risks which could have a negative effect on the Company’s operations.Resource exploration is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors such as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environment protection. Any one or a combination of these factors may result in the Company not receiving an adequate return on its investment capital.

The Company has limited mineral reserves.The Company is at the exploration or development stage on all of its properties and is engaged in ongoing engineering work in order to determine if any economic deposits exist on its properties. The Company may expend substantial funds in exploring certain of its properties only to abandon them and lose its entire expenditure on the properties if no commercial or economically viable quantities of minerals are found. Even in the event that commercial quantities of minerals are discovered, the exploration properties might not be brought into commercial production. Finding commercially viable mineral deposits is dependent on a number of factors, not the least of which is the technical skill of exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent on a number of factors, some of which are the particular attributes of the deposit, such as size, grade, amenability to metallurgical processing, and proximity to infrastructure, availability of power and water, as well as metal prices. While the Company has optioned registered surface water rights of 300 l/s, which is considered sufficient for an oxide only production project, (the ability to extract and use such water is subject to further permitting appraisal from the authorities and there is no guarantee that such permits will be received) the availability of additional water for the larger sulphide production project is not certain. The Company is continuing to aggressively pursue avenues for acquisition of this additional water. The Company is a development stage company with no history of pre-tax profit and no income from its operations. There can be no assurance that the Company’s operations will be profitable in the future. There is no certainty that the ongoing studies being conducted by the Company will result in a commercially viable mining operation. No assurance can be given that any particular level of recovery of mineral reserves will in fact be realized or that the identified mineral deposit will ever qualify as a commercially mineable (or viable) mineral deposit which can be legally and economically exploited. There can be no assurance that minerals recovered in small scale tests or the results of pilot plant operations and metallurgical testwork will be duplicated in large scale tests under on-site conditions or in production. If the Company is unsuccessful in its development efforts, the Company may be forced to acquire additional projects or cease operations.

The Company is required to make advance royalty payments and perform certain other obligations to maintain its interest. If the Company is unable to fulfill the requirements of these agreements, including the requirement to commence commercial production within a fixed period, its interest in its Caspiche project could be lost.

The Company’s operations contain significant uninsured risks which could negatively impact future profitability as the Company maintains no insurance against its operations. The Company’s development of its mineral properties contain certain risks, including unexpected or unusual operating conditions including rock bursts, cave-ins, flooding, fire and earthquakes. It is not always possible to insure against such risks. The Company currently maintains general liability and director and officer insurance but no insurance against its properties or operations. The Company may decide to take out such insurance in the future if such insurance is available at economically viable rates.

The Company has not surveyed any of its properties, has no guarantee of clear title to its mineral properties and the Company could lose title and ownership of its properties which would have a negative effect on the Company’s operations and valuation. The Company has only done a preliminary legal survey of the boundaries of some of its properties, and therefore, in accordance with the laws of the jurisdictions in which these properties are situated, their existence and area could be in doubt. If title is disputed, the Company will have to defend its ownership through the courts. In the event of an adverse judgment, the Company would lose its property rights. Some of the Company’s exploration concessions associated with its Caspiche project overlap exploration concessions held by other parties and entitlement to such concessions has not yet been determined and is not assured. Some of the land over which the Company holds exploration concessions may be subject to claims of indigenous populations which have not been resolved. In addition the Company will be required to apply for surface rights for the potential development of Caspiche and there is no guarantee that the Company will be able to secure such surface rights.

A shortage of equipment and supplies could adversely affect the Company’s ability to operate its business.The Company is dependent on various supplies and equipment to carry out its mineral exploration and, if warranted, development operations. The shortage of such supplies, equipment and parts could have a material adverse effect on the Company’s ability to carry out its operations and therefore limit or increase the cost of potential future production.

Changes in the market price of gold, copper, silver and other metals, which in the past has fluctuated widely, would affect the future profitability of the Company’s planned operations and financial condition.The Company’s long-term viability and future profitability depend, in large part, upon the market price of gold, copper, silver and other metals and minerals from potential future production from its mineral properties. The market price of gold, copper, silver and other metals is volatile and is impacted by numerous factors beyond the Company’s control, including:

| § | expectations with respect to the rate of inflation; |

| § | the relative strength of the U.S. dollar and certain other currencies; |

| § | global or regional political or economic conditions; |

| § | supply and demand for jewelry and industrial products containing metals; |

| § | sales by central banks and other holders, speculators and producers of gold, silver, copper and other metals in response to any of the above factors; and |

| § | any executive order curtailing the production or sale of gold, silver or copper. |

The Company cannot predict the effect of these factors on metal prices. A decrease in the market price of gold, silver, copper and other metals could affect the commercial viability of the Company’s properties and its anticipated development of such properties in the future. Lower gold and other commodity prices could also adversely affect the Company’s ability to finance exploration and development of its properties.

Land reclamation requirements for the Company’s properties may be burdensome and expensive.Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

| § | control dispersion of potentially deleterious effluents; |

| § | treat ground and surface water to drinking water standards; and |

| § | reasonably re-establish pre-disturbance land forms and vegetation. |

In order to carry out reclamation obligations imposed on the Company in connection with its potential development activities, the Company must allocate financial resources that might otherwise be spent on further exploration and development programs. If the Company is required to carry out unanticipated reclamation work, its financial position could be adversely affected.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on the Company’s business.A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on the Company, and its suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact the Company’s ability to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, the Company cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by the Company or other companies in its industry could harm its reputation. The potential physical impacts of climate change on the Company’s operations are highly uncertain, and would be particular to the geographic circumstances in areas in which it operates. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, potential production and financial performance of the Company’s operations.

The natural resource industry is highly competitive, which could restrict the Company’s growth.The Company competes with other exploration resource companies, which have similar operations, and many competitors have operations, financial resources and industry experience greater than those of the Company. This may place the Company at a disadvantage in acquiring, exploring and developing properties. Such companies could outbid the Company for potential projects or produce minerals at lower costs which would have a negative effect on the Company’s operations.

Mineral operations are subject to market forces outside of the Company’s control which could negatively impact the Company’s operations. The marketability of minerals is affected by numerous factors beyond the control of the entity involved in their mining and processing. These factors include market fluctuations, government regulations relating to prices, taxes, royalties, allowable production, imports, exports and supply and demand. One or more of these risk elements could have an impact on costs of an operation and if significant enough, reduce the profitability of the operation and threaten its continuation.

The Company is subject to substantial environmental requirements which could cause a restriction or suspension of Company operations. The current and anticipated future operations of the Company require permits from various governmental authorities and such operations are and will be governed by laws and regulations governing various elements of the mining industry. The Company’s development activities in Chile are subject to various federal and local laws governing land use, the protection of the environment, prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, and other matters. Such operations and exploration activities are also subject to substantial regulation under these laws by governmental agencies and may require that the Company obtain permits from various governmental agencies.

Exploration generally requires one form of permit while development and production operations require additional permits. There can be no assurance that all permits which the Company may require for future exploration or possible future development will be obtainable on reasonable terms. In addition, future changes in applicable laws or regulations could result in changes in legal requirements or in the terms of existing permits applicable to the Company or its properties. This could have a negative effect on the Company’s exploration activities or its ability to develop its properties.

The Company is also subject to environmental regulations, which require the Company to minimize impacts upon air, water, soils, vegetation and wildlife, as well as historical and cultural resources, if present. The Company is required to comply with the provisions of ILO 169 which sets out requirements for consultation with indigenous communities. Compliance with ILO 169 requirements could result in delays and significant additional expense in obtaining the necessary approvals or agreement with indigenous communities to advance the Caspiche project. In Chile, exploration activities require an environmental impact declaration, while mining activities require a significantly more detailed environmental impact evaluation under the “SEIA” system. These documents are presented to the government entity (Conama or Corena) who then consult with other government departments and arrange public comment before approving or imposing limits on proposed activities. As the Company is at the exploration stage, the disturbance of the environment is limited however if exploration activities result in negative effects upon the environment, government agencies will usually require the Company to provide remedial actions to correct the negative effects. The requirements of Government that can be imposed on planned operations as a result of the SEIA evaluation can require additional facilities, restrictions on operations, additional capital and operating expenditure and additional regulatory requirements that cannot be reasonably forecast by the Company prior to assessment.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or other remedial actions.

The Company's property interests in foreign countries are subject to risks from political and economic instability in those countries.Exploration in foreign jurisdictions exposes the Company to risks that may not otherwise be experienced if all operations were domestic. The risks include, but are not limited to: military repression, extreme fluctuations in currency exchange rates, labour instability or militancy, mineral title irregularities and high rates of inflation. In addition, changes in mining or investment policies or shifts in political attitude in foreign countries in which we operate may adversely affect our business. We may be affected in varying degrees by government regulation with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. The effect of these factors cannot be accurately predicted. Political risks may adversely affect the Company’s existing assets and operations. The Company does not maintain and does not intend to purchase political risk insurance at this time. Real and perceived political risk in some countries may also affect the Company’s ability to finance exploration programs and attract joint venture partners, and future mine development opportunities.

Financing Risks

The Company has a history of losses and expects losses to continue for the foreseeable future and will require additional equity financings, which will cause dilution to existing shareholders. The Company has limited financial resources and has no operating cash flow. As of December 31, 2012, the end of the last financial year, the Company had incurred accumulated losses totalling approximately $231 million. Continued development efforts will require additional capital to maintain and advance the studies on the Company’s Caspiche project and its commitments to the Angeles and La Buena properties. Additionally, development of the Company’s Caspiche project would require significant additional capital which the Company may be unable to access. The Company has been required to raise funds through the sale of its common shares and has no current plans to obtain financing through means other than equity financing however should it determine to proceed with development of its properties it may be required to obtain loans or other sources of finance for such development. However, the Company may not be able to obtain additional equity or other financing on reasonable terms, or at all. If the Company is unable to obtain sufficient financing in the future, it might have to dramatically slow development efforts and/or lose control of its Caspiche project. If equity financing is required, then such financings could result in significant dilution to existing or prospective shareholders. These financings may be on terms less favourable to the Company than those obtained previously.

The Company may be subject to risks relating to the global economy. Global financial conditions have been subject to volatility and access to public financing has been negatively impacted. These conditions could, among other things, make it more difficult for the Company to obtain, or increase its cost of obtaining, capital and financing for its operations. Access to additional capital may not be available to the Company on terms acceptable to it, or at all.

The Company is also exposed to liquidity risks in meeting its operating and capital expenditure requirements in instances where cash positions are unable to be maintained or appropriate financing is unavailable. These factors may impact the ability of the Company to obtain loans and other credit facilities in the future and, if obtained, on terms favourable to the Company. If these increased levels of volatility and market turmoil continue, the Company’s operations could be adversely impacted and the trading price of the common shares could be adversely affected.

The Company has a lack of cash flow sufficient to sustain operations and does not expect to begin receiving operating revenue in the foreseeable future. The Company’s properties have not advanced to the commercial production stage and the Company has no history of earnings or cash flow from operations. The Company has paid no dividends on its common shares since incorporation and does not anticipate doing so in the foreseeable future. Historically, the only source of funds available to the Company has been through the sale of its common shares. Any future additional equity financing would cause dilution to current shareholders. If the Company does not have sufficient capital for its operations, management would be forced to reduce or discontinue its activities, which would have a negative effect on the value of its securities.

The Company operates in foreign countries and is subject to currency fluctuations which could have a negative effect on the Company’s operating results. The Company’s operations at December 31, 2012 were located in Chile which makes it subject to foreign currency fluctuation as the Company’s accounts are maintained in Canadian dollars while certain expenses are numerated in U.S. Dollars, Australian Dollars, and Chilean Pesos. Such fluctuations may adversely affect the Company’s financial position and results. Management may not take any steps to address foreign currency fluctuations that will eliminate all adverse effects and, accordingly, the Company may suffer losses due to adverse foreign currency fluctuations.

Risks Relating to an Investment in the Common Shares of the Company

The market for the Company’s common shares has been subject to volume and price volatility which could negatively affect a shareholder’s ability to buy or sell the Company’s common shares. The market for the common shares of the Company may be highly volatile for reasons both related to the performance of the Company, or events pertaining to the industry (i.e. mineral price fluctuation/high production costs/accidents) as well as factors unrelated to the Company or its industry such as economic recessions and changes to legislation in the countries in which it operates. In particular, market demand for products incorporating minerals in their manufacture fluctuates from one business cycle to the next, resulting in change in demand for the mineral and an attendant change in the price for the mineral. In the last five financial years, the price of the Company’s common shares has fluctuated between $1.05 and $9.32. The Company’s common shares can be expected to continue to be subject to volatility in both price and volume arising from market expectations, announcements and press releases regarding the Company’s business, and changes in estimates and evaluations by securities analysts or other events or factors. In recent years the securities markets in the U.S. and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly small-capitalization companies such as the Company, have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies. For these reasons, the Company’s common shares can also be subject to volatility resulting from purely market forces over which the Company will have no control such as that experienced recently resulting from the economic downturn due to the on-going credit crisis centred in the United States and Europe. Further, despite the existence of a market for trading the Company’s common shares in Canada, the U.S. and Germany, shareholders of the Company may be unable to sell significant quantities of common shares in the public trading markets without a significant reduction in the price of the common shares.

The Company is dependent upon key management, the absence of which would have a negative effect on the Company’s operations. The Company depends on the business and technical expertise of its management and key personnel, including Wendell Zerb, President and Chief Executive Officer, Bryce Roxburgh, Co-Chairman, Yale Simpson, Co-Chairman and Cecil Bond, Chief Financial Officer. There is little possibility that this dependence will decrease in the near term. As the Company’s operations expand, additional general management resources will be required. The Company may not be able to attract and retain additional qualified personnel and this would have a negative effect on the Company’s operations. The Company has entered into services agreements with Bryce Roxburgh, Yale Simpson and Cecil Bond and some of its other officers. The Company maintains no “key man” life insurance on any members of its management or directors.

Certain officers and directors may have conflicts of interest, which could have a negative effect on the Company’s operations. Certain of the directors and officers of the Company are also directors and/or officers and/or shareholders of other natural resource companies. While the Company is engaged in the business of exploiting mineral properties, such associations may give rise to conflicts of interest from time to time. The directors of the Company are required by law to act honestly and in good faith with a view to uphold the best interests of the Company and to disclose any interest that they may have in any project or opportunity of the Company. If a conflict of interest arises at a meeting of the board of directors, any director in a conflict must disclose his interest and abstain from voting on such matter. In determining whether or not the Company will participate in any project or opportunity, the directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at the time.

The Company could be deemed a passive foreign investment company which could have negative consequences for U.S. investors. The Company could be classified as a Passive Foreign Investment Company (“PFIC”) under the U.S. tax code. If the Company is declared a PFIC, then owners of the Company’s common shares who are U.S. taxpayers generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund (“QEF”) election or a mark-to-market election with respect to the Company’s common shares. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of the Company’s net capital gain and ordinary earnings for any year in which the Company is classified as a PFIC, whether or not the Company distributes any amounts to its shareholders.

The Company does not intend to pay dividends.The Company has not paid out any cash dividends to date and has no plans to do so in the immediate future. As a result, an investor’s return on investment will be solely determined by his or her ability to sell common shares in the secondary market.

Increased costs and compliance risks as a result of being a public company.Legal, accounting and other expenses associated with public company reporting requirements have increased significantly in the past few years. The Company anticipates that general and administrative costs associated with regulatory compliance will continue to increase with ongoing compliance requirements under theSarbanes-Oxley Act of 2002,as amended (“Sarbanes-Oxley”), the Dodd-Frank Wall Street Reform and Consumer Protection Act,as well as any new rules implemented by the SEC, Canadian Securities Administrators, the NYSE MKT and the TSX in the future. These rules and regulations have significantly increased the Company’s legal and financial compliance costs and made some activities more time-consuming and costly. There can be no assurance that the Company will continue to effectively meet all of the requirements of these regulations, includingSarbanes-Oxley Section 404and National Instrument 52-109 of the Canadian Securities Administrators(“NI 52-109”).Any failure to effectively implement internal controls, or to resolve difficulties encountered in their implementation, could harm the Company’s operating results, cause the Company to fail to meet reporting obligations or result in management being required to give a qualified assessment of the Company’s internal controls over financial reporting or the Company’s independent auditors providing an adverse opinion regarding management’s assessment. Any such result could cause investors to lose confidence in the Company’s reported financial information, which could have a material adverse effect on the trading price of the common shares. These rules and regulations have made it more difficult and more expensive for the Company to obtain director and officer liability insurance, and the Company may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage in the future. As a result, it may be more difficult for the Company to attract and retain qualified individuals to serve on its board of directors or as executive officers. If the Company fails to maintain the adequacy of its internal control over financial reporting, the Company’s ability to provide accurate financial statements and comply with the requirements of Sarbanes-Oxleyand/or NI 52-109could be impaired, which could cause the Company’s stock price to decrease.

Differences in United States and Canadian reporting of reserves and resources.The disclosure in this AIF, including the documents incorporated herein by reference, uses terms that comply with reporting standards in Canada. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be used by the Company pursuant to NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of the measured mineral resources, indicated mineral resources, or inferred mineral resources will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility studies or other economic studies, except in rare cases.

Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Further, the terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM Standards. These definitions differ from the definitions in SEC Industry Guide 7. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits or governmental authorizations must be filed with the appropriate governmental authority.

Accordingly, information contained in this AIF and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

U.S. investors may not be able to enforce their civil liabilities against the Company or its directors, controlling persons and officers. It may be difficult to bring and enforce suits against the Company in the United States. The Company is a corporation incorporated in British Columbia under theBusiness Corporations Act. A majority of the Company’s directors and officers are residents of Canada and other countries and all of the Company’s assets and its subsidiaries are located outside of the U.S. Consequently, it may be difficult for U.S. investors to effect service of process in the U.S. upon those directors or officers who are not residents of the U.S., or to realize in the U.S. upon judgments of U.S. courts predicated upon civil liabilities under U.S. securities laws. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or the Company predicated solely upon such civil liabilities under the United States Securities Act of 1933, as amended.

As a “foreign private issuer”, the Company is exempt from Section 14 proxy rules and Section 16 of theSecurities Exchange Act of 1934. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”). Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the U.S. Exchange Act pursuant to Rule 3a12-3 of the U.S. Exchange Act. Therefore, the Company is not required to file a Schedule 14A proxy statement in relation to the annual meeting of shareholders. The submission of proxy and annual meeting of shareholder information on Form 6-K may result in shareholders having less complete and timely information in connection with shareholder actions. The exemption from Section 16 rules regarding reports of beneficial ownership and purchases and sales of common shares by insiders and restrictions on insider trading in our securities may result in shareholders having less data and there being fewer restrictions on insiders’ activities in our securities.

PRINCIPAL PROJECT

CASPICHE

By an agreement with Minera Anglo American Chile Limitada and its affiliate Empresa Minera Mantos Blancos S.A. (together “Anglo American”) dated October 11, 2005 and subsequently amended, the Company acquired the right to review a number of properties in the Maricunga region of Chile. Under the terms of the agreement, the Company had the right to acquire a 100% interest in the properties by incurring aggregate expenditures of US$2,550,000 over five years including conducting 15,500m of drilling.

Having met the requirements to earn its interest in the properties, effective February 14, 2011 the Company exercised its option and acquired the properties subject to a 3% NSR from production from the property and the vendor’s buy back right by re-paying certain of the Company’s expenditures incurred on the property if the property is not put into production within 15 years of exercising the option. In addition, the Company will be required to pay a further 0.08% NSR from production pursuant to an agreement with a private entity. The Company is required to make an advance annual royalty payment of US$250,000 up until March 31, 2020 (US$500,000 paid to December 31, 2012) and thereafter US$1 million annually for the period March 31, 2021 to March 31, 2025 or until commencement of commercial production, should production commence prior to March 31, 2025, at which time the advance royalty will cease and NSR will be payable.