Exhibit 99(e)(1)

Statement of Executive Compensation

For the purposes of this Information Circular, the Company has six “Named Executive Officers”. They are its current and its former Chief Executive Officer, its current and its former Chief Financial Officer and two of the Company’s most highly compensated executive officers other than the CEO and CFO, who were serving as executive officers at December 31, 2006 and whose total salary and bonus amounted to Cdn$150,000 or more.

The following table provides information for our most recently completed financial years ended December 31, 2004, December 31, 2005 and December 31, 2006 regarding compensation paid to or earned by our Named Executive Officers.

Summary Compensation Table

| | | | Annual Compensation | | Long-Term Compensation | | | |

Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | Other Annual

Compensation

($) | | Securities

Under

Options

Granted (#) | | Shares or

Units Subject

to Resale

Restrictions | | LTIP

Payouts

($) | | All Other

Compensation

($) | |

Gerald A. Wolfe(1)

President and Chief Executive Officer | | 2006 | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | |

| | | | | | | | | | | | | | | | | |

H. Eric C. Peitz

Chief Financial Officer(2) | | 2006 | | $ | 83,333 | | Nil | | Nil | | 450,000 | | Nil | | Nil | | Nil | |

| | | | | | | | | | | | | | | | | |

Charles G. Preble(3)

Former President and Chief Executive Officer | | 2006 | | $ | 166,008 | | $ | 60,000 | | $ | 22,000 | | Nil | | Nil | | Nil | | Nil | |

| | 2005 | | $ | 138,300 | | Nil | | $ | 23,250 | | 100,000 | | Nil | | Nil | | Nil | |

| | 2004 | | $ | 92,400 | | Nil | | Nil | | 1,800,000 | | Nil | | Nil | | Nil | |

| | | | | | | | | | | | | | | | | |

Thomas J. Findley (4)

Former Chief Financial Officer | | 2006 | | $ | 98,012 | | $ | 75,000 | | Nil | | 225,000 | | Nil | | Nil | | Nil | |

| | 2005 | | $ | 135,712 | | Nil | | Nil | | 450,000 | | Nil | | Nil | | Nil | |

| | 2004 | | $ | 83,951 | | Nil | | Nil | | 750,000 | | Nil | | Nil | | Nil | |

| | | | | | | | | | | | | | | | | |

J. David Lowell(5)

Executive Chairman of the Board | | 2006 | | $ | 154,063 | | Nil | | $ | 20,000 | | Nil | | Nil | | Nil | | Nil | |

| | 2005 | | $ | 137,500 | | Nil | | $ | 23,250 | | 100,000 | | Nil | | Nil | | Nil | |

| | 2004 | | $ | 8,333 | | Nil | | Nil | | 500,000 | | Nil | | Nil | | Nil | |

| | | | | | | | | | | | | | | | | |

Angel Alvarez(6)

Vice President, Exploration | | 2006 | | $ | 149,985 | | $ | 50,000 | | Nil | | 100,000 | | Nil | | Nil | | Nil | |

| | 2005 | | $ | 128,760 | | Nil | | Nil | | 110,000 | | Nil | | Nil | | Nil | |

| | 2004 | | $ | 96,000 | | Nil | | Nil | | 240,000 | | Nil | | Nil | | Nil | |

(1) Mr. Wolfe was appointed as President and Chief Executive Officer and as a director of the Company effective January 15, 2007.

(2) Mr. Peitz was appointed as Chief Financial Officer of the Company effective August 1, 2006.

(3) Mr. Preble was appointed as President and Chief Executive Officer effective February 24, 2004 and he ceased as President and Chief Financial Officer effective December 31, 2006, but continued as a director of the Company until February 28, 2007. Mr. Preble’s salary amount for 2004 represents salary from the date of our incorporation on February 24, 2004 to December 31, 2004. See also “Compensation of Directors”.

(4) Mr. Findley was appointed as Chief Financial Officer effective February 24, 2004 and he ceased as Chief Financial Officer of the Company effective July 31, 2006. Mr. Findley’s salary amount for 2004 represents salary from the date of our incorporation on February 24, 2004 to December 31, 2004.

(5) Mr. Lowell was appointed as Chairman effective February 24, 2004 and Executive Chairman effective June 8, 2004. The Company entered into a consulting agreement with Mr. Lowell on December 1, 2004. See also “Compensation of Directors”.

(6) Mr. Alvarez was appointed as Vice President, Exploration of the Company effective November 24, 2004.

4

Stock Options

The following table provides details of stock options granted to the Named Executive Officers during the financial year ended December 31, 2006 pursuant to our share option plan (the “Share Option Plan”).

Option Grants During the Financial Year Ended December 31, 2006

Name | | Securities

Under Options

Granted (#)(1) | | % of Total Options

Granted in Fiscal

Year(2) | | Exercise or Base

Price ($/Security) | | Market Value of

Securities

Underlying

Options on the

Date of Grant

($/Security) | | Expiration Date | |

H. Eric C. Peitz

Chief Financial Officer | | 450,000 | | 26 | % | Cdn$ | 4.97 | | Cdn$ | 4.97 | | August 10, 2011 | |

Thomas J. Findley

Former Chief Financial Officer | | 225,000 | | 13 | % | Cdn$ | 5.40 | | Cdn$ | 5.40 | | Aug. 30, 2006 | |

Angel Alvarez

Vice President, Exploration | | 100,000 | | 5.8 | % | Cdn$ | 5.40 | | Cdn$ | 5.40 | | May 5, 2010 | |

(1) All stock options are exercisable to acquire common shares of the Company.

(2) Based on the total number of options granted pursuant to the Share Option Plan during the fiscal year ended December 31, 2006 of 1,721,500.

The following table provides details regarding stock options exercised by the Named Executive Officers during the financial year ended December 31, 2006 and year-end option values.

Aggregated Option Exercises During the Financial Year Ended December 31, 2006

and Year-End Option Values

| | Securities | | Aggregate

Value | | Unexercised Options at

December 31, 2006 | | Value of Unexercised in-the-

money Options at

December 31, 2006(1) | |

Name | | Acquired on

Exercise (#) | | Realized

(Cdn$) | | Exercisable

(#) | | Unexercisable

(#) | | Exercisable

(Cdn$) | | Unexercisable

(Cdn$) | |

Gerald A. Wolfe

Current President & Chief Executive Officer | | Nil | | Nil | | Nil | | Nil | | Nil | | Nil | |

Charles G. Preble

Former President & Chief Executive Officer | | Nil | | Nil | | 1,900,000 | | Nil | | $ | 4,442,640 | | Nil | |

H. Eric C. Peitz

Current Chief Financial Officer | | Nil | | Nil | | Nil | | 450,000 | | Nil | | Nil | |

| | | | | | | | | | | | | | |

5

| | Securities | | Aggregate

Value | | Unexercised Options at

December 31, 2006 | | Value of Unexercised in-the-

money Options at

December 31, 2006 (1) | |

Name | | Acquired on

Exercise (#) | | Realized

(Cdn$) | | Exercisable

(#) | | Unexercisable

(#) | | Exercisable

(Cdn$) | | Unexercisable

(Cdn$) | |

Thomas J. Findley

Former Chief Financial Officer | | 840,000 | | $ | 3,133,020 | | Nil | | Nil | | Nil | | .Nil | |

J. David Lowell

Executive Chairman | | Nil | | Nil | | 460,000 | | 140,000 | | $ | 1,076,000 | | $ | 329,000 | |

Angel Alvarez

Vice President, Exploration | | 188,000 | | $ | 846,283 | | 109,200 | | 152,800 | | $ | 209,837 | | $ | 172,704 | |

(1) Value calculated based on the closing price of our common shares on the Toronto Stock Exchange (the “TSX”) on December 29, 2006 of Cdn$3.98, less the exercise price of the in-the-money options. For this calculation, the exercise price of our US$1.40 stock options was converted to Canadian dollars based on the noon exchange rate on the last business day of 2006 being December 29, 2006 which results in Cdn$1.638:US$1.40. These options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the common shares on the date of exercise.

Employment Agreements

Agreements with Named Executive Officers (Former) - Charles G. Preble and Thomas J. Findley

We entered into employment agreements with Mr. Charles G. Preble, our former President and Chief Executive Officer of the Company, and Mr. Thomas J. Findley, our former Chief Financial Officer of the Company, each dated as of February 24, 2004. Pursuant to the terms of their employment agreements, each of Messrs. Preble and Findley were entitled to a severance of 36 months’ base salary plus benefits for the earlier of 36 months or until the executive obtains comparable benefits from another source to be paid upon: (a) termination of employment without cause, (b) termination or resignation of employment upon a change of control of the Company (as defined in the agreements), or (c) a material decrease in any duties, powers, rights, discretion, salary or benefits within 6 months after a change of control (each of (a), (b) and (c) herein, collectively referred to as “Termination”).

Mr. Preble’s employment agreement provided for a base salary, to be reviewed annually by the board of directors, plus bonus and benefits as determined, from time to time, by the board of directors and the Compensation Committee, respectively, as applicable. On May 5, 2005, a bonus equal to 50% of his base salary was approved for Mr. Preble. The bonus was contingent upon achieving certain goals and objectives set by management and agreed upon by the Company’s Compensation Committee. Mr. Preble retired as of December 31, 2006 and accordingly ceased as our President and Chief Executive Officer as of that date (“Termination Date”). Pursuant to the terms of his confirmation of retirement, the Company agreed to pay Mr. Preble an amount equal to 18 months of salary within 30 days of his Termination Date. Also commencing on the Termination Date, the Company agreed to pay Mr. Preble for a six month consulting contract with a monthly retainer of U$3,000 based upon an hourly rate of $150 per hour based upon 24 hours minimum per month. In addition, effective upon the Termination Date, all stock options held by Mr. Preble which had not yet vested as of that date immediately vested and all Mr. Preble’s stock options remain exercisable until the earlier of (i) the termination date of such options or (ii) June 30, 2008, being the date which is 18 months from his Termination Date. See “Statement of Executive Compensation” for further details.

6

Mr. Findley’s employment agreement provided for a base salary, to be reviewed annually by the board of directors, plus bonus and benefits as determined, from time to time, by the board of directors and the Compensation Committee, respectively, as applicable. On May 5, 2005, a bonus equal to 50% of his base salary was approved for Mr. Findley. The bonus was contingent upon achieving certain goals and objectives set by management and agreed upon by the Company’s Compensation Committee. Due to health reasons, Mr. Findley resigned as our Chief Financial Officer effective as of July 31, 2006 but, effective September 1, 2006, the Company agreed to pay Mr. Findley for a two month consulting contract with a monthly retainer of $2,000 based upon an hourly rate of $125 per hour based upon 16 hours minimum per month. Because Mr. Findley remained with the Company in the capacity of a consultant until October 31, 2006, the board of directors and the Compensation Committee elected to extend the termination date of his stock options to October 31, 2006. All stock options held by Mr. Findley which had not vested as of October 31, 2006 were cancelled on such date and were of no further force or effect.

Agreements with Named Executive Officers (Current) - Gerald A. Wolfe and H. Eric C. Peitz

We have entered into an employment agreement dated January 15, 2007 with Gerald A. Wolfe, our current President and Chief Executive Officer. Mr. Wolfe’s employment agreement provides for a base salary, to be reviewed annually by the Board of Directors, plus bonus and benefits as determined, from time to time, by the Board of Directors and the Compensation Committee, respectively, as applicable. Upon termination of the agreement by the Company without just cause or by Mr. Wolfe following a “Triggering Event” (as defined in the agreement), Mr. Wolfe is entitled to a severance of 12 months’ base salary plus $100,000 in lieu of any benefits, plus accrued but unused vacation. If at any time during the term of the agreement, there is a Change of Control (as defined in the agreement), and within 12 months of such Change of Control (i) the Company gives notice of its intention to terminate the employment of Mr. Wolfe for any reason other than just cause, or (ii) a Triggering Event occurs and within three months after the Triggering Event, Mr. Wolfe elects to terminate the agreement and his employment with the Company, then Mr. Wolfe will be entitled to receive a lump sum equal to 12 months’ base salary plus $100,000 in lieu of any benefits. With respect to stock options, all stock options held by Mr. Wolfe which have not yet vested as of the date of Termination shall immediately vest and all stock options shall then be exercisable until the earlier of (i) the termination date of such options or (ii) the date which is 12 months from the date of Termination, notwithstanding the provisions of any agreement or plan. See “Statement of Executive Compensation”.

We have entered into an employment agreement dated August 1, 2006 with H. Eric C. Peitz, our current Chief Financial Officer. Mr. Peitz’ employment agreement provides for a base salary, to be reviewed annually by the board of directors, plus bonus and benefits as determined, from time to time, by the Board of Directors and the Compensation Committee, respectively, as applicable. Mr. Peitz is entitled to a severance of 36 months’ base salary plus benefits for the earlier of 36 months or until the executive obtains comparable benefits from another source to be paid upon: (a) termination of employment without cause, (b) termination or resignation of employment upon a Change of Control (as defined in the agreement) of the Company, or (c) a material decrease in any duties, powers, rights, discretion, salary or benefits within 6 months after a change of control. With respect to stock options, in the event of a Change of Control, all stock options held by Mr. Peitz which have not yet vested as of the date of termination shall immediately vest and all stock options shall then be exercisable until the earlier of (i) the termination date of such options or (ii) the date which is 36 months from the date of termination, notwithstanding the provisions of any agreement or plan. In the event that termination occurs under circumstances other than a Change of Control, then all stock options held by Mr. Peitz which are vested as of the date of termination shall remain exercisable until the earlier of (i) the termination date of such options or (ii) the date which is 36 months from the date of termination, notwithstanding the provisions of any agreement or plan and any stock options which are not vested in the date of termination shall be cancelled on such date and be of no further force or effect. See “Statement of Executive Compensation”.

7

Other Agreements with Executive Officers - Thomas G. White

Thomas G. White, the Company’s Vice President of Project Development, is not a “Named Executive Officer” by virtue of the fact that he earned less than Cdn$150,000 in 2006. However, pursuant to an Executive Employment Agreement dated May 22, 2006 between the Company and Mr. White, Mr. White earns a base salary of $17,000 per month ($204,000 annually) plus bonus and benefits as determined, from time to time, by the Board of Directors. The agreement is for a term of two years. If a Change of Control (as defined in the agreement) occurs during Mr. White’s employment, the agreement will immediately terminate and Mr. White will be paid the remainder of his base salary for the remainder of the term of the agreement prorated as of the date of the Change of Control. Any unexercised stock options held by Mr. White shall be exercisable as of the date of the Change of Control, but not thereafter. Under his employment agreement, Mr. White was paid $102,000 in 2006.

Other than as described above, we and our subsidiaries have no compensatory plans or arrangements with respect to the Named Executive Officers that result or will result in a Named Executive Officer being entitled to receive more than Cdn$100,000 from us or our subsidiaries in the event of the resignation, retirement or any other termination of employment of such officers’ employment with the Company or our subsidiaries, a change of control of the Company or our subsidiaries or a change in the Named Executive Officers’ responsibilities following a change of control.

Compensation of Directors

Standard Compensation Arrangements

Each of our directors receives an annual retainer fee of $20,000. Currently, Peru Copper has the following four committees:

Audit Committee

Compensation Committee

Corporate Governance & Nominating Committee

Environmental and Technical Committee

Each committee chairman receives an annual retainer of $8,000, with the exception of the Audit Committee chairman who receives an annual retainer of $12,000. Committee members receive an annual retainer of $2,000, with the exception of Audit Committee members who receive an annual retainer of $4,000. All director and committee retainer fees are paid quarterly.

For the financial year ended December 31, 2006, an aggregate of $236,000 was earned by the directors pursuant to these arrangements and the Company granted stock options to the directors to purchase an aggregate of 300,000 common shares.

In addition, all of our directors are granted stock options to acquire 300,000 common shares of the Company upon their initial election to the Board, in connection with their services on the Board, which options vest in 20% increments beginning six months after issuance.

Other Arrangements

None of our directors were compensated in their capacity as a director by the Company or our subsidiaries during the financial year ended December 31, 2006 pursuant to any other arrangement or in lieu of any standard compensation arrangement other than:

(a) a one-time special payment was authorized by the Company in November 2006 in the amount of $25,000 to Miguel Grau M. as consideration for the valuable work performed by him on behalf of the Company in connection with the Company’s negotiations with the Peruvian Government and related matters; and

8

(b) Dr. Thomas O’Neil was paid $3,600 by the Company in 2006 for consulting services in connection with the Company’s pre-feasibility study.

Compensation for Services

On December 1, 2004, we entered into consulting services agreements with each of Lowell Mineral Exploration, LLC (of which J. David Lowell is Manager), Catherine McLeod-Seltzer and Pathway Capital Ltd. (of which David E. De Witt is President and a director). Ms. McLeod-Seltzer’s agreement provides for a monthly consulting fee of $2,500 and reimbursement of expenses in the amount of Cdn$500 per month. For the year ended December 31, 2006, a total of $30,000 in consulting fees and Cdn$6,000 for reimbursement of expenses was paid to Ms. McLeod-Seltzer pursuant to this agreement. Mr. Lowell’s agreement provides for an annual consulting fee of $100,000 and $3,000 per month reimbursement for expenses. Effective April 1, 2005, this annual consulting fee was increased to $150,000. For the year ended December 31, 2006, a total of $154,063 in consulting fees and $36,000 for reimbursement of expenses was paid to Mr. Lowell pursuant to this agreement. Pathway Capital Ltd.’s agreement provides for a monthly consulting fee of Cdn$6,000 and can be terminated by either party with thirty (30) days written notice. For the year ended December 31, 2006, a total of Cdn$72,000 was paid to Pathway Capital Ltd. pursuant to this agreement.

For the year ended December 31, 2006, we paid $8,674 for legal services to a law firm in which Miguel Grau, a director of the Company, is a partner.

Directors’ and Officers’ Liability Insurance

We have purchased, for the benefit of the Company, our subsidiaries and our directors and officers, insurance against liability incurred by the directors or officers in their capacity as directors and/or officers of the Company or any subsidiary, in an amount commensurate to that held by other issuers of comparable size and maturity to Peru Copper. The current liability limit under the Company’s policy, inclusive of costs of defense, is Cdn$10,000,000.

The Company’s original policy contract period was from June 10, 2005 to June 10, 2006 and, for the first year of that contract, the Company paid a premium in the amount of Cdn$139,750. Effective July 4, 2006, the Company changed its policy carrier and entered into a new directors and officers liability insurance policy. The policy contract period for the new policy is July 4, 2006 to July 4, 2007 and, for the first year of the new contract, the Company paid a premium in the amount of Cdn$200,000. Retentions under the new policy are: (a) for each Claim in respect of a loss resulting from a “Wrongful Act” which a director/officer becomes legally obligated to pay, other than a Securities Claim, the loss for which Peru Copper has granted indemnification to such director/officer - Cdn$250,000; and (b) for each Claim in respect of a loss resulting from a “Wrongful Act” which a director/officer becomes legally obligated to pay arising from a Securities Claim, the loss for which Peru Copper has granted indemnification to such director/officer or, in respect of a loss resulting from a “Wrongful Act” which Peru Copper becomes legally obligated to pay on account of any Securities Claim first made against it - Cdn$500,000.

Report on Executive Compensation

When determining the compensation of our executive officers, including the Named Executive Officers, our Compensation Committee considers the objectives of: (i) recruiting and retaining the executives critical to the success of the Company and the enhancement of shareholder value; (ii) providing fair and competitive compensation; (iii) balancing the interests of management and our shareholders;

9

(iv) rewarding performance, both on an individual basis and with respect to the business in general. In order to achieve these objectives, the compensation paid to executive officers consists of the following three components:

(a) base salary;

(b) bonus; and

(c) long-term incentive in the form of stock options granted in accordance with the Share Option Plan.

Base Salary

The base salary of each particular executive officer is determined by an assessment by our Board of such executive’s performance, a consideration of competitive compensation levels in companies similar to us and a review of our performance as a whole and the role such executive officer played in such corporate performance.

Bonus

Bonuses are performance based short-term financial incentives. Bonuses are granted at the discretion of the Compensation Committee and the Board.

Long-Term Incentive

We provide long-term incentive by granting options to executive officers through our Share Option Plan. The options granted permit executives to acquire common shares at an exercise price equal to the closing market price of such shares under option on the trading day immediately preceding the date on which the option was granted. The objective of granting options is to encourage executives to acquire an ownership interest in our Company over a period of time, which acts as a financial incentive for such executive to consider the long-term interests of the Company and its shareholders.

Compensation of Chief Executive Officer

The components of the Chief Executive Officer’s compensation are the same as those which apply to our other senior executive officers, namely base salary, bonus and long-term incentives in the form of stock options. These components were set forth in our employment agreement with Charles C. Preble, our former President and Chief Executive Officer, who ceased in that capacity effective December 31, 2006. For the year ended December 31, 2006, Mr. Preble earned a salary of $166,008 and was paid a bonus of $60,000. The Chairman of our Compensation Committee presents recommendations of the Compensation Committee to the Board with respect to the Chief Executive Officer’s compensation. In setting the Chief Executive Officer’s salary, the Compensation Committee reviews salaries paid to our other senior officers, salaries paid to other chief executive officers in the industry and the Chief Executive Officer’s impact on the achievement of our Company’s objectives for the previous financial year. During the financial year ended December 31, 2006, no options were granted to Mr. Preble under our Share Option Plan. See “Option Grants During the Financial Year Ended December 31, 2006”.

The foregoing report has been submitted by: | George Ireland (Chairman) |

| Thomas J. O’Neil |

| Miguel Grau M. |

Performance Graph

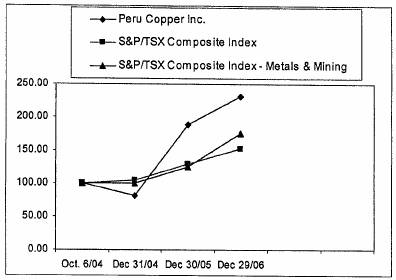

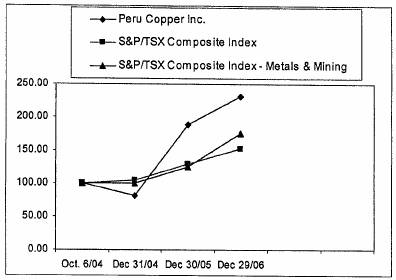

The following graph compares the yearly percentage change in the cumulative total shareholder return for Cdn$100 invested in common shares of the Company on October 6, 2004 (the date on which the Company’s common shares commenced trading on the TSX) against the cumulative total shareholder return of the S&P/TSX Composite Index and the S&P/TSX Composite Index - Metals & Mining for the period from October 6, 2004 to December 31, 2004 and the fiscal years ended December 31, 2005 and December 31, 2006, assuming the reinvestment of all dividends.

10

| | Oct. 6/04 | | Dec. 31/04 | | Dec. 30/05 | | Dec. 31/06 | |

Peru Copper Inc. | | 100.00 | | 81.40 | | 187.79 | | 231.40 | |

S&P/TSX Composite Index | | 100.00 | | 104.69 | | 129.94 | | 152.37 | |

S&P/TSX Composite Index - Metals & Mining | | 100.00 | | 100.04 | | 124.87 | | 175.28 | |

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides details of compensation plans under which our equity securities are authorized for issuance as of the financial year ended December 31, 2006.

Plan Category | | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights(1) | | Weighted-average price

of outstanding options,

warrants and rights(3)

(Cdn$) | | Number of securities

remaining available for future

issuance under equity

compensation plans(2)(4) | |

Equity compensation plans approved by securityholders | | 7,040,260 | (2) | $ | 2.36 | | 561,317 | |

Equity compensation plans not approved by securityholders | | N/A | | N/A | | N/A | |

Total | | 7,040,260 | | $ | 2.36 | | 561,317 | |

(1) Represents common shares issuable upon the exercise of stock options.

(2) 100,000 options were cancelled during the year ended December 31, 2004 following the resignation of one of our advisory committee members, which options became available for grant again under our Share Option Plan. In additional, an aggregate of 359,500 options were cancelled during the year ended December 31, 2005 following the resignation of one of our directors and various Peruvian employees, which options became available for grant again under our Share Option Plan. In addition, a further 840,460 options were cancelled during the year ended December 31, 2006 following the resignation of one of our directors, the resignation of one of our officers and the resignation of various Peruvian employees, which options became available for grant again under our Share Option Plan.

(3) For this calculation, the exercise price of our US$1.40 stock options was converted to Canadian dollars based on an average exchange rate for the period of Cdn$1.17:US$1.00.

(4) Based on the maximum number of common shares reserved for issuance upon the exercise of stock options under our Share Option Plan of 8,955,357.

11

Security Based Compensation Arrangements

Share Option Plan

Our current Share Option Plan, effective as of February 24, 2004, received TSX approval and deemed disinterested shareholder approval through the completion of our initial public offering in October 2004.

The Share Option Plan is designed to advance the interests of the Company by encouraging eligible participants, being employees, officers, directors and consultants, to have equity participation in our Company through the acquisition of common shares. The aggregate maximum number of common shares that are issuable pursuant to the Share Option Plan is currently 8,955,357, representing approximately 7.5% of our current issued and outstanding Common Shares. We currently have an aggregate of 7,540,260 options issued, representing approximately 6.3% of our issued and outstanding common shares, and there remains available 61,317 options available for grant, representing approximately 0.05% of our issued and outstanding common shares. Under the terms of the Share Option Plan, the maximum number of common shares which may be reserved for issuance to any one person is 5% of our issued and outstanding common shares, the maximum number of common shares which may be reserved for issuance to any one insider of the Company, and his or her associates, within a one-year period is 5% of our issued and outstanding shares and the maximum number of common shares which may be reserved for issuance to insiders as a group within a one-year period is 10% of our issued and outstanding common shares. All options granted under our Share Option Plan have an exercise price of not less than the closing price of the common shares on the TSX on the trading day on which the option is granted, and are exercisable for a period not to exceed ten years. The vesting of options is at the discretion of our Board, and the standard vesting provisions governing our outstanding stock options is equal 20% increments every six months following the date of issuance. All options are non-transferable and non-assignable. Under the terms of our Share Option Plan, in the event of the termination for cause or otherwise (including retirement) of an eligible participant under our Share Option Plan, each option held ceases to be exercisable within a period of 30 days after termination, as the case may be, or such longer period as our Board may determine, provided that no option shall remain outstanding for longer than 36 months following termination (other than in the case of a non-executive director, who has 12 months following termination) or the expiry date of such option. Upon death of an eligible participant, the legal representative of such participant is entitled exercise his or her options within a period after the date of death as determined by our Board, provided that no option will remain exercisable for longer than 12 months following death or the expiry date of the options. In all cases, unless the Board determines otherwise, only that portion of options that has vested by termination are exercisable. Our Share Option Plan does not provide the Company with any ability or provision to transform a stock option into a stock appreciation right involving an issuance of common shares. The Board may amend, suspend or terminate the Share Option Plan or any portion of the plan at any time in accordance with applicable legislation, and subject to any required regulatory or shareholder approval, provided that, subject provisions outlined for certain corporate events, no amendment, suspension or termination will alter or impair an eligible participant’s previously granted options or rights under the Share Option Plan without such participant’s consent.

Please refer to “Particulars of Matters to be Acted Upon - Approval of Amendments to Share Option Plan” for information concerning action to be taken at the Meeting in connection with certain proposed amendments to be made to our Share Option Plan to bring it into compliance with current Toronto Stock Exchange policies and guidelines. In addition, Management is requesting shareholder approval to its proposal to increase the aggregate maximum number of common shares issuable pursuant to the Share Option Plan by 2,978,595 from 8,955,357 to 11,933,952, representing approximately 10% of our current issued and outstanding common shares.

12