Exhibit 99.1

PERU COPPER INC.

RENEWAL ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2005

March 31, 2006

475 West Georgia Street, Suite 920

Vancouver, British Columbia

V6B 4M9

PERU COPPER INC.

RENEWAL ANNUAL INFORMATION FORM FOR THE

FISCAL YEAR ENDED DECEMBER 31, 2005

TABLE OF CONTENTS

| | |

| | | PAGE |

ITEM I - INTRODUCTORY NOTES | | 1 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | | 1 |

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION | | 1 |

ITEM 2 - CORPORATE STRUCTURE | | 2 |

ITEM 3 - GENERAL DEVELOPMENT OF THE BUSINESS OF THE COMPANY | | 2 |

OVERVIEWOF BUSINESS | | 2 |

THREE YEAR HISTORY | | 3 |

ITEM 4 - NARRATIVE DESCRIPTION OF THE BUSINESS | | 6 |

PRINCIPAL PRODUCTS | | 6 |

SPECIALIZED SKILLAND KNOWLEDGE | | 6 |

COMPETITIVE CONDITIONS | | 6 |

ECONOMIC DEPENDENCE | | 6 |

EMPLOYEES | | 6 |

FOREIGN OPERATIONS | | 6 |

REORGANIZATIONS | | 11 |

RISKSOFTHE BUSINESS | | 11 |

TECHNICAL INFORMATION | | 23 |

MINERAL PROJECTS | | 24 |

ITEM 5 - DIVIDENDS | | 31 |

ITEM 6 - DESCRIPTION OF CAPITAL STRUCTURE | | 32 |

ITEM 7 - MARKET FOR SECURITIES | | 32 |

ITEM 8 - DIRECTORS AND OFFICERS | | 33 |

CONFLICTSOF INTEREST | | 37 |

ITEM 9 - PROMOTERS | | 38 |

ITEM 10 - LEGAL PROCEEDINGS | | 38 |

ITEM 11 - INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | 39 |

ITEM 12 - TRANSFER AGENTS AND REGISTRARS | | 41 |

ITEM 13 - MATERIAL CONTRACTS | | 41 |

ITEM 14 - INTERESTS OF EXPERTS | | 44 |

ITEM 15 - AUDIT COMMITTEE | | 44 |

ITEM 16 - ADDITIONAL INFORMATION | | 47 |

SCHEDULE “A” - CHARTER OF THE AUDIT COMMITTEE | | 48 |

ITEM 1

INTRODUCTORY NOTES

Cautionary Note Regarding Forward-Looking Statements

Except for statements of historical fact relating to Peru Copper Inc., certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as “plan,” “expect,” “project,” “intend,” “believe,” “anticipate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Such forward-looking statements, including but not limited to the price of copper, the timing of completion of exploration activities and the determination and amount of estimated mineral resources and reserves are based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Such factors include, among other things, risks related to the exploration and potential development of the Toromocho Project, international operations, the actual results of current exploration activities, conclusions of economic evaluations, changes in project parameters as plans continue to be refined, future prices of copper and silver molybdenum and gold, the uncertainties involved in interpreting historical drilling results and other geological data, fluctuating metal prices, uncertainties relating to the availability and costs of financing needed in the future and other factors described in this document under the heading “Risks to the Business”. Although we have attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. We undertake no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change. The reader is cautioned not to place undue reliance on forward-looking statements.

Material factors included in this document include our continued compliance with regulatory requirements, the sufficiency of current working capital, the estimated cost and availability of funding for the continued exploration of the Company’s exploration property. Many factors could cause the actual results, performance or achievement of the Company’s to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements.

Currency Presentation And Exchange Rate Information

This annual information form contains references to both Canadian dollars and US dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in Canadian dollars and United States dollars are referred to herein as “US dollars” or “US$”.

The closing, high, low and average exchange rates for the Canadian dollar in terms of US dollars for the three years ended December 31, 2005, 2004 and 2003, as reported by the Bank of Canada, were as follows:

| | | | | | | | |

| | | Year Ended December 31 |

| | | 2005 | | 2004 | | 2003 |

Closing | | 0.8577 | | $ | 0.8333 | | $ | 0.7751 |

High | | 0.8751 | | | 0.8547 | | | 0.7751 |

Low | | 0.7853 | | | 0.7194 | | | 0.6369 |

Average(1) | | 0.8254 | | | 0.7692 | | | 0.7142 |

| (1) | Calculated as an average of the daily noon rates for the period. |

On March 30, 2006, the Bank of Canada noon rate of exchange was US$1.00 = Cdn$1.16 or Cdn$1.00 = US$0.86.

- 1 -

ITEM 2

CORPORATE STRUCTURE

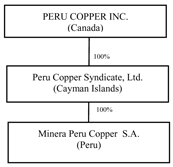

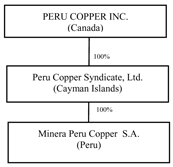

Peru Copper Inc. was incorporated on February 24, 2004 under theCanada Business Corporations Act. We amended our Articles of Incorporation on March 16, 2004 to delete certain restrictions on the transfer of our shares. We are a holding company, and conduct our business through our wholly-owned subsidiary, Peru Copper Syndicate, Ltd., a Cayman Islands company which beneficially owns 100% of Minera Peru Copper S.A., a Peruvian company. Our registered office is located at Suite 2100, Scotia Plaza, 40 King Street West, Toronto, Ontario, Canada M5H 3C2 and our head office is located at Suite 920, 475 West Georgia Street, Vancouver, British Columbia, Canada V6B 4M9.

The following chart illustrates our corporate structure, listing each of our subsidiaries, together with the jurisdiction of incorporation of each subsidiary and the percentage of voting securities beneficially owned or over which control or direction is exercised by us.

ITEM 3

GENERAL DEVELOPMENT OF THE BUSINESS OF THE COMPANY

Overview of Business

We are a Canadian exploration company in the business of identifying and acquiring potentially mineable deposits of copper in Peru. We currently hold exploration rights and an option to acquire development rights to a deposit of porphyry copper situated in Morococha, an historical mining district in central Peru called the Toromocho Project, and are conducting exploration on this project. Our right to develop the Toromocho Project is dependent on our exercise of an option (the “Toromocho Option”) granted to us in an option agreement (the “Toromocho Option Agreement”) entered into in 2003 with Empresa Minera del Centro del Peru S.A., a Peruvian state-owned mining company, also known as “Centromin”. The Toromocho Option Agreement gives us the right to acquire the mineral concessions and related assets held by Centromin in the Toromocho Project, including rights of use, and easements, buildings, a license for the use of water, and use of historical information regarding the mineral deposit. See “Three Year History” – “Toromocho Project” and “Material Contracts”.

We have retained UBS Investment Bank as our financial advisor to assist us in evaluating strategic alternatives to maximize shareholder value from the Toromocho Project. Strategic alternatives may include a sale of a portion of the project to a strategic partner to assist in the development of the Toromocho Project, a sale of the project or development of the Toromocho Project by the Company. See “Three Year History – UBS Retained.”

- 2 -

Three Year History

Toromocho Project

In 1999, J. David Lowell, our Executive Chairman and one of our founders, began studying potential mineable deposits of copper ore reserves in Equador, Peru and Argentina. Through this process, Mr. Lowell determined that Centromin was the owner of certain lands which appeared to include interesting potential targets for exploration. In 2002, Mr. Lowell, together with Catherine McLeod-Seltzer, Luis Baertl and, later, A. Geoffrey Loudon and David E. De Witt, began to study prospective deposits held by Centromin, several of which were considered before selecting the Toromocho mineral deposit. In April 2003, the group formed Peru Copper Syndicate, Ltd. for the purpose of making a bid for the Toromocho mineral concessions, which were being privatized by the Peruvian Government. In June 2003, through our wholly-owned subsidiary Peru Copper Syndicate, we successfully bid for the Toromocho mineral concessions.

Significant Arrangements with Third Parties

On June 11, 2003, following our successful bid, Minera Peru Copper S.A. entered into the Toromocho Option Agreement with Centromin, pursuant to which Centromin granted us the option to acquire its interest in the mining concessions and related assets of the Toromocho Project. See “Material Contracts”. Subsequently, we entered into two addendums to the Toromocho Option Agreement with Centromin, one on November 12, 2003 (the “First Addendum”) authorizing us to sign the MPCS Assignment Agreement and the other on August 26, 2004 (the “Second Addendum”) amending the terms of the Toromocho Option Agreement and the Toromocho Transfer Agreement. See “Material Contracts”. The Toromocho Option has an initial one-year term with four possible annual extensions, expiring on June 11, 2008. On May 25, 2005, we provided Centromin with notice to extend the agreement for a third year.

Sociedad Minera Corona S.A., also known as “Corona”, is a significant holder of mineral concessions and surface rights within the Morococha mining district. In order to ensure that we own all necessary mineral rights to develop the Toromocho Project, we have agreed to grant each other rights to acquire to certain mineral concessions held by the other party (the “Corona Transfer Agreement”). In our case, we have a right to purchase the mineral concessions held by Corona that are within the boundary of the Independent Mineral Consultant pit and, in return, we have granted Corona the right to acquire other concessions that will be acquired by us upon exercise of the Toromocho Option. See “Mineral Projects” and “Material Contracts”.

On November 19, 2003, Minera Peru Copper entered into an assignment agreement (the “MPCS Assignment Agreement”) with Corona pursuant to which Minera Peru Copper granted Corona an option to purchase the mineral concessions comprising the Buenaventura area in Morococha totalling 36.1509 hectares (the “Assigned Area”). We do not consider the mineral concessions in the Assigned Area as necessary in order to carry out the exploration and development of the Toromocho Project. See “Material Contracts”.

Project Drilling History

Prior to our involvement in the Toromocho Project, from 1966 to 1976 Cerro de Pasco Corporation, a United States mining company which owned a majority of the mineral concessions contained within the Cerro de Pasco mining district prior to their being nationalized in 1974, and Centromin conducted a total of 42,394 metres of diamond drilling on the deposit. From 1976 to 2002, Centromin did not conduct any exploration or development activities on the Toromocho Project.

We are currently in the exploration phase of the Toromocho Project. During 2003 and 2004, we conducted a diamond drilling program in order to confirm historical drilling results and to identify and delineate additional mineralization. During 2005 and 2006, our exploration program includes analysis of drilling completed in 2004 and additional drilling to confirm previous and historical drilling results and to identify additional mineralization in the Northeastern area of the Project. Approximately 88,108 meters of drilling was completed in 2004 and 2005. We completed a pre-feasibility study in February 2006, which was carried out by SNC-Lavalin Chile S.A. Our drilling activities for 2006 includes limited additional drilling. See “Business - General” and “Toromocho Project -

- 3 -

Proposed Exploration and Development Program.” During our exploration phase, we are also engaged in metallurgical testing as well as conducting studies to identify adequate water sources, and tailings pond sites to support mining operations. Based upon a preliminary evaluation, it appears that there are adequate sources of water and tailings pond sites for our development activities. We are studying the socio-economic impact of the Toromocho Project on the region and have recently hired a consulting firm to conduct more in-depth studies.

Private Placements and Share Exchange

On March 18, 2004, we completed a brokered treasury private placement of 8,571,429 units at US$1.40 per unit for gross proceeds of approximately US$12,000,000, to fund our Phase I exploration work program and general corporate expenses. Each unit consisted of one non-interest bearing, unsecured convertible note and one-half of one special warrant of Peru Copper. Upon completion of our initial public offering, each note was automatically converted into 1.1 common shares (for an aggregate of 9,428,570 common shares) and each whole special warrant was automatically exercised for 1.1 warrants (for an aggregate of 4,714,284 warrants). Each warrant is exercisable by the holder thereof to purchase one common share at a price of US$2.00 per share at any time before 5:00 p.m. (Toronto time) on March 18, 2006, pursuant to the terms of our warrant indenture with Computershare Trust Company of Canada dated March 18, 2004, as supplemented September 21, 2004 (the “Warrant Indenture”). See “Material Contracts”.

Concurrently with the completion of our March 18, 2004 private placement described above, we entered into a shareholders’ agreement with certain shareholders of Peru Copper Syndicate Ltd. pursuant to which such shareholders agreed to effect a share exchange as a result of which Peru Copper Syndicate would become our wholly-owned subsidiary. The share exchange was completed on April 30, 2004, and the shareholder’s agreement was terminated. Pursuant to the share exchange, certain shareholders of Peru Copper Syndicate exchanged all of their common shares of Peru Copper Syndicate for 46,999,999 common shares and 3,000,000 unsecured convertible notes of Peru Copper, as a result of which Peru Copper Syndicate became our wholly-owned subsidiary. The notes, which consisted of identical terms to those issued in the treasury private placement, were then sold by such shareholders pursuant to a secondary private placement. These notes were also automatically converted into 1.1 common shares (for an aggregate of 3,300,000 common shares) of Peru Copper upon completion of our initial public offering.

Initial Public Offering and TSX Listing

In October 2004, we completed an initial public offering of 34,298,750 units at $1.65 per unit for gross proceeds of approximately $56.6 million (which included the exercise of the underwriters’ over-allotment option) to fund further exploration of the Toromocho Project, potential land acquisitions and general corporate purposes. Each unit consisted of one common share and one-half of one common share purchase warrant of Peru Copper, with each whole warrant being exercisable to purchase one common share at a price of US$2.00 per share at anytime before 5:00 p.m. (Toronto time) on March 18, 2006, pursuant to the terms of the Warrant Indenture. The units were issued pursuant to the terms of an underwriting agreement (the “Underwriting Agreement”) dated September 20, 2004 between Peru Copper and BMO Nesbitt Burns Inc., GMP Securities Ltd., Haywood Securities Inc., National Bank Financial Inc., Canaccord Capital Corporation, Salman Partners Inc. and Sprott Securities Inc. See “Material Contracts”.

Concurrently with completing our initial public offering, we applied to the Toronto Stock Exchange (the “TSX”) for a listing of our common shares and warrants. Our common shares and warrants commenced trading on the TSX upon completion of our initial public offering on October 6, 2004.

On March 18, 2006, the common share purchase warrants issued in October 2004 expired. A total of 21,855,575 warrants were exercised, resulting in cash proceeds to the Company in the amount of US$43,711,150.

- 4 -

U.S. Registration Statement and AMEX Listing

In December 2004, we filed a United States registration statement, as amended February 25, 2005 and March 22, 2005, under theSecurities Act of 1933, to register our common shares and warrants for resale in the United States pursuant to the terms of a registration rights agreement dated October 6, 2004 entered into between Peru Copper and BMO Nesbitt Burns Inc. See “Material Contracts”. The registration statement was declared effective by the Securities Exchange Commission on April 15, 2005, and our common shares and warrants were listed and posted for trading on the American Stock Exchange (the “AMEX”) on April 19, 2005.

Sociedad Minera Austria Duvaz S.a.c.

On May 9, 2005, we entered into purchase agreements whereby we can acquire up to approximately $9.6 million in outstanding bank debt of Sociedad Minera Austria Duvaz S.A.C. (“Austria Duvaz”) from three lender banks in Peru. Austria Duvaz owns a mining concession and surface rights adjacent to the Toromocho Project and operates a small underground mine in the Morococha area. We have entered into agreements under which we are obligated to pay approximately $3.1 million for the acquisition of the debt. As of December 31, 2005, we have paid or accrued $1.3 million relating to the acquisition of this debt.The majority of the remaining payments of $1.8 million are contingent upon certain judicial and bankruptcy proceedings in Peru. See “Legal Proceedings”.

Updated Mineral Resource Estimate

On October 5, 2005, we announced an updated mineral resource estimate for the Toromocho Project prepared by Independent Mining Consultants Inc. (“IMC”).

UBS Retained

On November 7, 2005, we announced that we retained UBS Investment Bank as our financial advisor, to assist us in evaluating strategic alternatives to maximize shareholder value from the Toromocho Project. Strategic alternatives may include a sale of a portion of the project to a strategic partner to assist in the development of the Toromocho Project, a sale of the Project, or a development of the Toromocho Project by Peru Copper itself.

Lima Stock Exchange Listing

Effective January 16, 2006, our common shares were listed and posted for trading on the venture capital segment of the Lima Stock Exchange under the symbol “CUP”.

Completion of Pre-Feasibility Study

On February 9, 2006, we announced the completion of a pre-feasibility study on the Toromocho Project. The pre-feasibility study was conducted by SNC-Lavalin Chile S.A. See “Narrative Description of the Business – Mineral Projects”.

Appointment of New Director

On February 6, 2006, we announced that Dr. Miguel Grau was elected as a director of the Company by our board of directors, subject to regulatory approval. Mr. Alan Hill resigned his position as a director of the Company effective February 6, 2006, due to personal reasons. Mr. Hill had served as a director of the Company since May 2004.

New Mineral Reserve Estimate

New mineral reserve and resource estimates were announced in a press release on March 6, 2006 and an updated Technical Report pursuant to Canada’s National Instrument 43-101 was filed on SEDAR on March 27, 2006.

- 5 -

ITEM 4

NARRATIVE DESCRIPTION OF THE BUSINESS

We are engaged in the exploration and acquisition of rights to potential mineable copper.

Principal Products

Our principal product is copper.

Specialized Skill and Knowledge

The success of our business depends, in part, on our ability to attract management and personnel with specialized skills and knowledge in the mining industry. Our current management team and other contributors to our business possess experience in significant years and within the mining industry, as well as with the finance industry.

Competitive Conditions

The mineral exploration and mining business is a competitive business. We compete with numerous other companies and individuals in the search for and the acquisition of attractive mineral properties. Our ability to acquire mineral properties in the future will depend not only on our ability to develop our present property, but also on our ability to select and acquire suitable producing properties or prospects for mineral exploration or development.

Economic Dependence

We are substantially dependent on the Toromocho Option Agreement with Centromin and in the event that we are not able to satisfy the conditions necessary in order to exercise the Toromocho Option, we may lose our option to acquire development rights to the Toromocho Project and monies spent on the Toromocho Project. See “Material Contracts” and “Risks of the Business”.

Employees

As at December 31, 2005, the Company had 58 employees, of which 4 were in a management capacity, 25 were in an administrative capacity, and 29 were in a technical capacity. We had one employee in Canada and 57 in Peru.

Foreign Operations

We are solely dependent upon foreign operations due to the fact that our one exploration project is located in Peru.

Peru

Peru is a democratic republic governed by an elected government headed by a president. Despite a history of political instability under both civilian and military governments, Peru has become a leading country for mining activities in South America. No special taxes or registration requirements are imposed on foreign-owned companies and foreign investment in Peru is treated as equal to domestic capital.

Peru has a developed mining infrastructure, a large pool of skilled technical and professional personnel and an established legal system. Legislation allows for full repatriation of capital and profits from Peru and the country’s mining legislation offers access to mining concessions under an efficient registration system.

- 6 -

Peru has suffered and continues to suffer civil unrest resulting, in part, from high levels of unemployment and high expectations of an improvement in living standards. The Toromocho Project is situated in an historical mining district, an area which has not experienced any significant civil unrest to date. See “Risks of the Business”.

Current Government

Currently, Peru has a minority government led by President Alejandro Toledo of the Peru Posible party. President Toledo was elected to the presidency in June 2001 for a five-year term. Peru is currently divided into 25 regions plus Metropolitan Lima, with each regional government comprising a president, vice president and council. Presidential elections are scheduled to be held on April 9, 2006.

Mining in Peru

Peru is the world’s sixth-largest producer of gold and copper and the second-largest producer of silver. It also ranks high in output of zinc and lead. Minerals are traditionally the most important source of export revenue, averaging just under 50% of total Peruvian export earnings in 1998-2003. The mining sector has also consistently been the fastest growing sector in recent years due to increased exploration and development expenditures and the start-up of several new mines.

Peru has 15% of the world’s copper reserves, and production has increased since the mid-1990s, following heavy investment in the sector. Growth in export earnings slowed after 1997 as plunging mineral prices depressed revenue, but output has increased every year since 1998 and investment in the sector is still firm.

In 2003, Peru produced 625,000 tonnes of copper and achieved export earnings of US$1.26 billion. Strong growth in the mining sector is expected to be sustained by investment in new operations and rising gold and copper prices.

Peruvian Mining Laws

The Toromocho Project is subject to various Peruvian mining laws, regulation and procedures.

Mining activities in Peru are subject to the provisions of the Uniform Text of Mining Law, which was approved by Supreme Decree No. 14-92-EM on June 4, 1992, and enacted into law on October 10, 1992. Under Peruvian law, the right to explore for and exploit minerals is granted by way of concessions. A Peruvian mining concession is a property-related right, distinct and independent from the ownership of land on which it is located. The term of a concession is indefinite, provided that related annual fees are duly paid. The rights manifested in a mining concession are protected against third parties, transferable, chargeable and, in general, may be the subject of any transaction or contract. Mining concessions may be privately owned and no state participation is required. Buildings and other permanent structures used in a mining operation are considered real property accessories to the concession on which they are situated.

Annual Fees

Concession holders must pay an annual rent fee by June 30 of each year. The annual fee is currently US$3 per hectare. Concession holders must reach a minimum level of annual commercial production of at least US$100 per hectare in gross sales within six years of the date of the grant of the concession or, if the concession has not been put into production within that period, the annual fee increases by US$6 per hectare for the seventh through eleventh years following the date of grant and by an additional US$20 per hectare thereafter. Failure to pay the annual fee for two consecutive years will result in the termination of the concession.

Royalties

In June 2004, Peru’s congress approved a bill to allow royalties to be charged on mining projects. The royalties are payable on Peruvian mine production at the following rates: 1.0% for sales up to US$60 million; 2.0% for sales between US$60 million and US$120 million; and 3.0% for sales greater than US$120 million. In the case

- 7 -

of copper, the percentage royalty is a net smelter returns royalty, which cost will be deductible for income tax purposes.

In August 2004, a further bill was signed relating to the new royalties law, which provides that mining projects that contracted to pay mining royalties prior to the enactment of the new royalties law, which is the case for us, will be governed by such contracts and will not be subject to the royalties payable under the new royalties law.

On November 15, 2004, regulations were published implementing the Mining Royalty Law and defining the basis for calculating royalty payments. Monthly royalties are calculated using a Reference Royalty Basis which is generally defined as the gross sales value of “Concentrates or Equivalent” or of the “Mineral Component” for traded commodities or the gross value of the mineral component as declared by a concession holder. The royalty obligation is applied at the earlier of the date an invoice is delivered or the product is delivered. A penalty of 10% is imposed for non-payment. See “Risks of the Business”.

Ownership of Mining Rights

Pursuant to the Uniform Text of Mining Law:

| | • | | no restrictions are placed on the remittance of dividends, depreciation and royalties outside of Peru; |

| | • | | mining rights may be forfeited due to a number of enumerated circumstances (for example, the negligence of the title holder in carrying out operations); |

| | • | | equal rights to explore for and exploit minerals by way of concession may be granted to either Peruvian nationals or foreigners; and |

| | • | | the right to sell mining production freely in world markets is established. Peru has become party to agreements with the World Bank’s Multilateral Investment Guarantee Agency and with the Overseas Private Investment Corporation. |

Taxation and Foreign Exchange Controls

Corporate net income is taxed at a rate of 30% of annual net income, subject to an additional 4.1% tax if profits are distributed to shareholders. Advance monthly payments are required on a percentage of gross income, subject to a final settlement in March of the following business year (January 1 through December 31).

There are currently no restrictions on the ability of a company operating in Peru to transfer foreign currency to or from Peru or to convert Peruvian currency into foreign currency.

Congress has approved a Temporary Net Assets Tax, which will apply to companies subject to the General Income Tax Regime. Net assets are taxed at a rate of 0.6% on the value exceeding Nuevo Sol 5,000,000 (approximately US$1,515,090). Taxpayers must file a tax return during the first 12 days of April and the amounts paid can be used as a credit against Income Tax. Companies which have not started productive operations or those that are in their first year of operation are exempt from the tax.

The Tax Administration Superintendence is the entity empowered under the Peruvian Tax Code to regulate central government taxes. The Tax Administration Superintendence can enforce tax sanctions, which can result in fines, the confiscation of goods and vehicles, and the closing of a taxpayer’s offices.

- 8 -

Stability Agreements

The Peruvian Mining Act gives holders of mining rights the option to sign stability agreements with the Peruvian Government in connection with the commencement of new mining operations or expansion of existing mining operations and submission of satisfactory documentation to the government regarding the amount of investment. In order to qualify, companies must submit satisfactory documentation to the Government regarding the amount of investment. Holders of mining rights starting up operations producing over 350 tonnes per day up to 5,000 tonnes per day and mining units already in production that increase production by 100% up to 5,000 tonnes per day can sign a stability agreement upon documentation of an investment program valued at no less than US$2,000,000.

Stability Agreements contain the following provisions:

| | • | | Stability is applicable to the mining unit in which the investment is made. |

| | • | | Tax stability protecting the company from any new tax or modification in tax after the date of the agreement. |

| | • | | Any new regulation that creates mandatory bonds, loans to the Government or tax payments in advance will not be applicable. |

| | • | | Stability of foreign exchange regulations including the free use of foreign currency generated by exports. |

| | • | | No discrimination in the exchange rate including a guarantee of access to the most favourable exchange rate. |

| | • | | Free trade rights with respect to the company’s mineral production. |

| | • | | Stability with respect to any new non-income taxes such as temporary import or VAT refund for exportation. |

| | • | | Administrative stability protecting the company from increases in the amount of annual fees and penalties. |

If a company signs a stability agreement, the Corporate Income Tax rate increases from 30% to 32%.

We have not yet commenced operations, but it is our intention to enter into such stability agreements if we commence operations.

Environmental Laws

The Peruvian Ministry of Energy and Mines establishes an environmental protection policy and sets maximum allowable levels for effluents, signs environmental administrative stability agreements, oversees the impact of mining operations and imposes administrative sanctions.

Pursuant to Supreme Decree 38-98-EM approved on November 30, 1998, concession holders are required to obtain an environmental permit from the Directorate for Environmental Affairs in order to carry out exploration and development activities. Mining companies are responsible for the control of emissions, discharges of effluent and disposal of all by-products resulting from their operations, and for the control of substances that may impose any hazard, either due to excessive concentrations or prolonged exposure.

An exploration permit is only required in respect of surface hole drilling, and is not required for underground drilling. We obtained the appropriate environmental permit in order to carry out our Phase 1 exploration drilling program, which was completed in January 2005. We also have obtained all of the permits required to complete all of the drilling planned through 2006.

- 9 -

Mine Closure and Remediation

On October 14, 2003, the Peruvian government published Law 28090 “Mine Closure Law” which establishes provisions relating to mine closure plans. For existing mining operations the law provides that a mine closure plan must be submitted for certification to the Peruvian Ministry of Energy and Mines within a one-year period, after the law comes into effect.

The proposed law provides that a mine must grant an environmental warranty for the estimated costs associated with its mine closure plan. The law does not establish when such warranties must be in place nor does the law specify the form of the required warranty. However, the law indicates that a warranty may take the form of insurance, cash collateral, a trust agreement or other forms as permitted by the Peruvian law.

The Mine Closure Law became effective on August 16, 2005 with the enactment of the enabling regulations.

Workers Participation

Under Peruvian law, every company that generates income and has more than twenty workers on its payroll is obligated to permit its workers to share in its profits. For mining companies, the percentage of this profit-sharing benefit is 8% of pre-tax income. Cooperative, self-managed companies, civil partnerships and companies that do not have more than twenty workers are exempt from this profit-sharing obligation. Both permanent and contract workers must be taken into account for purposes of these laws; the only legal requirement is that such workers must be registered on a company’s payroll.

The profit-sharing amount made available to each worker is limited to 18 times the worker’s monthly salary, based upon their salary at the close of the previous tax year.

Regulatory and Supervisory Bodies

The two primary entities in Peru that regulate and supervise mining companies are the Ministry of Energy and Mines and the National Institute of Concessions and Mining Cadastre. The Mining of Energy and Mines oversees regulatory compliance for safety, environmental protection, job-related health, contractors, and mining development matters. In addition to the Ministry of Energy and Mines’ own officers, private companies specifically registered with the Ministry of Energy and Mines are also entitled to supervise such compliance. The National Institute of Concessions and Mining Cadastre grants mining concessions entitling the concession holder the right to explore and exploit the zone where such concessions are located. Concession holders are required to explain how operations will comply with Peruvian environmental regulations by filing an Environmental Impact Assessment.

Other Peruvian governmental and regulatory bodies involved with mining companies include the:

| | • | | National Institute of Natural Resources, which manages protected natural areas and issues an advisory opinion on every concession holder’s Environmental Impact Assessment, to the extent that planned operations will alter natural landscape; |

| | • | | General Bureau of Environmental Health of the Ministry of Health, which manages waste discharge into the environment and related issues, particularly those that may affect public health; |

| | • | | Mining of Internal Affairs, which approves the acquisition, transport and usage of explosives for mining companies; |

| | • | | National Institute of Culture, which grants certifies the non-existence of archaeological remains, as typically required for the Environmental Impact Assessment; |

| | • | | General Bureau of Harbor Masters’ Offices and Coastguards, which enforces sanctions if rivers or navigable lakes located within Peru’s national borders are contaminated for whatever reason; |

| | • | | Supervisory Board for Investment in Energy, which monitors compliance with conservation laws in regarding utility issues; and |

| | • | | Ministry of Agriculture, which approves water usage permits. |

- 10 -

In conjunction with the Peruvian central government, regional governments manage natural resources and improving the quality of the environment on a sustained basis. In addition, municipalities grant licenses for municipal, business, and residential construction.

Impact of Environmental Non-Compliance

Non-compliance with Peruvian environmental laws or regulations can result in the imposition of administrative sanctions, such as fines, closure orders, or the lapse of mining concessions.

Failing to comply with Environmental Impact Assessment obligations or tax regulations could result in criminal and civil action against the company and its representatives.

Reorganizations

We undertook a material reorganization of our business in April 2004 by completing a share exchange with the shareholders of Peru Copper Syndicate, in order to acquire Peru Copper Syndicate as a wholly owned subsidiary. See “General Development of the Business of the Company” – “Three Year History” – “Private Placements and Share Exchange”.

Risks of the Business

Our operations are speculative due to the high-risk nature of our business which is the exploration and acquisition of rights to potential mineable deposits of copper. These risk factors could materially affect our future results and could cause actual events to differ materially from those described in forward-looking statements relating to our company.

Exploration, Development and Operating Risks

Risks Relating To Our Business And Industry

We are an exploration-stage company with a very limited operating history and our estimates of mineralization are based on drilling data, which may not reflect the actual deposits or the economic viability of extraction.

We are engaged in copper mineral exploration. We have no operating history upon which to base estimates of any future production, operating costs and results. The estimating of mineralization is a subjective process and the accuracy of estimates is a function of quantity/and quality of available data, the accuracy of statistical computations, and the assumptions used and judgments made in interpreting engineering and geological information. There is significant uncertainty in any mineralization estimate, and the actual deposits encountered and the economic viability of mining a deposit may differ significantly from our estimates. See “Mineral Projects” – “Toromocho Project – Mineral Resources”.

Estimates may have to be recalculated based on changes in mineral prices or further exploration or development activity. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence estimates. Market price fluctuations for minerals, increased production costs or reduced recovery rates, or other factors can render production uneconomical at particular sites.

The mineralization estimates that we have relied upon regarding the Toromocho Project are, to some extent, based upon the interpretation of geologic data obtained from historical drill holes and other sampling techniques. We have further in part relied upon a technical report and a historical feasibility study which was obtained by a previous owner. This report and study derive estimates of costs based upon:

| | • | | anticipated tonnage and grades of ore to be mined and processed, |

| | • | | the estimated configuration of the ore body, |

- 11 -

| | • | | expected recovery rates from the ore, |

| | • | | estimated operating costs, and |

| | • | | anticipated climatic conditions and other factors. |

The accuracy of estimates is affected by the quantity and quality of available data. Until we complete a full feasibility study, we cannot be certain that it will be economically feasible to extract and process the copper even if the past mineral estimates and target locations are accurate.

As a result, it is possible that actual costs and economic returns will differ significantly from those currently estimated for the Toromocho Project. In addition, it is also not unusual in mining operations to experience unexpected problems both during the start-up and during ongoing operations. To the extent that unexpected problems occur affecting our production in the future, our revenues may be reduced, costs may increase and our profitability may be adversely affected.

We currently depend on a single mineral property, which is in the early stages of development and even if it is developed, negative developments affecting the properties could adversely affect our business.

Even if we are successful in meeting the requirements to exercise the option to acquire the Toromocho mining concessions and assets, our business will be dependent upon this single mining property. Unless we acquire more properties or projects, any negative development affecting this property or our rights to develop our mining concessions on this property, could materially adversely affect our business, financial condition and results of operations.

We have a history of losses and we expect to incur losses in the future.

As an exploration company that has no production history, we have incurred losses since our inception. From April 24, 2003, when our exploration activities began, through December 31, 2005, we have no revenues and incurred losses of US$3,742,800. We believe that we will be unable to generate enough revenue to offset our operating costs and, therefore, expect to continue to experience losses until we successfully complete a feasibility study and develop the Toromocho Project into an operating mine. There can be no assurance that we will successfully develop an operating mine, or achieve or sustain profitability in the future.

Copper exploration is highly speculative in nature and there can be no certainty of our successful development of profitable commercial mining operations.

Copper exploration is highly speculative. It involves many risks and frequently is not productive. Our copper exploration efforts may not be successful. The mineralization at the Toromocho Project is a “mineral reserve”. Investors cannot assume that we will ever be successful in converting the mineral reserve into proven and probable mineral reserves. Success in identifying commercially viable proven and probable mineral reserves is based upon a number of factors, including:

| | • | | the quality and experience of our management, |

| | • | | our level of geological and technical expertise, |

| | • | | the quantity and quality of land available to us for exploration, and |

| | • | | many other factors outside of our control. |

We have never had mineral producing properties. We cannot be certain that commercial quantities or grades of minerals will be discovered at the Toromocho Project or other future properties. The metallurgical properties of any minerals found may make them uneconomic to process. Even if commercial quantities and grades of minerals are discovered, we cannot be certain that any property will ever be brought to a stage where minerals can profitably be produced from it. Factors which may limit our ability to produce minerals from our properties include the market price of the minerals being sought, availability of additional capital and financing, and the nature and location of any mineral deposits.

- 12 -

It may take several years of drilling until production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to conduct a full feasibility study and to construct mining and processing facilities. We cannot be certain that our exploration programs will result in profitable commercial mining operations.

We do not own the mining concessions and assets of the Toromocho Project and may not satisfy the terms of the Toromocho Option Agreement to acquire such concessions.

We do not own the mining concessions in the Toromocho Project. The concessions to mine the Toromocho Project and the land and related assets are held by Centromin, a Peruvian state-owned mining company, and others. We hold an option that expires June 11, 2008 to acquire the Toromocho Project mining concessions and related assets held by Centromin. The option may only be exercised if we deliver to Centromin a detailed Feasibility Study on the Toromocho Project and provide evidence to them that we either:

| | • | | have at least one mining operation or concentrator with a capacity of 10,000 tonnes per day, and a net shareholders’ equity of US$100,000,000, or |

| | • | | that a financial institution acceptable to Centromin is willing to provide the financing required for the development of the Toromocho Project, as described in the Feasibility Study. |

Upon exercise of the Toromocho Option Agreement, we must deliver a performance bond or a letter of credit in the amount of US$30,000,000 towards required development obligations.

We do not now satisfy the conditions for option exercise. In the event that we do not in the future satisfy the option exercise conditions, we may become subject to penalties or lose our option. If this happens, we will have lost all monies spent on the Toromocho Project.

Historical metallurgical testing at Toromocho indicates limitations on producing high-grade copper concentrate resulting in higher costs to us and lower pricing for our products.

The results of historical metallurgical testing at Toromocho indicate an inability to produce copper concentrate grades higher than approximately 22% copper, at recovery levels in the low 80% range. Our metallurgical testing has produced copper concentrate with average grades of 26.5% at an average recovery level of 89.5%, based on estimated quantities of seven different rock types representative of the ore deposit. Our inability to produce higher-grade copper concentrates at higher recovery rates could increase our operating costs and reduce the potential profitability of our future operations.

We may not be able to access sufficient water, power and tailings storage areas that will be necessary in order to develop the Toromocho Project into an operating mine.

The current supply of water and electricity at the Toromocho Project site is limited. We may need to access additional water and electricity sources in order to develop the Toromocho Project. In addition, we will need to locate and develop storage areas for tailings. Our inability to secure adequate water and power resources or adequate storage areas for tailings sufficient to run a large open pit deposit could prevent or hinder our ability to fully exploit and develop the Toromocho Project. We cannot be certain that we will be able to obtain the permits and easements required to access there sources nor what the cost of such access will be.

We will require a significant amount of capital to fund our operations, our ability to obtain additional capital depends on many factors beyond our control and lack of adequate capital could delay or prevent us from achieving profitability.

With the proceeds of our initial public offering and the exercise of warrants, we expect to have sufficient financial resources to complete the preliminary development program for the Toromocho Project, including a feasibility study, environmental studies and required permitting. Future development of product at the Toromocho Project to production will depend upon our ability to obtain financing through debt financing, equity financing, joint

- 13 -

venture relationships, or other means. We have recently retained UBS Investment Bank as a financial advisor to assist the Company in evaluating strategic alternatives to maximize shareholder value from the Toromocho Project. Strategic alternatives under consideration may include a sale of a portion of the Toromocho Project to a strategic partner to assist in the development of the project, a sale of the project, or development of the project by the Company itself. The fact that we are engaged in the early stages of development in Peru, a country experiencing political and economic unrest, may limit the sources of financing available to us as well as increase the cost to us of securing that financing. We may not be successful in obtaining the required financing on terms acceptable to us for these or other purposes.

Fluctuations in copper prices could adversely affect our future profitability and we do not have a hedging policy to protect us from such fluctuations.

Our future profitability and long-term viability will depend, in large part, on the global market price of copper. Market prices for copper are volatile and are affected by numerous factors beyond our control, including:

| | • | | speculative activities, and |

| | • | | political and economic conditions. |

These factors could negatively impact the price for copper and lower copper prices would negatively impact our future profitability. We do not have a hedging policy to protect us from a decline in copper pricing and have no intention to establish one while we are in the exploratory phases of our operations. In addition, we may not have the ability to purchase hedging instruments in the future. Hedging instruments may also not protect us adequately from fluctuations in the market price of copper.

We may not be able to satisfy minimum investments to develop the mining concessions and, if we do not, we could become subject to penalties and to the loss of our mining concessions.

Even if we satisfy all the requirements to exercise our option to acquire Centromin’s mining concessions and assets, we will be required to spend 70% of the minimum investment necessary to develop the mining concessions within five years after exercise. If we fail to make yearly minimum investments to develop the mining concessions acquired from Centromin, we could become subject to significant cash penalties or lose the mining concessions and assets, which could increase our operating costs or could have a material adverse effect on our ability to continue operations.

Easements and rights of use owned by others in or near the Toromocho Project may interfere with our ability to develop our mining concessions.

Two third parties are currently operating small underground mines close to the area containing the Toromocho Project. One of them, Corona, which is owned by Pan American Silver Corp., has been granted a temporary easement by Centromin to gain access to its mining operations through a central shaft located within the Toromocho concessions. These third-party underground mining operations may restrict our ability to explore and develop our Toromocho mining concessions and could adversely affect our cost of operations and future profitability.

In addition, the northern part of the Toromocho concessions includes the town of Morococha with approximately 3,700 residents. Our ability to develop any mineral deposits in that area could be restricted or our costs could be significantly increased and our future profitability adversely affected.

- 14 -

We may not satisfy the terms of our agreements with Corona to exchange mining concessions in the Toromocho Project, which could have an adverse effect on our ability to fully develop the Project.

We have an option to acquire other Toromocho concessions held by Corona. In exchange, we granted Corona the option to acquire mining concessions within the Toromocho concessions near to Corona’s other mining operations. Any failure to conclude these transactions could hinder our ability to fully develop the Toromocho concessions.

Additional mining concessions adjacent to the Toromocho Project are owned by third parties and we may not be able to negotiate the acquisition of these rights, which could increase our cost of operations or adversely affect our ability to fully develop the Project.

Some mineral concessions adjacent to the Toromocho Project are owned by third parties and are not part of the agreements with Centromin or Corona. Our inability to acquire these rights may increase our operating costs or adversely affect our ability to fully explore and develop our mining concessions in the Toromocho Project.

We may not be able to secure good title to the additional mining concessions, which could delay or restrict the exploration and development of the Toromocho Project.

Our ability to secure good title to mining concessions is subject to known and unknown existing third-party rights in the mining concessions or property. Third parties may claim unrecorded rights to underlying portions of our interests in the Toromocho Project, and other future properties in which we acquire an interest. Such third-party rights could include prior unregistered liens, unregistered agreements, rights of way, easements, transfers or claims.

A lawsuit has been filed in Peru by Compania Minera Natividad, a company owned by Pan American Silver Corp., disputing our purchase of a 50% ownership interest in four mining concessions that are located outside of the area where the Toromocho Project concessions are located, on the grounds that it had a right of first refusal to such interests. If it is not resolved, this proceeding or any subsequent litigation and appeals could adversely affect our ownership and use of these additional concessions. See “Legal Proceedings”.

In addition, the Toromocho Project had been owned by Cerro de Pasco before it was nationalized by the Peruvian government in 1974. It is unclear whether the rights of a prior owner like Cerro de Pasco would ever be resurrected. Any claim relating to the Toromocho mining concessions and related assets could result in expensive litigation to protect our rights without any certainty as to the outcome.

Our operations are subject to risks and hazards inherent in the mining industry, all of which could have adverse effects on our financial condition, results of operation and future cash flows.

Our operations are and will continue to be subject to all of the hazards and risks normally incidental to exploring, developing and exploiting natural resources. Some of these risks include:

| | • | | unusual or unexpected geologic formations or other geological or grade problems, |

| | • | | unanticipated changes in metallurgical characteristics and copper recovery, |

| | • | | unanticipated ground or water conditions, cave-ins, pit wall failures, flooding, rock bursts, |

| | • | | periodic interruptions due to bad or hazardous weather conditions and other acts of God, and |

| | • | | unfavourable operating conditions. |

If any of these risks and hazards adversely affect our mining operations or our exploration activities, they may:

| | • | | increase the cost of exploration, development or production to a point where it is no longer economically feasible to continue, |

| | • | | require us to write down the carrying value of one or more mines or a property, |

| | • | | cause delays or a stoppage in the exploration, development or production of copper, |

- 15 -

| | • | | result in damage to or destruction of mineral properties or processing facilities, and |

| | • | | result in personal injury or death or legal liability. |

All of these adverse consequences may have a material adverse effect on our financial condition, results of operation, and future cash flows of the company.

Our operations are subject to environmental risks and we have assumed responsibility for environmental remediation of our activities in the Toromocho Project.

We have assumed responsibility for any environmental liabilities resulting from our activities in Toromocho. Our current or future operations, including development activities, are subject to extensive environmental regulations and contractual obligations with Centromin. We are subject to potential risks and liabilities associated with pollution of the environment and disposal of waste products from our mining activities. Under the Toromocho Option Agreement, it is our responsibility to control and remediate waste, effluents, tailings or other residual materials which might be generated as a result of exploration efforts. This includes restoration of surface areas that have been disturbed by the construction of drilling platforms. If the Toromocho option is exercised, the company becomes responsible for environmental liabilities that were created by Centromin or by its predecessors, estimated by SVS Ingenieros S.A. to be US$7.3 million, not including two reclamation projects currently being undertaken by Centromin and third parties at a total estimated cost of approximately US$14.5 million plus annual operating costs of US$2 million.

The payment of any liabilities or the costs that we may incur to remedy environmental impacts would reduce funds otherwise available to us for operations. We might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The potential financial exposure to us may be significant. We have not purchased insurance for environmental risks (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) as it is not generally available at what we believe to be a reasonable price.

Currency fluctuations may adversely affect our costs.

Since we use the United States dollar as our reporting currency, the effects on operating costs and on cash flows fluctuations in the foreign exchange rate and the escalation of the Peruvian Nuevo Sol relative to the US dollar may be significant. We do not intend to enter into hedging contracts in connection with currencies. The appreciation of the Peruvian Nuevo Sol against the US dollar would in US dollar terms increase the costs of exploration and development of the Toromocho Project, increase the future operating costs of any future mines, and increase future taxes and royalties paid to the government of Peru. These increased costs could affect the economic viability of mineralization and negatively impact copper production at our mining operations, which could materially and adversely affect our profitability, results of operation and financial condition. During 2005, the exchange rate between the US dollar and the Peruvian Nuevo Sol remained below NS3.50 per US$1.00. As at January 31, 2006, the exchange rate was NS3.32 per US$1.00.

Our business could be adversely affected if we fail to comply with extensive government regulations or fail to obtain, renew or comply with necessary licenses and permits.

Our operations and properties are subject to environmental, health and safety, and other laws and regulations in the jurisdictions in which we operate. For example, we are subject to laws and regulations governing:

| | • | | protection of the environment, |

| | • | | mine development and prospecting, |

- 16 -

It is possible that we may not be able to comply with existing and future laws and regulations. In addition, future changes in applicable laws, regulations, agreements or changes in their enforcement or regulatory interpretation could result in changes to the terms of our permits and agreements for our properties, which could have a material adverse impact on our current exploration program and future development projects.

Obtaining necessary permits and licenses can be a complex, time consuming process and we cannot be certain that we will be able to obtain all required permits on acceptable terms, in a timely manner or at all. The costs and delays associated with obtaining necessary permits and complying with these permits and applicable laws and regulations could stop, delay or restrict us from proceeding with the development of an exploration project or the development and operation of a mine. Any failure to comply with applicable laws and regulations or permits could result in interruption or closure of exploration, development or mining operations, or fines, penalties or other liabilities. We could also lose our mining concessions under the terms of our existing agreements.

The copper supply industry is subject to a world-wide antitrust investigation which could adversely affect the copper industry and copper prices.

It has been reported in the press that there is a multi-jurisdictional and industry-wide investigation relating to competitive practices in the copper concentrate market. The investigation was commenced in May 2003 by the Department of Justice, the Directorate-General of Competition of the European Commission, and the Competition Bureau of Canada and there have been no announcements by the investigating authorities since that time discussing the investigation or its outcome. An article inMining Journal, dated February 25, 2005 reported that the Department of Justice and the Competition Bureau of Canada have closed their investigations without making changes, although the investigation by the European Commission is ongoing.

We cannot be certain what the timing or ultimate outcome of the investigation will be. We also cannot determine the impact, if any, this investigation will have on our future operations, the copper industry, copper prices or on our ability to operate profitably. The investigation may reveal that copper production has been artificially restricted or copper prices otherwise artificially or illegally inflated. If that is the case and such anti-competitive practices are terminated as a result of the investigation, copper prices may fall and revenue from the sale of copper concentrates may decline. If such events occur in the future at a time when we have commenced mining operations, they could have a material adverse effect on our profitability.

We are likely to be deemed to be a passive foreign investment company for U.S. federal income tax purposes, which could lead to additional taxes for U.S. holders of our shares or warrants.

A passive foreign investment company or PFIC is a non-U.S. corporation that meets an income test and/or an asset test. The income test is met if 75% or more of a corporation’s gross income is “passive income” (generally dividends, interest, rents, royalties, and gains from the disposition of passive assets) in any taxable year. The asset test is met if at least 50% of the average value of a corporation’s assets produce, or are held for the production of, passive income. We believe that as of the end of 2005, the IRS would have treated us as PFIC. Based on our current income, assets and activities, it is likely that we will be considered a PFIC for U.S. federal income tax purposes for at least one or two years, if not more. As a result, a U.S. holder of our common shares or warrants could be subject to substantially increased tax liability, possibly including an interest charge, upon the sale or other disposition of the U.S. holder’s common shares or warrants or upon the receipt of “excess distributions” from the company. In the alternative, U.S. holders may enter into certain U.S. tax elections that may result in a current Federal tax liability prior to any distribution or disposition of the shares, and without the assurance of any eventual distribution or successful disposition.

- 17 -

Our insurance coverage does not cover all potential losses.

The mining industry is subject to significant risks that could result in damage to, or destruction of, mineral properties or producing facilities, personal injury or death, environmental damage, delays in mining, and monetary losses and possible legal liability. Where we consider it practical to do so, we maintain insurance in amounts that we believe to be reasonable, including insurance for workers’ compensation, theft, general liability, destruction of property, autos and mobile equipment. Such insurance, however, contains exclusions and limitations on coverage. Accordingly, our insurance policies may not provide coverage for all losses related to our business (and specifically do not cover environmental liabilities and losses). The occurrence of losses, liabilities or damage not covered by such insurance policies could have a material and adverse effect on our profitability, results of operation and financial condition. We cannot be certain that insurance will be available to us, or that it will be available on terms and conditions acceptable to us. In some cases, coverage is not available or considered too expensive relative to the perceived risk.

We rely on our management team, outside contractors, experts and other advisors and the loss of any of them, if they cannot be replaced, could have a material adverse effect on our business and financial performance.

The success of our operations and activities is dependent to a significant extent on the efforts and abilities of our small senior management team, as well as outside contractors, experts and other advisors. In making an investment in our common shares and warrants, shareholders must be willing to rely to a significant extent on management’s discretion and judgment, as well as the expertise and competence of outside contractors, experts and other advisors that we hire to advise us. The loss of one or more member of senior management, key employees or contractors, if not replaced, could materially adversely affect our operations and financial performance. See “Directors and Officers.”

- 18 -

Several of our directors and officers serve on boards of other natural resource, exploration and development companies and may have conflicts of interest.

Most of our directors and officers also serve as directors and/or officers of other companies involved in natural resource exploration and development. Consequently, there exists the possibility for such directors and officers to be or come into a position of conflict with us.

We are a small operator in a highly competitive industry and may not have the adequate resources to compete effectively.

We compete with other mineral exploration and mining companies for the acquisition of mineral claims, permits, concessions and other mineral interests as well as for the recruitment and retention of qualified employees. Upon the start of production we will compete against large and established companies in the world market to sell our products. Many of our competitors have greater resources than we do. Increased competition could result in increased costs and lower prices for copper and reduced profitability. Consequently, our revenues, operations and financial condition could be materially adversely affected.

Risks Relating To The Political And Economic Environment In Peru

We are subject to the risks associated with foreign operations.

The Toromocho Project is located in central Peru and, accordingly, we are subject to risks normally associated with exploration for and development of mineral properties in Peru. Peru is a developing country that has experienced political and economic difficulties over the years. Our mineral exploration activities could be affected in varying degrees by political instability and changes in government regulation relating to foreign investment and the mining business, including expropriation. Operations may also be affected in varying degrees by possible terrorism, military conflict, crime, fluctuations in currency rates and high inflation. In addition, from time to time in the past, Peru has nationalized private businesses including mining companies. There can be no assurance that the Peruvian government will not nationalize mining companies and their assets in the future.

Peru has experienced political and social unrest and protestors have from time to time targeted foreign mining firms. As an example of political unrest, in January 2005, a retired army major and a group of armed followers captured a police station in Andahuaylas, a small town in the southern Andes and subsequently killed four policemen. The rebel leader listed a number of grievances against Peru’s President Alejandro Toledo, including that he had sold out Peru’s interests to foreigners, and demanded that he resign. The incident lasted three days until all of the rebels were captured and put in jail in Lima pending charges.

Presidential elections will be held in Peru on April 9, 2006. Recent public opinion polls have identified one of the frontrunners as Ollanta Humala, the candidate of the Union por el Peru party. Mr. Humala is a retired lieutenant-colonel in the Peruvian army and is known as a left-leaning nationalist who has been described in the media as an opponent of free trade and free market policies. He is a leader of the Movimiento Etnocacerista, an extreme ethnic, nationalist group that embraces their Inca heritage, nationalization of the country’s industries, reintroduction of the death penalty, legalization of coca cultivation and a strong anti-Chilean stance.

Our operations could be adversely affected by continued political and social unrest in Peru.

Changes in Peruvian royalty regulations could increase our operating costs.

Our ability to conduct future exploration and development activities is subject to changes in government regulations and shifts in political attitudes over which we have no control.

A new law was recently passed in Peru requiring royalties of 1% to 3% of net smelter returns to be charged on Peruvian mining production. This law is now in force. Following its enactment the law was modified to, among other things, exempt from the new law mining projects such as ours with pre-existing contractual agreements to pay

- 19 -

royalties. However, future changes in the government mandated royalties charged on mining operations in Peru could materially adversely affect our results of operations.

If Peru increases taxes in future, there could be an adverse effect on the cost estimates that we have utilized in estimating mineralization, on our operating costs and on our profitability.

Although we currently have no revenues from our operations in Peru, we are required to pay taxes in Peru on earnings generated from our Peruvian operations and these taxes are subject to change in the future. Our estimates regarding the operating costs of the Toromocho Project, which we have utilized in estimating mineralization, have assumed a current Peruvian tax rate, which may be increased in the future. Accordingly, our cost estimates may not represent an accurate statement of our future tax costs.

Risks Relating To Our Common Shares And Warrants And The Trading Market

We may, in the future, issue additional common shares or other securities, which would reduce investors’ percentage ownership and may dilute the value of our shares.

Our Articles of Incorporation authorize the issuance of an unlimited number of common shares without par value and an unlimited number of preference shares without par value. Additional financing needed to continue exploration and development of the Toromocho Project may require the issuance of additional common shares, preference shares, warrants or other securities which may result in substantial dilution in the percentage of our shares held by our then existing shareholders. We may value any securities issued in the future on an arbitrary basis. The issuance of additional securities for future services or acquisitions or other corporate actions may also have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on the trading market for our common shares.

There is a limited history of public trading in the market for the common shares.

The common shares are listed on the TSX, the American Stock Exchange and the venture capital segment of the Lima Stock Exchange, and there is a limited trading history from which investors can make an investment decision to purchase the common shares (all of our previously listed warrants expired on March 18, 2006). There can be no assurance that an active market for the common shares will be sustained. If an active public market for the common shares is not maintained, the liquidity of our common shares may be limited.

We have not and do not plan to pay dividends.

We have never declared or paid any dividends on our common shares and do not currently intend to pay dividends in the future. Earnings, if any, will be retained to finance further growth and development of our business. See “Dividend Record and Policy.”

There will be dilution upon exercise of convertible securities.

In the event that all of our stock options and other options are exercised, there will be an additional 7,543,893 common shares available for trading in the public market. The increase in the number of common shares in the market will result in the dilution of the voting power of our existing shareholders.

We may pursue certain strategic alternatives and fail to accomplish them, which could significantly reduce the price of our common shares.

On November 7, 2005, we announced that we retained UBS Investment Bank as a financial advisor, to assist the Company in evaluating strategic alternatives to maximize shareholder value from the Toromocho Project. Strategic alternatives under consideration may include a sale of a portion of the Toromocho Project to a strategic partner to assist in the development of the project, a sale of the project, or development of the project by the Company itself. There can be no assurance that the Company will be able to implement any of these strategic alternatives. Furthermore, if we decide to sell all or a portion of the Toromocho Project and find that we cannot do

- 20 -

so on favorable terms, the investment community could interpret this negatively and the price of our common shares could be reduced significantly.

Technical Information

The estimated mineral resources for the Toromocho Project have been calculated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Council Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by the CIM Council on August 20, 2000, as amended (the “CIM Standards”). The following definitions are reproduced from the CIM Standards:

The term “Mineral Resource” means a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

The term “Inferred Mineral Resource” means that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

The term “Indicated Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

The term“Measured Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

The term“Mineral Reserve” means the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

The term“Probable Mineral Reserve” means the economically mineable part of an Indicated Mineral Resource and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

The term“Proven Mineral Reserve” means the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

- 21 -

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources