|

The Bond Fund

of America® Prospectus March 1, 2022 |  |

| |

| | | | | | | | | | | | |

| Class | A | C | T | F-1 | F-2 | F-3 | 529-A | 529-C | 529-E | 529-T | 529-F-1 |

| | ABNDX | BFACX | TBFFX | BFAFX | ABNFX | BFFAX | CFAAX | CFACX | CFAEX | TFBFX | CFAFX |

| Class | 529-F-2 | 529-F-3 | R-1 | R-2 | R-2E | R-3 | R-4 | R-5E | R-5 | R-6 | |

| | FFBOX | FBOFX | RBFAX | RBFBX | RBEBX | RBFCX | RBFEX | RBFHX | RBFFX | RBFGX | |

Table of contents

| |

| The U.S. Securities and Exchange Commission has not approved or disapproved of these securities. Further, it has not determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense. |

Prospectus Supplement March 1, 2022 |  |

For the following funds with prospectuses dated

May 1, 2021 – March 1, 2022 (as supplemented to date)

AMCAP Fund® (AMCAP)

American Balanced Fund® (AMBAL) American Funds Developing World Growth and Income FundSM (DWGI)

American Funds Corporate Bond Fund®

(CBF)

American Funds Emerging Markets Bond Fund®(EMBF) American Funds Global Balanced FundSM (GBAL) American Funds Global Insight FundSM (GIF) American Funds Inflation Linked Bond Fund®

(ILBF)

American Funds International Vantage FundSM (IVE) American Funds Mortgage Fund® (AFMF)

American Funds Multi-Sector Income FundSM

(MSI)

American Funds Strategic Bond FundSM (SBF) American Funds U.S. Government Money Market FundSM (MMF) | | American High-Income Trust® (AHIT)

American Mutual Fund® (AMF) The Bond Fund of America® (BFA)

Capital Income Builder® (CIB)

Capital World Bond Fund® (WBF) Capital World Growth and Income Fund® (WGI) EuroPacific Growth Fund® (EUPAC)

Fundamental Investors® (FI) The Growth Fund of America® (GFA) The Income Fund of America® (IFA) Intermediate Bond Fund of America® (IBFA) International Growth and Income FundSM (IGI)

The Investment Company of America® (ICA) The New Economy Fund® (NEF) New Perspective Fund® (NPF) New World Fund® (NWF) Short-Term Bond Fund of America® (STBF) SMALLCAP World Fund® (SCWF) U.S. Government Securities Fund® (GVT) Washington Mutual Investors FundSM (WMIF) |

Changes apply to all funds unless otherwise noted below.

1. The following is added to the section titled “The Capital System” in the “Management and organization” section of the Capital Income Builder prospectus:

Charles E. Ellwein, Partner, Capital Research Global Investors, serves as an equity portfolio manager for the fund. Charles has 26 years of experience in total; 16 years with Capital Research and Management Company or affiliate. He has one year of experience in managing the fund (plus 9 years of prior experience as an investment analyst for the fund).

2. The following is added to the “Investment objective(s), strategies and risks” section of the prospectus for each of the funds listed above (other than AMBAL, BFA, EMBF, FI, ICA, MSI, SBF, WBF):

The investment adviser may consider environmental, social and governance (“ESG”) factors that, depending on the facts and circumstances, are material to the value of an issuer or instrument. ESG factors may include, but are not limited to, environmental-related events resulting from climate change or society’s response to environmental change, social conditions (e.g., labor relations, investment in human capital, accident prevention, changing customer behavior) or governance issues (e.g., board composition, significant breaches of international agreements, unsound business practices).

3. The information under “Northwestern Mutual Investment Services, LLC” in the “Appendix – Sales charge waivers” section of the prospectus is amended to read as follows:

Northwestern Mutual Investment Services, LLC

Rights of accumulation on SIMPLE IRAs held at Northwestern Mutual Investment Services, LLC

Effective March 31, 2022, for SIMPLE IRA plans where the plan is held on the Simple IRA platform at Northwestern Mutual Investment Services, LLC (NMIS) through its clearing firm, Pershing LLC, each linked participant account will be aggregated at either the plan level or the individual level for rights of accumulation (ROA), depending on which aggregation method results in a greater breakpoint discount on front-end sales charges for the participant.

Class A and C share purchases in owner-only 401(k) plans held at Northwestern Mutual Investment Services, LLC

For 401(k) plans held at NMIS through its clearing firm, Pershing LLC, that cover only owners and their spouses and are not subject to ERISA, participants may purchase Class A shares with the applicable front-end sales charge or Class C shares with the applicable contingent deferred sales charge, in accordance with NMIS’s share class policies applicable to such plans.

4. The information under “Robert W. Baird & Co. Incorporated (Baird)” in the “Appendix – Sales charge waivers” section of the prospectus is amended to read as follows:

Robert W. Baird & Co. Incorporated (Baird)

Shareholders purchasing fund shares through a Baird platform or account will only be eligible for the following sales charge waivers (front-end sales charge waivers and CDSC waivers) and discounts, which may differ from those disclosed elsewhere in this prospectus or the SAI.

Front-end sales charge waivers on Class A shares available at Baird

| · | Shares purchased through reinvestment of capital gains distributions and dividend reinvestment when purchasing shares of the same fund |

| · | Shares purchased by employees and registered representatives of Baird or its affiliate and their family members as designated by Baird |

| · | Shares purchased from the proceeds of redemptions from another fund, provided (1) the repurchase occurs within 90 days following the redemption, (2) the redemption and purchase occur in the same accounts, and (3) redeemed shares were subject to a front-end or deferred sales charge (known as rights of reinstatement) |

| · | A shareholder in the fund’s Class C shares will have their shares converted at net asset value to Class A shares of the fund if the shares are no longer subject to CDSC and the conversion is in line with the policies and procedures of Baird |

| · | Charitable accounts in a transactional brokerage account at Baird |

CDSC waivers on Class A and C shares available at Baird

| · | Shares sold due to death or disability of the shareholder |

| · | Shares sold as part of a systematic withdrawal plan as described in the fund’s prospectus |

| · | Shares bought due to returns of excess contributions from an IRA Account |

| · | Shares sold as part of a required minimum distribution for IRA and retirement accounts due to the shareholder reaching the qualified age based on applicable IRS regulations as described in the fund’s prospectus |

| · | Shares sold to pay Baird fees but only if the transaction is initiated by Baird |

| · | Shares acquired through a right of reinstatement |

Front-end sales charge discounts available at Baird: breakpoints and/or rights of accumulation

| · | Breakpoints as described in this prospectus |

| · | Rights of accumulation which entitles shareholders to breakpoint discounts will be automatically calculated based on the aggregated holding of fund family assets held by accounts within the purchaser’s household at Baird. Eligible fund family assets not held at Baird may be included in the rights of accumulation calculation only if the shareholder notifies his or her financial advisor about such assets |

| · | Letters of intent (LOI) allow for breakpoint discounts based on anticipated purchases of fund family assets through Baird, over a 13-month period of time

|

Keep this supplement with your prospectus.

Lit. No. MFGEBS-503-0322P CGD/AFD/10039-S88045

Investment objective The fund’s investment objective is to provide as high a level of current income as is consistent with the preservation of capital.

Fees and expenses of the fund This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. For example, in addition to the fees and expenses described below, you may also be required to pay brokerage commissions on purchases and sales of Class F-2, F-3, 529-F-2 or 529-F-3 shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in American Funds. More information about these and other discounts is available from your financial professional, in the “Sales charge reductions and waivers” sections on page 38 of the prospectus and on page 82 of the fund’s statement of additional information, and in the sales charge waiver appendix to this prospectus.

| | | | | | | | |

| Shareholder fees (fees paid directly from your investment) |

| Share class: | A | 529-A | C and

529-C | 529-E | T and

529-T | All F and 529-F share classes | All R

share

classes |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 3.75% | 3.50% | none | none | 2.50% | none | none |

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) | 1.001 | 1.001 | 1.00% | none | none | none | none |

| Maximum sales charge (load) imposed on reinvested dividends | none | none | none | none | none | none | none |

| Redemption or exchange fees | none | none | none | none | none | none | none |

1 The Bond Fund of America / Prospectus

| | | | | | | | |

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

| Share class: | A | C | T | F-1 | F-2 | F-3 | 529-A |

| Management fees | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% |

| Distribution and/or service (12b-1) fees | 0.25 | 1.00 | 0.25 | 0.25 | none | none | 0.24 |

| Other expenses | 0.14 | 0.14 | 0.17 | 0.18 | 0.15 | 0.04 | 0.19 |

| Total annual fund operating expenses | 0.55 | 1.30 | 0.58 | 0.59 | 0.31 | 0.20 | 0.59 |

| | | | | | | | |

| Share class: | 529-C | 529-E | 529-T | 529-F-1 | 529-F-2 | 529-F-3 | R-1 |

| Management fees | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% |

| Distribution and/or service (12b-1) fees | 1.00 | 0.50 | 0.25 | 0.25 | none | none | 1.00 |

| Other expenses | 0.19 | 0.13 | 0.21 | 0.212 | 0.17 | 0.11 | 0.14 |

| Total annual fund operating expenses | 1.35 | 0.79 | 0.62 | 0.62 | 0.33 | 0.27 | 1.30 |

| Expense reimbursement | — | — | — | — | — | 0.023 | — |

| Total annual fund operating expenses after expense reimbursement | 1.35 | 0.79 | 0.62 | 0.62 | 0.33 | 0.25 | 1.30 |

| | | | | | | | |

| Share class: | R-2 | R-2E | R-3 | R-4 | R-5E | R-5 | R-6 |

| Management fees | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% | 0.16% |

| Distribution and/or service (12b-1) fees | 0.75 | 0.60 | 0.50 | 0.25 | none | none | none |

| Other expenses | 0.39 | 0.24 | 0.19 | 0.14 | 0.18 | 0.09 | 0.04 |

| Total annual fund operating expenses | 1.30 | 1.00 | 0.85 | 0.55 | 0.34 | 0.25 | 0.20 |

1 A contingent deferred sales charge of 1.00% applies on certain redemptions made within 18 months following purchases of $1 million or more made without an initial sales charge. Contingent deferred sales charge is calculated based on the lesser of the offering price and market value of shares being sold.

2 Restated to reflect current fees.

3 The investment adviser is currently reimbursing a portion of the other expenses. This reimbursement will be in effect through at least March 1, 2023. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time.

The Bond Fund of America / Prospectus 2

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The example reflects the expense reimbursement described above through the expiration date of such reimbursement and total annual fund operating expenses thereafter. You may be required to pay brokerage commissions on your purchases and sales of Class F-2, F-3, 529-F-2 or 529-F-3 shares of the fund, which are not reflected in the example. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | | | | |

| Share class: | A | C | T | F-1 | F-2 | F-3 | 529-A | 529-C | 529-E | 529-T | 529-F-1 | 529-F-2 | 529-F-3 | R-1 |

| 1 year | $429 | $232 | $308 | $60 | $32 | $20 | $408 | $237 | $81 | $312 | $63 | $34 | $26 | $132 |

| 3 years | 545 | 412 | 431 | 189 | 100 | 64 | 532 | 428 | 252 | 444 | 199 | 106 | 85 | 412 |

| 5 years | 671 | 713 | 566 | 329 | 174 | 113 | 668 | 739 | 439 | 587 | 346 | 185 | 150 | 713 |

| 10 years | 1,038 | 1,361 | 958 | 738 | 393 | 255 | 1,062 | 1,133 | 978 | 1,005 | 774 | 418 | 341 | 1,568 |

| | | | | | | | | | | | |

| Share class: | R-2 | R-2E | R-3 | R-4 | R-5E | R-5 | R-6 | For the share classes listed to the right, you would pay the following if you did not redeem your shares: | Share class: | C | 529-C |

| 1 year | $132 | $102 | $87 | $56 | $35 | $26 | $20 | 1 year | $132 | $137 |

| 3 years | 412 | 318 | 271 | 176 | 109 | 80 | 64 | 3 years | 412 | 428 |

| 5 years | 713 | 552 | 471 | 307 | 191 | 141 | 113 | 5 years | 713 | 739 |

| 10 years | 1,568 | 1,225 | 1,049 | 689 | 431 | 318 | 255 | 10 years | 1,361 | 1,133 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 368% of the average value of its portfolio.

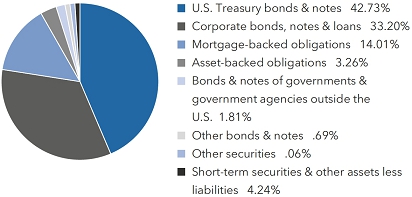

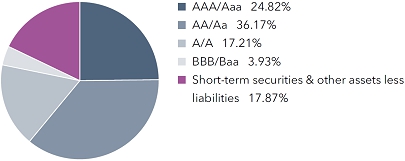

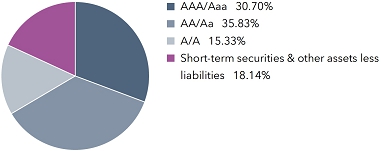

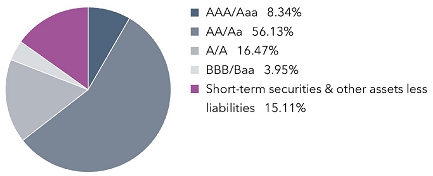

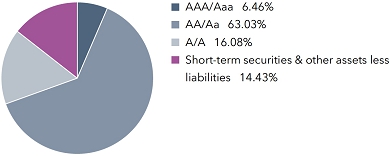

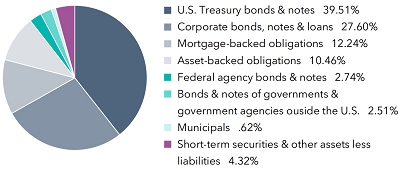

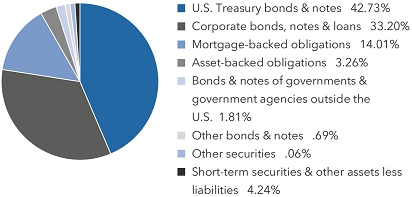

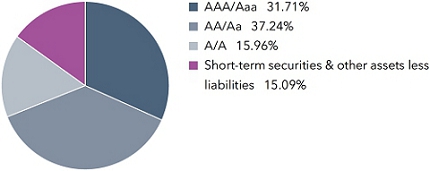

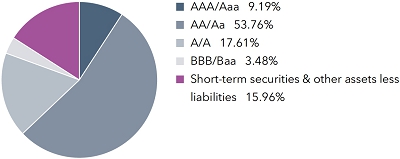

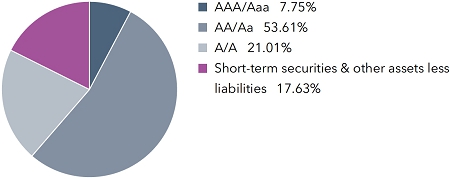

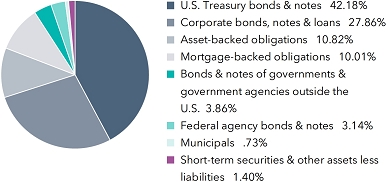

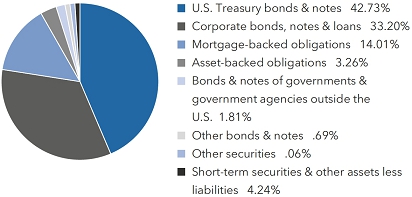

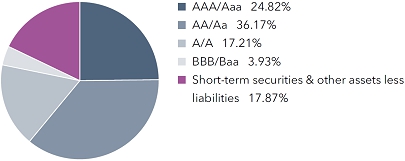

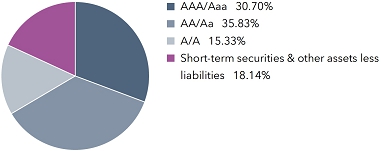

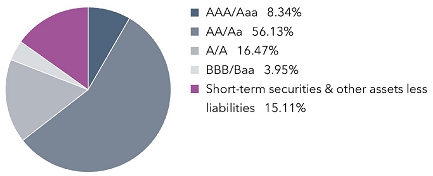

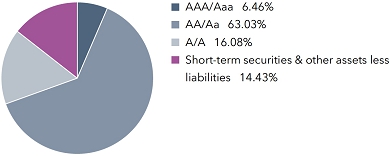

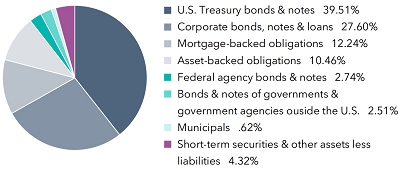

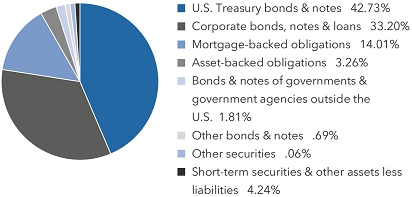

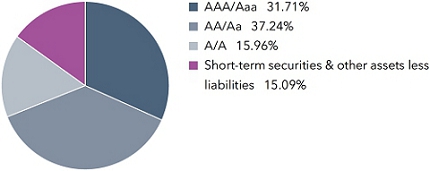

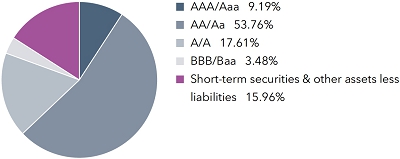

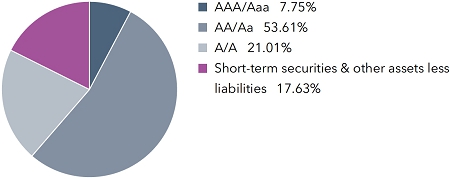

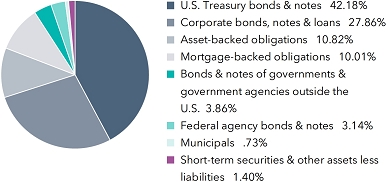

Principal investment strategies The fund seeks to maximize your level of current income and preserve your capital by investing primarily in bonds. Normally the fund invests at least 80% of its assets in bonds and other debt securities, which may be represented by derivatives. The fund invests at least 60% of its assets in debt securities (excluding derivatives) rated A3 or better or A- or better by Nationally Recognized Statistical Ratings Organizations designated by the fund’s investment adviser, or in debt securities that are unrated but determined to be of equivalent quality by the fund’s investment adviser, and in U.S. government securities, money market instruments, cash or cash equivalents.

The fund may invest in debt securities and mortgage-backed securities issued by government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government.

The fund may invest in inflation-linked bonds issued by U.S. and non-U.S. governments, their agencies or instrumentalities, and corporations. Inflation-linked bonds are structured to protect against inflation by linking the bond’s principal and interest payments to an inflation index, such as the Consumer Price Index for Urban Consumers, so that principal and interest adjust to reflect changes in the index.

3 The Bond Fund of America / Prospectus

The fund may invest in futures contracts and swaps, which are types of derivatives. A derivative is a financial contract, the value of which is based on the value of an underlying financial asset (such as a stock, bond or currency), a reference rate or a market index. The fund may invest in a derivative only if, in the opinion of the investment adviser, the expected risks and rewards of the proposed investment are consistent with the investment objective and strategies of the fund as disclosed in this prospectus and in the fund’s statement of additional information.

The fund may invest up to 10% of its assets in debt securities rated Ba1 or below and BB+ or below by Nationally Recognized Statistical Ratings Organizations designated by the fund’s investment adviser, or in debt securities that are unrated but determined to be of equivalent quality by the fund’s investment adviser. Securities rated Ba1 or below and BB+ or below are sometimes referred to as “junk bonds.”

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively priced securities that, in its opinion, represent good, long-term investment opportunities. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

Principal risks This section describes the principal risks associated with investing in the fund. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental, governmental agency or central bank responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Economies and financial markets throughout the world are highly interconnected. Economic, financial or political events, trading and tariff arrangements, wars, terrorism, cybersecurity events, natural disasters, public health emergencies (such as the spread of infectious disease) and other circumstances in one country or region, including actions taken by governmental or quasi-governmental authorities in response to any of the foregoing, could have impacts on global economies or markets. As a result, whether or not the fund invests in securities of issuers located in or with significant exposure to the countries affected, the value and liquidity of the fund’s investments may be negatively affected by developments in other countries and regions.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance, major litigation, investigations or other controversies related to the issuer, changes in government regulations affecting the issuer or its competitive

The Bond Fund of America / Prospectus 4

environment and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by factors such as the interest rates, maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. A general rise in interest rates may cause investors to sell debt securities on a large scale, which could also adversely affect the price and liquidity of debt securities and could also result in increased redemptions from the fund. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund failing to recoup the full amount of its initial investment and having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer or guarantor will weaken or be perceived to be weaker, and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. A downgrade or default affecting any of the fund’s securities could cause the value of the fund’s shares to decrease. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to assess credit and default risks.

Investing in mortgage-related and other asset-backed securities — Mortgage-related securities, such as mortgage-backed securities, and other asset-backed securities, include debt obligations that represent interests in pools of mortgages or other income-bearing assets, such as consumer loans or receivables. While such securities are subject to the risks associated with investments in debt instruments generally (for example, credit, extension and interest rate risks), they are also subject to other and different risks. Mortgage-backed and other asset-backed securities are subject to changes in the payment patterns of borrowers of the underlying debt, potentially increasing the volatility of the securities and the fund’s net asset value. When interest rates fall, borrowers are more likely to refinance or prepay their debt before its stated maturity. This may result in the fund having to reinvest the proceeds in lower yielding securities, effectively reducing the fund’s income. Conversely, if interest rates rise and borrowers repay their debt more slowly than expected, the time in which the mortgage-backed and other asset-backed securities are paid off could be extended, reducing the fund’s cash available for reinvestment in higher yielding securities. Mortgage-backed securities are also subject to the risk that underlying borrowers will be unable to meet their obligations and the value of property that secures the mortgages may decline in value and be insufficient, upon foreclosure, to repay the associated loans. Investments in asset-backed securities are subject to similar risks.

Investing in securities backed by the U.S. government — Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the

5 The Bond Fund of America / Prospectus

timely payment of interest and principal when held to maturity. Accordingly, the current market values for these securities will fluctuate with changes in interest rates and the credit rating of the U.S. government. Securities issued by U.S. government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government are neither issued nor guaranteed by the U.S. government.

Liquidity risk — Certain fund holdings may be or may become difficult or impossible to sell, particularly during times of market turmoil. Liquidity may be impacted by the lack of an active market for a holding, legal or contractual restrictions on resale, or the reduced number and capacity of market participants to make a market in such holding. Market prices for less liquid or illiquid holdings may be volatile, and reduced liquidity may have an adverse impact on the market price of such holdings. Additionally, the sale of less liquid or illiquid holdings may involve substantial delays (including delays in settlement) and additional costs and the fund may be unable to sell such holdings when necessary to meet its liquidity needs or may be forced to sell at a loss.

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations or revenues outside the United States, may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as nationalization, currency blockage or the imposition of price controls or punitive taxes, each of which could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different accounting and auditing practices and standards and different regulatory, legal and reporting requirements, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the United States may be heightened in connection with investments in emerging markets.

Investing in future delivery contracts — The fund may enter into contracts, such as to-be-announced contracts and mortgage dollar rolls, that involve the fund selling mortgage-related securities and simultaneously contracting to repurchase similar securities for delivery at a future date at a predetermined price. This can increase the fund’s market exposure, and the market price of the securities that the fund contracts to repurchase could drop below their purchase price. While the fund can preserve and generate capital through the use of such contracts by, for example, realizing the difference between the sale price and the future purchase price, the income generated by the fund may be reduced by engaging in such transactions. In addition, these transactions increase the turnover rate of the fund.

Investing in inflation-linked bonds — The values of inflation-linked bonds generally fluctuate in response to changes in real interest rates — i.e., rates of interest after factoring in inflation. A rise in real interest rates may cause the prices of inflation-linked securities to fall, while a decline in real interest rates may cause the prices to increase.

The Bond Fund of America / Prospectus 6

Inflation-linked bonds may experience greater losses than other debt securities with similar durations when real interest rates rise faster than nominal interest rates. There can be no assurance that the value of an inflation-linked security will be directly correlated to changes in interest rates; for example, if interest rates rise for reasons other than inflation, the increase may not be reflected in the security’s inflation measure.

Investing in inflation-linked bonds may also reduce the fund’s distributable income during periods of deflation. If prices for goods and services decline throughout the economy, the principal and income on inflation-linked securities may decline and result in losses to the fund.

Investing in derivatives — The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds. Changes in the value of a derivative may not correlate perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and a derivative instrument may expose the fund to losses in excess of its initial investment. Derivatives may be difficult to value, difficult for the fund to buy or sell at an opportune time or price and difficult, or even impossible, to terminate or otherwise offset. The fund’s use of derivatives may result in losses to the fund, and investing in derivatives may reduce the fund’s returns and increase the fund’s price volatility. The fund’s counterparty to a derivative transaction (including, if applicable, the fund’s clearing broker, the derivatives exchange or the clearinghouse) may be unable or unwilling to honor its financial obligations in respect of the transaction. In certain cases, the fund may be hindered or delayed in exercising remedies against or closing out derivative instruments with a counterparty, which may result in additional losses.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses, including models, tools and data, employed by the investment adviser in this process may be flawed or incorrect and may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

7 The Bond Fund of America / Prospectus

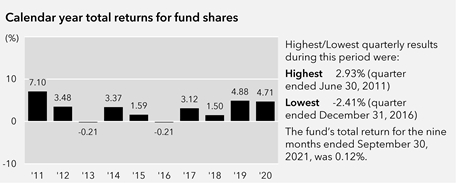

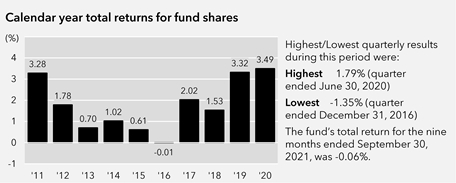

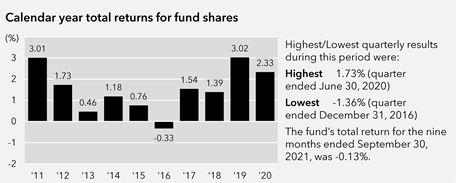

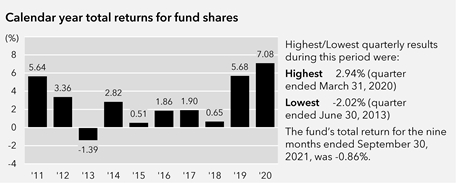

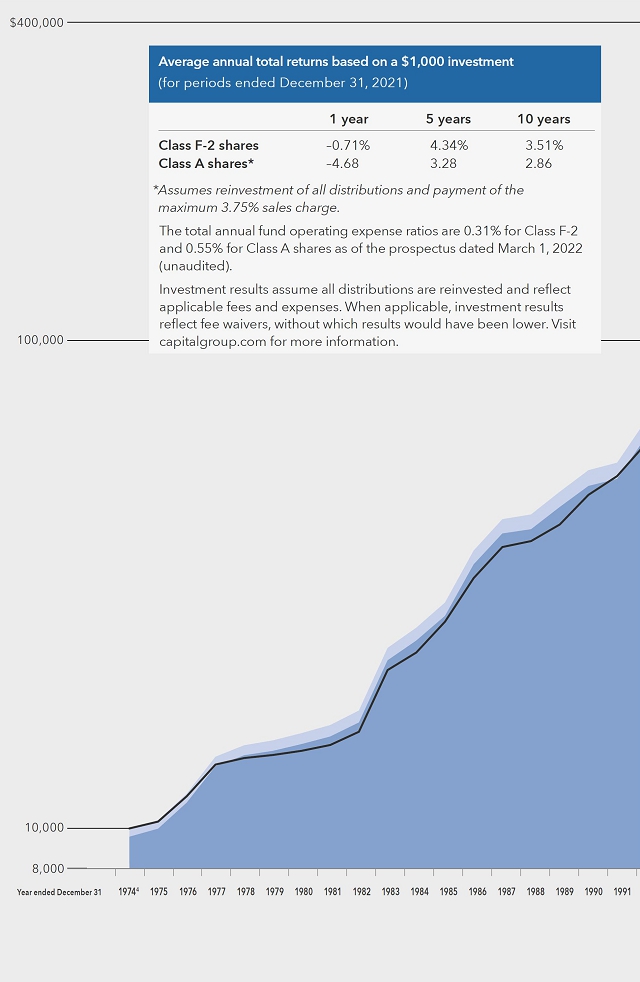

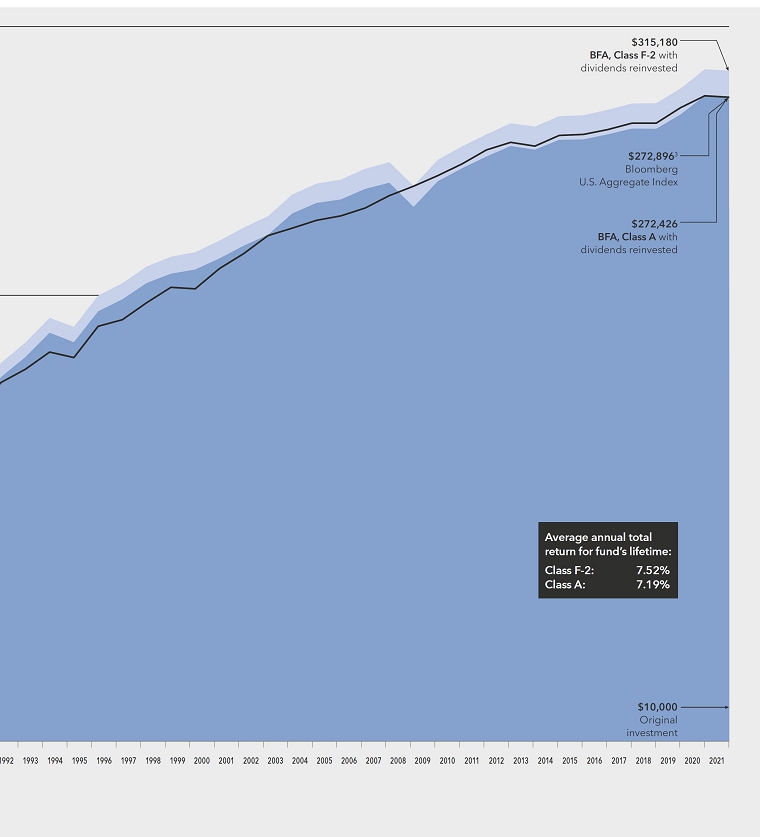

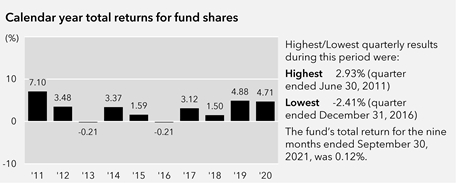

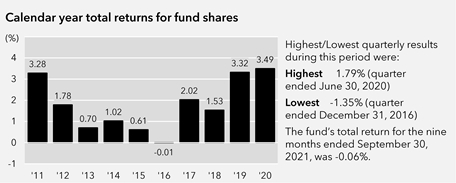

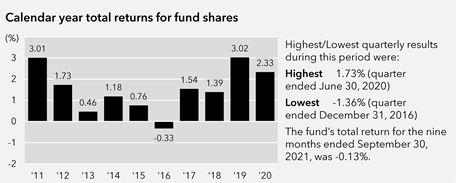

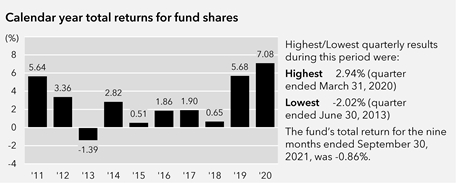

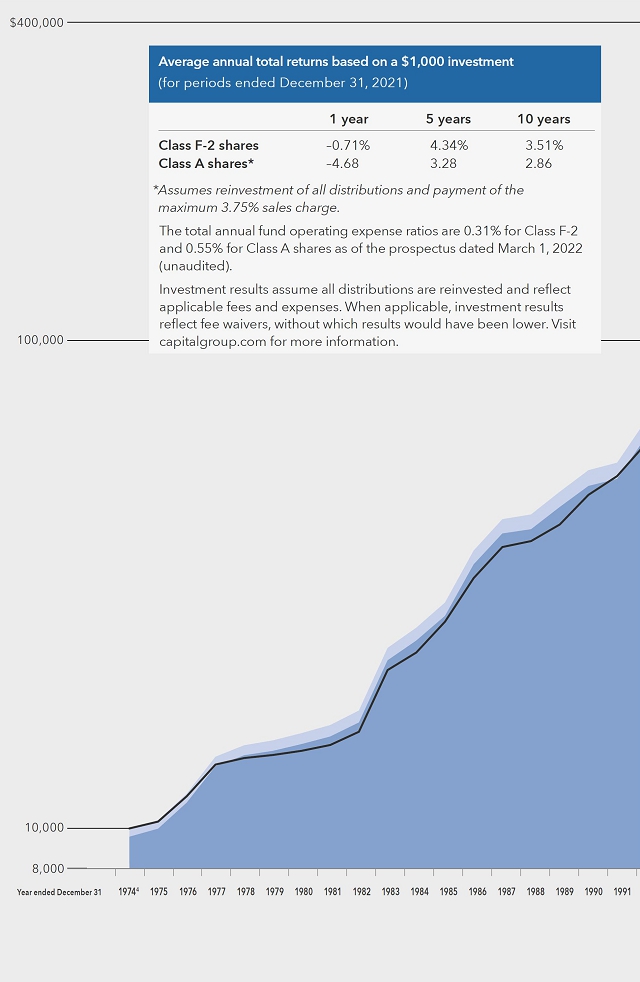

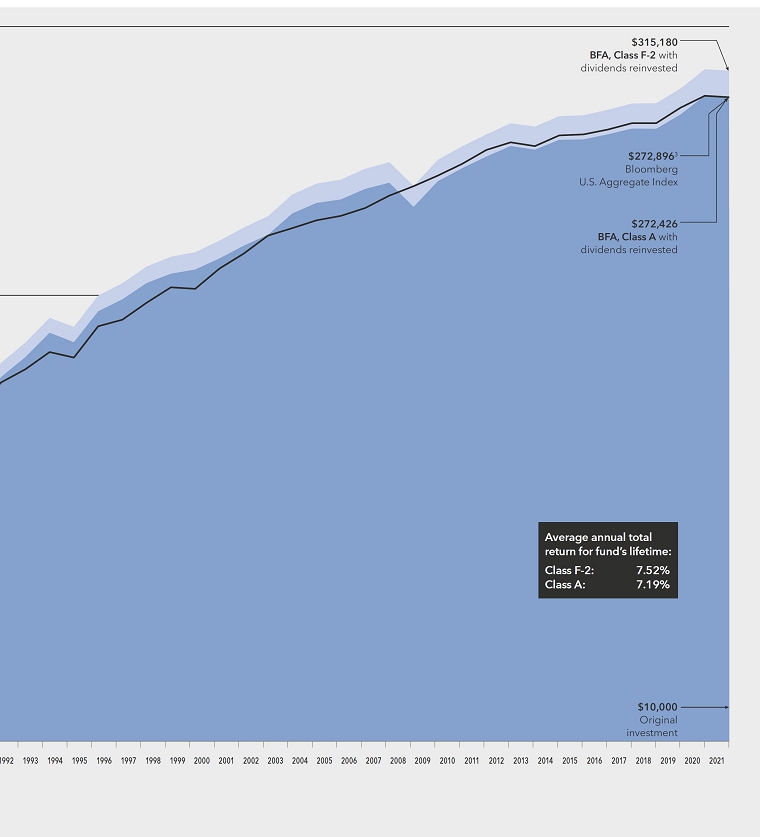

Investment results The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results and other applicable measures of market results. This information provides some indication of the risks of investing in the fund. The Lipper Core Bond Funds Average includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future investment results. Prior to October 30, 2020, certain fees, such as 12b-1 fees, were not charged on Class 529-F-1 shares. If these expenses had been deducted, results would have been lower. Updated information on the fund’s investment results can be obtained by visiting capitalgroup.com.

*We have elected to show Class F-2 shares because the share class has 10 years of history and has experienced substantial growth in net assets.

The Bond Fund of America / Prospectus 8

| | | | | | | |

| Average annual total returns For the periods ended December 31, 2021: | |

| Share class | Inception date | 1 year | 5 years | 10 years | Lifetime |

| F-2 − Before taxes | 8/4/2008 | -0.71% | 4.34% | 3.51% | 3.98% |

| − After taxes on distributions | | -1.52 | 3.05 | 2.36 | N/A |

| − After taxes on distributions and sale of fund shares | -0.33 | 2.82 | 2.22 | N/A |

| | | | | | |

| Share classes (before taxes) | Inception date | 1 year | 5 years | 10 years | Lifetime |

| A (with maximum sales charge) | 5/28/1974 | -4.68% | 3.28% | 2.86% | 7.19% |

| C | 3/15/2001 | -2.65 | 3.28 | 2.61 | 3.78 |

| F-1 | 3/15/2001 | -0.99 | 4.03 | 3.22 | 4.08 |

| F-3 | 1/27/2017 | -0.60 | N/A | N/A | 4.44 |

| 529-A (with maximum sales charge) | 2/15/2002 | -4.46 | 3.28 | 2.81 | 3.84 |

| 529-C | 2/19/2002 | -2.70 | 3.24 | 2.78 | 3.81 |

| 529-E | 3/7/2002 | -1.19 | 3.81 | 2.96 | 3.77 |

| 529-F-1 | 9/26/2002 | -0.82 | 4.24 | 3.41 | 4.30 |

| 529-F-2 | 10/30/2020 | -0.73 | N/A | N/A | 0.97 |

| 529-F-3 | 10/30/2020 | -0.69 | N/A | N/A | 1.02 |

| R-1 | 6/11/2002 | -1.69 | 3.29 | 2.48 | 3.28 |

| R-2 | 5/31/2002 | -1.69 | 3.30 | 2.49 | 3.26 |

| R-2E | 8/29/2014 | -1.40 | 3.61 | N/A | 2.84 |

| R-3 | 6/4/2002 | -1.25 | 3.77 | 2.94 | 3.71 |

| R-4 | 5/20/2002 | -0.94 | 4.08 | 3.26 | 4.07 |

| R-5E | 11/20/2015 | -0.75 | 4.29 | N/A | 3.94 |

| R-5 | 5/15/2002 | -0.65 | 4.39 | 3.57 | 4.39 |

| R-6 | 5/1/2009 | -0.60 | 4.44 | 3.62 | 4.98 |

| | | | | |

| Indexes | 1 year | 5 years | 10 years | Lifetime

(from Class F-2 inception) |

| Bloomberg U.S. Aggregate Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | -1.54% | 3.57% | 2.90% | 3.98% |

| Lipper Core Bond Funds Average (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | -1.26 | 3.65 | 3.10 | 4.07 |

Class F-2 annualized 30-day yield at December 31, 2021: 1.94%

(For current yield information, please call American Funds Service Company at (800) 421-4225 or visit capitalgroup.com.) |

After-tax returns are shown only for Class F-2 shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are not relevant if you hold your fund shares through a tax-favored arrangement, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan.

9 The Bond Fund of America / Prospectus

Management

Investment adviser Capital Research and Management CompanySM

Portfolio managers The individuals primarily responsible for the portfolio management of the fund are:

| | | |

Portfolio manager/

Fund title (if applicable) | Portfolio

manager

experience

in this fund | Primary title

with investment adviser |

| Pramod Atluri President | 6 years | Partner – Capital Fixed Income Investors |

| David J. Betanzos Senior Vice President | 6 years | Partner – Capital Fixed Income Investors |

| David A. Hoag Senior Vice President | 13 years | Partner – Capital Fixed Income Investors |

| Fergus N. MacDonald Senior Vice President | 7 years | Partner – Capital Fixed Income Investors |

| |

Purchase and sale of fund shares The minimum amount to establish an account for all share classes is normally $250 and the minimum to add to an account is $50. For a payroll deduction retirement plan account, payroll deduction savings plan account or employer-sponsored 529 account, the minimum is $25 to establish or add to an account. For accounts with Class F-3 shares held and serviced by the fund’s transfer agent, the minimum investment amount is $1 million.

If you are a retail investor, you may sell (redeem) shares on any business day through your dealer or financial professional or by writing to American Funds Service Company® at P.O. Box 6007, Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at (800) 421-4225; faxing American Funds Service Company at (888) 421-4351; or accessing our website at capitalgroup.com. Please contact your plan administrator or recordkeeper to sell (redeem) shares from your retirement plan.

Tax information Dividends and capital gain distributions you receive from the fund are subject to federal income taxes and may also be subject to state and local taxes, unless you are tax-exempt or your account is tax-favored.

Payments to broker-dealers and other financial intermediaries If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial professional to recommend the fund over another investment. Ask your individual financial professional or visit your financial intermediary’s website for more information.

The Bond Fund of America / Prospectus 10

Investment objective, strategies and risks The fund’s investment objective is to provide as high a level of current income as is consistent with the preservation of capital. While it has no present intention to do so, the fund’s board may change the fund’s investment objective without shareholder approval upon 60 days’ written notice to shareholders.

The fund seeks to maximize your level of current income and preserve your capital by investing primarily in bonds. Normally the fund invests at least 80% of its assets in bonds and other debt securities, which may be represented by derivatives. The fund invests at least 60% of its assets in debt securities (excluding derivatives) rated A3 or better or A- or better by Nationally Recognized Statistical Ratings Organizations designated by the fund’s investment adviser, or in debt securities that are unrated but determined to be of equivalent quality by the fund’s investment adviser, and in U.S. government securities, money market instruments, cash or cash equivalents.

The fund may invest in debt securities and mortgage-backed securities issued by government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government. The fund may invest in debt securities of any maturity or duration. Duration is a measure used to determine the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates.

The fund may invest in inflation-linked bonds issued by U.S. and non-U.S. governments, their agencies or instrumentalities, and corporations. Inflation-linked bonds are structured to protect against inflation by linking the bond’s principal and interest payments to an inflation index, such as the Consumer Price Index for Urban Consumers, so that principal and interest adjust to reflect changes in the index.

The fund may invest in futures contracts and swaps, which are types of derivatives. A derivative is a financial contract, the value of which is based on the value of an underlying financial asset (such as a stock, bond or currency), a reference rate or a market index. The fund may invest in a derivative only if, in the opinion of the investment adviser, the expected risks and rewards of the proposed investment are consistent with the investment objective and strategies of the fund as disclosed in this prospectus and in the fund’s statement of additional information.

The fund may invest in futures contracts and interest rate swaps in order to seek to manage the fund’s sensitivity to interest rates, and in credit default swap indices, or CDSI, in order to assume exposure to a diversified portfolio of credits or to hedge against existing credit risks. A futures contract is a standardized exchange-traded agreement to buy or sell a specific quantity of an underlying asset, rate or index at an agreed-upon price at a stipulated future date. An interest rate swap is an agreement between two parties to exchange or swap payments based on changes in one or more interest rates, one of which is typically fixed and the other of which is typically a floating rate based on a designated short-term interest rate, such as the Secured Overnight Financing Rate, prime rate or other benchmark. A CDSI is based on a portfolio of credit default swaps with similar characteristics, such as credit default swaps on high-yield bonds. In a typical CDSI transaction, one party – the protection buyer – is obligated to pay the other party – the protection seller – a stream of periodic payments over the term of the contract, provided generally that no credit event on an underlying reference obligation has occurred. If such a credit event has occurred, the protection seller must pay the protection buyer the loss on those credits.

11 The Bond Fund of America / Prospectus

The fund may also enter into currency transactions to provide for the purchase or sale of a currency needed to purchase a security denominated in such currency. In addition, the fund may enter into forward currency contracts to protect against changes in currency exchange rates, to increase exposure to a particular foreign currency, to shift exposure to currency fluctuations from one currency to another or to seek to increase returns. A forward currency contract is an agreement to purchase or sell a specific currency at a future date at a fixed price.

The fund may invest up to 10% of its assets in debt securities rated Ba1 or below and BB+ or below by Nationally Recognized Statistical Ratings Organizations designated by the fund’s investment adviser, or in debt securities that are unrated but determined to be of equivalent quality by the fund’s investment adviser. Securities rated Ba1 or below and BB+ or below are sometimes referred to as “junk bonds.”

The fund may hold cash or cash equivalents, including commercial paper and short-term securities issued by the U.S. government, its agencies and instrumentalities. The percentage of the fund invested in such holdings varies and depends on various factors, including market conditions and purchases and redemptions of fund shares. The investment adviser may determine that it is appropriate to invest a substantial portion of the fund’s assets in such instruments in response to certain circumstances, such as periods of market turmoil. For temporary defensive purposes, the fund may invest without limitation in such instruments. A larger percentage of such holdings could moderate the fund’s investment results in a period of rising market prices. Alternatively, a larger percentage of such holdings could reduce the magnitude of the fund’s loss in a period of falling market prices and provide liquidity to make additional investments or to meet redemptions.

The fund may invest in other funds managed by the investment adviser or its affiliates (“Central Funds”) to more effectively invest in a diversified set of securities in a specific asset class such as money market instruments, bonds and other securities. Shares of Central Funds are only offered for purchase to the fund’s investment adviser and its affiliates and other funds, investment vehicles and accounts managed by the fund’s investment adviser and its affiliates. When investing in Central Funds, the fund bears its proportionate share of the expenses of the Central Funds in which it invests but does not bear additional management fees through its investment in such Central Funds. The investment results of the portions of the fund’s assets invested in the Central Funds will be based upon the investment results of the Central Funds.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively priced securities that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is through fundamental research, which may include analysis of credit quality, general economic conditions and various quantitative measures and, in the case of corporate obligations, meeting with company executives and employees, suppliers, customers and competitors. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

The investment adviser may consider environmental, social and governance (“ESG”) factors that, depending on the facts and circumstances, are material to the value of an

The Bond Fund of America / Prospectus 12

issuer or instrument. ESG factors may include, but are not limited to, environmental-related events resulting from climate change or society’s response to environmental change, social conditions (e.g., labor relations, investment in human capital, accident prevention, changing customer behavior) or governance issues (e.g., board composition, significant breaches of international agreements, unsound business practices).

The following are principal risks associated with investing in the fund.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental, governmental agency or central bank responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Economies and financial markets throughout the world are highly interconnected. Economic, financial or political events, trading and tariff arrangements, wars, terrorism, cybersecurity events, natural disasters, public health emergencies (such as the spread of infectious disease) and other circumstances in one country or region, including actions taken by governmental or quasi-governmental authorities in response to any of the foregoing, could have impacts on global economies or markets. As a result, whether or not the fund invests in securities of issuers located in or with significant exposure to the countries affected, the value and liquidity of the fund’s investments may be negatively affected by developments in other countries and regions.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance, major litigation, investigations or other controversies related to the issuer, changes in government regulations affecting the issuer or its competitive environment and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by factors such as the interest rates, maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. A general rise in interest rates may cause investors to sell debt securities on a large scale, which could also adversely affect the price and liquidity of debt securities and could also result in increased redemptions from the fund. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund failing to recoup the full amount of its initial investment and having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer or guarantor will weaken or be perceived to be weaker, and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. A downgrade or default affecting any of the

13 The Bond Fund of America / Prospectus

fund’s securities could cause the value of the fund’s shares to decrease. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to assess credit and default risks.

Investing in mortgage-related and other asset-backed securities — Mortgage-related securities, such as mortgage-backed securities, and other asset-backed securities, include debt obligations that represent interests in pools of mortgages or other income-bearing assets, such as residential mortgage loans, home equity loans, mortgages on commercial buildings, consumer loans and equipment leases. While such securities are subject to the risks associated with investments in debt instruments generally (for example, credit, extension and interest rate risks), they are also subject to other and different risks. Mortgage-backed and other asset-backed securities are subject to changes in the payment patterns of borrowers of the underlying debt, potentially increasing the volatility of the securities and the fund’s net asset value. When interest rates fall, borrowers are more likely to refinance or prepay their debt before its stated maturity. This may result in the fund having to reinvest the proceeds in lower yielding securities, effectively reducing the fund’s income. Conversely, if interest rates rise and borrowers repay their debt more slowly than expected, the time in which the mortgage-backed and other asset-backed securities are paid off could be extended, reducing the fund’s cash available for reinvestment in higher yielding securities. Mortgage-backed securities are also subject to the risk that underlying borrowers will be unable to meet their obligations and the value of property that secures the mortgages may decline in value and be insufficient, upon foreclosure, to repay the associated loans. Investments in asset-backed securities are subject to similar risks, as well as additional risks associated with the assets underlying those securities.

Investing in securities backed by the U.S. government — Securities backed by the U.S. Treasury or the full faith and credit of the U.S. government are guaranteed only as to the timely payment of interest and principal when held to maturity. Accordingly, the current market values for these securities will fluctuate with changes in interest rates and the credit rating of the U.S. government. Securities issued by U.S. government-sponsored entities and federal agencies and instrumentalities that are not backed by the full faith and credit of the U.S. government are neither issued nor guaranteed by the U.S. government.

Liquidity risk — Certain fund holdings may be or may become difficult or impossible to sell, particularly during times of market turmoil. Liquidity may be impacted by the lack of an active market for a holding, legal or contractual restrictions on resale, or the reduced number and capacity of market participants to make a market in such holding. Market prices for less liquid or illiquid holdings may be volatile, and reduced liquidity may have an adverse impact on the market price of such holdings. Additionally, the sale of less liquid or illiquid holdings may involve substantial delays (including delays in settlement) and additional costs and the fund may be unable to sell such holdings when necessary to meet its liquidity needs or may be forced to sell at a loss.

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations or revenues outside the United States, may lose

The Bond Fund of America / Prospectus 14

value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as nationalization, currency blockage or the imposition of price controls or punitive taxes, each of which could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different accounting and auditing practices and standards and different regulatory, legal and reporting requirements, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the United States may be heightened in connection with investments in emerging markets.

Investing in future delivery contracts — The fund may enter into contracts, such as to-be-announced contracts and mortgage dollar rolls, that involve the fund selling mortgage-related securities and simultaneously contracting to repurchase similar securities for delivery at a future date at a predetermined price. This can increase the fund’s market exposure, and the market price of the securities that the fund contracts to repurchase could drop below their purchase price. While the fund can preserve and generate capital through the use of such contracts by, for example, realizing the difference between the sale price and the future purchase price, the income generated by the fund may be reduced by engaging in such transactions. In addition, these transactions increase the turnover rate of the fund.

Investing in inflation-linked bonds — The values of inflation-linked bonds generally fluctuate in response to changes in real interest rates — i.e., rates of interest after factoring in inflation. A rise in real interest rates may cause the prices of inflation-linked securities to fall, while a decline in real interest rates may cause the prices to increase. Inflation-linked bonds may experience greater losses than other debt securities with similar durations when real interest rates rise faster than nominal interest rates. There can be no assurance that the value of an inflation-linked security will be directly correlated to changes in interest rates; for example, if interest rates rise for reasons other than inflation, the increase may not be reflected in the security’s inflation measure.

Investing in inflation-linked bonds may also reduce the fund’s distributable income during periods of deflation. If prices for goods and services decline throughout the economy, the principal and income on inflation-linked securities may decline and result in losses to the fund.

Investing in derivatives — The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds. Changes in the value of a derivative may not correlate perfectly with, and may be more sensitive to market events than, the underlying asset, rate or index, and a derivative instrument may expose the fund to losses in excess of its initial investment. Derivatives may be difficult to value, difficult for the fund to buy or sell at an opportune time or price and difficult, or even impossible, to terminate or otherwise offset. The fund’s use of derivatives may result in losses to the fund, and investing in

15 The Bond Fund of America / Prospectus

derivatives may reduce the fund’s returns and increase the fund’s price volatility. The fund’s counterparty to a derivative transaction (including, if applicable, the fund’s clearing broker, the derivatives exchange or the clearinghouse) may be unable or unwilling to honor its financial obligations in respect of the transaction. In certain cases, the fund may be hindered or delayed in exercising remedies against or closing out derivative instruments with a counterparty, which may result in additional losses.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses, including models, tools and data, employed by the investment adviser in this process may be flawed or incorrect and may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

The following are additional risks associated with investing in the fund.

Interest rate risk — The values and liquidity of the securities held by the fund may be affected by changing interest rates. For example, the values of these securities may decline when interest rates rise and increase when interest rates fall. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities. The fund may invest in variable and floating rate securities. When the fund holds variable or floating rate securities, a decrease in market interest rates will adversely affect the income received from such securities and the net asset value of the fund’s shares. Although the values of such securities are generally less sensitive to interest rate changes than those of other debt securities, the value of variable and floating rate securities may decline if their interest rates do not rise as quickly, or as much, as market interest rates. Conversely, floating rate securities will not generally increase in value if interest rates decline. During periods of extremely low short-term interest rates, the fund may not be able to maintain a positive yield and, given the current low interest rate environment, risks associated with rising rates are currently heightened.

Investing in futures contracts — In addition to the risks generally associated with investing in derivative instruments, futures contracts are subject to the creditworthiness of the clearing organizations, exchanges and futures commission merchants with which the fund transacts. Additionally, although futures require only a small initial investment in the form of a deposit of initial margin, the amount of a potential loss on a futures contract could greatly exceed the initial amount invested. While futures contracts are generally liquid instruments, under certain market conditions futures may be deemed to be illiquid. For example, the fund may be temporarily prohibited from closing out its position in a futures contract if intraday price change limits or limits on trading volume imposed by the applicable futures exchange are triggered. If the fund is unable to close out a position on a futures contract, the fund would remain subject to the risk of adverse price movements until the fund is able to close out the futures position. The ability of the fund to successfully utilize futures contracts may depend in part upon the ability of the fund’s investment adviser to accurately forecast interest rates and other economic factors and to assess and predict the impact of such economic factors on the futures in which the fund invests. If the investment adviser incorrectly forecasts economic developments or incorrectly predicts the impact of such developments on the futures in which it invests, the fund could be exposed to the risk of loss.

The Bond Fund of America / Prospectus 16

Investing in swaps — Swaps, including interest rate swaps and credit default swap indices, or CDSI, are subject to many of the risks generally associated with investing in derivative instruments. Additionally, although swaps require no or only a small initial investment in the form of a deposit of initial margin, the amount of a potential loss on a swap contract could greatly exceed the initial amount invested. The use of swaps involves the risk that the investment adviser will not accurately predict anticipated changes in interest rates or other economic factors, which may result in losses to the fund. If the fund enters into a bilaterally negotiated swap transaction, the counterparty may fail to perform in accordance with the terms of the swap agreement. If a counterparty defaults on its obligations under a swap agreement, the fund may lose any amount it expected to receive from the counterparty, potentially including amounts in excess of the fund’s initial investment. Certain swap transactions are subject to mandatory central clearing or may be eligible for voluntary central clearing. Although clearing interposes a central clearinghouse as the ultimate counterparty to each participant’s swap, central clearing will not eliminate (but may decrease) counterparty risk relative to uncleared bilateral swaps. Some swaps, such as CDSI, may be dependent on both the individual credit of the fund’s counterparty and on the credit of one or more issuers of any underlying assets. If the fund does not correctly evaluate the creditworthiness of its counterparty and, where applicable, of issuers of any underlying reference assets, the fund’s investment in a swap may result in losses to the fund.

Currency transactions — In addition to the risks generally associated with investing in derivative instruments, the use of forward currency contracts involves the risk that currency movements will not be accurately predicted by the investment adviser, which could result in losses to the fund. While entering into forward currency contracts could minimize the risk of loss due to a decline in the value of the hedged currency, it could also limit any potential gain that may result from an increase in the value of the currency. Additionally, the adviser may use forward currency contracts to increase exposure to a certain currency or to shift exposure to currency fluctuations from one country to another. Forward currency contracts may expose the fund to potential gains and losses in excess of the initial amount invested.

Portfolio turnover — The fund may engage in frequent and active trading of its portfolio securities. Higher portfolio turnover may involve correspondingly greater transaction costs in the form of dealer spreads, brokerage commissions and other transaction costs on the sale of securities and on reinvestment in other securities. The sale of portfolio securities may also result in the realization of net capital gains, which are taxable when distributed to shareholders, unless the shareholder is exempt from taxation or his or her account is tax-favored. These costs and tax effects may adversely affect the fund’s returns to shareholders. The fund’s portfolio turnover rate may vary from year to year, as well as within a year.

Exposure to country, region, industry or sector — Subject to the fund’s investment limitations, the fund may have significant exposure to a particular country, region, industry or sector. Such exposure may cause the fund to be more impacted by risks relating to and developments affecting the country, region, industry or sector, and thus its net asset value may be more volatile, than a fund without such levels of exposure. For example, if the fund has significant exposure in a particular country, then social, economic, regulatory or other issues that negatively affect that country may have a greater impact on the fund than on a fund that is more geographically diversified.

17 The Bond Fund of America / Prospectus

Cybersecurity breaches — The fund may be subject to operational and information security risks through breaches in cybersecurity. Cybersecurity breaches can result from deliberate attacks or unintentional events, including “ransomware” attacks, the injection of computer viruses or malicious software code, the use of vulnerabilities in code to gain unauthorized access to digital information systems, networks or devices, or external attacks such as denial-of-service attacks on the investment adviser’s or an affiliate’s website that could render the fund’s network services unavailable to intended end-users. These breaches may, among other things, lead to the unauthorized release of confidential information, misuse of the fund’s assets or sensitive information, the disruption of the fund’s operational capacity, the inability of fund shareholders to transact business, or the destruction of the fund’s physical infrastructure, equipment or operating systems. These events could cause the fund to violate applicable privacy and other laws and could subject the fund to reputational damage, additional costs associated with corrective measures and/or financial loss. The fund may also be subject to additional risks if its third-party service providers, such as the fund’s investment adviser, transfer agent, custodian, administrators and other financial intermediaries, experience similar cybersecurity breaches and potential outcomes. Cybersecurity risks may also impact issuers of securities in which the fund invests, which may cause the fund’s investments in such issuers to lose value.

In addition to the principal investment strategies described above, the fund has other investment practices that are described in the statement of additional information, which includes a description of other risks related to the fund’s principal investment strategies and other investment practices. The fund’s investment results will depend on the ability of the fund’s investment adviser to navigate the risks discussed above as well as those described in the statement of additional information.

Fund comparative indexes The investment results table in this prospectus shows how the fund’s average annual total returns compare with various broad measures of market results. The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. The Lipper Core Bond Funds Average is composed of funds that invest at least 85% of their net assets in domestic investment-grade debt issues (rated in the top four grades) with any remaining investment in non-benchmark sectors such as high-yield, global and emerging market debt. These funds maintain dollar-weighted average maturities of five to ten years. The results of the underlying funds in the average include the reinvestment of dividends and capital gain distributions, as well as brokerage commissions paid by the funds for portfolio transactions and other fund expenses, but do not reflect the effect of sales charges, account fees or U.S. federal income taxes. Fund results All fund results in this prospectus reflect the reinvestment of dividends and capital gain distributions, if any. Unless otherwise noted, fund results reflect any fee waivers and/or expense reimbursements in effect during the periods presented.

Portfolio holdings Portfolio holdings information for the fund is available on our website at capitalgroup.com. A description of the fund’s policies and procedures regarding disclosure of information about its portfolio holdings is available in the statement of additional information.

The Bond Fund of America / Prospectus 18

Management and organization

Investment adviser Capital Research and Management Company, an experienced investment management organization founded in 1931, serves as the investment adviser to the fund and other funds, including the American Funds. Capital Research and Management Company is a wholly owned subsidiary of The Capital Group Companies, Inc. and is located at 333 South Hope Street, Los Angeles, California 90071. Capital Research and Management Company manages the investment portfolio and business affairs of the fund. The total management fee paid by the fund to its investment adviser for the most recent fiscal year, as a percentage of average net assets, appears in the Annual Fund Operating Expenses table under “Fees and expenses of the fund.” The management fee is based on the daily net assets of the fund and the fund’s monthly gross investment income. Please see the statement of additional information for further details. A discussion regarding the basis for approval of the fund’s Investment Advisory and Service Agreement by the fund’s board of trustees is contained in the fund’s semi-annual report to shareholders for the period ended June 30, 2021.

Capital Research and Management Company manages equity assets through three equity investment divisions and fixed income assets through its fixed income investment division, Capital Fixed Income Investors. The three equity investment divisions — Capital International Investors, Capital Research Global Investors and Capital World Investors — make investment decisions independently of one another.

The equity investment divisions may, in the future, be incorporated as wholly owned subsidiaries of Capital Research and Management Company. In that event, Capital Research and Management Company would continue to be the investment adviser, and day-to-day investment management of equity assets would continue to be carried out through one or more of these subsidiaries. Although not currently contemplated, Capital Research and Management Company could incorporate its fixed income investment division in the future and engage it to provide day-to-day investment management of fixed income assets. Capital Research and Management Company and each of the funds it advises have received an exemptive order from the U.S. Securities and Exchange Commission that allows Capital Research and Management Company to use, upon approval of the fund’s board, its management subsidiaries and affiliates to provide day-to-day investment management services to the fund, including making changes to the management subsidiaries and affiliates providing such services. The fund’s shareholders have approved this arrangement; however, there is no assurance that Capital Research and Management Company will incorporate its investment divisions or exercise any authority granted to it under the exemptive order.

The Capital SystemSM Capital Research and Management Company uses a system of multiple portfolio managers in managing mutual fund assets. Under this approach, the portfolio of a fund is divided into segments managed by individual managers. In addition, Capital Research and Management Company’s investment analysts may make investment decisions with respect to a portion of a fund’s portfolio. Investment decisions are subject to a fund’s objective(s), policies and restrictions and the oversight of the appropriate investment-related committees of Capital Research and Management Company and its investment divisions.

Certain senior members of Capital Fixed Income Investors, the investment adviser’s fixed income investment division, serve on the Portfolio Strategy Group. The group utilizes a research-driven process with input from the investment adviser’s analysts, portfolio

19 The Bond Fund of America / Prospectus

managers and economists to define investment themes on a range of macroeconomic factors, including duration, yield curve and sector allocation. The investment decisions made by the fund’s portfolio managers are informed by the investment themes discussed by the group.

The table below shows the investment experience and role in management of the fund for each of the fund’s primary portfolio managers.

| | | | |

| Portfolio manager | Investment

experience | Experience

in this fund | Role in

management

of the fund |

| Pramod Atluri | Investment professional for 24 years in total; 6 years with Capital Research and Management Company or affiliate | 6 years | Serves as a fixed income portfolio manager |

| David J. Betanzos | Investment professional for 22 years in total;

20 years with Capital Research and Management Company or affiliate | 6 years | Serves as a fixed income portfolio manager |

| David A. Hoag | Investment professional for

34 years in total;

31 years with Capital Research and Management Company or affiliate | 13 years | Serves as a fixed income portfolio manager |

| Fergus N. MacDonald | Investment professional for

29 years in total;

18 years with Capital Research and Management Company or affiliate | 7 years

(plus 11 years

of prior experience

as an

investment analyst

for the fund) | Serves as a fixed income portfolio manager |

| |

Information regarding the portfolio managers’ compensation, their ownership of securities in the fund and other accounts they manage is in the statement of additional information.

The Bond Fund of America / Prospectus 20

Certain privileges and/or services described on the following pages of this prospectus and in the statement of additional information may not be available to you, depending on your investment dealer or retirement plan recordkeeper. Please see your financial professional or retirement plan recordkeeper for more information.

Shareholder information

Shareholder services American Funds Service Company, the fund’s transfer agent, offers a wide range of services that you can use to alter your investment program should your needs or circumstances change. These services may be terminated or modified at any time upon 60 days’ written notice.

A more detailed description of policies and services is included in the fund’s statement of additional information and the owner’s guide sent to new American Funds shareholders entitled Welcome. Class 529 shareholders should also refer to the applicable program description for information on policies and services relating specifically to their account(s). These documents are available by writing to or calling American Funds Service Company.

21 The Bond Fund of America / Prospectus

Unless otherwise noted or unless the context requires otherwise, references on the following pages to (i) Class A, C, T or F shares also refer to the corresponding Class 529-A, 529-C, 529-T or 529-F shares, (ii) Class F shares refer to Class F-1, F-2 and F-3 shares and (iii) Class R shares refer to Class R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 shares.

Purchase, exchange and sale of shares The fund’s transfer agent, on behalf of the fund and American Funds Distributors,® the fund’s distributor, is required by law to obtain certain personal information from you or any other person(s) acting on your behalf in order to verify your or such person’s identity. If you do not provide the information, the transfer agent may not be able to open your account. If the transfer agent is unable to verify your identity or that of any other person(s) authorized to act on your behalf, or believes it has identified potentially criminal activity, the fund and American Funds Distributors reserve the right to close your account or take such other action they deem reasonable or required by law.

When purchasing shares, you should designate the fund or funds in which you wish to invest. Subject to the exception below, if no fund is designated, your money will be held uninvested (without liability to the transfer agent for loss of income or appreciation pending receipt of proper instructions) until investment instructions are received, but for no more than three business days. Your investment will be made at the net asset value (plus any applicable sales charge, in the case of Class A or Class T shares) next determined after investment instructions are received and accepted by the transfer agent. If investment instructions are not received, your money will be invested in Class A shares (or, if you are investing through a financial intermediary who offers only Class T shares, in Class T shares) of American Funds U.S. Government Money Market FundSM on the third business day after receipt of your investment.

If the amount of your cash investment is $10,000 or less, no fund is designated, and you made a cash investment (excluding exchanges) within the last 16 months, your money will be invested in the same proportion and in the same fund or funds and in the same class of shares in which your last cash investment was made. If you only have one open fund, the money will be invested into such fund on the day received if the investment is otherwise in good order.

Different procedures may apply to certain employer-sponsored arrangements, including, but not limited to, SEPs and SIMPLE IRAs.

Valuing shares The net asset value of each share class of the fund is the value of a single share of that class. The net asset value per share is calculated once daily as of the close of regular trading on the New York Stock Exchange, normally 4 p.m. New York time, each day the New York Stock Exchange is open. If the New York Stock Exchange makes a scheduled (e.g. the day after Thanksgiving) or an unscheduled close prior to 4 p.m. New York time, the net asset value of the fund will be determined at approximately the time the New York Stock Exchange closes on that day. If on such a day market quotations and prices from third-party pricing services are not based as of the time of the early close of the New York Stock Exchange but are as of a later time (up to approximately 4 p.m. New York time), for example because the market remains open after the close of the New York Stock Exchange, those later market quotations and prices will be used in determining the fund’s net asset value.

The Bond Fund of America / Prospectus 22