UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-02444

The Bond Fund of America

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street, 55th Floor

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Becky L. Park

The Bond Fund of America

6455 Irvine Center Drive

Irvine, California 92618

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

The Bond Fund of America® Annual report

for the year ended

December 31, 2023 |  |

Invest with a stable,

long-term approach

The Securities and Exchange Commission has adopted new regulations that will change the content and design of annual and semi-annual shareholder reports beginning in July 2024. Certain types of information, including investment portfolio and financial statements, will not be included in the shareholder reports but will be available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR.

If you would like to receive shareholder reports and other communications from the fund electronically, you may update your mailing preferences with your financial intermediary or enroll in e-delivery at capitalgroup.com (for accounts held directly with the fund).

The Bond Fund of America seeks as high a level of current income as is consistent with the preservation of capital.

This fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For over 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

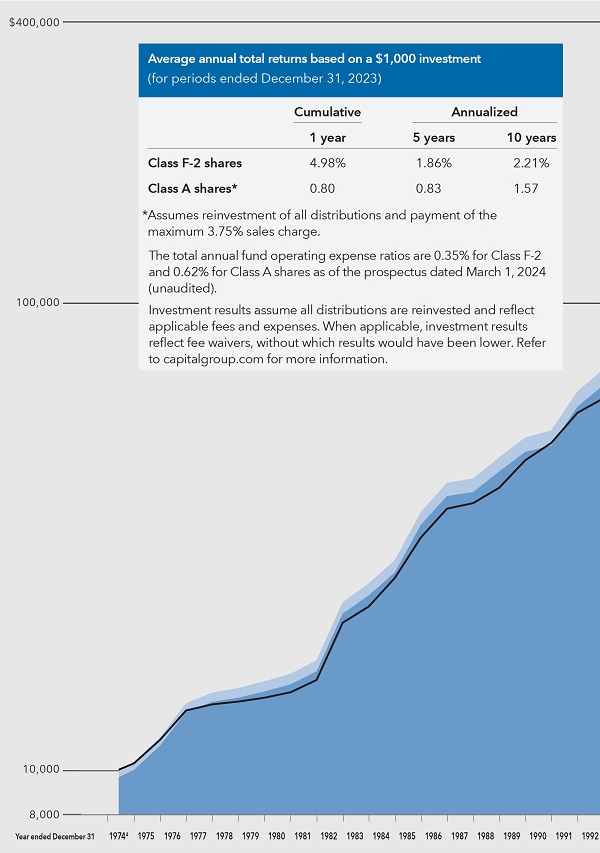

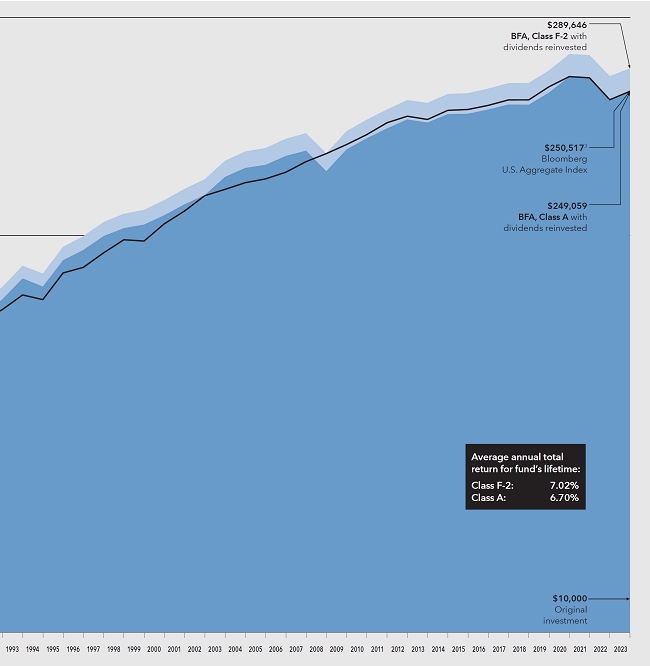

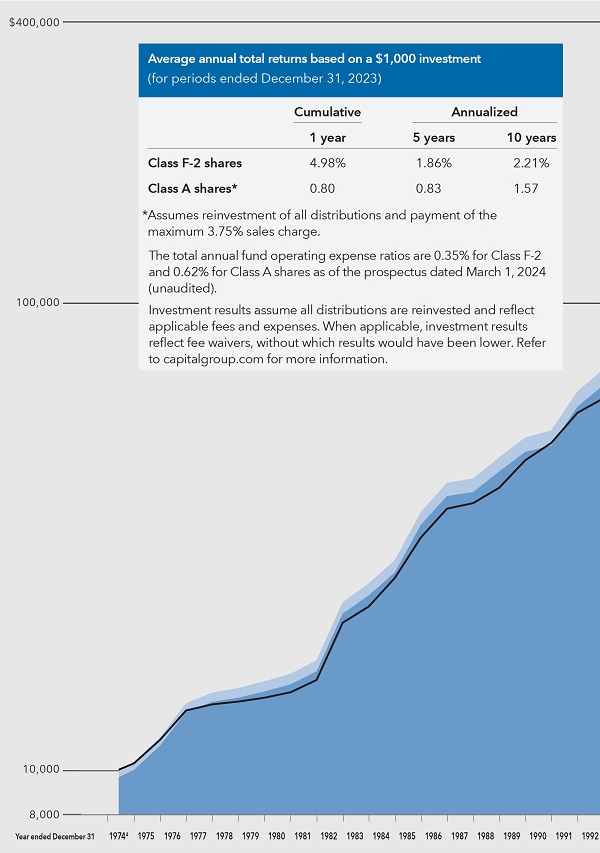

Fund results shown in this report, unless otherwise indicated, are for Class F-2 shares. Class A share results are shown at net asset value unless otherwise indicated. If a sales charge (maximum 3.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

Refer to page 4 for Class F-2 and Class A share results with relevant sales charges deducted. For other share class results, refer to capitalgroup.com and americanfundsretirement.com.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Refer to capitalgroup.com for more information.

The fund’s 30-day yield as of December 31, 2023, was 4.61% for Class F-2 shares and 4.18% for Class A shares calculated in accordance with the U.S. Securities and Exchange Commission formula. The fund’s distribution rate as of that date was 3.84% for Class F-2 shares and 3.44% for Class A shares. The Class A share results for both reflect the 3.75% maximum sales charge. The SEC yield reflects the rate at which the fund is earning income on its current portfolio of securities while the distribution rate reflects the fund’s past dividends paid to shareholders. Accordingly, the fund’s SEC yield and distribution rate may differ.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. High-yield bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade bonds. Investing in bonds issued outside the U.S. may be subject to additional risks. They include currency fluctuations, political and social instability, differing securities regulations and accounting standards, higher transaction costs, possible changes in taxation, illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

Fellow investors:

Slowing inflation and moderating economic growth led the U.S. Federal Reserve (the Fed) to soften its stance, marking a potential end to a hiking cycle that began in March 2022. Bond markets experienced a year-end rally, providing relief to investors after one of the most aggressive rate-hiking campaigns in decades. For the 12-month period ended December 31, The Bond Fund of America returned 4.98% for class F-2 shares.

By way of comparison, the Bloomberg U.S. Aggregate Index, a measure of the broader investment-grade (BBB/Baa and above) bond market, returned 5.53%. The fund’s peer group, as measured by the Lipper Core Bond Funds Average, returned 5.84%.

The fund paid dividends totaling just over 44 cents per share during the period. For investors, this amounted to an income return of 3.94% with dividends reinvested, or 3.87% if taken in cash.

Bond market overview

Last year was characterized by intense volatility as the market seesawed in response to murky readings on the path of inflation, Fed policy changes and the health of the U.S. economy. Early in the year, many investors hoped that declining inflation could pave the way for a more accommodative Fed. Markets were also on watch for a potential recession and signs of strain from higher interest rates. In March, those fears appeared to manifest with the collapse of several banks. Yields plunged on fears of a broader downturn, but the fallout was brief as regulators moved swiftly to seize failed lenders and limit contagion and panic.

A downturn did not materialize, and instead the U.S. economy came surging back with GDP growth reaching nearly 5% annualized in the third quarter. “Surprisingly resilient” was a phrase that came to characterize everything from the state of the labor market to consumer spending and the U.S. economy at large. Against this backdrop, the Fed raised the federal funds rate a full percentage point over the year, bringing the policy target range to a nearly 22-year high of 5.25%–5.5%. The Fed implemented what may be its final rate hike of the cycle in July, but volatility remained high. In September, the Fed slashed its projections for future rate cuts, and a narrative of “higher for longer” came to dominate markets.

Results at a glance

For periods ended December 31, 2023, with all distributions reinvested

| | | Cumulative

total returns | | Average annual total returns |

| | | 1 year | | 5 years | | 10 years | | Lifetime

(since class A

inception on

5/28/74) |

| | | | | | | | | |

| The Bond Fund of America (Class F-2 shares)1 | | | 4.98 | % | | | 1.86 | % | | | 2.21 | % | | | 7.02 | % |

| The Bond Fund of America (Class A shares) | | | 4.70 | | | | 1.61 | | | | 1.95 | | | | 6.78 | |

| Bloomberg U.S. Aggregate Index2 | | | 5.53 | | | | 1.10 | | | | 1.81 | | | | 6.71 | |

| Lipper Core Bond Funds Average3 | | | 5.84 | | | | 1.24 | | | | 1.73 | | | | 6.57 | |

| Past results are not predictive of results in future periods. |

| | |

| 1 | Class F-2 shares were first offered on August 1, 2008. Class F-2 share results prior to the date of first sale are hypothetical based on the results of the original share class of the fund without a sales charge, adjusted for typical estimated expenses. Refer to capitalgroup.com for more information on specific expense adjustments and the actual dates of first sale. |

| 2 | Bloomberg Index Services Limited. The Bloomberg U.S. Aggregate Index began on January 1, 1976. From May 28, 1974, through December 31, 1975, the Barclays U.S. Government/Credit Index (now called “the Bloomberg U.S. Government/Credit Index”) was used. The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. |

| 3 | Source: Refinitiv Lipper. Results for the Lipper averages do not reflect sales charges. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. To review the number of funds included in the Lipper category for each fund’s lifetime, please review the Quarterly Statistical Update, available on our website. |

| The Bond Fund of America | 1 |

Inflation, which peaked at 9.1% in June 2022 and started the year at 6.4%, dropped to 3.4% by December — shifting closer to the Fed’s 2% target. By December, the Fed appeared to have reversed course on its restrictive rhetoric and provided its clearest indication yet that it was done hiking rates. The move caught the market by surprise and accelerated a building rally that drove down yields further and lifted bond returns. The 10-year U.S. Treasury yield finished 2023 at 3.88%, exactly where it started the year and down from an October high of near 5%.

The shape of the Treasury yield curve has been inverted — meaning shorter term bond yields are higher than longer term bond yields — since 2022. Two-year U.S. Treasuries ended the year at 4.25%, down from 4.43% at its start and after an October high of 5.22%. The relatively larger year-over-year decline in these shorter term Treasury yields versus 10-year Treasury yields led this part of the curve to steepen, meaning it became less inverted.

The annual return for the Bloomberg U.S. Aggregate Index1 (the “benchmark”) reached 5.53%, a stark reversal from a loss of 13.01% in 2022. The Bloomberg Global Aggregate Index2 recorded a 5.72% return in 2023.

As economic growth surprised to the upside, the Bloomberg U.S. Corporate Investment Grade Index3 gained 8.52%, with its risk premium relative to Treasuries (or “spread”) tightening 31 basis points. High-yield corporates did even better, with the Bloomberg U.S. Corporate High Yield Index4 returning 13.44% as spreads tightened by 146 basis points. Emerging markets debt also experienced double-digit returns, with the JPM EMBI Global Diversified Index5 gaining 11.09%.

The Bloomberg U.S. Mortgage Backed Securities Index6 posted a gain of 5.05%, with the sector bouncing back in the fourth quarter after being hampered by heightened interest rate volatility. The Bloomberg Municipal Bond Index7 posted higher gains than some of the taxable debt market, rising 6.40%. With inflation falling, the Bloomberg U.S. Treasury Inflation-Protected Securities Index8 posted a weaker relative return of 3.90%.

Inside the portfolio

Managers remained agile in response to changing market conditions, with the macro backdrop switching course a surprising number of times throughout the year. Through our gradual contrarian approach, we sought to be opportunistic in adding exposure when markets were favorable and to be disciplined sellers when valuations moved higher. We remained focused on building a highly liquid, conservative and higher quality portfolio that maintained a balanced profile across different risk factors.

In a year where the economy surprised to the upside, the portfolio experienced relative gains from both sector and security selection in asset classes ranging from securitized to corporate bonds and emerging markets debt. The fund moved from holding less exposure to agency mortgage-backed securities (MBS) than the benchmark to holding more exposure, increasing exposure by about 14 percentage points during the year. Managers had been adding exposure through much of the year but shifted to higher exposure relative to the benchmark in May after the sector was battered by the earlier banking industry turmoil. The decision helped the portfolio as the sector rallied significantly later in the year. The portfolio favored senior tranches of securitized credit such as asset-backed securities, holding more than the index through the year. That led to relative gains, as did security selection within the sector.

In corporate bonds, managers held modestly higher exposure relative to the index, which benefited the portfolio as corporate bonds rallied strongly in 2023. While managers moderated exposures as the rally continued and valuations became less compelling, security selection within corporate bonds such as a preference for high-quality industrials and financials —especially select money center banks — also contributed. Further down the credit spectrum, the portfolio benefited from some holdings that were upgraded from high yield to investment grade, which boosted returns alongside a broader credit rally. Managers are hopeful that more of the fund’s lower rated issuers, where it has modest exposure, will follow suit in the coming year.

The portfolio’s interest rate exposure collectively detracted, including yield curve positioning and duration (a measure of a portfolio’s sensitivity to interest rates changing). We maintained a steepening bias — favoring the shorter maturities of the yield curve against longer maturities —for much of the year. The yield curve did eventually steepen modestly over the course of the year, but not enough to overcome the negative income drag associated with the position. Duration positioning, particularly having a greater interest rate sensitivity than the benchmark at times through the year, was a detractor to results relative to the benchmark.

The fund’s interest rate strategies utilized interest rate swaps and futures to more efficiently execute the portfolio’s positioning based on how managers expected yields to move. These had mixed impacts on results, but ultimately helped to express managers’ convictions more efficiently.

Looking ahead

The market experienced elevated volatility in 2023, but two broad themes remained in place — slowing economic growth and decelerating inflation. Managers expect both themes to continue through 2024.

Managers expect that inflation will continue to decelerate this year, as a broader set of categories within inflation measures like the Consumer Price Index9 are experiencing slower price growth. The prices of material goods are trending toward deflation while those of services, where inflation has been more stubborn, are beginning to moderate. Though the path to lower overall inflation may be bumpy, we believe both headline and core inflation could fall within striking distance of the Fed’s 2% target rate by the second half of this year. Of course, there are risks that inflation could reaccelerate, but managers view that as an unlikely outcome. Several components of inflation, such as rents, work with long lags, which

| 2 | The Bond Fund of America |

means we have yet to see their potential disinflationary impact.

If inflation continues its downward trend, managers believe the Fed will lower its policy rate by the middle of 2024, if not sooner. Should the economy stay on its present course, managers anticipate that the Fed will need to cut rates simply to maintain the current restrictive stance of policy as inflation slows, and then cut even more to shift policy away from one that seeks to dampen economic growth toward one that is neither restrictive nor stimulative. And if the economy loses momentum or falls into a recession, the Fed may choose to cut rates even further. On balance, managers see potential for economic growth to moderate to a 1–2% range.

The combination of slow, but positive, economic growth and easing monetary policy could lead to positive outcomes for both interest rate and credit exposures. This may be magnified by favorable market dynamics as managers expect significant allocations to core bond funds in 2024 as investors look to lock in yields that are at the higher end of the last 20-year range, ahead of expected Fed cuts.

While the likelihood of recession may have diminished for now, managers are mindful that downside risks remain prevalent, as slowing growth, softening labor markets, rising geopolitical tensions and the 2024 presidential election all have the potential to impact markets. Managers have a higher exposure relative to the benchmark on the shorter end of the rate curve, from the two-year to seven-year portion, which should benefit from expected Fed cuts in 2024. Managers have a lower exposure relative to the benchmark on the long end of the curve, from the 10-year to 30-year portion, which is less likely to benefit from rate cuts and could be negatively affected by elevated U.S. Treasury issuance to fund sustained high government deficits. Managers believe investors will be rewarded for taking greater interest rate exposure by the end of the year, but also expect market volatility could create opportunities to profit from shorter term duration positioning.

As valuations for risky assets like corporate bonds continue to move higher, managers will continue to harvest gains where possible. The room for upside given valuations in corporate bonds is becoming limited, but we are leaning into security selection to unearth compelling opportunities.

Managers see greater value in agency MBS, which didn’t gain as much during the recent rally and may have room for valuations to rise further. They feature a high-quality profile and minimal credit risk, which we believe makes them an attractive option relative to other sectors. Agency MBS may also disproportionately benefit if interest rate volatility falls as inflation moves closer to the Fed’s target and the Fed’s cutting cycle begins.

Select opportunities in high-quality securitized credit also look compelling given robust yields and valuations in that sector. Overall, managers expect that research-driven security selection across sectors can be an important contributor to results over the course of the year.

Following last year’s market reset, managers are responding with a more conservative, higher quality and balanced approach to the new landscape. We believe this stance boosts our role as a diversifier and a high-quality ballast in portfolios. While the bond market experienced an extremely difficult period as rates rose, we are optimistic that higher rates may now serve as a tailwind for investors. Relatively high starting yields and the potential for price appreciation as rates fall has brightened the outlook for core bonds in 2024. We see them continuing their vital role in pursuing attractive income and total returns while also diversifying investors’ portfolios.

This year we celebrate the 50th anniversary of The Bond Fund of America, and we are grateful for the support and trust of our investors and those who have been with us throughout our five-decade history.

Cordially,

Pramod Atluri

President

February 12, 2024

For current information about the fund, refer to capitalgroup.com.

The indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees,expenses or U.S. federal income taxes. There have been periods when the fund has lagged the index.

| 1 | Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. |

| 2 | Bloomberg Global Aggregate Index represents the global investment-grade fixed income markets. |

| 3 | Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment-grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. |

| 4 | Bloomberg U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment-grade debt. |

| 5 | J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified is a uniquely weighted emerging market debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities. |

| 6 | Bloomberg U.S. Mortgage Backed Securities Index is a market-value-weighted index that covers the mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). |

| 7 | Bloomberg Municipal Bond Index is a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market. |

| 8 | Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) Index consists of investment-grade, fixed-rate, publicly placed, dollar-denominated and non-convertible inflation-protected securities issued by the U.S. Treasury that have at least one year remaining to maturity, and have at least $250 million par amount outstanding. |

| 9 | Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Widely used as a measure of inflation, the CPI is computed by the U.S. Department of Labor, Bureau of Labor Statistics. |

| The Bond Fund of America | 3 |

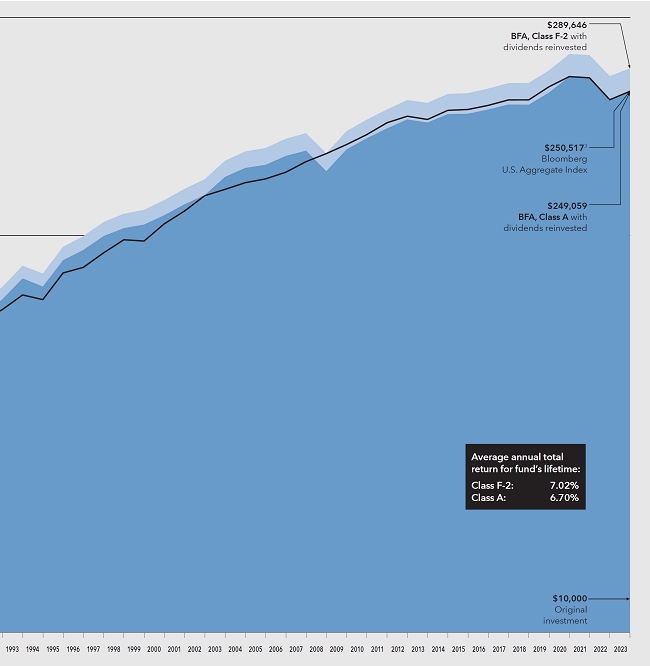

The value of a long-term perspective

Fund results shown are for Class F-2 and Class A shares. Class A share results reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.1 Thus, the net amount invested was $9,625.2 Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, refer to capitalgroup.com.

The results shown are before taxes on fund distributions and sale of fund shares.

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $500,000 or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The maximum initial sales charge was 8.5% prior to December 15, 1986, when it became 4.75% until January 9, 2000. |

| 3 | Source: Bloomberg Index Services Ltd. Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. From May 28, 1974, through December 31, 1975, Bloomberg U.S. Government/Credit Index was used because Bloomberg U.S. Aggregate Index did not yet exist. Since January 1, 1976, the Bloomberg U.S. Aggregate Index has been used. These indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. |

| 4 | For the period May 28, 1974, commencement of operations, through December 31, 1974. |

| 4 | The Bond Fund of America |

How a hypothetical $10,000 investment has grown

There have always been reasons not to invest. You will find, however, that despite occasional stumbles, financial markets have tended to reward investors over the long term. Dividends, particularly when reinvested, have accounted for a large portion of the fund’s overall results.

| The Bond Fund of America | 5 |

Investment portfolio December 31, 2023

| Portfolio by type of security | Percent of net assets |

| Portfolio quality summary* | | Percent of

net assets |

| U.S. Treasury and agency† | | 19.88 | % |

| AAA/Aaa | | 43.23 | |

| AA/Aa | | 3.58 | |

| A/A | | 12.00 | |

| BBB/Baa | | 15.05 | |

| Below investment grade | | 2.26 | |

| Unrated | | .05 | |

| Short-term securities & other assets less liabilities | | 3.95 | |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. The ratings are not covered by the Report of Independent Registered Public Accounting Firm. |

| † | These securities are guaranteed by the full faith and credit of the U.S. government. |

| Bonds, notes & other debt instruments 96.00% | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations 40.14% | | | | | | | | |

| Federal agency mortgage-backed obligations 36.96% | | | | | | | | |

| Fannie Mae Pool #932119 4.50% 11/1/20241 | | USD | 101 | | | $ | 100 | |

| Fannie Mae Pool #AD3149 4.50% 4/1/20251 | | | 66 | | | | 65 | |

| Fannie Mae Pool #AD6392 4.50% 5/1/20251 | | | 134 | | | | 133 | |

| Fannie Mae Pool #AD5692 4.50% 5/1/20251 | | | 78 | | | | 78 | |

| Fannie Mae Pool #AB1068 4.50% 5/1/20251 | | | — | 2 | | | — | 2 |

| Fannie Mae Pool #303591 6.50% 11/1/20251 | | | — | 2 | | | — | 2 |

| Fannie Mae Pool #745316 6.50% 2/1/20261 | | | 7 | | | | 7 | |

| Fannie Mae Pool #AL1237 6.50% 2/1/20261 | | | 1 | | | | 2 | |

| Fannie Mae Pool #256449 6.50% 10/1/20261 | | | 11 | | | | 11 | |

| Fannie Mae Pool #MA2973 3.00% 4/1/20271 | | | 3 | | | | 3 | |

| Fannie Mae Pool #256821 6.50% 7/1/20271 | | | 1 | | | | 1 | |

| Fannie Mae Pool #256856 6.50% 8/1/20271 | | | 25 | | | | 26 | |

| Fannie Mae Pool #MA3131 3.00% 9/1/20271 | | | 31 | | | | 31 | |

| Fannie Mae Pool #256886 6.50% 9/1/20271 | | | 17 | | | | 18 | |

| Fannie Mae Pool #995401 6.50% 10/1/20271 | | | — | 2 | | | — | 2 |

| Fannie Mae Pool #257145 6.50% 3/1/20281 | | | 6 | | | | 7 | |

| Fannie Mae Pool #251752 6.50% 6/1/20281 | | | — | 2 | | | — | 2 |

| Fannie Mae Pool #257431 6.50% 10/1/20281 | | | 1 | | | | 1 | |

| Fannie Mae Pool #AL8822 6.50% 11/1/20281 | | | — | 2 | | | — | 2 |

| Fannie Mae Pool #496029 6.50% 1/1/20291 | | | — | 2 | | | — | 2 |

| Fannie Mae Pool #AY1948 3.50% 1/1/20301 | | | 177 | | | | 171 | |

| Fannie Mae Pool #AL9668 3.00% 10/1/20301 | | | 5 | | | | 4 | |

| Fannie Mae Pool #AZ0554 3.50% 10/1/20301 | | | 229 | | | | 221 | |

| Fannie Mae Pool #AL6344 5.00% 2/1/20311 | | | 140 | | | | 140 | |

| Fannie Mae Pool #FM9892 5.00% 9/1/20311 | | | 69 | | | | 68 | |

| Fannie Mae Pool #BJ4856 3.00% 2/1/20331 | | | 315 | | | | 300 | |

| Fannie Mae Pool #695412 5.00% 6/1/20331 | | | 4 | | | | 4 | |

| 6 | The Bond Fund of America |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Fannie Mae Pool #MA3518 4.00% 11/1/20331 | | USD | 11 | | | $ | 11 | |

| Fannie Mae Pool #BO1359 2.50% 8/1/20341 | | | 1,380 | | | | 1,285 | |

| Fannie Mae Pool #AD3566 5.00% 10/1/20351 | | | 24 | | | | 25 | |

| Fannie Mae Pool #745140 5.00% 11/1/20351 | | | 149 | | | | 151 | |

| Fannie Mae Pool #MA2588 4.00% 4/1/20361 | | | 1,238 | | | | 1,211 | |

| Fannie Mae Pool #MA2717 4.00% 8/1/20361 | | | 257 | | | | 251 | |

| Fannie Mae Pool #MA2746 4.00% 9/1/20361 | | | 1,560 | | | | 1,525 | |

| Fannie Mae Pool #MA2787 4.00% 10/1/20361 | | | 873 | | | | 854 | |

| Fannie Mae Pool #AS8355 3.00% 11/1/20361 | | | 7,586 | | | | 7,069 | |

| Fannie Mae Pool #AS8554 3.00% 12/1/20361 | | | 775 | | | | 722 | |

| Fannie Mae Pool #MA2866 3.00% 1/1/20371 | | | 9,133 | | | | 8,510 | |

| Fannie Mae Pool #MA2897 3.00% 2/1/20371 | | | 16,069 | | | | 14,972 | |

| Fannie Mae Pool #913966 6.00% 2/1/20371 | | | 2 | | | | 2 | |

| Fannie Mae Pool #914612 7.50% 3/1/20371 | | | 52 | | | | 52 | |

| Fannie Mae Pool #924069 7.00% 5/1/20371 | | | 96 | | | | 96 | |

| Fannie Mae Pool #954927 7.00% 7/1/20371 | | | 93 | | | | 95 | |

| Fannie Mae Pool #966170 7.00% 7/1/20371 | | | 70 | | | | 72 | |

| Fannie Mae Pool #954936 7.00% 7/1/20371 | | | 36 | | | | 36 | |

| Fannie Mae Pool #945680 6.00% 9/1/20371 | | | 15 | | | | 16 | |

| Fannie Mae Pool #924866 4.765% 10/1/20371,3 | | | 5 | | | | 5 | |

| Fannie Mae Pool #988588 5.50% 8/1/20381 | | | 3 | | | | 3 | |

| Fannie Mae Pool #889982 5.50% 11/1/20381 | | | 15 | | | | 16 | |

| Fannie Mae Pool #MA3539 4.50% 12/1/20381 | | | 33 | | | | 33 | |

| Fannie Mae Pool #931768 5.00% 8/1/20391 | | | 37 | | | | 38 | |

| Fannie Mae Pool #AC2641 4.50% 10/1/20391 | | | 3,350 | | | | 3,347 | |

| Fannie Mae Pool #AC0794 5.00% 10/1/20391 | | | 26 | | | | 26 | |

| Fannie Mae Pool #932606 5.00% 2/1/20401 | | | 62 | | | | 63 | |

| Fannie Mae Pool #MA4093 2.00% 8/1/20401 | | | 6,350 | | | | 5,470 | |

| Fannie Mae Pool #AD8522 4.00% 8/1/20401 | | | 82 | | | | 80 | |

| Fannie Mae Pool #AB1297 5.00% 8/1/20401 | | | 264 | | | | 268 | |

| Fannie Mae Pool #AE1761 4.00% 9/1/20401 | | | 1,685 | | | | 1,644 | |

| Fannie Mae Pool #MA4152 2.00% 10/1/20401 | | | 7,139 | | | | 6,149 | |

| Fannie Mae Pool #AE5471 4.50% 10/1/20401 | | | 496 | | | | 495 | |

| Fannie Mae Pool #AE7567 4.00% 11/1/20401 | | | 1,769 | | | | 1,725 | |

| Fannie Mae Pool #AH0007 4.00% 12/1/20401 | | | 1,680 | | | | 1,638 | |

| Fannie Mae Pool #AH0539 4.00% 12/1/20401 | | | 424 | | | | 413 | |

| Fannie Mae Pool #AE8073 4.00% 12/1/20401 | | | 321 | | | | 313 | |

| Fannie Mae Pool #MA4287 2.00% 3/1/20411 | | | 82,154 | | | | 70,615 | |

| Fannie Mae Pool #AH6099 5.00% 3/1/20411 | | | 970 | | | | 985 | |

| Fannie Mae Pool #AH8144 5.00% 4/1/20411 | | | 31 | | | | 31 | |

| Fannie Mae Pool #AH9479 5.00% 4/1/20411 | | | 30 | | | | 30 | |

| Fannie Mae Pool #MA4333 2.00% 5/1/20411 | | | 67,145 | | | | 57,590 | |

| Fannie Mae Pool #AI1862 5.00% 5/1/20411 | | | 1,192 | | | | 1,210 | |

| Fannie Mae Pool #MA4364 2.00% 6/1/20411 | | | 117,028 | | | | 100,373 | |

| Fannie Mae Pool #AI3510 5.00% 6/1/20411 | | | 652 | | | | 662 | |

| Fannie Mae Pool #AE1248 5.00% 6/1/20411 | | | 43 | | | | 43 | |

| Fannie Mae Pool #MA4387 2.00% 7/1/20411 | | | 110,212 | | | | 94,458 | |

| Fannie Mae Pool #FM7690 2.00% 7/1/20411 | | | 32,136 | | | | 27,552 | |

| Fannie Mae Pool #BT5941 2.00% 7/1/20411 | | | 12,602 | | | | 10,804 | |

| Fannie Mae Pool #MA4407 2.00% 8/1/20411 | | | 240,546 | | | | 206,087 | |

| Fannie Mae Pool #FM8120 2.00% 8/1/20411 | | | 21,827 | | | | 18,782 | |

| Fannie Mae Pool #AI5172 4.00% 8/1/20411 | | | 400 | | | | 387 | |

| Fannie Mae Pool #AL0658 4.50% 8/1/20411 | | | 543 | | | | 542 | |

| Fannie Mae Pool #AJ0257 4.00% 9/1/20411 | | | 109 | | | | 107 | |

| Fannie Mae Pool #AJ0704 5.00% 9/1/20411 | | | 548 | | | | 557 | |

| Fannie Mae Pool #AJ1873 4.00% 10/1/20411 | | | 322 | | | | 314 | |

| Fannie Mae Pool #AJ4154 4.00% 11/1/20411 | | | 329 | | | | 320 | |

| Fannie Mae Pool #AJ5391 5.00% 11/1/20411 | | | 374 | | | | 380 | |

| Fannie Mae Pool #AE1277 5.00% 11/1/20411 | | | 107 | | | | 109 | |

| Fannie Mae Pool #MA4501 2.00% 12/1/20411 | | | 74,409 | | | | 63,633 | |

| Fannie Mae Pool #AB4050 4.00% 12/1/20411 | | | 622 | | | | 606 | |

| Fannie Mae Pool #AJ7471 4.00% 12/1/20411 | | | 392 | | | | 381 | |

| Fannie Mae Pool #AJ4189 4.00% 12/1/20411 | | | 371 | | | | 361 | |

| Fannie Mae Pool #AE1283 5.00% 12/1/20411 | | | 68 | | | | 69 | |

| Fannie Mae Pool #MA4540 2.00% 2/1/20421 | | | 31,839 | | | | 27,208 | |

| Fannie Mae Pool #890407 4.00% 2/1/20421 | | | 865 | | | | 842 | |

| Fannie Mae Pool #AE1290 5.00% 2/1/20421 | | | 133 | | | | 135 | |

| The Bond Fund of America | 7 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Fannie Mae Pool #MA4570 2.00% 3/1/20421 | | USD | 18,278 | | | $ | 15,614 | |

| Fannie Mae Pool #AK6740 4.00% 3/1/20421 | | | 3,212 | | | | 3,142 | |

| Fannie Mae Pool #AL2745 4.00% 3/1/20421 | | | 2,534 | | | | 2,467 | |

| Fannie Mae Pool #AK4949 4.00% 3/1/20421 | | | 187 | | | | 182 | |

| Fannie Mae Pool #MA4586 2.00% 4/1/20421 | | | 5,924 | | | | 5,061 | |

| Fannie Mae Pool #AX3703 4.00% 9/1/20421 | | | 3,696 | | | | 3,596 | |

| Fannie Mae Pool #AR1512 3.50% 1/1/20431 | | | 465 | | | | 440 | |

| Fannie Mae Pool #MA4908 6.00% 1/1/20431 | | | 56 | | | | 57 | |

| Fannie Mae Pool #AT0412 3.50% 3/1/20431 | | | 229 | | | | 215 | |

| Fannie Mae Pool #AT0300 3.50% 3/1/20431 | | | 63 | | | | 60 | |

| Fannie Mae Pool #AT3954 3.50% 4/1/20431 | | | 105 | | | | 100 | |

| Fannie Mae Pool #AT2683 4.00% 5/1/20431 | | | 1,517 | | | | 1,477 | |

| Fannie Mae Pool #AT5898 3.00% 6/1/20431 | | | 14,847 | | | | 13,653 | |

| Fannie Mae Pool #AL3829 3.50% 6/1/20431 | | | 2,158 | | | | 2,040 | |

| Fannie Mae Pool #AT7161 3.50% 6/1/20431 | | | 705 | | | | 664 | |

| Fannie Mae Pool #AV0786 4.00% 11/1/20431 | | | 2,787 | | | | 2,712 | |

| Fannie Mae Pool #AL8421 3.50% 1/1/20441 | | | 12,057 | | | | 11,387 | |

| Fannie Mae Pool #AX0817 4.00% 9/1/20441 | | | 187 | | | | 182 | |

| Fannie Mae Pool #AX8521 3.50% 12/1/20441 | | | 302 | | | | 285 | |

| Fannie Mae Pool #AY1829 3.50% 12/1/20441 | | | 100 | | | | 94 | |

| Fannie Mae Pool #BE5009 3.50% 1/1/20451 | | | 676 | | | | 632 | |

| Fannie Mae Pool #BE5017 3.50% 2/1/20451 | | | 1,195 | | | | 1,121 | |

| Fannie Mae Pool #FM9416 3.50% 7/1/20451 | | | 1,703 | | | | 1,590 | |

| Fannie Mae Pool #AZ7366 4.00% 11/1/20451 | | | 16,250 | | | | 15,678 | |

| Fannie Mae Pool #AS6348 4.00% 12/1/20451 | | | 2,866 | | | | 2,765 | |

| Fannie Mae Pool #AS6839 4.00% 3/1/20461 | | | 3,723 | | | | 3,588 | |

| Fannie Mae Pool #BC1352 4.00% 3/1/20461 | | | 1,083 | | | | 1,044 | |

| Fannie Mae Pool #AL8522 3.50% 5/1/20461 | | | 27 | | | | 26 | |

| Fannie Mae Pool #BC8647 4.50% 6/1/20461 | | | 259 | | | | 256 | |

| Fannie Mae Pool #BD1968 4.00% 7/1/20461 | | | 32 | | | | 31 | |

| Fannie Mae Pool #BD1550 4.50% 7/1/20461 | | | 245 | | | | 242 | |

| Fannie Mae Pool #BD7600 4.50% 9/1/20461 | | | 78 | | | | 77 | |

| Fannie Mae Pool #BD9236 3.50% 10/1/20461 | | | 319 | | | | 298 | |

| Fannie Mae Pool #BM5148 4.00% 10/1/20461 | | | 36,278 | | | | 34,899 | |

| Fannie Mae Pool #MA2809 4.50% 10/1/20461 | | | 614 | | | | 586 | |

| Fannie Mae Pool #MA2821 4.50% 10/1/20461 | | | 310 | | | | 298 | |

| Fannie Mae Pool #BD9248 4.50% 10/1/20461 | | | 225 | | | | 221 | |

| Fannie Mae Pool #AS8310 3.00% 11/1/20461 | | | 508 | | | | 465 | |

| Fannie Mae Pool #MA2833 3.00% 12/1/20461 | | | 35 | | | | 32 | |

| Fannie Mae Pool #BC9077 3.50% 12/1/20461 | | | 15,278 | | | | 14,264 | |

| Fannie Mae Pool #BD2440 3.50% 1/1/20471 | | | 1,671 | | | | 1,560 | |

| Fannie Mae Pool #BD7087 4.00% 3/1/20471 | | | 34,190 | | | | 32,986 | |

| Fannie Mae Pool #BM1179 3.00% 4/1/20471 | | | 600 | | | | 546 | |

| Fannie Mae Pool #BH0876 4.50% 4/1/20471 | | | 2,439 | | | | 2,414 | |

| Fannie Mae Pool #MA3002 4.50% 4/1/20471 | | | 431 | | | | 411 | |

| Fannie Mae Pool #BE8740 3.50% 5/1/20471 | | | 986 | | | | 925 | |

| Fannie Mae Pool #BE8742 3.50% 5/1/20471 | | | 324 | | | | 305 | |

| Fannie Mae Pool #BH2846 3.50% 5/1/20471 | | | 150 | | | | 141 | |

| Fannie Mae Pool #BH2848 3.50% 5/1/20471 | | | 130 | | | | 122 | |

| Fannie Mae Pool #BH2847 3.50% 5/1/20471 | | | 67 | | | | 63 | |

| Fannie Mae Pool #BH3122 4.00% 6/1/20471 | | | 68 | | | | 65 | |

| Fannie Mae Pool #BD3554 4.00% 7/1/20471 | | | 423 | | | | 405 | |

| Fannie Mae Pool #256893 7.00% 8/1/20471 | | | 10 | | | | 10 | |

| Fannie Mae Pool #CA0453 4.00% 9/1/20471 | | | 5,955 | | | | 5,738 | |

| Fannie Mae Pool #BH5696 4.00% 10/1/20471 | | | 42,725 | | | | 41,224 | |

| Fannie Mae Pool #CA0770 3.50% 11/1/20471 | | | 164 | | | | 153 | |

| Fannie Mae Pool #BJ3525 4.50% 11/1/20471 | | | 1,045 | | | | 1,031 | |

| Fannie Mae Pool #CA0854 3.50% 12/1/20471 | | | 12,266 | | | | 11,498 | |

| Fannie Mae Pool #MA3211 4.00% 12/1/20471 | | | 3,257 | | | | 3,147 | |

| Fannie Mae Pool #BJ5015 4.00% 12/1/20471 | | | 1,708 | | | | 1,649 | |

| Fannie Mae Pool #BM4413 4.50% 12/1/20471 | | | 4,520 | | | | 4,463 | |

| Fannie Mae Pool #BJ3558 4.50% 12/1/20471 | | | 1,438 | | | | 1,419 | |

| Fannie Mae Pool #BJ3581 4.50% 12/1/20471 | | | 528 | | | | 522 | |

| Fannie Mae Pool #CA1189 3.50% 2/1/20481 | | | 1,284 | | | | 1,201 | |

| Fannie Mae Pool #BK0163 4.50% 2/1/20481 | | | 1,320 | | | | 1,302 | |

| Fannie Mae Pool #BJ4901 3.50% 3/1/20481 | | | 752 | | | | 704 | |

| Fannie Mae Pool #CA1532 3.50% 4/1/20481 | | | 5,007 | | | | 4,690 | |

| 8 | The Bond Fund of America |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Fannie Mae Pool #BK5232 4.00% 5/1/20481 | | USD | 963 | | | $ | 929 | |

| Fannie Mae Pool #BK6840 4.00% 6/1/20481 | | | 1,297 | | | | 1,252 | |

| Fannie Mae Pool #BF0293 3.00% 7/1/20481 | | | 6,286 | | | | 5,691 | |

| Fannie Mae Pool #CA2102 5.00% 7/1/20481 | | | 420 | | | | 423 | |

| Fannie Mae Pool #BF0318 3.50% 8/1/20481 | | | 29,554 | | | | 27,472 | |

| Fannie Mae Pool #BK9743 4.00% 8/1/20481 | | | 414 | | | | 399 | |

| Fannie Mae Pool #BK9761 4.50% 8/1/20481 | | | 217 | | | | 216 | |

| Fannie Mae Pool #CA2166 4.50% 8/1/20481 | | | 14 | | | | 13 | |

| Fannie Mae Pool #BM5349 4.00% 9/1/20481 | | | 73,915 | | | | 71,322 | |

| Fannie Mae Pool #CA2850 4.00% 12/1/20481 | | | 2,336 | | | | 2,264 | |

| Fannie Mae Pool #BF0320 5.50% 1/1/20491 | | | 5,437 | | | | 5,706 | |

| Fannie Mae Pool #FM3280 3.50% 5/1/20491 | | | 448 | | | | 417 | |

| Fannie Mae Pool #FM1062 3.50% 6/1/20491 | | | 8,127 | | | | 7,622 | |

| Fannie Mae Pool #BN6708 3.50% 6/1/20491 | | | 8,130 | | | | 7,597 | |

| Fannie Mae Pool #CA3807 3.00% 7/1/20491 | | | 1,199 | | | | 1,081 | |

| Fannie Mae Pool #CA3806 3.00% 7/1/20491 | | | 782 | | | | 709 | |

| Fannie Mae Pool #CA4021 3.50% 8/1/20491 | | | 22,792 | | | | 21,223 | |

| Fannie Mae Pool #BJ8411 3.50% 8/1/20491 | | | 2,028 | | | | 1,897 | |

| Fannie Mae Pool #FM2318 3.50% 9/1/20491 | | | 39,945 | | | | 37,315 | |

| Fannie Mae Pool #CA4151 3.50% 9/1/20491 | | | 10,546 | | | | 9,908 | |

| Fannie Mae Pool #FM1443 3.50% 9/1/20491 | | | 6,011 | | | | 5,621 | |

| Fannie Mae Pool #FM1913 4.00% 9/1/20491 | | | 1,587 | | | | 1,529 | |

| Fannie Mae Pool #FM1963 4.00% 11/1/20491 | | | 35,570 | | | | 34,322 | |

| Fannie Mae Pool #CA4802 3.50% 12/1/20491 | | | 22,104 | | | | 20,654 | |

| Fannie Mae Pool #FS5313 3.50% 1/1/20501 | | | 206,872 | | | | 192,698 | |

| Fannie Mae Pool #CA5338 3.00% 3/1/20501 | | | 11,322 | | | | 10,071 | |

| Fannie Mae Pool #FM2664 3.50% 3/1/20501 | | | 26,078 | | | | 24,283 | |

| Fannie Mae Pool #CA5506 3.00% 4/1/20501 | | | 46,189 | | | | 41,611 | |

| Fannie Mae Pool #BP1948 3.00% 4/1/20501 | | | 15,713 | | | | 14,084 | |

| Fannie Mae Pool #BP1954 3.50% 4/1/20501 | | | 17,014 | | | | 15,842 | |

| Fannie Mae Pool #FS3189 4.00% 4/1/20501 | | | 19,193 | | | | 18,489 | |

| Fannie Mae Pool #CA5968 2.50% 6/1/20501 | | | 41,797 | | | | 36,153 | |

| Fannie Mae Pool #BP5717 2.50% 6/1/20501 | | | 10,033 | | | | 8,582 | |

| Fannie Mae Pool #CA6309 3.00% 7/1/20501 | | | 41,243 | | | | 37,376 | |

| Fannie Mae Pool #CA6349 3.00% 7/1/20501 | | | 13,972 | | | | 12,480 | |

| Fannie Mae Pool #FS3745 2.00% 8/1/20501 | | | 18,603 | | | | 15,302 | |

| Fannie Mae Pool #CA6593 2.50% 8/1/20501 | | | 12,910 | | | | 11,173 | |

| Fannie Mae Pool #CA6740 3.00% 8/1/20501 | | | 8,101 | | | | 7,236 | |

| Fannie Mae Pool #BQ1226 2.00% 9/1/20501 | | | 17,781 | | | | 14,622 | |

| Fannie Mae Pool #BP6715 2.00% 9/1/20501 | | | 7 | | | | 6 | |

| Fannie Mae Pool #FM4256 2.50% 9/1/20501 | | | 31,198 | | | | 27,047 | |

| Fannie Mae Pool #CA7028 2.50% 9/1/20501 | | | 7,009 | | | | 6,077 | |

| Fannie Mae Pool #CA7052 3.00% 9/1/20501 | | | 2,657 | | | | 2,370 | |

| Fannie Mae Pool #CA7325 2.00% 10/1/20501 | | | 36,011 | | | | 30,056 | |

| Fannie Mae Pool #FP0051 2.00% 10/1/20501 | | | 18,228 | | | | 15,008 | |

| Fannie Mae Pool #CA7257 2.50% 10/1/20501 | | | 2,423 | | | | 2,096 | |

| Fannie Mae Pool #CA7381 3.00% 10/1/20501 | | | 12,728 | | | | 11,369 | |

| Fannie Mae Pool #CA7739 2.50% 11/1/20501 | | | 93,636 | | | | 80,716 | |

| Fannie Mae Pool #CA7603 2.50% 11/1/20501 | | | 53,505 | | | | 45,835 | |

| Fannie Mae Pool #CA7599 2.50% 11/1/20501 | | | 4,397 | | | | 3,808 | |

| Fannie Mae Pool #MA4208 2.00% 12/1/20501 | | | 8,259 | | | | 6,800 | |

| Fannie Mae Pool #CA8108 2.00% 12/1/20501 | | | 1,021 | | | | 844 | |

| Fannie Mae Pool #CA8130 2.50% 12/1/20501 | | | 19,537 | | | | 16,736 | |

| Fannie Mae Pool #FM5173 2.50% 12/1/20501 | | | 8,835 | | | | 7,613 | |

| Fannie Mae Pool #CA8044 2.50% 12/1/20501 | | | 8,019 | | | | 6,869 | |

| Fannie Mae Pool #CA8285 3.00% 12/1/20501 | | | 52,833 | | | | 47,789 | |

| Fannie Mae Pool #CA8046 3.00% 12/1/20501 | | | 36,061 | | | | 32,663 | |

| Fannie Mae Pool #FM5166 3.00% 12/1/20501 | | | 8,511 | | | | 7,603 | |

| Fannie Mae Pool #MA4237 2.00% 1/1/20511 | | | 45,820 | | | | 37,691 | |

| Fannie Mae Pool #CA8623 3.00% 1/1/20511 | | | 88,637 | | | | 78,763 | |

| Fannie Mae Pool #FM6293 3.00% 1/1/20511 | | | 16,204 | | | | 14,371 | |

| Fannie Mae Pool #BR2666 2.00% 2/1/20511 | | | 3,257 | | | | 2,710 | |

| Fannie Mae Pool #CA8820 2.00% 2/1/20511 | | | 1,959 | | | | 1,619 | |

| Fannie Mae Pool #CA8828 2.50% 2/1/20511 | | | 39,631 | | | | 34,177 | |

| Fannie Mae Pool #FS1971 2.50% 2/1/20511 | | | 17,559 | | | | 15,027 | |

| Fannie Mae Pool #FM5778 2.50% 2/1/20511 | | | 9,544 | | | | 8,225 | |

| Fannie Mae Pool #CA8969 3.00% 2/1/20511 | | | 4,501 | | | | 4,013 | |

| The Bond Fund of America | 9 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Fannie Mae Pool #FM6548 2.00% 3/1/20511 | | USD | 35,369 | | | $ | 29,490 | |

| Fannie Mae Pool #MA4282 2.50% 3/1/20511 | | | 10,430 | | | | 8,925 | |

| Fannie Mae Pool #CA9391 3.00% 3/1/20511 | | | 187,423 | | | | 166,429 | |

| Fannie Mae Pool #CB0290 2.00% 4/1/20511 | | | 2,984 | | | | 2,451 | |

| Fannie Mae Pool #MA4305 2.00% 4/1/20511 | | | 214 | | | | 176 | |

| Fannie Mae Pool #MA4306 2.50% 4/1/20511 | | | 29,619 | | | | 25,364 | |

| Fannie Mae Pool #CB0041 3.00% 4/1/20511 | | | 54,370 | | | | 48,874 | |

| Fannie Mae Pool #CB0191 3.00% 4/1/20511 | | | 25,169 | | | | 22,482 | |

| Fannie Mae Pool #CB0046 3.00% 4/1/20511 | | | 8,550 | | | | 7,585 | |

| Fannie Mae Pool #CB0193 3.00% 4/1/20511 | | | 3,028 | | | | 2,703 | |

| Fannie Mae Pool #CB0449 2.00% 5/1/20511 | | | 23,796 | | | | 19,516 | |

| Fannie Mae Pool #BR1035 2.00% 5/1/20511 | | | 127 | | | | 104 | |

| Fannie Mae Pool #CB0457 2.50% 5/1/20511 | | | 4,996 | | | | 4,280 | |

| Fannie Mae Pool #FM7803 2.00% 6/1/20511 | | | 4,225 | | | | 3,516 | |

| Fannie Mae Pool #BT3317 2.50% 6/1/20511 | | | 5,193 | | | | 4,466 | |

| Fannie Mae Pool #FM7694 3.00% 6/1/20511 | | | 18,980 | | | | 16,971 | |

| Fannie Mae Pool #CB0737 3.00% 6/1/20511 | | | 16,767 | | | | 14,868 | |

| Fannie Mae Pool #FM7687 3.00% 6/1/20511 | | | 7,402 | | | | 6,646 | |

| Fannie Mae Pool #FM7909 3.00% 6/1/20511 | | | 2,365 | | | | 2,111 | |

| Fannie Mae Pool #FS3744 2.00% 7/1/20511 | | | 54,819 | | | | 45,065 | |

| Fannie Mae Pool #CB1136 2.50% 7/1/20511 | | | 150,334 | | | | 128,936 | |

| Fannie Mae Pool #FM7957 2.50% 7/1/20511 | | | 121,717 | | | | 104,752 | |

| Fannie Mae Pool #CB0988 2.50% 7/1/20511 | | | 106,703 | | | | 91,803 | |

| Fannie Mae Pool #BR2095 2.50% 7/1/20511 | | | 53,733 | | | | 45,929 | |

| Fannie Mae Pool #FM7900 2.50% 7/1/20511 | | | 3,962 | | | | 3,417 | |

| Fannie Mae Pool #BR2219 2.50% 8/1/20511 | | | 109,611 | | | | 93,690 | |

| Fannie Mae Pool #FM8442 2.50% 8/1/20511 | | | 59,824 | | | | 51,069 | |

| Fannie Mae Pool #FS1057 2.50% 8/1/20511 | | | 1,037 | | | | 886 | |

| Fannie Mae Pool #CB1304 3.00% 8/1/20511 | | | 19,951 | | | | 17,900 | |

| Fannie Mae Pool #FS4783 4.00% 8/1/20511 | | | 76,529 | | | | 73,355 | |

| Fannie Mae Pool #CB1527 2.50% 9/1/20511 | | | 14,562 | | | | 12,466 | |

| Fannie Mae Pool #BT4537 3.50% 9/1/20511 | | | 373 | | | | 343 | |

| Fannie Mae Pool #FM9068 2.50% 10/1/20511 | | | 12,500 | | | | 10,694 | |

| Fannie Mae Pool #FS4628 3.00% 10/1/20511 | | | 26,313 | | | | 23,487 | |

| Fannie Mae Pool #BU1498 3.50% 10/1/20511 | | | 343 | | | | 315 | |

| Fannie Mae Pool #FS0965 2.00% 11/1/20511 | | | 997 | | | | 823 | |

| Fannie Mae Pool #MA4465 2.00% 11/1/20511 | | | 882 | | | | 723 | |

| Fannie Mae Pool #FM9492 2.50% 11/1/20511 | | | 21,109 | | | | 18,205 | |

| Fannie Mae Pool #FM9694 2.50% 11/1/20511 | | | 11,002 | | | | 9,532 | |

| Fannie Mae Pool #FM9632 3.00% 11/1/20511 | | | 15,625 | | | | 13,963 | |

| Fannie Mae Pool #FM9810 3.00% 11/1/20511 | | | 7,729 | | | | 6,895 | |

| Fannie Mae Pool #FM9631 3.00% 11/1/20511 | | | 6,723 | | | | 6,022 | |

| Fannie Mae Pool #CB2292 3.00% 11/1/20511 | | | 1,943 | | | | 1,744 | |

| Fannie Mae Pool #BU3013 3.50% 11/1/20511 | | | 406 | | | | 375 | |

| Fannie Mae Pool #BU5976 4.00% 11/1/20511 | | | 61 | | | | 58 | |

| Fannie Mae Pool #CB2319 2.50% 12/1/20511 | | | 60,733 | | | | 52,301 | |

| Fannie Mae Pool #FS0433 2.50% 12/1/20511 | | | 52,824 | | | | 46,018 | |

| Fannie Mae Pool #CB2371 2.50% 12/1/20511 | | | 36,916 | | | | 31,834 | |

| Fannie Mae Pool #CB2372 2.50% 12/1/20511 | | | 29,378 | | | | 25,268 | |

| Fannie Mae Pool #BT9510 2.50% 12/1/20511 | | | 23,626 | | | | 20,368 | |

| Fannie Mae Pool #BT9483 2.50% 12/1/20511 | | | 22,939 | | | | 19,754 | |

| Fannie Mae Pool #CB2286 2.50% 12/1/20511 | | | 17,836 | | | | 15,329 | |

| Fannie Mae Pool #FM9804 2.50% 12/1/20511 | | | 11,880 | | | | 10,246 | |

| Fannie Mae Pool #CB2373 2.50% 12/1/20511 | | | 11,027 | | | | 9,487 | |

| Fannie Mae Pool #CB2375 2.50% 12/1/20511 | | | 9,783 | | | | 8,408 | |

| Fannie Mae Pool #MA4493 2.50% 12/1/20511 | | | 3,179 | | | | 2,707 | |

| Fannie Mae Pool #CB2414 3.00% 12/1/20511 | | | 32,643 | | | | 29,401 | |

| Fannie Mae Pool #FM9976 3.00% 12/1/20511 | | | 14,972 | | | | 13,516 | |

| Fannie Mae Pool #CB2293 3.00% 12/1/20511 | | | 1,921 | | | | 1,723 | |

| Fannie Mae Pool #BT9498 3.50% 12/1/20511 | | | 8,874 | | | | 8,187 | |

| Fannie Mae Pool #BU8404 3.50% 12/1/20511 | | | 491 | | | | 451 | |

| Fannie Mae Pool #BU8481 3.50% 12/1/20511 | | | 26 | | | | 24 | |

| Fannie Mae Pool #CB2544 3.00% 1/1/20521 | | | 31,828 | | | | 28,413 | |

| Fannie Mae Pool #FS0454 3.00% 1/1/20521 | | | 7,897 | | | | 7,049 | |

| Fannie Mae Pool #FS0972 3.50% 1/1/20521 | | | 27,246 | | | | 25,436 | |

| Fannie Mae Pool #FS0268 3.50% 1/1/20521 | | | 976 | | | | 895 | |

| Fannie Mae Pool #BV0783 3.50% 1/1/20521 | | | 852 | | | | 793 | |

| 10 | The Bond Fund of America |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Fannie Mae Pool #BV0790 3.50% 1/1/20521 | | USD | 713 | | | $ | 654 | |

| Fannie Mae Pool #BU7425 3.50% 1/1/20521 | | | 391 | | | | 359 | |

| Fannie Mae Pool #BU7427 3.50% 1/1/20521 | | | 57 | | | | 53 | |

| Fannie Mae Pool #BV3076 2.00% 2/1/20521 | | | 136,704 | | | | 111,927 | |

| Fannie Mae Pool #BV3080 2.00% 2/1/20521 | | | 111,743 | | | | 91,499 | |

| Fannie Mae Pool #BV3023 2.00% 2/1/20521 | | | 91,785 | | | | 75,113 | |

| Fannie Mae Pool #CB2765 2.00% 2/1/20521 | | | 57,213 | | | | 47,072 | |

| Fannie Mae Pool #BV3083 2.00% 2/1/20521 | | | 5,749 | | | | 4,704 | |

| Fannie Mae Pool #BV3013 2.00% 2/1/20521 | | | 192 | | | | 157 | |

| Fannie Mae Pool #BV3022 2.00% 2/1/20521 | | | 161 | | | | 132 | |

| Fannie Mae Pool #BU1330 2.50% 2/1/20521 | | | 21,835 | | | | 18,825 | |

| Fannie Mae Pool #BU7285 2.50% 2/1/20521 | | | 1,645 | | | | 1,414 | |

| Fannie Mae Pool #BU7294 3.50% 2/1/20521 | | | 52 | | | | 48 | |

| Fannie Mae Pool #BV4172 2.00% 3/1/20521 | | | 29,749 | | | | 24,326 | |

| Fannie Mae Pool #BV4128 2.00% 3/1/20521 | | | 29,554 | | | | 24,194 | |

| Fannie Mae Pool #BV3101 2.00% 3/1/20521 | | | 16,356 | | | | 13,384 | |

| Fannie Mae Pool #BV4118 2.00% 3/1/20521 | | | 8,780 | | | | 7,180 | |

| Fannie Mae Pool #BV4169 2.00% 3/1/20521 | | | 6,863 | | | | 5,615 | |

| Fannie Mae Pool #BV3316 3.50% 3/1/20521 | | | 46 | | | | 43 | |

| Fannie Mae Pool #FS2448 2.00% 5/1/20521 | | | 21,817 | | | | 17,878 | |

| Fannie Mae Pool #BV9644 2.50% 5/1/20521 | | | 380 | | | | 323 | |

| Fannie Mae Pool #BV7810 3.50% 5/1/20521 | | | 280 | | | | 257 | |

| Fannie Mae Pool #BW0958 5.00% 7/1/20521 | | | 23,244 | | | | 23,035 | |

| Fannie Mae Pool #CB4135 5.00% 7/1/20521 | | | 179 | | | | 177 | |

| Fannie Mae Pool #BW5402 5.50% 7/1/20521 | | | 617 | | | | 622 | |

| Fannie Mae Pool #FS2654 4.00% 8/1/20521 | | | 3,453 | | | | 3,267 | |

| Fannie Mae Pool #MA4737 5.00% 8/1/20521 | | | 685 | | | | 679 | |

| Fannie Mae Pool #CB5019 5.00% 8/1/20521 | | | 196 | | | | 194 | |

| Fannie Mae Pool #MA4731 3.50% 9/1/20521 | | | 66,078 | | | | 60,669 | |

| Fannie Mae Pool #MA4732 4.00% 9/1/20521 | | | 133 | | | | 126 | |

| Fannie Mae Pool #BW1192 4.50% 9/1/20521 | | | 2,049 | | | | 1,988 | |

| Fannie Mae Pool #BW9049 4.50% 9/1/20521 | | | 423 | | | | 411 | |

| Fannie Mae Pool #CB4852 4.50% 10/1/20521 | | | 25,003 | | | | 24,254 | |

| Fannie Mae Pool #BW5232 4.50% 10/1/20521 | | | 3,330 | | | | 3,230 | |

| Fannie Mae Pool #BW8175 4.50% 10/1/20521 | | | 1,937 | | | | 1,879 | |

| Fannie Mae Pool #BW1289 5.50% 10/1/20521 | | | 24,214 | | | | 24,388 | |

| Fannie Mae Pool #BW1243 5.50% 10/1/20521 | | | 21,550 | | | | 21,708 | |

| Fannie Mae Pool #FS5554 4.50% 11/1/20521 | | | 9,497 | | | | 9,213 | |

| Fannie Mae Pool #BW5182 4.50% 11/1/20521 | | | 2,741 | | | | 2,659 | |

| Fannie Mae Pool #BW1296 5.00% 11/1/20521 | | | 41,260 | | | | 40,889 | |

| Fannie Mae Pool #BW5057 5.00% 12/1/20521 | | | 25,464 | | | | 25,235 | |

| Fannie Mae Pool #BX5673 5.00% 12/1/20521 | | | 197 | | | | 195 | |

| Fannie Mae Pool #MA4842 5.50% 12/1/20521 | | | 41,587 | | | | 41,854 | |

| Fannie Mae Pool #BX2476 5.50% 12/1/20521 | | | 7,110 | | | | 7,161 | |

| Fannie Mae Pool #CB5778 6.00% 12/1/20521 | | | 1,506 | | | | 1,531 | |

| Fannie Mae Pool #MA4866 4.00% 1/1/20531 | | | 70,406 | | | | 66,615 | |

| Fannie Mae Pool #FS4947 4.00% 1/1/20531 | | | 219 | | | | 207 | |

| Fannie Mae Pool #MA4867 4.50% 1/1/20531 | | | 7,553 | | | | 7,327 | |

| Fannie Mae Pool #FS3981 5.50% 1/1/20531 | | | 34,580 | | | | 34,810 | |

| Fannie Mae Pool #BX6633 5.50% 1/1/20531 | | | 497 | | | | 500 | |

| Fannie Mae Pool #MA4894 6.00% 1/1/20531 | | | 283,635 | | | | 288,249 | |

| Fannie Mae Pool #BX5931 6.00% 1/1/20531 | | | 5,518 | | | | 5,611 | |

| Fannie Mae Pool #BX5040 6.00% 1/1/20531 | | | 2,797 | | | | 2,842 | |

| Fannie Mae Pool #BX4070 6.00% 1/1/20531 | | | 2,044 | | | | 2,078 | |

| Fannie Mae Pool #BX5666 6.00% 1/1/20531 | | | 1,207 | | | | 1,226 | |

| Fannie Mae Pool #FS3411 6.00% 1/1/20531 | | | 53 | | | | 54 | |

| Fannie Mae Pool #CB5525 6.00% 1/1/20531 | | | 51 | | | | 51 | |

| Fannie Mae Pool #MA4919 5.50% 2/1/20531 | | | 52,682 | | | | 52,933 | |

| Fannie Mae Pool #BX6216 5.50% 2/1/20531 | | | 853 | | | | 858 | |

| Fannie Mae Pool #MA4920 6.00% 2/1/20531 | | | 207,910 | | | | 211,253 | |

| Fannie Mae Pool #FS4238 5.00% 3/1/20531 | | | 899 | | | | 891 | |

| Fannie Mae Pool #CB5986 5.00% 3/1/20531 | | | 97 | | | | 96 | |

| Fannie Mae Pool #BX8515 5.50% 3/1/20531 | | | 4,946 | | | | 4,971 | |

| Fannie Mae Pool #BX7779 5.50% 3/1/20531 | | | 3,729 | | | | 3,753 | |

| Fannie Mae Pool #BX8514 5.50% 3/1/20531 | | | 1,914 | | | | 1,923 | |

| Fannie Mae Pool #BX9431 5.50% 3/1/20531 | | | 1,864 | | | | 1,877 | |

| Fannie Mae Pool #FS4774 5.50% 3/1/20531 | | | 908 | | | | 913 | |

| The Bond Fund of America | 11 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Fannie Mae Pool #BX8389 5.50% 3/1/20531 | | USD | 497 | | | $ | 500 | |

| Fannie Mae Pool #FS4152 5.50% 3/1/20531 | | | 378 | | | | 380 | |

| Fannie Mae Pool #BX8835 5.50% 3/1/20531 | | | 354 | | | | 357 | |

| Fannie Mae Pool #MA4942 6.00% 3/1/20531 | | | 259,273 | | | | 263,358 | |

| Fannie Mae Pool #MA4993 4.00% 4/1/20531 | | | 5,589 | | | | 5,286 | |

| Fannie Mae Pool #MA4977 4.50% 4/1/20531 | | | 4,599 | | | | 4,462 | |

| Fannie Mae Pool #BX8625 5.00% 4/1/20531 | | | 24,177 | | | | 23,928 | |

| Fannie Mae Pool #BX9135 5.00% 4/1/20531 | | | 5,912 | | | | 5,858 | |

| Fannie Mae Pool #BX8434 5.00% 4/1/20531 | | | 2,259 | | | | 2,236 | |

| Fannie Mae Pool #BY0889 5.00% 4/1/20531 | | | 1,943 | | | | 1,925 | |

| Fannie Mae Pool #BX8880 5.00% 4/1/20531 | | | 1,345 | | | | 1,331 | |

| Fannie Mae Pool #BX8673 5.00% 4/1/20531 | | | 942 | | | | 932 | |

| Fannie Mae Pool #BY0879 5.00% 4/1/20531 | | | 901 | | | | 892 | |

| Fannie Mae Pool #BX9041 5.00% 4/1/20531 | | | 191 | | | | 189 | |

| Fannie Mae Pool #MA4979 5.50% 4/1/20531 | | | 86,733 | | | | 87,247 | |

| Fannie Mae Pool #BY0003 5.50% 4/1/20531 | | | 6,955 | | | | 6,991 | |

| Fannie Mae Pool #BY0007 5.50% 4/1/20531 | | | 2,999 | | | | 3,015 | |

| Fannie Mae Pool #BX8556 5.50% 4/1/20531 | | | 1,986 | | | | 1,995 | |

| Fannie Mae Pool #BX9116 5.50% 4/1/20531 | | | 1,668 | | | | 1,676 | |

| Fannie Mae Pool #BW5286 5.50% 4/1/20531 | | | 51 | | | | 51 | |

| Fannie Mae Pool #MA4980 6.00% 4/1/20531 | | | 161,744 | | | | 164,420 | |

| Fannie Mae Pool #BW5278 6.00% 4/1/20531 | | | 2,622 | | | | 2,664 | |

| Fannie Mae Pool #CB6106 6.50% 4/1/20531 | | | 5,956 | | | | 6,170 | |

| Fannie Mae Pool #FS4919 2.50% 5/1/20531 | | | 13,750 | | | | 11,710 | |

| Fannie Mae Pool #MA5009 5.00% 5/1/20531 | | | 25,513 | | | | 25,250 | |

| Fannie Mae Pool #FS4563 5.00% 5/1/20531 | | | 11,741 | | | | 11,630 | |

| Fannie Mae Pool #BY2022 5.00% 5/1/20531 | | | 5,764 | | | | 5,705 | |

| Fannie Mae Pool #BY1497 5.00% 5/1/20531 | | | 3,980 | | | | 3,938 | |

| Fannie Mae Pool #BY1265 5.00% 5/1/20531 | | | 2,708 | | | | 2,680 | |

| Fannie Mae Pool #BY2251 5.00% 5/1/20531 | | | 2,263 | | | | 2,240 | |

| Fannie Mae Pool #BY0545 5.00% 5/1/20531 | | | 1,965 | | | | 1,946 | |

| Fannie Mae Pool #BY2247 5.00% 5/1/20531 | | | 581 | | | | 575 | |

| Fannie Mae Pool #MA5010 5.50% 5/1/20531 | | | 142,687 | | | | 143,319 | |

| Fannie Mae Pool #BY1223 5.50% 5/1/20531 | | | 7,538 | | | | 7,574 | |

| Fannie Mae Pool #BY0204 5.50% 5/1/20531 | | | 3,770 | | | | 3,788 | |

| Fannie Mae Pool #BY0091 5.50% 5/1/20531 | | | 2,774 | | | | 2,789 | |

| Fannie Mae Pool #BY3208 5.50% 5/1/20531 | �� | | 248 | | | | 250 | |

| Fannie Mae Pool #MA5011 6.00% 5/1/20531 | | | 501,534 | | | | 509,435 | |

| Fannie Mae Pool #MA5054 4.00% 6/1/20531 | | | 31,945 | | | | 30,220 | |

| Fannie Mae Pool #MA5037 4.50% 6/1/20531 | | | 12,805 | | | | 12,419 | |

| Fannie Mae Pool #MA5038 5.00% 6/1/20531 | | | 499,673 | | | | 494,526 | |

| Fannie Mae Pool #BY4405 5.00% 6/1/20531 | | | 31,586 | | | | 31,288 | |

| Fannie Mae Pool #BY4222 5.00% 6/1/20531 | | | 5,865 | | | | 5,805 | |

| Fannie Mae Pool #BY5875 5.00% 6/1/20531 | | | 5,500 | | | | 5,443 | |

| Fannie Mae Pool #BY2305 5.00% 6/1/20531 | | | 3,848 | | | | 3,808 | |

| Fannie Mae Pool #BY3600 5.00% 6/1/20531 | | | 2,543 | | | | 2,516 | |

| Fannie Mae Pool #BY4170 5.00% 6/1/20531 | | | 2,215 | | | | 2,193 | |

| Fannie Mae Pool #BX7642 5.00% 6/1/20531 | | | 2,101 | | | | 2,081 | |

| Fannie Mae Pool #MA5039 5.50% 6/1/20531 | | | 165,172 | | | | 165,904 | |

| Fannie Mae Pool #FS5192 5.50% 6/1/20531 | | | 67,220 | | | | 67,658 | |

| Fannie Mae Pool #BY3337 5.50% 6/1/20531 | | | 6,295 | | | | 6,327 | |

| Fannie Mae Pool #BY4223 5.50% 6/1/20531 | | | 215 | | | | 216 | |

| Fannie Mae Pool #MA5040 6.00% 6/1/20531 | | | 118,933 | | | | 120,807 | |

| Fannie Mae Pool #CB6485 6.00% 6/1/20531 | | | 32,469 | | | | 32,991 | |

| Fannie Mae Pool #CB6486 6.00% 6/1/20531 | | | 20,197 | | | | 20,556 | |

| Fannie Mae Pool #CB6465 6.00% 6/1/20531 | | | 14,489 | | | | 14,745 | |

| Fannie Mae Pool #BO9414 6.00% 6/1/20531 | | | 5,359 | | | | 5,444 | |

| Fannie Mae Pool #BY4290 6.00% 6/1/20531 | | | 994 | | | | 1,010 | |

| Fannie Mae Pool #CB6491 6.50% 6/1/20531 | | | 28,608 | | | | 29,466 | |

| Fannie Mae Pool #CB6490 6.50% 6/1/20531 | | | 9,975 | | | | 10,225 | |

| Fannie Mae Pool #CB6468 6.50% 6/1/20531 | | | 7,194 | | | | 7,397 | |

| Fannie Mae Pool #MA5070 4.50% 7/1/20531 | | | 43,643 | | | | 42,329 | |

| Fannie Mae Pool #CB6719 4.50% 7/1/20531 | | | 7,711 | | | | 7,479 | |

| Fannie Mae Pool #MA5071 5.00% 7/1/20531 | | | 301,271 | | | | 298,120 | |

| Fannie Mae Pool #BY6759 5.00% 7/1/20531 | | | 17,510 | | | | 17,327 | |

| Fannie Mae Pool #BU4046 5.00% 7/1/20531 | | | 7,701 | | | | 7,623 | |

| Fannie Mae Pool #BY2604 5.00% 7/1/20531 | | | 2,988 | | | | 2,957 | |

| 12 | The Bond Fund of America |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Fannie Mae Pool #BU4112 5.00% 7/1/20531 | | USD | 99 | | | $ | 98 | |

| Fannie Mae Pool #MA5072 5.50% 7/1/20531 | | | 214,354 | | | | 215,348 | |

| Fannie Mae Pool #MA5073 6.00% 7/1/20531 | | | 76,439 | | | | 77,631 | |

| Fannie Mae Pool #MA5105 4.50% 8/1/20531 | | | 30,500 | | | | 29,581 | |

| Fannie Mae Pool #CB6853 4.50% 8/1/20531 | | | 12,011 | | | | 11,649 | |

| Fannie Mae Pool #BY6723 5.00% 8/1/20531 | | | 5,939 | | | | 5,877 | |

| Fannie Mae Pool #BY8986 5.00% 8/1/20531 | | | 2,479 | | | | 2,453 | |

| Fannie Mae Pool #MA5136 4.50% 9/1/20531 | | | 10,157 | | | | 9,851 | |

| Fannie Mae Pool #MA5139 6.00% 9/1/20531 | | | 71,345 | | | | 72,458 | |

| Fannie Mae Pool #FS5749 6.50% 9/1/20531 | | | 147,613 | | | | 151,320 | |

| Fannie Mae Pool #CB7139 6.50% 9/1/20531 | | | 9,846 | | | | 10,124 | |

| Fannie Mae Pool #MA5163 4.50% 10/1/20531 | | | 909 | | | | 882 | |

| Fannie Mae Pool #MA5165 5.50% 10/1/20531 | | | 1,880 | | | | 1,888 | |

| Fannie Mae Pool #MA5166 6.00% 10/1/20531 | | | 76,513 | | | | 77,706 | |

| Fannie Mae Pool #MA5167 6.50% 10/1/20531 | | | 152,413 | | | | 156,239 | |

| Fannie Mae Pool #MA5190 5.50% 11/1/20531 | | | 39,685 | | | | 39,855 | |

| Fannie Mae Pool #MA5191 6.00% 11/1/20531 | | | 103,488 | | | | 105,102 | |

| Fannie Mae Pool #MA5192 6.50% 11/1/20531 | | | 196,602 | | | | 201,538 | |

| Fannie Mae Pool #MA5216 6.00% 12/1/20531 | | | 34,817 | | | | 35,360 | |

| Fannie Mae Pool #MA5218 7.00% 12/1/20531 | | | 3,689 | | | | 3,807 | |

| Fannie Mae Pool #MA5247 6.00% 1/1/20541 | | | 13,791 | | | | 14,007 | |

| Fannie Mae Pool #BF0145 3.50% 3/1/20571 | | | 14,161 | | | | 12,864 | |

| Fannie Mae Pool #BF0264 3.50% 5/1/20581 | | | 13,965 | | | | 12,686 | |

| Fannie Mae Pool #BF0299 3.50% 8/1/20581 | | | 22,995 | | | | 20,888 | |

| Fannie Mae Pool #BF0379 3.50% 4/1/20591 | | | 35,787 | | | | 32,509 | |

| Fannie Mae Pool #BM6693 3.50% 8/1/20591 | | | 25,821 | | | | 23,459 | |

| Fannie Mae Pool #BF0481 3.50% 6/1/20601 | | | 57,323 | | | | 52,079 | |

| Fannie Mae Pool #BF0480 3.50% 6/1/20601 | | | 36,684 | | | | 33,873 | |

| Fannie Mae Pool #BF0497 3.00% 7/1/20601 | | | 46,611 | | | | 40,007 | |

| Fannie Mae Pool #BF0548 3.00% 7/1/20611 | | | 23,206 | | | | 20,318 | |

| Fannie Mae Pool #BF0563 4.00% 9/1/20611 | | | 10,696 | | | | 10,224 | |

| Fannie Mae Pool #BF0585 4.50% 12/1/20611 | | | 8,383 | | | | 8,154 | |

| Fannie Mae, Series 2001-4, Class GA, 9.00% 4/17/20251,3 | | | — | 2 | | | — | 2 |

| Fannie Mae, Series 2001-4, Class NA, 9.00% 10/25/20251,3 | | | — | 2 | | | — | 2 |

| Fannie Mae, Series 1998-W5, Class B3, 6.50% 7/25/20281,4 | | | 230 | | | | 45 | |

| Fannie Mae, Series 2002-W7, Class A5, 7.50% 2/25/20291 | | | 43 | | | | 47 | |

| Fannie Mae, Series 2001-25, Class ZA, 6.50% 6/25/20311 | | | 305 | | | | 308 | |

| Fannie Mae, Series 2001-50, Class BA, 7.00% 10/25/20411 | | | 112 | | | | 113 | |

| Fannie Mae, Series 2002-W3, Class A5, 7.50% 11/25/20411 | | | 463 | | | | 495 | |

| Fannie Mae, Series 2001-T10, Class A1, 7.00% 12/25/20411 | | | 714 | | | | 728 | |

| Fannie Mae, Series 2002-W1, Class 2A, 4.68% 2/25/20421,3 | | | 592 | | | | 575 | |

| Fannie Mae, Series 2017-M3, Class A2, Multi Family, 2.465% 12/25/20261,3 | | | 7 | | | | 7 | |

| Fannie Mae, Series 2019-M5, Class A2, Multi Family, 3.273% 1/25/20291 | | | 419 | | | | 399 | |

| Fannie Mae, Series 2018-M12, Class A2, Multi Family, 3.631% 8/25/20301,3 | | | 3,050 | | | | 2,930 | |

| Fannie Mae, Series 2006-51, Class PO, principal only, 0% 3/25/20361 | | | 216 | | | | 201 | |

| Fannie Mae, Series 2006-32, Class OA, principal only, 0% 5/25/20361 | | | 310 | | | | 262 | |

| Fannie Mae, Series 2006-96, Class OP, principal only, 0% 10/25/20361 | | | 107 | | | | 94 | |

| Freddie Mac Pool #ZA1886 5.00% 6/1/20251 | | | 49 | | | | 48 | |

| Freddie Mac Pool #ZS8948 6.50% 3/1/20261 | | | 6 | | | | 6 | |

| Freddie Mac Pool #ZS8801 6.50% 3/1/20261 | | | 5 | | | | 5 | |

| Freddie Mac Pool #ZA1940 6.50% 4/1/20261 | | | 8 | | | | 8 | |

| Freddie Mac Pool #ZA1955 6.50% 9/1/20261 | | | 2 | | | | 2 | |

| Freddie Mac Pool #ZA1959 6.50% 10/1/20261 | | | 2 | | | | 2 | |

| Freddie Mac Pool #ZA0583 6.50% 3/1/20291 | | | — | 2 | | | — | 2 |

| Freddie Mac Pool #D98356 4.50% 5/1/20301 | | | 42 | | | | 41 | |

| Freddie Mac Pool #ZT0799 5.00% 9/1/20311 | | | 38 | | | | 38 | |

| Freddie Mac Pool #A15120 5.50% 10/1/20331 | | | 2 | | | | 2 | |

| Freddie Mac Pool #G30911 4.00% 3/1/20361 | | | 2,397 | | | | 2,347 | |

| Freddie Mac Pool #K93532 4.00% 4/1/20361 | | | 725 | | | | 709 | |

| Freddie Mac Pool #C91883 4.00% 6/1/20361 | | | 360 | | | | 353 | |

| Freddie Mac Pool #A56076 5.50% 1/1/20371 | | | 6 | | | | 7 | |

| Freddie Mac Pool #C91917 3.00% 2/1/20371 | | | 467 | | | | 436 | |

| Freddie Mac Pool #G04804 4.50% 5/1/20371 | | | 1,116 | | | | 1,118 | |

| Freddie Mac Pool #C91948 4.00% 7/1/20371 | | | 2,768 | | | | 2,707 | |

| Freddie Mac Pool #ZS1566 6.50% 8/1/20371 | | | 1 | | | | 1 | |

| Freddie Mac Pool #G03695 5.50% 11/1/20371 | | | 2 | | | | 2 | |

| Freddie Mac Pool #G08248 5.50% 2/1/20381 | | | 28 | | | | 28 | |

| The Bond Fund of America | 13 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Freddie Mac Pool #ZT1449 3.00% 6/1/20381 | | USD | 41,906 | | | $ | 39,049 | |

| Freddie Mac Pool #G05196 5.50% 10/1/20381 | | | 1 | | | | 1 | |

| Freddie Mac Pool #G05267 5.50% 12/1/20381 | | | 2 | | | | 2 | |

| Freddie Mac Pool #A87873 5.00% 8/1/20391 | | | 2,044 | | | | 2,070 | |

| Freddie Mac Pool #G06020 5.50% 12/1/20391 | | | 3 | | | | 3 | |

| Freddie Mac Pool #G05860 5.50% 2/1/20401 | | | 11 | | | | 11 | |

| Freddie Mac Pool #G05937 4.50% 8/1/20401 | | | 4,294 | | | | 4,296 | |

| Freddie Mac Pool #RB5071 2.00% 9/1/20401 | | | 6,931 | | | | 5,969 | |

| Freddie Mac Pool #A93948 4.50% 9/1/20401 | | | 6 | | | | 6 | |

| Freddie Mac Pool #SC0113 2.00% 12/1/20401 | | | 5,824 | | | | 5,016 | |

| Freddie Mac Pool #RB5105 2.00% 3/1/20411 | | | 122,949 | | | | 105,775 | |

| Freddie Mac Pool #SC0149 2.00% 3/1/20411 | | | 23,617 | | | | 20,318 | |

| Freddie Mac Pool #G06868 4.50% 4/1/20411 | | | 5 | | | | 5 | |

| Freddie Mac Pool #RB5114 2.00% 6/1/20411 | | | 114,018 | | | | 97,737 | |

| Freddie Mac Pool #RB0544 2.00% 6/1/20411 | | | 28,006 | | | | 24,016 | |

| Freddie Mac Pool #SC0169 2.00% 6/1/20411 | | | 10,299 | | | | 8,825 | |

| Freddie Mac Pool #G06648 5.00% 6/1/20411 | | | 496 | | | | 504 | |

| Freddie Mac Pool #Q01658 5.00% 6/1/20411 | | | 225 | | | | 228 | |

| Freddie Mac Pool #G06841 5.50% 6/1/20411 | | | 15 | | | | 15 | |

| Freddie Mac Pool #RB5118 2.00% 7/1/20411 | | | 141,646 | | | | 121,376 | |

| Freddie Mac Pool #SC0148 2.00% 7/1/20411 | | | 76,733 | | | | 65,800 | |

| Freddie Mac Pool #Q01992 4.50% 7/1/20411 | | | 36 | | | | 36 | |

| Freddie Mac Pool #RB5121 2.00% 8/1/20411 | | | 220,697 | | | | 189,114 | |

| Freddie Mac Pool #Q02705 4.50% 8/1/20411 | | | 1,937 | | | | 1,937 | |

| Freddie Mac Pool #G06956 4.50% 8/1/20411 | | | 462 | | | | 462 | |

| Freddie Mac Pool #G06769 4.50% 8/1/20411 | | | 189 | | | | 189 | |

| Freddie Mac Pool #SC0175 2.00% 9/1/20411 | | | 20,085 | | | | 17,223 | |

| Freddie Mac Pool #QK1181 2.00% 11/1/20411 | | | 11,378 | | | | 9,732 | |

| Freddie Mac Pool #RB5138 2.00% 12/1/20411 | | | 75,491 | | | | 64,547 | |

| Freddie Mac Pool #RB5145 2.00% 2/1/20421 | | | 15,406 | | | | 13,163 | |

| Freddie Mac Pool #RB5148 2.00% 3/1/20421 | | | 61,449 | | | | 52,483 | |

| Freddie Mac Pool #RB5153 2.00% 4/1/20421 | | | 19,491 | | | | 16,640 | |

| Freddie Mac Pool #Q15874 4.00% 2/1/20431 | | | 43 | | | | 42 | |

| Freddie Mac Pool #Q17696 3.50% 4/1/20431 | | | 501 | | | | 474 | |

| Freddie Mac Pool #Q18236 3.50% 5/1/20431 | | | 709 | | | | 671 | |

| Freddie Mac Pool #Q19133 3.50% 6/1/20431 | | | 578 | | | | 543 | |

| Freddie Mac Pool #Q22946 4.00% 11/1/20431 | | | 4,047 | | | | 3,917 | |

| Freddie Mac Pool #Q28558 3.50% 9/1/20441 | | | 2,483 | | | | 2,326 | |

| Freddie Mac Pool #760012 3.113% 4/1/20451,3 | | | 603 | | | | 598 | |

| Freddie Mac Pool #760013 3.194% 4/1/20451,3 | | | 319 | | | | 318 | |

| Freddie Mac Pool #760014 2.71% 8/1/20451,3 | | | 1,612 | | | | 1,559 | |

| Freddie Mac Pool #G60138 3.50% 8/1/20451 | | | 531 | | | | 501 | |

| Freddie Mac Pool #G60238 3.50% 10/1/20451 | | | 12,859 | | | | 12,081 | |

| Freddie Mac Pool #V81992 4.00% 10/1/20451 | | | 500 | | | | 480 | |

| Freddie Mac Pool #G60344 4.00% 12/1/20451 | | | 9,824 | | | | 9,492 | |

| Freddie Mac Pool #T65375 3.50% 7/1/20461 | | | 104 | | | | 95 | |

| Freddie Mac Pool #Q42034 4.50% 7/1/20461 | | | 92 | | | | 91 | |

| Freddie Mac Pool #G67700 3.50% 8/1/20461 | | | 4,762 | | | | 4,477 | |

| Freddie Mac Pool #Q42633 4.50% 8/1/20461 | | | 259 | | | | 257 | |

| Freddie Mac Pool #Q43312 4.50% 9/1/20461 | | | 467 | | | | 463 | |

| Freddie Mac Pool #Q43461 4.50% 10/1/20461 | | | 254 | | | | 252 | |

| Freddie Mac Pool #Q44689 4.50% 12/1/20461 | | | 360 | | | | 355 | |

| Freddie Mac Pool #760015 2.597% 1/1/20471,3 | | | 1,839 | | | | 1,749 | |

| Freddie Mac Pool #Q47615 3.50% 4/1/20471 | | | 918 | | | | 851 | |

| Freddie Mac Pool #Q47620 4.00% 4/1/20471 | | | 7,002 | | | | 6,796 | |

| Freddie Mac Pool #Q47828 4.50% 5/1/20471 | | | 250 | | | | 246 | |

| Freddie Mac Pool #ZS4735 3.50% 9/1/20471 | | | 67 | | | | 62 | |

| Freddie Mac Pool #Q51622 3.50% 10/1/20471 | | | 1,112 | | | | 1,030 | |

| Freddie Mac Pool #Q52069 3.50% 11/1/20471 | | | 1,372 | | | | 1,289 | |

| Freddie Mac Pool #SD0470 4.00% 11/1/20471 | | | 6,349 | | | | 6,104 | |

| Freddie Mac Pool #G61733 3.00% 12/1/20471 | | | 4,709 | | | | 4,282 | |

| Freddie Mac Pool #ZS4747 3.50% 12/1/20471 | | | 7,687 | | | | 7,160 | |

| Freddie Mac Pool #Q52613 4.00% 12/1/20471 | | | 4,210 | | | | 4,068 | |

| Freddie Mac Pool #G08793 4.00% 12/1/20471 | | | 2,872 | | | | 2,772 | |

| Freddie Mac Pool #Q52596 4.50% 12/1/20471 | | | 1,591 | | | | 1,571 | |

| Freddie Mac Pool #Q53878 4.00% 1/1/20481 | | | 4,088 | | | | 3,951 | |

| Freddie Mac Pool #G67709 3.50% 3/1/20481 | | | 23,079 | | | | 21,688 | |

| 14 | The Bond Fund of America |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Freddie Mac Pool #Q54709 3.50% 3/1/20481 | | USD | 973 | | | $ | 913 | |

| Freddie Mac Pool #Q54701 3.50% 3/1/20481 | | | 967 | | | | 908 | |

| Freddie Mac Pool #Q54700 3.50% 3/1/20481 | | | 734 | | | | 690 | |

| Freddie Mac Pool #Q54781 3.50% 3/1/20481 | | | 687 | | | | 645 | |

| Freddie Mac Pool #Q55056 3.50% 3/1/20481 | | | 646 | | | | 604 | |

| Freddie Mac Pool #Q54782 3.50% 3/1/20481 | | | 542 | | | | 507 | |

| Freddie Mac Pool #Q54699 3.50% 3/1/20481 | | | 396 | | | | 374 | |

| Freddie Mac Pool #Q54698 3.50% 3/1/20481 | | | 281 | | | | 265 | |

| Freddie Mac Pool #Q54831 3.50% 3/1/20481 | | | 278 | | | | 262 | |

| Freddie Mac Pool #G67711 4.00% 3/1/20481 | | | 21,729 | | | | 21,002 | |

| Freddie Mac Pool #G08805 4.00% 3/1/20481 | | | 1,024 | | | | 985 | |

| Freddie Mac Pool #Q55060 3.50% 4/1/20481 | | | 217 | | | | 202 | |

| Freddie Mac Pool #Q55971 4.00% 5/1/20481 | | | 898 | | | | 867 | |

| Freddie Mac Pool #Q56175 4.00% 5/1/20481 | | | 807 | | | | 779 | |

| Freddie Mac Pool #Q55970 4.00% 5/1/20481 | | | 423 | | | | 410 | |

| Freddie Mac Pool #Q56590 3.50% 6/1/20481 | | | 496 | | | | 466 | |

| Freddie Mac Pool #Q56589 3.50% 6/1/20481 | | | 331 | | | | 311 | |

| Freddie Mac Pool #Q56591 3.50% 6/1/20481 | | | 182 | | | | 170 | |

| Freddie Mac Pool #Q56599 4.00% 6/1/20481 | | | 1,301 | | | | 1,255 | |

| Freddie Mac Pool #Q57242 4.50% 7/1/20481 | | | 318 | | | | 313 | |

| Freddie Mac Pool #ZT2265 4.00% 8/1/20481 | | | 6,246 | | | | 5,994 | |

| Freddie Mac Pool #G61628 3.50% 9/1/20481 | | | 132 | | | | 124 | |

| Freddie Mac Pool #Q58411 4.50% 9/1/20481 | | | 2,566 | | | | 2,535 | |

| Freddie Mac Pool #Q58436 4.50% 9/1/20481 | | | 1,413 | | | | 1,393 | |

| Freddie Mac Pool #Q58378 4.50% 9/1/20481 | | | 951 | | | | 937 | |

| Freddie Mac Pool #ZA5889 4.00% 11/1/20481 | | | 1,588 | | | | 1,528 | |

| Freddie Mac Pool #QA0284 3.50% 6/1/20491 | | | 3,335 | | | | 3,119 | |

| Freddie Mac Pool #QA1885 3.50% 8/1/20491 | | | 4,342 | | | | 4,054 | |

| Freddie Mac Pool #QA2748 3.50% 9/1/20491 | | | 960 | | | | 897 | |

| Freddie Mac Pool #SD7508 3.50% 10/1/20491 | | | 57,916 | | | | 54,023 | |

| Freddie Mac Pool #RA1580 3.50% 10/1/20491 | | | 7,439 | | | | 6,987 | |

| Freddie Mac Pool #RA1463 3.50% 10/1/20491 | | | 7,232 | | | | 6,793 | |

| Freddie Mac Pool #QA4692 3.00% 11/1/20491 | | | 17,999 | | | | 16,213 | |

| Freddie Mac Pool #QA4673 3.00% 11/1/20491 | | | 7,502 | | | | 6,765 | |

| Freddie Mac Pool #SD0185 3.00% 12/1/20491 | | | 4,386 | | | | 3,931 | |

| Freddie Mac Pool #QA5125 3.50% 12/1/20491 | | | 21,557 | | | | 20,143 | |

| Freddie Mac Pool #SD0234 3.00% 1/1/20501 | | | 27,593 | | | | 24,738 | |

| Freddie Mac Pool #SD0187 3.00% 1/1/20501 | | | 12,038 | | | | 10,856 | |

| Freddie Mac Pool #RA2319 3.00% 3/1/20501 | | | 18,211 | | | | 16,225 | |

| Freddie Mac Pool #RA2596 2.50% 5/1/20501 | | | 3,855 | | | | 3,326 | |

| Freddie Mac Pool #SD7517 3.00% 5/1/20501 | | | 28,058 | | | | 25,302 | |

| Freddie Mac Pool #QB1368 2.50% 7/1/20501 | | | 38,137 | | | | 33,061 | |

| Freddie Mac Pool #RA3384 3.00% 8/1/20501 | | | 2,872 | | | | 2,566 | |

| Freddie Mac Pool #SI2077 2.00% 9/1/20501 | | | 14,115 | | | | 11,630 | |

| Freddie Mac Pool #SD8090 2.00% 9/1/20501 | | | 8,802 | | | | 7,246 | |

| Freddie Mac Pool #RA3506 3.00% 9/1/20501 | | | 14,090 | | | | 12,584 | |

| Freddie Mac Pool #SD7525 2.50% 10/1/20501 | | | 36,021 | | | | 31,226 | |

| Freddie Mac Pool #SD8106 2.00% 11/1/20501 | | | 27,689 | | | | 22,789 | |

| Freddie Mac Pool #RA4070 2.50% 11/1/20501 | | | 28,359 | | | | 24,289 | |

| Freddie Mac Pool #RA3987 2.50% 11/1/20501 | | | 23,002 | | | | 19,701 | |

| Freddie Mac Pool #RA4352 2.00% 1/1/20511 | | | 1,796 | | | | 1,483 | |

| Freddie Mac Pool #QB8605 2.00% 2/1/20511 | | | 3,480 | | | | 2,895 | |

| Freddie Mac Pool #SD8128 2.00% 2/1/20511 | | | 743 | | | | 610 | |

| Freddie Mac Pool #SD7535 2.50% 2/1/20511 | | | 4,174 | | | | 3,614 | |

| Freddie Mac Pool #RA4658 3.00% 2/1/20511 | | | 38,938 | | | | 34,827 | |

| Freddie Mac Pool #SD8134 2.00% 3/1/20511 | | | 63,797 | | | | 52,401 | |

| Freddie Mac Pool #RA5287 2.00% 5/1/20511 | | | 33,425 | | | | 27,456 | |

| Freddie Mac Pool #RA5288 2.00% 5/1/20511 | | | 24,200 | | | | 19,878 | |

| Freddie Mac Pool #RA5259 2.50% 5/1/20511 | | | 4,858 | | | | 4,161 | |

| Freddie Mac Pool #RA5267 3.00% 5/1/20511 | | | 9,051 | | | | 8,052 | |

| Freddie Mac Pool #SD1852 2.50% 6/1/20511 | | | 89,921 | | | | 76,752 | |

| Freddie Mac Pool #QC2817 2.50% 6/1/20511 | | | 16,060 | | | | 13,811 | |

| Freddie Mac Pool #SD0644 2.50% 7/1/20511 | | | 15,921 | | | | 13,620 | |

| Freddie Mac Pool #SD7544 3.00% 7/1/20511 | | | 82,608 | | | | 74,242 | |

| Freddie Mac Pool #RA5836 2.50% 9/1/20511 | | | 128,663 | | | | 110,551 | |

| Freddie Mac Pool #SD7545 2.50% 9/1/20511 | | | 65,601 | | | | 56,641 | |

| Freddie Mac Pool #RA5901 3.00% 9/1/20511 | | | 9,248 | | | | 8,254 | |

| The Bond Fund of America | 15 |

| Bonds, notes & other debt instruments (continued) | | Principal amount

(000) | | | Value

(000) | |

| Mortgage-backed obligations (continued) | | | | | | | | |

| Federal agency mortgage-backed obligations (continued) | | | | | | | | |

| Freddie Mac Pool #RA5971 3.00% 9/1/20511 | | USD | 4,151 | | | $ | 3,724 | |

| Freddie Mac Pool #QC7626 3.00% 9/1/20511 | | | 750 | | | | 669 | |

| Freddie Mac Pool #SD8172 2.00% 10/1/20511 | | | 874 | | | | 716 | |

| Freddie Mac Pool #SD2880 3.00% 10/1/20511 | | | 52,710 | | | | 47,028 | |

| Freddie Mac Pool #SD0734 3.00% 10/1/20511 | | | 25,582 | | | | 22,947 | |

| Freddie Mac Pool #RA6406 2.00% 11/1/20511 | | | 132,503 | | | | 108,707 | |

| Freddie Mac Pool #SD7548 2.50% 11/1/20511 | | | 14,016 | | | | 12,096 | |

| Freddie Mac Pool #SD1385 2.50% 11/1/20511 | | | 10,620 | | | | 9,151 | |

| Freddie Mac Pool #RA6411 2.50% 11/1/20511 | | | 866 | | | | 737 | |

| Freddie Mac Pool #RA6347 3.00% 11/1/20511 | | | 10,489 | | | | 9,362 | |

| Freddie Mac Pool #RA6483 2.50% 12/1/20511 | | | 8,424 | | | | 7,241 | |

| Freddie Mac Pool #QD3310 3.00% 12/1/20511 | | | 4,448 | | | | 3,938 | |

| Freddie Mac Pool #QD1946 3.50% 12/1/20511 | | | 246 | | | | 226 | |

| Freddie Mac Pool #SD7552 2.50% 1/1/20521 | | | 73,039 | | | | 62,918 | |

| Freddie Mac Pool #SD0855 2.50% 1/1/20521 | | | 30,374 | | | | 25,865 | |

| Freddie Mac Pool #QD5941 2.50% 1/1/20521 | | | 1,431 | | | | 1,230 | |

| Freddie Mac Pool #SD0813 3.00% 1/1/20521 | | | 42,181 | | | | 37,830 | |

| Freddie Mac Pool #SD0803 3.00% 1/1/20521 | | | 1,780 | | | | 1,587 | |

| Freddie Mac Pool #QD7321 3.50% 1/1/20521 | | | 354 | | | | 325 | |

| Freddie Mac Pool #RA6114 2.00% 2/1/20521 | | | 70,744 | | | | 57,873 | |

| Freddie Mac Pool #SD0881 2.50% 2/1/20521 | | | 27,770 | | | | 23,809 | |

| Freddie Mac Pool #SD7550 3.00% 2/1/20521 | | | 60,667 | | | | 54,647 | |

| Freddie Mac Pool #SD0873 3.50% 2/1/20521 | | | 24,894 | | | | 23,209 | |

| Freddie Mac Pool #QD7089 3.50% 2/1/20521 | | | 5,300 | | | | 4,889 | |

| Freddie Mac Pool #QD8207 2.00% 3/1/20521 | | | 19,563 | | | | 16,015 | |

| Freddie Mac Pool #QD8010 2.00% 3/1/20521 | | | 691 | | | | 565 | |

| Freddie Mac Pool #QD7603 2.00% 3/1/20521 | | | 40 | | | | 33 | |

| Freddie Mac Pool #SD1450 2.50% 3/1/20521 | | | 2,707 | | | | 2,332 | |