- LIQT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

LiqTech International (LIQT) DEF 14ADefinitive proxy

Filed: 16 Apr 21, 4:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant | ☑ |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

LIQTECH INTERNATIONAL, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

☐ | Fee paid previously with preliminary materials: | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: | |

(1) | Amount previously paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: |

LIQTECH INTERNATIONAL, INC.

Industriparken 22C

DK2750 Ballerup, Denmark

April 16, 2021

To our Stockholders:

The Annual Meeting of the Stockholders (the “Meeting”) of LiqTech International, Inc. (the “Company”) will be held at 3:00 p.m., local time on Thursday, May 20, 2021, and at any adjournment or adjournments thereof, at the corporate headquarters of the Company at Industriparken 22C, DK2750 Ballerup, Denmark. Details of the business to be conducted at the Meeting are provided in the enclosed Notice of Annual Meeting of Stockholders and Proxy Statement, which you are urged to read carefully.

On behalf of our Board of Directors, I cordially invite all stockholders to attend the Meeting. It is important that your shares be voted on the matters scheduled to come before the Meeting. Whether or not you plan to attend the Meeting, I urge you to vote your shares. We encourage you to vote your proxy by mailing in your enclosed proxy card in the enclosed postage paid envelope, or vote online or over the telephone according to the instructions in the proxy card. If you attend the Meeting, you may revoke such proxy and vote in person if you wish. Even if you do not attend the Meeting, you may revoke such proxy at any time prior to the Meeting by executing another proxy bearing a later date or providing written notice of such revocation to the Chief Executive Officer of the Company.

| Sincerely, |

| /s/ Sune Mathiesen |

| Sune Mathiesen |

| Chief Executive Officer, Principal Executive Officer and Director |

Important Notice Regarding the Availability of Proxy Materials for the annual meeting of stockholders to be held on May 20, 2021: In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission, we are now providing access to our proxy materials, including the Proxy Statement, our Annual Report for the fiscal year ended December 31, 2020 and a form of proxy relating to the Meeting, over the internet. All stockholders of record and beneficial owners will have the ability to access the proxy materials at https://materials.proxyvote.com/53632A. These proxy materials are available free of charge.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF LIQTECH INTERNATIONAL, INC.

TO BE HELD ON MAY 20, 2021

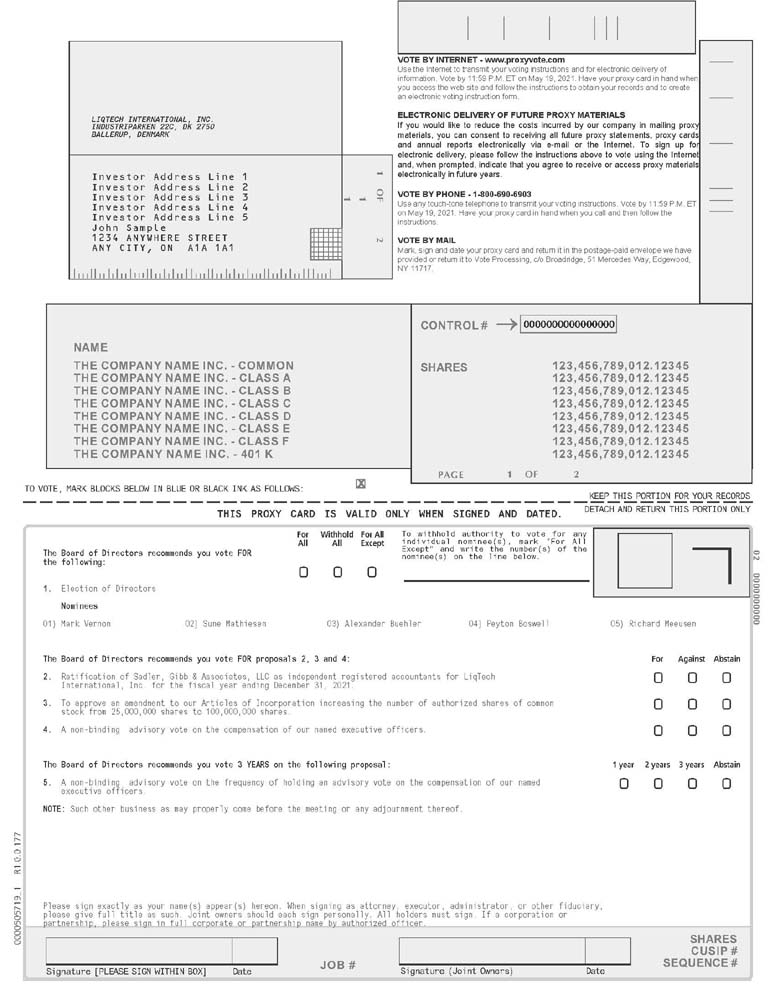

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of LiqTech International, Inc., a Nevada corporation (the “Company”), will be held at 3:00 p.m., local time on Thursday, May 20, 2021, and at any adjournment or adjournments thereof, at the corporate headquarters of the Company at Industriparken 22C, DK2750 Ballerup, Denmark for the following purposes:

1. | To elect a slate of nominees consisting of current directors Mark Vernon, Sune Mathiesen, Alexander Buehler, Peyton Boswell and Richard Meeusen to serve as directors of the Company; |

2. | To ratify the appointment of Sadler, Gibb & Associates, L.L.C. (“Sadler”) as the Company’s independent registered public accountants for the fiscal year ending December 31, 2021; |

| 3. | To approve an amendment to our Articles of Incorporation increasing the number of authorized shares of common stock from 25,000,000 shares to 100,000,000 shares; |

| 4. | To hold a non-binding advisory vote on the compensation of our named executive officers; |

| 5. | To hold a non-binding advisory vote on the frequency of holding an advisory vote on the compensation of our named executive officers; and |

6. | To consider and vote upon such other matter(s) as may properly come before the Meeting or any adjournment(s) thereof. |

The Company’s Board of Directors recommends that you vote in favor of proposals 1, 2, 3, 4 and for “every three years” for proposal 5.

Stockholders of record as of the Record Date (April 5, 2021) are entitled to notice of, and to vote at, this Meeting or any adjournment or postponement thereof.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE VOTE YOUR SHARES, SO THAT A QUORUM WILL BE PRESENT AND A MAXIMUM NUMBER OF SHARES MAY BE VOTED. IT IS IMPORTANT AND IN YOUR INTEREST FOR YOU TO VOTE. WE ENCOURAGE YOU TO VOTE YOUR PROXY BY MAILING IN YOUR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE PAID ENVELOPE, OR VOTE ONLINE OR OVER THE TELEPHONE ACCORDING TO THE INSTRUCTIONS IN THE PROXY CARD.

THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS USE.

Date: April 16, 2021 | BY ORDER OF THE BOARD OF |

| DIRECTORS |

| /s/ Sune Mathiesen |

| Sune Mathiesen |

| Chief Executive Officer, Principal Executive Officer and Director |

PROXY STATEMENT

LIQTECH INTERNATIONAL, INC.

Industriparken 22C

DK2750 Ballerup, Denmark

This Proxy Statement and the accompanying proxy card are being furnished with respect to the solicitation of proxies by the Board of Directors (the “Board”) of LiqTech International, Inc., a Nevada corporation (the “Company” or “LiqTech”) for the Annual Meeting of the Stockholders (the “Meeting”) to be held at 3:00 p.m., local time on Thursday, May 20, 2021, and at any adjournment or adjournments thereof, at the corporate headquarters of the Company at Industriparken 22C, DK2750 Ballerup, Denmark.

The approximate date on which this Proxy Statement and form of proxy are intended to be sent or given to the stockholders is April 16, 2021. These proxy materials are also available free of charge on the internet at https://materials.proxyvote.com/53632A. Stockholders are invited to attend the Meeting to vote on the proposals described in this Proxy Statement. However, stockholders do not need to attend the Meeting to vote. Instead, stockholders may simply complete, sign and return the proxy card in the enclosed postage paid envelope, or vote online or over the telephone according to the instructions in the proxy card.

We will bear the expense of solicitation of proxies for the Meeting, including the printing and mailing of this Proxy Statement. We may request persons, and reimburse them for their expenses with respect thereto, who hold stock in their name or custody or in the names of nominees for others to forward copies of such materials to those persons for whom they hold Common Stock (as defined below) and to request authority for the execution of the proxies. In addition, some of our officers, directors and employees, without additional compensation, may solicit proxies on behalf of the Board personally or by mail, telephone or facsimile.

VOTING SECURITIES, VOTING AND PROXIES

Record Date

Only stockholders of record of the Company’s common stock, $0.001 par value (the “Common Stock”), as of the close of business on April 5, 2021 (the “Record Date”) are entitled to notice and to vote at the Meeting and any adjournment or adjournments thereof.

Voting Stock

As of the Record Date, there were 21,697,373 shares of Common Stock outstanding. Each holder of Common Stock on the Record Date is entitled to one vote for each share then held on the matters to be voted at the Meeting. No other class of voting securities was then outstanding.

Quorum

The presence at the Meeting of a majority of the issued and outstanding shares of Common Stock as of the Record Date, in person or by proxy, is required for a quorum. Should you submit a proxy, even though you abstain as to a proposal, or you are present in person at the Meeting, your shares shall be counted for the purpose of determining if a quorum is present.

Broker non-vote

Broker “non-votes” are included for the purposes of determining whether a quorum of shares is present at the Meeting. A broker “non-vote” occurs when a nominee holder, such as a brokerage firm, bank or trust company, holding shares of record for a beneficial owner, does not vote on a particular proposal because the nominee holder does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Proposals 1, 4 and 5 are considered non-routine matters, and a broker or other nominee holder cannot vote without instructions on non-routine matters. Consequently, we expect broker non-votes with respect to Proposals 1, 4 and 5. Proposals 2 and 3 are considered routine matters, and a broker or other nominee holder generally may vote on routine matters without instructions.

Voting

The election of directors requires the approval of a plurality of the votes cast at the Meeting, and abstentions and broker non-votes will have no effect on Proposal 1. Proposal 2 requires the approval of a majority of votes cast at the meeting. Abstentions will have no effect on Proposal 2. Proposal 3 requires the approval of a majority of the voting power of the Company in favor of such action. Abstentions will have the effect of votes against Proposal 3. As Proposals 2 and 3 are routine matters, we do not expect broker non-votes with respect to such proposals. Proposals 4 and 5 call for advisory votes and are therefore not binding on the Company or the Board, but will be considered approved by the affirmative vote of a majority of votes cast at the Meeting. Additionally, abstentions and broker non-votes will have no effect on Proposals 4 and 5.

If you are the beneficial owner, but not the registered holder of our shares of Common Stock, you cannot directly vote those shares at the Meeting. You must provide voting instructions to your nominee holder, such as your brokerage firm or bank, by following the specific directions provided to you by your nominee holder.

If you wish to vote in person at the Meeting but you are not the record holder, you must obtain from your record holder a “legal proxy” issued in your name and bring it to the Meeting. At the Meeting, ballots will be distributed with respect to the proposals to each stockholder (or the stockholder’s proxy if not the management proxy holders) who is present and did not deliver a proxy to the management proxy holders or another person. The ballots shall then be tallied, one vote for each share owned of record as follows:

● | the votes for the election of directors being either “FOR”, “WITHHOLD ALL” or “FOR ALL EXCEPT” (where stockholders may withhold such vote by writing the names of such nominee(s) in a space provided on the ballot); | |

● | the votes for the ratification of the appointment of Sadler, for the Amendment and the non-binding advisory vote on the compensation of our named executive officers being either “FOR,” “AGAINST” or “ABSTAIN”; and | |

● | the votes for the non-binding advisory vote on the frequency of holding an advisory vote on the compensation of our named executive officers being either “EVERY YEAR”, “EVERY TWO (2) YEARS”, “EVERY THREE (3) YEARS” or “ABSTAIN.” |

Proxies

The form of proxy solicited by the Board affords you the ability to specify a choice among approval of, disapproval of, or abstention with respect to, the matters to be acted upon at the Meeting. Shares represented by the proxy will be voted and, where the solicited stockholder indicates a choice with respect to the matter to be acted upon, the shares will be voted as specified. If no choice is given, a properly executed proxy will be voted in favor of the proposals.

Revocability of Proxies

Even if you execute a proxy, you retain the right to revoke it and change your vote by notifying us at any time before your proxy is voted. Such revocation may be effected by execution of a subsequently dated proxy, or by a written notice of revocation, sent to the attention of the Chief Executive Officer (the “CEO”) of the Company at the address of the corporate headquarters of the Company set forth above in the Notice to this Proxy Statement or your attendance and voting at the Meeting. Unless so revoked, the shares represented by the proxies, if received in time, will be voted in accordance with the directions given therein.

You are requested, regardless of the number of shares you own or your intention to attend the Meeting, to sign the proxy and return it promptly in the enclosed envelope, or vote online or over the telephone according to the instructions in the proxy card.

Interests of Officers and Directors in Matters to Be Acted Upon

No person who has been a director or executive officer of the Company at any time since the beginning of our fiscal year and no associate of any of the foregoing persons has any substantial interest, direct or indirect, in any matter to be acted upon.

Dissenters’ Rights of Appraisal

Under the Nevada Revised Statutes and the Company’s Articles of Incorporation, as amended, stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of the proposals to be acted upon at the Meeting.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board is currently comprised of five (5) directors. Our Bylaws provide for the authorization of up to eight (8) directors. Any vacancies on the Board may be exclusively filled by a majority vote of the remaining directors, even if less than a quorum, or by a sole remaining director. Each director so elected shall hold office for the balance of the term to which such director is elected.

The Board has recommended for election current directors Mark Vernon, Sune Mathiesen, Alexander Buehler, Peyton Boswell and Richard Meeusen (each, a “Nominee” and collectively, the “Nominees”). If elected at the Meeting, each director would serve until the next annual meeting of the stockholders and his successor is duly elected and qualified.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the Meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the Nominees. In the event that any Nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute Nominee as the Board may propose. Each of the Nominees has agreed to serve if elected, and we have no reason to believe that they will be unable to serve.

The Nominees, their ages and current positions with the Company are as follows:

Name |

| Age |

| Title(s) |

Mark Vernon |

| 68 |

| Chairman of the Board |

Sune Mathiesen |

| 46 |

| Director, Chief Executive Officer (Principal Executive Officer) |

Alexander Buehler |

| 45 |

| Director |

Peyton Boswell |

| 50 |

| Director |

Richard Meeusen | 66 |

| Director |

A brief biography of each Nominee is set forth below:

Mark Vernon. Mr. Vernon has served as a Director of LiqTech International, Inc. since February 26, 2013 and as Chairman of the Board since July 2, 2018. Mr. Vernon also currently serves as a Director of Neles Oyj, a Finland-based industrial process valve company. Mr. Vernon served nine years as a Director of Senior plc, a UK-based aerospace and industrial engineering business. Mr. Vernon has had a long career in the industrial engineering industry and has wide international business experience. Mr. Vernon previously served as Chief Executive Officer and Director of Spirax-Sarco Engineering plc (London Stock Exchange: SPX), an industrial engineering business for industrial steam systems and peristaltic pumps. He also served previously as Group Vice President of Flowserve’s Flow Control Business, Group Vice President of Durco International and President of Valtek International. Mr. Vernon earned a BSc degree (magna cum laude) from Weber State University.

Sune Mathiesen. Mr. Mathiesen has served as Chief Executive Officer and a Director of LiqTech International since July 29, 2014. Mr. Mathiesen has served as Chief Executive Officer and as a Director of Masu A/S, a Danish company, since February 2013. He previously served as CEO and Director of Provital Solutions A/S. Before that he served as Country Manager of Broen Lab Group and as Country Manager of GPA Flowsystem. Mr. Mathiesen has a distinguished background in executive management, sales and turnarounds. Mr. Mathiesen has been working hands-on with technical products within the valves and fittings industry for the past 20 years. He has a degree in commercial science from Via College in Randers, Denmark.

Alexander Buehler. Mr. Buehler has served as a Director since August 11, 2017 and currently serves as the Audit Committee Chairman. Mr. Buehler is currently the President & CEO of the Brock Group, a leading industrial service provider to multiple industries, including petrochemical, oil & gas refining, power, pharmaceutical, and LNG. Before taking on his current position in February 2021, Mr. Buehler served as the Executive Vice President of Global Resources for Intertek, a publicly traded company headquartered in London providing quality assurances services across multiple industries. Mr. Buehler previously served as the President and Chief Executive Officer of Energy Maintenance Services and prior to that as Chief Financial Officer of Energy Recovery, Inc. Mr. Buehler also serves on the Board of Energy Recovery and also as Audit Committee Chairman, and he has previously served on the Board of Viscount Systems, also as Audit Committee Chairman. Mr. Buehler previously served in executive leadership positions at Insituform Technologies, Inc., and he worked for five years in the U.S. Army Corps of Engineers. He received a B.S. in Civil Engineering from the United States Military Academy at West Point and an MBA in Finance from the Wharton School at the University of Pennsylvania.

Peyton Boswell. Mr. Boswell has served as a Director since August 11, 2017. Mr. Boswell has served as the Chief Executive Officer of EnterSolar, LLC, a provider of commercial solar photovoltaic solutions, since 2010. Before joining EnterSolar, Mr. Boswell led solar development activities for Fortistar and was the founder of RenewCo V.I., a renewable energy development firm based in the U.S. Virgin Islands. Prior to entering the solar industry, Mr. Boswell was a finance and investment banking professional for 15 years with J.P. Morgan and Bank of America. Mr. Boswell is a Chartered Financial Analyst (CFA) and has earned a BA from Cornell University and holds an MBA from Columbia Business School.

Richard Meeusen. Mr. Meeusen has served as a Director since August 26, 2020. Mr. Meeusen most recently served as President, Chief Executive Officer and Chairman of Badger Meter, Inc., a publicly traded international manufacturer and seller of flow measurement equipment, primarily to the water industry. Mr. Meeusen retired as Chief Executive Officer on December 31, 2018 after serving 17 years as the company’s Chief Executive Officer. Prior to Badger Meter, Mr. Meeusen was Chief Financial Officer of Zenith Sintered Products and before that worked for Arthur Andersen & Co as a Senior Manager. In addition to his board service at Badger Meter, Mr. Meeusen serves as a director of Menasha Corporation, a $2 billion privately-held packaging and display equipment company and previously served 8 years on the board of Serigraph Corporation. Mr. Meeusen founded The Water Council in 2007, a 180-member company industry trade group where he still serves as a director. Mr. Meeusen earned an MBA degree from the Kellogg School of Management at Northwestern University.

Involvement in Certain Legal Proceedings

During the past ten (10) years, none of the Nominees has been involved in any legal proceeding that is material to the evaluation of their ability or integrity relating to any of the items set forth under Item 401(f) of Regulation S-K. None of the Nominees is a party adverse to the Company or any of its subsidiaries in any material proceeding or has a material interest adverse to the Company or any of its subsidiaries.

Family Relationships

None of the Nominees or the Company’s executive officers is related by blood, marriage or adoption.

Vote Required

The election of directors requires the approval of a plurality of the votes cast at the Meeting, and abstentions and broker non-votes will have no effect on Proposal 1.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE ELECTION OF EACH OF MARK VERNON, SUNE MATHIESEN, ALEXANDER BUEHLER,

PEYTON BOSWELL AND RICHARD MEEUSEN

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee of the Board has appointed Sadler, Gibb & Associates, L.L.C. (“Sadler”) as the Company’s independent registered public accountants for the fiscal year ending December 31, 2021. Services provided to the Company by our independent registered public accountants during the fiscal year ended December 31, 2020 are described under “Audit-Related Matters—Auditor Fees and Services” herein below.

We are asking our stockholders to ratify the selection of Sadler as our independent registered public accountants.

Proposal 2 shall be approved if the majority of votes cast in person or by proxy are in favor of such action. Since Proposal 2 is considered a routine matter, we do not expect broker non-votes. Abstentions will not be treated as votes cast and will have no impact on the proposal.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE RATIFICATION OF THE APPOINTMENT OF SADLER, GIBB & ASSOCIATES, L.L.C.

AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2021

In the event stockholders do not ratify the appointment, the appointment will be reconsidered by the Audit Committee and the Board. Even if the selection is ratified, the Audit Committee in its discretion may select a different registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

PROPOSAL THREE

AMENDMENT TO OUR ARTICLES OF INCORPORATION INCREASING

THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

Authorization of up to 100,000,000 shares of Common Stock

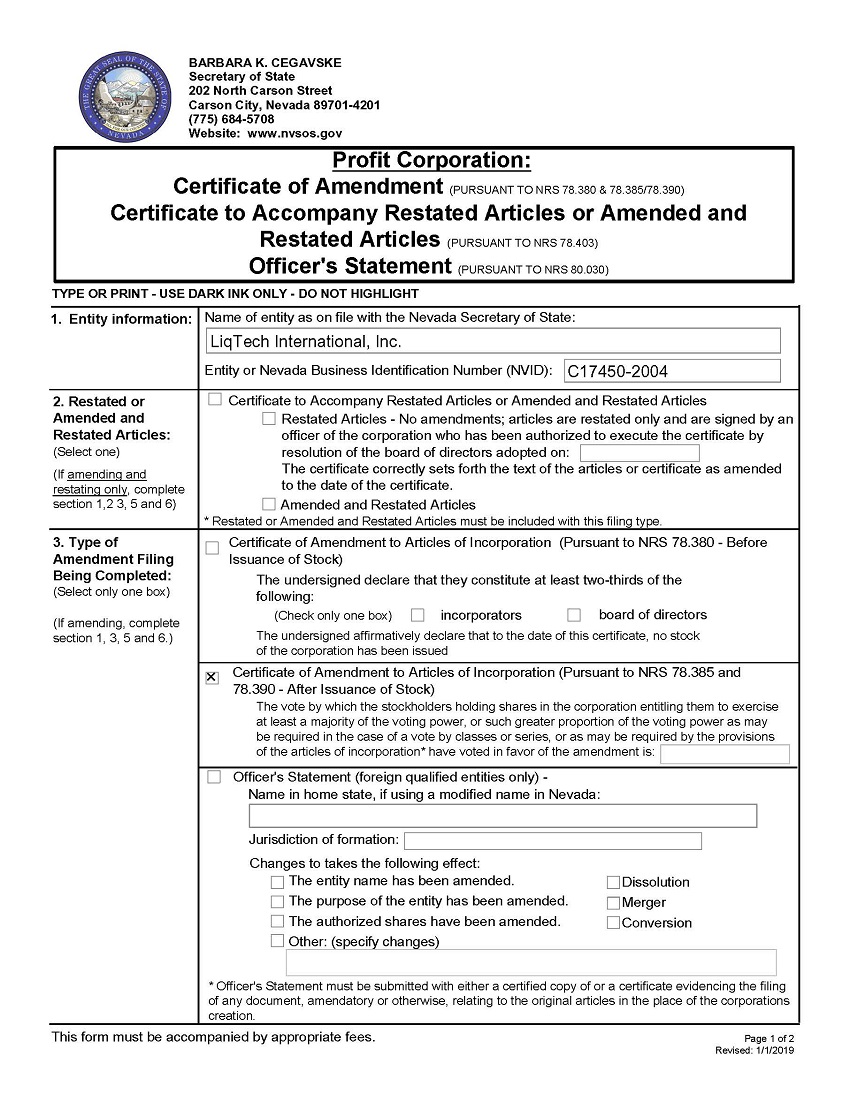

The Board is seeking stockholder approval of an amendment to our Articles of Incorporation that would increase the number of authorized shares of Common Stock from 25,000,000 to 100,000,000. The proposed Certificate of Amendment to the Articles of Incorporation (the “Certificate of Amendment”) is attached hereto as Appendix A.

The newly authorized shares of Common Stock would have the same rights as the currently outstanding shares of our Common Stock. As of April 5, 2021, 21,697,373 shares of our Common Stock were issued and outstanding, 0 shares that were subject to outstanding stock option awards, 104,848 shares were subject to unvested outstanding restricted stock unit awards, 515,000 shares of our Common Stock were subject to outstanding warrants, and 1,966,586 shares of our Common Stock were reserved for future issuance under our equity compensation plans. Accordingly, 24,283,807 of the 25,000,000 authorized shares of our Common Stock are currently issued or reserved while 716,193 of the authorized shares of our Common Stock remain available for future issuance.

Reasons for the Increase in Authorized Shares

The Board believes it would be prudent and advisable to have the additional shares available to provide additional flexibility regarding the potential use of shares of Common Stock for business and financial purposes in the future. Having an increased number of authorized but unissued shares of Common Stock would allow us to take prompt action with respect to corporate opportunities that develop, without the delay and expense of convening a special meeting of stockholders for the purpose of approving an increase in our authorized shares. The additional shares could be used for various purposes without further stockholder approval. These purposes may include: (i) raising capital, if we have an appropriate opportunity, through offerings of Common Stock or securities that are convertible into Common Stock; (ii) expanding our business through potential strategic transactions, including mergers, acquisitions, and other business combinations or acquisitions of new technologies or products; (iii) establishing strategic relationships with other companies; (iv) exchanges of Common Stock or securities that are convertible into Common Stock for other outstanding securities; (v) providing equity incentives to attract and retain employees, officers or directors; and (vi) other purposes. Additionally, on March 24, 2021, we entered into that certain Securities Purchase Agreement with High Trail Capital, LLC, pursuant to which we have agreed to seek approval for an increase in our Common Stock.

Potential Effects of the Proposed Amendment

If the proposed amendment is approved by our stockholders, the additional authorized shares of Common Stock would have rights identical to our currently outstanding Common Stock. Our Articles of Incorporation also currently authorize the issuance of 2,500,000 shares of preferred stock, none of which are issued or outstanding.

The proposed amendment to the Articles of Incorporation would not change the authorized number of shares of preferred stock. Future issuances of shares of Common Stock or securities convertible into shares of Common Stock could have a dilutive effect on our earnings per share, book value per share and the voting interest and power of current stockholders since holders of Common Stock are not entitled to preemptive rights.

SEC rules require disclosure of the possible anti-takeover effects of an increase in authorized capital stock and other charter and bylaw provisions that could have an anti-takeover effect. Although we have not proposed the increase in the number of authorized shares of Common Stock with the intent of using the additional shares to prevent or discourage any actual or threatened takeover of the Company, under certain circumstances, such shares could have an anti-takeover effect. The additional shares could be issued to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company or could be issued to persons allied with the Board or management and thereby have the effect of making it more difficult to remove directors or members of management by diluting the stock ownership or voting rights of persons seeking to effect such a removal. Accordingly, if the proposed amendment is approved, the additional shares of authorized Common Stock may render more difficult or discourage a merger, tender offer or proxy contest, the assumption of control by a holder of a large block of Common Stock, or the replacement or removal of members of the Board or management.

Implementation of the Authorized Share Increase

Following stockholder approval of this proposal, the authorized share increase would be implemented by our filing the Certificate of Amendment with the Secretary of State of the State of Nevada. However, at any time prior to the effectiveness of the filing of the Certificate of Amendment with the Secretary of State of the State of Nevada, the Board reserves the right to abandon this proposal and to not file the Certificate of Amendment, even if approved by the stockholders of the Corporation, if the Board, in its discretion, determines that such amendment is no longer in the best interests of the Corporation or its stockholders.

Vote Required for Approval

Proposal 3 shall be approved if the majority of the voting power of the Company votes in favor of such action. Since Proposal 3 is considered a routine matter, we do not expect broker non-votes.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE AMENDMENT TO OUR ARTICLES OF INCORPORATION INCREASING THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 25,000,000 SHARES TO 100,000,000 SHARES.

PROPOSAL FOUR

ADVISORY VOTE ON NAMED

EXECUTIVE OFFICER COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) added Section 14A to Securities Exchange Act of 1934, as amended (the “Exchange Act”), which enables our stockholders to vote to approve, on an advisory, non-binding basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules.

Our executive officer compensation program is designed to attract, motivate and retain our named executive officers, who are critical to our success, while working within the available resources. Our Board believes that they have taken a responsible approach to compensating our named executive officers given our limited resources.

Please read the “Compensation of Executive Officers and Directors” section of this proxy statement for additional details about our executive compensation. The compensation of our named executive officers is designed to enable us to attract and retain talented and experienced executives to lead us successfully in a competitive environment. Our Board believes that our executive compensation strikes the appropriate balance between utilizing responsible, measured pay practices and effectively incentivizing our named executive officers to dedicate themselves fully to value creation for our stockholders.

We are asking our stockholders to indicate their support for our named executive officer compensation as described in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on the compensation of our named executive officers. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we will ask our stockholders to vote “FOR” the following resolution at the Meeting:

“RESOLVED, that the Company’s stockholders approve, on a non-binding advisory basis, the compensation of the named executive officers, as disclosed in the Company’s proxy statement for the 2021 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission.”

The say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or our Board. Our Board values the views of our stockholders and will consider the outcome of the vote when determining future compensation arrangements for our named executive officers.

Vote Required for Approval

The vote required for approval of the compensation of our named executive officers is the majority of votes cast in person or by proxy are in favor of such action. Since Proposal 4 is considered a non-routine matter, and a broker or other nominee holder cannot vote without instructions on non-routine matters, we expect broker non-votes with respect to Proposal 4, which will have no effect on the proposal. Abstentions will not be treated as votes cast and will have no impact on the proposal.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT.

PROPOSAL FIVE

ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES

ON NAMED EXECUTIVE OFFICER COMPENSATION

The Dodd-Frank Act requires that we provide our stockholders with the opportunity to vote every six years, on a non-binding, advisory basis, for their preference as to how frequently to vote on future advisory votes on the compensation of our named executive officers as disclosed in accordance with the compensation disclosure rules of the SEC.

Under this Proposal 5, stockholders may vote in favor of holding this advisory vote every year, every two (2) years or every three (3) years beginning with the 2022 annual meeting of stockholders, or may choose to abstain.

Our Board has determined that a non-binding advisory vote on executive compensation that occurs every three years is the most appropriate alternative for us, given our size and stage of development and, therefore, our Board recommends that you vote for the option of every three years for the advisory vote on executive compensation. Further, in recommending that our stockholders vote for a frequency of every three years, our Board believes that an advisory vote held every three years will provide our Board and the Compensation Committee with sufficient time to thoughtfully evaluate and respond to stockholder input and effectively implement desired changes to compensation programs. The results of the say-on-pay vote received at the 2021 Annual Meeting will be considered by management and our Board as we develop our compensation policies for the coming years. Accordingly, we believe that a vote every three years is appropriate as it allows time for any changes to incentive programs to be designed and implemented and for the results to be evaluated and reported to stockholders. An advisory vote every three years will provide stockholders with sufficient time to evaluate the effectiveness of incentive programs, compensation strategies and our performance. Because our executive compensation programs do not generally change significantly from year to year, a vote every three years avoids a short-term focus on executive compensation and the cost of including an additional proposal and vote in the annual meeting proxy statement more frequently. We understand that our stockholders may have different views as to what is the best approach for the Company, and we look forward to hearing from our stockholders on this proposal.

After careful consideration, our Board recommends that the advisory vote by our stockholders on executive compensation be held every three (3) years.

Although non-binding, and therefore not binding on the Company, the Compensation Committee or our Board, our Board values the views of our stockholders and will consider the outcome of the vote when determining future compensation arrangements for our named executive officers.

Vote Required for Approval

Upon the affirmative vote of the holders of a majority of votes cast in person or represented by proxy in favor of a particular frequency alternative (whether every year, every two (2) years or every three (3) years), such frequency will be considered to be the recommendation of the stockholders on the advisory vote regarding the frequency of future advisory votes on the compensation paid to our named executive officers. Since Proposal 5 is considered a non-routine matter, and a broker or other nominee holder cannot vote without instructions on non-routine matters, we expect broker non-votes with respect to Proposal 5, which will have no effect on the proposal. Abstentions will not be treated as votes cast and will have no impact on the proposal.

THE BOARD RECOMMENDS THAT YOU VOTE

“EVERY THREE (3) YEARS”

ON FREQUENCY OF FUTURE ADVISORY VOTES

ON NAMED EXECUTIVE OFFICER COMPENSATION

CORPORATE GOVERNANCE

Committees of our Board of Directors

Committee Composition

The Board has an Audit Committee, a Compensation Committee, and a Governance and Nominating Committee. The following table sets forth the current membership of each of these committees:

Audit Committee |

| Compensation Committee |

| Governance and Nominating Committee |

Alexander Buehler* |

| Mark Vernon* |

| Mark Vernon* |

Mark Vernon |

| Alexander Buehler |

| Alexander Buehler |

Peyton Boswell |

| Peyton Boswell |

| Peyton Boswell |

Richard Meeusen | Richard Meeusen | Richard Meeusen |

* Chairman of the committee

Audit Committee

The Audit Committee consists of Alexander Buehler (Chairman), Mark Vernon, Peyton Boswell and Richard Meeusen, each of whom is an independent director as defined in the rules of The Nasdaq Capital Market and the rules of the U.S. Securities and Exchange Commission (the “SEC”). Based upon past employment experience in finance and other business experience requiring accounting knowledge and financial sophistication, our Board has determined that Mr. Buehler is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K, and that each member of our Audit Committee is able to read and understand fundamental financial statements. We have implemented a written charter, available at www.liqtech.com, for our Audit Committee, which provides that our Audit Committee is responsible for:

● | appointing, compensating, retaining, overseeing the independence and performance of and terminating our independent auditors and pre-approving all audit and non-audit services permitted to be performed by the independent auditors; |

● | discussing with management and the independent auditors our quarterly and annual audited financial statements, our internal control over financial reporting, and related matters; |

● | reviewing and discussing with management and the independent auditors the Management’s Discussion and Analysis section of the Company’s Forms 10-Q and 10-K prior to filing with the SEC; |

● | reviewing and discussing with the independent auditors any reports, comments or recommendations made to the Company and consulting with the independent auditors at least once per quarter regarding internal controls and reporting procedures; |

● | reviewing, at least quarterly, the status of any legal matters which could significantly impact the Company’s financial statements; |

● | reviewing, at least annually, with management the Company’s program for promoting compliance with the applicable legal and regulatory requirements; |

● | reviewing and approving any related party transactions; |

● | meeting separately, periodically, with management and the independent auditors; |

● | annually reviewing and reassessing the adequacy of the Audit Committee Charter; |

● | such other matters that are specifically delegated to our Audit Committee by the Board from time to time; and |

● | reporting regularly to the Board. |

During the fiscal year ended December 31, 2020, the Audit Committee met four times.

The Audit Committee has (i) reviewed and discussed the audited financial statements with management; (ii) discussed with the independent auditors the matters required to be discussed by the statement on Auditing Standards No. 16, as amended; and (iii) received the written disclosures and letter from the independent auditor required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee concerning independence and has discussed with the independent auditor the independent auditor’s independence. Based on such review and discussions, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2020.

Members of the Audit Committee:

Alexander Buehler

Mark Vernon

Peyton Boswell

Richard Meeusen

Compensation Committee

The Compensation Committee consists of Mark Vernon (Chairman), Peyton Boswell, Alexander Buehler and Richard Meeusen, each of whom is an independent director as defined in the rules of The Nasdaq Capital Market, a “non-employee director” under Rule 16b-3 promulgated under the Exchange Act, and an “outside director” for purposes of Section 162(m) of the Internal Revenue Code. We have implemented a written charter for our Compensation Committee, available at www.liqtech.com, which provides that our Compensation Committee is responsible for:

● | reviewing and making recommendations to the Board regarding our compensation policies and forms of compensation provided to our directors and officers; |

● | reviewing and making recommendations to the Board regarding bonuses for our executive officers; |

● | reviewing and making recommendations to the Board regarding stock-based compensation for our directors and officers; |

● | annually reviewing and reassessing the adequacy of the Compensation Committee Charter; |

● | administering any stock option plans in accordance with the terms thereof; and |

● | such other matters that are specifically delegated to the Compensation Committee by the Board from time to time. |

The Compensation Committee has the principal responsibility for the compensation plans of the Company, particularly as applied to the compensation of executive officers and directors. The Compensation Committee Charter sets forth the authority and responsibilities of the Compensation Committee for the performance evaluation and compensation of the Company’s CEO, executive officers and directors, and significant compensation arrangements, plans, policies and programs of the Company. The Compensation Committee has authority to retain such outside counsel, experts and other advisors as it determines to be necessary to carry out its responsibilities, including the authority to approve an external advisor’s fees and other retention terms on behalf of the Company. Pursuant to the Compensation Committee Charter, the Company shall provide appropriate funding to the Compensation Committee, as determined by the Compensation Committee in its capacity as a Committee of the Board, for payment of compensation to any outside advisors engaged by the Compensation Committee.

The Compensation Committee annually reviews and approves the corporate goals and objectives relevant to CEO compensation and evaluates the CEO’s performance in light of such goals and objectives. Based on this evaluation the Compensation Committee makes and annually reviews decisions regarding: (i) salary paid to the CEO; (ii) the grant of all cash-based bonuses and equity compensation to the CEO; (iii) the entering into or amendment or extension of any employment contract or similar arrangement with the CEO; (iv) any CEO severance or change in control arrangement; and (v) any other CEO compensation matters as from time to time directed by the Board. In determining the long-term incentive component(s) of the CEO’s compensation, the Compensation Committee considers the Company’s performance and relative stockholder return, the value of similar incentive awards to chief executive officers at companies that the Compensation Committee determines comparable based on factors it selects and the incentive awards given to the Company’s CEO in prior years.

The Compensation Committee also meets with the CEO within 90 days after the commencement of each fiscal year to discuss the compensation programs to be in effect for the Company’s executive officers for such fiscal year and to review and approve the corporate goals and objectives relevant to those programs. In light of these goals and objectives, the Compensation Committee makes and annually reviews decisions regarding: (i) salary paid to the executive officers; (ii) the grant of cash-based bonuses and equity compensation provided to the executive officers; (iii) performance targets for executive officers; (iv) the entering into or amendment or extension of any employment contract or similar arrangement with the executive officers; (v) executive officers’ severance or change in control arrangements; and (vi) any other executive officer compensation matters as from time to time directed by the Board. In determining the long-term incentive component(s) of the executive officer’s compensation, the Compensation Committee considers the Company’s performance and relative stockholder return, the value of similar incentive awards to executive officers at companies that the Compensation Committee determines comparable based on factors it selects and the incentive awards given to the Company’s executive officers in prior years.

During the fiscal year ended December 31, 2020, the Compensation Committee met three times.

Governance and Nominating Committee

The Governance and Nominating Committee consists of Mark Vernon (Chairman), Peyton Boswell, Alexander Buehler and Richard Meeusen, each of whom is an independent director as defined in the rules of The Nasdaq Capital Market. We have implemented corporate governance guidelines as well as a written charter for our Governance and Nominating Committee, available at www.liqtech.com, which provides that our Governance and Nominating Committee is responsible for:

● | defining the future membership needs of the Board and overseeing the process by which individuals may be nominated to our Board and its standing committees; |

● | making recommendations as to the size and composition of the Board and its committees; |

● | identifying, recruiting, evaluating, approving and nominating potential directors; |

● | considering nominees proposed by our stockholders; |

● | establishing and periodically assessing the criteria for the selection of potential directors; |

● | making recommendations to the Board on new candidates for Board membership; |

● | developing, recommending and reviewing a code of business conduct and ethics compliant with the rules and regulations of the SEC and The Nasdaq Capital Market; |

● | reviewing the Company’s Insider Trading Policy and recommending any changes for approval by the Board; |

● | overseeing corporate governance matters including educating directors and identifying any potential conflicts of interest; |

● | recommending that the Board establish special committees as necessary; and |

● | reviewing annually and reassessing the adequacy of the Governance and Nominating Committee Charter. |

In making nominations, the Governance and Nominating Committee intends to submit candidates who have high personal and professional integrity, who have demonstrated exceptional ability and judgment and who are effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the stockholders. In evaluating nominees, the Governance and Nominating Committee intends to take into consideration attributes such as leadership, independence, interpersonal skills, financial acumen, business experiences, industry knowledge, and diversity of viewpoints.

One of the primary responsibilities of the Governance and Nominating Committee is to make appropriate recommendations to the Board for the appointment or re-appointment of directors. The Company seeks to have directors who, in addition to relevant technical, commercial and securities expertise, meet the highest standards of personal integrity, judgment and critical thinking, and an ability to work in an open environment with other directors to further the interests of the Company and its stockholders. In recommending appointments to the Board, the Governance and Nominating Committee is mindful of the overall balance of the skills, knowledge and experience of Board members against the current and future requirements of the Company and of the benefits of diversity. The Company recognizes the importance of diversity at all levels of the Company as well as on the Board and considers overall Board balance and diversity when appointing new directors. Board appointments are, in the final analysis, made on merit.

The Company employs multiple strategies in identifying director nominees, including the obtaining of recommendations from security holders, recommendations from current directors, and from the Company’s corporate advisors. The Company also utilizes professional recruitment firms, as may be required, in seeking qualified director nominees. The qualifications of director nominees are evaluated by the Governance and Nominating Committee to determine if the director nominees have the requisite technical and commercial expertise to maintain a proper balance of skills required by the Board. There are no differences in the evaluation of director nominees recommended by security holders. Director nominees are interviewed in depth by the Governance and Nominating Committee and the Board to further qualify the director nominees and evaluate the personal integrity and character of the candidate.

During the fiscal year ended December 31, 2020, the Governance and Nominating Committee met three times.

Director Independence

The Board has determined that Messrs. Vernon, Boswell, Buehler and Meeusen are independent as that term is defined in the listing standards of The Nasdaq Capital Market. In making these determinations, our Board has concluded that none of our independent directors has an employment, business, family or other relationship which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Mr. Mathiesen is not considered independent because of his role as Chief Executive Officer of the Company. We expect that our independent directors will meet in executive session (without the participation of executive officers or other non-independent directors) at least two times each year, and Mark Vernon presides over such meetings of independent directors.

Compensation Committee Interlocks and Insider Participation

None of our directors who currently serve as members of our Compensation Committee is, or has at any time during the past year been, one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the Board or compensation committee of any other entity that has one or more executive officers serving on our Board or Compensation Committee.

Board Leadership Structure and Risk Oversight

The Board does not have a policy as to whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. Each year, the Governance and Nominating Committee assesses these roles and the board leadership structure to ensure the interests of the Company and its stockholders are best served. Currently, the independent non-executive Chairman position is held by Mark Vernon and the Chief Executive Officer is Sune Mathiesen.

The Committees of the Board, each comprised entirely of independent directors, play an active role in risk management and oversight for the Company. The Audit Committee assists the Board with respect to risk assessment and risk management related to financial reporting and other matters that could affect the Company’s financial statements. The Governance and Nominating Committee is charged with assisting the Board in corporate governance matters, conflicts of interest, the Company’s Code of Conduct and Ethics and other risk mitigation activities. The Compensation Committee is charged with assisting the Board in reviewing the Company’s overall compensation policies and practices for all employees as they relate to the Company’s risk.

Director Qualifications

The following is a brief description of the specific experience and qualifications, attributes or skills of each director that led to the conclusion that such person should serve as a director of the Company. Based on the attributes and skills of each director, the Company’s leadership structure is appropriate. The Board plays an active role in the risk oversight of the Company.

Mr. Vernon’s extensive global experience in the industrial engineering industry, provides the Board with valuable insight into the markets the Company serves, as well as proven management and public company Board expertise.

Mr. Mathiesen’s prior experience at leading businesses as the Chief Executive Officer and Chairman of companies in technical engineered products distinguish him as an integral part of the Company’s Board and management team. He is uniquely qualified to provide a perspective on matters involving strategic planning for the continued growth and development of the Company.

Mr. Boswell's experience in establishing and growing a successful renewable energy clean tech business and prior experience in investment banking provides the Board with a unique perspective on corporate finance and strategic growth matters. Further, the Board has determined that he qualifies as an Audit Committee Financial Expert.

Mr. Buehler has wide experience in general management and strategic planning as well as new product development, corporate development, mergers & acquisitions, operations management, manufacturing process optimization, sales management and back-office administration. Mr. Buehler has substantial experience in the global water, oil & gas, and manufacturing industries. Mr. Buehler has been determined by our Board to qualify as an Audit Committee Financial Expert.

Mr. Meeusen is an experienced Chief Executive Officer of an industrial engineering business serving the water industry and brings relevant expertise in LiqTech’s core markets. As a director and chairman of a public company headquartered in the United States, he also provides additional expertise in corporate governance, investor relations and capital markets. The Board has determined that Mr. Meeusen qualifies as an Audit Committee Financial Expert.

Board Meetings

The Board held fifteen meetings during the fiscal year ended December 31, 2020. Each incumbent director attended greater than seventy-five percent (75%) of the aggregate of the total number of meetings of the Board (held during the period for which each director has been a director) and the total number of meetings held by all committees of the Board on which each director served (during the period for which each director has been a director).

The Board encourages all of its members to attend its Board meetings.

Code of Ethics

Effective January 1, 2012, the Board adopted a Code of Conduct and Ethics with the purpose of assuring that all employees and officers of the Company and its subsidiaries understand and adhere to high ethical standards of conduct. The Code of Conducts and Ethics emphasizes employees’ obligations of civil responsibility, loyalty to the Company, compliance with applicable laws, non-disclosure of trade secrets, and abstinence from improper political payments and activity. A copy of the Code of Conduct and Ethics is available on the Company website at https://liqtech.com/media/afijs2es/code_of_conduct_and_ethics.pdf.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires a company’s officers and directors, and persons who own more than ten percent (10%) of a registered class of a company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors, and greater than ten percent (10%) stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us, each of our officers and directors other than Richard Meeusen have not timely filed reports under Section 16(a).

EXECUTIVE OFFICERS

General

Certain information concerning our executive officers as of the date of this Proxy Statement is set forth below. Each officer of the Company shall be elected by the Board, may be classified by the Board as an executive officer or a non-executive officer (or as a non-officer) at any time, and shall serve at the pleasure of the Board. None of our executive officers or directors is related by blood, marriage or adoption.

Name |

| Age |

| Titles |

Sune Mathiesen |

| 46 |

| Director, Chief Executive Officer (Principal Executive Officer) |

Claus Toftegaard |

| 55 |

| Chief Financial Officer (Principal Financial and Accounting Officer) |

A brief biography of the executive officer who is not also a Nominee is set forth below:

Claus Toftegaard. Mr. Toftegaard has served as Chief Financial Officer of the Company since August 15, 2018. From 2014 to 2018 he was Chief Financial Officer of Gabriel Holding A/S, a publicly traded fabric supply company in Denmark, and its Financial Manager from June of 2011 until his appointment as Chief Financial Officer. From 2006 to 2011 Mr. Toftegaard served as the CFO of RTX A/S, a publicly traded wireless solutions company in Denmark and from 2000 to 2006 he was Financial Manager of Glenco A/S / Siemens Technology Services A/S, an electrical infrastructure technology company in Denmark. Mr. Toftegaard also previously worked as an auditor at Ernst and Young in Denmark for U.S. GAAP reporting. Mr. Toftegaard holds a MSc. in Business Economics and Auditing from Aalborg University.

Involvement in Certain Legal Proceedings

During the past ten (10) years, none of our officers has been involved in any legal proceeding that is material to the evaluation of their ability or integrity relating to any of the items set forth under Item 401(f) of Regulation S-K. None of the officers is a party adverse to the Company or any of its subsidiaries in any material proceeding or has a material interest adverse to the Company or any of its subsidiaries.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Summary Compensation Table

The following table sets forth certain information with respect to compensation for the years ended December 31, 2020 and 2019 earned by or paid to our Chief Executive Officer and our two most highly compensated executive officers, other than our Chief Executive Officer, whose total compensation exceeded $100,000 (the “named executive officers”).

Summary Compensation Table

Name and Principal Position | Year | Salary ($) (1) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Nonequity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | Other ($) (4) | Total | ||||||||||||||||||||||||

Sune Mathiesen, Chief Executive Officer (2) | |||||||||||||||||||||||||||||||||

2020 | $ | 358,875 | $ | 100,000 | $ | 350,000 | $ | 35,888 | $ | 844,763 | |||||||||||||||||||||||

2019 | 305,271 | 262,962 | 75,000 | 30,527 | 673,760 | ||||||||||||||||||||||||||||

Claus Toftegaard, Chief Financial Officer (3) | |||||||||||||||||||||||||||||||||

2020 | $ | 249,162 | - | $ | 150,000 | $ | 24,916 | $ | 424,078 | ||||||||||||||||||||||||

2019 | 182,455 | - | - | - | - | 18,245 | 200,700 | ||||||||||||||||||||||||||

(1) | Total salaries for Messrs. Mathiesen and Toftegaard for 2019 are reported on an as-converted basis from Danish Krone (DKK) to U.S. dollars ($) based on the currency exchange rate of $1.00 = DKK 6.6703, as of December 31, 2019. Total salaries for Messrs. Mathiesen and Toftegaard for 2020 are reported on an as-converted basis from Danish Krone (DKK) to U.S. dollars ($) based on the currency exchange rate of $1.00 = DKK 6.5343, as of December 31, 2020. We do not make any representation that the Danish Krone amounts could have been, or could be, converted into U.S. dollars at such rate on December 31, 2019 or December 31, 2020, or at any other rate. |

| |

(2) | Mr. Mathiesen became our Chief Executive Officer in August 2014. Pursuant to his employment agreement, Mr. Mathiesen is entitled to an annual base salary of approximately $360,000 based on the currency exchange rate of $1.00 = DKK 6.5343, as of December 31, 2020. |

| |

(3) | Mr. Toftegaard became our Chief Financial Officer in August 2018. Pursuant to his employment agreement, Mr. Toftegaard is entitled to an annual base salary of approximately $250,000 based on the currency exchange rate of $1.00 = DKK 6.5343, as of December 31, 2020. |

| |

(4) | Pursuant to Mr. Mathiesen’s employment agreement, Mr. Mathiesen’s received $35,888 and $30,527 of contributions from the Company to his individual retirement account in 2020 and 2019. Pursuant to Mr. Toftegaard’s employment agreement, Mr. Toftegaard received $24,916 and $18,245 of contributions from the Company to his individual retirement account in 2020 and 2019. |

Employment Arrangements

During the year ended December 31, 2020, we had employment agreements with Messrs. Mathiesen and Toftegaard. A description of each agreement is set forth below.

Mathiesen Agreement

Effective July 30, 2014 the Company’s Board appointed Mr. Sune Mathiesen to serve as Chief Executive Officer of the Company and as a Director of the Company pursuant to a Director Contract, dated July 15, 2014 (updated on October 15, 2018), by and between Mr. Mathiesen and our subsidiary LiqTech Holding A/S (“LiqTech Holding”), which provided as of December 31, 2020 for an annual base salary initially set at DKK 2,345,000 (or approximately $358,875 based on the currency exchange rate of $1 = DKK 6.5343 as of December 31, 2020) and an annual cash bonus of 100% - 150% of the Director’s annual salary if certain performance targets are met, as determined annually by the Company’s Compensation Committee. Mr. Mathiesen is entitled to five weeks of vacation, home internet service, a company car, a LiqTech Holding mobile phone, a LiqTech Holding laptop and reimbursement of LiqTech Holding-related travel expenses. LiqTech Holding may terminate the Mathiesen Agreement upon not less than twelve months prior notice, and Mr. Mathiesen may terminate the Mathiesen Agreement with twelve months prior notice.

Toftegaard Agreement

On August 15, 2018 Mr. Claus Toftegaard was appointed Chief Financial Officer of the Company. Pursuant to the terms of a CFO Contract, in consideration for his services, Mr. Toftegaard shall receive an annual base salary of DKK 1,628,100 (or approximately $249,162 based on the currency exchange rate of $1 = DKK 6.5343 as of December 31, 2020). Mr. Toftegaard is entitled to six weeks of vacation, home internet service, a company car, a LiqTech Holding mobile phone, a LiqTech Holding laptop and reimbursement of LiqTech Holding-related travel expenses. LiqTech Holding may terminate the Toftegaard Agreement upon not less than five months prior notice and Mr. Toftegaard may terminate the Toftegaard Agreement with five months prior notice.

Outstanding Equity Awards at Last Fiscal Year End

The following table sets forth all outstanding equity awards held by our named executive officers as of December 31, 2020.

Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||

Name | Number of Securities Underlying Unexercised Exercisable (#) | Number of Securities Underlying Unexercised Unexercisable (#) | Equity Incentive Plan Awards: No. of Securities Underlying Unexercised Unearned Options | Option Exercise Price | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested | Equity Incentive Plan Awards: Number of Unearned Shares, Units, or Other Rights That Have Not Vested | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units, or Other Rights That Have Not Vested | |||||||||||||||||||||||||||

Sune Mathiesen, CEO | - | - | - | - | - | 64,457 | $ | 350,000 | - | - | ||||||||||||||||||||||||||

Claus Toftegaard, CFO | - | - | - | - | - | 27,624 | $ | 150,000 | - | - | ||||||||||||||||||||||||||

Compensation of Directors

For 2020 the Chairman of the Board was entitled to an annual fee of $60,000; each non-executive director was entitled to $30,000 for services on the Board; the Audit Committee Chairman was paid an additional annual fee of $10,000 per year, the Compensation Committee Chairman was paid an additional annual fee of $6,000 per year (however, since Mr. Vernon has continued to serve as the Chairman of the Compensation Committee after being appointed Chairman of the Board, he was not paid this additional fee). The Chairman of the Board also receives an automatic annual stock grant in the amount of $70,000 on January 2 each year. Each qualifying non-executive director would receive an automatic annual stock grant on January 2 of each year in the amount of $35,000 commencing the first year, after full vesting of their initial 25,000 share stock grant that vests over a three-year period. The Company has not entered any agreements with the Directors of any special compensation in relation to retirement, resignation, change of control or other kinds of events that might lead to the Director leaving the Board of LiqTech International, Inc.

The following table provides information regarding compensation that was earned or paid to the individuals who served as non-employee directors during the year ended December 31, 2020.

Name | Fees earned or paid in cash (1)($) | Stock Awards (2)($) | Option awards (2) | Non-equity incentive plan compensation | Non-qualified deferred compensation earnings | All other compensation | Total | |||||||||||||||||||||

Mark Vernon | 60,000 | 70,000 | - | - | - | - | 130,000 | |||||||||||||||||||||

Alexander Buehler | 39,996 | - | - | - | - | - | 39,996 | |||||||||||||||||||||

Peyton Boswell | 30,000 | - | - | - | - | - | 30,000 | |||||||||||||||||||||

Peter Leifland | 25,000 | - | - | - | - | - | 25,000 | |||||||||||||||||||||

Richard Meeusen | 10,000 | 172,500 | - | - | - | - | 182,500 | |||||||||||||||||||||

(1) | Our independent directors are entitled to cash compensation of $30,000 per year, the chairman of our Board is entitled to additional $30,000 per year, the chairman of our Audit Committee is entitled to additional $10,000 per year and the chairman of our Compensation Committee is entitled to additional $6,000 per year. |

| |

(2) | These amounts represent the aggregate grant date fair value for stock awards granted in 2020, computed in accordance with FASB ASC Topic 718. As such, these amounts do not correspond to the compensation actually realized by each director for the period. |

| |

The Company issued 11,218 shares of restricted stock valued at $70,000 in January 2020 for services provided and to be provided by Mr. Vernon.

The Company awarded in August 2020 25,000 restricted shares of Common Stock valued at $172,500 for services to be provided by Mr. Meeusen. The shares will vest over a three-year period. |

Our Bylaws which were adopted effective January 1, 2012, state that the Board may pay to directors a fixed sum for attendance at each meeting of the Board or of a standing or special committee, a stated retainer for services as a director, a stated fee for serving as a chair of a standing or special committee and such other compensation, including benefits, as the Board or any standing committee thereof shall determine from time to time. Additionally, the Directors may be paid their expenses of attendance at each meeting of the Board or of a standing or special committee.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Related Persons

The following discussion relates to types of transactions involving our company and any of our executive officers, directors, director nominees or five percent (5%) stockholders, each of whom we refer to as a "related party." For purposes of this discussion, a "related-party transaction" is a transaction, arrangement or relationship:

• in which we participate;

• that involves an amount in excess of the lesser of $120,000 or 1% of the average of our total assets at year end for the last two completed fiscal years; and

• in which a related party has a direct or indirect material interest.

From January 1, 2020 through the date of this Proxy Statement, there have been no related-party transactions, except for the executive officer and director compensation arrangements described in the section "Executive Compensation".

Policies and Procedures for Related Party Transactions

Any request for us to enter into a transaction with an executive officer, director, principal stockholder, or any of such persons’ immediate family members or affiliates, in which the amount involved exceeds the lesser of $120,000 or 1% of the average of our total assets at year-end for the last two completed fiscal years, must first be presented to our Audit Committee for review, consideration and approval. All of our directors, executive officers and employees will be required to report to our Audit Committee any such related-party transaction. In approving or rejecting the proposed agreement, our Audit Committee will consider the relevant facts and circumstances available and deemed relevant to the Audit Committee, including, but not limited to, the risks, costs and benefits to us, the terms of the transaction, the availability of other sources for comparable services or products, and, if applicable, the impact on a director’s independence. Our Audit Committee will approve only those agreements that, in light of known circumstances, are in, or are not inconsistent with, our best interests, as our Audit Committee determines in the good faith exercise of its discretion.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 25, 2021, certain information regarding the beneficial ownership of our Common Stock, the only class of capital stock we have currently outstanding, of (i) each director and “named executive officers” (as defined in the section titled “Executive Compensation — Summary Compensation Table”) individually, (ii) our Chief Financial officer, (iii) all directors and executive officers as a group, and (iv) each person known to us who is known to be the beneficial owner of more than 5% of our Common Stock. In accordance with the rules of the SEC, “beneficial ownership” includes voting or investment power with respect to securities. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of Common Stock beneficially owned by them.

Name of Beneficial Owner(1) | Shares of Common Stock Beneficially Owned (2) | Percentage of Common Stock Beneficially Owned (3) | ||||||

Directors and NEOs | ||||||||

Sune Mathiesen (4) | 367,610 | 1.7 | % | |||||

Claus Toftegaard | 10.708 | * | ||||||

Mark Vernon | 199,293 | * | ||||||

Alexander Buehler | 25,000 | * | ||||||

Peyton Boswell | 37,500 | * | ||||||

Richard Meeusen | 3,000 | * | ||||||

All executive officers and directors as a group (6 persons) | 643,111 | 3.0 | % | |||||

5% stockholders: | ||||||||

Bleichroeder LP (5) | 2,158,448 | 9.9 | % | |||||

AWM Investment Company, Inc. (6) | 2,043,290 | 9.4 | % | |||||

Laurence W. Lytton (7) (8) | 1,922,185 | 8.9 | % | |||||

Wellington Management Group LLP (9) | 1,454,327 | 6.7 | % | |||||

Russel Investments Group, Ltd. (10) | 1,283,965 | 5.9 | % | |||||

Clear Harbour Asset Management (11) | 1,227,822 | 5.7 | % | |||||

* | Less than one percent. |

(1) | Unless otherwise indicated, the address for each person listed above is: c/o LiqTech Holding A/S, Industriparken 22C, DK-2750 Ballerup, Denmark. | |

| ||

(2) | Under the rules and regulations of the SEC, beneficial ownership includes (i) shares actually owned, (ii) shares underlying preferred stock, options and warrants that are currently exercisable and (iii) shares underlying options and warrants that are exercisable within 60 days of March 25, 2021. All shares beneficially owned by a particular person under clauses (ii) and (iii) of the previous sentence are deemed to be outstanding for the purpose of computing the percentage ownership of that person but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. | |

| ||

(3) | Based on 21,697,373 shares issued and outstanding as of March 25, 2021. | |

| ||

(4) | These shares are partly owned by Masu A/S, a Danish entity. Mr. Mathiesen controls the voting and disposition of the shares owned by Masu A/S. | |

| ||

(5) | The address of the stockholder is 1345 Avenue of the Americas, 47th Floor, New York, NY 10105. | |

| ||

(6) | The address of the stockholder is c/o Special Situations Funds, 527 Madison Avenue, Suite 2600, New York, NY 10022. | |

| ||

(7) | The address of the stockholder is 467 Central Park West New York, NY 10025. | |

| ||

(8) | Includes 200,000 shares of Common Stock owned of record by the Alice W. Lytton Family LLC, 85,000 shares of Common Stock owned of record by the Lytton-Kambara Foundation and an immediately exercisable a pre-funded warrant to purchase 515,000 shares of Common Stock owned of record by the Lytton-Kambara Foundation and subject to a beneficial ownership limitation of 9.99%. | |

| ||

(9) | The address of the stockholder is c/o Wellington Trust Company 280 Congress Street, Boston, MA 02210. Wellington Management Group LLP is the direct or indirect owner of one or more investment advisors whose clients include, Wellington Trust Company, NA, and Wellington Trust Company, National Association Multiple Common Trust Funds Trust, Micro Cap Equity Portfolio. Wellington Management Group LLP is deemed to be a beneficial owner of the shares held by the clients of the investment advisers that it owns. | |

| ||

(10) | The address of the stockholder is 1301 Second Avenue, 18th Floor, Seattle, WA 98101. | |

| ||

(11) | The address of the stockholder is 420 Lexington Avenue, Suite 2006, New York, NY 10170. |

We know of no arrangements, including pledges, by or among any of the foregoing persons, the operation of which could result in a change of control of us.

AUDIT-RELATED MATTERS – AUDITOR FEES AND SERVICES

Our current principal independent registered public accountant is Sadler, Gibb & Associates, L.L.C. (“Sadler”). During the Company’s two most recent fiscal years ended December 31, 2020 and 2019, neither the Company nor anyone on its behalf consulted Sadler regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the consolidated financial statements of the Company, or (ii) any matter that was either the subject of a disagreement or a reportable event as described above. Since December 31, 2019, and through the date hereof, there were no disagreements (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K) with Sadler on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure for which disagreements, if not resolved to Sadler’s satisfaction, would have caused them to make reference to the subject matter in connection with their report on the Company’s consolidated financial statements for such periods. As used herein, the term “reportable event” means any of the items listed in paragraphs (a)(1)(v)(A)-(D) of Item 304 of Regulation S-K.

The Company does not expect a representative of Sadler to be present at the Meeting.

Audit Fees, Audit-Related Fees, Tax Fees & All Other Fees

Audit fees are the aggregate fees billed or expected to be billed by our independent auditors for the audit of our annual consolidated financial statements for the year ended December 31, 2020 and 2019 and for the review of our quarterly financial statements. During 2020 and 2019 audit fees were $152,500 and $252,500. The fee for 2019 included the audit of the Company’s SOX404 compliance, for which the Company is not subject to since 2020. Our auditors did not provide any tax compliance, planning services or audit related services for the Company. Our auditors did not provide any other services than those described above.

Audit Committee Pre-approval

The policy of the Audit Committee is to pre-approve all audit and non-audit services provided by the independent accountants. These services may include audit services, audit-related services, tax fees, and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services. The Audit Committee has delegated pre-approval authority to certain committee members when expedition of services is necessary. The independent auditor and management are required to periodically report to the full Audit Committee regarding the extent of services provided by the independent auditor in accordance with this pre-approval delegation and the fees for the services performed to date. The Audit Committee approved all of the services described above in advance during the fiscal year ended December 31, 2020.

OTHER MATTERS

Delivery of Documents to Stockholders Sharing an Address