- IVT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

InvenTrust Properties (IVT) DEF 14ADefinitive proxy

Filed: 24 Mar 23, 4:06pm

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| ☐ | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| ☒ | Definitive Proxy Statement | |||||||

| ☐ | Definitive Additional Materials | |||||||

| ☐ | Soliciting Material under § 240.14a-12 | |||||||

| ☒ | No fee required. | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023 |

| NOTICE OF ANNUAL MEETING |

| OF STOCKHOLDERS TO BE |

| HELD ON MAY 4, 2023 |

Dear Fellow Stockholder:

We are pleased to invite you to attend the annual meeting of stockholders of InvenTrust Properties Corp., a Maryland corporation (“InvenTrust”), on May 4, 2023 at 9:00 a.m. Central Time. Our annual meeting will be a “virtual meeting” of stockholders, which will be conducted solely by means of remote communication via live webcast. You will be able to attend the virtual annual meeting of stockholders online and submit your questions during the meeting by visiting www.virtualstockholdermeeting.com/IVT2023.

We are excited to embrace the latest technology to provide expanded access to and improved communication for our stockholders. We believe that hosting an environmentally friendly virtual meeting will enable greater stockholder attendance and safety, allowing participation from any location around the world and providing cost savings for our stockholders and InvenTrust.

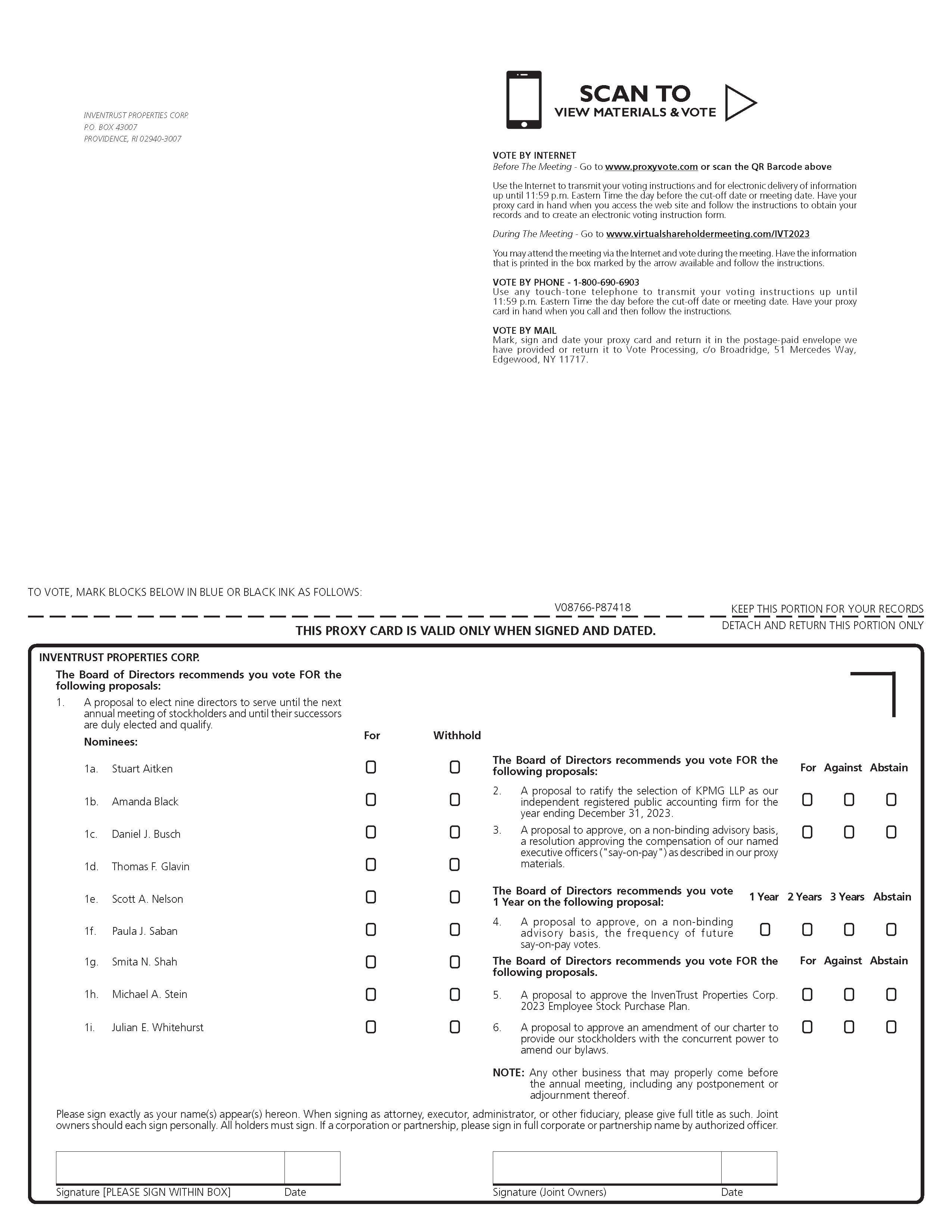

At our annual meeting, we will ask you to consider and vote upon:

| 1. | A proposal to elect nine directors to serve until the next annual meeting of stockholders and until their successors are duly elected and qualify; |

| 2. | A proposal to ratify the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023; |

| 3. | A proposal to approve, on a non-binding advisory basis, a resolution approving the compensation of our named executive officers (“say-on-pay”) as described in our proxy materials; |

| 4. | A proposal to approve, on a non-binding advisory basis, the frequency of future say-on-pay votes; |

| 5. | A proposal to approve the InvenTrust Properties Corp. 2023 Employee Stock Purchase Plan (“2023 ESPP”); |

| 6. | A proposal to approve an amendment of our charter to provide our stockholders with the concurrent power to amend our bylaws; and |

| 7. | Any other business that may properly come before the annual meeting, including any postponement or adjournment thereof. |

If you were a stockholder of record at the close of business on March 3, 2023, your shares may be voted at the annual meeting, including any continuations, postponements or adjournments of the meeting. In order to attend the virtual meeting, you will need your 16-digit control number that will be supplied to all stockholders via the proxy card or voting instructions form. If you have any questions regarding the format of the meeting, please contact Mr. Dan Lombardo, Vice President of Investor Relations, at dan.lombardo@inventrustproperties.com.

In order to reduce costs and the environmental impact associated with our annual meeting, we are primarily furnishing proxy materials to our stockholders electronically as permitted by the U.S. Securities and Exchange Commission. Unless an election has been affirmatively made to receive paper copies of the materials by mail, stockholders will receive a Notice of Annual Meeting and Notice of Internet Availability of Proxy Materials (“Notice”) with instructions for accessing the proxy materials free of charge over the Internet. If you receive a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the Notice.

| Please promptly submit your proxy by mail, telephone or Internet by following the instructions provided to ensure that your shares will be represented whether or not you attend the annual meeting. We encourage you to submit your proxy prior to the meeting to help ensure that a quorum is present, and our meeting can proceed.

By order of the Board of Directors,

Christy L. David E.V.P., Chief Operating Officer, General Counsel and Secretary March 24, 2023 |

TABLE OF CONTENTS

| 1 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROXY MATERIALS & ANNUAL MEETING

Information About the Proxy Materials

The board of directors (the “Board”) of InvenTrust Properties Corp., a Maryland corporation (referred to herein as the “Company,” “InvenTrust,” “we,” “our” or “us”), is furnishing the Notice of Annual Meeting, proxy statement and proxy card to you, and to all stockholders of record as of the close of business on March 3, 2023, because the Board is soliciting your proxy to vote at the Company’s 2023 annual meeting of stockholders (the “Annual Meeting”), and at any continuations, postponements or adjournments thereof.

The Securities and Exchange Commission (“SEC”) has adopted rules permitting the electronic delivery of proxy materials. In accordance with those rules, we are primarily furnishing proxy materials to our stockholders via the Internet, rather than mailing paper copies of the materials. Internet distribution of the proxy materials is designed to expedite receipt by stockholders and lower costs and the environmental impact of the Annual Meeting. Beginning on or about March 24, 2023, we will mail a Notice of Annual Meeting and Notice of Internet Availability of Proxy Materials (“Notice”) to our stockholders of record as of the close of business on March 3, 2023, which will contain instructions on how to access and review proxy materials, including our proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022, and how to submit proxies via the Internet or by telephone. If you received a Notice but would like to submit your proxy by mail or request paper copies of our proxy materials going forward, you may still do so by following the instructions described in the Notice.

Choosing to receive your proxy materials over the Internet will help reduce the environmental impact and costs associated with the printing and mailing of the proxy materials to you. Unless you affirmatively elect to receive paper copies of our proxy materials in the future by following the instructions included in the Notice, you will continue to receive a Notice directing you to a website for electronic access to our proxy materials.

On or about March 24, 2023, we will also begin mailing a full set of proxy materials to certain stockholders who previously requested a paper copy of the proxy materials.

If you own shares of common stock, par value $0.001 per share (the “common stock”), of the Company in more than one account, such as individually or jointly with your spouse, you may receive more than one Notice or set of these materials. Please make sure to authorize a proxy to vote all of your shares in all your accounts.

Important Notice Regarding the Availability of Proxy Materials

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 4, 2023. This proxy statement, the proxy card and our Annual Report on Form 10-K for the year ended December 31, 2022 are available at www. proxyvote.com.

Information About the Annual Meeting

The Annual Meeting will be held on May 4, 2023, beginning at 9:00 a.m., Central Time. The Annual Meeting will be a “virtual meeting” of stockholders, which will be conducted solely by means of remote communication via live webcast. We welcome and encourage you to attend. Please note that only stockholders of record as of the close of business on March 3, 2023 (the “record date”) will be permitted to attend and ask questions during the meeting. Questions pertinent to meeting matters will be answered during the Annual Meeting, subject to time limitations. In order to attend the virtual meeting, you will need your 16-digit control number that will be supplied to all stockholders via the proxy card or voting instructions form. At the meeting you will be allowed to vote your shares within the online portal, as well as submit questions. The online portal will open 60 minutes before the beginning of the Annual Meeting. We encourage you to access the meeting prior to the meeting start time.

| 2 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROXY MATERIALS & ANNUAL MEETING

Rules governing the conduct of the Annual Meeting will be posted on the virtual meeting platform along with an agenda. We reserve the right to eject an attendee or cut off speaking privileges for behavior likely to cause disruption or annoyance or for failure to comply with reasonable requests or the rules of conduct for the meeting, including time limits applicable to attendees who are permitted to speak.

We reserve the right to edit profanity or other inappropriate language and to exclude questions regarding topics that are not pertinent to meeting matters or company business. If we receive substantially similar questions, we may group questions together and provide a single response to avoid repetition.

If you encounter any difficulties while accessing the virtual meeting during the check-in or meeting time, a technical assistance phone number will be made available on the virtual meeting registration page 15 minutes prior to the start time of the meeting.

Information About Voting

Your attendance at the virtual meeting or by proxy is needed to ensure that the proposals can be acted upon. We are a widely held company and, as a result, a large number of our stockholders must be present or represented by proxy at the Annual Meeting in order for us to obtain a quorum. THEREFORE, YOUR PRESENCE AT THE VIRTUAL MEETING, IN PERSON VIRTUALLY OR BY PROXY IS VERY IMPORTANT, EVEN IF YOU OWN A SMALL NUMBER OF SHARES. Your immediate response will save us significant additional expense associated with soliciting stockholder votes.

You will have one vote for each share of common stock that you owned at the close of business on March 3, 2023, which is the record date for the Annual Meeting. As of March 3, 2023, there were 67,472,553 shares of common stock outstanding and entitled to vote. There is no cumulative voting.

Record Holders

If your shares are registered directly in your name with our transfer agent, Computershare Inc., you are, with respect to those shares, the stockholder of record or record holder. Record holders may vote while in attendance at the virtual Annual Meeting or by granting a proxy to vote on each of the proposals. You may authorize a proxy to vote your shares in any of the following ways:

| MAIL: if you received a hard copy proxy card, you may complete and return it as instructed on the proxy card. If you received a Notice, you may request a proxy card at any time by following the instructions on the Notice. You may then complete the proxy card and return it by mail as instructed on the proxy card in the pre-addressed, post-age-paid envelope provided. If mailed, your completed and signed proxy card must be received by May 3, 2023; |

| TELEPHONE: dial 1-800-690-6903 any time prior to 11:59 p.m. Eastern Time on May 3, 2023, and with your Notice in hand follow the instructions; or |

| INTERNET: go to www.proxyvote.com any time prior to 11:59 p.m. Eastern Time on May 3, 2023, and with your Notice in hand follow the instructions to obtain your records and to create an electronic voting instruction form. |

| 3 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROXY MATERIALS & ANNUAL MEETING

If you are a record holder and grant a proxy, you may nevertheless revoke your proxy at any time before it is exercised by: (1) sending written notice to us, 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, Attention: Corporate Secretary; (2) providing us with a properly executed, later-dated proxy; or (3) attending the virtual Annual Meeting and voting your shares while in attendance. Merely attending the Annual Meeting, without further action, will not revoke your proxy.

Beneficial Owners

If your shares are held in a brokerage account or by another nominee, you are the beneficial owner of shares held in street name, and the Notice (or in some cases, a full set of proxy materials) is being forwarded to you automatically, along with instructions from your broker, bank or other nominee. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares and are also invited to attend the Annual Meeting. Your broker, bank or other nominee has provided voting instructions for you to use in directing how to vote your shares. If you do not provide specific voting instructions by the deadline set forth in the materials you receive from your broker, bank or other nominee, your broker, bank or other nominee can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. See “Withhold, Abstentions and Broker Non-Votes” below for more information about broker non-votes. Beneficial owners who desire to revoke a previously submitted proxy should contact their bank or broker for instructions.

| 4 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROXY MATERIALS & ANNUAL MEETING

Information Regarding Tabulation of the Vote

Broadridge Investor Communication Solutions, Inc. (“Broadridge”) or its designee will act as the inspector of election and will count the votes.

Information About Items to be Voted on and Vote Necessary for Action to be Taken

At the Annual Meeting, stockholders will consider and vote upon the following matters, and such other matters as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof:

| 1 | PROPOSAL NO. 1: Election of nine directors, to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualify. A plurality of all the votes cast at the Annual Meeting shall be sufficient to elect a director. Each share may be voted for as many individuals as there are directors to be elected and for whose election the holder is entitled to vote. The Board unanimously recommends a vote FOR each of the nominees for director. | |

| 2 | PROPOSAL NO. 2: Ratification of the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023. A majority of the votes cast at the Annual Meeting shall be sufficient to approve Proposal No. 2. The Board unanimously recommends a vote FOR the ratification of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023. | |

| 3 | PROPOSAL NO. 3: Approval, on a non-binding advisory basis, of a resolution approving the compensation of our named executive officers as disclosed in this proxy statement pursuant to the SEC’s compensation disclosure rules (“say-on-pay”). A majority of the votes cast at the Annual Meeting shall be sufficient to approve Proposal No.3. The Board unanimously recommends a vote FOR the approval on a non-binding, advisory basis, of a resolution approving the compensation of our named executive officers as disclosed herein pursuant to the SEC’s compensation disclosure rules. | |

| 4 | PROPOSAL NO. 4: Approval on a non-binding, advisory basis, of the frequency of future say-on-pay votes. Stockholders will be able to specify one of four choices for this proposal on the proxy card: three years, two years, one year or abstain. A majority of the votes cast at the Annual Meeting shall be sufficient to approve any of the three alternative frequencies pursuant to Proposal No. 4. In the event that none of the frequency alternatives receives a majority of the votes cast, we will consider the alternative that receives the most votes to be the alternative selected by the stockholders. The Board unanimously recommends a vote that future say-on-pay votes be held EVERY YEAR. | |

| 5 | PROPOSAL NO. 5: Approval of the 2023 ESPP. A majority of the votes cast at the Annual Meeting shall be sufficient to approve Proposal No. 5. The Board unanimously recommends a vote FOR the approval of the 2023 ESPP, attached hereto as Appendix B. | |

| 6 | PROPOSAL NO. 6: Approval of an amendment of our charter to provide our stockholders with the concurrent power to amend our bylaws (the “Bylaws”). An affirmative vote of stockholders entitled to cast a majority of the votes entitled to be cast at the Annual Meeting shall be sufficient to approve Proposal No. 6. The Board has unanimously adopted and declared advisable, and recommends a vote FOR, the approval of an amendment of our current charter (the “Charter”) as set forth in the Articles of Amendment (the “Proposed Charter Amendment”), attached hereto as Appendix C. |

If you return your proxy but do not indicate how your shares should be voted, they will be voted “FOR” each director in Proposal No. 1, “FOR” Proposal No. 2, “FOR” Proposal No. 3, “EVERY YEAR” with respect to Proposal 4, “FOR” Proposal No. 5 and “FOR” Proposal No. 6, in accordance with the Board’s recommendation.

| 5 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROXY MATERIALS & ANNUAL MEETING

Quorum Requirement

The presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting on any matter shall constitute a quorum. There must be a quorum present in order for us to conduct business at the Annual Meeting.

Withhold, Abstentions and Broker Non-Votes

A “withhold” vote with respect to the election of directors will be considered present for purposes of determining a quorum. Because a plurality of all the votes cast at the Annual Meeting shall be sufficient to elect director (meaning that the nine director nominees who receive the highest number of “for” votes will be elected) and each of our directors is running unopposed, a “withhold” vote will have no effect with respect to the outcome of election of directors.

An “abstain” vote with respect to the other proposals to be voted on at the Annual Meeting will be considered present for purposes of determining a quorum, but is not considered a vote cast with respect to such proposals. Therefore, an abstention will not have any effect on the outcome of the vote on the ratification of appointment of our independent registered public accounting firm (Proposal No. 2), or the approval of the say-on-pay (Proposal No. 3), the frequency of say-on-pay (Proposal No. 4) or the 2023 ESPP (Proposal No. 5). Because the Amendment of the Charter (Proposal No. 6) requires an affirmative vote of stockholders entitled to cast a majority of all the votes entitled to be cast on the matter at the Annual Meeting, abstentions will have the same effect as a vote against this proposal.

A broker non-vote is considered present for purposes of determining whether a quorum exists. A “broker non-vote” occurs if your shares are not registered in your name and you do not provide the record holder of your shares (usually a bank, broker, or other nominee) with voting instructions on a matter and the record holder is not permitted to vote on the matter without instructions from you under applicable rules of the New York Stock Exchange (“NYSE”). The election of directors (Proposal No. 1), say-on-pay (Proposal No. 3), frequency of say-on-pay (Proposal No. 4), approval of the 2023 ESPP (Proposal No. 5) and approval of the Amendment of the Charter (Proposal No. 6), are considered “non-discretionary” items, so if you do not provide instructions to the holder of record, your shares will be treated as broker non-votes, will not be considered as a “vote cast” and will have no effect on the outcome of the vote on such proposals (other than Proposal No. 6). Because the Amendment of the Charter (Proposal No. 6) requires an affirmative vote of stockholders entitled to cast a majority of all the votes entitled to be cast on the matter at the Annual Meeting, broker non-votes will have the same effect as a vote against this proposal. The ratification of appointment of our independent registered public accounting firm (Proposal No. 2) is a “discretionary” or routine item under NYSE rules. As a result, the shares for which instructions are not provided to the holder of record will not be treated as broker non-votes and brokers who do not receive instructions as to how to vote on Proposal No. 2 generally may vote on this matter in their discretion. Thus, we do not expect any broker non-votes on this proposal.

| 6 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROXY MATERIALS & ANNUAL MEETING

Costs of Soliciting Proxies

We will bear all costs and expenses incurred in connection with soliciting proxies. Our directors and executive officers may solicit proxies by mail, personal contact, letter, telephone, facsimile or other electronic means. These individuals will not receive any additional compensation for these activities but may be reimbursed by us for their reasonable out-of-pocket expenses. In addition, Broadridge will collect and solicit proxies on our behalf. We will pay Broadridge fees that we expect will not exceed $210,000 and any out-of-pocket expenses for soliciting proxies.

Other Matters

At this time, no other matters are being presented for your consideration at the Annual Meeting. Generally, no business aside from the items discussed in this proxy statement may be transacted at the meeting. If, however, any other matter properly comes before the Annual Meeting as determined by the chair of the meeting, your proxies are authorized to act on the proposal at their discretion.

Householding

Only one Notice or copy of this proxy statement and the 2022 Annual Report on Form 10-K have been sent to certain stockholders who share a single address, unless any stockholder residing at that address has given contrary instructions. This procedure, referred to as householding, reduces the volume of duplicate information stockholders receive and reduces mailing and printing costs. Additional copies of this proxy statement or our Annual Report on Form 10-K for the year ended December 31, 2022, will be furnished to you, without charge, by writing us at: c/o InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, Attention: Investor Relations, or by emailing us at investorrelations@inventrustproperties.com. If you share an address with another stockholder and the two of you would like to receive only a single set of our annual disclosure documents, please contact us by writing us at: c/o InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, Attention: Investor Relations, or by emailing us at investorrelations@inventrustproperties.com, or, if a bank, broker or other nominee holds your shares, please contact your bank, broker or other nominee directly.

| 7 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

Corporate Governance Profile

Our corporate governance is structured in a manner that the Board believes closely aligns the Company’s interests with those of our stockholders. Notable features of our corporate governance structure include the following:

| • | Each of our directors being subject to annual elections; |

| • | of the nine persons who currently serve on our Board, eight have been determined by us to be independent for purposes of the NYSE’s corporate governance listing standards and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

| • | all of the members of our Audit, Compensation and Nominating and Corporate Governance Committees are independent; we have determined that at least three of our directors qualify as an ’‘audit committee financial expert’’ as defined by the SEC; |

| • | our stockholders owning at least 3% or more of the Company’s outstanding common stock continuously for at least three years may nominate and add director candidates in the Company’s proxy materials for annual meetings pursuant to, and subject to the provisions of, the proxy access provision in our Bylaws; |

| • | our directors have a diversity of skills, experience, gender, ethnicity and backgrounds; |

| • | we opted out of the provisions of Maryland law that permit the Board to classify itself without stockholder approval; |

| • | an Equity Retention Policy that requires each director, our CEO and other NEOs, and such other executive officers selected by our CEO and compensation committee, to own a certain amount of our equity; |

| • | our stockholders, by a majority vote of shares entitled to be cast on the matter, may call a special meeting of stockholders; and |

| • | we do not have a stockholder rights plan and we will not adopt one without stockholder approval or stockholder ratification within 12 months of adoption of such plan. |

Our Charter and Bylaws provide that the number of directors constituting the Board may be increased or decreased by a

majority vote of the entire Board, provided the number of directors may not be greater than 11 and may not be decreased to fewer than the minimum number required under the Maryland General Corporation Law (the “MGCL”), which currently is one director. The tenure of office of a director will not be affected by any decrease in the number of directors.

Our Bylaws currently provide that any vacancy on the Board for any cause other than an increase in the number of directors may be filled by a majority of the remaining directors, even if such majority is less than a quorum, any vacancy in the number of directors created by an increase in the number of directors may be filled by a majority vote of the entire Board, and any directors elected to fill a vacancy will hold office until the next annual meeting of stockholders and until a successor is duly elected and qualifies.

As a result of resolutions of our Board adopted on September 20, 2021 and Articles Supplementary to our Charter filed on October 12, 2021, we are prohibited from electing to be subject to the provisions of Subtitle 8 of Title 3 of the MGCL that would permit us to classify the Board without stockholder approval, and such prohibition may not be repealed unless a proposal to repeal such prohibition is approved by the affirmative vote of at least a majority of the votes cast on the matter by our stockholders.

There are no family relationships among our executive officers and directors. All directors, except Daniel J. Busch (our President & Chief Executive Officer), have been determined by the Board to be independent under applicable NYSE and SEC rules.

Corporate Governance Guidelines

Our Board has adopted corporate governance guidelines (the “Corporate Governance Guidelines”) to provide a transparent framework for the effective governance of InvenTrust. The Corporate Governance Guidelines are available on our website at www.inventrustproperties.com through the “Investors – Governance – Corporate Governance Guidelines” tab. In addition, printed copies of the Corporate Governance Guidelines are available to any stockholder, without charge, by writing us at InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, Attention: Investor Relations.

| 8 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

Corporate Culture and Strategy

Our employees are our greatest asset and the foundation for our success. Together, we focus on building an inclusive culture where innovative thinking is valued, collaboration is essential, and communicating the “why” is a necessity. We are committed to creating a corporate culture characterized by high levels of employee engagement, growth and development, and health and wellness. We seek to attract and retain diverse and talented professionals who provide a wide range of opinions and experiences to drive our business forward. As of December 31, 2022, we have 106 full-time employees.

We define racial diversity as employees who are African American or Black, Alaskan Native or Native American, Asian, Hispanic or Latinx, and Native Hawaiian or Pacific Islander. We define gender diversity as employees who identify as women. Overall diversity across our workforce is approximately 65%, including gender and racial/ethnic groups. Racial diversity across our workforce is 19%. Women represent approximately 59% of our employees.

Our Human Capital strategy is focused on talent management. The basis for hiring, development, training, compensation and advancement are qualifications, performance, skills and experience. We believe our employees are fairly compensated, without regard to gender, race, and ethnicity. All of our employees are offered a comprehensive benefits package, including, but not limited to, paid time off and parental leave, medical, dental and vision insurance, disability, life insurance, 401(k) matching, tuition reimbursement, flexible Fridays and work from home flexibility.

Employee engagement is critical to our success. We believe in fostering a highly engaged inclusive environment which drives growth and productivity. We believe that our heightened focus on development and health and wellness creates a more engaged workforce. In 2022, 81% of our employees were highly engaged and we were named as one of Chicago’s Top Workplaces by The Chicago Tribune. We believe that the more engaged our employees are the more likely productivity will increase and drive empowerment throughout the organization for our employees to act like owners. Our hybrid work model provides an opportunity for employees to balance work and life whether they are in the office or at home. We also host monthly events focused on employee education, health and wellness, engagement activities, and giving back to our communities. Our events consist of company-wide executive led meetings to stay connected with our employees, wellness competitions, food trucks, game days, happy hours, and charity events serving our communities. We are proud that 100% of our employees participated in charitable events giving back to our communities in 2022. We also implemented half day Fridays to help our employees balance work and life focusing on mental health as well as giving back to our communities through charitable endeavors.

We celebrate our employees’ success through our Circle of Excellence awards. Our monthly, “On The Spot” award recognizes employees who go above and beyond their job. Our annual awards, the “Rising Star” and “Standing Ovation” recognize new employees and tenured employees who exhibit exceptional promise, ability, and our InvenTrust values. We monitor our performance through employee engagement surveys and utilize the results to continually improve our organization.

| 9 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

Stockholder Engagement

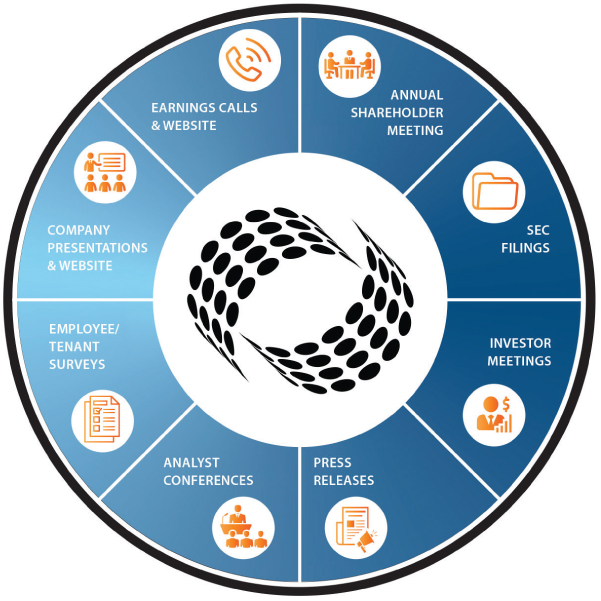

We have a robust investor engagement program led by our Investor Relations team and the Corporate Secretary’s office. The Company engages proactively with our stockholders, monitors developments in corporate governance and social responsibility, and in consultation with our Board, thoughtfully adopts practices in a manner that best supports our strategy and culture. We view stockholder engagement as continuous dialogue, rather than event-driven. Our engagement approach is grounded in a set of core principles:

TRANSPARENCY: engage openly with stockholders providing information and communications in a timely and understandable manner.

CONSISTENCY: maintain regular and consistent communication to ensure continuity and meaningful engagement.

ACCOUNTABILITY: inform stockholders of the Company’s performance and strategic execution as compared to the Company’s targets.

Therefore, we actively engage with our stockholders in a number of forums on a year-round basis as depicted by the following graphic:

Stockholder feedback is received through all of these interactions. As appropriate, relevant stockholder concerns are addressed promptly by the Investor Relations department. Stockholders may also make their views known through individual voting for directors, say-on-pay advisory vote and other matters submitted to stockholders for approval. In addition, stockholders may submit stockholder proposals in accordance with applicable rules and our Bylaws.

Environmental, Social and Governance (ESG)

ESG is not new to InvenTrust. Since 2013, we have participated in compiling and reporting on ESG metrics with GRESB (formerly “Global Real Estate Sustainability Benchmark”), an independent organization providing ESG performance data and peer benchmarks for investors and organizations. We believe we can enhance our communities, conserve resources and foster a best-in-class working environment while growing long-term stockholder value.

| 10 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

We remain committed to transparency in our investment strategy with a focus on operating efficiency, responding to evolving trends, and addressing the needs of our tenants and communities by continuing to fully integrate environmental sustainability, social responsibility, and strong governance practices throughout our organization.

| OUR COMPANY | ||

| ESG Strategy | ● | Annual reporting of our performance on environmental, social and governance (ESG) matters to our Board, with reporting by management to be done annually on strategy and performance to the Board. |

| ● | Management of social and environmental capital embedded in our investment strategy, corporate culture and stockholder engagement process. | |

| ● | Membership and participation in industry organizations focusing on sustainability including GRESB and the National Association of Real Estate Investment Trusts (“NAREIT”). | |

| Highlights | ● | Published our inaugural Environmental, Social and Governance Report highlighting our commitment to ESG. |

| ● | Continued to strategically execute on the 5-year goals stated in our ESG Report. | |

| ● | InvenTrust has been involved with the GRESB Real Estate Assessment since 2013. | |

| ● | InvenTrust has continued to expand on implementing the key principles of ESG and has an ongoing commitment to maximize value for its stakeholders in the long-term while conducting business in a socially, ethical and environmentally friendly manner. | |

| ● | Conducted ESG training for all employees to stay current with industry trends. | |

| ENVIRONMENTAL | ||

| Principle | ● | We focus on promoting sustainable culture practices through education, awareness, and opportunity in order to preserve our communities’ valuable resources for future generations. |

| Highlights | ● | Continued to expand our common area LED upgrade program to cover 20 additional properties in 2022. |

| ● | Signed agreements to install electric vehicle (EV) charging stations at 13 additional properties in 2022. | |

| ● | InvenTrust named a Green Lease Leader (Silver) in 2022, fairly aligning financial and environmental benefits of sustainability initiatives for both InvenTrust and its tenants. | |

| ● | Continued to execute on internal reduction targets for energy, water, and waste. | |

| SOCIAL | ||

| Principle | ● | Our people give us a competitive advantage – we strive to hire and retain the best in real estate. |

| Highlights | ● | We invest in our people through offering tuition reimbursement, continuing education, and training programs. |

| ● | Superior benefits - our program focuses on our employees’ health and well-being, financial security, and work-life balance. | |

| ● | Conducted employee satisfaction survey with 100% participation rate indicating that employee base is highly engaged. | |

| ● | 100% employee participation in volunteerism and/or charitable giving in 2022. | |

| ● | 100% employee participation in our Diversity, Equity & Inclusion (DEI), Ethics and Anti-Harassment trainings. | |

| ● | InvenTrust’s 2022 Employee Engagement Survey results showed that 81% of employees are “highly engaged” | |

| ● | InvenTrust named a Top Chicago Workplace in 2022 by The Chicago Tribune | |

| GOVERNANCE | ||

| Principle | ● | The structure and practices of our Board is committed to independence, education, and transparency. |

| Highlights | ● | 89% of our directors are independent. |

| ● | 33% of our independent directors are women. | |

| ● | The Board conducts a robust annual review of all its governing documents to ensure that the Company is current and relevant regarding governance trends. | |

| ● | Each new director goes through an on-boarding process to integrate them into the Company, its practices, and its people. | |

| 11 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

Director Independence

Our business is managed under the direction and oversight of our Board. The members of our Board are Paula J. Saban, our chairperson, Stuart Aitken, Amanda Black, Daniel J. Busch, Thomas F. Glavin, Scott A. Nelson, Smita N. Shah, Michael A. Stein and Julian E. Whitehurst. As required by our Charter, a majority of our directors must be “independent.” As defined by our Charter, an “independent director” means any director who qualifies as an “independent director” under the provisions of the NYSE Listed Company Manual in effect from time to time. The NYSE standards provide that to qualify as an independent director, in addition to satisfying certain bright-line criteria, the Board must affirmatively determine that a director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company).

Consistent with these considerations, after reviewing all relevant transactions or relationships between each director, or any of his or her family members, and the Company, our management, and our independent registered public accounting firm, and considering each director’s direct and indirect association with the Company and its management, the Board has determined that Mses. Black, Shah and Saban and Messrs. Aitken, Glavin, Nelson, Stein and Whitehurst qualify as independent directors.

Board Leadership Structure and Risk Oversight

Mr. Busch, in his role as our president and chief executive officer, is responsible for managing the strategic direction and for providing the day-to-day leadership of the Company. Ms. Saban, in her role as our chairperson of the Board, organizes the work of the Board and ensures that the Board has access to sufficient information to carry out its functions, including monitoring the Company’s performance. Ms. Saban presides over meetings of the Board and stockholders, establishes the agenda for each meeting and oversees the distribution of information to directors. We have separated the roles of the president and chairperson of the Board in recognition of the differences between the two roles. Our Board believes the current structure is appropriate and effective.

To ensure free and open discussion and communication among the non-employee directors of our Board, the non-employee directors meet periodically in private session with no members of management present. Ms. Saban, as our chairperson, presides at these sessions.

Our Board oversees the business and affairs of our Company, including its long-term health, overall success and financial strength. The full Board is actively involved in overseeing risk management for the Company. Our Board oversees risk through the: (1) review and discussion of regular periodic reports to the Board and its committees, including management reports, leasing activity and property operating data, as well as actual and projected financial results, the corporate model and outputs, and various other matters relating to our business; (2) required approval by the Board of certain transactions, including, among others, acquisitions and dispositions of properties exceeding certain dollar amounts and financings exceeding certain dollar amounts, as set forth in investment policies adopted by the Board; (3) oversight of risk associated with the various elements of compensation by the compensation committee; (4) oversight of risk policies and management as well as major financial risk exposures and steps taken to monitor and control such risks by the audit committee; (5) review of regular periodic reports from our independent public accounting firm, third-party internal audit firm and other outside consultants regarding various areas of potential risk, including, among others, those relating to the qualification of the Company as a real estate investment trust (“REIT”) for tax purposes and our internal control over financial reporting; and (6) oversight of ESG goals, policies and risks through updates to the Board by senior leaders of the ESG Steering Committee.

Policy on Hedging, Pledging and Speculative Transaction

Our Insider Trading Compliance Policy prohibits all directors, officers, and employees from engaging in short-term speculative securities transactions such as short sales and certain hedging or monetization transactions with respect to the Company’s securities. The policy also prohibits all directors, officers, and employees from pledging our securities as collateral for a loan, purchasing such securities on margin or placing such securities in a margin account, unless approved in advance by our General Counsel.

| 12 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

Equity Retention Policy

Our Equity Retention Policy (“ERP”) requires our directors, named executive officers (“NEOs”) and such other executive officers selected by the Company and the compensation committee (collectively, the “Covered Persons”) to own a certain amount of our equity. Our ERP sets forth minimum equity requirements for NEOs and other executive officers as a multiple of the annual base salary and for non-employee directors as a multiple of the annual cash retainer (exclusive of any committee fees and any annual equity retainers). Please refer to the table below for the applicable multiple. Equity interests that count toward the satisfaction of the minimum equity requirement include (i) vested common stock and (ii) unvested restricted common stock or restricted stock units provided that the vesting of such unvested restricted common stock or unrestricted stock units is not subject to the achievement of any performance goals. Each Covered Person shall accumulate the ownership requirements by the later of (i) within five (5) years of becoming a Covered Person or (ii) by December 31, 2026, and thereafter shall retain the minimum equity requirement for the duration of board service or employment, as the case may be. Compliance with the policy will be measured annually as of January 1 of each year (a “Measurement Date”). If after a Covered Person achieves the minimum equity requirement the amount of equity that the Covered Person owns subsequently falls below such minimum equity requirement, as measured on a Measurement Date (the “Drop Date”), then the Covered Person shall not sell any common stock of the Company until such time as the Covered Person has once again met the minimum equity requirement as of a Measurement Date. Notwithstanding the foregoing, a Covered Person may sell up to but not more than fifty percent (50%) of any common stock of the Company for underlying equity awards that vest after the Drop Date to pay any federal, state or local taxes that the Covered Person may owe on the Company common stock underlying such newly vested equity awards.

| COVERED PERSON | MULTIPLE OF SALARY/RETAINER |

| Non-Employee Director | 5x |

| Chief Executive Officer | 5x |

| Chief Financial Officer | 3x |

| Chief Operating Officer | 3x |

Communicating with Directors

Pursuant to our Corporate Governance Guidelines, discussed above under the heading “Corporate Governance Guidelines,” anyone who would like to communicate with, or otherwise make his or her concerns known directly to the chairperson of our Board, the chairperson of any of the audit, nominating and corporate governance and compensation committees, or to the non-employee or independent directors as a group, may do so by (1) addressing such communications or concerns to the Secretary of the Company, InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, who will forward such communications to the appropriate party, or (2) sending any emails to ShareholderCommunications@inventrustproperties.com. Such communications may be done confidentially or anonymously.

| 13 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

Nominating and Corporate Governance Committee

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||

MEMBERS: Stuart Aitken (Chairperson) Thomas Glavin Michael Stein

| The nominating and corporate governance committee is responsible for, among other things: | |

| ● | identifying individuals qualified to become members of our Board, including conducting inquiries into the background and qualifications of any candidate, and recommending candidates for election to the Board at annual meetings of stockholders (or special meetings of stockholders at which directors are to be elected); | |

| ● | reviewing periodically the committee composition and structure of the Board and recommending to the Board the number and function of board committees and directors to serve as members of each committee of the Board; | |

| ● | developing and recommending to the Board a set of corporate governance guidelines and, from time to time, reviewing such guidelines and the Company’s code of ethics and business conduct and recommending changes to the Board for approval as necessary; | |

| ● | overseeing and monitoring the Company’s sustainability, environmental and corporate social responsibility activities; and | |

| ● | overseeing the annual evaluations of the Board. | |

| NUMBER OF MEETINGS IN 2022: 5 | Each member of the nominating and corporate governance committee is independent as that term is defined in the rules and regulations of the SEC and the rules of the NYSE. | |

The nominating and corporate governance committee charter is available on our website at www.inventrustproperties.com through the “Investors – Governance – Board Committees and Charters” tab. In addition, a printed copy of the charter is available to any stockholder without charge by writing us at InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, Attention: Investor Relations.

| 14 |

Selection of Director Nominees

The nominating and corporate governance committee is responsible for reviewing the qualifications of potential director candidates and recommending those candidates to be nominated for election to the Board. The nominating and corporate governance committee considers relevant experience, skills and knowledge as well as individual qualifications, including personal and professional integrity, ethics and values; commitments to other businesses; independence, including absence of any personal or professional conflicts of interest; corporate governance experience; financial and accounting background; experience in our industry or familiarity with the issues affecting our business; diversity (including age, gender and ethnic and racial background, viewpoint and experience); academic expertise in an area of our operations; practical and mature business judgment, including ability to make independent analytical inquiries and the extent to which the interplay of the candidate’s skills, knowledge and experience with that of other Board members will build a Board that is effective, collegial and responsive to the needs of the Company.

The nominating and corporate governance committee screens all potential candidates in the same manner, regardless of the source of the recommendation. The review is expected to be based on any written materials provided with respect to potential candidates, and the nominating and corporate governance committee will review the materials to determine the qualifications, experience and background of the candidates. Final candidates are expected to be interviewed by one or more members of the nominating and corporate governance committee.

The nominating and corporate governance committee will consider director candidates recommended by stockholders for our 2024 annual meeting of stockholders. Any such recommendations must be submitted in accordance with the procedures specified in Section 9 of Article II of our Bylaws. Generally, this requires that the stockholder send certain information, including information about the candidate to our secretary not later than 5:00 p.m. Eastern Time on the 120th day and not earlier than the 150th day prior to the first anniversary of the date of the proxy statement for the preceding year’s annual meeting. For our annual meeting to be held in 2024, a stockholder must provide written notice of a candidate recommendation not earlier than October 26, 2023 and not later than 5:00 p.m., Eastern Time, on November 25, 2023, to our corporate secretary, c/o InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515. The notice must identify the author as a stockholder, provide a brief summary of the candidate’s qualifications and include the information required by our Bylaws for advance notice of stockholder nominees for director. If the shares of our common stock held by the stockholder making the recommendation are held in “street name,” notices should also attach proof of ownership of InvenTrust common stock as of the date of the notice. At a minimum, candidates recommended for nomination to the Board must meet the director independence standards of the NYSE. In addition, stockholders who intend to solicit proxies in support of director nominees other than the company’s nominees must also comply with the additional requirements of Rule 14a-19(b) of the Exchange Act.

| 15 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

Audit Committee

| AUDIT COMMITTEE | ||

MEMBERS: Thomas Glavin (Chairperson)* Stuart Aitken Amanda Black* Michael Stein* Smita N. Shah

NUMBER OF MEETINGS IN 2022: 4

*Our Board determined that each of Messrs. Glavin and Stein and Ms. Black qualifies as an “audit committee financial expert” as that term is defined in the rules of the SEC.

| The Audit committee assists the Board in fulfilling its oversight responsibility relating to: | |

| ● | the integrity of our financial statements; | |

| ● | our compliance with legal and regulatory requirements; | |

| ● | the qualifications and independence of the independent registered public accounting firm; and | |

| ● | the performance of our internal audit function and independent auditors. | |

| The audit committee is also responsible for, among other things: | ||

| ● | appointing, or replacing the independent auditors and retaining, compensating, evaluating and overseeing the work of the independent auditors and any other registered public accounting firm engaged for the purpose of preparing or issuing an audit report; | |

| ● | preparing the audit committee report required by SEC regulations to be included in our annual report and proxy statement; | |

| ● | reviewing and discussing our annual and quarterly financial statements with management and the independent auditor; | |

| ● | reviewing and discussing with management, our independent auditors and the head of the internal audit team the adequacy of the Company’s internal audit function; | |

| ● | discussing our guidelines and policies with respect to risk assessment and risk management, and our major financial risk exposures and the steps management takes to monitor and control such exposures; | |

| ● | considering and discussing with management and our independent auditor our Code of Ethics and Business Conduct, and procedures in place to enforce such code, and, if appropriate, granting any requested waivers; | |

| ● | reviewing, and if need be proposing and recommending changes to, the Company’s Whistleblower Policy; | |

| ● | establishing procedures for receiving, retaining and treating complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and | |

| ● | reviewing and approving related person transactions pursuant to our written policy described below under “Related Person Transaction Policy and Procedures.” | |

| Each member of the audit committee is independent as that term is defined in the rules and regulations of the SEC and the rules of the NYSE. | ||

The audit committee charter is available on our website at www.inventrustproperties.com through the “Investors – Governance – Board Committees and Charters” tab. In addition, a printed copy of the charter is available to any stockholder without charge by writing us at InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, Attention: Investor Relations.

| 16 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

Compensation Committee

| COMPENSATION COMMITTEE | ||

MEMBERS: Julian Whitehurst (Chairperson) Amanda Black Scott Nelson Paula Saban

NUMBER OF MEETINGS IN 2022: 5

| The compensation committee oversees the discharge of the responsibilities of the Board related to determining the compensation that we pay to our executive officers, including our chief executive officer, and directors and oversees the evaluation of our management | |

| The compensation committee is also responsible for, among other things: | ||

| ● | periodically reviewing the human capital practices and compensation philosophy of the Company; | |

| ● | reviewing and approving the corporate goals and objectives with respect to the compensation of our CEO, evaluating the performance of our CEO and determining and approving the compensation of our CEO; | |

| ● | reviewing and setting, or making recommendations to the Board regarding, the compensation for all of our other “executive officers” (as such term is defined in Rule 16a-1 under the Exchange Act) other than our CEO; | |

| ● | reviewing and making recommendations to the Board regarding director compensation; | |

| ● | reviewing and approving, or making recommendations to the Board regarding, the Company’s incentive compensation and equity-based plans and arrangements; | |

| ● | establishing, overseeing and/or reviewing all other executive compensation policies, plans and arrangements of the Company; | |

| ● | reviewing our incentive compensation arrangements to confirm that incentive pay does not encourage unnecessary risk taking; | |

| ● | reviewing the Company’s equity retention and ownership policy for named executive officers and the Board; and | |

| ● | overseeing and annually reviewing the Company’s human capital programs, including diversity, equity and inclusion, as well as culture, talent management, training and organizational health and wellness. | |

| Consistent with the requirements of Rule 10C-1 of the Exchange Act and any other applicable listing requirements and rules and regulations of the NYSE, the committee: | ||

| ● | has the sole and exclusive authority, as it deems appropriate to retain and/or replace, as needed, any independent counsel, compensation and benefits consultants and other outside experts or advisors as the committee believes to be necessary or appropriate (the “compensation advisors”); | |

| ● | has the direct responsibility to compensate and oversee any and all compensation advisors retained by the compensation committee; | |

| ● | has the authority to also utilize the services of the Company’s regular legal counsel or other advisors to the Company | |

| Each member of the compensation committee is independent and meets the additional standards for the independence of compensation committee members set forth in Section 303A.02 of the NYSE Listed Company Manual, and each is a “non-employee director,” as defined by Section 16 of the Exchange Act. | ||

The compensation committee charter is available on our website at www.inventrustproperties.com through the “Investors – Governance – Board Committees and Charters” tab. In addition, a printed copy of the charter is available to any stockholder without charge by writing us at InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, Attention: Investor Relations.

| 17 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

CORPORATE GOVERNANCE PRINCIPLES

Code of Ethics

Our Board has adopted a code of ethics and business conduct (the “Code of Ethics and Business Conduct”) applicable to our directors, officers and employees, including our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer or Controller (or persons performing similar functions), which is available on our website at www.inventrustproperties.com through the “Investors – Governance – Code of Ethics & Business Conduct” tab. In addition, printed copies of the Code of Ethics and Business Conduct are available to any stockholder, without charge, by writing us at InvenTrust Properties Corp., 3025 Highland Parkway, Suite 350, Downers Grove, Illinois 60515, Attention: Investor Relations. Within the time period required by the rules of the SEC, we will post on our website any amendment to, or waiver from, our Code of Ethics and Business Conduct that applies to the Company’s Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer or Controller (or persons performing similar functions).

| 18 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Election of Directors

Our Board has nominated the nine individuals set forth below to serve as directors until the next annual meeting and until their successors are duly elected and qualify. We know of no reason why any nominee will be unable to serve if elected. If any nominee is unable to serve, or for good cause will not serve, your proxy may vote for another nominee proposed by the nominating and corporate governance committee and the Board, or the Board may reduce the number of directors to be elected. If any director resigns, dies or is otherwise unable to serve out his or her term, or if the Board increases the number of directors, the Board may fill the vacancy until the next annual meeting and until the director’s successor is duly elected and qualifies. Our Board unanimously recommends that you vote “FOR” the election of all nine nominees.

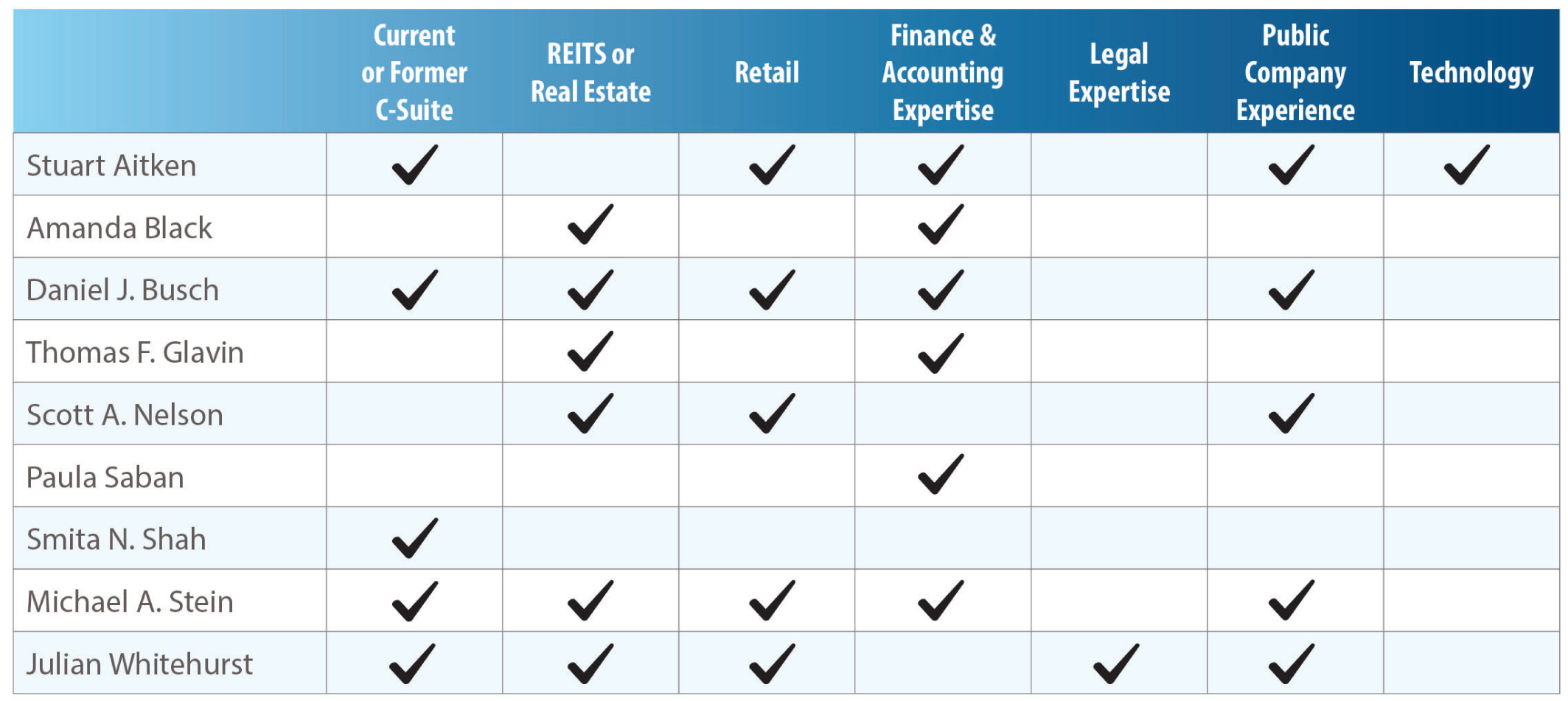

Board Skills and Experience

We believe it is important that our Board is composed of individuals that represent a diverse set of skills, knowledge and professional experience in order to provide effective leadership to support the needs and goals of the Company. The table below highlights the skills and experience of the director nominees.

Board Composition

The nominating and corporate governance committee and Board also value length of tenure and individuals with diverse backgrounds (including age, gender, and ethnic and racial backgrounds) when considering director candidates or nominees for election to the Board. The below charts disclose the composition of our Board as of December 31, 2022.

| 19 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Election of Directors

| Board Diversity Matrix (as of December 31, 2022) | ||||

| # of directors based on gender identity | 6 | 3 | ||

| # Of Directors Who Identity In Any Of The Categories Below | Male | Female | Non-Binary | Undisclosed |

| African America or Black (not of Hispanic or Latinx origin) | ||||

| Alaskan Native or American Indian | ||||

| Asian | 1 | |||

| Hispanic or Latinx | ||||

| Native Hawaiians and Pacific Islanders | ||||

| White (not of Hispanic or Latinx origin) | 6 | 2 | ||

| LGBTQ+ | ||||

| Undisclosed |

Vote Required

A plurality of all the votes cast at the Annual Meeting shall be sufficient to elect a director. Each share may be voted for as many individuals as there are directors to be elected and for whose election the holder is entitled to vote.

Recommendation

The Board unanimously recommends a vote FOR each of the nominees for director listed below.

| 20 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Election of Directors

Our Board of Directors

Set forth below for each director is a discussion of the experience, qualifications, attributes or skills that led the nominating and corporate governance committee and the Board to conclude that the director is qualified and should serve as a director of InvenTrust.

STUART AITKEN Director Since: 2017 Age: 51 | Key Experience & | ||

| Qualifications | |||

Mr. Aitken is a seasoned technology and marketing executive who currently serves as Chief Merchant and Marketing Officer of The Kroger Co. He previously served as Chief Executive Officer of 84.51°, a wholly owned data analytics subsidiary of The Kroger Co. Prior to joining Kroger, Mr. Aitken served as the chief executive officer of dunnhumby USA, LLC from July 2010 to June 2015. Prior to that, he served as Executive Vice President and Chief Marketing Officer for arts-and-crafts retailer Michael’s Stores. Previously, he led marketing strategies, loyalty marketing, data analytics, innovation and category management at Safeway, Inc. for nearly a decade.

Mr. Aitken received his Bachelor of Arts and Master of Science degrees in Information Management from Queen Margaret University and University of Strathclyde, respectively, both located in Scotland.

Committees: • Audit • Nominating & Corporate Governance (Chair)

| |||

AMANDA BLACK Director Since: 2018 Age: 47 | Key Experience & | ||

| Qualifications | |||

Ms. Black serves as the Managing Director and Portfolio Manager of JLP Asset Management, where she oversees all North American investments for the firm as portfolio manager for global and domestic real estate mutual funds and separate accounts. Prior to joining NWS in 2014, Ms. Black served as a Senior Vice President and Portfolio Manager at Ascent Investment Advisors from 2011 to 2014, where she co-managed a global REIT mutual fund and hedge fund. She has 20+ years of experience as an investor across a diverse set of investment firms and strategies with a specialization in real estate.

Ms. Black holds an MBA from Saint Louis University and a B.S. from Southern Illinois University. She was a licensed CPA from 2001 to approximately 2004 and earned her CFA designation in 2005.

Committees: • Audit • Compensation

| |||

| 21 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Election of Directors

DANIEL J. BUSCH Director Since: 2021 Age: 41 | Key Experience & | ||

| Qualifications | |||

Mr. Busch serves as our President and Chief Executive Officer. Mr. Busch was appointed to the position of CEO & Director of InvenTrust in August 2021 and President of InvenTrust in February 2021. Mr. Busch joined InvenTrust in September 2019, and served as our Executive Vice President, Chief Financial Officer and Treasurer until August 2021, providing oversight to our financial and accounting practices, and ensuring the financial viability of the Company’s strategy. Prior to that, Mr. Busch served as Managing Director, Retail at Green Street Advisors, an independent research and advisory firm for commercial real estate industry in North America and Europe, where he conducted independent research on the shopping center, regional mall, and net lease sectors. Previously, Mr. Busch served as an equity research analyst at Telsey Advisory Group. He is a member of the Urban Land Institute, contributing as an active member on the Commercial and Retail Development Council.

Mr. Busch received a B.S. in Applied Economics and Management from Cornell University and an MBA with specializations in general finance, financial instruments and markets from New York University.

| |||

THOMAS F. GLAVIN Director Since: 2007 Age: 63 | Key Experience & | ||

| Qualifications | |||

Mr. Glavin is the owner of Thomas F. Glavin & Associates, Inc., a certified public accounting firm that he started in 1988. In that capacity, Mr. Glavin specializes in providing accounting and tax services to closely held companies. Mr. Glavin began his career at Vavrus & Associates, a real estate firm, located in Joliet, Illinois, that owned and managed apartment buildings and health clubs. At Vavrus & Associates, Mr. Glavin was an internal auditor responsible for reviewing and implementing internal controls. In 1984, Mr. Glavin began working in the tax department of Touche Ross & Co., where he specialized in international taxation. In addition to his accounting experience, Mr. Glavin also has been involved in the real estate business for over 20 years. Mr. Glavin was a partner in Gateway Homes, which zoned, developed and managed a 440-unit manufactured home park in Frankfort, Illinois. The Manufactured Home Community was sold in April 2019.

Mr. Glavin received his bachelor’s degree in accounting from Michigan State University in East Lansing, Michigan and a Master of Science in taxation from DePaul University, Chicago, Illinois. Mr. Glavin is a member of the Illinois CPA Society and the American Institute of Certified Public Accountants.

Committees: • Audit (Chair) • Nominating & Corporate Governance

| |||

| 22 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Election of Directors

SCOTT A. NELSON Director Since: 2016 Age: 66 | Key Experience & | ||

| Qualifications | |||

Mr. Nelson is Principal of SAN Prop Advisors, a retail real estate advisory firm that he started in early 2016. Clients of SAN Prop Advisors have included major retailers and shopping center developers. Most recently, he served in various senior-level real estate positions at Target Corporation including Senior Vice President Target Properties Canada from 2015 to 2016; Senior Vice President, Target Properties - U.S. in 2014; Senior Vice President, Target Real Estate from 2007 to 2014; and Vice President of Real Estate from 2000 to 2007. In these roles, he was instrumental in the acquisition, development, and optimization of Target’s retail real estate portfolio. He joined the Target real estate department in 1995. Previously, Mr. Nelson spent 10 years at Mervyn’s, a West Coast department store chain, where he served in various positions including Director of Real Estate. He is a member of the International Council of Shopping Centers and served as a Trustee and Executive Committee member of the organization. Since 2009, Mr. Nelson has served as a board member of Heart of America, a non-profit focused on volunteering and improving learning environments in public schools. He is a real estate development and REIT guest speaker at Florida Gulf Coast University.

Committees: • Compensation

| |||

| 23 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Election of Directors

PAULA SABAN Director Since: 2004 Chairperson Since: 2017 Age: 69

| Key Experience & | ||

| Qualifications | |||

Ms. Saban has worked in the financial services and banking industry for over 25 years. She began her career in 1978 with Continental Bank, which later merged into Bank of America. From 1978 to 1990, Ms. Saban held various consultative sales roles in treasury management and traditional lending areas. She also managed client service teams and developed numerous client satisfaction programs. In 1990, Ms. Saban began designing and implementing various financial solutions for clients with Bank of America’s Private Bank and Banc of America Investment Services, Inc. Her clients included top management of publicly held companies and entrepreneurs. In addition to managing a diverse client portfolio, Ms. Saban was responsible for client management and overall client satisfaction. She retired from Bank of America in 2006 as a Senior Vice President/Private Client Manager. In 1994, Ms. Saban and her husband started a construction products company, Newport Distribution, Inc., of which she was secretary and treasurer, and a principal shareholder. The business was sold to a strategic buyer in 2021. Ms. Saban currently serves as a project-based development director of Interim Execs, a placement firm for interim CXO’s.

Ms. Saban received her bachelor’s degree from MacMurray College, Jacksonville, Illinois, and her Master of Business Administration degree from DePaul University, Chicago, Illinois. She is a former president of the Fairview Elementary School PTA and a former trustee of both the Goodman Theatre and Urban Gateways. Ms. Saban served as the legislative chair of Illinois PTA District 37 and as liaison to the No Child Left Behind Task Force of School District 54. Ms. Saban previously served on the Board of Hands On Suburban Chicago, a not-for-profit organization that matches community and corporate volunteers of all ages and skills with opportunities to connect and serve. Ms. Saban is Co-Chair for Women Build, an initiative of Habitat for Humanity of Northern Fox Valley Illinois. Ms. Saban is a member of the Private Directors Association of Chicago and Madame Chair.

Committee: • Compensation

| |||

| 24 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Election of Directors

SMITA N. SHAH Director Since: 2022 Age: 49 | Key Experience & | ||

| Qualifications | |||

Ms. Shah is the founder and Chief Executive Officer of SPAAN Tech, Inc., an architecture, engineering, and project management firm with 20+ years expertise in public and private infrastructure projects including transportation, aviation, facilities, and telecommunications systems. She has an extensive business and technical background, earning her Bachelor of Science from Northwestern University, a Master of Science in Civil and Environmental Engineering from M.I.T., and a Post Graduate Certificate in Management Studies from Oxford University.

In recognition of Ms. Shah’s leadership and commitment to the community, she was appointed by President Biden to the President’s Commission on Asian Americans, Native Hawaiians and Pacific Islanders. Her additional civic engagement includes Board Member of the Museum of Science and Industry, Trustee of the Lincoln Academy of Illinois, Visiting Committee for MIT Department of Civil and Environmental Engineering, Environmental Law and Policy Center, and Harris School Council at University of Chicago. She was the recent past Vice Chairman of Chicago Plan Commission, supporting the development of the Chicago of Chicago for the past 14 years.

Ms. Shah serves on the board of MacLean Fogg Company and is a member of the audit committee. She is a Co-Chair of Young President’s Organization (YPO) Chicago, and a member of the Economic Club and Commercial Club of Chicago. Ms. Shah also served as a U.S. delegate for the APEC Women and the Economy Forum (WEF) and is a recipient of the congressionally recognized Ellis Island Medal of Honor.

Committee: • Audit

| |||

| 25 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Election of Directors

MICHAEL A. STEIN Director Since: 2016 Age: 73 | Key Experience & | ||

| Qualifications | |||

Mr. Stein served as Senior Vice President and Chief Financial Officer of ICOS Corporation, a biotechnology company, from 2001 until its acquisition by Eli Lilly in 2007. Mr. Stein was Executive Vice President and Chief Financial Officer of Nordstrom, Inc. from 1998 to 2000.

He served in various capacities with Marriott International, Inc. from 1989 to 1998, including Executive Vice President and Chief Financial Officer from 1993 to 1998. Previously, Mr. Stein spent nearly 20 years in public accounting at Arthur Andersen LLP, where he was a Partner.

Mr. Stein served on the board of directors of Apartment Investment and Management Company (AIMCO), a NYSE listed public REIT, from 2004 until December 2022. AIMCO is focused on property development, redevelopment and various other value-creating investment strategies, targeting the U.S. multifamily market. He served as chair of the investment committee, and served on AIMCO’s audit, compensation and human resources, and nominating, environmental, social, and governance committee. From mid-December 2020, when it was spun-off from AIMCO, until its first annual meeting, on December 7, 2021, Mr. Stein served on the board of directors of Apartment Income REIT Corp (AIR), a NYSE listed public REIT focused on the ownership and management of quality apartment communities located in the largest markets in the United States. He was a member of the audit, compensation and human resources, and nominating and corporate governance committees at AIR. He has also served on the board of directors of two other NYSE companies, Nautilus, Inc. (2007 to 2011) and Getty Images, Inc. (2002-2008), and Providence Health & Services, a not-for-profit health system, (2008 to 2016), and Fred Hutchinson Cancer Research Center (2001 to 2007).

Mr. Stein has a Bachelor of Science degree from the University of Maryland.

Committees: • Audit • Nominating & Corporate Governance

| |||

JULIAN WHITEHURST Director Since: 2016 Age: 65 | Key Experience & | ||

| Qualifications | |||

Mr. Whitehurst has served as a director of National Retail Properties, Inc., since February 2017, as CEO of National Retail Properties since April 2017, as President since May 2006, and as Chief Operating Officer since June 2004. Mr. Whitehurst also previously served as Executive Vice President of National Retail Properties from February 2003 to May 2006, as Chief Operating Officer from June 2004 to April 2017 and as Secretary from May 2003 to May 2006, and previously served as General Counsel from 2003 to 2006. On January 19, 2022, Mr. Whitehurst retired as Chief Executive Officer and resigned from the National Retail Properties effective as of April 28, 2022. Prior to February 2003, Mr. Whitehurst was a shareholder at the law firm of Lowndes, Drosdick, Doster, Kantor & Reed, P.A. Mr. Whitehurst is a member of ICSC and Nareit and serves on the Nareit Advisory Board of Governors.

Committees: • Compensation (Chair)

| |||

| 26 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Director Compensation

Director Compensation

Under our Director Compensation Program, effective as of May 5, 2022 (the “Director Compensation Program”), each non-employee director is entitled to receive an annual cash retainer of $65,000. Non-employee directors are not entitled to meeting fees for attending individual Board or committee meetings. Non-employee committee members and chairpersons and our non-executive chairperson are entitled to receive additional annual cash retainers as indicated herein. In addition to the cash retainers, under the Director Compensation Program each non-employee director is entitled to an annual award of restricted stock units (“RSUs”) valued at $120,000, and a tandem dividend equivalent award with respect thereto. Each annual RSU award is granted at our annual meeting of stockholders and will vest in full on the earlier of (i) the date of the next annual meeting of our stockholders following the grant date or (ii) the first anniversary of the grant date, subject to the director’s continued service on the vesting date. Each RSU award generally settles partly in shares of our common stock (75%) and partly in cash (25%).

| ADDITIONAL CASH COMPENSATION | ||

| CHAIR | MEMBER | |

Independent Chairperson | $50,000 | - |

Audit Committee | $25,000 | $12,500 |

Compensation Committee | $20,000 | $10,000 |

| Nominating & Corporate Governance Committee | $20,000 | $10,000 |

Business Expenses

Pursuant to the terms of the Director Compensation Program and our standard expense reimbursement policy, we reimburse each non-employee director for reasonable business expenses incurred by the director in connection with his or her services to us.

| 27 |

ANNUAL MEETING OF STOCKHOLDERS & PROXY STATEMENT 2023

PROPOSAL NO. 1 Director Compensation

Director Compensation Table

The following table provides additional detail regarding the 2022 compensation of our non-employee directors:

| NAME (1) | FEES EARNED OR PAID IN CASH ($) (2) | STOCK AWARDS ($) (3) | TOTAL ($) |

| Stuart Aitken | 92,250 | 120,000 | 212,250 |

| Amanda Black | 85,000 | 120,000 | 205,000 |

| Thomas F. Glavin | 96,500 | 120,000 | 216,500 |

| Scott A. Nelson | 76,750 | 120,000 | 196,750 |

| Paula Saban | 131,250 | 120,000 | 251,250 |

| Smita N. Shah | — | 60,000 | 60,000 |

| Michael A. Stein | 83,750 | 120,000 | 203,750 |

| Julian E. Whitehurst | 86,750 | 120,000 | 206,750 |

(1) Mr. Busch did not receive any compensation for services on the Board in 2022.

(2) Amounts reflect annual Board cash retainers and, if applicable, additional cash retainers described above for committee and chair service, in each case, earned in 2022.