UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under § 240.14a-12 |

Inland American Real Estate Trust, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

| | |

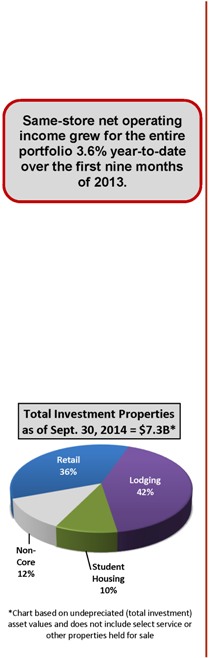

| | Dear Stockholder: As 2014 comes to a close, we continue to make progress on our long-term strategy. In this month’s letter we will provide you with a financial recap for the first nine months of the year and review some of our key accomplishments for the year: • In March, Inland American began the process of becoming fully self-managed. We expect the process to be completed by the end of the year when we hire the remaining property manager employees and assume all remaining property management functions. The company did not pay an internalization or self-management fee in connection with self-management. • We completed a modified “Dutch Auction” tender offer for approximately $395 million in value of our common stock. The company accepted for purchase approximately 60.7 million shares. Every stockholder that tendered received $6.50 and all properly tendered shares were purchased by the company. For the stockholders maintaining their position in Inland American, the tender offer was also accretive to the per share earnings of the REIT due to the retirement of the shares purchased. • Earlier this year, we announced the potential spin-off of our lodging portfolio, held by Xenia Hotels & Resorts, Inc. into a standalone, publicly traded lodging REIT. The spin-off would be a significant step in the execution of our strategic plan while providing liquidity to our stockholders. We currently anticipate that the spin-off will occur in the first half of 2015. • The sale of the select service hotel portfolio successfully closed on November 17th. With the approximate $480 million of net proceeds, we plan to advance the growth strategy of our student housing and retail portfolios. We also will use the proceeds for other general corporate purposes, which may include, among other things, debt reduction. • Including the December distribution, Inland American has paid out $4.92 in distributions on a per share basis since inception of the REIT. Third Quarter 2014 Inland American Financial Results(1) Inland American ended the quarter with 203 properties totaling 23.5 million square feet of retail, office and industrial space, 8,318 student housing beds and 12,797 hotel rooms. The total value of assets, before depreciation, equals $9.6 billion. Our funds from operations (FFO)(2) totaled $388 million, or $0.44 per share. We ended the quarter with $349 million in cash and a leverage ratio of 44% on $4.1 billion of debt. Other key financial and portfolio highlights include: • Same-store net operating income for the entire portfolio grew 3.6% year-to-date over the first nine months of 2013. |

| | • | | The retail portfolio’s economic occupancy equaled 93%. |

| | • | | For the lodging portfolio, year-to-date same-store revenue per available room increased to $127, up 8.5% over the first nine months of 2013. |

| | • | | For our student housing portfolio, rent per bed for our entire student housing portfolio increased 4.6% to $743 over the same time period in 2013. |

| | • | | Including the select service transaction, which was closed in November, we disposed of 302 properties for a gross disposition price of approximately $2.5 billion. We also acquired 3 properties totaling $209 million, consisting of 2 multi-tenant retail assets and the Aston Waikiki Beach Hotel in Honolulu. |

New Estimated Share Value

As we mentioned last month, with the announced potential spin-off of Xenia by Inland American, the timing of Inland American’s new estimated share value is uncertain. If the spin-off is consummated, we currently plan to publish a new estimated share value in closer proximity to the Xenia spin-off date.

Year-end 1099 Tax Forms

Form 1099-DIVs for Inland American will be mailed to stockholders no later than January 31, 2015 by DST Systems, Inc., Inland American’s transfer agent. If your investment is held in a retirement account, such as an IRA, SEP or ROTH, your custodian will provide you with any necessary tax information.In preparation for 2014 tax reporting,we anticipate that the amount of distributions that will be treated as income will be similar to last year’spercentage.This percentage is being driven by the significant number of properties we successfully sold at a gain in 2014. Please consult your tax professional with any questions regarding the filing of your individual tax return. We are unable to provide tax or legal advice.

Cash Distribution

Enclosed is a check for your cash distribution equaling $0.041666667 per share for the month of November 2014. If you have invested through a trustee, a distribution statement is enclosed in lieu of a check. As a reminder, with the potential spin-off of Xenia, the distribution reinvestment plan (“DRP”) and share repurchase program have been suspended until further notice. Any stockholders who previously received their monthly distributions through the DRP will now receive a check or distribution statement showing their monthly distribution deposits.

Sincerely,

INLAND AMERICAN REAL ESTATE TRUST, INC.

| | |

| |  |

Robert D. Parks Chairman of the Board | | Thomas P. McGuinness President, CEO |

(1) Q3 results do not include any properties included in the select service transaction.

(2) FFO is a non-GAAP financial measure. Please review our recently filed 10K for a reconciliation of the most direct comparable GAAP measure. Forward-looking statements in this document, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about our plans, strategies and future events, including the anticipated net cash proceeds from the sale of the select service hotels, the spin-off of our subsidiary Xenia Hotels & Resorts, Inc. (“Xenia”) and the listing of Xenia’s shares on the New York Stock Exchange, the anticipated timing to close the spin-off, our ability to successfully execute on our growth strategy and strategic transactions and provide liquidity events to our stockholders, among other things, each of which involve known and unknown risks that are difficult to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forwardlooking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, purchase price adjustments in accordance with the terms of the select service purchase agreement, indemnification obligations, if the SEC fails to declare Xenia’s preliminary registration statement on Form 10 effective in a timely manner or at all; if the NYSE fails to authorize the listing of Xenia’s common stock in a timely manner or at all; our current expectations with respect to the timing of the potential spin-off and/or the potential failure to satisfy certain closing conditions; Inland American’s board of directors may determine that the completion of the spin-off is not in our best interests and determine not to consummate the spin-off; other risks as described in the preliminary registration statement on Form 10; and other risks described in our filings with the SEC. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this press release. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. This letter shall not constitute an offer to sell or the solicitation of an offer to buy any securities.