- IVT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

InvenTrust Properties (IVT) 8-KRegulation FD Disclosure

Filed: 8 Jun 15, 12:00am

Exhibit 99.1

PORTFOLIO SUMMARY

Total Assets Undepreciated | $ | 4.9 billion | ||

Total Assets after Depreciation | $ | 4.3 billion | ||

Total Cash | $ | 198 million | ||

Same-Store NOI over 2014(a) | (0.9 | %) | ||

Cash Flow from Operations | $ | 41 million | ||

YTD FFO(b) | $ | 57 million | ||

YTD FFO per share | $ | 0.07 | ||

Annualized Distribution Rate | $ | 0.13 a share | ||

Number of Properties | 142 | |||

Mortgage Loans Outstanding | $ | 1.8 billion | ||

Mortgage Weighted Average Interest Rate | 5.03 | % | ||

Leverage Ratio | 37 | %* | ||

Mortgage Payable Breakdown | ||||

- Fixed Rate | 89% of mortgage debt | |||

- Variable Rate | 11% of mortgage debt | |||

| * | Based on line of credit covenants. |

| (a) | Decline is due to one-time termination fee & recovery income in 1Q 2014 in our retail segment. |

| (b) | FFO is a non-GAAP financial measure. Please review our recently filed 10Q for a reconciliation of the most direct comparable GAAP measure. |

InvenTrust Properties Update

Inland American is now InvenTrust Properties

| • | Following the successful completion of the self-management transactions and the spin-off of our lodging platform, we believe the time is right to highlight and develop a brand that is independent from our prior sponsor. Moving forward as InvenTrust Properties, we are: |

| • | Focusing on bringing high energy and active management to our multi-tenant retail and student housing properties; |

| • | Implementing our step-by-step strategic plan to create high-performing platforms positioned for value creation; and |

| • | Continuing to work in partnership with our realtors and tenants to build successful, engaged communities. |

Favorable Conclusion of SEC Investigation

| • | In 2012, we announced that the SEC was conducting a non-public, formal, fact-finding investigation to determine whether there had been violations of certain provisions of the federal securities laws. During the multi-year investigation, we cooperated fully with the SEC. |

| • | We are pleased to report that on March 24, 2015, the SEC staff informed us that it had concluded its investigation of the company. The SEC staff also informed us that, based on the information received to date, it did not intend to recommend any enforcement action against the company. We are pleased that we were able to cooperate with the SEC and bring this multi-year investigation to a favorable conclusion. |

Xenia Hotels & Resorts Spin-Off

| • | On February 3, 2015, we were very pleased to complete the spin-off of Xenia Hotels & Resorts, Inc. into a standalone, publicly traded company. As stockholders of a company listed on the New York Stock Exchange, Xenia stockholders have the ability to choose whether to sell their shares in the open market or to maintain their investment in Xenia. |

| • | Xenia holds a premium collection of properties affiliated with some of the strongest brands in the lodging industry. We also ensured that Xenia had the proper capital structure to thrive as an independent company upon completion of the spin-off. |

|

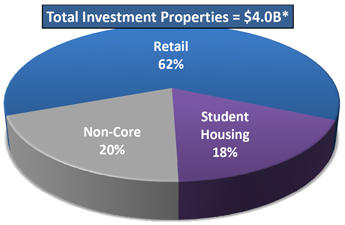

| * | Chart based on undepreciated (total investment) asset values |

MULTI-TENANT RETAIL PLATFORM OVERVIEW

108 Properties● 15.5 million square feet

| • | 71 comparable leases renewed YTD with a 1.83% increase in rent over prior contract rent. |

| • | Same-store net operating income decreased 2.4%, due to one-time termination fee & recovery income in 1Q 2014 in our retail segment. |

| • | Economic occupancy equals 93% for the portfolio. |

| • | Portfolio is expected to maintain a high occupancy rate. |

STUDENT HOUSING PLATFORM OVERVIEW

14 Properties● 7,989 Beds

| • | Same-store net operating income increased 4.8%. |

| • | In 2015, we anticipate the mid-year delivery of approximately 1,618 beds from three current development projects. |

| • | We anticipate an increase in our rental rates driven by the quality of our property metrics and strong demand. |

NON-CORE PROPERTY OVERVIEW

20 Properties● 6.4 Million Square Feet

| • | This segment has material lease maturities in 2016 through 2018 which will impact our overall cash flow and was part of our consideration in establishing our new distribution rate. |

| • | Same-Store portfolio is 92% occupied. |

| • | Portfolio consists of 14 industrial properties, nine office and five single-tenant retail. |

RECENT ACQUISITIONS

The Shops at Walnut Creek

Westminster, Colorado (outside Denver)

Acquired in April 2015 for approximately $57 million. 93% economic occupancy. Approximately 216,000 square feet.

University House – Denver

Denver, Colorado

Acquired in December 2014 for approximately $41 million. Located just one block from the University of Denver. Features fully furnished apartments with 352 beds. Amenities include a clubhouse, recreation center, billiards game room and 24-hour fitness center.

Forward-looking statements in this document, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, representation, plans or predictions of the future and are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, our ability to execute on our strategy and our ability to build our core multi-tenant retail and position our Company for growth. For further discussion of factors that could materially affect the outcome of our forward-looking statements and our future results and financial condition, see the Risk Factors included in our most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the Securities and Exchange Commission. We intend that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this release. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.