|

Exhibit 99.1

|

Investor Presentation

July 2015

Disclaimer

Forward-Looking Statements in this presentation, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, representation, plans or predictions of the future and are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, our ability to execute on our strategy, our ability to return value to our stockholders and the availability of cash flow from operating activities to fund distributions. For further discussion of factors that could materially affect the outcome of our forward-looking statements and our future results and financial condition, see the Risk Factors included in InvenTrust’s most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the Securities and Exchange Commission. InvenTrust intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this presentation. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

This presentation includes certain non-GAAP financial measures. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to GAAP measures. You should be aware that our presentation of these measures may not be comparable to similarly-titled measures used by other companies. For reconciliations to GAAP measures, see the Appendix to this presentation.

1

InvenTrust Properties Overview

Tom McGuinness – CEO & President

Frequent Questions from Stockholders

InvenTrust is Taking a Balanced Approach to our 170K Stockholders with the goal of driving stockholder value.

3

A New REIT – More than a Name Change

Investment Thesis:

Tailor portfolio into targeted asset classes (student housing & retail)

Focus & concentrate on key top-tier markets

Build complete / independent platforms per asset class

Key Executive Hires:

EVP – Portfolio Mgmt.

SVP – Transactions

SVP – Asset Mgmt.

SVP – Property Mgmt.

EVP – Investments (University House)

Committed to NAV Growth

Disciplined distribution policy

Comprehensive balance sheet management / capital allocation

Internal property and asset management

4

Accomplishments Align with Announced Strategy

2013

2014

2015

$460 million apartment portfolio sale

Announced $1.8 billion sale of net lease (non-core) a

Internalization of management and began implementing best-in-class systems

$395 million modified “Dutch Auction” tender offer

(Repurchased shares at high-end of the range and all shares tendered were repurchased)

$1.1 billion sale of select service lodging portfolio to joint venture between

Total other portfolio repositioning (acq. & sales) since 2012 = approx. $4.1B

(Does not include Xenia)

Successful liquidity event: spin-off & listing of Xenia on the NYSE

Highlighted and developed independent brands and business plans for multi-tenant retail and student housing platforms

5

Why Change the Name from Inland American to InvenTrust Properties?

Creates Clarity in the Market

Some vendors, tenants, lenders, and business partners assumed that Inland Group & Inland American were the same company

For example – tenant lease or property acquisition negotiations

Investors and/or FAs would contact the wrong company for information on Inland American

Further Demonstrates Independence after Self-Management

Next step in process

Management and Board of Directors are truly independent

Xenia Hotels & Resorts, Inc. (“Xenia”) received high marks from the investment community for having an independent brand from Inland American

InvenTrust has its own team of outstanding professionals to:

Source deals Manage our assets

Execute on a strategy to strictly benefit InvenTrust stockholders

6

What Did the Hotel Select Service Sale Provide Stockholders?

Select Service Transaction

Closed on the sale of 52 select service hotels for $1.1 billion in Q4 ‘14

Robust, competitive auction process

Net proceeds from the transaction = approximately $480 million Aligned with both Xenia’s and InvenTrust’s long-term strategy Positive outcome and pricing

Why Not Return Proceeds to Investors?

Xenia spin-off and listing required capital

$125 million went to fund Xenia’s “Dutch” tender offer

Approximately $150 million used to pay down Xenia’s debt and provide working capital upon Xenia’s spin-off

Student housing and retail portfolio acquisitions

Paid down debt

7

What Did the Xenia Hotels & Resorts Spin-Off Provide Stockholders?

Spin-off and listing of Xenia occurred in early Feb

Ticker symbol “XHR” on the New York Stock Exchange

Benefit to Stockholders

Meaningful liquidity option provided to stockholders Potential value appreciation

Xenia 3-month trading high (7/24/15) = $24.39

XHR has outperformed the lodging REIT sector since listing Recently added to MSCI US REIT Index Morgan Stanley recently picked up research coverage

Tax Consideration for Distribution (on a standalone basis)

The $2.76 Xenia distribution will be treated similar to other monthly/quarterly distributions $0.81 per InvenTrust share held would be taxable dividend income $1.95 per InvenTrust share would be a non-taxable return of capital and would reduce the tax basis of each share of InvenTrust held

** Please note that the taxability of the distribution of Xenia shares will not be determined on a stand-alone basis. Regardless of the above discussion, the determination of the taxable and non-taxable portions of the distribution will not be known until early 2016. For further information please review our Current Report on Form8 8-K filed on July 24, 2015.**

8

Moving Forward

Maintain flexible capital structure – Take advantage of historically attractive debt rates

Loan-to-value has declined from 54.6% in 2012 to 36.5% Q1 2015

Provides optionality for sources of debt

Prepared for unexpected disruptions in the credit markets

Refine and reduce the breadth of geographic exposure in our retail portfolio and turn focus to core markets while improving portfolio metrics

Markets with favorable demographics such as high job formation

Markets similar to: Dallas, Houston, Denver, Atlanta

Hub & Spoke strategy

Sell non-core assets or engage in other strategic transactions in an effort to maximize their asset value

Multi-tenant office -1.7MM SF and triple net properties—4.7MM SF

Dedicated team of professional managing these assets

Continue to grow best-in-class student housing platform

3University House developments (~1,600 beds) on schedule to be delivered in 2015

Continue concentration on people, process and systems to achieve long-term value creation

9

InvenTrust at a Glance

Focused Strategy of Balance Sheet Management, Capital Allocation & Rotation, and Concentration on People, Process & Systems

Non-Traded REIT that Became Self-Managed in 2014

Portfolio Consists of $4.9 billion* in Total Assets 142 Properties in 24 States

Rebranded to InvenTrust Properties Annualized Distribution Rate of $0.13 per share Favorable Conclusion of the SEC Investigation

*Based on undepreciated (total investment in properties) asset value. As of 3/31/15

10

Student Housing Platform

Travis Roberts—President

Overview of University House

Vertically Integrated Platform – Located in Dallas

Strong team with long-working relationship in student housing. Key strategic hires will move company into the next stage of life cycle

Best-in-class portfolio built through development pipeline and tactical acquisitions

Grown portfolio to 17 properties (9,848 beds)* with three additional developments** in pipeline (1,748 beds)

Created a platform and a portfolio, which we expect to be competitive with the leading private companies and the public REITs

* Includes UH Arena District JV property (240 beds) and phase II development (1,619 beds) that were placed into service during Q3 2015.

** Includes one development purchased in Q2 2015.

12

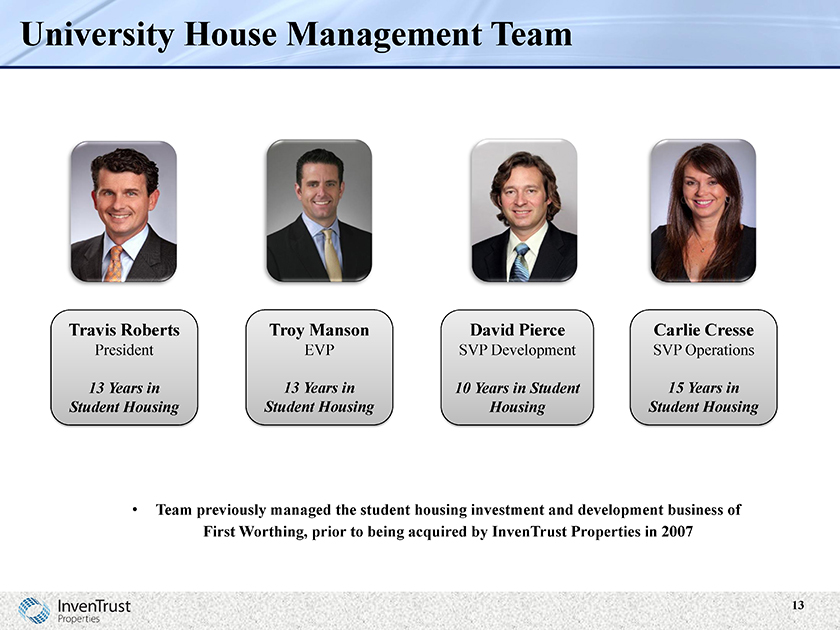

University House Management Team

Travis Roberts

President

13 Years in Student Housing

Troy Manson

EVP

13 Years in Student Housing

David Pierce

SVP Development

10 Years in Student Housing

Carlie Cresse

SVP Operations

15 Years in Student Housing

Team previously managed the student housing investment and development business of First Worthing, prior to being acquired by InvenTrust Properties in 2007

13

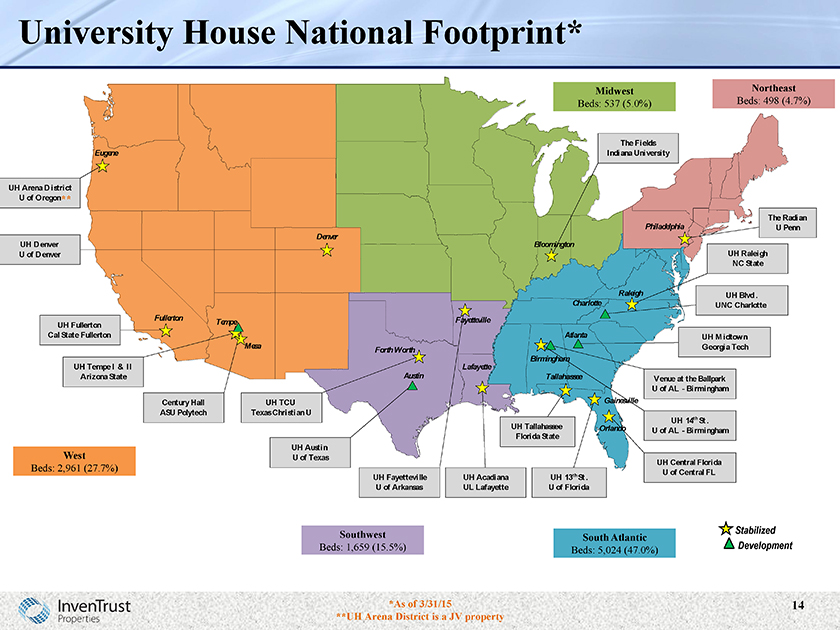

University House National Footprint*

*As of 3/31/15

**UH Arena District is a JV property

14

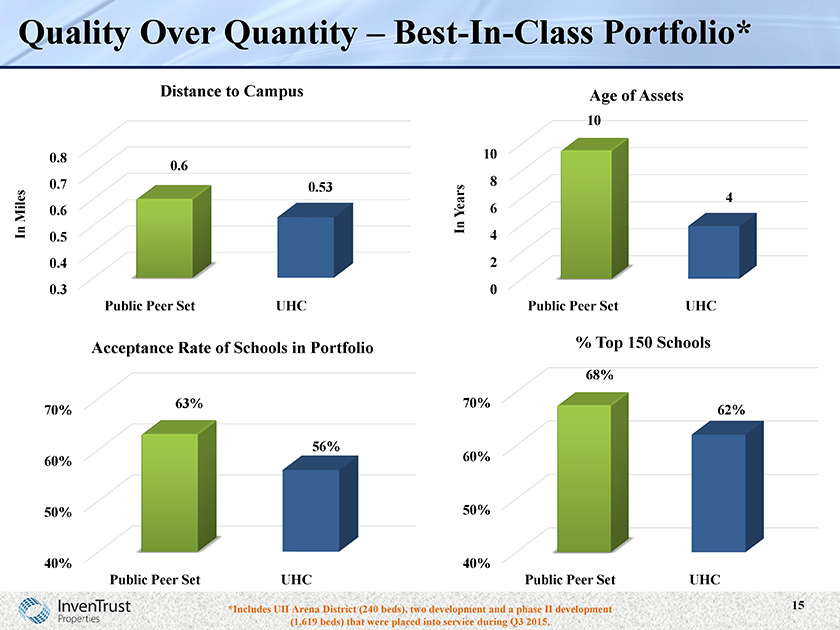

Quality Over Quantity – Best-In-Class Portfolio*

0.3

0.4

0.5

0.6

0.7

0.8

Public Peer Set

UHC

0.6

0.53

In Miles

Distance to Campus

0

10

Public Peer Set

UHC

10

In Years

Age of Assets

40%

50%

60%

70%

Public Peer Set

UHC

68%

62%

% Top 150 Schools

40%

50%

60%

70%

Public Peer Set

UHC

63%

56%

Acceptance Rate of Schools in Portfolio

*Includes UH Arena District (240 beds), two development and a phase II development (1,619 beds) that were placed into service during Q3 2015.

15

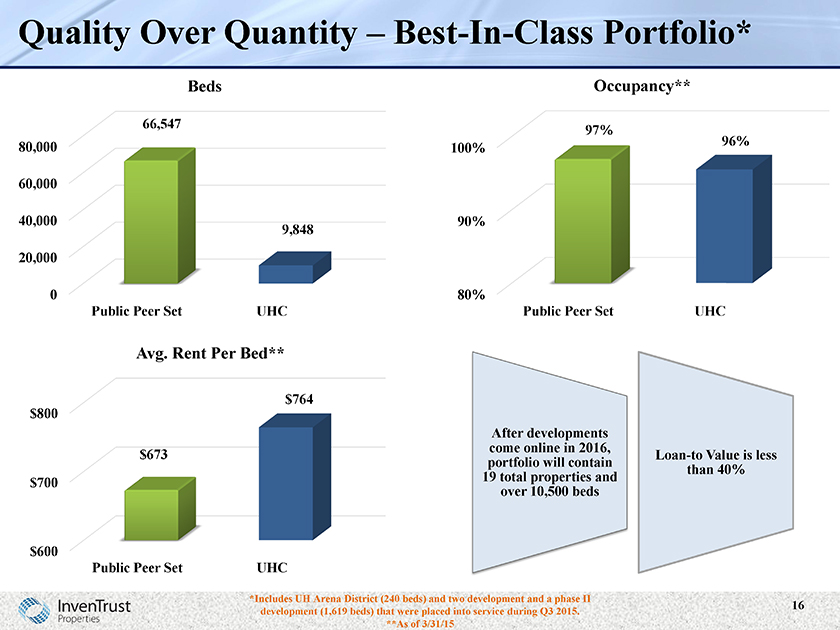

Quality Over Quantity – Best-In-Class Portfolio*

0

20,000

40,000

60,000

80,000

Public Peer Set

UHC

66,547

9,848

Beds

80%

90%

100%

Public Peer Set

UHC

97%

96%

Occupancy**

$600

$700

$800

Public Peer Set

UHC

$673

$764

Avg. Rent Per Bed**

After developments come online in 2016, portfolio will contain 19 total properties and over 10,500 beds

Loan-to Value is less than 40%

*Includes UH Arena District (240 beds) and two development and a phase II development (1,619 beds) that were placed into service during Q3 2015. **As of 3/31/15

16

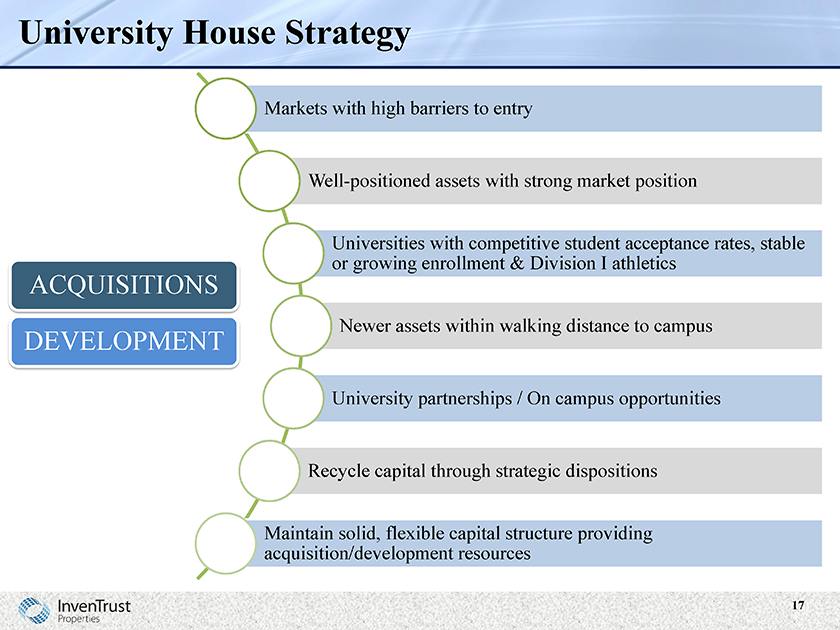

University House Strategy

ACQUISITIONS

DEVELOPMENT

Markets with high barriers to entry

Well-positioned assets with strong market position

Universities with competitive student acceptance rates, stable or growing enrollment & Division I athletics

Newer assets within walking distance to campus University partnerships / On campus opportunities Recycle capital through strategic dispositions

Maintain solid, flexible capital structure providing acquisition/development resources

17

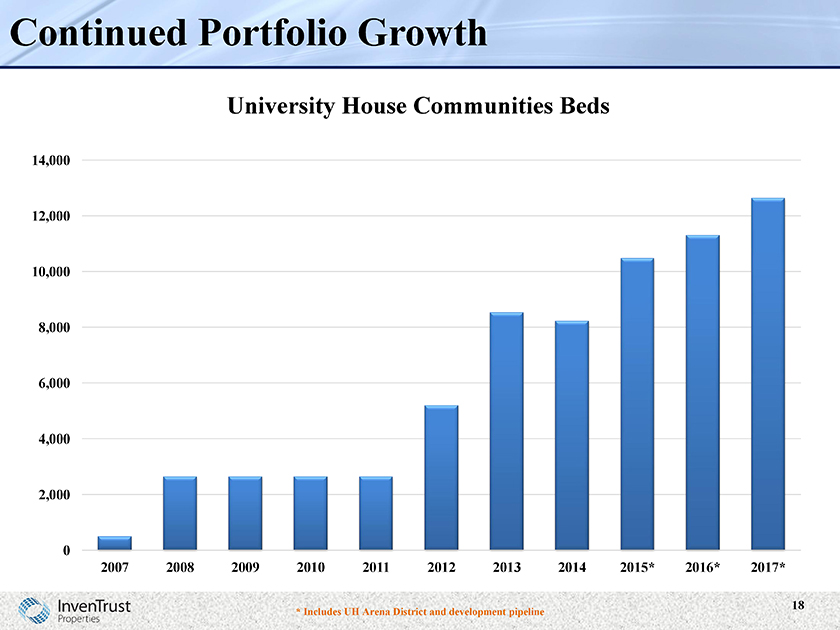

Continued Portfolio Growth

University House Communities Beds

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

2007 2008 2009 2010 2011 2012 2013 2014 2015* 2016* 2017*

* Includes UH Arena District and development pipeline

18

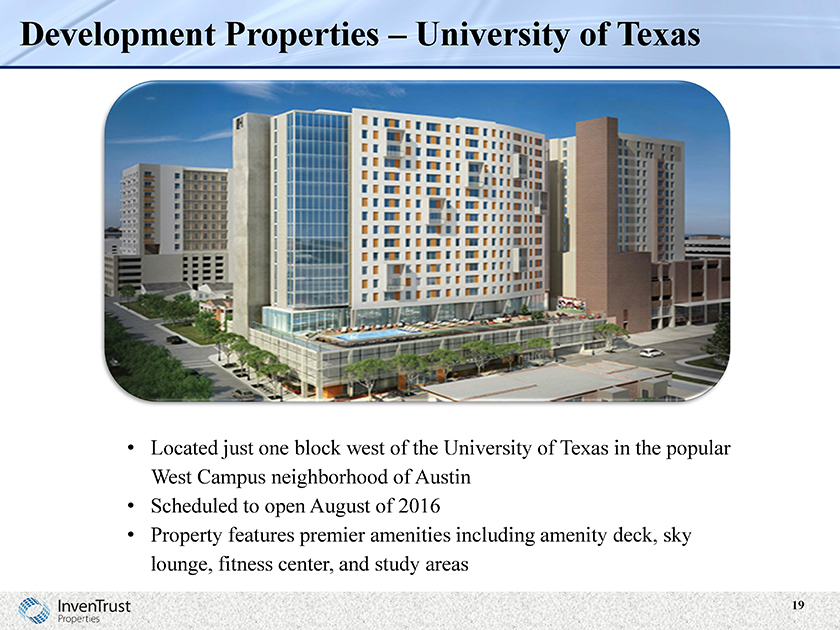

Development Properties – University of Texas

Located just one block west of the University of Texas in the popular West Campus neighborhood of Austin

Scheduled to open August of 2016

Property features premier amenities including amenity deck, sky lounge, fitness center, and study areas

19

Development Properties – Georgia Tech.

Located in the popular Midtown area of Atlanta

Opens in August - 706 beds & approximately 9,000 square feet of retail space

100 % pre-leased by spring of 2015

19-story residential tower offering one-, two-, three- and four- bedroom units

High-end student amenities include a clubroom, study lounge, 24-hour fitness center, rooftop terrace, and resort style pool

20

How Does Student Investment Benefit Stockholders?

Potential Value Appreciation

New acquisitions & developments can bring increased value to platform

Development yields well above current cap rates providing strong value creation

Low leverage = Access to lower cost of debt

Recycle capital through targeted acquisitions/developments and strategic dispositions

Stable Asset Class

Student housing fundamentals remain solid as the value of an education remains high, especially at UHC’s targeted universities

New supply has slowed as developers have shifted to a limited number of pedestrian sites near the top universities

Sustainable Distribution

Investment strategy focused on premier, well-located assets provides high operating margins and stable cash flows Conservative debt profile further enhances cash flow stability

21

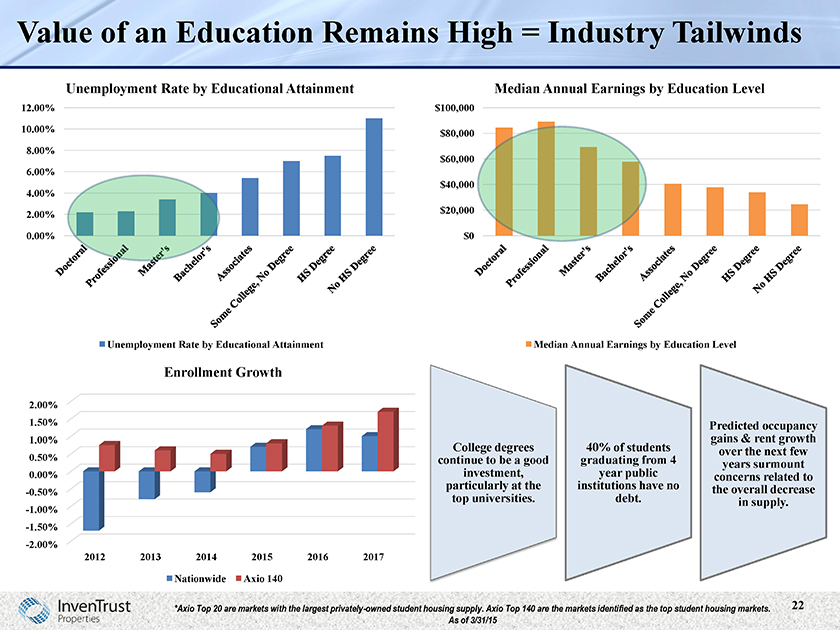

Value of an Education Remains High = Industry Tailwinds

Unemployment Rate by Educational Attainment

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

Unemployment Rate by Educational Attainment

Median Annual Earnings by Education Level

$100,000

$80,000

$60,000

$40,000

$20,000

$0

Median Annual Earnings by Education Level

Enrollment Growth

2.00%

1.50%

1.00%

0.50%

0.00%

-0.50%

-1.00%

-1.50%

-2.00%

Nationwide Axio 140

College degrees continue to be a good investment, particularly at the top universities.

40% of students graduating from 4 year public institutions have no debt.

Predicted occupancy gains & rent growth over the next few years surmount concerns related to the overall decrease in supply.

*Axio Top 20 are markets with the largest privately-owned student housing supply. Axio Top 140 are the markets identified as the top student housing markets. As of 3/31/15

22

Multi-Tenant Retail Platform

David Collins – EVP of Portfolio Management

Retail Landscape

Minimal New Development

Retailers are Expanding Again—Cautiously

Bricks and Clicks VS. Bricks or Clicks

Consumer Experience is Important

24

The InvenTrust Retail Strategy

Market Concentration – core market focus / reducing number of markets

“Hub and Spoke” strategy – leveraging the strategy to drive operating efficiencies and align with local & national tenants

Vertical Integrated Management & Leasing Platform – enhances leverage and market knowledge

Tenant Relationship Strategy—deep local and national tenant relationships are driven by the need to be in core market locations

InvenTrust plans to concentrate in markets with growing job & wage metrics, which deliver improved ABR and heightened stockholder returns

25

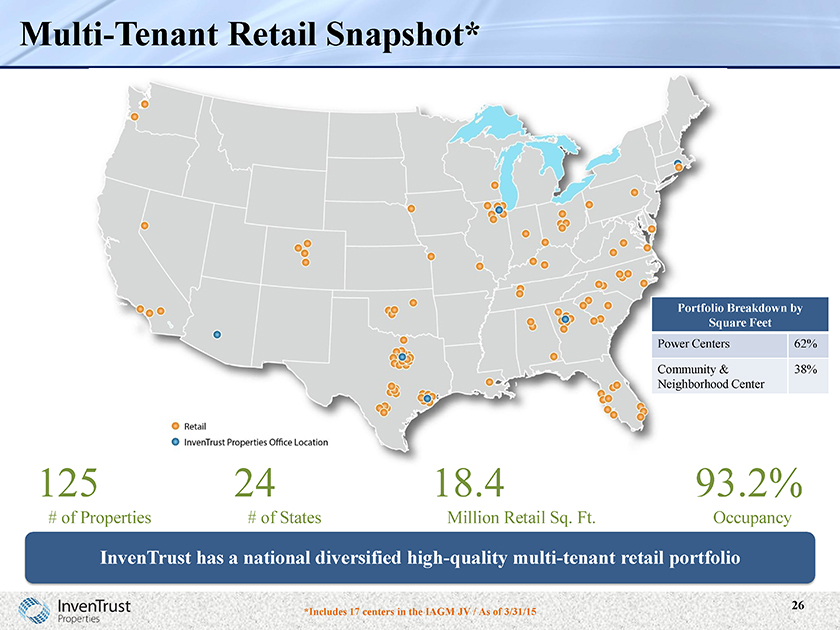

Multi-Tenant Retail Snapshot*

Portfolio Breakdown by Square Feet

Power Centers 62%

Community & 38%

Neighborhood Center

InvenTrust has a national diversified high-quality multi-tenant retail portfolio

*Includes 17 centers in the IAGM JV / As of 3/31/15

26

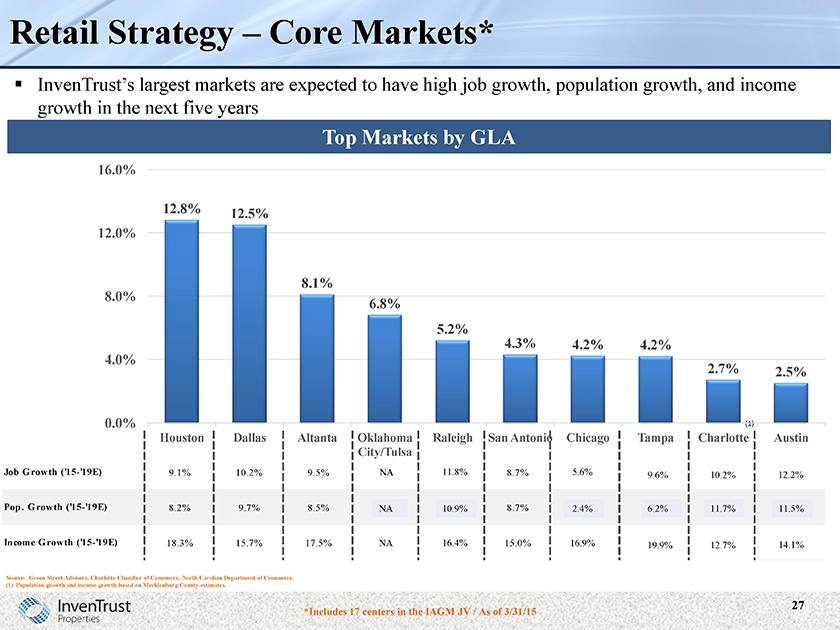

Retail Strategy – Core Markets*

InvenTrust’s largest markets are expected to have high job growth, population growth, and income growth in the next five years

Top Markets by GLA

16.0%

12.0%

8.0%

4.0%

0.0%

12.8% 12.5%

8.1%

6.8%

5.2%

4.3% 4.2% 4.2%

2.7% 2.5%

0.0% (1)

Houston Dallas Altanta Oklahoma Raleigh San Chicago Tampa Charlotte Austin

City/Tulsa Antonio

Job Growth (‘15-‘19E) 9.1% 10.2% 9.5% NA 11.8 8.7% 5.6%

9.6% 10.2 12.2

% % % Pop. Growth (‘15-‘19E) 8.2% 9.7% 8.5% NA 10.9 8.7% 2.4% 6.2% 11.7 11.5

% % %

Income Growth (‘15-‘19E) 18.3% 15.7% 17.5% NA 16.4 15.0% 16.9 14.1 19.9 12.7

% % % % %

Source: Green Street Advisors, Charlotte Chamber of Commerce, North Carolina Department of Commerce. (1) Population growth and income growth based on Mecklenburg County estimates.

*Includes 17 centers in the IAGM JV / As of 3/31/15

27

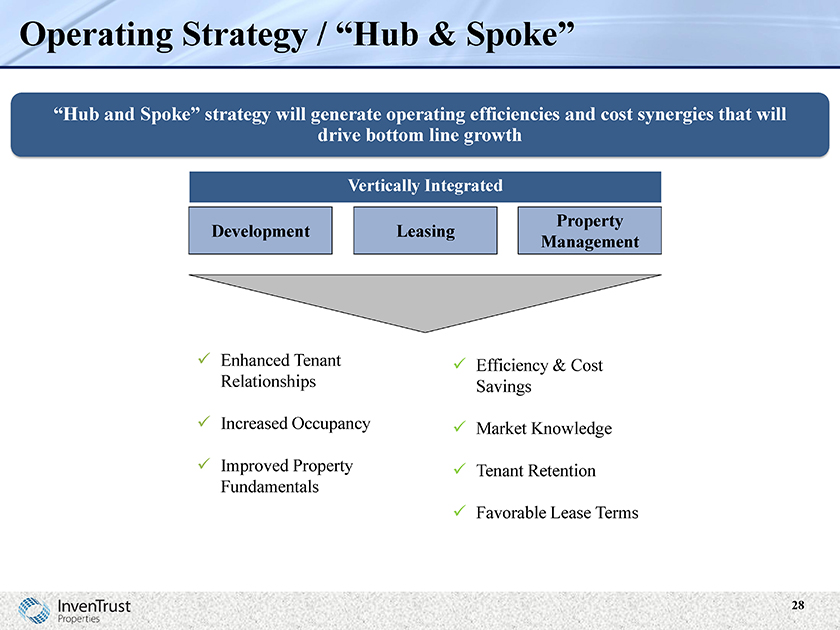

Operating Strategy / “Hub & Spoke”

“Hub and Spoke” strategy will generate operating efficiencies and cost synergies that will drive bottom line growth

Vertically Integrated

Development

Leasing

Property Management

Enhanced Tenant Relationships

Increased Occupancy

Improved Property Fundamentals

Efficiency & Cost Savings

Market Knowledge

Tenant Retention

Favorable Lease Terms

28

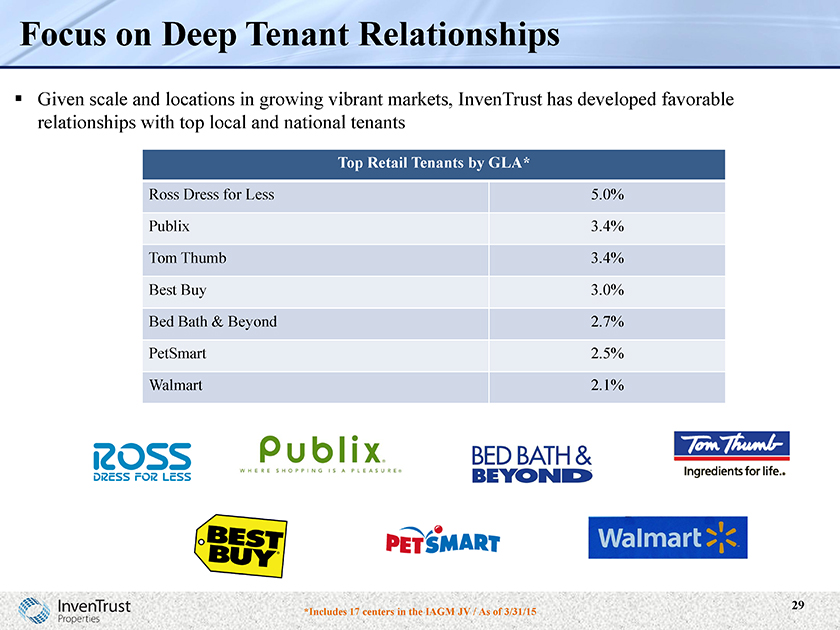

Focus on Deep Tenant Relationships

Given scale and locations in growing vibrant markets, InvenTrust has developed favorable relationships with top local and national tenants

Top Retail Tenants by GLA*

Ross Dress for Less

Publix

Tom Thumb

Best Buy

Bed Bath & Beyond

PetSmart

Walmart

5.0%

3.4%

3.4%

3.0%

2.7%

2.5%

2.1%

*Includes 17 centers in the IAGM JV / As of 3/31/15

29

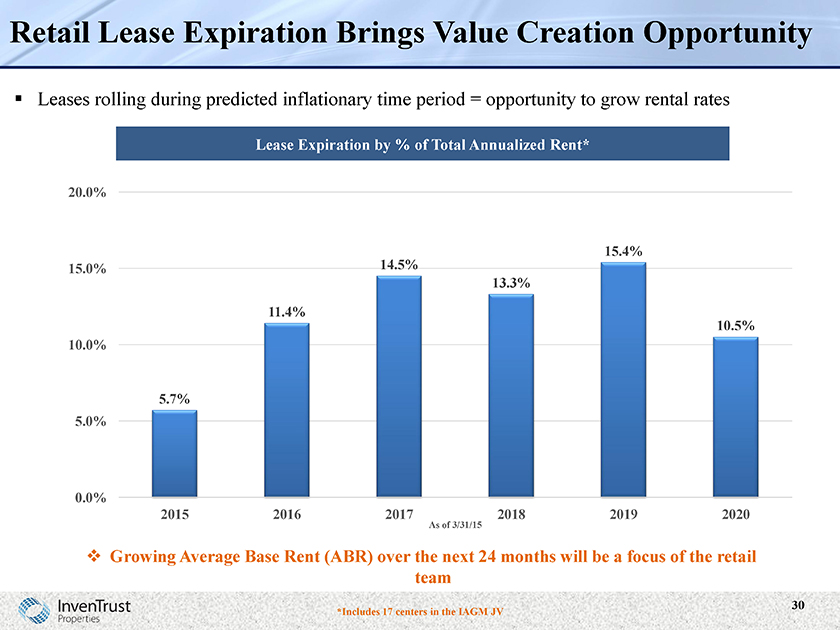

Retail Lease Expiration Brings Value Creation Opportunity

Leases rolling during predicted inflationary time period = opportunity to grow rental rates

Lease Expiration by % of Total Annualized Rent*

20.0%

15.0%

10.0%

5.0%

0.0%

15.4% 14.5% 13.3%

11.4%

10.5%

5.7%

2015 2016 2017 2018 2019 2020

As of 3/31/15

Growing Average Base Rent (ABR) over the next 24 months will be a focus of the retail team

*Includes 17 centers in the IAGM JV

30

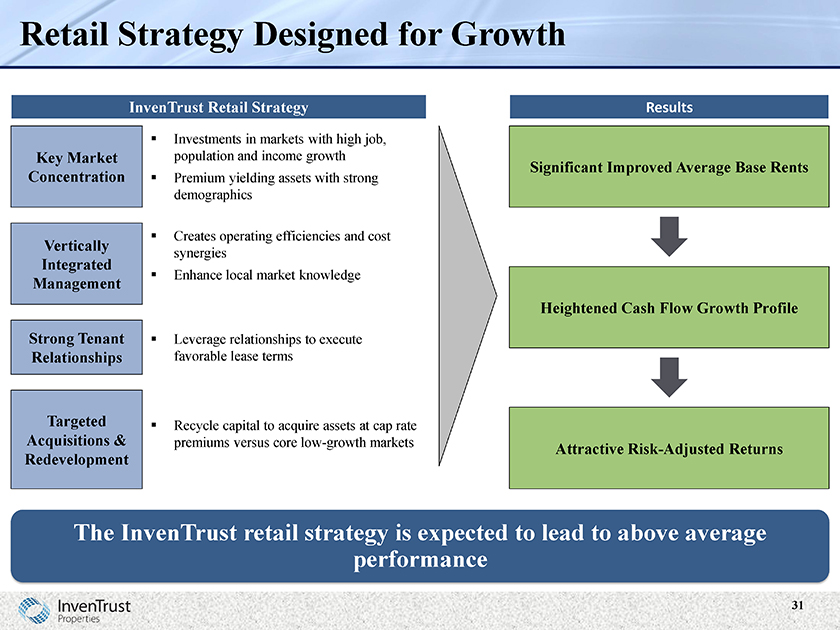

Retail Strategy Designed for Growth

InvenTrust Retail Strategy

Key Market Concentration

Vertically Integrated Management

Strong Tenant Relationships

Targeted Acquisitions & Redevelopment

Investments in markets with high job, population and income growth Premium yielding assets with strong demographics

Creates operating efficiencies and cost synergies Enhance local market knowledge

Leverage relationships to execute favorable lease terms

Recycle capital to acquire assets at cap rate premiums versus core low-growth markets

Results

Significant Improved Average Base Rents

Heightened Cash Flow Growth Profile

Attractive Risk-Adjusted Returns

The InvenTrust retail strategy is expected to lead to above average performance

31

Market Fundamentals / Capital Allocation / Acquisition & Disposition Strategies

Michael Podboy – CIO

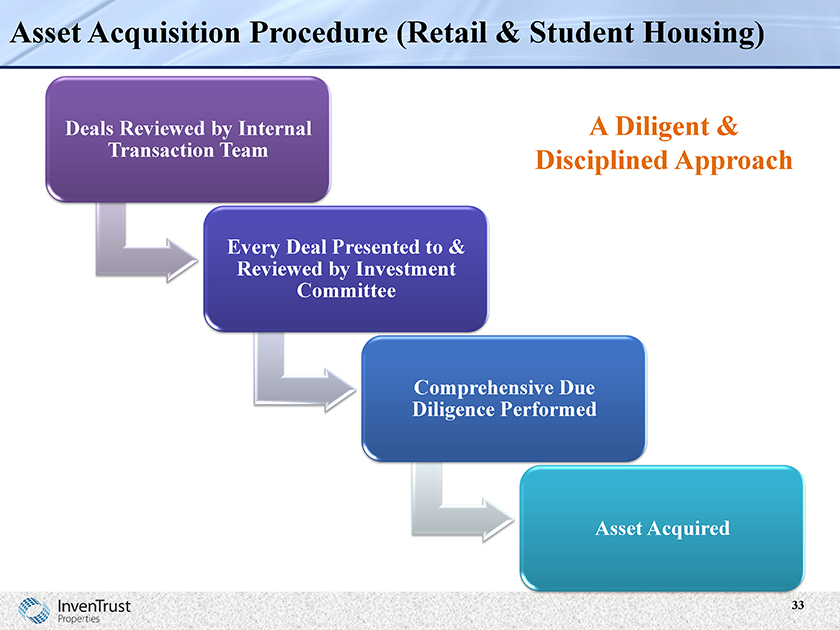

Asset Acquisition Procedure (Retail & Student Housing)

Deals Reviewed by Internal Transaction Team

Every Deal Presented to

& Reviewed by Investment Committee

Comprehensive Due Diligence Performed

Asset Acquired

A Diligent & Disciplined Approach

33

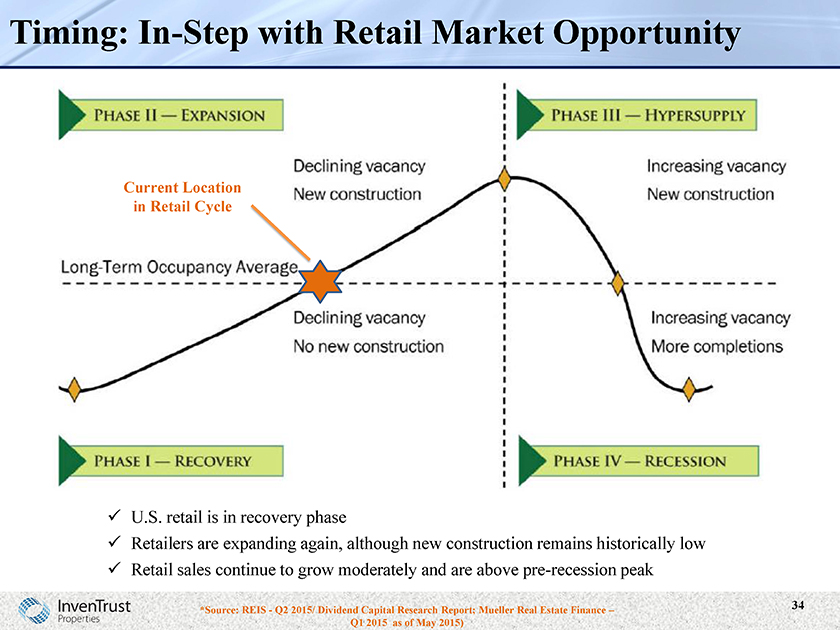

Timing: In-Step with Retail Market Opportunity

U.S. retail is in recovery phase

Retailers are expanding again, although new construction remains historically low Retail sales continue to grow moderately and are above pre-recession peak

*Source: REIS—Q2 2015/ Dividend Capital Research Report; Mueller Real Estate Finance – Q1 2015 as of May 2015)

34

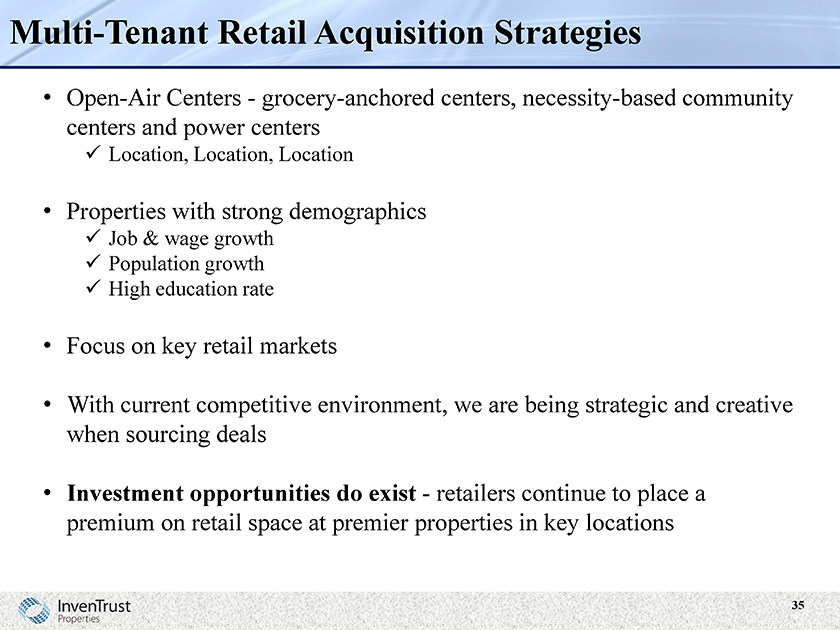

Multi-Tenant Retail Acquisition Strategies

Open-Air Centers—grocery-anchored centers, necessity-based community centers and power centers

Location, Location, Location

Properties with strong demographics

Job & wage growth Population growth High education rate

Focus on key retail markets

With current competitive environment, we are being strategic and creative when sourcing deals

Investment opportunities do exist—retailers continue to place a premium on retail space at premier properties in key locations

35

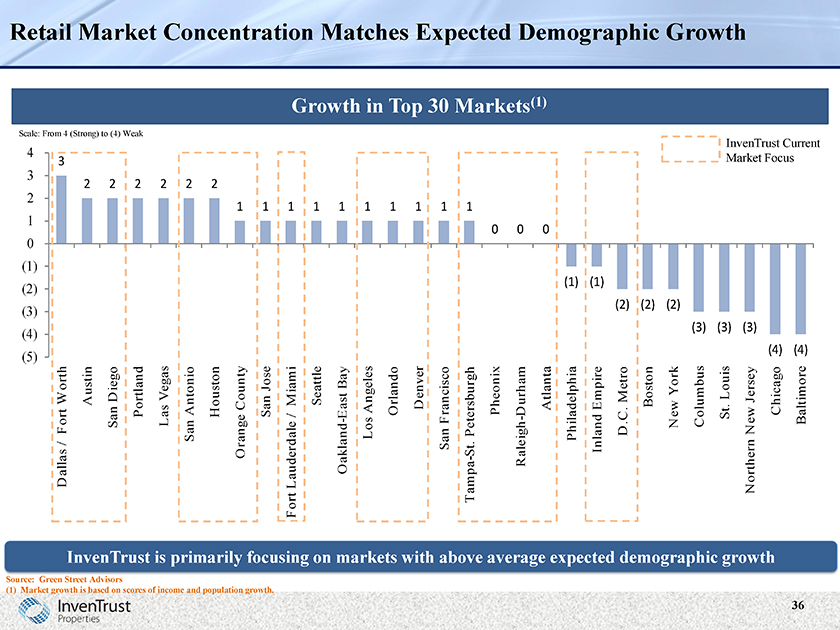

Retail Market Concentration Matches Expected Demographic Growth

Growth in Top 30 Markets(1)

Scale: From 4 (Strong) to (4) Weak

InvenTrust Current Market Focus

(5) | | (4) (3) (2) (1) 0 1 2 3 4 |

Dallas / Fort Worth 3

Austin2

San Diego2

Portland2

Las Vegas2

San Antonio2

Houston2

Orange County1

San Jose1

Fort Lauderdale / Miami 1

Seattle1

Oakland-East Bay1

Los Angeles1

Orlando1

Denver1

San Francisco1

Tampa-St. Petersburgh 1

Pheonix0

Raleigh-Durham 0

Atlanta0

Philadelphia (1)

Inland Empire (1)

D.C. Metro (2)

Boston (2)

New York (2)

Columbus (3)

St. Louis (3)

Northern New Jersey (3) Market

Chicago (4) InvenTrust

Baltimore Focus

Current

InvenTrust is primarily focusing on markets with above average expected demographic growth

Source: Green Street Advisors

(1) | | Market growth is based on scores of income and population growth. |

Recent Multi-Tenant Retail Acquisitions

The Highlands of Flower Mound

Outside Dallas

Acquired June 2015 as part of IAGM JV

Power Center

$45.8M

169K sq. ft.

3-mile Avg. HH Income—$144,000

3-mile Population – 65,000

Westpark Shopping Center

Richmond, VA

Acquired May 2015

Power Center

$33.8M

177K sq. ft.

3-mile Median HH Income—$62,000

3-mile Population – 89,000

The Shops at Walnut Creek

Outside Denver

Acquired April 2015

Power Center

$57.1M

216K sq. ft.

3-mile Avg. HH Income—$84,000

3-mile Population – 95,000

37

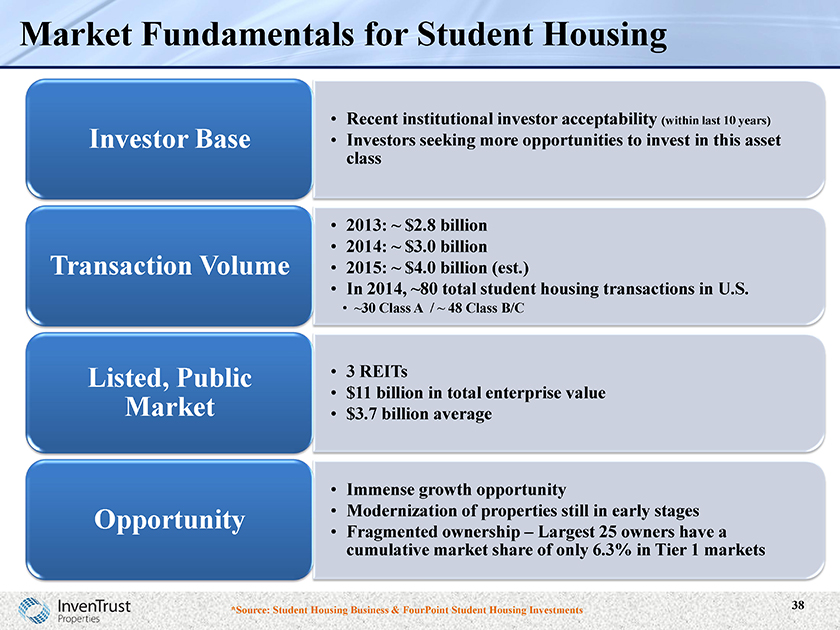

Market Fundamentals for Student Housing

Investor Base

Transaction Volume

Listed, Public Market

Opportunity

Recent institutional investor acceptability (within last 10

years)

Investors seeking more opportunities to invest in this asset class

2013: ~ $2.8 billion

2014: ~ $3.0 billion

2015: ~ $4.0 billion (est.)

In 2014, ~80 total student housing transactions in U.S.

~30 Class A / ~ 48 Class B/C

$11 billion in total enterprise value

$3.7 billion average

Immense growth opportunity

Modernization of properties still in early stages

Fragmented ownership – Largest 25 owners have a cumulative market share of only 6.3% in Tier 1 markets

*Source: Student Housing Business & FourPoint Student Housing Investments

38

Student Housing Acquisition Strategies

Student Housing Acquisition Strategy

Increase the scale of our platform through strategic acquisitions and developments

University House Denver purchased in Dec. 2014

Key characteristics:

Property located within walking distance to Competitive student acceptance rate Stable and growing enrollmen Division I athletics High barrier-to-entry market

Properties with high-end amenities, such as resort style swimming pools, fitness centers, sport courts and superior connectivity bandwidth

Our fully-integrated platform provides us options to build scale

Ability to develop properties Independently source deals

Independently source deals

Top manager/operator gives us an advantage in the marketplace

39

Disposition Strategy / Non-Core

Our long-term corporate strategy includes selling our non-core assets or engaging in other strategic transactions

Executing on this strategy since 2013

Properties no longer match our strategic focus

Outlook for value appreciation does not match our targeted asset classes

Continue to actively manage these assets to maximize their value

Reinvest capital into our student housing and retail platforms

Recent non-core dispositions

Office property in Manchester, NH—July

Industrial property in San Jose, CA – April

6.4M sq. ft. of triple net properties & multi-tenant office

3.4M sq. ft. are AT&T properties – lease expiration in ‘16 & ‘17

40

Financial Results & Balance Sheet Overview

Jack Potts – CFO

Estimated Per Share Value Information (February ‘15)

$4.00 per share (after Xenia Spin-Off)

Calculated and published after Xenia spin-off

Same-Store values for Multi-Tenant Retail and Student Housing Platforms increased

Non-Core portfolio values decreased

Calculated by independent third-party – Real Globe Advisors

42

Estimated Per Share Value Information (February ‘15)

NAV method used

FINRA – NTR required method

Used a 10-year discounted cash flow model for each individual property

Projected net operating income

Less capital expenditures

Applied a market supported discount rate and capitalization rate

For all other assets, such as marketable securities and JVs, fair value was determined separately

Subtracted the company’s debt obligations

Divided the result by the number of shares outstanding

Does not reflect any adjustment for “enterprise value”

43

Change in Distribution Rate (February ‘15)

Elimination of Xenia Cash Flow after Spin-Off

Capital for Acquisitions & Developments for Retail & Student Housing Platforms

Capital to Address Future Lease Renewals in our Non-Core / Legacy Portfolio

Disposition Strategy of Properties in our Non-Core / Legacy Portfolio

Distribution Rate for Entire Investment Portfolio is Sustainable

Covered by Cash Flow from Operations & Distributions from JVs

44

Select Total Company First Quarter Results

$4.9B = Total Assets Undepreciated

$1.8B = Total Debt

Same-Store NOI = $73.1M

FFO per Share = $0.07 (includes one-month of Xenia results)

45

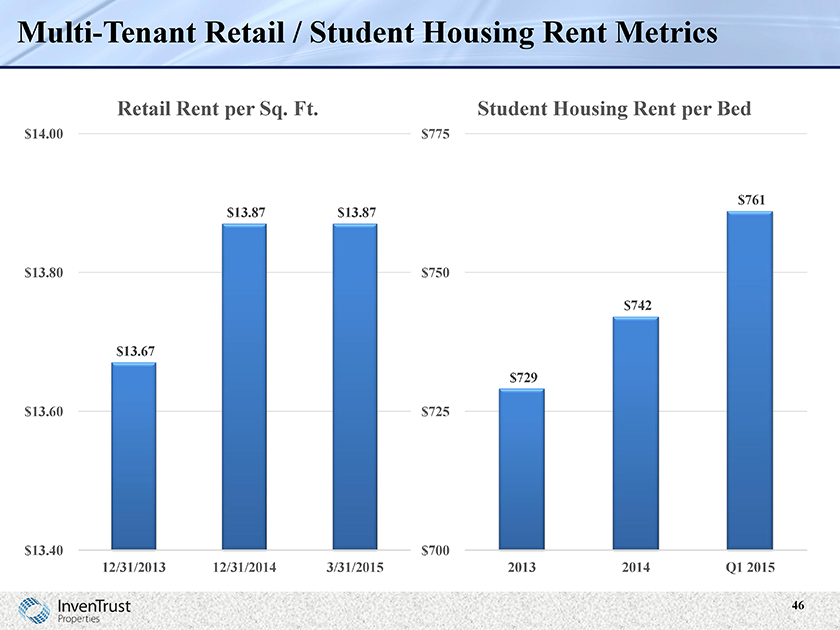

Multi-Tenant Retail / Student Housing Rent Metrics

Retail Rent per Sq. Ft. Student Housing Rent per Bed

$14.00 $775

$761

$13.87 $13.87

$13.80 $750

$742

$13.67

$729

$13.60 $725

$13.40 $700

12/31/2013 12/31/2014 3/31/2015 2013 2014 Q1 2015

46

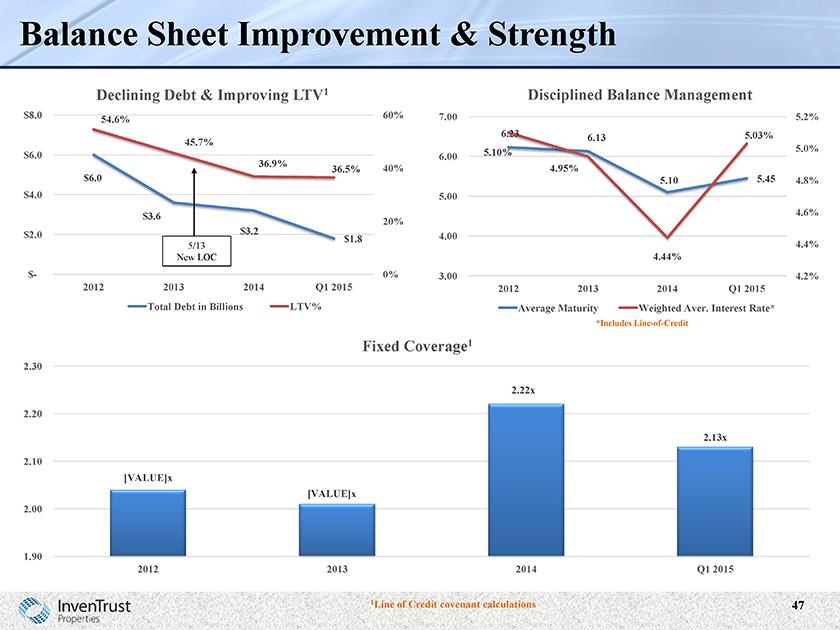

Balance Sheet Improvement & Strength

Declining Debt & Improving LTV1 Disciplined Balance Management

$8.0 60% 7.00 5.2%

54.6%

6.23 5.03%

6.13

45.7%

5.10% 5.0%

$6.0 6.00

36.9%

36.5% 40% 4.95%

$6.0 5.10 5.45 4.8%

$4.0 5.00

$3.6 4.6%

20%

$3.2

$2.0 4.00

$1.8

5/13 4.4%

New LOC 4.44%

$- 0% 3.00 4.2%

2012 2013 2014 Q1 2015 2012 2013 2014 Q1 2015

Total Debt in Billions LTV% Average Maturity Weighted Aver. Interest Rate*

*Includes Line-of-Credit

Fixed Coverage1

2.30

2.22x

2.20

2.13x

2.10

[VALUE]x

[VALUE]x

2.00

1.90

2012 2013 2014 Q1 2015

1Line of Credit covenant calculations 47

47

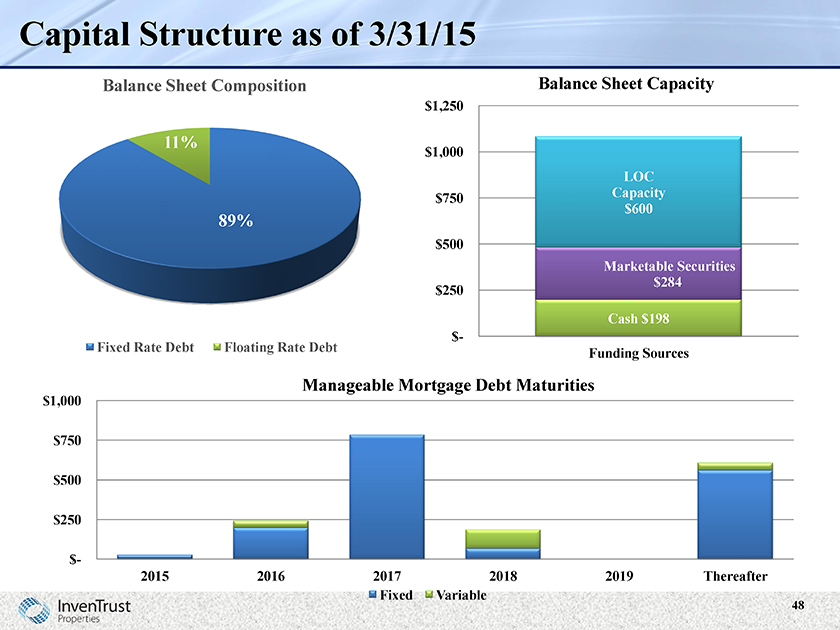

Capital Structure as of 3/31/15

Balance Sheet Composition Balance Sheet Capacity

$1,250

11%

$1,000

LOC

Capacity

$750 $600

89%

$500

Marketable Securities

$284

$250

Cash $198

$-

Fixed Rate Debt Floating Rate Debt Funding Sources

Manageable Mortgage Debt Maturities

$1,000

$750

$500

$250

$-

2015 2016 2017 2018 2019 Thereafter

Fixed Variable 48

48

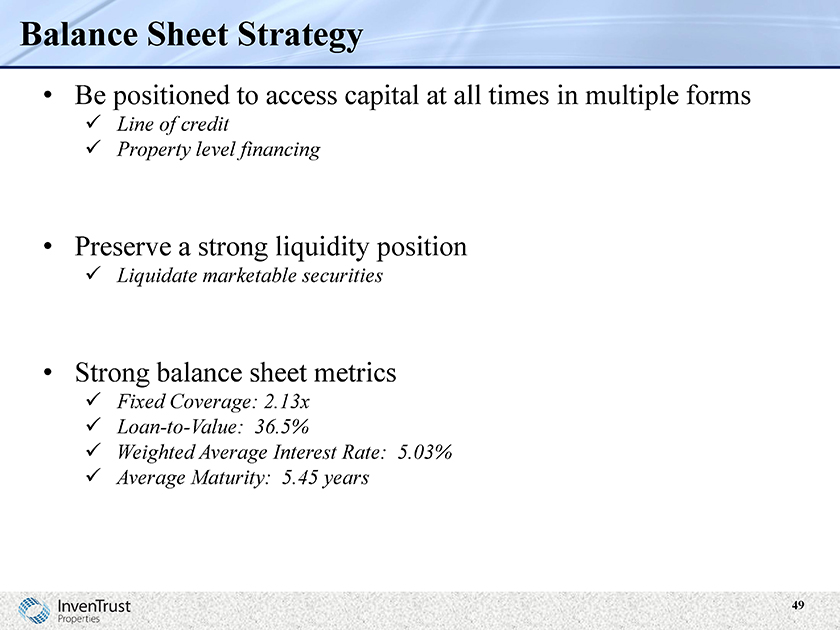

Balance Sheet Strategy

Be positioned to access capital at all times in multiple forms

Line of credit

Property level financing

Preserve a strong liquidity position

Liquidate marketable securities

Strong balance sheet metrics

Fixed Coverage: 2.13x Loan-to-Value: 36.5%

Weighted Average Interest Rate: 5.03% Average Maturity: 5.45 years

49

Q&A

Key Themes & Areas of Focus

Committed to Enhancing Portfolio and Increasing NAV

Experienced Management Team with Robust National Operating Platform

Committed to Sustainable Dividends

Strong, Flexible Balance Sheet & Capital Structure

Growth Initiatives Include Acquisitions, Development and Redevelopment Opportunities

51

Appendix

InvenTrust Management Team

Tom McGuinness Jack Potts Michael Podboy Anna Fitzgerald

President & CEO EVP—CFO EVP—CIO EVP—CAO

Travis Roberts David Collins Scott Wilton

President of EVP – Portfolio EVP – General

University House Management Counsel &

Secretary

53

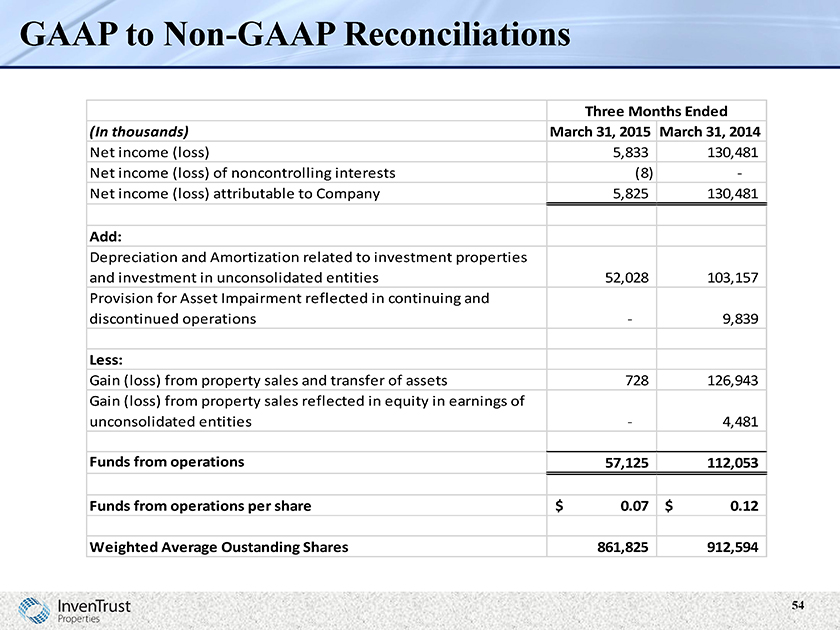

GAAP to Non-GAAP Reconciliations

(In thousands)

Net income (loss)

Net income (loss) of noncontrolling interests Net income (loss) attributable to Company

Add:

Depreciation and Amortization related to investment properties and investment in unconsolidated entities Provision for Asset Impairment reflected in continuing and discontinued operations

Less:

Gain (loss) from property sales and transfer of assets

Gain (loss) from property sales reflected in equity in earnings of unconsolidated entities

Funds from operations

Funds from operations per share

Weighted Average Oustanding Shares

Three Months Ended March 31, 2015 March 31, 2014

5,833

5,825

52,028

-

728

-

57,125

$ 0.07

861,825

130,481

-

130,481

103,157

9,839

126,943

4,481

112,053

$ 0.12

912,594

54