Exhibit 99.1

Annual Stockholders Meeting

Presentation

December 15, 2015

Exhibit 99.1

Disclaimer

Forward-Looking Statements in this presentation, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, plans or predictions of the future and are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, our ability to execute on our strategy, our ability to return value to our stockholders and the availability of cash flow from operating activities to fund distributions. For further discussion of factors that could materially affect the outcome of our forward-looking statements and our future results and financial condition, see the Risk Factors included in InvenTrust’s Properties Corp.’s (“InvenTrust”) most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the Securities and Exchange Commission. InvenTrust intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this presentation. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

This presentation includes certain non-GAAP financial measures. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to GAAP measures. You should be aware that our presentation of these measures may not be comparable to similarly-titled measures used by other companies. For reconciliations to GAAP measures, see the Appendix to this presentation and our most recent Quarterly Report on Form 10-Q filed with the SEC

1

Multi-Tenant Retail Strategy

Retail Landscape

Minimal New Development

Retailers are Expanding Again—Cautiously

Bricks and Clicks VS. Bricks or Clicks

Consumer Experience is Important

3

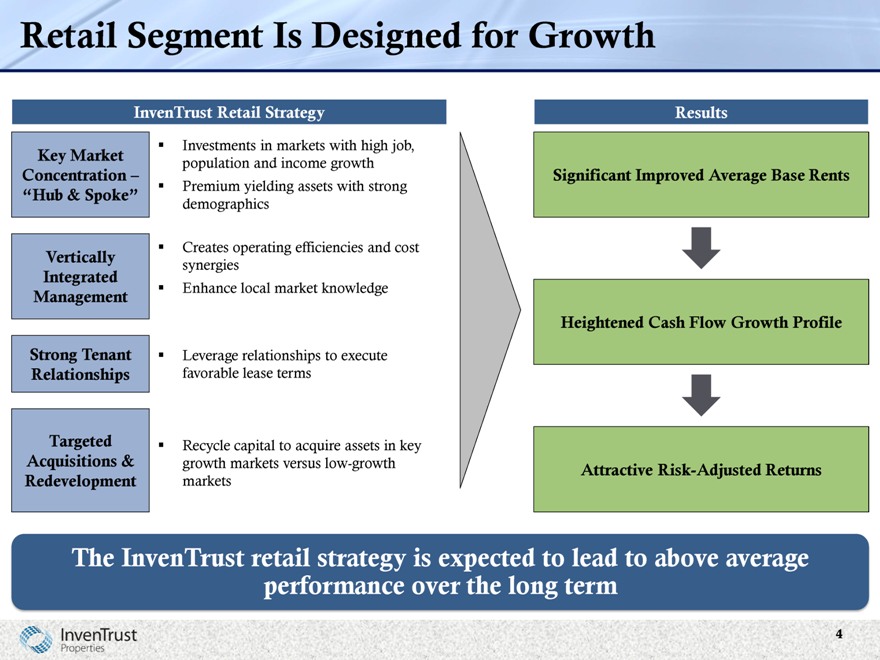

Retail Segment Is Designed for Growth

Key Market Concentration –

“Hub & Spoke”

Vertically Integrated Management

Strong Tenant Relationships

Targeted Acquisitions & Redevelopment

InvenTrust Retail Strategy

Investments in markets with high job, population and income growth Premium yielding assets with strong demographics

Creates operating efficiencies and cost synergies Enhance local market knowledge

Leverage relationships to execute favorable lease terms

Recycle capital to acquire assets in key growth markets versus low-growth markets

Results

Significant Improved Average Base Rents

Heightened Cash Flow Growth Profile

Attractive Risk-Adjusted Returns

The InvenTrust retail strategy is expected to lead to above average performance over the long term

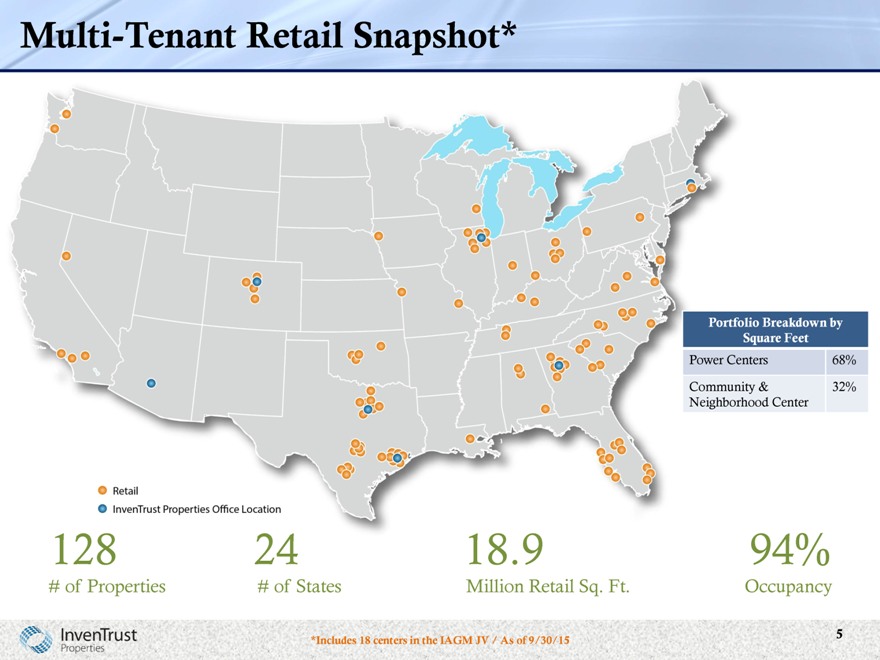

Multi-Tenant Retail Snapshot*

Portfolio Breakdown by

Square Feet

Power Centers 68%

Community & 32%

Neighborhood

Center

128 24 18.9 94%

# of Properties # of States Million Retail Sq. Ft. Occupancy

*Includes 18 centers in the IAGM JV / As of 9/30/15

5

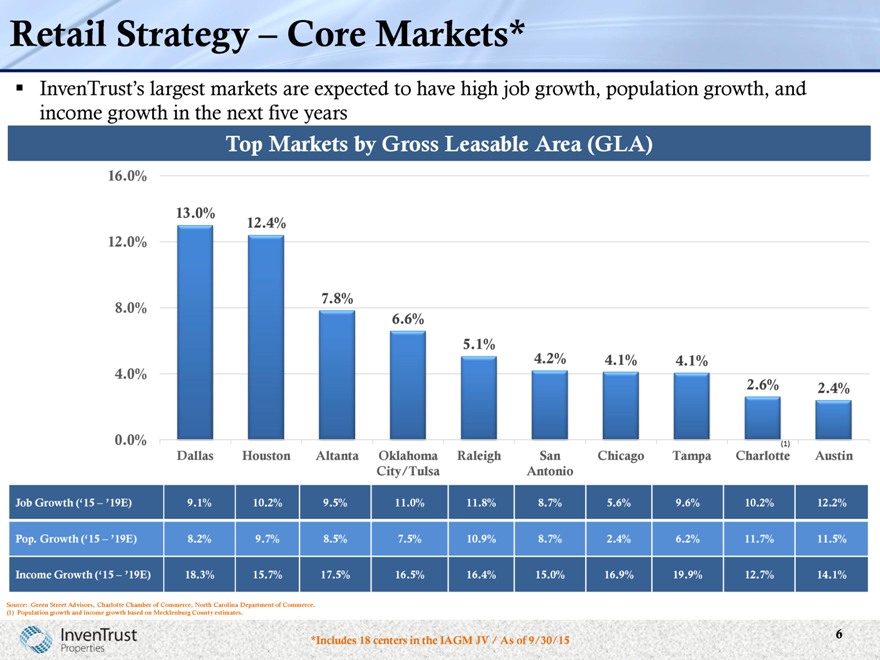

Retail Strategy – Core Markets*

InvenTrust’s largest markets are expected to have high job growth, population growth, and income growth in the next five years

Top Markets by Gross Leasable Area (GLA)

16.0%

13.0%

12.4%

12.0%

7.8%

8.0%

6.6%

5.1%

4.2% 4.1% 4.1%

4.0%

2.6% 2.4%

0.0% (1)

Dallas Houston Altanta Oklahoma Raleigh San Chicago Tampa Charlotte Austin

City/Tulsa Antonio

Job Growth (‘15 – ’19E) 9.1% 10.2% 9.5% 11.0% 11.8% 8.7% 5.6% 9.6% 10.2% 12.2%

Pop. Growth (‘15 – ’19E) 8.2% 9.7% 8.5% 7.5% 10.9% 8.7% 2.4% 6.2% 11.7% 11.5%

Income Growth (‘15 –

18.3% 15.7% 17.5% 16.5% 16.4% 15.0% 16.9% 19.9% 12.7% 14.1%

’19E)

Source: Green Street Advisors, Charlotte Chamber of Commerce, North Carolina Department of Commerce. (1) Population growth and income growth based on Mecklenburg County estimates.

*Includes 18 centers in the IAGM JV / As of 9/30/15

6

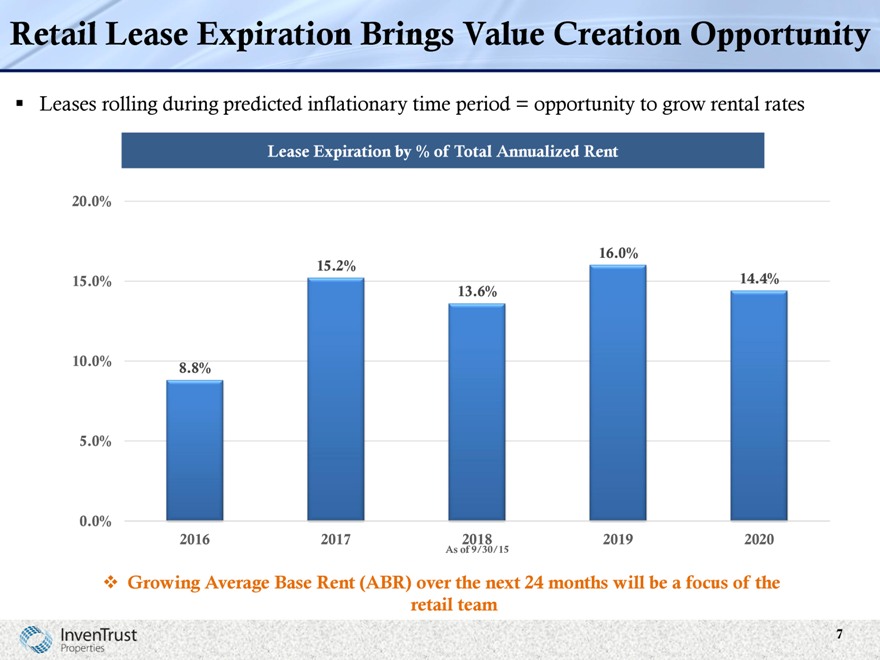

Retail Lease Expiration Brings Value Creation Opportunity

Leases rolling during predicted inflationary time period = opportunity to grow rental rates

Lease Expiration by % of Total Annualized Rent

20.0%

16.0%

15.2%

15.0% 14.4%

13.6%

10.0% 8.8%

5.0%

0.0%

2016 2017 2018 2019 2020

As of 9/30/15

Growing Average Base Rent (ABR) over the next 24 months will be a focus of the retail team

7

Focus on Deep Tenant Relationships

InvenTrust’s scale and locations in growing vibrant markets promotes favorable relationships with top local and national tenants

8

University House Platform Strategy

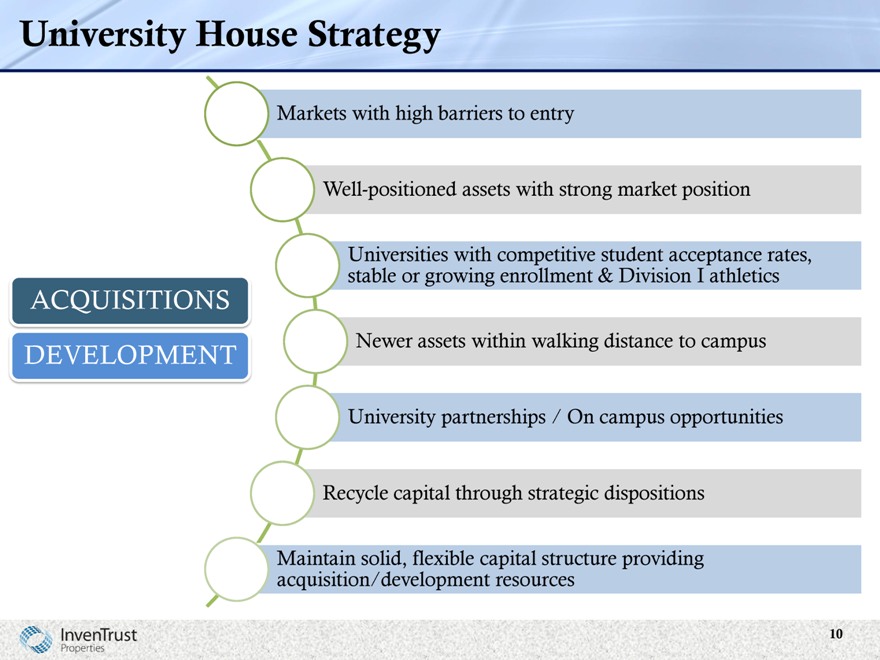

University House Strategy

Markets with high barriers to entry

Well-positioned assets with strong market position

Universities with competitive student acceptance rates, stable or growing enrollment & Division I athletics

Newer assets within walking distance to campus University partnerships / On campus opportunities Recycle capital through strategic dispositions

Maintain solid, flexible capital structure providing acquisition/development resources

ACQUISITIONS

DEVELOPMENT

10

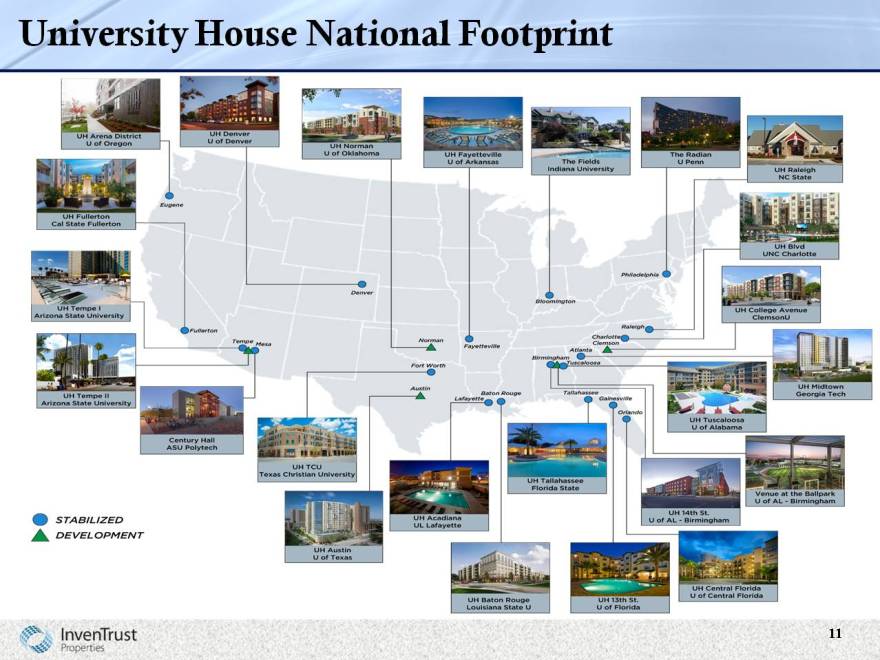

University House National Footprint*

11

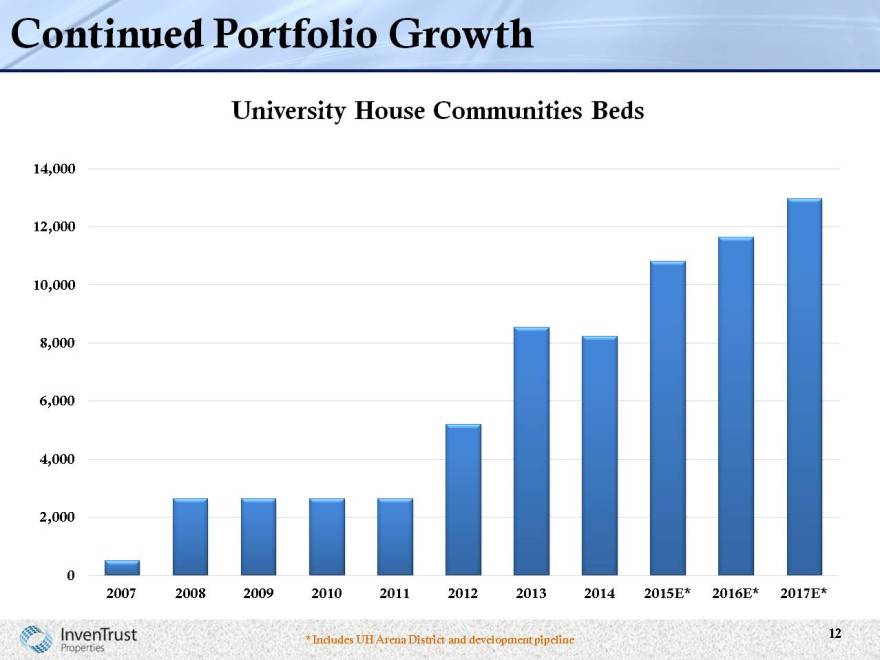

Continued Portfolio Growth

University House Communities Beds

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

2007 2008 2009 2010 2011 2012 2013 2014 2015* 2016* 2017*

* Includes UH Arena District and development pipeline

12

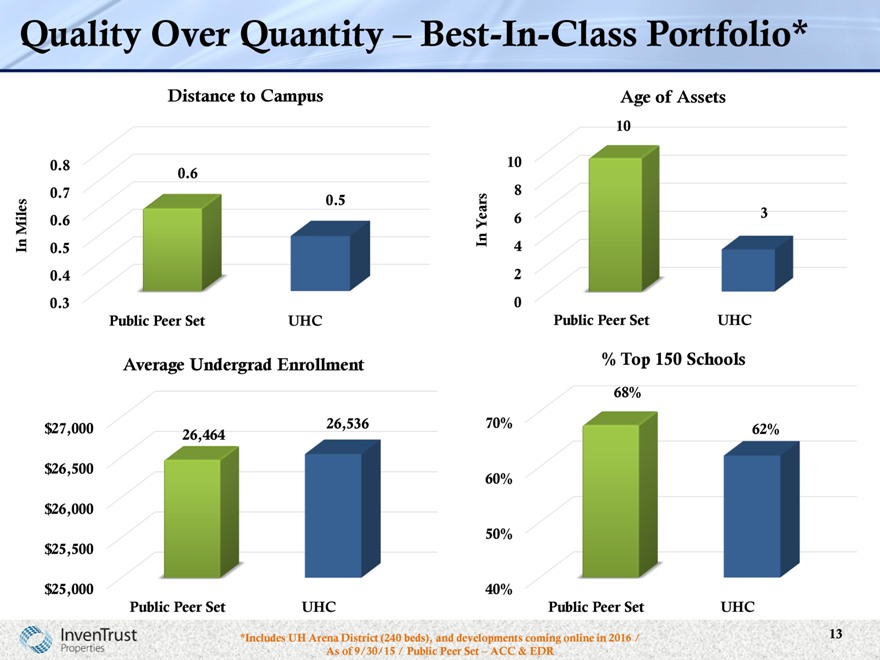

Quality Over Quantity – Best-In-Class Portfolio*

Distance to Campus Age of Assets

10

0.8 10

0.6

0.7 8

0.5

Miles 0.6 Years 6 3

In 0.5 In 4

0.4 2

0.3 0

Public Peer Set UHC Public Peer Set UHC

Average Undergrad Enrollment % Top 150 Schools

68%

$ 27,000 26,536 70% 62%

26,464

$ 26,500

60%

$ 26,000

50%

$ 25,500

$ 25,000 40%

Public Peer Set UHC

Public Peer Set UHC

*Includes UH Arena District (240 beds), and developments coming online in

2016 / As of 9/30/15 / Public Peer Set – ACC & EDR

13

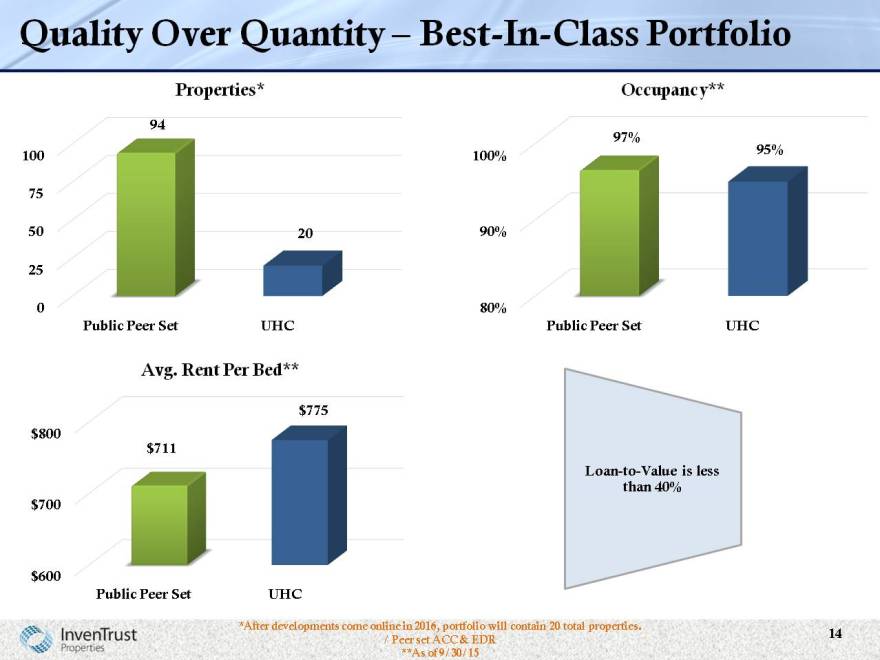

Quality Over Quantity – Best-In-Class Portfolio

Properties* Occupancy**

94

97%

100 100% 95%

75

50 20 90%

25

0 80%

Public Peer Set UHC Public Peer Set UHC

Avg. Rent Per Bed**

$ 775

$ 800

$ 711

Loan-to-Value is less

than 40%

$ 700

$ 600

Public Peer Set UHC

*After developments come online in 2016, portfolio will contain 20 total properties. 14

**As of 9/30/15

Georgia Tech. Another Successful Development

Located in the popular Midtown area of Atlanta

Opened in August—706 beds & approximately 9,000 square feet of retail space

100% pre-leased by spring of 2015

19-story residential tower offering one-, two-, three- and four- bedroom units

High-end student amenities include a clubroom, study lounge, 24-hour fitness center, rooftop terrace, and resort style pool

15

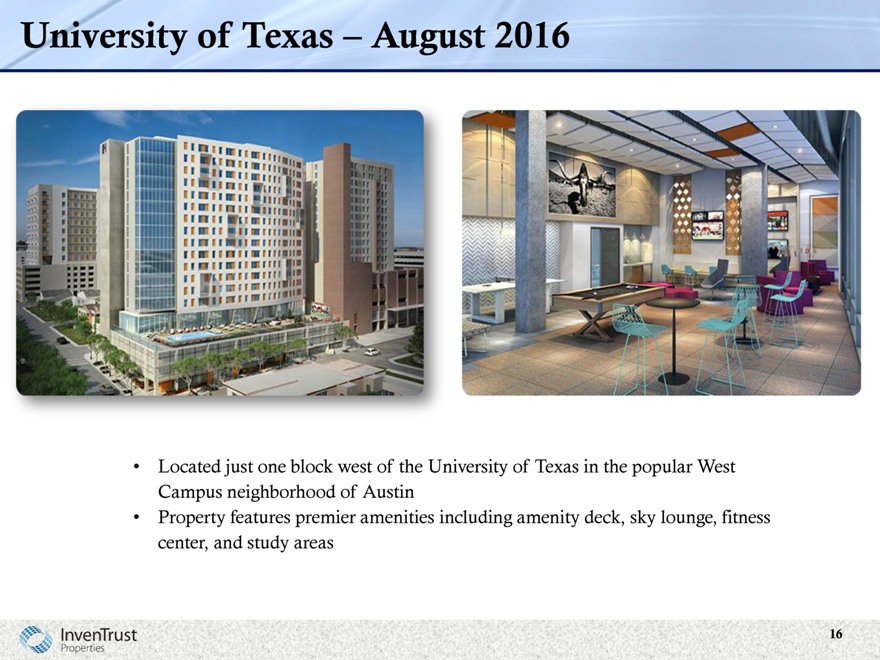

University of Texas – August 2016

Located just one block west of the University of Texas in the popular West Campus neighborhood of Austin

Property features premier amenities including amenity deck, sky lounge, fitness center, and study areas

16

Capital Allocation Strategies, Balance Sheet Management & Financial Results

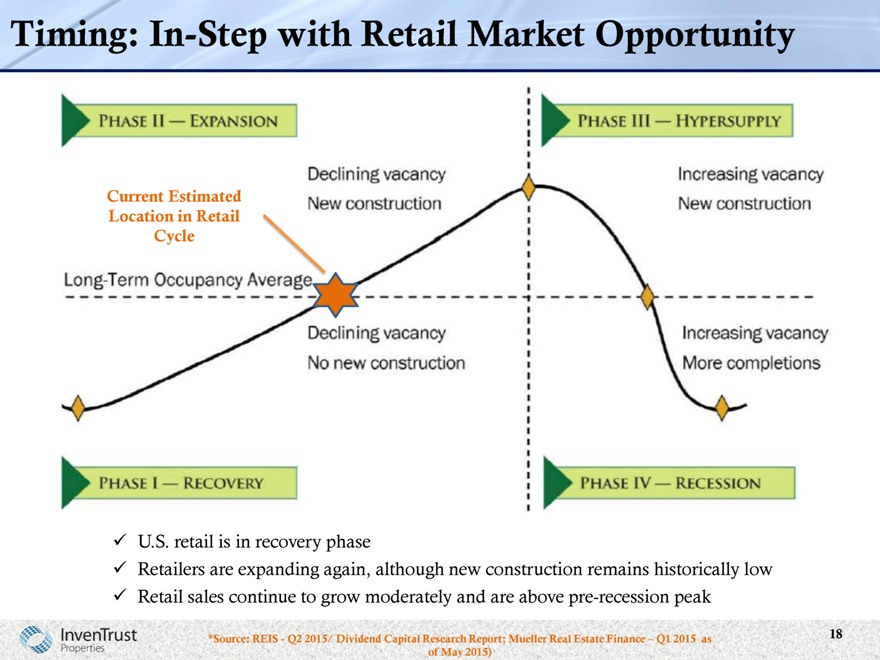

Timing: In-Step with Retail Market Opportunity

Current Estimated Location in Retail Cycle

U.S. retail is in recovery phase

Retailers are expanding again, although new construction remains historically low

Retail sales continue to grow moderately and are above pre-recession peak

*Source: REIS—Q2 2015/ Dividend Capital Research Report; Mueller Real Estate Finance – Q1 2015 as of May 2015)

18

Multi-Tenant Retail Acquisition Strategies

Open-Air Centers—grocery-anchored centers, necessity-based community centers and power centers

Location, Location, Location

Properties with strong demographics

Job & wage growth Population growth High education rate

Focus on key retail markets

With current competitive environment, we are being strategic and creative when sourcing deals

Investment opportunities exist—retailers continue to place a premium on retail space at premier properties in key locations

19

Retail Market Concentration Matches Expected Demographic Growth

(5) (4) (3) (2) (1) 0 1 2 3 4 Scale:

Dallas / Fo rt W orth 3 From

4

Austin 2 (Strong)

San D iego 2

to

P ortlan d 2 (4)

L a s Vegas 2 Weak

San A ntonio 2

H o u ston 2

Orange County 1

Sa n J ose 1

Fort Lauderdale / M iami 1

Seattle 1

Oakland -Ea st Bay 1 Growth

Los A ngeles 1 in

O rlando 1 Top

D enver 1

San F ra ncisco 1 30

Tampa -St. Petersbu rgh 1

Ph eonix 0

Raleigh -Durham 0 Markets

A tlan ta 0 (1)

Philad elphia (1)

Inland Empire (1)

D .C . M etro (2)

Bo sto n (2)

New York (2)

C olum bus (3)

St. Louis (3)

Northern New Jersey (3)

C hica go (4) Focus Market InvenTrust

Baltim ore (4) Current

InvenTrust is primarily focusing on markets with above average expected demographic growth

Source: Green Street Advisors

(1) Market growth is based on scores of income and population growth.

20

Recent Retail Acquisitions Match Our Strategy

The Highlands of Flower Mound

Outside Dallas

Acquired June 2015 as part of IAGM JV

Power Center

$45.8M

169K sq. ft.

3-mile Avg. HH Income—$144,000

3-mile Population – 65,000

Rio Pinar Plaza

Orlando, FL

Acquired Nov. 2015

Grocery Anchored—Publix

100% Occupied

$34M

124K sq. ft.

ABR of $16.73 psf

3-mile Population – 102,000

Price Plaza

Katy, TX

Acquired Nov. 2015 as part of IAGM

Power Center

$35.8M

206K sq. ft.

3-mile Avg. HH Income—$101,000

3-mile Population – 116,000

21

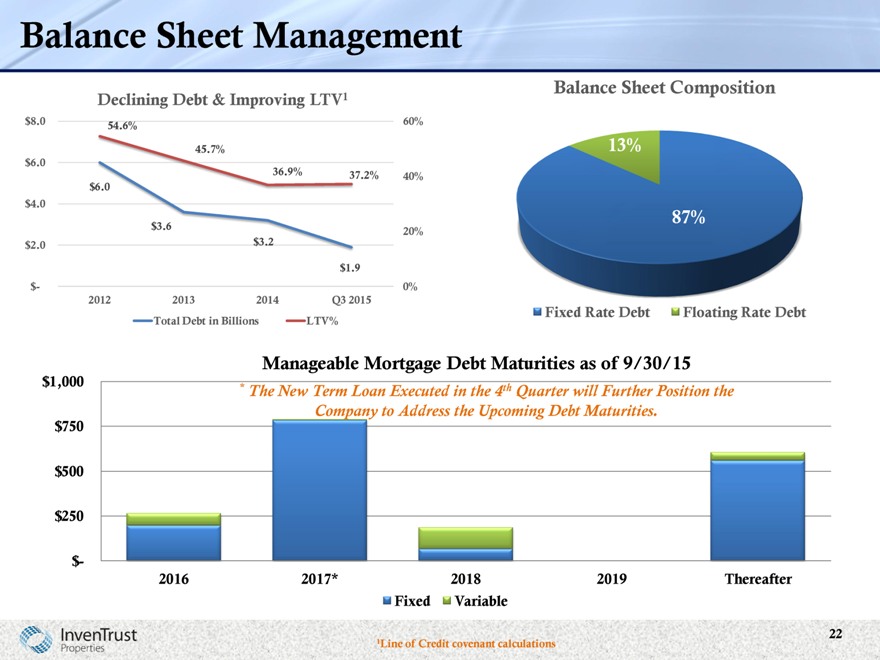

Balance Sheet Management

Declining Debt & Improving LTV1

$8.0 60%

54.6%

45.7%

$6.0

36.9% 37.2% 40%

$6.0

$4.0

$3.6

20%

$2.0 $3.2

$1.9

$- 0%

2012 2013 2014 Q3 2015

Total Debt in Billions LTV%

Balance Sheet Composition

13%

87%

Fixed Rate Debt Floating Rate Debt

Manageable Mortgage Debt Maturities as of 9/30/15

$1,000 * th

The New Term Loan Executed in the 4 Quarter will Further

Position the Company to Address the Upcoming Debt Maturities.

$750

$500

$250

$-

2016 2017* 2018 2019 Thereafter

Fixed Variable

1Line of Credit covenant calculations

22

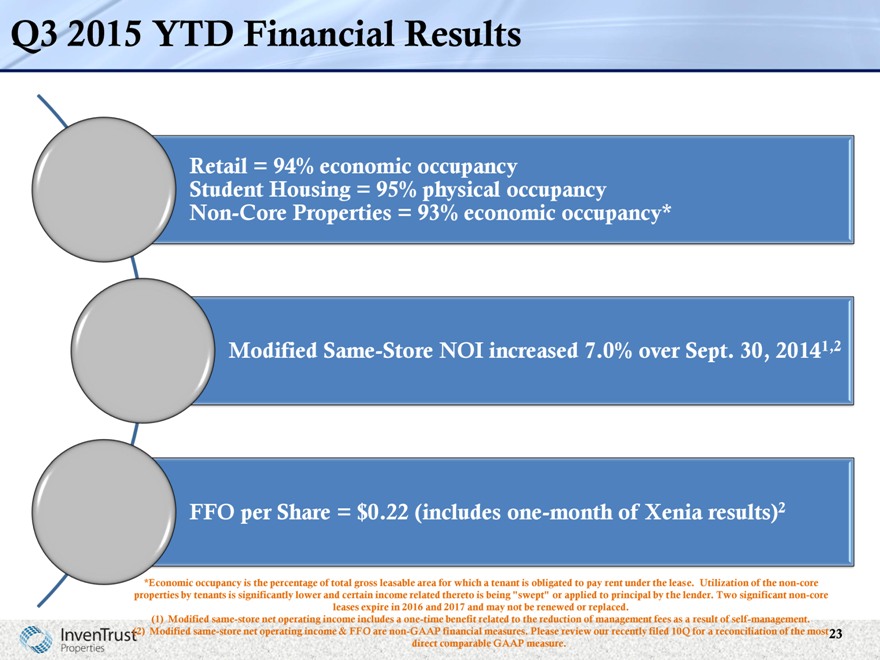

Q3 2015 YTD Financial Results

Retail = 94% economic occupancy

Student Housing = 95% physical occupancy Non-Core Properties = 93% economic occupancy*

Modified Same-Store NOI increased 7.0% over Sept. 30, 20141,2

FFO per Share = $0.22 (includes one-month of Xenia results)2

*Economic occupancy is the percentage of total gross leasable area for which a tenant is obligated to pay rent under the lease. Utilization of the non-core properties by tenants is significantly lower and certain income related thereto is being “swept” or applied to principal by the lender. Two significant non-core leases expire in 2016 and 2017 and may not be renewed or replaced.

(1) Modified same-store net operating income includes a one-time benefit related to the reduction of management fees as a result of self-management. (2) Modified same-store net operating income & FFO are non-GAAP financial measures. Please review our recently filed 10Q for a reconciliation of the most direct comparable GAAP measure.

23

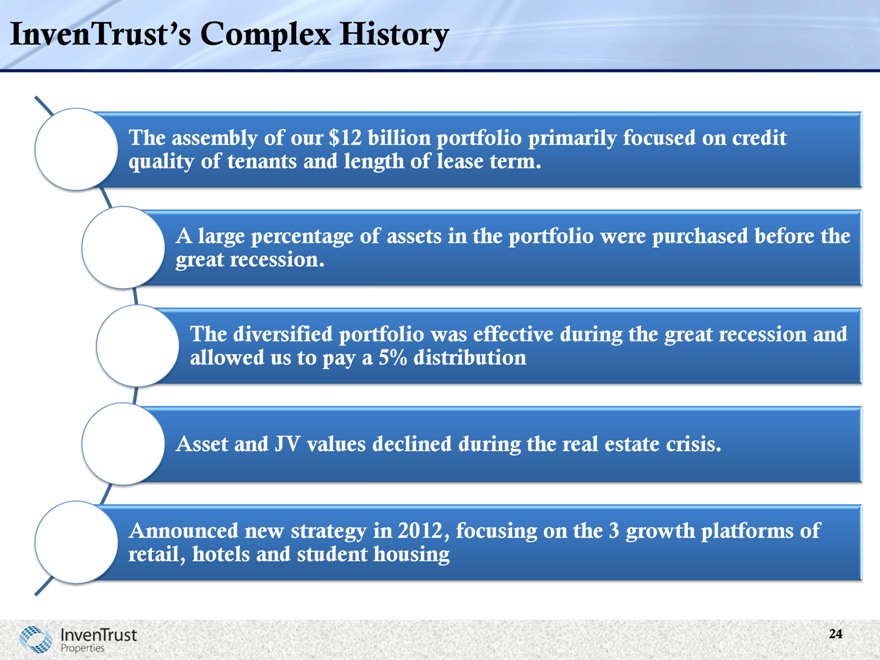

InvenTrust’s Complex History

The assembly of our $12 billion portfolio primarily focused on credit quality of tenants and length of lease term.

A large percentage of assets in the portfolio were purchased before the great recession.

The diversified portfolio was effective during the great recession and allowed us to pay a 5% distribution

Asset and JV values declined during the real estate crisis.

Announced new strategy in 2012, focusing on the 3 growth platforms of retail, hotels and student housing

24

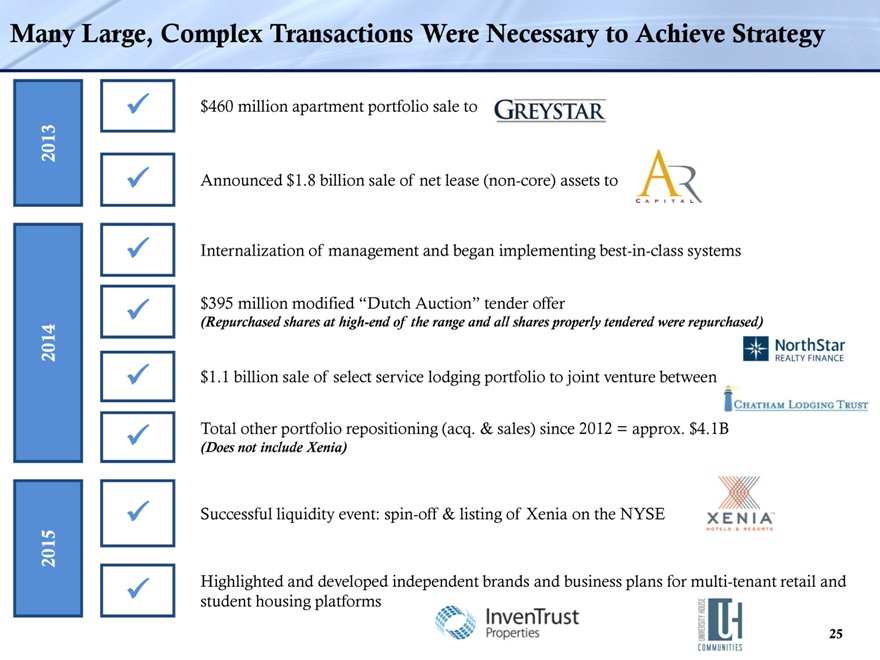

Many Large, Complex Transactions Were Necessary to Achieve Strategy

2015 2014 2013

$460 million apartment portfolio sale to

Announced $1.8 billion sale of net lease (non-core) assets to

Internalization of management and began implementing best-in-class systems

$395 million modified “Dutch Auction” tender offer

(Repurchased shares at high-end of the range and all shares properly tendered were repurchased)

$1.1 billion sale of select service lodging portfolio to joint venture between

Total other portfolio repositioning (acq. & sales) since 2012 = approx. $4.1B

(Does not include Xenia)

Successful liquidity event: spin-off & listing of Xenia on the NYSE

Highlighted and developed independent brands and business plans for multi-tenant retail and student housing platforms

25

Final Thoughts on InvenTrust & Remaining Challenges

Committed to Executing on 3 Unique Platform Strategies (Retail, Student Housing & Non-Core)

Experienced Management Team in Place to Execute Company’s

Strategies

Dividend Rate is Based on Current Portfolio (If our portfolio materially changes,

the Board would reconsider the dividend at that time)

Strong, Flexible Balance Sheet & Capital Structure

Additional Time Needed to Complete Recycling of Capital to Acquire Assets in Key Growth Markets Versus Low-Growth Markets

Non-Core, Legacy Assets Continue to Struggle

26

Q&A

Appendix

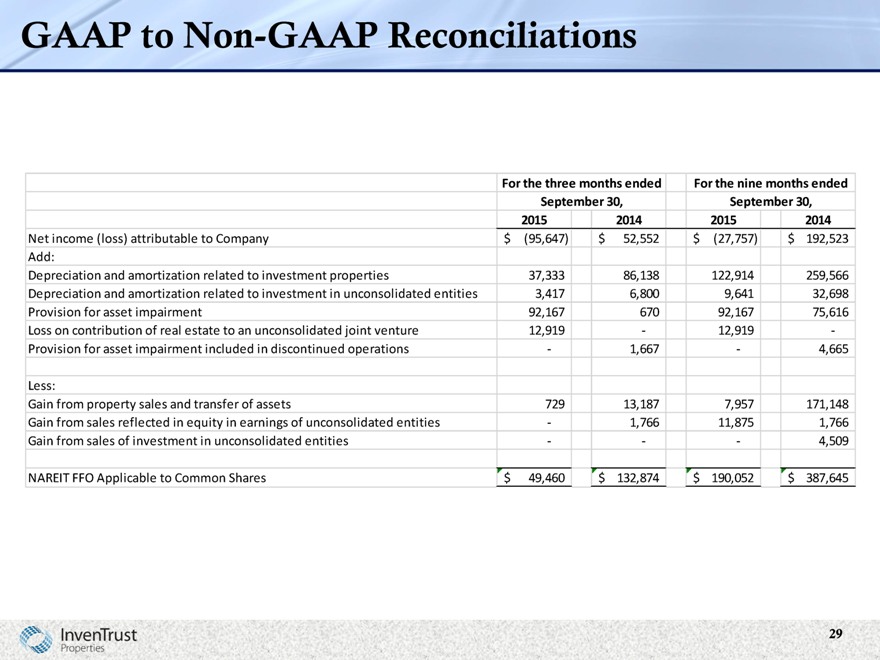

GAAP to Non-GAAP Reconciliations

For the three months ended For the nine months ended

September 30, September 30,

2015 2014 2015 2014

Net income (loss) attributable to Company $ (95,647) $ 52,552 $ (27,757) $ 192,523

Add:

Depreciation and amortization related to investment properties 37,333 86,138 122,914 259,566

Depreciation and amortization related to investment in unconsolidated entities 3,417 6,800 9,641 32,698

Provision for asset impairment 92,167 670 92,167 75,616

Loss on contribution of real estate to an unconsolidated joint venture 12,919 — 12,919 -

Provision for asset impairment included in discontinued operations — 1,667 — 4,665

Less:

Gain from property sales and transfer of assets 729 13,187 7,957 171,148

Gain from sales reflected in equity in earnings of unconsolidated entities — 1,766 11,875 1,766

Gain from sales of investment in unconsolidated entities — — — 4,509

NAREIT FFO Applicable to Common Shares $ 49,460 $ 132,874 $ 190,052 $ 387,645

29