simple. focused. disciplined. Investor Presentation May 2017 Exhibit 99.1

Forward Looking Statements Forward-Looking Statements in this presentation, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, representation, plans or predictions of the future and are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, market, political and economic volatility experienced by the U.S. economy or real estate industry as a whole, and the regional and local political and economic conditions in the markets in which our properties are located; competitive business market conditions experienced by our retail tenants and shadow anchor retailers, such as challenges competing with e-commerce channels; our ability to execute on our business strategy and enhance stockholder value; and our ability to manage our debt. For further discussion of factors that could materially affect the outcome of our forward-looking statements and our future results and financial condition, see the Risk Factors included in InvenTrust’s most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the Securities and Exchange Commission. InvenTrust intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this presentation. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. The companies depicted in the photographs or otherwise herein may have proprietary interests in their trade names and trademarks and nothing herein shall be considered to be an endorsement, authorization or approval of InvenTrust Properties Corp. by the companies. Further, none of these companies are affiliated with InvenTrust Properties Corp. in any manner.

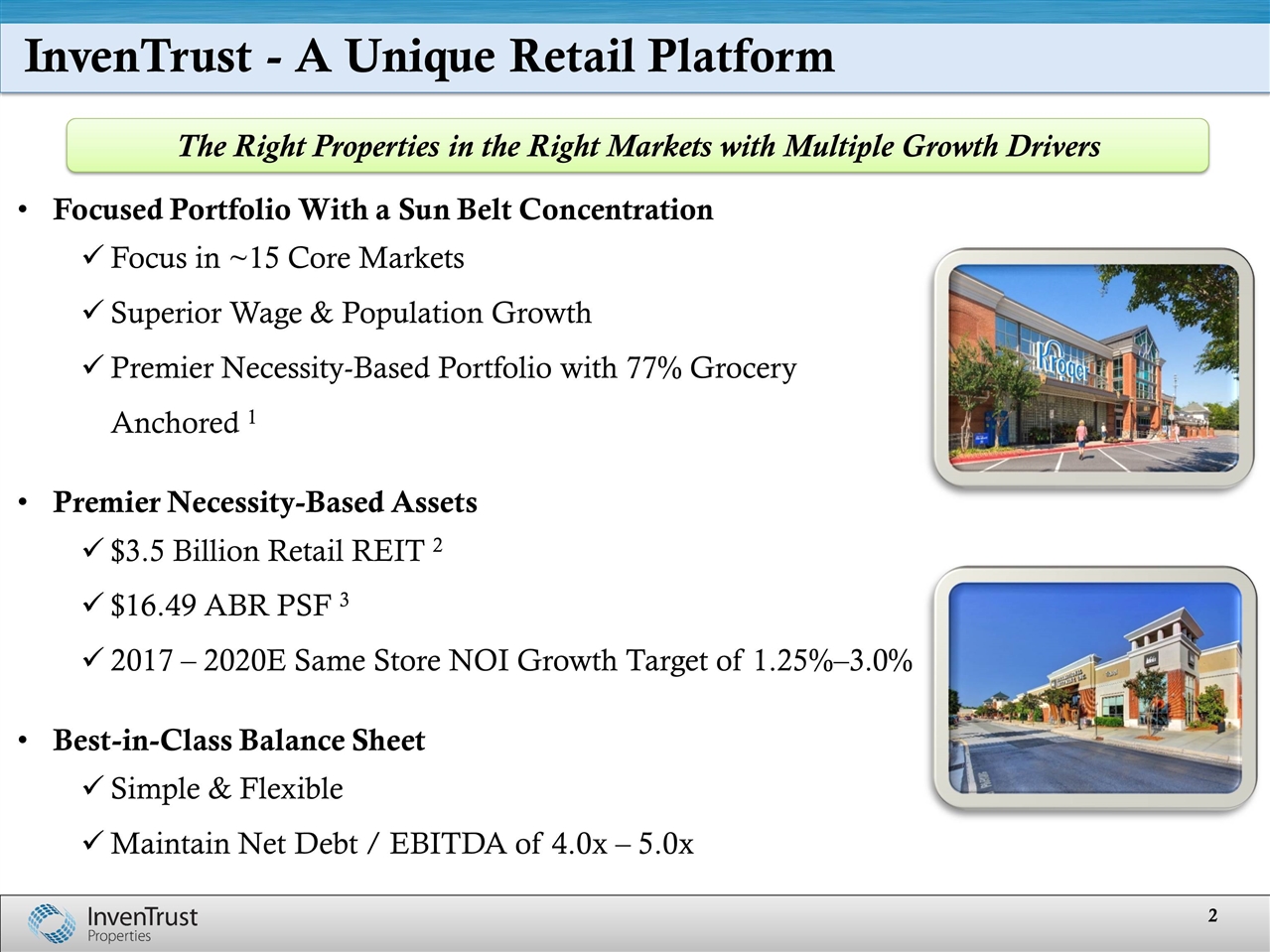

InvenTrust - A Unique Retail Platform Focused Portfolio With a Sun Belt Concentration Focus in ~15 Core Markets Superior Wage & Population Growth Premier Necessity-Based Portfolio with 77% Grocery Anchored 1 Premier Necessity-Based Assets $3.5 Billion Retail REIT 2 $16.49 ABR PSF 3 2017 – 2020E Same Store NOI Growth Target of 1.25%–3.0% Best-in-Class Balance Sheet Simple & Flexible Maintain Net Debt / EBITDA of 4.0x – 5.0x The Right Properties in the Right Markets with Multiple Growth Drivers

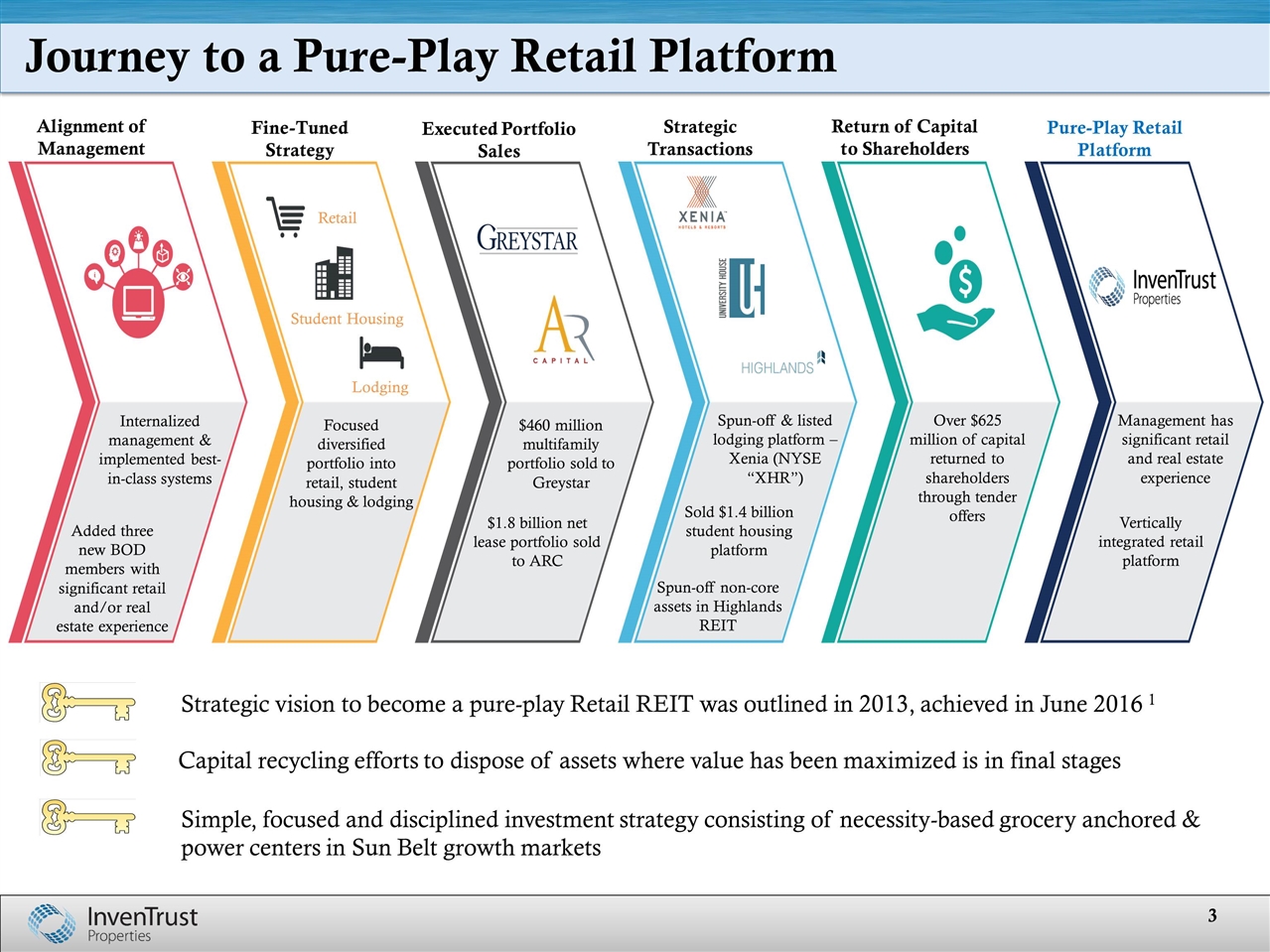

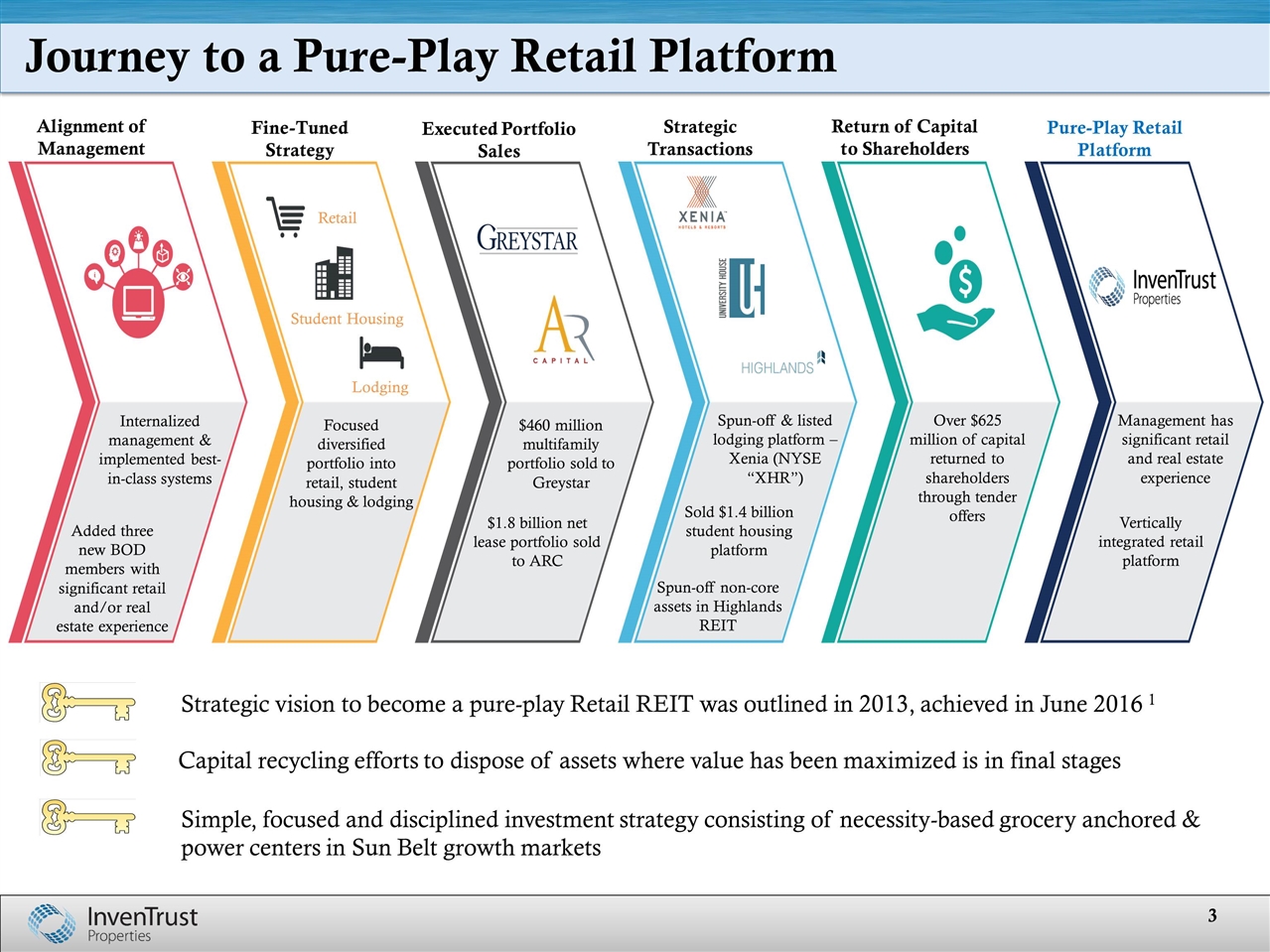

Journey to a Pure-Play Retail Platform Strategic vision to become a pure-play Retail REIT was outlined in 2013, achieved in June 2016 1 Focused diversified portfolio into retail, student housing & lodging Added three new BOD members with significant retail and/or real estate experience Internalized management & implemented best-in-class systems Over $625 million of capital returned to shareholders through tender offers $460 million multifamily portfolio sold to Greystar $1.8 billion net lease portfolio sold to ARC Spun-off & listed lodging platform – Xenia (NYSE “XHR”) Sold $1.4 billion student housing platform Spun-off non-core assets in Highlands REIT Simple, focused and disciplined investment strategy consisting of necessity-based grocery anchored & power centers in Sun Belt growth markets Alignment of Management Fine-Tuned Strategy Executed Portfolio Sales Return of Capital to Shareholders Pure-Play Retail Platform Strategic Transactions Management has significant retail and real estate experience Vertically integrated retail platform Capital recycling efforts to dispose of assets where value has been maximized is in final stages Retail Student Housing Lodging

Why InvenTrust? Premium Assets Within Select Sun Belt Markets Strong Management Team Able to Execute on Focused Strategic Vision Superior Asset Quality: $16.49 ABR PSF 2 Necessity-Based Portfolio of Assets: $3.5 Billion 1 Stable Growth Profile: 2017 – 2020E Same Store NOI Growth Target of 1.25% – 3.0% Flexible Capital Structure Supports Growth: Net Debt / EBITDA Target of 4.0x - 5.0x

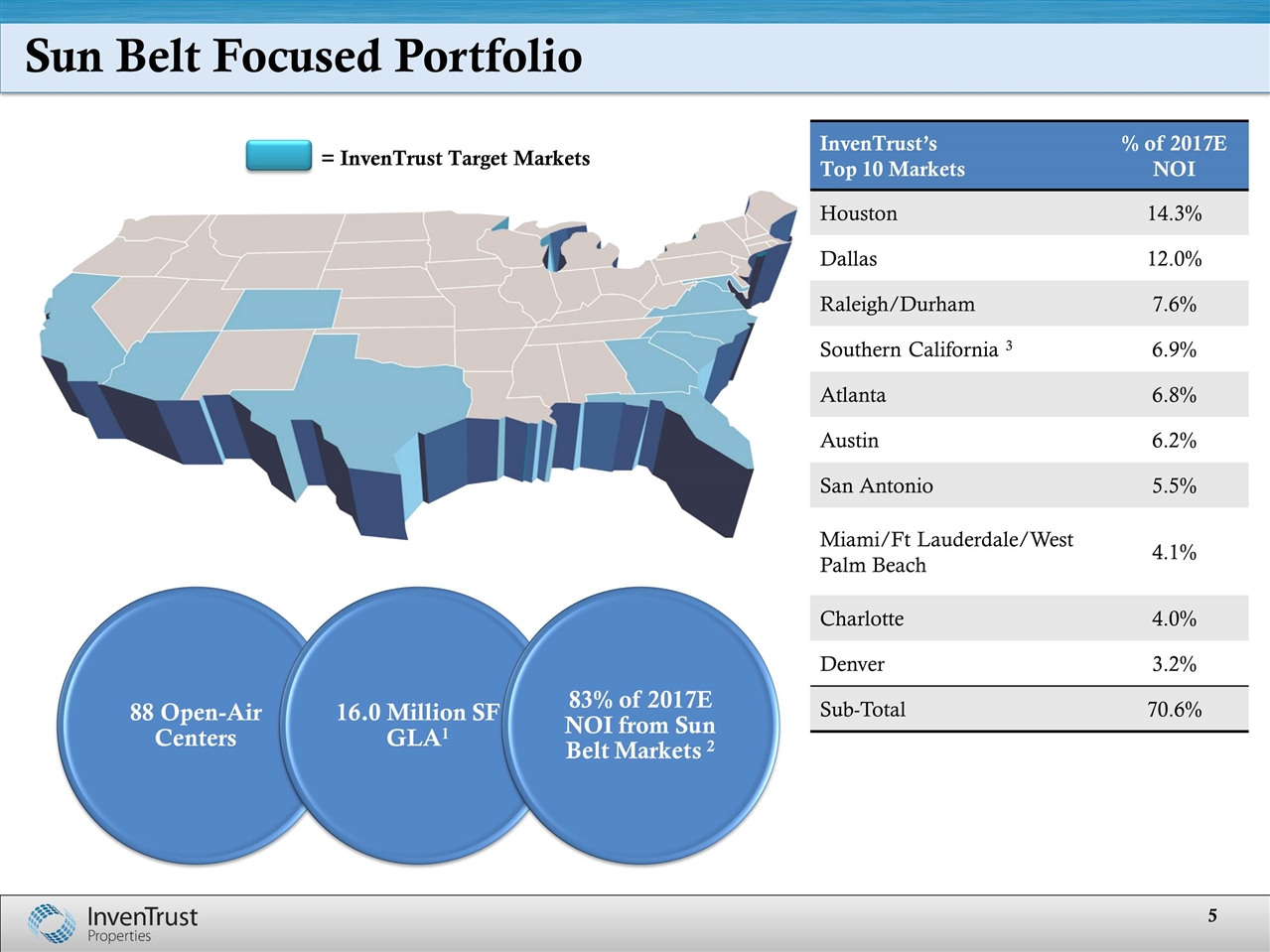

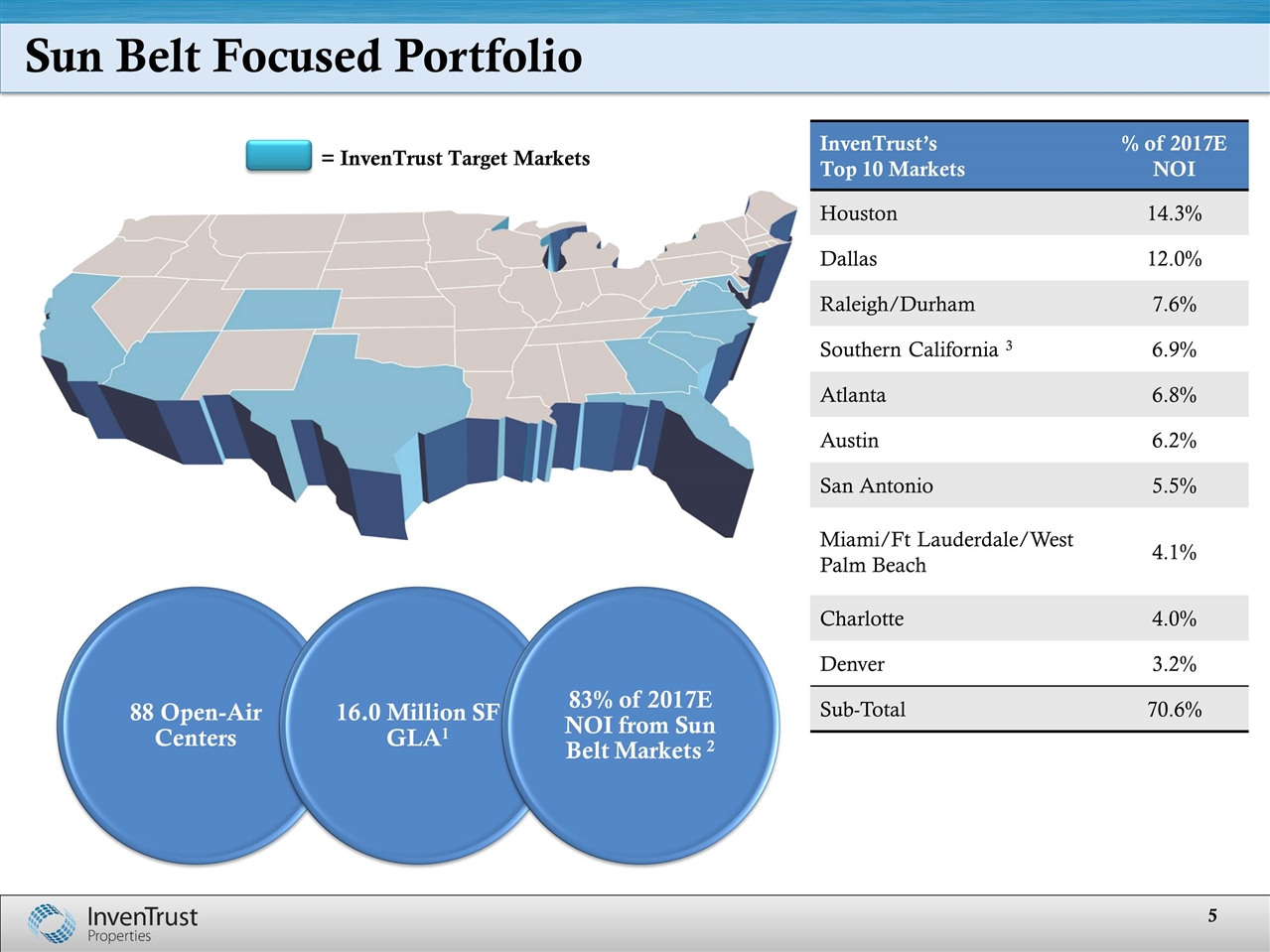

Sun Belt Focused Portfolio = InvenTrust Target Markets InvenTrust’s Top 10 Markets % of 2017E NOI Houston 14.3% Dallas 12.0% Raleigh/Durham 7.6% Southern California 3 6.9% Atlanta 6.8% Austin 6.2% San Antonio 5.5% Miami/Ft Lauderdale/West Palm Beach 4.1% Charlotte 4.0% Denver 3.2% Sub-Total 70.6% 88 Open-Air Centers 16.0 Million SF GLA 1 83% of 2017E NOI from Sun Belt Markets 2

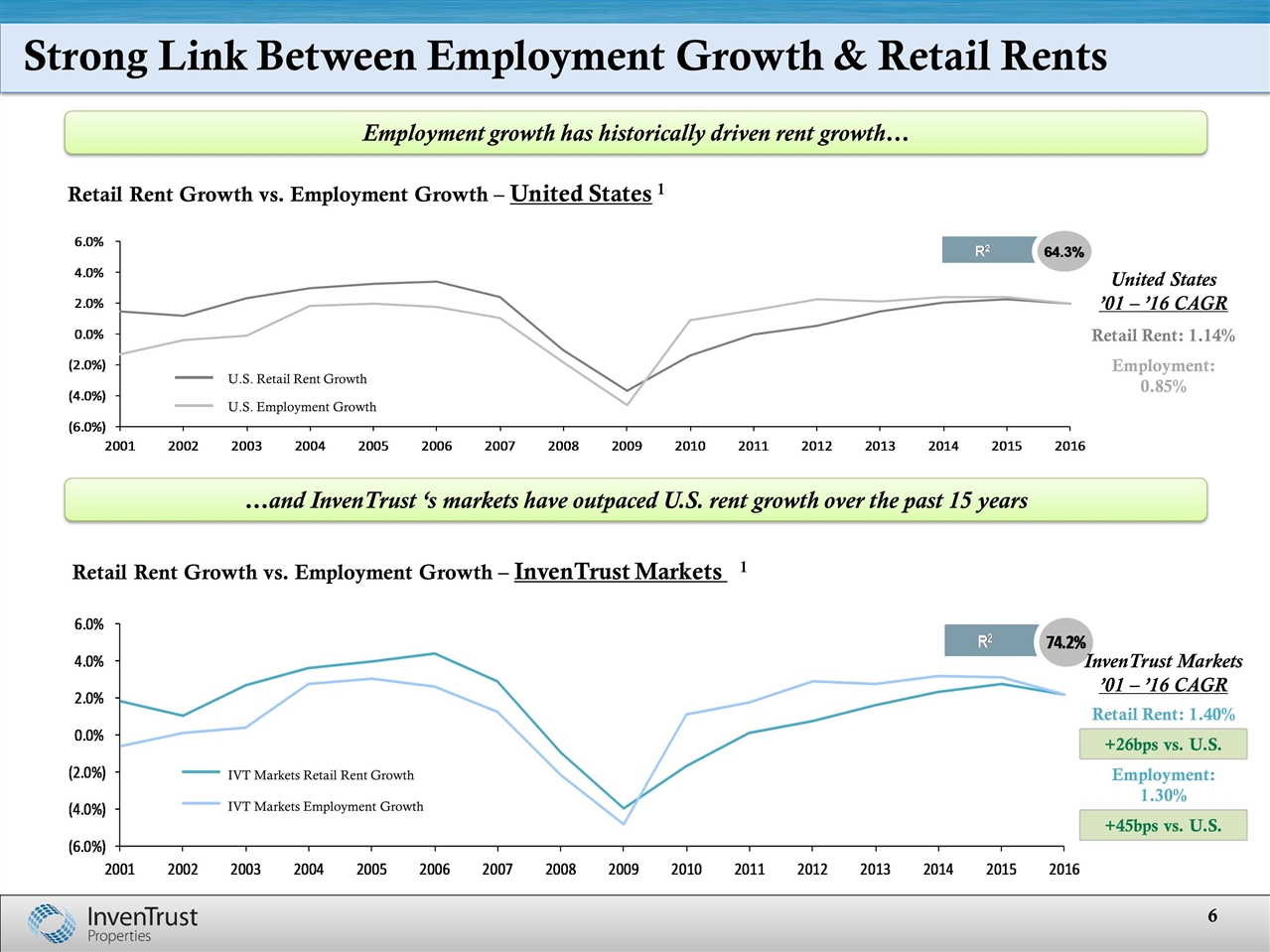

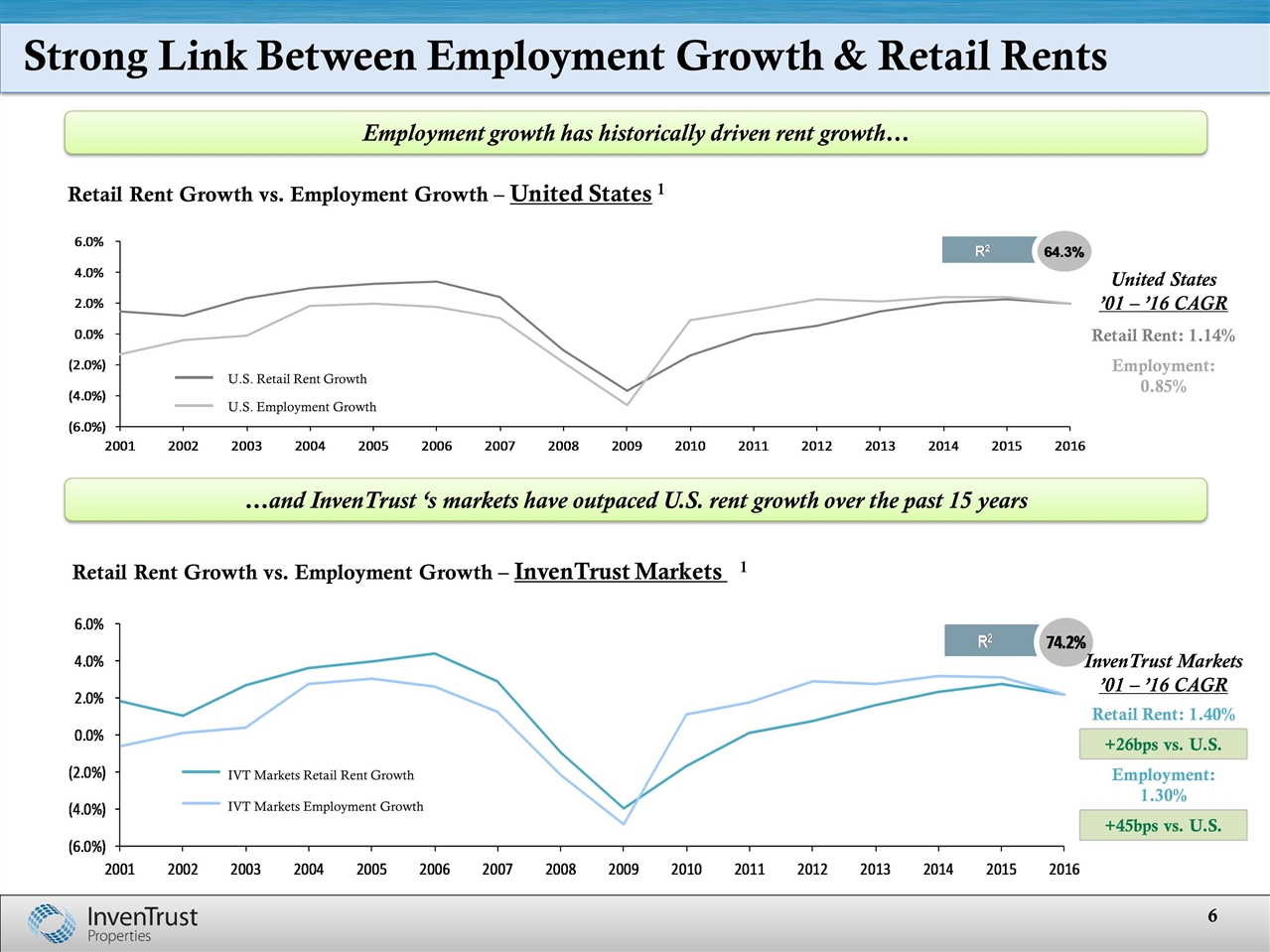

Strong Link Between Employment Growth & Retail Rents Retail Rent Growth vs. Employment Growth – United States 1 United States ’01 – ’16 CAGR Retail Rent: 1.14% Employment: 0.85% U.S. Retail Rent Growth U.S. Employment Growth Retail Rent Growth vs. Employment Growth – InvenTrust Markets 1 IVT Markets Retail Rent Growth IVT Markets Employment Growth InvenTrust Markets ’01 – ’16 CAGR Employment growth has historically driven rent growth… …and InvenTrust ‘s markets have outpaced U.S. rent growth over the past 15 years Retail Rent: 1.40% +26bps vs. U.S. Employment: 1.30% +45bps vs. U.S.

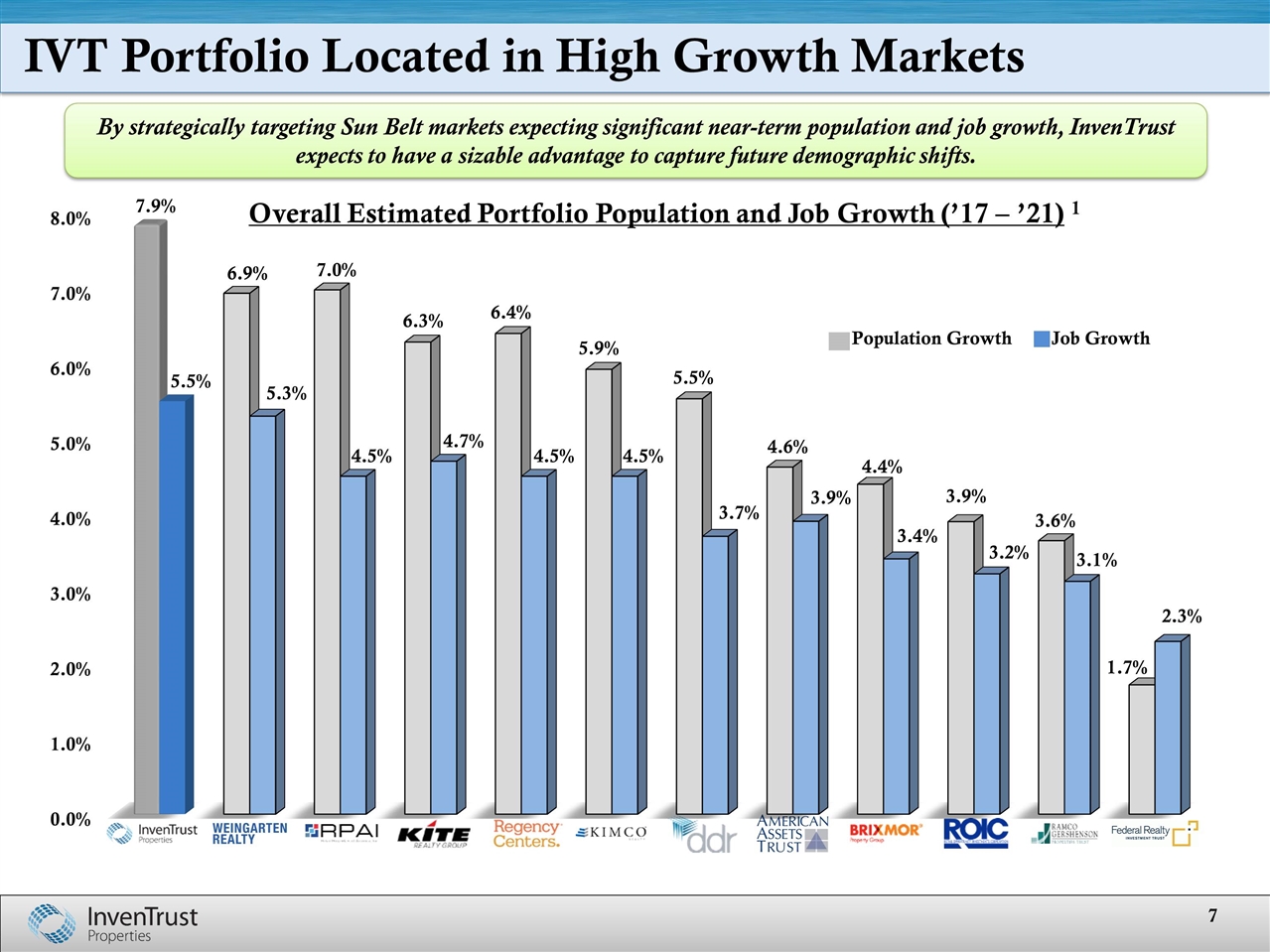

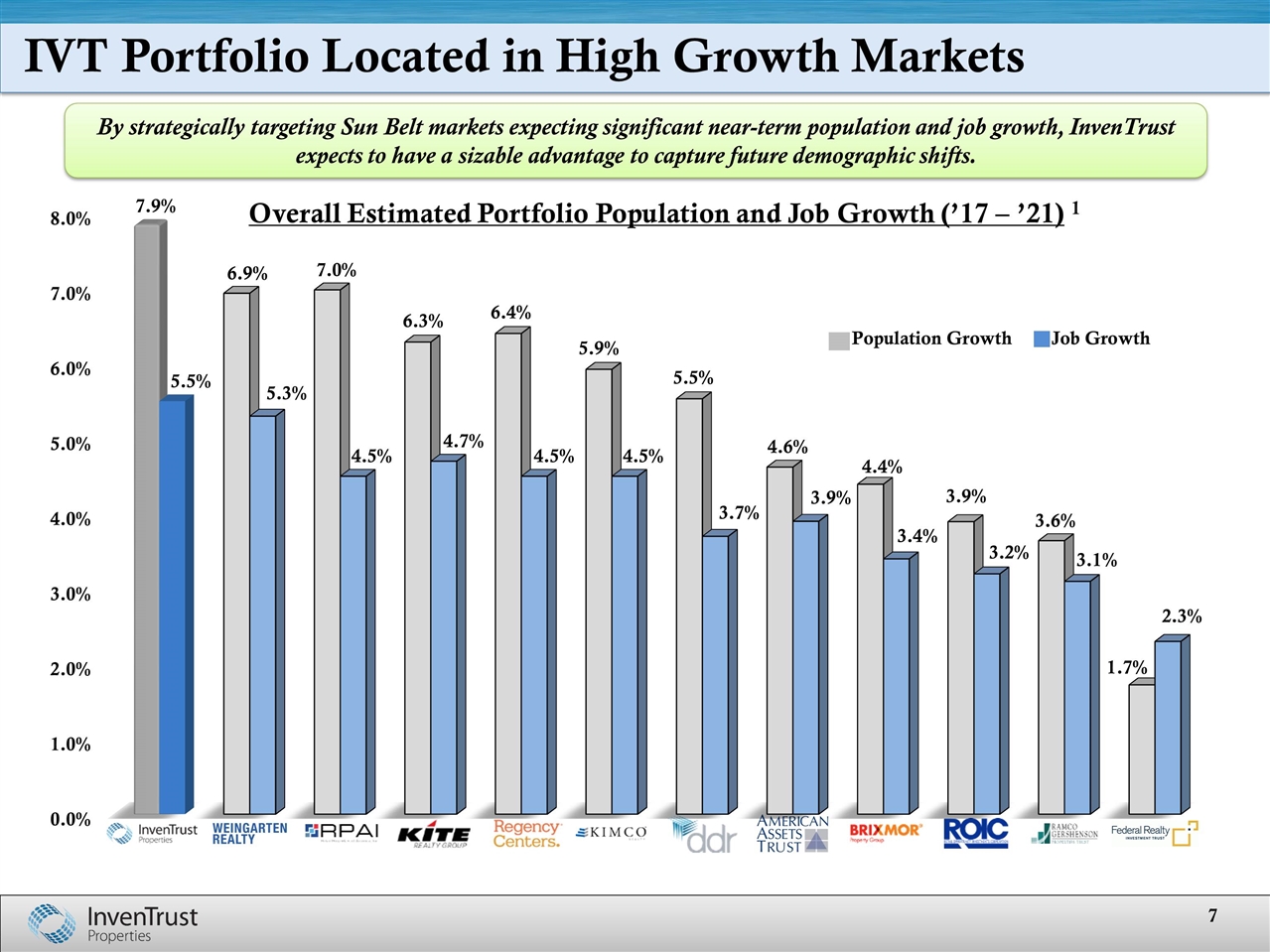

IVT Portfolio Located in High Growth Markets Overall Estimated Portfolio Population and Job Growth (’17 – ’21) 1 By strategically targeting Sun Belt markets expecting significant near-term population and job growth, InvenTrust expects to have a sizable advantage to capture future demographic shifts.

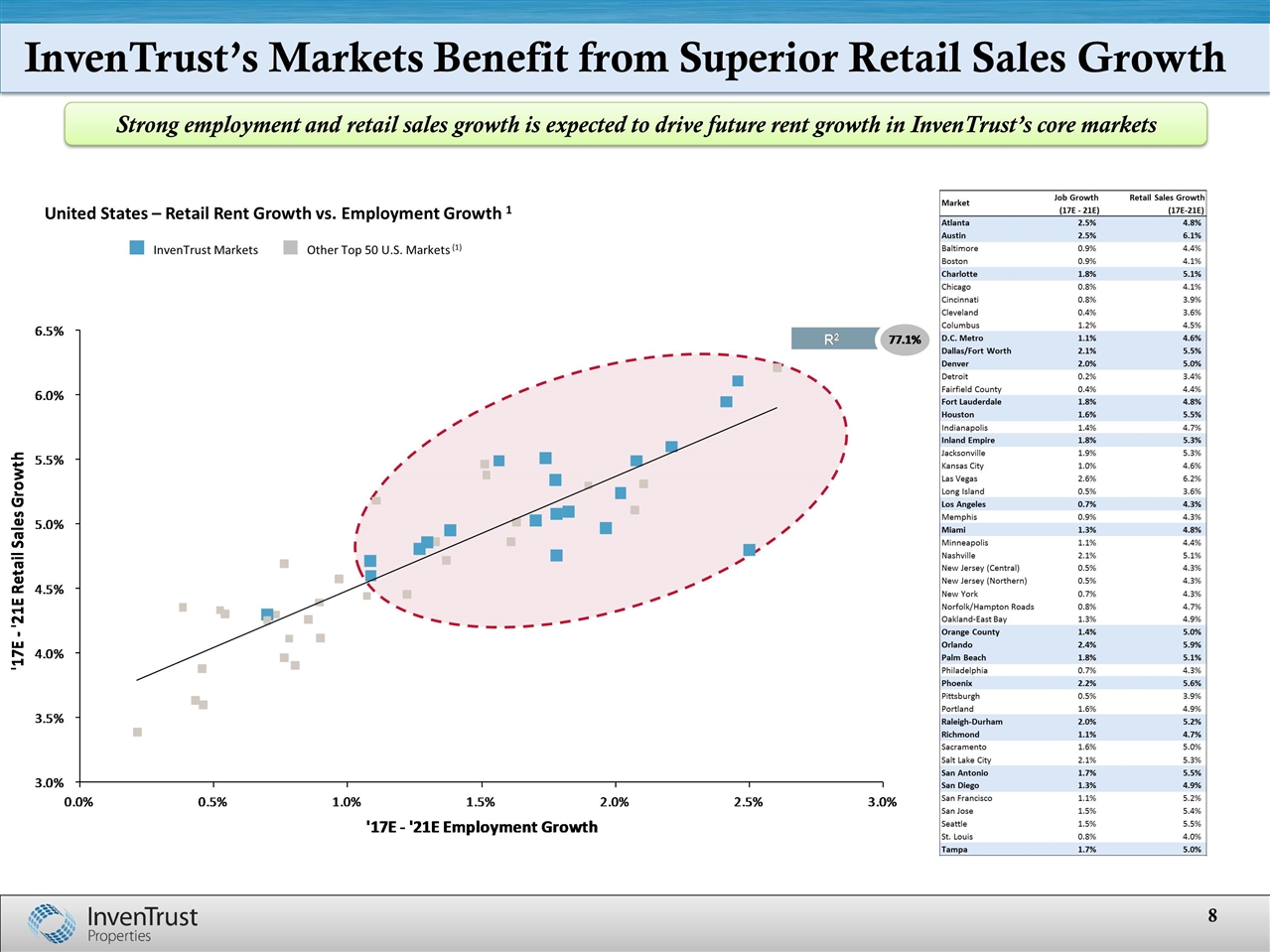

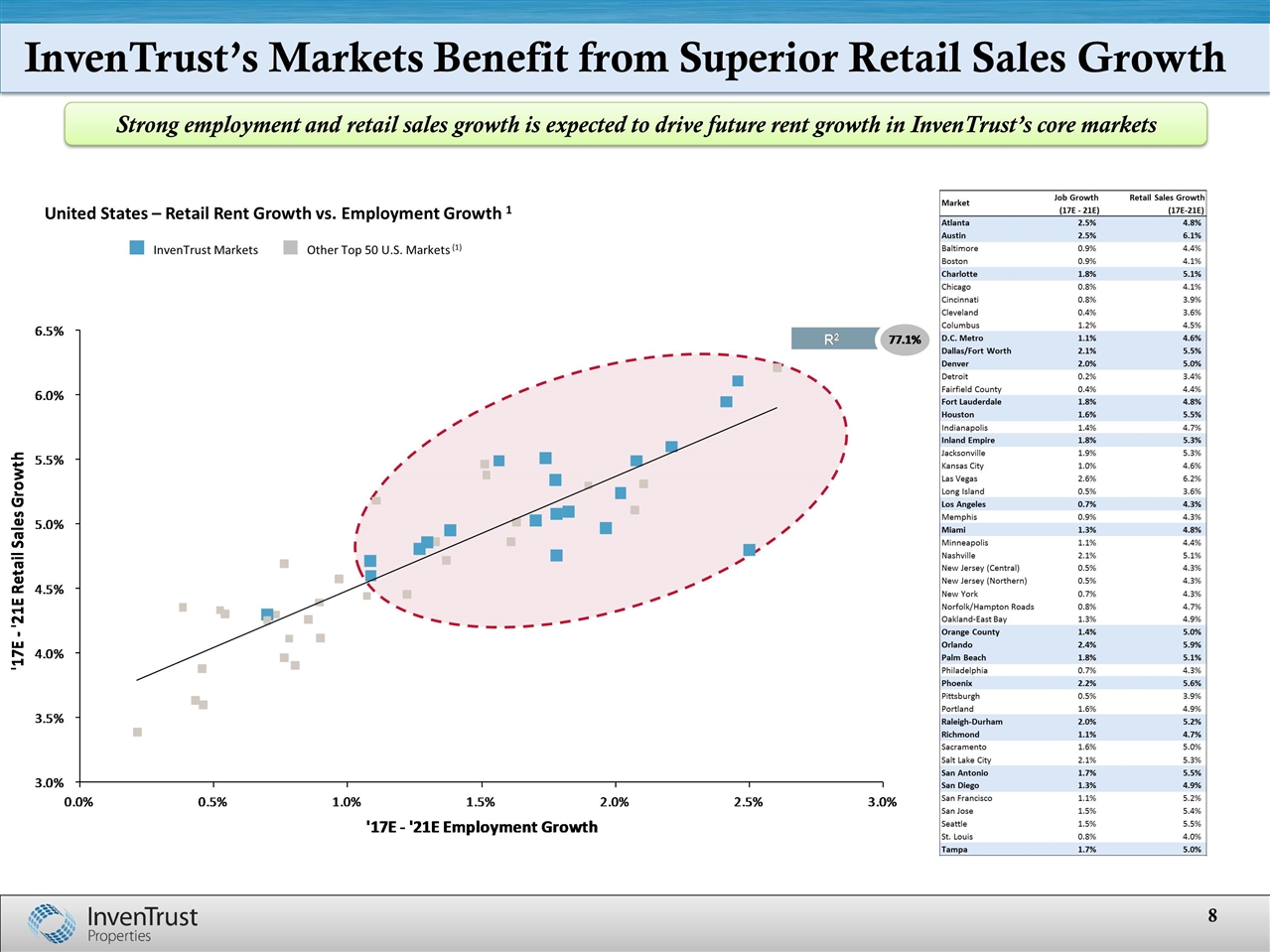

InvenTrust’s Markets Benefit from Superior Retail Sales Growth InvenTrust Markets Other Top 50 U.S. Markets (1) Strong employment and retail sales growth is expected to drive future rent growth in InvenTrust’s core markets United States – Retail Rent Growth vs. Employment Growth 1 Atlanta 2.5% 4.8% Austin 2.5% 6.1% Baltimore 0.9% 4.4% Boston 0.9% 4.1% Charlotte 1.8% 5.1% Chicago 0.8% 4.1% Cincinnati 0.8% 3.9% Cleveland 0.4% 3.6% Columbus 1.2% 4.5% D.C. Metro 1.1% 4.6% Dallas/Fort Worth 2.1% 5.5% Denver 2.0% 5.0% Detroit 0.2% 3.4% Fairfield County 0.4% 4.4% Fort Lauderdale 1.8% 4.8% Houston 1.6% 5.5% Indianapolis 1.4% 4.7% Inland Empire 1.8% 5.3% Jacksonville 1.9% 5.3% Kansas City 1.0% 4.6% Las Vegas 2.6% 6.2% Long Island 0.5% 3.6% Los Angeles 0.7% 4.3% Memphis 0.9% 4.3% Miami 1.3% 4.8% Minneapolis 1.1% 4.4% Nashville 2.1% 5.1% New Jersey (Central) 0.5% 4.3% New Jersey (Northern) 0.5% 4.3% New York 0.7% 4.3% Norfolk/Hampton Roads 0.8% 4.7% Oakland-East Bay 1.3% 4.9% Orange County 1.4% 5.0% Orlando 2.4% 5.9% Palm Beach 1.8% 5.1% Philadelphia 0.7% 4.3% Phoenix 2.2% 5.6% Pittsburgh 0.5% 3.9% Portland 1.6% 4.9% Raleigh-Durham 2.0% 5.2% Richmond 1.1% 4.7% Sacramento 1.6% 5.0% Salt Lake City 2.1% 5.3% San Antonio 1.7% 5.5% San Diego 1.3% 4.9% San Francisco 1.1% 5.2% San Jose 1.5% 5.4% Seattle 1.5% 5.5% St. Louis 0.8% 4.0% Tampa 1.7% 5.0% Job Growth (17E - 21E) Market Retail Sales Growth (17E-21E)

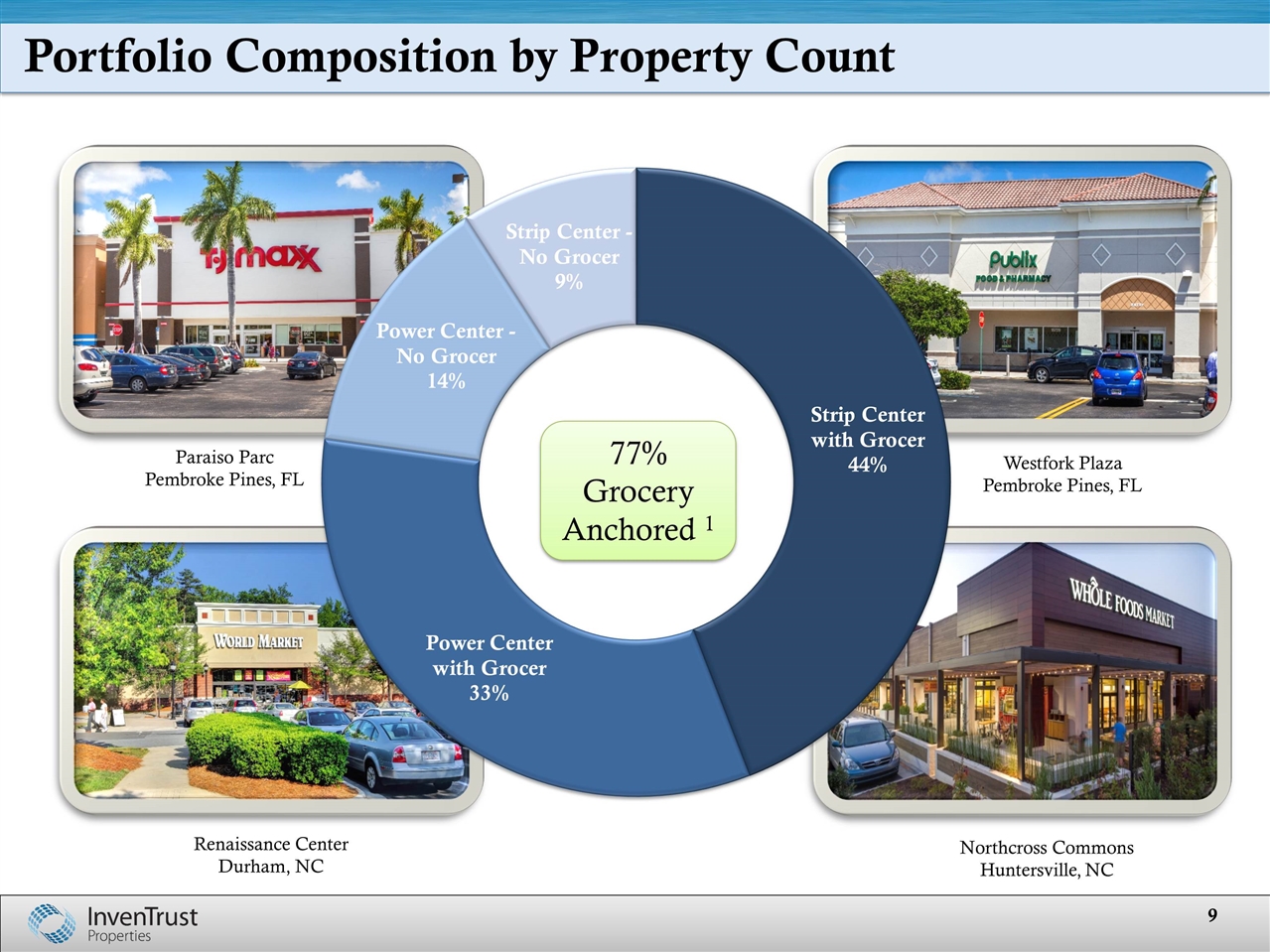

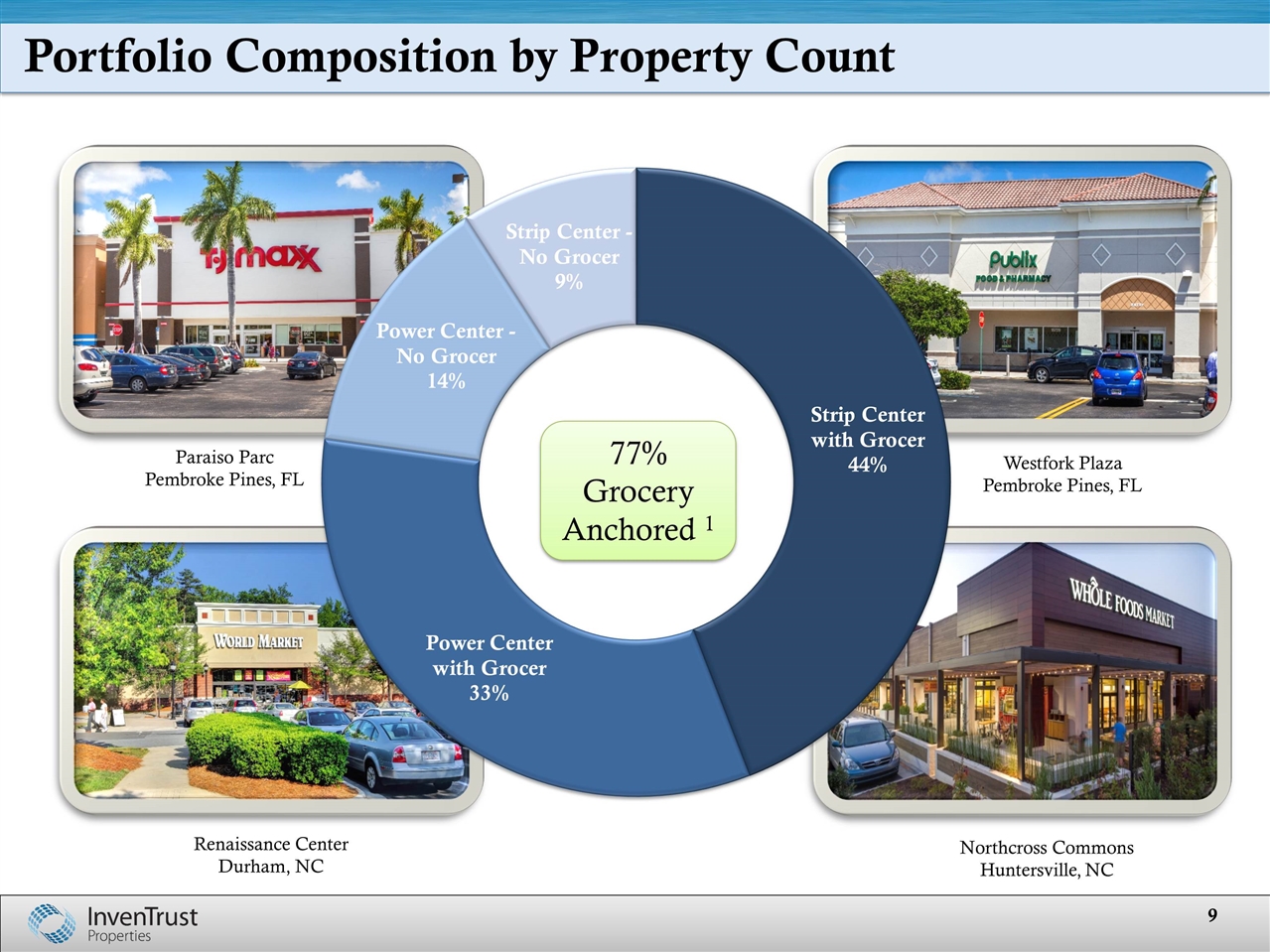

Portfolio Composition by Property Count 77% Grocery Anchored 1 Renaissance Center Durham, NC Westfork Plaza Pembroke Pines, FL Northcross Commons Huntersville, NC

Diversified & Balanced Tenant Concentration Top Tenant # Leases % of Total ABR ABR by Tenant 1 Tenant Credit Rating 2 28 3.9% $8.8 million A- 18 3.6% $8.2 million BBB- 21 2.7% $6.2 million B+ 10 2.5% $5.8 million BBB 11 1.9% $4.3 million N/R 7 1.8% $4.1 million B+ 13 1.7% $4.0 million BBB+ 14 1.6% $3.7 million BB- 6 1.5% $3.4 million N/R 11 1.5% $3.4 million BB Top 10 Tenants % of ABR – Only 14 tenants have an ABR exposure in excess of 1.0%

Driving Future Growth Through Selective Investment Strategy Simple, Focused & Disciplined The Right Centers in the Right Markets Significant Portfolio Transformation Completed Balance Sheet Provides Sizeable Capacity to Grow Portfolio Pursue Redevelopment Opportunities Identify Markets w/ Strong Demographics Source Off-Market Deals Through our Local Market Presence Acquire Properties that Drive NAV & Enhance NOI Growth Purchase Grocery-Anchored Community & Necessity-Based Power Centers Exited Markets with Low Growth & Declining Demos Sold Assets Where Value has been Maximized

Completed Capital Recycling Impact & Targets Acquisitions completed since 2015 Dispositions completed since 2015 Properties 17 41 GLA 1 3.1 million 4.2 million Value of Transactions $984 million $640 million Occupancy 2 95% 93% ABR PSF 3 $18.90 $13.14 2017E Acquisition / Disposition Target $750 million $400 million - $450 million InvenTrust has significantly improved the quality of its portfolio and operations with over $1.6 billion of transaction volume since embarking on our capital recycling efforts in 2015

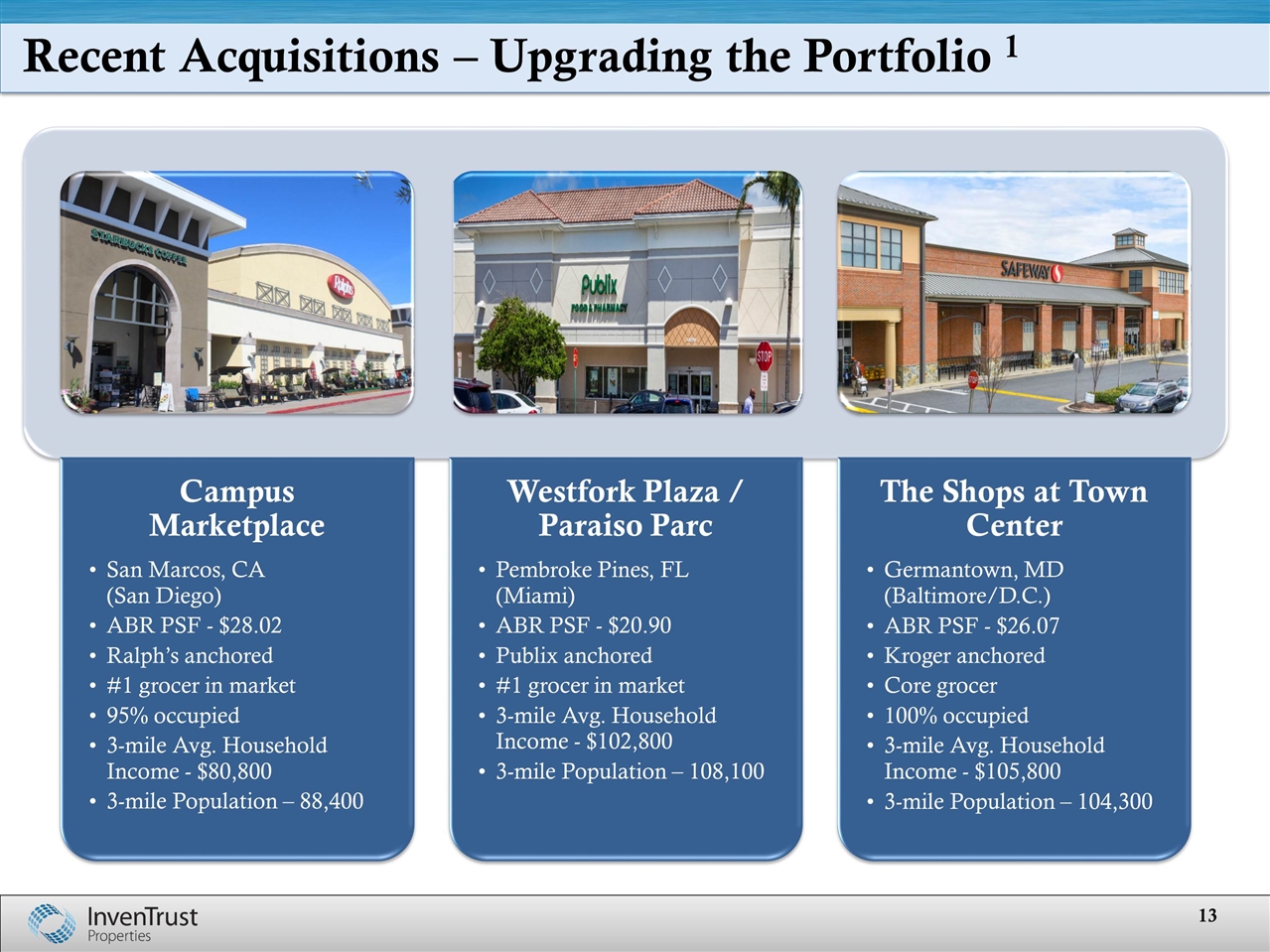

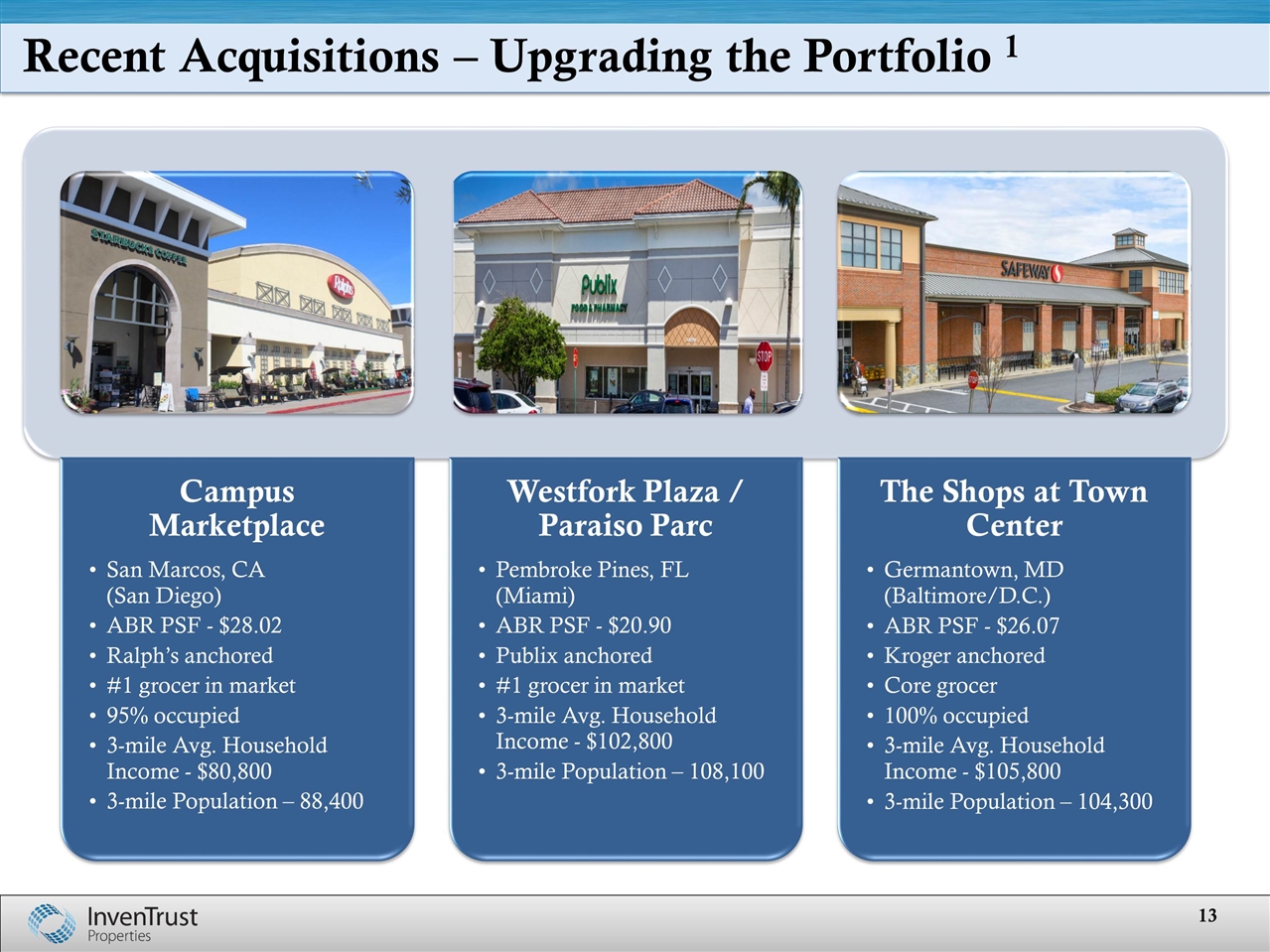

Recent Acquisitions – Upgrading the Portfolio 1 Campus Marketplace Westfork Plaza / Paraiso Parc The Shops at Town Center ABR PSF - $28.02 3-mile Population – 88,400 Pembroke Pines, FL (Miami) ABR PSF - $20.90 Publix anchored 3-mile Avg. Household Income - $102,800 3-mile Population – 108,100 Germantown, MD (Baltimore/D.C.) ABR PSF - $26.07 Kroger anchored 3-mile Avg. Household Income - $105,800 3-mile Population – 104,300 100% occupied 95% occupied Ralph’s anchored 3-mile Avg. Household Income - $80,800 San Marcos, CA (San Diego) #1 grocer in market Core grocer #1 grocer in market

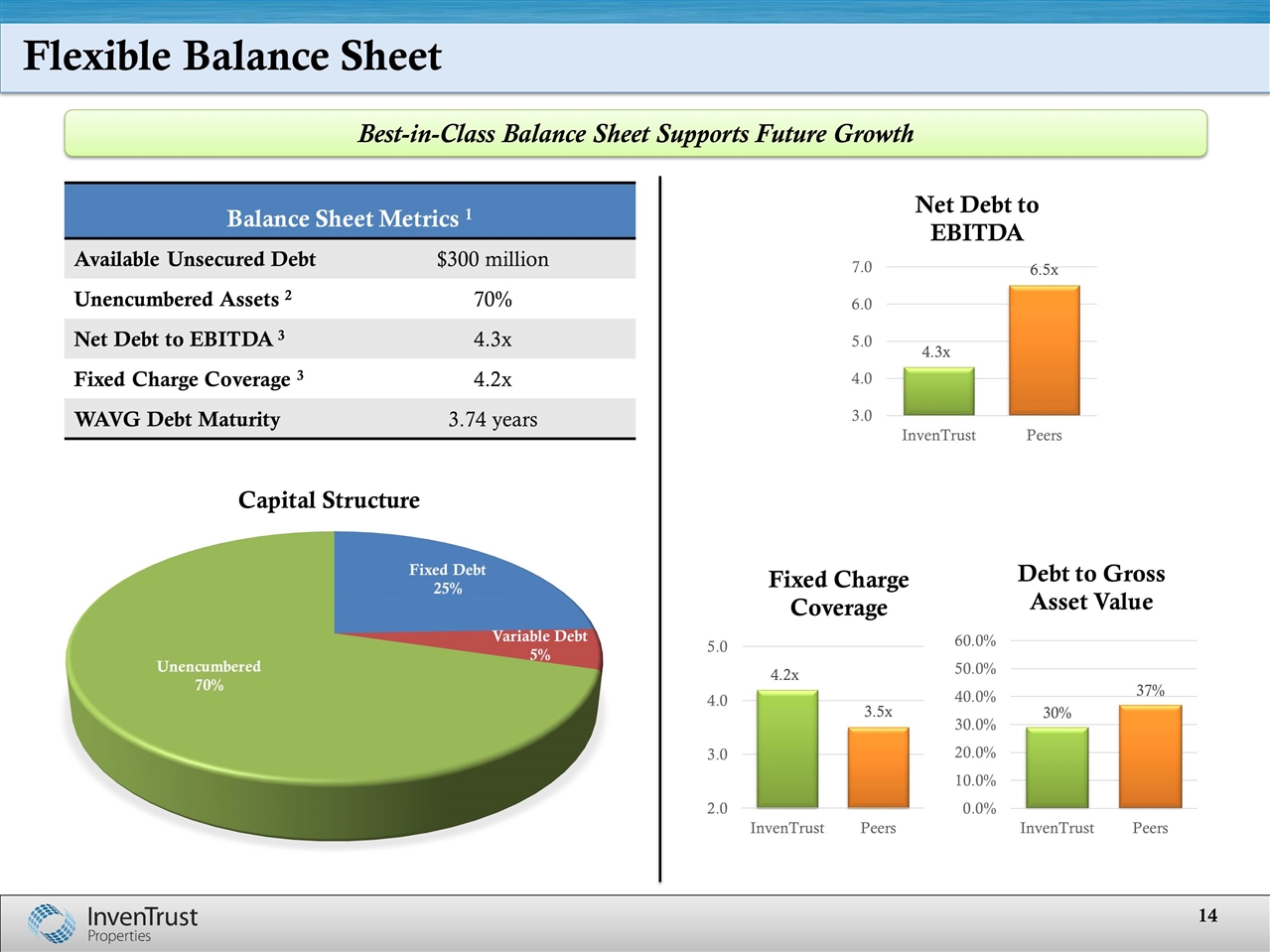

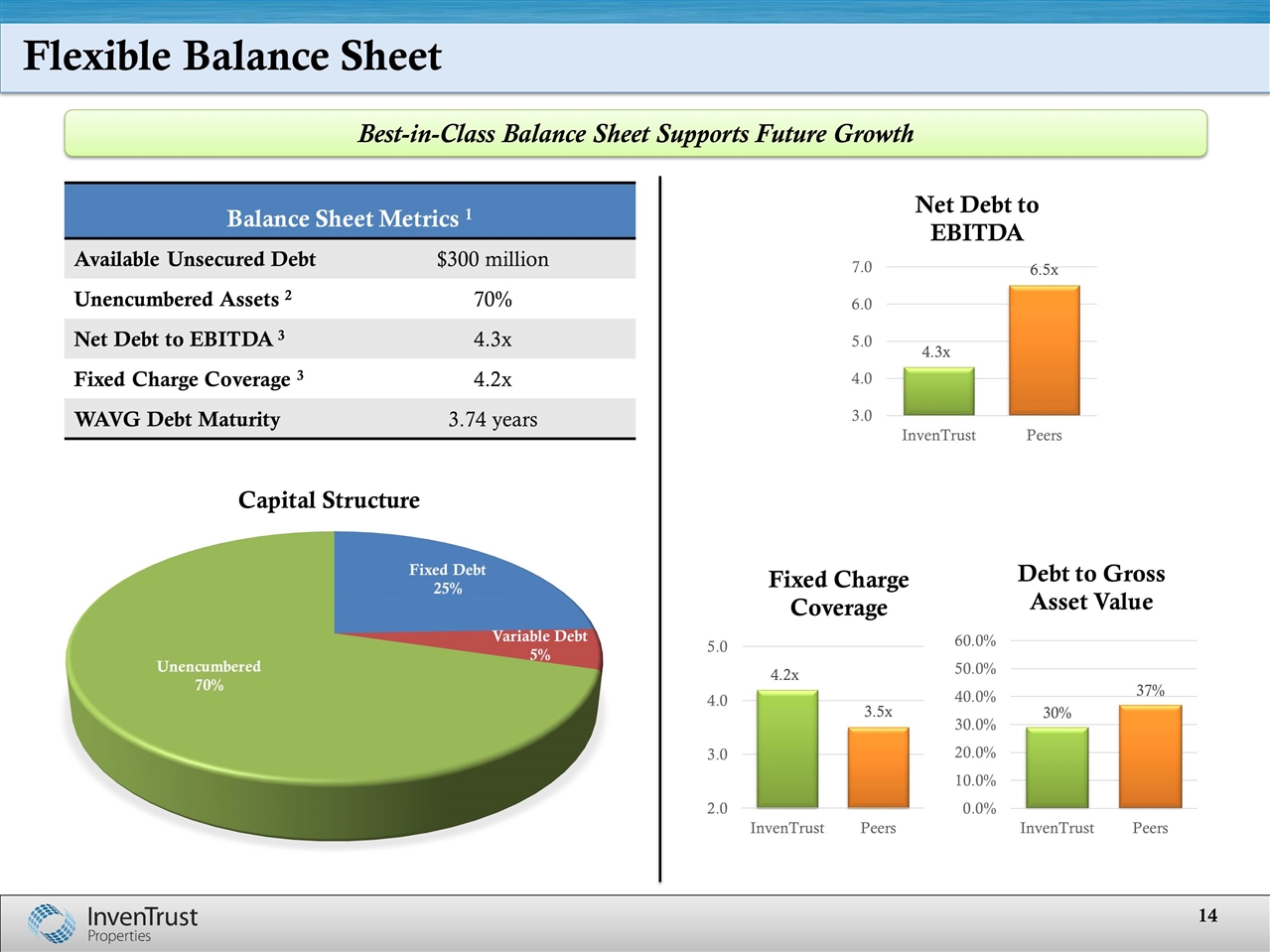

Flexible Balance Sheet Best-in-Class Balance Sheet Supports Future Growth Balance Sheet Metrics 1 Available Unsecured Debt $300 million Unencumbered Assets 2 70% Net Debt to EBITDA 3 4.3x Fixed Charge Coverage 3 4.2x WAVG Debt Maturity 3.74 years Capital Structure

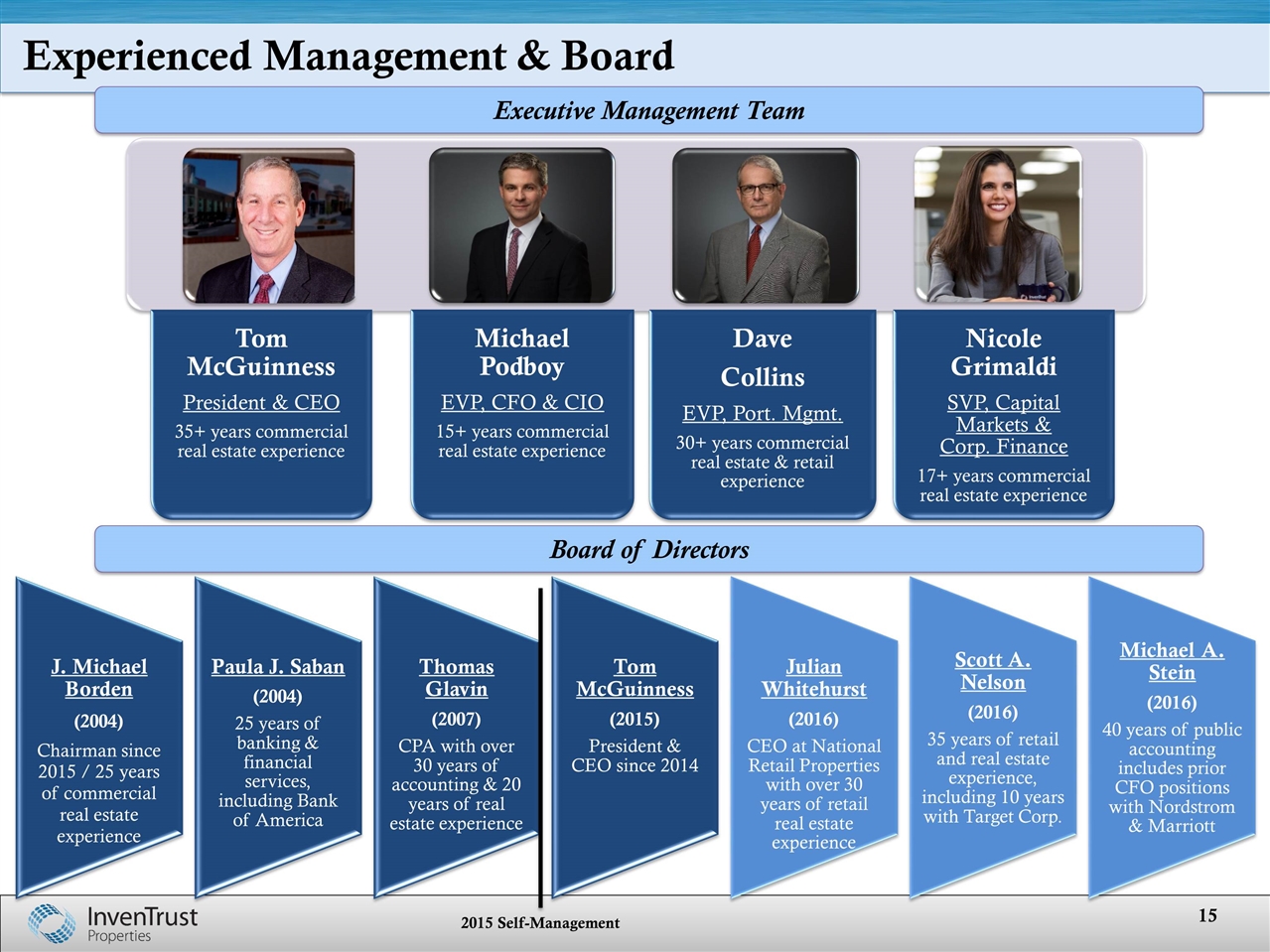

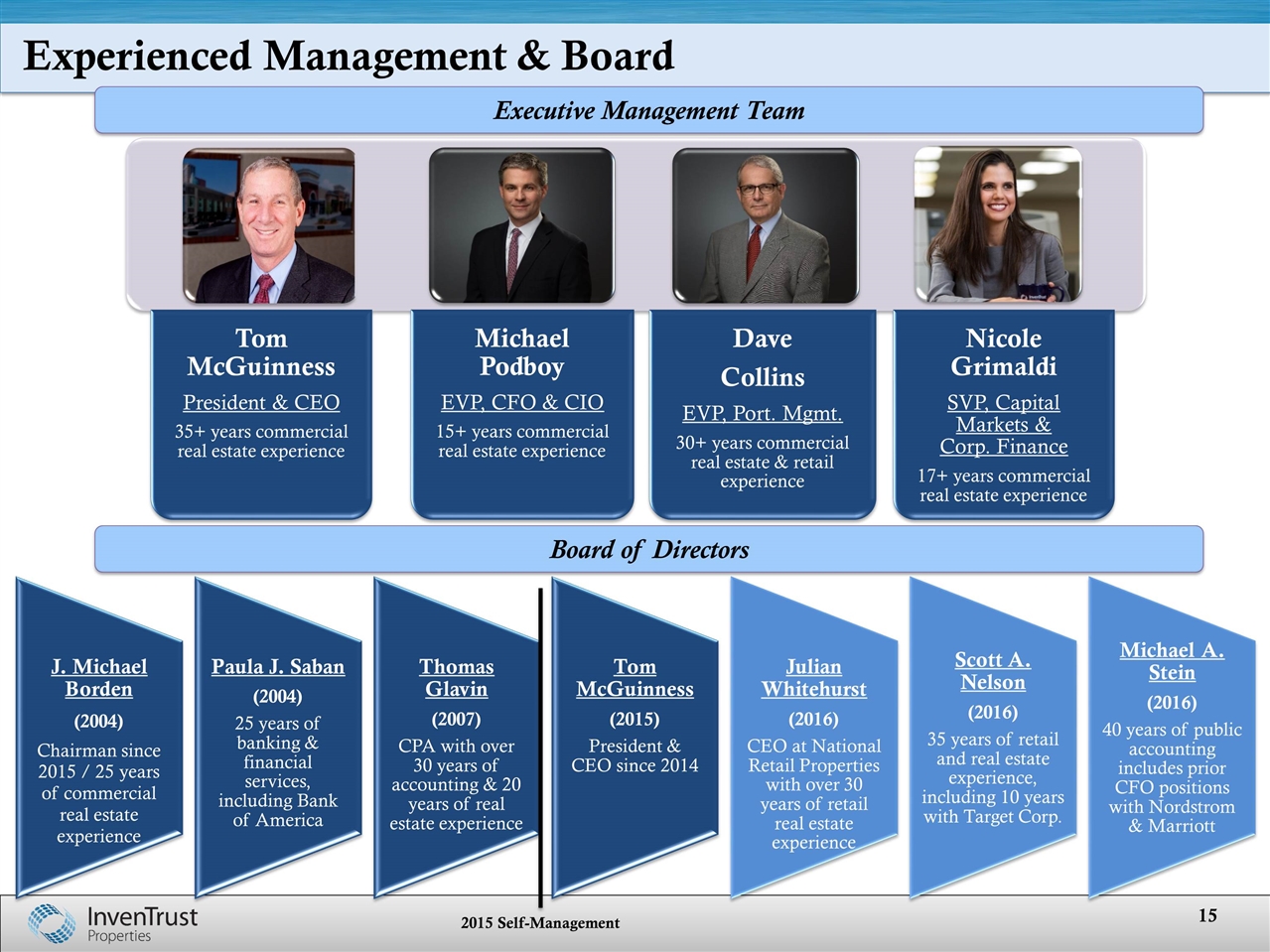

Experienced Management & Board Executive Management Team Board of Directors 2015 Self-Management J. Michael Borden (2004) Chairman since 2015 / 25 years of commercial real estate experience Tom McGuinness (2015) President & CEO since 2014 Paula J. Saban ( 2004 ) 25 years of banking & financial services, including Bank of America Michael A. Stein (2016) 40 years of public accounting includes prior CFO positions with Nordstrom & Marriott Thomas Glavin (2007) CPA with over 30 years of accounting & 20 years of real estate experience Scott A. Nelson (2016) 35 years of retail and real estate experience, including 10 years with Target Corp. Julian Whitehurst (2016) CEO at National Retail Properties with over 30 years of retail real estate experience Tom McGuinness President & CEO 35+ years commercial real estate experience Dave Collins EVP, Port. Mgmt. 30+ years commercial real estate & retail experience Michael Podboy EVP, CFO & CIO 15+ years commercial real estate experience Nicole Grimaldi SVP, Capital Markets & Corp. Finance 17+ years commercial real estate experience

Why InvenTrust? Premium Assets Within Select Sun Belt Markets Strong Management Team Able to Execute on Focused Strategic Vision Superior Asset Quality: $16.49 ABR PSF 2 Necessity-Based Portfolio of Assets: $3.5 Billion 1 Stable Growth Profile: 2017 – 2020E Same Store NOI Growth Target of 1.25% – 3.0% Flexible Capital Structure Supports Growth: Net Debt / EBITDA Target of 4.0x - 5.0x

Appendix

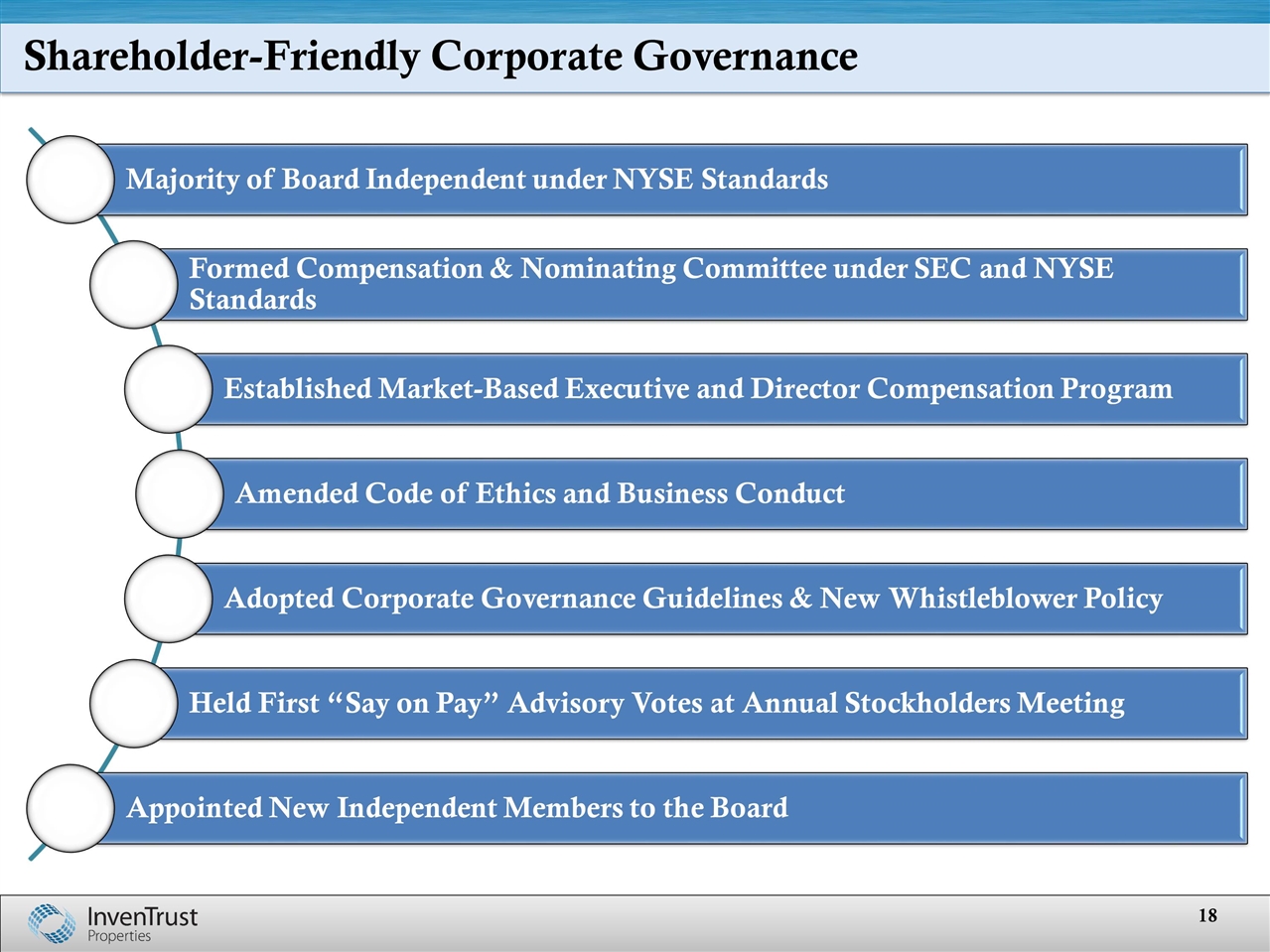

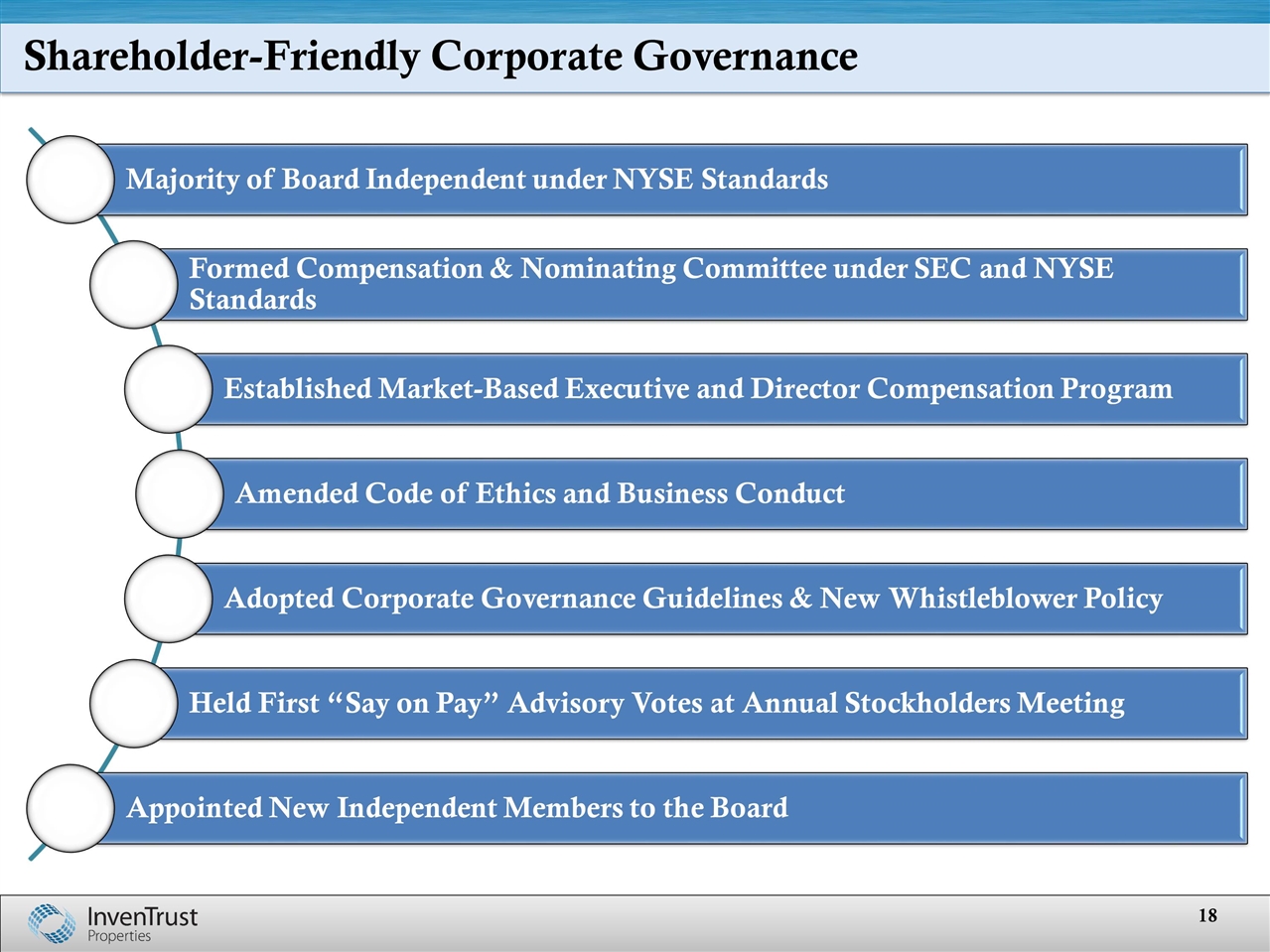

Shareholder-Friendly Corporate Governance Majority of Board Independent under NYSE Standards Formed Compensation & Nominating Committee under SEC and NYSE Standards Established Market-Based Executive and Director Compensation Program Amended Code of Ethics and Business Conduct Held First “Say on Pay” Advisory Votes at Annual Stockholders Meeting Appointed New Independent Members to the Board Adopted Corporate Governance Guidelines & New Whistleblower Policy

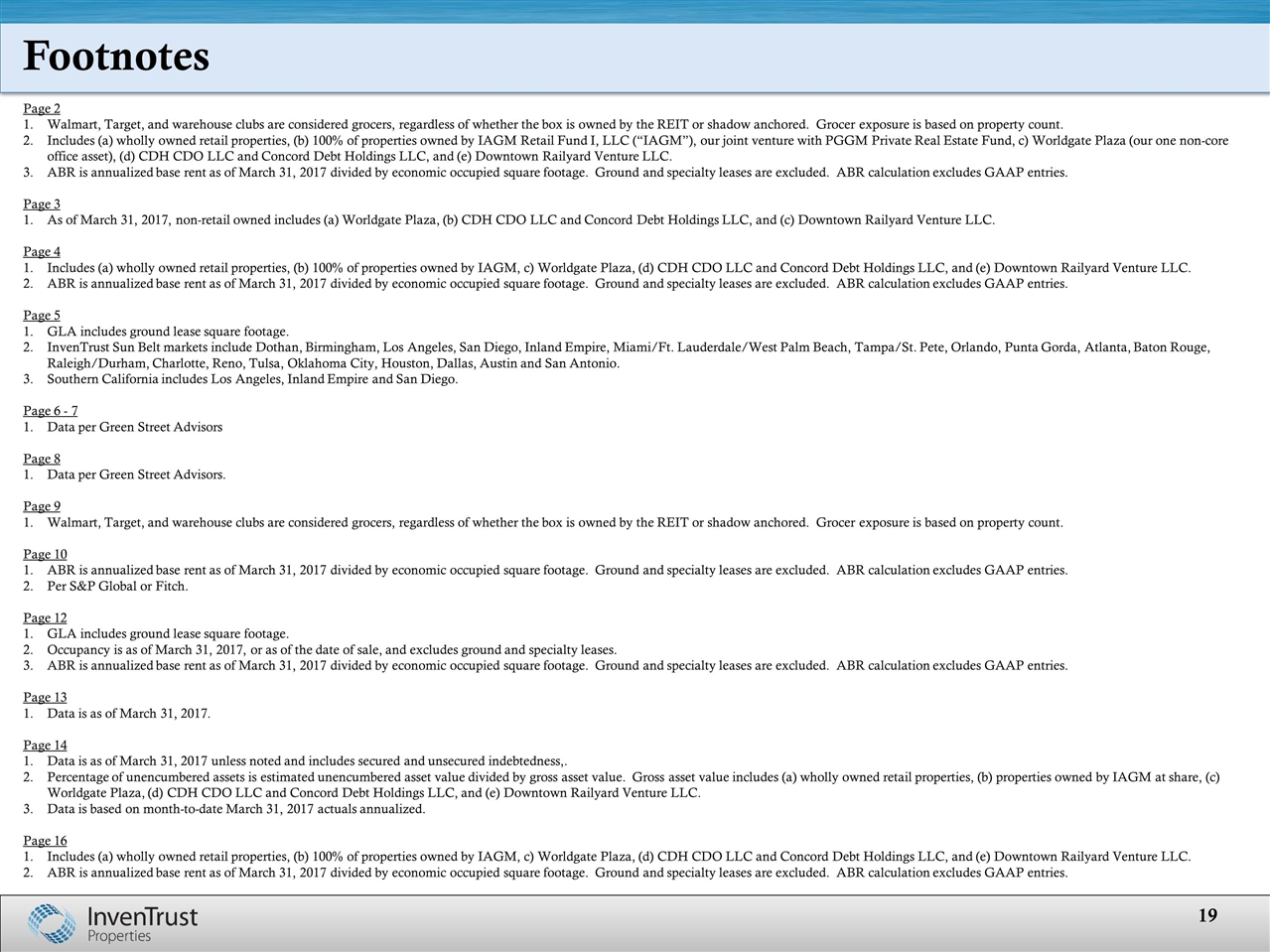

Footnotes Page 2 Walmart, Target, and warehouse clubs are considered grocers, regardless of whether the box is owned by the REIT or shadow anchored. Grocer exposure is based on property count. Includes (a) wholly owned retail properties, (b) 100% of properties owned by IAGM Retail Fund I, LLC (“IAGM”), our joint venture with PGGM Private Real Estate Fund, c) Worldgate Plaza (our one non-core office asset), (d) CDH CDO LLC and Concord Debt Holdings LLC, and (e) Downtown Railyard Venture LLC. ABR is annualized base rent as of March 31, 2017 divided by economic occupied square footage. Ground and specialty leases are excluded. ABR calculation excludes GAAP entries. Page 3 As of March 31, 2017, non-retail owned includes (a) Worldgate Plaza, (b) CDH CDO LLC and Concord Debt Holdings LLC, and (c) Downtown Railyard Venture LLC. Page 4 Includes (a) wholly owned retail properties, (b) 100% of properties owned by IAGM, c) Worldgate Plaza, (d) CDH CDO LLC and Concord Debt Holdings LLC, and (e) Downtown Railyard Venture LLC. ABR is annualized base rent as of March 31, 2017 divided by economic occupied square footage. Ground and specialty leases are excluded. ABR calculation excludes GAAP entries. Page 5 GLA includes ground lease square footage. InvenTrust Sun Belt markets include Dothan, Birmingham, Los Angeles, San Diego, Inland Empire, Miami/Ft. Lauderdale/West Palm Beach, Tampa/St. Pete, Orlando, Punta Gorda, Atlanta, Baton Rouge, Raleigh/Durham, Charlotte, Reno, Tulsa, Oklahoma City, Houston, Dallas, Austin and San Antonio. Southern California includes Los Angeles, Inland Empire and San Diego. Page 6 - 7 Data per Green Street Advisors Page 8 Data per Green Street Advisors. Page 9 Walmart, Target, and warehouse clubs are considered grocers, regardless of whether the box is owned by the REIT or shadow anchored. Grocer exposure is based on property count. Page 10 ABR is annualized base rent as of March 31, 2017 divided by economic occupied square footage. Ground and specialty leases are excluded. ABR calculation excludes GAAP entries. Per S&P Global or Fitch. Page 12 GLA includes ground lease square footage. Occupancy is as of March 31, 2017, or as of the date of sale, and excludes ground and specialty leases. ABR is annualized base rent as of March 31, 2017 divided by economic occupied square footage. Ground and specialty leases are excluded. ABR calculation excludes GAAP entries. Page 13 Data is as of March 31, 2017. Page 14 Data is as of March 31, 2017 unless noted and includes secured and unsecured indebtedness,. Percentage of unencumbered assets is estimated unencumbered asset value divided by gross asset value. Gross asset value includes (a) wholly owned retail properties, (b) properties owned by IAGM at share, (c) Worldgate Plaza, (d) CDH CDO LLC and Concord Debt Holdings LLC, and (e) Downtown Railyard Venture LLC. Data is based on month-to-date March 31, 2017 actuals annualized. Page 16 Includes (a) wholly owned retail properties, (b) 100% of properties owned by IAGM, c) Worldgate Plaza, (d) CDH CDO LLC and Concord Debt Holdings LLC, and (e) Downtown Railyard Venture LLC. ABR is annualized base rent as of March 31, 2017 divided by economic occupied square footage. Ground and specialty leases are excluded. ABR calculation excludes GAAP entries.