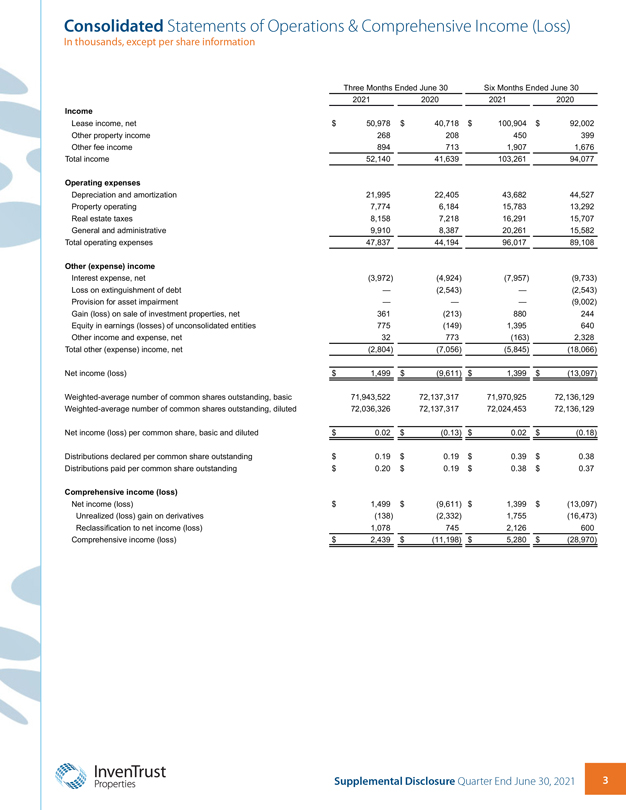

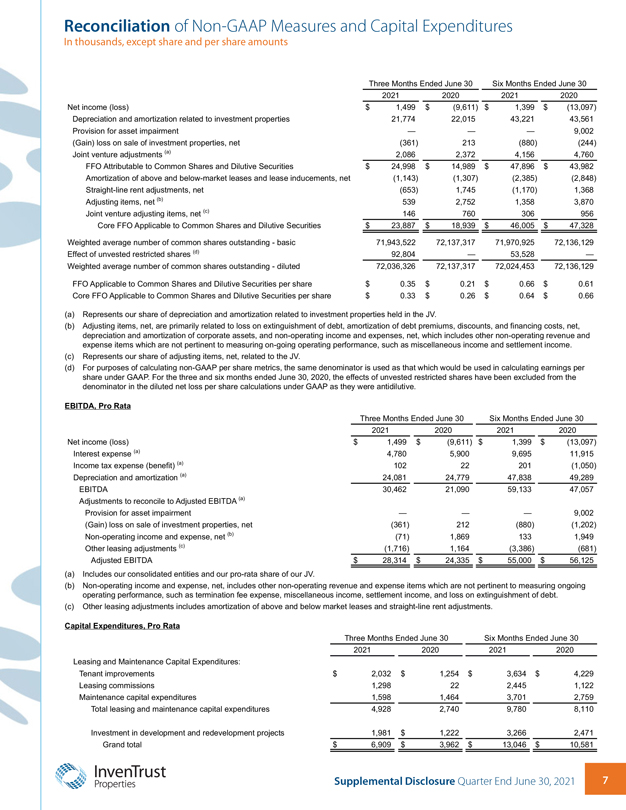

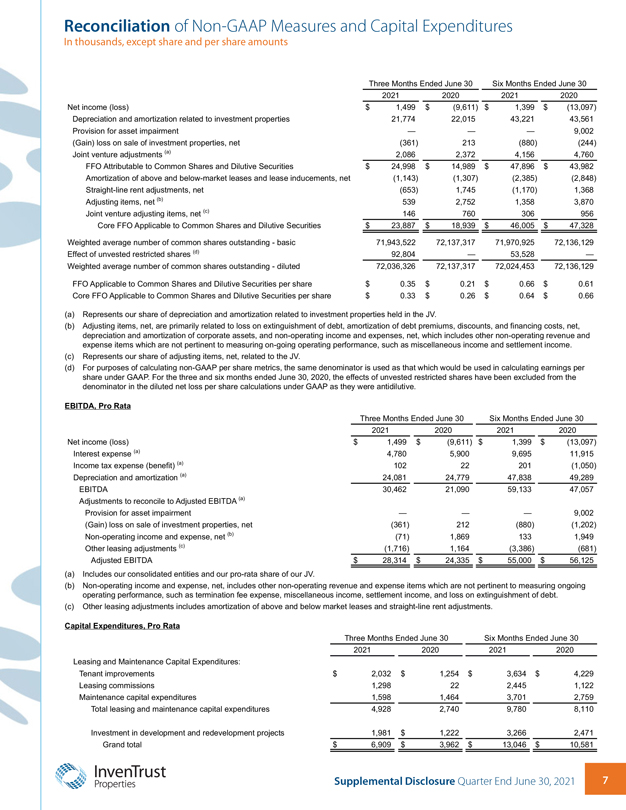

Reconciliation of Non-GAAP Measures and Capital Expenditures In thousands, except share and per share amounts Three Months Ended June 30 Six Months Ended June 30 2021 2020 2021 2020 Net Income (loss) $ 1,499 $ (9,611) $ 1,399 $ (13,097) Depreciation and amortization related to investment properties 21,774 22,015 43,221 43,561 Provision for asset impairment 9.002 (Gain) loss on sale of investment properties, net (361) 213 (880) (244) Joint venture adjustments 2,086 2,372 4,156 4,760 FFO Attributable to Common Shares and Dilutive Securities 24,998 $ 14,989 $ 47,896 $ 43,982 Amortization of above and below-market leases and lease inducements, net (1,143) (1,307) (2,385) (2,848) Straight-line rent adjustments, net (653) 1,745 (1,170) 1,368 Adjusting items, net P 539 2,752 1,358 3,870 Joint venture adjusting items, net i 146 760 306 956 Core FFO Applicable to Common Shares and Dilutive Securities $ 23,887 $ 18,939 $ 46,006 S 47,328 Weighted average number of common shares outstanding - basic 71,943,522 72,137,317 71,970,925 72,136,120 Effect of unvested restricted shares 92,804 53,528 Weighted average number of common shares outstanding - diluted 72,036,326 72,137,317 72,024,453 72,136, 129 FFO Applicable to Common Shares and Dilutive Securities per share $ 0.35 $ 0.21 $ 0.66 $ 0.61 Core FFO Applicable to Common Shares and Dilutive Securities per share $ 0.33 $ 0.26 $ 0.64 $ 0.66 (a) Represents our share of depreciation and amortization related to investment properties held in the JV. (b) Adjusting items, net, are primarily related to loss on extinguishment of debt, amortization of debt premiums, discounts, and financing costs, net, depreciation and amortization of corporate assets, and non-operating income and expenses, net, which includes other non-operating revenue and expense items which are not pertinent to measuring on-going operating performance, such as miscellaneous income and settlement income. (c) Represents our share of adjusting items, net, related to the JV. (d) For purposes of calculating non-GAAP per share metrics, the same denominator is used as that which would be used in calculating earnings per share under GAAP. For the three and six months ended June 30, 2020, the effects of unvested restricted shares have been excluded from the denominator in the diluted net loss per share calculations under GAAP as they were antidilutive. EBITDA. Pro Rata Three Months Ended June 30 Six Months Ended June 30 2021 2020 2021 2020 Net Income (loss) $ 1,499 $ (9,611) S 1,399 $ (13,097) Interest expense 4,780 5,900 9,695 11,915 Income tax expense (benefit) 102 22 201 (1,050) Depreciation and amortization 24,081 24,779 47,838 49,289 EBITDA 30,462 21,090 59,133 47,057 Adjustments to reconcile to Adjusted EBITDA Provision for asset impairment 9,002 (Gain) loss on sale of investment properties, net (361) 212 (880) (1.202) Non-operating income and expense, net (71) 1,869 133 1,949 Other leasing adjustments (1,716) 1,164 (3,386) (681) Adjusted EBITDA $ 28,314 $ 24.335 $ 55,000 $ 56,125 (a) Includes our consolidated entities and our pro-rata share of our JV. (b) Non-operating income and expense, net, includes other non-operating revenue and expense items which are not pertinent to measuring ongoing operating performance, such as termination fee expense, miscellaneous income, settlement income, and loss on extinguishment of debt. (c) Other leasing adjustments includes amortization of above and below market leases and straight-line rent adjustments. Capital Expenditures, Pro Rata Three Months Ended June 30 Six Months Ended June 30 2021 2020 2021 2020 Leasing and Maintenance Capital Expenditures: Tenant improvements $ 2,032 $ 1,254 $ 3,634 $ 4,229 Leasing commissions 1,298 22 2,445 1,122 Maintenance capital expenditures 1,598 1,464 3,701 2,759 Total leasing and maintenance capital expenditures 4,928 2,740 9,780 8,110 Investment in development and redevelopment projects Grand total 1,981 $ 6,909 $ 1,222 3,962 $ 3,266 13,046 $ 2,471 10.581 InvenTrust Properties Supplemental Disclosure Quarter End June 30, 2021 7