INVESTOR PRESENTATION March 2019

Forward Looking Statements Forward-Looking Statements in this presentation, which are not as updated by any subsequent Quarterly Report on Form 10-Q, in historical facts, are forward-looking statements within the meaning each case as filed with the Securities and Exchange Commission. of the Private Securities Litigation Reform Act of 1995. Forward- InvenTrust intends that such forward-looking statements be subject looking statements are statements that are not historical, including to the safe harbors created by Section 27A of the Securities Act of statements regarding management’s intentions, beliefs, 1933, as amended, and Section 21E of the Securities Exchange Act expectations, representation, plans or predictions of the future and of 1934, as amended, except as may be required by applicable law. are typically identified by words such as “may,” “could,” “expect,” We caution you not to place undue reliance on any forward-looking “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” statements, which are made as of the date of this presentation. We “potential,” “continue,” “likely,” “will,” “would” and variations of undertake no obligation to update publicly any of these forward- these terms and similar expressions, or the negative of these terms looking statements to reflect actual results, new information or or similar expressions. Such forward-looking statements are future events, changes in assumptions or changes in other factors necessarily based upon estimates and assumptions that, while affecting forward-looking statements, except to the extent required considered reasonable by us and our management, are inherently by applicable laws. If we update one or more forward-looking uncertain. Factors that may cause actual results to differ materially statements, no inference should be drawn that we will make from current expectations include, among others, market, political additional updates with respect to those or other forward-looking and economic volatility experienced by the U.S. economy or real statements. estate industry as a whole, and the regional and local political and economic conditions in the markets in which our properties are The companies depicted in the photographs or otherwise herein located; competitive business market conditions experienced by may have proprietary interests in their trade names and trademarks our retail tenants and shadow anchor retailers, such as challenges and nothing herein shall be considered to be an endorsement, competing with e-commerce channels; our ability to execute on our authorization or approval of InvenTrust Properties Corp. by the business strategy and enhance stockholder value; and our ability to companies. Further, none of these companies are affiliated with manage our debt. For further discussion of factors that could InvenTrust Properties Corp. in any manner. materially affect the outcome of our forward-looking statements and our future results and financial condition, see the Risk Factors included in InvenTrust’s most recent Annual Report on Form 10-K, 2

Meeting Topics 1. 2019 Strategy 2. InvenTrust’s Journey 3. Superior Balance Sheet a. Supporting IVT’s Distribution Rate & Third Consecutive 3% Increase in Distribution Rate b. Driving the Execution of IVT’s Premier Grocery-Anchored Portfolio Strategy 4. Evaluation of Market Conditions as it Relates to a Potential Liquidity Strategy 3

2019 Strategy Maintain a flexible balance sheet Grow property income through favorable leasing, redevelopment & expense savings Continue to evaluate disposition opportunities & execute on acquisition strategy Continue to improve public company readiness and monitor market conditions for potential final liquidity event 4

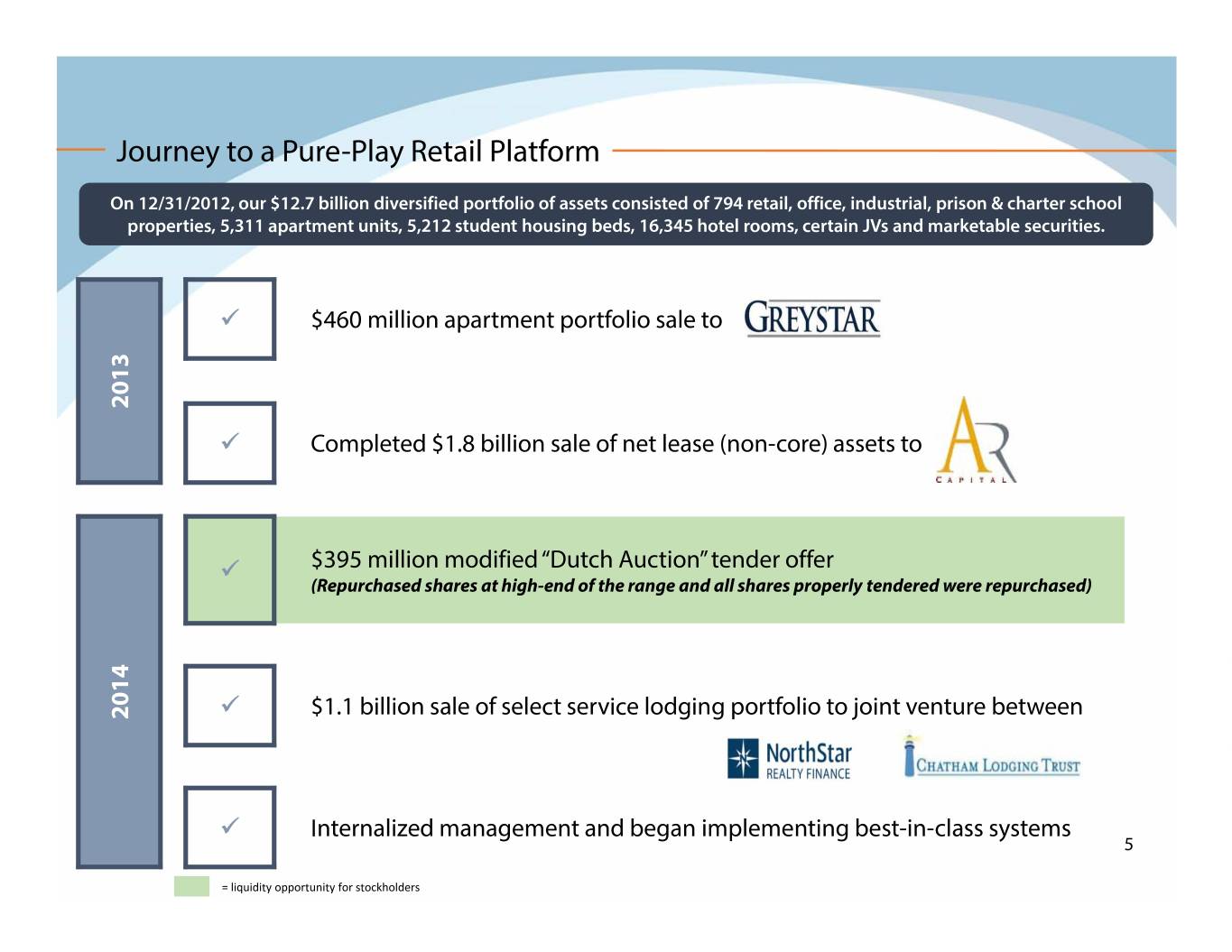

Journey to a Pure-Play Retail Platform On 12/31/2012, our $12.7 billion diversified portfolio of assets consisted of 794 retail, office, industrial, prison & charter school properties, 5,311 apartment units, 5,212 student housing beds, 16,345 hotel rooms, certain JVs and marketable securities. $460 million apartment portfolio sale to 2013 Completed $1.8 billion sale of net lease (non-core) assets to $395 million modified “Dutch Auction” tender offer (Repurchased shares at high-end of the range and all shares properly tendered were repurchased) 2014 $1.1 billion sale of select service lodging portfolio to joint venture between Internalized management and began implementing best-in-class systems 5 = liquidity opportunity for stockholders

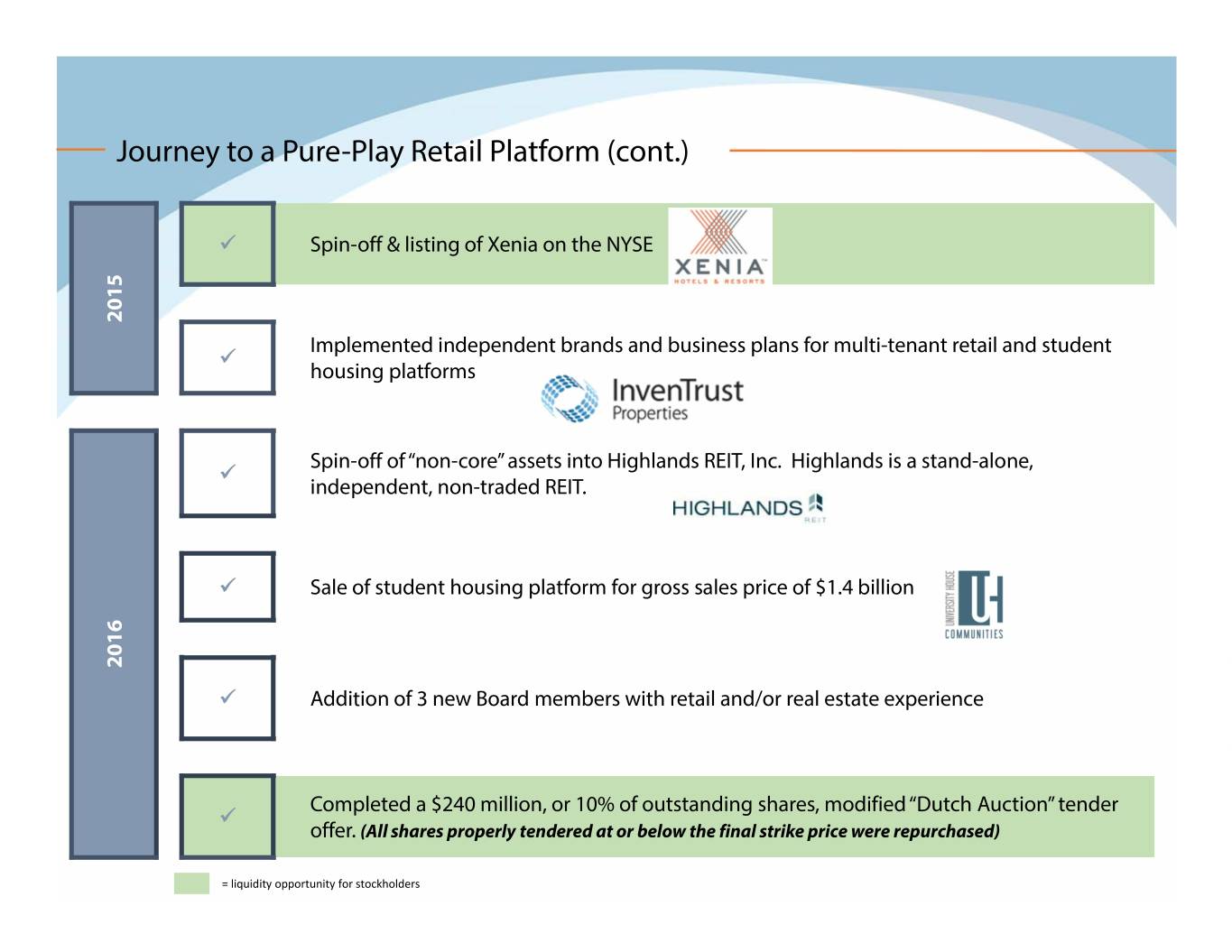

Journey to a Pure-Play Retail Platform (cont.) Spin-off & listing of Xenia on the NYSE 2015 Implemented independent brands and business plans for multi-tenant retail and student housing platforms Spin-off of “non-core” assets into Highlands REIT, Inc. Highlands is a stand-alone, independent, non-traded REIT. Sale of student housing platform for gross sales price of $1.4 billion 2016 Addition of 3 new Board members with retail and/or real estate experience Completed a $240 million, or 10% of outstanding shares, modified “Dutch Auction” tender offer. (All shares properly tendered at or below the final strike price were repurchased) 6 = liquidity opportunity for stockholders

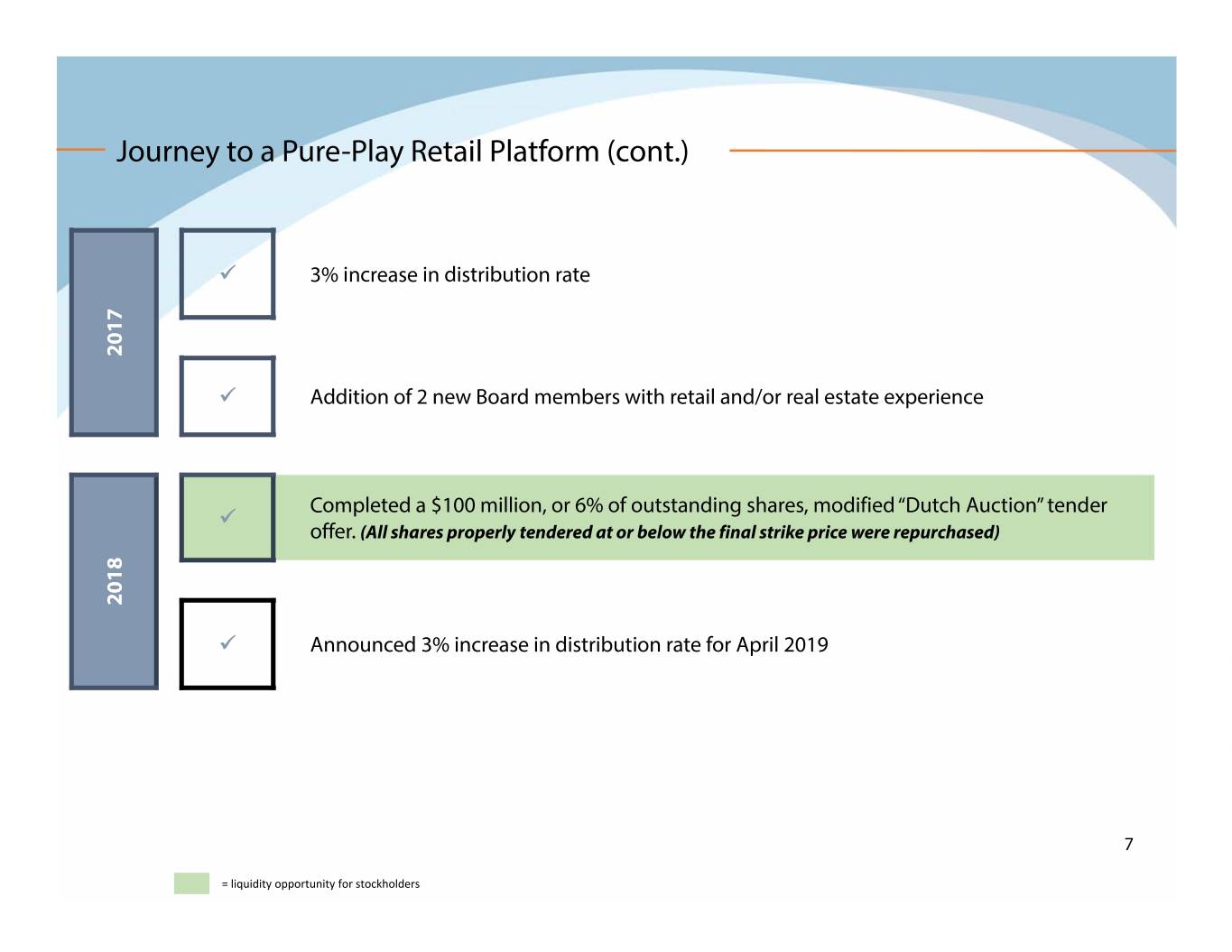

Journey to a Pure-Play Retail Platform (cont.) 3% increase in distribution rate 2017 Addition of 2 new Board members with retail and/or real estate experience Completed a $100 million, or 6% of outstanding shares, modified “Dutch Auction” tender offer. (All shares properly tendered at or below the final strike price were repurchased) 2018 Announced 3% increase in distribution rate for April 2019 7 = liquidity opportunity for stockholders

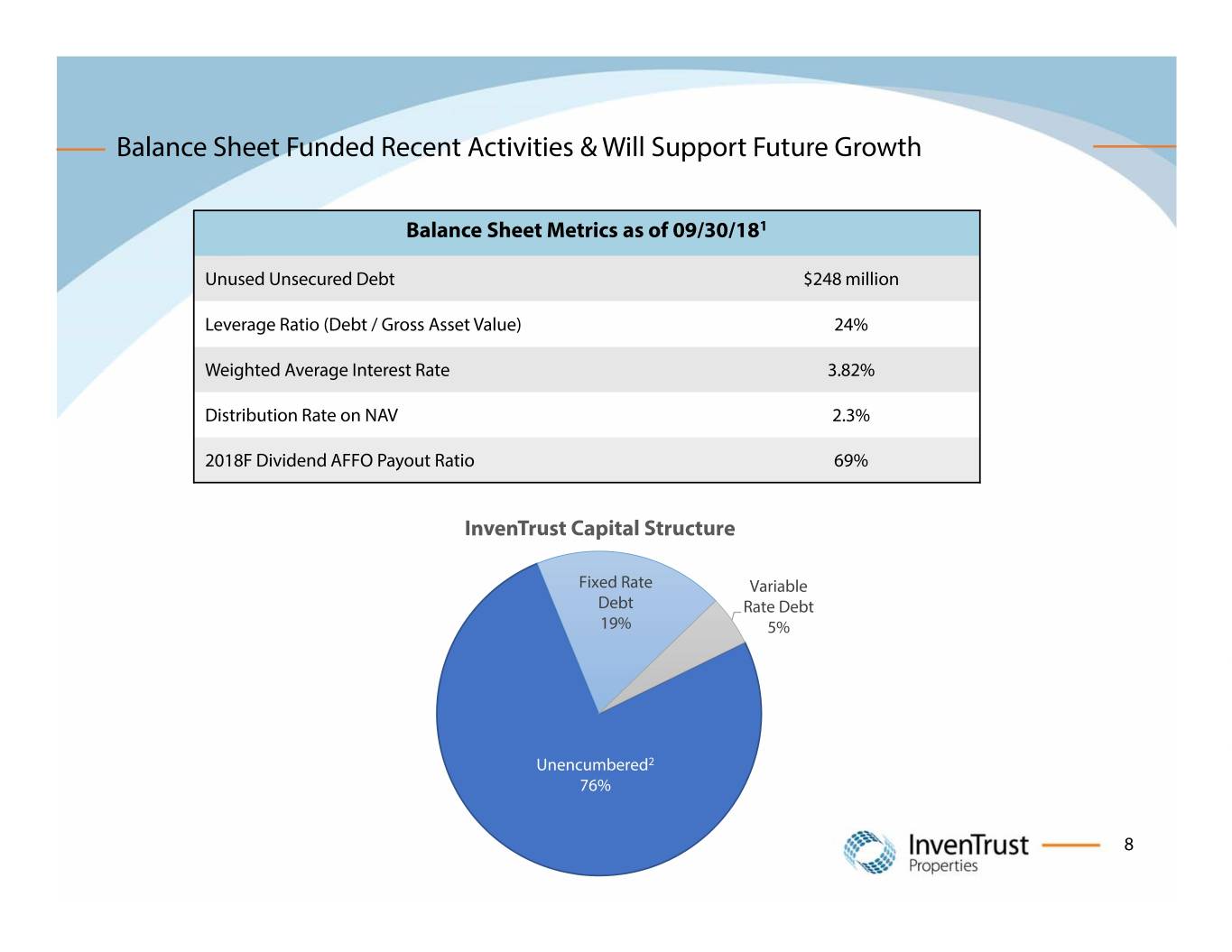

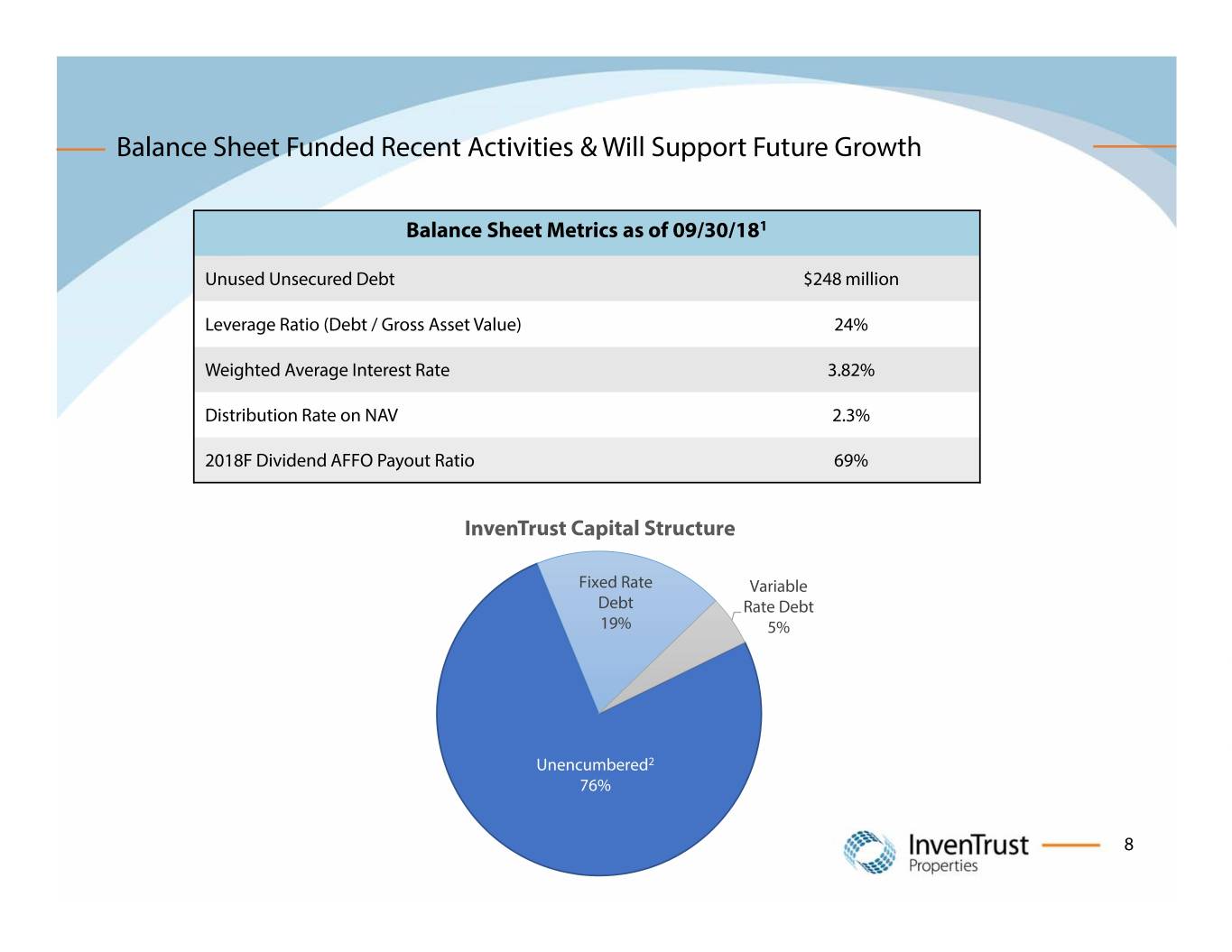

Balance Sheet Funded Recent Activities & Will Support Future Growth Balance Sheet Metrics as of 09/30/181 Unused Unsecured Debt $248 million Leverage Ratio (Debt / Gross Asset Value) 24% Weighted Average Interest Rate 3.82% Distribution Rate on NAV 2.3% 2018F Dividend AFFO Payout Ratio 69% InvenTrust Capital Structure Fixed Rate Variable Debt Rate Debt 19% 5% Variable Debt 5% Unencumbered2 76% 8

Growing Distribution Rate $0.076 $0.074 $0.0737 $0.072 $0.0716 $0.070 $0.0695 $0.068 $0.0675 $0.066 $0.064 2016 2017 2018 2019* Third Consecutive Annual Increase in IVT’s Distribution Rate in 2019 The increases in the distribution rate underscores the confidence that the Board has in our portfolio and business plan 9

InvenTrust – A Unique Retail Platform The Right Properties in the Right Markets with Multiple Growth Drivers • Focused Portfolio In Sun Belt Markets o $3.4 Billion Retail REIT 1 o Concentrating Portfolio into ~15 Core Markets with Superior Demographics (down from over 40 markets in 2013) o Fewer Markets with Additional Properties within These Markets Means Increased Operational Efficiencies • Premier Necessity-Based Assets o 80% of Portfolio’s Annualized Base Rent2 Comes from Grocery-Anchored Centers o Portfolio Annualized Base Rent per Square Foot of $18.113 o Recycled over $2.6 Billion of Assets in Markets with Low Net Operating Income Growth Characteristics 10

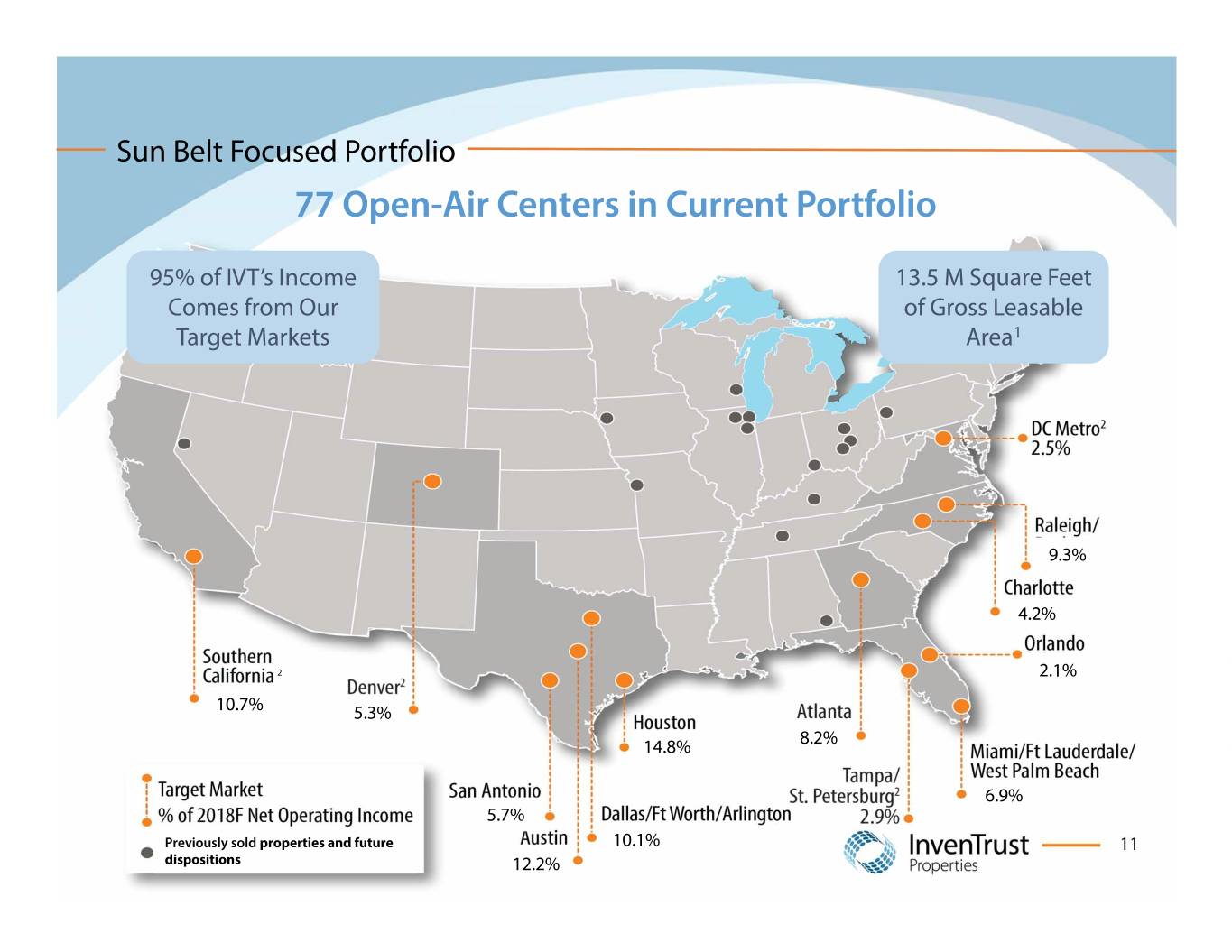

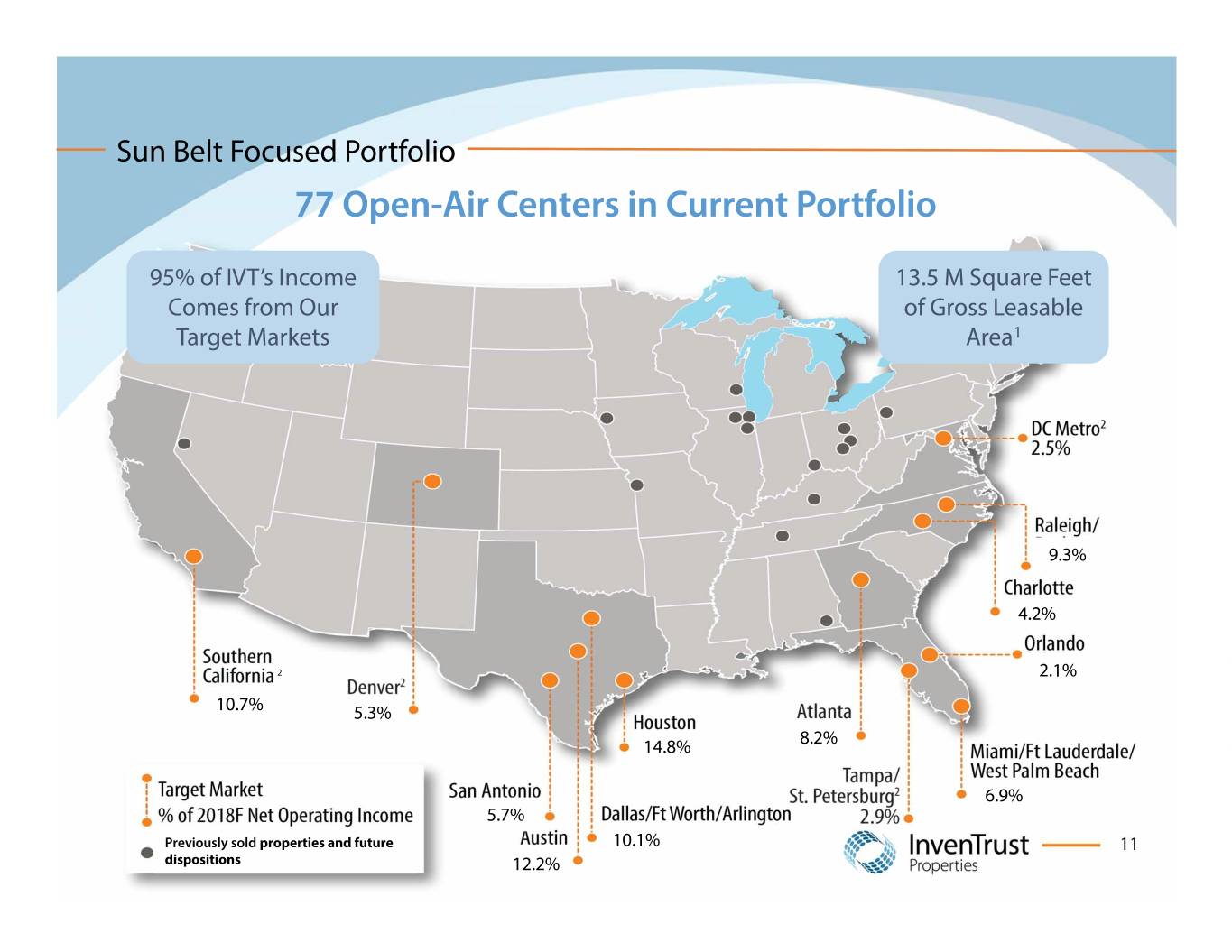

Sun Belt Focused Portfolio 77 Open-Air Centers in Current Portfolio 95% of IVT’s Income 13.5 M Square Feet Comes from Our of Gross Leasable Target Markets Area1 9.3% 4.2% 2 2.1% 10.7% 5.3% 14.8% 8.2% 6.9% 5.7% Previously sold properties and future 10.1% 3 11 dispositionsNon Target Market Retail Dispositions 12.2%

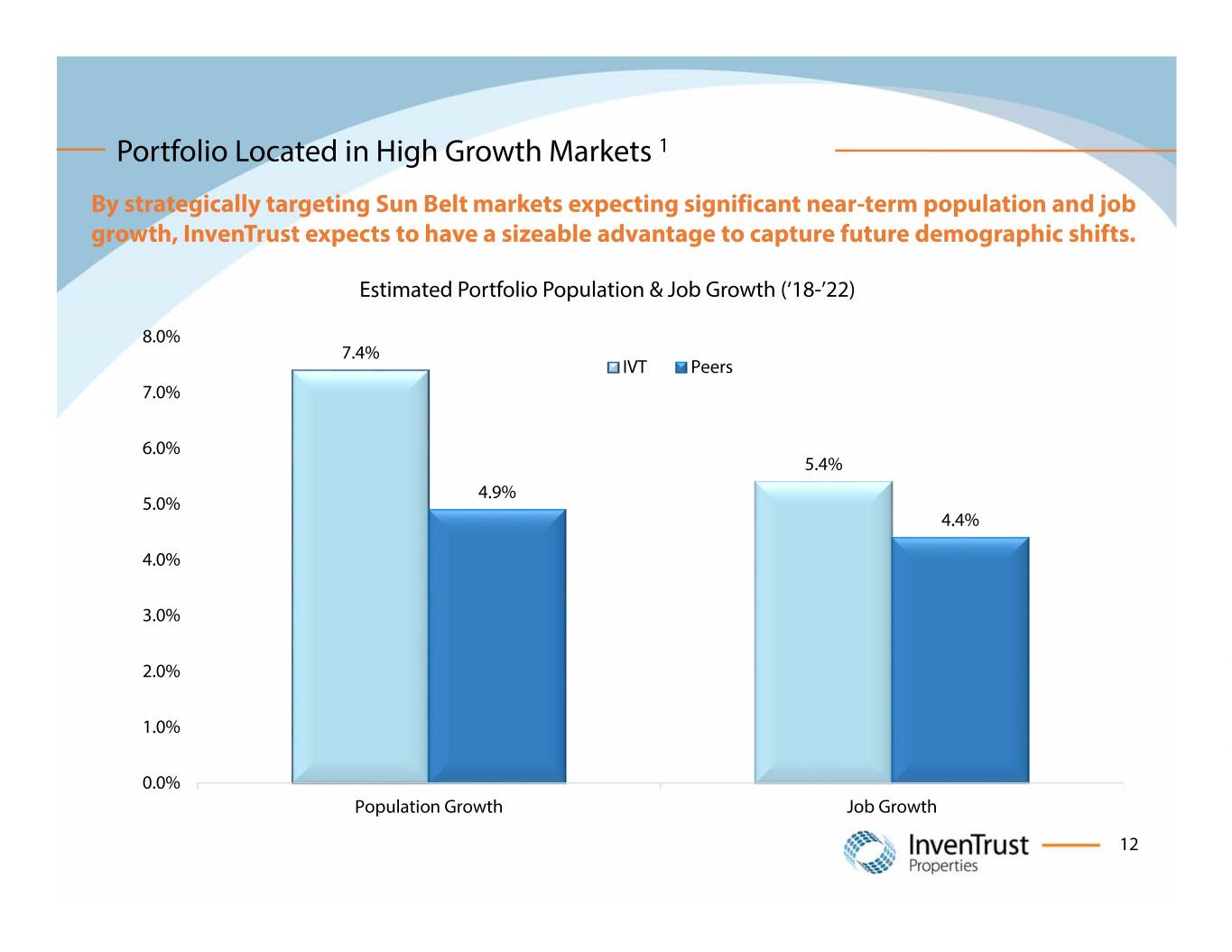

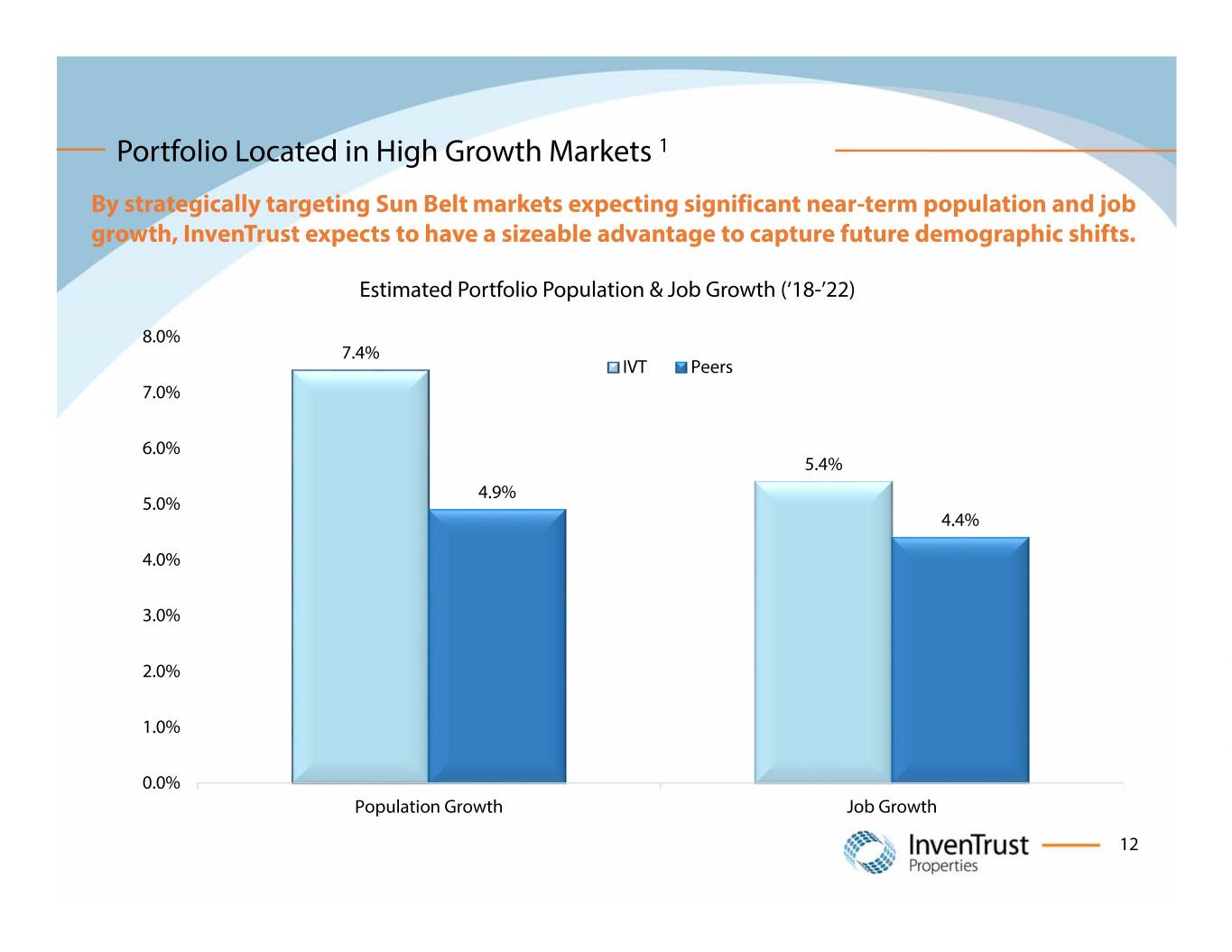

Portfolio Located in High Growth Markets 1 By strategically targeting Sun Belt markets expecting significant near-term population and job growth, InvenTrust expects to have a sizeable advantage to capture future demographic shifts. Estimated Portfolio Population & Job Growth (‘18-’22) 8.0% 7.4% IVT Peers 7.0% 6.0% 5.4% 4.9% 5.0% 4.4% 4.0% 3.0% 2.0% 1.0% 0.0% Population Growth Job Growth 12

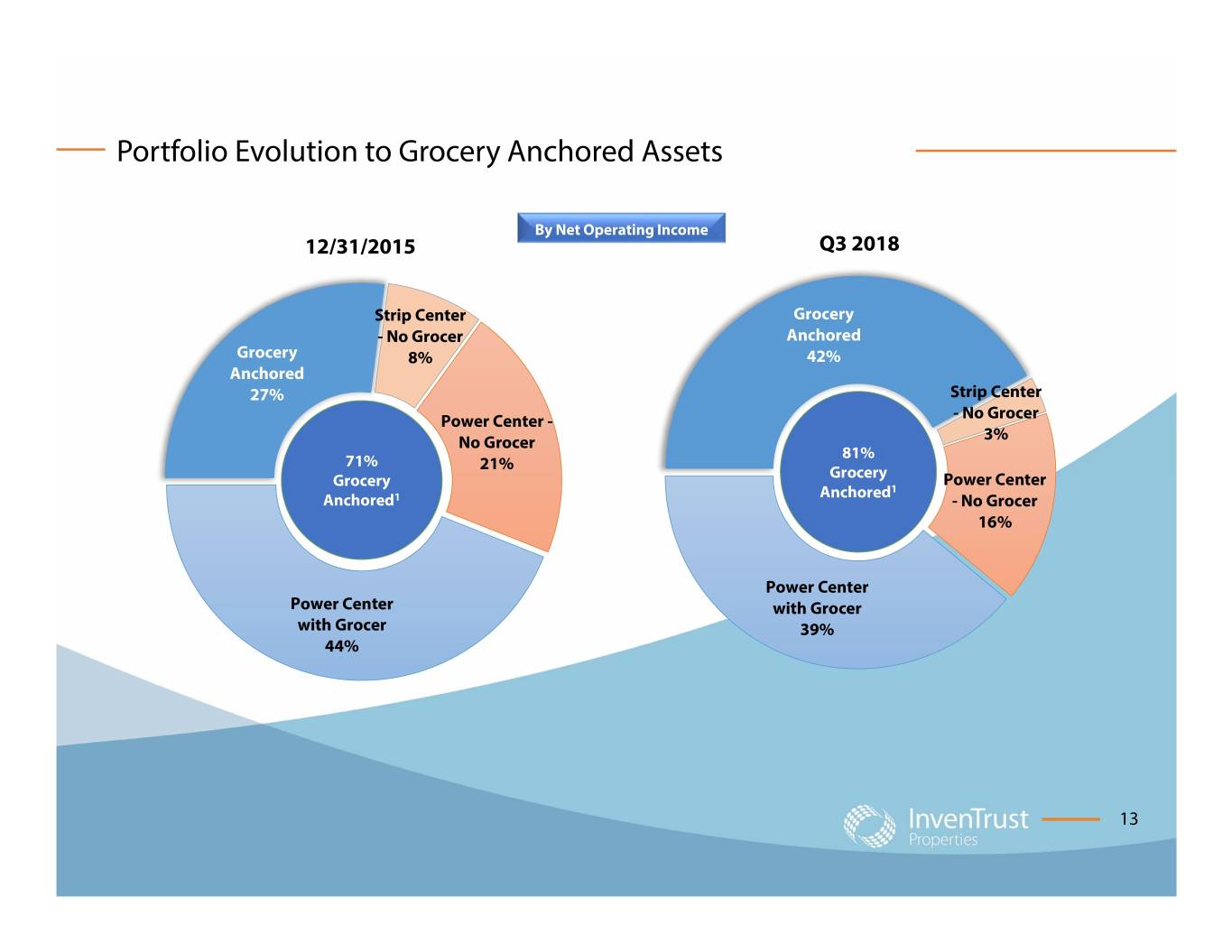

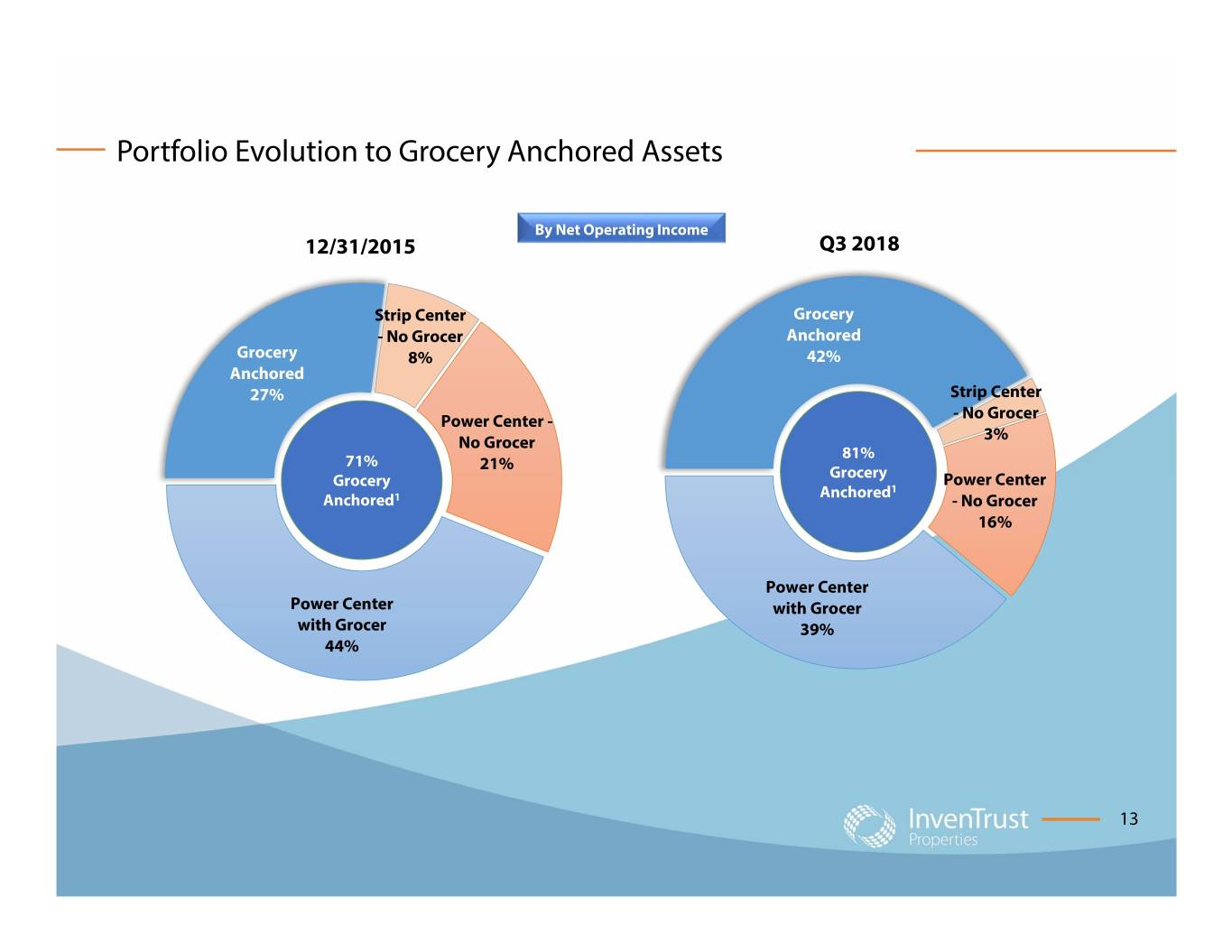

Portfolio Evolution to Grocery Anchored Assets By Net Operating Income 12/31/2015 Q3 2018 Strip Center Grocery - No Grocer Anchored Grocery 8% 42% Anchored 27% Strip Center Power Center - - No Grocer No Grocer 3% 81% 71% 21% Grocery Grocery Power Center Anchored1 Anchored1 - No Grocer 16% Power Center Power Center with Grocer with Grocer 39% 44% 13

Completed Capital Recycling Impact InvenTrust has significantly improved the quality of its portfolio and operations with $2.6 billion of transaction volume since embarking on our capital recycling efforts in 2015. Acquisitions Dispositions completed completed since 2015 since 2015 24 58 #Properties Gross Leasable Area 1 4.4 million 8.0 million Value of Transactions $1.5 billion $1.1 billion Occupancy 2 95% 91% Annualized Base Rent per Square Foot 3 $20.59 $13.70 Improving Household Income $111,000 $83,000 Improving Population Density 84,000 73,000 14

Recent Acquisitions – Upgrading the Portfolio PGA Plaza Sandy Plains Centre Commons at University Place Palm Beach Gardens, FL Marietta, GA Durham, NC • Annualized Base Rent per SF - $32.75 • Annualized Base Rent per SF - $20.50 • Annualized Base Rent per SF - $15.54 • Trader Joe’s anchored • Kroger anchored • Harris Teeter anchored • 92% occupied • 91% occupied • 97% occupied • 3-mile Avg. HH Income - $101,200 • 3-mile Avg. HH Income - $137,000 • 3-mile Avg. HH Income - $92,000 • 3-mile Population – 63,400 • 3-mile Population – 69,200 • 3-mile Population – 60,600 • Grocer Sales per SF - $2,619 • Grocer Sales per SF - $475 • Grocer Sales per SF - $489 15

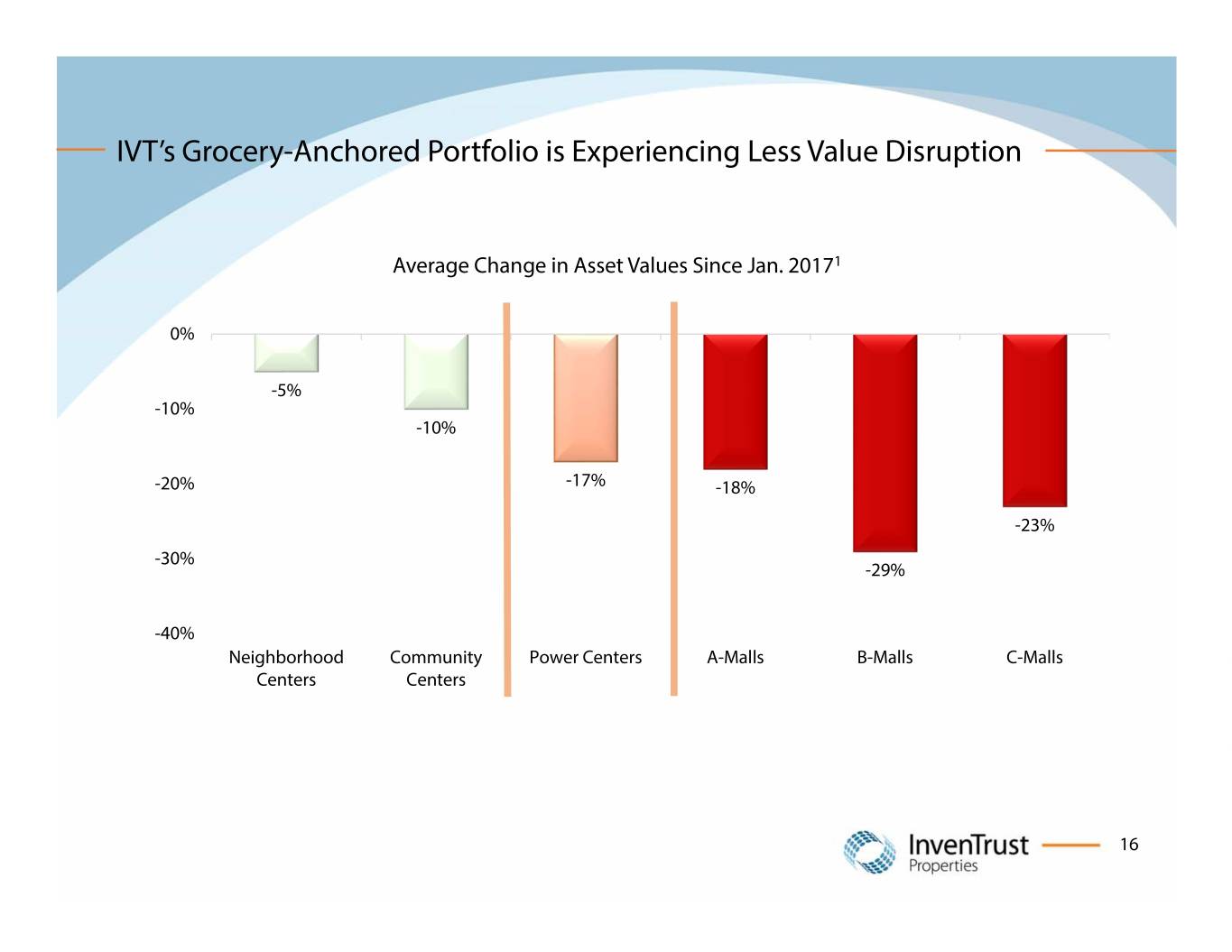

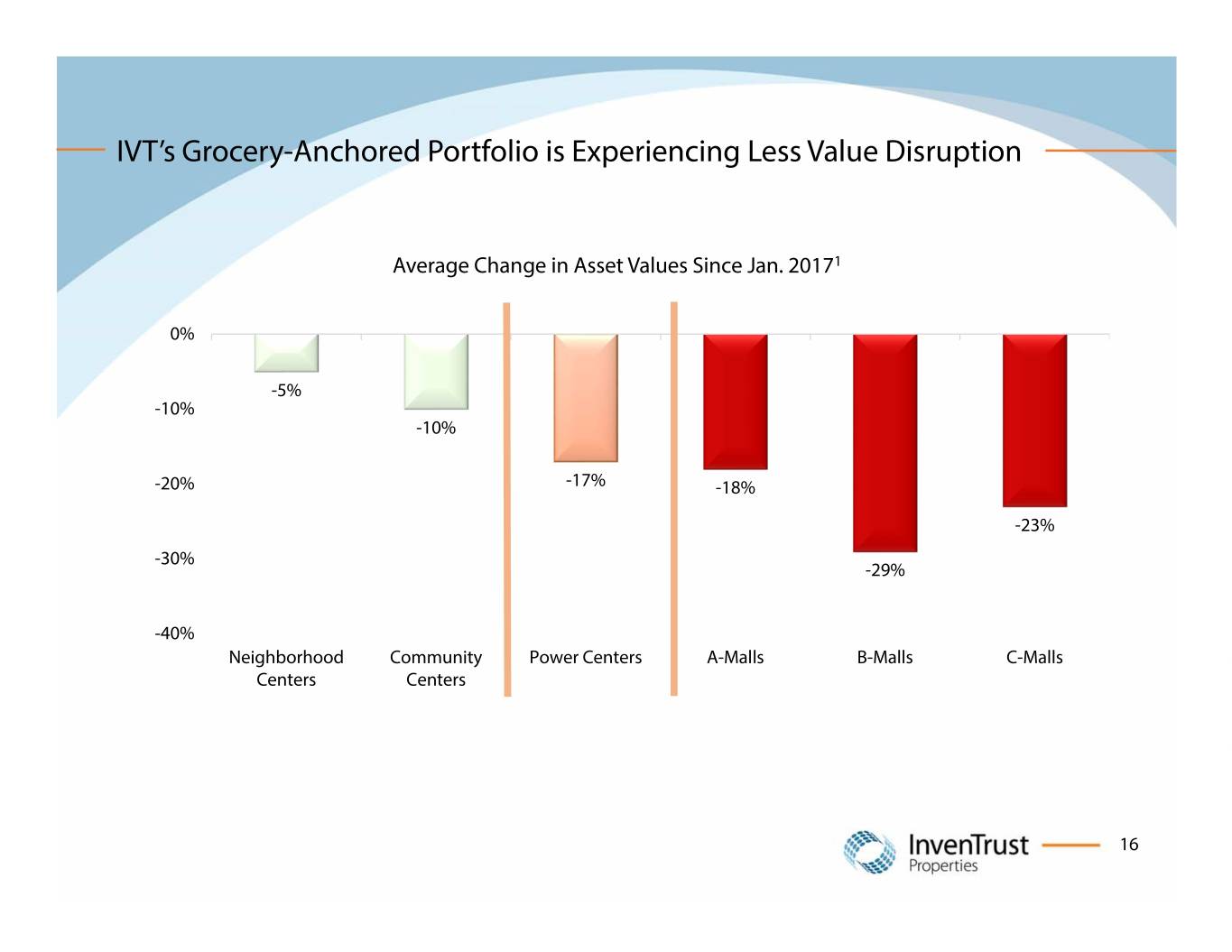

IVT’s Grocery-Anchored Portfolio is Experiencing Less Value Disruption Average Change in Asset Values Since Jan. 20171 0% -5% -10% -10% -20% -17% -18% -23% -30% -29% -40% Neighborhood Community Power Centers A-Malls B-Malls C-Malls Centers Centers 16

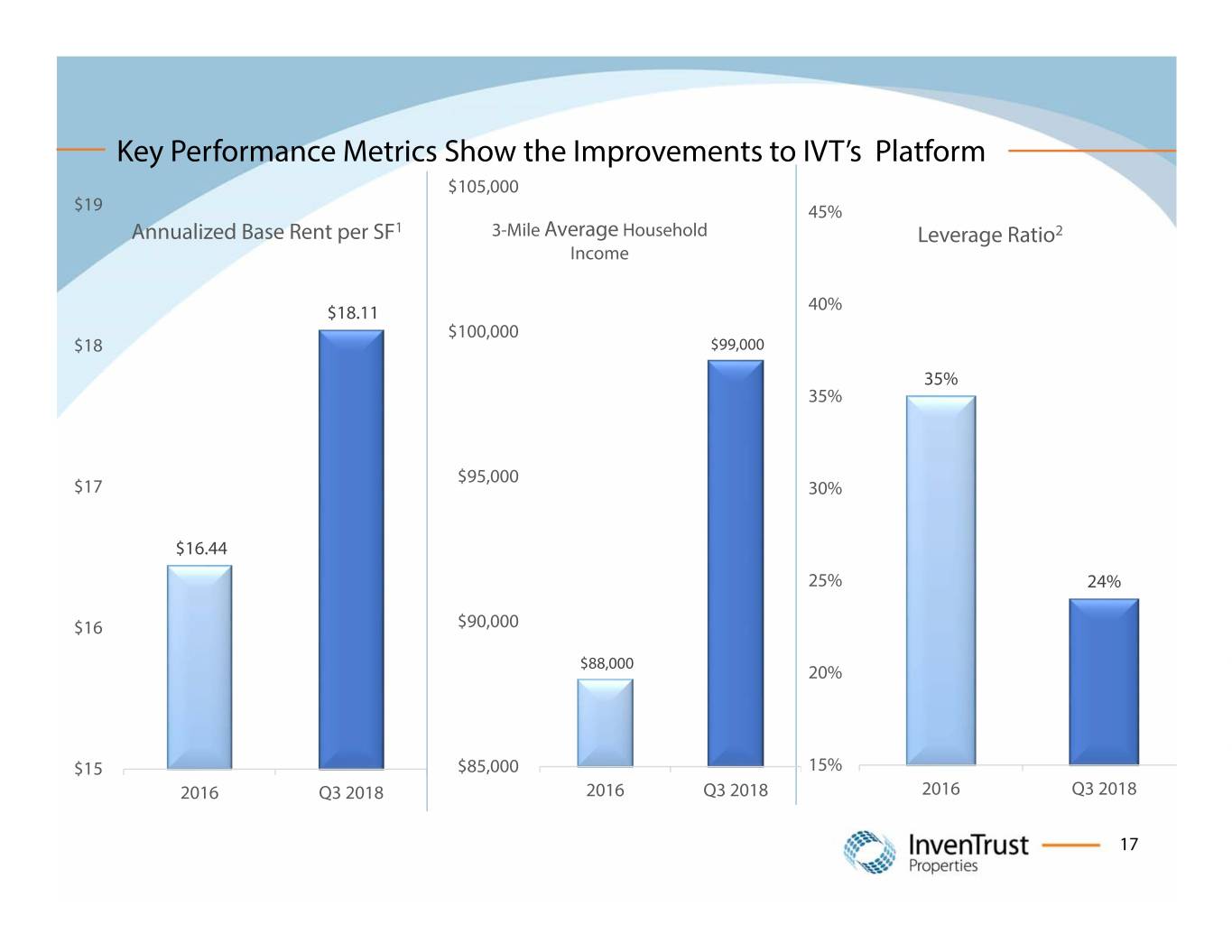

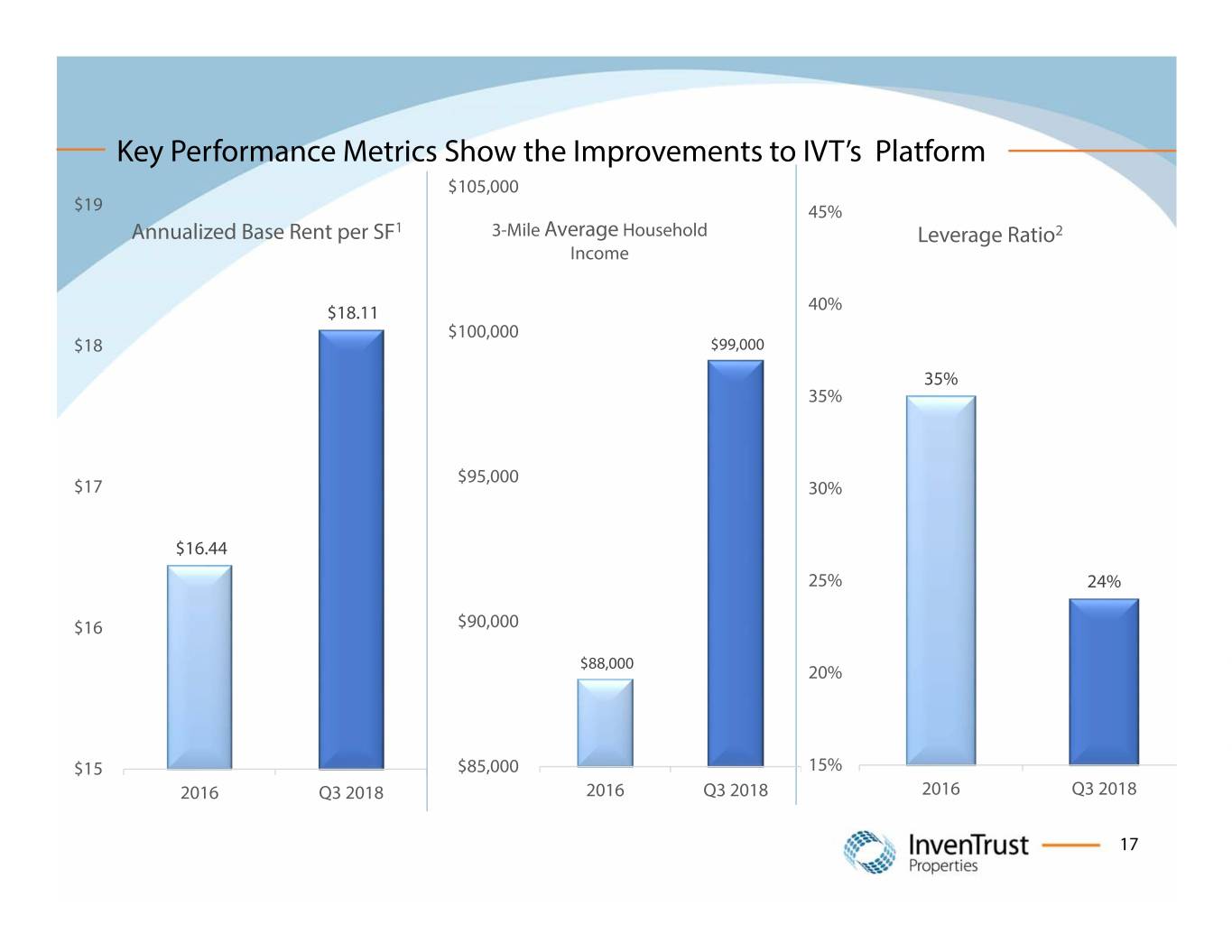

Key Performance Metrics Show the Improvements to IVT’s Platform $105,000 $19 45% Annualized Base Rent per SF1 3-Mile Average Household Leverage Ratio2 Income $18.11 40% $100,000 $18 $99,000 35% 35% $95,000 $17 30% $16.44 25% 24% $16 $90,000 $88,000 20% $15 $85,000 15% 2016 Q3 2018 2016 Q3 2018 2016 Q3 2018 17

Experienced Board of Directors Paula J. Saban (2004) Michael Stein (2016) Chairperson 40 years of public accounting 25+ years of banking & financial experience including prior CFO services experience, including positions with Nordstrom & Bank of America Marriott Thomas Glavin (2007) Scott Nelson (2016) CPA with over 30 years of 35 years of retail and real accounting & 20 years of estate experience, including real estate experience 21 years with Target Corporation Stuart Aitken (2017) Tom McGuinness (2015) 15+ years of extensive retail President & CEO since 2014 & consumer data analytics experience. Currently Group SVP with Kroger. Amanda Black (2018) Julian Whitehurst (2016) 15+ years of comprehensive real CEO of National Retail estate & banking experience. Properties with over 30 years Currently Portfolio Manager at of retail real estate experience Jaguar Listed Property. 18

Strategy Moving Forward o Drive value by focusing on a grocery-anchored retail platform. o Concentrate portfolio in high job & population growth markets. o Maintain our balance sheet strength and capital structure flexibility. o Opportunistically sell assets in low growth markets & where value has been maximized. o Evaluate various final liquidity options for when market conditions are right. 19

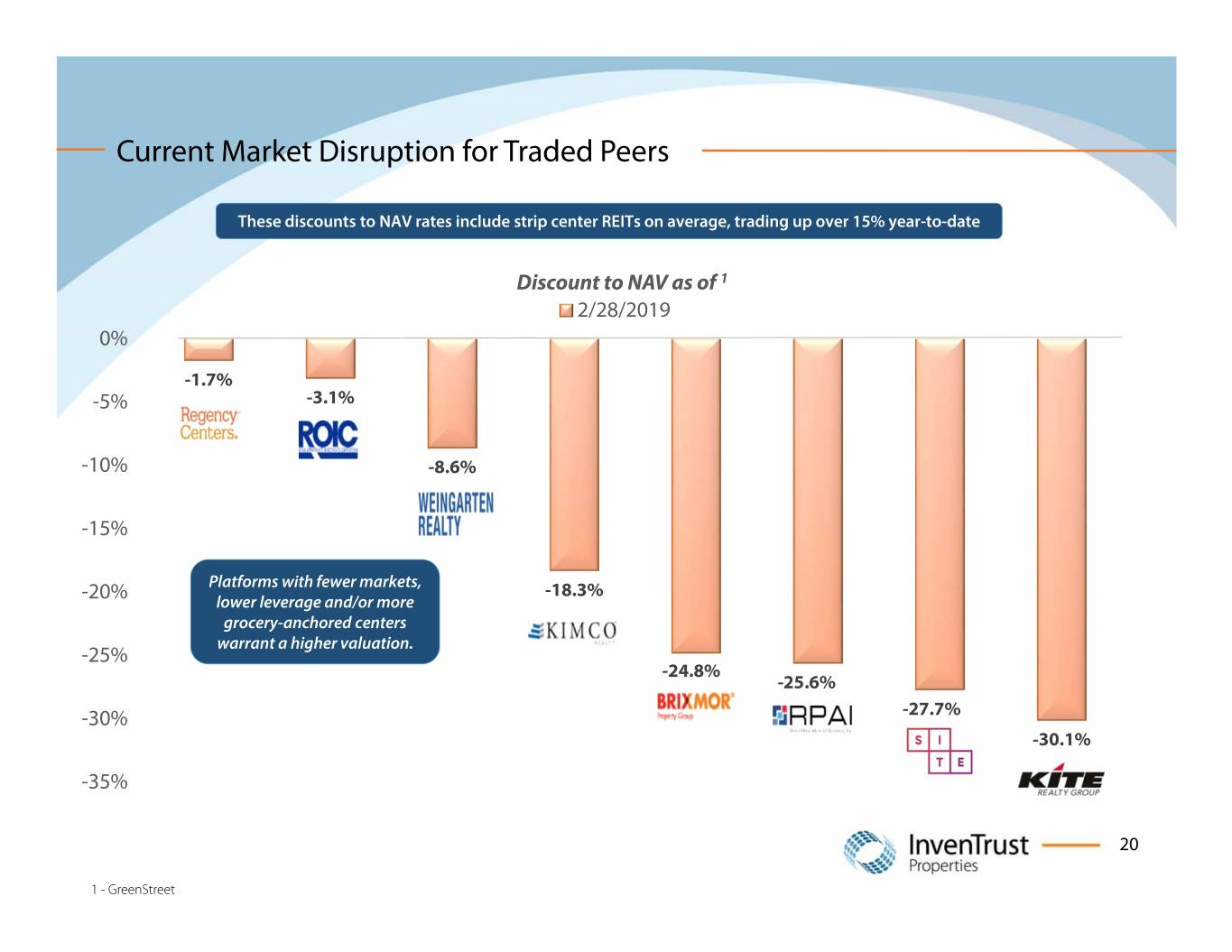

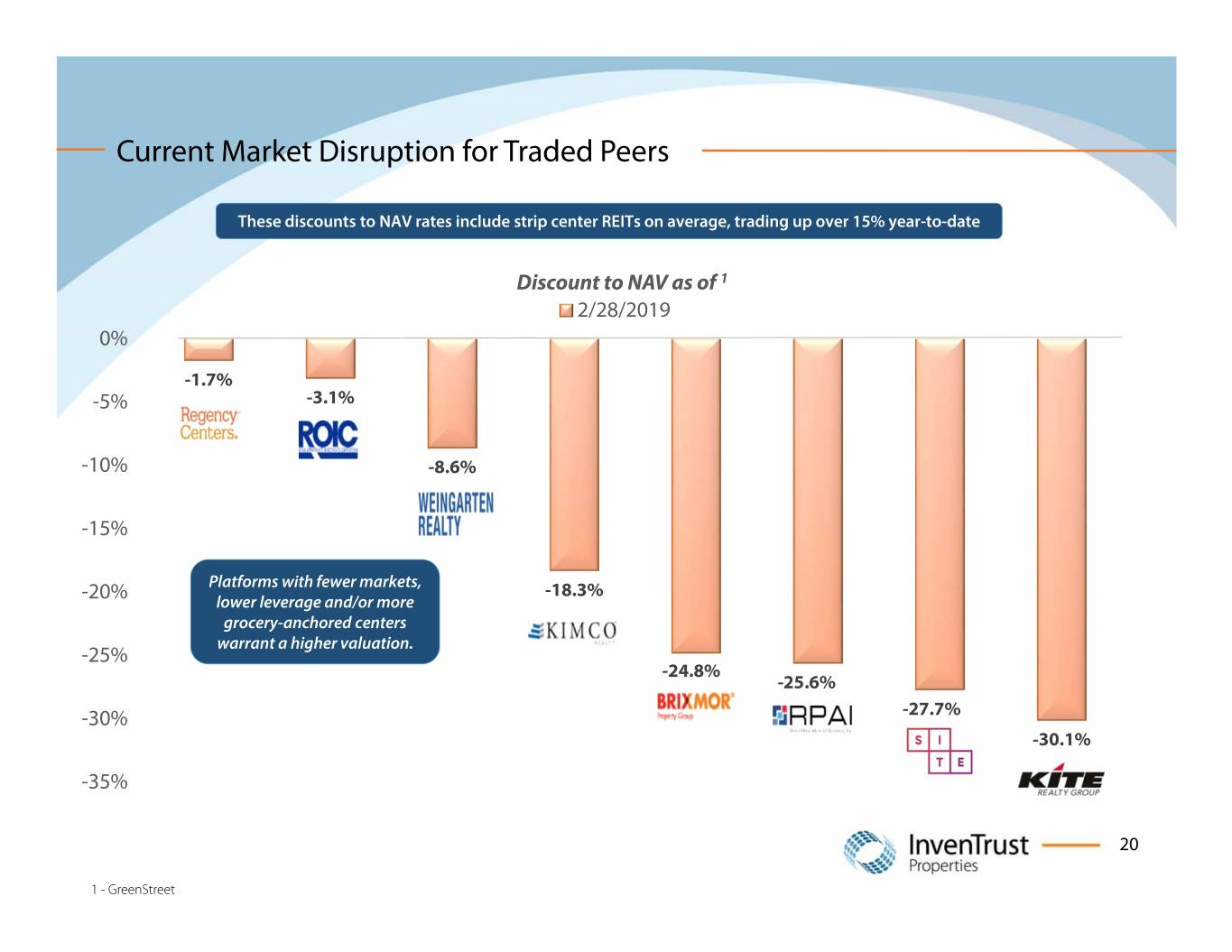

Current Market Disruption for Traded Peers These discounts to NAV rates include strip center REITs on average, trading up over 15% year-to-date Discount to NAV as of 1 2/28/2019 0% -1.7% -5% -3.1% -10% -8.6% -15% Platforms with fewer markets, -18.3% -20% lower leverage and/or more grocery-anchored centers warrant a higher valuation. -25% -24.8% -25.6% -30% -27.7% -30.1% -35% 20 1 - GreenStreet

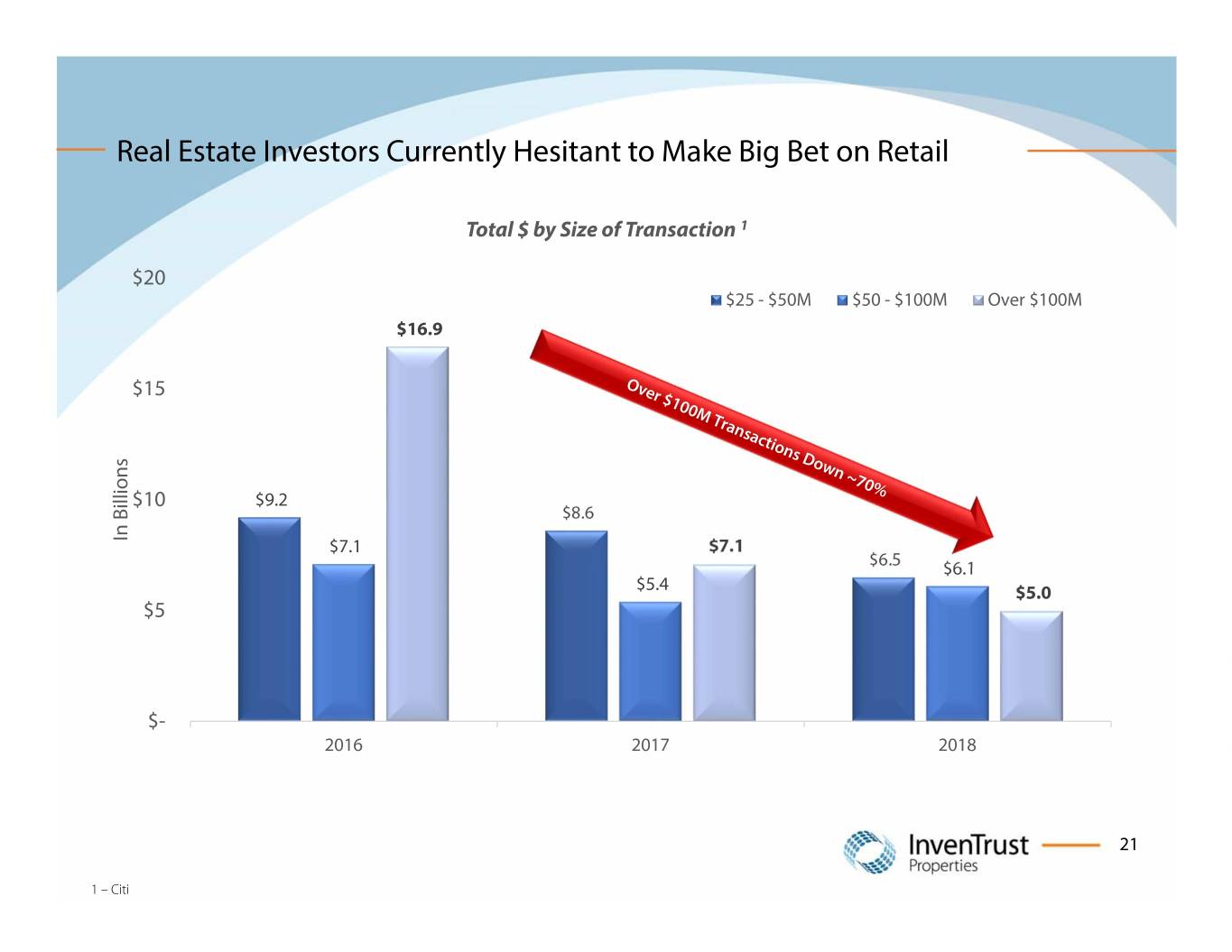

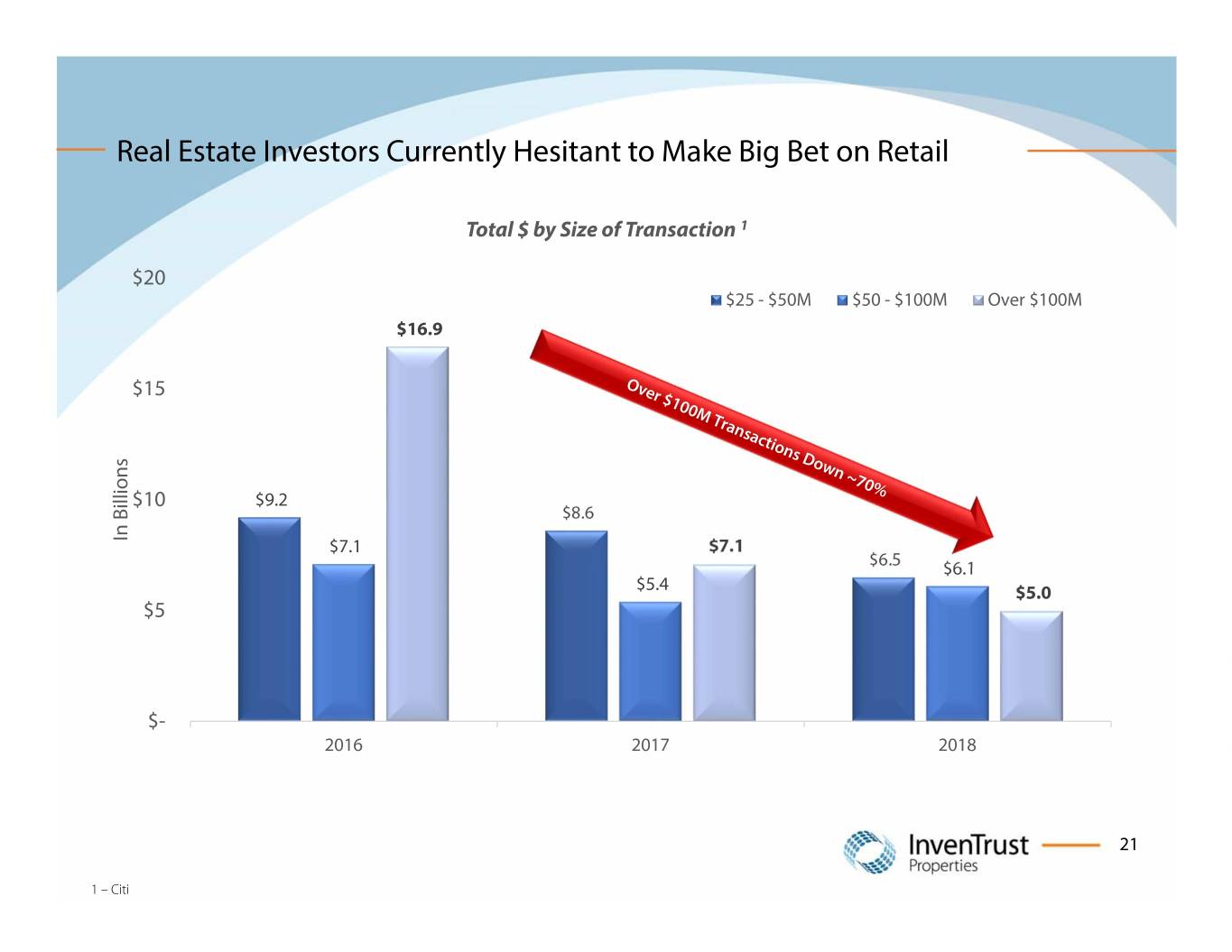

Real Estate Investors Currently Hesitant to Make Big Bet on Retail Total $ by Size of Transaction 1 $20 $25 - $50M $50 - $100M Over $100M $16.9 $15 $10 $9.2 $8.6 In Billions $7.1 $7.1 $6.5 $6.1 $5.4 $5.0 $5 $- 2016 2017 2018 21 1 – Citi

Q&A 22

appendix 23

Footnotes Page 8 3. ABR is annualized base rent as of Sept. 30, 2018, or as of date of sale, divided 1. Debt / Gross Asset Value (Gross asset value includes (a) wholly owned retail by economic occupied square footage. Ground and specialty leases are properties, (b) properties owned by IAGM at share, (c) CDH CDO LLC and excluded. ABR calculation excludes GAAP entries. Concord Debt Holdings LLC, (d) Downtown Railyard Venture LLC. and (e) cash and marketable securities.) Page 15 2. Percentage of unencumbered assets is estimated unencumbered asset value 1. Data as of 9/30/18. ABR is annualized base rent as of Sept. 30, 2018, divided divided by gross asset value by economic occupied square footage. Ground and specialty leases are excluded. ABR calculation excludes GAAP entries. Occupancy is as of Sept. Page 10 30, 2018, excludes ground and specialty leases. 1. Includes (a) wholly owned retail properties, (b) 100% of value related to IAGM Retail Fund I, LLC (“IAGM”), our joint venture with PGGM Private Real Estate Page 16 Fund, (c) CDH CDO LLC and Concord Debt Holdings LLC, (d) Downtown 1. Data per Green Street as of 1/9/2019 Railyard Venture LLC, and (e) cash and marketable securities. 2. Walmart, Target, and warehouse clubs are considered grocers, regardless of Page 17 whether the box is owned by the REIT or shadow anchored. 1. ABR is annualized base rent as of Sept. 30, 2018, divided by economic 3. ABR is annualized base rent as of Sept. 30, 2018. Ground and specialty leases occupied square footage. Ground and specialty leases are excluded. ABR are excluded. ABR calculation excludes GAAP entries. calculation excludes GAAP entries. Occupancy is as of Sept. 30, 2018, excludes ground and specialty leases. Page 11 2. Debt / Gross Asset Value (Gross asset value includes (a) wholly owned retail 1. GLA includes ground lease square footage as of Sept. 30, 2018. properties, (b) properties owned by IAGM at share, (c) CDH CDO LLC and 2. Southern California includes Los Angeles, Riverside/San Bernadino/Ontario Concord Debt Holdings LLC, (d) Downtown Railyard Venture LLC. and (e) (Inland Empire) and San Diego. Denver includes Fort Collins and Colorado cash and marketable securities.) Springs. Tampa/St. Petersburg includes Sarasota & Punta Gorda. DC Metro includes Richmond. Page 26 3. Map shows certain properties sold from 2015 to October 2018. Two assets 1. Per share value reflects, to the extent applicable, property-level debt. are still part of IVT’s portfolio but are being marketed for sale – Silverlake, 2. “Same Property” refers to assets included in both the May 1, 2017 estimate of Erlanger, KY. per share value and the May 1, 2018 estimate of per share value and excludes any dispositions and acquisitions between May 1, 2017 and May 1, 2018. Page 12 “Total Retail Portfolio” includes (a) wholly owned retail properties and (b) 1. Data per REIS & Green Street. Peers – REG, ROIC, KIM, WRI, Federal, RPAI, BRIX propertiesownedbyIAGMRetailFundI,LLC(“IAGM”),ourjointventurewith PGGM Private Real Estate Fund. For the joint venture properties described in (b), this table only includes the per share value attributed to the Company Page 13 based on its percentage ownership. 1. NOI percentages include shadow-anchored grocery store tenants. Walmart, 3. Includes cash and cash equivalents, marketable securities, and certain other Target and warehouse clubs are considered grocers, regardless of whether assets and liabilities. the box is owned by the REIT or shadow anchored. 4. The Audit Committee recommended and the Board determined an estimated share value at the mid-point value of the Duff & Phelps range was Page 14 appropriate. 1. GLA includes ground lease square footage. 2. Occupancy is as of Sept. 30, 2018, or as of the date of sale, and excludes 24 ground and specialty leases.