April 5, 2019 Dear Fellow Stockholder, As we announced last November, the Board of Directors of InvenTrust (“IVT” or “Company”) approved an approximately three percent increase of IVT’s 2019 annual distribution rate, payable beginning with the company’s April 5, 2019 distribution payment. This is our third consecutive three percent annual distribution rate increase. We are pleased to be able to consistently return capital to our stockholders, who will experience an increase from $0.0716 per share to $0.0737 per share on an annualized basis for the calendar year 2019. The decision to increase our distribution underscores our disciplined capital allocation priorities and the Board’s continued belief in InvenTrust’s strategy of investing in the right centers in the right markets to provide value and income for our stockholders. Proxy Season It is that time of year again when we ask for your voting support at our Annual Stockholders Meeting on May 9, 2019. To help inform your voting decisions, we encourage you to read our proxy materials, which you should have already received. Voting your shares is easy and can be done by mail, over the phone or online. Please vote as soon as possible to help save time and money with this process. At our annual meeting, we will ask you to consider and vote upon: a proposal to elect eight directors to the Board; a proposal to ratify the selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2019; and any other business that may properly come before the annual meeting, including any postponement or adjournment thereof. We encourage you to submit your proxy prior to the meeting to help ensure we reach a quorum for the proceedings. If you plan to attend the Annual Stockholder Meeting in person, please contact Dan Lombardo, the head of our Investor Relations team, at 630-570-0605, so that we can arrange for sufficient space to accommodate all attendees. New Additions to IVT’s Property Portfolio As you know, InvenTrust is a multi-tenant retail REIT focused on Essential Retail in Smart Locations. To us, this means grocery-anchored or necessity-based centers in growing Sunbelt markets such as Florida, Texas, Atlanta and Southern California. We recently added two new assets to our portfolio that complement this strategy. The first property is Sandy Plains Centre, a 124,000 square foot center anchored by Kroger Co. and Pets Supply Plus in Marietta, Georgia. Through this transaction, we expanded our existing presence in Atlanta, while bringing favorable demographics to our portfolio and

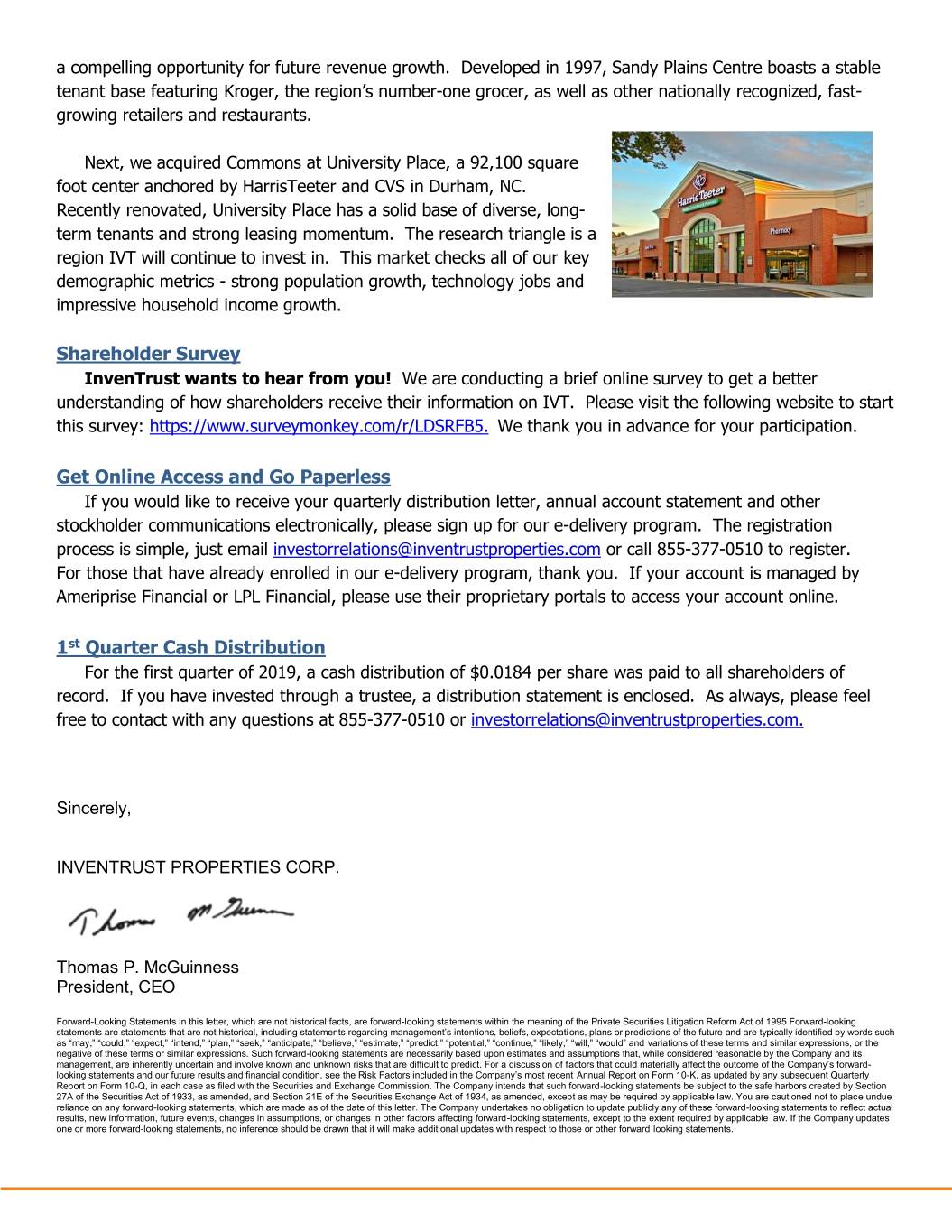

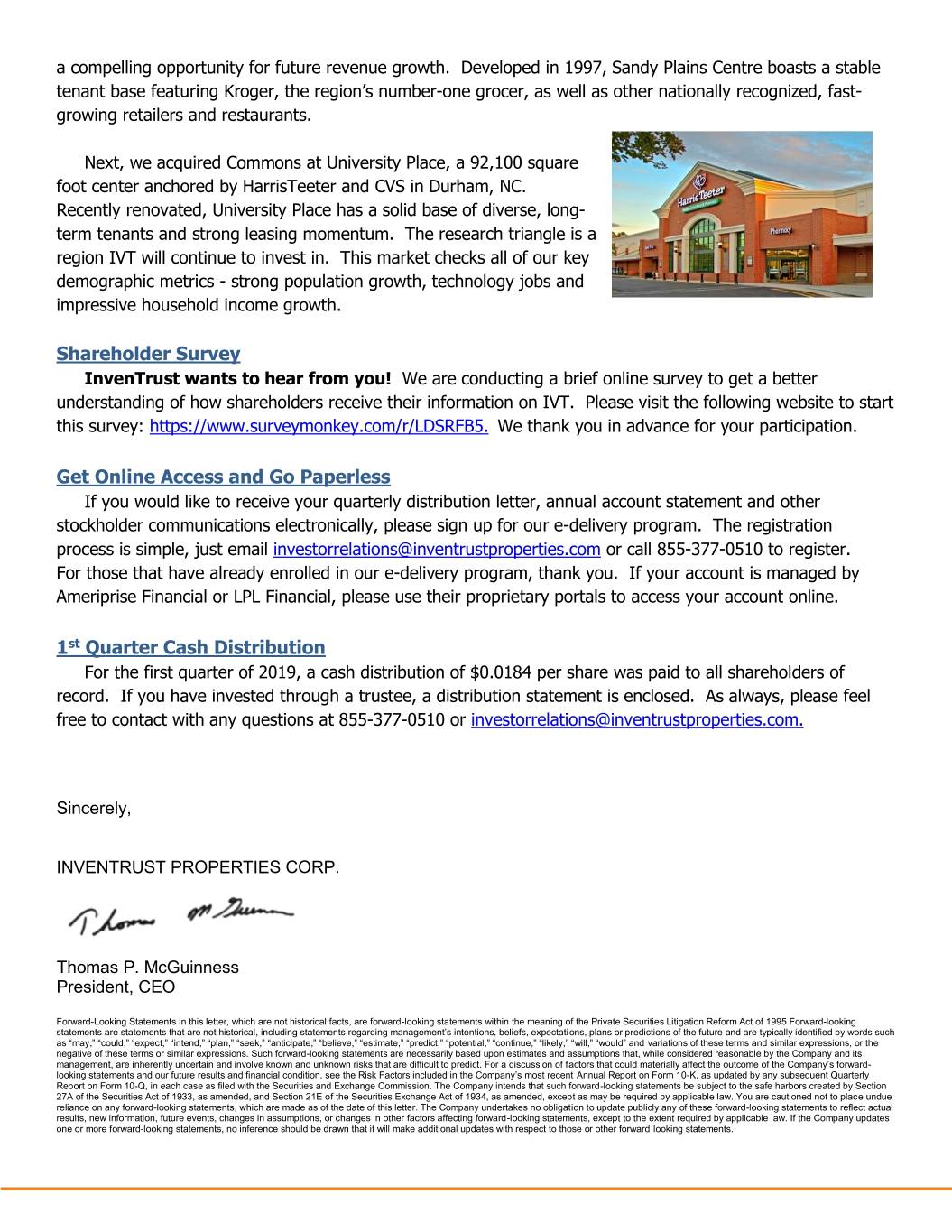

a compelling opportunity for future revenue growth. Developed in 1997, Sandy Plains Centre boasts a stable tenant base featuring Kroger, the region’s number-one grocer, as well as other nationally recognized, fast- growing retailers and restaurants. Next, we acquired Commons at University Place, a 92,100 square foot center anchored by HarrisTeeter and CVS in Durham, NC. Recently renovated, University Place has a solid base of diverse, long- term tenants and strong leasing momentum. The research triangle is a region IVT will continue to invest in. This market checks all of our key demographic metrics - strong population growth, technology jobs and impressive household income growth. Shareholder Survey InvenTrust wants to hear from you! We are conducting a brief online survey to get a better understanding of how shareholders receive their information on IVT. Please visit the following website to start this survey: https://www.surveymonkey.com/r/LDSRFB5. We thank you in advance for your participation. Get Online Access and Go Paperless If you would like to receive your quarterly distribution letter, annual account statement and other stockholder communications electronically, please sign up for our e-delivery program. The registration process is simple, just email investorrelations@inventrustproperties.com or call 855-377-0510 to register. For those that have already enrolled in our e-delivery program, thank you. If your account is managed by Ameriprise Financial or LPL Financial, please use their proprietary portals to access your account online. 1st Quarter Cash Distribution For the first quarter of 2019, a cash distribution of $0.0184 per share was paid to all shareholders of record. If you have invested through a trustee, a distribution statement is enclosed. As always, please feel free to contact with any questions at 855-377-0510 or investorrelations@inventrustproperties.com. Sincerely, INVENTRUST PROPERTIES CORP. Thomas P. McGuinness President, CEO Forward-Looking Statements in this letter, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, plans or predictions of the future and are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain and involve known and unknown risks that are difficult to predict. For a discussion of factors that could materially affect the outcome of the Company’s forward- looking statements and our future results and financial condition, see the Risk Factors included in the Company’s most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the Securities and Exchange Commission. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. You are cautioned not to place undue reliance on any forward-looking statements, which are made as of the date of this letter. The Company undertakes no obligation to update publicly any of these forward-looking statements to reflect actual results, new information, future events, changes in assumptions, or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If the Company updates one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward looking statements.