Investor Presentation May 2019

Forward Looking Statements Forward-Looking Statements in this presentation, which are not as updated by any subsequent Quarterly Report on Form 10-Q, in historical facts, are forward-looking statements within the meaning each case as filed with the Securities and Exchange Commission. of the Private Securities Litigation Reform Act of 1995. Forward- InvenTrust intends that such forward-looking statements be subject looking statements are statements that are not historical, including to the safe harbors created by Section 27A of the Securities Act of statements regarding management’s intentions, beliefs, 1933, as amended, and Section 21E of the Securities Exchange Act expectations, representation, plans or predictions of the future and of 1934, as amended, except as may be required by applicable law. are typically identified by words such as “may,” “could,” “expect,” We caution you not to place undue reliance on any forward-looking “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” statements, which are made as of the date of this presentation. We “potential,” “continue,” “likely,” “will,” “would” and variations of undertake no obligation to update publicly any of these forward- these terms and similar expressions, or the negative of these terms looking statements to reflect actual results, new information or or similar expressions. Such forward-looking statements are future events, changes in assumptions or changes in other factors necessarily based upon estimates and assumptions that, while affecting forward-looking statements, except to the extent required considered reasonable by us and our management, are inherently by applicable laws. If we update one or more forward-looking uncertain. Factors that may cause actual results to differ materially statements, no inference should be drawn that we will make from current expectations include, among others, market, political additional updates with respect to those or other forward-looking and economic volatility experienced by the U.S. economy or real statements. estate industry as a whole, and the regional and local political and economic conditions in the markets in which our properties are The companies depicted in the photographs or otherwise herein located; competitive business market conditions experienced by may have proprietary interests in their trade names and trademarks our retail tenants and shadow anchor retailers, such as challenges and nothing herein shall be considered to be an endorsement, competing with e-commerce channels; our ability to execute on our authorization or approval of InvenTrust Properties Corp. by the business strategy and enhance stockholder value; and our ability to companies. Further, none of these companies are affiliated with manage our debt. For further discussion of factors that could InvenTrust Properties Corp. in any manner. materially affect the outcome of our forward-looking statements and our future results and financial condition, see the Risk Factors included in InvenTrust’s most recent Annual Report on Form 10-K, 2

2019 Strategy o Grow same property NOI through favorable leasing, redevelopment & expense savings o Continue to evaluate disposition opportunities & execute on acquisition strategy o Maintain a flexible balance sheet o Continue to improve public company readiness and monitor market conditions for potential final liquidity event 3

InvenTrust – A Unique Retail Platform The Right Properties in the Right Markets with Multiple Growth Drivers • Focused Portfolio In Sun Belt Markets o $3.4 Billion Retail REIT 1 / 73 Open-Air Retail Centers o Concentrated Portfolio = ~15 Sun Belt Markets with Superior Demographics (down from over 40 markets in 2013) o Fewer Markets with Additional Properties = Operational Efficiencies • Premier Grocery-Anchored Assets o 81% of Portfolio’s NOI Comes from Grocery-Anchored Centers2 o Portfolio Annualized Base Rent per Square Foot of $18.713 o Recycled $3 Billion of Assets in Non-Core Markets & Assets with Low Growth Characteristics o Long-Term Target NOI growth 2% to 3% • Simple & Flexible Balance Sheet Providing Growth Opportunities o Maintain Long-Term Net Debt / EBITDA of 4.0x – 5.0x 4

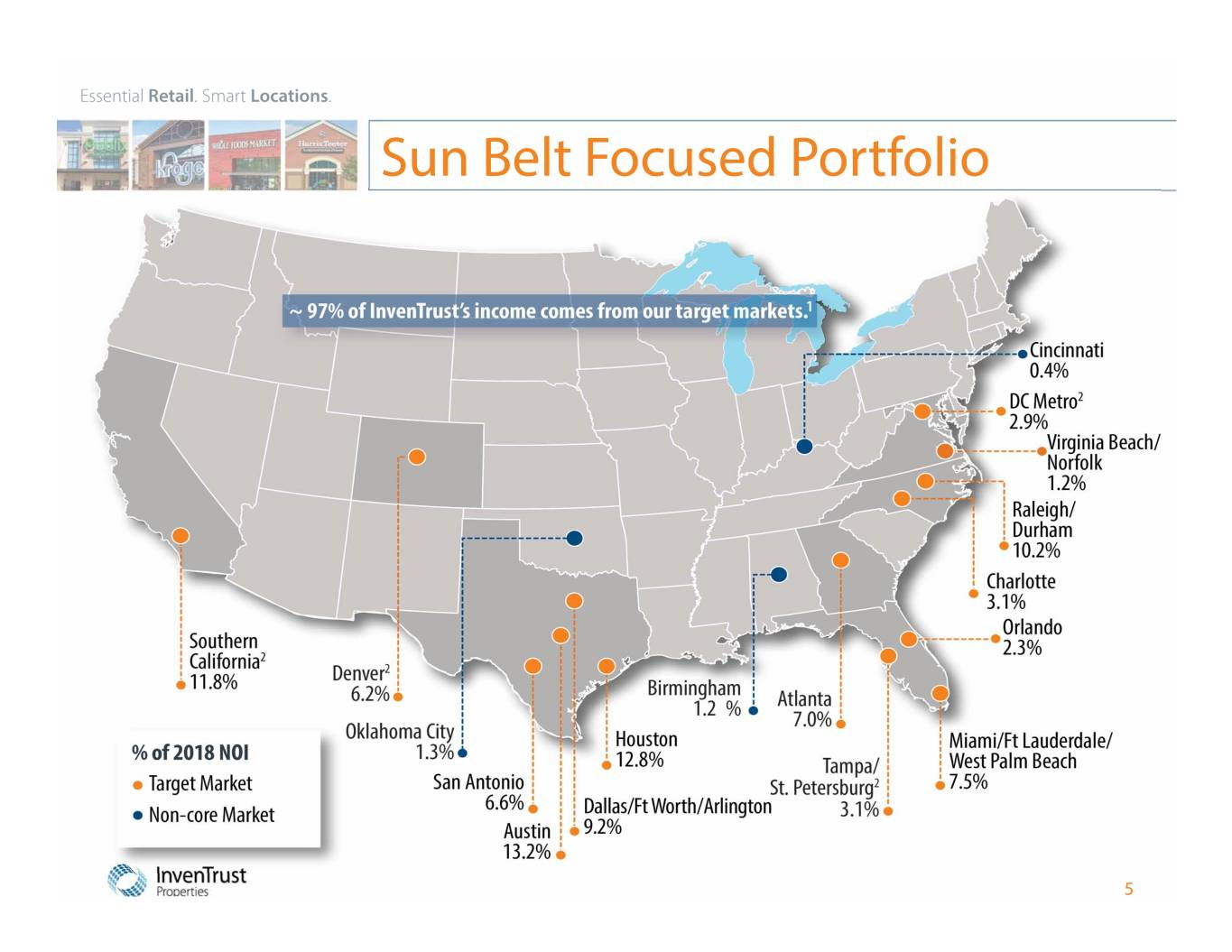

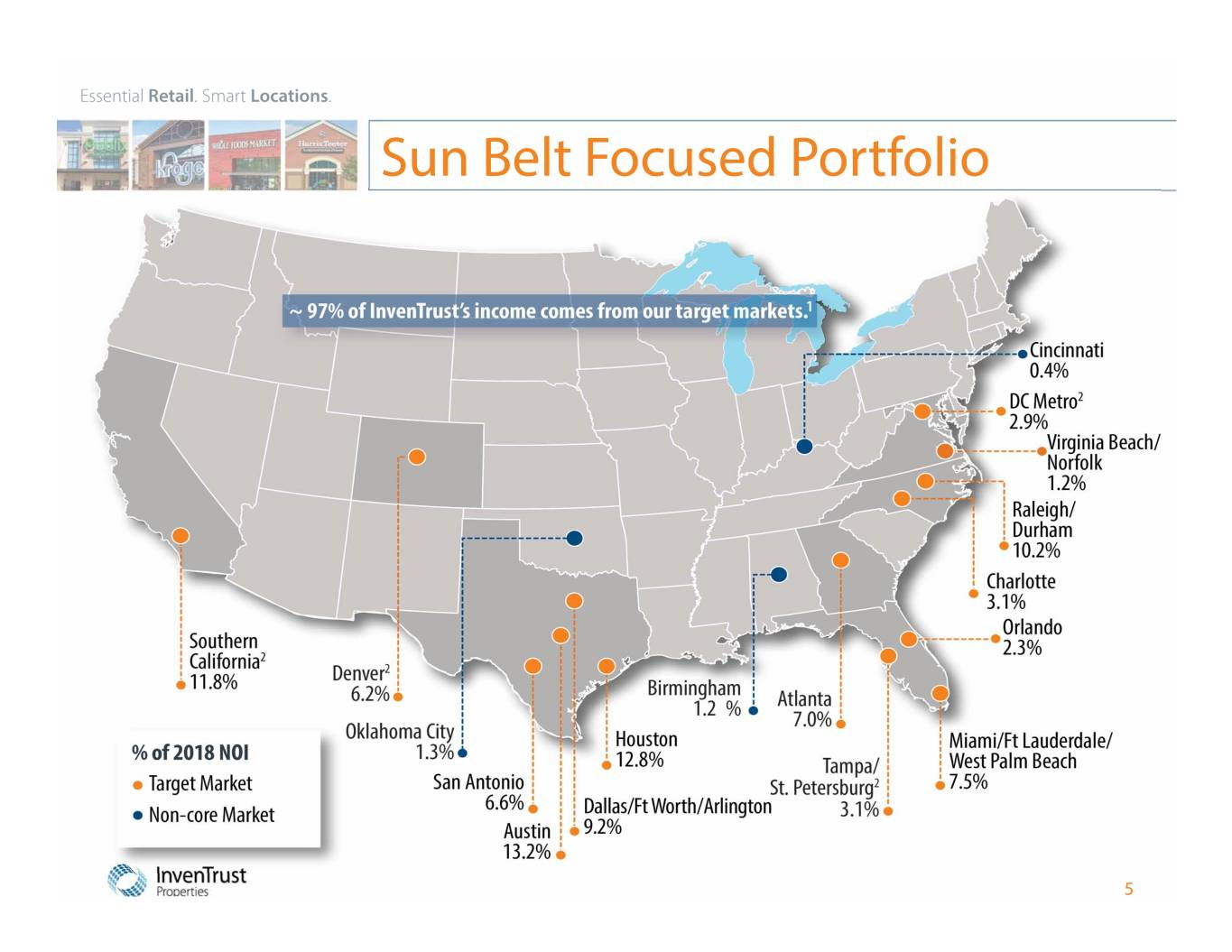

Sun Belt Focused Portfolio 1 5

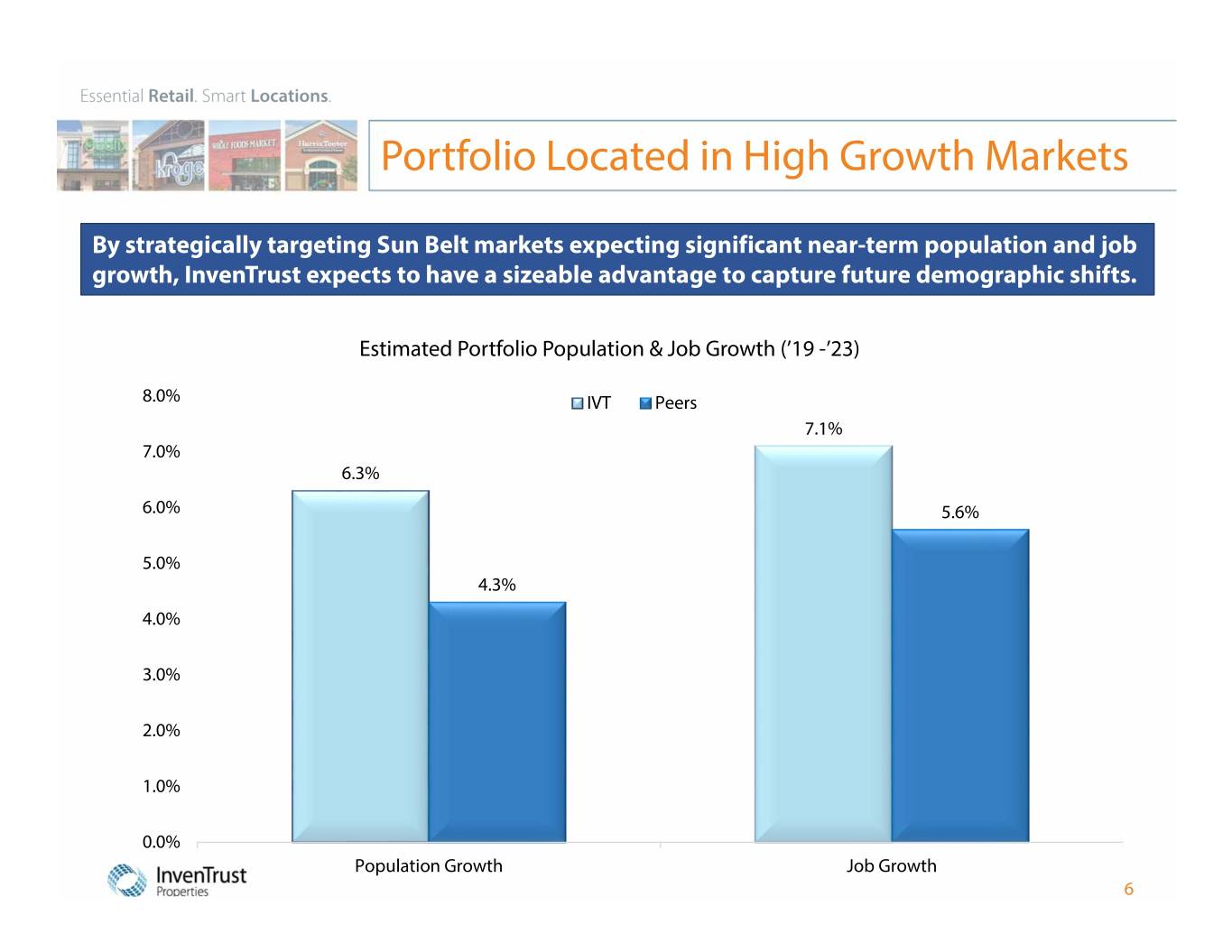

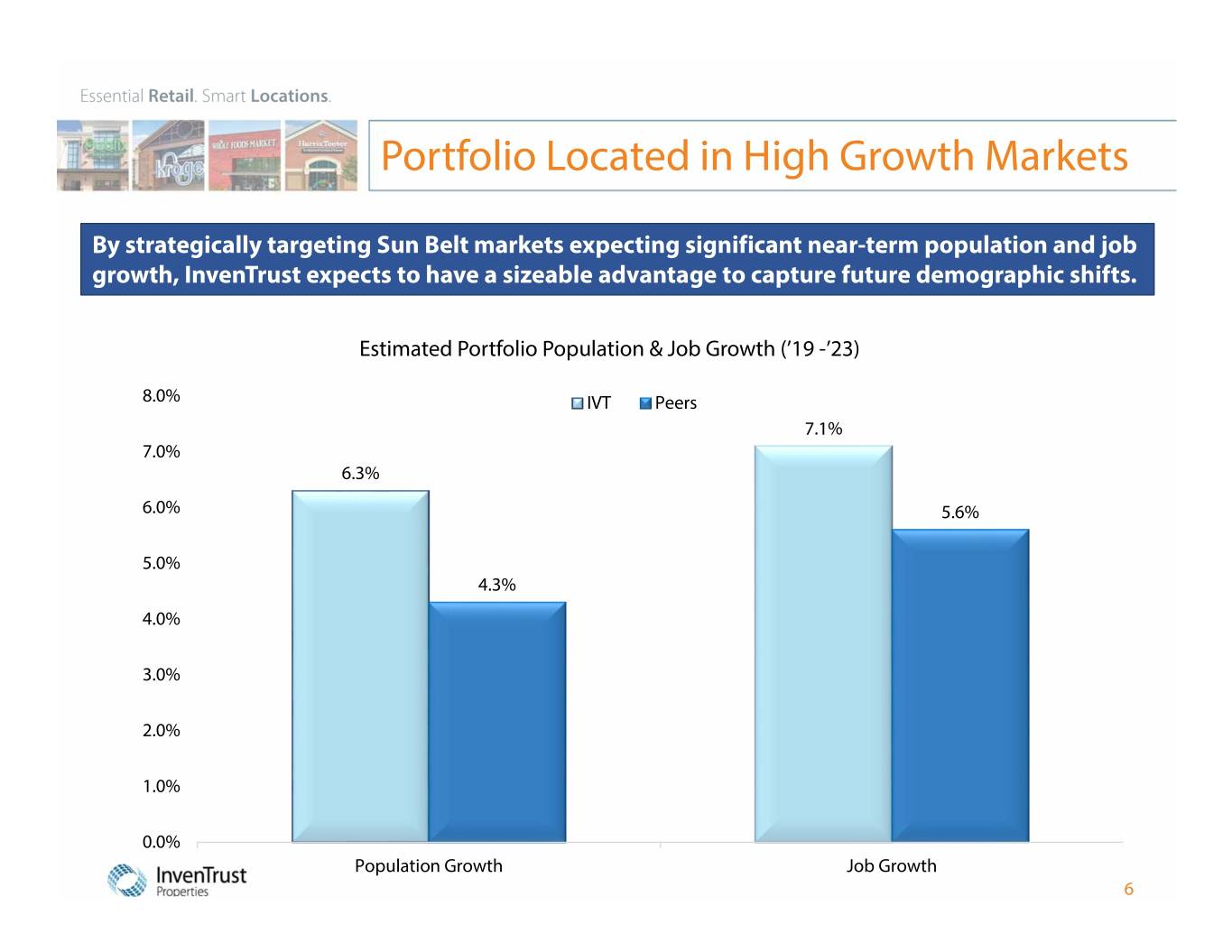

Portfolio Located in High Growth Markets By strategically targeting Sun Belt markets expecting significant near-term population and job growth, InvenTrust expects to have a sizeable advantage to capture future demographic shifts. Estimated Portfolio Population & Job Growth (’19 -’23) 8.0% IVT Peers 7.1% 7.0% 6.3% 6.0% 5.6% 5.0% 4.3% 4.0% 3.0% 2.0% 1.0% 0.0% Population Growth Job Growth 6

Current Retail Environment1 1. Top grocers in a market continue to perform well a) Grocery stores drive traffic as consumers prefer fresh prepared food and reinvent the center of the store b) Grocery asset pricing up almost 20% to $221 per square foot since 2012 c) New grocery store openings increased by 30% in 2018 i. FL, CA & TX experienced the largest share ii. Value and service grocers led square footage increases iii. Mid-market grocers getting squeezed out d) Top grocers are embracing and investing in technology i. Boost customer experiences ii. Solve “last mile” e) “Click & Pick-Up” trend is building 2. Retail Evolution a) Nearly half of Millennials are spending more on food-and-beverage than they did two years ago b) An ICSC survey indicated 57% of retailers plan to operate the same number of stores as last year, 36% more stores and 7% less stores. c) Dozens of pure-play online retailers are opening physical stores for brand awareness and building customer relationships d) Little development exists in the pipeline, but e) Redevelopment is on the rise 7

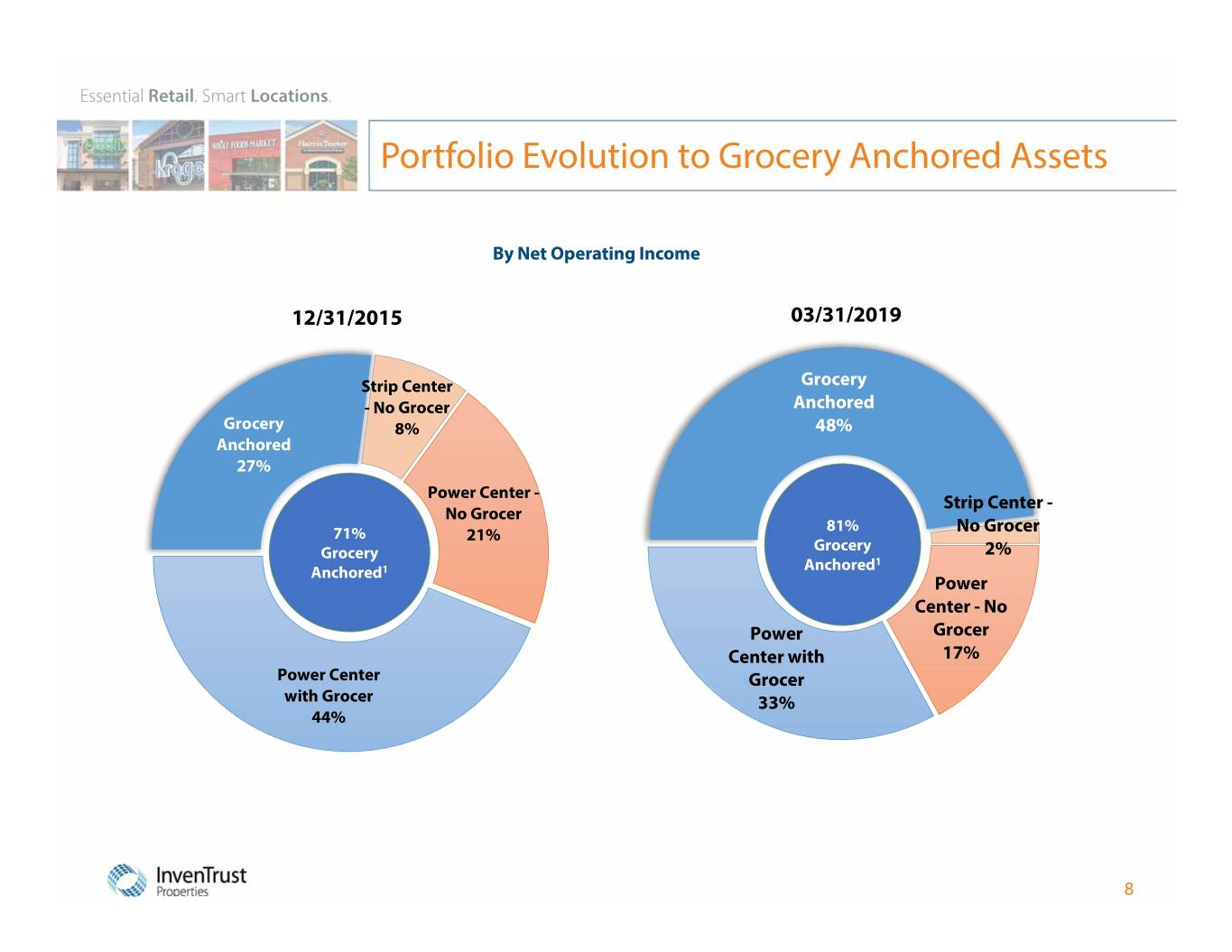

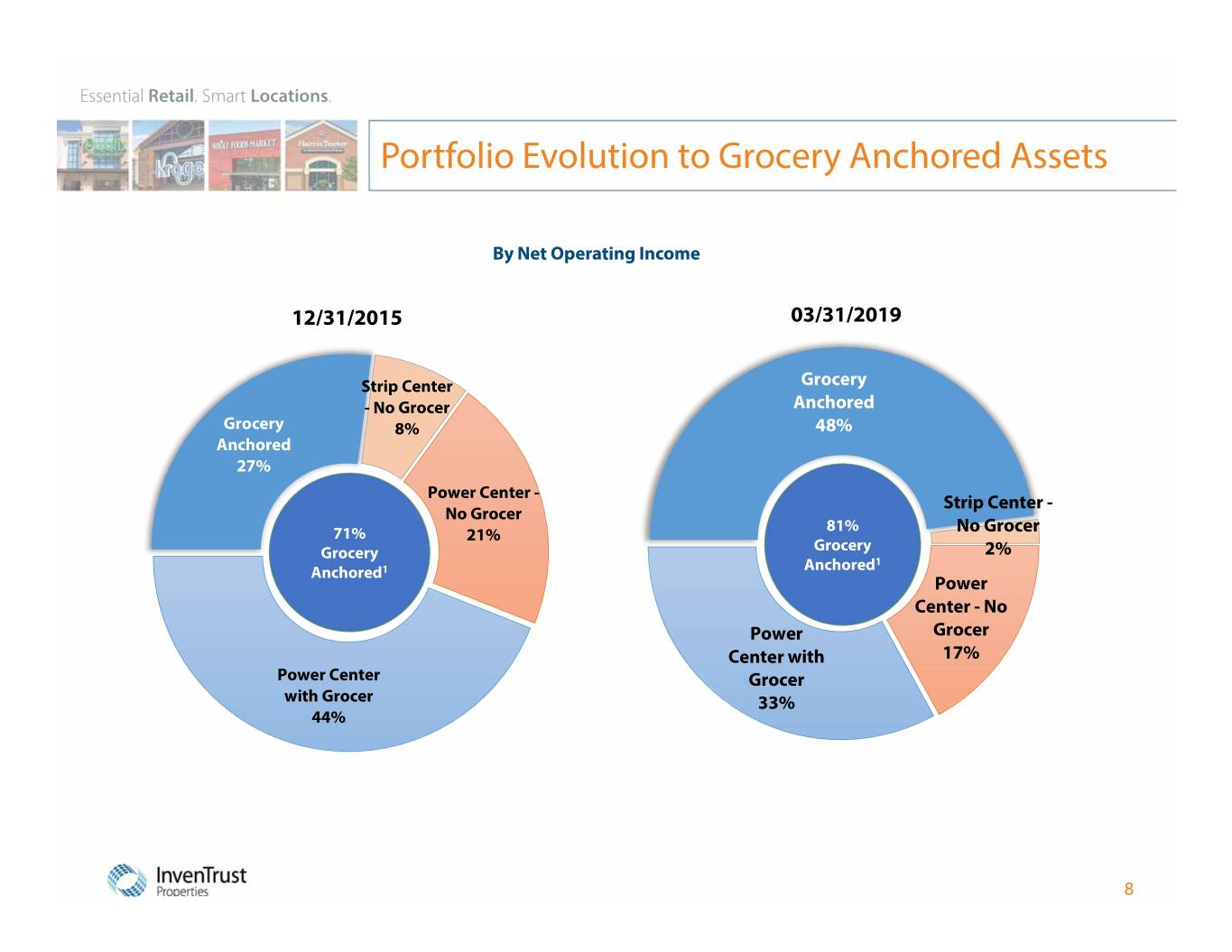

Portfolio Evolution to Grocery Anchored Assets By Net Operating Income 12/31/2015 03/31/2019 Strip Center Grocery - No Grocer Anchored Grocery 8% 48% Anchored 27% Power Center - Strip Center - No Grocer 81% No Grocer 71% 21% Grocery Grocery 2% 1 Anchored1 Anchored Power Center - No Power Grocer Center with 17% Power Center Grocer with Grocer 33% 44% 8

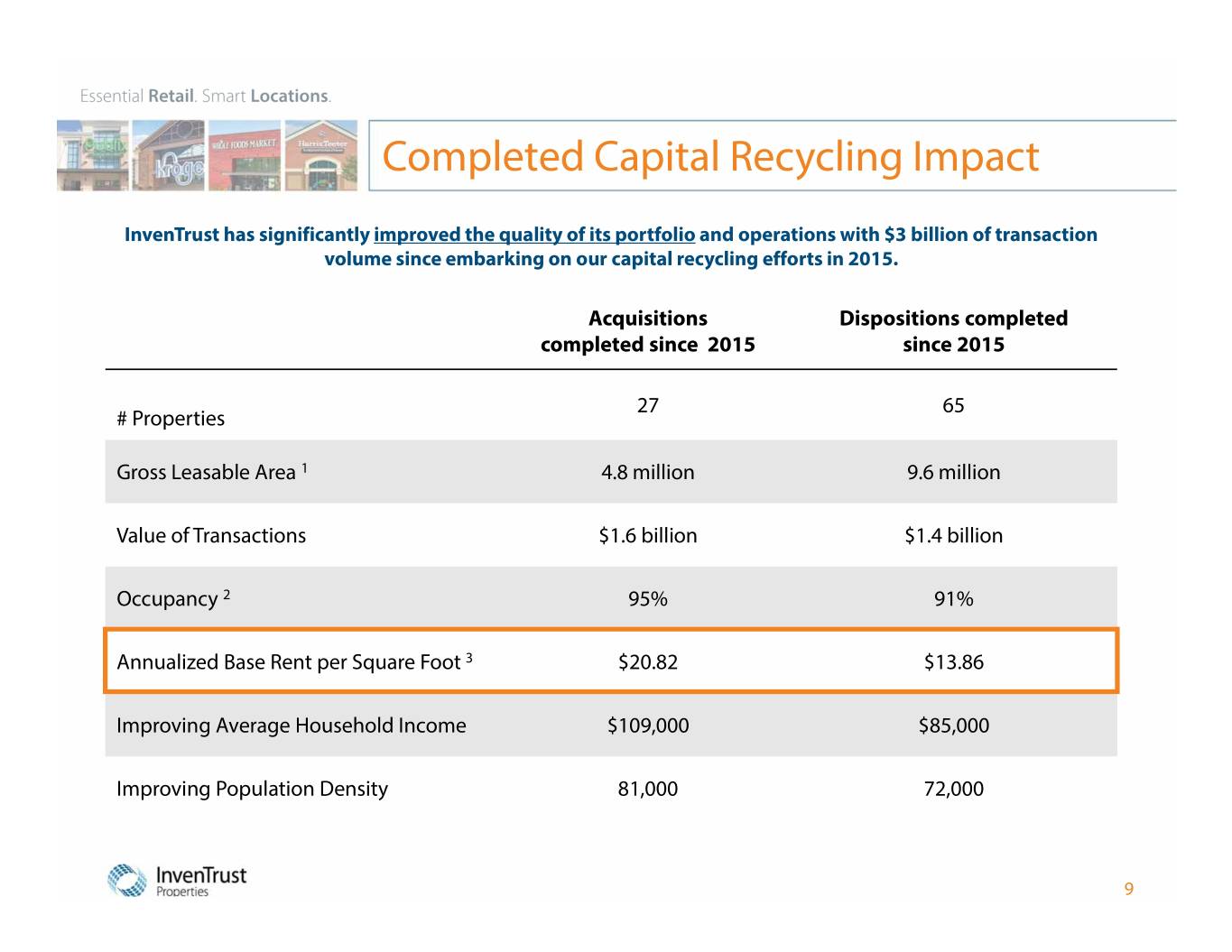

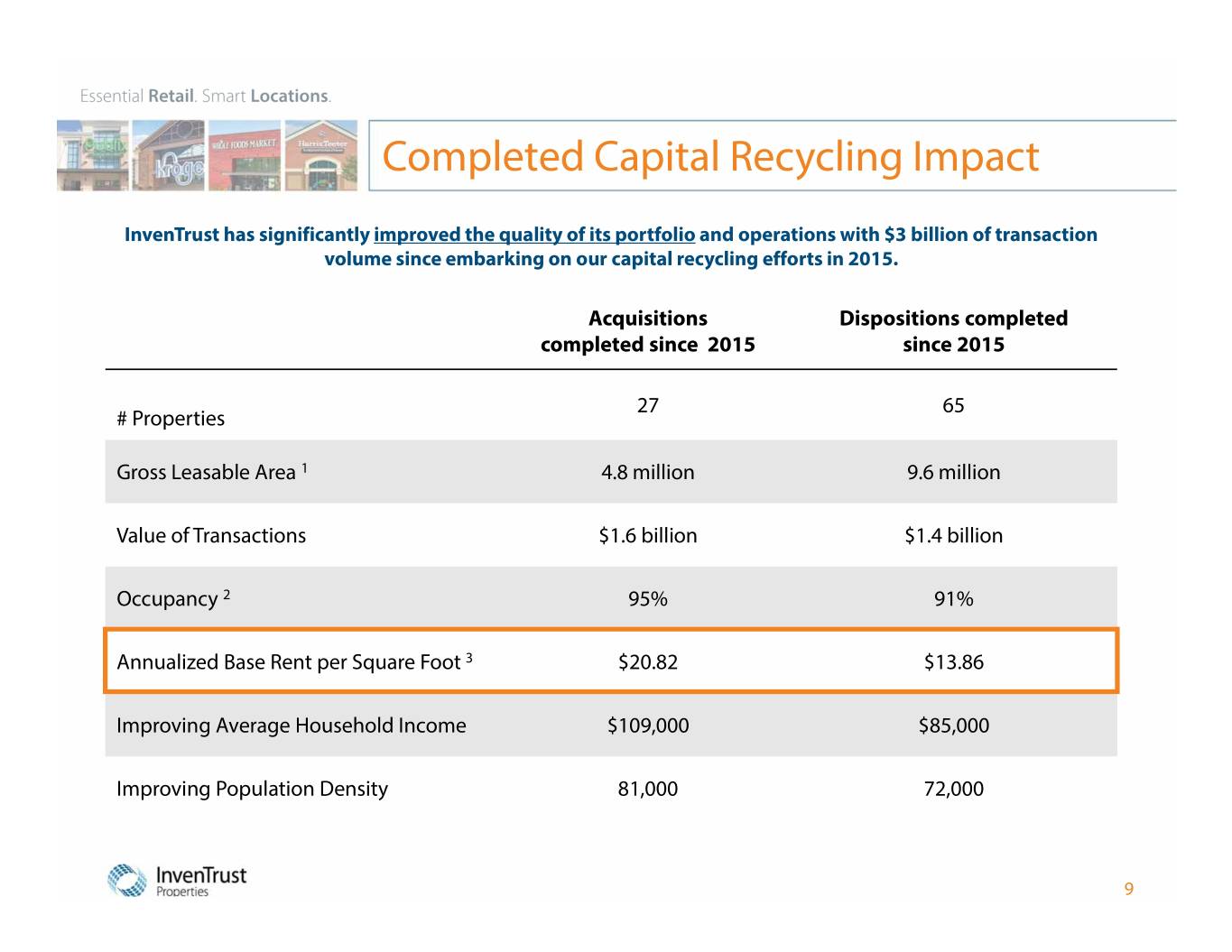

Completed Capital Recycling Impact InvenTrust has significantly improved the quality of its portfolio and operations with $3 billion of transaction volume since embarking on our capital recycling efforts in 2015. Acquisitions Dispositions completed completed since 2015 since 2015 27 65 #Properties Gross Leasable Area 1 4.8 million 9.6 million Value of Transactions $1.6 billion $1.4 billion Occupancy 2 95% 91% Annualized Base Rent per Square Foot 3 $20.82 $13.86 Improving Average Household Income $109,000 $85,000 Improving Population Density 81,000 72,000 9

Recent Acquisitions – Upgrading the Portfolio Lakeside Winter Park & Crossing Sandy Plains Centre Commons at University Place Winter Park, FL Marietta, GA Durham, NC • Annualized Base Rent per SF - $43.28 • Annualized Base Rent per SF - $20.50 • Annualized Base Rent per SF - $15.54 • Trader Joe’s anchored • Kroger anchored • Harris Teeter anchored • 93% occupied • 91% occupied • 97% occupied • 3-mile Avg. HH Income - $103,500 • 3-mile Avg. HH Income - $137,000 • 3-mile Avg. HH Income - $92,000 • 3-mile Population – 81,900 • 3-mile Population – 69,200 • 3-mile Population – 60,600 • Grocer Sales per SF - $2,800 • Grocer Sales per SF - $475 • Grocer Sales per SF - $489 10

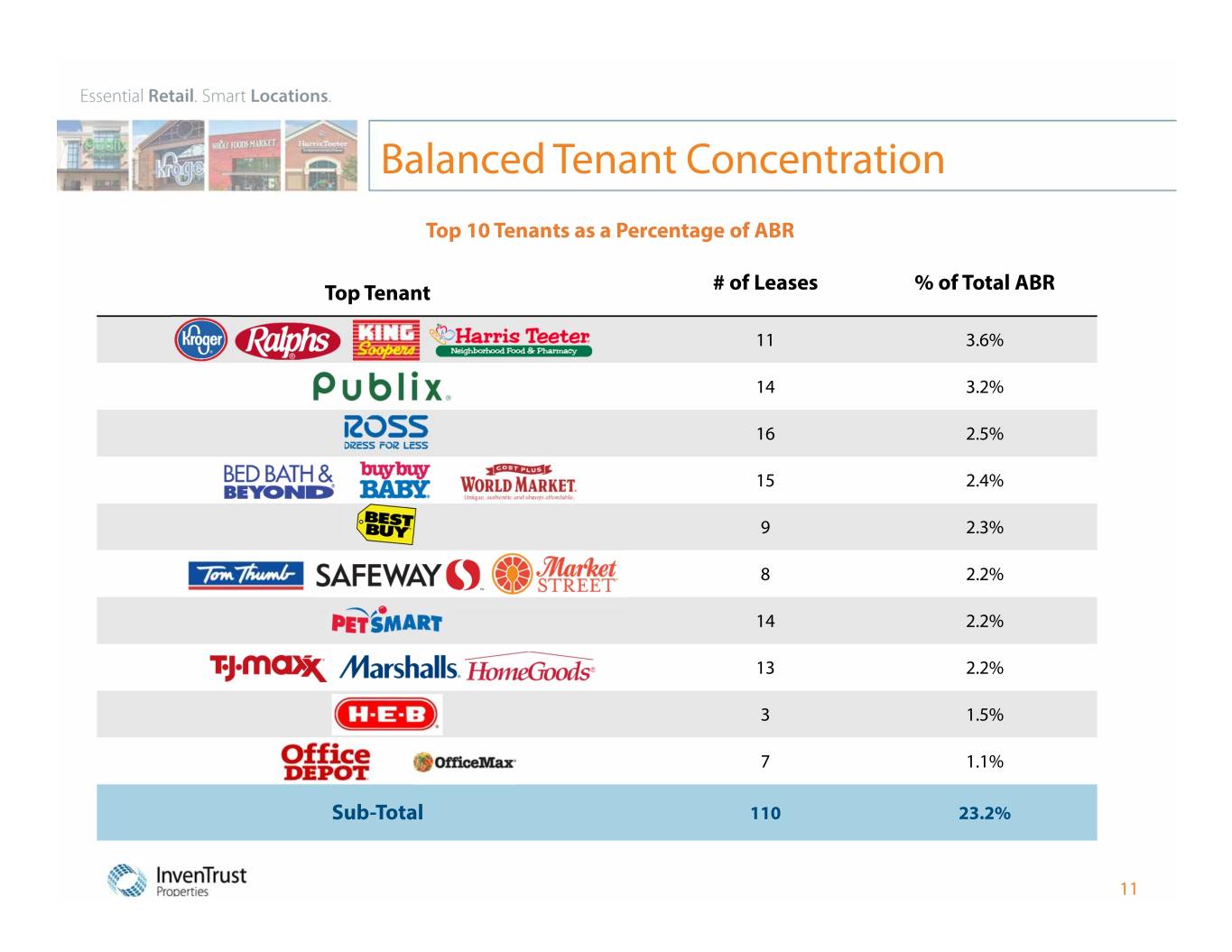

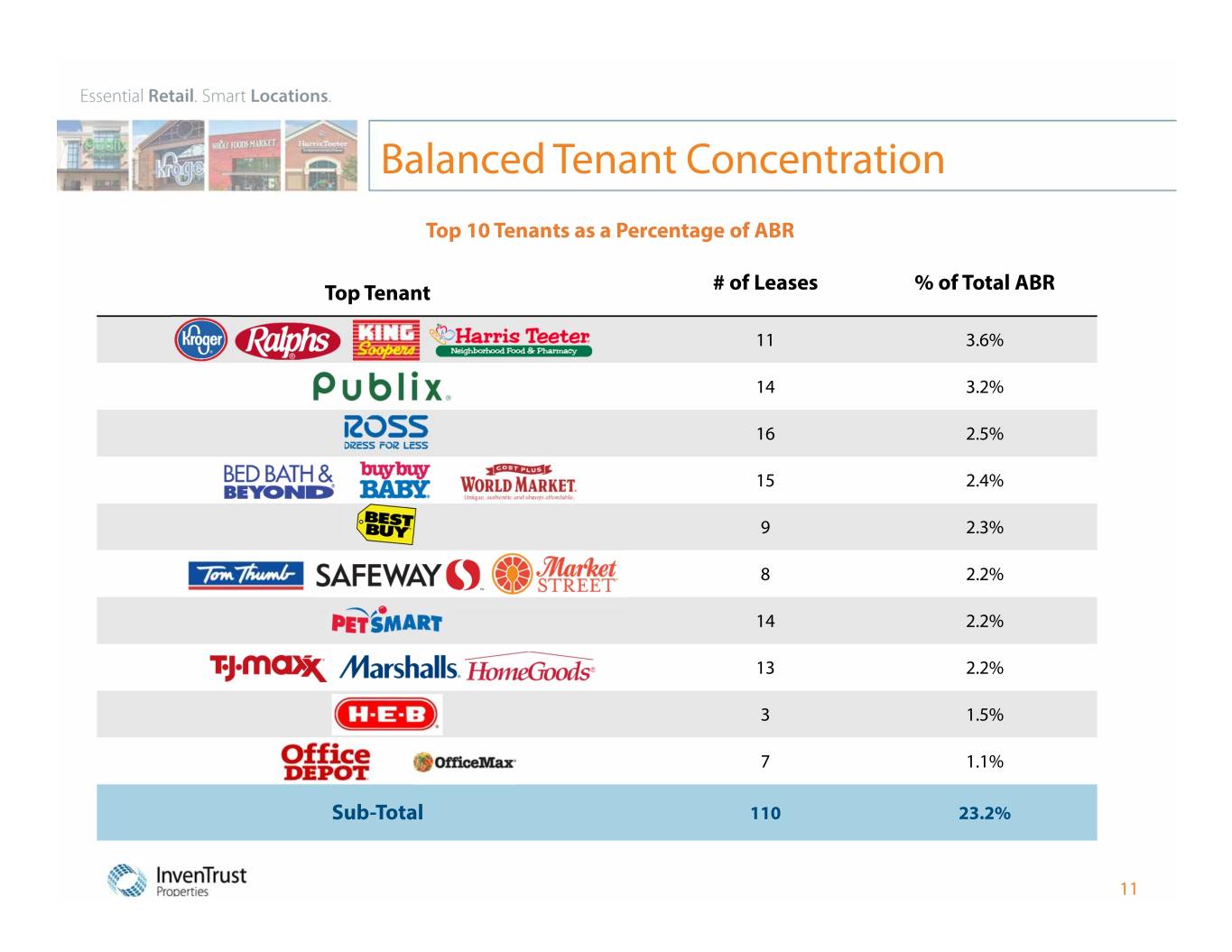

Balanced Tenant Concentration Top 10 Tenants as a Percentage of ABR Top Tenant # of Leases % of Total ABR 11 3.6% 14 3.2% 16 2.5% 15 2.4% 92.3% 82.2% 14 2.2% 13 2.2% 31.5% 71.1% Sub-Total 110 23.2% 11

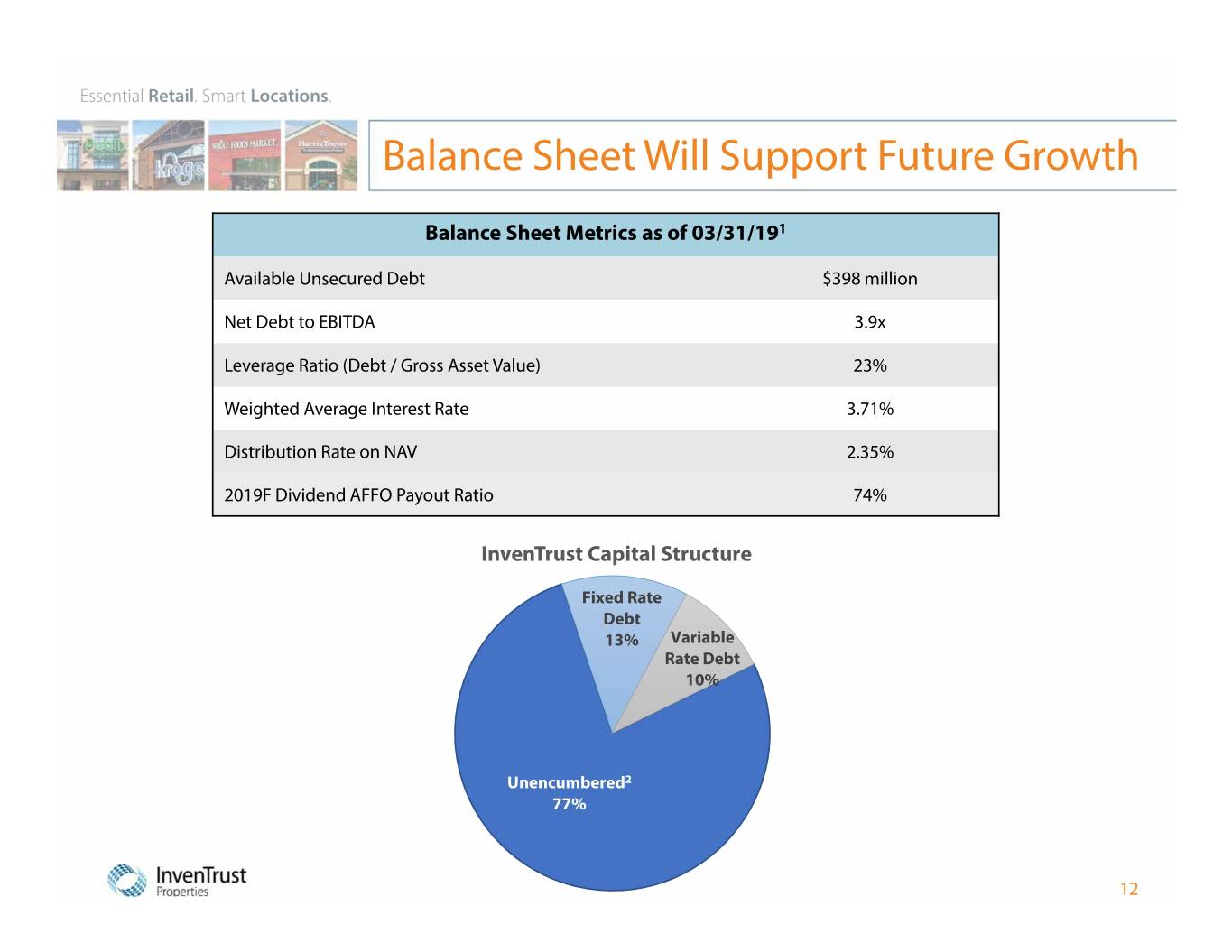

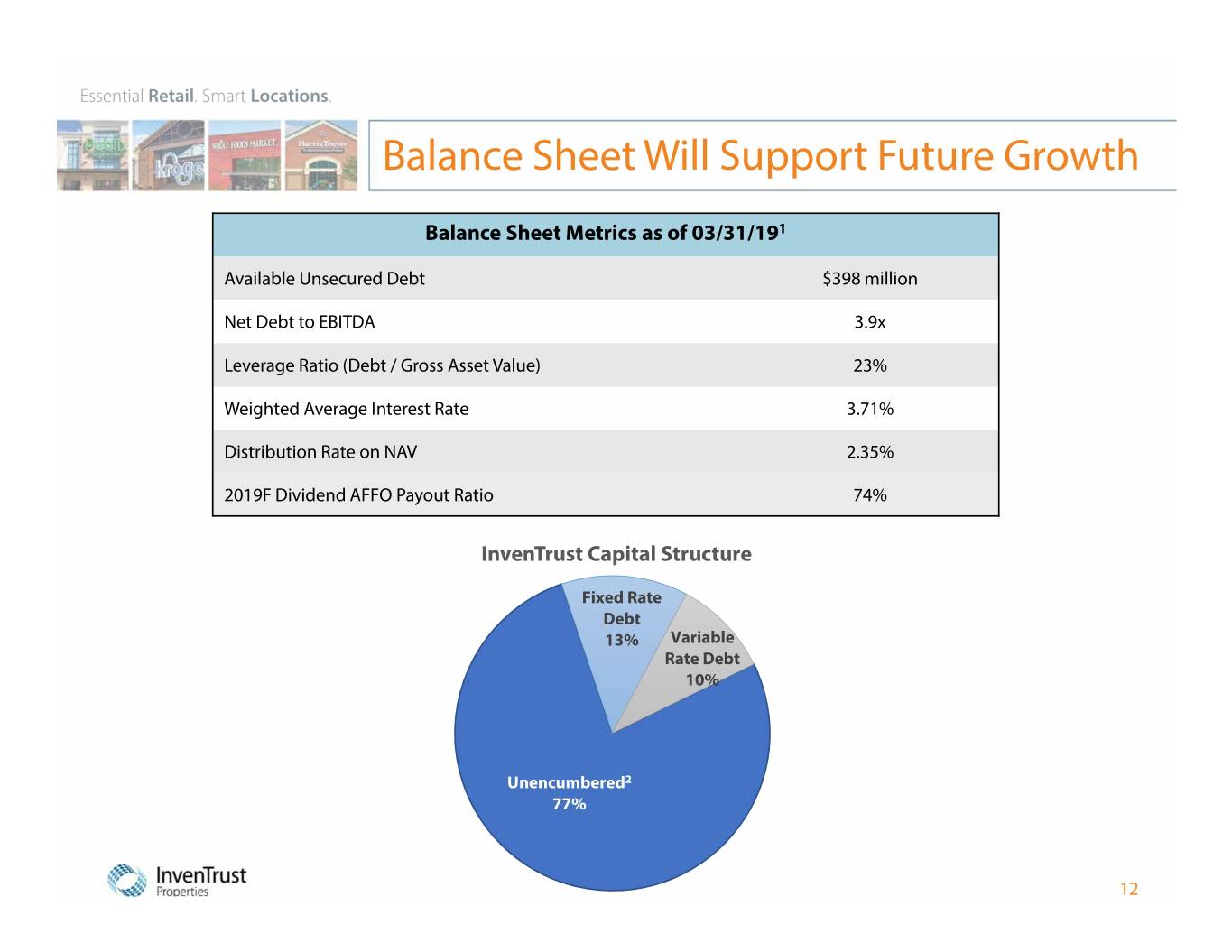

Balance Sheet Will Support Future Growth Balance Sheet Metrics as of 03/31/191 Available Unsecured Debt $398 million Net Debt to EBITDA 3.9x Leverage Ratio (Debt / Gross Asset Value) 23% Weighted Average Interest Rate 3.71% Distribution Rate on NAV 2.35% 2019F Dividend AFFO Payout Ratio 74% InvenTrust Capital Structure Fixed Rate Debt 13% Variable Rate Debt 10% Variable Debt 5% Unencumbered2 77% 12

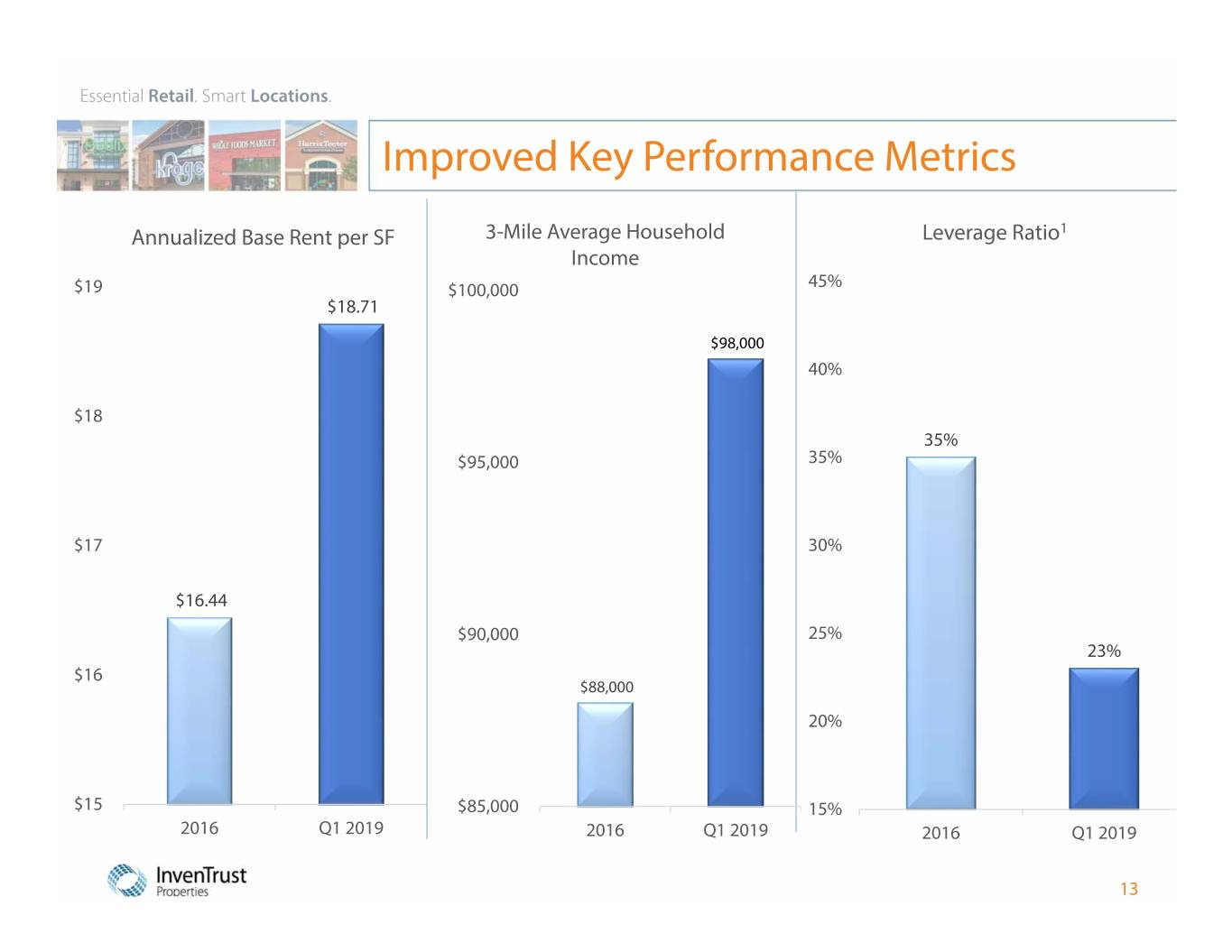

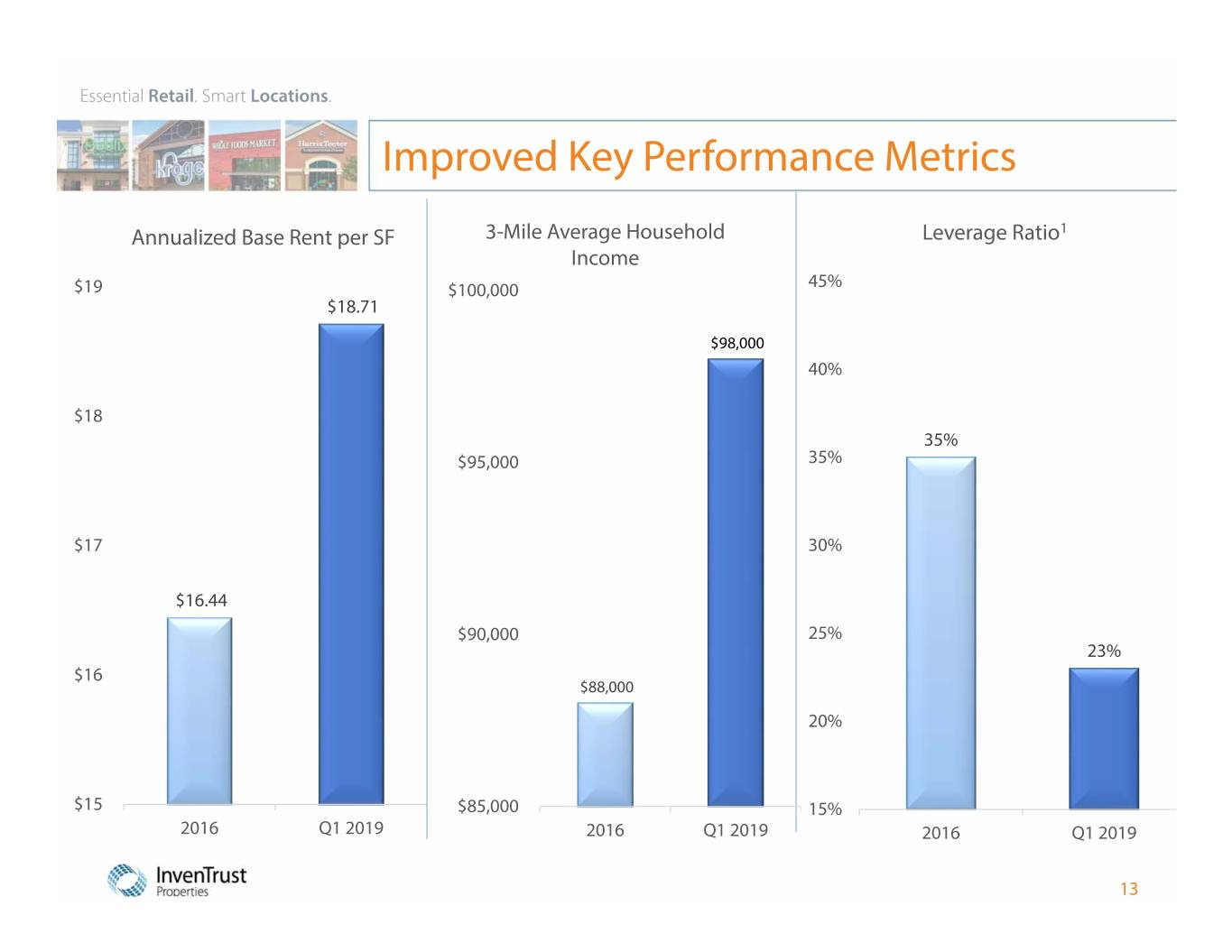

Improved Key Performance Metrics Annualized Base Rent per SF 3-Mile Average Household Leverage Ratio1 Income $19 $100,000 45% $18.71 $98,000 40% $18 35% $95,000 35% $17 30% $16.44 $90,000 25% 23% $16 $88,000 20% $15 $85,000 15% 2016 Q1 2019 2016 Q1 2019 2016 Q1 2019 13

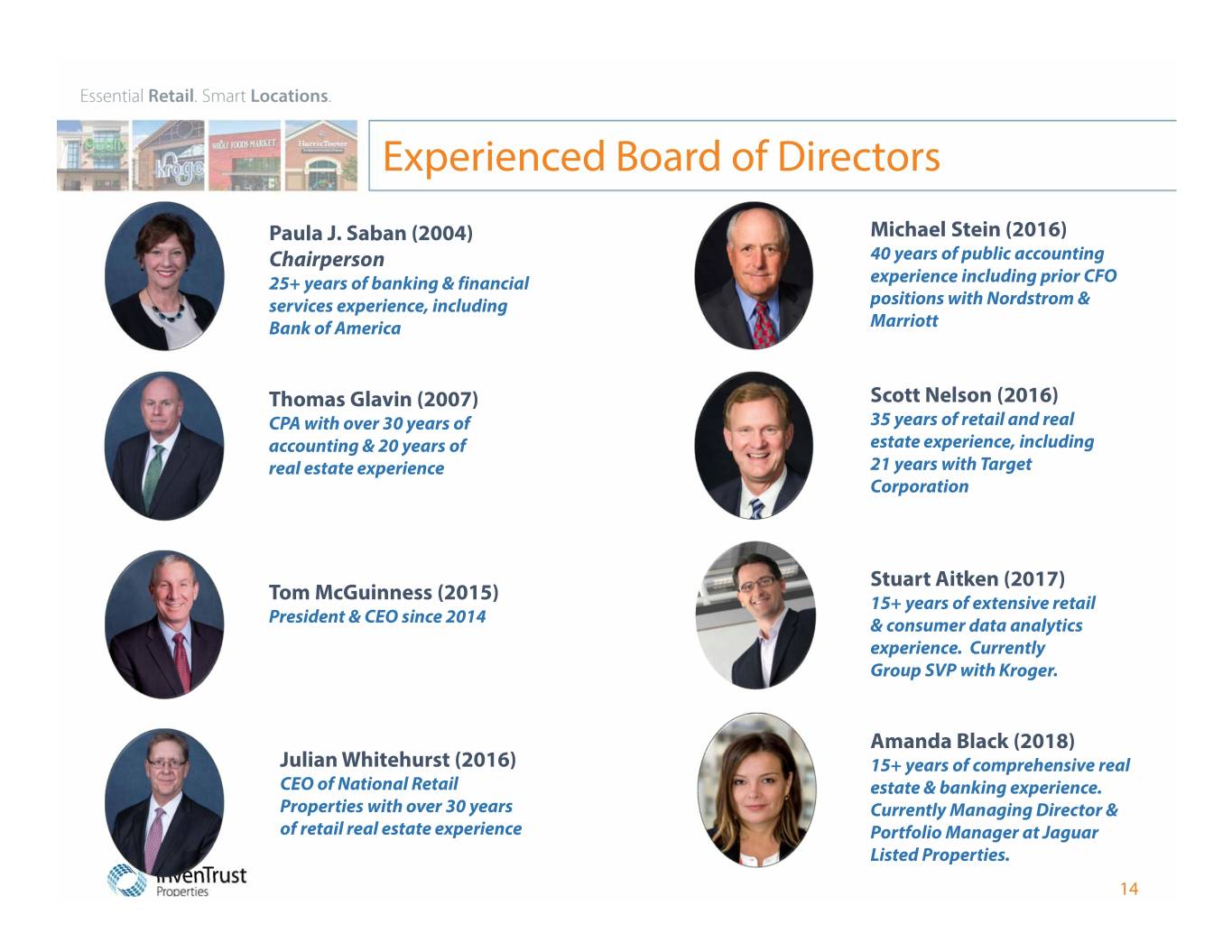

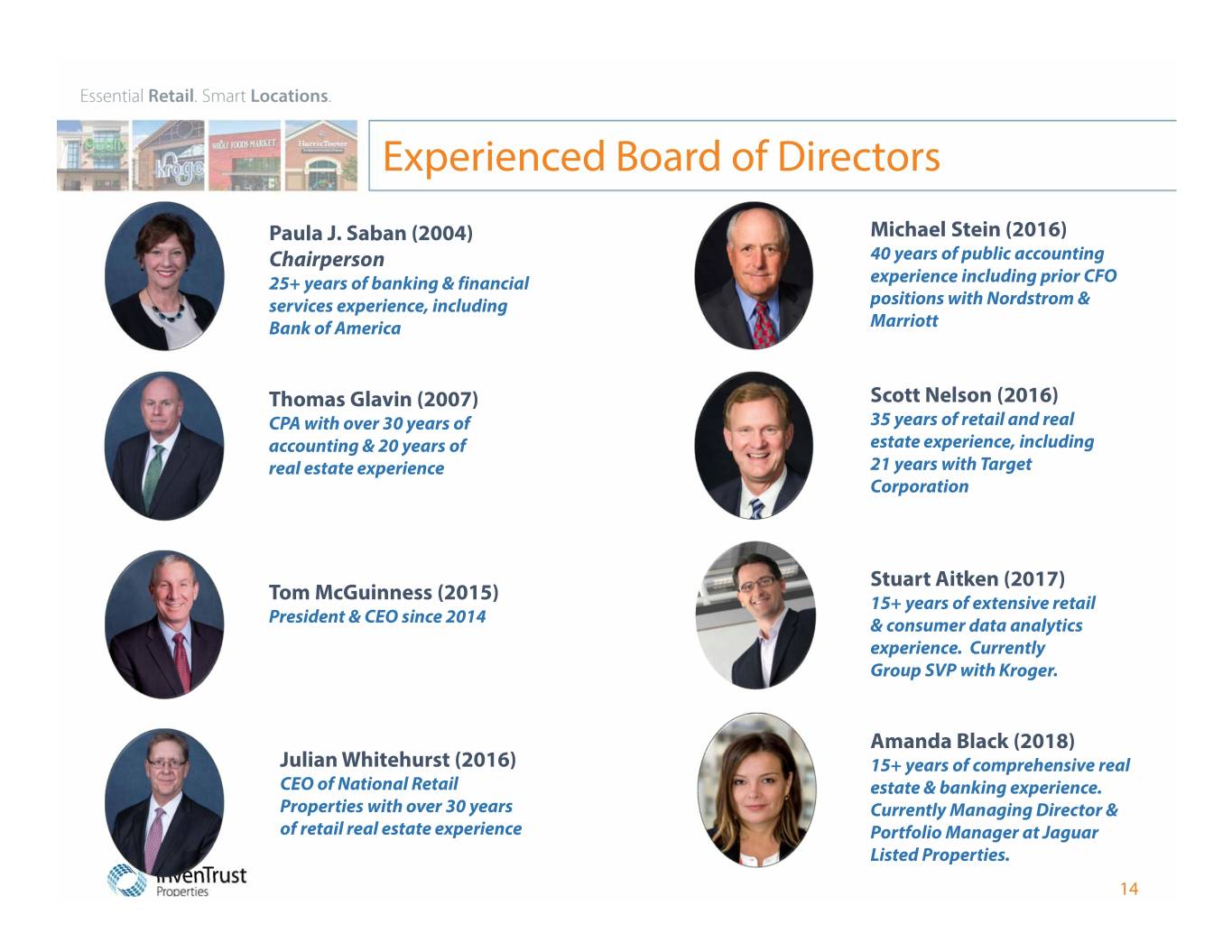

Experienced Board of Directors Paula J. Saban (2004) Michael Stein (2016) Chairperson 40 years of public accounting 25+ years of banking & financial experience including prior CFO services experience, including positions with Nordstrom & Bank of America Marriott Thomas Glavin (2007) Scott Nelson (2016) CPA with over 30 years of 35 years of retail and real accounting & 20 years of estate experience, including real estate experience 21 years with Target Corporation Stuart Aitken (2017) Tom McGuinness (2015) 15+ years of extensive retail President & CEO since 2014 & consumer data analytics experience. Currently Group SVP with Kroger. Amanda Black (2018) Julian Whitehurst (2016) 15+ years of comprehensive real CEO of National Retail estate & banking experience. Properties with over 30 years Currently Managing Director & of retail real estate experience Portfolio Manager at Jaguar Listed Properties. 14

Strategy Moving Forward o Focus and drive value as a grocery-anchored retail platform. o Concentrate portfolio in high job & population growth markets. o Maintain our flexible capital structure. o Opportunistically sell assets in low growth markets & where value has been maximized. o Evaluate various final liquidity options for when market conditions are right. 15

appendix 16

Footnotes Page 4 Page 9 1. Includes (a) wholly owned retail properties, (b) 100% of value related to IAGM 1. GLA includes ground lease square footage. Retail Fund I, LLC (“IAGM”), our joint venture with PGGM Private Real Estate 2. Occupancy is as of March 31, 2019, or as of the date of sale, and excludes Fund, (c) CDH CDO LLC and Concord Debt Holdings LLC, (d) Downtown ground and specialty leases. Railyard Venture LLC, and (e) cash. 3. ABR is annualized base rent as of March 31, 2019, or as of date of sale, divided 2. Walmart, Target, and warehouse clubs are considered grocers, regardless of by economic occupied square footage. Ground and specialty leases are whether the box is owned by the REIT or shadow anchored. excluded. ABR calculation excludes GAAP entries. 3. ABR is annualized base rent as of March 31, 2019. Ground and specialty leases are excluded. ABR calculation excludes GAAP entries. Page 1 1. ABR is annualized base rent as of March 31, 2019. Ground leases are Page 5 included. ABR calculation excludes GAAP entries. 1. As of December 31, 2018. 2. Southern California includes Los Angeles, Riverside/San Bernardino/Ontario (Inland Empire) and San Diego. Denver includes Fort Collins and Colorado Page 12 Springs. Tampa/St. Petersburg includes Sarasota & Punta Gorda. DC Metro 1. Gross asset value includes (a) wholly owned retail properties, (b) properties includes Richmond. owned by IAGM at share, (c) CDH CDO LLC and Concord Debt Holdings LLC, and (d) Downtown Railyard Venture LLC. 2. Percentage of unencumbered assets is estimated unencumbered asset value Page 6 divided by gross asset value. 1. Data per Green Street. Peers – REG, ROIC, KIM, WRI, FRT, BRX, RPAI Page 13 Page 7 1. Debt / Gross Asset Value (Gross asset value includes (a) wholly owned retail 1. JLL’s U.S. Grocery Tracker 2019 properties, (b) properties owned by IAGM at share, (c) CDH CDO LLC and Concord Debt Holding, LLC, (d) Downtown Railyard Venture LLC. and (e) cash and marketable securities.) Page 8 1. NOI percentages include shadow-anchored grocery store tenants. Walmart, Target and warehouse clubs are considered grocers, regardless of whether the box is owned by the REIT or shadow anchored. 17