UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

For the fiscal year ended December 31, 2010

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

For the transition period from ____ to____

Commission file number: 000-52018

VIRTUALSCOPICS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 04- 3007151 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 500 Linden Oaks, Rochester, New York | 14625 |

| (Address of principal executive offices) | (Zip Code) |

(585) 249-6231

(Registrant's Telephone Number, Including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE EXCHANGE ACT:

Common Stock, $0.001 par value

NASDAQ Capital Market

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE EXCHANGE ACT:

TITLE OF EACH CLASS:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

¨ Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). * ¨

* Registrant is not yet required to submit Interactive Data Files pursuant to Rule 405 of Regulation S-T

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting” in Rule 12b-2 of the Exchange Act.

Larger accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o or No x

The aggregate market value of the issuer’s voting and non-voting common equity held by non-affiliates of the issuer as of December 31, 2010 was approximately $42,500,000 (calculated by excluding all shares held by executive officers, directors and holders known to the registrant of five percent or more of the voting power of the registrant's common stock, without conceding that such persons are “affiliates” of the registrant for purposes of the federal securities laws). This amount does not include any value for the issuer’s series A preferred stock or series B preferred stock, for which there is no established United States public trading market, or any value for the common stock issuable upon conversion of shares of such preferred stock.

As of February 28, 2011, there were outstanding 28,378,997 shares of the issuer’s common stock, $.001 par value.

Documents Incorporated By Reference: Portions of the Company's Proxy Statement to be delivered to the Company’s stockholders in connection with the Company’s 2010 Annual Meeting of Stockholders, which the Company plans to file with the Securities and Exchange Commission pursuant to Regulation 14A promulgated under the Securities Exchange Act of 1934, on or prior to April 30, 2011, are incorporated by reference in Part III (Items 10, 11, 12, 13 and 14) of this Form 10-K.

TABLE OF CONTENTS

| | | Page Numbers |

| PART I | | |

| | ITEM 1: Business | 2 |

| | ITEM 1A: Risk Factors | 14 |

| | ITEM 2: Properties | 18 |

| | ITEM 3: Legal Proceedings | 18 |

| PART II | | |

| | ITEM 5: Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 19 |

| | ITEM 7: Management's Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| | ITEM 8: Financial Statements and Supplementary Data | 25 |

| | ITEM 9: Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 25 |

| | ITEM 9A: Controls and Procedures | 25 |

| | ITEM 9B: Other Information | 26 |

| PART III | | |

| | ITEM 10: Directors, Executive Officers and Corporate Governance | 27 |

| | ITEM 11: Executive Compensation | 27 |

| | ITEM 12: Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 27 |

| | ITEM 13: Certain Relationships and Related Transactions, and Director Independence | 27 |

| | ITEM 14: Principal Accountant Fees and Services | 27 |

| PART IV | | |

| | ITEM 15: Exhibits | 27 |

PART I

FORWARD-LOOKING STATEMENTS

Some of the statements under the captions of this report on Form 10-K titled “Risk Factors,” “Management's Discussion and Analysis of Financial Condition and Results of Operations” or “Business,” contained or incorporated by reference elsewhere in this report, and in our other reports filed with the Securities Exchange Commission (“SEC”) constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve risks and uncertainties. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements that address activities, events or developments that we expect, believe or anticipate may occur in the future, including:

| | · | adverse economic conditions; |

| | · | loss of market share due to competing products and services; |

| | · | unexpected costs, lower than expected sales and revenues, and operating defects; |

| | · | adverse results of any legal proceedings; |

| | · | the volatility of our operating results and financial condition; |

| | · | inability to attract or retain qualified senior management and scientific personnel; |

| | · | inability to raise sufficient additional capital to operate our business, if necessary, and; |

| | · | other specific risks that may be referred to in this report. |

All statements, other than statements of historical facts, included in this report regarding our strategy, future operations, financial position, estimated revenue or losses, projected costs, prospects and plans and objectives of management are forward-looking statements. When used in this report, the words “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “plan,” “could,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. All forward-looking statements speak only as of the date of this report. We do not undertake any obligation to update any forward-looking statements or other information contained in this report. Existing stockholders and potential investors should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements in this report are reasonable, we cannot assure our stockholders or potential investors that these plans, intentions or expectations will be achieved. We disclose important factors that could cause our actual results to differ materially from our expectations under “Risk Factors” and elsewhere in this report. These risk factors qualify all forward-looking statements attributable to us or persons acting on our behalf.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources, and we cannot assure our stockholders or potential investors of the accuracy or completeness of the data included in this report. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We have no obligation to update forward-looking information to reflect actual results or changes in assumptions or other factors that could affect those statements. See “Risk Factors” for a more detailed discussion of uncertainties and risks that may have an impact on future results.

ITEM 1: Business

We are a provider of quantitative imaging for clinical trials serving the pharmaceutical, biotechnology and medical device industries. We have created a suite of image analysis software tools and applications which are used in detecting and measuring specific anatomical structures and metabolic activity using medical images. Our proprietary software and algorithms provide measurement capabilities designed to improve clinical research and development. We focus on applying our imaging technology to improve the efficiency and effectiveness of the pharmaceutical and medical device research and development processes. We believe our technology can also be used in improving the treatment planning for patients with cancer.

VirtualScopics, LLC was formed in 2000. In November 2005, VirtualScopics, LLC (“VS”), a New York limited liability company, entered into a securities exchange agreement with ConsultAmerica, Inc. (“CA”), a Delaware corporation. As a result of the exchange, the members of VS became the controlling stockholders of CA. CA did not have any meaningful operations prior to the merger. Immediately following the merger, CA changed its name to VirtualScopics, Inc. VirtualScopics, Inc. is a Delaware corporation and headquartered in Rochester, New York.

Business Overview

Our image-based measurement and visualization tools enable automated, accurate and reproducible measurement of minute changes that occur in anatomic structures in musculoskeletal, oncological, cardiological and neurological diseases. For pharmaceutical, biotechnology and medical device manufacturers, these tools can significantly alleviate or reduce clinical development bottlenecks by increasing the speed, accuracy and reliability of the demonstration of a new compound’s efficacy. Further, these measurements can be used to assess the viability of continuing a drug development project and eliminate as soon as possible a drug that is likely to fail. Early failure is critical to the pharmaceutical industry to prevent the expenditure of R&D funds on a drug that will not perform as expected. We believe that this is especially important today with the large number of compounds that are awaiting evaluation.

We have also begun pursuing the application of one of our technologies into the personalized medicine market. Specifically, we believe there could be further benefit of our blood flow and vascular permeability software tool in providing patients and oncologists information to determine whether an anti-angiogenic therapy is having the desired effect. We believe this application will better assist oncologists with treatment planning for patients undergoing anti-angiogenic cancer therapies. Over the past year we have received a significant amount of feedback relative to market acceptance from leading Oncologists, payers, pharmaceutical companies and equipment manufacturers. Based on this feedback, we have developed a strategy to begin the commercialization of the application. We will need to further validate the benefits of technology and will begin seeking opportunities to partner with an organization to assist with the process. We have also begun the regulatory process for obtaining 510k clearance from the FDA. We will continue to assess the best mechanism for channeling our application into the market as well as the process for obtaining reimbursement from payers; however, there can be no assurance that approval will be granted or we will experience significant demand for our application.

Benefits to Pharmaceutical, Biotech and Medical Device Companies

The benefits to pharmaceutical companies from using our image analysis tools can include shorter clinical development time, and earlier determination of the effectiveness or ineffectiveness of a new drug or compound. Our technology helps to curtail trials that are not likely to be beneficial and to avoid mistaken termination of compounds that are likely to prove efficacious, through:

| | · | improved precision in the measurement of existing biomarkers resulting in shorter observation periods, with beneficial cost savings within a clinical trial; |

| | · | new biomarkers, which are better correlated with disease states, again reducing trial length and therefore costs; and |

| | · | reduced processing time for image data analysis through automation. |

In addition, our technology reduces aggregate clinical development costs through:

| | · | improved precision of existing biomarkers, thus requiring smaller patient populations and lower administrative costs; and |

| | · | new biomarkers that serve as better correlates, leading to better early screening and elimination of weak drug candidates in pre-clinical trials. |

Benefits to Patients and Health Care Providers in Personalized Medicine

The specific opportunities that we are pursuing within personalized medicine are mostly related to the treatment monitoring of patients. Cancer is a leading cause of death throughout much of the developed world, and technologies for closely monitoring disease progression and response to treatment are currently lacking. We believe this presents us with a significant market opportunity.

In personalized medicine, our technology is designed to offer physicians and medical insurers better treatment planning of patients based on determination of patient response to compounds or other treatment options. For example, in oncology we have demonstrated the ability to determine whether patients are showing response to an anti-angiogenic drug after only 48 hours of treatment (Glenn Liu et al., “Dynamic Contrast-Enhanced Magnetic Resonance Imaging as a Pharmacodynamic Measure of Response After Acute Dosing of AG-013736, an Oral Angiogenesis Inhibitor, in Patients With Advanced Solid Tumors: Results From a Phase I Study,” Journal of Clinical Oncology, vol. 20, August 20, 2005).

We are the first company able to provide blood flow and volume measurements for cancer diagnosis and monitoring in a standardized and consistent way across multiple institutions (Jerry M. Collins, “Imaging and Other Biomarkers in Early Clinical Studies: One Step at a Time or Re-Engineering Drug Development?,” Journal of Clinical Oncology, vol. 20, August 20, 2005). These measurements are vital for assessing patient response to next-generation anti-angiogenic cancer drugs.

During 2010, we expanded our assessment and commercialization efforts within this market. We began a dialogue with the FDA to gather the Agency's feedback on our services and validate our assumptions regarding regulatory approval. We also gained insight into the level of supporting data that will be necessary to claim and demonstrate predictability. Based on this feedback we plan to do a staged approach with the regulatory approvals (i.e. not include the predictability claim in our first approval) in order to begin performing blood flow and vascular permeability measurements and collect any necessary data to demonstrate and claim predictability. Also, during 2010, we engaged consultants to assist in our efforts to commercialize this service. They gathered feedback from key opinion leaders within oncology, insurance companies and pharmaceutical companies on their assessment and utility of the service. Based on this feedback we believe the best strategy for the broadest market acceptance would be to partner with an organization to assist in the further validation of the application as well as the distribution. We are in the process of discussing the opportunity with those parties that expressed the most interest during the gathering of market research data. Based on the nature of the partnership and the amount of validation required to demonstrate strong predicative values we will make an assessment whether additional capital will be required.

Our Technology Solution

Oncology Applications

Automated Measurement of Tumor Structure in Oncology

Rapid determination of drug efficacy depends on precise measurement of tumor structure and function. Yet current practices - direct measurement from films and computer-aided tracing - can be time-consuming, inaccurate and highly variable. Manual approaches often lead to false conclusions when tumors take on abnormal shapes; where a two-dimensional analysis may indicate no change, a three dimensional analysis may show a significant change in tumor volume. The RECIST standard, still the primary imaging endpoint for assessing disease progression or response to treatment in many types of cancer, measures structural changes in tumors through a simple summation of longest diameters, limited to the axial imaging plane. Originally developed for x-ray imaging, it fails to take advantage of the far richer three dimensional information set available with today's imaging technologies.

Our semi-automated, statistically driven feature analysis provides greater precision, higher throughput and less dependence on a particular reader than manual tracing does. In retrospective analysis for a leading pharmaceutical company, our volumetric measurement showed that tumors found to be stable under RECIST actually were growing significantly. With our semi-automated analysis we could have discovered the failure sooner and avoided the expense of funding the next phase of clinical research. Conversely, volumetric measurement can greatly accelerate clinical research by preventing mistaken kills and identifying efficacious compounds sooner.

Innovation in Image-Based Biomarkers

With a multidisciplinary team of medical professionals (including staff radiologists), scientists and software developers, we deliver unparalleled innovation in the analysis of specific biomarkers. Measurements may include specific FDA-acknowledged (RECIST and tumor volume) biomarkers as well as secondary or exploratory endpoints such as cavitation/necrosis, or shape. By extracting substantially more information from existing imaging modalities such as CT or MRI, we believe we offer a more definite and efficient basis for determining the course of clinical trials.

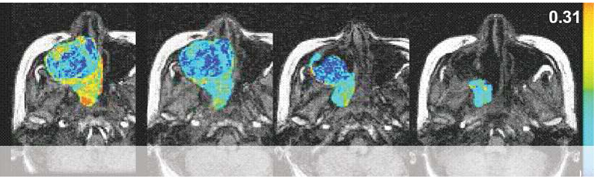

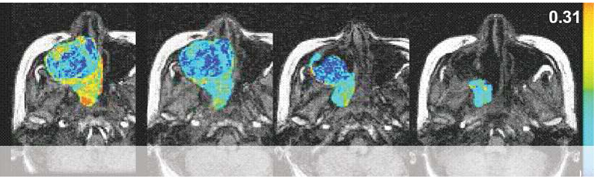

Measurement of Blood Flow and Metabolic Activity

A growing number of anti-cancer drugs both on the market (e.g., Iressa and Avastin) and under development are designed to reduce the blood supply available to tumors, thereby depriving them of the ability to grow and spread. During development, these compounds require the ability to accurately measure blood flow and vascular permeability in vivo, in order to determine dose-response relationships and compound efficacy. In the clinic, this same capability is necessary in order to determine whether a particular patient is responding to treatment. We have developed a method, using dynamic contrast enhanced magnetic resonance imaging (DCE-MRI), to accomplish this. This technique involves repeated imaging, generally every five to ten seconds, for a period of several minutes before and after the injection of a gadolinium-based, FDA-approved, contrast agent. Tracer concentration changes over time can then be measured both in normal and cancerous tissues, and based on this information parameters such as blood flow, blood volume and vascular permeability can be derived. These parameters have been shown to relate directly to the activity of anti-angiogenesis and anti-vascular cancer drugs, and to allow the prediction of response or failure after only a few days of treatment.

With dynamic contrast-enhanced series, changes in signal intensity can be related to tracer concentration in tissues. This information can be used to determine the blood flow to the tumor.

Musculoskeletal Applications

Our image analysis provides a degree of accuracy and reproducibility that cannot be duplicated by manual techniques. Standard endpoints, such as pain or functionality scoring are largely subjective and difficult to reproduce. Our quantitative imaging replaces subjective evaluation - knee pain ranked on a scale of 1 to 10 - with an objective quantification - volume of lost cartilage in cubic millimeters. Unlike manual assessment methods, our computer aided approach allows you to track the boundary location of each structure in a data set from one scan to another, even if the patient is not positioned in precisely the same way for each scan, or if there have been some anatomical changes between scans. For cartilage volumes and thickness measurements, the Coefficient of Variation (CV) typically falls between 2% and 4% - we can detect minute changes with statistical confidence, allowing our clients to reduce study populations or shorten study durations.

With our automated analysis, researchers can more confidently make the go/no go decision for a compound early in the evaluation process, allowing scarce resources to be allocated to the most promising candidates. In the evaluation of osteoarthritis, for example, MRI of the cartilage in the knee coupled with automated measurement of volume and composition shows disease changes in months; these changes would not be apparent for years using standard x-ray evaluation.

Reproducible medical image analysis is driven by computer image analysis algorithms that enable quantitative measurement of different structural parameters. Guided by the information present in the images, as well as embedded anatomical knowledge, the algorithms enable segmentation of different structures. From an MRI knee scan, for instance, it is possible to produce a three-dimensional reconstruction that graphically distinguishes cartilage from underlying bone, as well as from ligaments, fluid, degenerated menisci or inflamed synovium. This capability provides a valuable assessment tool for clinical research in osteoarthritis - a disease with multiple endpoints - because it allows sensitive and specific measurement of all the components of the knee joint and detects small changes in any of those components over time.

Medical Device and Biologics

New research continues to focus on the development of devices and/or biologics that will generate new and better cartilage for patients with osteoarthritis and knee injuries. Our technology uses a suite of tools to assist in the identification of cartilage lesions within the knee. These tools allow for the tracking of structural changes and the quality of new tissue being grown within those lesions. For example, we are currently working with leading biologic and medical device companies to determine the percent fill for lesions implanted with the device/biologic. This analysis serves as a useful tool in that it demonstrates the degree of success of the implant. It is presumed in the industry that the higher the percent fill the lower the degree of pain for the patient. We also provide quality of tissue assessments (i.e. T2 maps) to provide our customers with information on the composition of the repair tissue. It is also believed that the closer the repair tissue is to ‘normal’ tissue the longer the life span is of the repair tissue with the resulting benefit being the ultimate health and comfort of the patient.

Additionally, our motion tracking software capabilities allows us to more precisely measure changes in the structural and tissue quality measurements. It has been demonstrated that this technique can reduce the amount of variability inherent in these types of measurements, thereby, reducing the amount of patients necessary to demonstrate the effectiveness of the medical device and/or biologic.

Cardiovascular Applications

Cardiovascular disease is one of the leading causes of mortality within most developed countries. Early identification of the changes leading the disease can prompt early intervention which can result in longer and better quality of life as well as lower healthcare costs. Imaging provides a valuable tool for the assessment of early development of arterial plaques which can lead to arterial stenosis as well as stroke and myocardial infarction. The current primary imaging tool for screening cardiovascular patients is ultrasound but these carotid ultrasound scans produce a large amount of data which can be laborious and imprecise to analyze. We have developed a suite of patented semi-automated tools for the identification and measurement of carotid plaques which has proven to reduce analysis time to as little as 3 minutes per case compared to the current manual methods which can take over one hour. In addition, these tools have been tested against expert readers in the field and found to be highly precise and accurate and in many cases more sensitive to the appearance of small arterial plaques. This provides a valuable tool for screening of normal/healthy individuals as well as monitoring the use in patients enrolled in clinical trials.

More detailed information about plaque composition and progression can be obtained by using MRI. This modality has advantages over ultrasound in that it can precisely measure plaque volume as well as composition. This is important because it is widely recognized in the industry that certain plaques, in particular those with high lipid or necrotic cores, pose a much higher risk to the health of the patient, while those that are fibrous may pose a lower risk. Therefore, the ability to distinguish between benign and vulnerable plaques may enable treating physicians to better personalize the treatment for each patient. Additionally, certain drugs designed to reduce blood lipids may have greater effect on lipid rich plaques, making this a potentially beneficial screening tool for patients enrolled in clinical trials. Our patented semi-automated tools for the measurement of plaques in MRI and automated identification of lipids and calcification allows accurate and precise analysis of vulnerable plaques.

These proprietary ultrasound and MRI techniques for cardiovascular health are being used in large industry sponsored trials today.

Neurology Applications

Evaluating diseases such as multiple sclerosis (MS), epilepsy, and Alzheimer’s requires the identification and measurement of neurological structures and lesions. However, current methods for obtaining data points rely on subjective and error prone manual techniques. Manual tracing, especially of abnormal neurological structures, requires considerable expertise and time. Tracing introduces significant variability even when all measurements are made by one individual, an effect that is compounded with multiple operators. Intra- and inter-operator variability poses a major obstacle for researchers attempting to take advantage of the power of MRI analysis in the study of neurological disease. VirtualScopics eliminates these problems with automated, statistically driven feature analysis. Our algorithms employ the two types of knowledge that expert radiologists use to measure structures within the brain: differentiation of various tissue types and knowledge of structure, size, location, and shape. Our software incorporates an a priori model of neurological anatomy that enables the measurement of structures with indistinct boundaries such as the hippocampus. Knowledge of anatomical structures also improves reproducibility, allowing disease progression to be precisely monitored over time. To gain higher resolution and superior tissue separability, we reconstruct volumes by co-registering and fusing images from multiple imaging planes and pulse sequences. Moreover, its automatic reconstruction produces a smooth and continuous surface, much closer to actual shape than would result from manual segmentation.

Many neurological conditions can be detected and evaluated with quantitative measures of structures in MRI studies. While automated measurement tracks lesions in MS clinical trials, it also provides a critical tool in measuring hippocampal volume for diagnosing and monitoring both intractable temporal lobe epilepsy and Alzheimer’s disease. Validation studies prove that our automated approach provides greater speed, precision and accuracy in clinical trials than current manual methods do. In MS clinical trials, where current techniques to measure progress in drug development are largely manual, we provide an FDA-approved metric for quickly determining drug efficacy of MS compounds. A VirtualScopics validation study compared manual tracing using two VirtualScopics software algorithms for automated measurement: geometrically constrained region growth (GEORG) and directed clustering. Our Core Lab utilizes both algorithms to achieve an optimal system for quantification of MS lesions in multi-spectral MRI studies. In the MS validation study, mean processing time was 60 minutes for manual tracing, 10 minutes for GEORG, and 3 minutes for directed clustering. Intra- and inter-operator coefficients of variation were 5.1% and 16.5% for manual tracing, 1.4% and 2.3% for region growth and 1.5% and 5.2% for directed clustering. The study also compared our automated measurement and manual tracing from an expert radiologist against a phantom data set, obtained from the McConnell Brain Imaging Center. In all data sets, automated algorithms performed significantly better than manual tracing. Our automated measurements also proved more repeatable than manual methods, an important feature in multi-center clinical trials.

Sales and Marketing

Our sales and business development strategy is centered around the publication and presentation of our technology and services at targeted industry conferences along with an active marketing effort aimed at pharmaceutical, medical device, and biotechnology companies. To date, we have made significant inroads by having contracts with 12 of the 15 leading pharmaceutical, biotechnology and medical device companies. During 2010, we performed services for 121 projects representing 31 customers. We continue to grow our business by leveraging relationships with our current customers and through referrals. As a result, our current customers have been instrumental in introducing us to other therapeutic groups within their organization. Our marketing efforts are instrumental in broadening the awareness of VirtualScopics throughout the industry and educating current customers on the breadth of our services.

Complementing our sales and marketing effort, we actively participate in medical conferences to showcase our technology, services and results, as well as joint publications with sponsors which often results in highly visible, research. We have built a strong base of clinical collaborators across varied disease platforms.

We are continuing an active sales and marketing effort and are currently in discussions with a number of additional potential customers to form businesses and/or partnerships.

Industry Background and Market Trends

Market in Pharmaceutical and Medical Device Development

Industry Overview

The global Pharmaceutical market is expected to grow by 5-7% in 2011 with the industry forecasted to generate around $880 billion in revenues with an expected expansion to $975 billion by 2013. Although impacted by the economic downturn in 2009, the industry is insulated to a greater extent than other industries where consumer spending is far more discretionary. Other factors such as patent expirations, the introduction of cheaper generics, a slowdown in innovative product launches, and hurdles imposed by payers on market access and acceptance have contributed to record low sales growth this year. While the pharmaceutical market is expected to rebound as the global economy recovers, an unprecedented level of potential patent expirations in 2011 and 2012 will curb sales growth. In spite of these pressures, the demand for medicines and treatments is expected to rise due to 1) an aging world population with an increased need for medical care, 2) unhealthy lifestyles leading to increased frequency of chronic diseases, 3) high economic growth in emerging markets leading to an increased demand for better quality healthcare and 4) scientific advances that create the foundation for innovative treatments for previously untreatable diseases.

The global compound annual growth rate (CAGR) for pharmaceutical market growth is forecasted to be 4-7 percent through 2013.1The U.S. Pharmaceutical market is expected to expand by 3-5 percent in 2011. Emerging markets on the other hand are expected to grow collectively at a 15-17 percent rate in 2011 to $170-180 billion. Meanwhile, the five major European markets of Germany, France, Italy, Spain and the UK, along with Canada, will only grow at a 1-3% pace. Approximately 50 - 60 new chemical or biological products are expected to be launched over the next two years with at least 10 of them being potential blockbuster drugs.

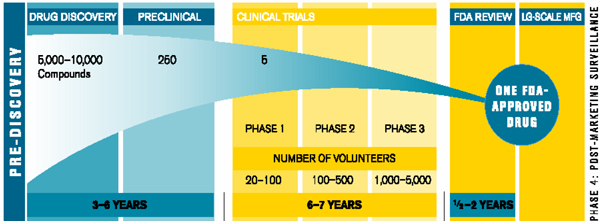

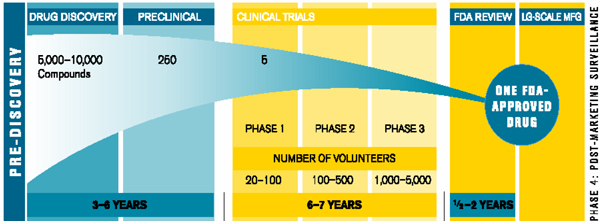

As the growth rate in the demand for prescription drugs decreases, it is getting harder for Pharmaceutical companies to maintain the same levels of R&D spending as in the past. Additionally, the cost and complexity of developing new drugs, in part due to the increased scrutiny over product safety and the pressure to demonstrate health outcomes earlier, has increased substantially relative to its eventual potential value. Due to the high attrition rates, with Phase 3 terminations alone doubling from 2007-2009 compared with 2004-2006, the total resources required to yield one successful product are rising. For every 5,000 -10,000 compounds that enter at the discovery stage, only one goes on to reach the market. The table below illustrates the complete R&D process from pre discovery to market.

1 imshealth.com - IMS Health Lowers 2009 Global Pharmaceutical Market Forecast to 2.5 – 3.5 Percent Growth

2

2

Drug Development Process

Typically, most functions of the drug and medical device R&D process are managed by Clinical Research Organizations (CROs). Rising costs and falling productivity, among other trends are driving pharmaceutical companies to outsource an increasing range of functions to CROs in search of time and cost savings. This produced strong double-digit growth in the CRO sector between 2003 and 2008. The total CRO market size is estimated to reach $27bn by 2011 with a CAGR of 15%. The market is highly fragmented and the number of CROs worldwide has reached over 1,100 despite continued consolidation. The leading CRO’s are Quintiles (7.6%), Covance (4.7%) and PPD (4.3%)

Although the FDA has significantly reduced the average approval time for new drugs (1.1 years in 2005-2007 period), clinical development time has been increasing over the years, resulting in total development time being fairly flat in recent years (average of 8.6 years since 2002). Growing complexities in protocol design leading to longer clinical development times has been the major contributor to the rising costs that sponsors are facing. The table below illustrates the increasing trend in R&D costs over the years, while the number of new drug approvals continues to stagnate.

2 PHRMA Industry Report 2009

The current trend in drug development is for pharmaceutical companies to shift towards a niche market. The 'one size fits all' approach is being replaced by a more targeted, innovative approach to develop treatments for small patient groups with complicated diseases such as cancer, rheumatoid arthritis and immune disorders. Such 'niche buster drugs' are expected to exploit new technologies such as biomarkers and theranostics and will support the continued development of personalized medicine.

With the U.S administration trying to implement health care reform, increased regulatory oversight and pressure on drug companies to reduce prices, there is a need for R&D to become more efficient and reduce costs to prevent an innovation slowdown in the industry. Many leading pharmaceutical companies have restructured their R&D processes by establishing centers of R&D excellence and disease focused centers. Commercial success rate for new drugs is low, with only 2 out of 10 drugs matching or exceeding average R&D costs.

Because of these factors, we believe our quantitative imaging analysis offer a solution to these issues within drug development by providing more precise and reliable information in the assessment of compounds being developed. We believe our increased precision and reproducibility enable our customers to make more confident decisions on the efficacy of their compounds.

Quantitative Image Analysis Services

We have conducted research to determine the current size of the market for image analysis services in clinical trials supporting the pharmaceutical, biotech and medical device industries. Based on our research and discussion within the imaging CRO and medical device and drug development industries, we have found that the market is fragmented, with approximately $550 million in total annual revenues projected for 2010.

Prior to 2010, the industry underwent a growth phase as the use of imaging end-points is becoming more prevalent within the FDA. In 2010, we estimate that the market size was consistent with 2009 as companies experienced reductions in R&D spending. We currently estimate the annual growth rate for the market at 5% to 10% for the next five years. Our estimates are based on the amount of trials currently conducted within therapeutic areas that we work in. We also have performed a bottom-up calculation of the individual growth rates of the companies and academic centers within the industry. We believe that some of the largest players, which offer the broadest set of capabilities, are also growing. Specifically, BioClinica, Perceptive (division of Parexel), RadPharm and ICON.

Image Analysis Solutions in the Pharmaceutical and Medical Device Industries

It is well known that greater reproducibility of measurements can decrease the cost and time to market of compounds in development. The higher reproducibility of our automated analysis enables researchers to achieve statistically significant results with substantially smaller patient populations. Automated analysis greatly reduces the analyst variability and interaction time required to process clinical trial data. Published studies demonstrate that our automated analysis consistently yields a lower coefficient of variation than manual techniques. As measurement variation diminishes, so does the percentage change in a given structure necessary to determine whether a treatment is having the desired effect. In short, precise measurement allows companies to learn more from smaller populations earlier in the compound development process.

Drug discovery and development has been constrained by the lack of accurate image analysis tools and appropriate image-based biomarkers. In many musculoskeletal clinical studies, X-ray is the chosen modality for evaluating a compound’s efficacy. X-ray imaging in drug discovery has significant limitations, which include:

| | · | partial or complete inability to detect changes in a region of interest due to poor contrast or occlusion; |

| | · | the potential for inter/intra-observer variability - error in radiologist measurements can amount to upwards of 30% for small structures of interest; |

| | · | the need for a radiologist to perform manual tracings is not only subject to error, but is also time consuming; and |

| | · | reliance on a radiologist for biomarker measurements results in very limited throughput. |

The constraints mentioned above can add months and years to the drug discovery process.

The use of MRI and CT to determine drug efficacy is increasing, owing to its superior information content relative to X-ray. MRI and CT are more sensitive to pathology, provide higher contrast for soft tissue and are three-dimensional. These attributes improve the detection of disease and the ability to monitor disease progression over time. While MRI and CT are preferred modalities, they too suffer from the need to have a radiologist review the images, detect disease, monitor progression and, when necessary, perform manual calculations.

Intellectual Property

We consider our proprietary and patented technology and the technology for which we have applied for patent protection to be of importance to our business plan. We hold ten patents issued by the United States Patent and Trademark Office. These patents begin to expire in November 2018 through 2027. We have also applied for a number of other patents, both domestically and in foreign jurisdictions. To protect our proprietary technology, we rely primarily on a combination of confidentiality procedures, copyright, trademark and patent laws. Our policy is to require employees and consultants to execute confidentiality and invention assignment agreements upon the commencement of their relationship with us. These agreements provide that confidential information developed or made known during the course of a relationship with us must be kept confidential and not disclosed to third parties except in specific circumstances and for the assignment to us of intellectual property rights developed within the scope of the employment relationship.

Competition

Our main competitors are clinical research organizations (CROs) providing clinical trial services to pharmaceutical companies. As of the date of this report, we believe that none of the leading CROs have technology capabilities that are comparable to our technology. CROs typically provide manual and non-differentiated interpretation of medical images for the pharmaceutical industry. As a result, we believe that currently there is an opportunity for us to establish a technology advantage and a set of differentiated services in the advanced image-based biomarker market.

Our technology competition is largely comprised of a limited number of university research centers that are working on developing the next generation of image analysis tools. Aside from the university centers, there are a few commercial entities that have a desire to provide these advanced imaging services; however, we believe they are constrained by their lack of technical capabilities.

Competitors in Accelerating Pharmaceutical and Medical Device Development

The main CROs which participate in imaging trials are BioClinica, Core Lab Partners, Synarc, Perceptive and ICON. It is our understanding that these companies use predominately manual approaches that are unable to quantify minute structures in medical images. As a result, it may be difficult for them to offer differentiated services to achieve higher profit margins and at the same levels of reproducibility as ours. Additionally, some academic centers have worked on software that has applications for neurological diseases. These academic centers include Duke Image Analysis Laboratory, University of Pennsylvania, University of Montreal and University of California at San Francisco. However, we believe these organizations lack the required FDA compliance standards and ability to scale their operations to meet customer demand and we believe they offer inferior technology.

Government Regulation

Healthcare in the United States is heavily regulated by the federal government, and by state and local governments. The federal laws and regulations affecting healthcare change constantly, thereby increasing the uncertainty and risk associated with any healthcare-related company.

The federal government regulates healthcare through various agencies, including the following:

| | · | the Food and Drug Administration, or FDA, which administers the Food, Drug, and Cosmetic Act, or FD&C Act, as well as other relevant laws; |

| | · | Centers for Medicare & Medicaid Services, or CMS, which administers the Medicare and Medicaid programs; |

| | · | the Office of Inspector General, or OIG, which enforces various laws aimed at curtailing fraudulent or abusive practices, including by way of example, the Anti-Kickback Law, the Anti-Physician Referral Law, commonly referred to as Stark, the Anti-Inducement Law, the Civil Money Penalty Law, and the laws that authorize the OIG to exclude health care providers and others from participating in federal healthcare programs; and |

| | · | the Office of Civil Rights which administers the privacy aspects of the Health Insurance Portability and Accountability Act of 1996, or HIPAA. |

All of the aforementioned are agencies within the Department of Health and Human Services, or HHS. Healthcare is also provided or regulated, as the case may be, by the Department of Defense through its TriCare program, the Public Health Service within HHS under the Public Health Service Act, the Department of Justice through the Federal False Claims Act and various criminal statutes, and state governments under the Medicaid program and their internal laws regulating all healthcare activities.

FDA

The FDA regulates medical devices. A “medical device,” or device, is an article, including software and software associated with another medical device, which, among other things, is intended for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment or prevention of disease, in man or other animals. Computer software that complements a CT or MRI scan, such as VirtualScopics, we believe is considered a medical device and is therefore subject to FDA regulation. To date, our sales have been to the pharmaceutical and medical device industries to support their clinical trials. We would need to obtain FDA clearance or approval, as discussed below, before using our technology and services for diagnostic or treatment planning in a clinical setting. When we begin pursuing the application of our services in patient diagnostics, no assurance can be given that such clearance or approval would be granted or that it would be granted in a timely manner.

Devices are subject to varying levels of regulatory control, the most comprehensive of which requires that a clinical evaluation be conducted before a device receives approval for commercial distribution. In the United States, we generally are able to obtain permission to distribute a new device in two ways. The first applies to any new device that is substantially equivalent to a device first marketed prior to May 1976. In this case, to obtain FDA permission to distribute the device, we generally must submit a premarket notification application (a section 510(k) submission), and receive an FDA order finding substantial equivalence to a device (first marketed prior to May 1976) and permitting commercial distribution of that device for its intended use. A 510(k) submission must provide information supporting its claim of substantial equivalence to the predicate device.

If clinical data from human experience are required to support the 510(k) submission, these data must be gathered in compliance with investigational device exemption (IDE) regulations for investigations performed in the United States. The 510(k) process is normally used for software products of the type that we propose distributing. The FDA review process for premarket notifications submitted pursuant to section 510(k) takes on average about 90 days, but it can take substantially longer if the agency has concerns, and there is no guarantee that the agency will “clear” the device for marketing, in which case the device cannot be used for diagnosis and distributed in the United States. Nor is there any guarantee that the agency will deem the article subject to the 510(k) process, as opposed to the more time-consuming and resource intensive and problematic, premarket approval, or PMA, process described below.

The second, more comprehensive, approval process applies to a new device that is not substantially equivalent to a pre-1976 product. In this case, two steps of FDA approval generally are required before we can market the product in the United States. First, we must comply with IDE regulations in connection with any human clinical investigation of the device. Second, the FDA must review our PMA application, which contains, among other things, clinical information acquired under the IDE. The FDA will approve the PMA application if it finds there is reasonable assurance the device is safe and effective for its intended use.

Certain changes to existing devices that do not significantly affect safety or effectiveness can be made with in vitro testing under reduced regulatory procedures, generally without human clinical trials and by filing a PMA supplement to a prior PMA. Exported devices are subject to the regulatory requirements of each country to which the device is exported, as well as certain FDA export requirements.

After approval or clearance to market is given, the FDA and foreign regulatory agencies, upon the occurrence of certain events, have the power to withdraw the clearance or require changes to a device, its manufacturing process, or its labeling or additional proof that regulatory requirements have been met.

A device manufacturer is also required to register with the FDA. As a result, we may be subject to periodic inspection by the FDA for compliance with the FDA’s Quality System Regulation requirements and other regulations. In the European Community, we are required to maintain certain International Organization for Standardization (ISO) certifications in order to sell product and to undergo periodic inspections by notified bodies to obtain and maintain these certifications. These regulations require us to manufacture products and maintain documents in a prescribed manner with respect to design, manufacturing, testing and control activities. Further, we are required to comply with various FDA and other agency requirements for labeling and promotion. The Medical Device Reporting regulations require that we provide information to the FDA whenever there is evidence to reasonably suggest that a device may have caused or contributed to a death or serious injury or, if a malfunction were to occur, could cause or contribute to a death or serious injury. In addition, the FDA prohibits us from promoting a medical device for unapproved indications.

We currently meet the requirements of Good Clinical Practices: Consolidated Guidance, which governs the conduct of clinical trials, and our software complies with the FDA’s Regulation 21 CFR Part 11 (Electronic Records; Signatures) and 21 CFR Part 820.30, which outline the requirements for design controls in medical devices. As mentioned throughout this section, as we develop our approach into personalized medicine, FDA approval would most likely be required for the use of our software in that market.

Privacy Provisions of HIPAA

HIPAA, among other things, protects the privacy and security of individually identifiable health information by limiting its use and disclosure. HIPAA directly regulates “covered entities” (healthcare providers, insurers and clearinghouses) and indirectly regulates “business associates” with respect to the privacy of patients’ medical information. All entities that receive and process protected health information are required to adopt certain procedures to safeguard the security of that information. It is our policy to comply with HIPAA requirements.

Research and Development Costs

We incurred $1,130,744 and $1,058,676 in research and development costs for the years ended December 31, 2010 and 2009, respectively.

Customers

One customer accounted for 10% or more of our revenue during the year ended December 31, 2010, this same customer accounted for more than 10% of our revenue during the year ended December 31, 2009. The following table sets forth information as to revenue and percentage of revenue for these years for our three largest customers in 2010 and corresponding revenues for 2009:

| | | Years Ended December 31, | |

| Customer | | 2010 | | | 2009 | |

| | | | | | | | | | | | | |

| Novartis | | $ | 7,494,103 | | | | (56 | )% | | $ | 4,473,523 | | | | (43 | )% |

| Merck Serono | | $ | 721,069 | | | | (5 | )% | | $ | 851,385 | | | | (8 | )% |

| Johnson & Johnson | | $ | 642,616 | | | | (5 | )% | | $ | 470,825 | | | | (5 | )% |

Employees

As of December 31, 2010, we had 88 employees and seven contract radiologists. Of our employees, 81 are full-time.

ITEM 1A: Risk Factors

You should carefully consider the following risk factors before making an investment decision. If any of the following risks actually occur, our business, financial condition, or results of operations could be materially adversely affected. In such cases, the trading price of our common stock could decline, and you may lose all or part of your investment.

We have a history of operating losses and uncertain future profitability.

Prior to 2009, VirtualScopics incurred losses from operating activities since it began operations in 2001. As we continue to grow the business, we may face risks and difficulties in our business including uncertainties of further market penetration, competition, cost increases and delays in achieving business objectives. There can be no assurance that we will succeed in addressing any or all of these risks or that we will achieve future profitability and the failure to do so would have a material adverse effect on our business, financial condition and operating results.

If our products and services do not continue to attract interest from new and existing customers, we may not achieve future growth.

If we are unable to continue to attract interest in the industry for our services, we could fail to achieve future growth which would have a detrimental effect on our business. Our ability to generate revenues is highly dependent on building and maintaining relationships with leading pharmaceutical and biotechnology companies. No assurance can be given that a sufficient number of such companies will increase their demand for our services, thereby limiting the overall market for quantitative imaging services and not enable us to increase our revenue to the extent expected. In addition, the rate of the growth of MRI and CT image-based biomarkers is difficult to predict. Failure to attract and maintain a significant customer base would have a detrimental effect on our business, operating results and financial condition.

The majority of the contracts we have with customers are cancelable for any reason by giving 30 days advance notice.

Our customers typically engage us to perform services for them on a project-by-project basis and are required by us to enter into a written contractual agreement for the work, labor and services to be performed. Generally, our project contracts are terminable by the customer for any or no reason on 30 days’ advance notice to us. If a number of our customers were to exercise cancellation rights, our business and operating results would be materially and adversely affected.

If we are unable to manage and sustain our growth, our operating results would be adversely affected.

We have seen a growing demand for our image analysis services over the past several years. Although there can be no assurance that this will continue, if it does continue we may be unable to scale our capacity efficiently to meet this demand. If we are unable to do so, we may fail to maintain our operating margins or achieve expected operating margins. This may have a material and adverse effect on our operating results.

Our services may become obsolete if we do not effectively respond to rapid technological change on a timely basis.

Our services depend on the needs of our customers and their desire to utilize image-related services in drug and medical device development and clinical diagnosis and treatment. Since the image-based biomarker industry is characterized by evolving technologies, uncertain technology and limited availability of standards, we must respond to new research findings and technological changes affecting our customers. We may not be successful in developing and marketing, on a timely and cost-effective basis, new or modified products and services, which respond to technological changes, evolving customer requirements and competition. If we are unsuccessful in this regard, our business and operating results could be materially and adversely affected.

Although we believe that our products and services do not and will not infringe upon the patents or violate the proprietary rights of others, it is possible such infringement or violation has occurred or may occur which could have a material adverse effect on our business.

Portions of our business are reliant upon patented and patentable systems and methods used in our image analysis and related intellectual property. In the event that products and services we sell are deemed to infringe upon the patents or proprietary rights of others, we could be required to modify our products and services or obtain a license for the manufacture and/or sale of such products and services. In such event, there can be no assurance that we would be able to do so in a timely manner, upon acceptable terms and conditions, or at all, and the failure to do any of the foregoing could have a material adverse effect upon our business. Moreover, there can be no assurance that we will have the financial or other resources necessary to enforce or defend a patent infringement or proprietary rights violation action. In addition, if our products and services or proposed products and services are deemed to infringe or likely to infringe upon the patents or proprietary rights of others, we could be subject to injunctive relief and, under certain circumstances, become liable for damages, which could also have a material adverse effect on our business.

We are subject to numerous pharmaceutical, medical device and healthcare industry regulations, which could adversely affect the nature and extent of the products and services we offer.

Many aspects of the pharmaceutical, medical device and healthcare industry are subject to regulation at the federal level. From time to time, the regulatory entities that have jurisdiction over the industry adopt new or modified regulations or take other actions as a result of their own regulatory processes or as directed by other governmental bodies. This changing regulatory environment could adversely affect the nature and extent of the services we are able to offer.

To date, our sales have been within the clinical trial industry. To enter the patient treatment or personalized medicine market we would need to obtain FDA clearance or approval before marketing our services in this area. There can be no assurance that such clearance or approval would be granted or that it would be granted in a timely manner. To effectively market our products to physicians as a treatment aid, we would also need to obtain appropriate coverage and favorable reimbursement from third-party payers, such as Medicare and insurance companies, in order to more fully benefit from the market opportunity. There can be no assurance that appropriate coverage would be granted or that reimbursement levels or conditions of coverage would be adequate to ensure acceptance among physicians. Additionally, the efforts of governments and third-party payers to contain or reduce the cost of health care, such as a number of legislative and regulatory proposals currently being discussed, could affect our ability to implement our plans in this area.

We may in the future experience competition from academic sites, imaging CROs, and other competing technologies.

Competition in the development of imaging solutions may become more widespread as with emerging technologies such as proteomics and genomics which can serve as predictive tools of drug efficacy. Competitors range from university-based research and development projects which would develop advanced tools to development stage companies and major domestic and international companies which would commercialize the tools. Some of these entities have greater financial, technical, marketing, sales, distribution and other resources than ours. There can be no assurance that we can continue to develop our technologies or that present or future competitors will not develop technologies that render our image-based biomarker industry obsolete or less marketable or that we will be able to introduce new products and product enhancements that are competitive with other products marketed by industry participants.

We have experienced significant demand from one customer, thereby increasing our dependence on the customer until we can further diversify our customer base.

While we continue to serve a broad range of customers, we’ve experienced strong demand from one of our customers, and our dependence on that customer to sustain our continued growth has increased. In 2010, this customer accounted for 56% of our revenue. We continue to see demand from other customers, however, not to the same significant pace. We continue to invest on our sales and marketing efforts to further diversify our customers and more broadly penetrate the market, in order to minimize reliance on any one customer. As with all of our contracts, this customer may terminate its contractual relationship with us for any or no reason on 30 days’ advance notice. A decision by the customer to cancel all of its studies with us could have an adverse impact on the growth of our business.

Consolidation within the pharmaceutical industry and changes within healthcare regulation may have an adverse impact on our business.

Over the past few years, there have been several mergers and acquisitions among pharmaceutical and biotechnology companies. Historically, these transactions have positively impacted our business due to a broader exposure within the merged entity, however, there can be no assurance that consolidation within the industry will continue to be beneficial to us. Additionally, with the recent political landscape and changes within the healthcare industry, there may be an adverse impact on our business if the cost of imaging significantly increases or no longer becomes standard of care for patients. Although, we don’t believe imaging will decline in its level of use, if it does we may need to reduce prices or invest in research to advance the education and science of medical imaging.

The trading price of our stock may be adversely affected if we are not able to continue to grow the business.

We intend to continue to use our cash on hand to broaden our market penetration of our services within the industry and pursue the application of one of our technologies in the personalized medicine market. If our plans or assumptions with respect to our business change or prove to be inaccurate, we may be required to use part or all of our cash to fund general operating expenses and/or reduce costs within the organization. This will depend on a number of factors, including, but not limited to:

| | · | the lack of significant cancellations of customer contracts |

| | · | the further market penetration of our products and services; and |

| | · | our ability to manage and sustain the growth of our business. |

We currently do not plan to raise additional capital, however, if we need to raise additional capital, it may not be available on acceptable terms, or at all. Our failure to obtain required capital, or the acquisition of capital on less favorable terms, would have a material adverse effect on our business. If we issue additional equity securities in the future, you could experience dilution or a reduction in priority of your securities.

The market price of our common stock may fluctuate significantly.

The market price of our common stock may fluctuate significantly in response to factors, some of which are beyond our control, such as the announcement of new products or product enhancements by us or our competitors; developments concerning intellectual property rights and regulatory approvals; quarterly variations in our competitors’ results of operations; changes in earnings estimates or recommendations by securities analysts; developments in our industry; product liability claims or other litigation; and general market conditions and other factors, including factors unrelated to our own operating performance.

Our common stock may be considered a “penny stock” and may be difficult to sell.

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market or exercise price of less than $5.00 per share, subject to specific exemptions. The market price of our common stock is currently below $5.00 per share and therefore may be designated as a “penny stock” according to SEC rules. This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect the ability of our stockholders to sell their shares.

Our strategic alliance with PPD is an important aspect of our growth, and the market may not value our strategic alliance with PPD as we anticipate.

In 2010, we formed an alliance with PPD to provide a joint solution to provide clients with an integrated and customized clinical development and medical imaging solution for oncology clinical trials. If the market does not value this model as we anticipate, our ability to grow our business may be negatively impacted. Additionally, the agreement may be terminated by either party on 90 days notice. In the event PPD terminates the agreement, we may also experience a negative impact in our ability to experience the level of growth the company has historically achieved.

A significant number of the shares of our common stock are eligible for sale, and their sale could depress the market price of the our common stock.

Sales of a significant number of shares of our common stock in the public market or the possibility of such sales, could harm the market price of our common stock and impede our ability to raise capital through the issuance of equity securities. As of December 31, 2010, we had 27,414,620 shares of common stock outstanding. These shares are eligible for resale in the public market either immediately or subject to applicable volume, manner of sale, holding period and other limitations of Rule 144. In addition to these outstanding shares of common stock, the series B convertible preferred stock and the warrants to purchase common stock issued in our 2007 private placement are convertible into 2,774,494 shares of our common stock and registered for resale under a registration statement on Form S-3. Additionally, there are outstanding warrants issued prior to 2005 that are convertible into 444,888 shares of our common stock. There are also 2,647,191 shares of our common stock issuable upon conversion of our series A convertible preferred stock and warrants sold in our November 2005 private placement, eligible for resale under Rule 144. Additionally, we have filed registration statements on Form S-8 to register the sale of up to 6,900,000 shares issued or to be issued pursuant to our Amended and Restated 2006 Long-Term Incentive Plan. Finally, we have approximately 6,021,033 shares of common stock underlying options issued under our 2001, 2005, and 2006 Long-Term Incentive Plans that may be eligible for resale in the public market pursuant to an exemption under Rule 701 of the Securities Act. Sales of our common stock in the public market may have a depressive effect on the market for the shares of our common stock.

Our principal stockholders have significant voting power and may take actions that may not be in the best interests of other stockholders.

Our officers, directors, principal stockholders (greater than 10%) and their affiliates control approximately 30% of our outstanding voting securities. If these stockholders act together, they will be able to exert significant control over our management and affairs requiring stockholder approval, including approval of significant corporate transactions. This concentration of ownership may have the effect of delaying or preventing a change in control and might adversely affect the market price of our common stock. This concentration of ownership may not be in the best interests of all our stockholders.

We do not anticipate paying dividends on our common stock in the foreseeable future, and the lack of dividends may have a negative effect on the stock price.

We currently intend to retain our future earnings to support operations and to finance expansion and meet dividend obligations on our series B convertible preferred stock. In addition, the terms of our series B preferred stock limit our ability to pay dividends to the holders of our common stock. Therefore, we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

ITEM 2: Properties

In July, 2007 we began leasing approximately 19,500 square feet of office space at our corporate headquarters in Rochester, New York. The base annual rent under the lease is $360,000, and increases three percent (3%) a year. During the first twenty months of the lease, the rent was paid in two portions: a cash portion of $156,000 annually, paid in equal monthly installments, increasing three percent (3%) annually; and, a stock portion of $204,000 annually, paid in equal monthly installments, increasing three percent (3%) annually. The stock portion was payable in shares of our common stock. In February 2009, the Landlord exercised their option to receive their remaining rental payments in all cash. During 2010 and 2009, we issued 0 and 88,132 shares, respectively, of the Company’s common stock ranging from $1.20 to $2.50 per share for a total value of $0 and $105,570, respectively. Management believes that the leased property is adequately covered by insurance.

ITEM 3: Legal Proceedings

None.

PART II

ITEM 5: Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our shares of common stock are listed for trading on the NASDAQ Capital Market under the trading symbol “VSCP.” The following table sets forth the high and low closing sales prices for our common stock as reported on the NASDAQ Capital Market for the period from January 1, 2009 through December 31, 2010. These prices do not include retail markup, markdown or commission and may not necessarily represent actual transactions. Investors should not rely on historical stock price performance as an indication of future price performance.

Fiscal Year Ended December 31, 2009

| | | HIGH | | | LOW | |

| | | | | | | |

| First Quarter | | $ | 1.10 | | | $ | 0.43 | |

| Second Quarter | | | 1.26 | | | | 0.83 | |

| Third Quarter | | | 1.48 | | | | 1.01 | |

| Fourth Quarter | | | 1.22 | | | | 1.01 | |

Fiscal Year Ended December 31, 2010

| | | HIGH | | | LOW | |

| | | | | | | |

| First Quarter | | $ | 1.25 | | | $ | 0.82 | |

| Second Quarter | | | 1.35 | | | | 1.13 | |

| Third Quarter | | | 1.17 | | | | 0.90 | |

| Fourth Quarter | | | 2.50 | | | | 0.89 | |

As of February 28, 2011, we had approximately 28,378,997 registered holders of record of shares of our common stock.

Dividend Policy

We have never declared a cash dividend on our common stock. We intend to retain any earnings to fund future growth and the operation of our business and, therefore, we do not anticipate paying any cash dividends on our common stock in the foreseeable future. In addition, the terms of our series B preferred stock limit our ability to pay dividends to the holders of our common stock. Thereafter, dividends may be paid on our common stock only if and when declared by our board of directors and paid on an as-converted basis to the holders of our series A and series B convertible preferred stock.

Equity Compensation Plan Information The following table summarizes information, as of December 31, 2010, relating to our equity compensation plans:

| | | Number of Securities to be Issued Upon Exercise of Outstanding Options | | | Weighted-Average Exercise Price of Outstanding Options | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a) | |

Plan Category | | (a) | | | (b) | | | (c) | |

| Equity compensation plans approved by security holders | | | 6,183,451 | (1) | | $ | 1.16 | | | | 2,228,190 | |

| Equity compensation plans not approved by security holders | | | 350,000 | (2) | | $ | 2.50 | | | | - | |

| Total | | | 6,533,451 | | | $ | 1.23 | | | | 2,228,190 | |

(1) This amount includes shares under the plans of VirtualScopics, LLC, in addition to 444,888 shares of our common stock to holders of warrants granted by VirtualScopics, LLC, in exchange for consideration in the form of goods and services. Also we agreed to issue 5,671,033 shares of common stock collectively, under our 2001, 2005 and 2006 Long Term Incentive Plans. Also included are 67,530 shares of common stock underlying warrants we issued to the placement agent in connection with our September 2007 private placement, which was approved by stockholders in November 2007.

(2) In November 2005, our Board of Directors granted to our Chairman and former CEO, Robert Klimasewski, an option to purchase 350,000 shares of our common stock at $2.50 per share.

Recent Sales of Unregistered Securities

During the quarter ended December 31, 2010, the Company issued 1,018,019 shares of common stock upon the conversion of 1,226 shares of series B convertible preferred stock. The Company did not receive any cash or other consideration in connection with the conversion. Additionally, no commission or other remuneration was paid by the Company in connection with the conversion. The issuance of common stock upon conversion of the series B convertible preferred stock was made in reliance on the exemption provided in Section 3(a)(9) of the Securities Act of 1933, as amended.

Issuer Repurchases of Equity Securities

None.

ITEM 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with VirtualScopics’ consolidated balance sheet, and related consolidated statements of operations, changes in stockholders’ equity and cash flows for the years ended December 31, 2010 and 2009, included elsewhere in this report. This discussion contains forward-looking statements, the accuracy of which involves risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements for many reasons including, but not limited to, those discussed in “Risk Factors” and elsewhere in this report. We disclaim any obligation to update information contained in any forward-looking statements.

Overview

VirtualScopics, Inc. is a leading provider of imaging solutions to accelerate drug and medical device development. We have developed a robust software platform for analysis and modeling of both structural and functional medical images. In combination with our industry-leading experience and expertise in advanced imaging biomarker measurement, this platform provides a uniquely clear window into the biological activity of drugs and devices in clinical trial patients, allowing our customers to make better decisions faster.

In July 2000, VirtualScopics was formed after being spun out of the University of Rochester. In June 2002, we purchased the underlying technology and patents created by VirtualScopics’ founders from the University of Rochester. In November 2005, we performed an exchange transaction with ConsultAmerica whereby prior to the exchange ConsultAmerica, Inc. had no meaningful operations and, therefore, the exchange was treated as recapitalization of VirtualScopics, LLC. Following the transaction, we succeeded to the business of VirtualScopics, Inc. as a provider of image-based biomarker solutions and have continued this business since that time. We own all rights to the patents underlying its technology.

Revenue over the past nine years has been derived primarily from image processing services in connection with pharmaceutical drug trials. For these services, we have been concentrating in the areas of oncology and osteoarthritis. We have also derived a small portion of revenue from consulting services, and pharmaceutical drug trials in the neurology and cardiovascular areas. We expect that the concentration of our revenue will continue in these services and in those areas in 2011. Revenues are recognized as the MRI and CT images that we process are quantified and delivered to our customers and/or the services are performed. Beginning in 2010, we began to pursue the personalized medicine market, however, we do not anticipate significant revenues from this market opportunity in 2011 as we are just beginning the process of executing on our regulatory, validation and commercialization strategy.