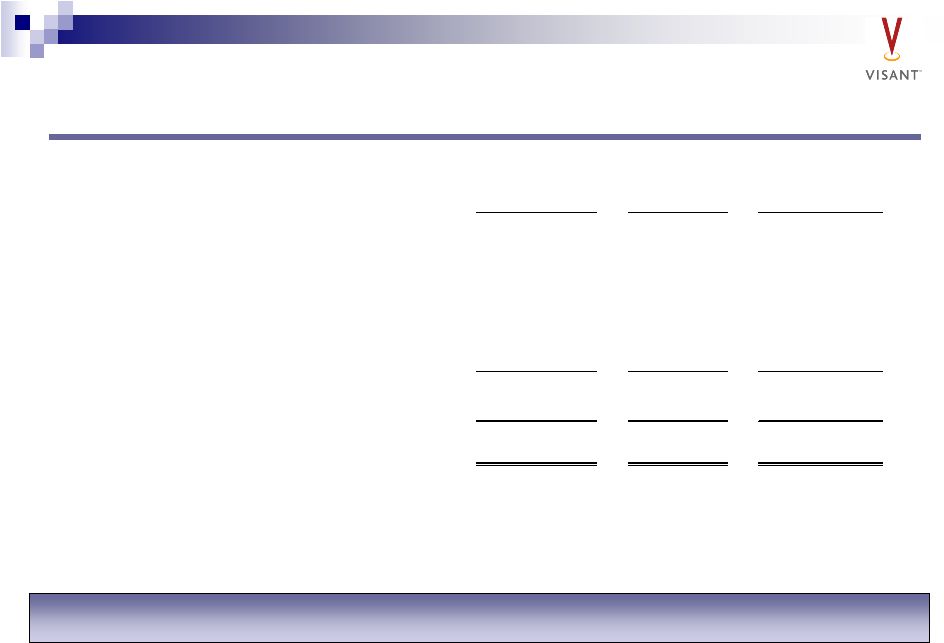

19 Reconciliation to Adjusted EBITDA Estimated and Unaudited 2008 Fiscal Year Results ($000's) Estimated and unaudited earnings before interest and taxes - GAAP $210,805 Depreciation and amortization 103,018 Estimated and unaudited earnings before interest, taxes depreciation and amortization (EBITDA) $313,823 Management fees 3,386 Special charges 14,433 Loss (gain) on disposal of assets 958 Other (1) 7,313 Adjusted EBITDA - non-GAAP $339,913 (1) Includes non-recurring charges related to facility consolidations, inventory write-down and other miscellaneous non-recurring costs. Note Regarding Presentation of Non-GAAP Financial Measure “Adjusted EBITDA” is defined as net income plus net interest expense, income taxes, depreciation and amortization, and income from discontinued operations, excluding certain non-recurring items. Adjusted EBITDA excludes certain items that are also excluded for purposes of calculating required covenant ratios and compliance under the indentures governing Visant’s and its parent’s, Visant Holding Corp.’s, outstanding notes and Visant’s senior secured credit facilities. As such, Adjusted EBITDA is a material component of these covenants. Non-compliance with the financial ratio maintenance covenants contained in Visant’s senior secured credit facilities could result in the requirement to immediately repay all amounts outstanding under such facilities, while non-compliance with the debt incurrence ratios contained in the indentures governing Visant’s and its parent’s notes would prohibit Visant and its restricted subsidiaries from being able to incur additional indebtedness other than pursuant to specified exceptions. Adjusted EBITDA is not a presentation made in accordance with generally accepted accounting principles in the United States of America (GAAP), is not a measure of financial condition or profitability, and should not be considered as an alternative to (a) net income (loss) determined in accordance with GAAP or (b) operating cash flows determined in accordance with GAAP. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Because not all companies use identical calculations, this presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. |