Consolidated Financial Statements TC LNG Shipping L.L.C. December 31, 2022

Independent Auditors’ Report KPMG LLP PO Box 10426 777 Dunsmuir Street Vancouver BC V7Y 1K3 Canada Telephone (604) 691-3000 Fax (604) 691-3031 The Board of Directors TC LNG Shipping L.L.C. Report on the Audit of the Consolidated Financial Statements Opinion We have audited the consolidated financial statements of TC LNG Shipping L.L.C. and its subsidiaries (the Company), which comprise the consolidated balance sheets as of December 31, 2022 and 2021, and the related consolidated statements of income and comprehensive income, changes in shareholders’ equity, and cash flows for each of the years in the three-year period ended December 31, 2022, and the related notes to the consolidated financial statements. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the three-year period ended December 31, 2022 in accordance with U.S. generally accepted accounting principles. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with U.S. generally accepted accounting principles, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the consolidated financial statements are available to be issued. Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute

TC LNG Shipping L.L.C. Page 2 2 assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit. Chartered Professional Accountants Vancouver, Canada March 1, 2023

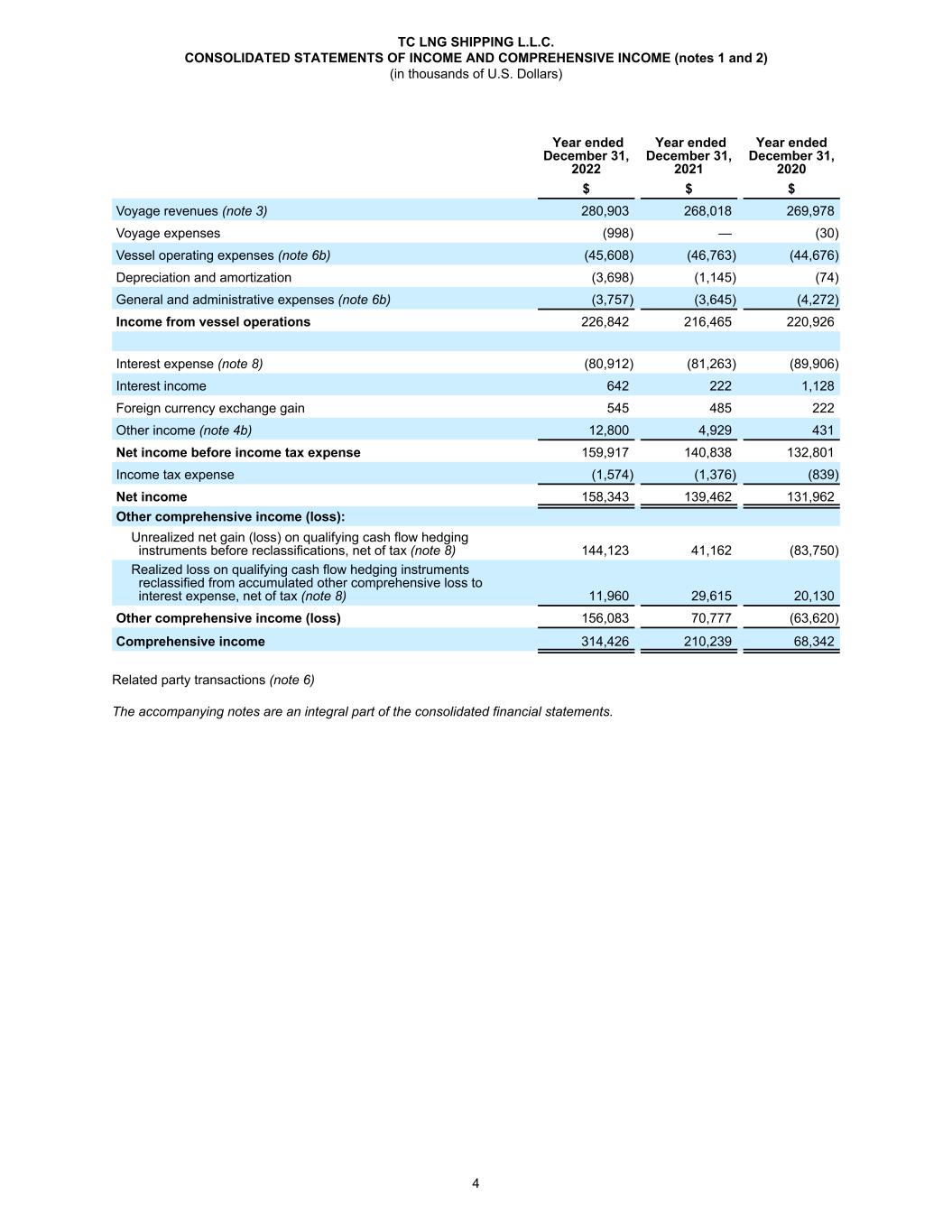

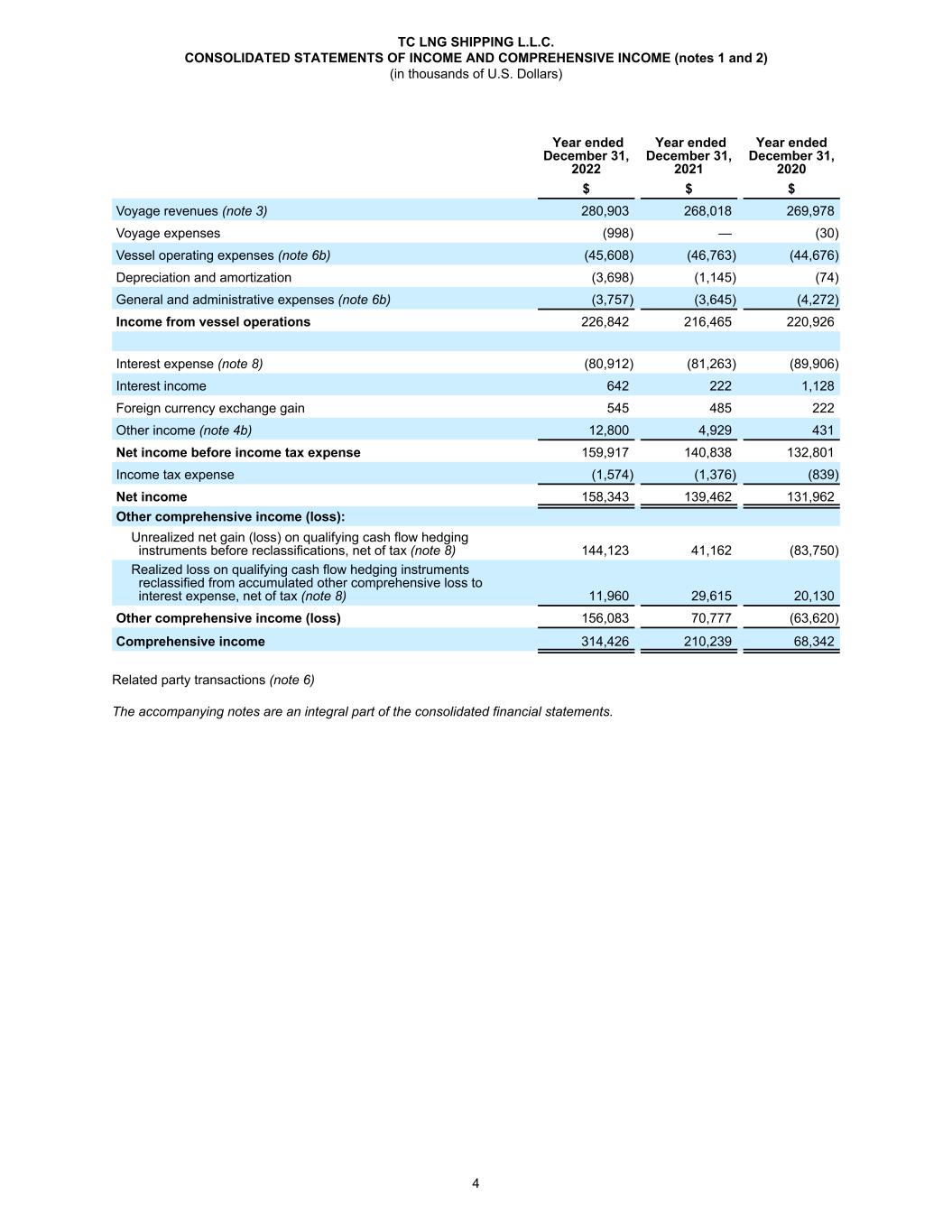

Year ended December 31, 2022 Year ended December 31, 2021 Year ended December 31, 2020 $ $ $ Voyage revenues (note 3) 280,903 268,018 269,978 Voyage expenses (998) — (30) Vessel operating expenses (note 6b) (45,608) (46,763) (44,676) Depreciation and amortization (3,698) (1,145) (74) General and administrative expenses (note 6b) (3,757) (3,645) (4,272) Income from vessel operations 226,842 216,465 220,926 Interest expense (note 8) (80,912) (81,263) (89,906) Interest income 642 222 1,128 Foreign currency exchange gain 545 485 222 Other income (note 4b) 12,800 4,929 431 Net income before income tax expense 159,917 140,838 132,801 Income tax expense (1,574) (1,376) (839) Net income 158,343 139,462 131,962 Other comprehensive income (loss): Unrealized net gain (loss) on qualifying cash flow hedging instruments before reclassifications, net of tax (note 8) 144,123 41,162 (83,750) Realized loss on qualifying cash flow hedging instruments reclassified from accumulated other comprehensive loss to interest expense, net of tax (note 8) 11,960 29,615 20,130 Other comprehensive income (loss) 156,083 70,777 (63,620) Comprehensive income 314,426 210,239 68,342 Related party transactions (note 6) The accompanying notes are an integral part of the consolidated financial statements. TC LNG SHIPPING L.L.C. CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (notes 1 and 2) (in thousands of U.S. Dollars) 4

As at December 31, 2022 As at December 31, 2021 $ $ ASSETS Current assets Cash and cash equivalents 11,872 13,000 Restricted cash – current (note 9a) 40,203 65,320 Accounts receivable 7,799 970 Prepaid expenses 1,528 1,818 Derivative assets – current (note 8) 26,057 — Net investments in direct financing and sales-type leases, net – current (notes 3 and 4b) 35,791 31,840 Advances to affiliates (note 6c) 2,664 1,645 Other assets – current (note 4b) 6,499 3,550 Total current assets 132,413 118,143 Restricted cash (note 9a) 100,266 118,469 Deferred dry-docking expenditures at cost, less accumulated depreciation of $3,067 (2021 – $1,219) 12,431 3,598 Net investments in direct financing and sales-type leases, net (notes 3 and 4b) 1,819,287 1,843,031 Other assets (note 4b) 33,477 22,257 Derivative assets (note 8) 54,259 11,438 Total assets 2,152,133 2,116,936 LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities Accounts payable 995 2,273 Accrued liabilities (notes 5 and 8) 9,480 40,261 Unearned revenue (note 3) 25,113 24,544 Debt – current (note 7) 79,618 75,164 Derivative liabilities – current (note 8) — 23,414 Total current liabilities 115,206 165,656 Debt (note 7) 1,227,751 1,305,030 Derivative liabilities (note 8) — 63,791 Other liabilities 8,240 5,949 Total liabilities 1,351,197 1,540,426 Commitments and contingencies (notes 7 and 8) Shareholders’ equity Contributed capital 527,848 527,848 Retained earnings 192,772 124,429 Accumulated other comprehensive income (loss) 80,316 (75,767) Total shareholders’ equity 800,936 576,510 Total liabilities and shareholders’ equity 2,152,133 2,116,936 The accompanying notes are an integral part of the consolidated financial statements. TC LNG SHIPPING L.L.C. CONSOLIDATED BALANCE SHEETS (notes 1 and 2) (in thousands of U.S. Dollars) 5

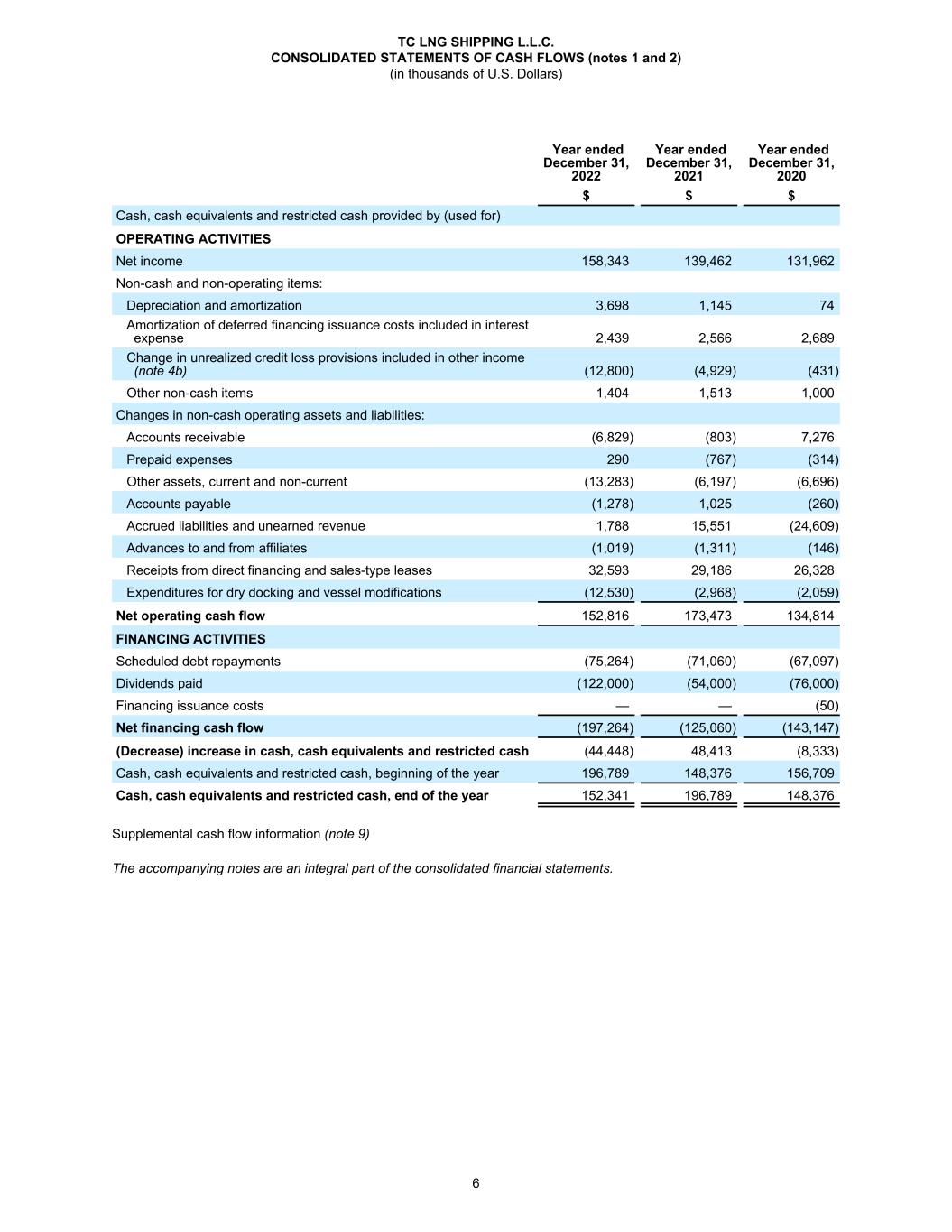

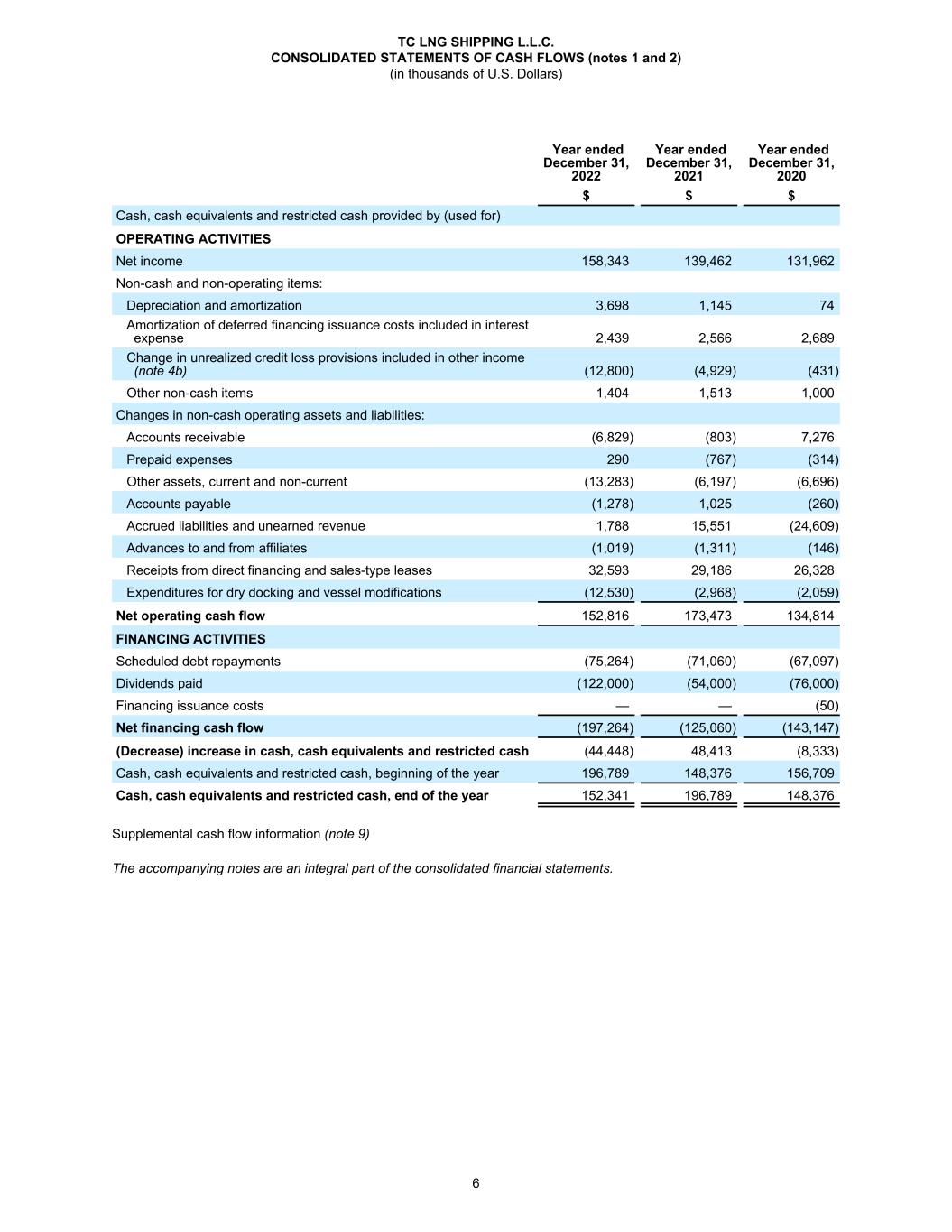

Year ended December 31, 2022 Year ended December 31, 2021 Year ended December 31, 2020 $ $ $ Cash, cash equivalents and restricted cash provided by (used for) OPERATING ACTIVITIES Net income 158,343 139,462 131,962 Non-cash and non-operating items: Depreciation and amortization 3,698 1,145 74 Amortization of deferred financing issuance costs included in interest expense 2,439 2,566 2,689 Change in unrealized credit loss provisions included in other income (note 4b) (12,800) (4,929) (431) Other non-cash items 1,404 1,513 1,000 Changes in non-cash operating assets and liabilities: Accounts receivable (6,829) (803) 7,276 Prepaid expenses 290 (767) (314) Other assets, current and non-current (13,283) (6,197) (6,696) Accounts payable (1,278) 1,025 (260) Accrued liabilities and unearned revenue 1,788 15,551 (24,609) Advances to and from affiliates (1,019) (1,311) (146) Receipts from direct financing and sales-type leases 32,593 29,186 26,328 Expenditures for dry docking and vessel modifications (12,530) (2,968) (2,059) Net operating cash flow 152,816 173,473 134,814 FINANCING ACTIVITIES Scheduled debt repayments (75,264) (71,060) (67,097) Dividends paid (122,000) (54,000) (76,000) Financing issuance costs — — (50) Net financing cash flow (197,264) (125,060) (143,147) (Decrease) increase in cash, cash equivalents and restricted cash (44,448) 48,413 (8,333) Cash, cash equivalents and restricted cash, beginning of the year 196,789 148,376 156,709 Cash, cash equivalents and restricted cash, end of the year 152,341 196,789 148,376 Supplemental cash flow information (note 9) The accompanying notes are an integral part of the consolidated financial statements. TC LNG SHIPPING L.L.C. CONSOLIDATED STATEMENTS OF CASH FLOWS (notes 1 and 2) (in thousands of U.S. Dollars) 6

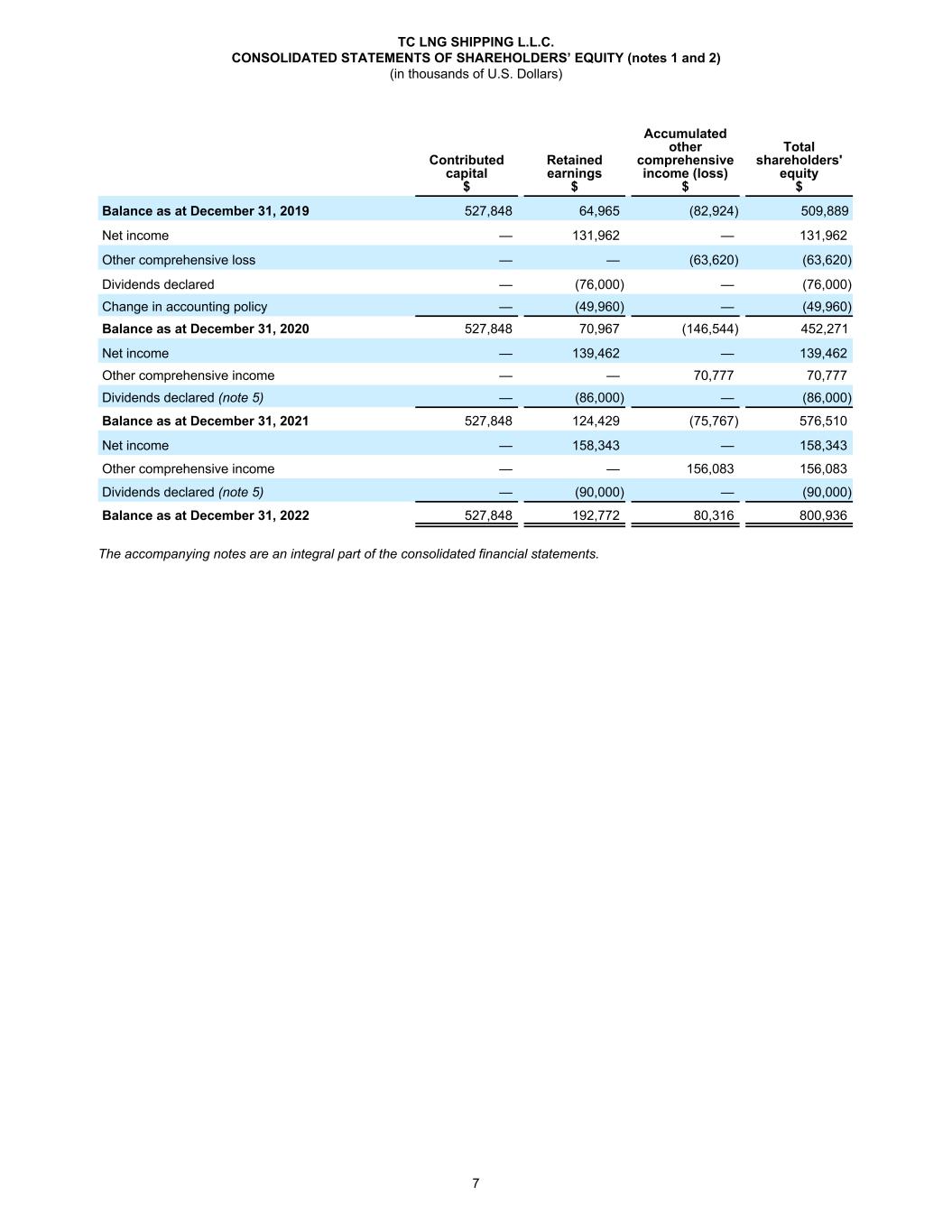

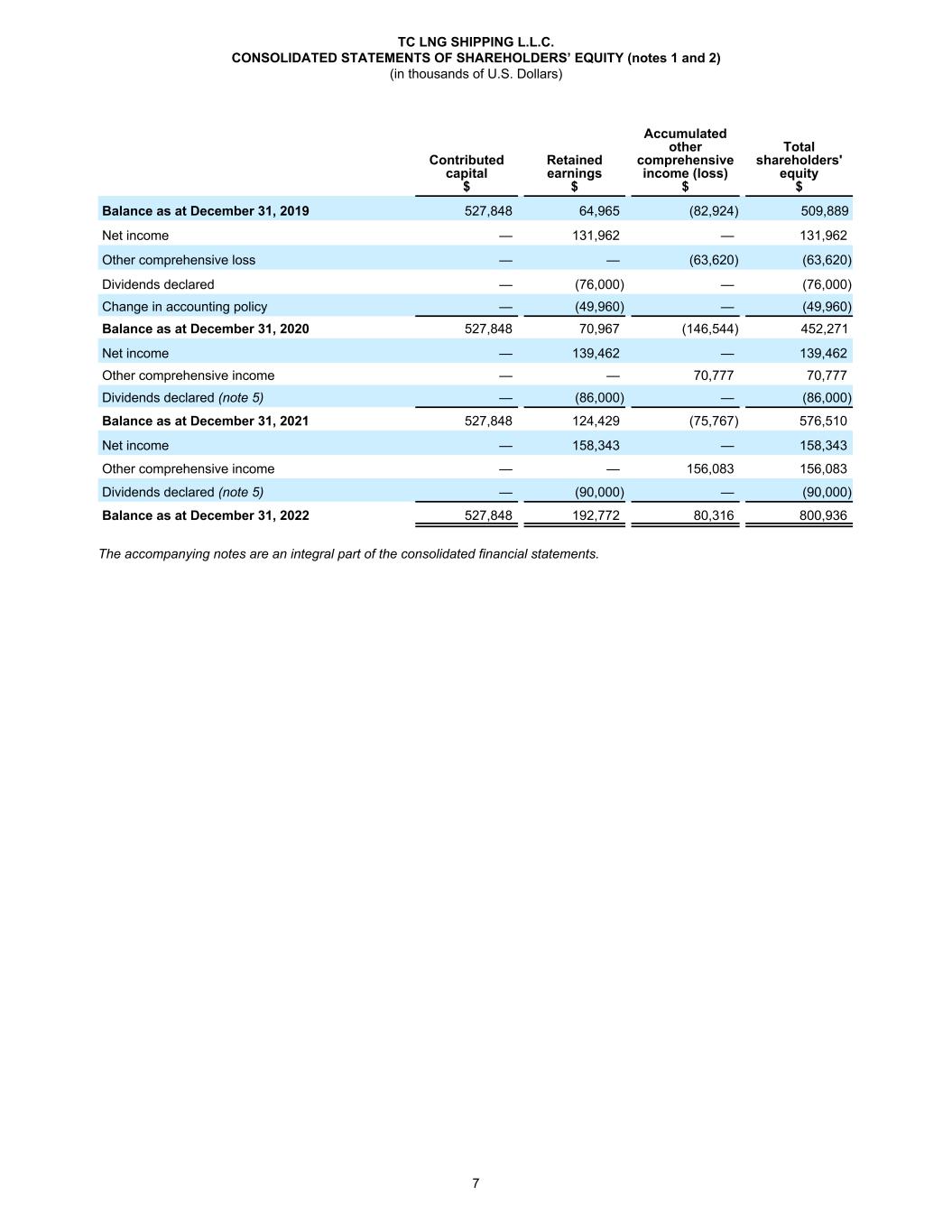

Contributed capital $ Retained earnings $ Accumulated other comprehensive income (loss) $ Total shareholders' equity $ Balance as at December 31, 2019 527,848 64,965 (82,924) 509,889 Net income — 131,962 — 131,962 Other comprehensive loss — — (63,620) (63,620) Dividends declared — (76,000) — (76,000) Change in accounting policy — (49,960) — (49,960) Balance as at December 31, 2020 527,848 70,967 (146,544) 452,271 Net income — 139,462 — 139,462 Other comprehensive income — — 70,777 70,777 Dividends declared (note 5) — (86,000) — (86,000) Balance as at December 31, 2021 527,848 124,429 (75,767) 576,510 Net income — 158,343 — 158,343 Other comprehensive income — — 156,083 156,083 Dividends declared (note 5) — (90,000) — (90,000) Balance as at December 31, 2022 527,848 192,772 80,316 800,936 The accompanying notes are an integral part of the consolidated financial statements. TC LNG SHIPPING L.L.C. CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (notes 1 and 2) (in thousands of U.S. Dollars) 7

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of presentation These consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (or GAAP). They include the accounts of TC LNG Shipping L.L.C., which is a limited liability company formed under the laws of the Republic of The Marshall Islands, and its wholly-owned subsidiaries (collectively, the Company). The following is a list of TC LNG Shipping L.L.C.’s subsidiaries: Proportion of Jurisdiction of ownership Name of significant subsidiaries incorporation interest TC LNG Explorer I L.L.C. Marshall Islands 100% TC LNG Explorer II L.L.C. Marshall Islands 100% TC LNG Explorer III L.L.C. Marshall Islands 100% TC LNG Explorer IV L.L.C. Marshall Islands 100% TC LNG Explorer V L.L.C. Marshall Islands 100% TC LNG Explorer VI L.L.C. Marshall Islands 100% The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimates. Significant intercompany balances and transactions have been eliminated upon consolidation. The Company evaluated events and transactions occurring after the balance sheet date and through the day the consolidated financial statements were available to be issued which was March 1, 2023. Foreign currency The consolidated financial statements are stated in U.S. Dollars and the functional currency of the Company is the U.S. Dollar. Transactions involving other currencies during the year are converted into U.S. Dollars using the exchange rates in effect at the time of the transactions. At the balance sheet date, monetary assets and liabilities that are denominated in currencies other than the U.S. Dollar are translated to reflect the year-end exchange rates. Resulting gains or losses are reflected in foreign currency exchange gain in the accompanying consolidated statements of income and comprehensive income. Revenues The Company’s time-charter contracts accounted for as direct financing leases and sales-type leases contain both a lease component (lease of the vessel) and a non-lease component (operation of the vessel). The Company has allocated the contract consideration between the lease component and non-lease component on a relative standalone selling price basis. The standalone selling price of the non-lease component has been determined using a cost-plus approach, whereby the Company estimates the cost to operate the vessel using cost benchmarking studies prepared by a third party, when available, or internal estimates when not available, plus a profit margin. The standalone selling price of the lease component has been determined using an adjusted market approach, whereby the Company calculates a rate excluding the operating component based on a market time-charter rate from published broker estimates, when available, or internal estimates when not available. Given that there are no observable standalone selling prices for either of these two components, judgment is required in determining the standalone selling price of each component. Upon commencement of a time charter accounted for as a sales-type lease or a direct financing lease, the carrying value of the vessel is derecognized and the net investment in the lease is recognized, based on the fair value of the vessel. For direct financing leases and sales-type leases, the lease element of time-charter hire receipts is allocated to the lease receivable and voyage revenues over the term of the lease using the effective interest rate method. The non-lease element of time- charter hire receipts is recognized by the Company on a straight-line basis daily over the term of the charter. Drydock cost reimbursements allocable to the non-lease element of a time-charter are recognized on a straight-line basis over the period between the previous scheduled drydock and the next scheduled drydock. In addition, if collectibility of non-lease receipts of charter payments from charterers is not probable, any such receipts are recognized as a liability unless the receipts are non- refundable and either the time-charter contract has been terminated or the Company has no remaining performance obligations. The Company does not recognize revenues during days that the vessel is off-hire. When the time-charter contains a variable consideration, the Company recognizes this revenue in the period in which the changes in facts and circumstances on which the variable charter hire payments are based occur. TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 8

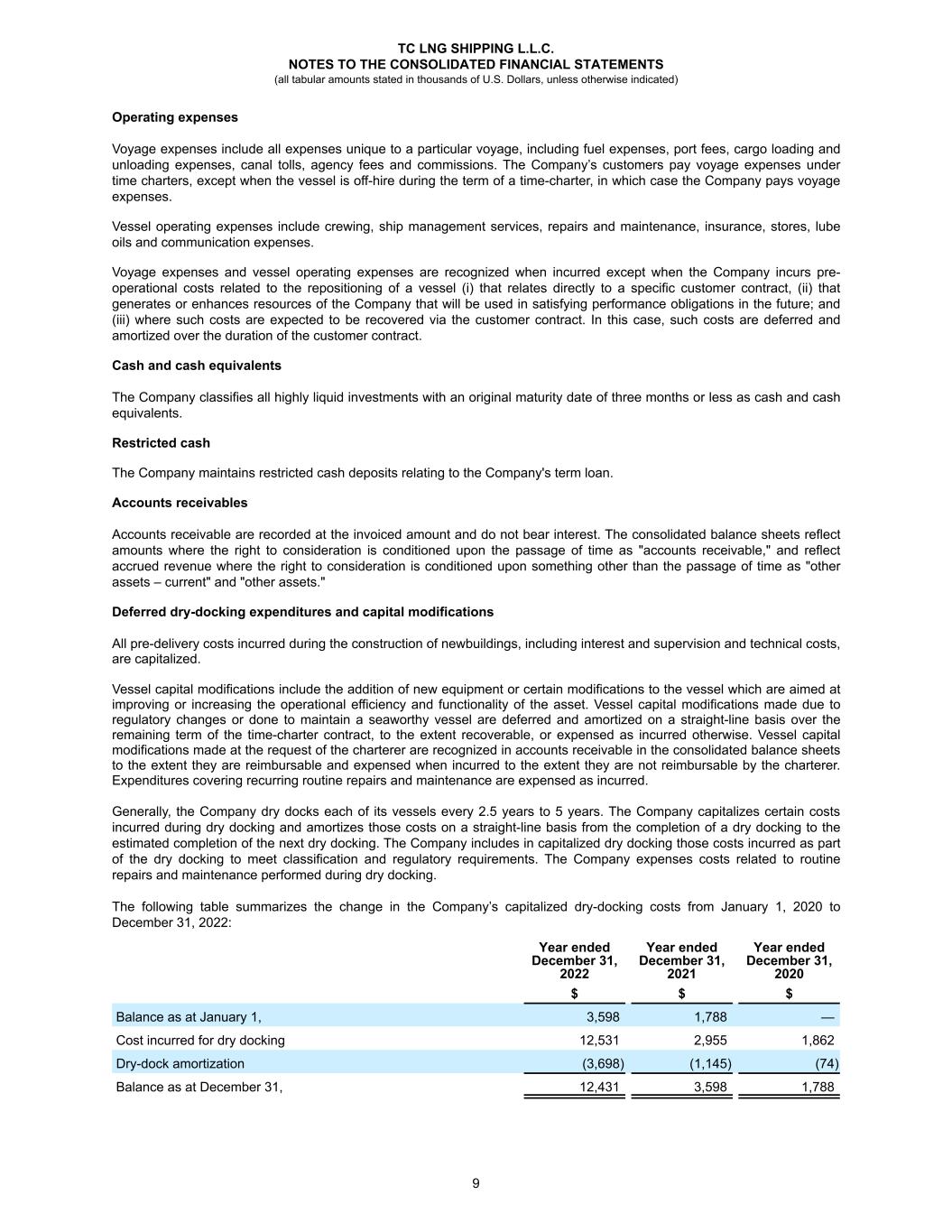

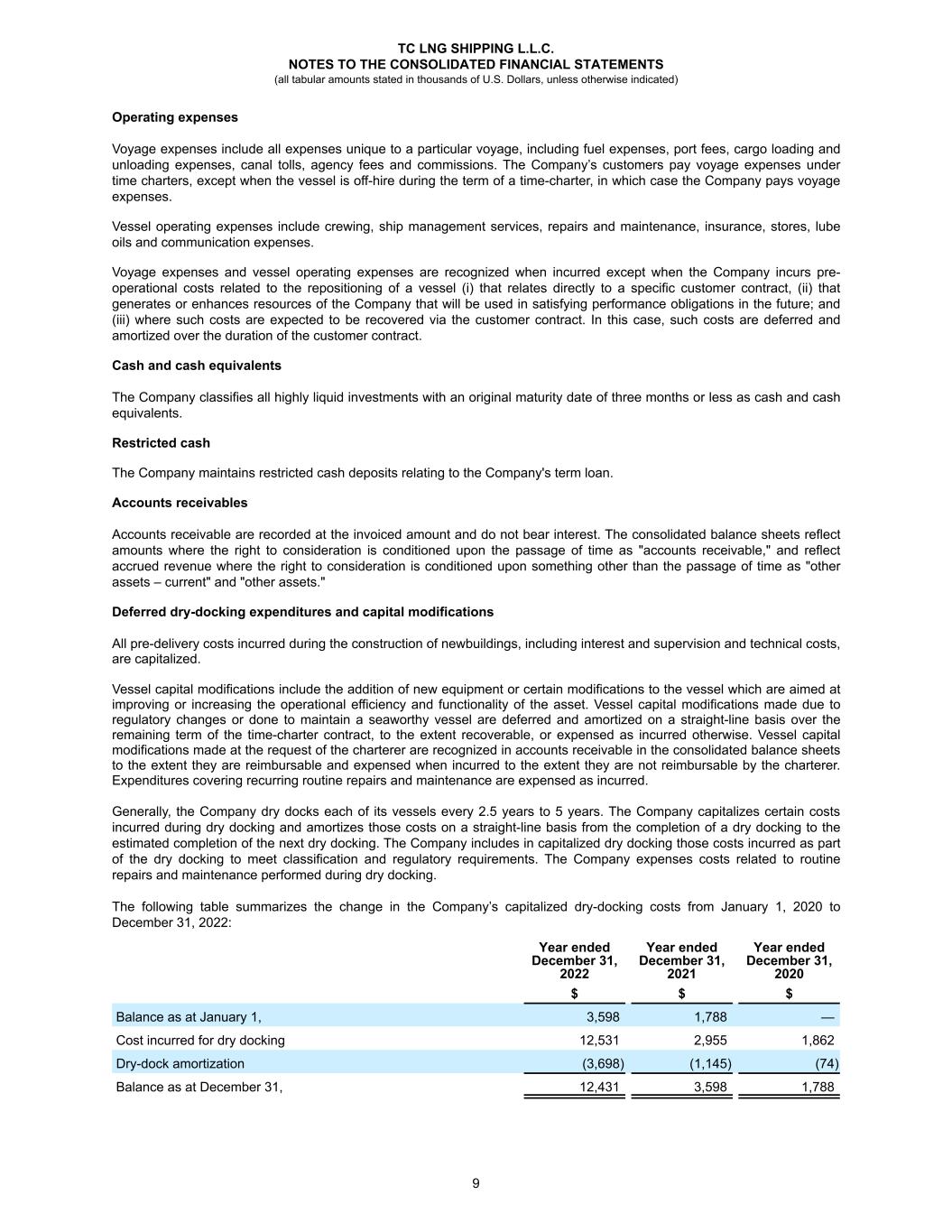

Operating expenses Voyage expenses include all expenses unique to a particular voyage, including fuel expenses, port fees, cargo loading and unloading expenses, canal tolls, agency fees and commissions. The Company’s customers pay voyage expenses under time charters, except when the vessel is off-hire during the term of a time-charter, in which case the Company pays voyage expenses. Vessel operating expenses include crewing, ship management services, repairs and maintenance, insurance, stores, lube oils and communication expenses. Voyage expenses and vessel operating expenses are recognized when incurred except when the Company incurs pre- operational costs related to the repositioning of a vessel (i) that relates directly to a specific customer contract, (ii) that generates or enhances resources of the Company that will be used in satisfying performance obligations in the future; and (iii) where such costs are expected to be recovered via the customer contract. In this case, such costs are deferred and amortized over the duration of the customer contract. Cash and cash equivalents The Company classifies all highly liquid investments with an original maturity date of three months or less as cash and cash equivalents. Restricted cash The Company maintains restricted cash deposits relating to the Company's term loan. Accounts receivables Accounts receivable are recorded at the invoiced amount and do not bear interest. The consolidated balance sheets reflect amounts where the right to consideration is conditioned upon the passage of time as "accounts receivable," and reflect accrued revenue where the right to consideration is conditioned upon something other than the passage of time as "other assets – current" and "other assets." Deferred dry-docking expenditures and capital modifications All pre-delivery costs incurred during the construction of newbuildings, including interest and supervision and technical costs, are capitalized. Vessel capital modifications include the addition of new equipment or certain modifications to the vessel which are aimed at improving or increasing the operational efficiency and functionality of the asset. Vessel capital modifications made due to regulatory changes or done to maintain a seaworthy vessel are deferred and amortized on a straight-line basis over the remaining term of the time-charter contract, to the extent recoverable, or expensed as incurred otherwise. Vessel capital modifications made at the request of the charterer are recognized in accounts receivable in the consolidated balance sheets to the extent they are reimbursable and expensed when incurred to the extent they are not reimbursable by the charterer. Expenditures covering recurring routine repairs and maintenance are expensed as incurred. Generally, the Company dry docks each of its vessels every 2.5 years to 5 years. The Company capitalizes certain costs incurred during dry docking and amortizes those costs on a straight-line basis from the completion of a dry docking to the estimated completion of the next dry docking. The Company includes in capitalized dry docking those costs incurred as part of the dry docking to meet classification and regulatory requirements. The Company expenses costs related to routine repairs and maintenance performed during dry docking. The following table summarizes the change in the Company’s capitalized dry-docking costs from January 1, 2020 to December 31, 2022: Year ended December 31, 2022 Year ended December 31, 2021 Year ended December 31, 2020 $ $ $ Balance as at January 1, 3,598 1,788 — Cost incurred for dry docking 12,531 2,955 1,862 Dry-dock amortization (3,698) (1,145) (74) Balance as at December 31, 12,431 3,598 1,788 TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 9

Debt issuance costs Debt issuance costs related to a recognized debt liability, including fees, commissions and legal expenses, are deferred and presented as a direct reduction from the carrying amount of that debt liability and amortized on an effective interest rate method over the term of the relevant loan. Amortization of debt issuance costs is included in interest expense in the Company's consolidated statements of income and comprehensive income. Credit losses The Company utilizes a lifetime expected credit loss measurement objective for the recognition of credit losses for net investments in direct financing and sales-type leases and other receivables at the time the financial asset is originated or acquired. The expected credit losses are subsequently adjusted each period for changes in expected lifetime credit losses. The Company discontinues accrual of interest on financial assets if collection of required payments is no longer probable, and in those situations, recognizes payments received on non-accrual assets on a cash basis method, until collection of required payments becomes probable. The Company considers a financial asset to be past due when payment is not made with 30 days of it being owed, assuming there is no dispute or other uncertainty regarding the amount owing. Expected credit loss provisions are presented on the consolidated balance sheets as a reduction to the carrying value of the related financial asset. Changes in expected credit loss provisions are presented within other income in the Company's consolidated statements of income and comprehensive income. Derivative instruments All derivative instruments are initially recorded at fair value as either assets or liabilities in the accompanying consolidated balance sheets and subsequently remeasured to fair value each period end, regardless of the purpose or intent for holding the derivative. The method of recognizing the resulting gain or loss is dependent on whether the derivative contract is designed to hedge a specific risk and whether the contract qualifies for hedge accounting. The Company applies hedge accounting to its derivative instruments (see Note 8). When a derivative is designated as a cash flow hedge, the Company formally documents the relationship between the derivative and the hedged item. This documentation includes the strategy and risk management objective for undertaking the hedge and the method that will be used to assess the effectiveness of the hedge. Any gains and losses on the derivative that are excluded from the assessment of hedge effectiveness are recognized immediately in earnings. The Company does not apply hedge accounting if it is determined that the hedge was not effective or will no longer be effective, the derivative was sold or exercised, or the hedged item was sold, repaid or no longer probable of occurring. For derivative financial instruments designated and qualifying as cash flow hedges, changes in the fair value of the derivative financial instruments are initially recorded as a component of accumulated other comprehensive income (loss) in total equity. In the periods when the hedged items affect earnings, the associated fair value changes on the hedging derivatives are transferred from total equity to the corresponding earnings line item (e.g. interest expense) in the Company’s consolidated statements of income and comprehensive income. If a cash flow hedge is terminated or de-designated and the originally hedged item is still considered probable of occurring, the gains and losses initially recognized in total equity remain there until the hedged item impacts earnings, at which point they are transferred to the corresponding earnings line item in the Company’s consolidated statements of income and comprehensive income. If the hedged items are no longer probable of occurring, amounts recognized in total equity are immediately transferred to the earnings line item in the Company’s consolidated statements of income and comprehensive income. For derivative financial instruments that are not designated or that do not qualify as hedges under Financial Accounting Standards Board (or FASB) Accounting Standards Codification (or ASC) 815, Derivatives and Hedging, changes in the fair value of the derivative financial instruments are recognized in earnings. Income taxes The legal jurisdictions in which the Company’s Marshall Island subsidiaries are incorporated do not impose income taxes upon shipping-related activities. The Company recognizes the tax benefits of uncertain tax positions only if it is more-likely-than-not that a tax position taken or expected to be taken in a tax return will be sustained upon examination by the taxing authorities, including resolution of any related appeals or litigation processes, based on the technical merits of the position. The tax benefits recognized in the Company’s consolidated financial statements from such positions are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. Included in the Company's income tax expense are provisions for uncertain tax positions relating to freight taxes. The Company does not presently anticipate that its provisions for uncertain tax positions will significantly increase in the next 12 months; however, this is dependent on the jurisdictions in which vessel trading activity occurs. The Company reviews its TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 10

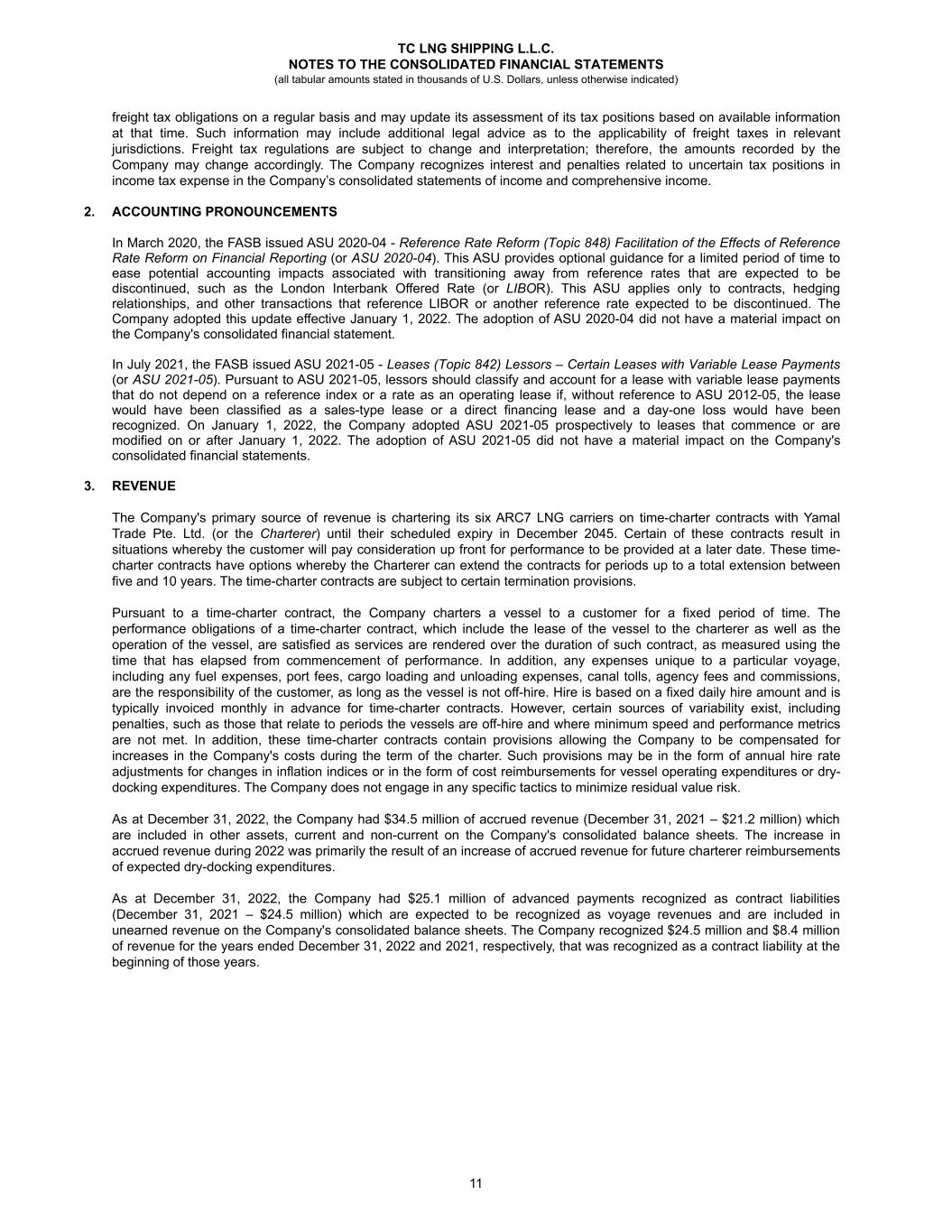

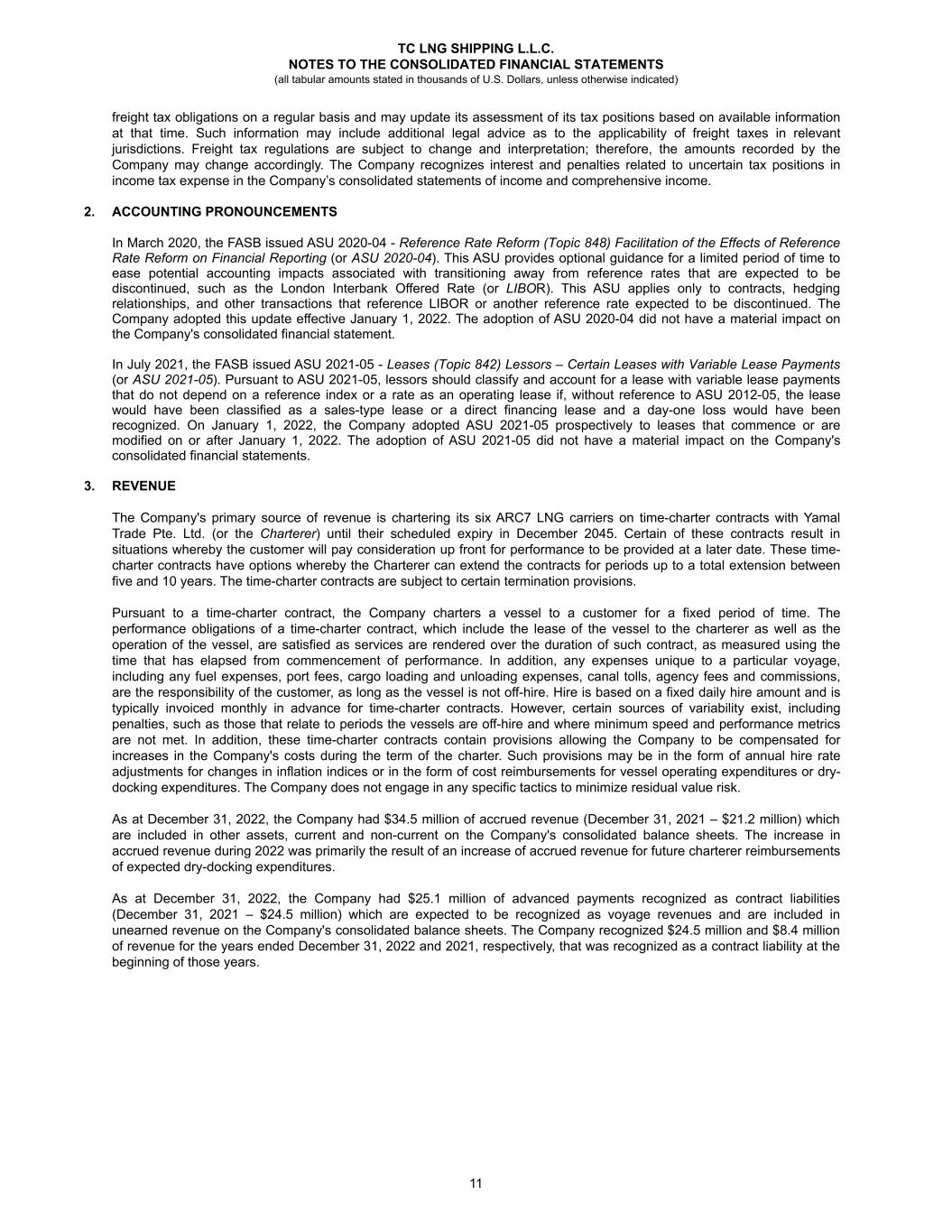

freight tax obligations on a regular basis and may update its assessment of its tax positions based on available information at that time. Such information may include additional legal advice as to the applicability of freight taxes in relevant jurisdictions. Freight tax regulations are subject to change and interpretation; therefore, the amounts recorded by the Company may change accordingly. The Company recognizes interest and penalties related to uncertain tax positions in income tax expense in the Company’s consolidated statements of income and comprehensive income. 2. ACCOUNTING PRONOUNCEMENTS In March 2020, the FASB issued ASU 2020-04 - Reference Rate Reform (Topic 848) Facilitation of the Effects of Reference Rate Reform on Financial Reporting (or ASU 2020-04). This ASU provides optional guidance for a limited period of time to ease potential accounting impacts associated with transitioning away from reference rates that are expected to be discontinued, such as the London Interbank Offered Rate (or LIBOR). This ASU applies only to contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued. The Company adopted this update effective January 1, 2022. The adoption of ASU 2020-04 did not have a material impact on the Company's consolidated financial statement. In July 2021, the FASB issued ASU 2021-05 - Leases (Topic 842) Lessors – Certain Leases with Variable Lease Payments (or ASU 2021-05). Pursuant to ASU 2021-05, lessors should classify and account for a lease with variable lease payments that do not depend on a reference index or a rate as an operating lease if, without reference to ASU 2012-05, the lease would have been classified as a sales-type lease or a direct financing lease and a day-one loss would have been recognized. On January 1, 2022, the Company adopted ASU 2021-05 prospectively to leases that commence or are modified on or after January 1, 2022. The adoption of ASU 2021-05 did not have a material impact on the Company's consolidated financial statements. 3. REVENUE The Company's primary source of revenue is chartering its six ARC7 LNG carriers on time-charter contracts with Yamal Trade Pte. Ltd. (or the Charterer) until their scheduled expiry in December 2045. Certain of these contracts result in situations whereby the customer will pay consideration up front for performance to be provided at a later date. These time- charter contracts have options whereby the Charterer can extend the contracts for periods up to a total extension between five and 10 years. The time-charter contracts are subject to certain termination provisions. Pursuant to a time-charter contract, the Company charters a vessel to a customer for a fixed period of time. The performance obligations of a time-charter contract, which include the lease of the vessel to the charterer as well as the operation of the vessel, are satisfied as services are rendered over the duration of such contract, as measured using the time that has elapsed from commencement of performance. In addition, any expenses unique to a particular voyage, including any fuel expenses, port fees, cargo loading and unloading expenses, canal tolls, agency fees and commissions, are the responsibility of the customer, as long as the vessel is not off-hire. Hire is based on a fixed daily hire amount and is typically invoiced monthly in advance for time-charter contracts. However, certain sources of variability exist, including penalties, such as those that relate to periods the vessels are off-hire and where minimum speed and performance metrics are not met. In addition, these time-charter contracts contain provisions allowing the Company to be compensated for increases in the Company's costs during the term of the charter. Such provisions may be in the form of annual hire rate adjustments for changes in inflation indices or in the form of cost reimbursements for vessel operating expenditures or dry- docking expenditures. The Company does not engage in any specific tactics to minimize residual value risk. As at December 31, 2022, the Company had $34.5 million of accrued revenue (December 31, 2021 – $21.2 million) which are included in other assets, current and non-current on the Company's consolidated balance sheets. The increase in accrued revenue during 2022 was primarily the result of an increase of accrued revenue for future charterer reimbursements of expected dry-docking expenditures. As at December 31, 2022, the Company had $25.1 million of advanced payments recognized as contract liabilities (December 31, 2021 – $24.5 million) which are expected to be recognized as voyage revenues and are included in unearned revenue on the Company's consolidated balance sheets. The Company recognized $24.5 million and $8.4 million of revenue for the years ended December 31, 2022 and 2021, respectively, that was recognized as a contract liability at the beginning of those years. TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 11

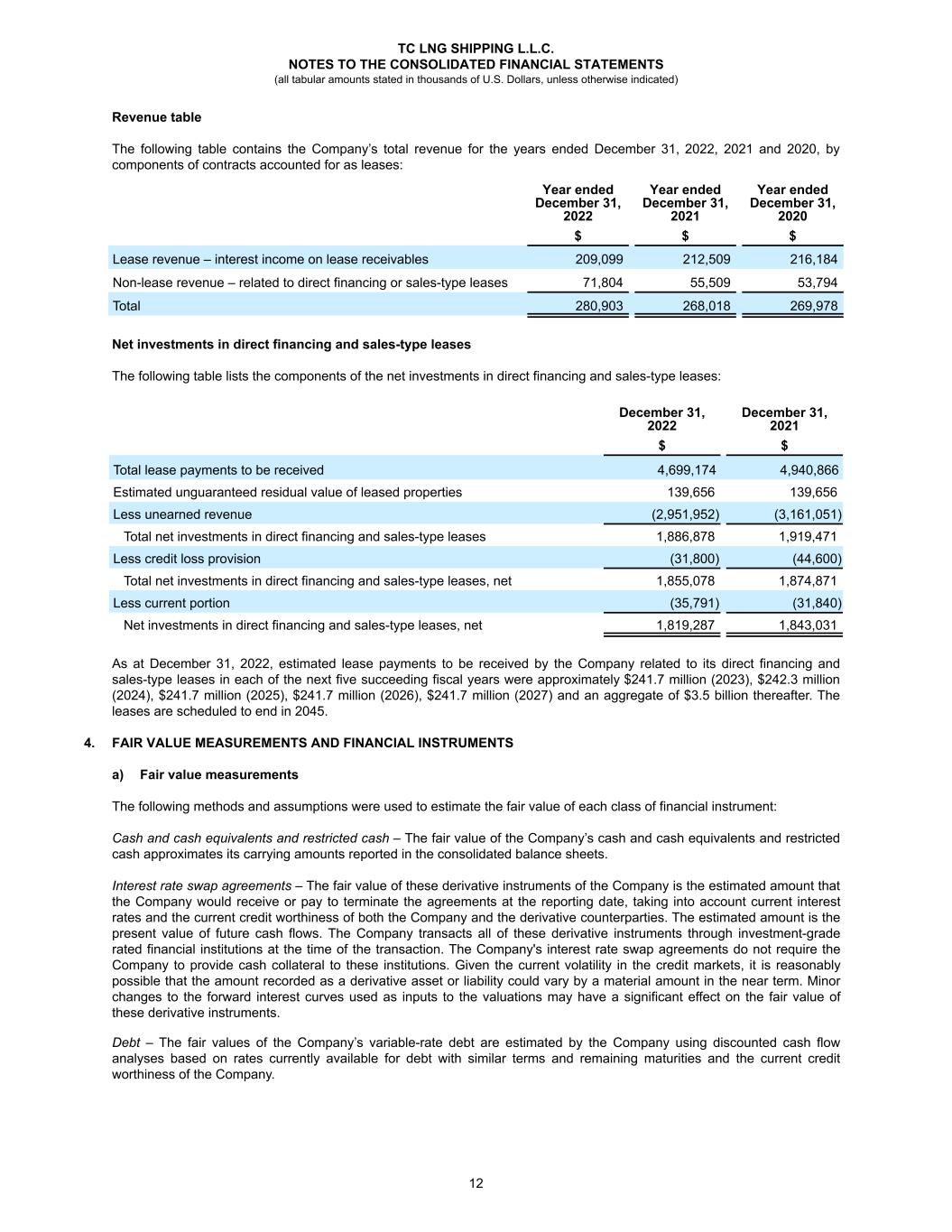

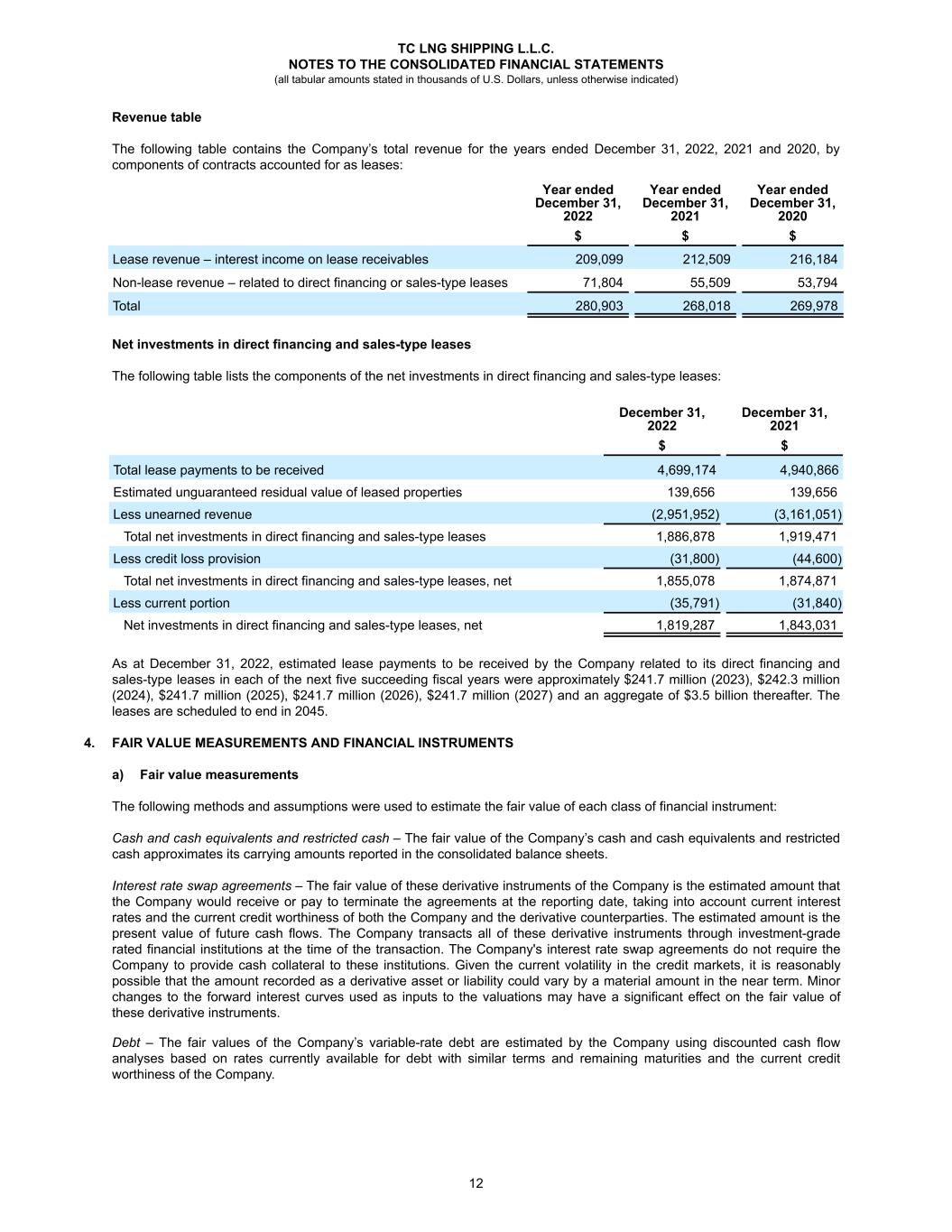

Revenue table The following table contains the Company’s total revenue for the years ended December 31, 2022, 2021 and 2020, by components of contracts accounted for as leases: Year ended December 31, 2022 Year ended December 31, 2021 Year ended December 31, 2020 $ $ $ Lease revenue – interest income on lease receivables 209,099 212,509 216,184 Non-lease revenue – related to direct financing or sales-type leases 71,804 55,509 53,794 Total 280,903 268,018 269,978 Net investments in direct financing and sales-type leases The following table lists the components of the net investments in direct financing and sales-type leases: December 31, 2022 December 31, 2021 $ $ Total lease payments to be received 4,699,174 4,940,866 Estimated unguaranteed residual value of leased properties 139,656 139,656 Less unearned revenue (2,951,952) (3,161,051) Total net investments in direct financing and sales-type leases 1,886,878 1,919,471 Less credit loss provision (31,800) (44,600) Total net investments in direct financing and sales-type leases, net 1,855,078 1,874,871 Less current portion (35,791) (31,840) Net investments in direct financing and sales-type leases, net 1,819,287 1,843,031 As at December 31, 2022, estimated lease payments to be received by the Company related to its direct financing and sales-type leases in each of the next five succeeding fiscal years were approximately $241.7 million (2023), $242.3 million (2024), $241.7 million (2025), $241.7 million (2026), $241.7 million (2027) and an aggregate of $3.5 billion thereafter. The leases are scheduled to end in 2045. 4. FAIR VALUE MEASUREMENTS AND FINANCIAL INSTRUMENTS a) Fair value measurements The following methods and assumptions were used to estimate the fair value of each class of financial instrument: Cash and cash equivalents and restricted cash – The fair value of the Company’s cash and cash equivalents and restricted cash approximates its carrying amounts reported in the consolidated balance sheets. Interest rate swap agreements – The fair value of these derivative instruments of the Company is the estimated amount that the Company would receive or pay to terminate the agreements at the reporting date, taking into account current interest rates and the current credit worthiness of both the Company and the derivative counterparties. The estimated amount is the present value of future cash flows. The Company transacts all of these derivative instruments through investment-grade rated financial institutions at the time of the transaction. The Company's interest rate swap agreements do not require the Company to provide cash collateral to these institutions. Given the current volatility in the credit markets, it is reasonably possible that the amount recorded as a derivative asset or liability could vary by a material amount in the near term. Minor changes to the forward interest curves used as inputs to the valuations may have a significant effect on the fair value of these derivative instruments. Debt – The fair values of the Company’s variable-rate debt are estimated by the Company using discounted cash flow analyses based on rates currently available for debt with similar terms and remaining maturities and the current credit worthiness of the Company. TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 12

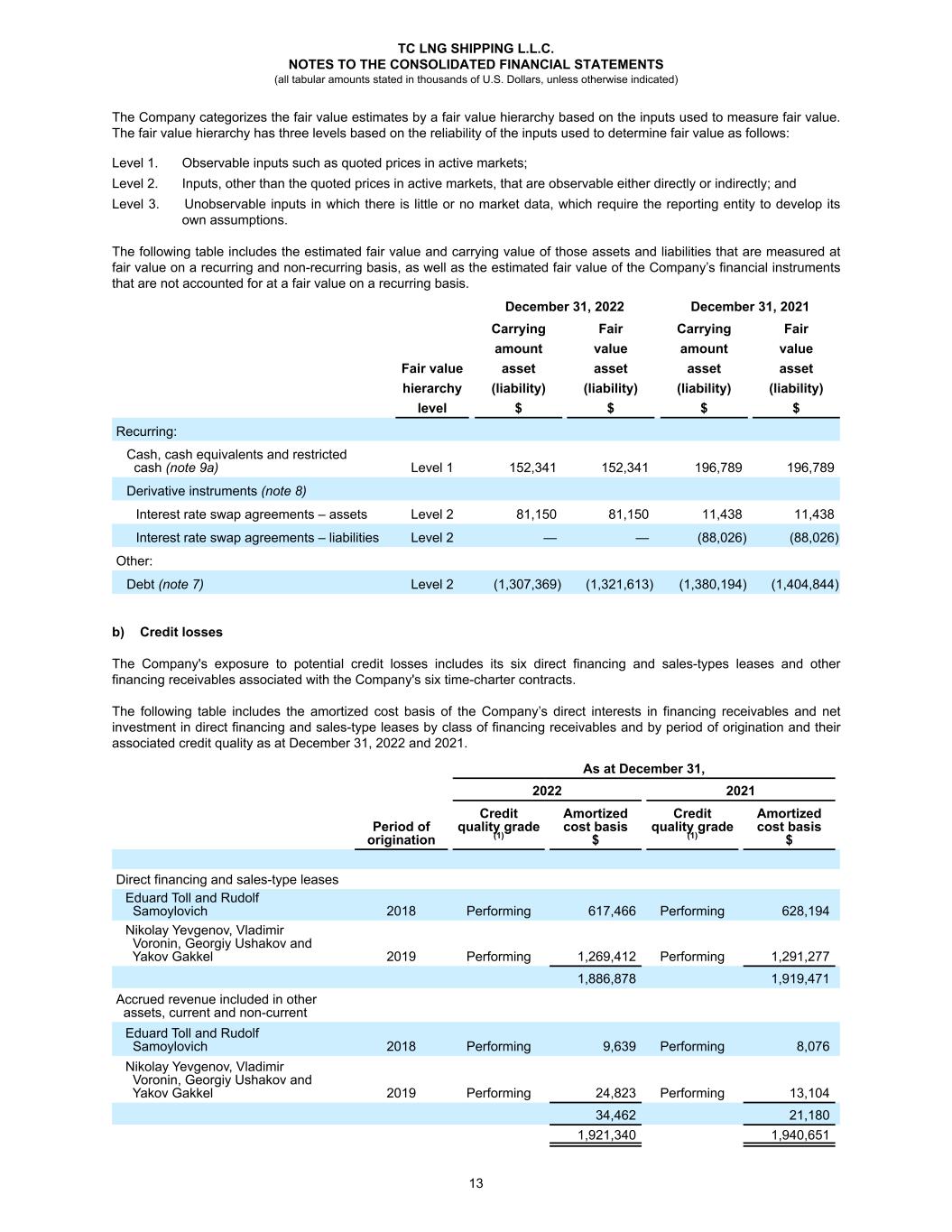

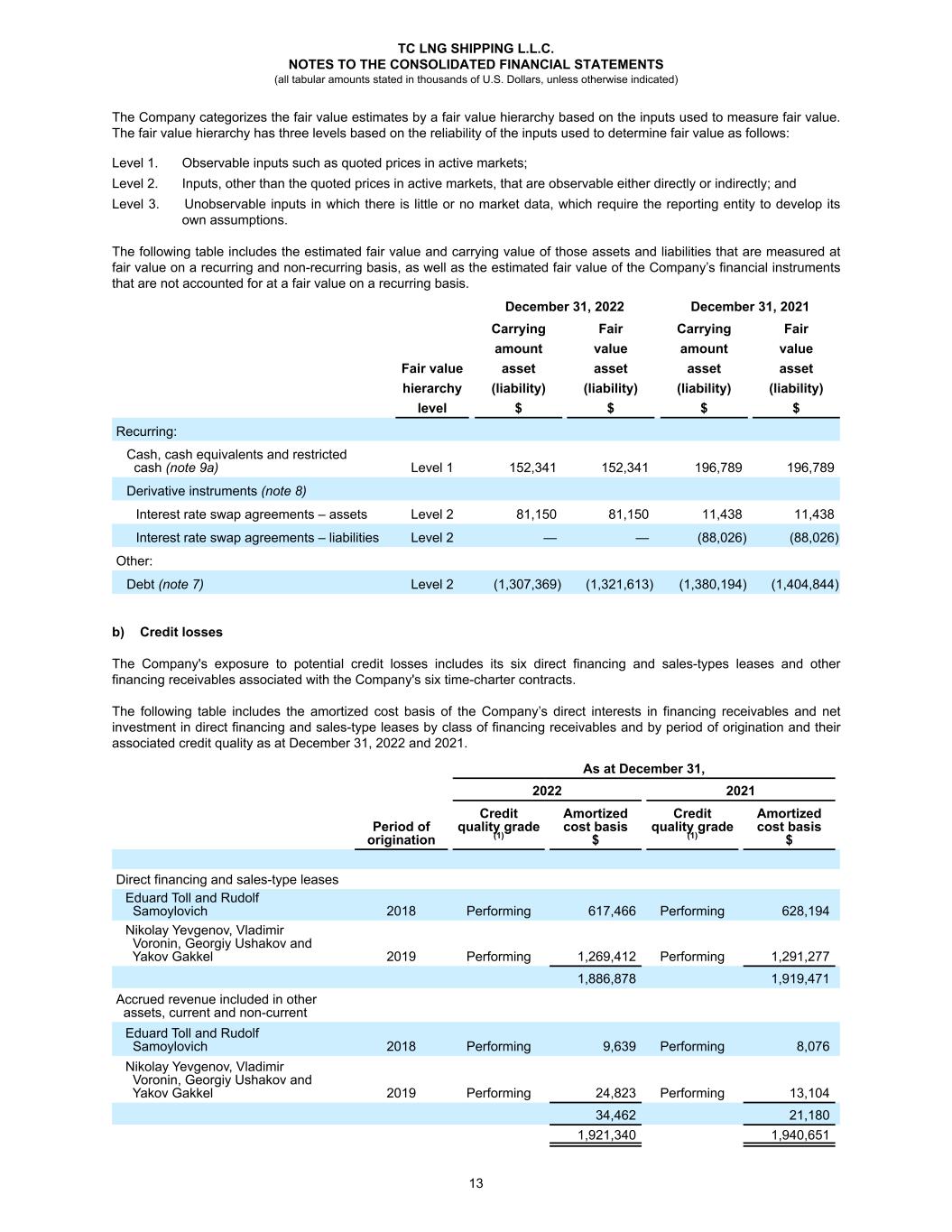

The Company categorizes the fair value estimates by a fair value hierarchy based on the inputs used to measure fair value. The fair value hierarchy has three levels based on the reliability of the inputs used to determine fair value as follows: Level 1. Observable inputs such as quoted prices in active markets; Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions. The following table includes the estimated fair value and carrying value of those assets and liabilities that are measured at fair value on a recurring and non-recurring basis, as well as the estimated fair value of the Company’s financial instruments that are not accounted for at a fair value on a recurring basis. December 31, 2022 December 31, 2021 Carrying Fair Carrying Fair amount value amount value Fair value asset asset asset asset hierarchy (liability) (liability) (liability) (liability) level $ $ $ $ Recurring: Cash, cash equivalents and restricted cash (note 9a) Level 1 152,341 152,341 196,789 196,789 Derivative instruments (note 8) Interest rate swap agreements – assets Level 2 81,150 81,150 11,438 11,438 Interest rate swap agreements – liabilities Level 2 — — (88,026) (88,026) Other: Debt (note 7) Level 2 (1,307,369) (1,321,613) (1,380,194) (1,404,844) b) Credit losses The Company's exposure to potential credit losses includes its six direct financing and sales-types leases and other financing receivables associated with the Company's six time-charter contracts. The following table includes the amortized cost basis of the Company’s direct interests in financing receivables and net investment in direct financing and sales-type leases by class of financing receivables and by period of origination and their associated credit quality as at December 31, 2022 and 2021. As at December 31, 2022 2021 Period of origination Credit quality grade (1) Amortized cost basis $ Credit quality grade (1) Amortized cost basis $ Direct financing and sales-type leases Eduard Toll and Rudolf Samoylovich 2018 Performing 617,466 Performing 628,194 Nikolay Yevgenov, Vladimir Voronin, Georgiy Ushakov and Yakov Gakkel 2019 Performing 1,269,412 Performing 1,291,277 1,886,878 1,919,471 Accrued revenue included in other assets, current and non-current Eduard Toll and Rudolf Samoylovich 2018 Performing 9,639 Performing 8,076 Nikolay Yevgenov, Vladimir Voronin, Georgiy Ushakov and Yakov Gakkel 2019 Performing 24,823 Performing 13,104 34,462 21,180 1,921,340 1,940,651 TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 13

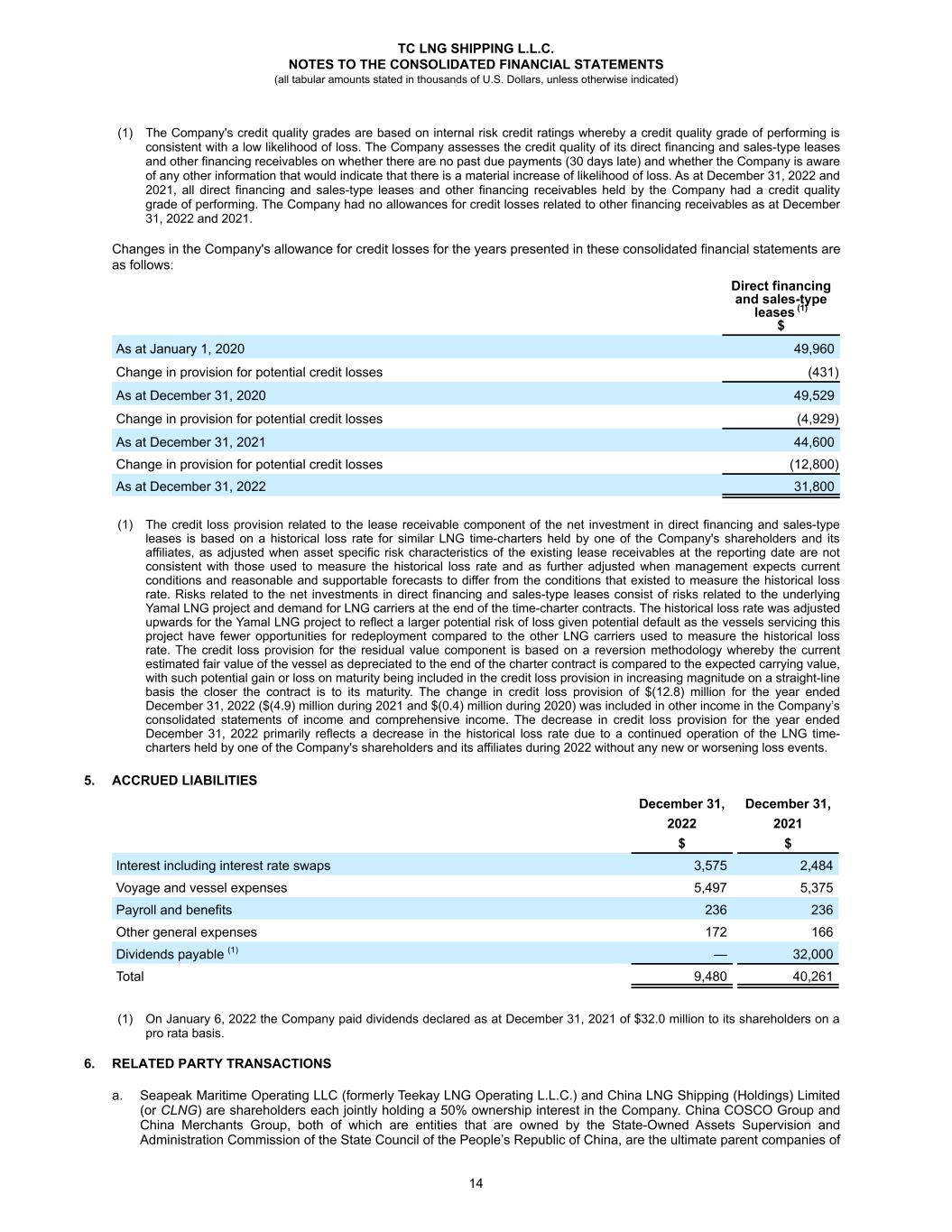

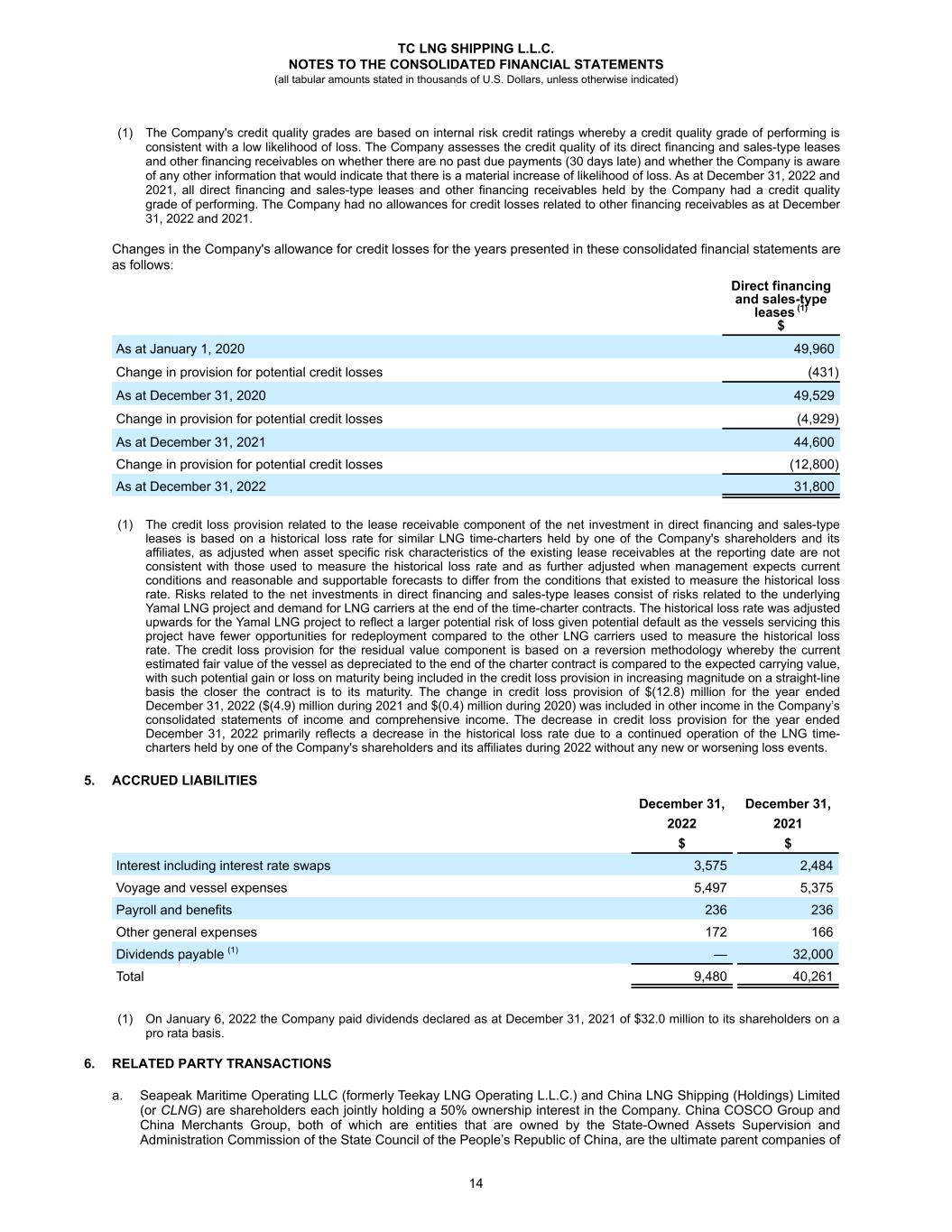

(1) The Company's credit quality grades are based on internal risk credit ratings whereby a credit quality grade of performing is consistent with a low likelihood of loss. The Company assesses the credit quality of its direct financing and sales-type leases and other financing receivables on whether there are no past due payments (30 days late) and whether the Company is aware of any other information that would indicate that there is a material increase of likelihood of loss. As at December 31, 2022 and 2021, all direct financing and sales-type leases and other financing receivables held by the Company had a credit quality grade of performing. The Company had no allowances for credit losses related to other financing receivables as at December 31, 2022 and 2021. Changes in the Company's allowance for credit losses for the years presented in these consolidated financial statements are as follows: Direct financing and sales-type leases (1) $ As at January 1, 2020 49,960 Change in provision for potential credit losses (431) As at December 31, 2020 49,529 Change in provision for potential credit losses (4,929) As at December 31, 2021 44,600 Change in provision for potential credit losses (12,800) As at December 31, 2022 31,800 (1) The credit loss provision related to the lease receivable component of the net investment in direct financing and sales-type leases is based on a historical loss rate for similar LNG time-charters held by one of the Company's shareholders and its affiliates, as adjusted when asset specific risk characteristics of the existing lease receivables at the reporting date are not consistent with those used to measure the historical loss rate and as further adjusted when management expects current conditions and reasonable and supportable forecasts to differ from the conditions that existed to measure the historical loss rate. Risks related to the net investments in direct financing and sales-type leases consist of risks related to the underlying Yamal LNG project and demand for LNG carriers at the end of the time-charter contracts. The historical loss rate was adjusted upwards for the Yamal LNG project to reflect a larger potential risk of loss given potential default as the vessels servicing this project have fewer opportunities for redeployment compared to the other LNG carriers used to measure the historical loss rate. The credit loss provision for the residual value component is based on a reversion methodology whereby the current estimated fair value of the vessel as depreciated to the end of the charter contract is compared to the expected carrying value, with such potential gain or loss on maturity being included in the credit loss provision in increasing magnitude on a straight-line basis the closer the contract is to its maturity. The change in credit loss provision of $(12.8) million for the year ended December 31, 2022 ($(4.9) million during 2021 and $(0.4) million during 2020) was included in other income in the Company’s consolidated statements of income and comprehensive income. The decrease in credit loss provision for the year ended December 31, 2022 primarily reflects a decrease in the historical loss rate due to a continued operation of the LNG time- charters held by one of the Company's shareholders and its affiliates during 2022 without any new or worsening loss events. 5. ACCRUED LIABILITIES December 31, December 31, 2022 2021 $ $ Interest including interest rate swaps 3,575 2,484 Voyage and vessel expenses 5,497 5,375 Payroll and benefits 236 236 Other general expenses 172 166 Dividends payable (1) — 32,000 Total 9,480 40,261 (1) On January 6, 2022 the Company paid dividends declared as at December 31, 2021 of $32.0 million to its shareholders on a pro rata basis. 6. RELATED PARTY TRANSACTIONS a. Seapeak Maritime Operating LLC (formerly Teekay LNG Operating L.L.C.) and China LNG Shipping (Holdings) Limited (or CLNG) are shareholders each jointly holding a 50% ownership interest in the Company. China COSCO Group and China Merchants Group, both of which are entities that are owned by the State-Owned Assets Supervision and Administration Commission of the State Council of the People’s Republic of China, are the ultimate parent companies of TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 14

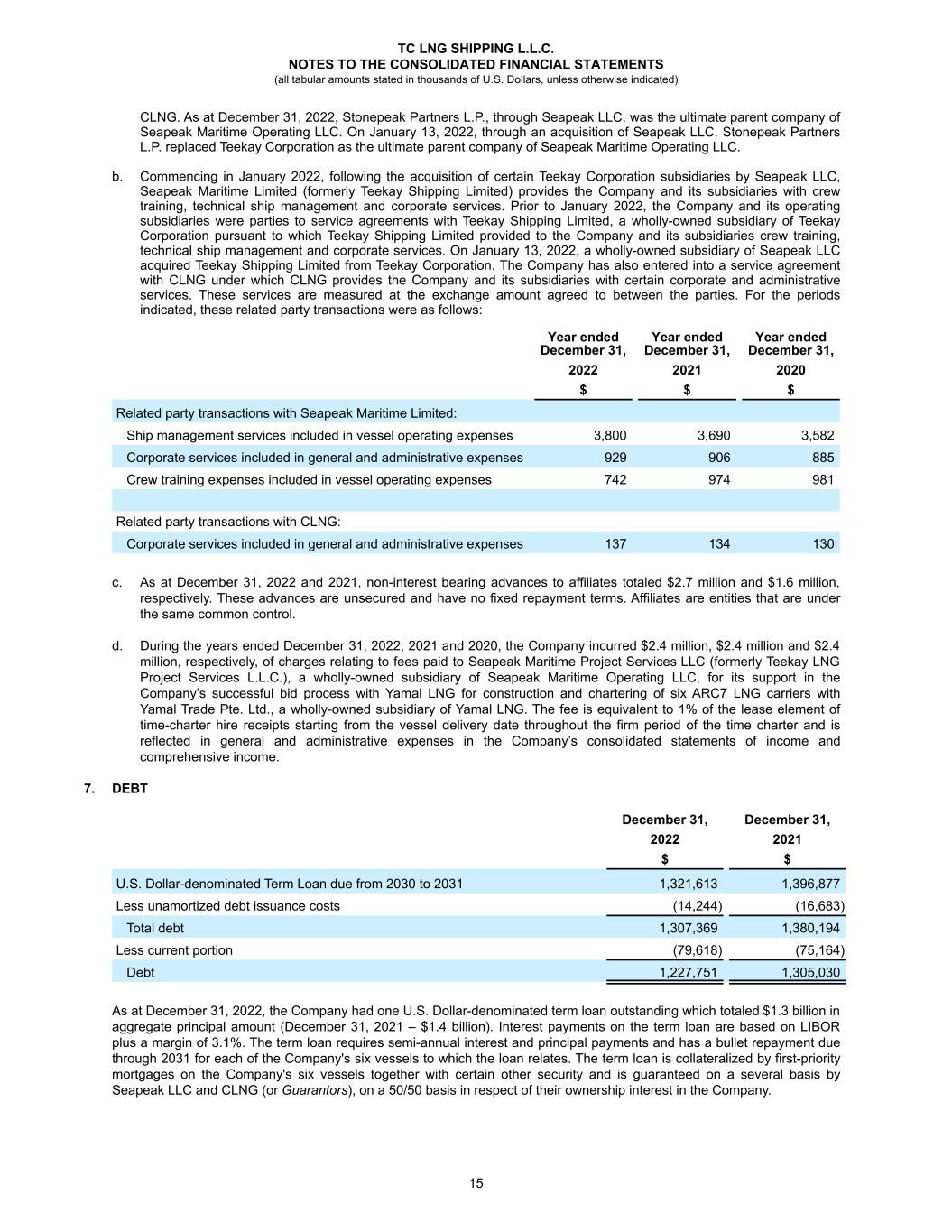

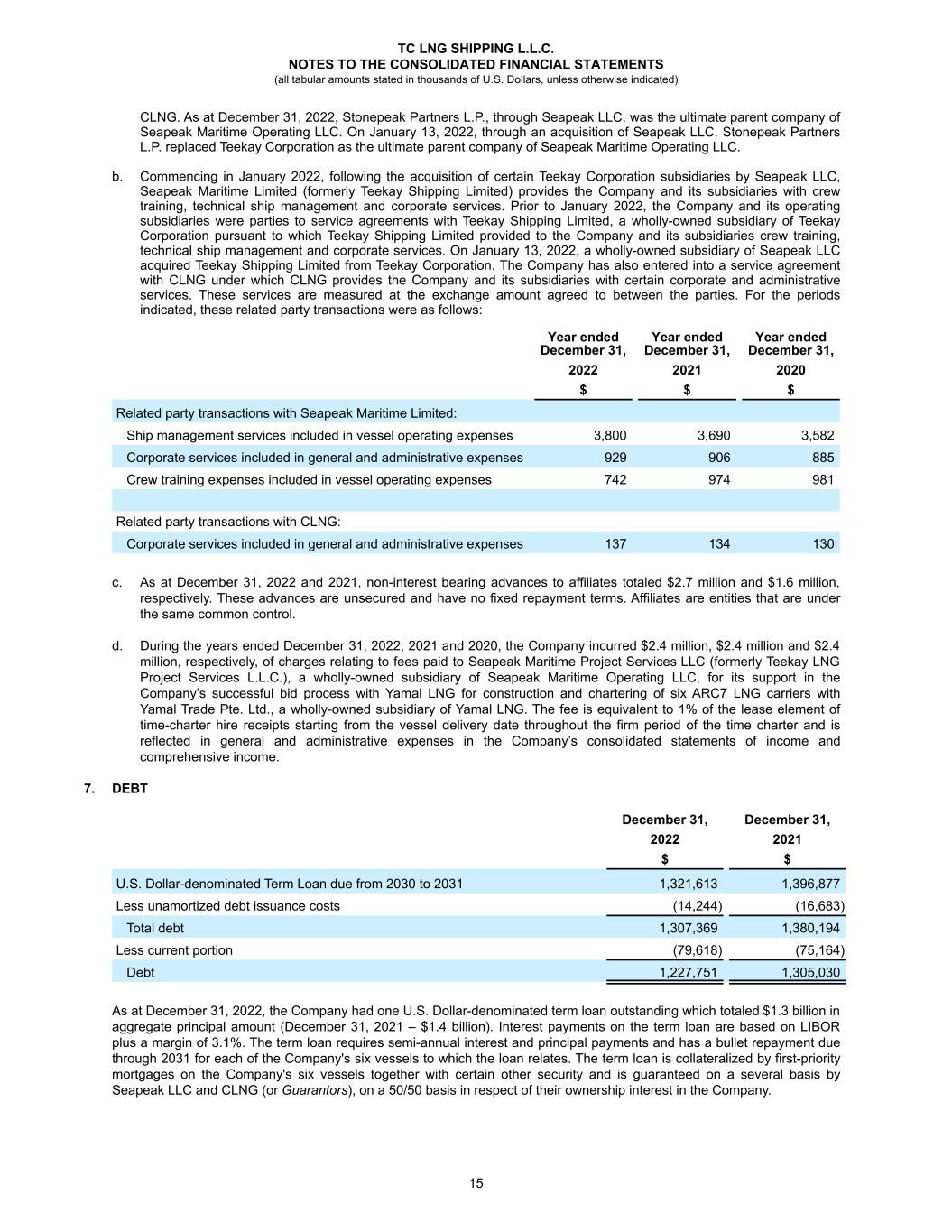

CLNG. As at December 31, 2022, Stonepeak Partners L.P., through Seapeak LLC, was the ultimate parent company of Seapeak Maritime Operating LLC. On January 13, 2022, through an acquisition of Seapeak LLC, Stonepeak Partners L.P. replaced Teekay Corporation as the ultimate parent company of Seapeak Maritime Operating LLC. b. Commencing in January 2022, following the acquisition of certain Teekay Corporation subsidiaries by Seapeak LLC, Seapeak Maritime Limited (formerly Teekay Shipping Limited) provides the Company and its subsidiaries with crew training, technical ship management and corporate services. Prior to January 2022, the Company and its operating subsidiaries were parties to service agreements with Teekay Shipping Limited, a wholly-owned subsidiary of Teekay Corporation pursuant to which Teekay Shipping Limited provided to the Company and its subsidiaries crew training, technical ship management and corporate services. On January 13, 2022, a wholly-owned subsidiary of Seapeak LLC acquired Teekay Shipping Limited from Teekay Corporation. The Company has also entered into a service agreement with CLNG under which CLNG provides the Company and its subsidiaries with certain corporate and administrative services. These services are measured at the exchange amount agreed to between the parties. For the periods indicated, these related party transactions were as follows: Year ended December 31, Year ended December 31, Year ended December 31, 2022 2021 2020 $ $ $ Related party transactions with Seapeak Maritime Limited: Ship management services included in vessel operating expenses 3,800 3,690 3,582 Corporate services included in general and administrative expenses 929 906 885 Crew training expenses included in vessel operating expenses 742 974 981 Related party transactions with CLNG: Corporate services included in general and administrative expenses 137 134 130 c. As at December 31, 2022 and 2021, non-interest bearing advances to affiliates totaled $2.7 million and $1.6 million, respectively. These advances are unsecured and have no fixed repayment terms. Affiliates are entities that are under the same common control. d. During the years ended December 31, 2022, 2021 and 2020, the Company incurred $2.4 million, $2.4 million and $2.4 million, respectively, of charges relating to fees paid to Seapeak Maritime Project Services LLC (formerly Teekay LNG Project Services L.L.C.), a wholly-owned subsidiary of Seapeak Maritime Operating LLC, for its support in the Company’s successful bid process with Yamal LNG for construction and chartering of six ARC7 LNG carriers with Yamal Trade Pte. Ltd., a wholly-owned subsidiary of Yamal LNG. The fee is equivalent to 1% of the lease element of time-charter hire receipts starting from the vessel delivery date throughout the firm period of the time charter and is reflected in general and administrative expenses in the Company’s consolidated statements of income and comprehensive income. 7. DEBT December 31, December 31, 2022 2021 $ $ U.S. Dollar-denominated Term Loan due from 2030 to 2031 1,321,613 1,396,877 Less unamortized debt issuance costs (14,244) (16,683) Total debt 1,307,369 1,380,194 Less current portion (79,618) (75,164) Debt 1,227,751 1,305,030 As at December 31, 2022, the Company had one U.S. Dollar-denominated term loan outstanding which totaled $1.3 billion in aggregate principal amount (December 31, 2021 – $1.4 billion). Interest payments on the term loan are based on LIBOR plus a margin of 3.1%. The term loan requires semi-annual interest and principal payments and has a bullet repayment due through 2031 for each of the Company's six vessels to which the loan relates. The term loan is collateralized by first-priority mortgages on the Company's six vessels together with certain other security and is guaranteed on a several basis by Seapeak LLC and CLNG (or Guarantors), on a 50/50 basis in respect of their ownership interest in the Company. TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 15

The weighted-average interest rate on the Company’s debt as at December 31, 2022 and 2021 was 8.3% and 3.4%, respectively. These rates do not reflect the effect of related interest rate swaps that the Company has used to economically hedge a portion of its floating-rate debt (see Note 8). The aggregate annual debt principal repayments required subsequent to December 31, 2022 are $79.7 million (2023), $84.5 million (2024), $89.5 million (2025), $94.8 million (2026), $100.5 million (2027) and $0.9 billion (thereafter). The loan agreements require that (a) Seapeak LLC and CLNG maintain minimum levels of tangible net worth of at least $400.0 million and $300.0 million, aggregate liquidity of at least $35.0 million and $32.0 million, and net-debt-to-net-debt- plus-equity ratio of not more than 80% and 75%, respectively, (b) the Company maintains minimum vessel-value-to- outstanding-loan-principal-balance ratios of 111% for the Company's vessels, which as at December 31, 2022 was 156%, on average per vessel; the vessel values used in calculating these ratios are the appraised values provided by third parties, and given that vessel values can be volatile, the Company’s estimates of market value may not be indicative of either the current or future prices that could be obtained if the Company sold any of the vessels, (c) the Company maintains a debt service coverage ratio of at least 1.05-to-1, and (d) the Company maintains restricted cash reserve deposits. The Company’s ship-owning subsidiaries may not, among other things, pay dividends or distributions if the Company is in default under its loan. As at December 31, 2022, the Company and the Guarantors were in compliance with all covenants relating to the Company’s term loan. 8. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES The Company uses derivative instruments in accordance with its overall risk management policy. Seapeak LLC and CLNG have guaranteed its ownership share of a secured loan facility and interest rate swaps in the Company. Interest rate risk The Company enters into interest rate swaps which exchange a receipt of floating interest for a payment of fixed interest to reduce the Company’s exposure to interest rate variability on a portion of its outstanding floating-rate debt. As at December 31, 2022, the Company was committed to the following interest rate swap agreements: Fair value / Weighted- carrying average Average Interest Principal amount of remaining fixed rate amount (i) asset term interest index $ $ (years) rate (ii) LIBOR-based debt: U.S. Dollar-denominated interest rate swaps LIBOR 1,080,975 81,150 8.1 2.7% (i) Principal amount reduces semi-annually. (ii) Excludes the margin the Company pays on its variable-rate debt, which as at December 31, 2022 was 3.1%. Credit risk The Company is exposed to credit loss in the event of non-performance by the counterparty to the interest rate swap agreements. In order to minimize counterparty risk, the Company only enters into derivative transactions with counterparties that are rated A- or better by Standard & Poor’s or A3 or better by Moody’s at the time of the transactions. The following table presents the classification and fair value amounts of derivative instruments, segregated by type of contract, on the Company’s consolidated balance sheets. Accounts receivable $ Derivative assets – current $ Derivative assets $ Accrued liabilities $ Derivative liabilities – current $ Derivative liabilities $ As at December 31, 2022 Interest rate swap agreements 834 26,057 54,259 — — — As at December 31, 2021 Interest rate swap agreements — — 11,438 (821) (23,414) (63,791) For the periods indicated, the following table presents the gains or losses on interest rate swap agreements designated and qualifying as cash flow hedges and their impact on other comprehensive income (loss) (or OCI). TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 16

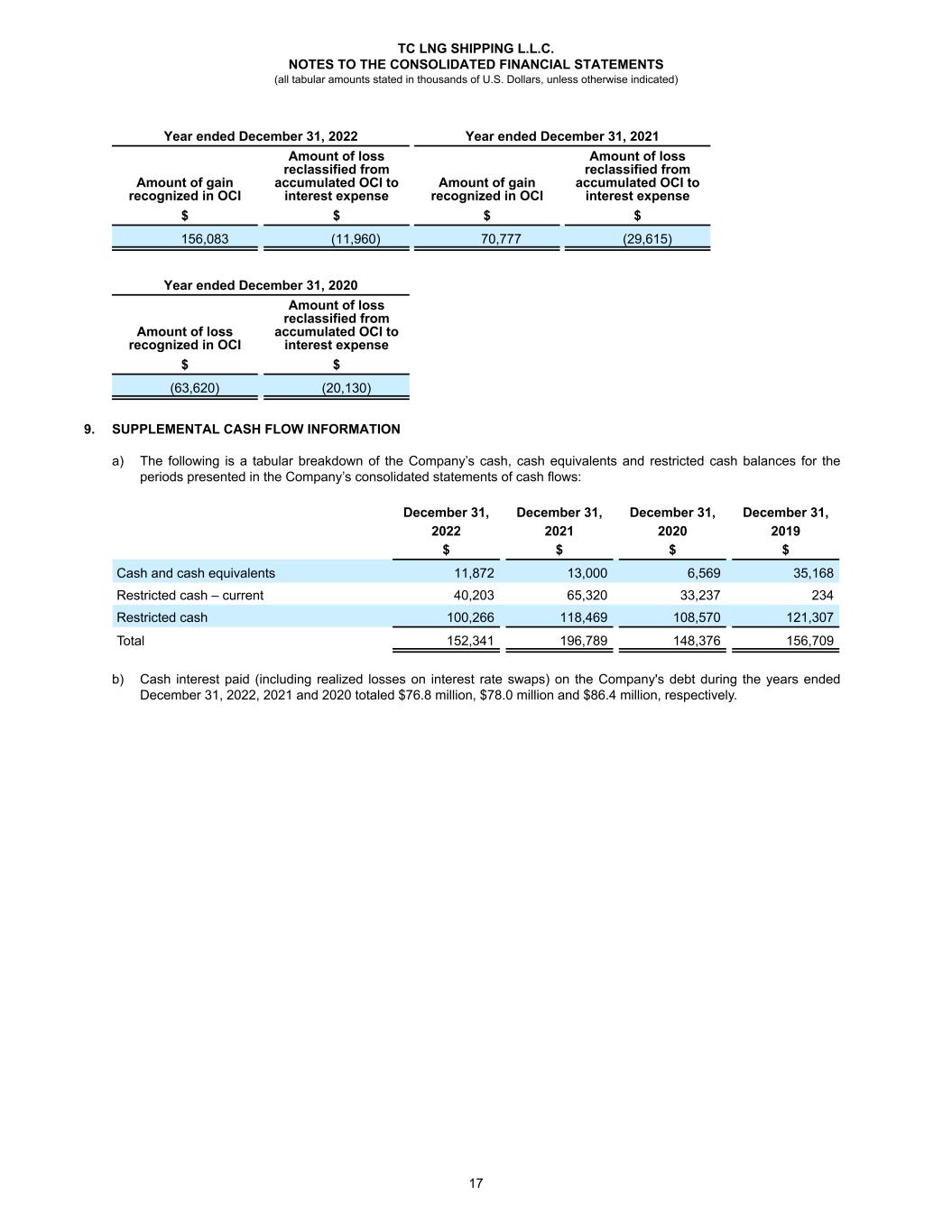

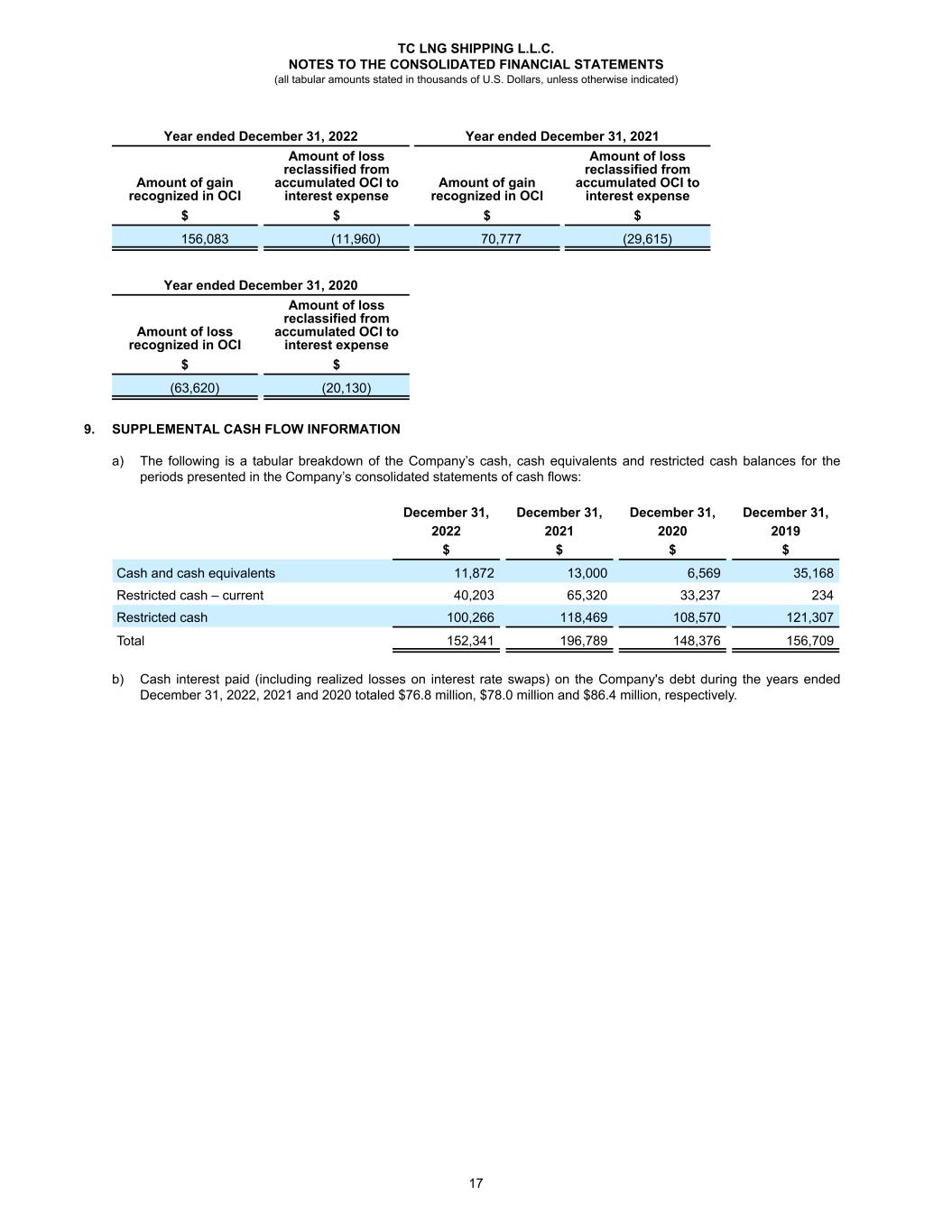

Year ended December 31, 2022 Year ended December 31, 2021 Amount of gain recognized in OCI Amount of loss reclassified from accumulated OCI to interest expense Amount of gain recognized in OCI Amount of loss reclassified from accumulated OCI to interest expense $ $ $ $ 156,083 (11,960) 70,777 (29,615) Year ended December 31, 2020 Amount of loss recognized in OCI Amount of loss reclassified from accumulated OCI to interest expense $ $ (63,620) (20,130) 9. SUPPLEMENTAL CASH FLOW INFORMATION a) The following is a tabular breakdown of the Company’s cash, cash equivalents and restricted cash balances for the periods presented in the Company’s consolidated statements of cash flows: December 31, December 31, December 31, December 31, 2022 2021 2020 2019 $ $ $ $ Cash and cash equivalents 11,872 13,000 6,569 35,168 Restricted cash – current 40,203 65,320 33,237 234 Restricted cash 100,266 118,469 108,570 121,307 Total 152,341 196,789 148,376 156,709 b) Cash interest paid (including realized losses on interest rate swaps) on the Company's debt during the years ended December 31, 2022, 2021 and 2020 totaled $76.8 million, $78.0 million and $86.4 million, respectively. TC LNG SHIPPING L.L.C. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (all tabular amounts stated in thousands of U.S. Dollars, unless otherwise indicated) 17