| Blacksands Petroleum Inc.

401 Bay Street, Suite 2700, PO Box 152

Toronto, Ontario Canada M5H 2Y4 Tel: +1 (416) 359 7805 Fax: +1 (416) 359 7801 E-mail: pparisotto@coniston.ca

Website: www.blacksandspetroleum.com |

May 15, 2008

Mr. James Giugliano

Staff Accountant

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, DC 20549-7010

Original follows by mail

Dear Mr. Giugliano:

| Re: | Blacksands Petroleum, Inc. |

| Form 10-KSB for Fiscal Year Ended October 31, 2007, Filed January 29, 2008 |

| Form 10-Q for Quarterly Period Ended January 31, 2008, Filed March 24, 2008 |

Further to your letter of April 4, 2008, we have incorporated our responses to each of the SEC comments included in your letter of April 4, 2008 below.

We attach a blacklined version of each of our amended Form 10-KSB and amended Form 10-Q.

In connection with our response to the SEC comments, Blacksands Petroleum, Inc. (the “Company”) acknowledges that:

• | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

• staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

• the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Form 10-KSB for the Fiscal Year Ended October 31, 2007

General

1. Throughout your filing and financial statements you refer to your company as “development stage” in accordance with the requirements of FAS 7. Within the context of oil and

Page 1

gas producing activities, “development stage” identifies a company that is incurring costs to obtain access to proved reserves or develop facilities to extract, treat, gather or store oil and gas. Refer to paragraph 21 of FAS 19. Based on disclosures regarding the description of your business, please modify your filing and financial statements to refer to your company as being in the “exploration stage” to avoid investor confusion. Please note, the requirements of FAS 7 continue to apply.

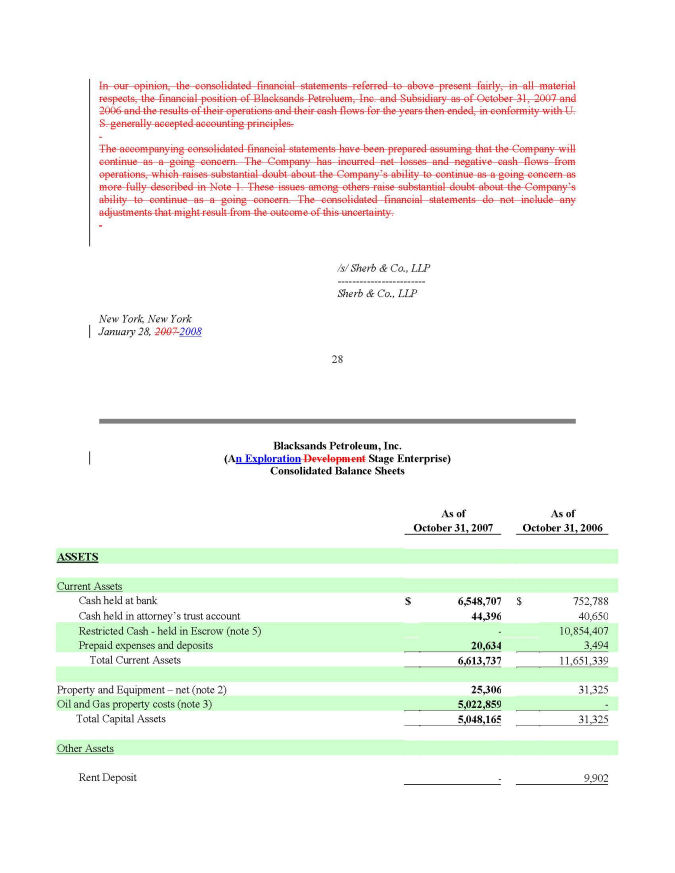

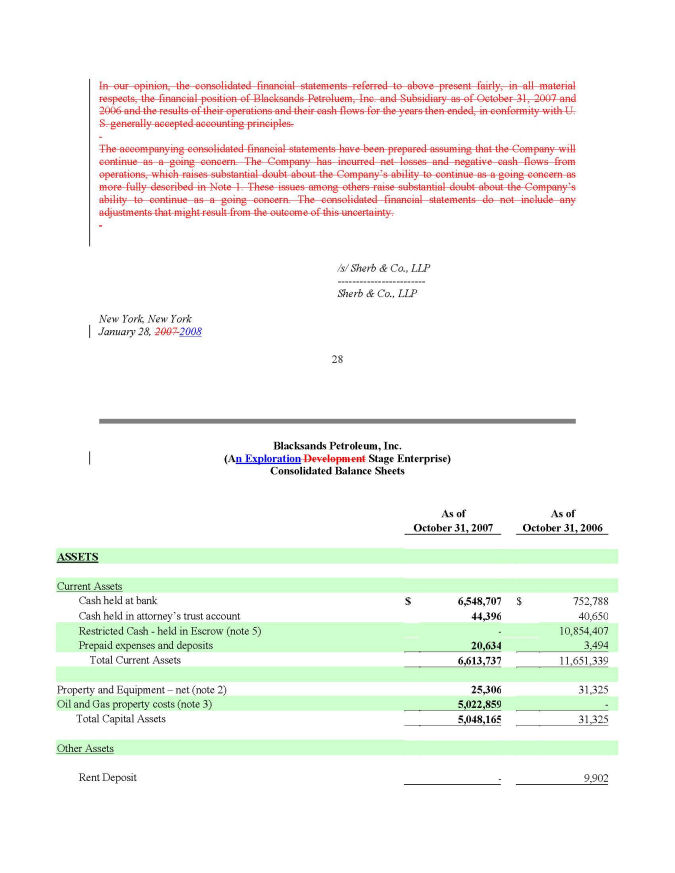

MANAGEMENT’S RESPONSE:

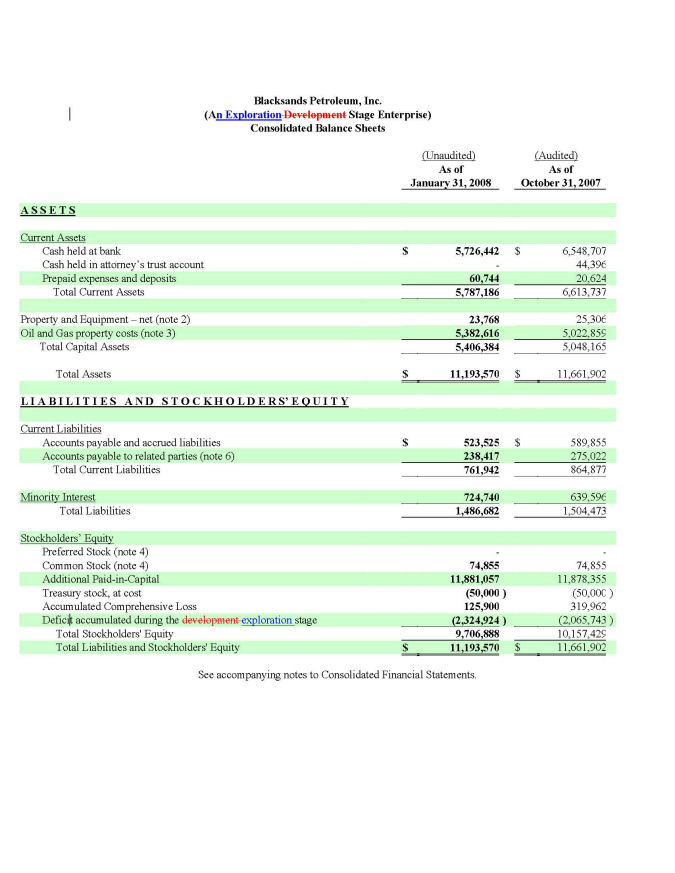

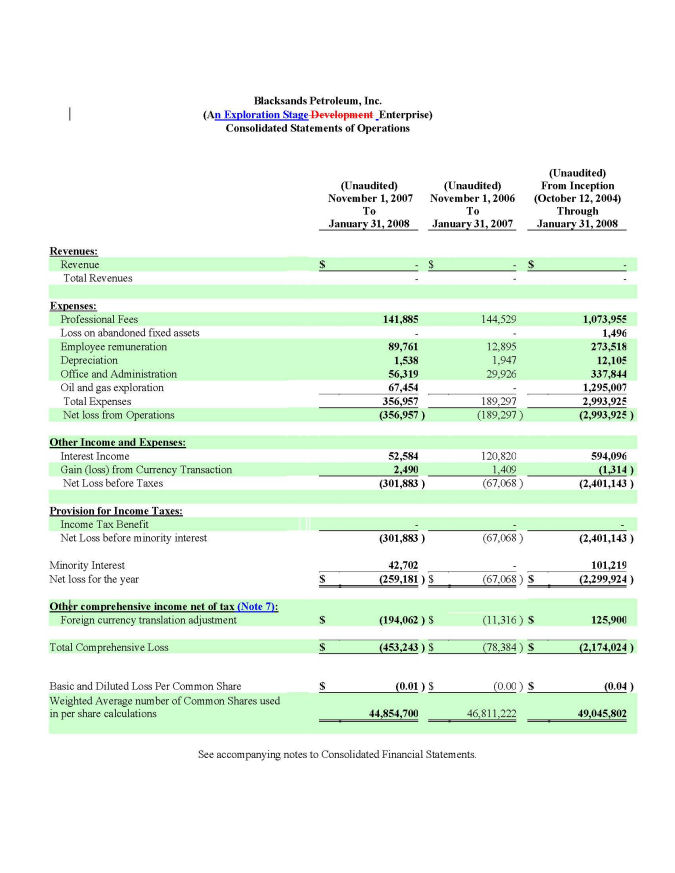

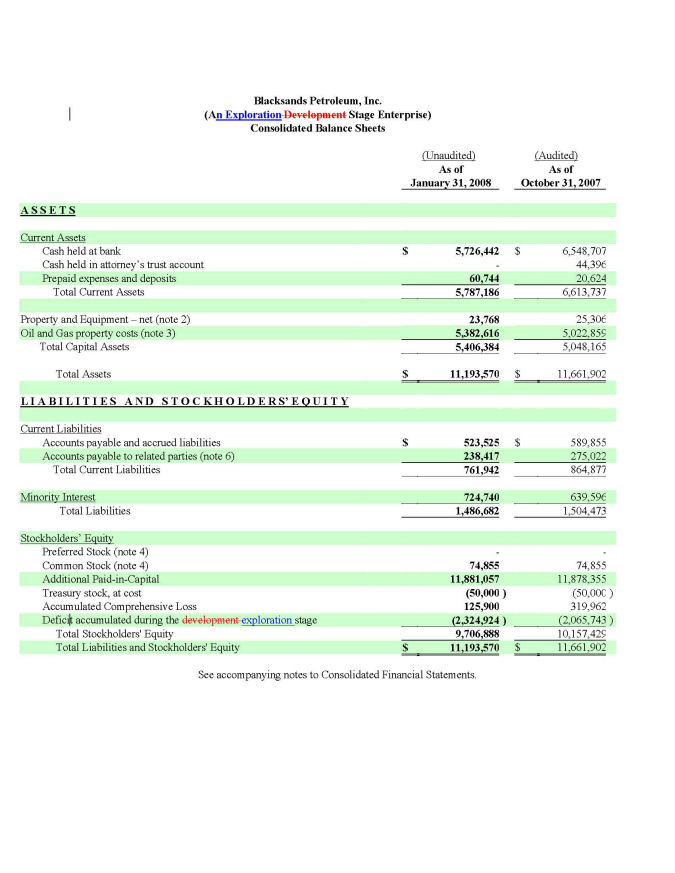

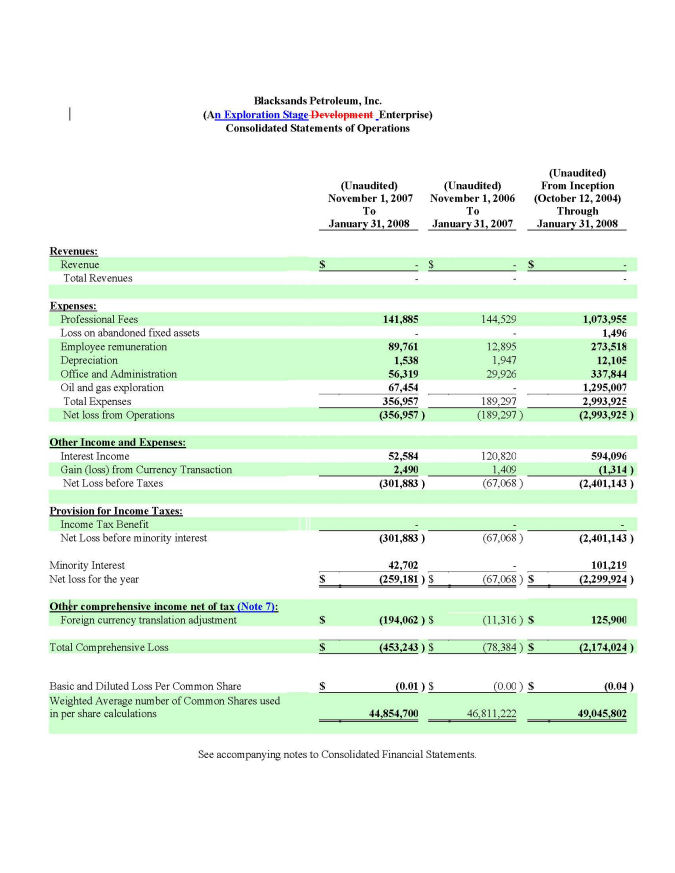

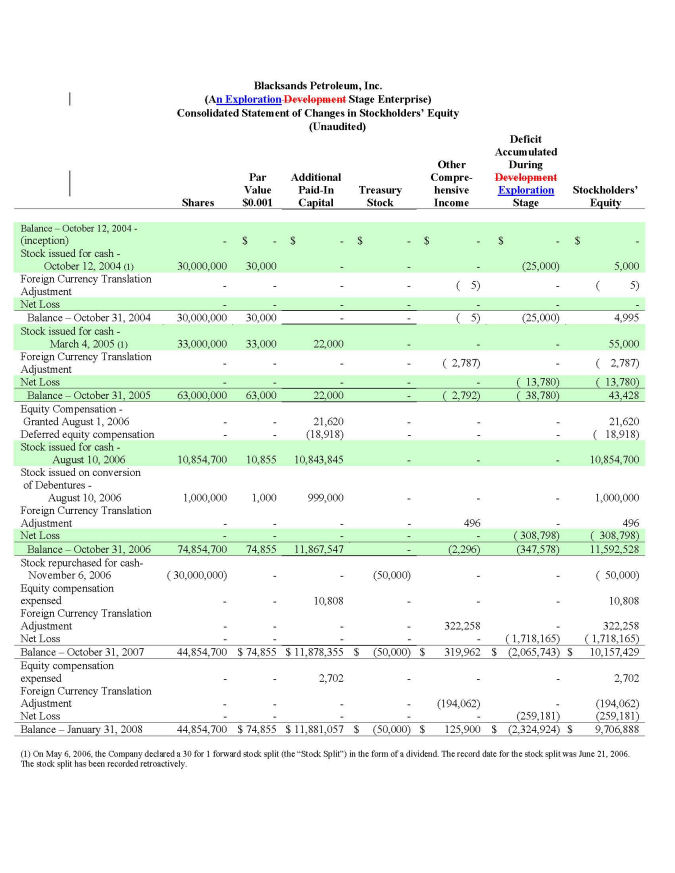

We agree that the Company is an exploration stage company per FAS 19, and will make the required changes in our amended 10KSB as at October 31, 2007, and in our amended 10Q as at January 31, 2008.

Item 1 – Description and Development of Business, page 3

2. Please expand your disclosure to include the summary financial terms of your joint venture agreement with the BRDCC, particularly in regards to the sharing of costs and the allocation of profits.

MANAGEMENT’S RESPONSE:

The financial terms of the Joint Venture Agreement with the BRDCC are confidential. In August 2007, Blacksands submitted an application under Rule 24b-2 requesting confidential treatment of this information. The Company received an “Order granting confidential treatment” dated September 27, 2007 for this, which has a period of 3 years from application. The File No. referred to on the Order is File No. 0-51427-CF#20678.

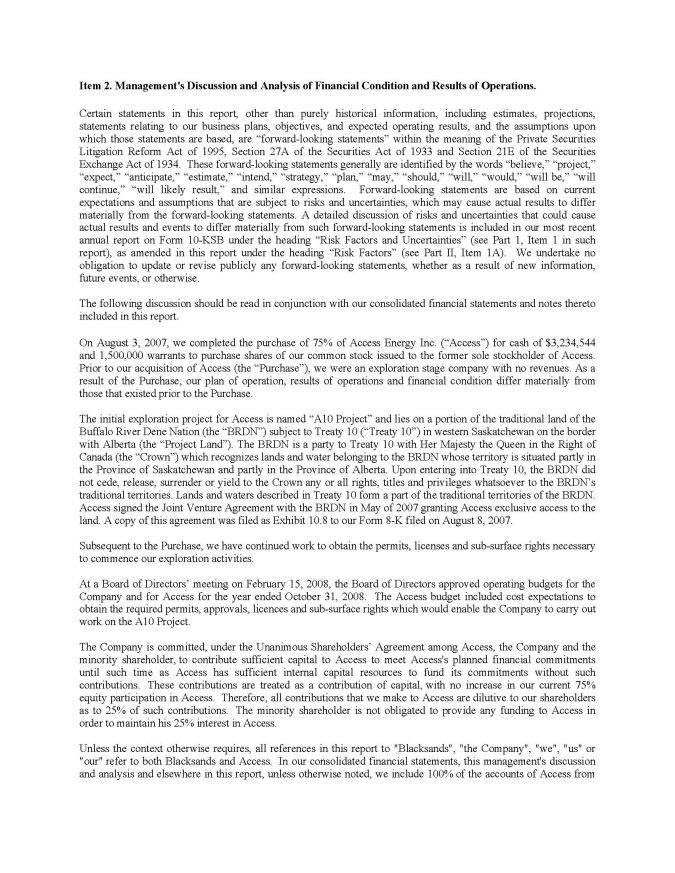

Item 6 – Management’s Discussion and Analysis

Plan of Operation, page 22

3. We note your disclosure that you expect your purchase of Access “will cause our plan of operation, results of operations and capital resources to differ materially from our financial position as it existed prior to the Purchase.” Please expand your management’s discussion and analysis to elaborate on the nature and extent of changes. Please discuss management’s expectations for future results of operations or plans for operations. Please refer to FRC 501.02 and Interpretative Release No. 33-8350: “Commission Guidance Regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Release No. 33-8350 can be located at our website at: http://www.sec.gov/rules/interp/33-8350.htm.

MANAGEMENT’S RESPONSE:

We propose the following wording to expand our MD&A accordingly (new wording in italics):

“Plan of Operation

On August 3, 2007 we completed the purchase of 75% of Access Energy Inc. (“Access”) for cash of $3,234,544 and 1,500,000 warrants to purchase shares of our common stock issued to the former sole stockholder of Access. We expect that the Purchase will cause our plan of operation, results of operations and capital resources to differ materially from our financial position as it existed prior to the Purchase in a few areas. Pursuant to the purchase agreement, Blacksands is now responsible for funding 100% of Access’ operations including general and administration, and all costs associated with the acquisition, exploration and development, until such time as Access is self-sufficient. (The

Page 2

minority shareholder is not required to fund any of Access’ costs.) This will have an impact on the operating results of Blacksands, the balance sheet, and cash position.

Subsequent to the Purchase, Access has commenced activities to obtain the permits, licenses and sub-surface rights necessary to begin our exploration activities.”

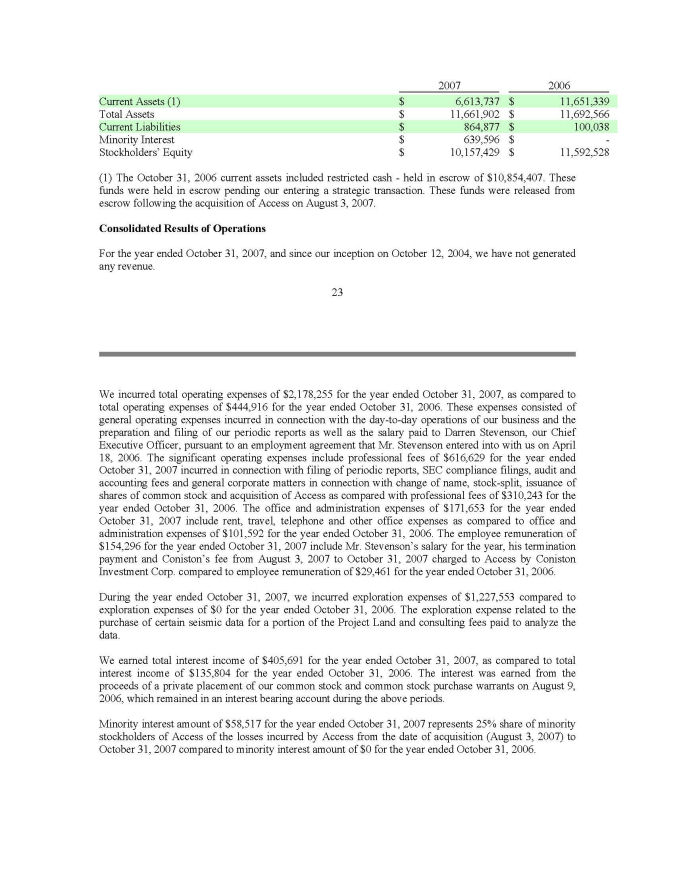

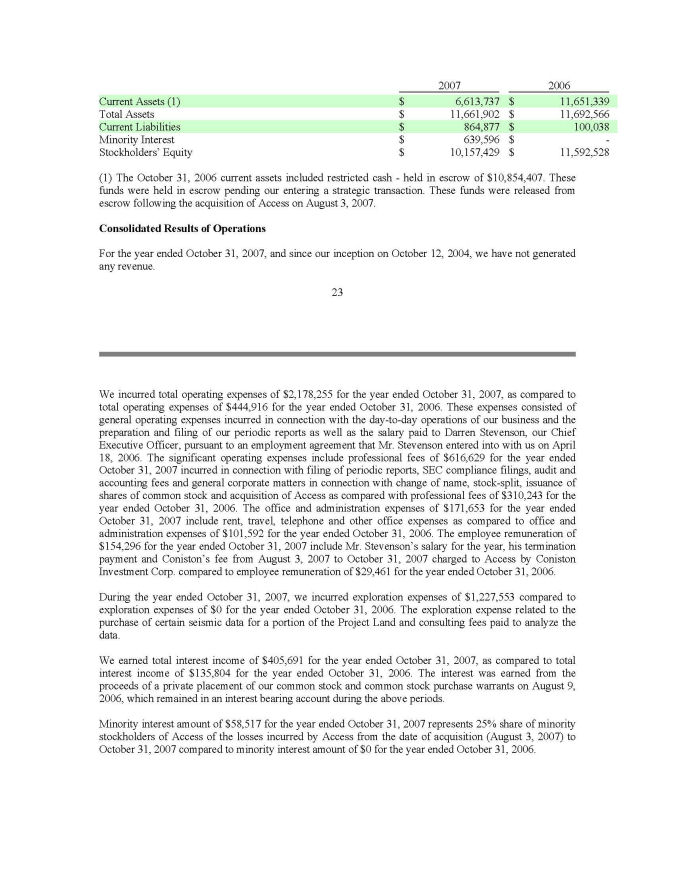

Consolidated Results of Operations, page 23

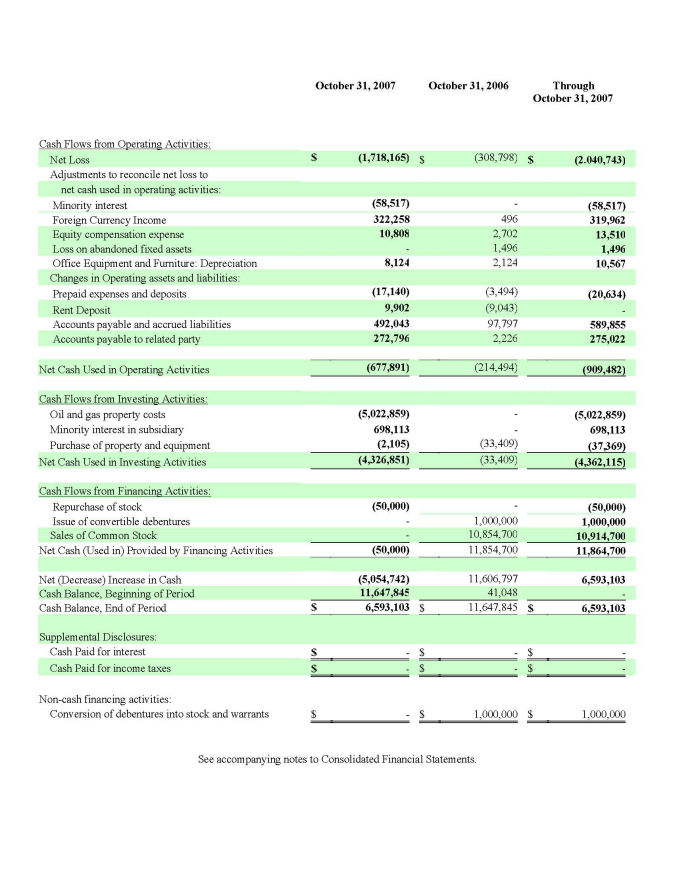

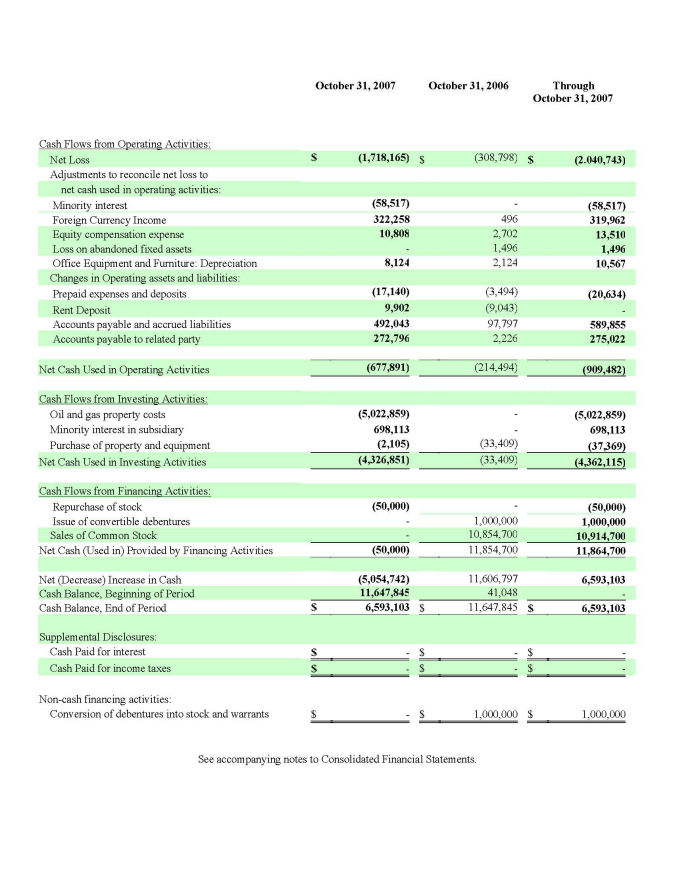

4. Please expand your management’s discussion and analysis to include qualitative and quantitative disclosures regarding the expected sources and uses of funds in the next twelve months. Refer to Item 303(b)(1) of Regulation S-B.

MANAGEMENT’S RESPONSE:

We propose to add to the Consolidated Results of Operations, starting on page 23, the following disclosure:

“As of October 31, 2007 the combined companies had cash on hand of $6,593,103. The Company believes this amount to be sufficient to fund the Company’s general and administrative costs for the next twelve months, and fund the work necessary to obtain permits, licenses and necessary approvals to commence exploration activities on the A10 Project. If the Company is successful in obtaining the permits, licenses and necessary approvals, it will require additional capital to carry out any additional exploration activities, and the funding may come through the exercising of outstanding warrants and/or through the raising of additional capital.”

Report of Independent Registered Public Accounting Firm, page 28

5. We note you provide the inception to date financial information required by SFAS 7. We further note the report from your independent auditors does not include a reference to the inception to date financial statement periods. Please revise to include an audit report(s) that covers your inception to date financial statement periods, or tell us why you believe such revision is not required.

MANAGEMENT’S RESPONSE:

We have included a revised audit report referencing the prior auditors in the amended Form 10KSB.

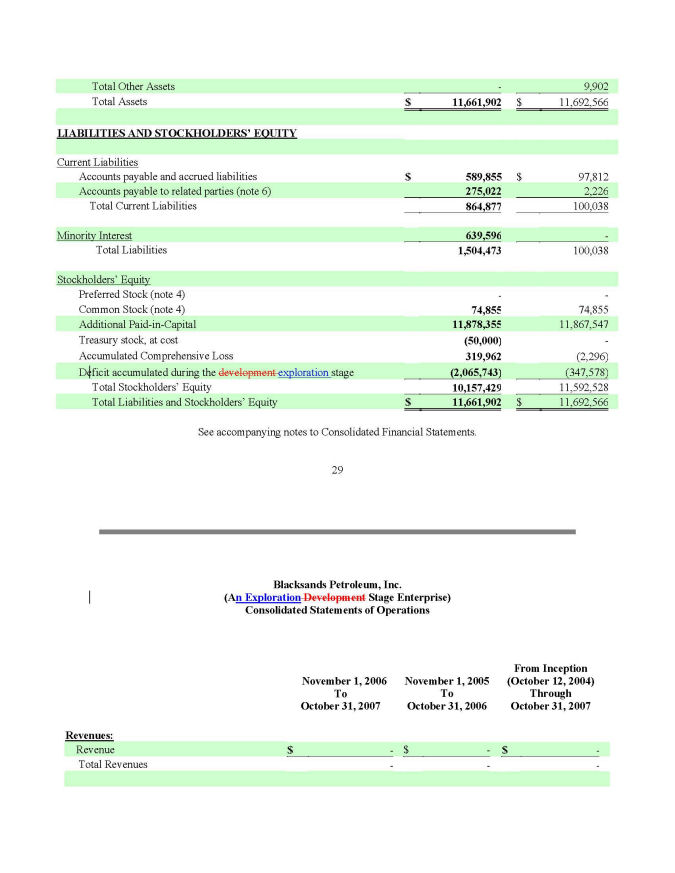

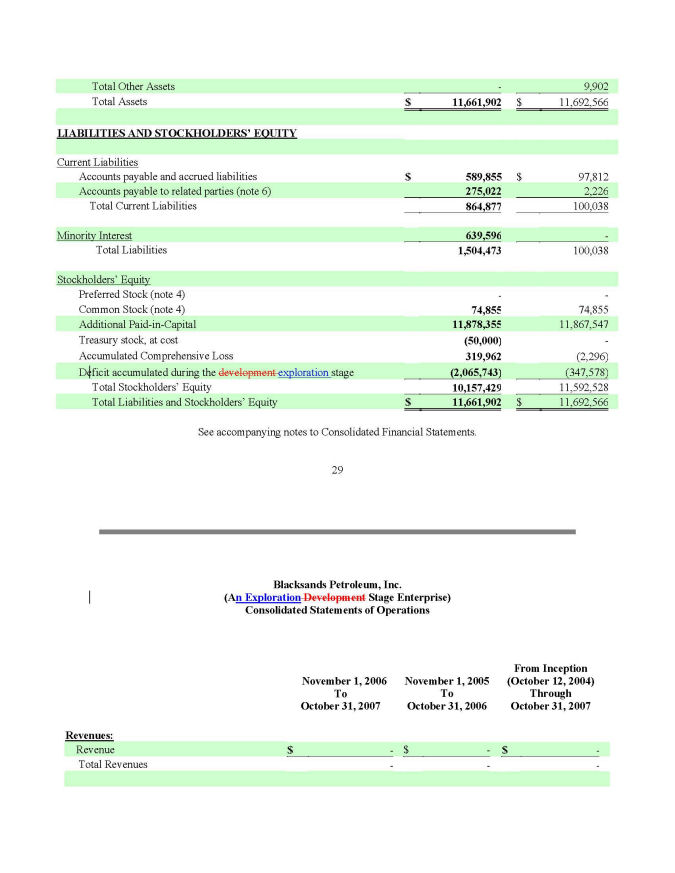

Item 7 – Financial Statements, page 28

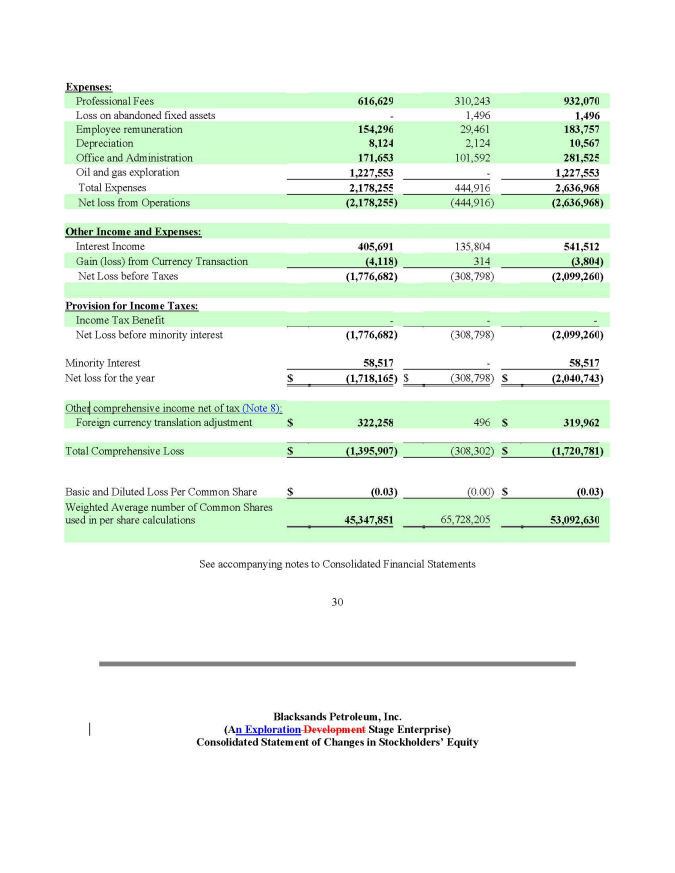

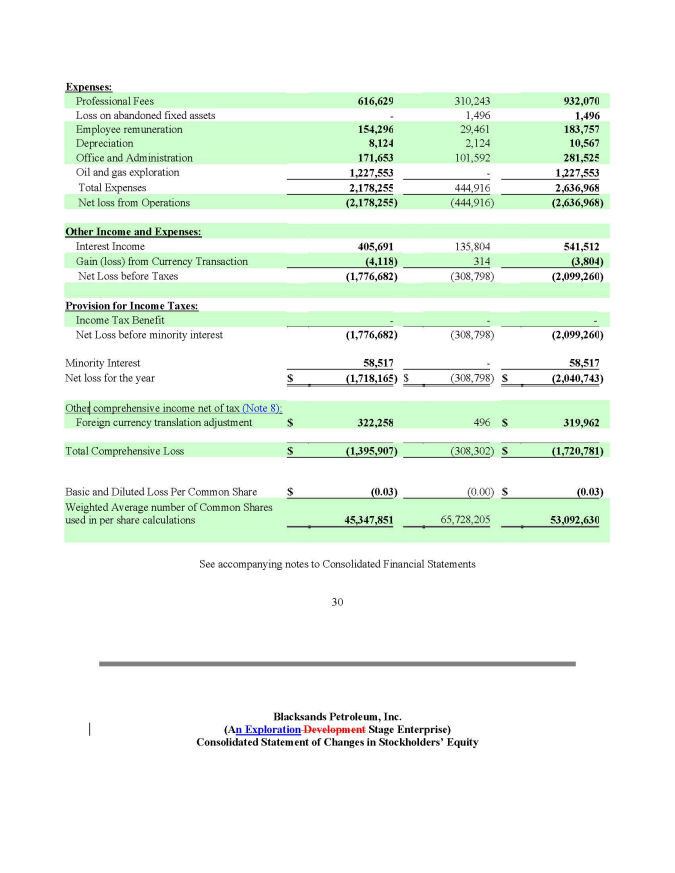

Consolidated Statement of Operations, page 30

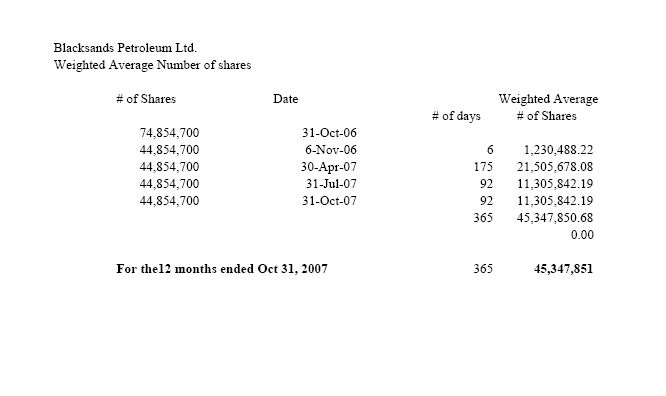

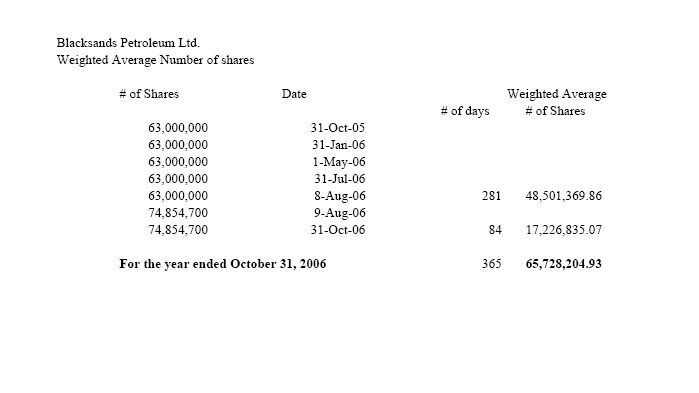

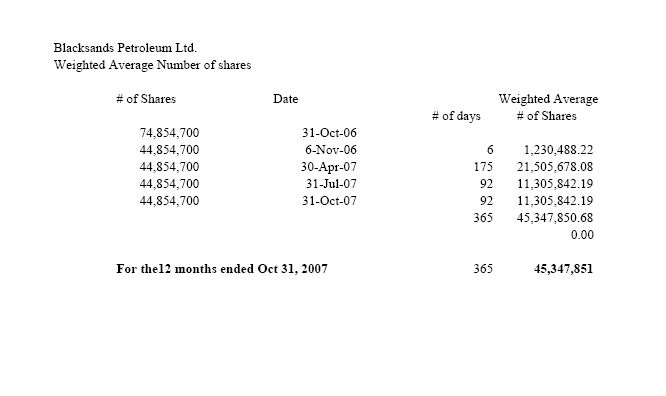

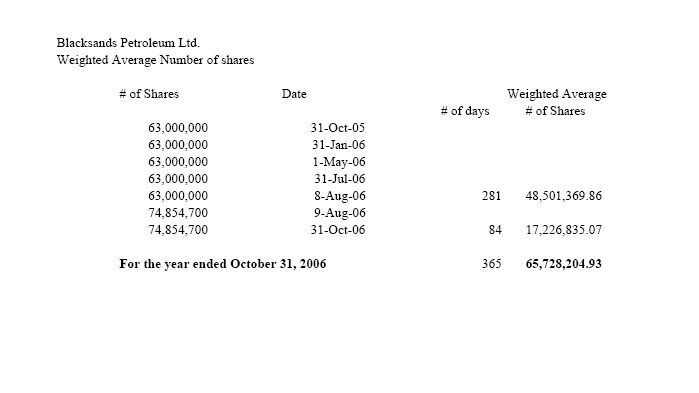

6. Please tell us how you calculated basic and diluted loss per share amounts for all periods presented. Consider providing us with your calculation, if necessary.

MANAGEMENT’S RESPONSE:

Please see attached calculations in Appendix A.

7. We note you disclose other comprehensive income items net of tax. Please disclose the tax amount on the face of the financial statements or in a note thereto. Refer to paragraph 25 of FAS 130.

Page 3

MANAGEMENT’S RESPONSE:

We propose to include the following sentences at the end of Note 8 in the financial statements in the amended 10-KSB (Note 7 in the amended 10Q), cross-referencing to the Statement of Operations.

Amended 10KSB

“Foreign currency translation adjustments for the year ended October 31, 2007 and those for the year ended October 31, 2006, are net of tax of $Nil. Foreign currency translation adjustments for the period from inception to October 31, 2007 are net of tax of $Nil.”

Amended 10Q

“Foreign currency translation adjustments for the three months ended January 31, 2008 and for the three months ended January 31, 2007 are net of tax of $Nil. Foreign currency translation adjustments for the period from inception to January 31, 2008 are net of tax of $Nil.”

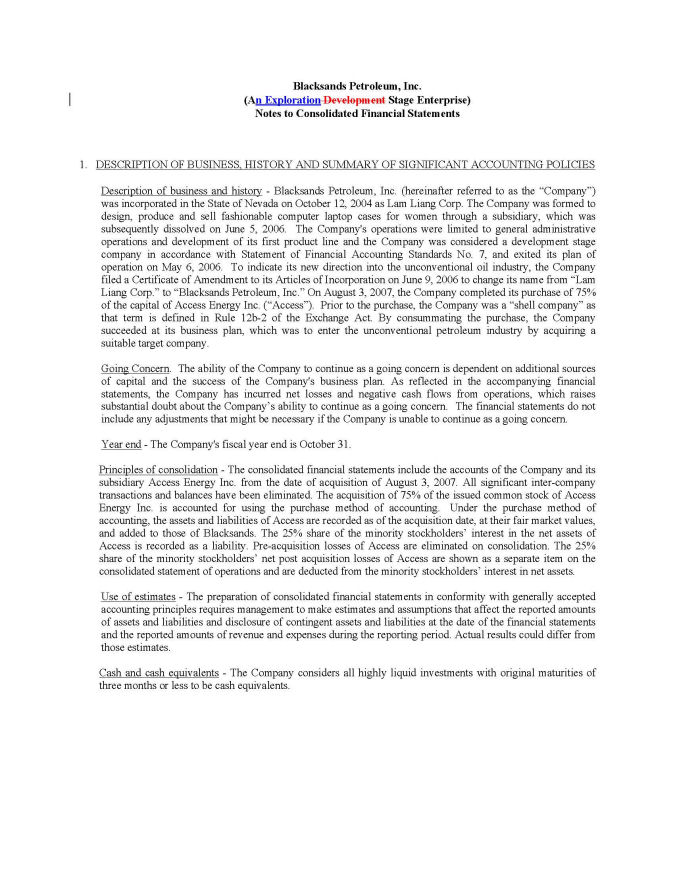

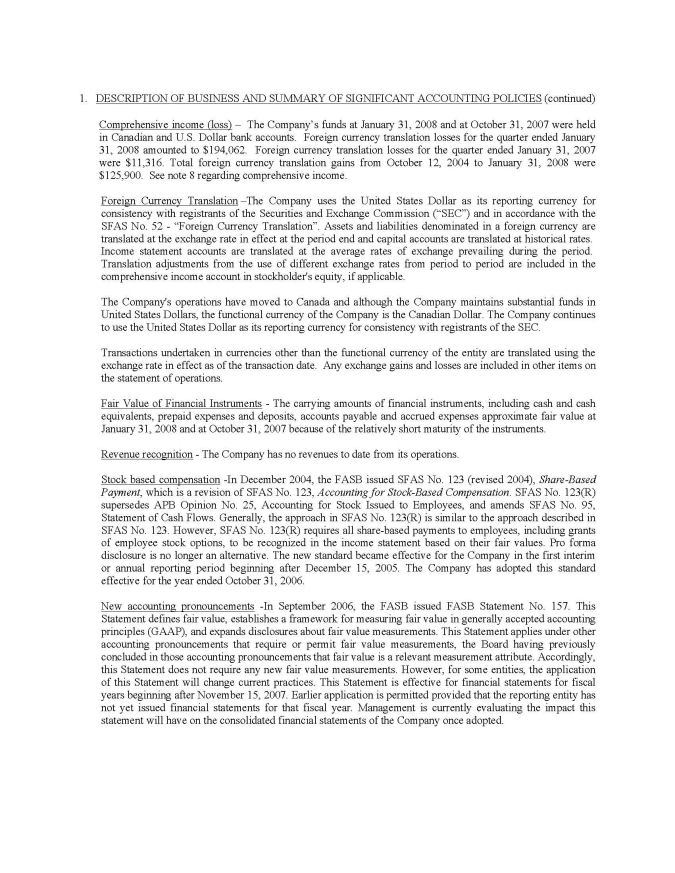

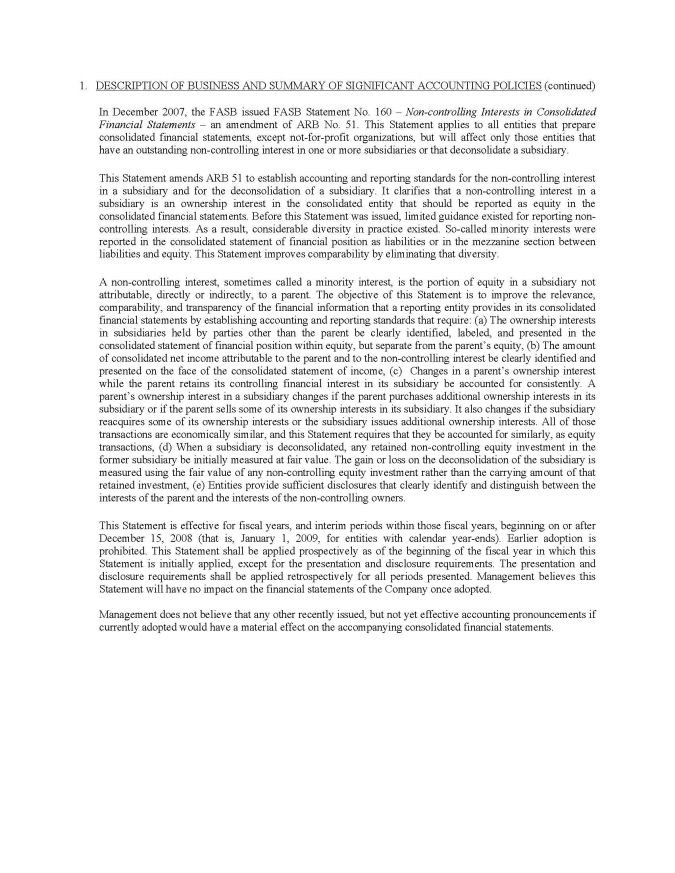

Footnote 1 – Description of Business, History, and Summary of Significant Accounting Policies, page 33

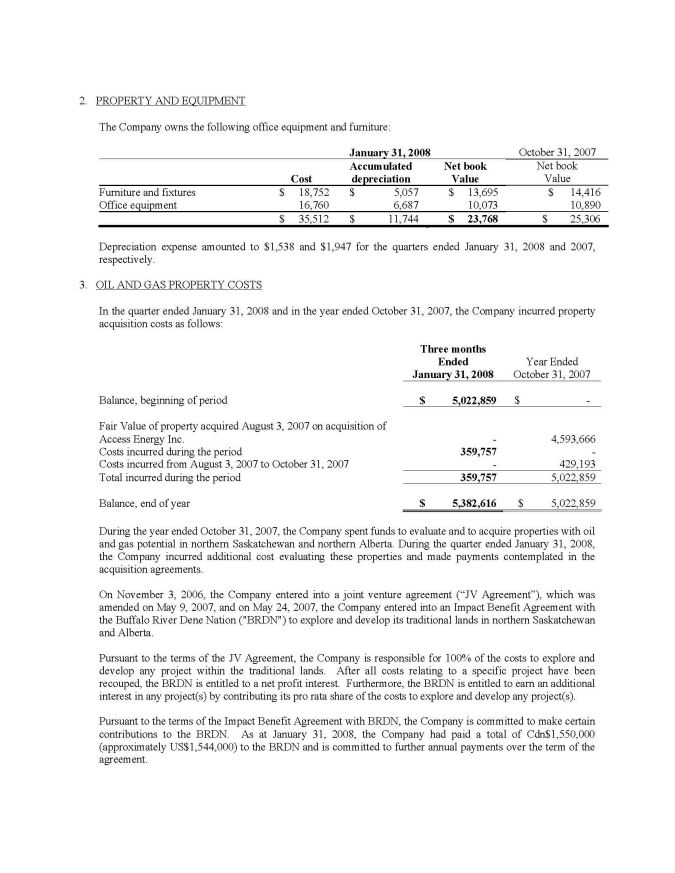

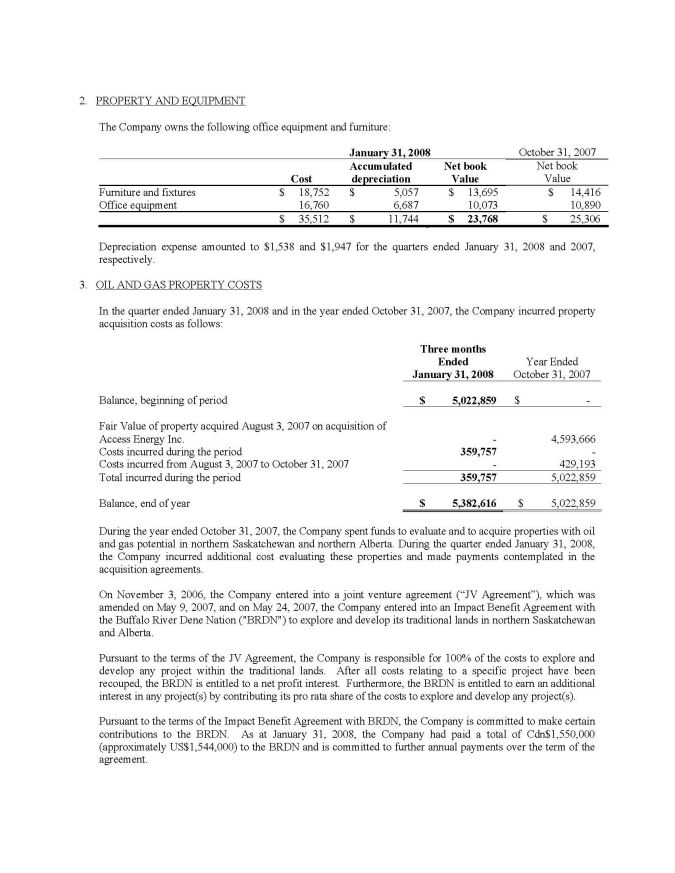

Property and Equipment, page 34

8. You state that “Upon sale or other disposition of a depreciable property, cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in other income.” Paragraph 45 of FAS 141 explains that if a subtotal such as income/loss from operations is presented, it shall include the amount of gain or loss recognized on the sale of a long lived asset. Please modify your policy to be consistent with this guidance, or tell us why you believe such modification is not necessary.

MANAGEMENT’S RESPONSE:

We propose to amend the wording of our accounting policy to read: “Upon sale or other disposition of a depreciable property, cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the statement of operations.”

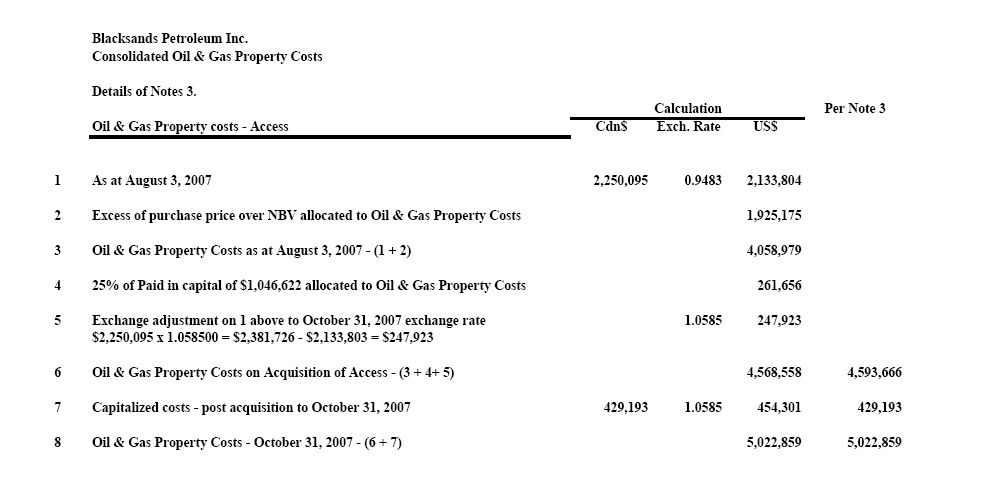

Footnote 3 – Oil and Gas Property Costs, page 38

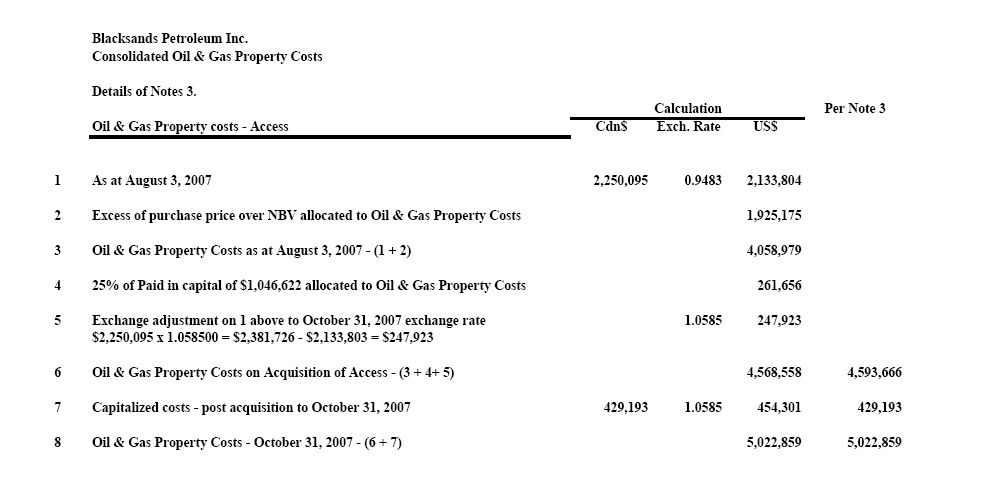

9. We note you have incurred and capitalized $429,193 of oil and gas property costs in the period from August 3, 2007 thru October 31, 2007. Please explain to us the nature of these costs and the accounting basis for capitalization.

MANAGEMENT’S RESPONSE:

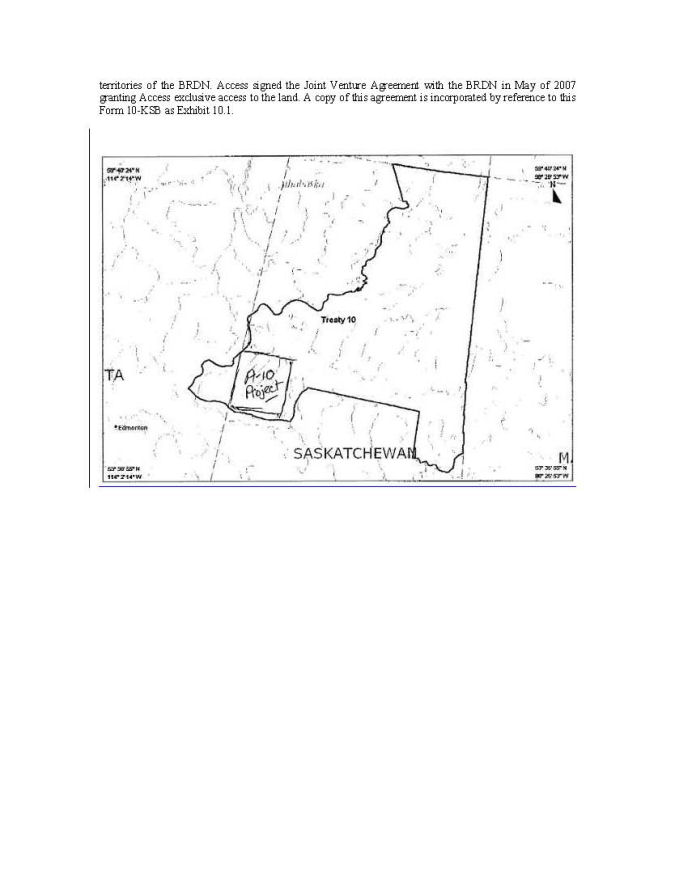

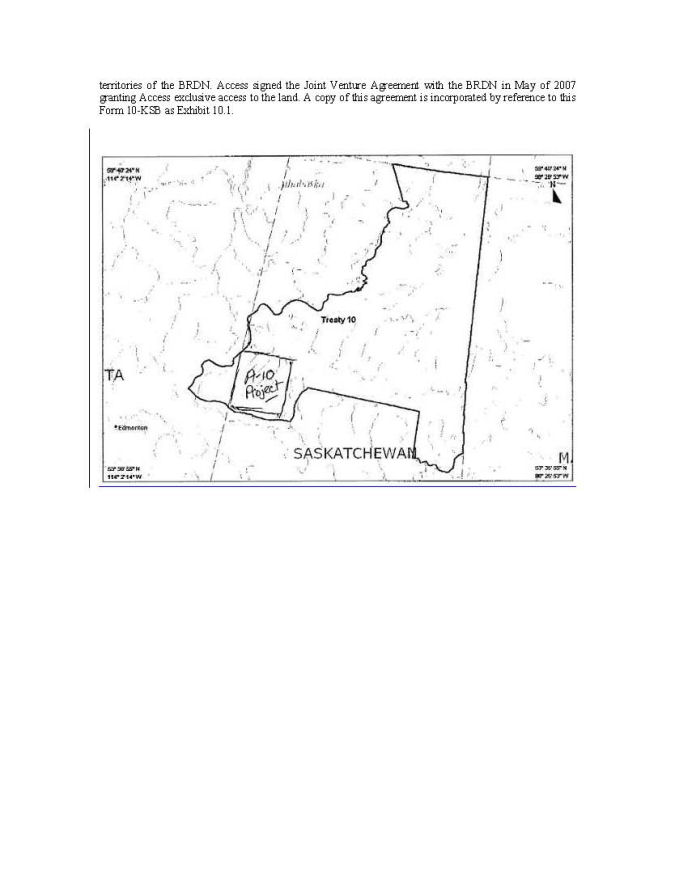

The oil and gas property costs capitalized from August 3, 2007 through October 31, 2007 were related to the acquisition of the A10 Project and included payments made under the Impact Benefit Agreement and other amounts.

These costs are capitalized as acquisition costs in accordance with FAS 19, paragraph 15.

We noted that there was an inadvertent error in our filing in that the Cdn$ amount of $429,193 had been used. The amount should have been US$454,301, as detailed in Appendix B. We have corrected the information in Footnote 3, and also balanced the Purchase Price allocation to Note 11 as per comment 10 below – both in the amended Form 10KSB.

Page 4

10. Your table presenting the beginning and ending balance of oil and gas property costs identifies the fair value or property acquired from Access Energy as $4,593,666. However, the purchase price allocation on page 43 identifies oil and gas property costs of $4,058,979. Please reconcile this difference for us.

MANAGEMENT’S RESPONSE:

As a result of the error explained in comment 9 above, the $4,593,666 should have been $4,568,558. We have revised Footnote 3, and the amounts are now in balance in the amended Form 10KSB. (See also Appendix B).

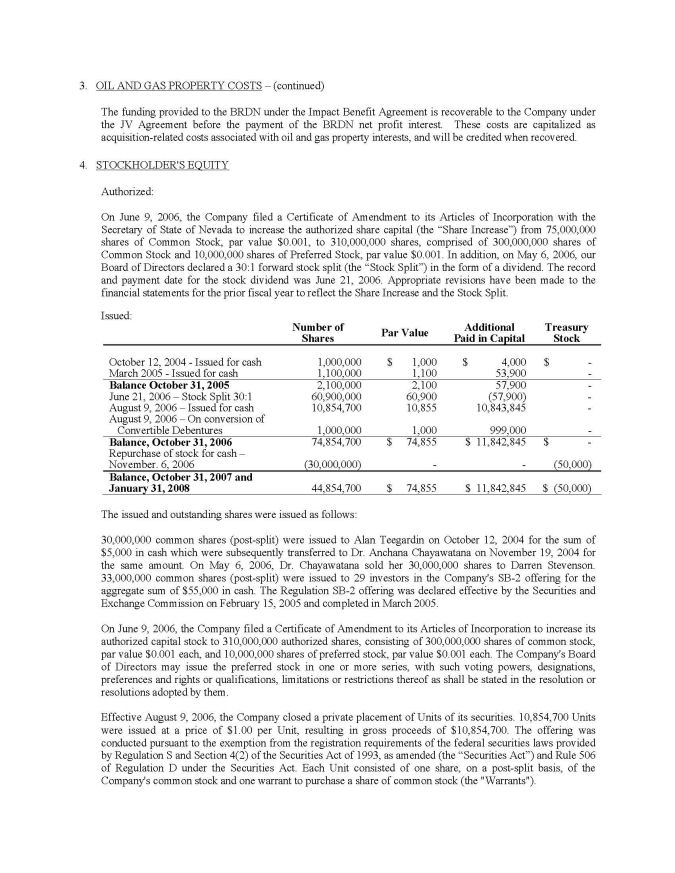

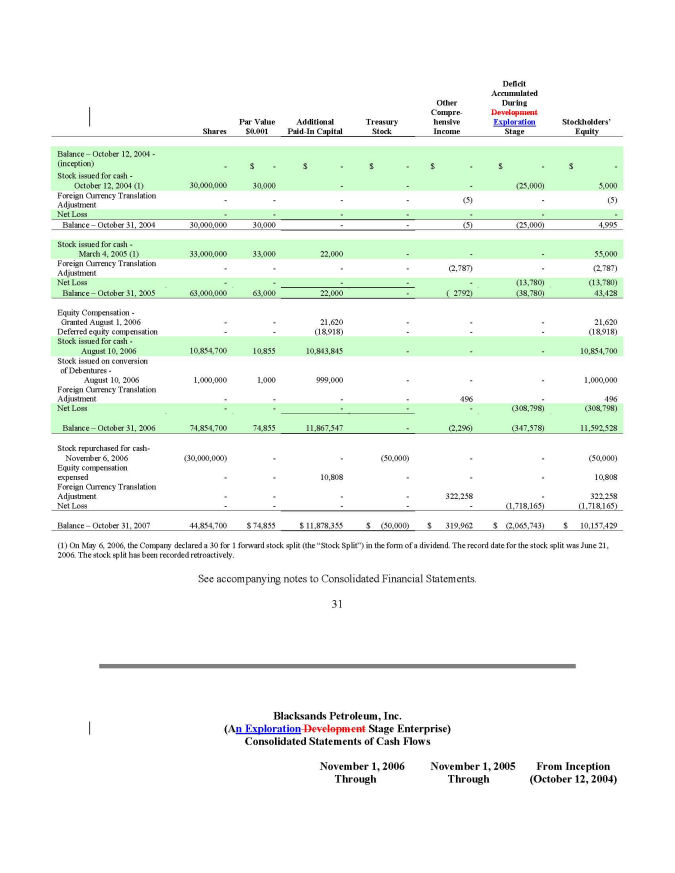

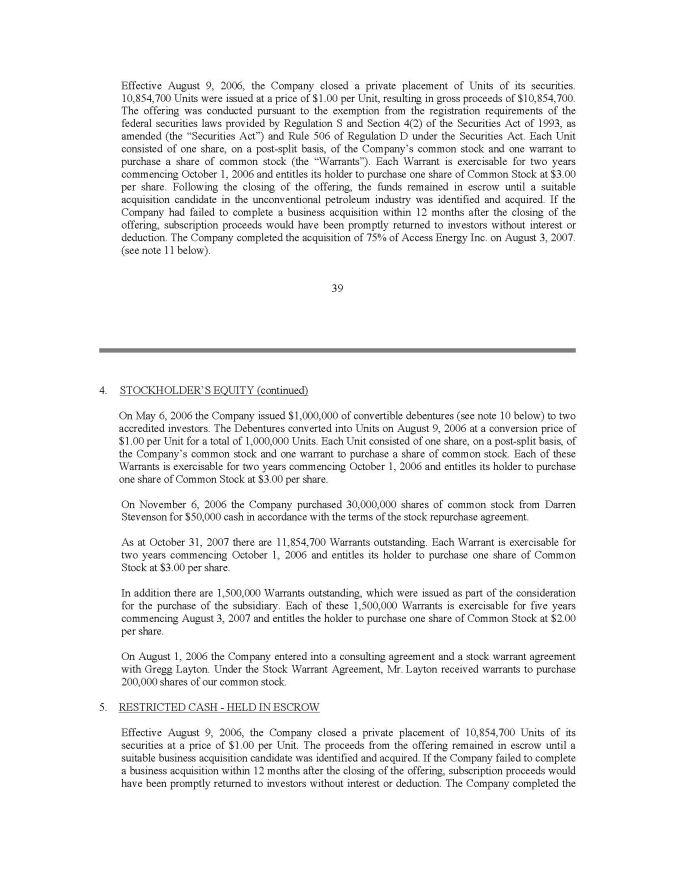

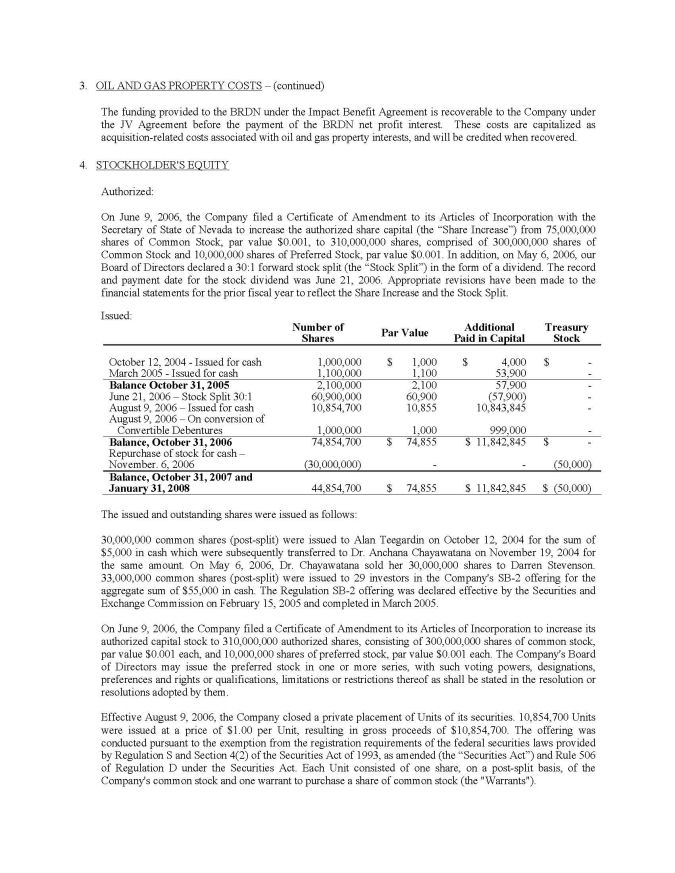

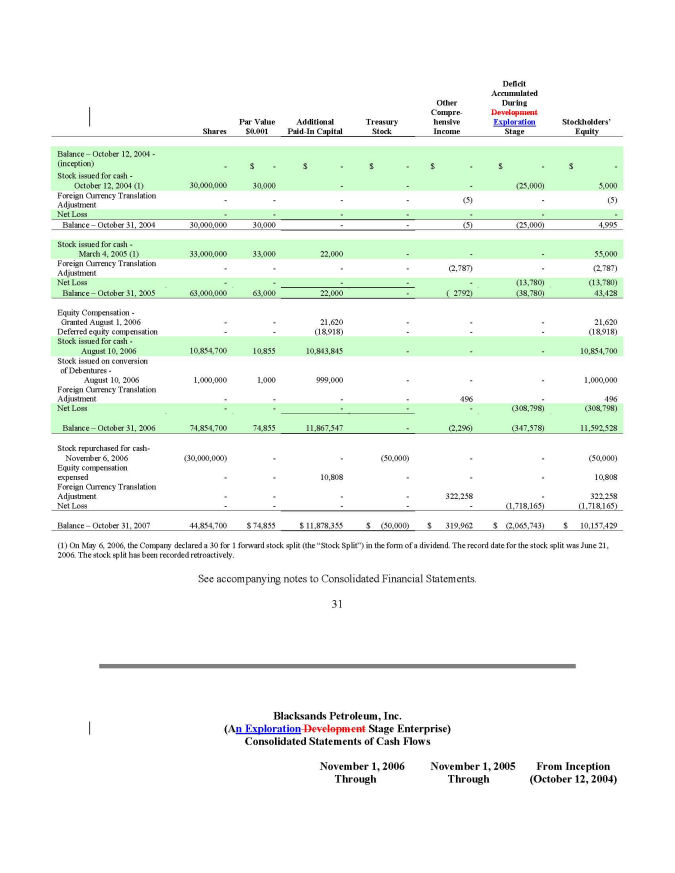

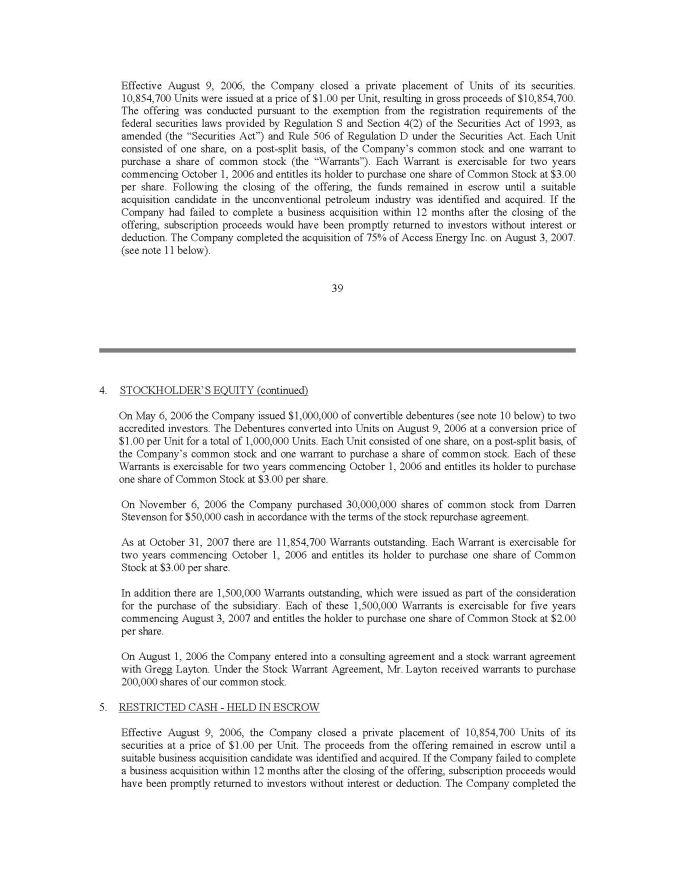

Footnote 4 – Stockholders’ Equity, page 39

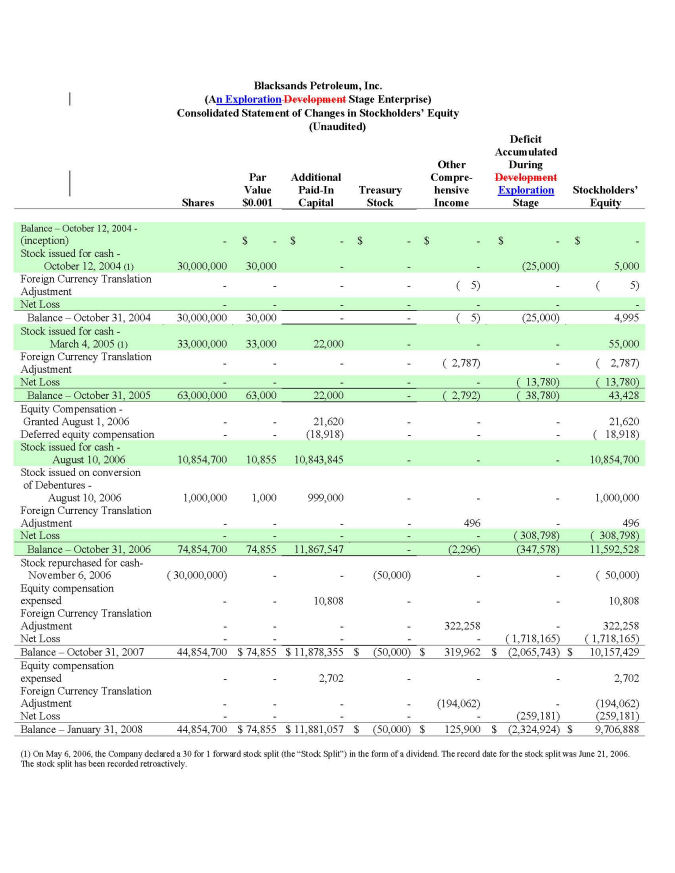

11. Please tell us why your table of issued shares does not give effect to the June 21, 2006 stock split retroactively for all periods presented. Also ensure all share amounts disclosed in the filing are consistently presented on a post split basis.

MANAGEMENT’S RESPONSE:

The Statement of Changes in Stockholders’ Equity gives effect to the June 21, 2006 stock split on a retroactive basis. The table provided in Footnote 4 is a chronological listing of share issuances and shows the stock split event on June 21, 2006. We felt that providing this table will assist the reader reconcile the numbers of shares issued, the timing of the issuance, and the effect of the stock split on June 21, 2006.

12. We note you repurchased 30,000,000 shares of common stock in November 2006 pursuant to a stock repurchase agreement. Please expand your disclosure to include the terms of the stock repurchase agreement. Please also tell us the accounting basis for equity classification of these shares. In your response, address how paragraphs 8 thru 17 of FAS 150 were applied to your common stock and repurchase agreement.

MANAGEMENT’S RESPONSE:

The following are the two paragraphs in the Employment Agreement filed as an Exhibit to the May 8, 2006 filing pursuant to Rule 13D-101. Note the paragraphs reference 1,000,000 shares which were then subject to the 30:1 split resulting in 30,000,000 shares repurchased.

WHEREAS, simultaneously herewith Employee is entering into a Stock Purchase Agreement (the "Stock Purchase Agreement") with a shareholder of the Company pursuant to which, among other things, Employee is purchasing 1,000,000 shares of the common stock (the "Restricted Stock"), US$.001 par value (the "Common Stock"), of the Company for a purchase price of US$0.025 per share, or an aggregate purchase price of US$25,000.

7. REPURCHASE OF RESTRICTED STOCK. Employee hereby grants the Company the right (the "Repurchase Right") to repurchase the Restricted Stock, at any time or from time to time, for a purchase price of $0.05 per share, or an aggregate purchase price of $50,000. The Company may exercise the Repurchase Right upon written notice to Employee, accompanied by the Purchase Price therefor. At the same time as such delivery, Employee shall duly convey and transfer the Restricted Stock to the Company.

Based on our reading, FAS 150 does not apply in the case of the above shares. The above shares are outstanding shares, without an embedded redemption feature, where the Company

Page 5

has an option to repurchase. The holder of the shares does not have a put option, hence no obligation on the part of the Company to repurchase the shares. The shares are therefore classified as equity.

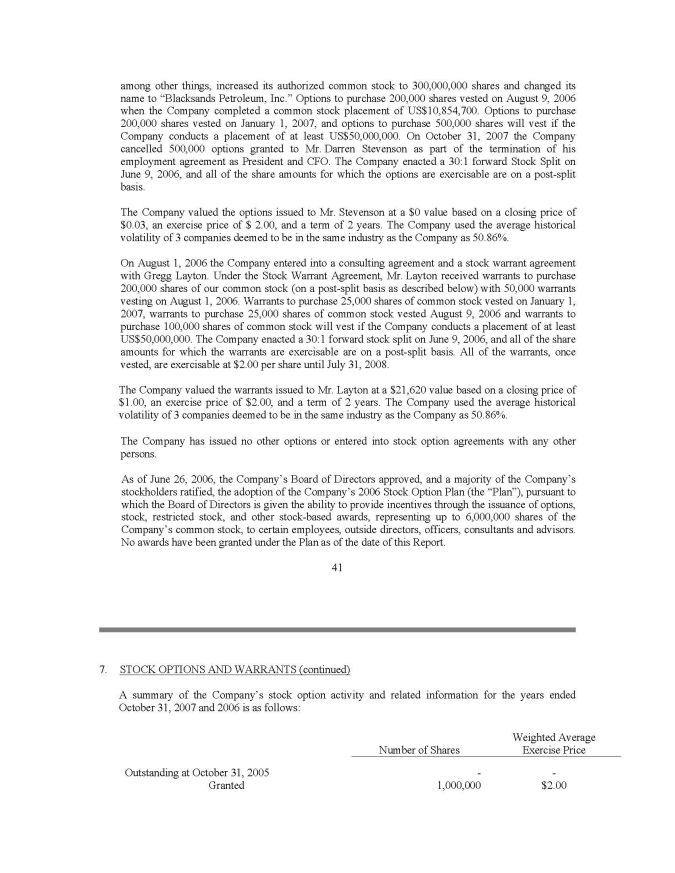

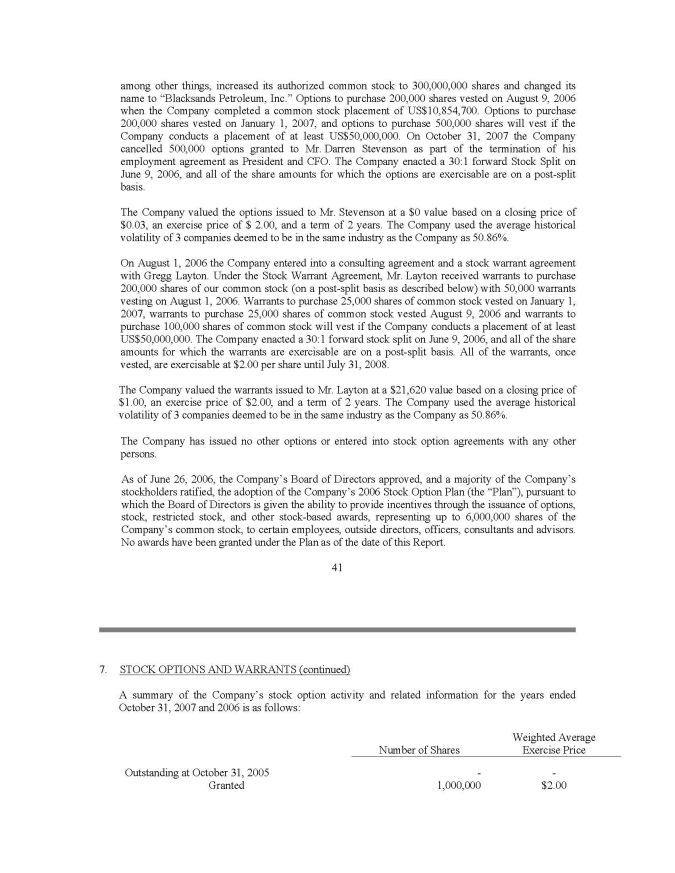

Footnote 7 – Stock Options and Warrants, page 41

13. We note from your table on page 42 that as of October 31, 2007 you have 13,554,700 total warrants outstanding. It appears from your disclosures in Footnote four, that the warrant purchase price is based in US dollars. As you explain in Footnote eight that your functional currency is the Canadian Dollar, please tell us whether or not your warrants contain an embedded derivative under US GAAP. Refer to SFAS 133 Implementation Issue B4.

MANAGEMENT’S RESPONSE:

We have carefully reviewed US GAAP to reconfirm our understanding and to respond to the question from a US GAAP perspective. Based on that review, we believe that the warrants themselves are not a derivative. SFAS 133 – paragraph 57(c) (3) as confirmed by SFAS 133 Implementation Issue A14 provides that the warrants themselves are not a derivative instrument as they are not readily convertible to cash by virtue of the fact that the sale of the converted stock is restricted for more than 31 days and the issued stock is that of the entity itself.

Blacksands Petroleum, Inc., as an entity, keeps its records in US Dollars and raises capital in US Dollars. The capital stock is denominated in US Dollars and the warrants are in denominated in US Dollars. The stock is traded only on a US stock exchange. At October 31, 2007, cash and cash equivalents consisted of US$ cash of $5,693,788 and Cdn$ cash of $112,487.

Access Energy Inc., the operating subsidiary, as an entity, keeps its records in Canadian Dollars and operates its business entirely in Canadian Dollars in Canada. All its cash and cash equivalents of US$780,247 as at October 31, 2007 was in Canadian Dollars.

As Access Energy Inc. is the only operating asset of Blacksands, we consider the functional currency of the consolidated entity to be Canadian Dollars.

We believe that Blacksands Petroleum, Inc.’s warrants do not have an embedded derivative (Foreign Currency) as they are denominated in a currency that Blacksands operates in. The warrants, once exercised will generate US dollar cash in Blacksands which will remain there until an investment is made in the operating subsidiary or in another project which may or may not be in US dollars. Furthermore, the existing cash resources of Blacksands are considered to be in excess of its operating budget requirements of both entities over the next twelve months.

Any cash invested in the subsidiary would be converted to Canadian Dollars and the resulting gain or loss thereafter will be recorded in the financial statements.

We note that SFAS 133 Implementation Issue 4 addresses an instrument which has an embedded derivative and whether or not that embedded derivative should be separated from the host contract. We are of the view that the warrants do not have an embedded derivative.

Page 6

Footnote 11 – Acquisition of Access Energy Inc. (“Access”), page 43

14. You disclose a total purchase price for the Access Energy acquisition of C$3,427,935. We note from your disclosure that the purchase price was made up of the following items:

| • | C$250,000 – offset against amount held in escrow created on May 17, 2007 |

| • | C$100,000 – paid to Access pursuant to the Exclusivity agreement |

It appears from this disclosure that you did not assign any value to the warrants issued in the acquisition. Please tell us why you believe it is appropriate to exclude the value of these warrants from the purchase price.

MANAGEMENT’S RESPONSE:

We did not assign a value to the warrants for the following reason:

We evaluated the value of the assets acquired at the date of acquisition and concluded that the fair value of the assets acquired after the arms’ length negotiations approximated the cash purchase price paid for those assets, and consequently we attributed zero value to the warrants in accordance with FAS 141, paragraph 23.

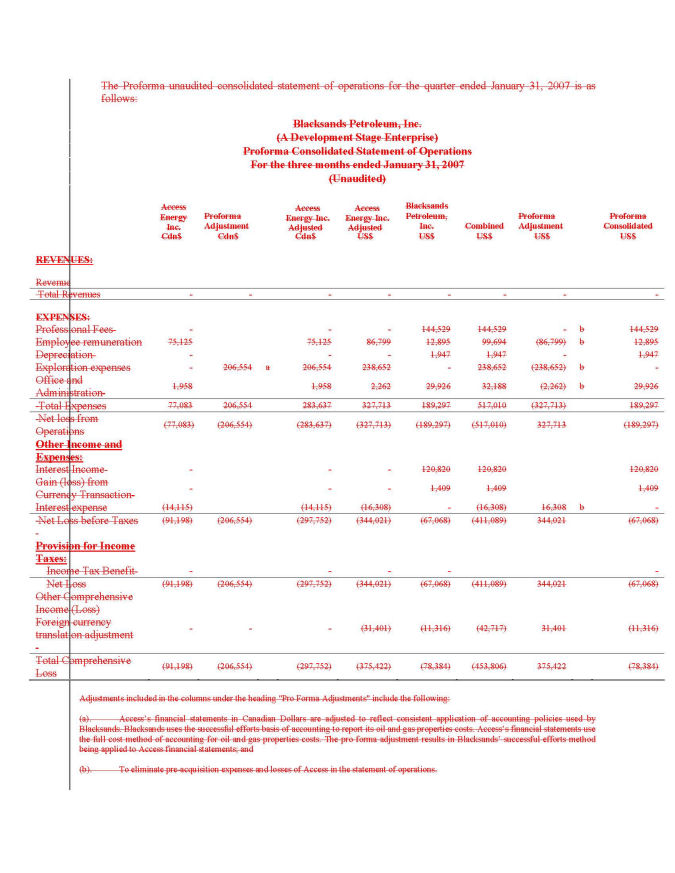

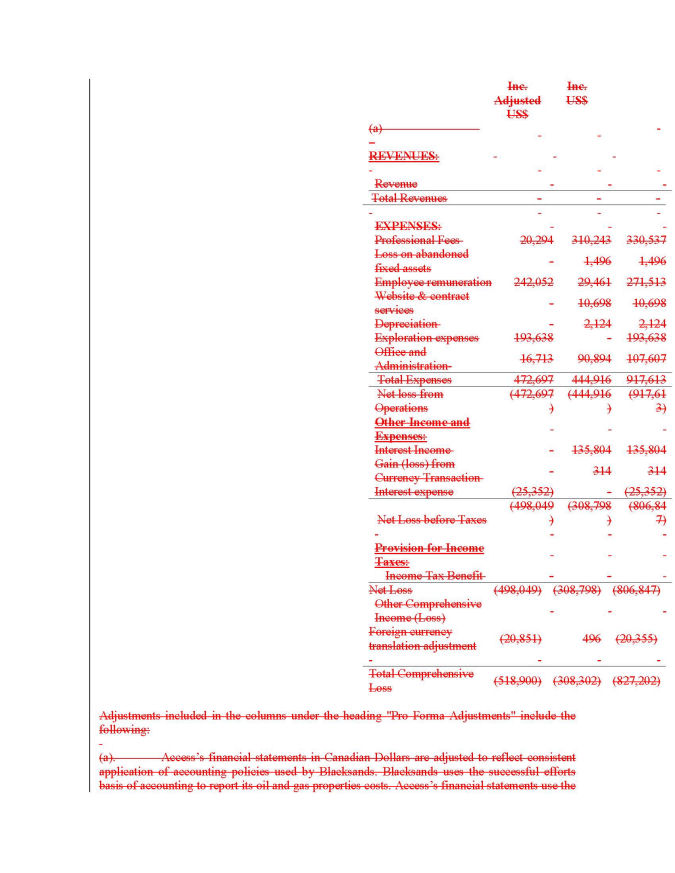

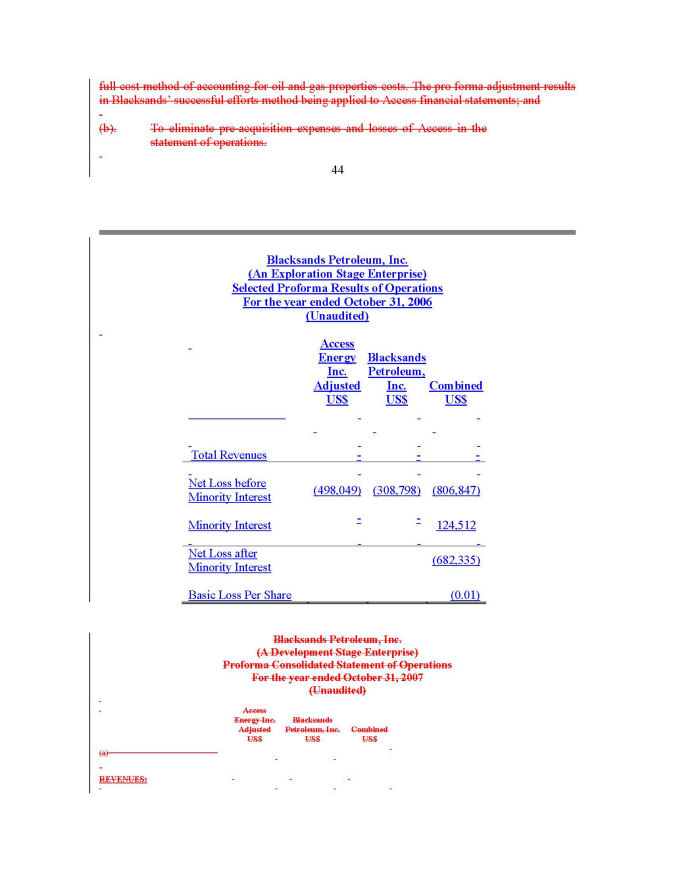

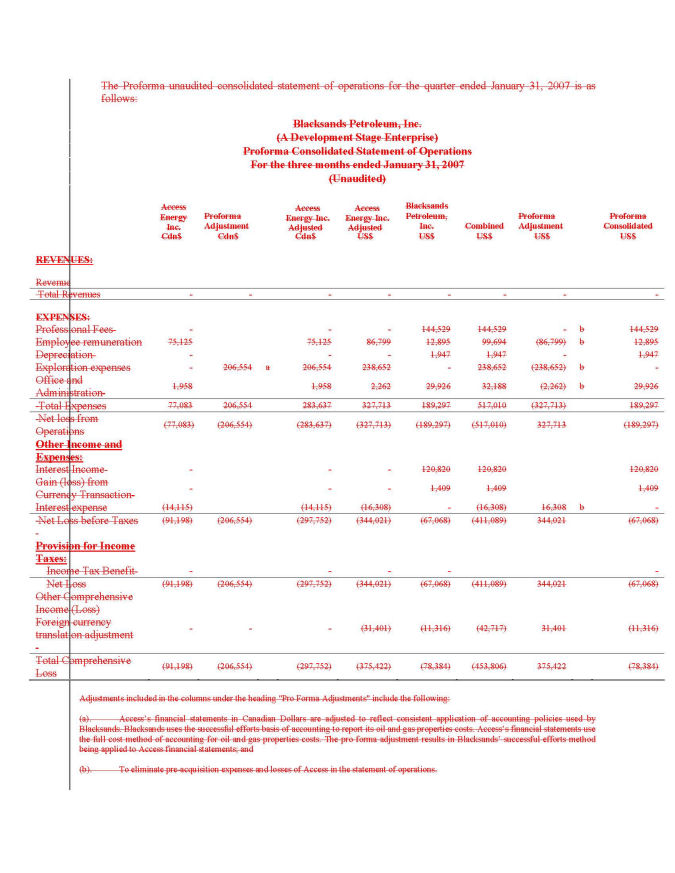

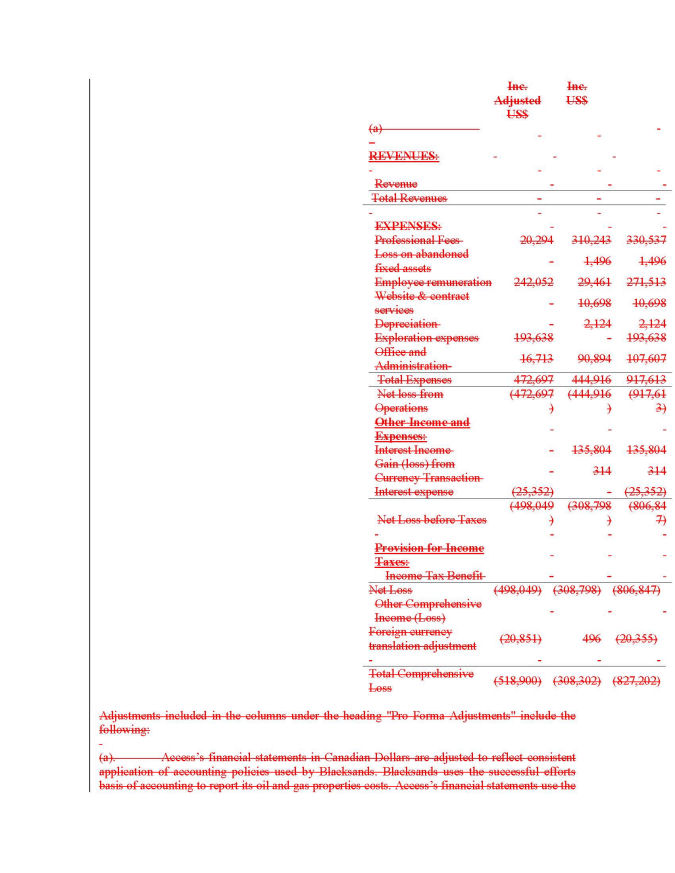

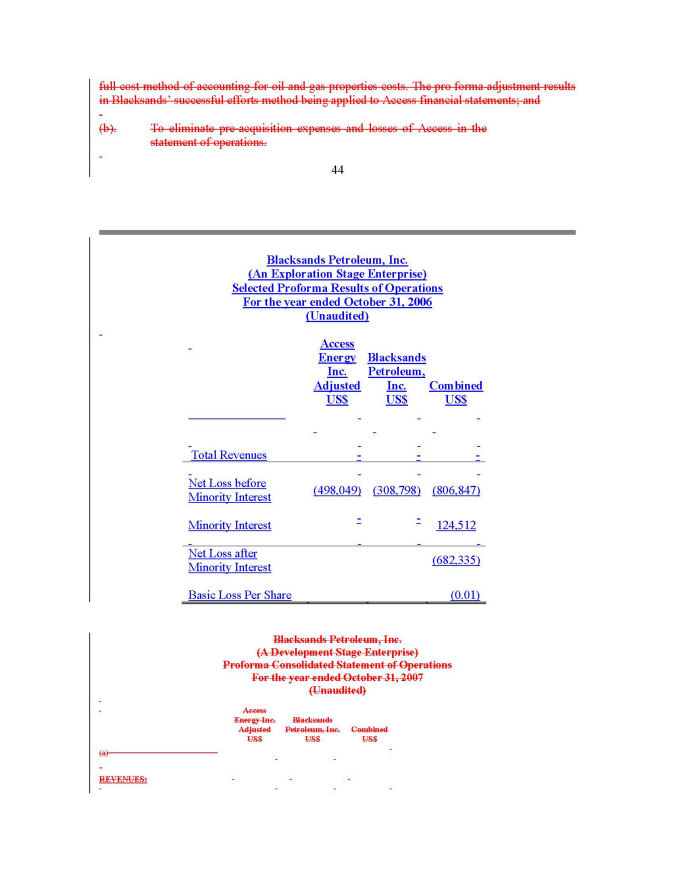

15. We note your inclusion of unaudited pro forma statements of operations as a footnote to your financial statements. Please contact us at your earliest convenience to discuss your unaudited pro forma statements of operations.

MANAGEMENT’S RESPONSE:

We discussed this matter with you by telephone Tuesday April 8, 2008. We have reduced our reporting to supplementary information only.

Footnote 12 – Income Taxes, page 46

16. Please expand your risk factor disclosure and your management’s discussion and analysis to discuss the impact and relevant risks, if any, resulting from your unfiled Federal and State Income Tax Returns for the years 2004 to 2006.

MANAGEMENT’S RESPONSE:

Our principal accountants are in the process of preparing and filing required federal and State tax returns. We propose to include the following paragraph in the MD&A:

“The Company has incurred losses, and does not believe the Company has any tax liabilities for the years 2004 to 2007 inclusive. We have commissioned the preparation of the Income Tax Returns and expect to have them completed and filed as soon as possible.”

Principal Accountant Fees and Services, page 54

17. Please limit your disclosures to those related to the services performed by your principal accountant(s). Do not refer to other accountants, which has the potential to imply a level of

Page 7

shared responsibility for the audit, if no such shared responsibility exists. Refer to Item 14 of the general instructions to Form 10-KSB.

MANAGEMENT’S RESPONSE:

We will revise the wording (to exclude any fees paid to the auditors of Access Energy) to be as follows:

“Sherb & Co. (“Sherb”) serves as our independent registered public accounting firm for the Company.

Audit Fees

Our principal accountant, Sherb, billed us aggregate fees in the amount of approximately $38,000 for the fiscal year ended October 31, 2007 and approximately $33,000 for the fiscal year ended October 31, 2006. These amounts were billed for professional services that Sherb provided for the audit of our annual financial statements and the review of the financial statements included in our report on 10-KSB.

Audit-Related Fees

Sherb billed us aggregate fees in the amount of $17,000 for the review of the financial statements included in our report on 10-QSB and $6,500 for the review of the financial statements included in our report on 8K for the fiscal year ended October 31, 2007 and $Nil for the fiscal year ended October 31, 2006 for assurance and related services that were reasonably related to the performance of the audit or review of our financial statements and/or Form 8K filings.

Tax Fees

Sherb billed us $nil for tax compliance for the fiscal year ended October 30, 2007 and $nil for the fiscal year ended October 31, 2006. During the fiscal years ended October 31, 2007 and 2006, Sherb did not provide any tax advice.

All Other Fees

Sherb billed us $nil in other fees for the fiscal year ended October 31, 2007 and $nil for the fiscal year ended October 31, 2006 for other fees. Our principal accountant (through its full time employees) performed all work regarding the audit of our financial statements for the most recent fiscal year.”

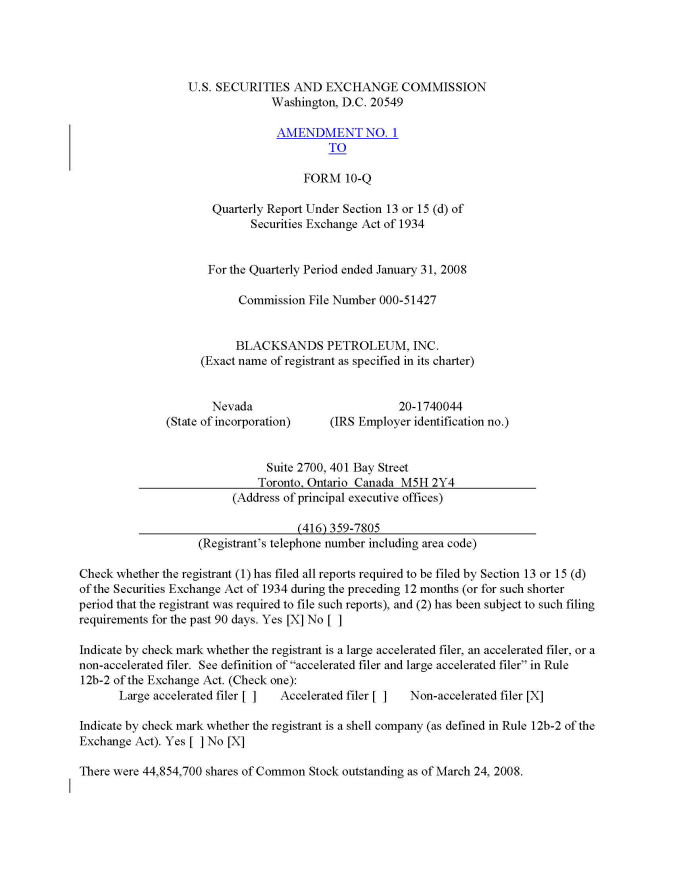

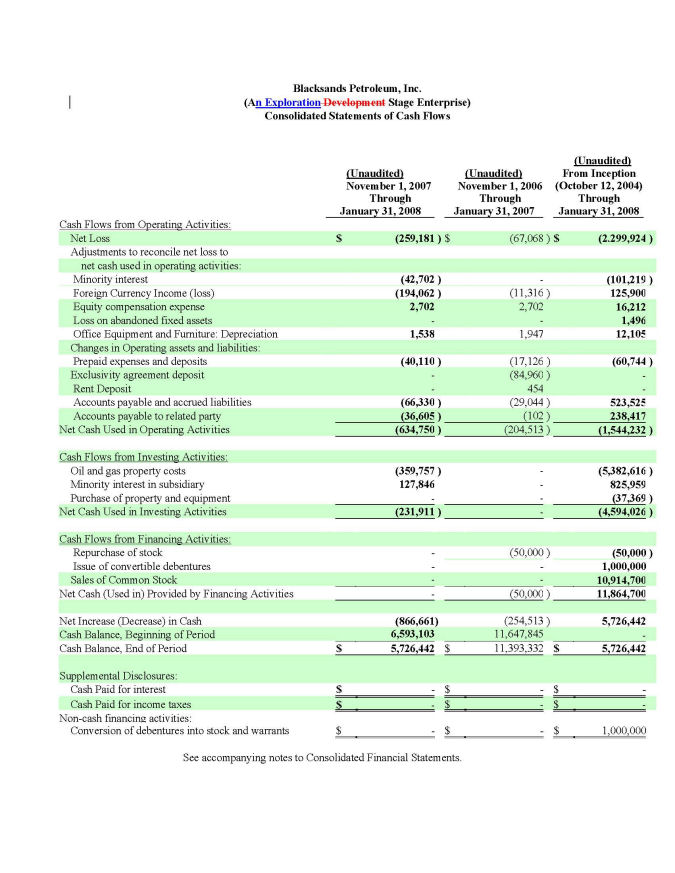

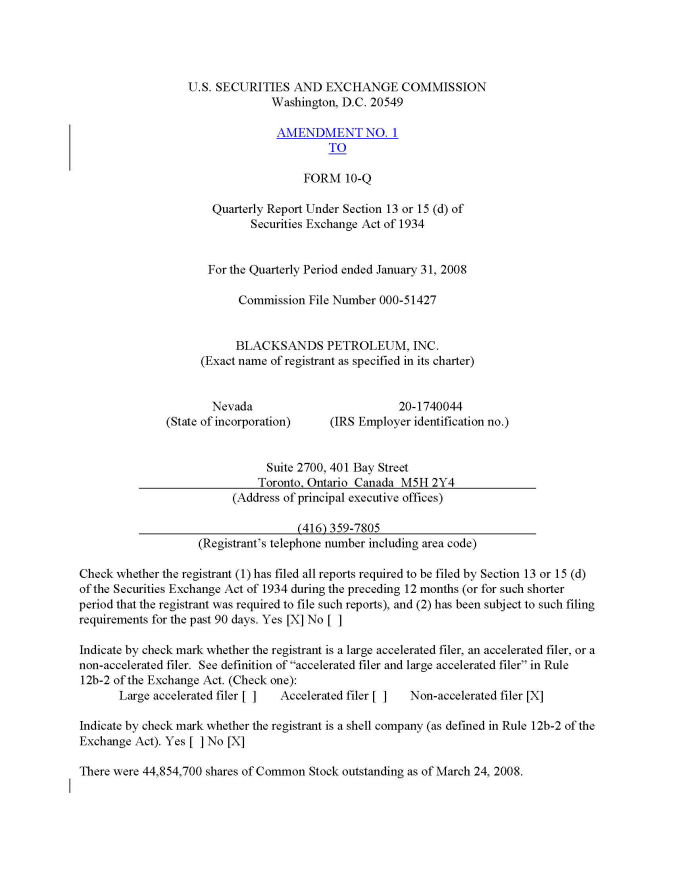

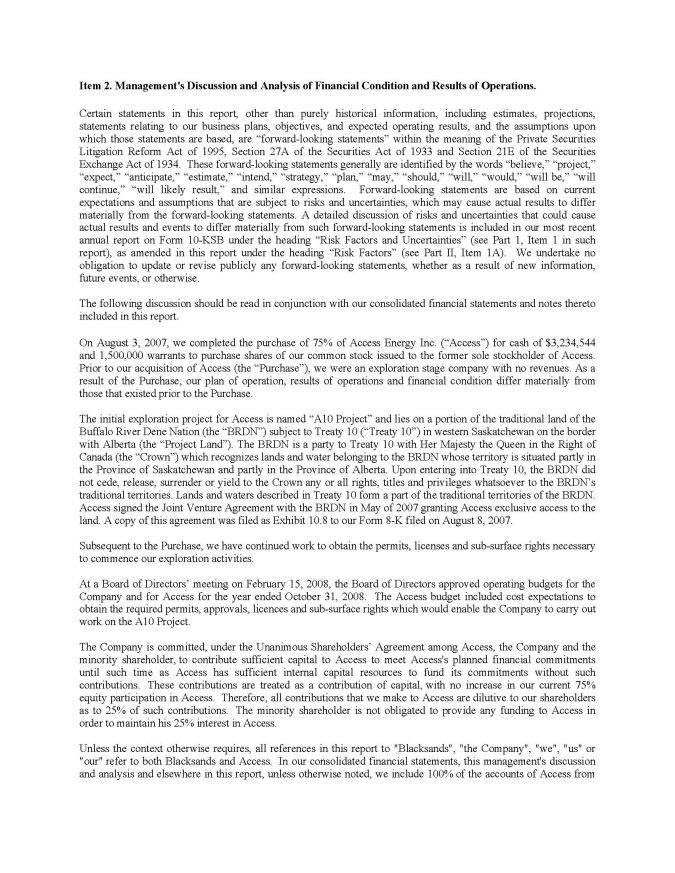

Form 10-Q for the Quarterly Period Ended January 31, 2008

Cover Page

18. Please ensure your future filings include the newly required disclosure and checkbox regarding the registrant’s status as a large accelerated filer, accelerated filer, non-accelerated filer or smaller reporting company.

Page 8

MANAGEMENT’S RESPONSE:

This will be done.

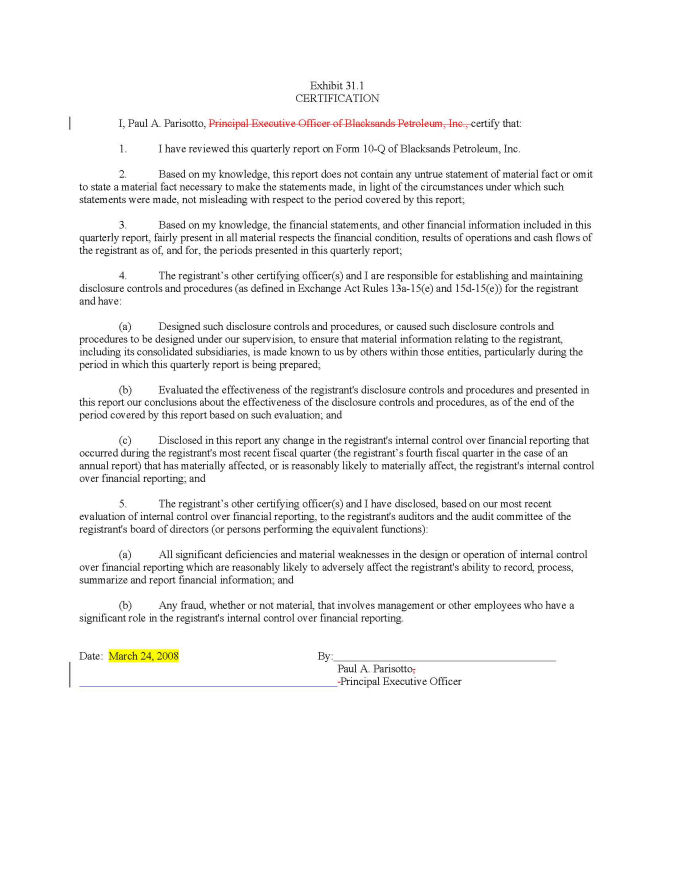

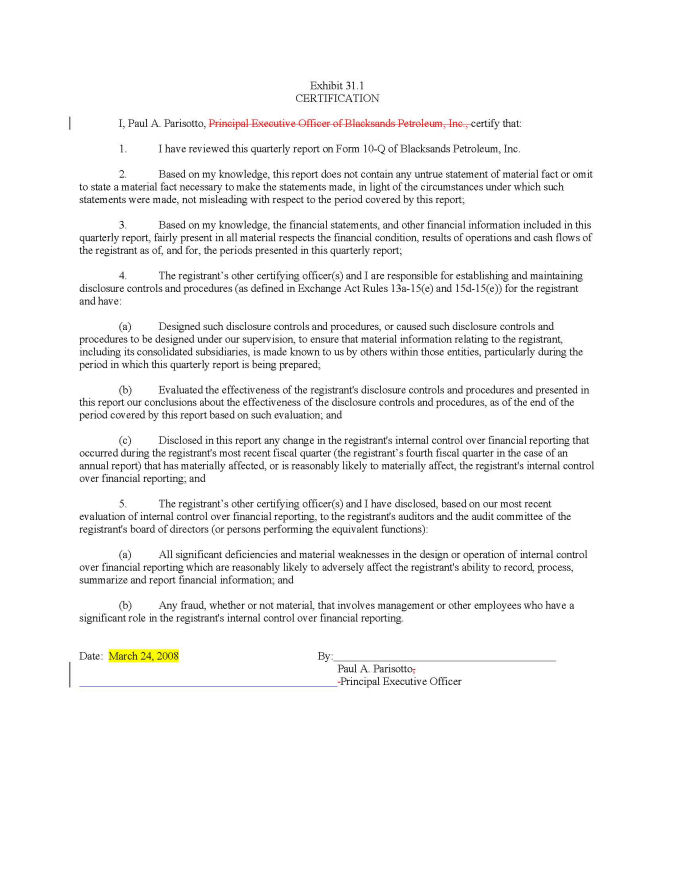

Exhibit 31 – Certifications Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

19. In a March 4, 2005 Staff Alert entitled “Annual Report Reminders”, the staff of the Division of Corporation Finance reminded issuers that the certifications required under Exchange Act Rules 13a-14(a) and 15d-14(a) must be in the exact form set forth in Item 601(b)(31) of Regulation S-K. We note the identification of the certifying individual at the beginning of the certifications required by Exchange Act Rule 13a-14(a) also includes the title of the certifying individual. The identification of the certifying individual at the beginning of the certifications should be modified so as not to include the individual’s title. Please ensure your certifications are in the exact form set forth in Item 601 of Regulation S-K.

MANAGEMENT’S RESPONSE:

This will be done.

This concludes our response to your letter of April 4, 2008. Please advise if there are any further comments.

Yours truly,

Paul A. Parisotto

President & Chief Executive Officer

Page 9

APPENDIX A

Calculations of Weighted Average Number of Shares

Page 10

APPENDIX B

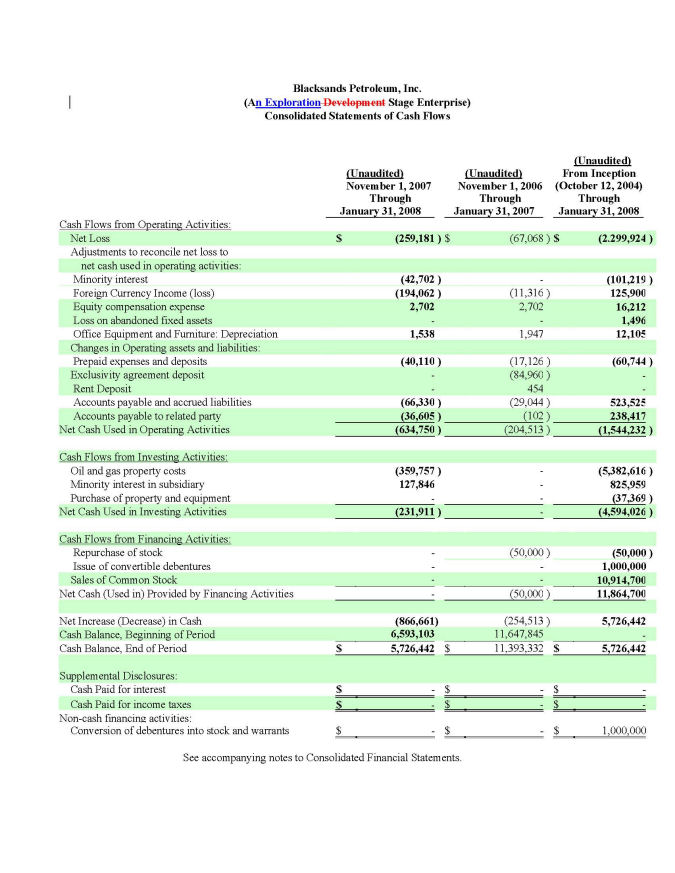

Consolidated Oil & Gas Property Costs – Details for Footnote 3

Page 14

10 KSB

10 Q