- DLB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Dolby Laboratories (DLB) DEF 14ADefinitive proxy

Filed: 18 Dec 19, 5:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted byRule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

DOLBY LABORATORIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule240.0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Dolby Laboratories, Inc.

1275 Market Street

San Francisco, California 94103

(415)558-0200

December 18, 2019

Dear Stockholder:

We cordially invite you to attend the Annual Meeting of Stockholders of Dolby Laboratories, Inc. to be held on Tuesday, February 4, 2020, at 10:30 a.m. Pacific Standard Time at our principal executive offices located at 1275 Market Street, San Francisco, California 94103. We are making available to you the accompanying Notice of Annual Meeting, Proxy Statement and form of proxy card or voting instruction on or about December 18, 2019.

We are pleased to furnish proxy materials to stockholders primarily over the internet. We believe that this process expedites stockholders’ receipt of proxy materials, lowers the costs of our Annual Meeting, and conserves natural resources. On or about December 18, 2019, we mailed to our stockholders a notice that includes instructions on how to access our Proxy Statement and 2019 Annual Report and how to vote online. The notice also includes instructions on how you can receive a paper copy of your Annual Meeting materials, including the Notice of Annual Meeting, Proxy Statement and proxy card or voting instruction form. If you elected to receive your Annual Meeting materials by mail, the Notice of Annual Meeting, Proxy Statement and proxy card or voting instruction form were enclosed. If you elected to receive your Annual Meeting materials viae-mail, thee-mail contains voting instructions and links to the 2019 Annual Report and the Proxy Statement, both of which are available athttp://investor.dolby.com/annual-reports-and-proxies.

Details regarding admission to, and the business to be conducted at, the Annual Meeting are described in the accompanying Notice of Annual Meeting and Proxy Statement. A copy of our 2019 Annual Report is included with the Proxy Statement for those stockholders who are receiving paper copies of the proxy materials.

Your vote is important. Regardless of whether you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote over the internet, by telephone or by mailing a proxy card or voting instruction form. Please review the instructions on the proxy card or voting instruction form regarding each of these voting options. Voting will ensure your representation at the Annual Meeting regardless of whether you attend in person.

Thank you for your ongoing support of Dolby Laboratories, Inc.

Sincerely yours,

Kevin Yeaman

President and Chief Executive Officer

Dolby Laboratories, Inc.

Notice of Annual Meeting of Stockholders

to be held on February 4, 2020

To the Stockholders of Dolby Laboratories, Inc.:

The Annual Meeting of Stockholders of Dolby Laboratories, Inc., a Delaware corporation, will be held at our principal executive offices located at 1275 Market Street, San Francisco, California 94103 on Tuesday, February 4, 2020, at 10:30 a.m. Pacific Standard Time, for the following purposes:

| 1. | To elect nine directors to serve until the 2021 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| 2. | To vote upon a proposal to amend and restate our 2005 Stock Plan; |

| 3. | To hold an advisory vote to approve Named Executive Officer compensation; |

| 4. | To ratify the appointment of KPMG LLP as Dolby’s independent registered public accounting firm for the fiscal year ending September 25, 2020; and |

| 5. | To transact such other business as may properly come before the Annual Meeting and any postponement, adjournment or continuation of the Annual Meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice. We are not aware of any other business to come before the Annual Meeting.

Only stockholders of record as of the close of business on December 6, 2019 and their proxies are entitled to notice of and to vote at the Annual Meeting and any postponement, adjournment or continuation thereof.

All stockholders are invited to attend the Annual Meeting in person. Any stockholder attending the Annual Meeting may vote in person even if the stockholder returned a proxy card. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a “legal proxy” issued in your name from the record holder giving you the right to vote the shares.You will need to bring proof of ownership to enter the Annual Meeting.

By Order of the Board of Directors,

Andy Sherman

Secretary

December 18, 2019

Whether or not you expect to attend the Annual Meeting, we encourage you to read the Proxy Statement accompanying this Notice and submit your proxy or voting instructions as promptly as possible in order to ensure your representation at the Annual Meeting. You may submit your proxy or voting instructions for the Annual Meeting by completing, signing, dating and returning your proxy card or voting instruction form in thepre-addressed envelope provided, or, in most cases, by using the telephone or the internet. For specific instructions on how to vote your shares, please refer to the section entitled “Additional Meeting Matters” in the Proxy Statement accompanying this Notice and the instructions on the proxy card or voting instruction form. Even if you have given your proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a “legal proxy” issued in your name from the record holder.

This summary highlights certain information contained elsewhere in this Proxy Statement. You should read the entire Proxy Statement carefully before voting as this summary does not contain all of the information that you should consider.

2020 Annual Meeting of Stockholders

Date and Time: | Tuesday, February 4, 2020 at 10:30 a.m. Pacific Standard Time | |

Place: | Dolby’s principal executive offices at 1275 Market Street, San Francisco, California 94103 | |

Record Date: | December 6, 2019 |

Proposals to Be Voted on at Annual Meeting

Proposal | Board Recommendation | Page Number for Additional Information | ||||

1. Election of Directors | FOR | 8 | ||||

2. Amendment and Restatement of our 2005 Stock Plan | FOR | 32 | ||||

| 3. Advisory Vote to Approve Named Executive Officer Compensation | FOR | 77 | ||||

4. Ratification of Appointment of Independent Registered Public Accounting Firm | FOR | 79 | ||||

Director Nominees

The nominees for election to our Board at the 2020 Annual Meeting of Stockholders are listed below. Anjali Sud was appointed to the Board effective May 13, 2019 to fill the vacancy resulting from the passing of director Nicholas Donatiello, Jr. in June 2018. She is standing for election by our stockholders for the first time.

| Committee Memberships | ||||||||||||||||||||||

Name | Age | Director Since | Principal Occupation | Indep. | AC | CC | NGC | SPC | TSC | |||||||||||||

Kevin Yeaman | 53 | 2009 | President and CEO | No |

| |||||||||||||||||

Peter Gotcher | 60 | 2003 | Chairman of the Board | Yes |  | |||||||||||||||||

Micheline Chau | 66 | 2013 | Director | Yes |  |  | ||||||||||||||||

David Dolby | 42 | 2011 | Chief Executive Officer, Dolby Family Ventures | No |  | |||||||||||||||||

N. William Jasper, Jr. | 72 | 2003 | Director | Yes | ||||||||||||||||||

Simon Segars | 52 | 2015 | CEO, Arm Ltd | Yes |  |  | ||||||||||||||||

Roger Siboni | 65 | 2004 | Director | Yes |  |  | ||||||||||||||||

Anjali Sud | 36 | 2019 | CEO, Vimeo, Inc. | Yes | ||||||||||||||||||

Avadis Tevanian, Jr. | 58 | 2009 | Managing Director, Elevation Partners and NextEquity Partners | Yes |  |  |  |  | ||||||||||||||

AC = Audit Committee, CC = Compensation Committee, NGC = Nominating and Governance Committee, SPC = Stock Plan Committee, TSC = Technology Strategy Committee

= Chairman

= Chairman  = Member

= Member

1

Fiscal 2019 Financial and Operational Highlights

Business Overview

We create audio and imaging technologies that transform entertainment and communications at the cinema, at home, at work, and on mobile devices. Founded in 1965, our strengths stem from expertise in analog and digital signal processing and digital compression technologies that have transformed the ability of artists to convey entertainment experiences to their audiences through recorded media. Such technologies led to the development of our noise-reduction systems for analog tape recordings, and have since evolved into multiple offerings that enable more immersive sound for cinema, digital television transmissions and devices, mobile devices,over-the-top video services, DVD andBlu-ray Discs, speaker products, PCs, and gaming consoles. Today, we derive the majority of our revenue from licensing our audio technologies. We also derive revenue from licensing our consumer imaging and communication technologies, as well as audio and imaging technologies for premium cinema offerings in collaboration with exhibitors. Finally, we provide products and services for a variety of applications in the cinema, broadcast, communications, and home entertainment markets.

Key Financial Highlights

Our key financial highlights for fiscal 2019 were as follows:

Fiscal 2019 | Fiscal 20181 (as adjusted) | |||

Total Revenue | $1.24 billion | $1.05 billion | ||

Net Income | $255.2 million | $41.7 million2 | ||

Diluted Earnings Per Share | $2.44 | $0.392 | ||

Non-GAAP Net Income(3) | $334.6 million | $215.8 million | ||

Non-GAAP Diluted Earnings Per Share(3) | $3.20 | $2.02 | ||

Stock Price Per Share (High and Low) | $71.77 / $56.09 | $74.29 / $56.50 | ||

Stock Price Per Share as of FiscalYear-End | $63.79 | $69.97 |

| (1) | For fiscal 2018, revenue, net income, and diluted earnings per share numbers are as adjusted to reflect Accounting Standards Codification Topic 606,Revenue from Contracts with Customers (ASC 606). |

| (2) | For fiscal 2018, net income on a GAAP basis and diluted earnings per share on a GAAP basis reflect the accounting impact of the 2017 U.S. Tax Cuts and Jobs Act. See Appendix A of this Proxy Statement and Note 11 to our consolidated financial statements in our 2019 Annual Report on Form10-K for more information. |

| (3) | A reconciliation of ournon-GAAP to GAAP financial results is set forth in Appendix A to this Proxy Statement. |

Return of Capital to Stockholders

In fiscal 2019, we returned $418.1 million to our stockholders, $340.6 million of which was in the form of stock repurchases and $77.5 million of which was in the form of dividends.

Beginning with the introduction of our stock repurchase program in fiscal 2010 and through the end of fiscal 2019, we have returned cash of over $2.34 billion to our stockholders through stock repurchases, our quarterly dividend program, and our fiscal 2013 special dividend.

In November 2019, we announced a 16% increase in the per share dividend amount under our quarterly dividend program, from $0.19 to $0.22.

2

Key Business Highlights

In fiscal 2019, we continued to focus on expanding our leadership in audio and imaging entertainment experiences. The following are select highlights for fiscal 2019:

Audio and Imaging Licensing

| • | Broadcast. Panasonic joined our growing list of TV partners supporting Dolby Vision®, and Vizio expanded its support of Dolby Vision throughout its entire 4K TV lineup. A number of TV partners have released models that feature the combined experience of Dolby Vision and Dolby Atmos®, including LG, Sony, TCL, and TP Vision. In addition, the first set top boxes supporting Dolby Vision and Dolby Atmos were launched in fiscal 2019, while the adoption of ourAC-4 technologies continued to increase globally. |

We also saw more instances of live content experiences featuring Dolby Atmos. Selected NBA basketball games became the first professional sports in North America broadcast in Dolby Atmos, and DirectTV delivered certain college football primetime games in Dolby Atmos on ESPN. In addition, BT and CCTV continued delivering Premier League Soccer and The Champions League Final in Dolby Atmos.

| • | Mobile.We continued to focus on adoption of our technologies across major mobile ecosystems such as Apple, Android, and Amazon. During fiscal 2019, the breadth of mobile devices supporting Dolby technologies increased globally. For example, Apple announced the support of the combined experience of Dolby Vision and Dolby Atmos in its latest iOS devices. Dolby Atmos-enabled mobile devices are now available in the market from a growing list of partners such as Samsung, Amazon, Oppo, and Lenovo. |

| • | Consumer Electronics.The availability of devices and services compatible with Dolby technologies continued to increase, as a number of streaming services indicated that they will be supporting Dolby Vision and Dolby Atmos-enabled content. Apple announced that its new content programming and video subscription service, Apple TV+, will support Dolby Vision and Dolby Atmos. In addition, Disney’s new streaming service, Disney+, will support content in Dolby Vision and Dolby Atmos. Additionalover-the-top services supporting the combined experience of Dolby Vision and Dolby Atmos include Netflix, Amazon, Tencent, and iQiYi. With the growing list of global streaming partners supporting our technologies, there are now over 2,400 pieces of content available in Dolby Vision, and over 1,600 pieces available in Dolby Atmos. |

In addition, the first Dolby Atmos-enabled smart speaker, the Amazon Echo Studio, was announced in fiscal 2019. The availability of Dolby-Atmos-enabled soundbars also continued to grow in fiscal 2019 as three of our partners, Samsung, Sony, and Vizio, introduced their new lineup of soundbars. Certain models are now available starting at $300. In general, as entry level price points decline, a wider range of consumers have the ability to purchase products incorporating Dolby technologies.

Further, the first streaming service to support Dolby Atmos Music, Amazon Music HD, was announced in fiscal 2019, with a library to include thousands of songs from a wide range of genres.

| • | Personal Computers. A number of PC models were announced or released supporting the combined experience of Dolby Vision and Dolby Atmos. Apple’s newest MacBook supporting Dolby Vision and Dolby Atmos via its latest MacOS was announced during fiscal 2019, and Lenovo expanded its lineup of PCs that support Dolby Vision and Dolby Atmos. In addition, Dell released several Dolby Vision-enabled PC models throughout the year, while Samsung and Huawei extended their support of Dolby Atmos to more PC models. |

3

| • | Other. Dolby Digital PlusTM is incorporated in both the Xbox and PlayStation gaming consoles and platforms. The Xbox gaming console also supports the combined experience of Dolby Vision and Dolby Atmos. Customers can purchase an original equipment manufacturer (OEM) gaming headset bundled with Dolby Atmos for Headphones, or an app on the Microsoft app store to enable Dolby Atmos on their headphones. |

Cinema and Other

| • | Cinema Products and Services.We continued to see adoption of Dolby Atmos by studios, content creators, post-production facilities, and exhibitors. At the end of fiscal 2019, there were over 5,000 Dolby Atmos-enabled screens installed or committed across 90 countries around the world, and over 1,500 Dolby Atmos theatrical titles announced or released. |

| • | Dolby Cinema®.We continued to expand our global presence for Dolby Cinema. At the end of fiscal 2019, we had over 230 Dolby Cinema locations in operation across 11 countries, and a total of more than 400 screens open or committed. During the fiscal year, several of the top global box office films were featured in Dolby Cinema, includingAvengers: Endgame andThe Lion King. The breadth of motion pictures for Dolby Cinema continues to grow with over 260 theatrical titles in Dolby Vision and Dolby Atmos having been announced or released from all the major studios. |

| • | Dolby Voice®. Our newest audio and video conferencing offering is Dolby Voice RoomTM, which is aimed at customers in the growing huddle room space. In fiscal 2019, we added LogMeIn as a partner, joining BlueJeans and Highfive. Also in fiscal 2019, together with BlueJeans and LogMeIn, we introduced a “Room as a Service” offering, which enables our customers access to our partners’ conferencing services with our Dolby Voice Room solution for a monthly subscription fee. We continue to focus on expanding Dolby Voice’s availability to the global market for audio and video conferencing services. |

Named Executive Officers

Our named executive officers (our “NEOs”) for fiscal 2019 were:

| • | Kevin Yeaman, our President and Chief Executive Officer; |

| • | Lewis Chew, our Executive Vice President and Chief Financial Officer; |

| • | Andy Sherman, our Executive Vice President, General Counsel, and Corporate Secretary; |

| • | Giles Baker, our Senior Vice President, Consumer Entertainment; and |

| • | Todd Pendleton, our Senior Vice President and Chief Marketing Officer. |

Principal Elements of Executive Compensation and Fiscal 2019 Executive Compensation Highlights

CEO Fiscal 2019 Target Total Direct Compensation Opportunity

| Other NEOs Fiscal 2019 Target Total Direct Compensation Opportunity (Average)

|

4

Element of Compensation | Fiscal 2019 Highlights | |

Base Salary

Comprised 11% of the target total direct compensation opportunity of our CEO, and 20% for our other NEOs (on average), in fiscal 2019. | • For calendar 2019, the Compensation Committee of our Board increased the base salary of Mr. Yeaman by 5%, Mr. Chew by 3%, Mr. Sherman by 4%, and Mr. Baker by 8%. Mr. Pendleton joined us as Senior Vice President and Chief Marketing Officer in the fourth quarter of fiscal 2018 and therefore did not receive an increase in base salary for calendar 2019. | |

| ||

Annual Incentive Compensation (Cash)

Comprised 11% of the target total direct compensation opportunity of our CEO, and 13% for our other NEOs (on average), in fiscal 2019. | • NEO annual incentive compensation targets—stated as a percentage of base salary for calendar 2019—were maintained at fiscal 2017 and 2018 levels (100% for our CEO and 65% for each of our other NEOs).

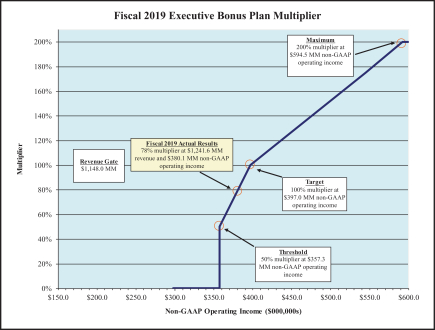

• Annual incentive compensation payments for our NEOs under our fiscal 2019 executive bonus plan were based on a multiplier keyed to our achievement of a combination of revenue andnon-GAAP operating income targets. No payouts would be made under the fiscal 2019 executive bonus plan unless we achieved a revenue “gate” of $1.15 billion.

• We achieved revenue of $1.24 billion, andnon-GAAP operating income of $380.1 million against a threshold requirement of $357.3 million and a target of $397.0 million, resulting in a multiplier of 78%. Based on these results and team and individual performance, our NEOs received annual incentive compensation payments equal to 78% of their annual incentive compensation targets, except for Messrs. Sherman and Baker. Mr. Sherman received a payment equal to 104% of his annual incentive compensation target, and Mr. Baker received a payment equal to 97.5% of his annual incentive compensation target.

A reconciliation of ournon-GAAP to GAAP financial results is set forth in Appendix A to this Proxy Statement. | |

| ||

Long-Term Incentive Compensation (Performance Stock Options, Time-Based Stock Options and Restricted Stock Unit Awards)

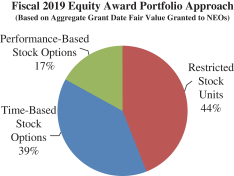

Comprised 78% of the target total direct compensation opportunity of our CEO, and 67% for our other NEOs (on average), in fiscal 2019. | • The equity mix for the long-term incentive compensation granted to our NEOs was approximately 17% performance stock options, 39% time-based stock options, and 44% restricted stock unit awards, based on grant date fair value. | |

| ||

5

Performance Stock Options

A portion of the long-term incentive compensation granted to our NEOs for fiscal 2019 was in the form of performance stock options, pursuant to a program adopted in fiscal 2016. The shares of our Class A Common Stock subject to such awards may be earned contingent on our achievement ofpre-established annualized total stockholder return levels for Dolby measured over a three-year performance period. From 0% to 125% of the shares subject to the performance stock options may be earned, depending on our level of achievement of these performance conditions. The Compensation Committee believes that granting a portion of long-term incentive compensation in the form of equity that is earned only upon the achievement of specified performance conditions further aligns the interests of our NEOs with those of our stockholders

Executive Stock Ownership Guidelines

Based on our belief that stock ownership further aligns the interests of senior management with those of our stockholders, our executive officers, including our NEOs, are subject to our executive stock ownership guidelines, which provide that:

| • | Our CEO is expected to accumulate and hold an amount of qualifying Dolby equity securities equal to the lesser of the value of five times his annual base salary, or a fixed number of shares having a value equal to five times his annual base salary on the date of adoption of the guidelines (September 22, 2015); and |

| • | Each other executive officer is expected to accumulate and hold an amount of qualifying Dolby equity securities equal to the lesser of the value of two times his annual base salary, or a fixed number of shares having a value equal to two times his annual base salary on the date of adoption of the guidelines. |

As of the end of fiscal 2019, all of our executive officers were in compliance with our executive stock ownership guidelines.

Compensation Recovery (“Clawback”) Policy

Our policy on the recovery of incentive compensation allows us to recover certain cash or equity-based incentive compensation payments or awards made or granted to an executive officer in the event of misconduct that results in the need for us to prepare a material financial restatement.

Advisory Vote on the Compensation of our NEOs

We are asking our stockholders to approve, on an advisory(non-binding) basis, the compensation of our NEOs as described in this Proxy Statement. At our 2019 Annual Meeting of Stockholders, approximately 98% of the voting power of the shares present and entitled to vote voted in favor of the compensation of our NEOs. For fiscal 2019, there were no material changes to our executive compensation program. The Compensation Committee believes that our executive compensation policies and practices continue to support an executive compensation program that is closely aligned with stockholder interests and that benefits us in the long term.

6

Dolby Laboratories, Inc.

1275 Market Street

San Francisco, California 94103

(415)558-0200

PROXY STATEMENT

The Board of Directors (our “Board”) of Dolby Laboratories, Inc., a Delaware corporation, is soliciting proxies to be used at the Annual Meeting of Stockholders to be held at our principal executive offices located at 1275 Market Street, San Francisco, California 94103 on Tuesday, February 4, 2020, at 10:30 a.m. Pacific Standard Time and any postponement, adjournment or continuation thereof (the “Annual Meeting”). This Proxy Statement and the accompanying notice and form of proxy are first being made available to stockholders on or about December 18, 2019.

INTERNET AVAILABILITY OF PROXY MATERIALS

We are furnishing proxy materials to our stockholders primarily via the internet. On or about December 18, 2019, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our Proxy Statement and our 2019 Annual Report. The Notice of Internet Availability of Proxy Materials also provides information on how to access your voting instructions to be able to vote through the internet or by telephone. Other stockholders, in accordance with their prior requests, have receivede-mail notification of how to access our proxy materials and vote via the internet, or have been mailed paper copies of our proxy materials and a proxy card or voting instruction form.

Internet distribution of our proxy materials helps to expedite receipt by stockholders, lowers the cost of the Annual Meeting and conserves natural resources. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials viae-mail unless you elect otherwise.

7

ELECTION OF DIRECTORS

Nominees

Our Board currently consists of nine members. Our Bylaws permit our Board to establish by resolution the authorized number of directors, and nine directors are currently authorized.

Our Board proposes the election of nine directors, each to serve until the next Annual Meeting of Stockholders or until his or her successor is duly elected and qualified. Anjali Sud was appointed to the Board effective May 13, 2019 to fill the vacancy resulting from the passing of director Nicholas Donatiello, Jr. in June 2018. Ms. Sud was recommended as a director to our Nominating and Governance Committee by a third-party search firm, which assisted the committee in identifying and evaluating potential director nominees. Ms. Sud is standing for election to the Board by our stockholders for the first time. All other incumbent directors are nominees forre-election to our Board. All of the nominees have been recommended for nomination by the Nominating and Governance Committee, and all of them are currently serving as directors. All nominees other than Ms. Sud were elected by the stockholders at last year’s annual meeting. Your proxy cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unavailable to serve. If any nominee is unable or declines to serve as director at the time of the Annual Meeting, an event that we do not currently anticipate, proxies will be voted for any nominee designated by our Board to fill the vacancy. Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” the nominees named below.

Information Regarding the Director Nominees

Names of the nominees and certain biographical information about them as of December 6, 2019, the record date for the Annual Meeting, are set forth below:

Name | Age | Position with the Company | Director Since | |||||

Kevin Yeaman(1) | 53 | President, Chief Executive Officer and Director | 2009 | |||||

Peter Gotcher(2) | 60 | Chairman of the Board of Directors | 2003 | |||||

Micheline Chau(3)(4) | 66 | Director | 2013 | |||||

David Dolby(5) | 42 | Director | 2011 | |||||

N. William Jasper, Jr. | 72 | Director | 2003 | |||||

Simon Segars(2)(3) | 52 | Director | 2015 | |||||

Roger Siboni(3)(4) | 65 | Director | 2004 | |||||

Anjali Sud | 36 | Director | 2019 | |||||

Avadis Tevanian, Jr.(1)(2)(4)(5) | 58 | Director | 2009 | |||||

| (1) | Member of the Stock Plan Committee |

| (2) | Member of the Nominating and Governance Committee |

| (3) | Member of the Audit Committee |

| (4) | Member of the Compensation Committee |

| (5) | Member of the Technology Strategy Committee |

Kevin Yeaman became our President and CEO in March 2009 and has been a member of our Board since he assumed the role of CEO. He joined Dolby as Chief Financial Officer and Vice President in October 2005, was appointed Senior Vice President in November 2006 and Executive Vice President in July 2007. Prior to joining Dolby, he worked for seven years at Epiphany, Inc., a publicly traded enterprise software company, most recently as Chief Financial Officer from August 1999 to October 2005. Previously, Mr. Yeaman also served as

8

Worldwide Vice President of Field Finance Operations for Informix Software, Inc., a provider of relational database software, from February 1998 to August 1998. From September 1988 to February 1998, Mr. Yeaman served in Silicon Valley and London in various positions at KPMG LLP, an accounting firm, serving most recently as a senior manager. Mr. Yeaman is a member of the Academy of Motion Picture Arts and Sciences. He also sits on the Board of Trustees of the Academy Museum Foundation. He holds a B.S. degree in commerce from Santa Clara University.

As Dolby’s Chief Executive Officer and former Chief Financial Officer, Mr. Yeaman has extensive experience in Dolby’s markets and brings to our Board a deep understanding of Dolby, its finances, operations and strategy.

Peter Gotcher has served as a director since June 2003 and as Chairman of the Board of Directors since March 2011. Mr. Gotcher served as Executive Chairman of the Board of Directors from March 2009 until March 2011. Mr. Gotcher is an independent investor. Mr. Gotcher was a venture partner with Redpoint Ventures, a private investment firm, from September 1999 to January 2003. Prior to joining Redpoint Ventures, Mr. Gotcher was a venture partner with Institutional Venture Partners, a private investment firm, from 1997 to September 1999. Prior to joining Institutional Venture Partners, Mr. Gotcher founded and served as the President, Chief Executive Officer and Chairman of the Board of Digidesign from 1984 to 1995. Digidesign was acquired by Avid Technology, a media software company, in 1995 and Mr. Gotcher served as the General Manager of Digidesign and Executive Vice President of Avid Technology from January 1995 to May 1996. Mr. Gotcher serves on the board of directors of GoPro, Inc., and served on the board of directors of Pandora Media, Inc. from September 2005 to May 2017. Mr. Gotcher also serves on the boards of directors of several private companies. Mr. Gotcher holds a B.A. degree in English literature from the University of California at Berkeley.

As the founder, former Chief Executive Officer and Chairman of Digidesign and a former venture capitalist, Mr. Gotcher has a broad understanding of the operational, financial and strategic issues facing public companies. In addition, his service on other boards and committees, including as a member of the Audit Committee and Compensation and Leadership Committee (where he serves as chairman) of GoPro, Inc., as a former member of the Compensation Committee and member and chairman of the Nominating and Corporate Governance Committee of Pandora Media, Inc., and his extensive experience in Dolby’s markets, provide valuable perspective for our Board and give him significant operating experience, as well as financial, accounting and corporate governance experience.

Micheline Chau has served as a director since February 2013. Ms. Chau served as President and Chief Operating Officer of Lucasfilm Ltd., a film and entertainment company, from April 2003 to September 2012. Prior to assuming her role as President and Chief Operating Officer, Ms. Chau served as Lucasfilm’s Chief Financial Officer, from 1991 to March 2003. Before that, Ms. Chau was Chief Financial/Administrative Officer for Bell Atlantic Healthcare Systems and held other executive-level positions within various industries, including retail, restaurant, venture capital and financial services. Ms. Chau is a member of the board of directors of Las Vegas Sands Corp., a developer, owner and operator of integrated resorts in Asia and the United States, and serves on Las Vegas Sands’ Compensation and Audit Committees. Ms. Chau also sat on the board of directors of Red Hat, Inc., an open source enterprise software provider, from November 2008 to August 2012, and also served as a member of Red Hat’s Compensation and Nominating and Corporate Governance Committees. In addition, Ms. Chau currently sits on the boards of directors of several private andnon-profit entities. Ms. Chau holds an undergraduate degree in English and Asian Studies from Wellesley College and an M.B.A. from Stanford University.

As the former President, Chief Operating Officer and Chief Financial Officer of Lucasfilm, Ms. Chau brings to our Board senior leadership and significant operating experience, as well as financial and entertainment industry expertise. In addition, as a member of the Compensation and Audit Committees of Las Vegas Sands and a former member of the Compensation and Nominating and Corporate Governance Committees of Red Hat, Ms. Chau brings to our Board corporate governance experience.

9

David Dolby has served as a director since February 2011. Mr. Dolby is founder and currently serves as Chief Executive Officer of Dolby Family Ventures, an early stage venture firm unrelated to Dolby Laboratories that launched in June 2014 to invest in companies and technologies with the potential for significant social impact. Previously, Mr. Dolby served as a consultant to our Board on technology strategy matters from February 2011 until February 2015. Mr. Dolby also served as Manager, Strategic Partnerships of Dolby Laboratories from May 2008 until February 2011. In this role, Mr. Dolby was responsible for managing the company’s strategic partnerships and technology standards for internet media encoding, delivery and playback. He represented the company in technical and business working groups at a variety of international standards groups, including Universal Serial Bus, Digital Living Network Alliance, Digital Entertainment Content Ecosystem Ultraviolet, andBlu-ray Disc Association. Mr. Dolby has attended industry events with the company for a significant number of years, including Audio Engineering Society, National Association of Broadcasters, International Consumer Electronics Show, ShoWest, Cine Expo International, IFA, and Custom Electronic Design and Installation Association. From 2006 to 2008, Mr. Dolby was a self-employed entrepreneur and investor. Mr. Dolby attended Stanford Business School between 2004 and 2006. During that time, he served as product manager at Kaleidescape, Inc., a Silicon Valley technology firm focused on high-performance music and movie server systems. From 2003 to 2006, he owned and operated Charter Flight LLC, a private aircraft leasing business. In addition, during 2004, Mr. Dolby was an investment banking analyst focused on technology at Perseus Group (now GCA Savvian). From 2000 to 2002, Mr. Dolby was an employee of NetVMG, a company developing route control software for optimizing multi-homed IP network routing. Before joining NetVMG, Mr. Dolby worked for engineering firms Bechtel and Poe & Associates. Mr. Dolby serves on the board of directors of Cogstate Limited, a cognitive assessment and training company focused on the development and commercialization of computerized tests of cognition. Mr. Dolby serves on Cogstate’s Remuneration and Nomination Committee. Mr. Dolby received a B.S.E. in Civil Engineering from Duke University and an M.B.A. from Stanford University.

Mr. Dolby brings experience to our Board in home theater system technology and software technology productization, and offers a long-term perspective on the growth of the company and its commitment to excellence in audio and video.

N. William Jasper, Jr. has served as a director since June 2003. Mr. Jasper joined Dolby in February 1979 as Chief Financial Officer and retired as President and Chief Executive Officer in March 2009. Mr. Jasper served in a variety of positions prior to becoming President in May 1983, including as our Vice President, Finance and Administration and as our Executive Vice President. Mr. Jasper is anat-large member of the Academy of Motion Picture Arts and Sciences. He holds a B.S. degree in industrial engineering from Stanford University and an M.B.A. from the University of California at Berkeley.

With his 30 years of experience as an executive officer of Dolby, Mr. Jasper has extensive experience in Dolby’s markets and brings to our Board a deep understanding not only of the role of our Board, but also of the company and its operations.

Simon Segarshas served as a director since February 2015. Since 1991, Mr. Segars has worked for Arm Ltd (known as Arm Holdings Plc prior to 2017), a designer and provider of microprocessors, software development tools and related technologies that was publicly held until its acquisition by SoftBank Group Corp. in September 2016. Mr. Segars has served as Arm’s Chief Executive Officer since July 2013 and as a member of its board of directors since 2005. Mr. Segars also has served as a member of SoftBank Group Corp.’s board of directors since June 2017. He served as President of Arm in 2013 before being promoted to Chief Executive Officer. Mr. Segars held the position of Executive Vice President and General Manager, Physical IP Division, from 2007 to 2012. Prior senior roles at Arm include Executive Vice President, Engineering; Executive Vice President, Worldwide Sales; and Executive Vice President, Business Development. Mr. Segars worked on many of the early Arm CPU products and led the development of the ARM7 and ARM9 Thumb® families. He holds a number of patents in the field of embedded CPU architectures. Mr. Segars received his Bachelors in Electronic Engineering from the University of Sussex, and obtained a Masters of Computer Science from the University of

10

Manchester. In recognition of his extraordinary lifetime accomplishments and his impact on the global technology industry, Mr. Segars was conferred an Honorary Doctor of Science from the University of Sussex in 2019. In addition to serving on Arm and SoftBank Group Corp.’s boards of directors, Mr. Segars currently serves on the boards of directors of the Global Semiconductor Alliance (where he serves as Vice Chairman) and the UK’s TechWorks.

As a trained and former engineer, Mr. Segars has extensive experience in the technological elements of Dolby’s business operations. In addition, with his significant experience as an executive officer of Arm, and his service on the boards of both public and private companies, Mr. Segars brings to our Board a valuable understanding of the operational and strategic issues facing companies.

Roger Siboni has served as a director since July 2004. Mr. Siboni served as the Chairman of the Board of Epiphany, Inc., a provider of data analytics for customer personalization, from December 1999 until Epiphany, Inc. was acquired by SSA Global Technologies, Inc. in September 2005. Mr. Siboni also served as President and Chief Executive Officer of Epiphany from August 1998 to July 2003. From July 1996 to August 1998, Mr. Siboni was Deputy Chairman and Chief Operating Officer of KPMG Peat Marwick LLP, a member firm of KPMG International, an accounting and consulting firm. From July 1993 to June 1996, Mr. Siboni was Managing Partner of KPMG Peat Marwick LLP’s information, communication and entertainment practice. Mr. Siboni also serves on the boards of directors of Cadence Design Systems, a provider of software, hardware, and system design tools to enable the design and development of electronic products, Coupa Software Incorporated, a cloud-based provider of spend management solutions, and a number of private companies. Previously, Mr. Siboni served on the board of FileNet Corporation, from December 1998 until it was acquired by IBM in October 2006; the board of infoGROUP Inc., from January 2009 until it was acquired by CCMP Capital Advisors in July 2010; the board of ArcSight, Inc., from June 2009 until it was acquired by Hewlett-Packard Company in October 2010; the board of Classmates Media Corporation, a wholly owned subsidiary of United Online, from 2007 to 2010; and the board of Marketo, Inc., from October 2011 until it was acquired by Milestone Holdco, LLC in August 2016. Mr. Siboni holds a B.S. degree in business administration from the University of California at Berkeley.

As a former Chairman of the Board and Chief Executive Officer of Epiphany, Inc., a former Chief Operating Officer and Managing Partner of the information, communication and entertainment practice at KPMG LLP and a director of a number of companies, including as a member of the Audit (where he also serves as Chairman), Finance and Corporate Governance and Nominating Committees of Cadence Design Systems, and as a member of the Audit (where he also serves as Chairman) and Nominating and Corporate Governance Committees and Lead Independent Director of Coupa Software Incorporated, Mr. Siboni has significant operating experience, as well as financial, accounting and corporate governance experience.

Anjali Sudhas served as a director since May 2019. Ms. Sud currently serves as the Chief Executive Officer of Vimeo, Inc., a wholly-owned subsidiary of IAC/InterActiveCorp, and provider of cloud-based software tools that enable creative professionals, marketers and enterprises to stream, host, distribute and monetize videos online and across devices. Ms. Sud has held various positions at Vimeo since July 2014, before being promoted to CEO in July 2017. Prior to Vimeo, Ms. Sud served in various positions at Amazon.com, Inc. from 2010 to 2014, most recently as Director of Marketing. Ms. Sud holds a B.S. degree from the Wharton School at the University of Pennsylvania and an M.B.A. from Harvard Business School.

As the Chief Executive Officer of Vimeo, Ms. Sud brings extensive knowledge of the technology industry and operational experience to the boardroom, including an understanding of the operational, financial and strategic issues facing audio-visual content creators. In addition, through her prior role as Director of Marketing at Amazon, Ms. Sud brings valuable business and marketing insight and experience to our Board.

Avadis Tevanian, Jr.has served as a director since February 2009. Dr. Tevanian serves as a Managing Director of NextEquity Partners, a firm heco-founded in July 2015, and Elevation Partners, a firm he joined in

11

January 2010, making venture capital and private equity investments. Previously, Dr. Tevanian served as the Software Chief Technology Officer of Apple Inc. from 2003 to 2006. As Software CTO, Dr. Tevanian focused on setting the company-wide software technology direction for Apple. Prior to his tenure as Software CTO, Dr. Tevanian was Senior Vice President of Software at Apple, a role he took on when Apple acquired NeXT, Inc. in 1997. As Senior Vice President of Software, Dr. Tevanian led the software engineering team responsible for the creation of macOS and worked as part of Apple’s executive team. Before joining Apple, he was Vice President of Engineering at NeXT, Inc. and was responsible for managing NeXT’s engineering department. Dr. Tevanian started his professional career at Carnegie Mellon University, where he was a principal designer and engineer of the Mach operating system upon which Nextstep, and now macOS and iOS, are based. Dr. Tevanian is a former board member of Tellme Networks, Inc., an internet telecom company acquired by Microsoft. He holds a B.A. degree in mathematics from the University of Rochester and M.S. and Ph.D. degrees in computer science from Carnegie Mellon University.

With more than 30 years of operational and software expertise, including as Apple’s Chief Software Technology Officer, Dr. Tevanian brings to our Board extensive experience in consumer technology businesses and a deep understanding of the operational and strategic issues facing companies.

There are no family relationships among any of our directors and executive officers.

See “Corporate Governance Matters” and “Compensation of Directors” for additional information regarding our Board.

Our Board of Directors recommends a vote “FOR” the election of each of the nominees set forth above.

12

The following table provides information concerning the compensation paid by us to each of ournon-employee directors for fiscal 2019. Our CEO did not receive additional compensation for his service as a director, and his compensation as an employee is presented in the Fiscal 2019 Summary Compensation Table.

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($) | All Other Compensation ($) | Total ($) | |||||||||||||||

Micheline Chau | 73,000 | 259,340 | — | — | 332,340 | |||||||||||||||

David Dolby | 55,000 | 259,340 | — | — | 314,340 | |||||||||||||||

Peter Gotcher | 115,000 | 259,340 | — | — | 374,340 | |||||||||||||||

N. William Jasper, Jr. | 50,000 | 259,340 | — | — | 309,340 | |||||||||||||||

Simon Segars | 70,000 | 259,340 | — | — | 329,340 | |||||||||||||||

Roger Siboni | 90,000 | 259,340 | — | — | 349,340 | |||||||||||||||

Anjali Sud(3) | 18,950 | 162,054 | — | — | 181,004 | |||||||||||||||

Avadis Tevanian, Jr. | 92,000 | 259,340 | — | — | 351,340 | |||||||||||||||

| (1) | Consists of Board and committee annual retainers and, if applicable, Board chairman retainer and committee chairman retainers. |

| (2) | Stock Awards consist solely of restricted stock unit awards for shares of our Class A Common Stock. The amounts reported reflect the grant date fair value of each equity award computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation (“ASC Topic 718”), excluding estimated forfeitures. See Note 8 to our consolidated financial statements in our 2019 Annual Report on Form10-K for more information. The amounts reported do not reflect the compensation actually realized by thenon-employee directors. There can be no assurance that the restricted stock unit awards will vest (in which case no value will be realized by the individual) or that the value on vesting will approximate the compensation expense recognized by us. |

| (3) | Ms. Sud was appointed to the Board effective May 13, 2019. Her compensation reflects a partial year of service. |

In fiscal 2019, ournon-employee directors received the following restricted stock unit awards (which are also reflected in the above table):

Name | Grant Date | Approval Date | Number of Securities Subject to Restricted Stock Unit Awards | Grant Date Fair Value ($) | ||||||||||||

Micheline Chau | 02/05/2019 | 02/05/2019 | 3,996 | 259,340 | ||||||||||||

David Dolby | 02/05/2019 | 02/05/2019 | 3,996 | 259,340 | ||||||||||||

Peter Gotcher | 02/05/2019 | 02/05/2019 | 3,996 | 259,340 | ||||||||||||

N. William Jasper, Jr. | 02/05/2019 | 02/05/2019 | 3,996 | 259,340 | ||||||||||||

Simon Segars | 02/05/2019 | 02/05/2019 | 3,996 | 259,340 | ||||||||||||

Roger Siboni | 02/05/2019 | 02/05/2019 | 3,996 | 259,340 | ||||||||||||

Anjali Sud | 05/13/2019 | 05/13/2019 | 2,585 | 162,054 | ||||||||||||

Avadis Tevanian, Jr. | 02/05/2019 | 02/05/2019 | 3,996 | 259,340 | ||||||||||||

13

As of September 27, 2019, the aggregate number of shares of our Class A Common Stock subject to outstanding stock options and restricted stock unit awards held by each of ournon-employee directors is listed in the table below.

Name | Aggregate Number of Shares of Class A Common Stock Subject to Outstanding Stock Options at Sep. 27, 2019 | Aggregate Number of Shares of Class A Common Stock Subject to Outstanding Restricted Stock Unit Awards at Sep. 27, 2019 | ||||||||

Micheline Chau | — | 3,996 | ||||||||

David Dolby | 1,285 | 3,996 | ||||||||

Peter Gotcher | 13,857 | 3,996 | ||||||||

N. William Jasper, Jr. | — | 3,996 | ||||||||

Roger Siboni | — | 3,996 | ||||||||

Simon Segars | — | 3,996 | ||||||||

Anjali Sud | — | 2,585 | ||||||||

Avadis Tevanian, Jr. | — | 3,996 | ||||||||

StandardNon-Employee Director Compensation Arrangements

We use a combination of cash and equity compensation to attract and retain qualified candidates to serve on our Board. The Nominating and Governance Committee is responsible for conducting periodic reviews of ournon-employee director compensation and, if appropriate, recommending to our Board any changes in the type or amount of compensation.

Cash Compensation

During fiscal 2019, the annual cash retainers for serving as anon-employee director on our Board or committees of the Board were as follows:

Board/Committee | Member Annual Retainer | Chairman Annual Retainer (in Addition to Member Retainer) | ||||||||

Board | $50,000 | $50,000 | ||||||||

Audit | $13,000 | $17,000 | ||||||||

Compensation | $10,000 | $15,000 | ||||||||

Nominating and Governance | $ 7,000 | $ 8,000 | ||||||||

Technology Strategy | $ 5,000 | $ 5,000 | ||||||||

Members of the Stock Plan Committee receive no annual cash retainer for serving on this committee.

Equity Compensation

During fiscal 2019, a newly appointednon-employee director was eligible to receive an “initial” restricted stock unit award, and all incumbent/continuingnon-employee directors were eligible to receive an annual “subsequent” restricted stock unit award, in each case covering that number of shares of our Class A Common Stock as determined by dividing $250,000(pro-rated for complete months of service in the case of an initial restricted stock unit award) by the average closing price of our Class A Common Stock for the 30 trading days ending on (and including) the trading day immediately preceding the grant date, rounded down to the nearest whole share. Both initial and subsequent restricted stock unit awards vest in full on the day preceding the date of the next Annual Meeting of Stockholders following the grant date of the award (or if earlier, the first anniversary of the award’s grant date). All shares covered by initial or subsequent restricted stock unit awards will become fully vested immediately prior to a change in control of Dolby.

14

Director Compensation Review; Changes for Fiscal 2020

The Nominating and Governance Committee reviews ournon-employee director compensation on an annual basis, and if appropriate, recommends changes to our Board. In fiscal 2019, the Nominating and Governance Committee engaged Compensia, Inc., an independent executive compensation consulting firm, for purposes of advising on itsnon-employee director compensation review. The Nominating and Governance Committee provided Compensia with instructions regarding the goals of ournon-employee director compensation program. The committee also directed Compensia to evaluate our director compensation relative to director compensation at companies included in our compensation peer group that we use as a market check for our fiscal 2020 executive officer compensation. Following such review, the Nominating and Governance Committee recommended, and our Board subsequently approved, an increase in the annual retainer for serving as the Chairman of the Board, from $50,000 to $75,000, effective fiscal 2020, to better align with market compensation for serving in that role. The Nominating and Governance Committee otherwise concluded that no changes tonon-employee director compensation were advisable for fiscal 2020.

In addition to assisting the Nominating and Governance Committee on itsnon-employee director compensation review, Compensia has advised the Compensation Committee on executive officer compensation matters and has provided other services to Dolby in designing employee compensation programs. The Compensation Committee took into account the provision of these services and the compensation to Compensia for such services in determining that its relationship with Compensia and the work of Compensia on behalf of the Compensation Committee has not raised any conflict of interest, as described in “Compensation Discussion and Analysis—Roles of the Compensation Committee, Management and Compensation Consultant—Role of Compensation Consultant.”

Other Arrangements

We reimburse ournon-employee directors for reasonable travel, lodging, and related expenses in connection with attendance at our Board and committee meetings and company-related activities. Eligiblenon-employee directors may elect to participate in our company-wide healthcare program (which is a program that does not discriminate in scope, terms or operation, in favor of executive officers or directors), provided that they pay the premiums associated with their (and their eligible dependents’) healthcare coverage.

Non-Employee Director Stock Ownership Guidelines

Our Board has approved stock ownership guidelines for ournon-employee directors based on our belief that stock ownership further aligns the interests of ournon-employee directors with those of our stockholders. These guidelines provide that eachnon-employee director is expected to accumulate and hold an amount of qualifying Dolby equity securities equal to the lesser of (i) the value of five times his or her annual retainer for service on our Board or (ii) a fixed number of shares having a value equal to five times his or her annual retainer on September 22, 2015 (representing the date of the most recent amendment of the stock ownership guidelines). Compliance is measured as of the last day of each fiscal year. For purposes of ournon-employee director stock ownership guidelines, a director’s “annual retainer” excludes any retainer for serving as a member or as a chairman of any Board committees, or for serving as the Chairman of the Board. Directors have five years from the date they first become anon-employee director to achieve the requisite level of ownership.

As of the end of fiscal 2019, all of ournon-employee directors were in compliance with ournon-employee director stock ownership guidelines.

15

Board Meetings and Committees

Our Board held six meetings during fiscal 2019. Each of our directors attended at least 75% of the aggregate number of meetings held by our Board and the committees on which he or she served during fiscal 2019.

The standing committees of our Board consist of an Audit Committee, a Compensation Committee, a Nominating and Governance Committee, and a Stock Plan Committee, each of which has the composition and responsibilities described below. Our Board also has convened an ad hoc Technology Strategy Committee, which has the composition and responsibilities described below. Our Board may in the future convene additional ad hoc committees of our Board as it deems necessary or advisable.

Each of the committees of our Board described below acts pursuant to a written charter approved by our Board, each of which is available on the Corporate Governance section of the Investors page of our website athttp://investor.dolby.com/corporate-governance.

Thenon-employee members of our Board regularly meet in executive session without management present. In addition, the independent members of our Board also meet regularly in executive session. Peter Gotcher, our independent Chairman of the Board, serves as the Presiding Director of these executive sessions.

Audit Committee

The current members of the Audit Committee are Micheline Chau, Roger Siboni, and Simon Segars, each of whom is anon-employee member of our Board. No other members of our Board served on the Audit Committee during fiscal 2019. Mr. Siboni is the chairman of the Audit Committee. The Audit Committee held 11 meetings during fiscal 2019. Our Board has determined that each member of the Audit Committee meets the requirements for independence under the current requirements of the New York Stock Exchange (the “NYSE”) and the rules and regulations of the Securities and Exchange Commission (the “SEC”). Our Board also has determined that each member of the Audit Committee meets the requirements for financial literacy under the applicable rules and regulations of the NYSE and SEC, and is an “audit committee financial expert” as defined in SEC rules.

The Audit Committee has established a telephone and internet whistleblower hotline for the anonymous submission of suspected violations, including accounting, internal controls or auditing matters, harassment, fraud and policy violations.

The Audit Committee is responsible for, among other things:

| • | Monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| • | Selecting and hiring our independent auditors, and approving the audit and permissiblenon-audit services to be performed by them; |

| • | Evaluating the qualifications, performance and independence of our independent auditors; |

| • | Evaluating the performance of our internal audit function; |

| • | Reviewing the adequacy and effectiveness of our control policies and procedures; |

| • | Acting as our Qualified Legal Compliance Committee to review any report made known to the committee by attorneys employed or retained by Dolby or its subsidiaries of a material violation of U.S. federal or state securities or similar laws; |

| • | Reviewing, approving or ratifying related person transactions; |

16

| • | Attending to risk management matters; and |

| • | Preparing the Audit Committee report that the SEC requires in our annual report on Form10-K and in this Proxy Statement. |

Compensation Committee

The current members of the Compensation Committee are Micheline Chau, Roger Siboni and Avadis Tevanian, Jr., each of whom is anon-employee member of our Board. No other members of our Board served on the Compensation Committee during fiscal 2019. Mr. Tevanian is the chairman of the Compensation Committee. In fiscal 2019, the Compensation Committee held eight meetings and granted equity awards by written consent on one occasion. Our Board has determined that each member of the Compensation Committee meets the requirements for independence under current NYSE and SEC rules and regulations. The Compensation Committee is responsible for, among other things:

| • | Reviewing and approving corporate goals and objectives relevant to our CEO’s compensation and evaluating our CEO’s performance in light of those goals and objectives; |

| • | Reviewing and approving the following elements of compensation for our CEO and other executive officers: annual base salary; annual incentive compensation, including the specific performance goals and amounts; long-term incentive compensation; employment agreements; severance arrangements and change in control provisions; and any other significant benefits, compensation or arrangements that are not available to employees generally; |

| • | Administering Dolby’s broad-based equity incentive plans, including granting equity awards under such plans; |

| • | Evaluating and approving compensation plans, policies and programs for our CEO and other executive officers; |

| • | Attending to compensation-related risk management matters; |

| • | Overseeing our policy on the recovery (“clawback”) of incentive compensation and our executive stock ownership guidelines; |

| • | Retaining and assessing the independence of any Compensation Committee advisors; and |

| • | Reviewing the Compensation Discussion and Analysis, and preparing the Compensation Committee report, that the SEC requires in our annual report on Form10-K and in this Proxy Statement. |

Nominating and Governance Committee

The current members of the Nominating and Governance Committee are Peter Gotcher, Simon Segars, and Avadis Tevanian, Jr., each of whom is anon-employee member of our Board. No other members of our Board served on the Nominating and Governance Committee during fiscal 2019. Mr. Gotcher is the chairman of the Nominating and Governance Committee. The Nominating and Governance Committee held 12 meetings during fiscal 2019. Our Board has determined that each member of the Nominating and Governance Committee meets the requirements for independence under current NYSE and SEC rules and regulations. The Nominating and Governance Committee is responsible for, among other things:

| • | Assisting our Board in identifying and recommending director nominees; |

| • | Developing and recommending corporate governance principles; |

| • | Overseeing the evaluation of our Board, Board committees and individual directors; |

| • | Recommending Board committee assignments; |

| • | Making an annual report to our Board on succession planning for the position of CEO; |

17

| • | Attending to Board- and corporate governance-related risk management matters; and |

| • | Reviewing and making recommendations to our Board regarding director compensation. |

Stock Plan Committee

The current members of the Stock Plan Committee are Avadis Tevanian, Jr. and Kevin Yeaman. No other members of our Board served on the Stock Plan Committee during fiscal 2019. In fiscal 2019, the Stock Plan Committee held one meeting and granted equity awards by written consent on 12 occasions. The Stock Plan Committee has the authority to grant stock options, stock appreciation rights and restricted stock unit awards to newly hired employees and consultants who will not be executive officers or directors of Dolby on the date of grant, and to make performance, promotion or retention grants of equity awards to employees and consultants who are not executive officers or directors of Dolby on the date of grant. Equity awards granted by the Stock Plan Committee are subject to the terms and conditions of the Equity-Based Award Grant and Vesting Policy described in the Compensation Discussion and Analysis below.

Technology Strategy Committee

The current members of the Technology Strategy Committee are David Dolby and Avadis Tevanian, Jr. No other members of our Board served on the Technology Strategy Committee during fiscal 2019. Mr. Tevanian is the chairman of the Technology Strategy Committee. The Technology Strategy Committee held two meetings during fiscal 2019. The Technology Strategy Committee is responsible for exploring the opportunities and issues associated with Dolby’s technology strategies and intellectual property.

Board’s Role in Risk Oversight

Our Board is responsible for overseeing Dolby’s risk management structure. Management is responsible for establishing our business and operational strategies, identifying and assessing the related risks and implementing appropriate risk management practices on aday-to-day basis. Our Board reviews our business and operational strategies and management’s assessment of the related risk, and discusses with management the appropriate level of risk for the company. Our Board meets with management at least quarterly to review, advise and direct management with respect to strategic business risks, operational risks, legal risks and risks related to Dolby’s acquisition strategies, among others. Our Board also delegates oversight to Board committees to oversee selected elements of risk.

The Audit Committee oversees financial risk exposures, including monitoring our financial condition and investments, the integrity of our financial statements, accounting matters, internal control over financial reporting, the independence of Dolby’s independent registered public accounting firm, KPMG, plans regarding business continuity and cybersecurity, and guidelines and policies with respect to risk assessment and risk management. The Audit Committee receives periodic internal controls and related assessments from Dolby’s finance department and an annual attestation report on internal control over financial reporting from KPMG. The Audit Committee oversees Dolby’s annual enterprise business risk assessment, which is conducted by our Internal Audit Department. The annual enterprise business risk assessment reviews the primary risks facing the company and Dolby’s associated risk mitigation measures. In addition, the Audit Committee discusses other risk assessment and risk management policies of the company periodically with management.

The Compensation Committee oversees the design of executive compensation structures that create incentives that encourage behaviors and decisions consistent with our business strategy, including a review of an annual risk assessment with respect to our compensation programs and policies.

The Nominating and Governance Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership, structure and compensation, succession planning for our directors and executive officers and corporate governance policies.

18

Board Leadership Structure

Our Corporate Governance Guidelines provide that our Board does not have a policy regarding the separation of the offices of the Chairman of the Board and CEO and that our Board is free to choose the Chairman of the Board in any way that it deems best for the company at any given point in time. Our Board believes that these issues should be considered as part of our Board’s broader governance responsibilities.

Our Board has determined that having two different individuals serve in the roles of Chairman of the Board and CEO is in the best interest of the company’s stockholders at this time. Mr. Yeaman currently serves as our CEO and Mr. Gotcher currently serves as our independent Chairman of the Board. The CEO is responsible for the strategic direction,day-to-day leadership, and performance of the company, while the Chairman of the Board provides overall leadership to our Board. The Chairman of the Board also works with the CEO and General Counsel to prepare Board meeting agendas and chairs meetings of our Board. The leadership structure allows the CEO to focus on his operational responsibilities, while keeping a measure of independence between the oversight function of our Board and those operating decisions. Our Board believes that this leadership structure provides an appropriate allocation of roles and responsibilities at this time.

Board Independence

Our Board has determined that Mses. Chau and Sud, and Messrs. Gotcher, Jasper, Segars, Siboni and Dr. Tevanian do not have any material relationship with Dolby and are independent within the meaning of the standards established by the NYSE. In making this determination, our Board considered all relevant facts and circumstances known to us, including the director’s commercial, accounting, legal, banking, consulting, charitable and familial relationships. With respect to Mr. Jasper, our Board also specifically considered that Mr. Jasper retired as President and Chief Executive Officer of Dolby in March 2009 and has not held a management position with the company for more than ten years.

Succession Planning

As reflected in our Corporate Governance Guidelines, a key responsibility of our Board is to work with the Nominating and Governance Committee on succession planning for our CEO. As part of this process, our Board works with the Nominating and Governance Committee to identify potential successors to our CEO and the committee makes an annual report to our Board. Our Board also has adopted an emergency succession plan in the event of the death, disability, incapacity or unanticipated departure or leave of our CEO.

Policy for Director Recommendations

It is the policy of the Nominating and Governance Committee to consider recommendations for candidates to our Board from stockholders holding at least 250,000 shares of our Common Stock continuously for at least 12 months prior to the date of the submission of the recommendation.

A stockholder that wishes to recommend a candidate for election to our Board should send the recommendation by letter to Dolby Laboratories, Inc., 1275 Market Street, San Francisco, California 94103, Attn: General Counsel. The recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and Dolby, and evidence of the recommending stockholder’s ownership of Dolby Common Stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership, addressing issues of character, integrity, judgment, diversity of experience, diversity of perspective, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments, and personal references.

19

The committee will use the following procedures to identify and evaluate any individual recommended or offered for nomination to our Board:

| • | The committee will consider candidates recommended by stockholders in the same manner as candidates recommended to the committee from other sources; |

| • | In its evaluation of director candidates, including the members of our Board eligible forre-election, the committee will consider the following: (i) the current size and composition of our Board and the needs of our Board, and the respective committees of our Board; (ii) without assigning any particular weighting or priority to any of these factors, such factors as character, integrity, judgment, diversity of experience, diversity of perspective, independence, area of expertise, corporate experience, length of service, potential conflicts of interest and other commitments; and (iii) other factors that the committee may consider appropriate; |

| • | The committee requires the following minimum qualifications, which are the desired qualifications and characteristics for Board membership, to be satisfied by any nominee for a position on our Board: (i) the highest personal and professional ethics and integrity; (ii) proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment; (iii) skills that are complementary to those of the existing Board; (iv) the ability to assist and support management and make significant contributions to Dolby’s success; and (v) an understanding of the fiduciary responsibilities that are required of a member of our Board and the commitment of time and energy necessary to diligently carry out those responsibilities; |

| • | If the committee determines that an additional or replacement director is required, the committee may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, our Board or management; and |

| • | The committee may propose to our Board a candidate recommended or offered for nomination by a stockholder as a nominee for election to our Board. |

We do not maintain a separate policy regarding the diversity of our Board, but during the director nomination process, as described above, the Nominating and Governance Committee considers diversity of experience and diversity of perspective.

For stockholders who wish to nominate a candidate for election to our Board (as opposed to only recommending a candidate for consideration by the Nominating and Governance Committee as described above), see the procedures discussed in “Additional Meeting Matters” below.

Policies and Procedures for Communications toNon-Employee or Independent Directors

In cases where stockholders or interested parties wish to communicate directly with ournon-employee or independent directors, messages may be sent to our General Counsel, at generalcounsel@dolby.com, or to Dolby Laboratories, Inc., 1275 Market Street, San Francisco, California 94103, Attn: General Counsel. Our General Counsel monitors these communications and will provide a summary of all received messages to our Board at each regularly scheduled meeting of our Board, or if appropriate, solely to thenon-employee or independent directors at each regularly scheduled executive session ofnon-employee or independent directors. Where the nature of a communication warrants, our General Counsel may obtain the more immediate attention of the appropriate committee of our Board, ofnon-employee or independent directors, of independent advisors or of Dolby management, as our General Counsel considers appropriate. Our General Counsel may decide in the exercise of his judgment whether a response to any stockholder or interested party communication is necessary.

20

Attendance at Annual Meeting of Stockholders

We encourage our directors to attend our Annual Meetings of Stockholders, and all of the members of our Board then in office attended the 2019 Annual Meeting.

Code of Business Conduct and Ethics

Our Board has adopted a Code of Business Conduct and Ethics, which is applicable to all of our directors and our employees, including our principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions. The Code of Business Conduct and Ethics is available on the Corporate Governance section of the Investors page of our website athttp://investor.dolby.com/corporate-governance. We will post any amendments or waivers to the Code of Business Conduct and Ethics that are required to be disclosed by the rules of the SEC or NYSE on this website.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that contain the general framework for the governance of the company. Among other things, our Corporate Governance Guidelines address:

| • | The role of our Board; |

| • | The size and composition of our Board and its committees; |

| • | New director orientation and continuing education; |

| • | Board and committee authority to retain independent advisors; |

| • | Board meetings and process; |

| • | Board self-evaluation; |

| • | Evaluation of our CEO and succession planning; |

| • | Corporate business principles and policies applicable to our Board; and |

| • | Communications by Board members with outside constituencies. |

The Nominating and Governance Committee will periodically review the guidelines and report any recommended changes to our Board. The Corporate Governance Guidelines are available on the Corporate Governance section of the Investors page of our website athttp://investor.dolby.com/corporate-governance.

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee are Micheline Chau, Roger Siboni and Avadis Tevanian, Jr. None of the members of our Compensation Committee during the last fiscal year is or has been an officer or employee of our company or had any relationship requiring disclosure under Item 404 ofRegulation S-K under the Securities Act of 1933. None of our executive officers has served as a member of the board of directors or compensation committee (or other committee serving an equivalent function) of any entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Rule10b5-1 Trading Plans

Certain of our directors and executive officers have adopted, and in the future may adopt, written trading plans that meet the requirements of Rule10b5-1 of the Securities Exchange Act of 1934. Rule10b5-1 allows persons who may be considered insiders of an issuer to adoptpre-arranged written plans for trading specified amounts of stock. Rule10b5-1 trading plans establish predetermined trading parameters that, among other things, do not permit the person adopting the trading plan to exercise subsequent influence over how, when or whether to

21