This policy formalizes required provisions for the contents of any Rule 10b5-1 trading plan relating to stock of Dolby Laboratories, Inc. (along with its subsidiaries, the “Company”). [X] Global [ ] Geographic Geography covered: [ ] Functional Function: [ ] Departmental Department: Legal Rule 10b5-1 Trading Plan Requirements. The following are requirements applicable to any Rule 10b5-1 trading plan relating to stock of the Company (a “10b5-1 Plan”). The Insider Trading Compliance Officer will not approve a 10b5-1 Plan that does not comply with this policy. In addition, the Insider Trading Compliance Officer may impose additional criteria. i. 10b5-1 Plan Eligibility. Any director, executive officer, affiliate or employee of the Company may enter into a 10b5-1 Plan. ii. Approval by Company’s Insider Trading Compliance Officer. Each 10b5- 1 Plan, or amendment or modification thereto, used by a director, executive officer, affiliate or employee (each, an “Insider”) must be approved in writing or electronically by the Insider Trading Compliance Officer or his or her delegate. iii. Timing of Plan Adoption Date. Each 10b5-1 Plan used by an Insider must be adopted (a) during a trading window under the Company’s Insider Trading Policy and Guidelines With Respect to Certain Transactions in Company Securities (the “Insider Trading Policy”), (b) when the Insider does not otherwise possess material nonpublic information about the Company, and (c) and operated in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1. Any 10b5-1 Plan adopted by an Insider must have representations confirming that clauses (b) and (c) are satisfied at adoption.

iv. Timing of Plan Amendment or Modification Date. Each 10b5-1 Plan used by an Insider may be amended or modified only when the conditions to adoption set forth in Section IV.A(iii) are met. v. Effectiveness of Adoption or Amendment/Modification. Each 10b5-1 Plan adopted by an Insider may become effective immediately but no trading may occur under such 10b5-1 Plan until the later of: (a) 91 days after the adoption of such 10b5-1 Plan and (b) three business days following the disclosure of the Company’s financial results in a Form 10- Q or Form 10-K for the completed fiscal quarter in which the plan was adopted, provided trading may begin 121 days after adoption of such 10b5-1 plan (the applicable required period from adoption to when trades may begin, the “Cooling-Off Period”). In addition, any modification or change to the amount, price, or timing of the purchase or sale of the securities underlying a 10b5-1 Plan is considered a termination of the 10b5-1 Plan and the adoption of a new 10b5-1 Plan, so trading under any such amendment or modification of a 10b5-1 Plan may only begin after the lapsing of a new Cooling-Off Period. vi. Out of 10b5-1 Plan Trades. 10b5-1 Plans may allow for an Insider to trade in Company securities while the 10b5-1 Plan is in effect only so long as such trades (a) do not consist of the sale or other transfer of Company securities which may potentially transact under such 10b5-1 Plan (“Specified Securities”) and (b) are made during trading windows under the Insider Trading Policy, and otherwise in compliance with the Insider Trading Policy. vii. Relationships with Plan Broker; No Subsequent Influence. Each 10b5-1 Plan used by an Insider must provide that, to the extent such plan permits any discretion to a broker regarding the details (e.g., timing, share amounts, etc.) of trading, such Insider must not communicate any material nonpublic information about the Company to such broker, or attempt to influence how the broker exercises its discretion in any way. viii. No Hedging Positions. Each 10b5-1 Plan used by an Insider must prohibit extra-plan, corresponding hedging positions with respect to Company securities. ix. Mandatory Suspension. Each 10b5-1 Plan used by an Insider must provide for suspension of trades under such plan if legal, regulatory or contractual restrictions are imposed on the Insider, or other events occur, that would prohibit sales under such plan. x. Volume Restrictions. The Company may impose restrictions on whether Company securities may be sold and/or the number of shares of stock that may be sold during specified time periods under 10b5-1 Plans. xi. Compliance with Rule 144. Each 10b5-1 Plan used by an Insider must provide for specific procedures to comply with Rule 144 under the Securities Act of 1933, as amended, including the filing of Forms 144.

xii. Broker Obligation to Provide Notice of Trades. Each 10b5-1 Plan used by an Insider must provide that the broker will provide notice of any trades under the 10b5-1 Plan to the Insider and the Company in sufficient time to allow for the Insider to make timely filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (i.e., no later than the close of business, Eastern time, on the day of the trade). xiii. Insider Obligation to Make Exchange Act Filings. Each 10b5-1 Plan used by an Insider must contain an explicit acknowledgement by such Insider that all filings required by the Exchange Act, as a result of or in connection with trades under such plan are the sole obligation of such Insider. xiv. Pre-Clearance. Employees with active 10b5-1 Plans will be subject to Insider Trading Policy pre-clearance for non-10b5-1 Plan trades. xv. Term and Automatic Termination of Plan. Each 10b5-1 Plan must remain in effect for at least one year following its adoption and must automatically terminate within two years from the adoption date to avoid frequent amendments of such plan. Notwithstanding the foregoing, 10b5-1 Plans may be terminated pursuant to the termination provisions set forth in a Board approved 10b5-1 Plan template, provided that a person who terminates a 10b5-1 Plan prior to its expiration may not trade in the Specified Securities of such 10b5-1 Plan until 30 calendar days after termination, and then only in accordance with the Insider Trading Policy. i. The Company will publicly disclose the existence of a 10b5-1 Plan by a director, executive officer or affiliate covering 500,000 or more shares of common stock of the Company. ii. In determining whether shares covered under multiple 10b5-1 Plans should be aggregated for purposes of the foregoing 500,000 share threshold, the General Counsel will consider applicable beneficial ownership rules. iii. The Chief Executive Officer, Chief Financial Officer or General Counsel of the Company may choose the method of public disclosure, which may be by Periodic Report on Form 10-K or 10-Q, Proxy Statement, Current Report on Form 8-K, press release or conference call, or any combination of the foregoing. iv. Disclosure will be made prior to the effective date of the first trading order under the applicable 10b5-1 Plan. Subject to the foregoing, the Chief Executive Officer, Chief Financial Officer or General Counsel of the Company may determine the exact date the disclosure will be made. v. This policy does not prevent the Company from publicly disclosing the existence of a 10b5-1 Plan covering fewer than 500,000 shares of common stock so long as the disclosure is approved by the Chairman of the Audit Committee of the Board of Directors of the Company. No approval by the Chairman of the Audit Committee is required for the

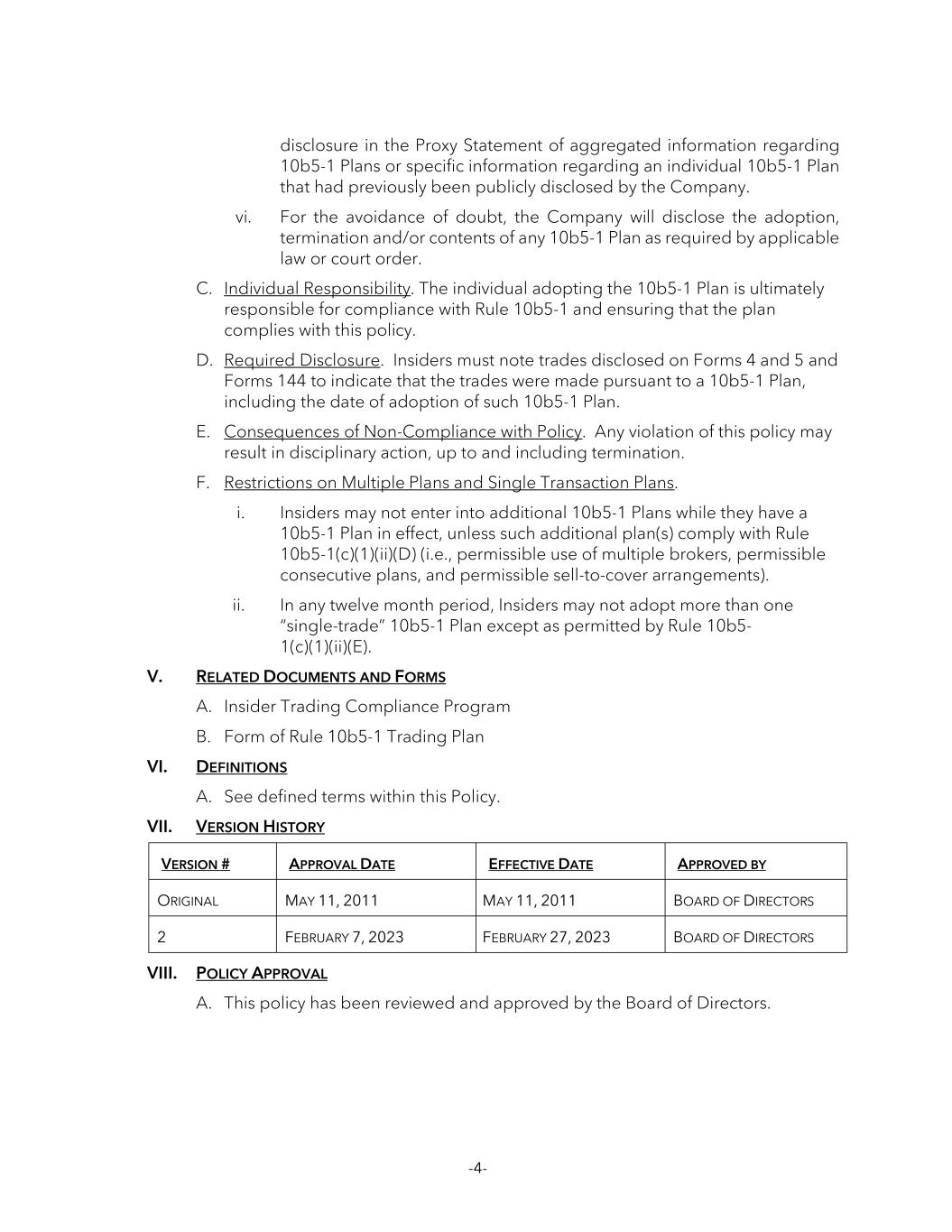

disclosure in the Proxy Statement of aggregated information regarding 10b5-1 Plans or specific information regarding an individual 10b5-1 Plan that had previously been publicly disclosed by the Company. vi. For the avoidance of doubt, the Company will disclose the adoption, termination and/or contents of any 10b5-1 Plan as required by applicable law or court order. C. Individual Responsibility. The individual adopting the 10b5-1 Plan is ultimately responsible for compliance with Rule 10b5-1 and ensuring that the plan complies with this policy. D. Required Disclosure. Insiders must note trades disclosed on Forms 4 and 5 and Forms 144 to indicate that the trades were made pursuant to a 10b5-1 Plan, including the date of adoption of such 10b5-1 Plan. E. Consequences of Non-Compliance with Policy. Any violation of this policy may result in disciplinary action, up to and including termination. F. Restrictions on Multiple Plans and Single Transaction Plans. i. Insiders may not enter into additional 10b5-1 Plans while they have a 10b5-1 Plan in effect, unless such additional plan(s) comply with Rule 10b5-1(c)(1)(ii)(D) (i.e., permissible use of multiple brokers, permissible consecutive plans, and permissible sell-to-cover arrangements). ii. In any twelve month period, Insiders may not adopt more than one “single-trade” 10b5-1 Plan except as permitted by Rule 10b5- 1(c)(1)(ii)(E). A. Insider Trading Compliance Program B. Form of Rule 10b5-1 Trading Plan A. See defined terms within this Policy. A. This policy has been reviewed and approved by the Board of Directors.