UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

Universal Capital Management, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

N/A

2) Form, Schedule, or Registration Statement No.:

N/A

3) Filing party:

N/A

4) Date filed:

N/A

Universal Capital Management, Inc.

2601 Annand Drive

Suite 16

Wilmington, DE 19808

Notice of Annual Meeting of Stockholders

To Be Held on September 19, 2006

To the Stockholders:

Notice is hereby given that the Annual Meeting of Stockholders of Universal Capital Management, Inc. will be held on Tuesday, September 19, 2006, commencing at 9:00 a.m. local time, at 2601 Annand Drive, Suite 16, Wilmington, Delaware 19808 (telephone: 302-998-8824).

The 2006 Annual Meeting of Stockholders of Universal Capital Management, Inc. will be held for the following purposes:

1. To elect five directors to serve until the next Annual Meeting of Stockholders following their election and until their successors have been duly elected and qualified, or until the director’s earlier death, resignation or removal;

2. To consider and ratify the Audit and Compliance Committee’s appointment of Morison Cogen LLP as the Company’s independent registered public accountants for the fiscal year ending April 30, 2007; and

3. To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

Only stockholders of record at the close of business on July 31, 2006, the record date, will be entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof.

Information concerning the matters to be acted upon at the Annual Meeting is set forth in the accompanying Proxy Statement.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, we urge you to mark, sign and return the enclosed proxy card as promptly as possible in the postage prepaid envelope enclosed for that purpose. Any stockholder attending the Annual Meeting may vote in person even if he or she returned a proxy.

| | | Sincerely, |

| | |

|

|

|

| | William Colucci |

| | Secretary |

| | |

Wilmington, Delaware

August 25, 2006

UNIVERSAL CAPITAL MANAGEMENT, INC.

PROXY STATEMENT

Annual Meeting of Stockholders

September 19, 2006

SOLICITATION OF PROXIES, REVOCABILITY AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of Universal Capital Management, Inc., a Delaware corporation (the “Company”), for use at the Annual Meeting of Stockholders or any postponement or adjournment thereof (the “Meeting”). The Meeting is scheduled to be held on Tuesday, September 19, 2006, commencing at 9:00 a.m. local time, at 2601 Annand Drive, Suite 16, Wilmington, Delaware 19808. This Proxy Statement and the accompanying proxy card are first being mailed to stockholders on or about August 25, 2006.

Outstanding Shares and Voting Rights

The Board of Directors of the Company (the “Board of Directors”) has set the close of business on July 31, 2006 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Meeting. On the Record Date, there were 5,437,524 shares of the Company’s common stock (“Common Stock”) outstanding. These securities constitute the only class of securities entitled to vote at the Meeting.

The holder of each share of Common Stock outstanding on the Record Date is entitled to one vote on each matter to be considered.

Quorum and Voting

The presence at the Meeting, in person or by proxy, of the holders of shares representing a majority of the outstanding shares of Common Stock is necessary to constitute a quorum for the transaction of business.

Required Vote for Directors

The election of directors will be determined by a plurality vote. Because directors are elected by a plurality of the votes cast, withholding authority to vote with respect to one or more nominees likely will have no effect on the outcome of the election, although shares for which authority is withheld would be counted as present for purposes of determining the existence of a quorum.

Similarly, any “broker non-votes” (i.e., shares of Common Stock held by a broker or nominee which are represented at the Meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) are not considered to be votes cast and therefore, would have no effect on the outcome of the election of directors, although they would be counted as present for purposes of determining the existence of a quorum.

Required Vote for Other Proposals

Proposal No. 2 requires the approval of a majority of the votes represented by the shares of stock present and entitled to vote thereon. Therefore, abstentions will have the same effect as votes against such proposal. Broker non-votes will be treated as shares not entitled to vote and will not be included in the calculation of the number of votes represented by shares present and entitled to vote.

Revocability of Proxies

Any person giving a proxy in the form accompanying this Proxy Statement has the power to revoke it at any time before its exercise. A proxy may be revoked by filing with the Secretary of the Company or by the presentation at the Meeting of an instrument of revocation or a duly executed proxy bearing a later date. A proxy may also be revoked by attendance at the Meeting and the casting of a written ballot in person. Unless so revoked, the shares represented by proxies will be voted at the Meeting in accordance with the instructions on the proxy card or, as to any matter as to which no instructions are given, FOR the election of the proposed nominees and FOR the other proposal.

Stockholder Proposals

If a stockholder wishes to submit a proposal to be included in the proxy materials for the 2007 Annual Meeting of Stockholders, the Company must receive such proposal by May 22, 2007. Stockholder proposals to be presented at the 2007 Annual Meeting of Stockholders, but not included in the related proxy material, must be received no later than August 5, 2007. The Company is not required to include stockholder proposals in the proxy materials relating to the 2007 Annual Meeting of Stockholders if such proposal does not meet all of the requirements for inclusion established by the Securities and Exchange Commission (the “SEC”) and the Company By-laws in effect at that time.

Solicitation

The Company will bear the entire cost of preparing, assembling, printing and mailing this Proxy Statement, the accompanying proxy card, and any additional material which may be furnished to stockholders by the Company. The Company’s solicitation of proxies will be made by the use of the mails and through direct communication with certain stockholders or their representatives by officers, directors and employees of the Company, who will receive no additional compensation therefor.

SECURITY OWNERSHIP

The following table sets forth information concerning the shares of our common stock that are beneficially owned by each of our directors and executive officers, by all of our directors and executive officers as a group, and by each person who owns 5% or more of our outstanding common stock based on filings made by such persons with the SEC. Unless otherwise indicated, the amounts are based on the number of Company shares held by such persons as of July 31, 2006. The address of each person in the table where no other address is specified is c/o Universal Capital Management, Inc., 2601 Annand Drive, Suite 16, Wilmington, DE 19808.

Beneficial Owner | | Beneficial Number of Shares | | Ownership Percent of Total (1) (2) | |

| | | | | | |

| Michael D. Queen | | | 0 | (3) | | * | |

| William R. Colucci | | | 300,000 | (4) | | 5.47 | % |

| Joseph Drennan | | | 400,000 | | | 7.36 | % |

| Jeff Muchow | | | 100,000 | | | 1.84 | % |

| Steven P. Pruitt, Jr. | | | 100,000 | | | 1.84 | % |

| Thomas M. Pickard, Sr. | | | 50,000 | | | * | |

David Bovi 319 Clematis Street Suite 700 West Palm Beach, FL 33401 | | | 500,000 | (5) | | 9.20 | % |

L&B Partnership 3128 New Castle Avenue New Castle, DE 19720 | | | 300,000 | | | 5.52 | % |

McCrae Associates LLC 196 Fern Avenue Litchfield, CT 06759 | | | 300,000 | | | 5.52 | % |

Zenith Holdings Inc. 3100 Old Limestone Road Wilmington, Delaware 19808 | | | 300,000 | | | 5.52 | % |

| | | | | | | | |

| All executive officers and directors as a group (6 persons) | | | 950,000 | (3)(4) | | 17.31 | % |

* Less than one percent

| (1) | This table is based on information supplied by officers, directors and principal stockholders of the Company and on any Schedules 13D or 13G filed with the SEC. On that basis, the Company believes that each of the stockholders named in this table has sole voting and dispositive power with respect to the shares indicated as beneficially owned except as otherwise indicated in the footnotes to this table. |

| (2) | Applicable percentages are based on 5,437,524 shares outstanding on July 31, 2006, adjusted as required by rules promulgated by the SEC. |

| (3) | Excludes 350,000 shares owned indirectly by Mr. Queen’s wife (of which 300,000 shares are owned by Zenith Holdings Inc.) as to which he disclaims beneficial ownership. |

| (4) | Includes options to purchase 50,000 shares of the Company at an exercise price of $2.00 per share which are exercisable by Mr. Colucci within 60 days. |

| (5) | On June 15, 2006 Mr. Bovi purchased 400,000 shares of Company common stock at a price of $2.00 per share. The purchase price was paid by delivery of a promissory note in the amount of $800,000 calling for monthly payments of principal and interest over twelve months. |

The value of the equity securities of the Company beneficially owned by each director is as follows:

Name of Director | | Dollar Range of Equity Securities in the Fund (1) | | Aggregate Dollar Range of Equity Securities in all Funds Overseen or to be Overseen by Director in Family of Investment Companies (1) | |

| Michael D. Queen | | $ | 0 | | $ | 0 | |

| Joseph Drennan | | $ | 1,600,000 | | $ | 1,600,000 | |

| Jeff Muchow | | $ | 400,000 | | $ | 400,000 | |

| Steven P. Pruitt, Jr. | | $ | 400,000 | | $ | 400,000 | |

| Thomas M. Pickard, Sr. | | $ | 200,000 | | $ | 200,000 | |

(1) At July 31, 2006

None of the directors bought or sold securities in the Company, or any of its portfolio companies, since May 1, 2005. In addition, Messrs. Muchow, Pruitt, and Pickard, who are not “interested persons” within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended, do not own any securities beneficially or of record in (i) an investment adviser, principal underwriter or sponsoring insurance company of the Company or (ii) a person directly or indirectly controlling, controlled by, or under common control with an investment adviser, principal underwriter, or sponsoring insurance company of the Company.

PROPOSAL 1

(Item 1 on Proxy Card)

Nominees

The directors will be elected at the Meeting to serve until the next annual meeting of stockholders following their election and until their respective successors have been duly elected and qualified, or until the director’s earlier death, resignation, or removal. Directors will be elected by a plurality of the votes properly cast in person or by proxy. If so authorized, the persons named in the accompanying proxy card will vote the shares represented by the accompanying proxy card for the election of each nominee named in this Proxy Statement. Stockholders who do not wish their shares to be voted for a particular nominee may so indicate in the space provided on the proxy card. If any nominee becomes unable or unwilling to serve at the time of the Meeting, which is not anticipated, the Board of Directors, at its discretion, may designate a substitute nominee or nominees, in which event the shares represented by the accompanying proxy card will be voted for such substituted nominee or nominees. All of the nominees for election currently serve as directors, and have consented to continue to serve if elected.

The following table sets forth information as of August 1, 2006 with respect to the nominees who are interested persons because of their positions with the Company:

Name of Nominee or Director | | Age | | Principal Occupation | | Director Since |

| Michael D. Queen | | 50 | | President and Director | | 2004 |

| Joseph Drennan | | 61 | | Vice-President, Chief Financial Officer and Director | | 2004 |

The following table sets forth information as of August 1, 2006 with respect to the nominees who are not interested persons:

Name of Nominee or Director | | Age | | Principal Occupation | | Director Since |

| Jeffrey Muchow | | 60 | | Director | | 2004 |

| Steven P. Pruitt, Jr. | | 31 | | Director | | 2004 |

| Thomas M. Pickard, Sr. | | 68 | | Director | | 2004 |

The following description contains certain information concerning the nominees, including current positions and principal occupations during the past five years.

Michael D. Queen. Mr. Queen has been the President and a director of the Company since 2004. Between 2003 and 2004, Mr. Queen and Mrs. Queen owned and operated Dickenson Holdings, LLC, a firm providing consulting services to small businesses. Mr. Queen served as President and a director of Pennexx Foods, Inc., a food processing company, from 1999 to 2003. From 1997 to 1999, Mr. Queen was the Vice President of Sales, Marketing, and Business Analysis at Prizm Marketing Consultants of Blue Bell, Pennsylvania. Prizm Marketing provided market research, pricing modules and distribution and advertising plans for business clients. From 1995 to 1997, Mr. Queen served as the President of Ocean King Enterprises, Inc., in Folcroft, Pennsylvania. Ocean King was a specialty seafood appetizer supplier to supermarkets.

Joseph Drennan. Mr. Drennan has more than 30 years of experience in management, marketing and finance in the financial services and information technology industries and has served as Vice President, Chief Financial Officer and a director of the Company since 2004. He has directed and implemented business turnarounds, crisis management and strategic planning for customers and clients ranging in size from $5 million in revenue to Fortune 100 companies in a variety of industries. From 2001 to 2004, Mr. Drennan was a partner in and a co-founder of Mulberry Consulting Group, LLC. Mulberry provided business and management consulting services to small and mid-market companies in a variety of industries with emphasis on operational analysis, strategic and operational planning and implementation solutions and processes. From 1996 to 2000, Mr. Drennan served as Vice President and corporate secretary for CoreTech Consulting Group, Inc., a leading Information Technology consulting firm. His responsibilities included planning, marketing, finance, legal and facilities management. Mr. Drennan currently serves on the Board of Directors of United Bank of Philadelphia and serves on its Audit and Capital and Planning Committees. He is a past Chairman of the Board of St. Joseph’s Prep, the Jesuit high school in Philadelphia.

Jeffrey Muchow. Mr. Muchow is a veteran of the food and agricultural processing industries and has served as a director of the Company since 2004. Since 2001, he has served as an independent consultant in business startups, mergers and turnaround situations for food processing enterprises. From 2000 to 2001, he served as President of Vertia, Inc., a supply chain company engaged in supply chain services for perishable food companies, and from 1999 to 2000, he served as Vice President - - Business Development of Working Machines, Inc.

Steven P. Pruitt, Jr. A certified public accountant, Mr. Pruitt has been DuPont’s Internal Control Coordinator since 2004 and, in this capacity, is responsible for implementing Sarbanes-Oxley compliance procedures on a global basis. He has served as a director of the Company since 2004. Mr. Pruitt also assists in the development and implementation of critical internal controls and business processes throughout the Company. From 2000 to 2001, Mr. Pruitt served as Audit Control Consultant for DuPont Mexico. From 2001 to 2002, he served as Senior Auditor for DuPont USA. As a Senior Auditor for DuPont, he helped to lead and train business teams on assessing and improving their business models. As the Audit Control Consultant, he focused on educating DuPont’s joint ventures and subsidiaries on better business practices. He holds a MBA from The University of North Carolina Kenan-Flagler Business School, which he attended from 2002 to 2004, and a BS in Accounting Degree from the University of Delaware.

Thomas M. Pickard, Sr. Mr. Pickard is the founder and owner of Alpha Equipment Company. Established in August 2003, Alpha Equipment Company is a distributor for CO2 Blasting Machines. Alpha Equipment Company developed an air operated chiller/dryer for cooling and removing moisture from compressor air lines for which there is a patent pending. From 1995 to 2003, Mr. Pickard served in various sales capacities for Alpheus Cleaning Technologies of Rancho Cucamonga, CA, which is a industrial service company.

The Board of Directors recommends a vote FOR each nominee listed in Proposal 1.

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

(Item 2 on Proxy Card)

The Audit Committee has appointed Morison Cogen LLP as the Company’s independent registered public accountants for the Company’s 2007 fiscal year, and has recommended that the stockholders vote for ratification of such appointment. A representative of Morison Cogen LLP is expected to be present at the Annual Meeting and will have the opportunity to make a statement if desired and is expected to be available to respond to appropriate questions.

Neither the Company’s By-laws nor other governing documents or law require stockholder ratification of the appointment of Morison Cogen LLP as the Company’s independent registered public accountants. However, the Audit Committee is submitting the appointment of Morison Cogen LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the appointment, the Audit Committee will reconsider whether to retain such firm. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of different independent public accountants at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the majority of the votes represented by the holders of shares present in person or represented by proxy and entitled to vote at the Meeting will be required to ratify the appointment of Morison Cogen LLP.

The Board of Directors recommends a vote FOR Proposal 2.

Independence of the Board of Directors

After review of all relevant information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and its senior management and independent auditors, the Board of Directors has determined affirmatively that Steven P. Pruit, Jr., Jeffrey Muchow and Thomas M. Pickard, Sr. are independent directors within the meaning of the rules promulgated by the Securities and Exchange Commission (and not “interested persons” within the meaning of the Investment Company Act of 1940).

Code of Ethics

The Company has adopted a Code of Ethics that also applies to its principal executive officer and principal financial officer. The text of the Code of Ethics is available on the Company’s website at http://www.unicapman.com.

Meetings of the Board of Directors and Committees

Directors do not receive compensation for their services as directors.

The Board of Directors held 3 meetings during fiscal year 2006. All Company directors are expected regularly to attend Board and committee meetings and stockholder meetings and to spend the time needed, and meet as frequently as necessary, to discharge their responsibilities properly. During fiscal year 2006, each member of the Board of Directors attended at least 75% in the aggregate of the number of meetings of the Board of Directors and Committees of the Board of Directors on which he served, held during the period for which he was a director or committee member, respectively.

The sole standing committee of the Board is the Audit and Compliance Committee. The members of this committee are appointed by the Board. The independent directors approve the compensation of the executive officers.

The Board does not feel it is necessary to have a Nominating Committee because the Company does not anticipate the need to locate new board members on any repeated basis. Accordingly, at the present time, the Board also will not accept director nominations from stockholders.

Audit and Compliance Committee

The Audit and Compliance Committee (the “Audit Committee”) is currently comprised of Steven P. Pruit, Jr. (Chair), Jeffrey Muchow and Thomas M. Pickard, Sr. Each of the members of the Audit Committee is independent as currently defined under Item 7(d)(3)(iv) of Schedule 14A of the Securities Exchange Act of 1934, as amended and no such member is an “interested person” of the Company within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended.

The Audit Committee is responsible for overseeing the adequacy of corporate accounting, financial and operating controls, and the engagement of the Company’s independent auditors. The Audit Committee meets with the Company’s independent auditors to review the services rendered by them to the Company.

The Board has determined that Steven P. Pruitt, Jr. is an Audit Committee Financial Expert, as defined by the SEC rules.

During the 2006 fiscal year, the Audit Committee held 4 meetings.

Audit and Related Fees

Morison Cogen LLP has been the independent accounting firm and has audited the financial statements of the Company since August 16, 2004 (inception).

The following table shows the aggregate fees billed to the Company by Morison Cogen LLP for professional services rendered during August 16, 2004 (inception) through April 30, 2005 and during the fiscal year ended April 30, 2006:

| | | Amount ($) | |

Description of Fees | | August 16, 2004 (inception) - April 30, 2005 | | May 1, 2005 - April 30, 2006 | |

| Audit Fees | | $ | 11,500 | | $ | 32,100 | |

| Audit-Related Fees | | $ | 0 | | $ | 0 | |

| Tax Fees | | $ | 0 | | $ | 1,500 | |

| All Other Fees | | $ | 0 | | $ | 0 | |

| Total | | $ | 11,500 | | $ | 33,600 | |

Audit Fees

Represents fees for professional services provided for the audit of the Company’s annual financial statements and review of the Company’s financial statements included in the Company’s quarterly reports.

Tax Fees

Represents fees related to tax audit and other tax advisory services, tax compliance and tax return preparation.

The Audit Committee pre-approves all work done by its outside auditors.

Executive Officers of the Company

The following table lists the names, ages and positions held by all executive officers of the Company as of August 1, 2006:

| Name | | Age | | Position |

| Michael D. Queen | | 50 | | President and Director |

| William R. Colucci | | 67 | | Vice-President and Secretary |

| Joseph Drennan | | 61 | | Vice-President, Chief Financial Officer, Treasurer and Director |

The following description contains certain information concerning Mr. Colucci; information about Messrs. Queen and Drennan, is found beginning on page 6.

William R. Colucci. Mr. Colucci has been the Vice President and Secretary of the Company since 2004. He has, since 1999, served as an independent consultant who provides investment banking and business consulting services for emerging growth companies. From September 1997 to December 1999, Mr. Colucci served as a consultant with Harbor Town Management Group Inc., a privately held management firm that provided investment banking and business consulting services. From June 1996 to May 1997, Mr. Colucci served as Chief Operating Officer and SEC Compliance Officer for Physicians’ Laser Services, Inc. From April 1991 to May 1996, he served as a senior partner of Decision Dynamics, Inc., a private business and real estate consulting firm, where he provided clients such as Alcoa Properties, the Branigar Corporation, and Mobil Land Development Corporation with consulting services that included market and investment analysis, property positioning and economic payback analysis.

The following table sets forth information concerning the compensation received by the executive officers of the Company:

| | | | | | | Long-Term Compensation | | | |

| | | Annual Compensation | | Awards Payouts | | | |

Name and Principal Position | | Fiscal Year | | Salary ($) | | Bonus ($) | | Restricted Stock Awards ($) | | Securities Underlying Options (#) | | LTIP Payouts ($) | | All Other Compensation ($) | |

| Michael D. Queen | | | 2006 | | $ | 175,000 | | | — | | | — | | | — | | | — | | | — | |

| President | | | 2005 | (1) | $ | 80,769 | | | | | | | | | | | | | | | | |

| William R. Colucci | | | 2006 | | $ | 125,000 | | | — | | | — | | | — | | | — | | | — | |

Vice President and Secretary | | | 2005 | (1) | $ | 57,692 | | | | | | | | | | | | | | | | |

| Joseph T. Drennan | | | 2006 | | $ | 125,000 | | | — | | | — | | | — | | | — | | | — | |

| Chief Financial Officer | | | 2005 | (1) | $ | 57,692 | | | | | | | | | | | | | | | | |

| and Vice President | | | | | | | | | | | | | | | | | | | | | | |

(1) The 2005 fiscal year represents the period from August 16, 2004 (inception) to April 30, 2005 and the amounts paid reflect annual salaries of $175,000 for Mr. Queen and $125,000 for Messrs. Colucci and Drennan which first became payable as of November 15, 2004.

Other than the 2006 Equity Compensation Plan the Company does not currently have any stock option, pension plan, long-term incentive plan, or other compensation plan.

The Company has not entered into any employment agreements with any of its officers or directors. Directors are not currently compensated for their services as directors.

COMPENSATION TABLE

Name of Person, Position | | Aggregate Compensation From Fund | | Pension or Retirement Benefits Accrued as Part of Fund Expenses | | Estimated Annual Benefits Upon Retirement | | Total Compensation From Fund and Fund Complex Paid to Directors | |

Michael D. Queen, President & Director | | $ | 175,000 | | $ | 0 | | $ | 0 | | $ | 0 | |

William R. Colucci, Vice President & Secretary | | $ | 125,000 | | $ | 0 | | $ | 0 | | $ | 0 | |

Joseph T. Drennan, Chief Financial Officer, Vice President & Director | | $ | 125,000 | | $ | 0 | | $ | 0 | | $ | 0 | |

Jeffrey Muchow, Director | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

Steven P. Pruitt, Jr., Director | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

Thomas M. Pickard, Sr., Director | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

Equity Compensation Plan Information

The following table summarizes information regarding securities authorized for issuance under the Company’s equity compensation plans as of April 30, 2006:

Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| | | (a) | | (b) | | (c) | |

| Equity compensation plans approved by security holders | | | 0 | | | 0 | | | 0 | |

| Equity compensation plans not approved by security holders | | | 0 | | | 0 | | | 0 | |

| Total: | | | 0 | | | 0 | | | 0 | |

The 2006 Equity Incentive Plan (the “Plan”) had not yet been adopted by the Board of the Company and the stockholders on April 30, 2006. The Plan was approved by the stockholders on May 8, 2006. As of July 31, 2006, 585,000 options had been granted and the number of options still available for issuance under the Plan was 1,415,000.

REPORT OF THE COMPENSATION COMMITTEE

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

Base Salary: Base salaries for executives, including the President, are set according to the responsibilities of the position, the specific skills and experience of the individual, the individual’s performance and the competitive market for executive talent. Market data is gathered from salary surveys of comparable companies operating in the same and similar industries. The independent directors review salaries annually and adjust them as appropriate to reflect changes in market conditions and individual performance and responsibilities. In addition, the independent directors who are responsible for reviewing compensation for senior executives considered that the senior executives were not compensated during the start-up phase of the Company, the short-term and long-term business objectives of the Company and the continued positive performance of the Company in setting the compensation levels of the senior executives.

The independent directors intend on reviewing the possibility of implementing certain life and health insurance plans during the upcoming fiscal year.

The compensation of the President in fiscal year 2006 was determined in a manner substantially consistent with that of other executive officers, taking into account the independent directors’ evaluation of the Company’s need to attract, motivate and retain a highly qualified President.

The Independent Directors who fulfill the function of approving executive compensation are:

Steven P. Pruitt, Jr

Jeffrey Muchow

Thomas M. Pickard, Sr.

REPORT OF THE AUDIT AND COMPLIANCE COMMITTEE

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

Membership and Role of the Audit and Compliance Committee

In fiscal 2006, the Audit and Compliance Committee was comprised of three outside directors, Messrs. Steven P. Pruitt, Jr., Jeffrey Muchow and Thomas M. Pickard, Sr., appointed by the Board of Directors. The Audit and Compliance Committee is governed by a written charter adopted and approved by the Board of Directors. The Audit and Compliance Committee will review its charter annually.

Review of the Company’s Audited Financial Statements for the 2006 Fiscal Year

The Audit and Compliance Committee has reviewed and discussed the audited financial statements of the Company for the 2006 fiscal year with the Company’s management. The Audit and Compliance Committee has discussed with Morison Cogen LLP, the Company’s independent registered public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards).

The Audit and Compliance Committee has also received the written disclosures and the letter from Morison Cogan LLP relating to its independence as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and the Audit and Compliance Committee has discussed with Morison Cogen LLP the independence of that firm.

Based on the Audit and Compliance Committee’s reviews and discussions noted above, the Audit and Compliance Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the 2006 fiscal year, for filing with the SEC.

| | | |

| | AUDIT AND COMPLIANCE COMMITTEE Mr. Jeffrey Muchow Mr. Thomas M. Pickard, Sr. |

STOCK PERFORMANCE

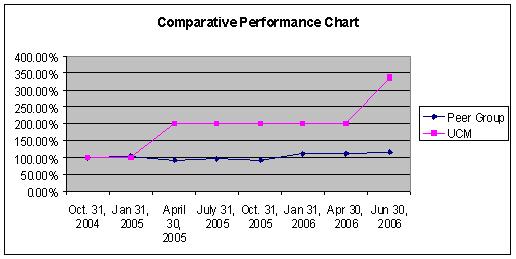

The Company’s performance peer group is composed of Utek Corporation, Harris and Harris Group, Inc. and Safeguard Scientifics, Inc. which are other public “venture capital” firms that invest in similar kinds of early stage and growth stage companies. Utek and Harris and Harris are regulated as business development companies as is the Company. Performance is measured from October 31, 2004, the Company’s first reporting period, to June 30, 2006.

COMPLIANCE WITH SECTION 16(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers and directors, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required during the period from May 1, 2005 through April 30, 2006, its officers, directors and ten percent stockholders complied with all applicable Section 16(a) filing requirements.

RELATIONSHIPS AMONG DIRECTORS OR EXECUTIVE OFFICERS

To the knowledge of the Company, there are no family relationships among any of the current directors or executive officers of the Company.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

To the knowledge of the Company, no interlocking relationship exists between any member of the Company’s Board of Directors in its capacity as Compensation Committee and any other member of the board of directors or compensation committee of any other companies, nor has such interlocking relationship existed in the past.

COMMUNICATIONS FROM STOCKHOLDERS TO THE BOARD OF DIRECTORS

The Board of Directors has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Stockholders who wish to communicate with the Board of Directors may do so by sending a written communication addressed to the Company’s Corporate Secretary at Universal Capital Management, Inc., 2601 Annand Drive, Suite 16, Wilmington, Delaware 19808. All such communications will be compiled by the Corporate Secretary and submitted to the Board of Directors or the individual director so designated on a periodic basis. The Board of Directors has instructed the Corporate Secretary, prior to forwarding any correspondence, to review such correspondence and, in his discretion, not to forward items if they are deemed of a commercial, irrelevant or frivolous nature or otherwise inappropriate for consideration by the Board of Directors. These screening procedures are designed to assist the Board of Directors in reviewing and responding to stockholder communications in an appropriate manner, and have been approved by a majority of the independent directors of the Board of Directors. All communications directed to the Audit Committee in accordance with the procedures set forth in this paragraph that relate to questionable accounting or auditing matters involving the Company will be forwarded promptly and directly to the Chairman (or another member) of the Audit Committee.

GENERAL INFORMATION

Stockholders who wish to obtain, free of charge, a copy of the Company’s Annual Report on Form 10-K for the 2006 fiscal year, as filed with the SEC, may do so by writing or calling William Colucci, Secretary, Universal Capital Management, Inc., 2601 Annand Drive, Suite 16, Wilmington, Delaware 19808 (telephone: 302-998-8824).

With regard to the delivery of annual reports and proxy statements, under certain circumstances the SEC permits a single set of such documents to be sent to any household at which two or more stockholders reside if they appear to be members of the same family. Each stockholder, however, still receives a separate proxy card. This procedure, known as “householding,” reduces the amount of duplicative information received at a household and reduces mailing and printing costs as well.

If one set of these documents was sent to your household for the use of all Company stockholders in your household, and one or more of you would prefer to receive your own set, please contact the Company at the address or telephone number set forth above.

In addition, (i) if any stockholder who previously consented to householding desires to receive a separate copy of the proxy statement or annual report for each stockholder at his or her address or (ii) if any stockholder shares an address with another stockholder and both stockholders of such address desire to receive only a single copy of the proxy statement or annual report, then such stockholder should contact the Company at the address or telephone number set forth above.