Supplemental Investor Presentation MAY 2023 Q1 2023 Exhibit 99.2

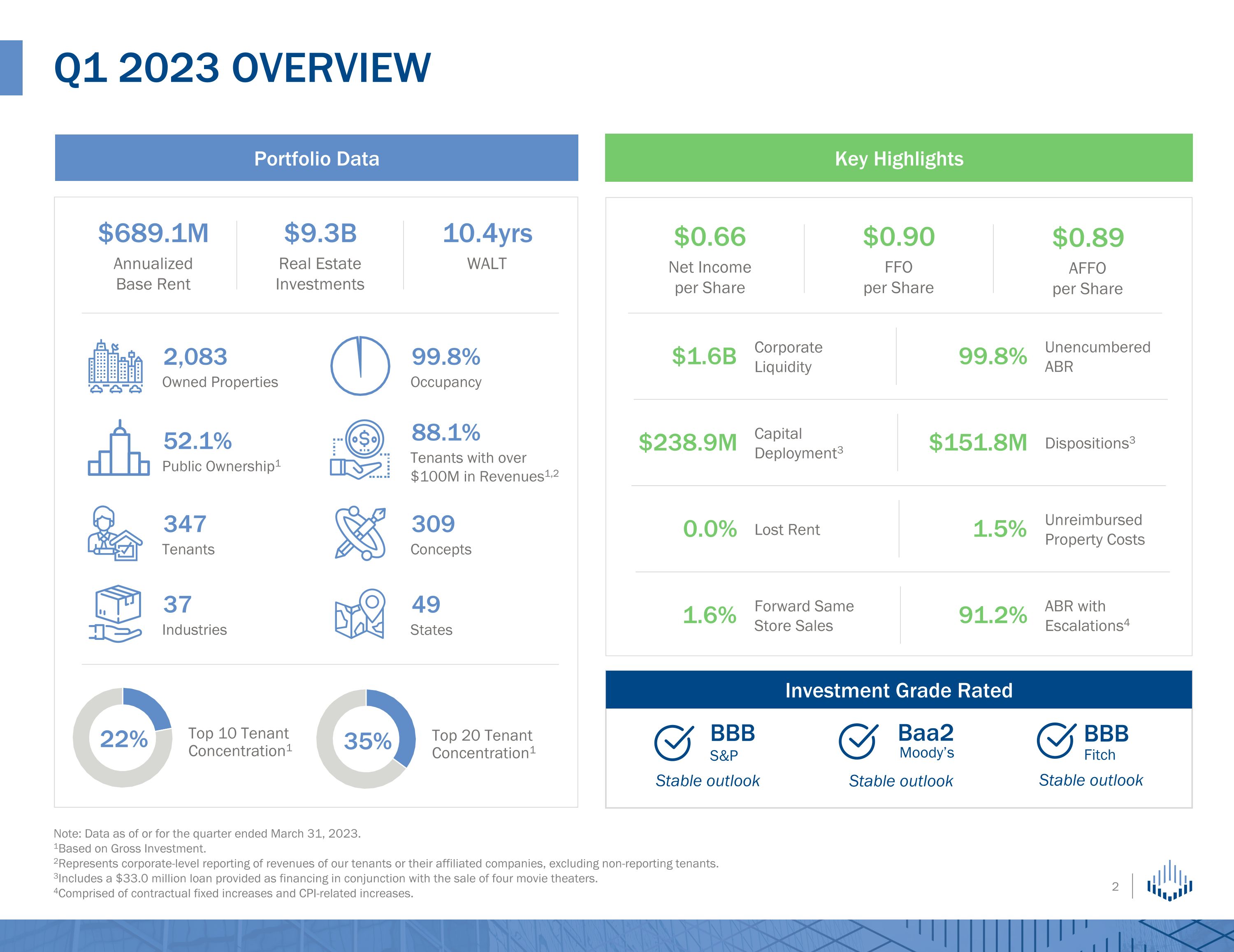

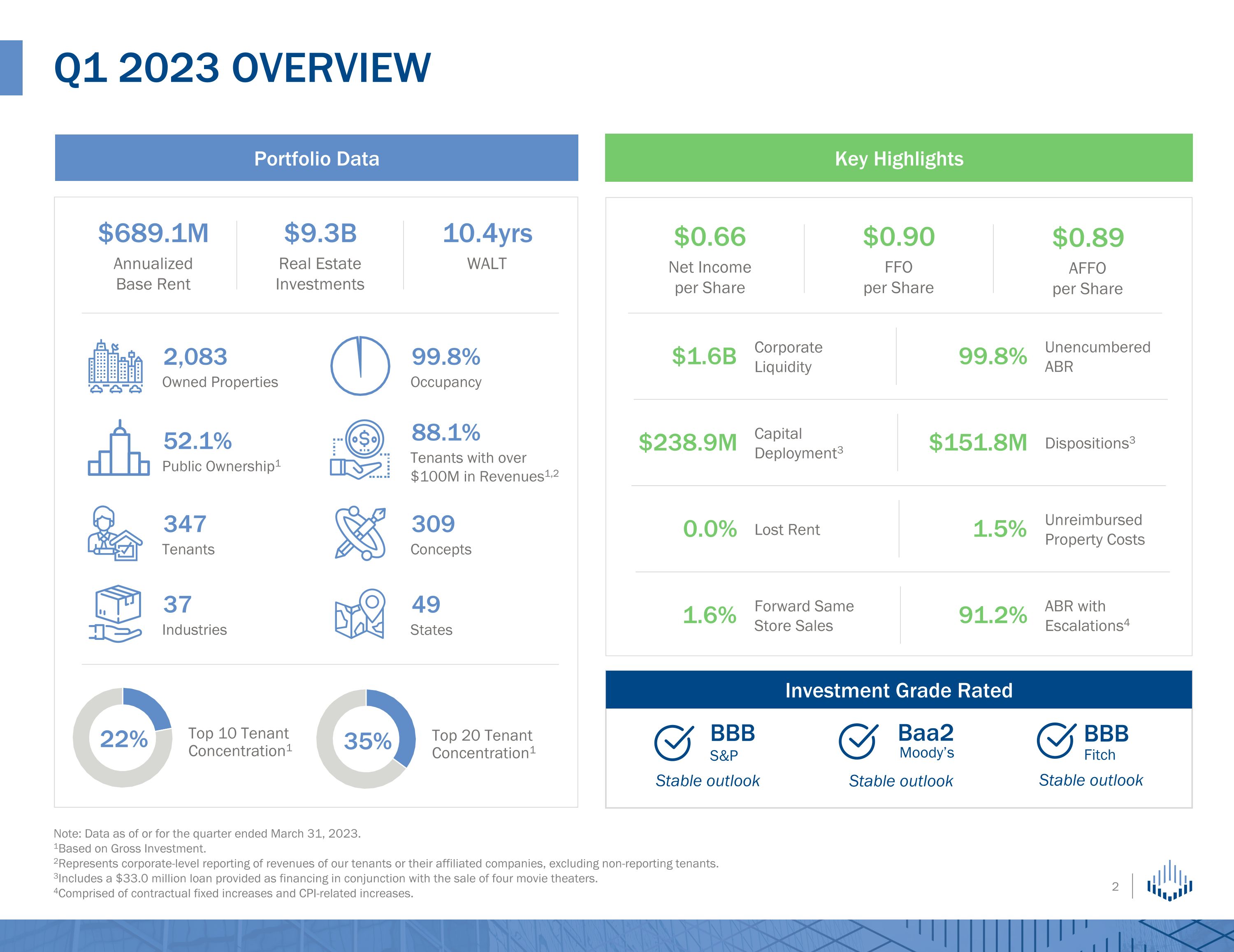

35% Top 20 Tenant Concentration1 Note: Data as of or for the quarter ended March 31, 2023. 1Based on Gross Investment. 2Represents corporate-level reporting of revenues of our tenants or their affiliated companies, excluding non-reporting tenants. 3Includes a $33.0 million loan provided as financing in conjunction with the sale of four movie theaters. 4Comprised of contractual fixed increases and CPI-related increases. Q1 2023 Overview Key Highlights Portfolio Data Top 10 Tenant Concentration1 22% $689.1M $9.3B Real Estate Investments Annualized Base Rent 10.4yrs WALT 99.8% Occupancy 2,083 Owned Properties 52.1% Public Ownership1 88.1% Tenants with over $100M in Revenues1,2 347 Tenants 309 Concepts 37 Industries 49 States $0.90 FFO per Share $0.66 Net Income per Share $0.89 AFFO per Share Investment Grade Rated BBB S&P Stable outlook Baa2 Moody’s Stable outlook BBB Fitch Stable outlook $1.6B Corporate Liquidity 99.8% Unencumbered ABR $238.9M Capital Deployment3 $151.8M Dispositions3 0.0% Lost Rent 1.5% Unreimbursed Property Costs 1.6% Forward Same Store Sales 91.2% ABR with Escalations4

Spirit’s underwriting approach Utilizing proprietary tools and underwriting expertise to invest in high-quality, single-tenant, operationally essential real estate with a focus on industry relevance, tenant credit quality, and real estate strength Industry Relevance Tenant�Credit Quality Real Estate�Strength Key Tools

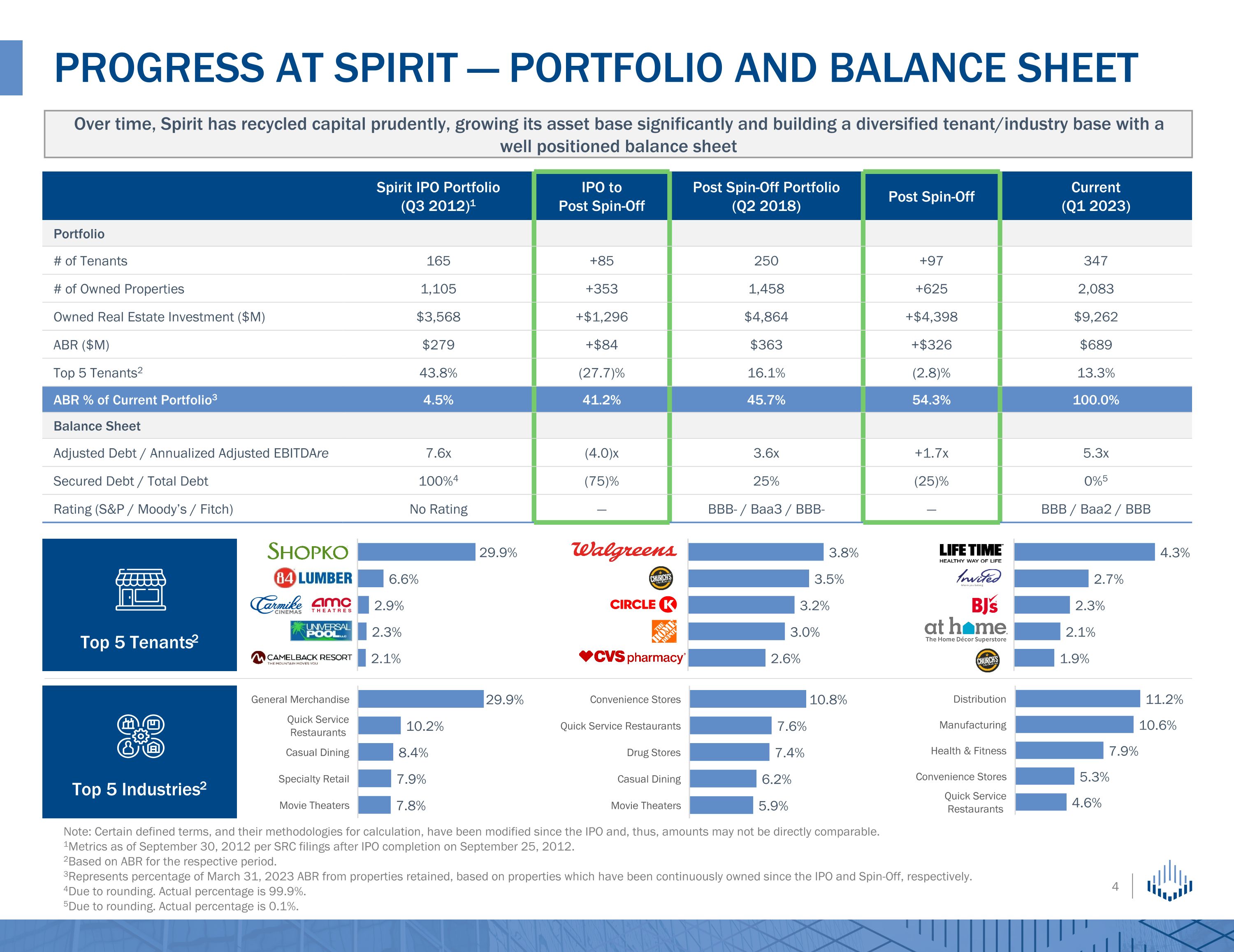

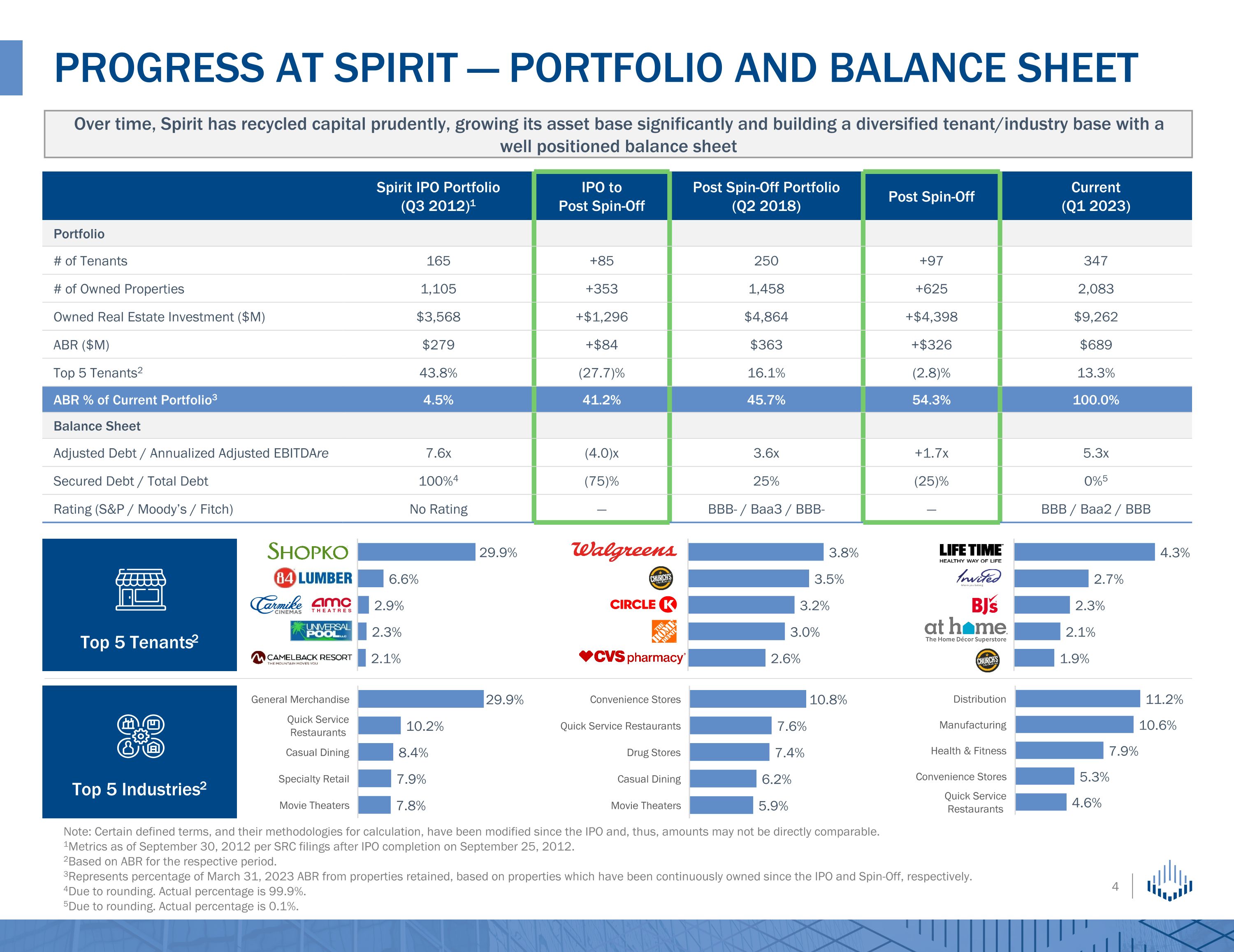

Progress at Spirit — portfolio and balance sheet Spirit IPO Portfolio �(Q3 2012)1 IPO to�Post Spin-Off Post Spin-Off Portfolio�(Q2 2018) Post Spin-Off Current�(Q1 2023) Portfolio # of Tenants 165 +85 250 +97 347 # of Owned Properties 1,105 +353 1,458 +625 2,083 Owned Real Estate Investment ($M) $3,568 +$1,296 $4,864 +$4,398 $9,262 ABR ($M) $279 +$84 $363 +$326 $689 Top 5 Tenants2 43.8% (27.7)% 16.1% (2.8)% 13.3% ABR % of Current Portfolio3 4.5% 41.2% 45.7% 54.3% 100.0% Balance Sheet Adjusted Debt / Annualized Adjusted EBITDAre 7.6x (4.0)x 3.6x +1.7x 5.3x Secured Debt / Total Debt 100%4 (75)% 25% (25)% 0%5 Rating (S&P / Moody’s / Fitch) No Rating — BBB- / Baa3 / BBB- — BBB / Baa2 / BBB Top 5 Tenants2 Top 5 Industries2 Over time, Spirit has recycled capital prudently, growing its asset base significantly and building a diversified tenant/industry base with a well positioned balance sheet Note: Certain defined terms, and their methodologies for calculation, have been modified since the IPO and, thus, amounts may not be directly comparable. 1Metrics as of September 30, 2012 per SRC filings after IPO completion on September 25, 2012. 2Based on ABR for the respective period. 3Represents percentage of March 31, 2023 ABR from properties retained, based on properties which have been continuously owned since the IPO and Spin-Off, respectively. 4Due to rounding. Actual percentage is 99.9%. 5Due to rounding. Actual percentage is 0.1%.

Capital Deployment Highlights

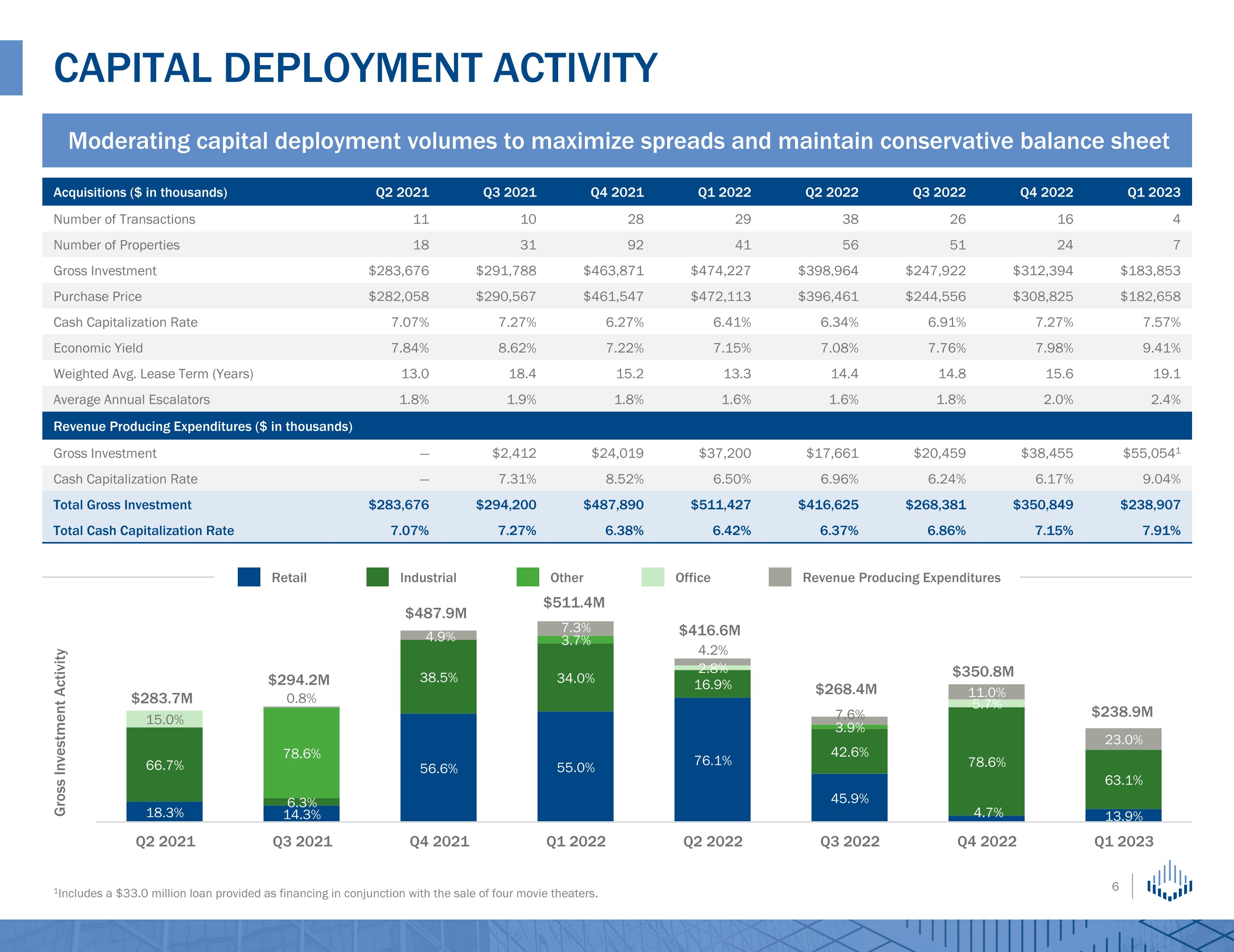

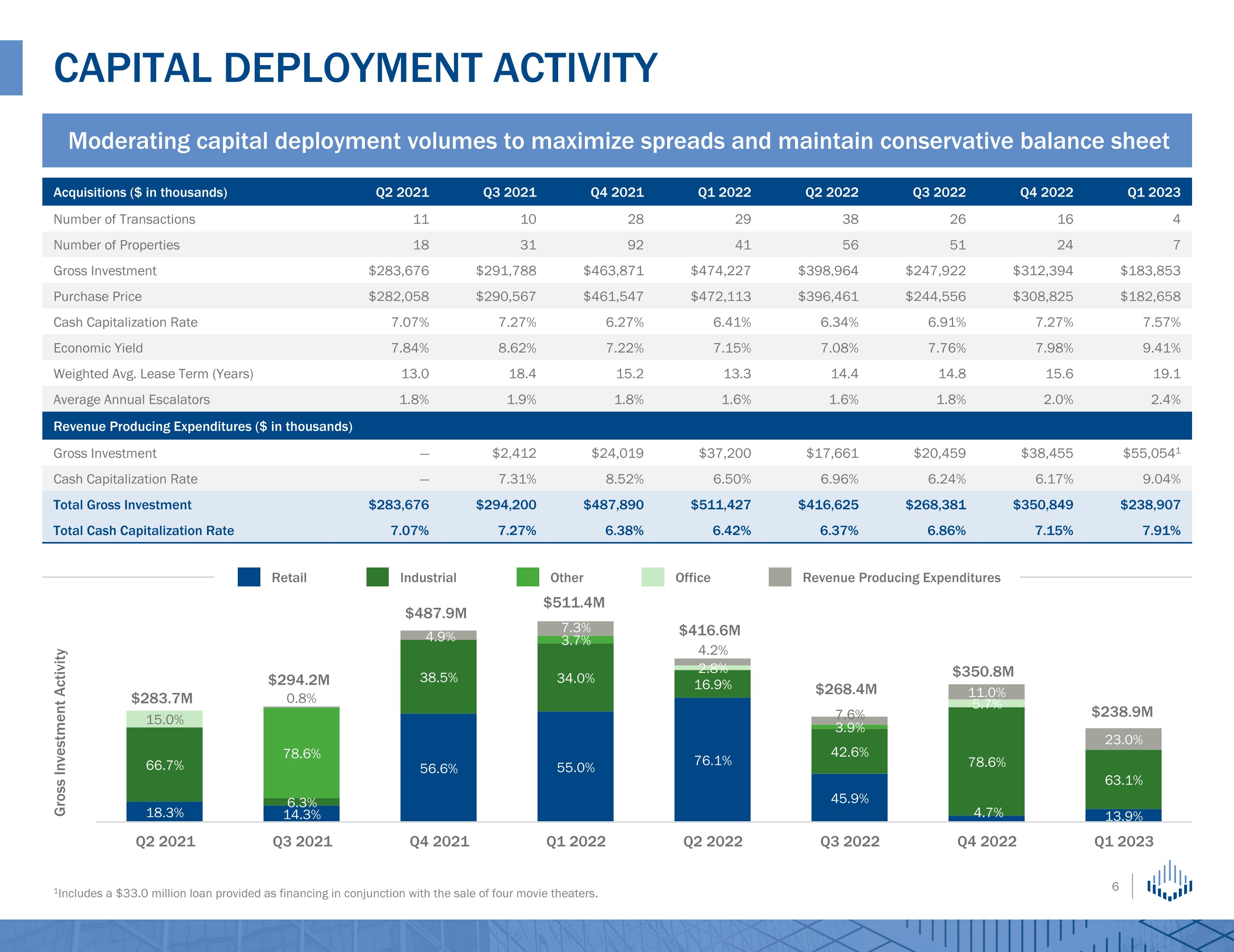

1Includes a $33.0 million loan provided as financing in conjunction with the sale of four movie theaters. Capital deployment Activity Moderating capital deployment volumes to maximize spreads and maintain conservative balance sheet Gross Investment Activity $283.7M $294.2M Acquisitions ($ in thousands) Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Number of Transactions 11 10 28 29 38 26 16 4 Number of Properties 18 31 92 41 56 51 24 7 Gross Investment $283,676 $291,788 $463,871 $474,227 $398,964 $247,922 $312,394 $183,853 Purchase Price $282,058 $290,567 $461,547 $472,113 $396,461 $244,556 $308,825 $182,658 Cash Capitalization Rate 7.07% 7.27% 6.27% 6.41% 6.34% 6.91% 7.27% 7.57% Economic Yield 7.84% 8.62% 7.22% 7.15% 7.08% 7.76% 7.98% 9.41% Weighted Avg. Lease Term (Years) 13.0 18.4 15.2 13.3 14.4 14.8 15.6 19.1 Average Annual Escalators 1.8% 1.9% 1.8% 1.6% 1.6% 1.8% 2.0% 2.4% Revenue Producing Expenditures ($ in thousands) Gross Investment — $2,412 $24,019 $37,200 $17,661 $20,459 $38,455 $55,0541 Cash Capitalization Rate — 7.31% 8.52% 6.50% 6.96% 6.24% 6.17% 9.04% Total Gross Investment $283,676 $294,200 $487,890 $511,427 $416,625 $268,381 $350,849 $238,907 Total Cash Capitalization Rate 7.07% 7.27% 6.38% 6.42% 6.37% 6.86% 7.15% 7.91% $511.4M $487.9M $416.6M Retail Industrial Other Office Revenue Producing Expenditures $268.4M $350.8M $238.9M

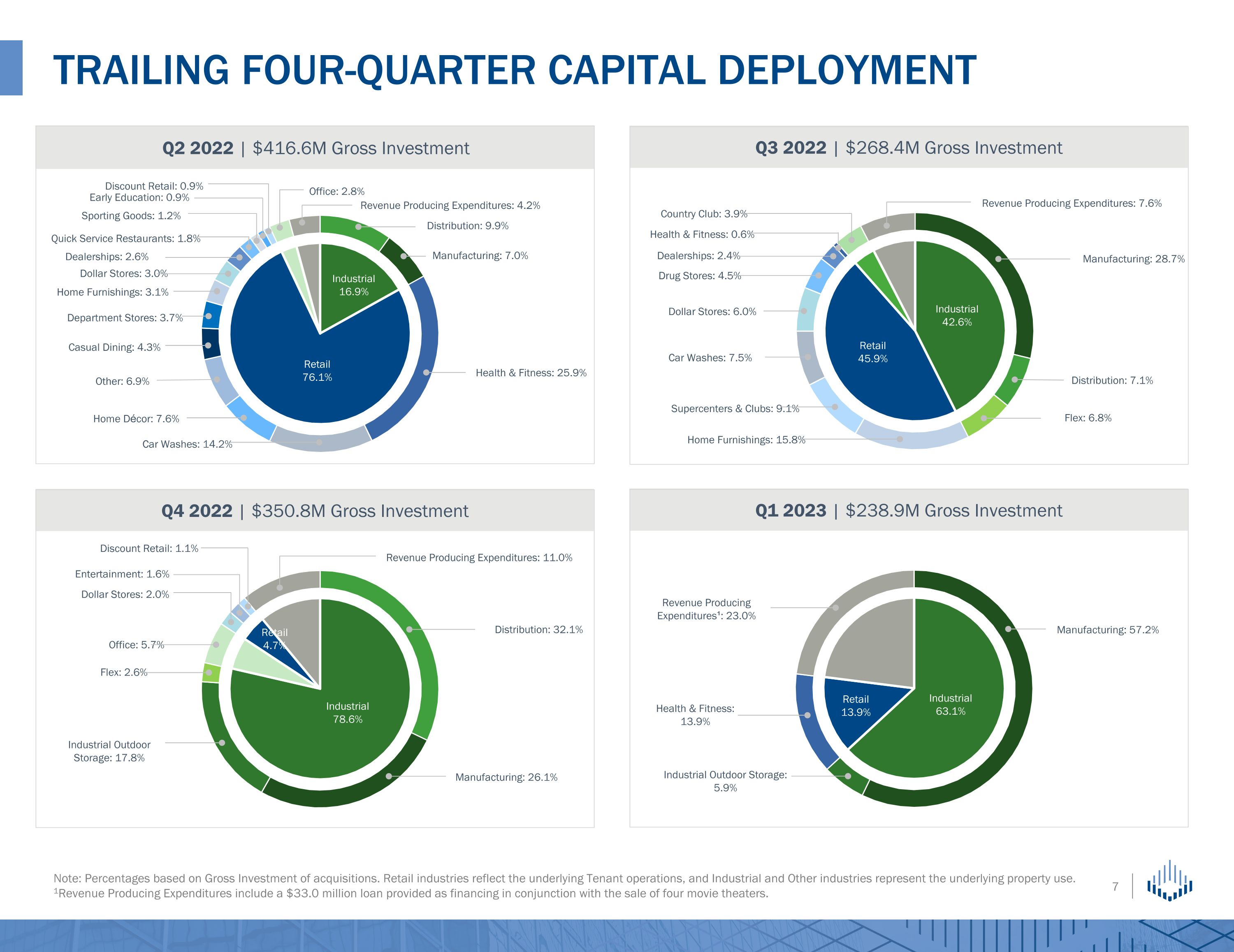

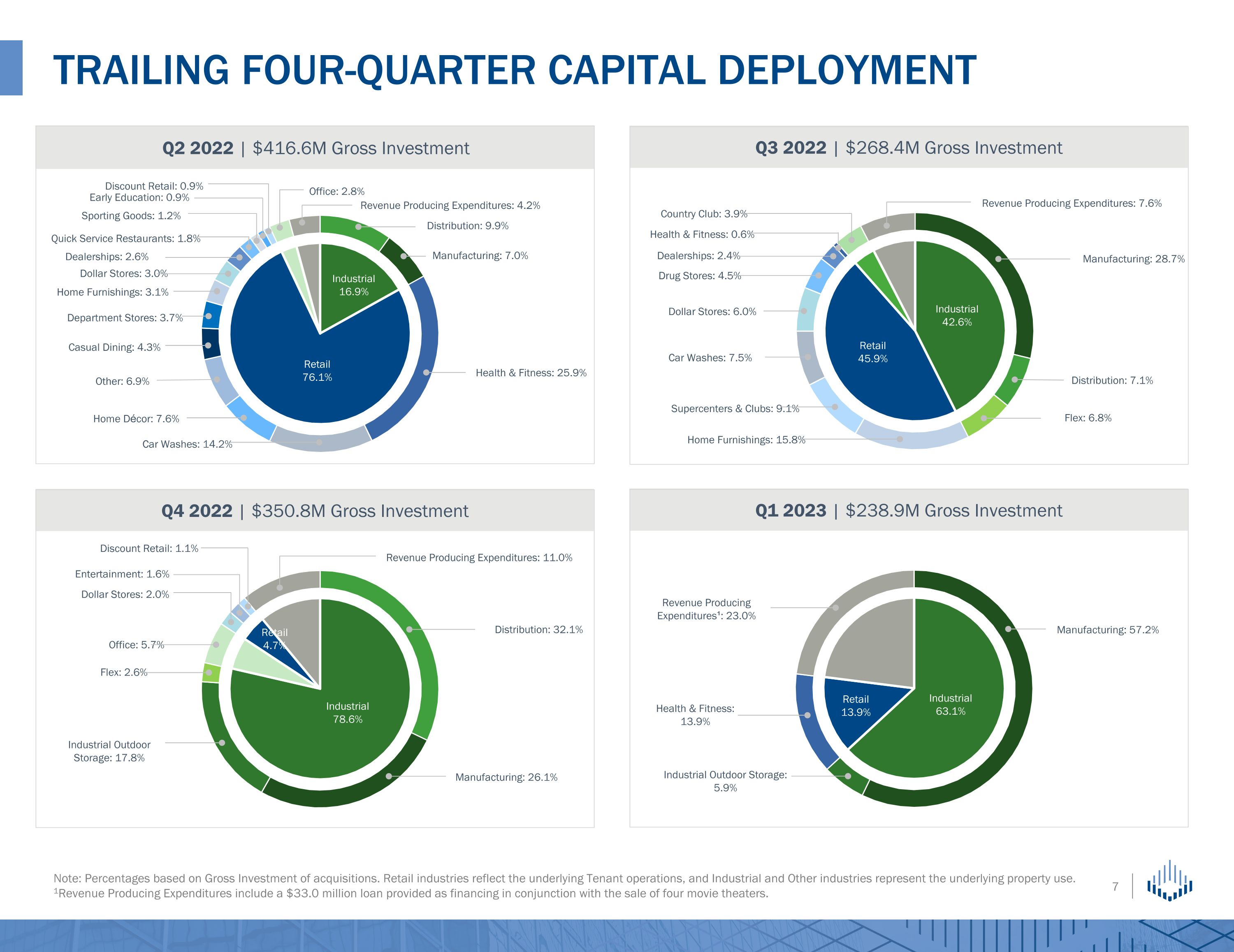

Trailing four-quarter capital deployment Note: Percentages based on Gross Investment of acquisitions. Retail industries reflect the underlying Tenant operations, and Industrial and Other industries represent the underlying property use. 1Revenue Producing Expenditures include a $33.0 million loan provided as financing in conjunction with the sale of four movie theaters. Q3 2022 | $268.4M Gross Investment Q1 2023 | $238.9M Gross Investment Q2 2022 | $416.6M Gross Investment Q4 2022 | $350.8M Gross Investment

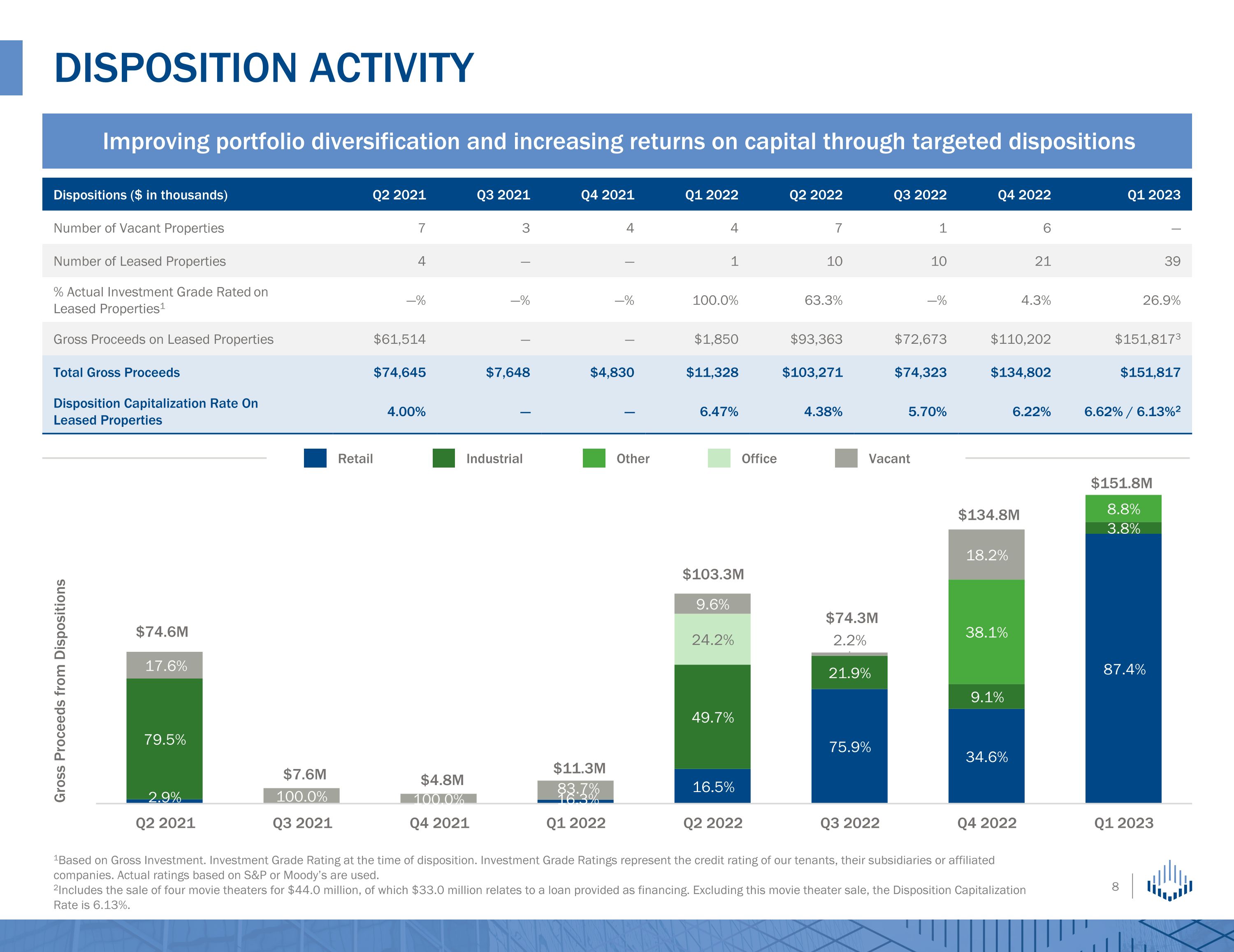

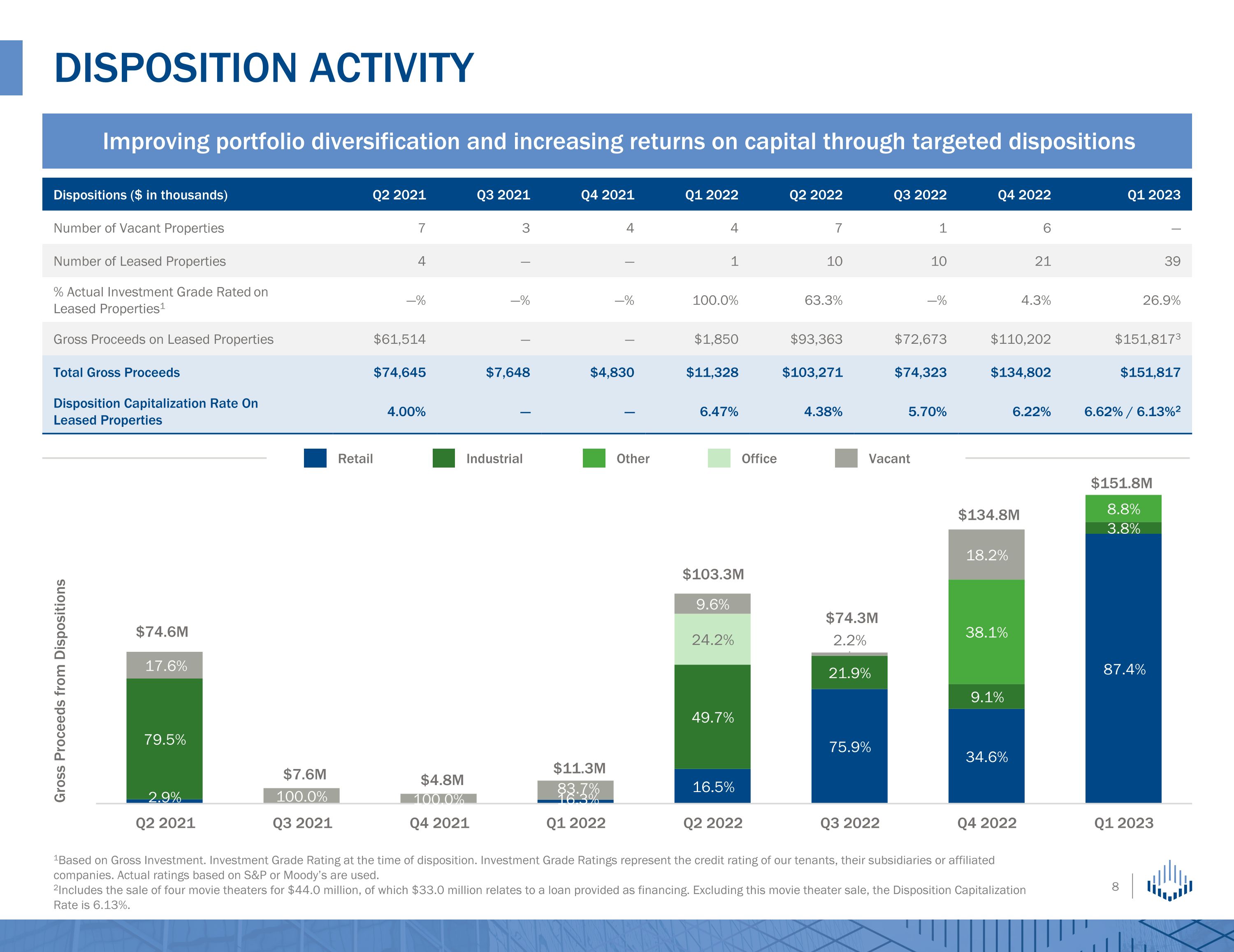

1Based on Gross Investment. Investment Grade Rating at the time of disposition. Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies. Actual ratings based on S&P or Moody’s are used. 2Includes the sale of four movie theaters for $44.0 million, of which $33.0 million relates to a loan provided as financing. Excluding this movie theater sale, the Disposition Capitalization Rate is 6.13%. DISPOSITION activity Improving portfolio diversification and increasing returns on capital through targeted dispositions Dispositions ($ in thousands) Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Number of Vacant Properties 7 3 4 4 7 1 6 — Number of Leased Properties 4 — — 1 10 10 21 39 % Actual Investment Grade Rated on �Leased Properties1 —% —% —% 100.0% 63.3% —% 4.3% 26.9% Gross Proceeds on Leased Properties $61,514 — — $1,850 $93,363 $72,673 $110,202 $151,8173 Total Gross Proceeds $74,645 $7,648 $4,830 $11,328 $103,271 $74,323 $134,802 $151,817 Disposition Capitalization Rate On �Leased Properties 4.00% — — 6.47% 4.38% 5.70% 6.22% 6.62% / 6.13%2 Gross Proceeds from Dispositions $11.3M Retail Industrial Other Office Vacant $74.6M $7.6M $4.8M $103.3M $74.3M $134.8M $151.8M

Portfolio Composition

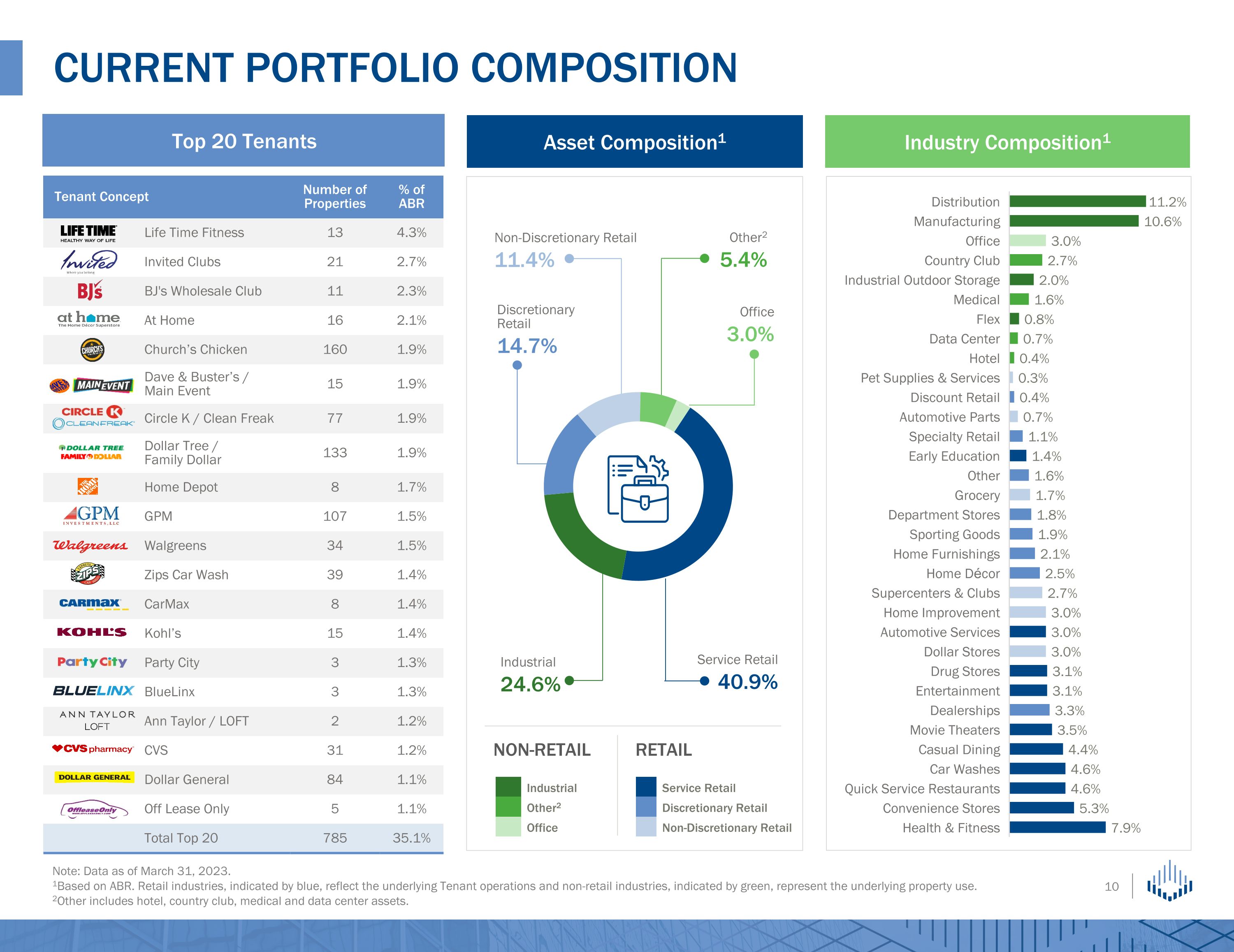

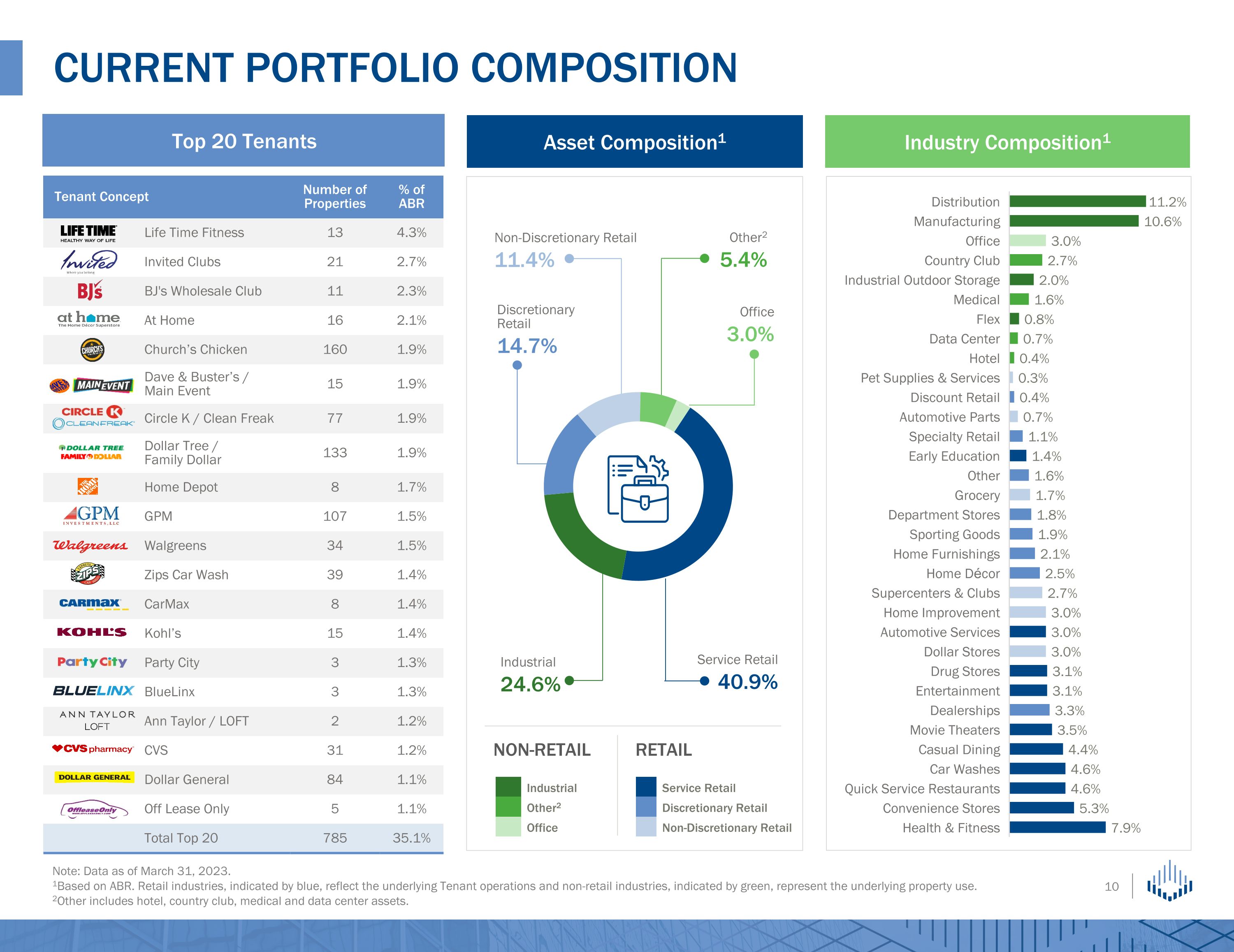

Tenant Concept Number of

Properties % of

ABR Life Time Fitness 13 4.3% Invited Clubs 21 2.7% BJ's Wholesale Club 11 2.3% At Home 16 2.1% Church’s Chicken 160 1.9% Dave & Buster’s / Main Event 15 1.9% Circle K / Clean Freak 77 1.9% Dollar Tree / Family Dollar 133 1.9% Home Depot 8 1.7% GPM 107 1.5% Walgreens 34 1.5% Zips Car Wash 39 1.4% CarMax 8 1.4% Kohl’s 15 1.4% Party City 3 1.3% BlueLinx 3 1.3% Ann Taylor / LOFT 2 1.2% CVS 31 1.2% Dollar General 84 1.1% Off Lease Only 5 1.1% Total Top 20 785 35.1% Top 20 Tenants Note: Data as of March 31, 2023. 1Based on ABR. Retail industries, indicated by blue, reflect the underlying Tenant operations and non-retail industries, indicated by green, represent the underlying property use. 2Other includes hotel, country club, medical and data center assets. Current Portfolio composition Non-Discretionary Retail

11.4% Industrial

24.6% Discretionary�Retail

14.7% Other2

5.4% Office

3.0% Service Retail

40.9% NON-RETAIL RETAIL Asset Composition1 Industry Composition1 Service Retail Discretionary Retail Non-Discretionary Retail Industrial Other2 Office

Industrial portfolio highlights Note: Data as of March 31, 2023. 1Based on ABR. Represents corporate-level reporting of revenues of our tenants or their affiliated companies. Number of �Properties Square Feet�(000s) % �of ABR % �Public Distribution 136 13,588 11.2% 64.6% Manufacturing 76 12,241 10.6% 29.5% Industrial Outdoor Storage 21 1,145 2.0% 77.7% Flex 14 511 0.8% 37.5% Total Industrial 247 27,485 24.6% 49.7% 12.2 yrs Average WALT $6.18 Average Rent PSF $9.6M Average RE Investment 111.3K Average SQF Representative Tenants $2.4B RE Investment Our industrial assets are mission-critical properties leased at low rents to sophisticated operators, with 92.4% generating over $100 million in revenue1 Representative Tenants

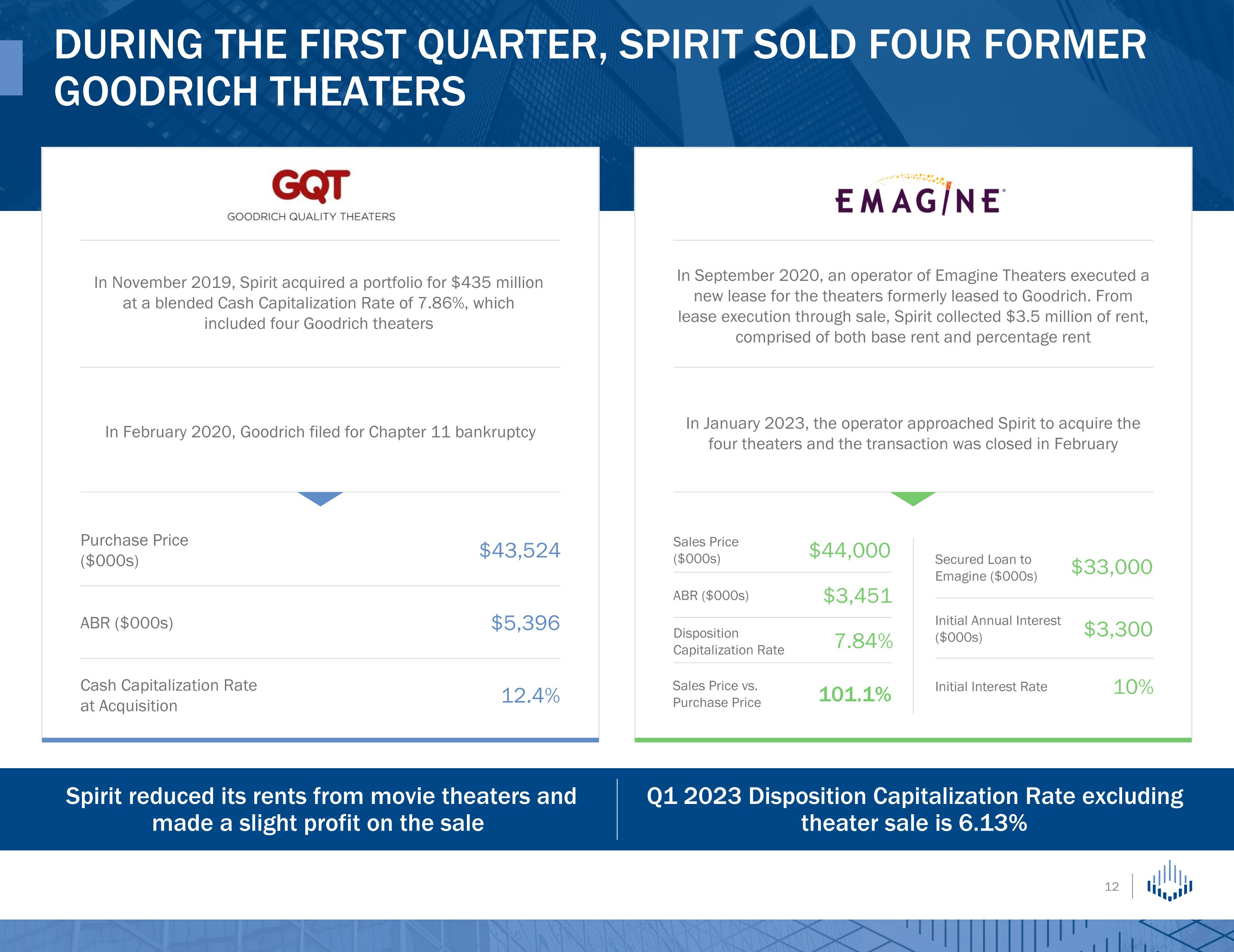

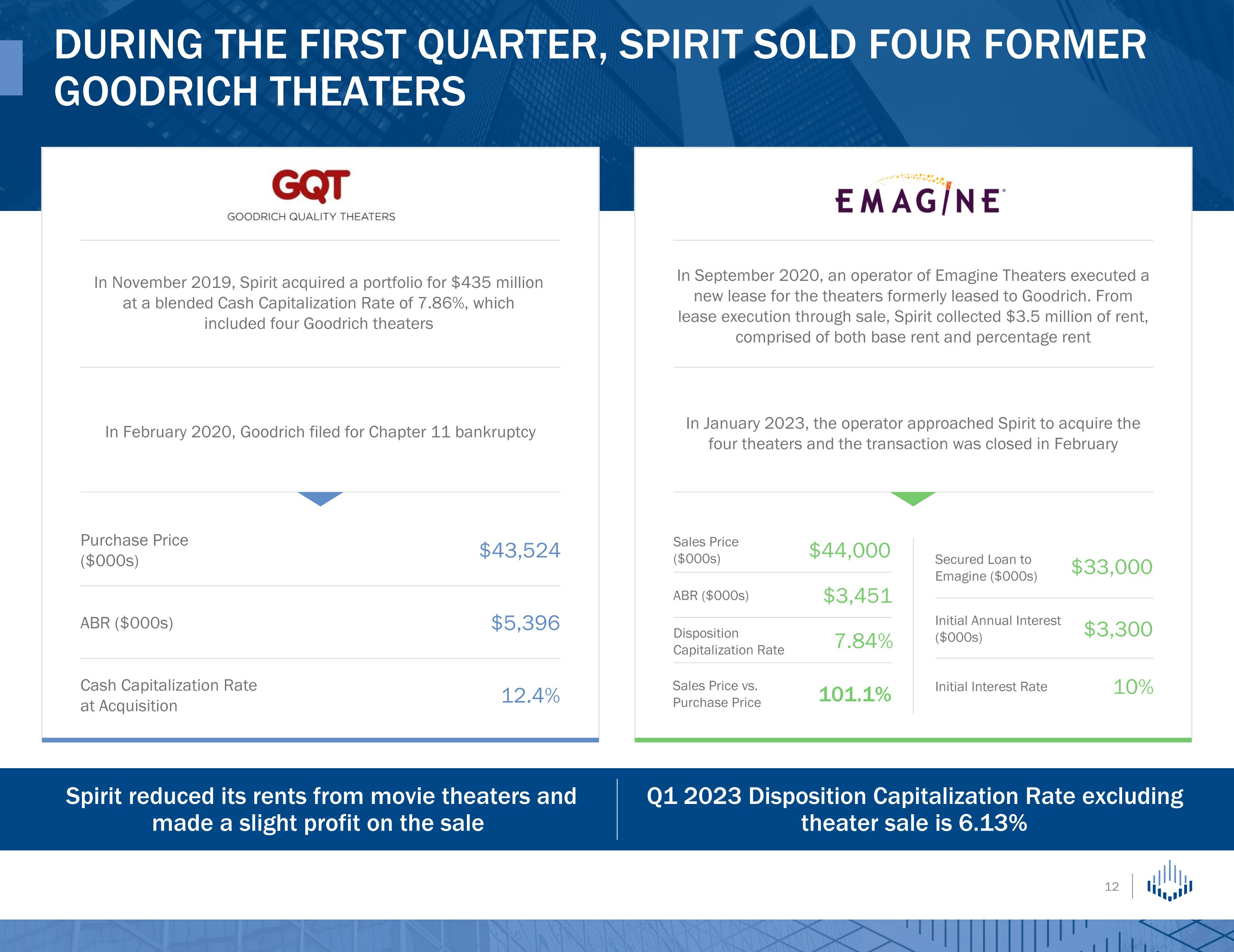

During the First Quarter, Spirit Sold Four Former Goodrich Theaters In November 2019, Spirit acquired a portfolio for $435 million at a blended Cash Capitalization Rate of 7.86%, which included four Goodrich theaters In February 2020, Goodrich filed for Chapter 11 bankruptcy In September 2020, an operator of Emagine Theaters executed a new lease for the theaters formerly leased to Goodrich. From lease execution through sale, Spirit collected $3.5 million of rent, comprised of both base rent and percentage rent In January 2023, the operator approached Spirit to acquire the four theaters and the transaction was closed in February Sales Price�($000s) ABR ($000s) Disposition Capitalization Rate Sales Price vs. Purchase Price $44,000 $3,451 7.84% 101.1% $3,300 Initial Annual Interest ($000s) 10% Initial Interest Rate $33,000 Secured Loan to Emagine ($000s) Purchase Price �($000s) Cash Capitalization Rate �at Acquisition $43,524 ABR ($000s) $5,396 12.4% Spirit reduced its rents from movie theaters and made a slight profit on the sale Q1 2023 Disposition Capitalization Rate excluding theater sale is 6.13%

Retail portfolio highlights $6.2B RE Investment Our retail assets are granular properties leased to sophisticated operators, with 81.8% generating over $100 million in revenue1, located in markets with strong demand drivers Note: Data as of March 31, 2023. 1Based on ABR. Represents corporate-level reporting of revenues of our tenants or their affiliated companies. Number of �Properties Square Feet�(000s) % �of ABR % �Public Service 1,227 11,689 40.9% 44.7% Discretionary Retail 184 9,509 14.7% 55.0% Non-Discretionary Retail 358 8,077 11.4% 89.0% Total Retail 1,769 29,275 67.0% 54.6% 9.5 yrs Average WALT $15.75 Average Rent PSF $3.5M Average RE Investment 16.5K Average SQF Representative Tenants

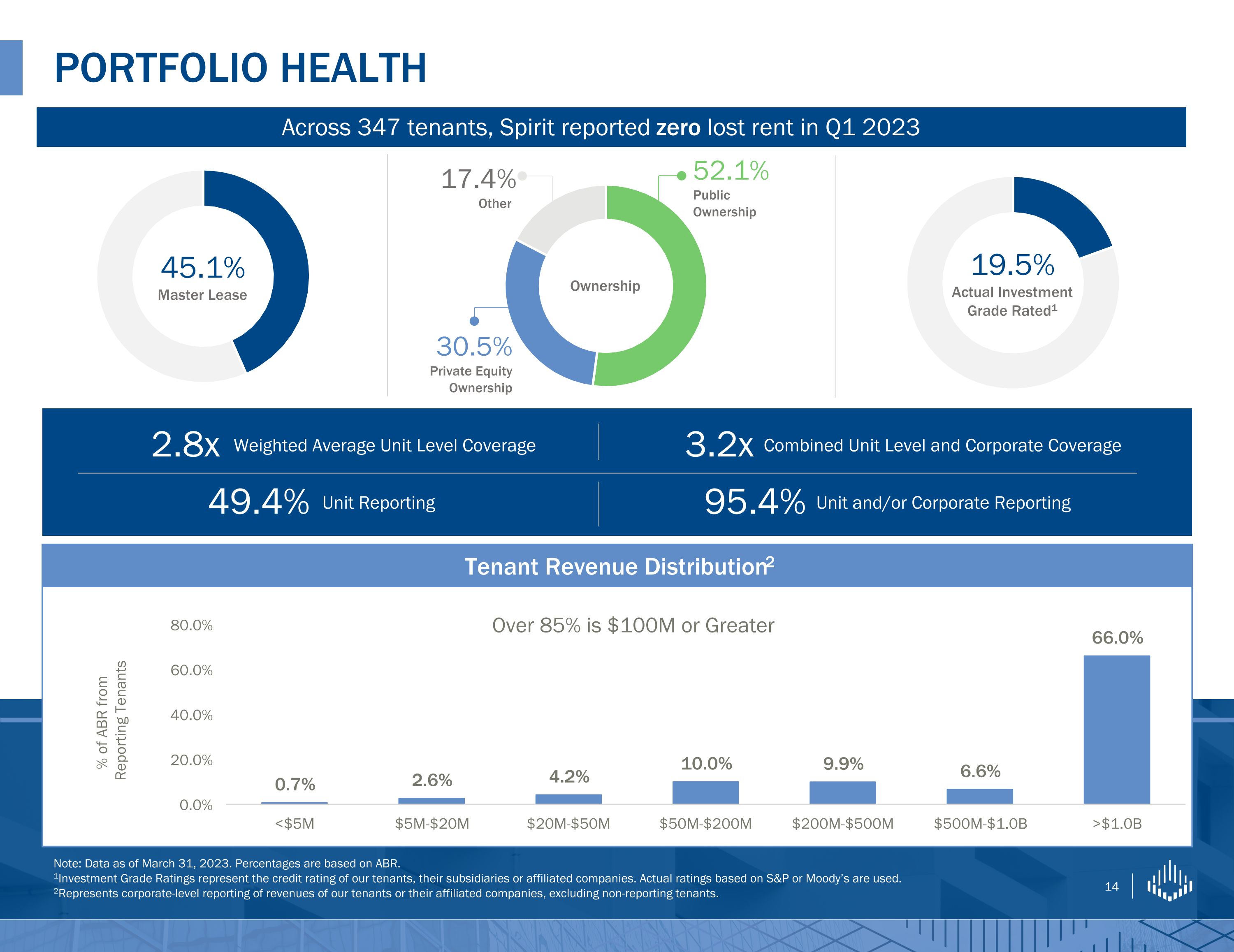

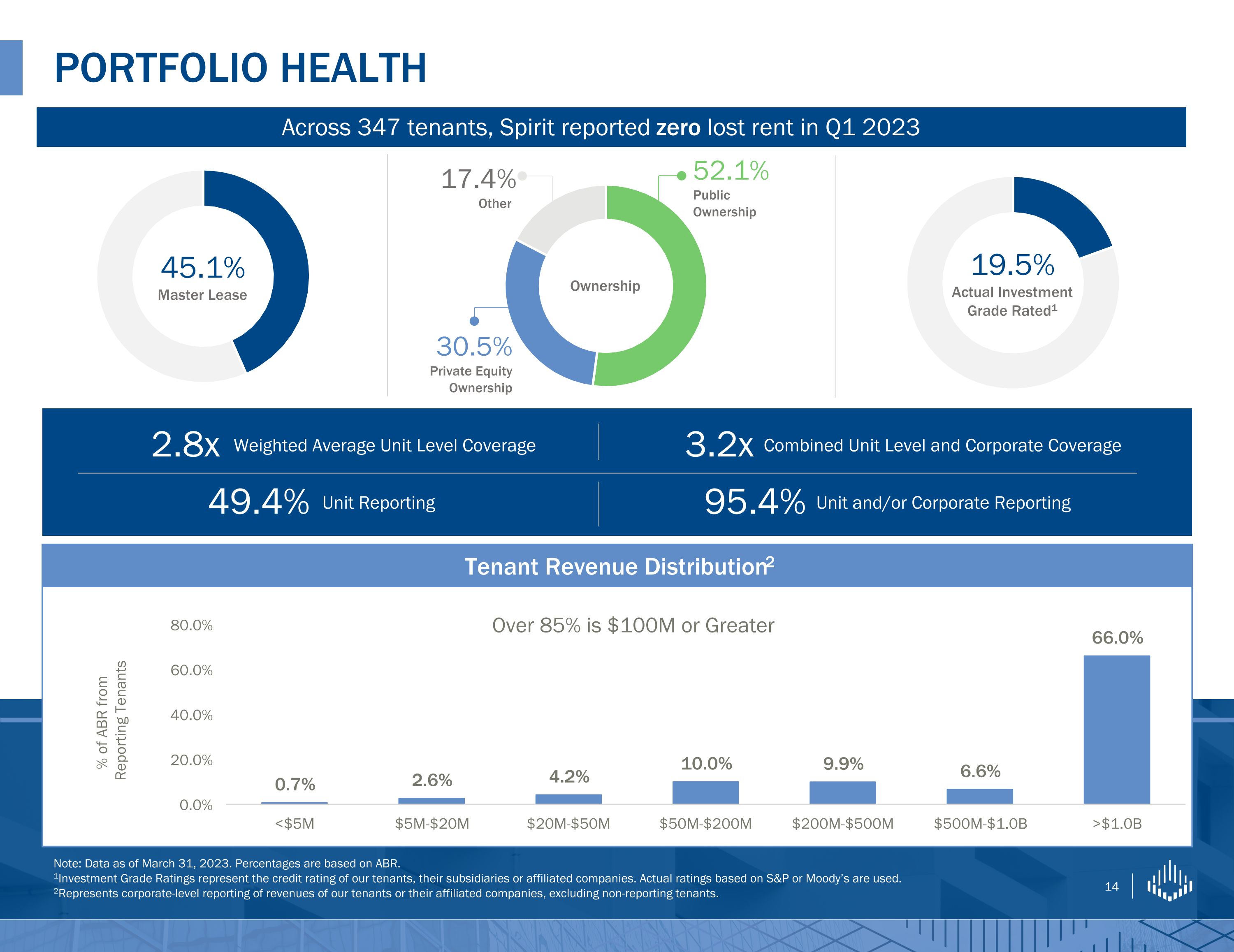

19.5% Actual Investment Grade Rated1 Note: Data as of March 31, 2023. Percentages are based on ABR. 1Investment Grade Ratings represent the credit rating of our tenants, their subsidiaries or affiliated companies. Actual ratings based on S&P or Moody’s are used. 2Represents corporate-level reporting of revenues of our tenants or their affiliated companies, excluding non-reporting tenants. Portfolio Health 14 45.1% Master Lease 52.1% Public Ownership Ownership 30.5% Private Equity Ownership 17.4% Other Tenant Revenue Distribution2 % of ABR from Reporting Tenants Over 85% is $100M or Greater Weighted Average Unit Level Coverage 2.8x Combined Unit Level and Corporate Coverage 3.2x Unit Reporting 49.4% Unit and/or Corporate Reporting 95.4% Across 347 tenants, Spirit reported zero lost rent in Q1 2023

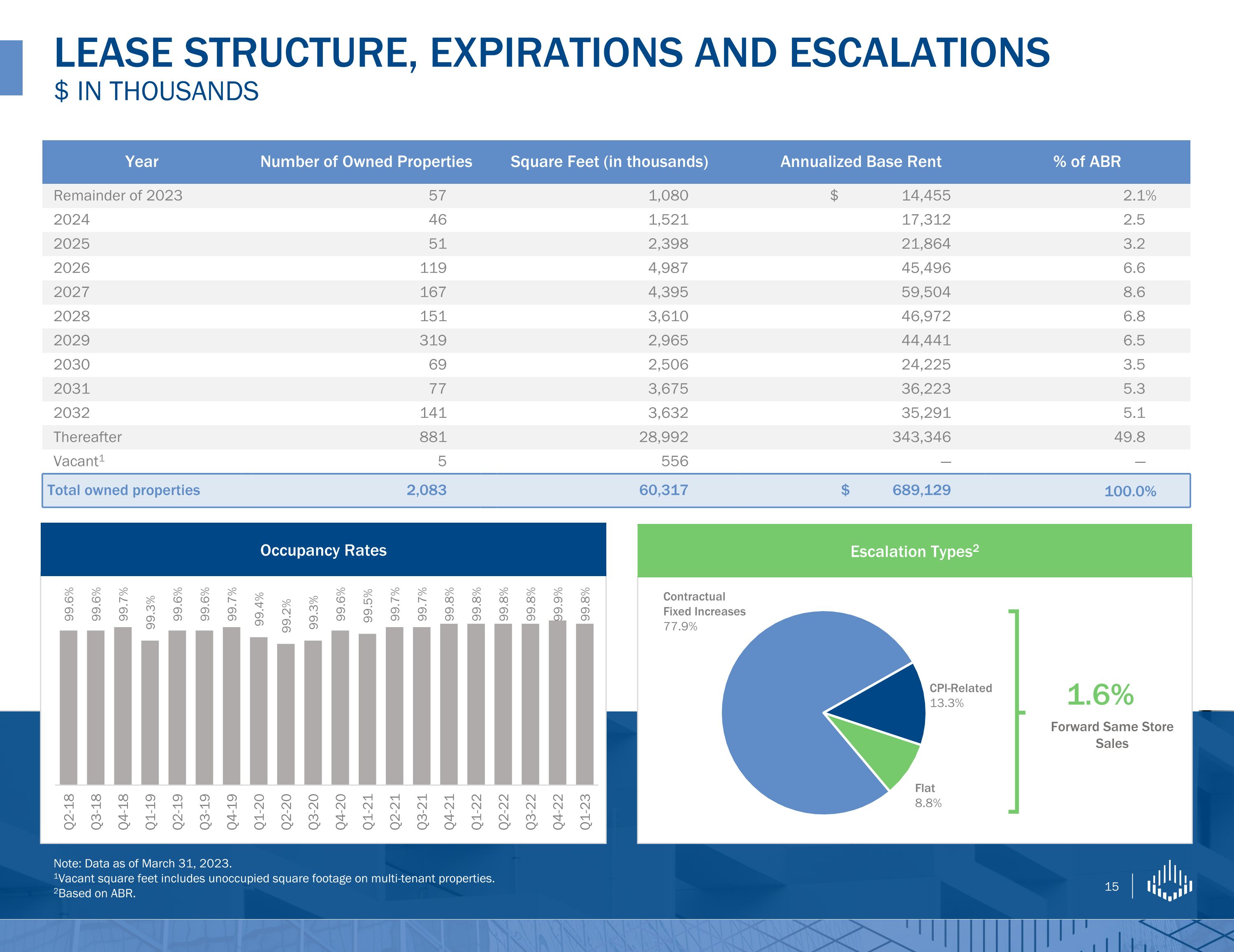

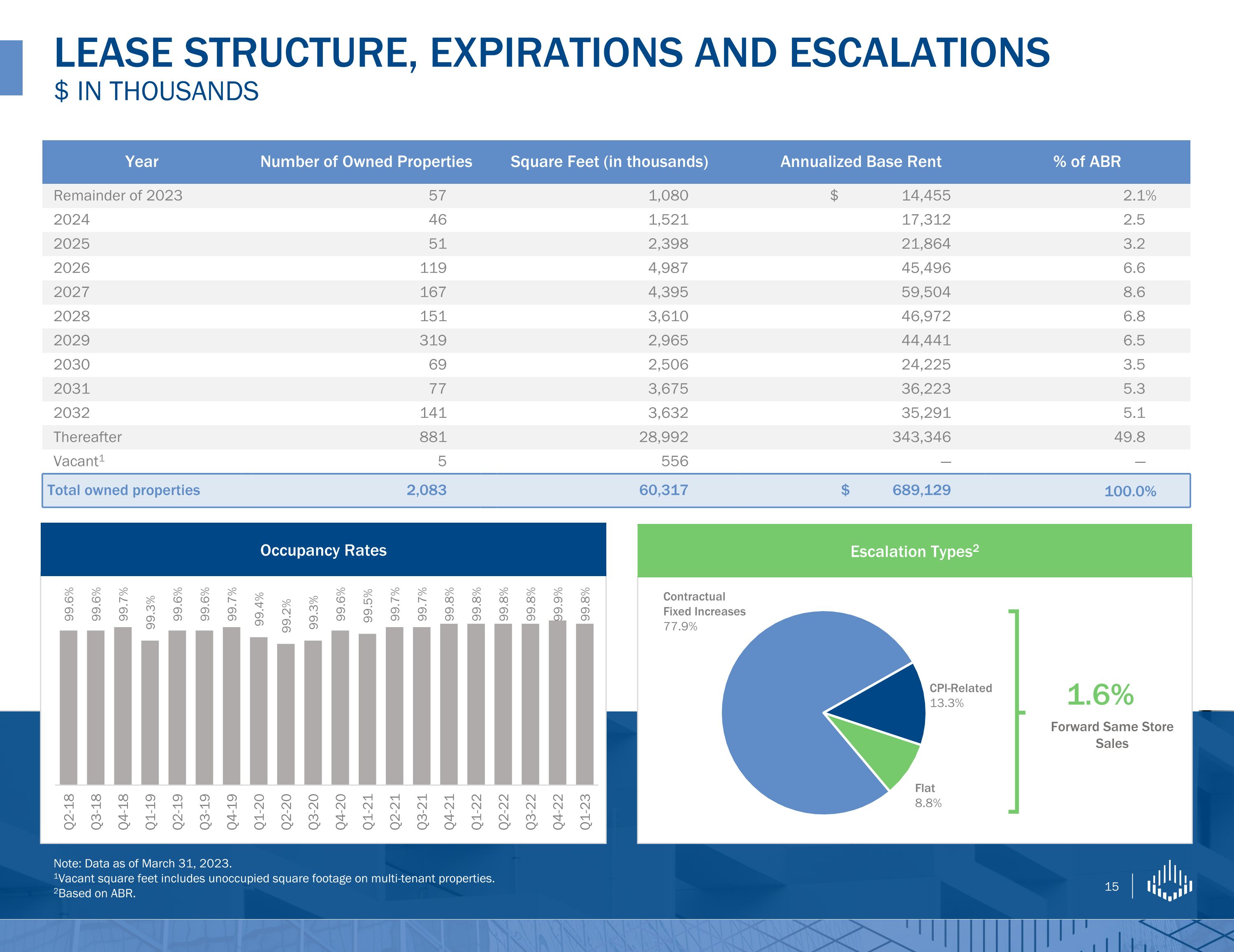

LEASE STRUCTURE, EXPIRATIONS AND ESCALATIONS�$ in thousands Year Number of Owned Properties Square Feet (in thousands) Annualized Base Rent Contractual Rent Annualized (1) % of ABR Remainder of 2023 57 1,080 $ 14,455 2.1% 2024 46 1,521 17,312 2.5 2025 51 2,398 21,864 3.2 2026 119 4,987 45,496 6.6 2027 167 4,395 59,504 8.6 2028 151 3,610 46,972 6.8 2029 319 2,965 44,441 6.5 2030 69 2,506 24,225 3.5 2031 77 3,675 36,223 5.3 2032 141 3,632 35,291 5.1 Thereafter 881 28,992 343,346 49.8 Vacant1 5 556 — — Total owned properties 2,083 60,317 $ 689,129 100.0% Occupancy Rates 1.6% Forward Same Store Sales Escalation Types2 Note: Data as of March 31, 2023. 1Vacant square feet includes unoccupied square footage on multi-tenant properties. 2Based on ABR. 15

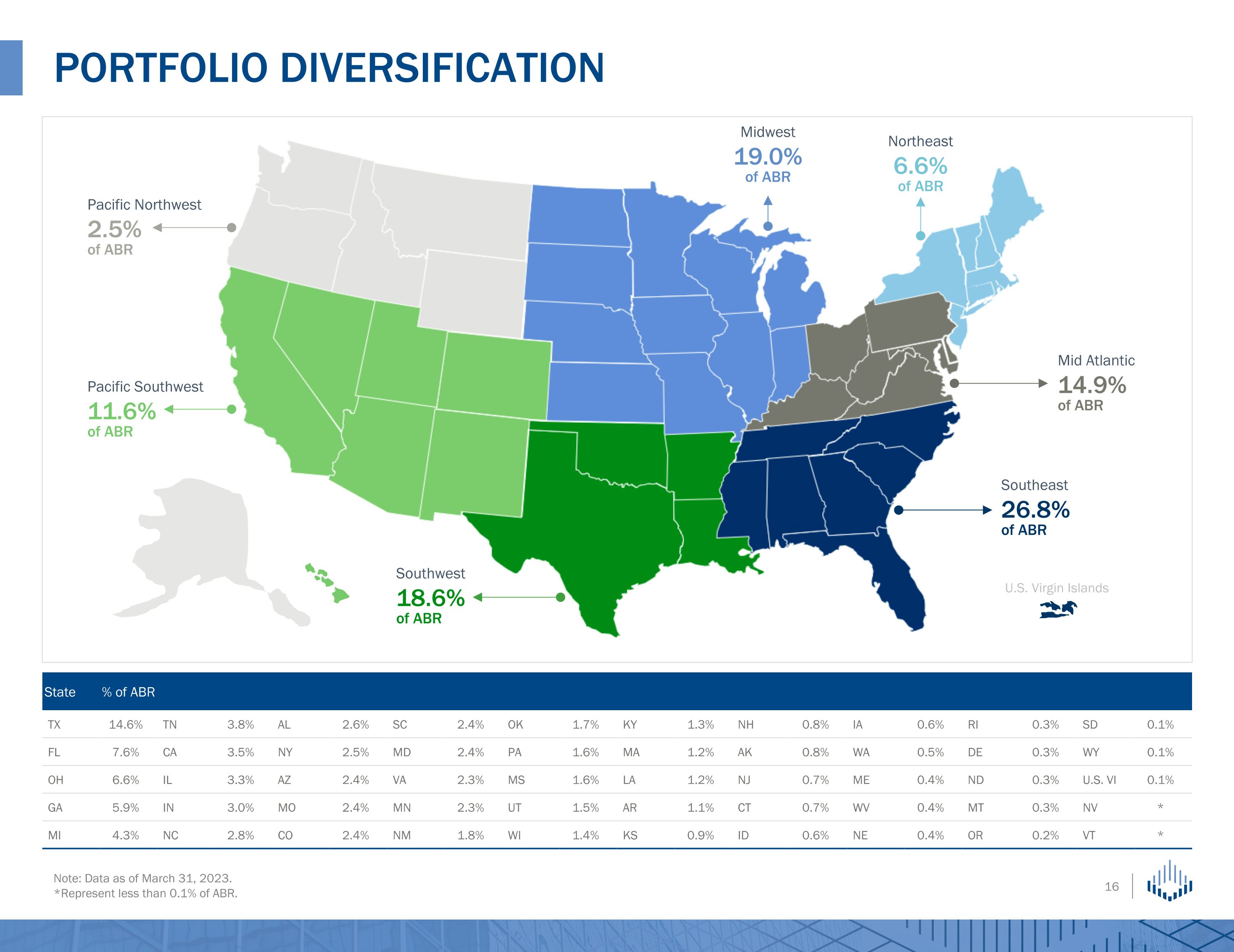

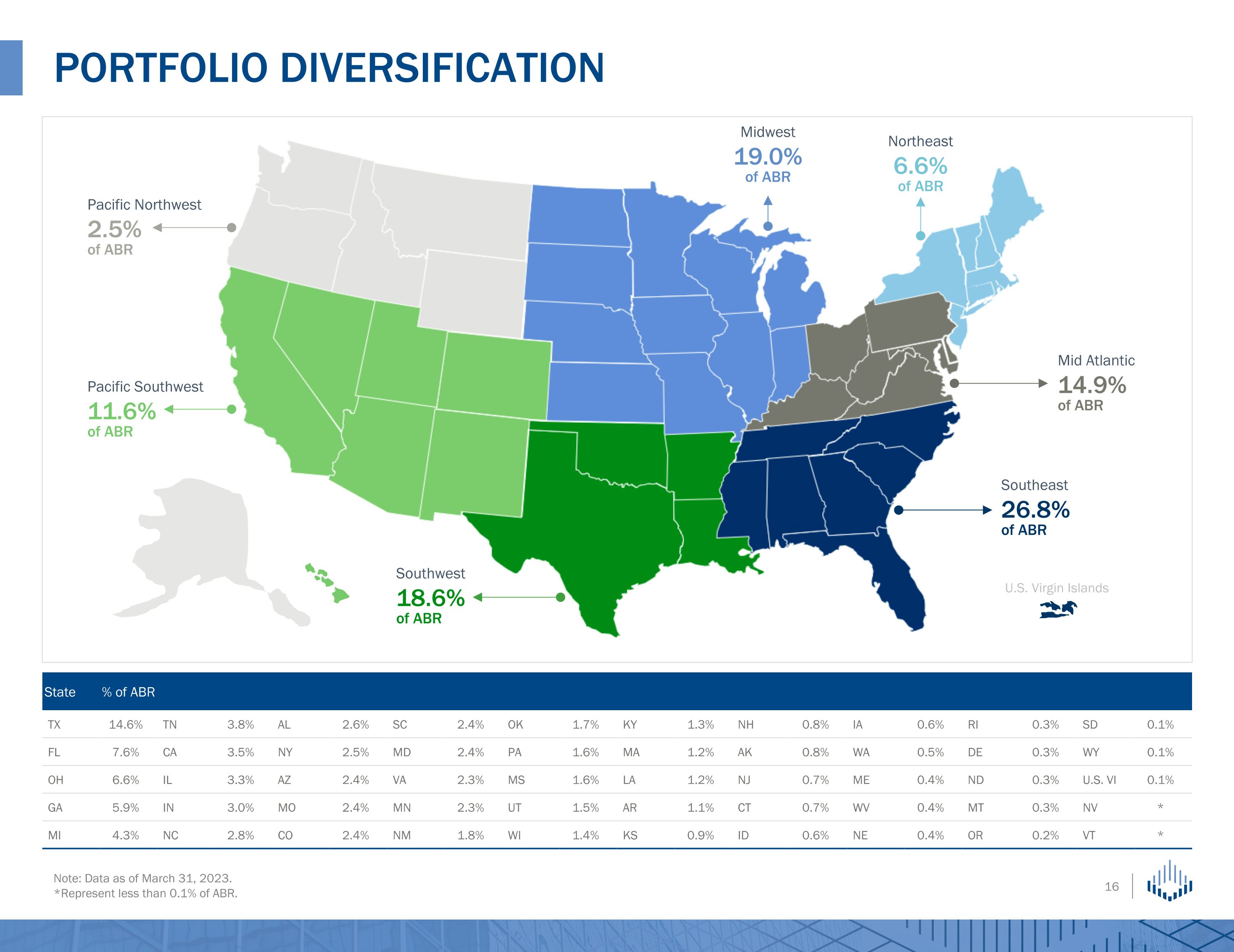

Note: Data as of March 31, 2023. *Represent less than 0.1% of ABR. PORTFOLIO DIVERSIFICATION Pacific Northwest

2.5%�of ABR Mid Atlantic

14.9% �of ABR Southeast

26.8%�of ABR Midwest

19.0%�of ABR Southwest

18.6% �of ABR Northeast

6.6%�of ABR Pacific Southwest

11.6%�of ABR State % of ABR TX 14.6% TN 3.8% AL 2.6% SC 2.4% OK 1.7% KY 1.3% NH 0.8% IA 0.6% RI 0.3% SD 0.1% FL 7.6% CA 3.5% NY 2.5% MD 2.4% PA 1.6% MA 1.2% AK 0.8% WA 0.5% DE 0.3% WY 0.1% OH 6.6% IL 3.3% AZ 2.4% VA 2.3% MS 1.6% LA 1.2% NJ 0.7% ME 0.4% ND 0.3% U.S. VI 0.1% GA 5.9% IN 3.0% MO 2.4% MN 2.3% UT 1.5% AR 1.1% CT 0.7% WV 0.4% MT 0.3% NV * MI 4.3% NC 2.8% CO 2.4% NM 1.8% WI 1.4% KS 0.9% ID 0.6% NE 0.4% OR 0.2% VT * U.S. Virgin Islands

Financial Information�and Non-GAAP Reconciliations

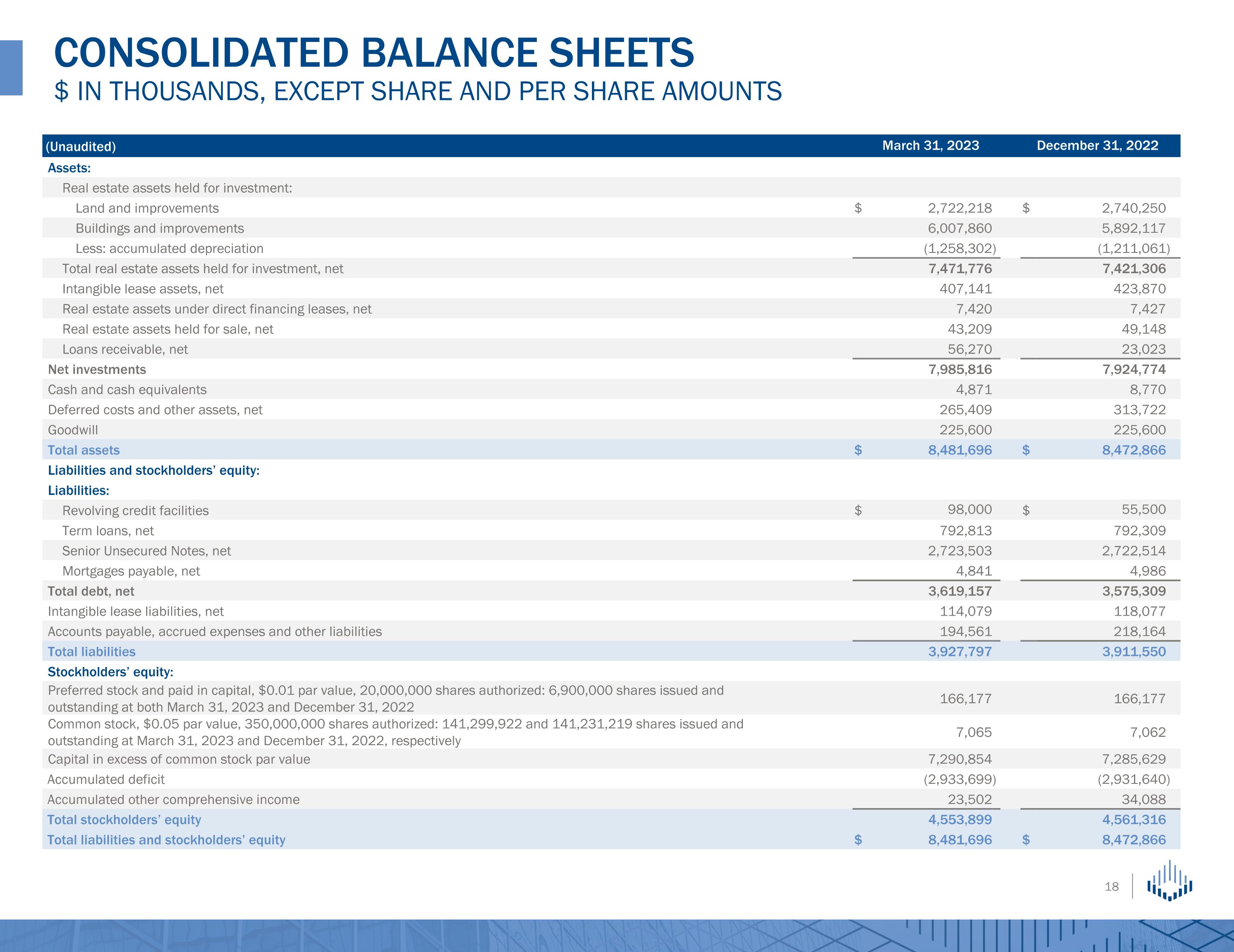

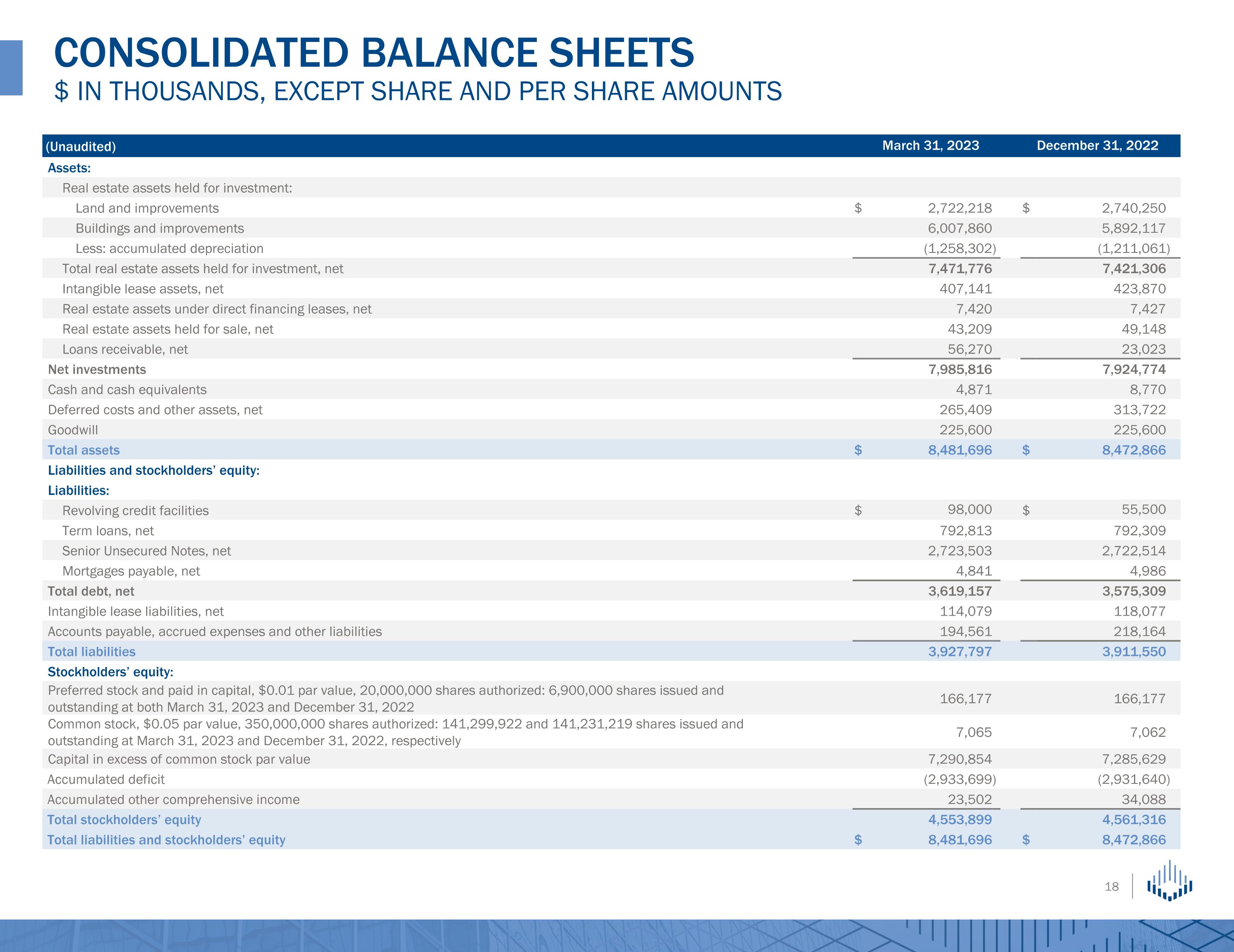

(Unaudited) March 31, 2023 March 31, 2019 December 31, 2022 December 31, 2018 Assets: Real estate assets held for investment: Land and improvements $ 2,722,218 $ 2,740,250 Buildings and improvements 6,007,860 5,892,117 Less: accumulated depreciation (1,258,302 ) (1,211,061 ) Total real estate assets held for investment, net 7,471,776 7,421,306 Intangible lease assets, net 407,141 423,870 Real estate assets under direct financing leases, net 7,420 7,427 Real estate assets held for sale, net 43,209 49,148 Loans receivable, net 56,270 23,023 Net investments 7,985,816 7,924,774 Cash and cash equivalents 4,871 8,770 Deferred costs and other assets, net 265,409 313,722 Goodwill 225,600 225,600 Total assets $ 8,481,696 $ 8,472,866 Liabilities and stockholders’ equity: Liabilities: Revolving credit facilities $ 98,000 $ 55,500 Term loans, net 792,813 792,309 Senior Unsecured Notes, net 2,723,503 2,722,514 Mortgages payable, net 4,841 4,986 Total debt, net 3,619,157 3,575,309 Intangible lease liabilities, net 114,079 118,077 Accounts payable, accrued expenses and other liabilities 194,561 218,164 Total liabilities 3,927,797 3,911,550 Stockholders’ equity: Preferred stock and paid in capital, $0.01 par value, 20,000,000 shares authorized: 6,900,000 shares issued and outstanding at both March 31, 2023 and December 31, 2022 166,177 166,177 Common stock, $0.05 par value, 350,000,000 shares authorized: 141,299,922 and 141,231,219 shares issued and outstanding at March 31, 2023 and December 31, 2022, respectively 7,065 7,062 Capital in excess of common stock par value 7,290,854 7,285,629 Accumulated deficit (2,933,699 ) (2,931,640 ) Accumulated other comprehensive income 23,502 34,088 Total stockholders’ equity 4,553,899 4,561,316 Total liabilities and stockholders’ equity $ 8,481,696 $ 8,472,866 CONSOLIDATED BALANCE SHEETS�$ IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS

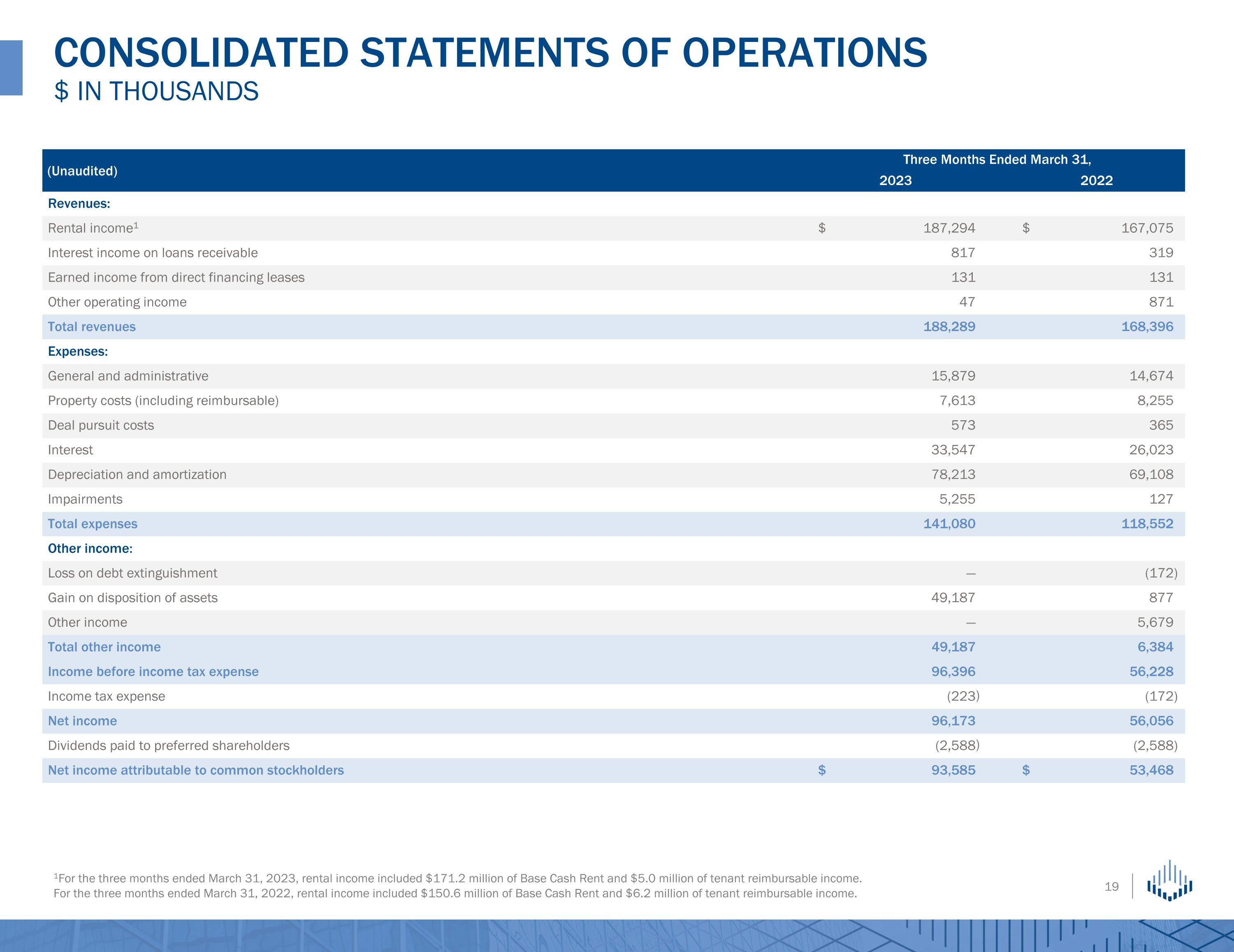

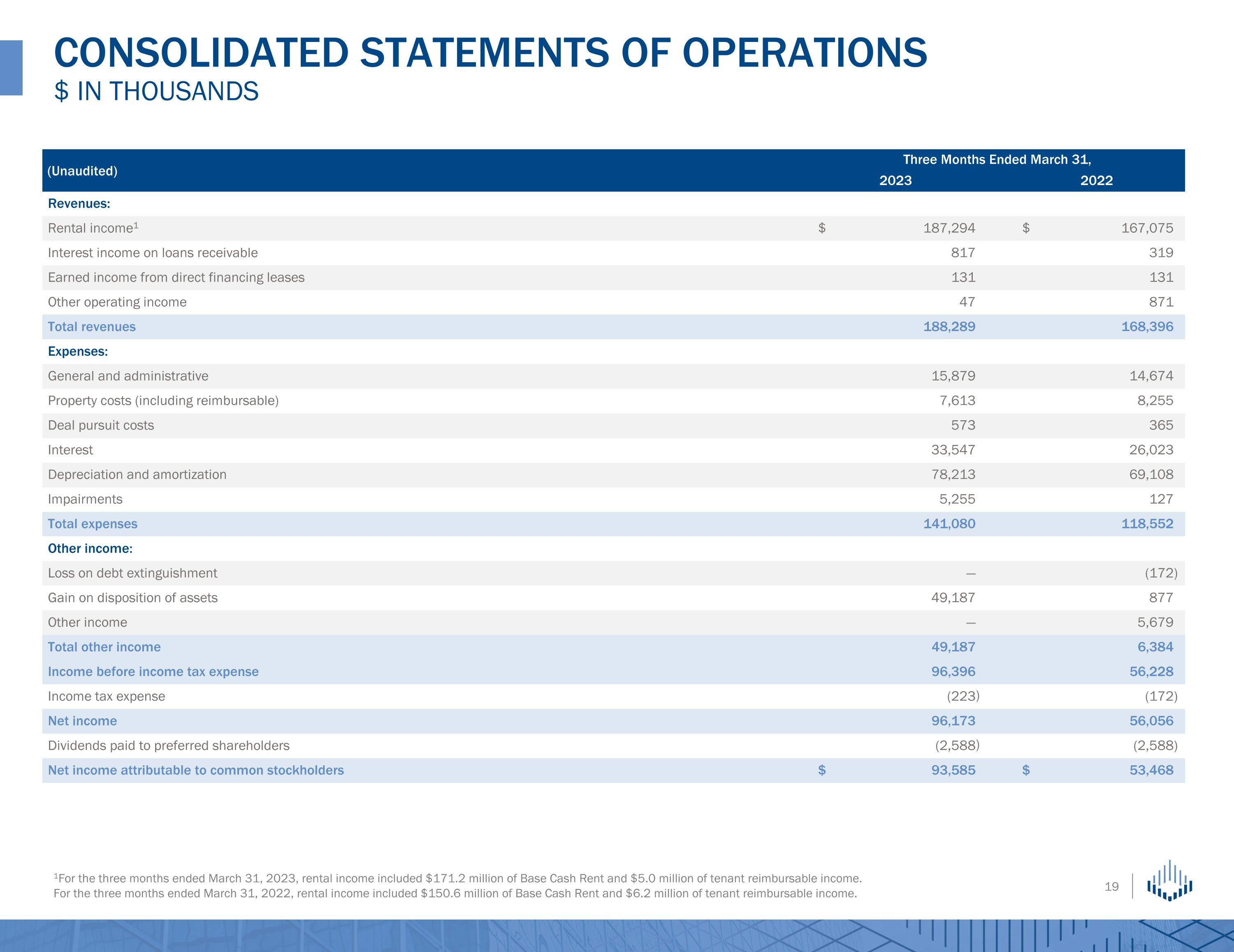

(Unaudited) Three Months Ended March 31, Three Months Ended March 31, 2023 2019 2022 2018 Revenues: Rental income1 $ 104,067 187,294 $ 98,236 167,075 Interest income on loans receivable 986 817 294 319 Earned income from direct financing leases 396 131 465 131 Other operating income 217 47 1,245 871 Total revenues 112,593 188,289 102,459 168,396 Expenses: General and administrative 15,879 14,674 Property costs (including reimbursable) 7,613 8,255 Deal pursuit costs 573 365 Interest 33,547 26,023 Depreciation and amortization 78,213 69,108 Impairments 5,255 127 Total expenses 141,080 118,552 Other income: Loss on debt extinguishment — (172 ) Gain on disposition of assets 49,187 877 Other income — 5,679 Total other income 49,187 6,384 Income before income tax expense 96,396 56,228 Income tax expense (223 ) (172 ) Net income 96,173 56,056 Dividends paid to preferred shareholders (2,588 ) (2,588 ) Net income attributable to common stockholders $ 93,585 $ 53,468 CONSOLIDATED STATEMENTS OF OPERATIONS�$ IN THOUSANDS 1For the three months ended March 31, 2023, rental income included $171.2 million of Base Cash Rent and $5.0 million of tenant reimbursable income. For the three months ended March 31, 2022, rental income included $150.6 million of Base Cash Rent and $6.2 million of tenant reimbursable income.

1Costs related to COVID-19 are included in general and administrative expense and primarily relate to legal fees for executing rent deferral or abatement agreements. 2Dividends paid and undistributed earnings allocated, if any, to unvested restricted stockholders are deducted from FFO and AFFO for the computation of the per share amounts. The following amounts were deducted: (Unaudited) Three Months Ended March 31, 2023 2022 Net income attributable to common stockholders $ 93,585 $ 53,468 Portfolio depreciation and amortization 78,069 68,965 Portfolio impairments 5,255 127 Gain on disposition of assets (49,187 ) (877 ) FFO attributable to common stockholders $ 127,722 $ 121,683 Loss on debt extinguishment — 172 Deal pursuit costs 573 365 Non-cash interest expense, excluding capitalized interest 2,780 1,937 Straight-line rent, net of uncollectible reserve (9,920 ) (8,575 ) Other amortization and non-cash charges (349 ) (647 ) Non-cash compensation expense 5,230 4,025 Costs related to COVID-191 — 6 Other income — (5,679 ) AFFO attributable to common stockholders $ 126,036 $ 113,287 Dividends declared to common stockholders $ 93,675 $ 85,688 Dividends declared as a percent of AFFO 74% 76% Net income per share of common stock – Basic $ 0.66 $ 0.42 Net income per share of common stock – Diluted $ 0.66 $ 0.42 FFO per share of common stock – Diluted2 $ 0.90 $ 0.95 AFFO per share of common stock – Diluted2 $ $ 0.89 $ 0.88 Weighted average shares of common stock outstanding – Basic 141,055,850 127,951,825 Weighted average shares of common stock outstanding – Diluted 141,055,850 128,360,431 3 Mo. Ended 03/31/2023 3 Mo. Ended 3/31/2022 FFO $0.2 million $0.2 million AFFO $0.2 million $0.2 million FUNDS AND ADJUSTED FUNDS FROM OPERATIONS �$ IN THOUSANDS, EXCEPT PER SHARE AMOUNTS

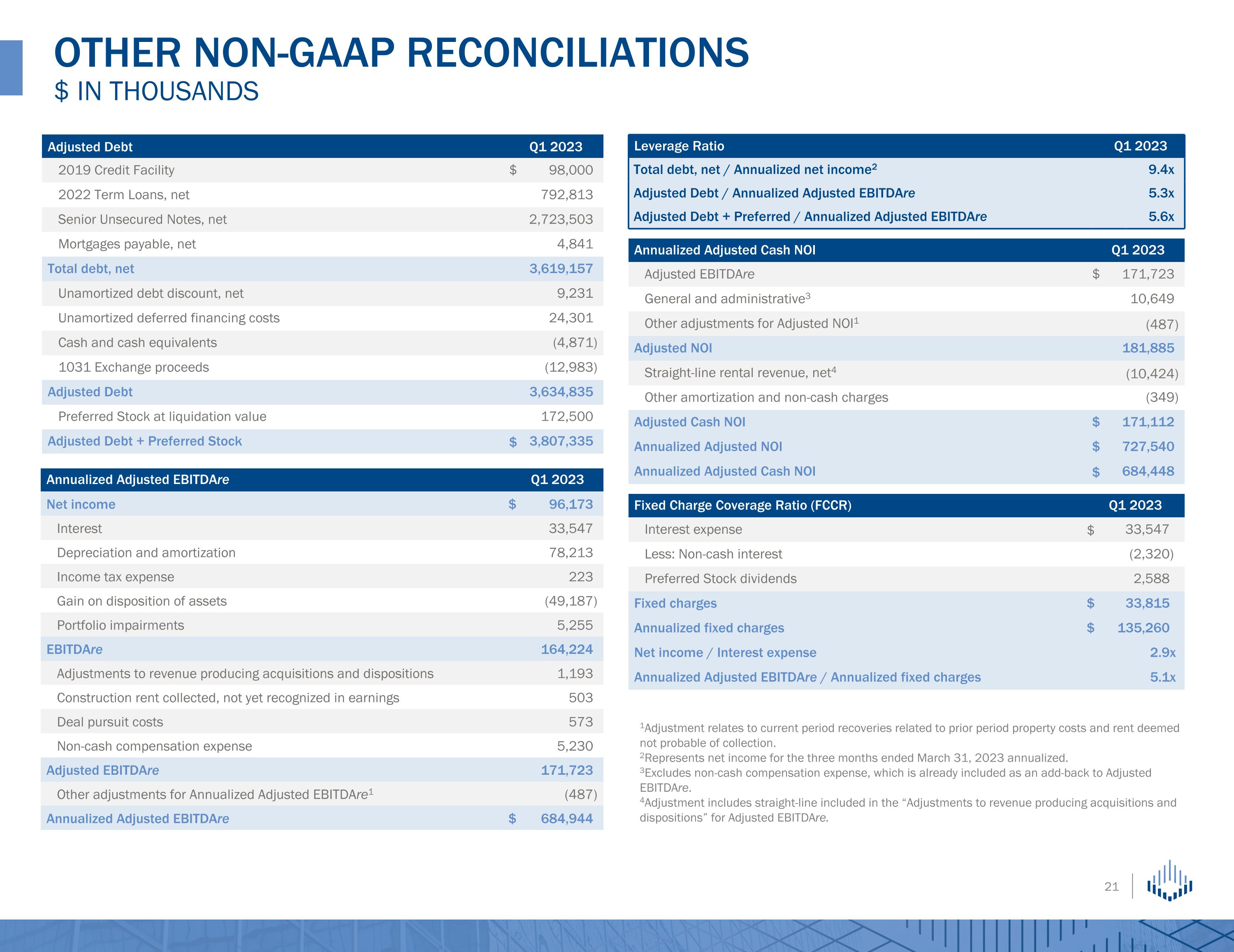

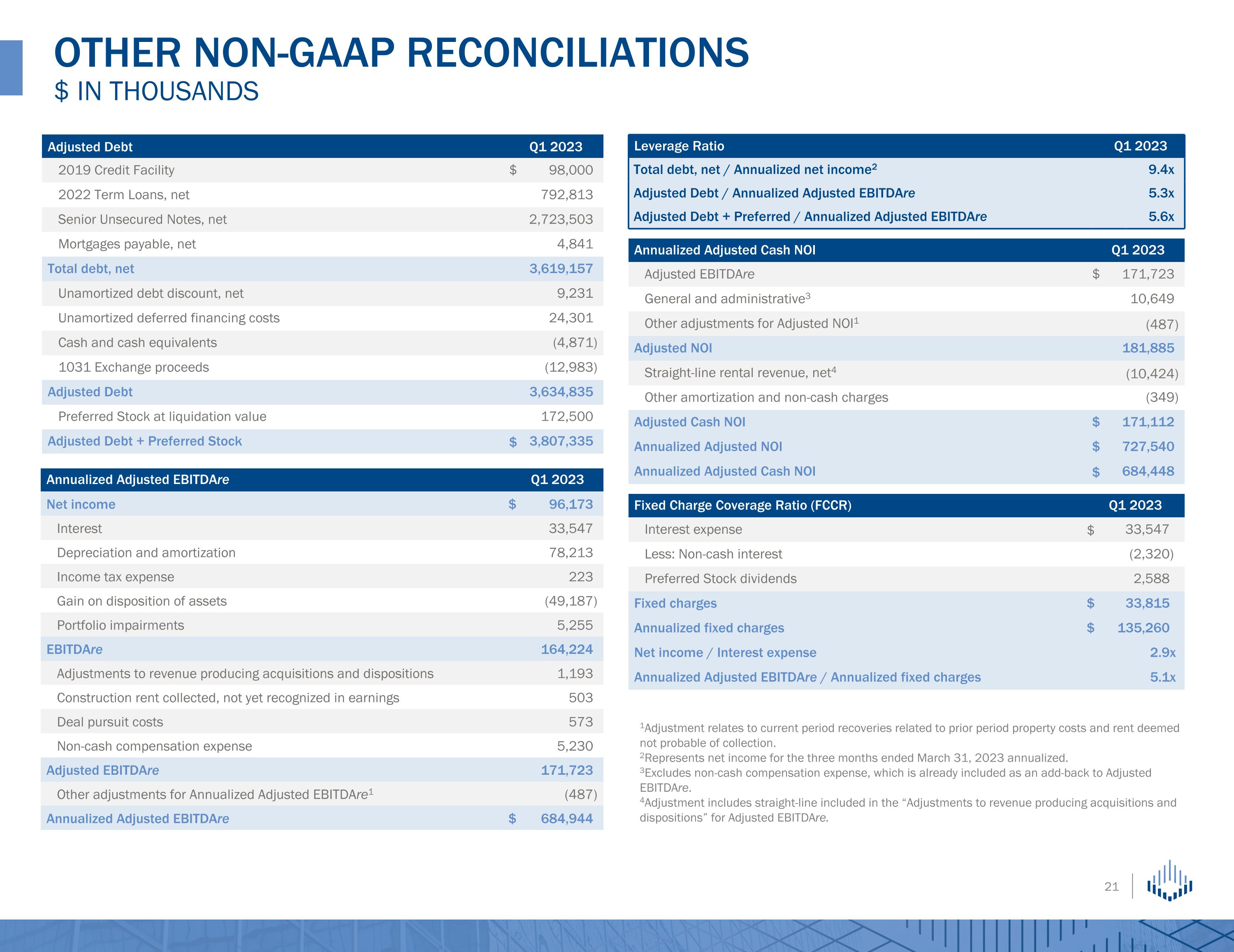

Annualized Adjusted EBITDAre Q1 2023 Q1 2019 Net income $ 96,173 Interest 33,547 Depreciation and amortization 78,213 Income tax expense 223 Gain on disposition of assets (49,187 ) Portfolio impairments 5,255 EBITDAre 164,224 Adjustments to revenue producing acquisitions and dispositions 1,193 Construction rent collected, not yet recognized in earnings 503 Deal pursuit costs 573 Non-cash compensation expense 5,230 Adjusted EBITDAre 171,723 Other adjustments for Annualized Adjusted EBITDAre1 (487 ) Annualized Adjusted EBITDAre $ 684,944 Fixed Charge Coverage Ratio (FCCR) Q1 2023 Q1 2019 Interest expense $ 33,547 Less: Non-cash interest (2,320 ) Preferred Stock dividends 2,588 Fixed charges $ 33,815 Annualized fixed charges $ 135,260 Net income / Interest expense 2.9 x Annualized Adjusted EBITDAre / Annualized fixed charges 5.1 x Annualized Adjusted Cash NOI Q1 2023 Q1 2019 Adjusted EBITDAre $ 171,723 General and administrative3 10,649 Other adjustments for Adjusted NOI1 (487 ) Adjusted NOI 181,885 Straight-line rental revenue, net4 (10,424 ) Other amortization and non-cash charges (349 ) Adjusted Cash NOI $ 171,112 Annualized Adjusted NOI $ 727,540 Annualized Adjusted Cash NOI $ 684,448 Leverage Ratio Q1 2023 Q1 2019 Total debt, net / Annualized net income2 9.4 x Adjusted Debt / Annualized Adjusted EBITDAre 5.3 x Adjusted Debt + Preferred / Annualized Adjusted EBITDAre 5.6 x Other NON-GAAP RECONCILIATIONS �$ in thousands Adjusted Debt Q1 2023 Q1 2019 2019 Credit Facility $ 98,000 2022 Term Loans, net 792,813 Senior Unsecured Notes, net 2,723,503 Mortgages payable, net 4,841 Total debt, net 3,619,157 Unamortized debt discount, net 9,231 Unamortized deferred financing costs 24,301 Cash and cash equivalents (4,871 ) 1031 Exchange proceeds (12,983 ) Adjusted Debt 3,634,835 Preferred Stock at liquidation value 172,500 Adjusted Debt + Preferred Stock $ 3,807,335 1Adjustment relates to current period recoveries related to prior period property costs and rent deemed not probable of collection. 2Represents net income for the three months ended March 31, 2023 annualized. 3Excludes non-cash compensation expense, which is already included as an add-back to Adjusted EBITDAre. 4Adjustment includes straight-line included in the “Adjustments to revenue producing acquisitions and dispositions” for Adjusted EBITDAre.

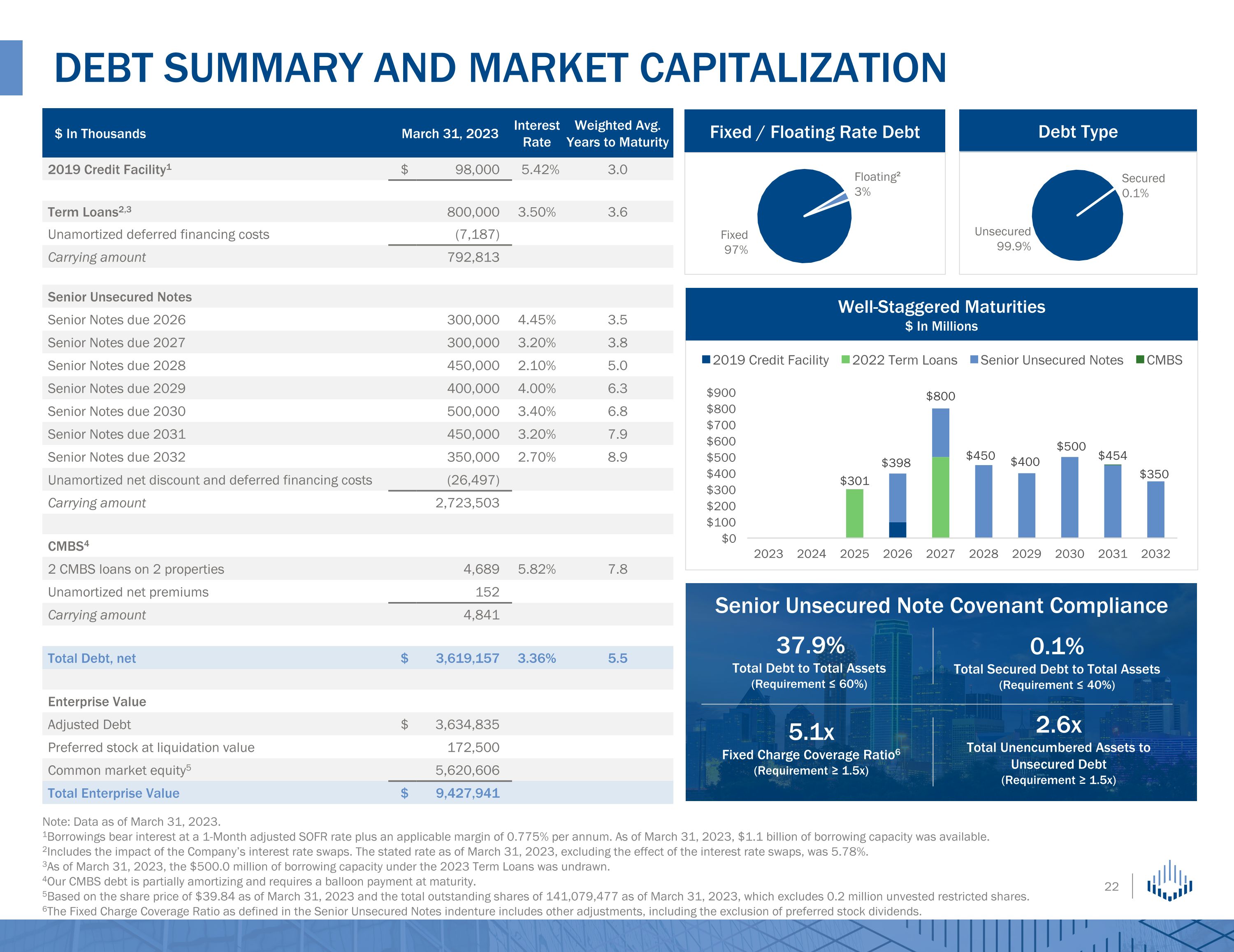

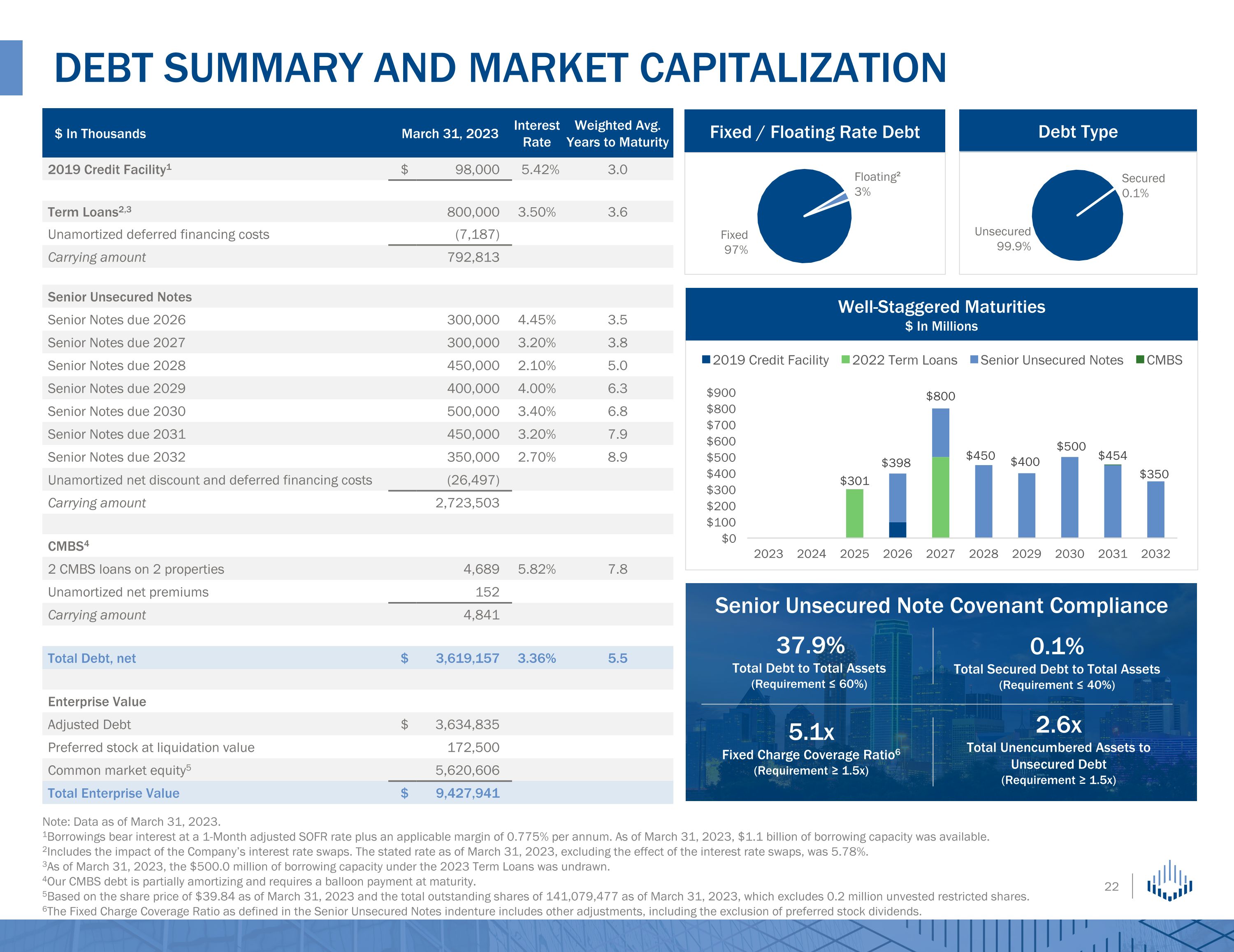

Note: Data as of March 31, 2023. 1Borrowings bear interest at a 1-Month adjusted SOFR rate plus an applicable margin of 0.775% per annum. As of March 31, 2023, $1.1 billion of borrowing capacity was available. 2Includes the impact of the Company’s interest rate swaps. The stated rate as of March 31, 2023, excluding the effect of the interest rate swaps, was 5.78%. 3As of March 31, 2023, the $500.0 million of borrowing capacity under the 2023 Term Loans was undrawn. 4Our CMBS debt is partially amortizing and requires a balloon payment at maturity. 5Based on the share price of $39.84 as of March 31, 2023 and the total outstanding shares of 141,079,477 as of March 31, 2023, which excludes 0.2 million unvested restricted shares. 6The Fixed Charge Coverage Ratio as defined in the Senior Unsecured Notes indenture includes other adjustments, including the exclusion of preferred stock dividends. Debt Summary and Market Capitalization $ In Thousands March 31, 2023 Interest Rate Weighted Avg. Years to Maturity 2019 Credit Facility1 $ 98,000 5.42% 3.0 Term Loans2,3 800,000 3.50% 3.6 Unamortized deferred financing costs (7,187) Carrying amount 792,813 Senior Unsecured Notes Senior Notes due 2026 300,000 4.45% 3.5 Senior Notes due 2027 300,000 3.20% 3.8 Senior Notes due 2028 450,000 2.10% 5.0 Senior Notes due 2029 400,000 4.00% 6.3 Senior Notes due 2030 500,000 3.40% 6.8 Senior Notes due 2031 450,000 3.20% 7.9 Senior Notes due 2032 350,000 2.70% 8.9 Unamortized net discount and deferred financing costs (26,497) Carrying amount 2,723,503 CMBS4 2 CMBS loans on 2 properties 4,689 5.82% 7.8 Unamortized net premiums 152 Carrying amount 4,841 Total Debt, net $ 3,619,157 3.36% 5.5 Enterprise Value Adjusted Debt $ 3,634,835 Preferred stock at liquidation value 172,500 Common market equity5 5,620,606 Total Enterprise Value $ 9,427,941 Debt Type Fixed / Floating Rate Debt 37.9% Total Debt to Total Assets (Requirement ≤ 60%) Senior Unsecured Note Covenant Compliance 0.1% Total Secured Debt to Total Assets (Requirement ≤ 40%) 5.1x Fixed Charge Coverage Ratio6 (Requirement ≥ 1.5x) 2.6x Total Unencumbered Assets to Unsecured Debt (Requirement ≥ 1.5x) Well-Staggered Maturities $ In Millions

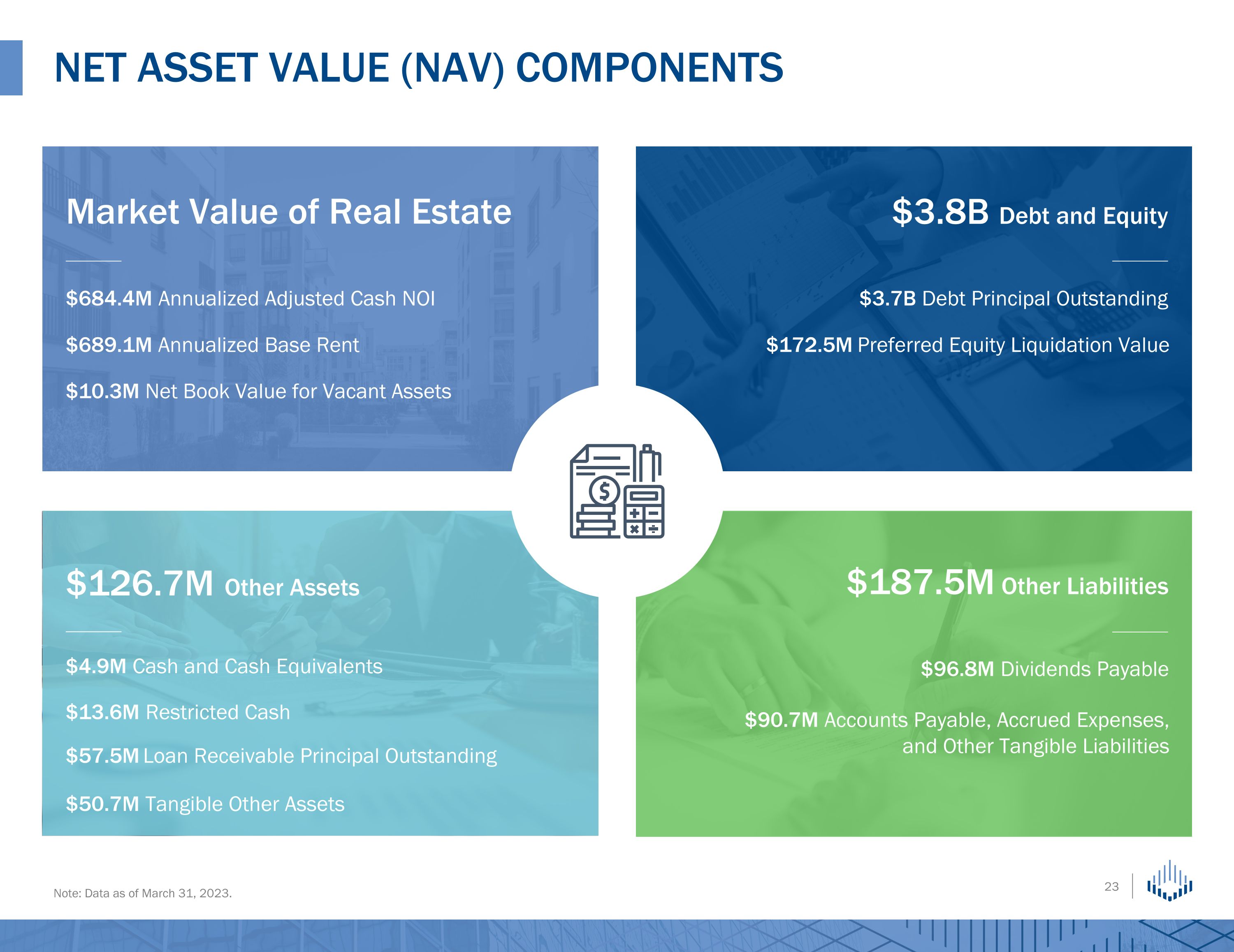

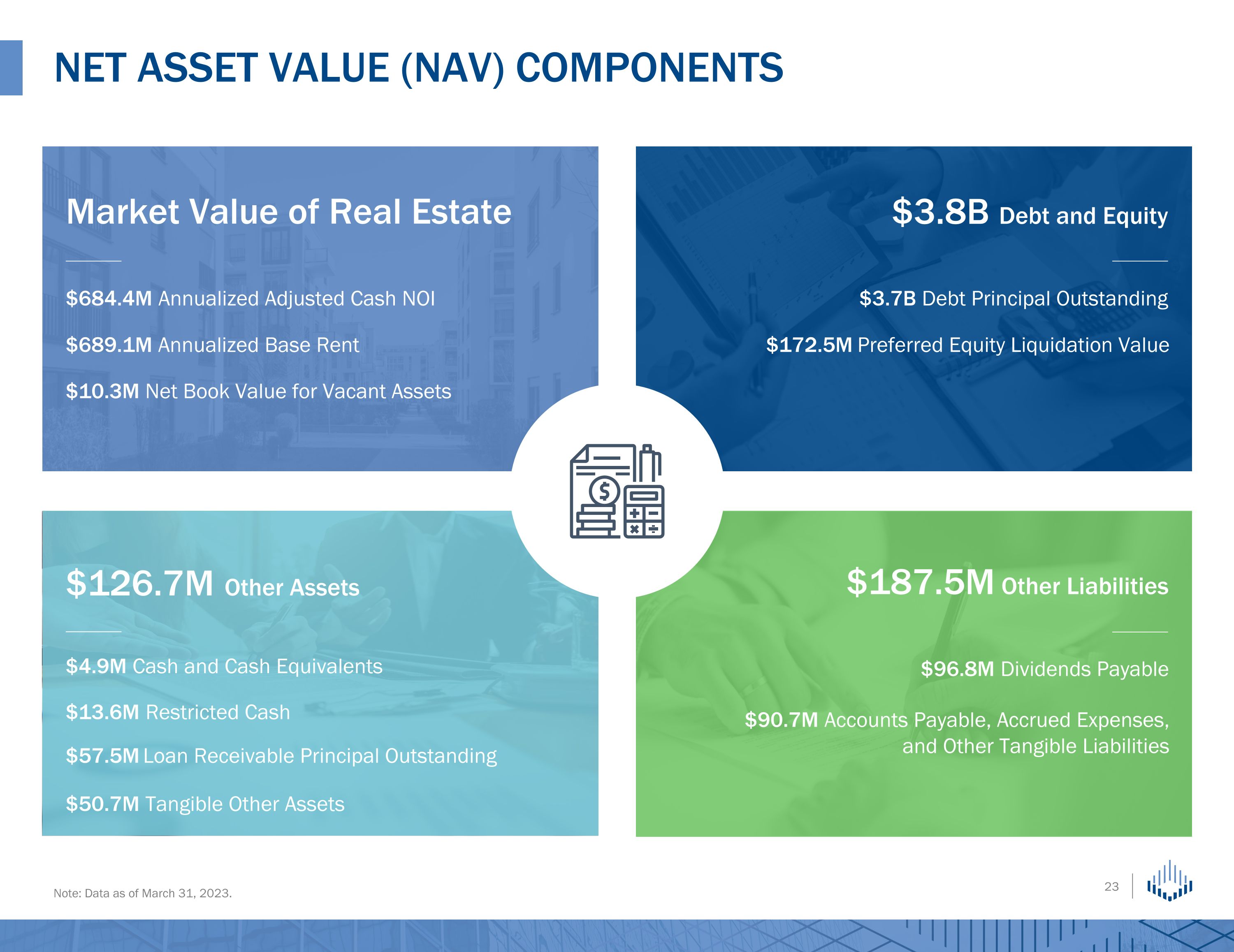

Net Asset Value (NAV) Components Note: Data as of March 31, 2023. Market Value of Real Estate $3.8B Debt and Equity $126.7M Other Assets $187.5M Other Liabilities $689.1M Annualized Base Rent $10.3M Net Book Value for Vacant Assets $3.7B Debt Principal Outstanding $172.5M Preferred Equity Liquidation Value $4.9M Cash and Cash Equivalents $50.7M Tangible Other Assets $96.8M Dividends Payable $90.7M Accounts Payable, Accrued Expenses, and Other Tangible Liabilities $684.4M Annualized Adjusted Cash NOI $57.5M Loan Receivable Principal Outstanding $13.6M Restricted Cash

Appendix

Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO) FFO is calculated in accordance with the standards established by NAREIT as net income (loss) attributable to common stockholders (computed in accordance with GAAP), excluding real estate-related depreciation and amortization, impairment charges and net (gains) losses from property dispositions. By excluding amounts which do not relate to or are not indicative of operating performance, we believe FFO provides a performance measure that captures trends in occupancy rates, rental rates and operating costs when compared year-over-year. We also believe that, as a widely recognized measure of the performance of equity REITs, FFO will be used by investors as a basis to compare our performance with that of other equity REITs. However, because FFO excludes depreciation and amortization and does not capture the changes in the value of our properties that result from use or market conditions, all of which have real economic effects and could materially impact our results from operations, the utility of FFO as a measure of our performance is limited. AFFO is an operating performance measure used by many companies in the REIT industry. We adjust FFO to eliminate the impact of certain items that we believe are not indicative of our core operating performance, such as net gains (losses) on debt extinguishment, deal pursuit costs, costs related to the COVID-19 pandemic, income associated with expiration of a contingent liability related to a guarantee of a former tenant's debt and certain non-cash items. These certain non-cash items include non-cash interest expenses (comprised of amortization of deferred financing costs, amortization of net debt discount/premium, and amortization of interest rate swap losses), non-cash revenues (comprised of straight-line rents net of bad debt expense, amortization of lease intangibles, and amortization of net premium/discount on loans receivable), and non-cash compensation expense. Other equity REITs may not calculate FFO and AFFO as we do, and, accordingly, our FFO and AFFO may not be comparable to such other equity REITs’ FFO and AFFO. FFO and AFFO do not represent cash generated from operating activities determined in accordance with GAAP, are not necessarily indicative of cash available to fund cash needs and should only be considered a supplement, and not an alternative, to net income (loss) attributable to common stockholders (computed in accordance with GAAP) as a performance measure. Adjusted Debt represents interest bearing debt (reported in accordance with GAAP) adjusted to exclude unamortized debt discount/premium and deferred financing costs and reduced by cash and cash equivalents and 1031 Exchange proceeds. By excluding these amounts, the result provides an estimate of the contractual amount of borrowed capital to be repaid, net of cash available to repay it. We believe this calculation constitutes a beneficial supplemental non-GAAP financial disclosure to investors in understanding our financial condition. EBITDAre, Adjusted EBITDAre and Annualized Adjusted EBITDAre EBITDAre is computed in accordance with the standards established by NAREIT as net income (loss) (computed in accordance with GAAP), excluding interest expense, income tax expense, depreciation and amortization, net (gains) losses from property dispositions, and impairment charges. Adjusted EBITDAre represents EBITDAre as adjusted for revenue producing acquisitions, capital expenditures and dispositions for the quarter (as if such acquisitions and dispositions had occurred as of the beginning of the quarter), construction rent collected, not yet recognized in earnings, and for other certain items that we believe are not indicative of our core operating performance. These other certain items include deal pursuit costs, net (gains) losses on debt extinguishment, costs related to the COVID-19 pandemic, and non-cash compensation expense. We believe that excluding these items, which are not key drivers of our investment decisions and may cause short-term fluctuations in net income (loss), provides a useful supplemental measure to investors in assessing the net earnings contribution of our real estate portfolio. Because these measures do not represent net income (loss) that is computed in accordance with GAAP, they should only be considered a supplement, and not an alternative, to net income (loss) (computed in accordance with GAAP) as a performance measure. Annualized Adjusted EBITDAre is calculated as Adjusted EBITDAre, adjusted for straight-line rent related to prior periods, including amounts deemed not probable of collection (recoveries), and items where annualization would not be appropriate, multiplied by four. Our computation of Adjusted EBITDAre and Annualized Adjusted EBITDAre may differ from the methodology used by other equity REITs to calculate these measures and, therefore, may not be comparable to such other REITs. Adjusted Debt to Annualized Adjusted EBITDAre is used to evaluate the level of borrowed capital being used to increase the potential return of our real estate investments, and a proxy for a measure we believe is used by many lenders and ratings agencies to evaluate our ability to repay and service our debt obligations. We believe the ratio is a beneficial disclosure to investors as a supplemental means of evaluating our ability to meet obligations senior to those of our equity holders. Our computation of this ratio may differ from the methodology used by other equity REITs, and, therefore, may not be comparable to such other REITs. Fixed Charge Coverage Ratio (FCCR) Fixed charges consist of interest expense, reported in accordance with GAAP, less non-cash interest expense (including capitalized interest) and plus preferred dividends. Annualized Fixed Charges is calculated by multiplying fixed charges for the quarter by four. The Fixed Charge Coverage Ratio is the ratio of Annualized Adjusted EBITDAre to Annualized Fixed Charges and is used to evaluate our liquidity and ability to obtain financing. Adjusted NOI, Annualized Adjusted NOI, Adjusted Cash NOI and Annualized Adjusted Cash NOI Adjusted NOI is calculated as Adjusted EBITDAre for the quarter less general and administrative costs, plus (minus) items where annualization would not be appropriate. Annualized Adjusted NOI is Adjusted NOI multiplied by four. Adjusted Cash NOI is calculated as Adjusted NOI less certain non-cash items, including straight-line rents net of bad debt expense, amortization of lease intangibles, and amortization of net premium/discount on loans receivable. Annualized Adjusted Cash NOI is Adjusted Cash NOI multiplied by four. We believe these metrics provide useful information because they reflect only those income and expenses incurred at the property level. We believe this calculation constitutes a beneficial supplemental non-GAAP financial disclosure to investors in understanding our financial results. NON-GAAP DEFINITIONS AND EXPLANATIONS

2019 Credit Facility refers to the $1.2 billion unsecured credit facility which matures on March 31, 2026. 2022 Term Loans refers to the $800.0 million senior unsecured term loan facility, comprised of a $300.0 million tranche which matures on August 22, 2025 and a $500.0 million tranche which matures on August 20, 2027. 2023 Term Loans refers to the $500.0 million senior unsecured delayed-draw term loan facility, which matures on June 16, 2025. Annualized Base Rent (ABR) represents Base Rent plus earned income from direct financing leases and deferred revenue from development deals for the final month of the reporting period. It is adjusted to reflect acquisitions and dispositions for that month as if such acquisitions and dispositions had occurred as of the beginning of the month. The total is then multiplied by 12. We use ABR when calculating certain metrics to evaluate portfolio credit and diversification and to manage risk. Average Annual Escalators are the weighted average contractual escalation per year under the terms of the in-place leases, weighted by ABR. Base Rent represents contractual rental income for the period, prior to deferral or abatement agreements, and excluding contingent rents. We use Base Rent to monitor cash collection and to evaluate past due receivables. Base Cash Rent represents Base Rent adjusted for contractual rental income abated, deemed not probable of collection, or recovered from prior period reserves. Cash Capitalization Rate is a measure of the contractual cash rent expected to be earned on an acquired property or Revenue Producing Expenditures in the first year and is calculated by dividing the first twelve months of contractual cash rent (excluding any contingent rent) by the purchase price of the related property or capital expenditure amount. Because it excludes any contingent rent that may be contractually provided for in the lease, as well as any other income or fees that may be earned from lease modifications or asset dispositions, Cash Capitalization Rate does not represent the annualized investment rate of return. Additionally, the actual rate earned may differ from the Cash Capitalization Rate based on other factors, including difficulties collecting contractual rent owed and unanticipated expenses at these properties that we cannot pass on to tenants. CMBS are notes secured by owned properties and rents therefrom under which certain indirect wholly-owned special purpose subsidiaries of the Company are the borrowers. Corporate Liquidity is comprised of availability under the 2019 Credit Facility, 2023 Term Loans, cash and cash equivalents, 1031 Exchange proceeds and available proceeds from unsettled forward equity contracts. Disposition Capitalization Rate represents the ABR on the date of a leased property disposition divided by the gross sales price. For multi-tenant properties, non-reimbursable property costs are deducted from the ABR prior to computing the Disposition Capitalization Rate. Economic Yield is calculated by dividing the contractual cash rent, including fixed rent escalations and/or cash increases determined by CPI (increases calculated using CPI as of the end of the reporting period) by the initial lease term, expressed as a percentage of the Gross Investment. FASB is the Financial Accounting Standards Board. Forward Same Store Sales represents the expected change in ABR as of the reporting period as compared to the projected ABR at the end of the next 12 months. For properties where rent escalations are fixed, actual contractual escalations over the next 12 months are used. For properties where rent escalations are CPI-related, a growth rate of 2% has been assumed. For properties whose leases expire (or renewal options have not yet been exercised) in the next 12 months, a 100% renewal rate has been assumed. GAAP are the Generally Accepted Accounting Principles in the United States. Gross Investment represents the gross acquisition cost including the contracted purchase price and related capitalized transaction costs. Lost Rent is calculated as rent deemed not probable of collection for the quarterly period. This amount is divided by Base Rent for the quarterly period, reduced for amounts abated. Net Book Value represents the Real Estate Investment value, less impairment charges and net of accumulated depreciation. Public Ownership represents ownership of our tenants or their affiliated companies. Purchase Price represents the contracted acquisition purchase price, excluding any related capitalized transaction costs. Real Estate Investment represents the Gross Investment plus improvements less impairment charges. Revenue Producing Expenditures represent expenditures for development transactions, tenant property improvements, and investments in tenant loans, debt securities or similar instruments that provide a return on investment. Senior Unsecured Notes refers to the $300 million aggregate principal amount of 4.450% notes due 2026, the $300 million aggregate principal amount of 3.200% notes due 2027, the $450 million aggregate principal amount of 2.100% notes due 2028, the $400 million aggregate principal amount of 4.000% notes due 2029, the $500 million aggregate principal amount of 3.400% notes due 2030, the $450 million aggregate principal amount of 3.200% notes due 2031, and the $350 million aggregate principal amount of 2.700% notes due 2032. Tenant represents the legal entity ultimately responsible for obligations under the lease agreement or an affiliated entity. Other tenants may operate under the same or similar brand or trade name. Tenant Concept represents the brand or trade name under which our tenant operates. Unreimbursed Property Costs is calculated by subtracting tenant reimbursement income from property costs for the quarterly period. The resulting difference is divided by the Base Rent for the quarterly period. WALT represents the weighted average remaining lease term of our in-place leases at period end. Weighted Average Unit Coverage is used as an indicator of individual asset profitability, as well as signaling the property’s importance to our tenants’ financial viability. We calculate Unit Coverage by dividing our reporting tenants’ trailing 12-month EBITDAR (earnings before interest, tax, depreciation, amortization and rent) by annual contractual rent. These are then weighted based on the tenant’s ABR. Tenants in the manufacturing industry are excluded from the calculation. OTHER DEFINITIONS AND EXPLANATIONS

FORWARD-LOOKING STATEMENTS AND RISK FACTORS The information in this presentation should be read in conjunction with the accompanying earnings press release, as well as the Company's Annual Report on Form 10-K and other information filed with the Securities and Exchange Commission. This presentation is not incorporated into such filings. This document is not an offer to sell or a solicitation to buy securities of Spirit Realty Capital, Inc. Any offer or solicitation shall be made only by means�of a prospectus approved for that purpose. This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act, as amended, Section 21E of the Exchange Act, as amended, the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements can be identified by the use of words and phrases such as “preliminary,” “expect,” “plan,” “will,” “estimate,” “project,” “intend,” “believe,” “guidance,” “approximately,” “anticipate,” “may,” “should,” “seek,” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate to historical matters but are meant to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions of management. These forward-looking statements are subject to known and unknown risks and uncertainties that you should not rely on as predictions of future events. Forward-looking statements depend on assumptions, data and/or methods which may be incorrect or imprecise, and Spirit may not be able to realize them. Spirit does not guarantee that the events described will happen as described (or that they will happen at all). The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: industry and economic conditions; volatility and uncertainty in the financial markets, including potential fluctuations in the Consumer Price Index; Spirit's success in implementing its business strategy and its ability to identify, underwrite, finance, consummate, integrate and manage diversified acquisitions or investments; the financial performance of Spirit's retail tenants and the demand for retail space; Spirit's ability to diversify its tenant base; the nature and extent of future competition; increases in Spirit's costs of borrowing as a result of changes in interest rates and other factors; Spirit's ability to access debt and equity capital markets; Spirit's ability to pay down, refinance, restructure and/or extend its indebtedness as it becomes due; Spirit's ability and willingness to renew its leases upon expiration and to reposition its properties on the same or better terms upon expiration in the event such properties are not renewed by tenants or Spirit exercises its rights to replace existing tenants upon default; the impact of any financial, accounting, legal or regulatory issues or litigation that may affect Spirit or its major tenants; Spirit's ability to manage its expanded operations; Spirit's ability and willingness to maintain its qualification as a REIT under the Internal Revenue Code of 1986, as amended; the impact on Spirit’s business and those of its tenants from epidemics, pandemics or other outbreaks of illness, disease or virus; and other risks inherent in the real estate business, including tenant defaults, potential liability relating to environmental matters, illiquidity of real estate investments and potential damages from natural disasters discussed in Spirit's most recent filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. You are cautioned not to place undue reliance on forward-looking statements which are based on information that was available, and speak only, as of the date on which they were made. While forward-looking statements reflect Spirit's good faith beliefs, they are not guarantees of future performance. Spirit expressly disclaims any responsibility to update or revise forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. Forward-Looking and Cautionary Statements Notice Regarding Non-GAAP Financial Measures In addition to U.S. GAAP financial measures, this presentation contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this Appendix if the reconciliation is not presented on the page in which the measure is published.