Exhibit 99.3 |

2 Forward Looking Statements Forward Looking Statements In addition to historical information, this document contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which Spirit Realty Capital, Inc. (“Spirit”), and Cole Credit Property Trust II, Inc. (“CCPT II”) operate and beliefs of and assumptions made by Spirit management and CCPT II management, involve risks and uncertainties that could significantly affect the financial results of Spirit or CCPT II or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “projects,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Spirit and CCPT II, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to rent and occupancy growth, changes in sales or contribution volume of developed properties, general conditions in the geographic areas where we operate and the availability of capital — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, international, regional and local economic climates, (ii) changes in financial markets, interest rates, credit spreads, and foreign currency exchange rates, (iii) changes in the real estate markets, (iv) continued ability to source new investments, (v) increased or unanticipated competition for our properties, (vi) risks associated with acquisitions, (vii) maintenance of real estate investment trust status, (viii) availability of financing and capital, (ix) changes in demand for developed properties, (x) risks associated with achieving expected revenue synergies or cost savings, (xi) risks associated with the ability to consummate the merger and the timing of the closing of the merger, and (xii) those additional risks and factors discussed in reports filed with the Securities and Exchange Commission (“SEC”) by Spirit and CCPT II from time to time. Neither Spirit nor CCPT II undertakes any duty to update any forward-looking statements appearing in this document. |

3 Disclaimer Disclaimer In connection with the proposed transaction, CCPT II expects to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of CCPT II and Spirit that also constitutes a prospectus of Spirit. CCPT II and Spirit also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by Spirit and CCPT II with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by Spirit with the SEC will be available free of charge on Spirit’s website at www.spiritrealty.com or by directing a written request to Spirit Realty Capital, Inc., 16767 North Perimeter Drive, Suite 210, Scottsdale, Arizona 85260, Attention: Investor Relations. Copies of the documents filed by CCPT II with the SEC will be available free of charge by directing a written request to Cole Credit Property Trust II, Inc., 2325 East Camelback Road, Suite 1100, Phoenix, Arizona, 85016, Attention: Investor Relations. Spirit and CCPT II and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about Spirit’s executive officers and directors in Spirit’s final prospectus filed with the SEC on September 21, 2012. You can find information about CCPT II’s executive officers and directors in CCPT II’s definitive proxy statement filed with the SEC on April 13, 2012. Additional information regarding the interests of such potential participants will be included in the joint proxy statement/prospectus and other relevant documents filed with the SEC if and when they become available. You may obtain free copies of these documents from Spirit or CCPT II using the sources indicated above. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. |

4 Merger Benefits Merger Benefits Additional Size and Scale Increased Tenant Diversification Broadened Tenant Credit Profile Enhanced Operating Efficiencies Increased Financial Strength and Flexibility The merger of Spirit and CCPT II creates the second largest -lease company publicly traded triple-net |

5 Cole Credit Property Trust II Cole Credit Property Trust II CCPT II is a large and high-quality portfolio of assets Founded 2005 # of Investors ~40,000 Enterprise Value (3) $3.7bn Number of Properties (5) 822 Total Square Feet (MM) 21.2 Occupancy (4) 99.5% Avg. Remaining Lease Term (1) 10.0 % Investment Grade (1) (2) 45% Number of Tenants 282 Number of Industries 47 Number of States 45 Net Debt / Enterprise Value (3) 47% Tenant Credit Ratings (1) (2) Property Type Diversity (1) CCPT II Overview Non- Rated 30% Non-Inv. Grade 24% Inv. Grade 45% Office 6% Single- Tenant Retail 65% Industrial 11% Multi- Tenant Retail 18% Source: Company filings. Notes: (1) Based on rental revenue. (2) Includes single tenant properties only. (3) Based on the January 18, 2013 closing price of Spirit Realty of $17.82 and exchange ratio of 1.9048. (4) Based on number of properties as of September 30, 2012. (5) Includes 69 mortgage notes receivables. (6) Excludes mortgage notes receivables. (6) |

Transaction Overview Transaction Overview 6 Merger of Spirit Realty Capital, Inc. (“Spirit”) and Cole Credit Property Trust II (“CCPT II”) 100% stock merger transaction resulting in $7.1 billion combined pro forma enterprise value Fixed exchange ratio with each common share of Spirit converted into 1.9048 shares of CCPT II common stock (equates to 0.525 Spirit shares for each share of CCPT II) Transaction Consideration Combined company will be named Spirit Realty Capital Spirit management team to lead merged entity Spirit board to grow to nine members with addition of two directors from CCPT II Corporate Governance Closing Q3 2013 Expected Timing Proxy filed Q1 2013 Implied value per CCPT II share of $9.27 based on the volume weighted average of Spirit’s share price from the date of its inclusion in the Russell 2000 Index through the closing price on January 18, 2013, which was $17.66. Implied value per CCPT II share of $9.17 based on Spirit’s 20 trading day volume weighted average price (VWAP) of $17.47 as of January 18, 2013 Combined entity to be listed on the NYSE under Spirit’s ticker SRC Ownership: 44% Spirit / 56% CCPT II Contingent upon majority approval of both companies’ stockholders Spirit’s largest shareholders, Macquarie and TPG-Axon, who together own ~15% of Spirit, have executed agreements that state their intention to vote in favor of the transaction Implied value per CCPT II share of $9.36 based on Spirit closing price of $17.82 on January 18, 2013 |

Additional Size and Scale Additional Size and Scale Properties (2) Square Feet (MM) Number of States Number of Tenants Weighted Average Occupancy (3) Remaining Lease Term (4) Top 10 Tenant Concentration (4) Improved portfolio characteristics 7 Pro Forma Investment Grade Rental Revenue (4)(5) Enterprise Value (1) 822 (6) 2,012 1,190 33.1 47 165 98.4% 11.2 52% 21.2 45 282 99.5% 10.0 41% 54.3 48 300+ 98.8% 10.6 37% 1% 45% 19% $3.7 billion $7.1 billion $3.4 billion Source: Company filings. Notes: (1) Based on the January 18, 2013 closing price of Spirit Realty of $17.82 and exchange ratio of 1.9048. (2) 98.5% of Spirit’s total gross investments represent owned properties. Remaining investments include properties securing mortgage loans. (3) Occupancy based on number of properties. (4) Based on rental revenue. (5) Includes single tenant properties only. (6) Includes 69 mortgage notes receivables. |

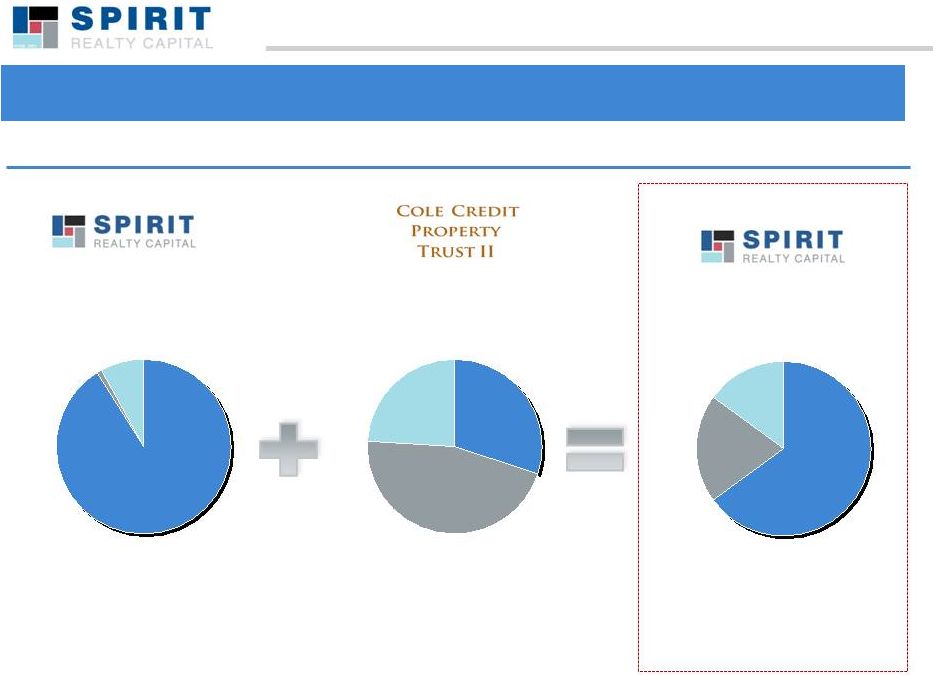

8 Increased Tenant Diversification Increased Tenant Diversification Property Type Diversity Single-Tenant Retail Industrial Office Other Industry Type Diversity Increased diversity by property type and industry Source: Company filings. Note: (1) Based on rental revenue. Multi-Tenant Retail General and Discount Retail Properties Restaurants – Quick Service Specialty Retail Restaurants – Casual Dining Automotive Dealers, Parts, and Service Facilities Recreational Movie Theatres Convenience Stores / Car Washes Industrial Home Improvement Other Drugstores (2) (2) Excludes mortgage loans. (1) |

Top Tenants (1) % of Portfolio 15.7% 4.4% 3.5% Church’s Chicken 2.6% 2.4% Circle K 2.2% 1.8% 1.5% The Home Depot 1.3% 1.3% OTHER 63.4% Increased Tenant Diversification Increased Tenant Diversification Tenants are industry leaders in pharmacy, consumer goods, restaurant and home improvement sectors 9 Sources: Company filings and reports as of September 30, 2012 Notes: The trade names shown are of tenants in properties owned by SRC or CCPT II. SRC or CCPT II are not affiliated or associated with, are not endorsed by, do not endorse, and are not sponsored by or sponsors of the tenants or of the tenant’s products or services pictured or mentioned above. The names, logos, and all related product and service names, design marks, and slogans are the trademarks or service marks of the respective companies. (1) Based on rental revenue. Excludes mortgage notes receivables. 52% 37% 0% 10% 20% 30% 40% 50% 60% Current Pro Forma Top Ten Tenant Concentration (1) |

10 Increased Tenant Diversification Increased Tenant Diversification Increases geographic diversity across 48 states Note: Hatched shading denotes states in which only one standalone company operated prior to the merger (1) Based on NCREIF regions rental revenue. Geographic Diversity (1) West 14% Midwest 34% South 33% East 19% |

11 Broadened Tenant Credit Profile Broadened Tenant Credit Profile Addition of investment grade tenants creates more investment opportunities Tenant Credit Ratings (1) Note: Based on rental revenue. (1) Includes single tenant properties only. Pro Forma Non- Rated 91% Non-Inv. Grade 8% Inv. 1% Non- Rated 30% Non-Inv. Grade 26% Inv. Grade 45% Non- Rated 66% Non-Inv. Grade 15% Inv. Grade 19% |

12 Attractive Lease Profile Attractive Lease Profile A significant portion of the leases provide for contractual increases in future annual base rent Lease Expirations 1.3% 2.2% 3.1% 4.1% 4.7% 5.7% 3.5% 6.7% 8.5% 60.3% 0% 10% 20% 30% 40% 50% 60% 70% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 and Thereafter Note: Based on rental revenue. Weighted average remaining non-cancellable lease term of 10.6 years with no significant near-term maturities Pro forma company will derive ~40% of rental revenue from master leases, which protects against tenants “cherry picking” properties in the event of adverse business performance |

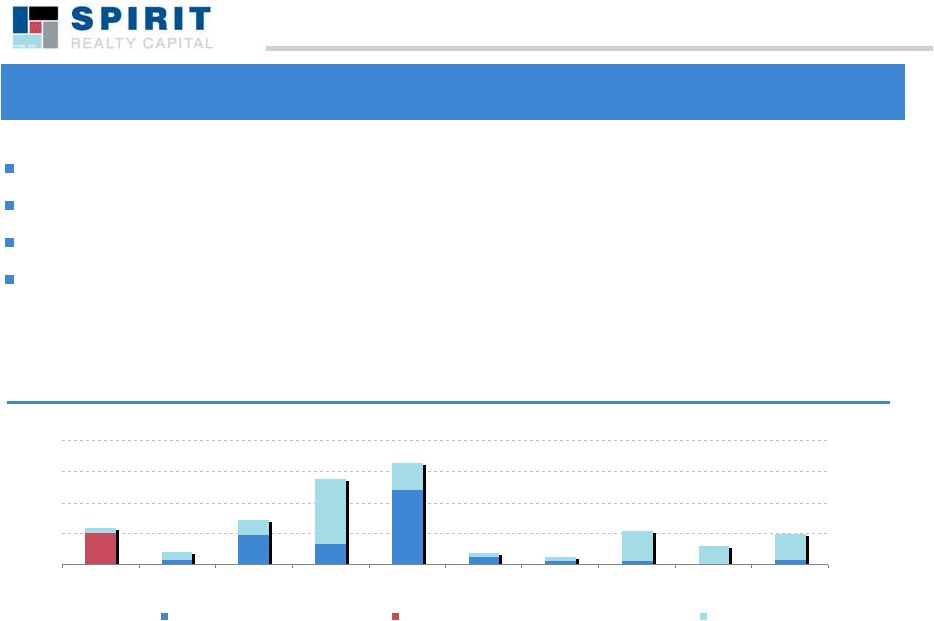

13 Increased Financial Strength and Flexibility Increased Financial Strength and Flexibility Source: Company filings. Note: (1) Does not give effect to any repayments or modifications that may be made in connection with the transaction. Diversified sources of capital including the equity capital markets, preferred equity, CMBS and ABS markets Less than 15% of property-level debt matures in the next three years Established strong relationship with financial institutions Approximately $1 billion unencumbered asset base provides financial flexibility Merger expected to provide greater financial flexibility 0 300 600 900 1,200 2013 2014 2015 2016 2017 2018 2019 2020 2021 Thereafter CCPT II CCPT II Credit Facility Spirit Pro Forma Debt Maturity Schedule (1) ($ in millions) |

The Benefits of Scale The Benefits of Scale Net Lease REITs by Enterprise Value 14 Sources: Company filings and FactSet. Notes: (1) Dotted-line box represents the announced acquisition of ARCT III. (2) Dotted-line box represents the announced acquisition of American Realty Capital Trust (ARCT). Large cap REITS generally enjoy benefits of scale vs. peers |

Top-Tier Net Lease REIT Top-Tier Net Lease REIT % Investment Grade Tenants (2) Lease Term (2) 15 Square Feet Dividend Yield Sources: FactSet, SNL Financial and Company financials. Note: (1) Pro forma for the announced acquisition of ARCT. (2) Based on rental revenue. (3) Single tenant assets only. Attractive investment profile relative to the peers with highest trading levels |

16 Merger Benefits Merger Benefits Additional Size and Scale Increased Tenant Diversification Broadened Tenant Credit Profile Enhanced Operating Efficiencies Increased Financial Strength and Flexibility The merger of Spirit and CCPT II checks all the boxes for shareholder value |