NYSE:SRC Supplemental Financial & Operating Information SECOND QUARTER ENDED JUNE 30, 2015

NYSE:SRC About Spirit Spirit Realty Capital, Inc. (NYSE:SRC) is a premier net lease real estate investment trust (REIT) that invests in and manages a portfolio primarily of single-tenant, operationally essential real estate assets throughout the United States. Single-tenant, operationally essential real estate generally refers to free-standing, commercial real estate facilities where our tenants conduct business activities that are essential to the generation of their sales and profits. Our properties are frequently acquired through strategic sale-leaseback transactions and predominantly leased on a long-term, triple-net basis to high- quality tenants. Founded in 2003, we are an established net-lease REIT with a proven growth strategy and a seasoned management team focused on producing superior risk adjusted returns. As of June 30, 2015, our undepreciated gross real estate investment portfolio was approximately $8.2 billion, representing investments in 2,600 properties, including properties securing mortgage loans made by the Company. Our properties are leased to over 450 tenants who represent 27 diverse industries across 49 states. At June 30, 2015, Spirit’s leases had a weighted average remaining term of 10.8 years. In addition, approximately 46% of Spirit’s annual rental revenues were derived from master leases and approximately 89% of Spirit’s single tenant leases provided for periodic rent increases. Q2 2015 2 CORPORATE OVERVIEW Corporate Headquarters 16767 N. Perimeter Dr., Suite 210 Scottsdale, Arizona 85260 Phone: 480-368-3205 www.spiritrealty.com Transfer Agent American Stock Transfer & Trust Company, LLC Phone: 866-703-9065 www.amstock.com Investor Relations Mary Jensen Vice President (480) 315-6604 mjensen@spiritrealty.com SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

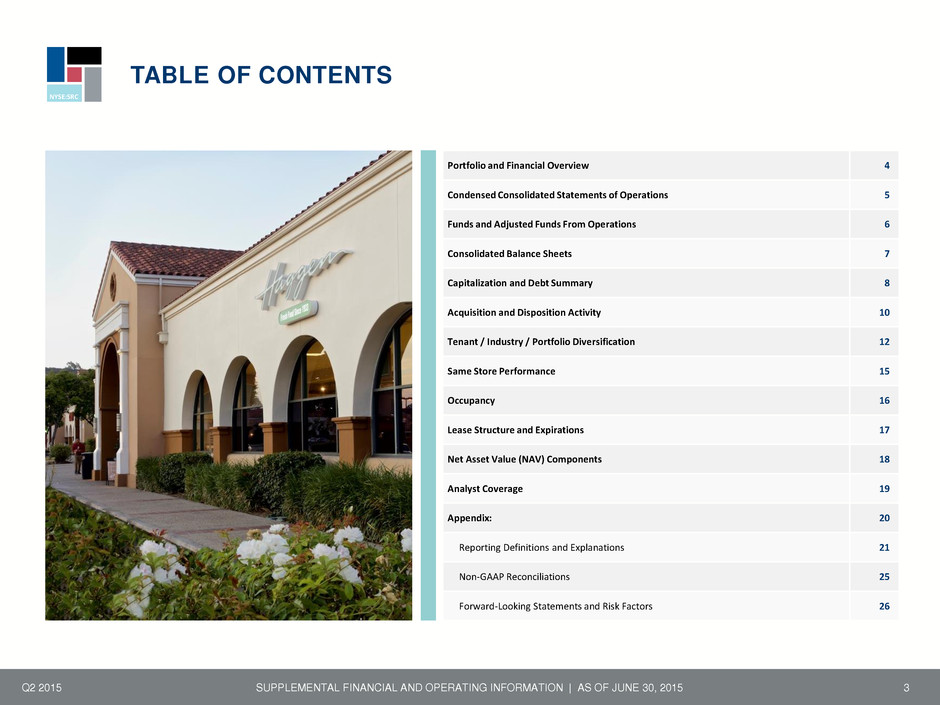

NYSE:SRC TABLE OF CONTENTS Q2 2015 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015 3 Portfolio and Financial Overview 4 Condensed Consolidated Statements of Operations 5 Funds and Adjusted Funds From Operations 6 Consolidated Balance Sheets 7 Capitalization and Debt Summary 8 Acquisition and Disposition Activity 10 Tenant / Industry / Portfolio Diversification 12 Same Store Performance 15 Occupancy 16 Lease Structure and Expirations 17 Net Asset Value (NAV) Components 18 Analyst Coverage 19 Appendix: 20 Reporting Definitions and Explanations 21 Non-GAAP Reconciliations 25 Forward-Looking Statements and Risk Factors 26

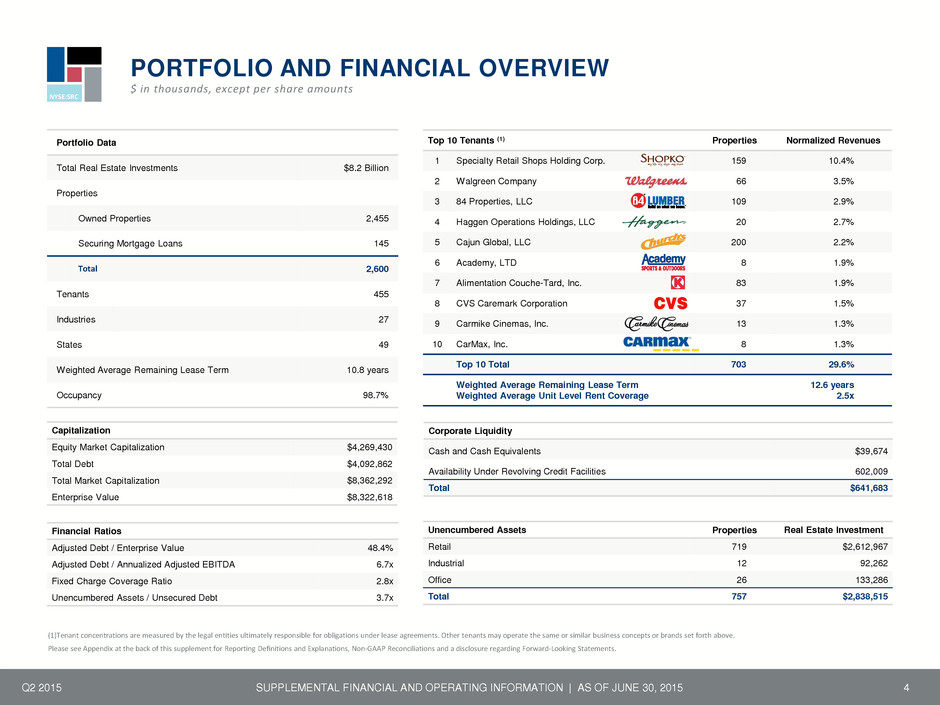

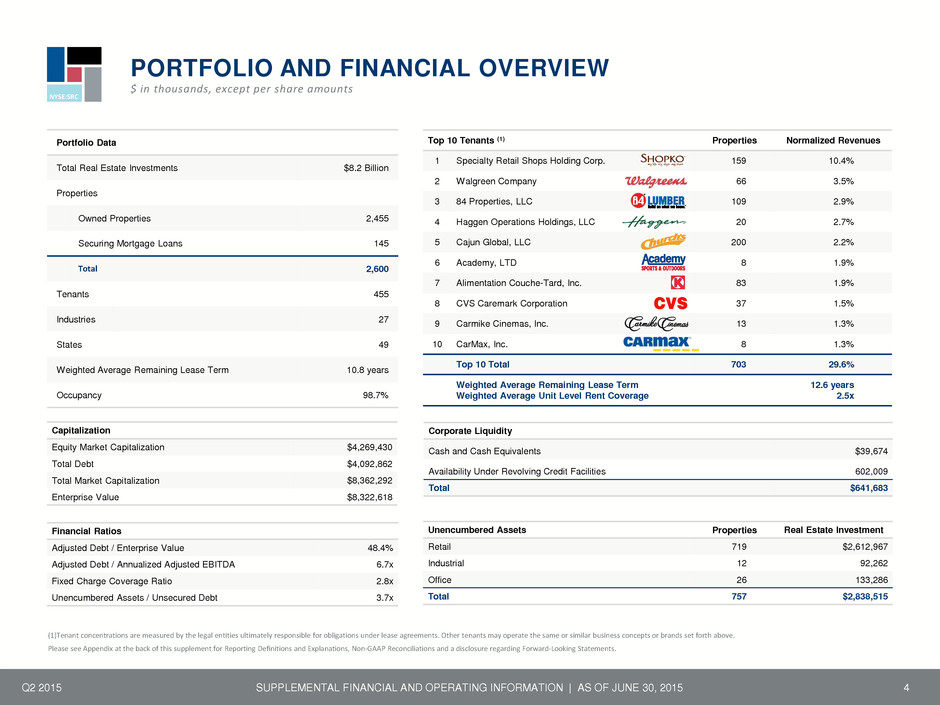

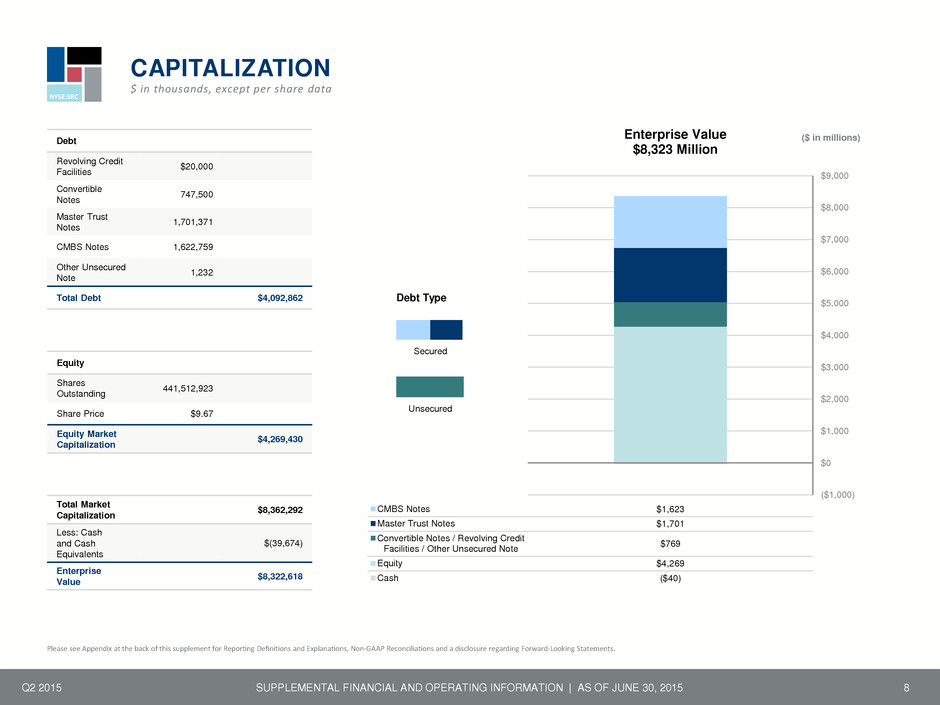

NYSE:SRC PORTFOLIO AND FINANCIAL OVERVIEW $ in thousands, except per share amounts Q2 2015 4 Portfolio Data Total Real Estate Investments $8.2 Billion Properties Owned Properties 2,455 Securing Mortgage Loans 145 Total 2,600 Tenants 455 Industries 27 States 49 Weighted Average Remaining Lease Term 10.8 years Occupancy 98.7% Capitalization Equity Market Capitalization $4,269,430 Total Debt $4,092,862 Total Market Capitalization $8,362,292 Enterprise Value $8,322,618 Financial Ratios Adjusted Debt / Enterprise Value 48.4% Adjusted Debt / Annualized Adjusted EBITDA 6.7x Fixed Charge Coverage Ratio 2.8x Unencumbered Assets / Unsecured Debt 3.7x Top 10 Tenants (1) Properties Normalized Revenues 1 Specialty Retail Shops Holding Corp. 159 10.4% 2 Walgreen Company 66 3.5% 3 84 Properties, LLC 109 2.9% 4 Haggen Operations Holdings, LLC 20 2.7% 5 Cajun Global, LLC 200 2.2% 6 Academy, LTD 8 1.9% 7 Alimentation Couche-Tard, Inc. 83 1.9% 8 CVS Caremark Corporation 37 1.5% 9 Carmike Cinemas, Inc. 13 1.3% 10 CarMax, Inc. 8 1.3% Top 10 Total 703 29.6% Weighted Average Remaining Lease Term Weighted Average Unit Level Rent Coverage 12.6 years 2.5x Corporate Liquidity Cash and Cash Equivalents $39,674 Availability Under Revolving Credit Facilities 602,009 Total $641,683 Unencumbered Assets Properties Real Estate Investment Retail 719 $2,612,967 Industrial 12 92,262 Office 26 133,286 Total 757 $2,838,515 (1)Tenant concentrations are measured by the legal entities ultimately responsible for obligations under lease agreements. Other tenants may operate the same or similar business concepts or brands set forth above. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

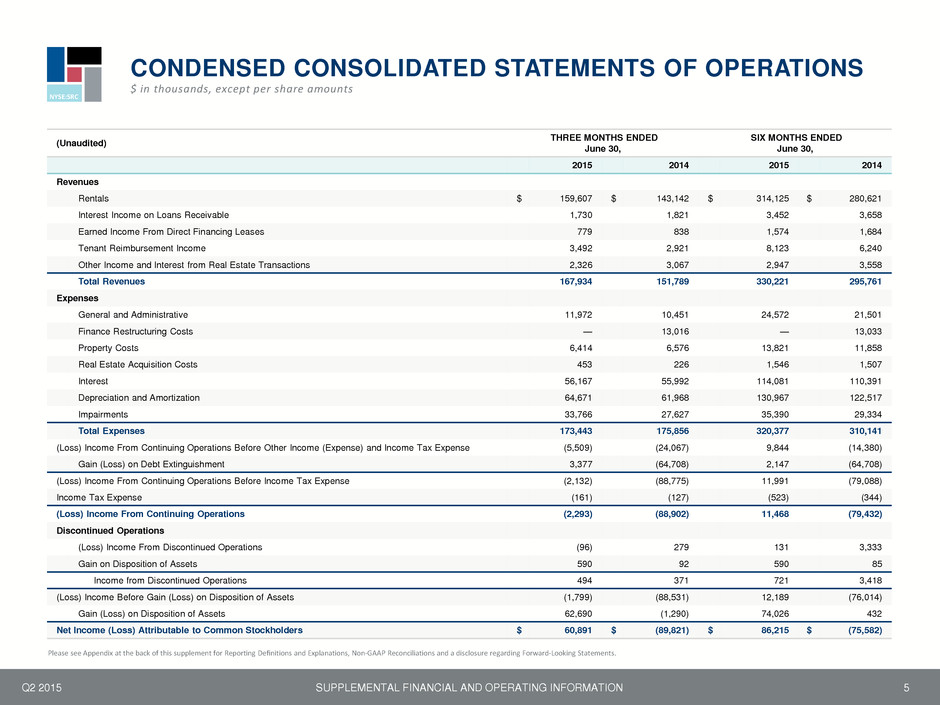

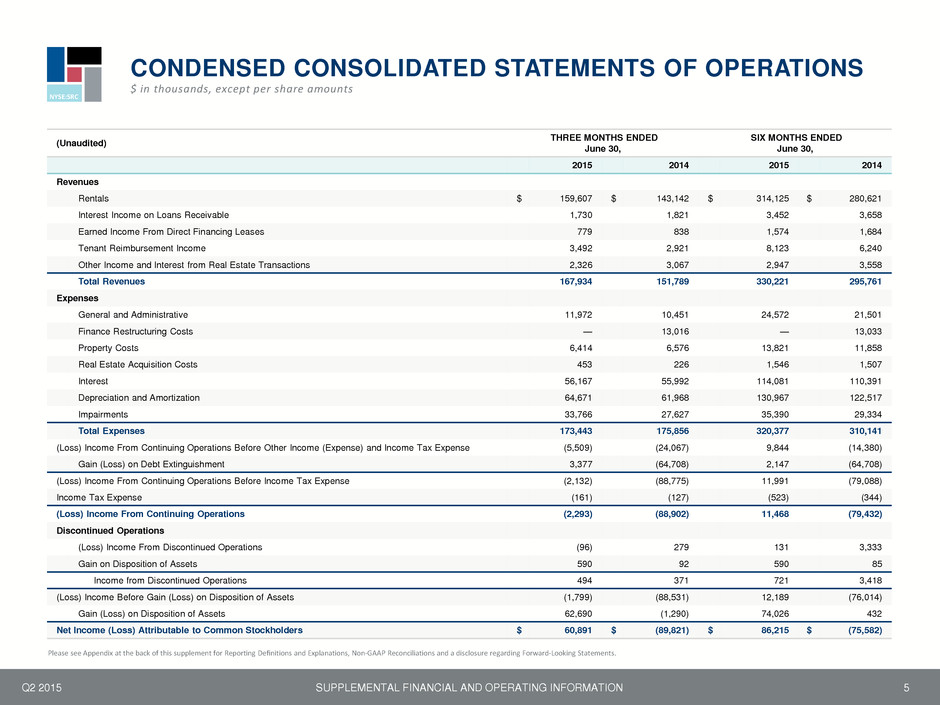

NYSE:SRC CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS $ in thousands, except per share amounts Q2 2015 5 (Unaudited) THREE MONTHS ENDED June 30, SIX MONTHS ENDED June 30, 2015 2014 2015 2014 Revenues Rentals $ 159,607 $ 143,142 $ 314,125 $ 280,621 Interest Income on Loans Receivable 1,730 1,821 3,452 3,658 Earned Income From Direct Financing Leases 779 838 1,574 1,684 Tenant Reimbursement Income 3,492 2,921 8,123 6,240 Other Income and Interest from Real Estate Transactions 2,326 3,067 2,947 3,558 Total Revenues 167,934 151,789 330,221 295,761 Expenses General and Administrative 11,972 10,451 24,572 21,501 Finance Restructuring Costs — 13,016 — 13,033 Property Costs 6,414 6,576 13,821 11,858 Real Estate Acquisition Costs 453 226 1,546 1,507 Interest 56,167 55,992 114,081 110,391 Depreciation and Amortization 64,671 61,968 130,967 122,517 Impairments 33,766 27,627 35,390 29,334 Total Expenses 173,443 175,856 320,377 310,141 (Loss) Income From Continuing Operations Before Other Income (Expense) and Income Tax Expense (5,509) (24,067) 9,844 (14,380) Gain (Loss) on Debt Extinguishment 3,377 (64,708) 2,147 (64,708) (Loss) Income From Continuing Operations Before Income Tax Expense (2,132) (88,775) 11,991 (79,088) Income Tax Expense (161) (127) (523) (344) (Loss) Income From Continuing Operations (2,293) (88,902) 11,468 (79,432) Discontinued Operations (Loss) Income From Discontinued Operations (96) 279 131 3,333 Gain on Disposition of Assets 590 92 590 85 Income from Discontinued Operations 494 371 721 3,418 (Loss) Income Before Gain (Loss) on Disposition of Assets (1,799) (88,531) 12,189 (76,014) Gain (Loss) on Disposition of Assets 62,690 (1,290) 74,026 432 Net Income (Loss) Attributable to Common Stockholders $ 60,891 $ (89,821) $ 86,215 $ (75,582) Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION

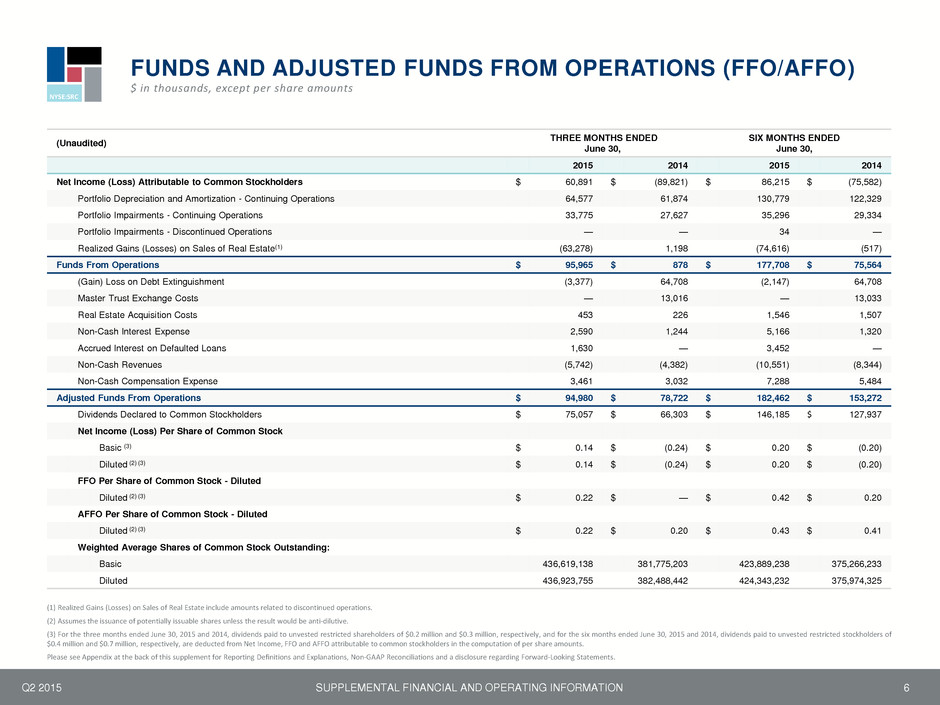

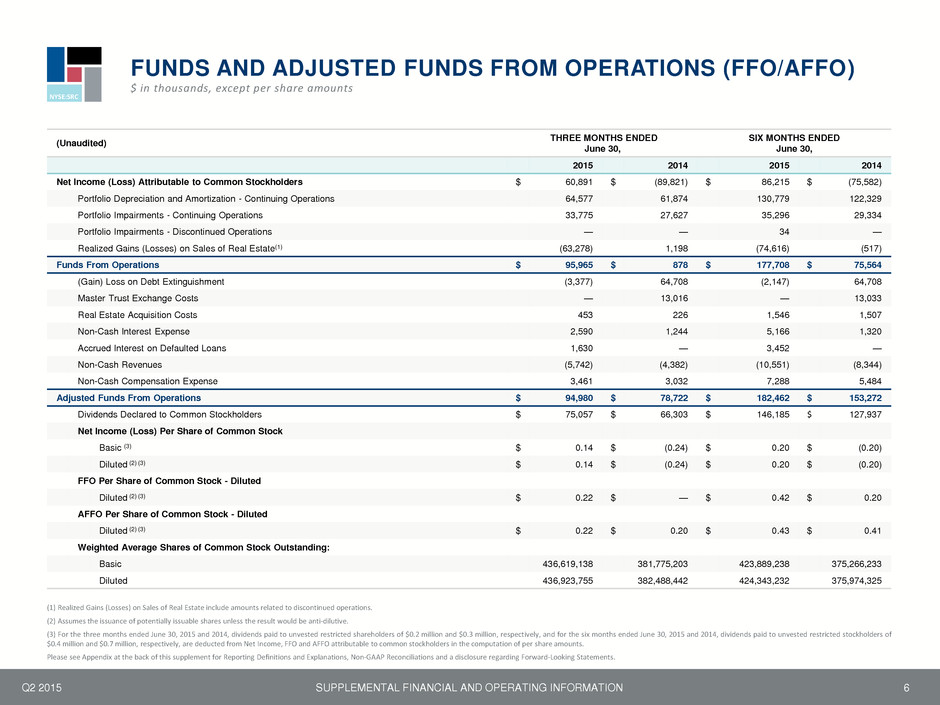

NYSE:SRC FUNDS AND ADJUSTED FUNDS FROM OPERATIONS (FFO/AFFO) $ in thousands, except per share amounts Q2 2015 6 (Unaudited) THREE MONTHS ENDED June 30, SIX MONTHS ENDED June 30, 2015 2014 2015 2014 Net Income (Loss) Attributable to Common Stockholders $ 60,891 $ (89,821) $ 86,215 $ (75,582) Portfolio Depreciation and Amortization - Continuing Operations 64,577 61,874 130,779 122,329 Portfolio Impairments - Continuing Operations 33,775 27,627 35,296 29,334 Portfolio Impairments - Discontinued Operations — — 34 — Realized Gains (Losses) on Sales of Real Estate(1) (63,278) 1,198 (74,616) (517) Funds From Operations $ 95,965 $ 878 $ 177,708 $ 75,564 (Gain) Loss on Debt Extinguishment (3,377) 64,708 (2,147) 64,708 Master Trust Exchange Costs — 13,016 — 13,033 Real Estate Acquisition Costs 453 226 1,546 1,507 Non-Cash Interest Expense 2,590 1,244 5,166 1,320 Accrued Interest on Defaulted Loans 1,630 — 3,452 — Non-Cash Revenues (5,742) (4,382) (10,551) (8,344) Non-Cash Compensation Expense 3,461 3,032 7,288 5,484 Adjusted Funds From Operations $ 94,980 $ 78,722 $ 182,462 $ 153,272 Dividends Declared to Common Stockholders $ 75,057 $ 66,303 $ 146,185 $ 127,937 Net Income (Loss) Per Share of Common Stock Basic (3) $ 0.14 $ (0.24) $ 0.20 $ (0.20) Diluted (2) (3) $ 0.14 $ (0.24) $ 0.20 $ (0.20) FFO Per Share of Common Stock - Diluted Diluted (2) (3) $ 0.22 $ — $ 0.42 $ 0.20 AFFO Per Share of Common Stock - Diluted Diluted (2) (3) $ 0.22 $ 0.20 $ 0.43 $ 0.41 Weighted Average Shares of Common Stock Outstanding: Basic 436,619,138 381,775,203 423,889,238 375,266,233 Diluted 436,923,755 382,488,442 424,343,232 375,974,325 (1) Realized Gains (Losses) on Sales of Real Estate include amounts related to discontinued operations. (2) Assumes the issuance of potentially issuable shares unless the result would be anti-dilutive. (3) For the three months ended June 30, 2015 and 2014, dividends paid to unvested restricted shareholders of $0.2 million and $0.3 million, respectively, and for the six months ended June 30, 2015 and 2014, dividends paid to unvested restricted stockholders of $0.4 million and $0.7 million, respectively, are deducted from Net Income, FFO and AFFO attributable to common stockholders in the computation of per share amounts. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION

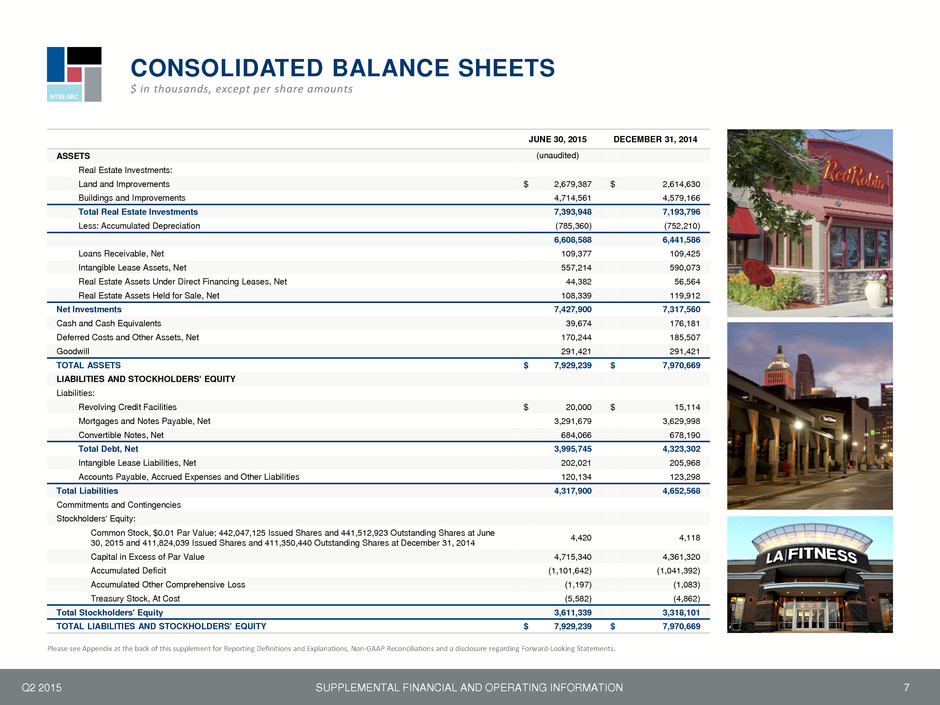

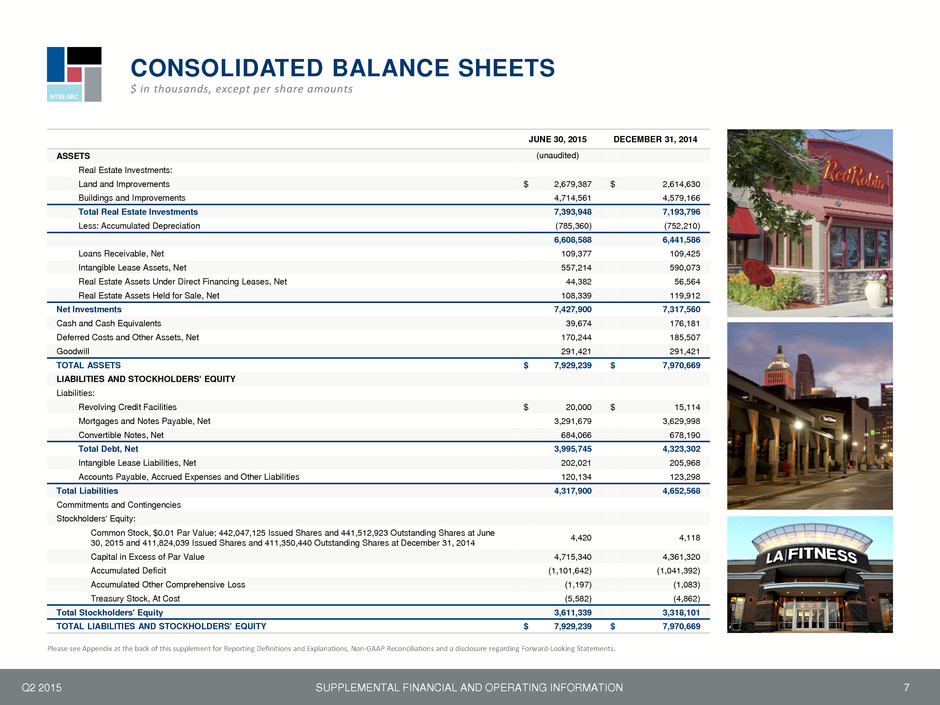

NYSE:SRC Q2 2015 7 JUNE 30, 2015 DECEMBER 31, 2014 ASSETS (unaudited) Real Estate Investments: Land and Improvements $ 2,679,387 $ 2,614,630 Buildings and Improvements 4,714,561 4,579,166 Total Real Estate Investments 7,393,948 7,193,796 Less: Accumulated Depreciation (785,360) (752,210) 6,608,588 6,441,586 Loans Receivable, Net 109,377 109,425 Intangible Lease Assets, Net 557,214 590,073 Real Estate Assets Under Direct Financing Leases, Net 44,382 56,564 Real Estate Assets Held for Sale, Net 108,339 119,912 Net Investments 7,427,900 7,317,560 Cash and Cash Equivalents 39,674 176,181 Deferred Costs and Other Assets, Net 170,244 185,507 Goodwill 291,421 291,421 TOTAL ASSETS $ 7,929,239 $ 7,970,669 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Revolving Credit Facilities $ 20,000 $ 15,114 Mortgages and Notes Payable, Net 3,291,679 3,629,998 Convertible Notes, Net 684,066 678,190 Total Debt, Net 3,995,745 4,323,302 Intangible Lease Liabilities, Net 202,021 205,968 Accounts Payable, Accrued Expenses and Other Liabilities 120,134 123,298 Total Liabilities 4,317,900 4,652,568 Commitments and Contingencies Stockholders' Equity: Common Stock, $0.01 Par Value; 442,047,125 Issued Shares and 441,512,923 Outstanding Shares at June 30, 2015 and 411,824,039 Issued Shares and 411,350,440 Outstanding Shares at December 31, 2014 4,420 4,118 Capital in Excess of Par Value 4,715,340 4,361,320 Accumulated Deficit (1,101,642) (1,041,392) Accumulated Other Comprehensive Loss (1,197) (1,083) Treasury Stock, At Cost (5,582) (4,862) Total Stockholders' Equity 3,611,339 3,318,101 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 7,929,239 $ 7,970,669 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. CONSOLIDATED BALANCE SHEETS $ in thousands, except per share amounts SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION

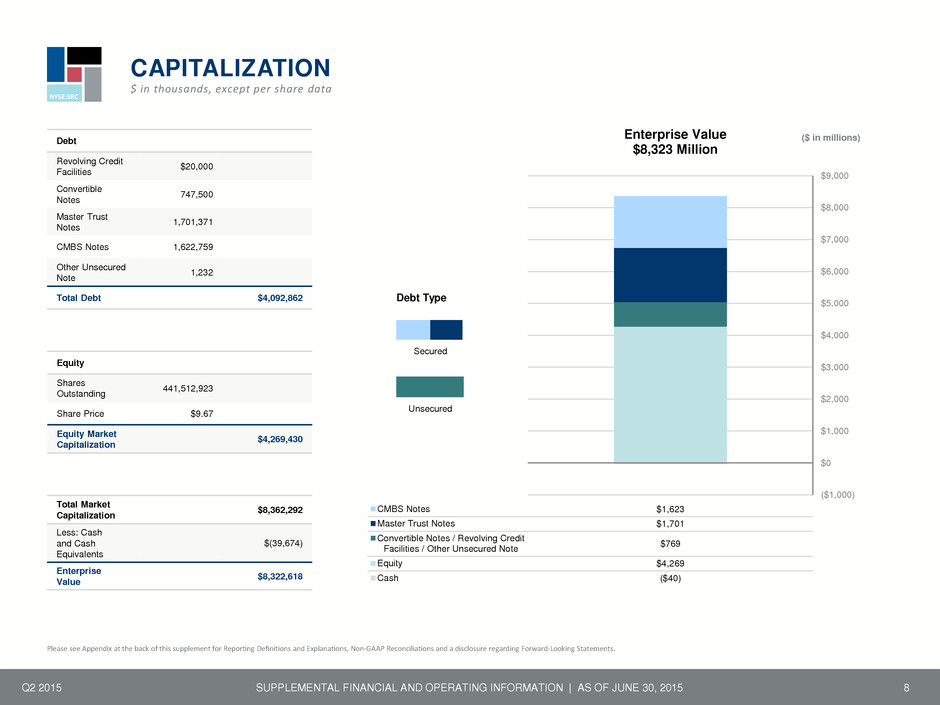

NYSE:SRC Q2 2015 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015 8 Equity Shares Outstanding 441,512,923 Share Price $9.67 Equity Market Capitalization $4,269,430 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. ($1,000) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 CMBS Notes $1,623 Master Trust Notes $1,701 Convertible Notes / Revolving Credit Facilities / Other Unsecured Note $769 Equity $4,269 Cash ($40) ($ in millions) Enterprise Value $8,323 Million Debt Type Secured Unsecured Debt Revolving Credit Facilities $20,000 Convertible Notes 747,500 Master Trust Notes 1,701,371 CMBS Notes 1,622,759 Other Unsecured Note 1,232 Total Debt $4,092,862 CAPITALIZATION $ in thousands, except per share data Total Market Capitalization $8,362,292 Less: Cash and Cash Equivalents $(39,674) Enterprise Value $8,322,618

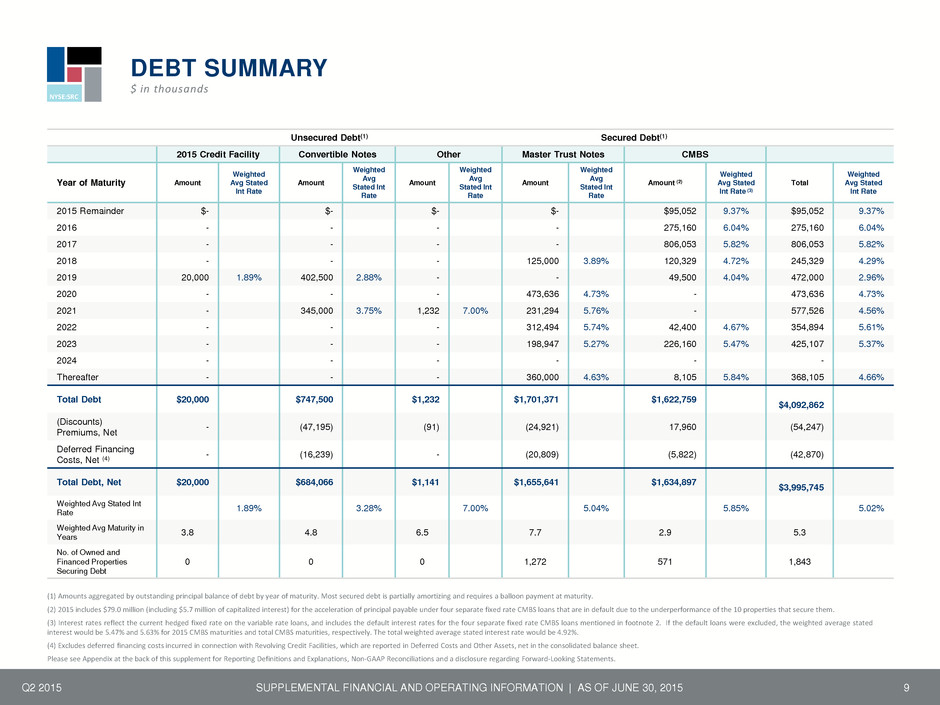

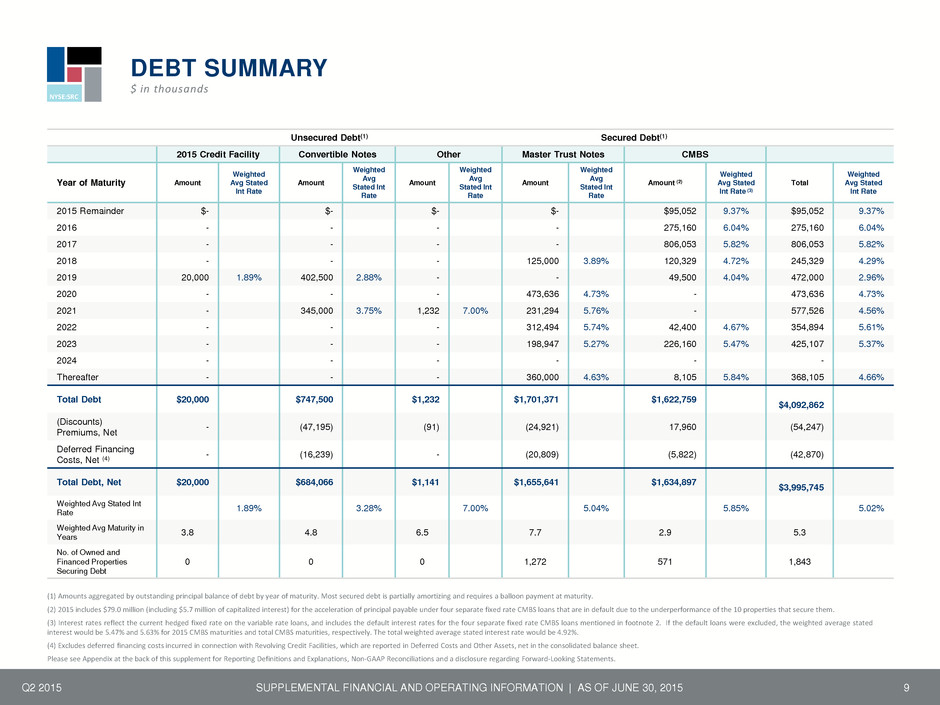

NYSE:SRC Q2 2015 9 Unsecured Debt(1) Secured Debt(1) 2015 Credit Facility Convertible Notes Other Master Trust Notes CMBS Year of Maturity Amount Weighted Avg Stated Int Rate Amount Weighted Avg Stated Int Rate Amount Weighted Avg Stated Int Rate Amount Weighted Avg Stated Int Rate Amount (2) Weighted Avg Stated Int Rate (3) Total Weighted Avg Stated Int Rate 2015 Remainder $- $- $- $- $95,052 9.37% $95,052 9.37% 2016 - - - - 275,160 6.04% 275,160 6.04% 2017 - - - - 806,053 5.82% 806,053 5.82% 2018 - - - 125,000 3.89% 120,329 4.72% 245,329 4.29% 2019 20,000 1.89% 402,500 2.88% - - 49,500 4.04% 472,000 2.96% 2020 - - - 473,636 4.73% - 473,636 4.73% 2021 - 345,000 3.75% 1,232 7.00% 231,294 5.76% - 577,526 4.56% 2022 - - - 312,494 5.74% 42,400 4.67% 354,894 5.61% 2023 - - - 198,947 5.27% 226,160 5.47% 425,107 5.37% 2024 - - - - - - Thereafter - - - 360,000 4.63% 8,105 5.84% 368,105 4.66% Total Debt $20,000 $747,500 $1,232 $1,701,371 $1,622,759 $4,092,862 (Discounts) Premiums, Net - (47,195) (91) (24,921) 17,960 (54,247) Deferred Financing Costs, Net (4) - (16,239) - (20,809) (5,822) (42,870) Total Debt, Net $20,000 $684,066 $1,141 $1,655,641 $1,634,897 $3,995,745 Weighted Avg Stated Int Rate 1.89% 3.28% 7.00% 5.04% 5.85% 5.02% Weighted Avg Maturity in Years 3.8 4.8 6.5 7.7 2.9 5.3 No. of Owned and Financed Properties Securing Debt 0 0 0 1,272 571 1,843 (1) Amounts aggregated by outstanding principal balance of debt by year of maturity. Most secured debt is partially amortizing and requires a balloon payment at maturity. (2) 2015 includes $79.0 million (including $5.7 million of capitalized interest) for the acceleration of principal payable under four separate fixed rate CMBS loans that are in default due to the underperformance of the 10 properties that secure them. (3) Interest rates reflect the current hedged fixed rate on the variable rate loans, and includes the default interest rates for the four separate fixed rate CMBS loans mentioned in footnote 2. If the default loans were excluded, the weighted average stated interest would be 5.47% and 5.63% for 2015 CMBS maturities and total CMBS maturities, respectively. The total weighted average stated interest rate would be 4.92%. (4) Excludes deferred financing costs incurred in connection with Revolving Credit Facilities, which are reported in Deferred Costs and Other Assets, net in the consolidated balance sheet. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. DEBT SUMMARY $ in thousands SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

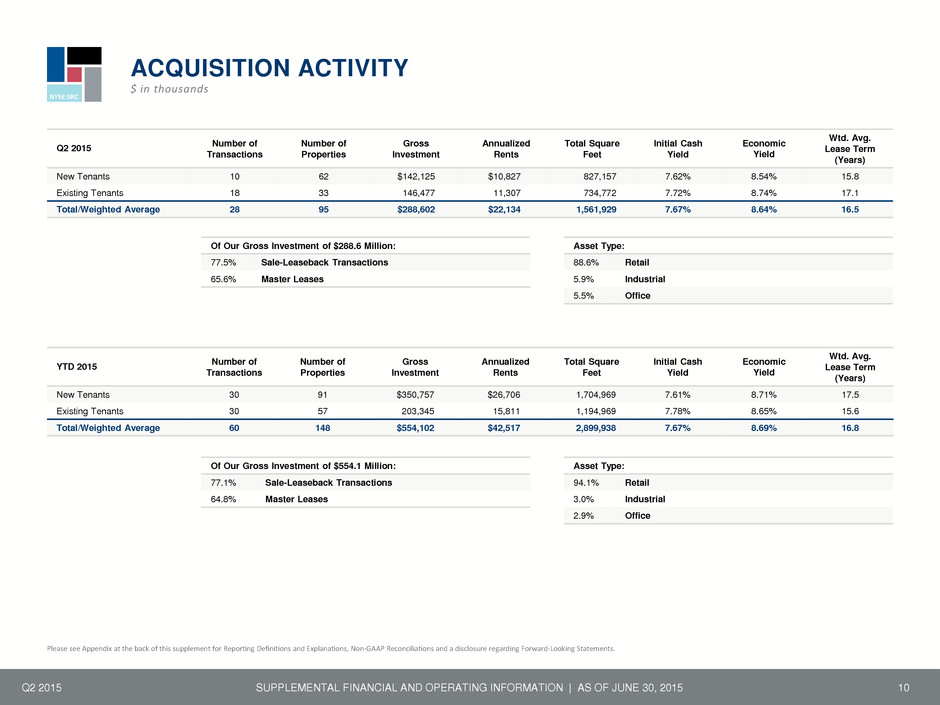

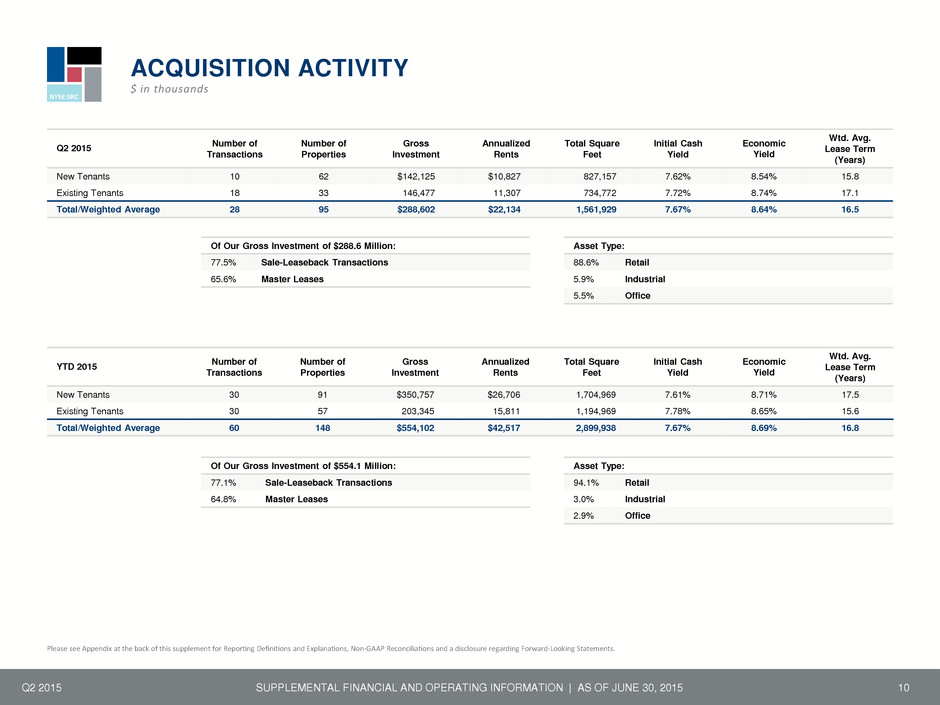

NYSE:SRC Q2 2015 10 Q2 2015 Number of Transactions Number of Properties Gross Investment Annualized Rents Total Square Feet Initial Cash Yield Economic Yield Wtd. Avg. Lease Term (Years) New Tenants 10 62 $142,125 $10,827 827,157 7.62% 8.54% 15.8 Existing Tenants 18 33 146,477 11,307 734,772 7.72% 8.74% 17.1 Total/Weighted Average 28 95 $288,602 $22,134 1,561,929 7.67% 8.64% 16.5 Of Our Gross Investment of $288.6 Million: 77.5% Sale-Leaseback Transactions 65.6% Master Leases YTD 2015 Number of Transactions Number of Properties Gross Investment Annualized Rents Total Square Feet Initial Cash Yield Economic Yield Wtd. Avg. Lease Term (Years) New Tenants 30 91 $350,757 $26,706 1,704,969 7.61% 8.71% 17.5 Existing Tenants 30 57 203,345 15,811 1,194,969 7.78% 8.65% 15.6 Total/Weighted Average 60 148 $554,102 $42,517 2,899,938 7.67% 8.69% 16.8 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. ACQUISITION ACTIVITY $ in thousands Asset Type: 88.6% Retail 5.9% Industrial 5.5% Office Of Our Gross Investment of $554.1 Million: 77.1% Sale-Leaseback Transactions 64.8% Master Leases Asset Type: 94.1% Retail 3.0% Industrial 2.9% Office SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

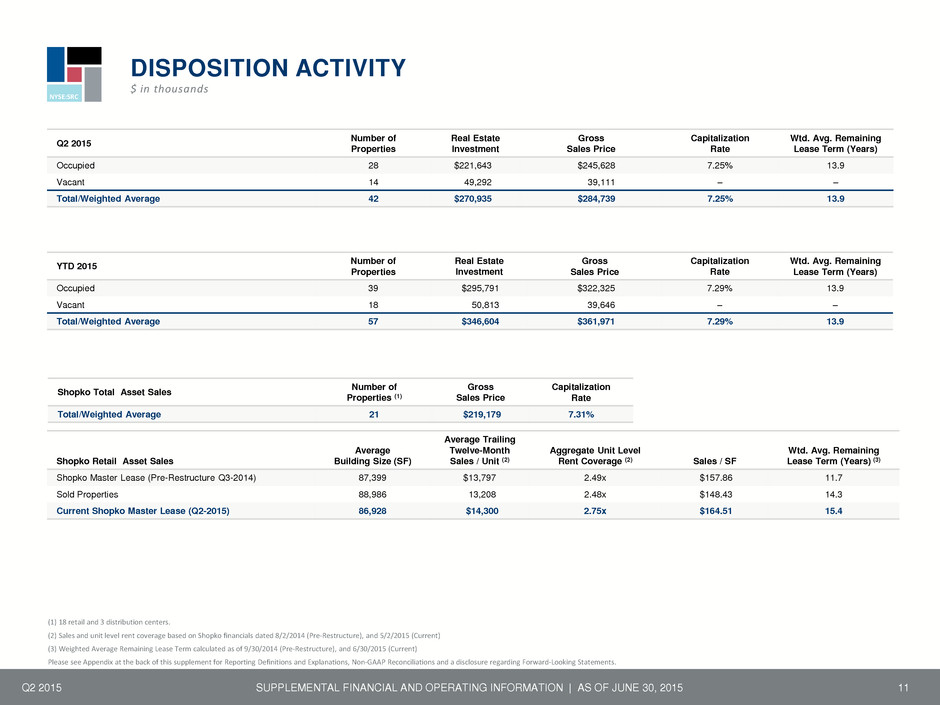

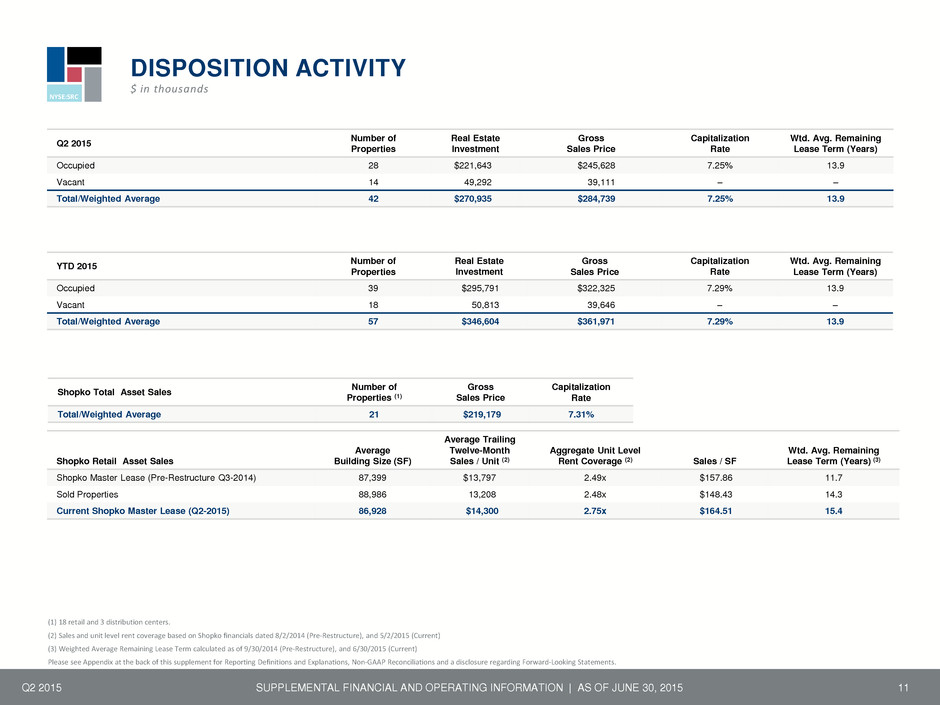

NYSE:SRC Q2 2015 11 Q2 2015 Number of Properties Real Estate Investment Gross Sales Price Capitalization Rate Wtd. Avg. Remaining Lease Term (Years) Occupied 28 $221,643 $245,628 7.25% 13.9 Vacant 14 49,292 39,111 – – Total/Weighted Average 42 $270,935 $284,739 7.25% 13.9 YTD 2015 Number of Properties Real Estate Investment Gross Sales Price Capitalization Rate Wtd. Avg. Remaining Lease Term (Years) Occupied 39 $295,791 $322,325 7.29% 13.9 Vacant 18 50,813 39,646 – – Total/Weighted Average 57 $346,604 $361,971 7.29% 13.9 DISPOSITION ACTIVITY $ in thousands Shopko Retail Asset Sales Average Building Size (SF) Average Trailing Twelve-Month Sales / Unit (2) Aggregate Unit Level Rent Coverage (2) Sales / SF Wtd. Avg. Remaining Lease Term (Years) (3) Shopko Master Lease (Pre-Restructure Q3-2014) 87,399 $13,797 2.49x $157.86 11.7 Sold Properties 88,986 13,208 2.48x $148.43 14.3 Current Shopko Master Lease (Q2-2015) 86,928 $14,300 2.75x $164.51 15.4 (1) 18 retail and 3 distribution centers. (2) Sales and unit level rent coverage based on Shopko financials dated 8/2/2014 (Pre-Restructure), and 5/2/2015 (Current) (3) Weighted Average Remaining Lease Term calculated as of 9/30/2014 (Pre-Restructure), and 6/30/2015 (Current) Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015 Shopko Total Asset Sales Number of Properties (1) Gross Sales Price Capitalization Rate Total/Weighted Average 21 $219,179 7.31%

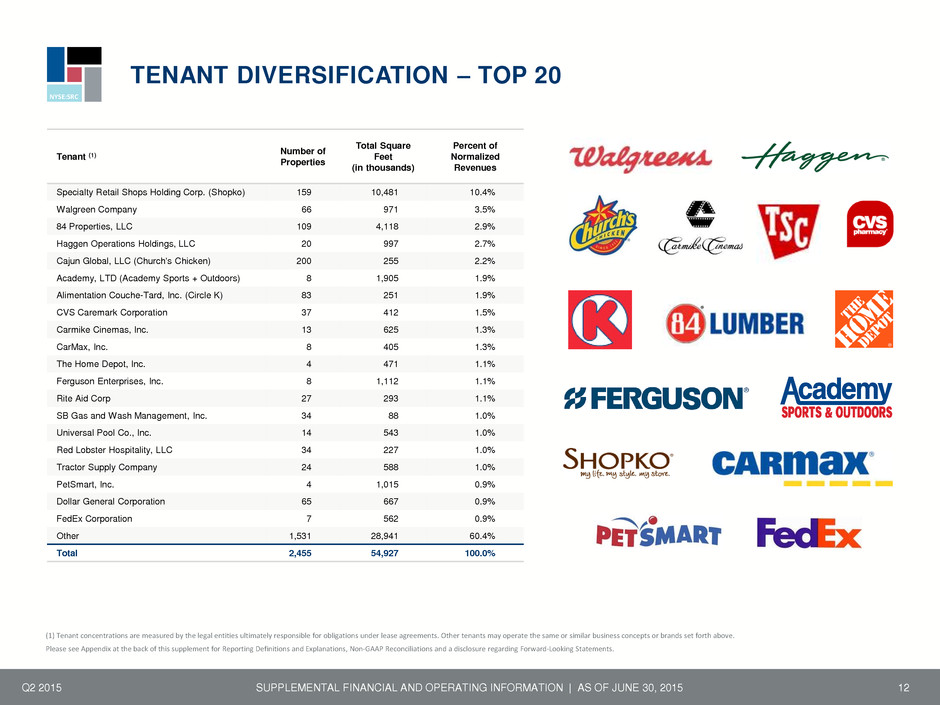

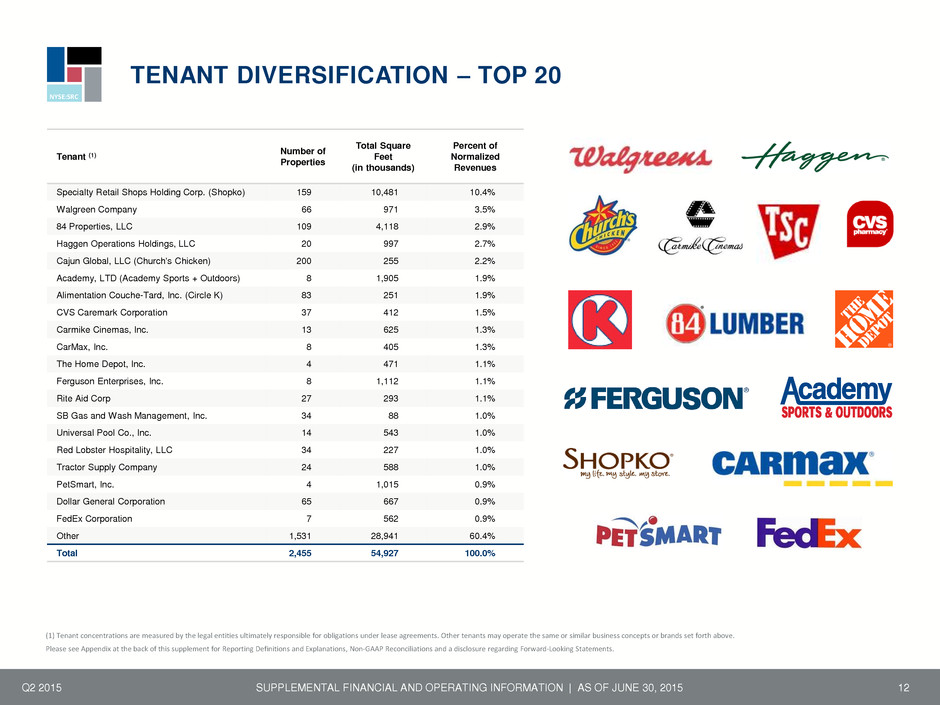

NYSE:SRC TENANT DIVERSIFICATION – TOP 20 Q2 2015 12 Tenant (1) Number of Properties Total Square Feet (in thousands) Percent of Normalized Revenues Specialty Retail Shops Holding Corp. (Shopko) 159 10,481 10.4% Walgreen Company 66 971 3.5% 84 Properties, LLC 109 4,118 2.9% Haggen Operations Holdings, LLC 20 997 2.7% Cajun Global, LLC (Church's Chicken) 200 255 2.2% Academy, LTD (Academy Sports + Outdoors) 8 1,905 1.9% Alimentation Couche-Tard, Inc. (Circle K) 83 251 1.9% CVS Caremark Corporation 37 412 1.5% Carmike Cinemas, Inc. 13 625 1.3% CarMax, Inc. 8 405 1.3% The Home Depot, Inc. 4 471 1.1% Ferguson Enterprises, Inc. 8 1,112 1.1% Rite Aid Corp 27 293 1.1% SB Gas and Wash Management, Inc. 34 88 1.0% Universal Pool Co., Inc. 14 543 1.0% Red Lobster Hospitality, LLC 34 227 1.0% Tractor Supply Company 24 588 1.0% PetSmart, Inc. 4 1,015 0.9% Dollar General Corporation 65 667 0.9% FedEx Corporation 7 562 0.9% Other 1,531 28,941 60.4% Total 2,455 54,927 100.0% (1) Tenant concentrations are measured by the legal entities ultimately responsible for obligations under lease agreements. Other tenants may operate the same or similar business concepts or brands set forth above. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

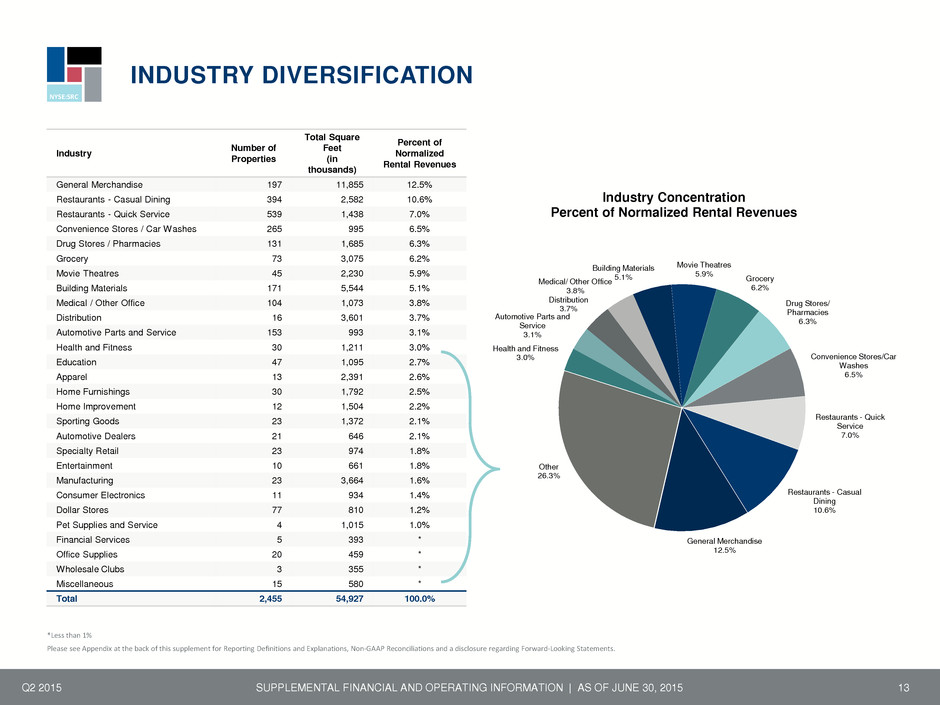

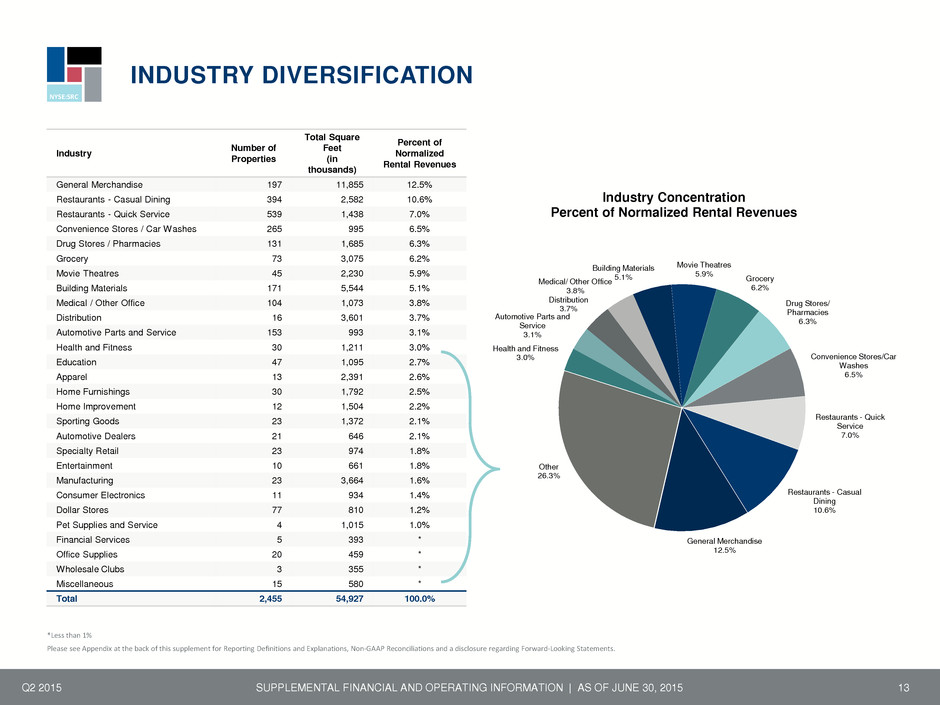

NYSE:SRC INDUSTRY DIVERSIFICATION Q2 2015 13 Industry Number of Properties Total Square Feet (in thousands) Percent of Normalized Rental Revenues General Merchandise 197 11,855 12.5% Restaurants - Casual Dining 394 2,582 10.6% Restaurants - Quick Service 539 1,438 7.0% Convenience Stores / Car Washes 265 995 6.5% Drug Stores / Pharmacies 131 1,685 6.3% Grocery 73 3,075 6.2% Movie Theatres 45 2,230 5.9% Building Materials 171 5,544 5.1% Medical / Other Office 104 1,073 3.8% Distribution 16 3,601 3.7% Automotive Parts and Service 153 993 3.1% Health and Fitness 30 1,211 3.0% Education 47 1,095 2.7% Apparel 13 2,391 2.6% Home Furnishings 30 1,792 2.5% Home Improvement 12 1,504 2.2% Sporting Goods 23 1,372 2.1% Automotive Dealers 21 646 2.1% Specialty Retail 23 974 1.8% Entertainment 10 661 1.8% Manufacturing 23 3,664 1.6% Consumer Electronics 11 934 1.4% Dollar Stores 77 810 1.2% Pet Supplies and Service 4 1,015 1.0% Financial Services 5 393 * Office Supplies 20 459 * Wholesale Clubs 3 355 * Miscellaneous 15 580 * Total 2,455 54,927 100.0% *Less than 1% Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. Other 26.3% Health and Fitness 3.0% Automotive Parts and Service 3.1% Distribution 3.7% Medical/ Other Office 3.8% Building Materials 5.1% Movie Theatres 5.9% Grocery 6.2% Drug Stores/ Pharmacies 6.3% Convenience Stores/Car Washes 6.5% Restaurants - Quick Service 7.0% Restaurants - Casual Dining 10.6% General Merchandise 12.5% Industry Concentration Percent of Normalized Rental Revenues SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

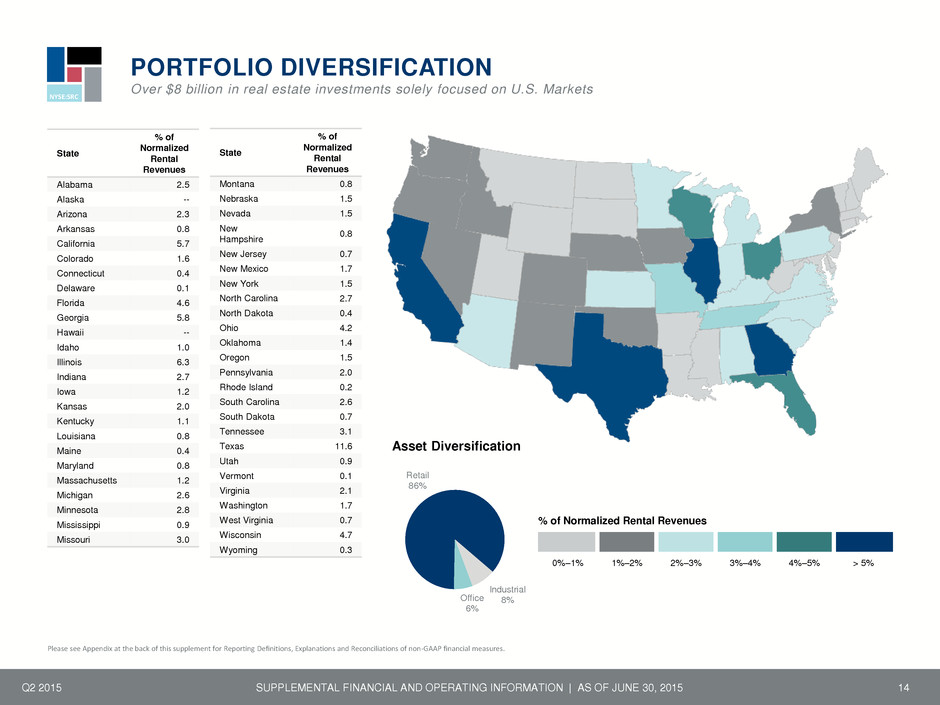

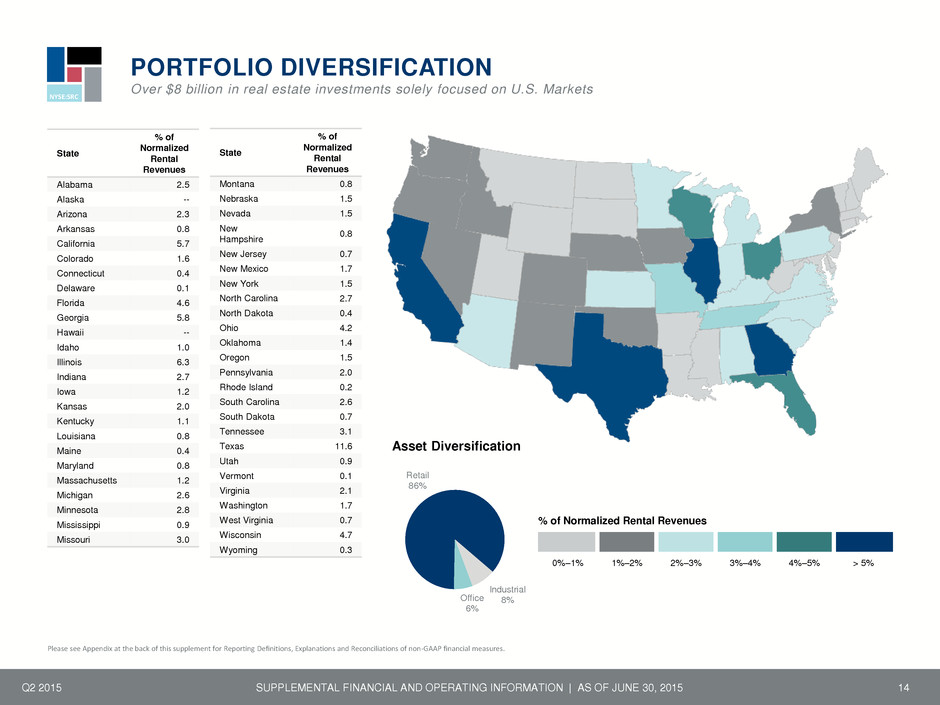

NYSE:SRC PORTFOLIO DIVERSIFICATION Over $8 billion in real estate investments solely focused on U.S. Markets Q2 2015 14 Please see Appendix at the back of this supplement for Reporting Definitions, Explanations and Reconciliations of non-GAAP financial measures. Retail 86% Industrial 8% Office 6% Asset Diversification State % of Normalized Rental Revenues Alabama 2.5 Alaska -- Arizona 2.3 Arkansas 0.8 California 5.7 Colorado 1.6 Connecticut 0.4 Delaware 0.1 Florida 4.6 Georgia 5.8 Hawaii -- Idaho 1.0 Illinois 6.3 Indiana 2.7 Iowa 1.2 Kansas 2.0 Kentucky 1.1 Louisiana 0.8 Maine 0.4 Maryland 0.8 Massachusetts 1.2 Michigan 2.6 Minnesota 2.8 Mississippi 0.9 Missouri 3.0 State % of Normalized Rental Revenues Montana 0.8 Nebraska 1.5 Nevada 1.5 New Hampshire 0.8 New Jersey 0.7 New Mexico 1.7 New York 1.5 North Carolina 2.7 North Dakota 0.4 Ohio 4.2 Oklahoma 1.4 Oregon 1.5 Pennsylvania 2.0 Rhode Island 0.2 South Carolina 2.6 South Dakota 0.7 Tennessee 3.1 Texas 11.6 Utah 0.9 Vermont 0.1 Virginia 2.1 Washington 1.7 West Virginia 0.7 Wisconsin 4.7 Wyoming 0.3 % of Normalized Rental Revenues 0%–1% 1%–2% 2%–3% 3%–4% 4%–5% > 5% SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

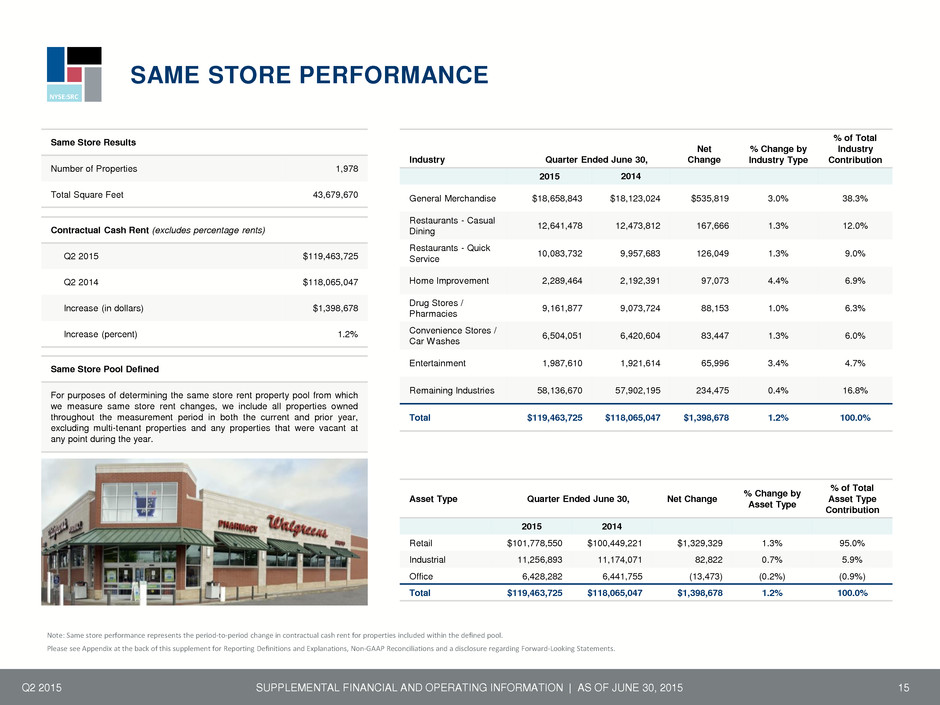

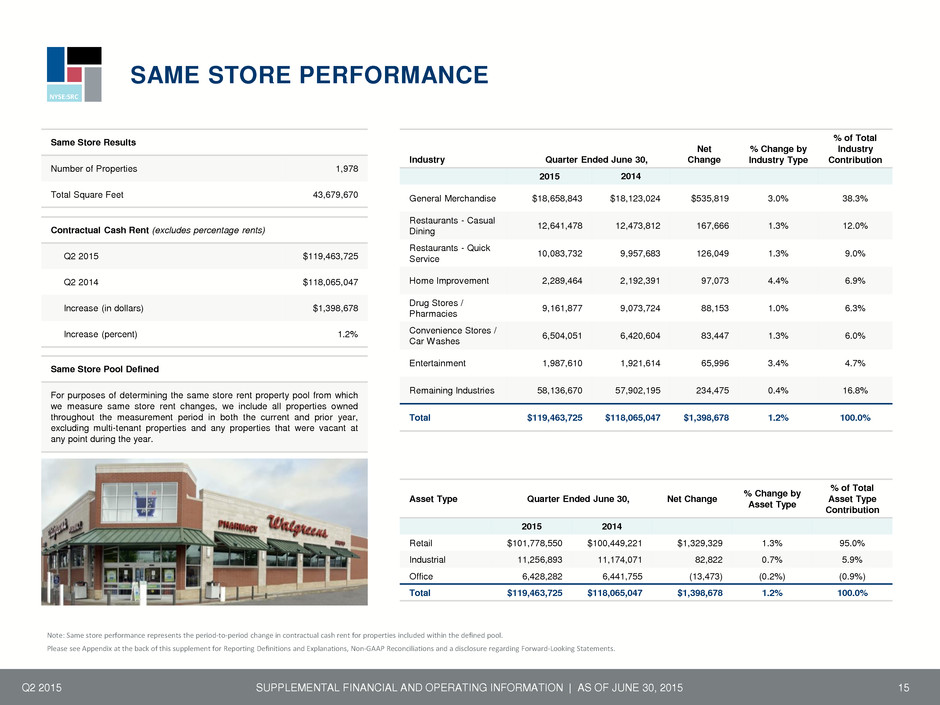

NYSE:SRC SAME STORE PERFORMANCE Q2 2015 15 Note: Same store performance represents the period-to-period change in contractual cash rent for properties included within the defined pool. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. Same Store Results Number of Properties 1,978 Total Square Feet 43,679,670 Industry Quarter Ended June 30, Net Change % Change by Industry Type % of Total Industry Contribution 2015 2014 General Merchandise $18,658,843 $18,123,024 $535,819 3.0% 38.3% Restaurants - Casual Dining 12,641,478 12,473,812 167,666 1.3% 12.0% Restaurants - Quick Service 10,083,732 9,957,683 126,049 1.3% 9.0% Home Improvement 2,289,464 2,192,391 97,073 4.4% 6.9% Drug Stores / Pharmacies 9,161,877 9,073,724 88,153 1.0% 6.3% Convenience Stores / Car Washes 6,504,051 6,420,604 83,447 1.3% 6.0% Entertainment 1,987,610 1,921,614 65,996 3.4% 4.7% Remaining Industries 58,136,670 57,902,195 234,475 0.4% 16.8% Total $119,463,725 $118,065,047 $1,398,678 1.2% 100.0% Asset Type Quarter Ended June 30, Net Change % Change by Asset Type % of Total Asset Type Contribution 2015 2014 Retail $101,778,550 $100,449,221 $1,329,329 1.3% 95.0% Industrial 11,256,893 11,174,071 82,822 0.7% 5.9% Office 6,428,282 6,441,755 (13,473) (0.2%) (0.9%) Total $119,463,725 $118,065,047 $1,398,678 1.2% 100.0% Same Store Pool Defined For purposes of determining the same store rent property pool from which we measure same store rent changes, we include all properties owned throughout the measurement period in both the current and prior year, excluding multi-tenant properties and any properties that were vacant at any point during the year. Contractual Cash Rent (excludes percentage rents) Q2 2015 $119,463,725 Q2 2014 $118,065,047 Increase (in dollars) $1,398,678 Increase (percent) 1.2% SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

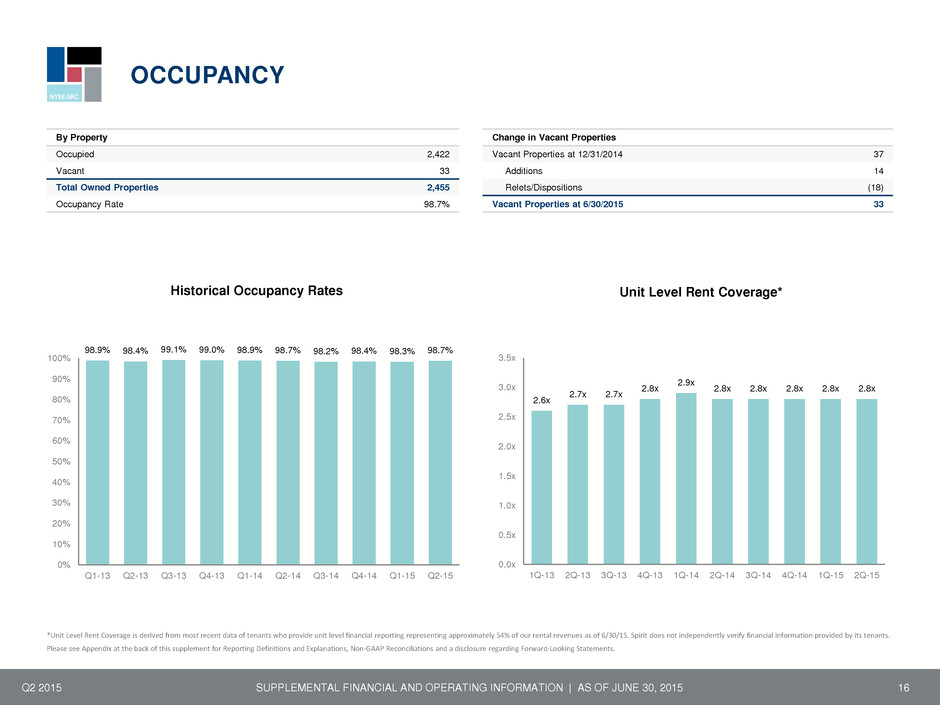

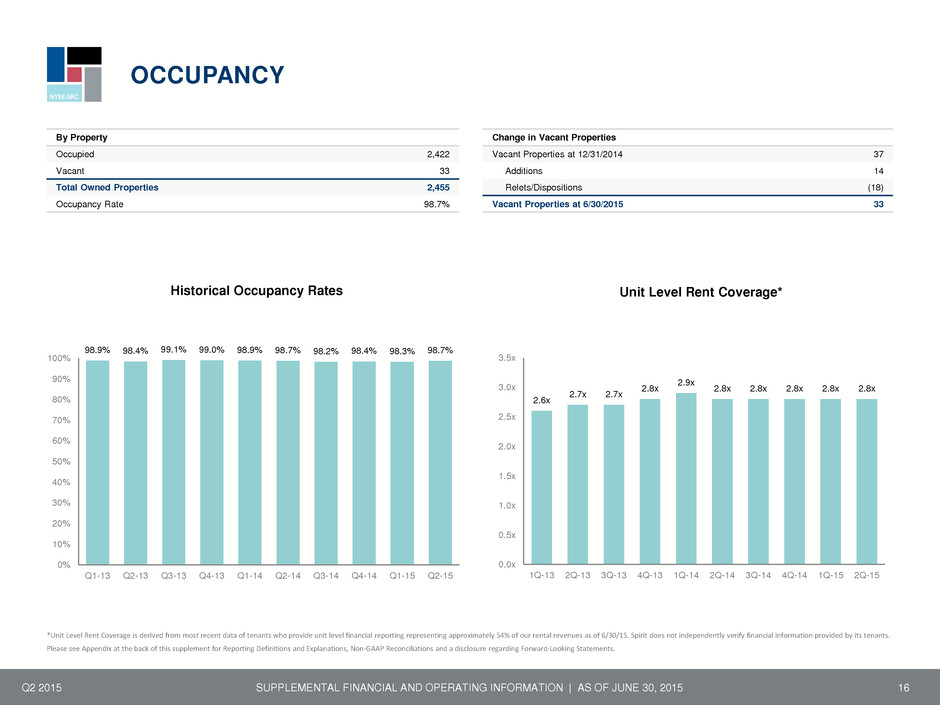

NYSE:SRC OCCUPANCY Q2 2015 16 *Unit Level Rent Coverage is derived from most recent data of tenants who provide unit level financial reporting representing approximately 54% of our rental revenues as of 6/30/15. Spirit does not independently verify financial information provided by its tenants. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. By Property Occupied 2,422 Vacant 33 Total Owned Properties 2,455 Occupancy Rate 98.7% Change in Vacant Properties Vacant Properties at 12/31/2014 37 Additions 14 Relets/Dispositions (18) Vacant Properties at 6/30/2015 33 98.9% 98.4% 99.1% 99.0% 98.9% 98.7% 98.2% 98.4% 98.3% 98.7% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q1-13 Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Q2-15 Historical Occupancy Rates 2.6x 2.7x 2.7x 2.8x 2.9x 2.8x 2.8x 2.8x 2.8x 2.8x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 1Q-13 2Q-13 3Q-13 4Q-13 1Q-14 2Q-14 3Q-14 4Q-14 1Q-15 2Q-15 Unit Level Rent Coverage* SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

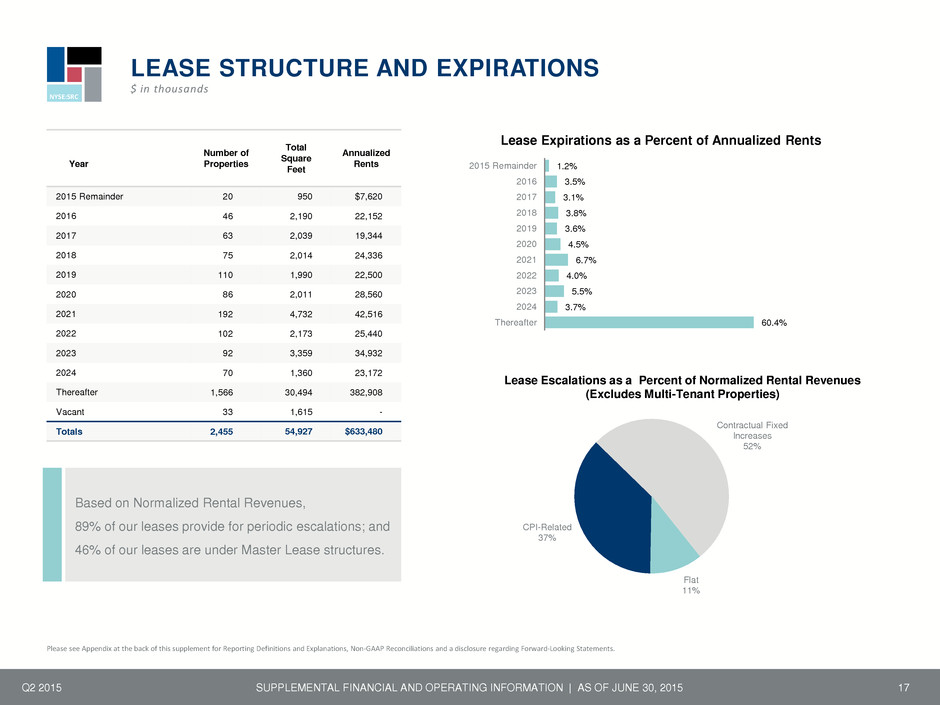

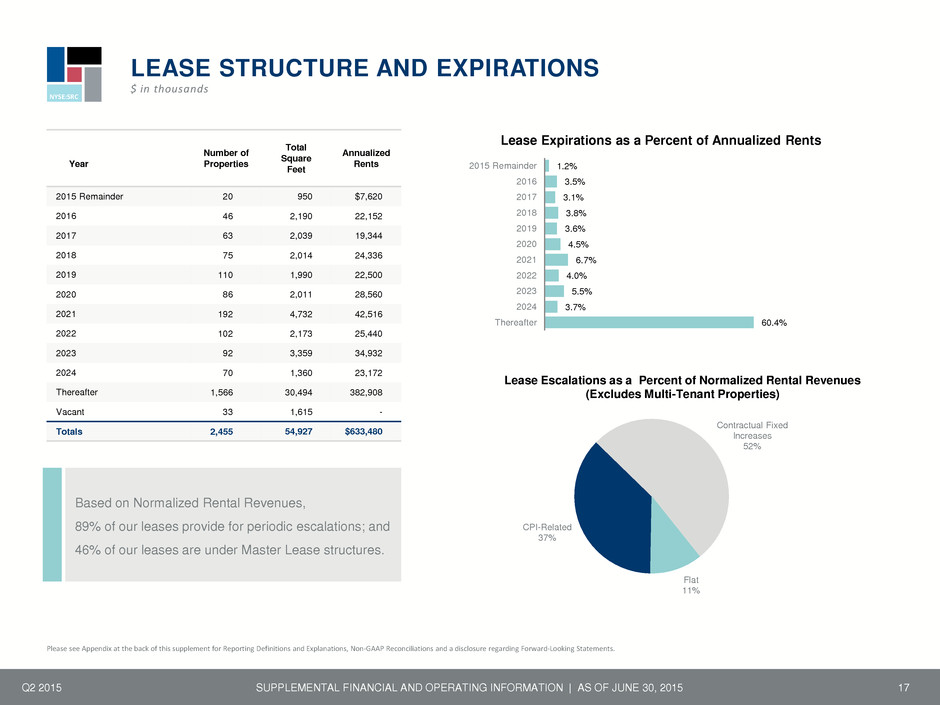

NYSE:SRC Q2 2015 17 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. Year Number of Properties Total Square Feet Annualized Rents 2015 Remainder 20 950 $7,620 2016 46 2,190 22,152 2017 63 2,039 19,344 2018 75 2,014 24,336 2019 110 1,990 22,500 2020 86 2,011 28,560 2021 192 4,732 42,516 2022 102 2,173 25,440 2023 92 3,359 34,932 2024 70 1,360 23,172 Thereafter 1,566 30,494 382,908 Vacant 33 1,615 - Totals 2,455 54,927 $633,480 Based on Normalized Rental Revenues, 89% of our leases provide for periodic escalations; and 46% of our leases are under Master Lease structures. 1.2% 3.5% 3.1% 3.8% 3.6% 4.5% 6.7% 4.0% 5.5% 3.7% 60.4% 2015 Remainder 2016 2017 2018 2019 2020 2021 2022 2023 2024 Thereafter Lease Expirations as a Percent of Annualized Rents LEASE STRUCTURE AND EXPIRATIONS $ in thousands SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015 CPI-Related 37% Contractual Fixed Increases 52% Flat 11% Lease Escalations as a Percent of Normalized Rental Revenues (Excludes Multi-Tenant Properties)

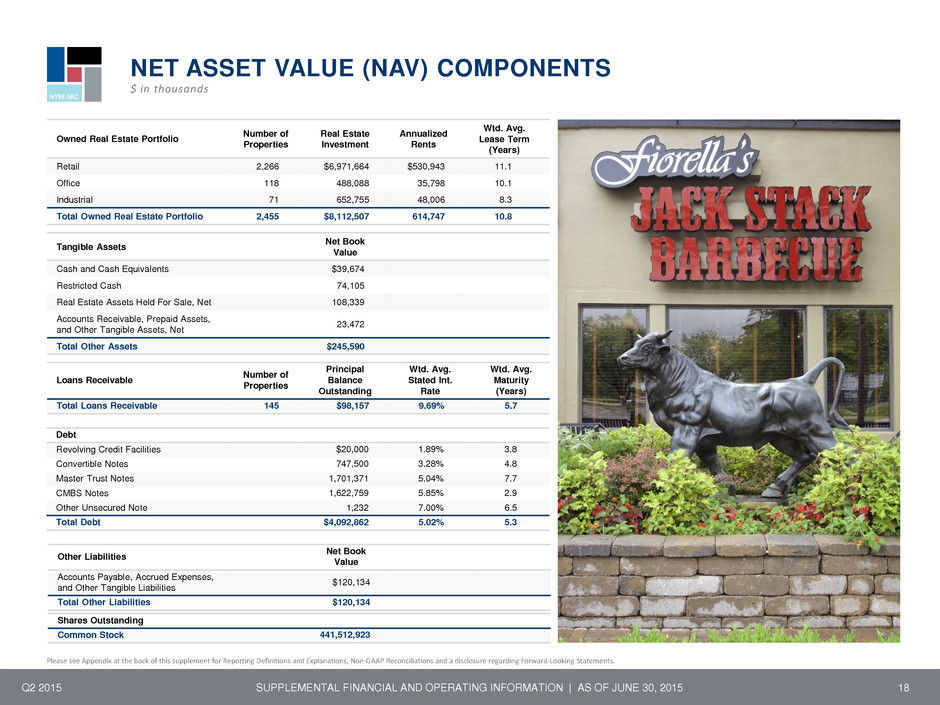

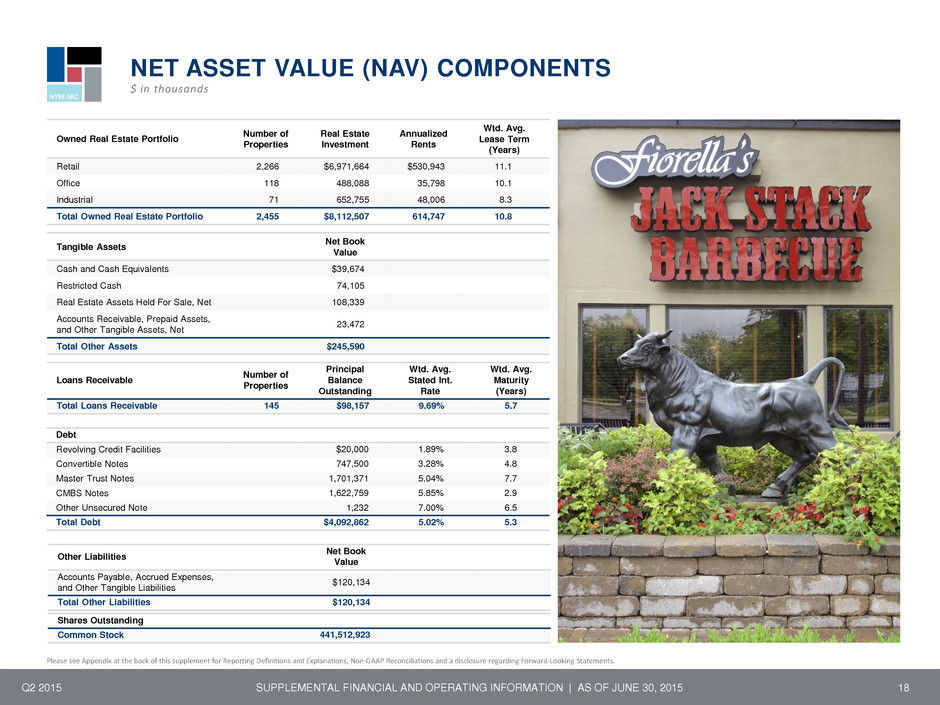

NYSE:SRC Q2 2015 18 Owned Real Estate Portfolio Number of Properties Real Estate Investment Annualized Rents Wtd. Avg. Lease Term (Years) Retail 2,266 $6,971,664 $530,943 11.1 Office 118 488,088 35,798 10.1 Industrial 71 652,755 48,006 8.3 Total Owned Real Estate Portfolio 2,455 $8,112,507 614,747 10.8 Loans Receivable Number of Properties Principal Balance Outstanding Wtd. Avg. Stated Int. Rate Wtd. Avg. Maturity (Years) Total Loans Receivable 145 $98,157 9.69% 5.7 NET ASSET VALUE (NAV) COMPONENTS $ in thousands Tangible Assets Net Book Value Cash and Cash Equivalents $39,674 Restricted Cash 74,105 Real Estate Assets Held For Sale, Net 108,339 Accounts Receivable, Prepaid Assets, and Other Tangible Assets, Net 23,472 Total Other Assets $245,590 Debt Revolving Credit Facilities $20,000 1.89% 3.8 Convertible Notes 747,500 3.28% 4.8 Master Trust Notes 1,701,371 5.04% 7.7 CMBS Notes 1,622,759 5.85% 2.9 Other Unsecured Note 1,232 7.00% 6.5 Total Debt $4,092,862 5.02% 5.3 Other Liabilities Net Book Value Accounts Payable, Accrued Expenses, and Other Tangible Liabilities $120,134 Total Other Liabilities $120,134 Shares Outstanding Common Stock 441,512,923 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations and a disclosure regarding Forward-Looking Statements. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

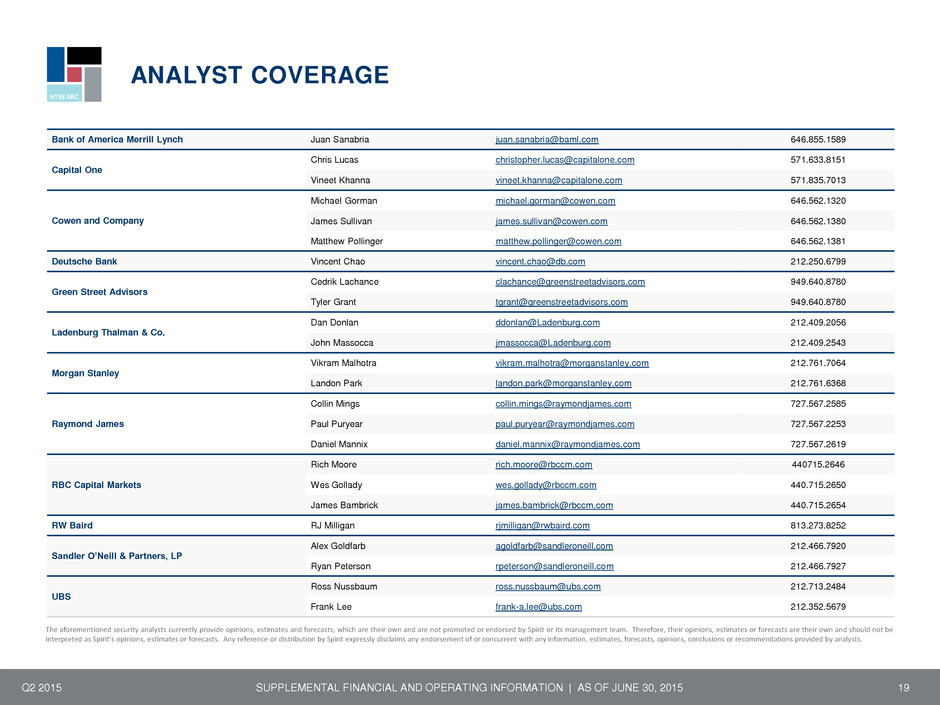

NYSE:SRC ANALYST COVERAGE Q2 2015 19 Bank of America Merrill Lynch Juan Sanabria juan.sanabria@baml.com 646.855.1589 Capital One Chris Lucas christopher.lucas@capitalone.com 571.633.8151 Vineet Khanna vineet.khanna@capitalone.com 571.835.7013 Cowen and Company Michael Gorman michael.gorman@cowen.com 646.562.1320 James Sullivan james.sullivan@cowen.com 646.562.1380 Matthew Pollinger matthew.pollinger@cowen.com 646.562.1381 Deutsche Bank Vincent Chao vincent.chao@db.com 212.250.6799 Green Street Advisors Cedrik Lachance clachance@greenstreetadvisors.com 949.640.8780 Tyler Grant tgrant@greenstreetadvisors.com 949.640.8780 Ladenburg Thalman & Co. Dan Donlan ddonlan@Ladenburg.com 212.409.2056 John Massocca jmassocca@Ladenburg.com 212.409.2543 Morgan Stanley Vikram Malhotra vikram.malhotra@morganstanley.com 212.761.7064 Landon Park landon.park@morganstanley.com 212.761.6368 Raymond James Collin Mings collin.mings@raymondjames.com 727.567.2585 Paul Puryear paul.puryear@raymondjames.com 727.567.2253 Daniel Mannix daniel.mannix@raymondjames.com 727.567.2619 RBC Capital Markets Rich Moore rich.moore@rbccm.com 440715.2646 Wes Gollady wes.gollady@rbccm.com 440.715.2650 James Bambrick james.bambrick@rbccm.com 440.715.2654 RW Baird RJ Milligan rjmilligan@rwbaird.com 813.273.8252 Sandler O’Neill & Partners, LP Alex Goldfarb agoldfarb@sandleroneill.com 212.466.7920 Ryan Peterson rpeterson@sandleroneill.com 212.466.7927 UBS Ross Nussbaum ross.nussbaum@ubs.com 212.713.2484 Frank Lee frank-a.lee@ubs.com 212.352.5679 The aforementioned security analysts currently provide opinions, estimates and forecasts, which are their own and are not promoted or endorsed by Spirit or its management team. Therefore, their opinions, estimates or forecasts are their own and should not be interpreted as Spirit’s opinions, estimates or forecasts. Any reference or distribution by Spirit expressly disclaims any endorsement of or concurrent with any information, estimates, forecasts, opinions, conclusions or recommendations provided by analysts. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

NYSE:SRC Appendix Q2 2015 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015 20

NYSE:SRC REPORTING DEFINITIONS AND EXPLANATIONS Q2 2015 21 Adjusted Funds from Operations (AFFO) and Funds from Operation (FFO) We calculate FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts, or NAREIT. FFO represents net income (loss) attributable to common stockholders (computed in accordance with GAAP), excluding real estate-related depreciation and amortization, impairment charges and net losses (gains) from property dispositions. FFO is a supplemental non-GAAP financial measure. We use FFO as a supplemental performance measure because we believe that FFO is beneficial to investors as a starting point in measuring our operational performance. Specifically, in excluding real estate-related depreciation and amortization, gains and losses from property dispositions and impairment charges, which do not relate to or are not indicative of operating performance, FFO provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of the performance of equity REITs, FFO will be used by investors as a basis to compare our operating performance with that of other equity REITs. However, because FFO excludes depreciation and amortization and does not capture the changes in the value of our properties that result from use or market conditions, all of which have real economic effects and could materially impact our results from operations, the utility of FFO as a measure of our performance is limited. In addition, other equity REITs may not calculate FFO as we do, and, accordingly, our FFO may not be comparable to such other equity REITs’ FFO. Accordingly, FFO should be considered only as a supplement to net income (loss) attributable to common stockholders as a measure of our performance. AFFO is a non-GAAP financial measure of operating performance used by many companies in the REIT industry. We adjust FFO to eliminate the impact of certain items that we believe are not indicative of our core operating performance, including merger and finance restructuring costs, default interest on non- recourse mortgage indebtedness, debt extinguishment gains (losses), transaction costs incurred in connection with the acquisition of real estate investments subject to existing leases and certain non-cash items. These certain non-cash items include non-cash revenues (comprised of straight-line rents, amortization of above and below market rent on our leases, amortization of lease incentives, amortization of net premium (discount) on loans receivable and amortization of capitalized lease transaction costs), non-cash interest expense (comprised of amortization of deferred financing costs and amortization of net debt discount/premium) and non-cash compensation expense (stock-based compensation expense). In addition, other equity REITs may not calculate AFFO as we do, and, accordingly, our AFFO may not be comparable to such other equity REITs’ AFFO. AFFO does not represent cash generated from operating activities determined in accordance with GAAP, is not necessarily indicative of cash available to fund cash needs and should not be considered as an alternative to net income (determined in accordance with GAAP) as a performance measure. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

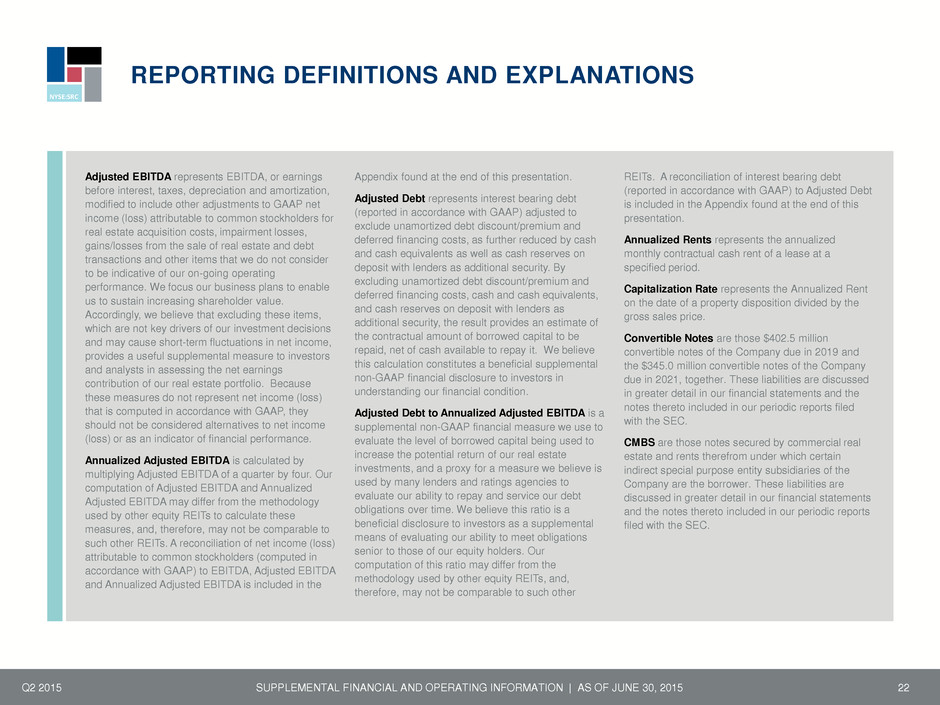

NYSE:SRC REPORTING DEFINITIONS AND EXPLANATIONS Q2 2015 22 Adjusted EBITDA represents EBITDA, or earnings before interest, taxes, depreciation and amortization, modified to include other adjustments to GAAP net income (loss) attributable to common stockholders for real estate acquisition costs, impairment losses, gains/losses from the sale of real estate and debt transactions and other items that we do not consider to be indicative of our on-going operating performance. We focus our business plans to enable us to sustain increasing shareholder value. Accordingly, we believe that excluding these items, which are not key drivers of our investment decisions and may cause short-term fluctuations in net income, provides a useful supplemental measure to investors and analysts in assessing the net earnings contribution of our real estate portfolio. Because these measures do not represent net income (loss) that is computed in accordance with GAAP, they should not be considered alternatives to net income (loss) or as an indicator of financial performance. Annualized Adjusted EBITDA is calculated by multiplying Adjusted EBITDA of a quarter by four. Our computation of Adjusted EBITDA and Annualized Adjusted EBITDA may differ from the methodology used by other equity REITs to calculate these measures, and, therefore, may not be comparable to such other REITs. A reconciliation of net income (loss) attributable to common stockholders (computed in accordance with GAAP) to EBITDA, Adjusted EBITDA and Annualized Adjusted EBITDA is included in the Appendix found at the end of this presentation. Adjusted Debt represents interest bearing debt (reported in accordance with GAAP) adjusted to exclude unamortized debt discount/premium and deferred financing costs, as further reduced by cash and cash equivalents as well as cash reserves on deposit with lenders as additional security. By excluding unamortized debt discount/premium and deferred financing costs, cash and cash equivalents, and cash reserves on deposit with lenders as additional security, the result provides an estimate of the contractual amount of borrowed capital to be repaid, net of cash available to repay it. We believe this calculation constitutes a beneficial supplemental non-GAAP financial disclosure to investors in understanding our financial condition. Adjusted Debt to Annualized Adjusted EBITDA is a supplemental non-GAAP financial measure we use to evaluate the level of borrowed capital being used to increase the potential return of our real estate investments, and a proxy for a measure we believe is used by many lenders and ratings agencies to evaluate our ability to repay and service our debt obligations over time. We believe this ratio is a beneficial disclosure to investors as a supplemental means of evaluating our ability to meet obligations senior to those of our equity holders. Our computation of this ratio may differ from the methodology used by other equity REITs, and, therefore, may not be comparable to such other REITs. A reconciliation of interest bearing debt (reported in accordance with GAAP) to Adjusted Debt is included in the Appendix found at the end of this presentation. Annualized Rents represents the annualized monthly contractual cash rent of a lease at a specified period. Capitalization Rate represents the Annualized Rent on the date of a property disposition divided by the gross sales price. Convertible Notes are those $402.5 million convertible notes of the Company due in 2019 and the $345.0 million convertible notes of the Company due in 2021, together. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. CMBS are those notes secured by commercial real estate and rents therefrom under which certain indirect special purpose entity subsidiaries of the Company are the borrower. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

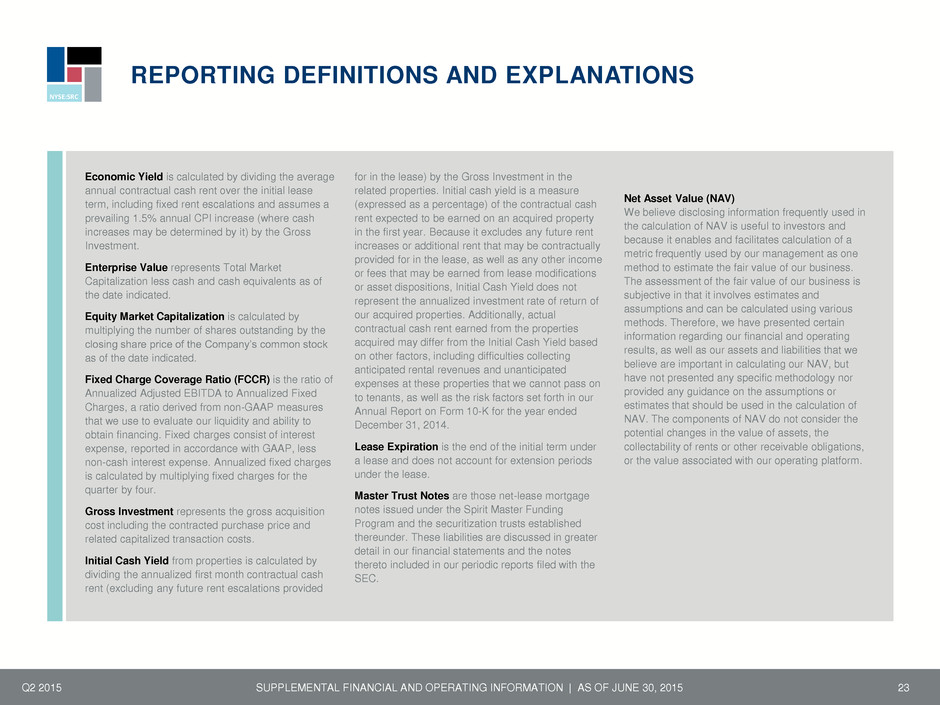

NYSE:SRC REPORTING DEFINITIONS AND EXPLANATIONS Q2 2015 23 Economic Yield is calculated by dividing the average annual contractual cash rent over the initial lease term, including fixed rent escalations and assumes a prevailing 1.5% annual CPI increase (where cash increases may be determined by it) by the Gross Investment. Enterprise Value represents Total Market Capitalization less cash and cash equivalents as of the date indicated. Equity Market Capitalization is calculated by multiplying the number of shares outstanding by the closing share price of the Company’s common stock as of the date indicated. Fixed Charge Coverage Ratio (FCCR) is the ratio of Annualized Adjusted EBITDA to Annualized Fixed Charges, a ratio derived from non-GAAP measures that we use to evaluate our liquidity and ability to obtain financing. Fixed charges consist of interest expense, reported in accordance with GAAP, less non-cash interest expense. Annualized fixed charges is calculated by multiplying fixed charges for the quarter by four. Gross Investment represents the gross acquisition cost including the contracted purchase price and related capitalized transaction costs. Initial Cash Yield from properties is calculated by dividing the annualized first month contractual cash rent (excluding any future rent escalations provided for in the lease) by the Gross Investment in the related properties. Initial cash yield is a measure (expressed as a percentage) of the contractual cash rent expected to be earned on an acquired property in the first year. Because it excludes any future rent increases or additional rent that may be contractually provided for in the lease, as well as any other income or fees that may be earned from lease modifications or asset dispositions, Initial Cash Yield does not represent the annualized investment rate of return of our acquired properties. Additionally, actual contractual cash rent earned from the properties acquired may differ from the Initial Cash Yield based on other factors, including difficulties collecting anticipated rental revenues and unanticipated expenses at these properties that we cannot pass on to tenants, as well as the risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2014. Lease Expiration is the end of the initial term under a lease and does not account for extension periods under the lease. Master Trust Notes are those net-lease mortgage notes issued under the Spirit Master Funding Program and the securitization trusts established thereunder. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. Net Asset Value (NAV) We believe disclosing information frequently used in the calculation of NAV is useful to investors and because it enables and facilitates calculation of a metric frequently used by our management as one method to estimate the fair value of our business. The assessment of the fair value of our business is subjective in that it involves estimates and assumptions and can be calculated using various methods. Therefore, we have presented certain information regarding our financial and operating results, as well as our assets and liabilities that we believe are important in calculating our NAV, but have not presented any specific methodology nor provided any guidance on the assumptions or estimates that should be used in the calculation of NAV. The components of NAV do not consider the potential changes in the value of assets, the collectability of rents or other receivable obligations, or the value associated with our operating platform. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

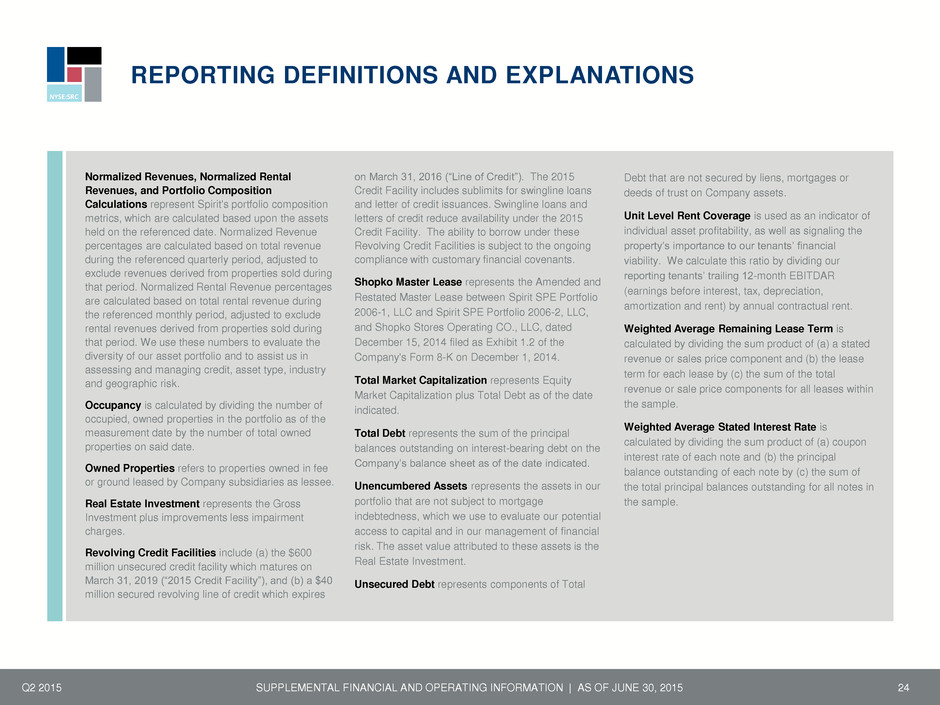

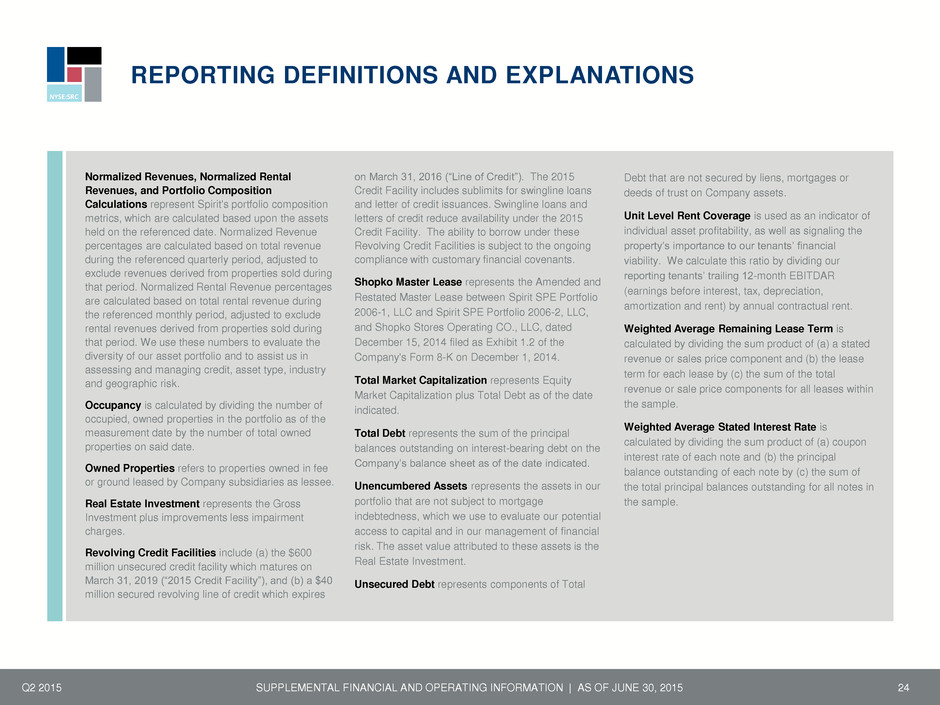

NYSE:SRC REPORTING DEFINITIONS AND EXPLANATIONS Q2 2015 24 Normalized Revenues, Normalized Rental Revenues, and Portfolio Composition Calculations represent Spirit's portfolio composition metrics, which are calculated based upon the assets held on the referenced date. Normalized Revenue percentages are calculated based on total revenue during the referenced quarterly period, adjusted to exclude revenues derived from properties sold during that period. Normalized Rental Revenue percentages are calculated based on total rental revenue during the referenced monthly period, adjusted to exclude rental revenues derived from properties sold during that period. We use these numbers to evaluate the diversity of our asset portfolio and to assist us in assessing and managing credit, asset type, industry and geographic risk. Occupancy is calculated by dividing the number of occupied, owned properties in the portfolio as of the measurement date by the number of total owned properties on said date. Owned Properties refers to properties owned in fee or ground leased by Company subsidiaries as lessee. Real Estate Investment represents the Gross Investment plus improvements less impairment charges. Revolving Credit Facilities include (a) the $600 million unsecured credit facility which matures on March 31, 2019 (“2015 Credit Facility”), and (b) a $40 million secured revolving line of credit which expires on March 31, 2016 (“Line of Credit”). The 2015 Credit Facility includes sublimits for swingline loans and letter of credit issuances. Swingline loans and letters of credit reduce availability under the 2015 Credit Facility. The ability to borrow under these Revolving Credit Facilities is subject to the ongoing compliance with customary financial covenants. Shopko Master Lease represents the Amended and Restated Master Lease between Spirit SPE Portfolio 2006-1, LLC and Spirit SPE Portfolio 2006-2, LLC, and Shopko Stores Operating CO., LLC, dated December 15, 2014 filed as Exhibit 1.2 of the Company's Form 8-K on December 1, 2014. Total Market Capitalization represents Equity Market Capitalization plus Total Debt as of the date indicated. Total Debt represents the sum of the principal balances outstanding on interest-bearing debt on the Company’s balance sheet as of the date indicated. Unencumbered Assets represents the assets in our portfolio that are not subject to mortgage indebtedness, which we use to evaluate our potential access to capital and in our management of financial risk. The asset value attributed to these assets is the Real Estate Investment. Unsecured Debt represents components of Total Debt that are not secured by liens, mortgages or deeds of trust on Company assets. Unit Level Rent Coverage is used as an indicator of individual asset profitability, as well as signaling the property’s importance to our tenants’ financial viability. We calculate this ratio by dividing our reporting tenants’ trailing 12-month EBITDAR (earnings before interest, tax, depreciation, amortization and rent) by annual contractual rent. Weighted Average Remaining Lease Term is calculated by dividing the sum product of (a) a stated revenue or sales price component and (b) the lease term for each lease by (c) the sum of the total revenue or sale price components for all leases within the sample. Weighted Average Stated Interest Rate is calculated by dividing the sum product of (a) coupon interest rate of each note and (b) the principal balance outstanding of each note by (c) the sum of the total principal balances outstanding for all notes in the sample. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

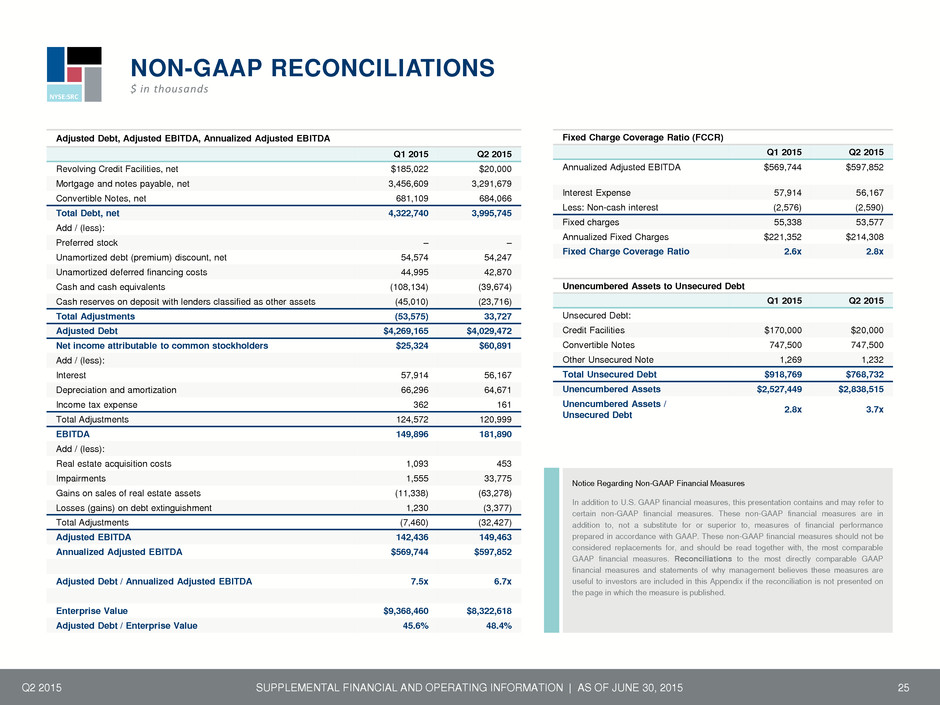

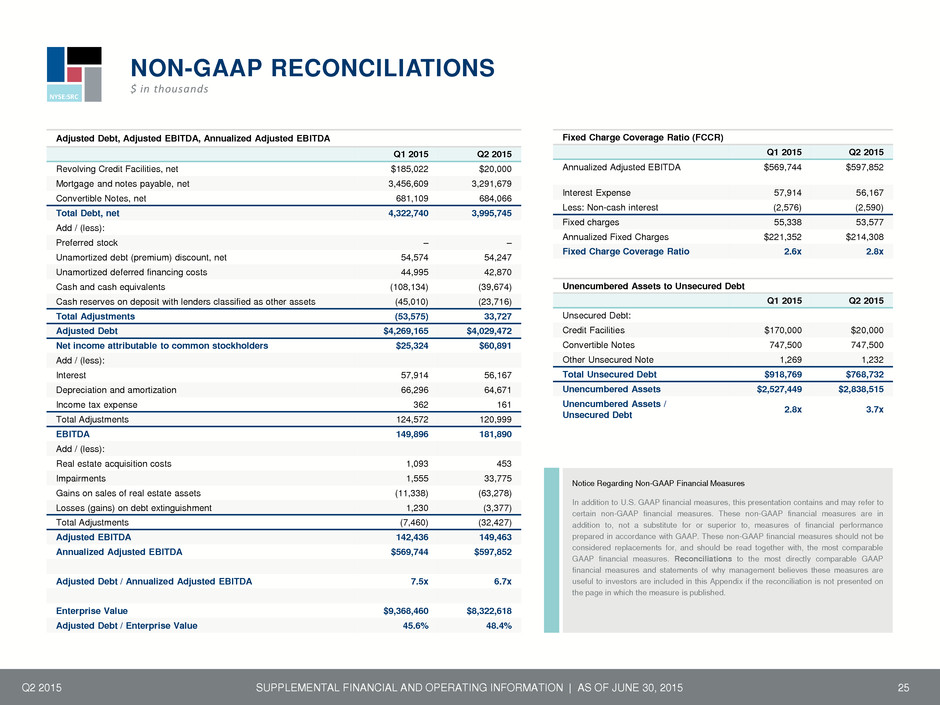

NYSE:SRC Q2 2015 25 Adjusted Debt, Adjusted EBITDA, Annualized Adjusted EBITDA Q1 2015 Q2 2015 Revolving Credit Facilities, net $185,022 $20,000 Mortgage and notes payable, net 3,456,609 3,291,679 Convertible Notes, net 681,109 684,066 Total Debt, net 4,322,740 3,995,745 Add / (less): Preferred stock – – Unamortized debt (premium) discount, net 54,574 54,247 Unamortized deferred financing costs 44,995 42,870 Cash and cash equivalents (108,134) (39,674) Cash reserves on deposit with lenders classified as other assets (45,010) (23,716) Total Adjustments (53,575) 33,727 Adjusted Debt $4,269,165 $4,029,472 Net income attributable to common stockholders $25,324 $60,891 Add / (less): Interest 57,914 56,167 Depreciation and amortization 66,296 64,671 Income tax expense 362 161 Total Adjustments 124,572 120,999 EBITDA 149,896 181,890 Add / (less): Real estate acquisition costs 1,093 453 Impairments 1,555 33,775 Gains on sales of real estate assets (11,338) (63,278) Losses (gains) on debt extinguishment 1,230 (3,377) Total Adjustments (7,460) (32,427) Adjusted EBITDA 142,436 149,463 Annualized Adjusted EBITDA $569,744 $597,852 Adjusted Debt / Annualized Adjusted EBITDA 7.5x 6.7x Enterprise Value $9,368,460 $8,322,618 Adjusted Debt / Enterprise Value 45.6% 48.4% Fixed Charge Coverage Ratio (FCCR) Q1 2015 Q2 2015 Annualized Adjusted EBITDA $569,744 $597,852 Interest Expense 57,914 56,167 Less: Non-cash interest (2,576) (2,590) Fixed charges 55,338 53,577 Annualized Fixed Charges $221,352 $214,308 Fixed Charge Coverage Ratio 2.6x 2.8x Unencumbered Assets to Unsecured Debt Q1 2015 Q2 2015 Unsecured Debt: Credit Facilities $170,000 $20,000 Convertible Notes 747,500 747,500 Other Unsecured Note 1,269 1,232 Total Unsecured Debt $918,769 $768,732 Unencumbered Assets $2,527,449 $2,838,515 Unencumbered Assets / Unsecured Debt 2.8x 3.7x NON-GAAP RECONCILIATIONS $ in thousands Notice Regarding Non-GAAP Financial Measures In addition to U.S. GAAP financial measures, this presentation contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this Appendix if the reconciliation is not presented on the page in which the measure is published. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015

NYSE:SRC FORWARD-LOOKING STATEMENTS AND RISK FACTORS Q2 2015 26 The information in this supplemental report should be read in conjunction with the accompanying earnings press release, as well as the Company's Quarterly Report on Form 10-Q, Annual Report on Form 10-K and other information filed with the Securities and Exchange Commission. This supplemental report is not incorporated into such filings. This document is not an offer to sell or a solicitation to buy securities of Spirit Realty Capital, Inc. Any offer or solicitation shall be made only by means of a prospectus approved for that purpose. Forward-Looking and Cautionary Statements This document contains forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward‐looking statements can be identified by the use of words such as “expects,” “plans,” “estimates,” “projects,” “intends,” “believes,” “guidance,” and other similar expressions that do not relate to historical matters. These forward‐looking statements are subject to known and unknown risks and uncertainties that can cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, Spirit’s continued ability to source new investments, risks associated with using debt and equity financing to fund Spirit’s business activities (including refinancing and interest rate risks, changes in interest rates and/or credit spreads, changes in the price of our common stock, and conditions of the equity and debt capital markets, generally), unknown liabilities acquired in connection with acquired properties or interests in real‐estate related entities, general risks affecting the real estate industry (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition and operating performance, and competition from other developers, owners and operators of real estate), risks associated with our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended, and other additional risks discussed in Spirit’s most recent filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Spirit expressly disclaims any responsibility to update or revise forward‐looking statements, whether as a result of new information, future events or otherwise, except as required by law. SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | AS OF JUNE 30, 2015