NYSE:SRC NYSE:SRC FACT SHEET Haggen Valuation Revised February 24, 2016 Haggen – Laguna Beach, CA

NYSE:SRC NYSE:SRC TRANSACTION BACKGROUND 2 FACT SHEET – HAGGEN VALUATION| FEBRUARY 24, 2016 Initial Investment • 20 stores (1 million square feet) • $224.4 million investment ($221 / square feet) • Annual rent of $16.8 million (7.5% Cap Rate) • 20-year Master Lease with 2% annual bumps • Executed a purchase and sale agreement in December 2014 Current Valuation Spirit anticipates that it will recapture at least $40 million in excess of its initial investment in the 20 stores, which have an approximate total valuation range of $265.1 million to $288.2 million, which includes an estimated $15 - $21 million recovery of its unsecured claim as compensation for the restructuring of the original Master Lease. Current Status Haggen Holdings, LLC, and Haggen Operations Holdings, LLC, filed a petition for relief under Chapter 11 bankruptcy on September 8, 2015. Haggen and Spirit elected to negotiate and restructure the Master Lease in a comprehensive Settlement Agreement approved by the bankruptcy court through an order entered into on November 25, 2015. • 9 Stores: Gelson’s – Albertson’s – Smart & Final Nine stores were re-let to other grocery store operators in 2015 – Gelson’s, Albertson’s and Smart & Final. These assets comprise 456,611 square feet, generating annual rent of approximately $9.3 million. These assets have a current valuation ranging from $161.0 million to $170.5 million, representing cap rates ranging from 5.43% to 5.75%. • 5 Core Stores: TBD (currently operating as Haggen’s) Haggen Holdings, LLC, assumed 5 stores under an amended Master Lease, which aggregates 231,470 square feet and annual rent of approximately $3.6 million. These assets are currently being marketed as part of a 32-store portfolio. The auction date is set for mid-March 2016. These assets have a current valuation ranging from $51.1 million and $57.1 million representing cap rates ranging from 6.26% to 7.00%. • 4 Stores: Vacant Locations/Being Re-Let Spirit owns the four vacant stores, which comprise 222,396 square feet. These stores were part of the six stores that were rejected as a result of the comprehensive Settlement Agreement. They are in various stages of being sold or re-let. These assets have a current valuation ranging from $23.0 million and $24.6 million. • 2 Stores: Sold Comprising 102,186 square feet, these stores were part of the six stores that were rejected as a result of the comprehensive Settlement Agreement approved by the bankruptcy court through an order entered on November 25, 2015. Spirit sold these two assets in the first quarter of 2016 for approximately $15 million, which resulted in an impairment charge of $3.3 million recorded in the fourth quarter of 2015. • Unsecured Claim Spirit anticipates recovering between $15 million - $21 million of its $21 million unsecured stipulated damages claim. The recovery from this claim is predicated on the ultimate resolution of the bankruptcy. Valuation Source: Low end of range is based on management estimates, high end of the range is equal to Lowest by Property Valuation Provided by Marcus & Millichap, CBRE, HFF, and Duff & Phelps. This valuation was based upon current market conditions, which could materially differ in the future and does not include transactions costs.

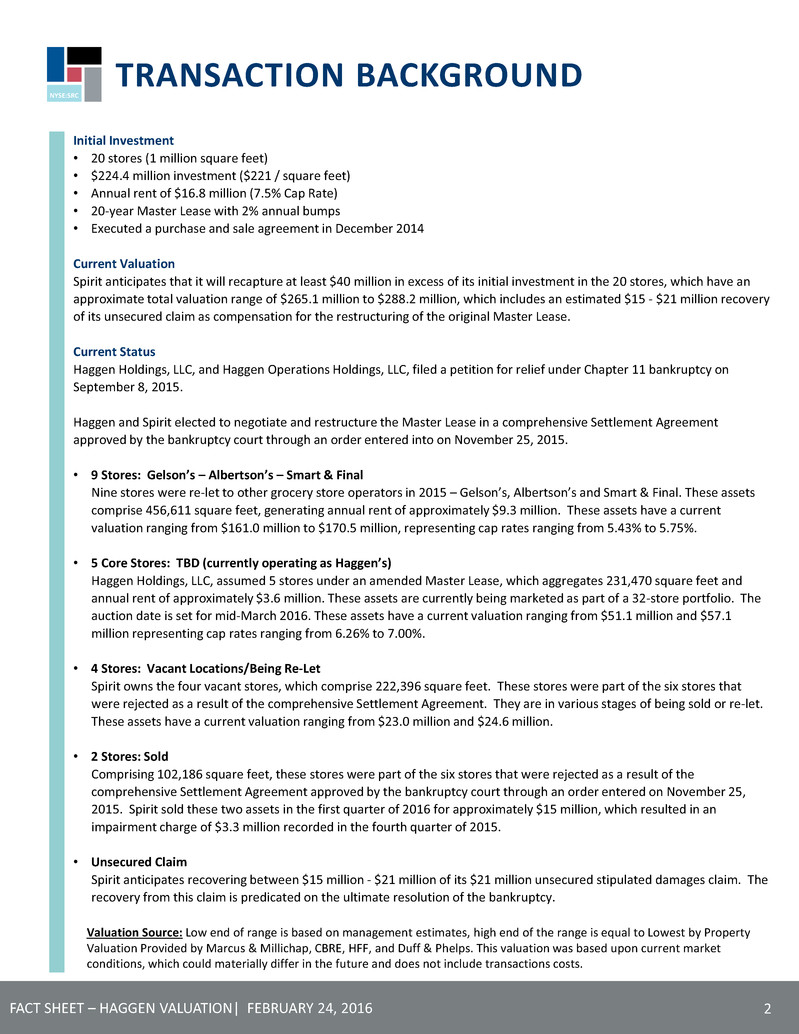

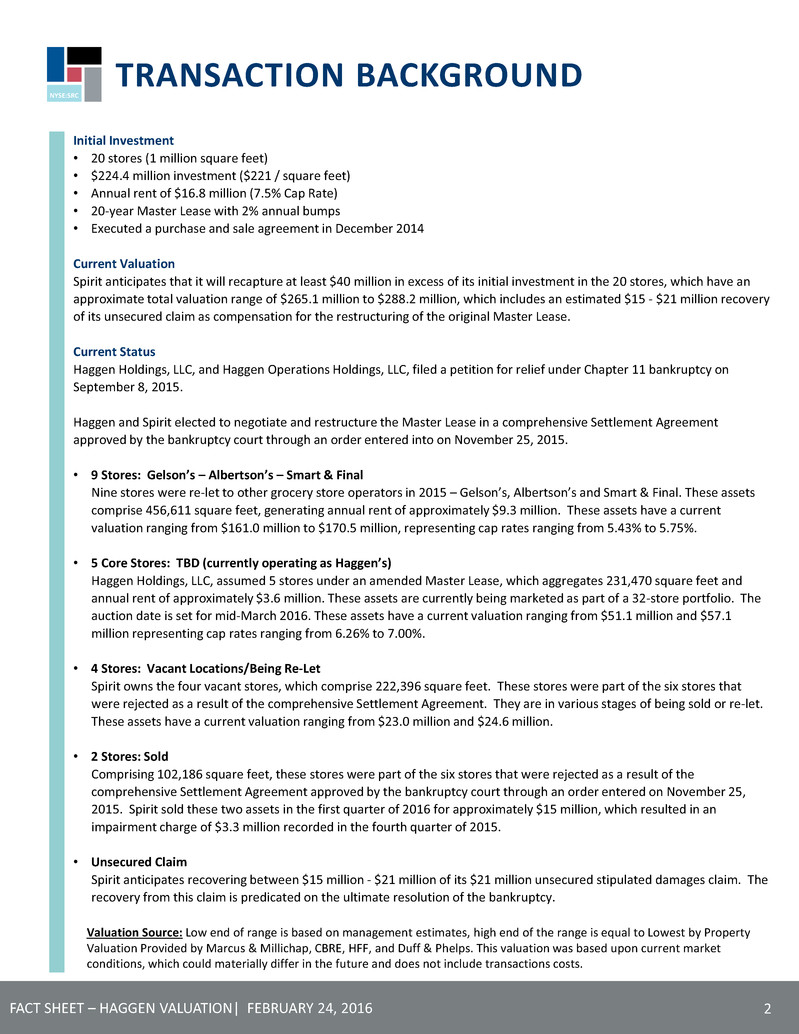

NYSE:SRC NYSE:SRC ASSET ALLOCATION 3 FACT SHEET – HAGGEN VALUATION| FEBRUARY 24, 2016 Haggen – Laguna Beach, CA Property Address Sq. Ft. Tenant Outcome 450 N. Wilbur Ave., Walla Walla, WA 99362 60,026 Haggen Core / Lease Assumed 114. E Lauridsen Blvd., Port Angeles, WA 98632 47,388 Haggen Core / Lease Assumed 3075 Hilyard St., Eugene, OR 97405 33,720 Haggen Core / Lease Assumed 14300 SW Barrows Rd., Tigard, OR 97223 50,408 Haggen Core / Lease Assumed 16199 Boones Ferry Rd., Lake Oswego, OR 97035 39,928 Haggen Core / Lease Assumed 2222 NW Bucklin Hill Road, Silverdale, WA 98383 56,026 TBD Vacant/Being Re-Let 19881 Highway 2, Monroe, WA 98272 52,576 TBD Vacant/Being Re-Let 16200 SW Pacific Hwy., Tigard, OR 97224 50,666 TBD Vacant / Under Contract to Sell 7900 White Lane, Bakersfield, CA 93309 42,791 Sold Sold 820 S. Rampart Blvd., Las Vegas, NV 89145 63,128 TBD Vacant/Being Re-let 11475 E. Via Linda, Scottsdale, AZ 85259 59,395 Sold Sold 7660 El Camino Real, Carlsbad, CA 92009 50,689 Gelson’s Lease Assumed and Assigned 30922 S. Pacific Coast Highway, Laguna Beach, CA 92651 34,478 Gelson’s Lease Assumed and Assigned 4300 NE 4th Street, Renton, WA 98059 60,473 Albertson’s Lease Assumed and Assigned 5038 W. Avenue N., Palmdale, CA 93551 47,850 Smart & Final Lease Assumed and Assigned 1500 N. H Street, Lompoc, CA 93436 58,033 Albertson’s Lease Assumed and Assigned 8200 El Camino Real, Atascadero, CA 93422 57,744 Smart & Final Lease Assumed and Assigned 13439 Camino Canada, El Cajon, CA 92021 56,731 Smart & Final Lease Assumed and Assigned 360 E. H Street, Chula Vista, CA 91910 37,196 Smart & Final Lease Assumed and Assigned 5770 Lindero Canyon Rd., Westlake Village, CA 91362 53,417 Smart & Final Lease Assumed and Assigned

NYSE:SRC NYSE:SRC QUESTIONS & ANSWERS 4 FACT SHEET – HAGGEN VALUATION| FEBRUARY 24, 2016 Q: You have provided the valuation for all of the 20 stores – do you expect to sell them? A: Yes, investor interest in these stores are very strong at this time. We expect to sell most, if not all of the stores in 2016. Q: You estimate a $15-21MM recovery on your $21MM stipulated damages claim. Where does your claim sit in the bankruptcy proceeding’s distribution priority waterfall? A: Our $21MM stipulated damages claim is an unsecured claim against each of Haggen Operations Holdings, LLC (the entity in which the grocery store operations were conducted, or “OpCo”) and Haggen Holdings, LLC (the owner of the equity of Haggen Operations Holdings, LLC as well as Haggen Property Holdings, LLC and Haggen Property Holdings II, LLC) and therefore sits behind administrative claims and secured claims (including the bankruptcy DIP facility). It is our understanding that the vast majority of the unsecured claims in the bankruptcy are against OpCo, and our claims against that entity sit pari passu with those other unsecured claims. However, unlike almost all of the other unsecured OpCo claims, our lease has a parent guarantee from Haggen Holdings, LLC, which we believe will give us access to collateral for satisfaction of our claims that is not generally available to satisfy OpCo claims. We understand that there are substantial assets in the subsidiaries of Haggen Holdings, LLC that give us confidence that we will recover most, if not all of our $21 million claim. Haggen – Chula Vista, CA Haggen – Carlsbad, CA

NYSE:SRC NYSE:SRC Statements contained in this fact sheet and any accompanying oral presentation by Spirit Realty Capital, Inc. (“Spirit” or the “Company”) that are not strictly historical are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements can be identified by the use of words such as “expect,” “plan,” "will," “estimate,” “project,” “intend,” “believe,” “guidance,” and other similar expressions that do not relate to historical matters. These forward-looking statements are subject to known and unknown risks and uncertainties that can cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, Spirit’s continued ability to source new investments, risks associated with using debt to fund Spirit’s business activities (including refinancing and interest rate risks, changes in interest rates and/or credit spreads), unknown liabilities acquired in connection with acquired properties or interests in real-estate related entities, risks related to the potential relocation of our corporate headquarters to Dallas, Texas, general risks affecting the real estate industry and local real estate markets (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition and operating performance, and competition from other developers, owners and operators of real estate), potential fluctuations in the consumer price index, risks associated with our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended, and other additional risks discussed in Spirit’s most recent filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Spirit expressly disclaims any responsibility to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. FORWARD-LOOKING STATEMENTS 5 For Additional Information Mary Jensen Vice President Investor Relations (480) 315-6604 Haggen – Carlsbad, CA FORWARD-LOOKING LANGUAGE FACT SHEET – HAGGEN VALUATION| FEBRUARY 24, 2016