Path Forward August 2017

Pg. 2 FORWARD LOOKING STATEMENTS This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements can be identified by the use of words such as “expect,” “plan,” "will," “estimate,” “project,” “intend,” “believe,” “guidance,” and other similar expressions that do not relate to historical matters. These forward-looking statements are subject to known and unknown risks and uncertainties that can cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, Spirit’s continued ability to source new investments, risks associated with using debt and equity financing to fund Spirit’s business activities (including refinancing and interest rate risks, changes in interest rates and/or credit spreads, changes in the price of our common stock, and conditions of the equity and debt capital markets, generally), unknown liabilities acquired in connection with acquired properties or interests in real-estate related entities, general risks affecting the real estate industry and local real estate markets (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition and operating performance, and competition from other developers, owners and operators of real estate), the financial performance of our retail tenants and the demand for retail space, particularly with respect to challenges being experienced by general merchandise retailers, potential fluctuations in the consumer price index, risks associated with our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended, risks and uncertainties related to the completion and timing of Spirit's proposed spin-off of properties leased to Shopko and assets that collateralize Master Trust 2014 and the impact of the spin-off on Spirit's business, and other additional risks discussed in Spirit’s most recent filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Spirit expressly disclaims any responsibility to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Pg. 3 PATH FORWARD (1) Based on either public rating or Expected Default Frequency score as of June 30, 2017. (2) Requires raising approximately $300 million of incremental loan proceeds capital to reach target, see page 13 for details. Investment Grade Larger Portfolios Small & Medium Tenants with Master Leases Unit Level Financial Reporting I N V E S T M E N T S T R A T E G Y - G O O D R E A L E S T A T E − Removal of Impediments − Deleveraging Capital Structure − Accretion to NAV − Accretion to Growth − Simplicity & Flexibility − Actionability What are we solving for? N e w S p i r i t Improved Credit Metrics Targets A G R E E M E N T S I N T E R C O M P A N Y − $5.4BN Real Estate Investment − 1,547 Owned Properties − $395MM in Contractual Rent 45% Investment Grade Equivalent Tenants¹ Initially 5x or Below Adj. Debt/ Ann. Adj. EBITDA² Very Diverse Tenancy and Industries 278 Tenants S p i n C o A+ MTN Program Rating S&P 73% Provide Unit Level Financials Maximize ShopKo Unencumbered Investment 60% Master Leases 196 Tenants − $2.7BN Real Estate Investment − 928 Owned Properties − $220MM in Contractual Rent

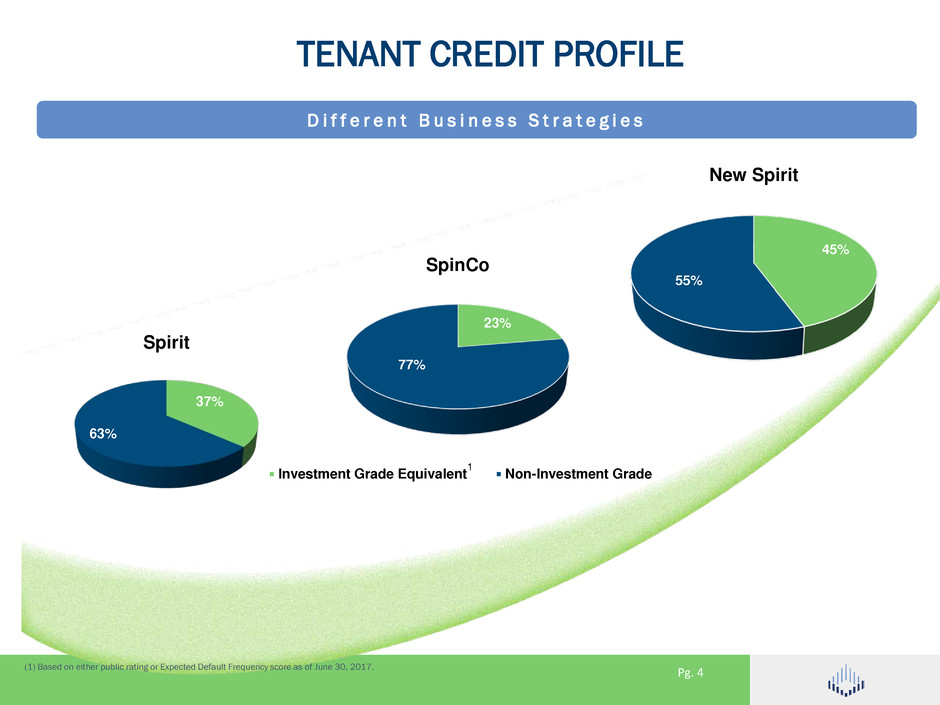

Pg. 4 23% 77% SpinCo Investment Grade Equivalent Non-Investment Grade D i f f e r e n t B u s i n e s s S t r a t e g i e s TENANT CREDIT PROFILE 37% 63% Spirit 45% 55% New Spirit 1 (1) Based on either public rating or Expected Default Frequency score as of June 30, 2017.

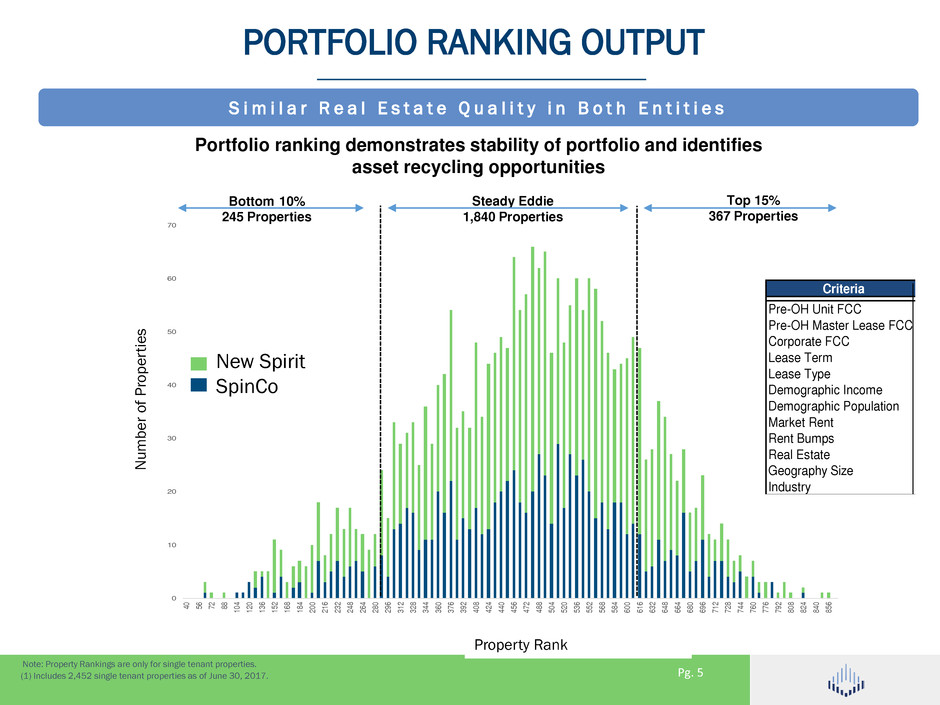

Pg. 5 0 10 20 30 40 50 60 70 40 56 72 88 10 4 12 0 13 6 15 2 16 8 18 4 20 0 21 6 23 2 24 8 26 4 28 0 29 6 31 2 32 8 34 4 36 0 37 6 39 2 40 8 42 4 44 0 45 6 47 2 48 8 50 4 52 0 53 6 55 2 56 8 58 4 60 0 61 6 63 2 64 8 66 4 68 0 69 6 71 2 72 8 74 4 76 0 77 6 79 2 80 8 82 4 84 0 85 6 Steady Eddie 1,840 Properties PORTFOLIO RANKING OUTPUT Portfolio ranking demonstrates stability of portfolio and identifies asset recycling opportunities Note: Property Rankings are only for single tenant properties. (1) Includes 2,452 single tenant properties as of June 30, 2017. S i m i l a r R e a l E s t a t e Q u a l i t y i n B o t h E n t i t i e s Criteria Pre-OH Unit FCC Pre-OH Master Lease FCC Corporate FCC Lease Term Lease Type Demographic Income Demographic Population Market Rent Rent Bumps Real Estate Geography Size Industry Bottom 10% 245 Properties Top 15% 367 Properties New Spirit SpinCo Property Rank N um be r of P ro pe rt ie s

Pg. 6 NEW SPIRIT HIGHLIGHTS F i n a n c i n g P l a n D e s i g n e d t o P r o d u c e S t r o n g B a l a n c e S h e e t f o r G r o w t h Target $400 loan proceeds for New Spirit from the following: − Issue additional notes in Master Trust 2014 (targeting 75% LTV) − Leverage certain unencumbered assets with CMBS and contribute to SpinCo − Structure a contractual management fee from SpinCo Use of target loan proceeds of $400MM: − New investment in key industries and existing tenant relationships − Repurchase stock − Debt repayment Predominantly service oriented retail portfolio with industrial and distribution industries − No tenant greater than 5% of Contractual Rent − Investment grade equivalent tenancy increases to 45% of Contractual Rent¹ Strong balance sheet, ample liquidity to fund external growth − Significantly increases unencumbered asset pool and generates excess loan proceeds from CMBS and Master Trust 2014 notes issuances R e s u l t s i n P o r t f o l i o w i t h S i g n i f i c a n t L i q u i d i t y Plan Targets Adj. Debt/ Ann. Adj. EBITDA Below 5x Level at Completion² Plan Removes ShopKo Assets and Significant Secured Debt Plan Targets Investment Grade Equivalent Tenants at 45%¹ (1) Based on either public rating or Expected Default Frequency score as of June 30, 2017. Plan Targets 76% Unencumbered Assets Base (2) Pro forma for non-redeployment of capital at completion.

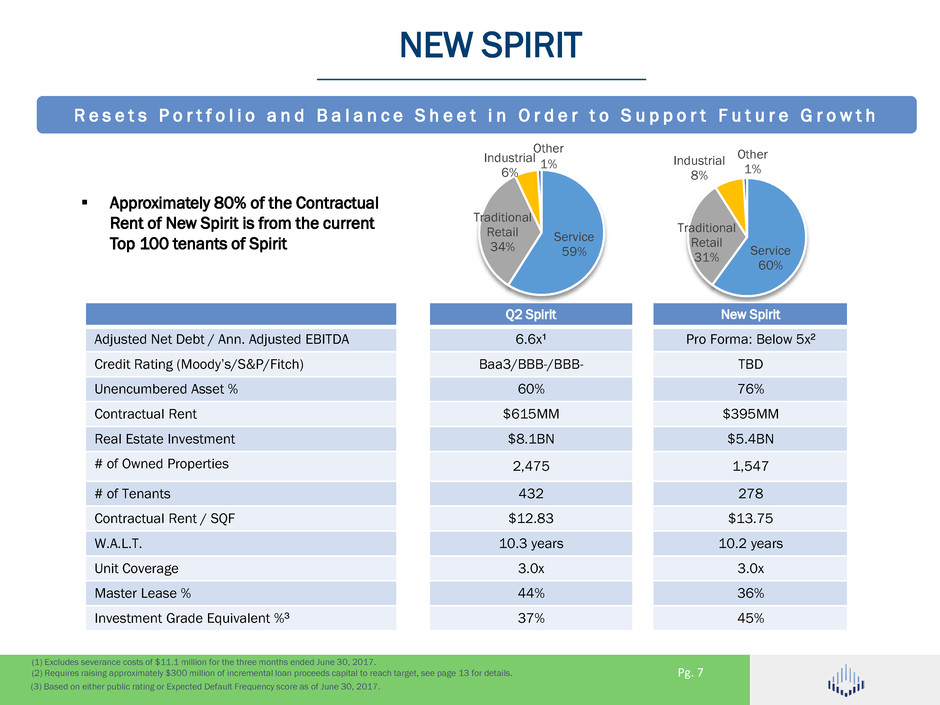

Pg. 7 Service 59% Traditional Retail 34% Industrial 6% Service 60% Traditional Retail 31% Industrial 8% Other 1% NEW SPIRIT Q2 Spirit New Spirit Adjusted Net Debt / Ann. Adjusted EBITDA 6.6x¹ Pro Forma: Below 5x² Credit Rating (Moody’s/S&P/Fitch) Baa3/BBB-/BBB- TBD Unencumbered Asset % 60% 76% Contractual Rent $615MM $395MM Real Estate Investment $8.1BN $5.4BN # of Owned Properties 2,475 1,547 # of Tenants 432 278 Contractual Rent / SQF $12.83 $13.75 W.A.L.T. 10.3 years 10.2 years Unit Coverage 3.0x 3.0x Master Lease % 44% 36% Investment Grade Equivalent %³ 37% 45% R e s e t s P o r t f o l i o a n d B a l a n c e S h e e t i n O r d e r t o S u p p o r t F u t u r e G r o w t h (3) Based on either public rating or Expected Default Frequency score as of June 30, 2017. (1) Excludes severance costs of $11.1 million for the three months ended June 30, 2017. (2) Requires raising approximately $300 million of incremental loan proceeds capital to reach target, see page 13 for details. Approximately 80% of the Contractual Rent of New Spirit is from the current Top 100 tenants of Spirit Other 1%

Pg. 8 SPINCO — GREAT BRANDS AND HIGHLIGHTS 154 Concepts 98% Occupied 60% under Master Leases 928 Total properties 73% reporting unit level financials 196 Tenants

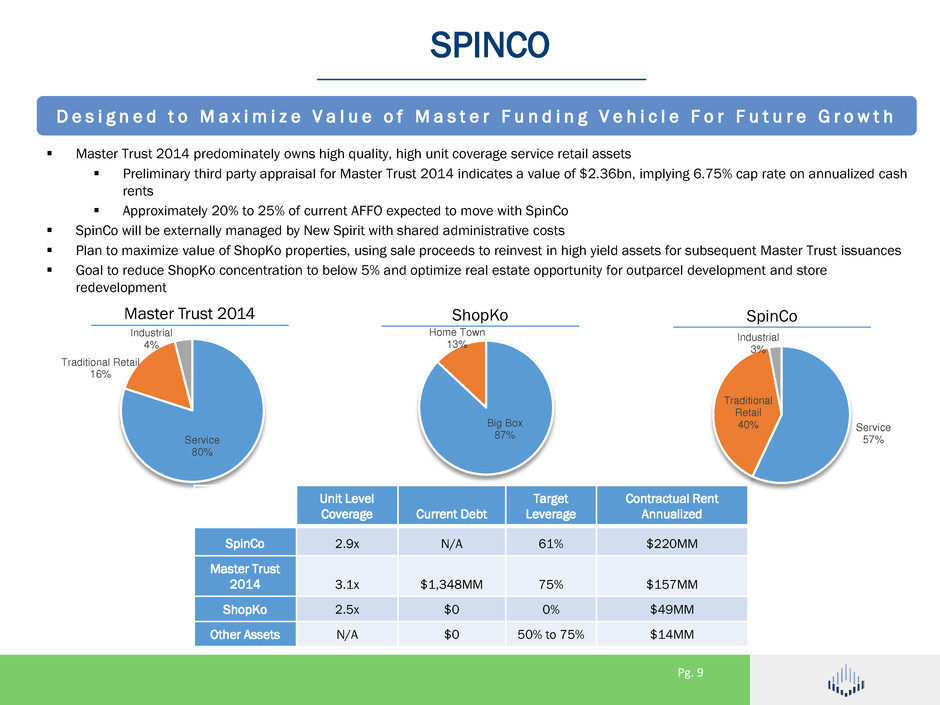

Pg. 9 SPINCO D e s i g n e d t o M a x i m i z e V a l u e o f M a s t e r F u n d i n g V e h i c l e F o r F u t u r e G r o w t h Service 80% Traditional Retail 16% Industrial 4% Master Trust 2014 Big Box 87% Home Town 13% ShopKo Service 57% Traditional Retail 40% Industrial 3% SpinCo Unit Level Coverage Current Debt Target Leverage Contractual Rent Annualized SpinCo 2.9x N/A 61% $220MM Master Trust 2014 3.1x $1,348MM 75% $157MM ShopKo 2.5x $0 0% $49MM Other Assets N/A $0 50% to 75% $14MM Master Trust 2014 predominately owns high quality, high unit coverage service retail assets Preliminary third party appraisal for Master Trust 2014 indicates a value of $2.36bn, implying 6.75% cap rate on annualized cash rents Approximately 20% to 25% of current AFFO expected to move with SpinCo SpinCo will be externally managed by New Spirit with shared administrative costs Plan to maximize value of ShopKo properties, using sale proceeds to reinvest in high yield assets for subsequent Master Trust issuances Goal to reduce ShopKo concentration to below 5% and optimize real estate opportunity for outparcel development and store redevelopment

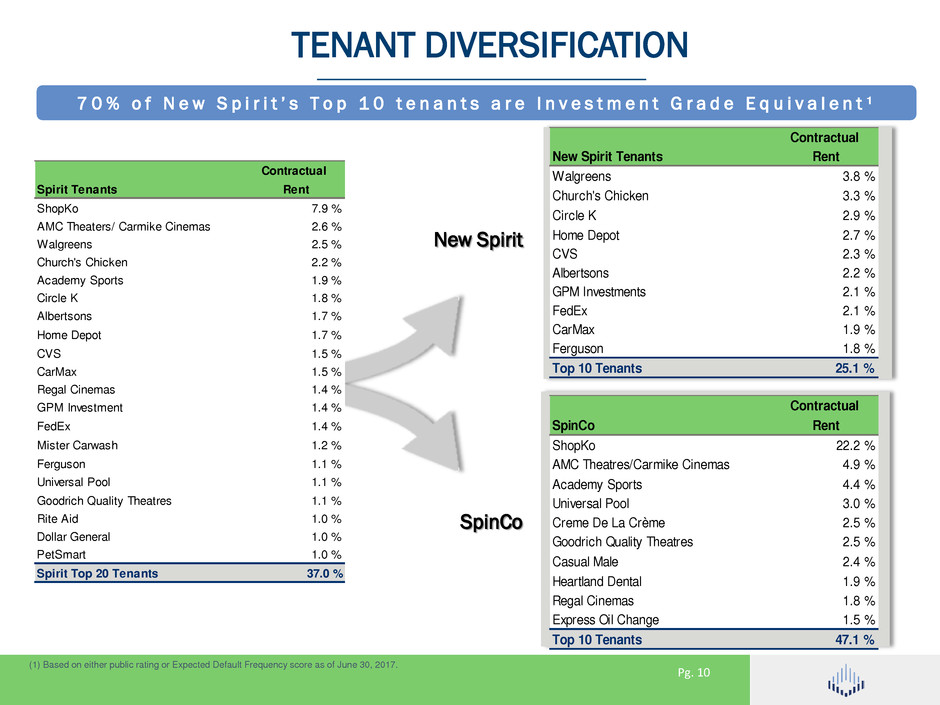

Pg. 10 Contractual New Spirit Tenants Rent Walgreens 3.8 % Church's Chicken 3.3 % Circle K 2.9 % Home Depot 2.7 % CVS 2.3 % Albertsons 2.2 % GPM Investments 2.1 % FedEx 2.1 % CarMax 1.9 % Ferguson 1.8 % Top 10 Tenants 25.1 % Contractual SpinCo Rent ShopKo 22.2 % AMC Theatres/Carmike Cinemas 4.9 % Academy Sports 4.4 % Universal Pool 3.0 % Creme De La Crème 2.5 % Goodrich Quality Theatres 2.5 % Casual Male 2.4 % Heartland Dental 1.9 % Regal Cinemas 1.8 % Express Oil Change 1.5 % Top 10 Tenants 47.1 % TENANT DIVERSIFICATION 7 0 % o f N e w S p i r i t ’ s T o p 1 0 t e n a n t s a r e I n v e s t m e n t G r a d e E q u i v a l e n t ¹ New Spirit SpinCo (1) Based on either public rating or Expected Default Frequency score as of June 30, 2017. Contractual Spirit Tenants Rent ShopKo 7.9 % AMC Theaters/ Carmike Cinemas 2.6 % Walgreens 2.5 % Church's Chicken 2.2 % Academy Sports 1.9 % Circle K 1.8 % Albertsons 1.7 % Home Depot 1.7 % CVS 1.5 % CarMax 1.5 % Regal Cinemas 1.4 % GPM Investment 1.4 % FedEx 1.4 % Mister Carwash 1.2 % Ferguson 1.1 % Universal Pool 1.1 % Goodrich Quality Theatres 1.1 % Rite Aid 1.0 % Dollar General 1.0 % PetSmart 1.0 % Spirit Top 20 Tenants 37.0 %

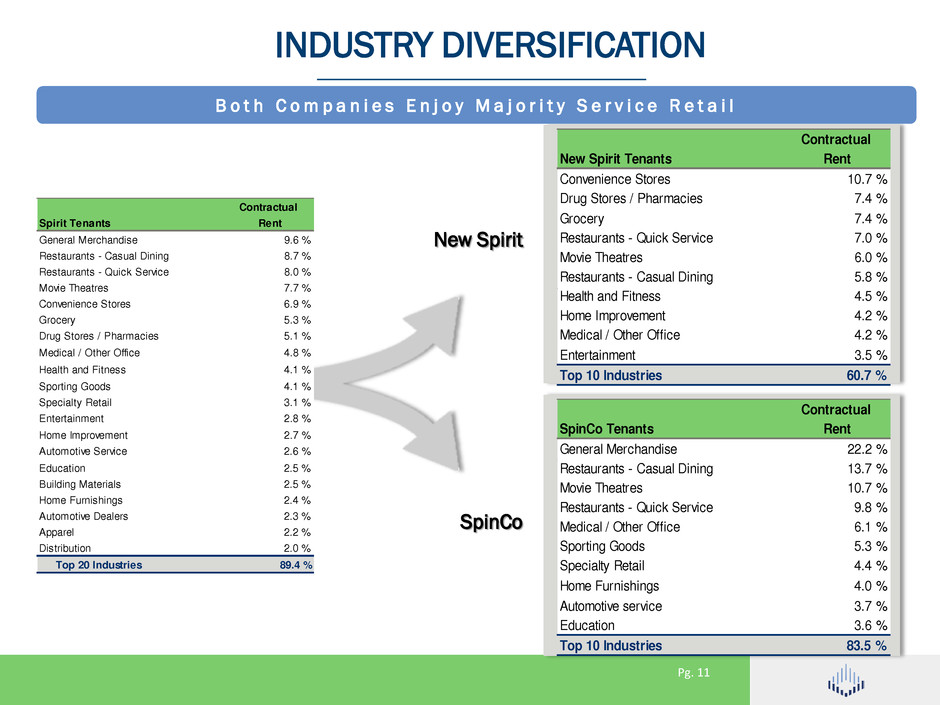

Pg. 11 Contractual SpinCo Tenants Rent General Merchandise 22.2 % Restaurants - Casual Dining 13.7 % Movie Theatres 10.7 % Restaurants - Quick Service 9.8 % Medical / Other Office 6.1 % Sporting Goods 5.3 % Specialty Retail 4.4 % Home Furnishings 4.0 % Automotive service 3.7 % Education 3.6 % Top 10 Industries 83.5 % Contractual New Spirit Tenants Rent Convenience Stores 10.7 % Drug Stores / Pharmacies 7.4 % Grocery 7.4 % Restaurants - Quick Service 7.0 % Movie Theatres 6.0 % Restaurants - Casual Dining 5.8 % Health and Fitness 4.5 % Home Improvement 4.2 % Medical / Other Office 4.2 % Entertainment 3.5 % Top 10 Industries 60.7 % INDUSTRY DIVERSIFICATION B o t h C o m p a n i e s E n j o y M a j o r i t y S e r v i c e R e t a i l New Spirit SpinCo Contractual Spirit Tenants Rent General Merchandise 9.6 % Restaurants - Casual Dining 8.7 % Restaurants - Quick Service 8.0 % Movie Theatres 7.7 % Convenience Stores 6.9 % Grocery 5.3 % Drug Stores / Pharmacies 5.1 % Medical / Other Office 4.8 % Health and Fitness 4.1 % Sporting Goods 4.1 % Specialty Retail 3.1 % Entertainment 2.8 % Home Improvement 2.7 % Automotive Service 2.6 % Education 2.5 % Building Materials 2.5 % Home Furnishings 2.4 % Automotive Dealers 2.3 % Apparel 2.2 % Distribution 2.0 % Top 20 Industries 89.4 %

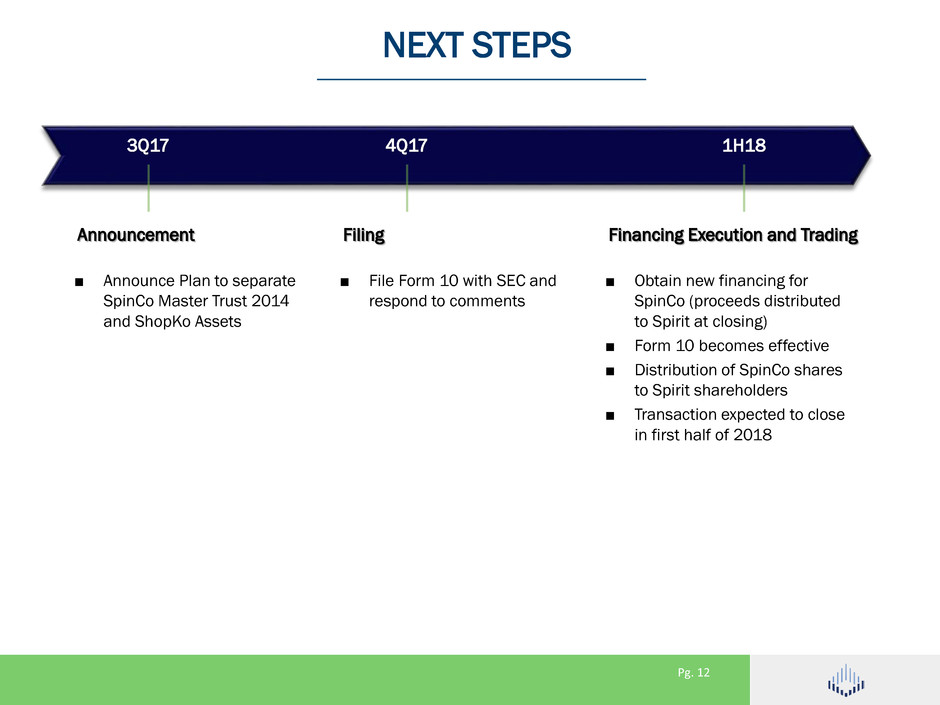

Pg. 12 NEXT STEPS ■ Announce Plan to separate SpinCo Master Trust 2014 and ShopKo Assets ■ File Form 10 with SEC and respond to comments ■ Obtain new financing for SpinCo (proceeds distributed to Spirit at closing) ■ Form 10 becomes effective ■ Distribution of SpinCo shares to Spirit shareholders ■ Transaction expected to close in first half of 2018 Announcement Filing Financing Execution and Trading 3Q17 4Q17 1H18

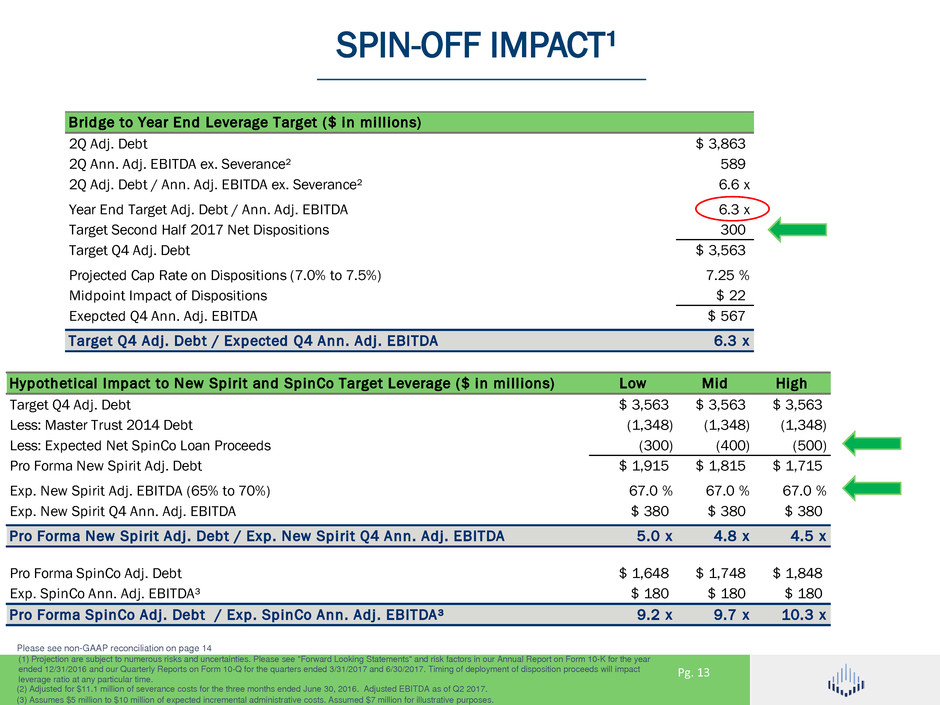

Pg. 13 SPIN-OFF IMPACT¹ (2) Adjusted for $11.1 million of severance costs for the three months ended June 30, 2016. Adjusted EBITDA as of Q2 2017. (3) Assumes $5 million to $10 million of expected incremental administrative costs. Assumed $7 million for illustrative purposes. (1) Projection are subject to numerous risks and uncertainties. Please see "Forward Looking Statements" and risk factors in our Annual Report on Form 10-K for the year ended 12/31/2016 and our Quarterly Reports on Form 10-Q for the quarters ended 3/31/2017 and 6/30/2017. Timing of deployment of disposition proceeds will impact leverage ratio at any particular time. Bridge to Year End Leverage Target ($ in mil l ions) 2Q Adj. Debt $ 3,863 2Q Ann. Adj. EBITDA ex. Severance² 589 2Q Adj. Debt / Ann. Adj. EBITDA ex. Severance² 6.6 x Year End Target Adj. Debt / Ann. Adj. EBITDA 6.3 x Target Second Half 2017 Net Dispositions 300 Target Q4 Adj. Debt $ 3,563 Projected Cap Rate on Dispositions (7.0% to 7.5%) 7.25 % Midpoint Impact of Dispositions $ 22 Exepcted Q4 Ann. Adj. EBITDA $ 567 Target Q4 Adj. Debt / Expected Q4 Ann. Adj. EBITDA 6.3 x Hypothetical Impact to New Spirit and SpinCo Target Leverage ($ in mil l ions) Low Mid High Target Q4 Adj. Debt $ 3,563 $ 3,563 $ 3,563 Less: Master Trust 2014 Debt (1,348) (1,348) (1,348) Less: Expected Net SpinCo Loan Proceeds (300) (400) (500) Pro Forma New Spirit Adj. Debt $ 1,915 $ 1,815 $ 1,715 Exp. New Spirit Adj. EBITDA (65% to 70%) 67.0 % 67.0 % 67.0 % Exp. New Spirit Q4 Ann. Adj. EBITDA $ 380 $ 380 $ 380 Pro Forma New Spirit Adj. Debt / Exp. New Spirit Q4 Ann. Adj. EBITDA 5.0 x 4.8 x 4.5 x Pro Forma SpinCo Adj. Debt $ 1,648 $ 1,748 $ 1,848 Exp. SpinCo Ann. Adj. EBITDA³ $ 180 $ 180 $ 180 Pro Forma SpinCo Adj. Debt / Exp. SpinCo Ann. Adj. EBITDA³ 9.2 x 9.7 x 10.3 x Please see non-GAAP reconciliation on page 14

Pg. 14 NON-GAAP RECONCILIATIONS